UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22534

Versus Capital Multi-Manager Real Estate Income Fund LLC

(Exact name of registrant as specified in charter)

5050 South Syracuse Street, Suite 1100

Denver, CO 80237

(Address of principal executive offices) (Zip code)

Mark D. Quam

c/o Versus Capital Advisors LLC

5050 South Syracuse Street, Suite 1100

Denver, CO 80237

(Name and address of agent for service)

COPY TO:

David C. Sullivan, Esq.

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199-3600

Registrant’s telephone number, including area code: (877) 200-1878

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | The Report to Shareholders is attached herewith. |

VERSUS CAPITAL MULTI-MANAGER

REAL ESTATE INCOME FUND LLC

Annual Report

March 31, 2022

VERSUS CAPITAL ADVISORS LLC

This report is for shareholders of Versus Capital Multi-Manager Real Estate Income Fund LLC. It is not

authorized for distribution unless preceded or accompanied by a current prospectus for the Fund. Shares

of the Fund are distributed by Foreside Funds Distributors LLC, Berwyn, Pennsylvania.

TABLE OF CONTENTS

Economic and market conditions change frequently.

There is no assurance that the trends described in this report will continue or commence.

Privacy Notice

This notice describes the Fund’s privacy policy. The Fund is committed to protecting the personal information that it collects about individuals who are prospective, former or current investors. The Fund collects personal information (“Personal Information”) for business purposes, such as to process requests and transactions, to maintain accounts, and to provide customer service. Personal Information is obtained from the following sources:

| • | | Investor applications and other forms, which may include your name(s), address, social security number or tax identification number; |

| • | | Written and electronic correspondence, including telephone contacts; and |

| • | | Transaction history, including information about the Fund’s transactions and balances in your accounts with the Fund or its affiliates or other holdings of the Fund and any affiliation with the Adviser and its subsidiaries. |

The Fund limits access to Personal Information to those employees and service providers who need to know that information for business purposes. Employees are required to maintain and protect the confidentiality of Personal Information. The Adviser, on behalf of the Fund, maintains written policies and procedures that address physical, electronic and administrative safeguards designed to protect Personal Information.

The Fund may share Personal Information described above with the Adviser and its various other affiliates or service providers for business purposes, such as to facilitate the servicing of accounts. The Fund may share the Personal Information described above for business purposes with a non-affiliated third party only as authorized by exceptions to Regulation S-P’s opt-out requirements, for example, if it is necessary to effect, administer, or enforce a transaction that an investor requests or authorizes; (ii) in connection with processing or servicing a financial product or service an investor requests or authorizes; and (iii) in connection with maintaining or servicing the investor’s account with the Fund. The Fund also may disclose Personal Information to regulatory authorities or otherwise as permitted by law. The Fund endeavors to keep its customer files complete and accurate. The Fund should be notified if any information needs to be corrected or updated.

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Shareholder Letter

March 31, 2022 (Unaudited)

Dear Shareholders,

As always, we are grateful for the trust you place in us and greatly appreciate the privilege to invest on your behalf. The twelve month period ended March 31, 2022 (the “Reporting Period”) has been an unusually positive period for real estate and real assets investments. The U.S. economy experienced a historically strong rebound as we saw U.S. real gross domestic product increase at a rate of nearly 6.0% in 2021. The strong economic growth was supported by strong labor markets, consumer spending and private investments.

In the years leading up to the pandemic, the real estate market was fundamentally sound and generally had positive supply and demand balances. These measures were consistent across sectors as demonstrated by low vacancy rates and solid rental growth rates. However, when major economies shut down to combat the pandemic, it placed a severe amount of stress on the demand for space and there was a significant acceleration of existing structural trends in real estate markets. Property sectors including office, retail and hotel sectors experienced strong headwinds, while other sectors such as industrial, life sciences, self-storage and multifamily benefited.

The Fund’s property sector and geographically diverse portfolio of institutional quality assets proved resilient throughout the pandemic, helping to limit downside and maintain weighted average occupancy in the mid-90% range during the Reporting Period. The industrial sector was the strongest performer within the real estate markets, and the VCMIX portfolio benefited from significant appreciation in that sector over the last Reporting Period. U.S. industrial market vacancy rates declined to just over 3%, which is the lowest level on record, and rent growth rose to the highest pace in over 20 years. The multifamily sector was another area that saw significant appreciation over the Reporting Period. In the U.S., multifamily vacancy rates declined to historic lows – nearly 2.0% below pre-pandemic levels. These two sectors were the largest drivers of return in the VCMIX portfolio over the Reporting Period.

While the trends for industrial, multifamily and life sciences were very strong, certain sub-sectors including office, retail and hospitality faced more headwinds during the Reporting Period because of the pandemic. However, we have seen positive trends that we believe will help office and retail recover. Specifically, office vacancy rates declined in the second half of 2021 after rising for six consecutive quarters. On the retail side, leasing activity continued to gain steam in 2021 with net absorption showing the highest numbers since 2017. In addition, in-person shopping increased nearly 20% for retail and food services sales year-over-year.

We have continued to allocate VCMIX capital into funds we believe have the potential to generate attractive risk-adjusted returns by focusing on stable, high-quality cash flows and long-term asset appreciation. As of March 31, 2022, the Fund provided our investors exposure to over $160 billion of high-quality commercial real estate assets spread across over 1,700 distinct investments.

Demand for owning real estate was strong in 2021, and we have continued to witness significant investor appetite for deploying capital into the real estate asset class. 2021 was a record-breaking year for real estate investment sales with over $800 billion in transactions completed, up nearly 90% year-over-year and driven largely by the multifamily and industrial sectors.

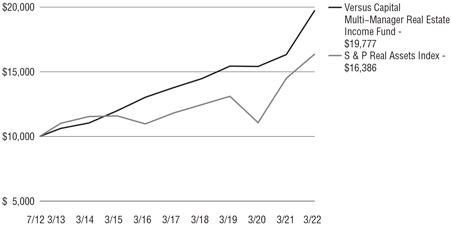

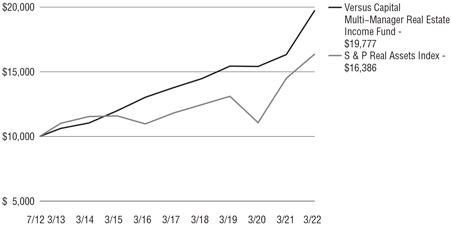

VCMIX concluded its fiscal year March 31, 2022 with record performance for the Fund, generating a 21.04% return over the trailing twelve-month period. Over the medium term through March 31, 2022, the Fund has produced three and five-year annualized returns of 8.56% and 7.48%, respectively. The Fund will reach its ten-year track record in the summer of 2022, and through March 31, 2022 has delivered a since-inception annualized return of 7.26%. The Fund’s inception date is July 9, 2012. By comparison, the S&P Real Assets Index returns over the one-year, annualized three-year, five-year, and since VCMIX inception periods, were 13.03%, 7.71%, 6.73%, and 5.21%, respectively. In our opinion, the Fund has performed admirably relative to its benchmark over multiple periods and produced attractive, consistent risk-adjusted returns.

Performance Disclosure: Quoted performance is net of all fees and expenses. Past performance does not guarantee future results. The performance data quoted represents past performance and future returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost and current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-200-1878.

With a track record approaching ten years and a proven ability to successfully navigate a significant downturn in the economy and financial markets, we think the case for investing in institutional private real estate funds and customized public real estate securities portfolios has continued to strengthen.

In closing, on behalf of myself and our employees, our best wishes to you and your loved ones for good health and safety. We consider it a privilege to invest on your behalf. Thank you for your continued partnership.

Sincerely,

Mark Quam

Chief Executive Officer

Versus Capital Advisors LLC

2

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Fund Performance

March 31, 2022 (Unaudited)

| | | | | | | | | | | | |

Average Annual Total Returns(a) for the periods ended March 31, 2022 | | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Year | | | Since

Inception

(July 9, 2012) | |

Versus Capital Multi-Manager Real Estate Income Fund LLC(b) | | | 21.04% | | | | 7.48% | | | | 7.26% | |

S&P Real Assets Index(c) | | | 13.03% | | | | 6.73% | | | | 5.21% | (d) |

Growth of $10,000 for periods ended March 31, 2022(a),(b)

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund made on July 9, 2012 (inception date of the Fund) for the years indicated. For comparison, the same investment is shown in the indicated index.

| (a) | Past performance is not indicative of future results. Current performance may be lower or higher than performance in historical periods. |

| (b) | Total return is calculated using the net asset value of the Fund on the beginning and ending date of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at the Fund’s net asset value. Returns are not annualized for periods of less than one year. Brokerage commissions that a shareholder may pay are not reflected. Total return does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the repurchase of Fund shares. The Fund’s gross expense ratio as of its Prospectus dated July 29, 2021 was 1.25%. |

| (c) | The index is unmanaged and is not available for direct investment. Its performance does not reflect the expenses associated with the active management of a portfolio. |

| (d) | Represents the average annual return of the index from the Fund’s inception date. |

3

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Fund Performance

March 31, 2022 (Unaudited) (continued)

Definitions & Index Descriptions

S&P Real Assets Index is an unmanaged index designed to measure global property, infrastructure, commodities, and inflation-linked bonds using liquid and investable component indices that track public equities, fixed income, and futures. It is not possible to invest directly in an index.

Cash Flow is remaining profits after collecting all rents and income, paying all operating expenses, and setting aside cash reserves for future repairs.

An investment in the Fund is subject to a high degree of risk. These risks include, but are not limited to, the following: Real estate entails special risks, including tenant default, environmental problems, and adverse changes in local economies. The yield from an underlying investment fund could be significantly reduced if it fails to qualify as a REIT (real estate investment trust) for tax purposes. The Fund is “non-diversified” under the Investment Company Act of 1940. Changes in the market value of a single holding may cause greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended as a complete investment program but instead as a way to help investors diversify into real estate. Diversification does not ensure a profit or guarantee against a loss. A multi-manager strategy involves certain risks. For example, it is possible that some Investment Managers may take similar market positions, thereby interfering with the Fund’s investment goal. The Fund and underlying Investment Managers may borrow as an investment strategy, up to one third of the Fund’s gross asset value. Borrowing presents opportunities to increase the Fund’s return, but potentially increases the losses as well. The Adviser and Investment Managers manage portfolios for themselves and other clients. A conflict of interest between the Fund and these other parties may arise which could disadvantage the Fund. For example, a suitable but limited investment opportunity might be allocated to another client rather than to the Fund. The Fund does not intend to list its Shares on any securities exchange during the offering period, and a secondary market in the Shares is not expected to develop. There is no guarantee that shareholders will be able to sell all of their tendered shares during a quarterly repurchase offer. An investment is not suitable for investors that require liquidity, other than through the Fund’s repurchase policy. You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs.

4

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Shareholders

Versus Capital Multi-Manager Real Estate Income Fund LLC

Opinion on the financial statements

We have audited the accompanying statement of assets and liabilities of Versus Capital Multi-Manager Real Estate Income Fund LLC (the “Fund”), including the portfolio of investments, as of March 31, 2022, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2022, and the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2022, by correspondence with custodian, underlying fund managers and brokers, or by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ GRANT THORNTON LLP

We have served as the Fund’s auditor of one or more investment companies in the Fund’s investment company group since 2011.

Chicago, Illinois

May 27, 2022

5

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Portfolio of Investments – March 31, 2022

| | | | | | | | |

Shares | | | | | Value | |

|

| | Private Investment Funds(a) - 77.2% | |

| | | | Diversified – 77.2% | |

| | 103,618 | | | AEW Core Property (U.S.), LP | | $ | 131,921,616 | |

| | — | | | AEW Value Investors US LP(b)(c)(d) | | | 100,587,444 | |

| | 72,560 | | | Barings European Core Property Fund | | | 99,897,361 | |

| | 122,982,873 | | | CBRE U.S. Core Partners LP | | | 246,519,169 | |

| | 11,725,745 | | | CBRE U.S. Logistics Partners LP | | | 14,871,762 | |

| | 89,172 | | | Clarion Gables Multifamily Trust LP | | | 163,644,402 | |

| | 127,263 | | | Clarion Lion Properties Fund LP | | | 245,688,024 | |

| | 18,326 | | | GI Partners ETS Fund(e) | | | 23,057,812 | |

| | — | | | GWL U.S. Property Fund LP(e)(f) | | | 159,144,867 | |

| | 79,032 | | | Harrison Street Core Property Fund | | | 121,423,998 | |

| | 99,046 | | | Heitman America Real Estate LP | | | 150,355,681 | |

| | 144,358 | | | Heitman Core Real Estate Debt Income Trust LP(e) | | | 145,139,154 | |

| | 1,060 | | | Invesco Core Real Estate USA LP | | | 240,625,494 | |

| | 1,049,052 | | | Invesco Real Estate Asia Fund(e) | | | 152,039,042 | |

| | | | LaSalle Property Fund LP | | | | |

| | 19,839 | | | Class A Shares | | | 41,441,777 | |

| | 1,422 | | | Class B Shares | | | 2,970,422 | |

| | 969,603 | | | RREEF America REIT II, Inc. | | | 153,304,977 | |

| | 34,640 | | | TA Realty Core Property Fund, LP | | | 53,556,908 | |

| | 2,610 | | | Trumbull Property Fund LP | | | 30,393,457 | |

| | 2,801 | | | Trumbull Property Income Fund, LP | | | 39,931,938 | |

| | — | | | US Government Building Open-End Feeder, LP(g) | | | 72,180,112 | |

| | — | | | USGBF Alpha Feeder LP(d)(h) | | | 18,522,000 | |

| | 54,495 | | | Walton Street Real Estate Core-Plus Fund, LP | | | 72,507,706 | |

| | | | | | | | |

| | | | Total Private Investment Funds | | | 2,479,725,123 | |

| | | | | | | | |

| | | | (Cost $2,012,002,685) | | | | |

| |

| | Rights - 0.0% | | | | |

| | | | Real Estate Operation/Development – 0.0% | |

| | 250,299 | | | Lendlease Rights, (i) | | | 9,739 | |

| | | | | | | | |

| | | | Total Rights | | | 9,739 | |

| | | | | | | | |

| | | | (Cost $0) | | | | |

|

| | Common Stocks - 12.1% | |

| | | | Apartments/Single Family Residential – 2.2% | |

| | 308,972 | | | American Homes 4 Rent, Class A Shares, REIT | | | 12,368,149 | |

| | 159,949 | | | Apartment Income REIT Corp. | | | 8,550,874 | |

| | 48,690 | | | AvalonBay Communities, Inc., REIT | | | 12,093,135 | |

| | 23,782 | | | Camden Property Trust, REIT | | | 3,952,568 | |

| | 488 | | | Daiwa House REIT Investment Corp. (Japan) | | | 1,315,652 | |

| | 101,774 | | | Equity Residential, REIT | | | 9,151,518 | |

| | 11,795 | | | Essex Property Trust, Inc., REIT | | | 4,074,937 | |

| | 229,230 | | | Independence Realty Trust, Inc., REIT | | | 6,060,841 | |

| | 267,536 | | | Invitation Homes, Inc., REIT | | | 10,749,597 | |

| | 80,036 | | | STORE Capital Corp., REIT | | | 2,339,452 | |

| | | | | | | | |

| | | | | | 70,656,723 | |

| | | | | | | | |

| | | | Diversified – 2.4% | |

| | 375 | | | Activia Properties, Inc., REIT (Japan) | | | 1,307,333 | |

| | 12,496 | | | American Tower Corp., REIT | | | 3,139,245 | |

| | 175,975 | | | Arena, REIT (Australia) | | | 643,950 | |

| | 86,457 | | | Broadstone Net Lease, Inc., REIT | | | 1,883,033 | |

| | 61,769 | | | Charter Hall Group, REIT (Australia) | | | 750,639 | |

| | 467,080 | | | Cromwell European Real Estate Investment Trust, REIT (Singapore) | | | 1,178,093 | |

| | 1,786,480 | | | Digital Core REIT Management Pte, Ltd. (Singapore)(i) | | | 1,982,993 | |

| | 34,658 | | | Digital Realty Trust, Inc., REIT | | | 4,914,504 | |

| | 18,950 | | | DR Horton, Inc. | | | 1,411,965 | |

| | 26,493 | | | Equinix, Inc., REIT | | | 19,647,739 | |

| | 220,944 | | | ESR Kendall Square Co., Ltd., REIT (South Korea) | | | 1,271,749 | |

| | | | | | | | |

Shares | | | | | Value | |

| | |

| | | | Diversified - (continued) | | | | |

| | 93,534 | | | Fabege AB (Sweden) | | $ | 1,381,193 | |

| | 11,350 | | | Gecina SA, REIT (France) | | | 1,430,421 | |

| | 213,776 | | | Ingenia Communities Group, REIT (Australia) | | | 807,047 | |

| | 81,819 | | | InvenTrust Properties Corp., REIT | | | 2,518,389 | |

| | 792,425 | | | Irongate Group, REIT (Australia) | | | 1,130,465 | |

| | 1,244,419 | | | Life Science PLC, REIT (United Kingdom)(i) | | | 1,634,731 | |

| | 220,444 | | | LXP Industrial Trust, REIT | | | 3,460,971 | |

| | 208,978 | | | Merlin Properties Socimi SA, REIT (Spain) | | | 2,443,200 | |

| | 32,391 | | | Minto Apartment Real Estate Investment Trust, 144A, REIT (Canada) | | | 556,281 | |

| | 162,800 | | | Mitsubishi Estate Co., Ltd. (Japan) | | | 2,424,167 | |

| | 626 | | | Mori Hills REIT Investment Corp. (Japan) | | | 775,472 | |

| | 37,777 | | | NSI NV, REIT (Netherlands) | | | 1,659,369 | |

| | 21,643 | | | Persimmon, PLC (United Kingdom) | | | 606,900 | |

| | 978,198 | | | Qualitas, Ltd. (Australia)(i) | | | 1,660,982 | |

| | 3,338 | | | Sekisui House Reit, Inc., REIT (Japan) | | | 2,208,366 | |

| | 170,722 | | | VICI Properties, Inc., REIT | | | 4,858,748 | |

| | 133,683 | | | Vonovia SE (Germany) | | | 6,231,021 | |

| | 38,637 | | | Weyerhaeuser Co., REIT | | | 1,464,342 | |

| | 64,673 | | | Wihlborgs Fastigheter AB (Sweden) | | | 1,352,861 | |

| | | | | | | | |

| | | | | | 76,736,169 | |

| | | | | | | | |

| | | | Health Care – 1.0% | |

| | 64,120 | | | Healthcare Trust of America, Inc., Class A Shares, REIT | | | 2,009,521 | |

| | 164,296 | | | HealthCo, REIT (Australia) | | | 237,286 | |

| | 140,037 | | | Healthpeak Properties, Inc., REIT | | | 4,807,470 | |

| | 156,094 | | | Medical Properties Trust, Inc., REIT | | | 3,299,827 | |

| | 263,659 | | | Sabra Health Care REIT, Inc. | | | 3,925,883 | |

| | 209,128 | | | Ventas, Inc., REIT | | | 12,915,745 | |

| | 67,260 | | | Welltower, Inc., REIT | | | 6,466,376 | |

| | | | | | | | |

| | | | | | 33,662,108 | |

| | | | | | | | |

| | | | Hotels – 0.6% | |

| | 4,430 | | | Choice Hotels International, Inc. | | | 627,997 | |

| | 153,907 | | | Host Hotels & Resorts, Inc., REIT | | | 2,990,413 | |

| | 136,103 | | | MGM Growth Properties LLC, Class A Shares, REIT | | | 5,267,186 | |

| | 94,279 | | | Park Hotels & Resorts, Inc., REIT | | | 1,841,269 | |

| | 228,387 | | | Sunstone Hotel Investors, Inc., REIT(i) | | | 2,690,399 | |

| | 30,307 | | | Travel + Leisure Co. | | | 1,755,987 | |

| | 147,755 | | | Xenia Hotels & Resorts, Inc., REIT(i) | | | 2,850,194 | |

| | | | | | | | |

| | | | | | 18,023,445 | |

| | | | | | | | |

| | | | Office Properties – 1.3% | |

| | 71,087 | | | Alexandria Real Estate Equities, Inc., REIT | | | 14,306,259 | |

| | 37,600 | | | Allied Properties Real Estate Investment Trust, REIT (Canada) | | | 1,402,462 | |

| | 18,559 | | | Boston Properties, Inc., REIT | | | 2,390,399 | |

| | 261,555 | | | Brandywine Realty Trust, REIT | | | 3,698,388 | |

| | 669,900 | | | Capitaland Investment, Ltd. (Singapore)(i) | | | 1,962,857 | |

| | 490,537 | | | Centuria Capital Group (Australia) | | | 1,045,739 | |

| | 106 | | | Daiwa Office Investment Corp., REIT (Japan) | | | 658,039 | |

| | 226,079 | | | Dexus, REIT (Australia) | | | 1,845,409 | |

| | 108,543 | | | Douglas Emmett, Inc., REIT | | | 3,627,507 | |

| | 114,728 | | | Hudson Pacific Properties, Inc., REIT | | | 3,183,702 | |

| | 92,748 | | | Inmobiliaria Colonial Socimi SA, REIT (Spain) | | | 845,480 | |

| | 80,107 | | | Kilroy Realty Corp., REIT | | | 6,121,777 | |

| | | | | | | | |

| | | | | | 41,088,018 | |

| | | | | | | | |

| | | | Real Estate Operation/Development – 0.5% | |

| | 223,455 | | | Aroundtown SA (Luxembourg) | | | 1,276,905 | |

| | 78,509 | | | Castellum AB (Sweden) | | | 1,938,367 | |

| | 99,610 | | | Echo Investment SA (Poland) | | | 83,577 | |

| | 381,228 | | | Hongkong Land Holdings, Ltd. (Hong Kong) | | | 1,862,643 | |

See accompanying notes to financial statements.

6

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Portfolio of Investments – March 31, 2022 (continued)

| | | | | | | | |

Shares | | | | | Value | |

| |

| | | | Real Estate Operation/Development - (continued) | |

| | 621,100 | | | Midea Real Estate Holding, Ltd., 144A (China) | | $ | 1,237,965 | |

| | 217,000 | | | Mitsui Fudosan Co., Ltd. (Japan) | | | 4,644,304 | |

| | 663,425 | | | New World Development Co., Ltd. (Hong Kong) | | | 2,691,614 | |

| | 1,599,791 | | | RAM Essential Services Property Fund (Australia) | | | 1,116,038 | |

| | 622,500 | | | Zhongliang Holdings Group Co., Ltd. (China) | | | 171,652 | |

| | | | | | | | |

| | | | | | 15,023,065 | |

| | | | | | | | |

| | | | Regional Malls – 0.4% | |

| | 41,617 | | | Klepierre SA, REIT (France) | | | 1,108,015 | |

| | 232,676 | | | Macerich Co. (The), REIT | | | 3,639,053 | |

| | 66,297 | | | Simon Property Group, Inc., REIT | | | 8,722,033 | |

| | | | | | | | |

| | | | | | 13,469,101 | |

| | | | | | | | |

| | | | Residential – 0.3% | |

| | 30,997 | | | Equity LifeStyle Properties, Inc., REIT | | | 2,370,651 | |

| | 38,989 | | | Sun Communities, Inc., REIT | | | 6,834,382 | |

| | | | | | | | |

| | | | | | 9,205,033 | |

| | | | | | | | |

| | | | Shopping Centers – 0.4% | |

| | 46,940 | | | Brixmor Property Group, Inc., REIT | | | 1,211,522 | |

| | 990,100 | | | CapitaLand Integrated Commercial Trust, REIT (Singapore) | | | 1,637,962 | |

| | 45,541 | | | Federal Realty Investment Trust, REIT | | | 5,559,190 | |

| | 310 | | | Japan Metropolitan Fund Invest, REIT (Japan) | | | 261,579 | |

| | 234,099 | | | Kite Realty Group Trust, REIT | | | 5,330,434 | |

| | 863,100 | | | Lendlease Global Commercial, REIT (Singapore) | | | 492,087 | |

| | | | | | | | |

| | | | | | 14,492,774 | |

| | | | | | | | |

| | | | Storage – 0.9% | |

| | 67,858 | | | Big Yellow Group, PLC, REIT (United Kingdom) | | | 1,368,028 | |

| | 201,446 | | | CubeSmart, REIT | | | 10,481,235 | |

| | 17,006 | | | Extra Space Storage, Inc., REIT | | | 3,496,434 | |

| | 31,897 | | | Public Storage, REIT | | | 12,448,761 | |

| | 150,309 | | | Safestore Holdings, PLC, REIT (United Kingdom) | | | 2,639,322 | |

| | | | | | | | |

| | | | | | 30,433,780 | |

| | | | | | | | |

| | | | Warehouse/Industrial – 2.1% | |

| | 438,306 | | | Centuria Industrial, REIT (Australia) | | | 1,253,372 | |

| | 890 | | | CRE Logistics, Inc., REIT (Japan) | | | 1,513,221 | |

| | 315,500 | | | Dream Industrial Real Estate Investment Trust, REIT (Canada) | | | 4,073,247 | |

| | 2,618,907 | | | ESR, REIT (Singapore) | | | 829,641 | |

| | 112,497 | | | First Industrial Realty Trust, Inc., REIT | | | 6,964,689 | |

| | 71,709 | | | Goodman Group, REIT (Australia) | | | 1,218,803 | |

| | 888 | | | Industrial & Infrastructure Fund Investment Corp., REIT (Japan) | | | 1,345,382 | |

| | 185,861 | | | Industrial Logistics Properties Trust, REIT | | | 4,213,469 | |

| | 310 | | | Mitsubishi Estate Logistics Investment Corp., REIT (Japan) | | | 1,206,046 | |

| | 282,600 | | | Nexus Industrial, REIT (Canada) | | | 2,886,695 | |

| | 76,573 | | | Plymouth Industrial, Inc., REIT | | | 2,075,128 | |

| | 162,769 | | | Prologis, Inc., REIT | | | 26,283,938 | |

| | 45,925 | | | Rexford Industrial Realty, Inc., REIT | | | 3,425,546 | |

| | 203,510 | | | Segro, PLC, REIT (United Kingdom) | | | 3,577,513 | |

| | 3,080,000 | | | SF Real Estate Investment Trust, REIT (Virgin Islands (British)) | | | 1,279,963 | |

| | 187,456 | | | Summit Industrial Income, REIT (Canada) | | | 3,301,829 | |

| | 840,209 | | | Tritax Big Box REIT, PLC (United Kingdom) | | | 2,660,369 | |

| | | | | | | | |

| | | | | | 68,108,851 | |

| | | | | | | | |

| | | | Total Common Stocks | | | 390,899,067 | |

| | | | | | | | |

| | | | (Cost $356,925,202) | | | | |

| | | | | | | | |

Shares | | | | | Value | |

|

| | Preferred Stocks - 1.3% | |

| | | | Apartments/Single Family Residential – 0.0% | |

| | 765 | | | Agree Realty Corp., REIT, Series A, 4.25% | | $ | 15,208 | |

| | | | American Homes 4 Rent, REIT, | | | | |

| | 18,850 | | | Series G, 5.88% | | | 472,758 | |

| | 6,009 | | | Series H, 6.25% | | | 155,092 | |

| | 5,616 | | | Mid-America Apartment Communities, Inc., REIT, Series I, 8.50% | | | 341,341 | |

| | 3,075 | | | Spirit Realty Capital, Inc., REIT, Series A, 6.00% | | | 77,367 | |

| | | | | | | | |

| | | | | | 1,061,766 | |

| | | | | | | | |

| | | | Diversified – 0.2% | |

| | 20,730 | | | Armada Hoffler Properties, Inc., REIT, Series A, 6.75% | | | 538,565 | |

| | | | Digital Realty Trust, Inc., REIT, | | | | |

| | 22,590 | | | Series J, 5.25% | | | 562,717 | |

| | 27,925 | | | Series K, 5.85% | | | 726,888 | |

| | 20,215 | | | Series L, 5.20% | | | 503,354 | |

| | | | DigitalBridge Group, Inc., REIT, | | | | |

| | 11,725 | | | Series I, 7.15% | | | 291,835 | |

| | 18,525 | | | Series J, 7.13% | | | 457,938 | |

| | | | PS Business Parks, Inc., REIT, | | | | |

| | 26,370 | | | Series X, 5.25% | | | 665,315 | |

| | 23,401 | | | Series Z, 4.88% | | | 549,689 | |

| | | | UMH Properties, Inc., REIT, | | | | |

| | 14,767 | | | Series C, 6.75% | | | 374,934 | |

| | 5,710 | | | Series D, 6.38% | | | 145,891 | |

| | | | | | | | |

| | | | | | 4,817,126 | |

| | | | | | | | |

| | | | Health Care – 0.0% | |

| | | | Diversified Healthcare Trust, REIT, | | | | |

| | 9,960 | | | 6.25% | | | 197,606 | |

| | 3,180 | | | 5.63% | | | 57,590 | |

| | | | | | | | |

| | | | | | 255,196 | |

| | | | | | | | |

| | | | Hotels – 0.1% | |

| | 61,165 | | | Chatham Lodging Trust, REIT, Series A, 6.63% | | | 1,490,591 | |

| | 16,720 | | | DiamondRock Hospitality Co., REIT, 8.25% | | | 450,604 | |

| | | | Hersha Hospitality Trust, REIT, | | | | |

| | 4,575 | | | Series C, 6.88% | | | 106,781 | |

| | 2,490 | | | Series D, 6.50% | | | 55,154 | |

| | | | Pebblebrook Hotel Trust, REIT, | | | | |

| | 1,935 | | | Series F, 6.30% | | | 46,769 | |

| | 23,875 | | | Series G, 6.38% | | | 589,712 | |

| | 34,265 | | | Series H, 5.70% | | | 777,130 | |

| | | | Sunstone Hotel Investors, Inc., REIT, | | | | |

| | 12,100 | | | Series H, 6.13% | | | 291,731 | |

| | 18,855 | | | Series I, 5.70% | | | 430,460 | |

| | | | | | | | |

| | | | | | 4,238,932 | |

| | | | | | | | |

| | | | Office Properties – 0.2% | |

| | 103 | | | Highwoods Properties, Inc., REIT, Series A, 8.63% | | | 133,900 | |

| | 51,505 | | | Hudson Pacific Properties, Inc., REIT, Series C, 4.75% | | | 1,108,903 | |

| | 15,810 | | | Office Properties Income Trust, REIT, 6.38% | | | 392,720 | |

| | 120,531 | | | SL Green Realty Corp., REIT, Series I, 6.50% | | | 3,040,997 | |

| | | | Vornado Realty Trust, REIT, | | | | |

| | 64,748 | | | Series M, 5.25% | | | 1,498,269 | |

| | 22,130 | | | Series N, 5.25% | | | 514,080 | |

| | 60,320 | | | Series O, 4.45% | | | 1,208,209 | |

| | | | | | | | |

| | | | | | 7,897,078 | |

| | | | | | | | |

| | | | Shopping Centers – 0.3% | |

| | 80,969 | | | Kimco Realty Corp., REIT, Series M, 5.25% | | | 2,018,557 | |

| | 24,300 | | | RPT Realty, REIT, Series D, 7.25% | | | 1,440,711 | |

See accompanying notes to financial statements.

7

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Portfolio of Investments – March 31, 2022 (continued)

| | | | | | | | |

Shares | | | | | Value | |

| | |

| | | | Shopping Centers - (continued) | | | | |

| | | | Saul Centers, Inc., REIT, | | | | |

| | 4,995 | | | Series D, 6.13% | | $ | 124,825 | |

| | 52,000 | | | Series E, 6.00% | | | 1,307,727 | |

| | 55,507 | | | SITE Centers Corp., REIT, Series A, 6.38% | | | 1,388,230 | |

| | | | Urstadt Biddle Properties, Inc., REIT, | | | | |

| | 63,325 | | | Series H, 6.25% | | | 1,586,925 | |

| | 39,420 | | | Series K, 5.88% | | | 989,836 | |

| | | | | | | | |

| | | | | | | 8,856,811 | |

| | | | | | | | |

| | | | Storage – 0.4% | | | | |

| | | | Public Storage, REIT, | | | | |

| | 3,375 | | | Series F, 5.15% | | | 85,219 | |

| | 32,680 | | | Series G, 5.05% | | | 819,288 | |

| | 240,998 | | | Series H, 5.60% | | | 6,302,098 | |

| | 50,705 | | | Series I, 4.88% | | | 1,235,681 | |

| | 9,495 | | | Series J, 4.70% | | | 221,328 | |

| | 19,500 | | | Series K, 4.75% | | | 477,360 | |

| | 42,470 | | | Series L, 4.63% | | | 988,702 | |

| | 38,190 | | | Series M, 4.13% | | | 831,014 | |

| | 2,345 | | | Series N, 3.88% | | | 48,026 | |

| | 35,070 | | | Series O, 3.90% | | | 703,504 | |

| | 46,600 | | | Series P, 4.00% | | | 954,834 | |

| | 14,850 | | | Series R, 4.00% | | | 306,355 | |

| | 26,340 | | | Series S, 4.10% | | | 547,082 | |

| | | | | | | | |

| | | | | | | 13,520,491 | |

| | | | | | | | |

| | | | Warehouse/Industrial – 0.1% | | | | |

| | | | Rexford Industrial Realty, Inc., REIT, | | | | |

| | 14,948 | | | Series B, 5.88% | | | 375,942 | |

| | 82,255 | | | Series C, 5.63% | | | 2,059,665 | |

| | | | | | | | |

| | | | | | | 2,435,607 | |

| | | | | | | | |

| | | | Total Preferred Stocks | | | 43,083,007 | |

| | | | | | | | |

| | | | (Cost $45,624,095) | | | | |

| | |

Par | | | | | | |

| |

| | Commercial Mortgage Backed Securities - 3.6% | | | | |

| | | | BANK, 144A | | | | |

| $ | 23,841,000 | | | 1.05%, 10/17/2052 Ser 2019-BN21, Class XF(j) | | | 1,388,226 | |

| | 9,170,167 | | | 1.12%, 12/15/2052 Ser 2019-BN23, Class XD(j) | | | 600,466 | |

| | 9,188,000 | | | 0.71%, 12/15/2053 Ser 2020-BN30, Class XD(j) | | | 410,426 | |

| | 1,600,000 | | | 2.50%, 12/15/2053 Ser 2020-BN30, Class D(j) | | | 1,282,751 | |

| | 1,160,500 | | | 2.50%, 12/15/2053 Ser 2020-BN30, Class E(j) | | | 887,885 | |

| | 8,575,000 | | | 1.56%, 11/15/2054 Ser 2017-BNK9, Class XD(j) | | | 597,947 | |

| | 1,600,000 | | | 3.08%, 6/15/2060 Ser 2017-BNK5, Class D(j) | | | 1,355,915 | |

| | 3,000,000 | | | 4.38%, 6/15/2060 Ser 2017-BNK5, Class E(j) | | | 2,242,222 | |

| | 4,000,000 | | | 1.50%, 11/15/2062 Ser 2019-BN22, Class XF(j) | | | 343,807 | |

| | 3,500,000 | | | 2.08%, 11/15/2062 Ser 2019-BN22, Class F(j) | | | 2,245,064 | |

| | 9,703,500 | | | 1.03%, 1/15/2063 Ser 2020-BN25, Class XD(j) | | | 587,273 | |

| | 6,000,000 | | | 1.50%, 1/15/2063 Ser 2020-BN25, Class XF | | | 522,691 | |

| | 6,000,000 | | | 2.03%, 1/15/2063 Ser 2020-BN25, Class F(j) | | | 3,408,077 | |

| | 1,250,000 | | | 2.50%, 1/15/2063 Ser 2020-BN25, Class E | | | 947,787 | |

| | 2,000,000 | | | 2.25%, 6/15/2063 Ser 2021-BN34, Class F | | | 1,254,096 | |

| | 7,000,000 | | | 1.01%, 5/15/2064 Ser 2021-BN33, Class XD(j) | | | 493,179 | |

| | 12,250,000 | | | BBCMS Mortgage Trust, 1.55%, 10/15/2053 Ser 2020-C8, Class XD, 144A(j) | | | 1,287,122 | |

| | | | BENCHMARK Mortgage Trust, | | | | |

| | 12,667,000 | | | 1.24%, 1/15/2051 Ser 2018-B1, Class XE, 144A(j) | | | 749,000 | |

| | 5,520,000 | | | 1.50%, 4/10/2051 Ser 2018-B3, Class XD, 144A(j) | | | 412,443 | |

| | 1,719,500 | | | 3.26%, 10/10/2051 Ser 2018-B6, Class D, 144A(j) | | | 1,447,112 | |

| | 3,800,000 | | | 1.21%, 2/15/2053 Ser 2020-B16, Class XD, 144A(j) | | | 279,341 | |

| | 1,000,000 | | | 2.50%, 2/15/2053 Ser 2020-B16, Class D, 144A | | | 786,778 | |

| | | | | | | | |

Par | | | | | Value | |

| |

| | Commercial Mortgage Backed Securities (continued) | | | | |

| $ | 1,500,000 | | | 2.50%, 2/15/2053 Ser 2020-B16, Class E, 144A | | $ | 1,125,063 | |

| | 10,000,000 | | | 1.53%, 1/15/2054 Ser 2020-B22, Class XD, 144A(j) | | | 1,034,074 | |

| | 3,950,000 | | | 2.00%, 1/15/2054 Ser 2020-B22, Class D, 144A | | | 2,943,043 | |

| | 3,500,000 | | | 2.00%, 2/15/2054 Ser 2021-B23, Class E, 144A | | | 2,398,172 | |

| | 38,326,798 | | | 1.23%, 4/15/2054 Ser 2021-B25, Class XA(j) | | | 2,899,898 | |

| | 18,000,000 | | | 1.68%, 4/15/2054 Ser 2021-B25, Class XD, 144A(j) | | | 2,112,655 | |

| | 13,000,000 | | | 1.48%, 6/15/2054 Ser 2021-B26, Class XD, 144A(j) | | | 1,387,626 | |

| | 57,358,000 | | | 1.49%, 8/15/2054 Ser 2021-B28, Class XD, 144A(j) | | | 6,093,129 | |

| | 6,500,000 | | | 1.14%, 8/15/2057 Ser 2019-B13, Class XF, 144A(j) | | | 378,838 | |

| | 4,000,000 | | | 1.64%, 8/15/2057 Ser 2019-B13, Class XD, 144A(j) | | | 377,141 | |

| | 6,500,000 | | | 3.00%, 8/15/2057 Ser 2019-B13, Class F, 144A | | | 4,125,116 | |

| | 2,500,000 | | | 3.78%, 3/15/2062 Ser 2019-B10, Class F, 144A(j) | | | 1,452,544 | |

| | 2,750,000 | | | CD Mortgage Trust, 3.26%, 8/15/2051 Ser 2018-CD7, Class D, 144A(j) | | | 2,360,568 | |

| | 4,500,000 | | | CGMS Commercial Mortgage Trust, 3.00%, 8/15/2050 Ser 2017-B1, Class D, 144A | | | 3,771,956 | |

| | | | Citigroup Commercial Mortgage Trust, 144A | | | | |

| | 1,000,000 | | | 5.35%, 9/10/2046 Ser 2013-GC15, Class D(j) | | | 969,079 | |

| | 1,000,000 | | | 3.34%, 6/10/2051 Ser 2018-C5, Class D(j) | | | 833,217 | |

| | 5,000,000 | | | 0.74%, 11/10/2052 Ser 2019-GC43, Class XF(j) | | | 191,466 | |

| | 3,750,000 | | | 0.74%, 11/10/2052 Ser 2019-GC43, Class XG(j) | | | 142,106 | |

| | 3,750,000 | | | 3.00%, 11/10/2052 Ser 2019-GC43, Class G | | | 2,237,630 | |

| | 2,800,000 | | | 3.00%, 8/10/2056 Ser 2019-GC41, Class F | | | 1,746,720 | |

| | | | Comm Mortgage Trust, | | | | |

| | 1,094,000 | | | 5.45%, 5/15/2045 Ser 2012-CR1, Class C(j) | | | 1,084,126 | |

| | 1,000,000 | | | 5.45%, 5/15/2045 Ser 2012-CR1, Class D, 144A(j) | | | 918,811 | |

| | 2,500,000 | | | 4.46%, 12/10/2045 Ser 2012-CR5, Class F, 144A(j) | | | 1,993,882 | |

| | 2,165,000 | | | 4.46%, 12/10/2045 Ser 2012-CR5, Class E, 144A(j) | | | 2,029,508 | |

| | 1,146,500 | | | 4.43%, 1/10/2046 Ser 2013-LC6, Class D, 144A(j) | | | 1,125,844 | |

| | 3,250,000 | | | 4.22%, 3/10/2046 Ser 2013-CR6, Class E, 144A(j) | | | 2,918,035 | |

| | 2,600,000 | | | 5.01%, 5/10/2047 Ser 2014-CR17, Class D, 144A(j) | | | 2,345,576 | |

| | 1,500,000 | | | 3.50%, 9/10/2047 Ser 2014-UBS5, Class D, 144A | | | 1,267,017 | |

| | 2,730,000 | | | 1.14%, 8/15/2057 Ser 2019-GC44, Class XD, 144A(j) | | | 186,872 | |

| | 3,980,500 | | | CSAIL Commercial Mortgage Trust, 2.15%, 3/15/2052 Ser 2019-C15, Class XD, 144A(j) | | | 445,642 | |

| | | | Freddie Mac Multifamily Structured Pass Through Certificates, | | | | |

| | 10,500,000 | | | 2.57%, 11/25/2047 Ser K740, Class X3(j) | | | 1,217,793 | |

| | 10,000,000 | | | 2.72%, 2/25/2049 Ser K123, Class X3(j) | | | 1,821,291 | |

| | 6,880,000 | | | 2.53%, 3/25/2049 Ser K741, Class X3(j) | | | 811,818 | |

| | 4,750,000 | | | 3.06%, 6/25/2049 Ser K743, Class X3(j) | | | 722,639 | |

| | | | GS Mortgage Securities Trust, | | | | |

| | 4,463,000 | | | 5.64%, 8/10/2043 Ser 2010-C1, Class C, 144A(j) | | | 4,137,628 | |

| | 2,500,000 | | | 5.51%, 5/10/2045 Ser 2012-GCJ7, Class D, 144A(j) | | | 2,425,045 | |

| | 2,000,000 | | | 4.89%, 8/10/2046 Ser 2013-GC14, Class F, 144A(j) | | | 1,504,232 | |

| | 1,250,000 | | | 4.89%, 8/10/2046 Ser 2013-GC14, Class D, 144A(j) | | | 1,197,755 | |

| | 3,500,000 | | | 5.16%, 4/10/2047 Ser 2014-GC20, Class D, 144A(j) | | | 2,039,472 | |

| | 3,600,600 | | | 4.68%, 11/10/2047 Ser 2014-GC26, Class C(j) | | | 3,359,808 | |

| | 4,249,000 | | | 2.57%, 5/12/2053 Ser 2020-GC47, Class F, 144A(j) | | | 2,929,149 | |

| | 1,500,000 | | | 3.57%, 5/12/2053 Ser 2020-GC47, Class D, 144A(j) | | | 1,329,904 | |

| | | | JPMBB Commercial Mortgage Securities Trust, | | | | |

| | 1,500,000 | | | 4.70%, 8/15/2046 Ser 2013-C14, Class C(j) | | | 1,430,093 | |

| | 1,425,000 | | | 4.81%, 4/15/2047 Ser 2014-C19, Class D, 144A(j) | | | 1,373,275 | |

| | 2,525,000 | | | 4.03%, 11/15/2047 Ser 2014-C24, Class D, 144A(j) | | | 1,799,181 | |

| | | | Morgan Stanley Bank of America Merrill Lynch Trust, | | | | |

| | 1,250,000 | | | 4.91%, 6/15/2047 Ser 2014-C16, Class D, 144A(j) | | | 949,296 | |

| | 18,969,435 | | | 1.42%, 5/15/2050 Ser 2017-C33, Class XA(j) | | | 906,637 | |

| | | | Morgan Stanley Capital I Trust, 144A | | | | |

| | 1,414,000 | | | 3.00%, 6/15/2052 Ser 2019-H6, Class D | | | 1,173,802 | |

See accompanying notes to financial statements.

8

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Portfolio of Investments – March 31, 2022 (continued)

| | | | | | | | |

Par | | | | | Value | |

|

| | Commercial Mortgage Backed Securities (continued) | |

| $ | 2,629,600 | | | 2.50%, 5/15/2054 Ser 2021-L5, Class F | | $ | 1,688,637 | |

| | 12,377,454 | | | SG Commercial Mortgage Securities Trust, 2.06%, 10/10/2048 Ser 2016-C5, Class XA(j) | | | 666,093 | |

| | 3,350,000 | | | SREIT Trust L + 0.73%, 1.13%, 11/15/2038 Ser 2021-MFP, Class A, 144A(k) | | | 3,284,948 | |

| | | | UBS-Barclays Commercial Mortgage Trust, 144A | | | | |

| | 21,171,160 | | | 1.71%, 12/10/2045 Ser 2012-C4, Class XA(j) | | | 74,395 | |

| | 2,000,000 | | | 5.22%, 8/10/2049 Ser 2012-C3, Class D(j) | | | 2,000,208 | |

| | | | | | | | |

| | | | Total Commercial Mortgage Backed Securities | | | 115,268,061 | |

| | | | | | | | |

| | | | (Cost $126,063,500) | | | | |

| | |

Shares | | | | | | |

| |

| | Short-Term Investment - 4.6% | | | | |

| | 146,857,313 | | | Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio, Institutional Share Class, 0.18% | | | 146,857,313 | |

| | | | | | | | |

| | | | (Cost $146,857,313) | | | | |

| | | | Total Investments - 98.8% | | | 3,175,842,310 | |

| | | | | | | | |

| | | | (Cost $2,687,472,795) | | | | |

| | | | Other Assets - 1.2% | | | 37,653,094 | |

| | | | | | | | |

| | | | Net Assets - 100.0% | | $ | 3,213,495,404 | |

| | | | | | | | |

| (a) | Restricted Securities. |

| (b) | Partnership is not designated in units. The Fund owns approximately 28.4% of this Fund. |

| (d) | The Fund owns more than 25% of the Private Investment Fund, but has contractually limited its voting interests to less than 5% of total voting interests. |

| (e) | The Fund owns more than 5.0% of the Private Investment Fund, but has contractually limited its voting interests to less than 5.0% of total voting interests. |

| (f) | Partnership is not designated in units. The Fund owns approximately 15.9% of this Fund. |

| (g) | Partnership is not designated in units. The Fund owns approximately 2.7% of this Fund. |

| (h) | Partnership is not designated in units. The Fund owns approximately 32.3% of this Fund. |

| (i) | Non-income producing security. |

| (j) | Variable rate security. The coupon is based on an underlying pool of mortgages. The rate reported is the rate in effect at period end. |

| (k) | Variable rate security. Represents the current interest rate for a variable or increasing rate security, determined as [Referenced Rate + Basis-point spread]. |

Portfolio Abbreviations:

144A - Rule 144A Security

L - 30 Day London Inter-bank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnership

PLC - Public Limited Company

REIT - Real Estate Investment Trust

| | | | |

| Industry | | % of Net Assets | |

| |

Diversified | | | 79.8 | % |

Short-Term Investment | | | 4.6 | % |

Commercial Mortgage Backed Securities | | | 3.6 | % |

Apartments/Single Family Residential | | | 2.2 | % |

Warehouse/Industrial | | | 2.2 | % |

Office Properties | | | 1.5 | % |

Storage | | | 1.3 | % |

Health Care | | | 1.0 | % |

Shopping Centers | | | 0.7 | % |

Hotels | | | 0.7 | % |

Real Estate Operation/Development | | | 0.5 | % |

Regional Malls | | | 0.4 | % |

Residential | | | 0.3 | % |

Rights | | | 0.0 | % |

Other Assets net of Liabilities | | | 1.2 | % |

| | | | |

Total | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

9

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Statement of Assets and Liabilities

March 31, 2022

| | | | |

ASSETS: | | | | |

Investments: | | | | |

Non-affiliated investment in securities at cost | | $ | 2,612,472,795 | |

Non-affiliated investment net unrealized appreciation | | | 462,782,071 | |

| | | | |

Total non-affiliated investment in securities, at fair value | | | 3,075,254,866 | |

| | | | |

Affiliated investment in securities at cost | | | 75,000,000 | |

Affiliated net unrealized appreciation | | | 25,587,444 | |

| | | | |

Total affiliated investment in securities, at fair value | | | 100,587,444 | |

| | | | |

Cash | | | 15,604 | |

Foreign Currency (Cost $71,986) | | | 71,866 | |

Receivables for: | | | | |

Dividends and interest | | | 18,361,891 | |

Fund shares sold | | | 7,260,114 | |

Reclaims | | | 102,725 | |

Investments sold | | | 23,602,640 | |

| | | | |

Total receivables | | | 49,327,370 | |

Prepaid expenses | | | 67,926 | |

| | | | |

Total Assets | | | 3,225,325,076 | |

| | | | |

LIABILITIES: | | | | |

Payables for: | | | | |

Adviser fees | | | 7,767,133 | |

Investments purchased | | | 3,528,721 | |

Administrative fees | | | 147,235 | |

Professional fees | | | 127,963 | |

Transfer agent fees | | | 49,070 | |

Custodian fees | | | 24,375 | |

Accrued expenses and other liabilities | | | 185,175 | |

| | | | |

Total Liabilities(a) | | | 11,829,672 | |

| | | | |

| |

NET ASSETS | | $ | 3,213,495,404 | |

| | | | |

NET ASSETS consist of: | | | | |

Paid-in capital | | $ | 2,661,575,426 | |

Total distributable earnings | | | 551,919,978 | |

| | | | |

TOTAL NET ASSETS | | $ | 3,213,495,404 | |

| | | | |

| |

Net Assets | | $ | 3,213,495,404 | |

Shares of beneficial interest outstanding (unlimited authorization) | | | 102,260,626 | |

| | | | |

Net asset value price per share (Net Assets/Shares Outstanding) | | $ | 31.42 | |

| | | | |

| (a) | See Note 9. Restricted Securities for detail of Commitments and Contingencies related to unfunded commitments. |

See accompanying notes to financial statements.

10

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Statement of Operations

For the Year Ended March 31, 2022

| | | | |

Investment Income: | | | | |

Dividends from non-affiliated investments | | $ | 76,359,485 | |

Dividends from affiliated investments | | | 1,534,829 | |

Interest income | | | 8,104,377 | |

Less: foreign taxes withheld | | | (406,807 | ) |

| | | | |

Total Investment Income | | | 85,591,884 | |

| | | | |

Expenses: | | | | |

Adviser fees (Note 4) | | | 29,581,245 | |

Interest and Line of Credit fees | | | 1,305,460 | |

Administration fees | | | 852,537 | |

Shareholder reporting fees | | | 476,628 | |

Professional fees | | | 401,386 | |

Custodian fees | | | 266,382 | |

Transfer agent fees | | | 265,888 | |

Directors’ fees (Note 4) | | | 249,328 | |

Registration fees | | | 28,638 | |

Other expenses | | | 295,639 | |

| | | | |

Total Expenses | | | 33,723,131 | |

| | | | |

Net Investment Income | | | 51,868,753 | |

| | | | |

Net Realized and Unrealized Gain (Loss) on Investments: | | | | |

Net realized gain on non-affiliated investments | | | 122,199,060 | |

Net realized gain on foreign currency transactions | | | 178,045 | |

Net change in unrealized appreciation on non-affiliated investments and foreign currency | | | 344,272,632 | |

Net change in unrealized appreciation on affiliated investments | | | 24,716,542 | |

| | | | |

Net Realized and Unrealized Gain on Investments | | | 491,366,279 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 543,235,032 | |

| | | | |

See accompanying notes to financial statements.

11

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Statement of Changes in Net Assets

| | | | | | | | | | |

| | | Year Ended

March 31, 2022 | | Year Ended

March 31, 2021 |

| | |

Increase in Net Assets: | | | | | | | | | | |

From Operations: | | | | | | | | | | |

Net investment income | | | $ | 51,868,753 | | | | $ | 54,463,564 | |

Net realized gain on investments and foreign currency transactions | | | | 122,377,105 | | | | | 53,979,290 | |

Net change in unrealized appreciation on investments and foreign currency | | | | 368,989,174 | | | | | 49,373,268 | |

| | | | | | | | | | |

Net Increase in Net Assets Resulting From Operations | | | | 543,235,032 | | | | | 157,816,122 | |

| | | | | | | | | | |

| | |

Distributions to Shareholders from: | | | | | | | | | | |

Net investment income and net realized gains | | | | (170,821,298 | ) | | | | (87,948,261 | ) |

Return of capital | | | | (8,592,647 | ) | | | | (20,449,303 | ) |

| | | | | | | | | | |

Total Distributions | | | | (179,413,945 | ) | | | | (108,397,564 | ) |

| | | | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | | | |

Shares issued | | | | 743,276,979 | | | | | 363,971,004 | |

Reinvested dividends | | | | 36,255,366 | | | | | 22,028,613 | |

Shares redeemed | | | | (426,118,962 | ) | | | | (904,369,665 | ) |

| | | | | | | | | | |

Net Increase (Decrease) in Net Assets | | | | | | | | | | |

Resulting From Capital Share Transactions | | | | 353,413,383 | | | | | (518,370,048 | ) |

| | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | | 717,234,470 | | | | | (468,951,490 | ) |

| | | | | | | | | | |

Net Assets: | | | | | | | | | | |

Beginning of Year | | | $ | 2,496,260,934 | | | | $ | 2,965,212,424 | |

| | | | | | | | | | |

End of Year | | | $ | 3,213,495,404 | | | | $ | 2,496,260,934 | |

| | | | | | | | | | |

| | |

Share Transactions: | | | | | | | | | | |

Shares sold | | | | 25,303,369 | | | | | 13,483,119 | |

Shares issued in reinvestment of dividends | | | | 1,233,237 | | | | | 825,886 | |

Shares redeemed | | | | (14,802,602 | ) | | | | (33,815,167 | ) |

| | | | | | | | | | |

Net Increase (Decrease) in Shares of Beneficial Interest Outstanding | | | | 11,734,004 | | | | | (19,506,162 | ) |

| | | | | | | | | | |

See accompanying notes to financial statements.

12

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Statement of Cash Flows

For the Year Ended March 31, 2022

| | | | |

Cash Flows Used in Operating Activities: | | | | |

Net increase in net assets resulting from operations | | $ | 543,235,032 | |

Adjustments to Reconcile Net Increase in Net Assets Resulting | | | | |

From Operations to Net Cash Used in Operating Activities: | | | | |

Purchases of investment securities | | | (1,106,439,676 | ) |

Proceeds from disposition of investment securities | | | 928,275,137 | |

Net purchases of short-term investment securities | | | (51,441,600 | ) |

Net change in unrealized appreciation on investments and foreign currency | | | (368,989,174 | ) |

Net realized gain from investments sold and foreign currency transactions | | | (122,377,105 | ) |

Net amortization/(accretion) of premium/(discount) | | | 757,852 | |

Increase in dividends and interest receivable | | | (1,947,630 | ) |

Increase in reclaims receivable | | | (31,782 | ) |

Decrease in prepaid expenses | | | 427,197 | |

Increase in Adviser fees payable | | | 1,245,720 | |

Increase in administrative fees payable | | | 30,970 | |

Decrease in professional fees payable | | | (119,000 | ) |

Decrease in custodian fees payable | | | (16,380 | ) |

Decrease in transfer agent fees payable | | | (18,783 | ) |

Increase in accrued expenses and other liabilities | | | 12,116 | |

| | | | |

Net Cash Used in Operating Activities | | | (177,397,106 | ) |

| | | | |

Cash Flows From Financing Activities: | | | | |

Proceeds from shares issued | | | 746,489,859 | |

Payments of shares redeemed | | | (426,118,962 | ) |

Dividends paid (net of reinvestment of dividends) | | | (143,158,579 | ) |

| | | | |

Net Cash Provided by Financing Activities | | | 177,212,318 | |

| | | | |

Effect of exchange rate changes on foreign currency | | | 175,853 | |

| | | | |

Net Decrease in Cash | | | (8,935 | ) |

| | | | |

Cash and Foreign Currency: | | | | |

Beginning of period | | | 96,405 | |

| | | | |

End of period | | $ | 87,470 | |

| | | | |

Supplemental Disclosure of Cash Flow Information: | | | | |

Interest paid during the year | | $ | 48,681 | |

Reinvestment of dividends | | | 36,255,366 | |

See accompanying notes to financial statements.

13

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

March 31,

2022 | | | Year Ended

March 31,

2021 | | | Year Ended

March 31,

2020 | | | Year Ended

March 31,

2019 | | | Year Ended

March 31,

2018 | |

Net Asset Value, Beginning of Year | | $ | 27.57 | | | $ | 26.95 | | | $ | 28.22 | | | $ | 27.70 | | | $ | 27.52 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.56 | | | | 0.56 | | | | 0.67 | | | | 0.77 | | | | 0.65 | |

Net realized and unrealized gain (loss) | | | 5.20 | | | | 1.12 | | | | (0.74 | ) | | | 0.99 | | | | 0.79 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 5.76 | | | | 1.68 | | | | (0.07 | ) | | | 1.76 | | | | 1.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Distribution from net investment income and net realized gains | | | (1.82 | )(b) | | | (0.86 | ) | | | (0.73 | ) | | | (0.79 | ) | | | (0.61 | ) |

Return of Capital | | | (0.09 | ) | | | (0.20 | ) | | | (0.47 | ) | | | (0.45 | ) | | | (0.65 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (1.91 | ) | | | (1.06 | ) | | | (1.20 | ) | | | (1.24 | ) | | | (1.26 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 31.42 | | | $ | 27.57 | | | $ | 26.95 | | | $ | 28.22 | | | $ | 27.70 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return Based On Net Asset Value | | | 21.04 | % | | | 6.00 | % | | | (0.27 | )% | | | 6.70 | % | | | 5.32 | % |

Ratios and Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 3,213,495 | | | $ | 2,496,261 | | | $ | 2,965,212 | | | $ | 2,797,314 | | | $ | 2,184,488 | |

Ratios of gross expenses to average net assets | | | 1.24 | % | | | 1.20 | % | | | 1.19 | % | | | 1.17 | % | | | 1.24 | % |

Ratios of net expenses to average net assets | | | 1.24 | % | | | 1.20 | % | | | 1.19 | % | | | 1.17 | % | | | 1.24 | % |

Ratios of net investment income to average net assets | | | 1.90 | % | | | 2.09 | % | | | 2.37 | % | | | 2.77 | % | | | 2.37 | % |

Portfolio turnover rate | | | 33.66 | % | | | 26.19 | % | | | 15.77 | % | | | 13.48 | % | | | 13.03 | % |

| (a) | Per Share amounts are calculated based on average outstanding shares. |

| (b) | Includes one-time distribution of net realized gains of $0.74 per share paid on December 29, 2021. |

See accompanying notes to financial statements.

14

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Notes to Financial Statements

March 31, 2022

NOTE 1. ORGANIZATION

Versus Capital Multi-Manager Real Estate Income Fund LLC (the “Fund”) is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company that is operated as an interval fund. The Fund’s primary investment objective is to seek consistent current income, while its secondary objectives are capital preservation and long-term capital appreciation. The Fund attempts to achieve these objectives by allocating its capital among a select group of institutional asset managers (the “Investment Managers”) with expertise in managing portfolios of real estate and real estate-related investments. The Fund is authorized to issue an unlimited number of common shares of beneficial interest without par value and has registered an aggregate offering amount of $5.5 billion. The Fund’s investment adviser is Versus Capital Advisors LLC (the ‘‘Adviser’’).

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Investment Income and Securities Transactions - Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Dividend income is recorded net of applicable withholding taxes. Interest income is accrued daily. Premiums and discounts are amortized or accreted on an effective yield method on fixed income securities. Dividend income from REIT investments is recorded using management’s estimate of the percentage of income included in distributions received from such investments based on historical information and other industry sources. The return of capital portion of the estimate is a reduction to investment income and a reduction in the cost basis of each investment which increases net realized gain (loss) and net change in unrealized appreciation (depreciation). If the return of capital distributions exceed its cost basis, the distributions are treated as realized gains. The actual amounts of income, return of capital, and capital gains are only determined by each REIT after its fiscal year-end, and may differ from the estimated amounts. The Fund may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and reclaims as applicable, based upon their current interpretation of tax rules and regulations that exist in the markets in which the Fund invests. Securities are accounted for on a trade date basis. The cost of securities sold is determined and gains (losses) are based upon the specific identification method.

Foreign Currency - Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the exchange rates at 4:00 p.m. U.S. ET (Eastern Time). Fluctuations in the value of the foreign currencies and other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses). Realized gains (losses) and unrealized appreciation (depreciation) on investment securities and income and expenses are translated on the respective dates of such transactions. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities, and are included with the net realized and net change in unrealized gain or loss on investment securities.

Dividends and Distributions to Shareholders - The Fund will make regular quarterly distributions to shareholders of all or a portion of any dividends or investment income it earns on investments. In addition, the Fund will make regular distributions to the shareholders of all or a portion of capital gains distributed to the Fund by Investment Funds and capital gains earned by the Fund from the disposition of Investment Funds or other investments, together with any dividends or interest income earned from such investments. A portion of any distribution may be a return of capital or from other capital sources. Dividends and distributions to shareholders are recorded on the ex-dividend date.

U.S. Federal Income Tax Information - The Fund intends to qualify each year as a “regulated investment company” under the Internal Revenue Code of 1986, as amended. By so qualifying, the Fund will not be subject to federal income taxes to the extent that it distributes substantially all of its net investment income and any realized capital gains. This policy may cause multiple distributions during the course of the year, which are recorded on the ex-dividend date.

As of and during the year ended March 31, 2022, the Fund did not have a liability for any unrecognized tax obligations. The Fund recognizes interest and penalties, if any, related to unrecognized tax obligations as income tax expense in the statement of operations. During the year, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdiction as U.S. Federal.

Dividends from net investment income and distributions from realized gains are determined in accordance with federal income tax regulations, which may differ from net investment income and realized gains recognized for financial reporting purposes. Accordingly, the character of distributions and composition of net assets for tax purposes may differ from those reflected in the accompanying financial statements. To the extent these differences are permanent, such amounts are reclassified within the capital accounts at fiscal year end based on the tax treatment; temporary differences do not require such reclassification. As of March 31, 2022, permanent differences identified and reclassified among the components of net assets were to increase undistributed net investment income by approximately $52,356,000, to decrease accumulated net realized gain by approximately $46,015,000 and to decrease paid-in-capital by approximately $6,341,000.

For the year ended March 31, 2022, tax character of the distribution paid by the Fund was approximately $75,147,000 of ordinary income dividends, approximately $95,674,000 of long-term capital gains and approximately $8,593,000 of return of capital. For the year ended March 31, 2021, tax character of the distribution paid by the Fund was approximately $22,759,000 of ordinary income dividends, approximately $65,190,000 of long-term capital gains and approximately $20,449,000 of return of capital. Distribution from net investment income and short-term capital gains are treated as ordinary income for federal income tax purposes.

15

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Notes to Financial Statements

March 31, 2022 (continued)

Net capital losses incurred may be carried forward for an unlimited time period, and retain their tax character as either short-term or long-term capital losses. As of March 31, 2022, the Fund had no capital loss carryovers available to offset future capital gains.

Under federal tax law, capital and qualified ordinary losses realized after October 31 and December 31, respectively, may be deferred and treated as having arisen on the first day of the following fiscal year. For the year ended March 31, 2022, the Fund elected to defer approximately $5,456,000 in qualified late year losses.

As of March 31, 2022, the gross unrealized appreciation and depreciation and net unrealized appreciation on a tax basis were approximately $599,104,000, $(41,615,000) and $557,490,000, respectively. The aggregate cost of securities for federal income tax purposes at March 31, 2022, was approximately $2,618,341,000.

Guarantees and Indemnifications - In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown and this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund would expect the risk of loss to be remote.

Use of Estimates - The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities (disclosure of contingent assets and liabilities) at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 3. SECURITIES VALUATION

Consistent with Section 2(a)(41) of the 1940 Act, the Fund prices its securities as follows:

Publicly Traded Securities - Investments in securities that are listed on the New York Stock Exchange (the “NYSE”) are valued, except as indicated below, at the official closing price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no published closing price on such day, the securities are valued at the mean of the closing bid and ask prices for the day or, if no ask price is available, at the bid price. Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the closing price of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If, after the close of a domestic or foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, the domestic or foreign securities may be valued pursuant to procedures established by the Board of Directors (the “Board”).

Securities traded in the over-the-counter market, such as fixed-income securities and certain equities, including listed securities whose primary market is believed by the Advisor to be over-the-counter, are valued at the official closing prices as reported by sources as the Board deems appropriate to reflect their fair market value. If there has been no official closing price on such day, the securities are valued at the mean of the closing bid and ask prices for the day or, if no ask price is available, at the bid price. Fixed-income securities typically will be valued on the basis of prices provided by a pricing service, generally an evaluated price or the mean of closing bid and ask prices obtained by the pricing service, when such prices are believed by the Adviser to reflect the fair market value of such securities. Furthermore, the Fund’s Adviser will review the valuation methodology of any pricing service used in the Fund’s investment valuation process, subject to oversight and/or approval of the Board.

Short-term debt securities, which have a maturity date of 60 days or less, are valued at amortized cost, which approximates fair value.

Investments in open-end mutual funds are valued at their closing NAV.

Securities for which market prices are unavailable, or securities for which the Adviser determines that the market quotation is unreliable, will be valued at fair value pursuant to procedures approved by the Board. In these circumstances, the Adviser determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include recent transactions in comparable securities, information relating to the specific security and developments in the markets. The Fund’s use of fair value pricing may cause the NAV of the Shares to differ from the NAV that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of such security.

Private Investment Funds - The Board has adopted procedures pursuant to which the Fund will value its investments in Private Investment Funds. Before investing in any Private Investment Fund, the Adviser will conduct a due diligence review of the valuation methodology utilized by such Private Investment Fund, which as a general matter will employ market values when available, and otherwise look at principles of fair value that the Adviser reasonably believes to be consistent with (but not necessarily the same as) those used by the Fund for valuing its own investments. The Adviser shall use its best efforts to ensure that each private Investment Fund has in place policies and procedures that are consistent with the practices provided for in the Real Estate Information Standards (‘‘REIS’’), as established and amended by the National Council of Real Estate Investment Fiduciaries (‘‘NCREIF’’) in conjunction with the Pension Real Estate Association (‘‘PREA’’), or comparable standards which may apply. REIS provides underlying principles behind the disclosure of reliable information with adequate policies and practices that include, but are not limited to the following:

| • | | Property valuation standards and policy that are expected to be applied consistent with Generally Accepted Accounting Principles (“GAAP”) fair value principles and uniform appraisal standards or such comparable standards as may apply to international managers. Real estate investments are required |

16

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

Notes to Financial Statements

March 31, 2022 (continued)

| | to be valued, (a) internally (by the Private Investment Fund’s manager) with third party (preferably an accounting or valuation firm) oversight to assure the reasonableness of and compliance with valuation policies, at least quarterly and (b) externally by an appraiser or other third party preferably once annually, but at least once every 36 months. Furthermore, the valuations should be performed with impartiality, objectivity and independence, and with control to demonstrate they have been completed fairly. This includes the maintenance of records of methods and techniques for valuation with sufficient documentation to understand the scope of work completed. |

| • | | Market Value Accounting and Reporting Standards including the production of quarterly financial statements and annual audited financials. This also incorporates quarterly performance measurement and reporting standards for every asset held by the Private Investment Fund. After investing in a Private Investment Fund, the Adviser will monitor the valuation methodology used by such Private Investment Fund and its manager. |

The Fund values its investments in Private Investment Funds based in large part on valuations provided by the managers of the Private Investment Funds and their agents. These fair value calculations will involve significant professional judgment by the managers of the Private Investment Funds in the application of both observable and unobservable attributes. The calculated NAVs of the Private Investment Funds’ assets may differ from their actual realizable value or future fair value. Valuations will be provided to the Fund based on the interim unaudited financial records of the Private Investment Funds and, therefore, will be estimates subject to adjustment (upward or downward) upon the auditing of such financial records and may fluctuate as a result. The Board and the Adviser may not have the ability to assess the accuracy of these valuations. Because a significant portion of the Fund’s assets are invested in Investment Funds, these valuations have a considerable impact on the Fund’s NAV.