UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

CURRENCYWORKS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

CURRENCYWORKS INC.

3250 Oakland Hills Court

Fairfield, California 94535

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 16, 2022

Dear Stockholder:

Our annual meeting of stockholders will be held on Thursday, June 16, 2022, at 1:00 p.m., Pacific time, via teleconference only for the following purposes:

| | 1. | To elect Cameron Chell, James P. Geiskopf, Edmund C. Moy and Shelly Murphy as the directors of our company; |

| | 2. | To ratify the appointment of Haynie & Company as our independent registered public accounting firm; |

| | 3. | To hold a non-binding advisory vote on the compensation of our named executive officers as disclosed in the proxy statement; |

| | 4. | To hold a non-binding advisory vote on whether a non-binding advisory vote on the compensation of our named executive officers should be held every one, two or three years; and |

| | 5. | To transact such other business as may properly come before the annual meeting or any adjournment thereof. |

These items of business are more fully described in the proxy statement accompanying this notice.

Our board of directors has fixed the close of business on April 20, 2022 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the annual meeting or any adjournment thereof. Only the stockholders of record on the record date are entitled to vote at the annual meeting.

In view of the current COVID-19 outbreak, our company will not be providing a physical location for stockholders to attend the annual meeting in person. As always, we encourage stockholders to vote prior to the annual meeting. Stockholders are encouraged to vote on the matters before the annual meeting by proxy and to join the annual meeting by teleconference. To access the annual meeting by teleconference, dial toll free at 888-289-4573, access code: 3904509#.

Whether or not you plan on attending the annual meeting, we ask that you vote by proxy by following instructions provided in the enclosed proxy card as promptly as possible. If your shares are held of record by a broker, bank, or other nominee, please follow the voting instructions sent to you by your broker, bank, or other nominee in order to vote your shares.

Even if you have voted by proxy, you may still vote at the annual meeting if you attend the annual meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the annual meeting, you must obtain a valid proxy issued in your name from that record holder.

Sincerely,

By Order of the Board of Directors

| /s/ Bruce Elliott | |

| Bruce Elliott | |

| President | |

| | |

| April 27, 2022 | |

CURRENCYWORKS INC.

3250 Oakland Hills Court

Fairfield, California 94535

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 16, 2022

Questions and Answers about the Annual Meeting of Stockholders

Why am I receiving these materials?

The board of directors of CurrencyWorks Inc. (“we”, “us” or “our”) is soliciting proxies for use at the annual meeting of stockholders to be held on Thursday, June 16, 2022, at 1:00 p.m., Pacific time.

In view of the current COVID-19 outbreak, our company will not be providing a physical location for stockholders to attend the annual meeting in person. As always, we encourage stockholders to vote prior to the annual meeting. Stockholders are encouraged to vote on the matters before the annual meeting by proxy and to join the annual meeting by teleconference. To access the annual meeting by teleconference, dial toll free at 888-289-4573, access code: 3904509#.

Pursuant to the “notice and access” rules adopted by the Securities and Exchange Commission, we have elected to provide stockholders access to our proxy materials over the Internet. Accordingly, we are sending the Notice of Internet Availability of Proxy Materials to all of our stockholders as of the close of business on April 20, 2022. The Notice of Internet Availability of Proxy Materials includes instructions on how to access our proxy materials over the Internet and how to request a printed copy of these materials. In addition, by following the instructions in the Notice of Internet Availability of Proxy Materials, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis. The Notice of Internet Availability of Proxy Materials is expected to be first sent or given to our stockholders on or about May 2, 2022.

What is included in these materials?

These materials include:

| | ● | the notice of the annual meeting of stockholders; |

| | ● | this proxy statement for the annual meeting of stockholders; |

| | ● | the proxy card; and |

| | ● | our annual report on Form 10-K for the year ended December 31, 2021, as filed with the Securities and Exchange Commission on April 15, 2022. |

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be Held on June 16, 2022

Above materials are available at https://odysseytrust.com/client/currencyworks-inc/.

The annual report on Form 10-K accompanies this proxy statement, but does not constitute a part of the proxy soliciting material.

What items will be voted at the annual meeting?

Our stockholders will vote on:

| | ● | the election of directors; |

| | | |

| | ● | the ratification of appointment of our independent registered public accounting firm; |

| | | |

| | ● | a non-binding advisory vote on the compensation of our named executive officers as disclosed in this proxy statement; and |

| | | |

| | ● | a non-binding advisory vote on the frequency with which we will conduct a non-binding advisory vote on the compensation of our named executive officers. |

What do I need to do now?

We urge you to carefully read and consider the information contained in this proxy statement. We request that you cast your vote on each of the proposals described in this proxy statement. You are invited to attend the annual meeting, but you do not need to attend the annual meeting to vote your shares. Even if you do not plan to attend the annual meeting, please vote by proxy by following instructions provided in the proxy card.

Who can vote at the annual meeting?

Our board of directors has fixed the close of business on April 20, 2022 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the annual meeting or any adjournment. If you were a stockholder of record of our common stock on the record date, you are entitled to vote at the annual meeting.

As of the record date, 77,953,057 shares of our common stock were issued and outstanding and, therefore, a total of 77,953,057 votes are entitled to be cast at the annual meeting.

How many votes do I have?

On each proposal to be voted upon, you have one vote for each share of our common stock that you owned on the record date. There is no cumulative voting.

How do I vote my shares?

If you are a stockholder of record, you may vote at the annual meeting or by proxy.

| | ● | To vote at the annual meeting, attend the annual meeting, and we will give you instruction as to how to vote. |

| | ● | If you do not wish to vote at the annual meeting or if you will not be attending the annual meeting, you may vote by proxy by following instructions provided in the proxy card. |

If you hold your shares in “street name” and:

| | ● | you wish to vote at the annual meeting, you must obtain a valid proxy from your broker, bank, or other nominee that holds your shares giving you the right to vote the shares at the annual meeting. |

| | ● | you do not wish to vote at the annual meeting or you will not be attending the annual meeting, you must vote your shares in the manner prescribed by your broker, bank or other nominee. Your broker, bank or other nominee should have enclosed or otherwise provided a voting instruction card for you to use in directing the broker, bank or nominee how to vote your shares. |

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with our transfer agent, Odyssey Trust Company, then you are a stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, or other nominee, then the broker, bank, or other nominee is the stockholder of record with respect to those shares. However, you still are the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, or other nominee how to vote their shares. Street name holders are also invited to attend the annual meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one name or in different accounts. To ensure that all of your shares are voted, please vote by proxy by following instructions provided in each proxy card. If some of your shares are held in “street name,” you should have received voting instruction with these materials from your broker, bank or other nominee. Please follow the voting instruction provided to ensure that your vote is counted.

What vote is required for the election of directors or for the approval of a proposal?

Our directors are elected by a majority of the votes cast. This means that the nominees who receive more “For” votes than “Against” votes will be elected as directors. There is no cumulative voting in the election of directors.

The non-binding advisory vote on the frequency with which we will conduct a non-binding advisory vote on the compensation of our named executive officers will be determined by a plurality of the votes of the stockholders of our stock having voting power present in person or represented by proxy at the annual meeting, which means that the option receiving the highest number of votes will be determined to be the preferred frequency.

All other proposals require the affirmative vote of a majority of the shares represented at the annual meeting and entitled to vote on any matter (which shares voting affirmatively also constitute at least a majority of the required quorum). Therefore, for the other proposals to be approved, each proposal must receive more “For” votes than the combined votes of “Against” votes and votes that are abstained.

How are votes counted?

For the election of directors, you may vote “For”, “Against”, or “Abstain” for each nominee for the directors. Votes that are abstained and broker non-votes will have no effect on the outcome of the vote on the election of directors.

For the non-binding advisory vote on the frequency with which we will conduct a non-binding advisory vote on the compensation of our named executive officers, you may vote “One Year”, “Two Years”, “Three Years”, or “Abstain”. Votes that are abstained and broker non-votes will have no effect on the outcome of the vote on this non-binding advisory vote on the frequency.

For all other proposals, you may vote “For”, “Against”, or “Abstain” for each proposal. Votes that are abstained will have the same effect as “Against” votes. Broker non-votes will have no effect on the outcome of the vote on the proposal.

A “broker non-vote” occurs when a broker, bank, or other nominee holding shares for a beneficial owner in street name does not vote on a particular proposal because it does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner of those shares, despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions.

What happens if I do not make specific voting choices?

If you are a stockholder of record and you submit your proxy without specifying how you want to vote your shares, then the proxy holder will vote your shares in the manner recommended by our board of directors on all proposals.

If you hold your shares in the street name and you do not give instructions to your broker, bank or other nominee to vote your shares, under the rules that govern brokers, banks, and other nominees who are the stockholders of record of the shares held in street name, it generally has the discretion to vote uninstructed shares on routine matters but has no discretion to vote them on non-routine matters.

What is the quorum requirement?

A quorum of stockholders is necessary for the transaction of business at the annual meeting. Stockholders holding at least 10% of the shares entitled to vote, represented in person or by proxy, constitute a quorum at the annual meeting. Your shares will be counted towards the quorum requirement only if you or the registered holder of your shares, properly vote by proxy or present in person at the annual meeting. Votes that are abstained and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the annual meeting may be adjourned by the vote of a majority of the shares represented either in person or by proxy.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote your shares:

| | ● | “For” the election of all nominees for directors; |

| | ● | “For” the ratification of the appointment of the independent registered public accounting firm; |

| | ● | “For” the approval of the compensation of our named executive officers; and |

| | ● | “For” a frequency of every three years regarding how frequently we should seek an advisory vote on the compensation of our named executive officers. |

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. If you are a stockholder of record, you may vote again on a later date via the Internet (only your latest Internet proxy submitted prior to the annual meeting will be counted), by signing and returning a new proxy card with a later date, or by attending the annual meeting and voting at the annual meeting. Your attendance at the annual meeting will not automatically revoke your proxy unless you vote again at the annual meeting or specifically request in writing that your prior proxy be revoked. You may also request that your prior proxy be revoked by delivering us a written notice of revocation prior to the annual meeting at CurrencyWorks Inc., 3250 Oakland Hills, Fairfield, California 94534, Attn: President.

If you hold your shares in the street name, you will need to follow the voting instruction provided by your broker, bank or other nominee regarding how to revoke or change your vote.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokers, banks or other nominees for forwarding proxy materials to street name holders.

We are soliciting proxies primarily by mail. In addition, our directors and officers may solicit proxies by telephone, facsimile, mail, other means of communication or personally. These individuals will receive no additional compensation for such services.

We will ask brokers, banks, and other nominees to forward the proxy materials to their principals and to obtain their authority to execute proxies and voting instructions. We will reimburse them for their reasonable expenses.

Forward-Looking Statements

This proxy statement contains forward-looking statements. These statements relate to future events. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Unless otherwise indicated, all reference to “dollars”, “$”, “USD” or “US$” are to United States dollars and all reference to “CDN$” are to Canadian dollars.

Voting Securities and Principal Holders Thereof

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 27, 2022, certain information with respect to the beneficial ownership of our common stock by each stockholder known by us to be the beneficial owner of more than 5% of any class of our voting securities and by each of our directors and named executive officers (as defined in the “Executive Compensation” section below) and by our directors and executive officers as a group.

| Name | | Title of Class | | Amount and Nature of Beneficial Ownership(1) | | | Percentage of Class(1)(2) | |

| Bruce Elliott | | Common Stock | | | 466,666 | (3) | | | * | |

| Swapan Kakumanu | | Common Stock | | | 1,129,523 | (4) | | | 1.4 | % |

| Cameron Chell | | Common Stock | | | 1,546,366 | (5) | | | 2.0 | % |

James P. Geiskopf

3250 Oakland Hills Court, Fairfield, California 94534 | | Common Stock | | | 4,804,523 | (6) | | | 6.0 | % |

| Edmund C. Moy | | Common Stock | | | 367,666 | (7) | | | * | |

| Shelly Murphy | | Common Stock | | | 133,333 | (8) | | | * | |

| All executive officers and directors as a group (6 persons) | | Common Stock | | | 8,448,077 | | | | 10.1 | % |

| (1) | Except as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Common stock subject to options or warrants currently exercisable or exercisable within 60 days, are deemed outstanding for purposes of computing the percentage ownership of the person holding such option or warrants, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. |

| | |

| (2) | Percentage of ownership is based on 77,953,057 shares of our common stock issued and outstanding as of April 27, 2022. |

| | |

| (3) | Consists of 466,666 shares of our common stock underlying 466,666 stock options that are vested or will be vested within 60 days. |

| | |

| (4) | Consists of 137,857 shares of our common stock held directly and 50,000 shares of our common stock held by Red to Black Inc., a company controlled by Mr. Kakumanu, 175,000 shares of our common stock underlying 175,000 stock options granted to Red to Black Inc. that are vested or will be vested within 60 days, 766,666 shares of our common stock underlying 766,666 stock options that are vested or will be vested within 60 days. |

| | |

| (5) | Consists of 213,034 shares of our common stock held directly and 1,333,332 shares of our common stock underlying 1,333,332 stock options that are vested or will be vested within 60 days. |

| | |

| (6) | Consists of 2,637,857 shares of our common stock, 1,000,000 shares of our common stock underlying 1,000,000 warrants and 1,166,666 shares of our common stock underlying 1,166,666 stock options that are vested or will be vested within 60 days. |

| | |

| (7) | Consists of 1,000 shares of our common stock and 366,666 shares of our common stock underlying 366,666 stock options that are vested or will be vested within 60 days. |

| | |

| (8) | Consists of 133,333 shares of our common stock underlying 133,333 stock options that are vested or will be vested within 60 days. |

Changes in Control

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change in control of our company.

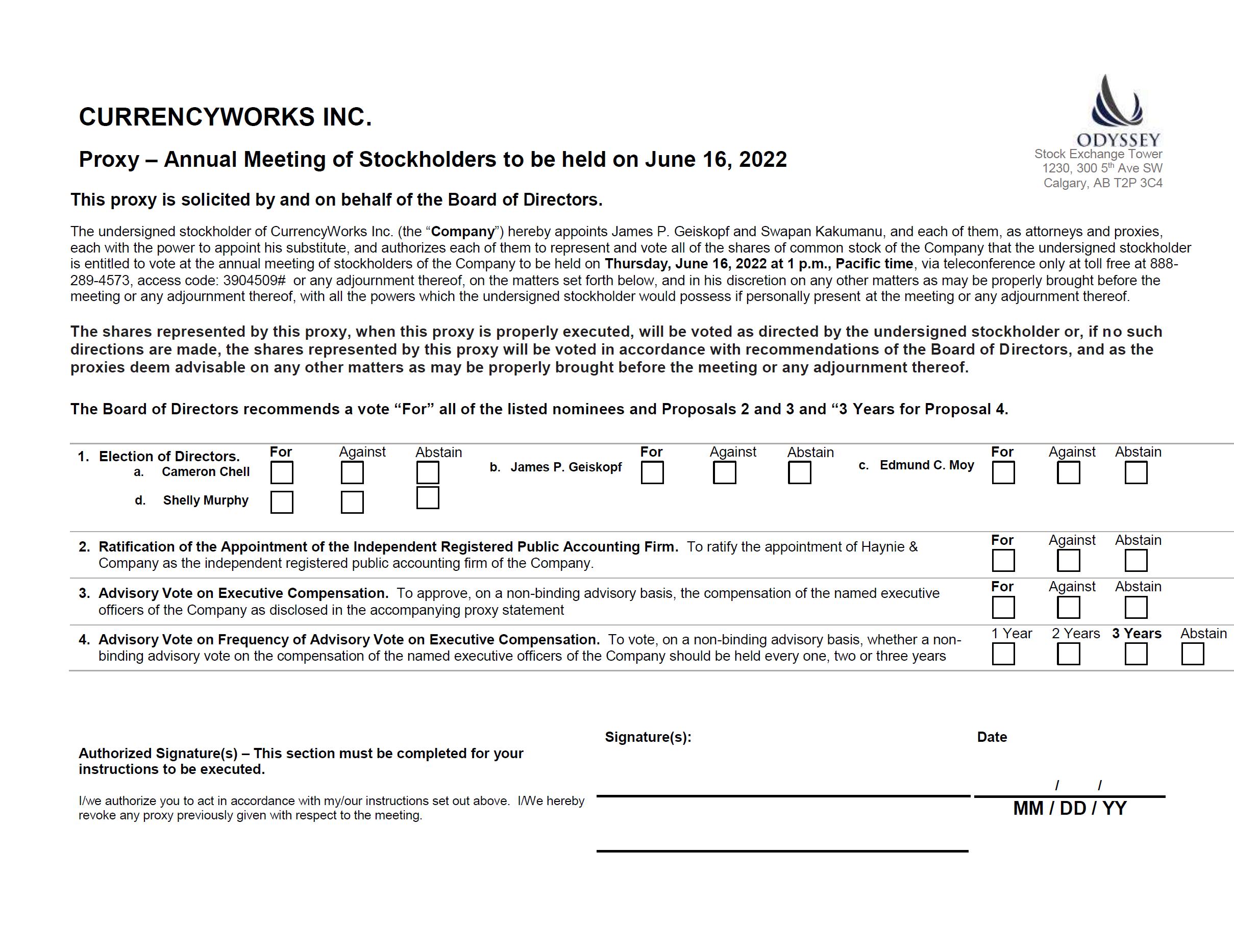

Proposal 1

Election of Directors

Our board of directors has nominated the persons named below as candidates for directors at the annual meeting. Unless otherwise directed, the proxy holder will vote the proxies received by him for the four nominees named below.

All of our directors hold office until the next annual meeting of our stockholders or until their successors have been elected and qualified, or until their death, resignation or removal.

Our board of directors recommends that you vote FOR these nominees.

Nominees

| Name | | Positions Held with Our Company | | Age | | Date First Elected or Appointed |

| Cameron Chell | | Chairman and Director | | 53 | | August 21, 2017 |

| James P. Geiskopf | | Lead Director | | 62 | | August 28, 2014 |

| Edmund C. Moy | | Director | | 64 | | February 9, 2018 |

| Shelly Murphy | | Director | | 50 | | June 14, 2021 |

Business Experience of Nominees

The following is a brief account of the education and business experience of the nominees during at least the past five years, indicating their principal occupation during the period, and the name and principal business of the organization by which they were employed.

Cameron Chell

On August 21, 2017, Cameron Chell was appointed as the president and chief executive officer and a director of our company. On October 15, 2017, Mr. Chell resigned as our president and chief executive officer in order to accommodate the appointment of Bruce Elliott as our president. On the same day, Mr. Chell was appointed as the non-executive chairman.

Mr. Chell founded Business Instincts Group Inc. in November 2009. Business Instincts Group is a venture creation accelerator and services firm whose focus is building high-tech startups. The companies that Business Instincts Group has helped build include Draganfly, RaptorRig, ColdBore, UrtheCast, the first commercial video platform on the International Space Station, and Slyce, the visual purchasing engine. As well, Mr. Chell has founded several startups including Futurelink, the original cloud computing company. Today Mr. Chell is CEO of Draganfly Innovations Inc and publicly listed Drone solutions and manufacturing company. Mr. Chell also sits on a number of boards both private and public in which Mr Chell’s primary responsibility is to provide strategic management facilitation while working with his co-founders, executives, and investors to determine what is most important and specifically how to get it done. Mr. Chell has also been a director and secretary of Ryde from December 2017 and chairman of Ryde from February 2018.

We believe that Mr. Chell is qualified to serve on our board of directors because of his extensive business experience derived from his current and past occupation.

James P. Geiskopf

Effective August 28, 2014, Mr. Geiskopf was appointed as president, secretary, treasurer and director of our company. On August 21, 2017, Mr. Geiskopf resigned as our president. On October 9, 2017, Mr. Geiskopf resigned as our secretary and treasurer. Mr. Geiskopf has been our lead director since August 21, 2017.

Mr. Geiskopf currently serves on the board of directors of Verb Technology Company, Inc. (VERB: NASDAQ), formerly nFusz, Inc. (since May 7, 2014), a company having shares of common stock registered under the Securities Exchange Act of 1934. He served as a director of Electronic Cigarettes International Group, Ltd. from June 2013 to March 2017. He was the president, secretary, treasurer and a director of Searchbyheadlines.com (now Naked Brand Group Inc.) from December 22, 2011 to July 30, 2012, and the president and director of The Resource Group from 2007 to 2009. From 1986 to 2007, he served as the president and chief executive officer of Budget Rent-a-Car of Fairfield, California. Mr. Geiskopf also served on the board of directors of Suisun Valley Bank from 1986 to 1993 and on the board of directors of Napa Valley Bancorp. from 1991 to 1993.

We believe that Mr. Geiskopf is qualified to serve on our board of directors because of his extensive business management and financial expertise derived from his past occupation and his past and current board participation.

Edmund C. Moy

On February 9, 2018, we appointed Edmund C. Moy as a director of our company.

Mr. Moy has been self-employed since July 2013. He has provided autographs for Numismatic Guarantee Corporation since December 2015 and to Profession Coin Grading Services, a division of Collectors Universe (CLCT: NASDAQ) from November 2013 to November 2015. Mr. Moy has also been an author with Whitman Publishing since December 2013, and was a provider of endorsement to Fortress Gold Group from August 2014 to July 2017 and to Morgan Gold from November 2011 to July 2014. As a consultant since August 2013, he has advised the U.S. Department of Labor and the U.S. Department of Transportation during most of 2017 and worked on projects to develop the first Bitcoin IRA and the first state gold bullion depository in America. He has also been a professional speaker since August 2013. He was the vice president for corporate infrastructure of L&L Energy, Inc. from January 2011 to July 2013 and a director of L&L Energy, Inc. from January 2012 to September 2012. From September 2006 to January 2011, Mr. Moy served as Director of the United States Mint, the world’s largest manufacturer of coins and medals. He was appointed by President George W. Bush and unanimously confirmed by the U.S. Senate.

He currently serves on the advisory board or board of directors of several privately-held companies: AID:Tech (a blockchain company that fights global corruption in foreign aid and relief with digital identification), OmniSparx (develops healthy decentralized token ecosystems), and Valaurum (which sells the smallest verifiable unit of gold in the world). He is also a member of the Executive Advisory Board for the School of Business & Economics of Seattle Pacific University, the Board of Regents for Trinity International University, and the National Council for C3 Leaders.

Mr. Moy has served on public, private and non-profit boards and advisory boards, including coin.co, Axon Connected, LLC, L&L Energy, Inc. (NASDAQ: LLEN), Xactimed, Emerald Health Network, Christianity Today International, and Tau Kappa Epsilon International Fraternity.

We believe that Mr. Moy is qualified to serve on our board of directors because of his extensive business experience derived from his current and past occupation.

Shelly Murphy

On June 14, 2021, we appointed Shelly Murphy as a director of our company.

Ms. Murphy is the CEO and Managing Partner of GSD Group, the innovation and strategy group behind Atari Hotels, and the Foundation Chair of the Woz Innovation Foundation, Steve Wozniak’s non-profit organization to help build the future of technology.

Ms. Murphy is at the nexus of creating new verticals in technology, education, and entertainment. Murphy has an extensive background and career experience in executive leadership, management, business development, and over two decades of experience in finance with over $900MM issued in private activity bonds. Murphy established her career and was appointed by Governor’s Executive Order as the Executive Director and CEO of Arizona Higher Education Loan Authority, a not-for-profit organization with a mission to provide low-cost education financing solutions.

Ms. Murphy currently serves on the Advisory Boards for OfferPad, an industry leader in innovative end-to-end real estate transactions, and The Game Fund Partners, a venture fund focused on Gaming, Esports, and related media.

We believe that Ms. Murphy is qualified to serve on our board of directors because of her extensive business experience derived from her current and past occupation.

Executive Officers

Our executive officers are appointed by our board of directors and hold office until their death, resignation or removal from office.

The names of our executive officers, their age, positions held, and duration of such and a brief description of the background and business experience for the past five years are as follows:

Business Experience of Executive Officers

| Name | | Position Held with Our Company | | Age | | Date First Elected or Appointed |

| Bruce Elliott | | President | | 58 | | October 15, 2017 |

| Swapan Kakumanu | | Chief Financial Officer, Secretary and Treasurer | | 52 | | December 4, 2018 |

The following is a brief account of the education and business experience of our executive officers during at least the past five years, indicating their principal occupation during the period, and the name and principal business of the organization by which they were employed.

Bruce Elliott

On October 15, 2017, Bruce Elliott was appointed as the president of our company. From April 2012 to October 2017, Mr. Elliott served as director of Boston Limited, Isle of Man, a regulated fiduciary and corporate service provider. From January 2013 to October 2017, Mr. Elliott served as director of Boston Ventures Limited, Isle of Man. From December 2017 to February 2018, Mr. Elliott served as the chief marketing officer of Ryde. From August 23, 2021 until present, Bruce Elliott is a Director and CEO of Memory Lane Games Limited, Isle of Man and as of October 2021 to present, a Director of VON Republic Holdings Inc.

Mr. Elliott is a 25-year eCommerce veteran having held senior leadership roles in privately held and listed companies in online payments, gaming, venture capital and trust and corporate service sectors in North America and Europe. Mr. Elliott is a recognized international conference speaker on entrepreneurship, venture capital and emerging technology trends and has also led venture capital investments into clean tech, gaming, blockchain, fintech and digital health companies.

Swapan Kakumanu

On December 4, 2018, Swapan Kakumanu was appointed as the chief financial officer of our company. Mr. Kakumanu had been the controller of our company since October 2017. On September 16, 2020, we appointed Mr. Kakumanu as our secretary and treasurer.

Mr. Kakumanu has been a partner, controller and chief financial officer for Red to Black Inc., a financial services firm offering chief financial officer, controller and strategic consulting services to both public and private companies, since November 2012. Mr. Kakumanu was the chief financial officer of RYDE Holding Inc. from October 2018 to November 2019, the chief financial officer and a director of BLOCKStrain Technology Corp (now TruTrace Technologies Inc.) from September 2018 to March 2020, and the chief financial officer of Pounce Technologies Inc. from July 2016 to December 2019. Mr. Kakumanu was also the chief financial officer of Intercept Energy Services Inc. from June 2014 to September 2018, the chief financial officer of Vogogo Inc. from August 2017 to April 2018, the controller of Vogogo Inc. from November 2013 to April 2018.

Mr. Kakumanu has over 20 years of senior finance and operations experience. He has served at the executive levels in both public and private companies including senior roles as president, chief executive officer, chief financial officer and company secretary, as well as director roles on boards. Mr. Kakumanu has extensive experience in public company reporting, investor relations, ERP implementations, mergers and acquisitions, internal controls and general overall financial, strategic and operations management. His diverse industry experience spans commercializing technologies and launching software solutions, blockchain, manufacturing, distribution, oilfield services, healthcare technologies and multi-jurisdictional operations. He holds CPA.CGA, ACA (Chartered Accountant, India) and ACMA (Certified Management Accountant, India) designations.

Family Relationships

There are no family relationships between any director or executive officer.

Involvement in Certain Legal Proceedings

We know of no material proceedings in which any of our directors or executive officers, or any associate of any such director or executive officer is a party adverse to our company or any of our subsidiaries or has a material interest adverse to our company or any of our subsidiaries.

None of our directors and executive officers has been involved in any of the following events during the past ten years:

| | (a) | any petition under the federal bankruptcy laws or any state insolvency laws filed by or against, or an appointment of a receiver, fiscal agent or similar officer by a court for the business or property of such person, or any partnership in which such person was a general partner at or within two years before the time of such filing, or any corporation or business association of which such person was an executive officer at or within two years before the time of such filing; |

| | | |

| | (b) | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

| | | |

| | (c) | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining such person from, or otherwise limiting, the following activities: (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; engaging in any type of business practice; or (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodities laws; |

| | | |

| | (d) | being the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (c)(i) above, or to be associated with persons engaged in any such activity; |

| | | |

| | (e) | being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission to have violated a federal or state securities or commodities law, and the judgment in such civil action or finding by the Securities and Exchange Commission has not been reversed, suspended, or vacated; |

| | | |

| | (f) | being found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| | (g) | being the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (i) any federal or state securities or commodities law or regulation; or (ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease- and-desist order, or removal or prohibition order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| | | |

| | (h) | being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Corporate Governance

Meetings

During the year ended December 31, 2021, our board of directors held 11 board meetings and, each director attended 100% of these meetings.

We encourage all incumbent directors and nominees for election as director to attend our meeting of stockholders. 4 directors attended our annual meeting of stockholders on May 27, 2021.

Committees of Board of Directors

Audit Committee

We have an audit committee consisting of James P. Geiskopf, Edmund C. Moy, and Shelly Murphy. Our audit committee assists our board of directors in fulfilling its responsibility to our stockholders relating to corporate accounting matters, the financial reporting practices of our company, and the quality and integrity of the financial reports of our company.

Our audit committee fulfills these responsibilities primarily by carrying out the activities enumerated in the audit committee charter adopted by our board of directors on October 9, 2017. The audit committee charter is attached to this proxy statement as Schedule “A”.

During the year ended December 31, 2021, our audit committee held 4 meetings, and each member of our audit committee attended 100% of these meetings.

Audit Committee Report

Our audit committee oversees our financial reporting process. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal accounting controls.

Our audit committee has reviewed and discussed the audited financial statements for the year ended December 31, 2021 with management.

Our audit committee has discussed with Haynie & Company, our independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission.

Our audit committee has received written disclosure and the letter from Haynie & Company required by applicable requirements of the Public Company Accounting Oversight Board regarding communications of Haynie & Company with our audit committee concerning independence, and has discussed with Haynie & Company its independence.

Based on the reviews and discussions referred to above, our audit committee recommended to our board of directors that the audited financial statements referred to above to be included in our annual report on Form 10-K for the year ended December 31, 2021 for filing with the Securities and Exchange Commission.

Members of the Audit Committee

| James P. Geiskopf | Edmund C. Moy |

| Shelly Murphy | |

The material in this report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any filing of our company under the Securities Act of 1933 or the Securities Exchange Act of 1934 whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Other Committees of Board of Directors

We do not have nominating or compensation committees or committees performing similar functions nor do we have a written nominating or compensation committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes that the functions of such committees can be adequately performed by our board of directors.

We do not have any defined policy or procedure requirements for our stockholders to submit recommendations or nominations for directors. We do not currently have any specific or minimum criteria for the election of nominees to our board of directors and we do not have any specific process or procedure for evaluating such nominees. Our board of directors assesses all candidates, whether submitted by management or stockholders, and makes recommendations for election or appointment.

A stockholder who wishes to communicate with our board of directors may do so by directing a written request to CurrencyWorks Inc., 3250 Oakland Hills Court, Fairfield, California 94534, Attention: President.

Director Independence

We currently act with four directors consisting of Cameron Chell, James P. Geiskopf, Edmund C. Moy, and Shelly Murphy. Our common stock is quoted on the OTCQB operated by the OTC Markets Group, which does not impose any director independence requirements. Under NASDAQ Rule 5605(a)(2), a director is not independent if, among other things, (1) he or she is also an executive officer or employee of the corporation or was, at any time during the past three years, employed by the corporation; or (2) he or she accepted or who has a family member who accepted any compensation from our company in excess of $120,000 during any period of twelve consecutive months within the past three years, other than the following: (i) compensation for board or board committee service; (ii) compensation paid to a family member who is an employee (other than an executive officer) of our company; or (iii) benefits under a tax-qualified retirement plan, or non-discretionary compensation. Using this definition of independent director, we have three independent directors, James Geiskopf, Edmund C. Moy, and Shelly Murphy.

In addition, James P. Geiskopf, Edmund C. Moy, and Shelly Murphy, the members of our audit committee, have not accepted directly or indirectly any consulting, advisory, or other compensatory fee from our company or subsidiary other than in his or her capacity as a member of the audit committee, our board of directors, or any other board committee, and each member of our audit committee is not a beneficial owner, directly or indirectly, of more than 10% of our common stock and is not an executive officer of our company. Accordingly, they are independent under independence standards applicable to the audit committee of a company whose stock is listed on the Nasdaq Capital Market.

Board Leadership Structure

The positions of our principal executive officer and the chairman of our board of directors are served by two individuals. Bruce Elliott is our president and Cameron Chell is our chairman of the board and a director of our company. In addition, James P. Geiskopf is our lead director. Because of the separation of those functions, we have determined that the leadership structure of our board of directors is appropriate, especially given the current stage of our development.

Our board of directors provides oversight of our risk exposure by receiving periodic reports from senior management regarding matters relating to financial, operational, legal and strategic risks and mitigation strategies for such risks.

Hedging Transactions

Except as disclosed below, our company has not adopted any practices or policies regarding the ability of our employees, including officers, or directors (or any of their designees) to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common shares.

Under our insider trading policy, no officer or director may make a short sale of our common stock.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of our common stock, to file reports regarding ownership of, and transactions in, our securities with the Securities and Exchange Commission and to provide us with copies of those filings. Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons we believe that during year ended December 31, 2021 all filing requirements applicable to our executive officers and directors, and persons who own more than 10% of our common stock were complied with, with the exception of the following:

Name | |

Number of

Late Reports | | Number of Transactions

Not Reported on a

Timely Basis | |

Failure to File

Requested Forms |

| Cameron Chell | | 1 | | 1 | | Nil |

Executive Compensation

Summary Compensation

The particulars of compensation paid to the following persons:

| | (a) | all individuals serving as our principal executive officer during the year ended December 31, 2021; |

| | (b) | each of our two most highly compensated executive officers who were serving as executive officers at the end of the year ended December 31, 2021; and |

| | | |

| | (c) | up to two additional individuals for whom disclosure would have been provided under (b) but for the fact that the individual was not serving as our executive officer at December 31, 2021, |

who we will collectively refer to as the named executive officers, for all services rendered in all capacities to our company and subsidiaries for the years ended December 31, 2021 and 2020are set out in the following summary compensation table:

| Summary Compensation Table – Years ended December 31, 2021 and 2020 |

| Name and Principal Position | | Year | | Salary

($) | | | Bonus

($) | | | Stock Awards

($) | | | Option Awards

($) | | | Non-Equity Incentive Plan Compensation

($) | | | Non-qualified Deferred Compensation Earnings

($) | | | All Other Compensation

($) | | | Total

($) | |

Bruce Elliott

| | 2021

| | | - | | | | - | | | | - | | | | 435,600 | (2) | | | - | | | | - | | | | - | | | | 435,600 | |

| President | | 2020 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Swapan | | 2021 | | | - | | | | - | | | | - | | | | 1,239,600 | (2) | | | - | | | | - | | | | - | | | | 1,239,600 | |

Kakumanu

Chief Financial Officer, Secretary and Treasurer(1) | | 2020 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Notes:

| (1) | On December 4, 2018, Mr. Kakumanu was appointed as the chief financial officer of our company. On September 16, 2020, we appointed Mr. Kakumanu as our secretary and treasurer. |

| (2) | Reflects the grant date fair value computed in accordance with FASB ASC Topic 718. Nonvested shares are valued at the date of the grant at the fair value of the common stock and are expensed over the vesting period. As vesting conditions are not wholly dependent on the employee and there is no timeline for them, for accounting purposes, the fair value are calculated and the expense will be recognized upon the achievement of the milestones. |

Narrative Disclosure to Summary Compensation Table

In connection with the appointment of Bruce Elliott as president, we have entered into an independent consultant agreement dated October 15, 2017 with Bruce Elliott whereby we agreed to pay Mr. Elliott a signing bonus of $7,500, payable within 30 days, and a consulting fee in the amount of $10,000 per month, which was increased to $12,000 per month commencing on February 1, 2018 with the approval of our board of directors. On June 1, 2018, his consulting fee increased to $16,000 per month with the approval of our board of directors. On December 1, 2019, his consulting fee decreased to $1 per month. Subject to compliance with all applicable securities laws, we also agreed to grant to Mr. Elliott 200,000 stock options within 60 days at a price of $0.10 per share, which stock options become exercisable as follows: (i) 1/3 upon the date of grant; (ii) 1/3 on the first anniversary date and (iii) 1/3 on the second anniversary date. The agreement continues for twelve months terms which will automatically be renewed unless we provide 90 days prior written notice of our intention to not renew the agreement. The agreement may be terminated by (i) Mr. Elliott by providing at least 90 days advance notice in writing, (ii) us by giving at least 90 days advance notice in writing, or (iii) us without notice in the event that Mr. Elliott: (a) breaches any term of the agreement, (b) neglects the services or any other duty to be performed under the agreement, (c) engages in any conduct which is dishonest, or damages our reputation or standing, (d) is convicted of any criminal act, (e) engages in any act of moral turpitude, (f) files a voluntary petition in bankruptcy, or (g) is adjudicated as bankrupt or insolvent. Mr. Elliott has also agreed for the term of the agreement not to compete with us in the business of providing services for blockchain initial coin offerings. During the term of the agreement and for a period of one year immediately following the termination or expiration of the agreement, Mr. Elliott has agreed not to solicit or induce any customer, prospective customer, supplier, sales personnel, employee or independent contractor involved with us to terminate or breach any employment, contractual or other relationship with us, or to otherwise discontinue or alter such third party’s relationship with us.

Since October 1, 2017, we have paid Red to Black Inc., a company controlled by Swapan Kakumanu $4,000 per month which was amended to $10,000 per month from February 1, 2018 for providing accounting and controller services. On December 4, 2018, we removed Michael Blum as our chief financial officer in order to accommodate the appointment of Swapan Kakumanu as our chief financial officer in connection with our application to list our common stock on the TSX Venture Exchange. In connection with the appointment of Swapan Kakumanu as chief financial officer, we have entered into an independent consultant agreement dated December 4, 2018 with Swapan Kakumanu whereby we agreed to pay a consulting fee of $5,000 per month. Commencing December 1, 2019, the consulting agreement was amended to pay $1 per month. Subject to compliance with all applicable securities laws, we also agreed to grant to Mr. Kakumanu stock options in an amount to be determined by our board of directors. The agreement continues for a twelve month term, which will automatically be renewed unless we provide 30 days prior written notice of our intention to not renew the agreement. The agreement may be terminated by (i) Mr. Kakumanu by providing at least 30 days advance notice in writing, (ii) us by giving at least 30 days advance notice in writing, or (iii) us without notice in the event that Mr. Kakumanu: (a) breaches any term of the agreement, (b) neglects the services or any other duty to be performed under the agreement, (c) engages in any conduct which is dishonest or damages our reputation or standing, (d) is convicted of any criminal act, (e) engages in any act of moral turpitude, (f) files a voluntary petition in bankruptcy, or (g) is adjudicated as bankrupt or insolvent. Mr. Kakumanu has also agreed, for the term of the agreement, not to compete with us in the business of providing services for blockchain initial coin offerings. During the term of the agreement, and for a period of one year immediately following the termination or expiration of the agreement, Mr. Kakumanu has agreed not to solicit or induce any customer, prospective customer, supplier, sales personnel, employee, or independent contractor involved with us to terminate or breach any employment, contractual or other relationship with us, or to otherwise discontinue or alter such third party’s relationship with us.

On October 15, 2017, as amended on January 22, 2018, November 22, 2018, and December 7, 2020, our board of directors adopted and approved the 2017 Equity Incentive Plan. The purpose of the plan is to (a) enable us and any of our affiliates to attract and retain the types of employees, consultants and directors who will contribute to our long range success; (b) provide incentives that align the interests of employees, consultants and directors with those of our stockholders; and (c) promote the success of our business. On November 22, 2018, our board of directors amended our 2017 Equity Incentive Plan in connection with our application to list our common stock on the TSX Venture Exchange. On December 7, 2020, the plan was amended to provide that a total of 6,985,207 shares of our common stock will be available for the grant of stock options and no shares will be available for the grant of non-stock option awards. On April 26, 2021, our board of directors amended our 2017 Equity Incentive Plan to increase the number of shares of our common stock available for the grant of stock options from 6,985,207 to 13,300,000 and on May 27, 2021, our stockholders approved this amendment.

On February 10, 2021, we granted 400,000 stock options to Bruce Elliott and 400,000 stock options to Swapan Kakumanu. Each stock option is exercisable for a period of 10 years at a price of $1.17 per share. The stock options vest as to one-third on the date of grant, one-third on the first anniversary of the date of grant and one-third on the second anniversary of the date of grant.

On June 15, 2021, we granted 750,000 stock options to Swapan Kakumanu. Each stock option is exercisable for a period of 10 years at a price of $1.16 per share. The stock options vest as to one-third on the date of grant, one-third on the first anniversary of the date of grant and one-third on the second anniversary of the date of grant.

Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide retirement or similar benefits for our directors or named executive officers.

Resignation, Retirement, Other Termination, or Change in Control Arrangements

We have no contract, agreement, plan or arrangement, whether written or unwritten, that provides for payments to our directors or executive officers at, following, or in connection with the resignation, retirement or other termination of its directors or executive officers, or a change in control of our company or a change in our directors’ or executive officers’ responsibilities following a change in control.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth for each named executive officer certain information concerning the outstanding equity awards as of December 31, 2021:

| | | Option awards | | Stock awards | |

| Name | | Number of securities underlying unexercised options (#) exercisable | | | Number of securities underlying unexercised options (#) unexercisable | | | Equity incentive plan awards: Number of securities underlying unexercised unearned options (#) | | | Option exercise price ($) | | | Option expiration date | | Number of shares or units of stock that have not vested (#) | | | Market value of shares of units of stock that have not vested ($) | | | Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested (#) | | | Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested ($) | |

| Bruce Elliott | | | 200,000 | | | | | | | | - | | | | 0.10 | | | October 15, 2027 | | | - | | | | - | | | | - | | | | - | |

| Bruce Elliott | | | 133,333 | (1) | | | 266,667 | (1) | | | | | | | 1.17 | | | February 10, 2031 | | | | | | | | | | | | | | | | |

| Swapan Kakumanu | | | 100,000 | (2) | | | - | | | | - | | | | 0.10 | | | October 15, 2027 | | | | | | | | | | | | | | | | |

| Swapan Kakumanu | | | 75,000 | (2) | | | - | | | | - | | | | 0.60 | | | June 8, 2028 | | | - | | | | - | | | | - | | | | - | |

| Swapan Kakumanu | | | 133,333 | (1) | | | 266,667 | (1) | | | - | | | | 1.17 | | | February 10, 2031 | | | - | | | | - | | | | - | | | | - | |

| Swapan Kakumanu | | | 250,000 | (1) | | | 500,000 | (1) | | | - | | | | 1.16 | | | June 15, 2031 | | | - | | | | - | | | | - | | | | - | |

Notes:

| (1) | The stock options become exercisable as follows: (i) 1/3 on the first anniversary date of grant; (ii) 1/3 on the second anniversary date and (iii) 1/3 on the third anniversary date. |

| | |

| (2) | These stock options are held by Red to Black Inc., a company controlled by Swapan Kakumanu. |

Compensation of Directors

The particulars of compensation paid to our directors who are not named executive officers for the fiscal year ended December 31, 2021 are set out in the following director compensation table:

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| Cameron Chell(1) | | | 135,000 | | | | - | | | | 1,507,600 | (2)

(11) | | | - | | | | - | | | | - | | | | 1,642,600 | |

| James P. Geiskopf | | | 155,000 | | | | - | | | | 1,239,600 | (3)

(11) | | | - | | | | - | | | | - | | | | 1,394,600 | |

| Edmund C. Moy | | | - | | | | - | | | | 432,200 | (4)

(11) | | | - | | | | - | | | | - | | | | 432,200 | |

| Shelly Murphy(5) | | | - | | | | - | | | | 214,400 | (6)

(11) | | | - | | | | - | | | | - | | | | 214,400 | |

| Michael Blum(7) | | | - | | | | - | | | | 217,800 | (8)

(11) | | | - | | | | - | | | | - | | | | 217,800 | |

| James M. Carter(9) | | | - | | | | - | | | | 217,800 | (10)

(11) | | | - | | | | - | | | | - | | | | 217,800 | |

Notes:

| (1) | Does not include the fees and stock options received by Business Instincts Group Inc. On October 18, 2017, we entered into a business services agreement with Business Instincts Group Inc., a company of which Mr. Chell was a director, officer and indirect shareholder until January 15, 2021. The fees and stock options received by Business Instincts Group Inc. are compensation for the services provided by that company as a whole and we did not compensate Mr. Chell separately for these services. |

| | |

| (2) | As of December 31, 2021, Mr. Chell owned the following stock options: stock options to purchase 400,000 shares of our common stock at an exercise price of $0.10 per share until October 15, 2027 pursuant to the stock option agreement dated October 15, 2017, stock options to purchase 400,000 shares of our common stock at an exercise price of $1.17 per share until February 10, 2031 pursuant to the stock option agreement dated February 10, 2021 and stock options to purchase 1,000,000 shares of our common stock at an exercise price of $1.16 per share until June 15, 2031 pursuant to the stock option agreement dated June 15, 2021. |

| | |

| (3) | As of December 31, 2021, Mr. Geiskopf owned the following stock options: stock options to purchase 400,000 shares of our common stock at an exercise price of $0.10 per share until October 15, 2027 pursuant to the stock option agreement dated October 15, 2017, stock options to purchase 400,000 shares of our common stock at an exercise price of $1.17 per share until February 10, 2031 pursuant to the stock option agreement dated February 10, 2021 and stock options to purchase 750,000 shares of our common stock at an exercise price of $1.16 per share until June 15, 2031 pursuant to the stock option agreement dated June 15, 2021. |

| | |

| (4) | As of December 31, 2021, Mr. Moy owned the following stock options: stock options to purchase 100,000 shares of our common stock at an exercise price of $0.60 per share until February 9, 2028 pursuant to the stock option agreement dated February 9, 2018, stock options to purchase 200,000 shares of our common stock at an exercise price of $1.17 per share until February 10, 2031 pursuant to the stock option agreement dated February 10, 2021 and stock options to purchase 200,000 shares of our common stock at an exercise price of $1.16 per share until June 15, 2031 pursuant to the stock option agreement dated June 15, 2021. |

| | |

| (5) | On June 14, 2021, Ms. Murphy was appointed a director of our company. |

| | |

| (6) | As of December 31, 2021, Ms. Murphy owned the following stock options: stock options to purchase 200,000 shares of our common stock at an exercise price of $1.16 per share until June 15, 2031 pursuant to the stock option agreement dated June 15, 2021. |

| | |

| (7) | On June 14, 2021, Mr. Blum resigned as a director of our company. |

| | |

| (8) | As of December 31, 2021, Mr. Blum owned no stock options of our company. |

| | |

| (9) | On June 14, 2021, Mr. Carter resigned as a director of our company. |

| | |

| (10) | As of December 31, 2021, Mr. Carter owned no stock options of our company. |

| | |

| (11) | Reflects the grant date fair value computed in accordance with FASB ASC Topic 718. Nonvested shares are valued at the date of the grant at the fair value of the common stock and are expensed over the vesting period. As vesting conditions are not wholly dependent on the employee and there is no timeline for them, for accounting purposes, the fair value will be calculated and the expense will be recognized upon the achievement of the milestones. |

On January 22, 2018, we entered into an offer letter with James P. Geiskopf, pursuant to which, among other things, we agreed to pay Mr. Geiskopf $120,000 in annual cash compensation commencing on January 1, 2018. On June 26, 2019, Mr. Geiskopf agreed to a credit $30,000 of his annual cash compensation. On December 20, 2019, Mr. Geiskopf agreed to credit the remaining outstanding invoices of $50,000.

In connection with the appointment of Edmund C. Moy as a director on February 9, 2018, we entered into an offer letter dated February 9, 2018 with Mr. Moy, pursuant to which, among other things, we agreed to pay Mr. Moy $50,000 in annual cash compensation and grant 100,000 stock options. Effective February 9, 2018, we granted to Mr. Moy 100,000 stock options, which are exercisable at an exercise price of $0.60 per share until February 9, 2028. The stock options become exercisable as follows: (i) 1/3 on the grant date, (ii) 1/3 on the first anniversary of the grant date and (iii) 1/3 on the second anniversary of the grant date. On December 20, 2019, Mr. Moy agreed to credit the remaining outstanding invoices of $33,333.

In connection with the appointment of Shelly Murphy as a director on June 15, 2021, we entered into an offer letter dated June 15, 2021 with Ms. Murphy, pursuant to which, among other things, we granted to Ms. Murphy 200,000 stock options, which are exercisable at an exercise price of $1.16 per share until June 15, 2031. The stock options become exercisable monthly over 36 months as follows: 1/36 of the stock options vesting each month commencing on June 15, 2021.

On February 10, 2021, we granted stock options to our directors (200,000 stock options to Michael Blum, 400,000 stock options to Cameron Chell, 400,000 stock options to James P. Geiskopf, 200,000 to Edmund Moy, and 200,000 to James M. Carter). Each stock option is exercisable for a period of 10 years at a price of $1.17 per share. The stock options vest as to one-third on the date of grant, one-third on the first anniversary of the date of grant and one-third on the second anniversary of the date of grant.

On June 15, 2021, we granted stock options to our directors (1,000,000 stock options to Cameron Chell, 750,000 stock options to James P. Geiskopf, 200,000 to Edmund Moy, and 200,000 to Shelly Murphy). Each stock option is exercisable for a period of 10 years at a price of $1.16 per share. The stock options vest as to one-third on the date of grant, one-third on the first anniversary of the date of grant and one-third on the second anniversary of the date of grant.

Transactions with Related Persons

Other than as disclosed below, there has been no transaction, since January 1, 2020, or currently proposed transaction, in which our company was or is to be a participant and the amount involved exceeds $54,069.05, being the lesser of $120,000 or one percent of the average of our total assets at year end for the last two completed fiscal years, and in which any of the following persons had or will have a direct or indirect material interest:

| | (a) | any director, director nominee or executive officer of our company; |

| | | |

| | (b) | any person who beneficially owns, directly or indirectly, more than 5% of any class of our voting securities; |

| | | |

| | (c) | any person who acquired control of our company when it was a shell company or any person that is part of a group, consisting of two or more persons that agreed to act together for the purpose of acquiring, holding, voting or disposing of our common stock, that acquired control of our company when it was a shell company; and |

| | | |

| | (d) | any member of the immediate family (including spouse, parents, children, siblings and in- laws) of any of the foregoing persons. |

We entered into 7 promissory notes with rate of interest payable at 5% per annum on July 18, 2019, August 9, 2019, September 13, 2019, October 4, 2019, November 19, 2019, December 18, 2019, and January 9, 2020 with Business Instincts Group Inc. (“BIG”). We repaid BIG $101,460 of the principal amount owing in the fiscal year ended December 31, 2020. As of April 27, 2022, we owed $28,804 in principal and interest (December 31, 2020 - $414,547 and December 31, 2019 - $484,525). The largest aggregate principal outstanding during the period from January 1, 2020 to December 31, 2021 was $1,915,205, with $nil outstanding as at December 31, 2021. No interest was paid in the period from January 1, 2020 to December 31, 2021. Our chairman and director, Cameron Chell, was a director, officer and an indirect shareholder of BIG until January 15, 2021.

Effective as of December 10, 2020, we entered into a business services agreement with BIG, whereby we retained the services of BIG to provide various business and product development services. The term of the business services

agreement, the services to be provided by BIG under the business services agreement and the amounts to be paid to BIG for providing the services under the business services agreement (the “Fees”) will be set out separately in the future as separate schedules to the business services agreement. We and BIG have agreed that the Fees be calculated based on new business services agreements we sign with our customers and such Fees will not be more than eighty percent of the fees that we charge our customers. We expect that the Fees will be eighty percent of the fees that we charge our customers for most of our customers. Under the business services agreement, the Fees are to be calculated only on the revenue earned and collected by us from our customers that relates to monthly services fee and product development fees and the Fees will not be calculated on any revenues earned and collected by us from our customers that are based on transaction processing fees or any revenue earned in the form of equity or joint venture or profit-sharing arrangements in our customer’s company. Under the business services agreement, we are responsible for paying specific disbursements charged by third parties to BIG relating to the business services agreement, including graphic design, creative, legal and other advisory fees. We have also agreed to reimburse BIG for any out-of-pocket expenses incurred by BIG in connection with the business services agreement and carrying out the services once we collect these out-of-pocket expenses from our customers. Any out-of-pocket expenses and disbursements to be charged by third parties must be pre-approved by us.

We engaged two clients to build out their business models, technology strategy, market entry strategy, and capital structure, including a blockchain platform launch. We signed an agreement with BIG in which 80% of the revenue received is reimbursed to BIG for expenses incurred to meet the performance obligations as outlined above.

For the year ended December 31, 2020, we incurred expenses of $132,266 of which $102,267 was payable as at December 31, 2020 to BIG related to these customers.

For the year ended December 31, 2021, we incurred expenses of which $140,000 was payable as at December 31, 2021 to BIG related to these customers.

Effective as of May 5, 2021, we loaned $400,000 to Fogdog Energy Solutions Inc. pursuant to convertible promissory note. The note bears interest at a rate of 4% per annum and comes due on May 5, 2022. The note may not be prepaid without the written consent of our company. Under certain conditions as outlined in the promissory note, we may convert the outstanding loan into common shares. Our chief financial officer, secretary and treasurer, Swapan Kakumanu, is a director, chief financial officer and a shareholder of Fogdog. Accrued interest as at December 31, 2021 is $24,773. Effective as of August 20, 2021, we loaned an additional $850,000 to Fogdog Energy Solutions Inc. pursuant to convertible promissory note. The note bears interest at a rate of 10% per annum and comes due on August 20, 2027. The note may not be prepaid without the written consent of our company. Under certain conditions as outlined in the promissory note, we may convert the outstanding loan into common shares. The largest aggregate amount of principal outstanding during the period from January 1, 2020 to December 31, 2021 and the amount thereof outstanding as of April 27, 2022 is $1,250,000. Accrued interest as at December 31, 2021 is $24,773. The amount of principal and accrued interest paid during the period from January 1, 2020 to December 31, 2021 was $nil.

On December 29, 2021, we completed a private placement of an aggregate of 173,609 shares of common stock at a price of $0.288 per share for aggregate gross proceeds of $50,000. Of the 173,609 shares: (i) Cameron Chell, our chairman and director, subscribed for 59,027 shares of our common stock; (ii) Swapan Kakumanu, our Chief Financial Officer, subscribed for 57,291 shares of our common stock; and (iii) James P. Geiskopf, our lead director, subscribed for 57,291 shares of our common stock.

On January 28, 2022, we completed a private placement of an aggregate of 244,139 shares of common stock at a price of $0.2048 per share for aggregate gross proceeds of $50,000. Of the 244,139 shares: (i) Cameron Chell, our chairman and director, subscribed for 83,007 shares of our common stock; (ii) Swapan Kakumanu, our Chief Financial Officer, subscribed for 80,566 shares of our common stock; and (iii) James P. Geiskopf, our lead director, subscribed for 80,566 shares of our common stock.

Compensation for Named Executive Officers and Directors

For information regarding compensation for our named executive officers and directors, see “Executive Compensation”.

Proposal 2

Ratification of the Appointment of the Independent Registered Public Accounting Firm

Our board of directors is asking our stockholders to ratify the appointment of Haynie & Company as our independent registered public accounting firm.

Stockholder ratification of the appointment of Haynie & Company as our independent registered public accounting firm is not required by our bylaws or otherwise. However, our board of directors is submitting the appointment of Haynie & Company to the stockholders for ratification as a matter of corporate practice. If the stockholders fail to ratify the appointment, our board of directors will reconsider whether or not to retain the firm. Even if the appointment is ratified, our board of directors in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if our board of directors determines that such a change would be in the best interest of our company and our stockholders.

Representatives of Haynie & Company are not expected to be present at the annual meeting. However, we will provide contact information for Haynie & Company to any stockholders who would like to contact the firm with questions.

Unless otherwise directed, the proxy holder will vote the proxies received by him for the ratification of the appointment of Haynie & Company as our independent registered public accounting firm.

Our board of directors recommends that you vote FOR the ratification of the appointment of Haynie & Company as our independent registered public accounting firm.

Fees Paid to Our Independent Registered Public Accounting Firms

The following table sets forth the fees billed or expected to be billed to our company for the years ended December 31, 2021 and December 31, 2020 for professional services rendered by Haynie & Company, our independent registered public accounting firm:

| Fees | | 2021 | | | 2020 | |

| Audit Fees | | $ | 55,000 | * | | $ | 55,542 | |

| Audit Related Fees | | | - | | | | - | |

| Tax Fees | | | - | | | | - | |

| Other Fees | | | 55,000 | | | | 55,542 | |

*Estimated

Pre-Approval Policies and Procedures

Our audit committee pre-approves all services provided by our independent registered public accountants. All of the above services and fees were reviewed and approved by our audit committee before the respective services were rendered.

Our board of directors has considered the nature and amount of fees billed by our independent registered public accountants and believes that the provision of services for activities unrelated to the audit is compatible with maintaining the independence of our independent registered public accountants.

Our board of directors recommends that you vote FOR the ratification of the appointment of Haynie & Company as our independent registered public accounting firm.

Proposal 3

Advisory Vote on Executive Compensation

Pursuant to the rules of the Securities and Exchange Commission, we are required to provide our stockholders with a non-binding advisory vote on the compensation of our named executive officers.

We urge you to read the “Executive Compensation” section of this proxy statement. This advisory vote, commonly known as “Say-on-Pay,” gives you as a stockholder the opportunity to endorse or not endorse the compensation of our named executive officers.

Because your vote is advisory, it will not be binding on our board of directors. However, our board of directors will take into account the outcome of the vote when considering future executive compensation arrangements.

Our board of directors recommends that you vote FOR the approval of compensation of our named executive officers as disclosed in this proxy statement.

Proposal 4

Advisory Vote on Frequency of Advisory Vote on Executive Compensation

In addition to providing you with a non-binding advisory vote on compensation of our named executive officers, we are also presenting the following proposal, which gives you as a stockholder the opportunity to cast a non-binding advisory vote on how frequently we should seek an advisory vote on the compensation of our named executive officers. This non-binding advisory vote is commonly referred to as a “say on frequency” vote. Under this proposal, our stockholders may cast a non-binding advisory vote on whether they would prefer to have a vote on the compensation of our named executive officers every year, every two years or every three years.