© 2016 Advanced Emissions Solutions, Inc. Company All rights reserved. 2014 Form 10-K Investor Call Slides March 1, 2016

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -2- EVENT TITLE This presentation includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, which provides a "safe harbor" for such statements in certain circumstances. The forward- looking statements include statements or expectations regarding future growth or contraction, competition, and our ability to capitalize on our target markets; future contracts, projects, and operations; amount and timing of production of RC, timing and terms of the lease or sale of RC facilities, future revenues, royalties earned, backlog, funding for our business and projects, margins, expenses, earnings, tax rate, cash flow and use of cash, royalty payment obligations, working capital, liquidity, the ability to recognize tax benefits, and other financial and accounting measures; sale of our equity interest in RCM6; scope, timing and impact of current and anticipated regulations and legislation; the ability of our products and technologies to assist our customers in complying with government regulations and related matters; and the outcome of current and pending legal proceedings. These statements are based on current expectations, estimates, projections, beliefs and assumptions of our management. Such statements involve significant risks and uncertainties. Actual events or results could differ materially from those discussed in the forward-looking statements as a result of various factors, including but not limited to, changes and timing in laws, regulations, IRS interpretations or guidance, accounting rules and any pending court decisions, legal challenges to or repeal of them; changes in prices, economic conditions and market demand; the ability of the RC facilities to produce coal that qualifies for tax credits; the timing, terms and changes in contracts for RC facilities, or failure to lease or sell facilities; impact of competition; availability, cost of and demand for alternative tax credit vehicles and other technologies; technical, start-up and operational difficulties; availability of raw materials; loss of key personnel; elevated spending on non-recurring cash expenses may last longer than expected or reductions in operating costs may be less than expected; inability to comply with the terms of the bridge loan; intellectual property infringement claims from third parties; the outcome of pending litigation; seasonality and other factors discussed in greater detail in our filings with the Securities and Exchange Commission (SEC). You are cautioned not to place undue reliance on such statements and to consult our SEC filings for additional risks and uncertainties that may apply to our business and the ownership of our securities. Our forward-looking statements are presented as of the date made, and we disclaim any duty to update such statements unless required by law to do so. Safe Harbor

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -3- Agenda Welcome and safe harbor Upcoming events Priorities 2016 Significant restatement items ADES businesses Balance Sheets, Statement of Operations, Statement and Cash Flows ADES businesses segment reviews Refined Coal- CCS, CCSS, RCM6, RC royalties, 453A interest expense Emissions Control- Equipment, Chemicals, and Services Corporate overview Operating expenses Financial obligations and liabilities Tax status Question & Answers

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -4- 1Q 2015 Forms 10-Q and 10-Ks 2016 corporate strategy NASDAQ application pending 2Q 2016 Q1 Form 10-Q June Annual stockholder meeting Upcoming Events

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -5- Refined Coal: Via Clean Coal Solutions, LLC (“CCS”), produce Refined Coal and generate cash by securing tax equity investors SEC Financial Reporting: Become current with our SEC filing requirements and relisted on NASDAQ Emissions Control: Successfully deliver on customer commitments and obligations; sell products to prove asset value Corporate Transformation: Continue to transform the organization and ensure cash is used to achieve the above priorities Priorities 2016

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -6- Significant Restatement Items Deconsolidation of CCS • No longer consolidate CCS in ADES financials • Earnings or losses from CCS recorded in earnings from equity method investments line on the Income Statement Revenue Recognition on Long-Term Equipment Contracts • Completed contract accounting; no longer use percentage- of-completion methodology • Revenues and expenses recognized only when the contract is substantially complete

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -7- Significant restatement items (cont.) Settlement and Royalty Indemnity Accounting • Expected ongoing payments (2011- 2018) related to the Norit lawsuit should have been recognized in 2011 in addition to lump sum payments already recognized in 2011 • Previously recorded expenses in 2013 and 2012 were removed • Actual payments reflected in the Statement-of-Cash Flows for all years • Future changes, if any, in payment estimates will be recorded in the Income Statement Other Adjustments • Warranty reserves, 453A interest, purchase price accounting of the BCSI, LLC acquisition, accounting for stock-based compensation expenses, various other. Please see Note 2 of the Form 10-K for more information.

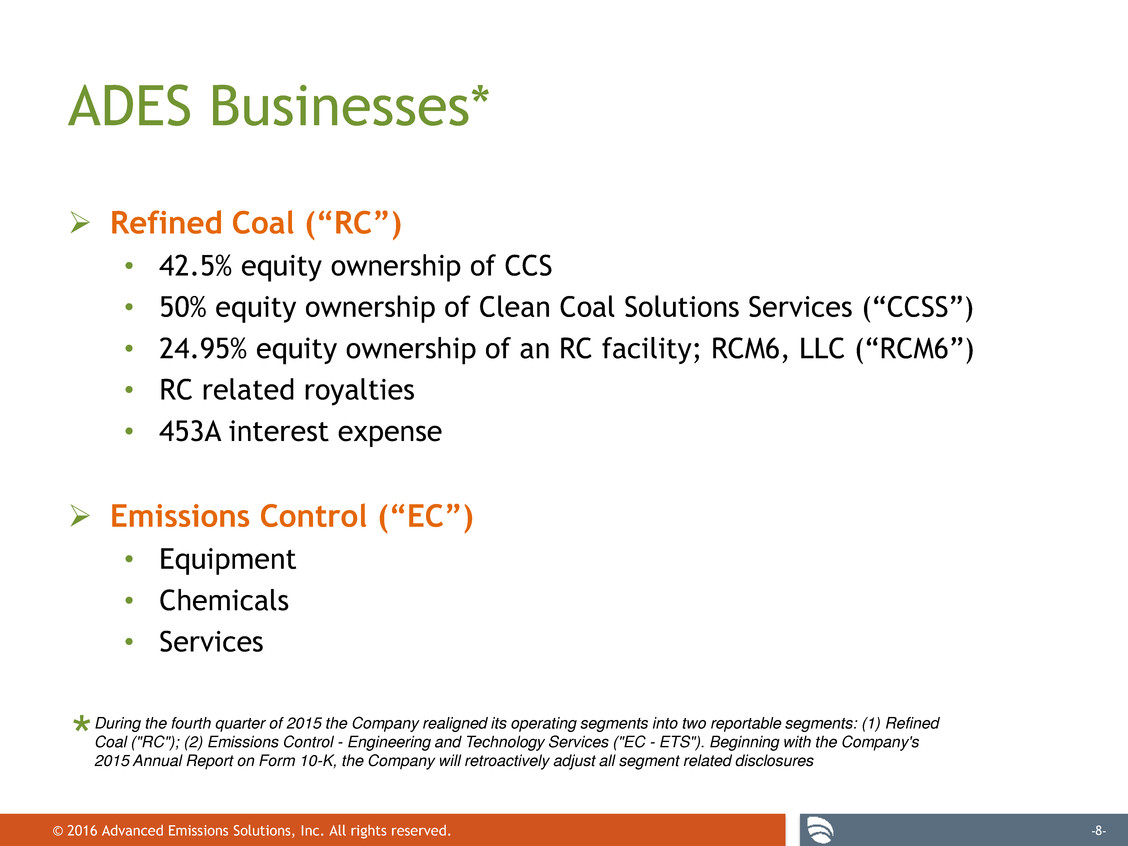

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -8- During the fourth quarter of 2015 the Company realigned its operating segments into two reportable segments: (1) Refined Coal ("RC"); (2) Emissions Control - Engineering and Technology Services ("EC - ETS"). Beginning with the Company's 2015 Annual Report on Form 10-K, the Company will retroactively adjust all segment related disclosures * ADES Businesses* Refined Coal (“RC”) • 42.5% equity ownership of CCS • 50% equity ownership of Clean Coal Solutions Services (“CCSS”) • 24.95% equity ownership of an RC facility; RCM6, LLC (“RCM6”) • RC related royalties • 453A interest expense Emissions Control (“EC”) • Equipment • Chemicals • Services

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -9- Condensed Consolidated Balance Sheet* (in thousands $) 2013 2014 ASSETS Current assets: Cash and cash equivalents 37,890 25,181 Receivables, net 12,943 17,070 Costs in excess of billings on uncompleted contracts 2,700 6,153 Total current assets 55,355 54,429 Restricted cash, long-term 7,667 8,771 Total Assets 73,524 93,699 LIABILITIES AND STOCKHOLDERS’ DEFICIT Current liabilities: Accounts payable 5,186 7,514 Current portion of notes payable related party - 1,479 Billings in excess of costs on uncompleted contracts 20,269 22,518 Settlement and royalty indemnity obligation 4,622 3,749 Other current liabilities 7,381 6,739 Total current liabilities 42,559 47,157 Long-term portion of notes payable, related party - 14,431 Settlement and royalty indemnification, long-term 24,021 20,273 Advance deposit, related party 8,659 6,524 Other long-term liabilities 4,452 6,011 Total Liabilities 79,691 94,396 Total Liabilities and Stockholders’ deficit 73,524 93,699 Represents a partial view of the Consolidated Balance Sheet. The rows reflecting total assets and liabilities are accurate and inclusive but many line items are not shown for display purposes. The complete Consolidated Balance Sheet can be seen in the appendix. *

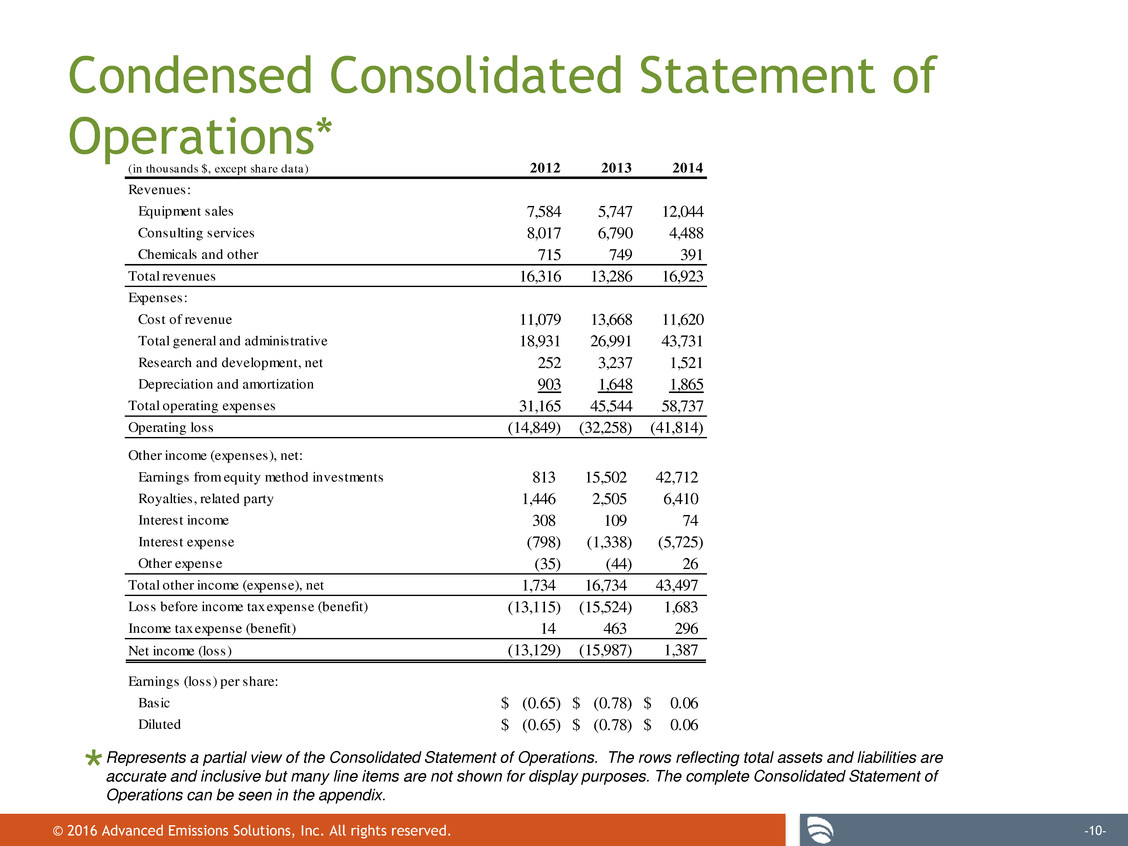

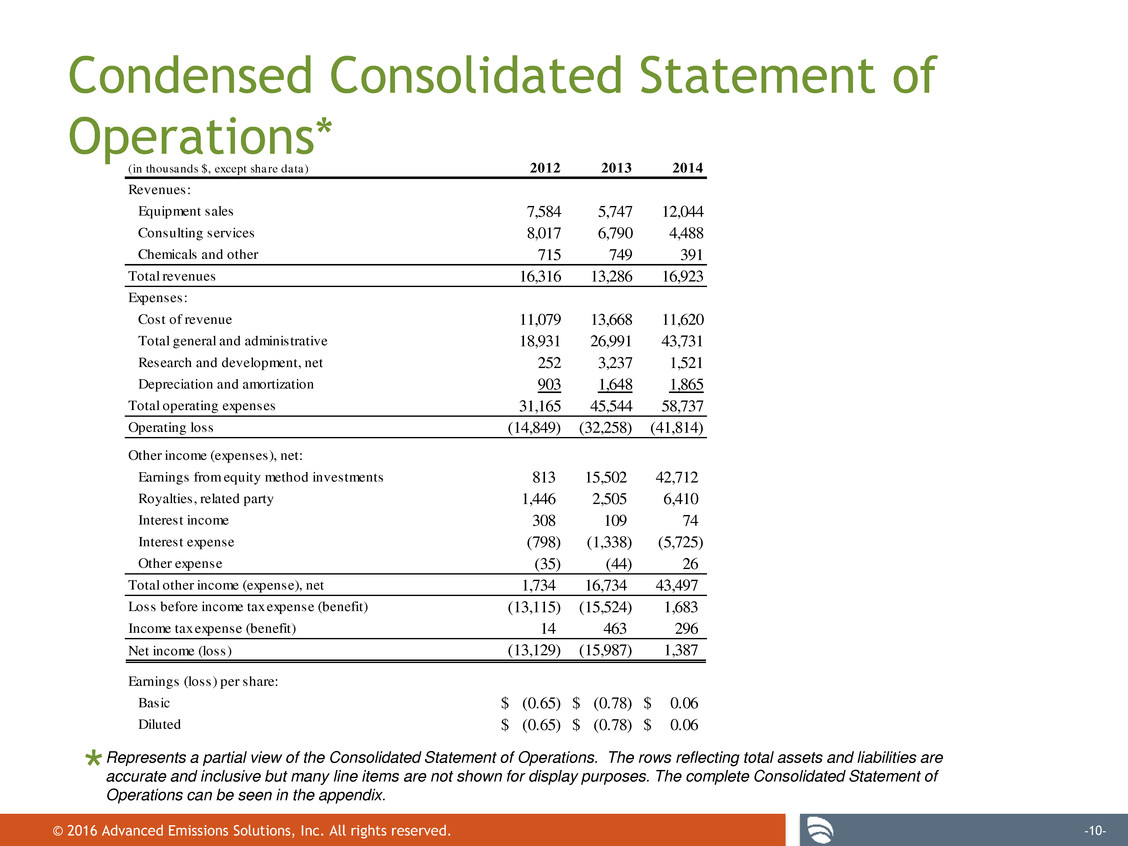

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -10- (in thousands $, except share data) 2012 2013 2014 Revenues: Equipment sales 7,584 5,747 12,044 Consulting services 8,017 6,790 4,488 Chemicals and other 715 749 391 Total revenues 16,316 13,286 16,923 Expenses: Cost of revenue 11,079 13,668 11,620 Total general and administrative 18,931 26,991 43,731 Research and development, net 252 3,237 1,521 Depreciation and amortization 903 1,648 1,865 Total operating expenses 31,165 45,544 58,737 Operating loss (14,849) (32,258) (41,814) Other income (expenses), net: Earnings from equity method investments 813 15,502 42,712 Royalties, related party 1,446 2,505 6,410 Interest income 308 109 74 Interest expense (798) (1,338) (5,725) Other expense (35) (44) 26 Total other income (expense), net 1,734 16,734 43,497 Loss before income tax expense (benefit) (13,115) (15,524) 1,683 Income tax expense (benefit) 14 463 296 Net income (loss) (13,129) (15,987) 1,387 Earnings (loss) per share: Basic (0.65)$ (0.78)$ 0.06$ Diluted (0.65)$ (0.78)$ 0.06$ Represents a partial view of the Consolidated Statement of Operations. The rows reflecting total assets and liabilities are accurate and inclusive but many line items are not shown for display purposes. The complete Consolidated Statement of Operations can be seen in the appendix. * Condensed Consolidated Statement of Operations*

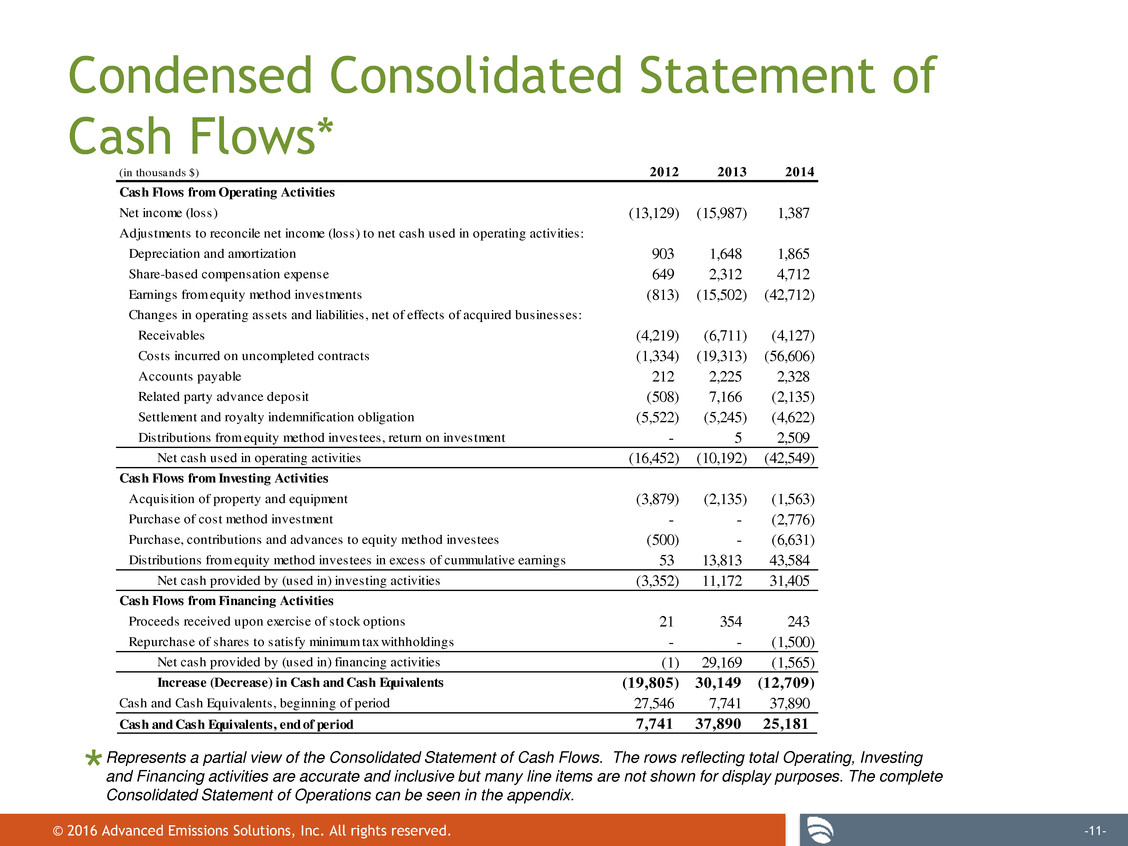

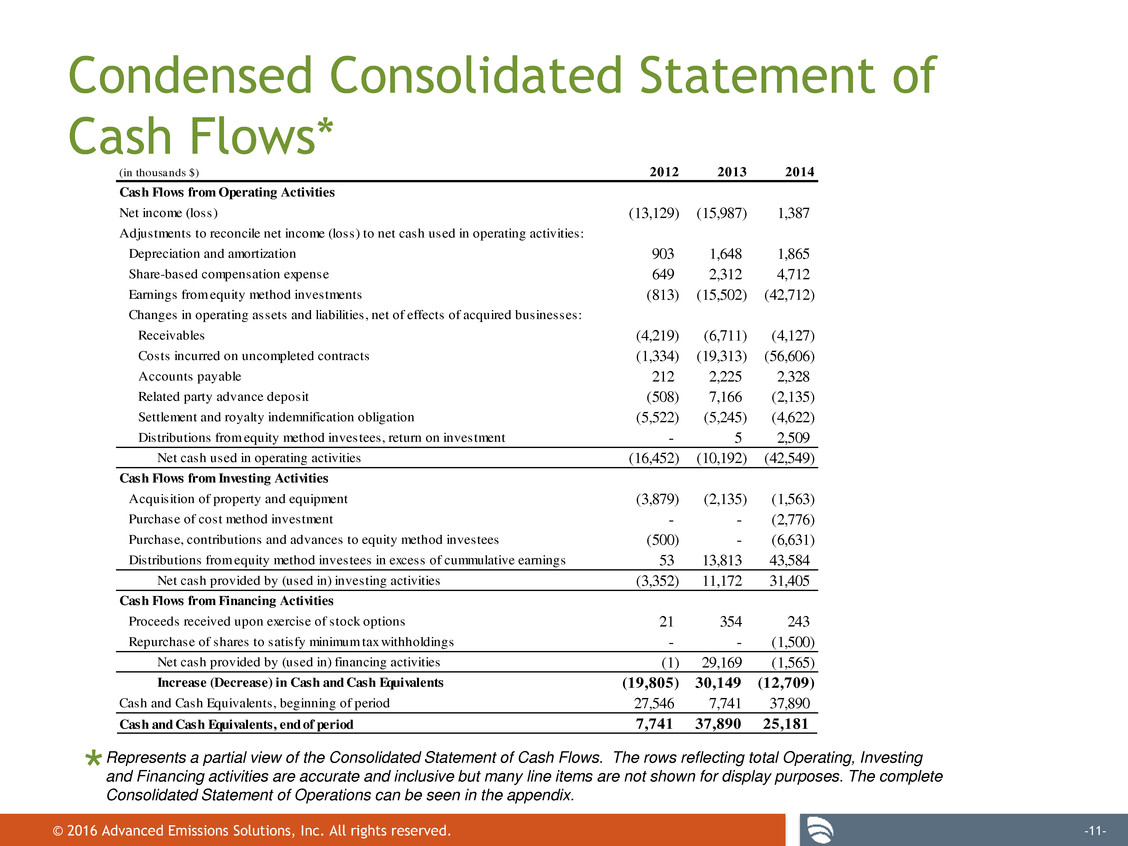

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -11- (in thousands $) 2012 2013 2014 Cash Flows from Operating Activities Net income (loss) (13,129) (15,987) 1,387 Adjustments to reconcile net income (loss) to net cash used in operating activities: Depreciation and amortization 903 1,648 1,865 Share-based compensation expense 649 2,312 4,712 Earnings from equity method investments (813) (15,502) (42,712) Changes in operating assets and liabilities, net of effects of acquired businesses: Receivables (4,219) (6,711) (4,127) Costs incurred on uncompleted contracts (1,334) (19,313) (56,606) Accounts payable 212 2,225 2,328 Related party advance deposit (508) 7,166 (2,135) Settlement and royalty indemnification obligation (5,522) (5,245) (4,622) Distributions from equity method investees, return on investment - 5 2,509 Net cash used in operating activities (16,452) (10,192) (42,549) Cash Flows from Investing Activities Acquisition of property and equipment (3,879) (2,135) (1,563) Purchase of cost method investment - - (2,776) Purchase, contributions and advances to equity method investees (500) - (6,631) Distributions from equity method investees in excess of cummulative earnings 53 13,813 43,584 Net cash provided by (used in) investing activities (3,352) 11,172 31,405 Cash Flows from Financing Activities Proceeds received upon exercise of stock options 21 354 243 Repurchase of shares to satisfy minimum tax withholdings - - (1,500) Net cash provided by (used in) financing activities (1) 29,169 (1,565) Increase (Decrease) in Cash and Cash Equivalents (19,805) 30,149 (12,709) Cash and Cash Equivalents, beginning of period 27,546 7,741 37,890 Cash and Cash Equivalents, end of period 7,741 37,890 25,181 Represents a partial view of the Consolidated Statement of Cash Flows. The rows reflecting total Operating, Investing and Financing activities are accurate and inclusive but many line items are not shown for display purposes. The complete Consolidated Statement of Operations can be seen in the appendix. * Condensed Consolidated Statement of Cash Flows*

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -12- Business Segment Review

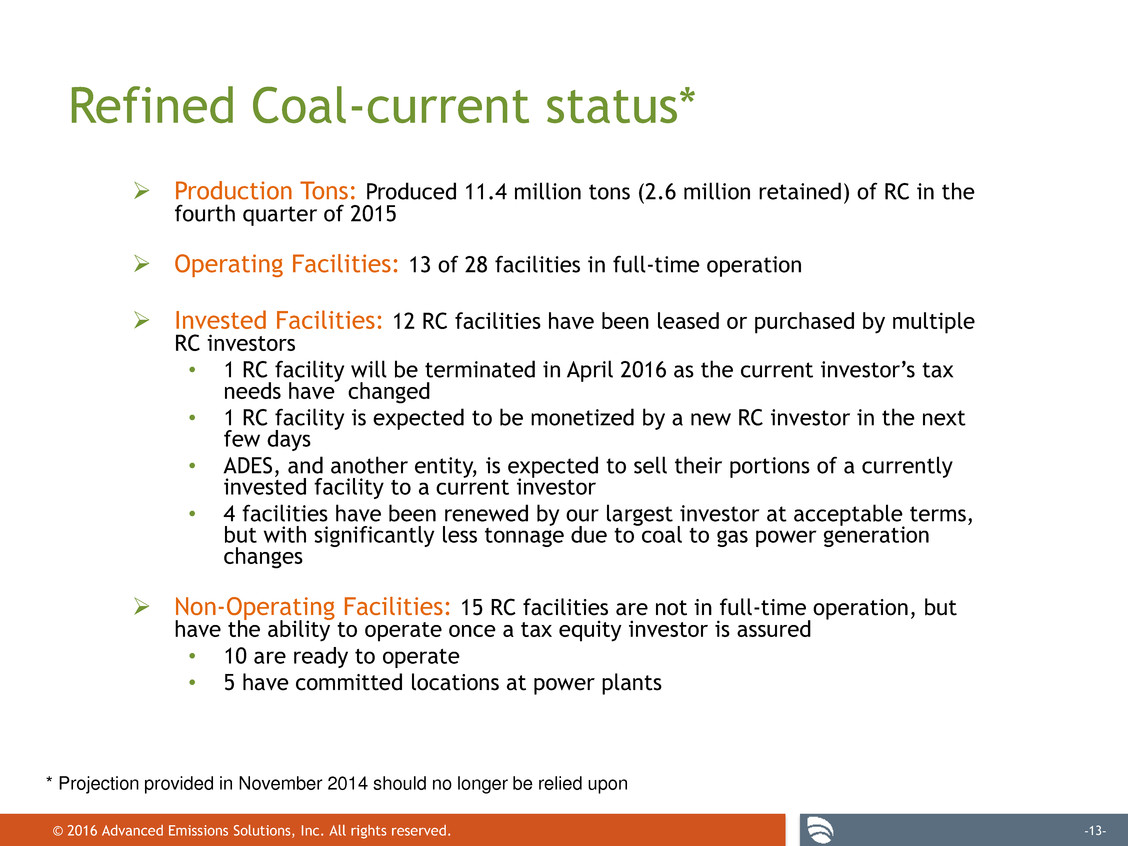

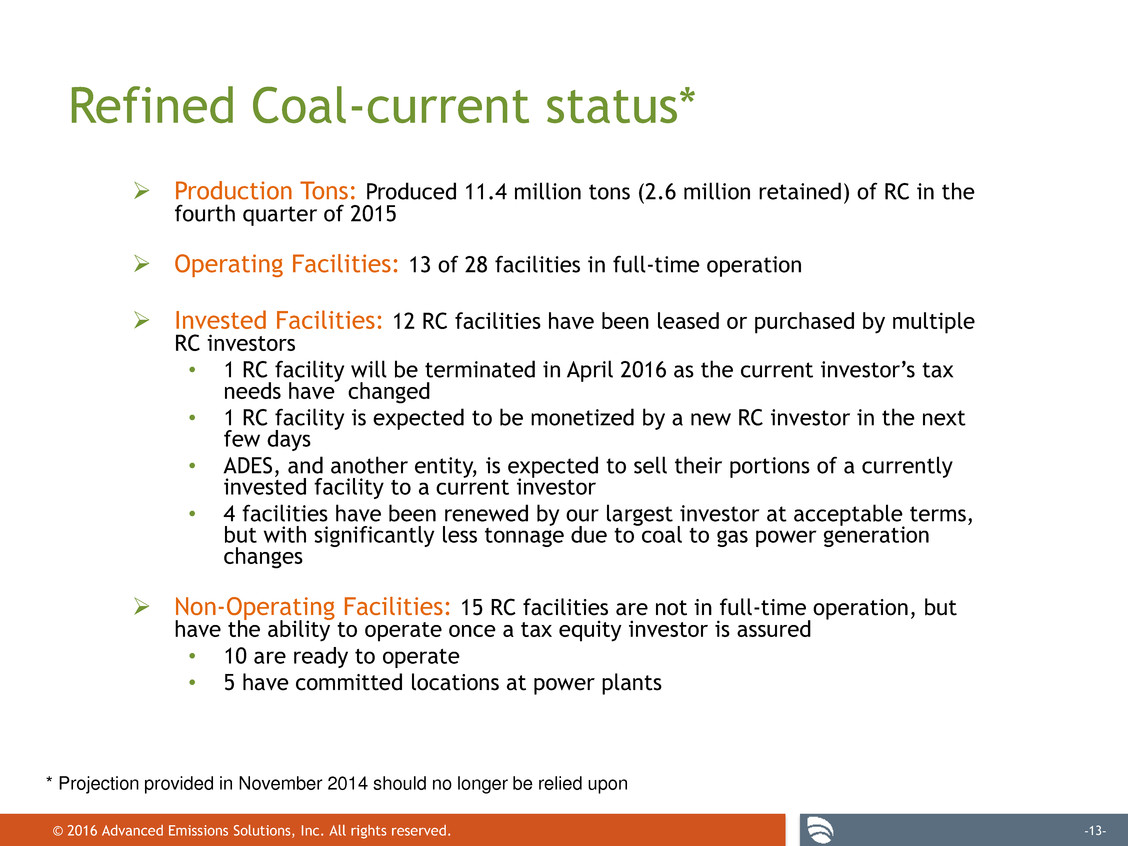

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -13- Refined Coal-current status* Production Tons: Produced 11.4 million tons (2.6 million retained) of RC in the fourth quarter of 2015 Operating Facilities: 13 of 28 facilities in full-time operation Invested Facilities: 12 RC facilities have been leased or purchased by multiple RC investors • 1 RC facility will be terminated in April 2016 as the current investor’s tax needs have changed • 1 RC facility is expected to be monetized by a new RC investor in the next few days • ADES, and another entity, is expected to sell their portions of a currently invested facility to a current investor • 4 facilities have been renewed by our largest investor at acceptable terms, but with significantly less tonnage due to coal to gas power generation changes Non-Operating Facilities: 15 RC facilities are not in full-time operation, but have the ability to operate once a tax equity investor is assured • 10 are ready to operate • 5 have committed locations at power plants * Projection provided in November 2014 should no longer be relied upon

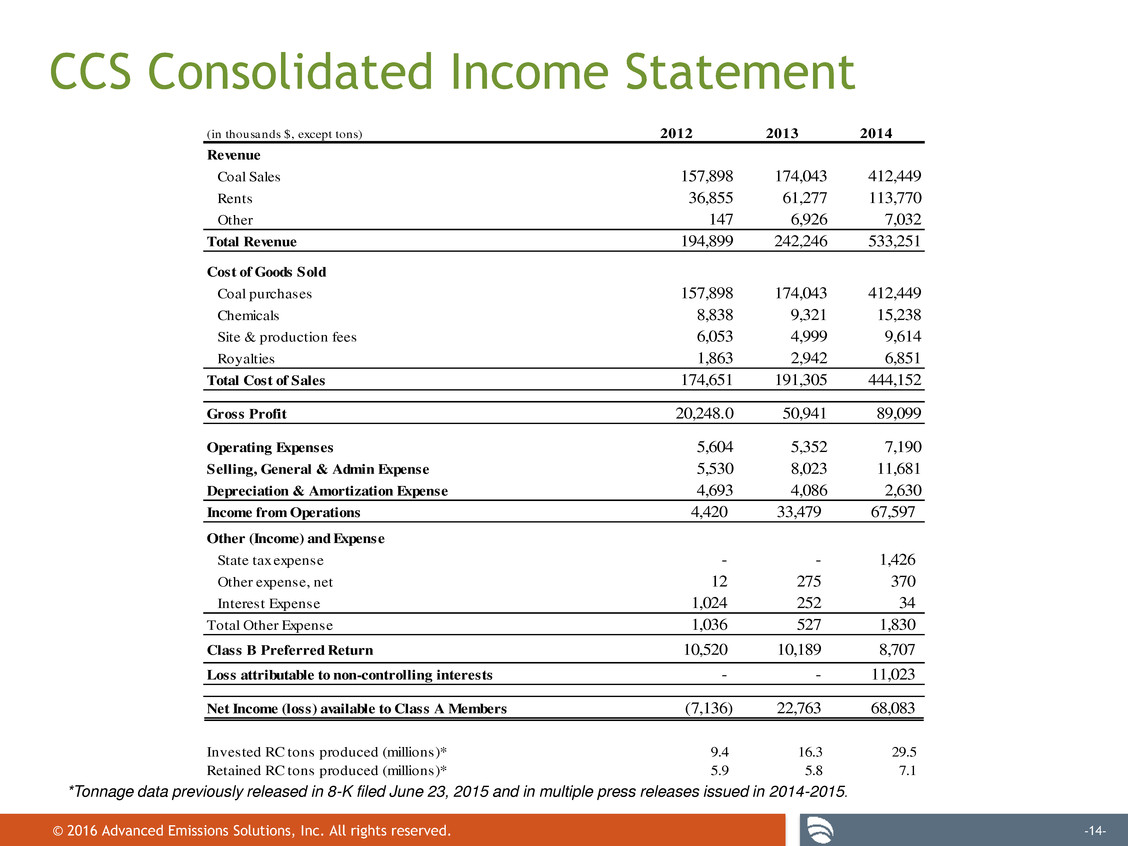

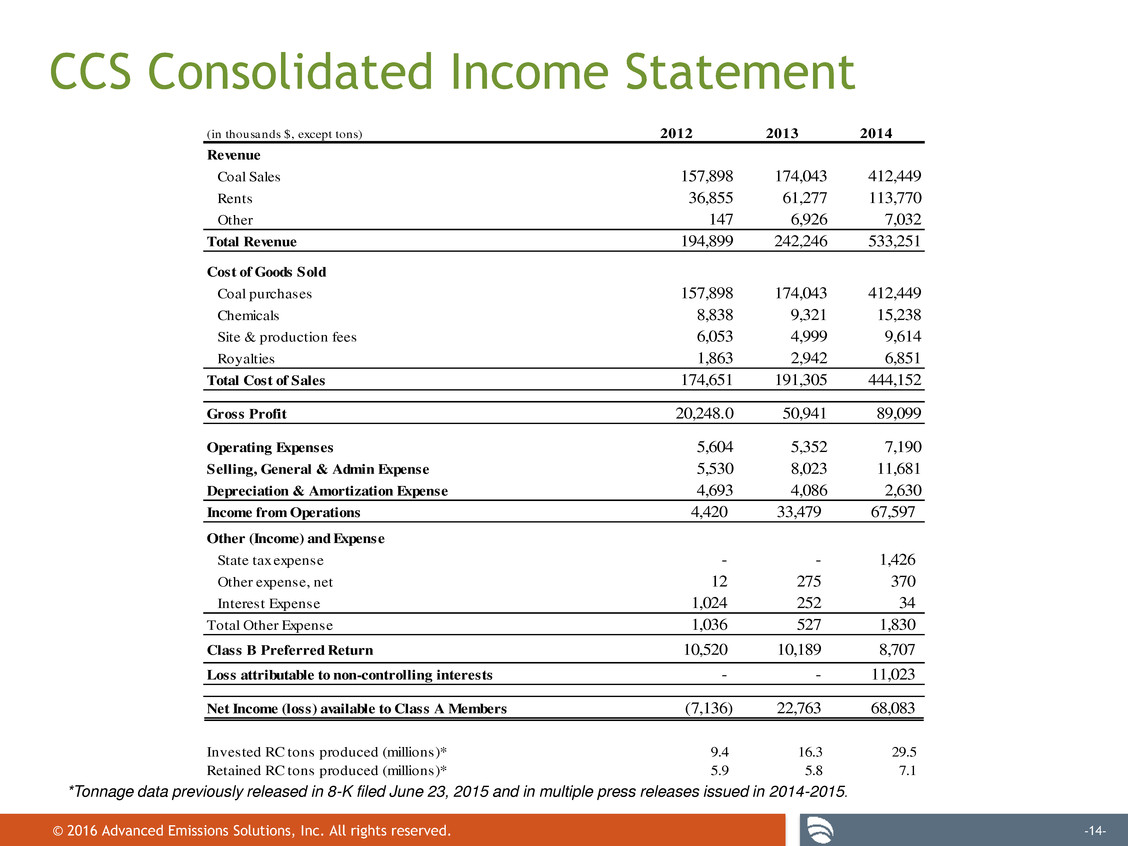

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -14- CCS Consolidated Income Statement *Tonnage data previously released in 8-K filed June 23, 2015 and in multiple press releases issued in 2014-2015. (in thousands $, except tons) 2012 2013 2014 Revenue Coal Sales 157,898 174,043 412,449 Rents 36,855 61,277 113,770 Other 147 6,926 7,032 Total Revenue 194,899 242,246 533,251 Cost of Goods Sold Coal purchases 157,898 174,043 412,449 Chemicals 8,838 9,321 15,238 Site & production fees 6,053 4,999 9,614 Royalties 1,863 2,942 6,851 Total Cost of Sales 174,651 191,305 444,152 Gross Profit 20,248.0 50,941 89,099 Operating Expenses 5,604 5,352 7,190 Selling, General & Admin Expense 5,530 8,023 11,681 Depreciation & Amortization Expense 4,693 4,086 2,630 Income from Operations 4,420 33,479 67,597 Other (Income) and Expense State tax expense - - 1,426 Other expense, net 12 275 370 Interest Expense 1,024 252 34 Total Other Expense 1,036 527 1,830 Class B Preferred Return 10,520 10,189 8,707 Loss attributable to non-controlling interests - - 11,023 Net Income (loss) available to Class A Members (7,136) 22,763 68,083 Invested RC tons produced (millions)* 9.4 16.3 29.5 Retained RC tons produced (millions)* 5.9 5.8 7.1

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -15- Refined Coal market commentary CCS modified its sales process in the second half of 2015 to add resources to help support and accelerate discussions at the right levels within an organization. Negotiations with new and existing investors continue and our pipeline of potential investors is growing. We are confident that CCS will secure additional investors in the coming months. Refined Coal markets are competitive but deals are getting done with strong economics Low natural gas prices are pressuring coal burn usage and forecasts

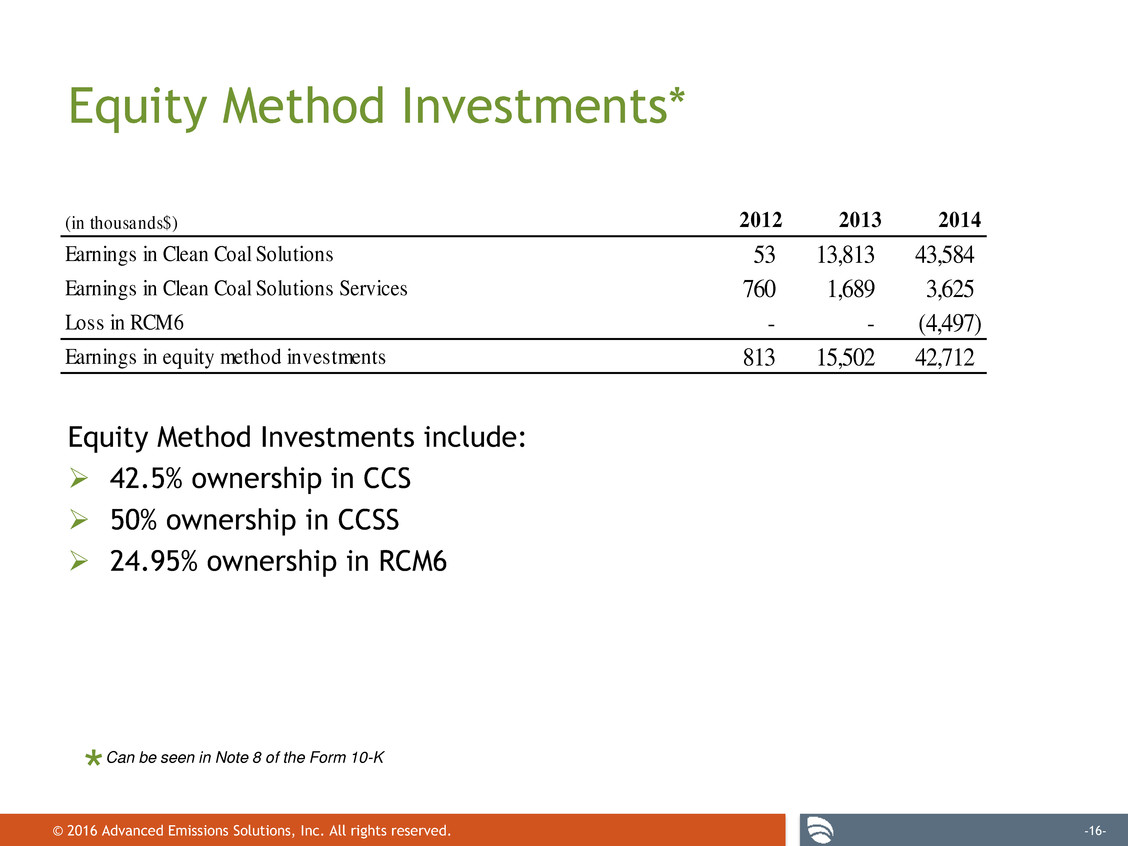

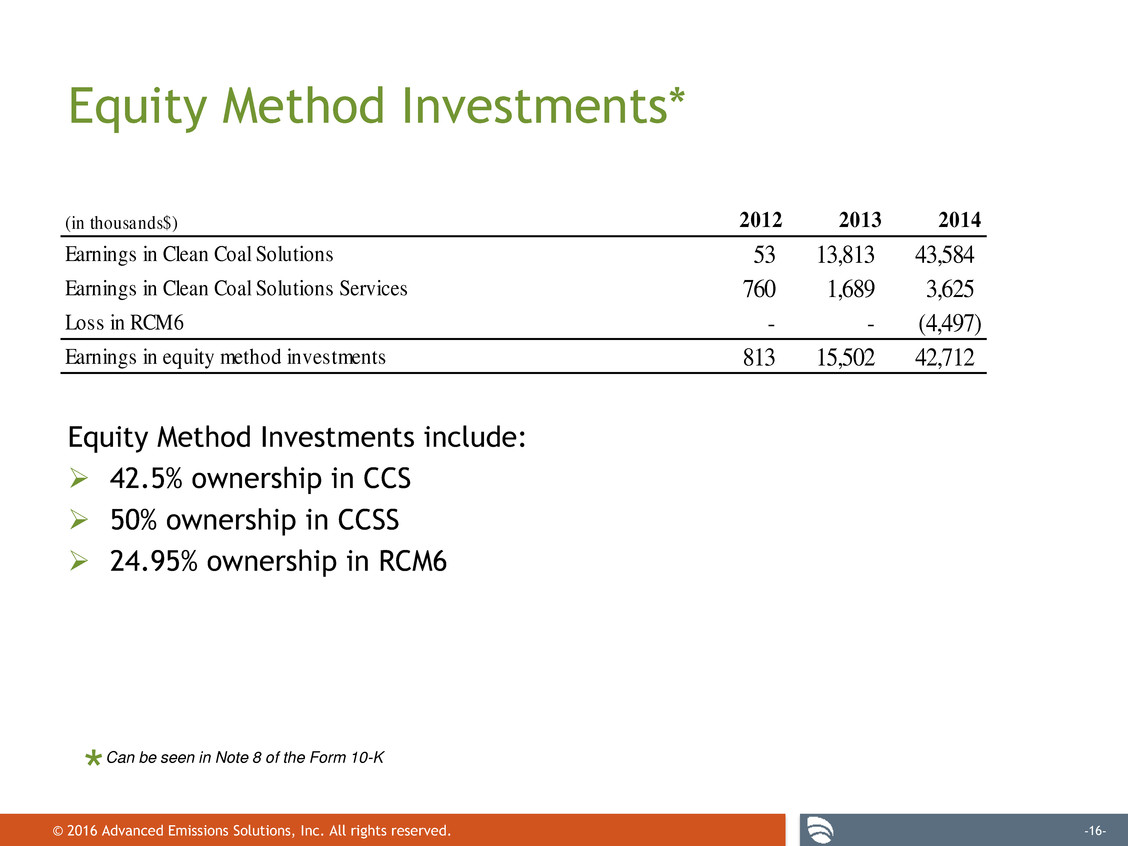

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -16- (in thousands$) 2012 2013 2014 Earnings in Clean Coal Solutions 53 13,813 43,584 Earnings in Clean Coal Solutions Services 760 1,689 3,625 Loss in RCM6 - - (4,497) Earnings in equity method investments 813 15,502 42,712 Equity Method Investments* Equity Method Investments include: 42.5% ownership in CCS 50% ownership in CCSS 24.95% ownership in RCM6 Can be seen in Note 8 of the Form 10-K *

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -17- Accounting for CCS ADES has received cash distributions from CCS in excess of the carrying value of the investment in CCS. Because there are no repayment obligations on the cash distributions, ADES recognizes the amount of cash distributions from CCS as equity income in the income statement when the cash distributions exceed ADES’s 42.5% share of CCS’s net income. When CCS subsequently reports income, we will recognize income only to the extent cash distributions until such time as the cumulative amount of earnings equals distributions; thereafter, the Company would continue to recognize its proportionate share of net income (loss).

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -18- RC Facility - RCM6 In February 2014, ADES purchased a 24.95% share in an RC facility (“RCM6”) for a cash payment of $2.4 million and the execution of a $13.3 million note payable In 2014 ADES made contributions and variable payments of $4.2M to RCM6 RCM6 generated $5.8 million in tax credits to ADES in 2014 as well as other potential tax benefits ADES expects to sell its interest in RCM6 in the next few days

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -19- Royalties ADES receives a royalty from CCS for the use of its M-45™ technologies (“M-45 Royalty”). M-45 Royalty payments are based upon a percentage of margin or tax credits claimed at the RC facilities that utilize the licensed technology. In 2013 ADES received an advance deposit of $7.2 million related to the M-45 Royalty. The advanced deposit is amortized at 33% of future royalty income. (in thousands $, except tons) 2012 2013 2014 Mar-15* Jun-15* Sept-15* Dec-15** Royalty Income for M45 and M45PC $1,446 $2,505 $6,410 $2,000 $2,000 $3,000 $2,900 RC tons produced with M45 and M45PC 2,600 5,100 12,400 4,200 4,900 7,000 5,800 Advance deposit balance from related party - CCS $624 $8,659 $6,524 * October 2015 Company press release; ** Feb 2016 Company press release

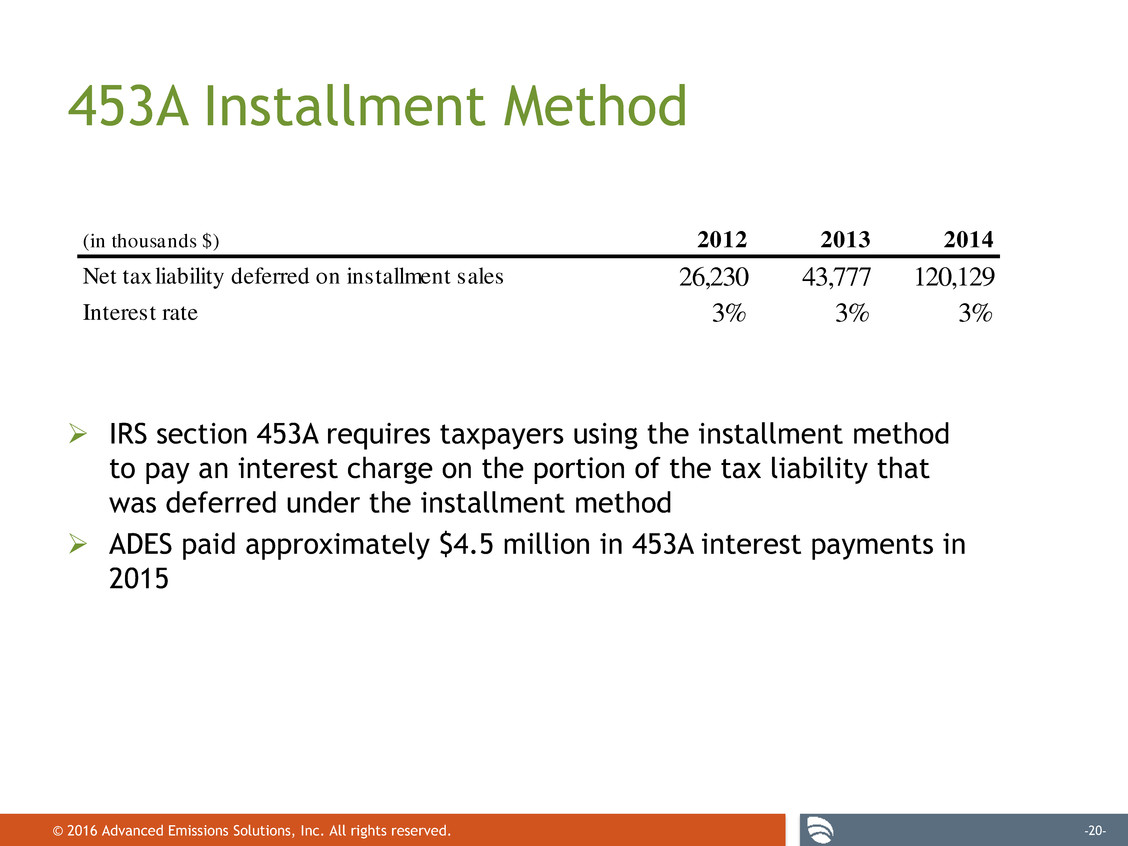

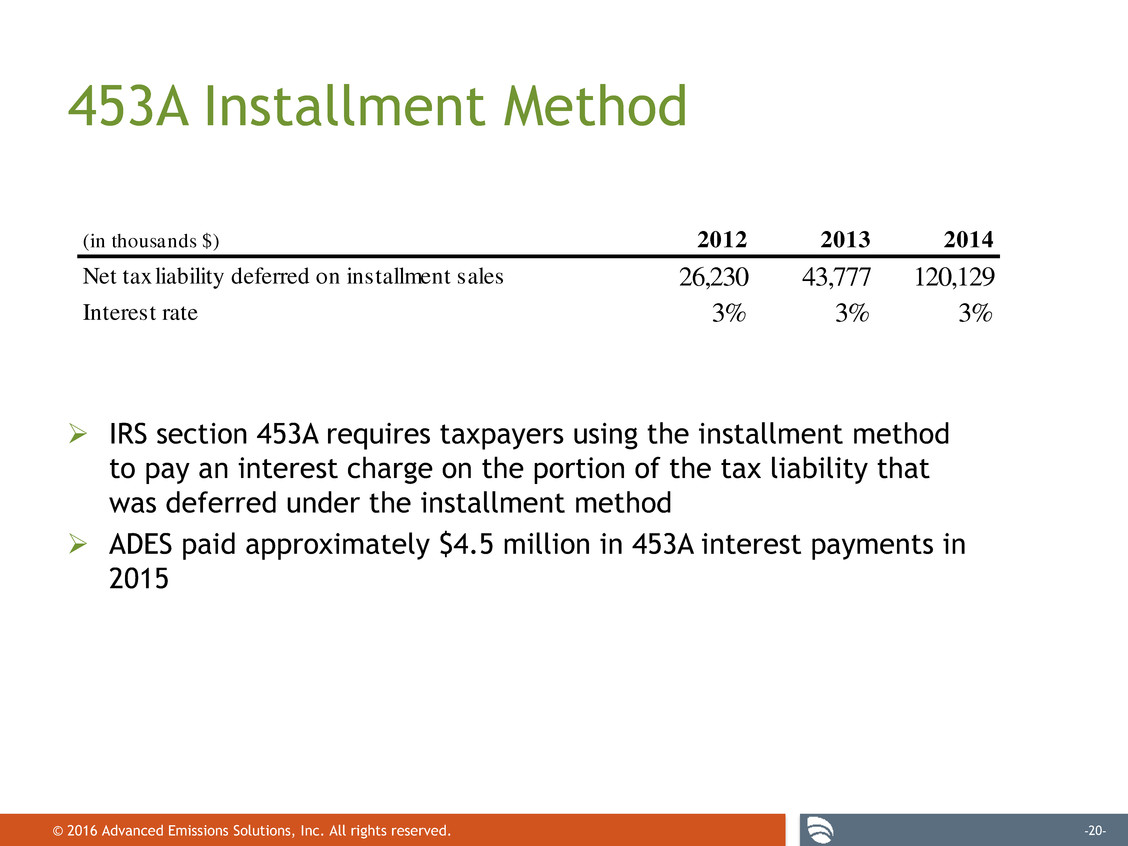

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -20- IRS section 453A requires taxpayers using the installment method to pay an interest charge on the portion of the tax liability that was deferred under the installment method ADES paid approximately $4.5 million in 453A interest payments in 2015 (in thousands $) 2012 2013 2014 Net tax liability deferred on installment sales 26,230 43,777 120,129 Interest rate 3% 3% 3% 453A Installment Method

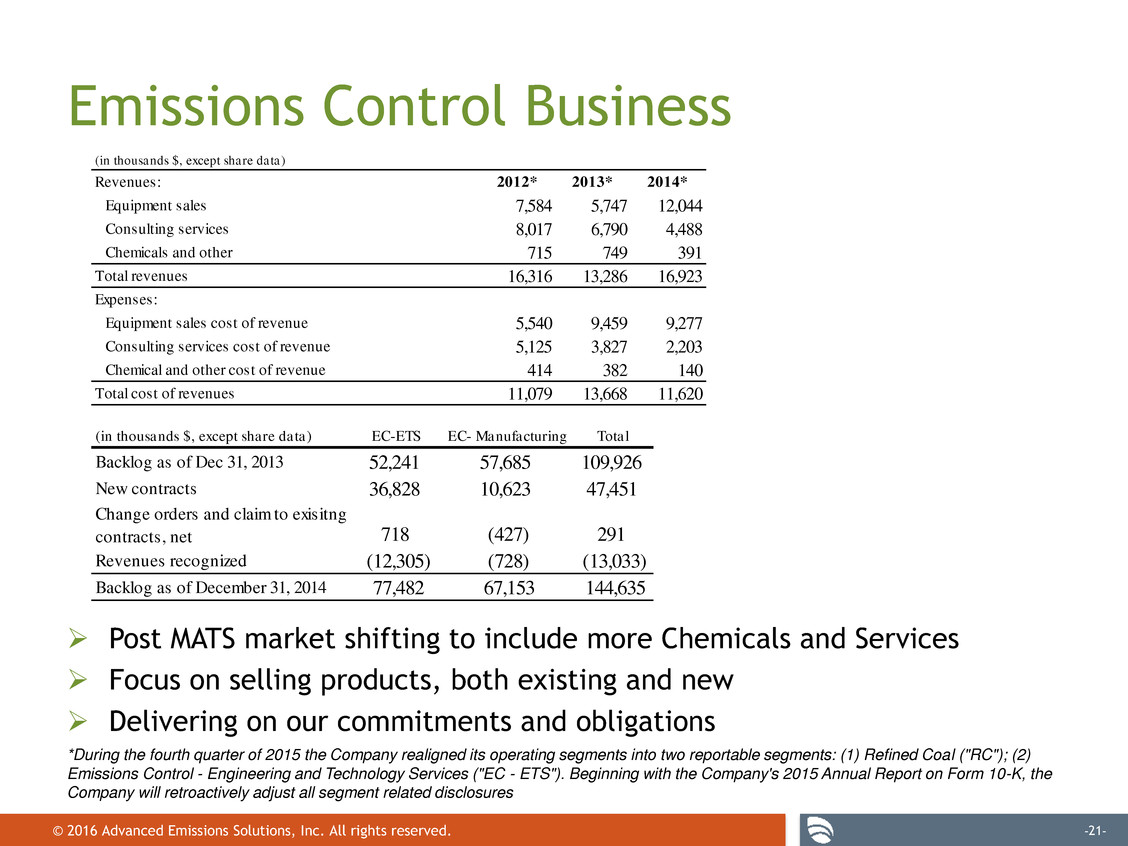

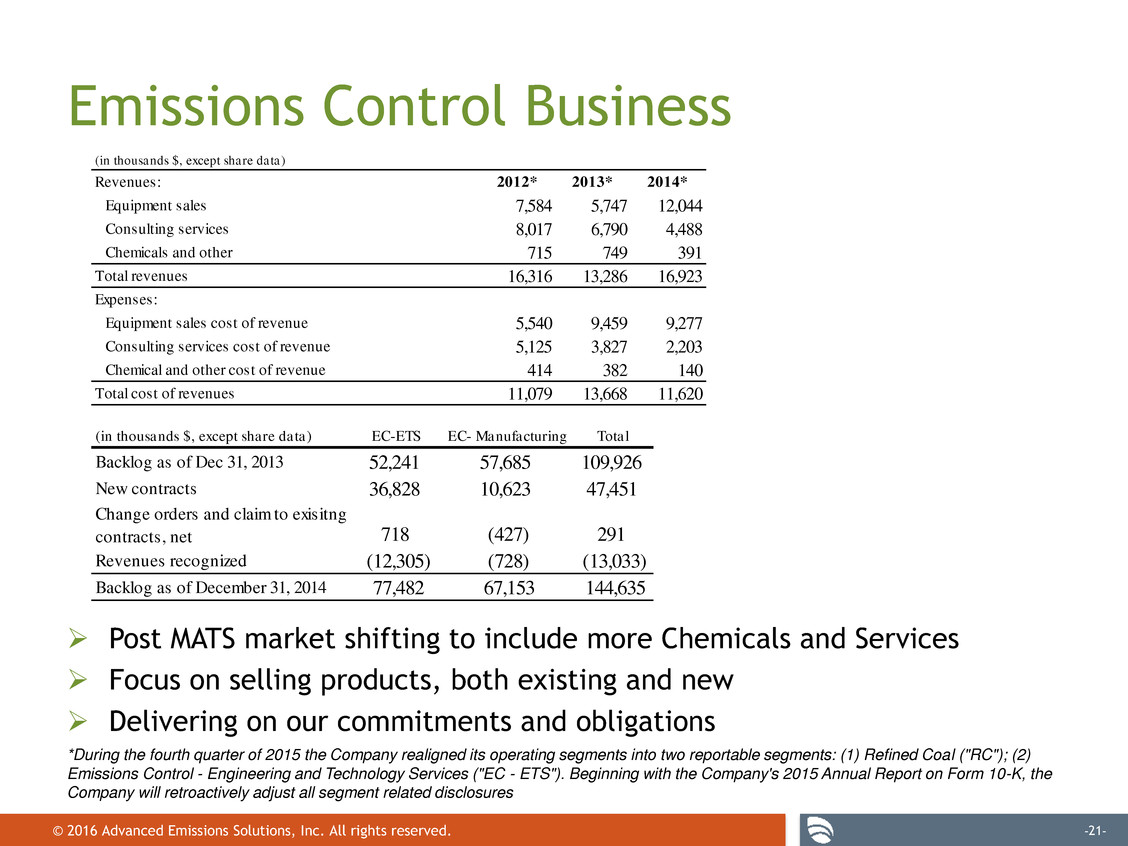

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -21- Post MATS market shifting to include more Chemicals and Services Focus on selling products, both existing and new Delivering on our commitments and obligations (in thousands $, except share data) Revenues: 2012* 2013* 2014* Equipment sales 7,584 5,747 12,044 Consulting services 8,017 6,790 4,488 Chemicals and other 715 749 391 Total revenues 16,316 13,286 16,923 Expenses: Equipment sales cost of revenue 5,540 9,459 9,277 Consulting services cost of revenue 5,125 3,827 2,203 Chemical and other cost of revenue 414 382 140 Total cost of revenues 11,079 13,668 11,620 *During the fourth quarter of 2015 the Company realigned its operating segments into two reportable segments: (1) Refined Coal ("RC"); (2) Emissions Control - Engineering and Technology Services ("EC - ETS"). Beginning with the Company's 2015 Annual Report on Form 10-K, the Company will retroactively adjust all segment related disclosures Emissions Control Business (in thousands $, except share data) EC-ETS EC- Manufacturing Total Backlog as of Dec 31, 2013 52,241 57,685 109,926 New contracts 36,828 10,623 47,451 Change orders and claim to exisitng contracts, net 718 (427) 291 Revenues recognized (12,305) (728) (13,033) Backlog as of December 31, 2014 77,482 67,153 144,635

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -22- CORPORATE OVERVIEW

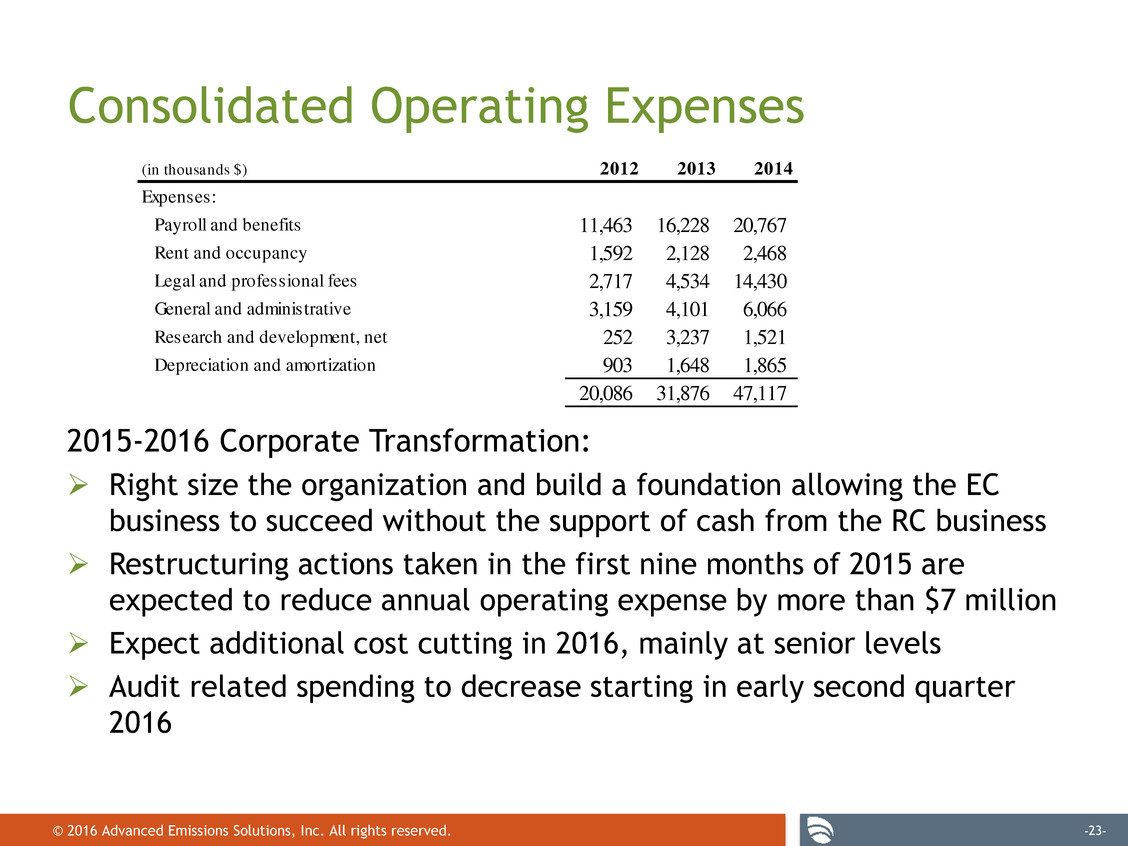

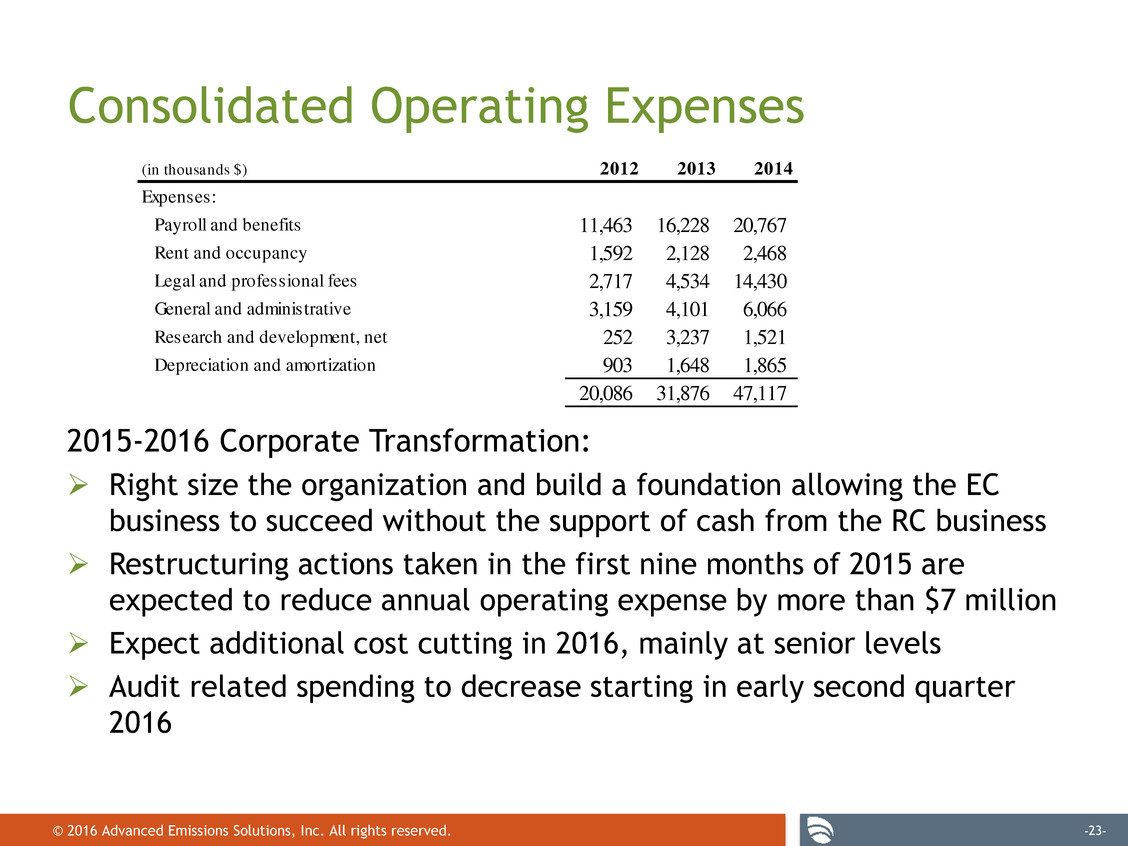

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -23- 2015-2016 Corporate Transformation: Right size the organization and build a foundation allowing the EC business to succeed without the support of cash from the RC business Restructuring actions taken in the first nine months of 2015 are expected to reduce annual operating expense by more than $7 million Expect additional cost cutting in 2016, mainly at senior levels Audit related spending to decrease starting in early second quarter 2016 (in thousands $) 2012 2013 2014 Expenses: Payroll and benefits 11,463 16,228 20,767 Rent and occupancy 1,592 2,128 2,468 Legal and professional fees 2,717 4,534 14,430 General and administrative 3,159 4,101 6,066 Research and development, net 252 3,237 1,521 Depreciation and amortization 903 1,648 1,865 20,086 31,876 47,117 Consolidated Operating Expenses

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -24- At December 31, 2015, cash and cash equivalents was approximately $9 million. Restricted cash was $12 million, of which $6 million was used to secure letters of credit for equipment and $6 million to secure letters of credit for Norit royalty obligations 2014 Net income of $1.4 million, which included $42.7 million in equity earnings from equity method investees, $6.4 million of RC royalties earned, $5.7 million in interest expense and $47 million in other operating expenses. Included in these numbers were losses of $13.3 million in our reportable segments, primarily at BCSI and $6.1 million associated with the re-audit and restatement 2015 Cash declined to approximately $9 million at the end of 2015 2015 cash expenditures included in operating losses associated with our reportable segments, approximately $4.5 million related to 453A interest, $4.6 million related to RCM6, $2.8 million in loan payments and fees, and $8.5 million associated with the re-audit and restatement Cash

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -25- Letters of credit secured by restricted cash- $6 million to secure letters of credit for equipment and $6 million to secure letters of credit for royalty obligations Warranty and performance guarantees related to our EC equipment sales Settlement and Royalty- Expected royalty payments related to the Norit settlement. Payable through the third quarter of 2018 October 2015 Credit Agreement- $15 million term loan due April 2016, with a possible three month extension Subsequent changes in 2016 Seller’s Note: in February 2016, ADES entered into an agreement with the DSI Business Owner to settle the remaining amounts owed as of the date of the agreement of approximately $1.1 million for $0.3 million. RCM6 note payable: The note payable to CCS is expected to be transferred as part of the sale of ADES’s ownership of RCM6 Financial obligations and liabilities

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -26- Tax assets from Net Operating Losses and the generation of Section 45 Tax Credits ADES has carried a full valuation allowance against its tax assets since 2012 These tax assets are subject to IRC Section 382 for Net Operating Losses (NOLs) and Section 383 for tax credits. There are often limits to using NOLS and tax credits in the event of an ownership change. However, tax rules may allow us to substantially increase the limits as a result of the deferred installment sales gain at CCS. (in thousands $) Beginning expiration year Ending expiration year Federal net operating loss carryforwards 26,034 2031 2032 State net operating loss carryforwards 2017 2034 Federal tax credit carryforwards 2018 2034 12/31/2014 43,465 58,479 Tax Status

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -27- Refined Coal execution and securing additional RC investors Completing our SEC filings and NASDAQ relisting Delivering on our existing equipment contract obligations and selling new products Transforming the company to move forward and achieve the highest future value Summary and Closing Remarks

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -28- Appendix

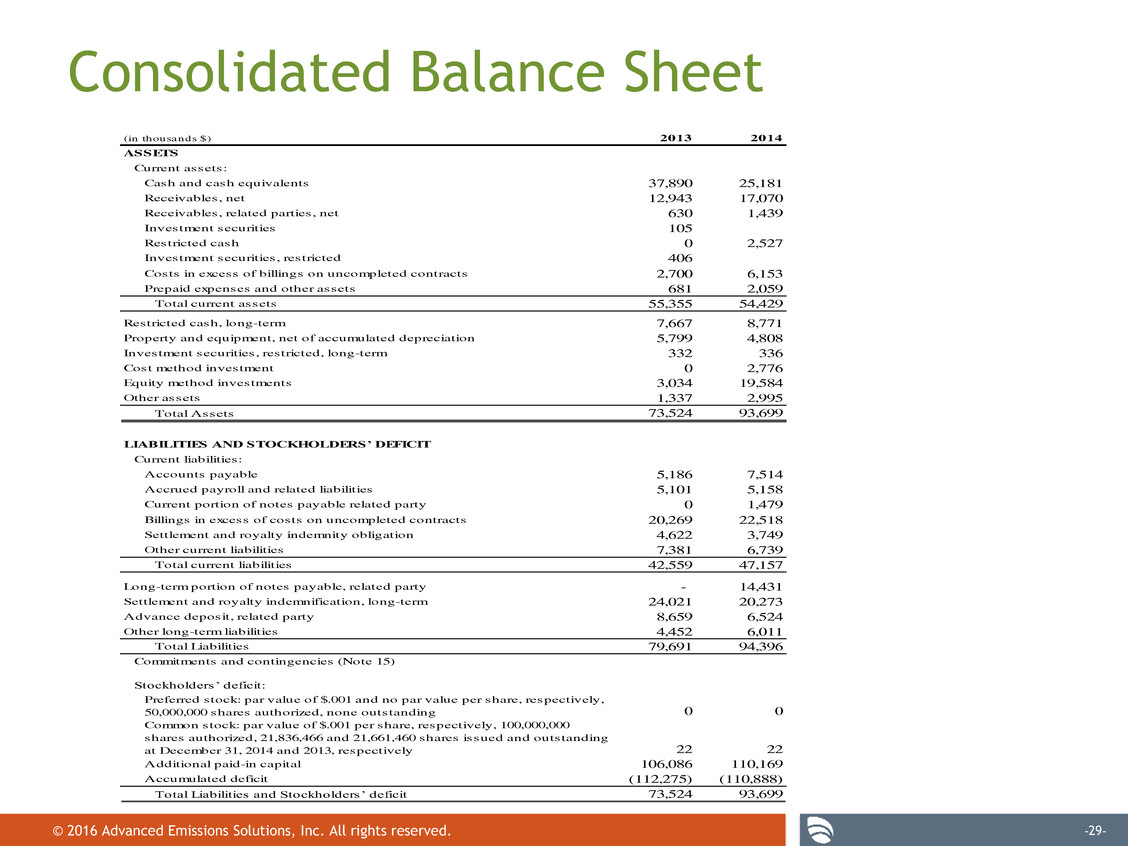

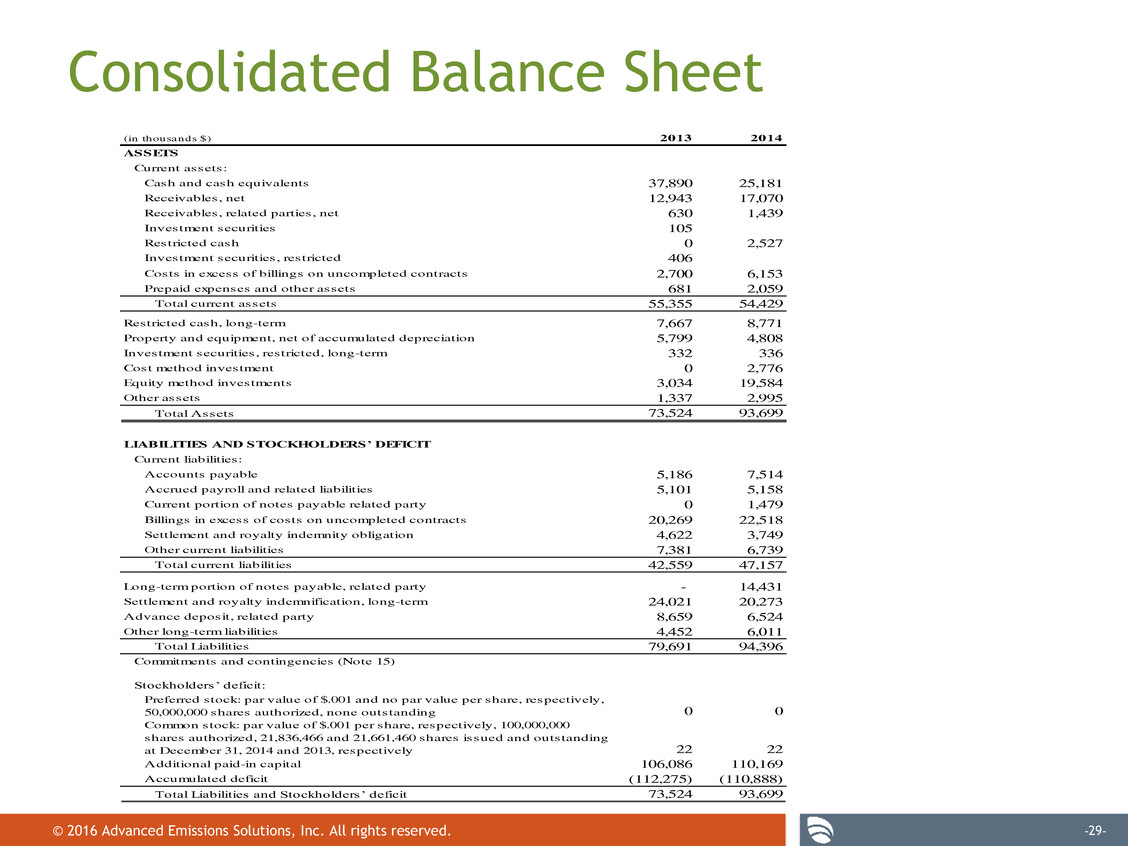

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -29- Consolidated Balance Sheet (in thousands $) 2013 2014 ASSETS Current assets: Cash and cash equivalents 37,890 25,181 Receivables, net 12,943 17,070 Receivables, related parties, net 630 1,439 Investment securities 105 Restricted cash 0 2,527 Investment securities, restricted 406 Costs in excess of billings on uncompleted contracts 2,700 6,153 Prepaid expenses and other assets 681 2,059 Total current assets 55,355 54,429 Restricted cash, long-term 7,667 8,771 Property and equipment, net of accumulated depreciation 5,799 4,808 Investment securities, restricted, long-term 332 336 Cost method investment 0 2,776 Equity method investments 3,034 19,584 Other assets 1,337 2,995 Total Assets 73,524 93,699 LIABILITIES AND STOCKHOLDERS’ DEFICIT Current liabilities: Accounts payable 5,186 7,514 Accrued payroll and related liabilities 5,101 5,158 Current portion of notes payable related party 0 1,479 Billings in excess of costs on uncompleted contracts 20,269 22,518 Settlement and royalty indemnity obligation 4,622 3,749 Other current liabilities 7,381 6,739 Total current liabilities 42,559 47,157 Long-term portion of notes payable, related party - 14,431 Settlement and royalty indemnification, long-term 24,021 20,273 Advance deposit, related party 8,659 6,524 Other long-term liabilities 4,452 6,011 Total Liabilities 79,691 94,396 Commitments and contingencies (Note 15) Stockholders’ deficit: Preferred stock: par value of $.001 and no par value per share, respectively, 50,000,000 shares authorized, none outstanding 0 0 Common stock: par value of $.001 per share, respectively, 100,000,000 shares authorized, 21,836,466 and 21,661,460 shares issued and outstanding at December 31, 2014 and 2013, respectively 22 22 Additional paid-in capital 106,086 110,169 Accumulated deficit (112,275) (110,888) Total Liabilities and Stockholders’ deficit 73,524 93,699

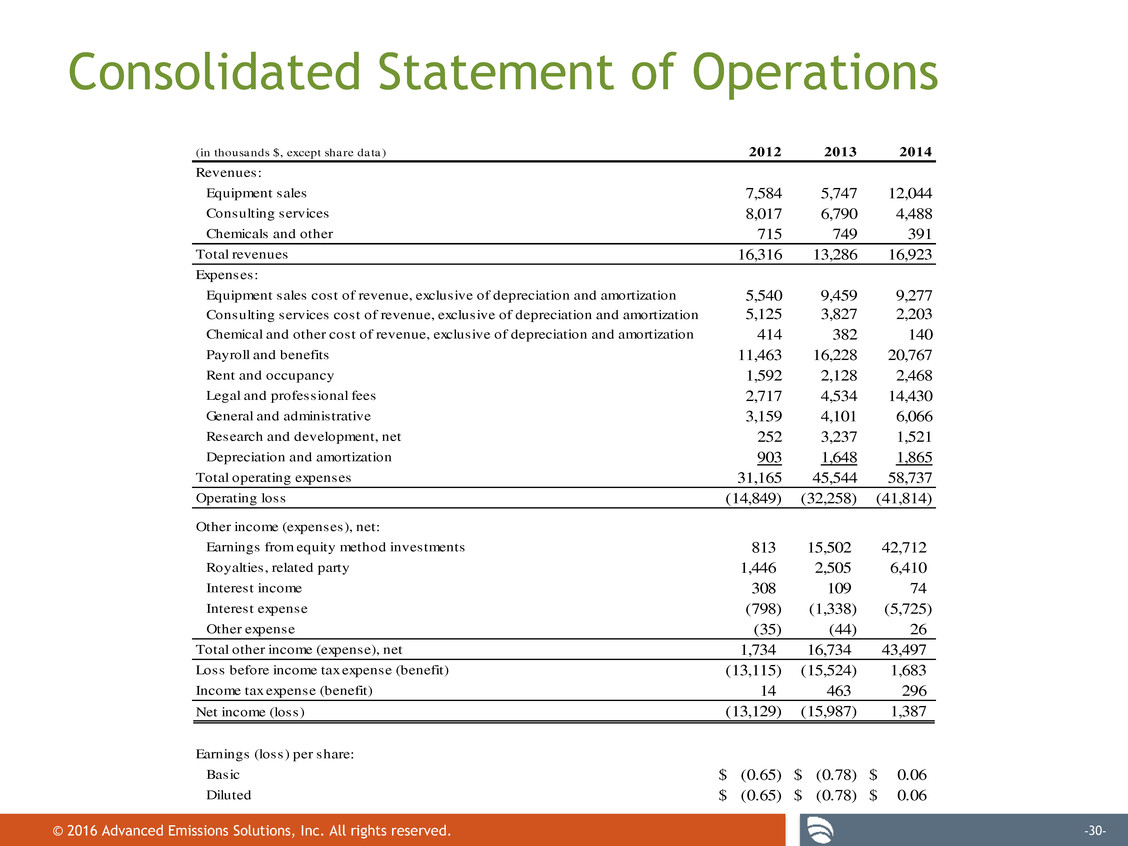

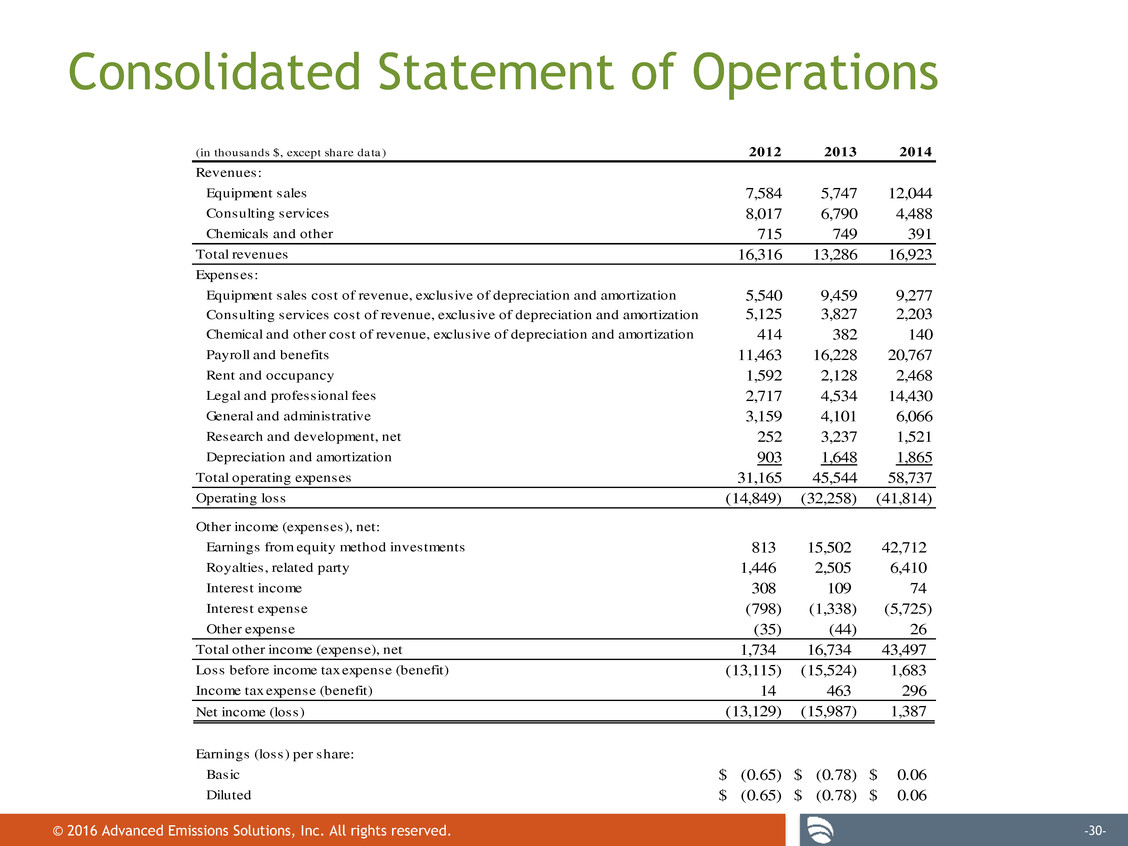

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -30- Consolidated Statement of Operations (in thousands $, except share data) 2012 2013 2014 Revenues: Equipment sales 7,584 5,747 12,044 Consulting services 8,017 6,790 4,488 Chemicals and other 715 749 391 Total revenues 16,316 13,286 16,923 Expenses: Equipment sales cost of revenue, exclusive of depreciation and amortization 5,540 9,459 9,277 Consulting services cost of revenue, exclusive of depreciation and amortization 5,125 3,827 2,203 Chemical and other cost of revenue, exclusive of depreciation and amortization 414 382 140 Payroll and benefits 11,463 16,228 20,767 Rent and occupancy 1,592 2,128 2,468 Legal and professional fees 2,717 4,534 14,430 General and administrative 3,159 4,101 6,066 Research and development, net 252 3,237 1,521 Depreciation and amortization 903 1,648 1,865 Total operating expenses 31,165 45,544 58,737 Operating loss (14,849) (32,258) (41,814) Other income (expenses), net: Earnings from equity method investments 813 15,502 42,712 Royalties, related party 1,446 2,505 6,410 Interest income 308 109 74 Interest expense (798) (1,338) (5,725) Other expense (35) (44) 26 Total other income (expense), net 1,734 16,734 43,497 Loss before income tax expense (benefit) (13,115) (15,524) 1,683 Income tax expense (benefit) 14 463 296 Net income (loss) (13,129) (15,987) 1,387 Earnings (loss) per share: Basic (0.65)$ (0.78)$ 0.06$ Diluted (0.65)$ (0.78)$ 0.06$

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -31- Consolidated Statement of Cash Flows (in thousands $) 2012 2013 2014 Cash Flows from Operating Activities Net income (loss) (13,129) (15,987) 1,387 Adjustments to reconcile net income (loss) to net cash used in operating activities: Depreciation and amortization 903 1,648 1,865 Accretion of asset retirement obligatrions - 55 58 Non-cash research and development expense - 1,075 Impairment of property equipment and goodwill - 277 355 Provision (recovery) for bad debt expense - 10 500 Interest added to principal balance of notes - - 1,124 Consulting expense financed through note payable - - 1,600 Share-based compensation expense 649 2,312 4,712 Earnings from equity method investments (813) (15,502) (42,712) Other non-cash items, net 65 56 81 Changes in operating assets and liabilities, net of effects of acquired businesses: Receivables (4,219) (6,711) (4,127) Related party receivables 3,108 1,224 (809) Prepaid expenses and other assets (692) 361 (1,402) Costs incurred on uncompleted contracts (1,334) (19,313) (56,606) Restricted cash - - (2,387) Restricted cash, long-term - (4,860) - Other long-term assets (485) (49) (47) Accounts payable 212 2,225 2,328 Accrued payroll and related liabilities 867 1,655 686 Other current liabilities (757) 5,918 (672) Billings on uncompleted contracts 4,185 33,220 55,621 Related party advance deposit (508) 7,166 (2,135) Other long-term liabilities 1,018 268 144 Settlement and royalty indemnification obligation (5,522) (5,245) (4,622) Distributions from equity method investees, return on investment - 5 2,509 Net cash used in operating activities (16,452) (10,192) (42,549) Cash Flows from Investing Activities Maturity of investment securities 4,300 - 105 Purchase of investment securities, restricted (1,765) 1,800 403 Maturity of investment securities, restricted - - - Increase in restricted cash - (2,807) (1,243) Acquisition of property and equipment (3,879) (2,135) (1,563) Proceeds from sale of property and equipment 39 1 26 Principal payments received on notes receivable, related party - 500 - Advance on note receivable - - (500) Acquisition of business (1,600) - - Purchase of cost method investment - - (2,776) Purchase, contributions and advances to equity method investees (500) - (6,631) Distributions from equity method investees in excess of cummulative earnings 53 13,813 43,584 Net cash provided by (used in) investing activities (3,352) 11,172 31,405 Cash Flows from Financing Activities Gross proceeds from issuance of common stock - 31,050 - Stock issuance and registration costs (22) (2,135) - Proceeds received upon exercise of stock options 21 354 243 Repurchase of shares to satisfy minimum tax withholdings - - (1,500) Principal payments on note payable - - (238) Line of credit amendment fee (100) (70) Net cash provided by (used in) financing activities (1) 29,169 (1,565) Increase (Decrease) in Cash and Cash Equivalents (19,805) 30,149 (12,709) Cash and Cash Equivalents, beginning of period 27,546 7,741 37,890 Cash and Cash Equivalents, end of period 7,741 37,890 25,181

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -32- Refined Coal- Accounting for CCS ADES does not record its share of CCS income until it equals the amount of distributions in excess of carrying value that were previously recognized in income. a) Beginning balance at 12/31/2012 b) ADES’s 42.5% share of CCS net income (loss) available to Class A members c) Cash distributions from received from CCS d) Adjustment for cash distributions in excess of investment balance (a+b+c)=d e) Balance at 12/31/13 f) New Balance at 12/31/14 On the Statement of Cash Flows: (c) Cash distributions from received from CCS Description Date(s) Investment balance ADES equity earnings (loss) Cash distributions ADES equity (loss) gain 2013 activity 8,910 b 8,910 - - Recovery of cash distributions in excess of investment balance (prior to cash distributions) 2013 activity (8,003) a (8,003) - (8,003) Current year cash distributions from CCS 2013 activity (13,813) c - 13,813 - Adjustment for current year cash distributions in excess of investment balance 2013 activity 12,906 d 12,906 - (12,906) Total investment balance, equity earnings (loss) and cash distributions 12/31/2013 - 13,813 13,813 (12,906) e ADES equity (loss) gain 2014 activity 26,613 b 26,613 - - Recovery of cash distributions in excess of investment balance (prior to cash distributions) 2014 activity (12,906) e (12,906) - 12,906 Current year cash distributions from CCS 2014 activity (43,584) c - 43,584 - Adjustment for current year cash distributions in excess of investment balance 2014 activity 29,877 d 29,877 - - Total investment balance, equity earnings (loss) and cash distributions 12/31/2014 - 43,584 43,584 (29,877) f Memo Account: Cash distributions and equity loss in (excess) of investment balance

© 2016 Advanced Emissions Solutions, Inc. All rights reserved. -33- Contact Information Graham Mattison- VP, Strategic Initiatives & Investor Relations 9135 South Ridgeline Blvd, Suite 200 Highlands Ranch, CO 80129 Corporate Office graham.mattison@adaes.com www.advancedemissionssolutions.com 720-598-3504