FIRST AMENDMENT AND WAIVER REGARDING 2013 LOAN AND SECURITY AGREEMENT THIS FIRST AMENDMENT AND WAIVER REGARDING 2013 LOAN AND SECURITY AGREEMENT (“First Amendment”) is made as of the 2nd day of December, 2013 (the "Effective Date") by and among ADA-ES, INC., a Colorado corporation (“Borrower”), ADVANCED EMISSIONS SOLUTIONS, INC., a Delaware corporation (“ADES”), and COBIZ BANK, a Colorado corporation, d/b/a COLORADO BUSINESS BANK (“Lender”). RECITALS A. Borrower and Lender are parties to that certain 2013 Loan and Security Agreement dated as of September 19, 2013 (as amended, supplemented, modified and restated from time to time, the “Loan Agreement”). B. In accordance with the provisions of the Loan Agreement, on November 7, 2013, Lender granted Borrower a waiver as to Borrower’s compliance with the minimum tangible net worth requirement contained in the Loan Agreement. B. In accordance with the provisions of the Loan Agreement, Lender has agreed to amend or waive, for the benefit of Borrower, certain terms and conditions contained in the Loan Agreement, as specifically provided herein. C. ADES wishes to provide its consent to the amendments and waiver set forth herein. D. Other than as defined in this First Amendment, all capitalized terms used in this Agreement without definition shall have the meanings given to such terms in the Loan Agreement. NOW THEREFORE, in consideration of the premises and covenants made by Borrower and contained in this First Amendment and the consent provided given by ADES herein, Lender grants the waivers and agrees to the amendments forth below: 1. Waiver for RCM6 Transaction. With respect to the transaction (“RCM6 Transaction”) described in the letter dated December 2, 2013 from Mark H. McKinnies, Senior Vice President and CFO of Borrower, to Doug Pogge, Senior Vice President of Lender,(a copy of which letter is attached hereto as Exhibit A), Lender waives the violations of Sections 7.3(b) and Section 7.3(d) of the Loan Agreement which would occur upon completion of the RCM6 Transaction and subsequent capital contributions contemplated thereby. 2. Amendment to Tangible Equity Covenant. Section 6.13 is amended and restated, effective for the fiscal quarter ending December 31, 2013 and all subsequent quarters, to read, in its entirety, as follows: DEC-1769079-1

Tangible Equity Covenant. ADES shall maintain a minimum tangible equity, calculated as set forth on Exhibit F attached hereto, of not less than Twenty Five Million and no/100 Dollars ($25,000,000.00), measured quarterly as of the end of each calendar quarter. 3. Amendment to Exhibit F. Exhibit F to the Loan Agreement is amended and restated, effective for the fiscal quarter ending December 31, 2013 and all subsequent quarters, to read, in its entirety, as attached hereto as Exhibit B. 4. Definition of “Borrowing Base”. The definition of Borrowing Base is amended and restated, effective immediately, to read, in its entirety, as follows: “Borrowing Base” means, as of any date, ninety percent (90%) of the net present value, applying a ten percent (10%) discount rate, of the fixed payments due to Borrower by CCS as the result of the AECI Leases. 5. Amendment to Exhibit C. Exhibit C to the Loan Agreement is amended and restated, effective immediately, to read, in its entirety, as attached hereto as Exhibit C. 6. No Default. Borrower and ADES hereby certify to Lender that, after giving effect to the amendments and waiver provided herein, Borrower is in full compliance with the provisions of the Loan Agreement, and that no Event of Default will occur as a result of the effects of this First Amendment. 7. Release of Claims. Borrower and ADES hereby release and forever discharge Lender, its affiliates, directors, officers, agents, employees, and attorneys ("Lender Parties") of and from any and all liability, suits, damages, claims, counterclaims, demands, reckonings and causes of action, setoffs and defenses, whether known or unknown, whether arising in law or equity, which any of Borrower or ADES have, now have or may have in the future against Lender Parties by reason of any acts, omissions, causes or things arising out of or in any way related to this First Amendment or the Loan Agreement existing or accrued as of the date of this First Amendment. This release shall survive the termination of this First Amendment. Borrower acknowledges that the foregoing release is a material inducement to Lender's decision to extend to Borrower the financial accommodations hereunder and has been relied upon by Lender in agreement to enter into this First Amendment. 8. Certification. Borrower will execute and deliver to Lender a Certificate in the form of Exhibit D attached hereto. 9. Costs. Borrower will pay Lender's attorneys' fees for preparation of this First Amendment. 10. Miscellaneous. (a) The paragraph headings used herein are intended for reference purposes only and shall not be considered in the interpretation of the terms and conditions hereof. 2

(b) The terms and conditions of this First Amendment shall be binding upon and shall inure to the benefit of the parties hereto, their successors and permitted assigns. (c) This First Amendment may be executed in any number of counterparts, and by Lender, ADES and Borrower on separate counterparts, each of which, when so executed and delivered, shall be an original, but all of which shall together constitute one and the same Agreement. (d) Except as expressly modified by this First Amendment, the Loan Agreement shall remain in full force and effect and shall be enforceable in accordance with its terms. (e) This First Amendment and the Loan Agreement constitute the entire agreement and understanding between the parties hereto with respect to the subject matter hereof and supersede all prior negotiations, understandings, and agreements between such parties with respect to such subject matter. (f) This First Amendment, and the transactions evidenced hereby, shall be governed by, and construed under; the internal laws of the State of Colorado, without regard to principles of conflicts of law, as the same may from time to time be in effect, including, without limitation, the Uniform Commercial Code as in effect in the State of Colorado. IN WITNESS WHEREOF, the parties hereto have executed and delivered this First Amendment as of the date first above set forth. (Signatures on follow page) 3

ADA-ES, INC., a Colorado corporation By: Name: Title: ADVANCED EMISSIONS SOLUTIONS, INC., a Delaware corporation By: Name: Title: COBIZ BANK, a Colorado corporation d/b/a COLORADO BUSINESS BANK By: Douglas L. Pogge, Senior Vice President 4

Exhibit A Letter of December 2, 2013 5

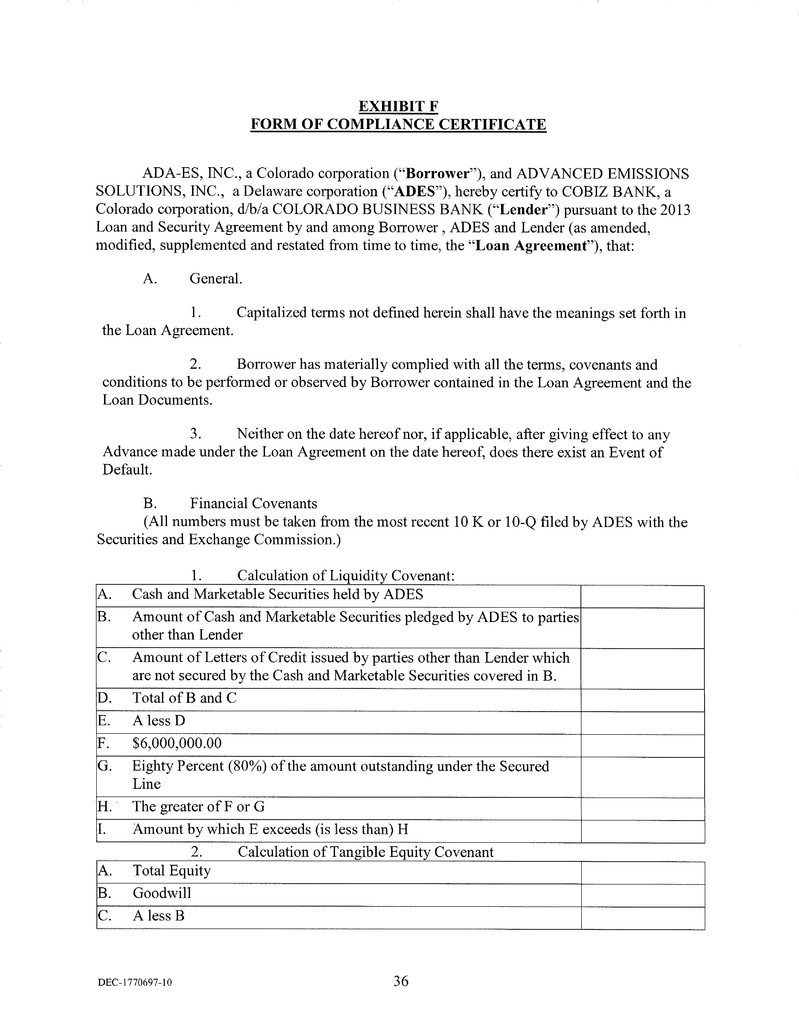

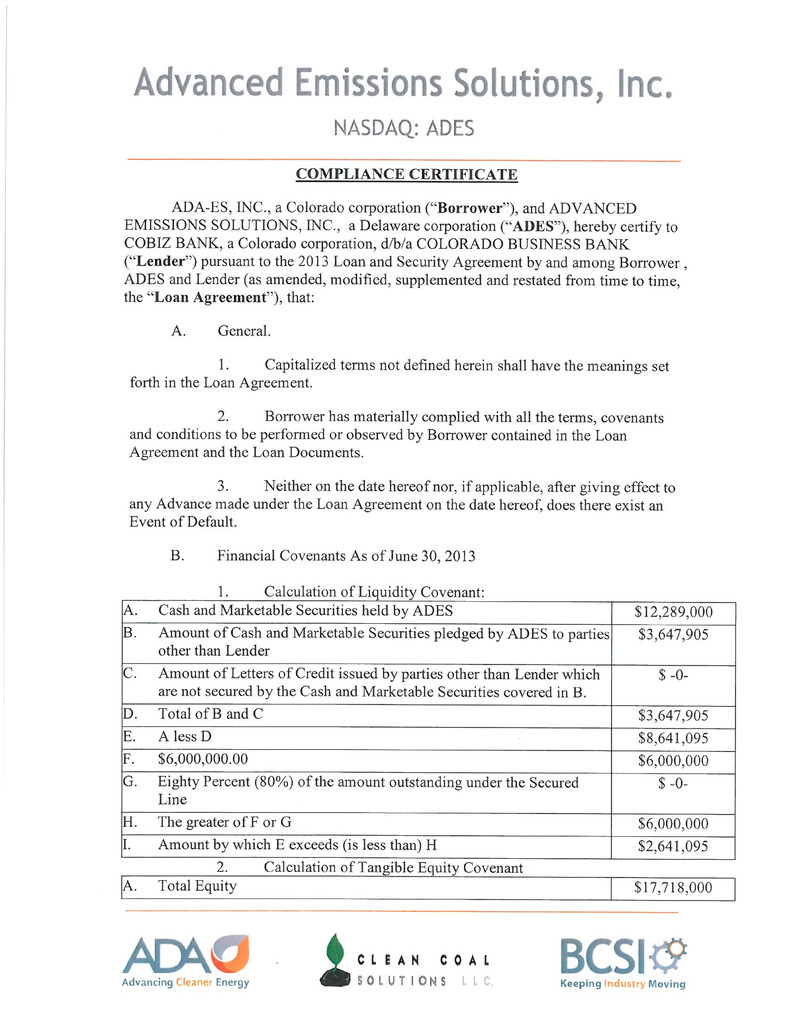

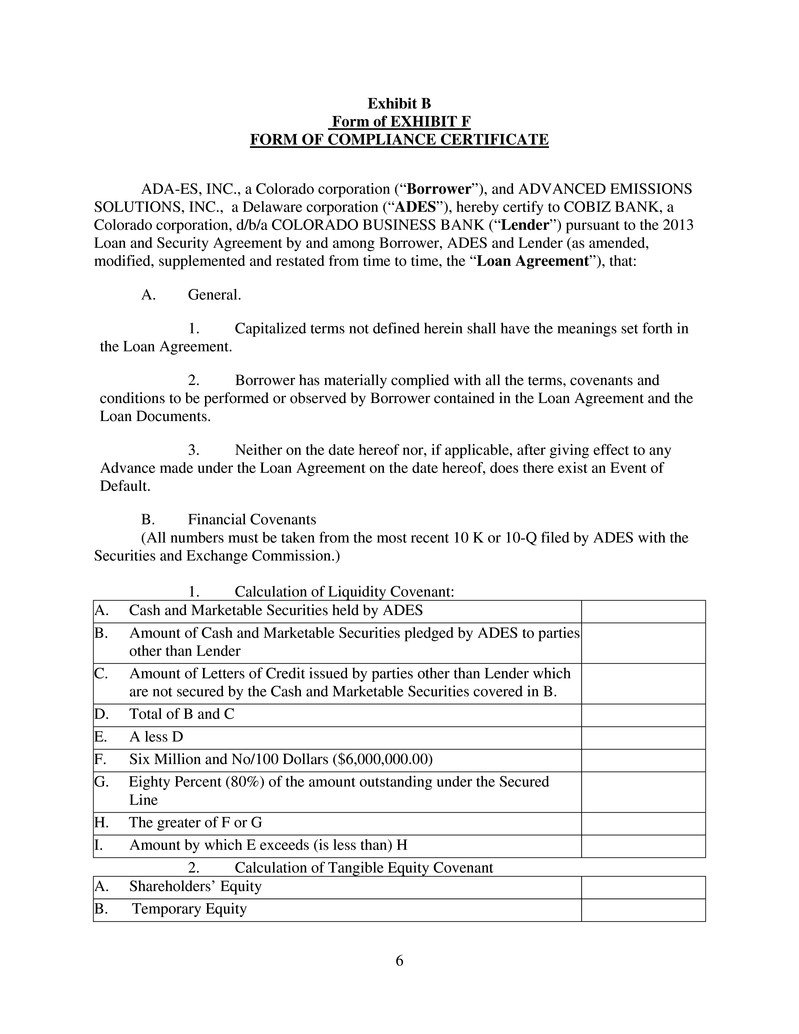

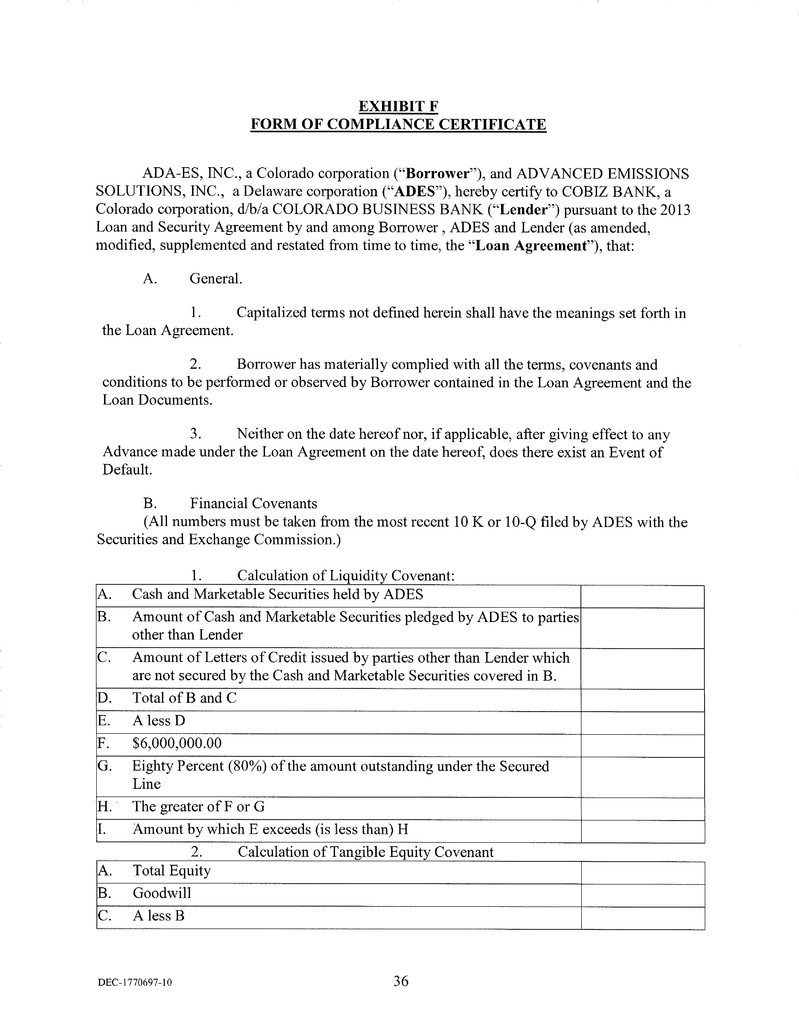

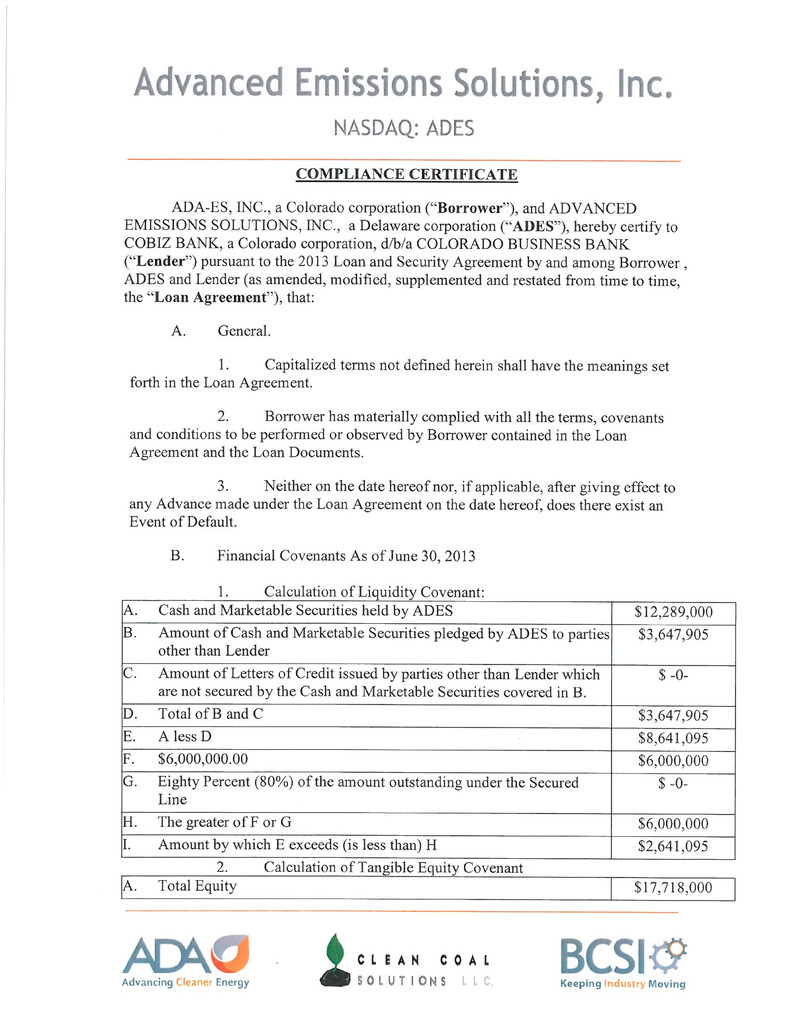

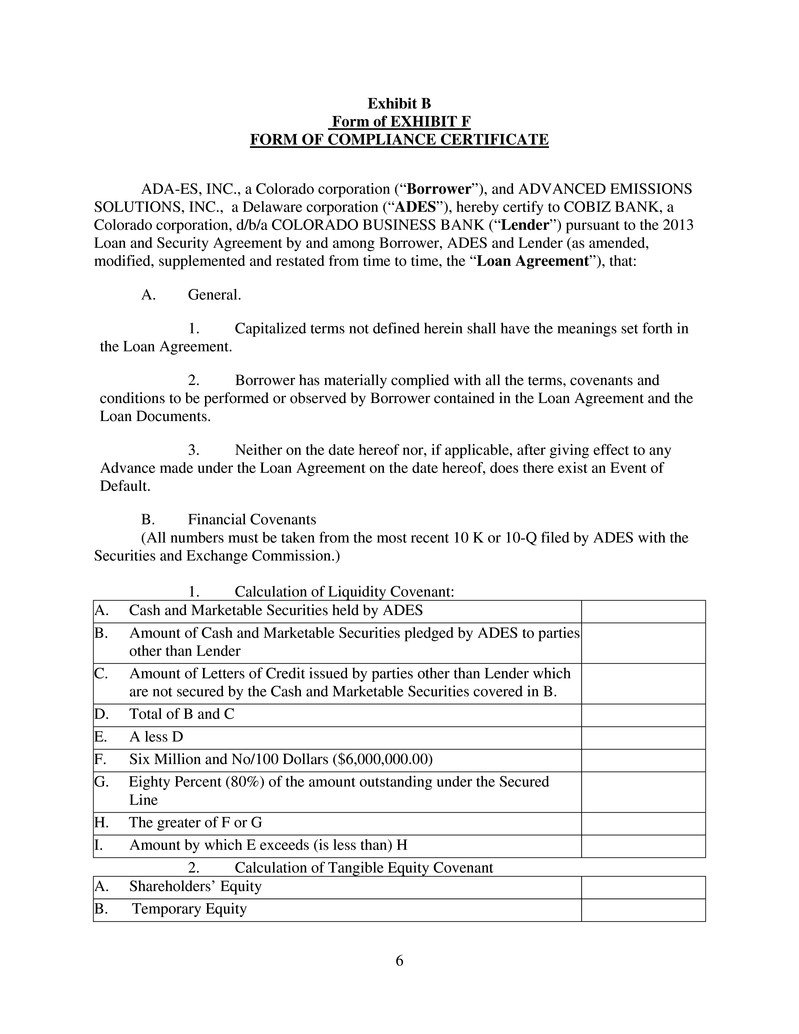

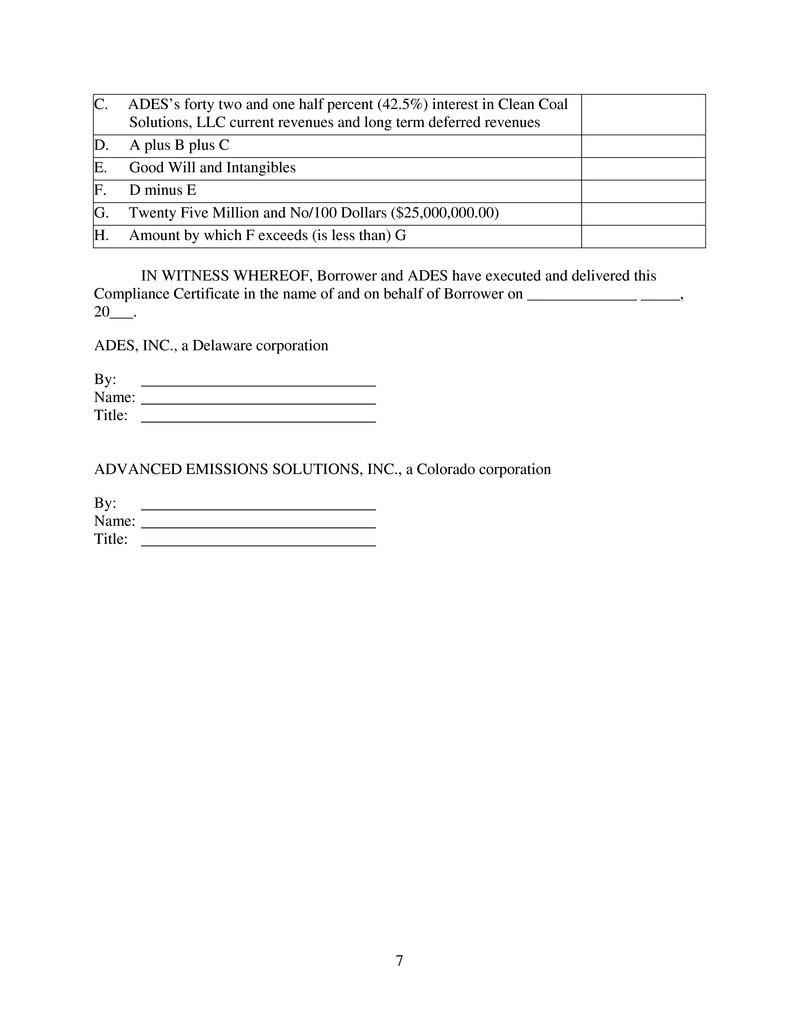

Exhibit B Form of EXHIBIT F FORM OF COMPLIANCE CERTIFICATE ADA-ES, INC., a Colorado corporation (“Borrower”), and ADVANCED EMISSIONS SOLUTIONS, INC., a Delaware corporation (“ADES”), hereby certify to COBIZ BANK, a Colorado corporation, d/b/a COLORADO BUSINESS BANK (“Lender”) pursuant to the 2013 Loan and Security Agreement by and among Borrower, ADES and Lender (as amended, modified, supplemented and restated from time to time, the “Loan Agreement”), that: A. General. 1. Capitalized terms not defined herein shall have the meanings set forth in the Loan Agreement. 2. Borrower has materially complied with all the terms, covenants and conditions to be performed or observed by Borrower contained in the Loan Agreement and the Loan Documents. 3. Neither on the date hereof nor, if applicable, after giving effect to any Advance made under the Loan Agreement on the date hereof, does there exist an Event of Default. B. Financial Covenants (All numbers must be taken from the most recent 10 K or 10-Q filed by ADES with the Securities and Exchange Commission.) 1. Calculation of Liquidity Covenant: A. Cash and Marketable Securities held by ADES B. Amount of Cash and Marketable Securities pledged by ADES to parties other than Lender C. Amount of Letters of Credit issued by parties other than Lender which are not secured by the Cash and Marketable Securities covered in B. D. Total of B and C E. A less D F. Six Million and No/100 Dollars ($6,000,000.00) G. Eighty Percent (80%) of the amount outstanding under the Secured Line H. The greater of F or G I. Amount by which E exceeds (is less than) H 2. Calculation of Tangible Equity Covenant A. Shareholders’ Equity B. Temporary Equity 6

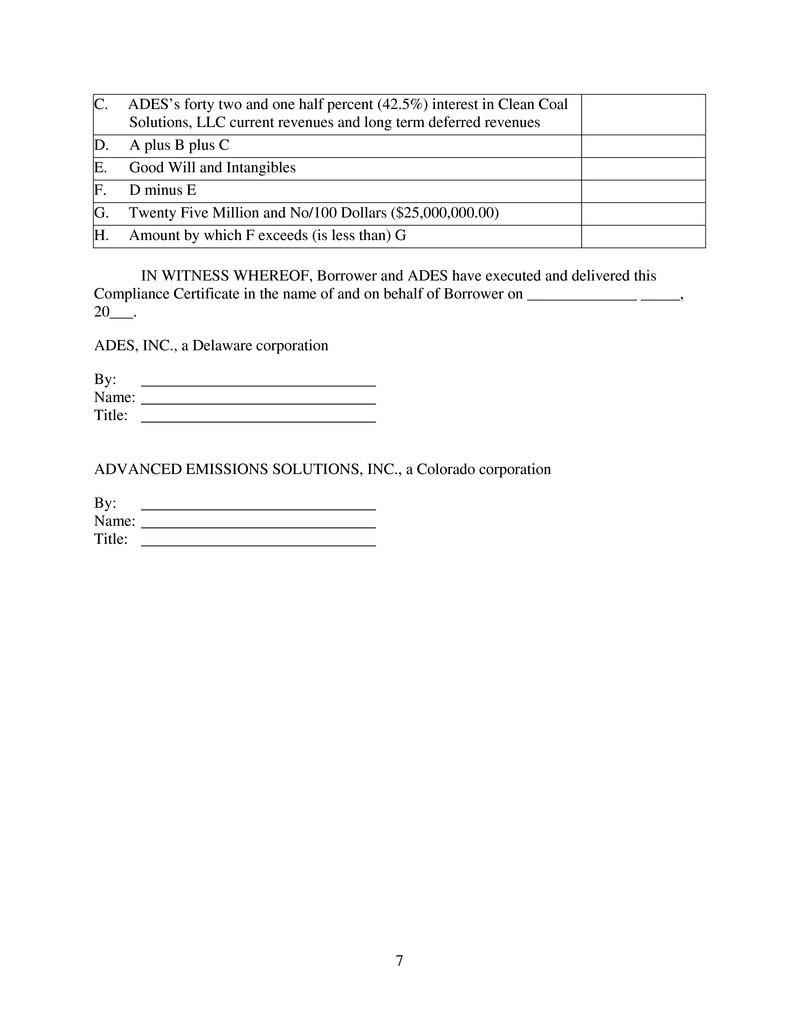

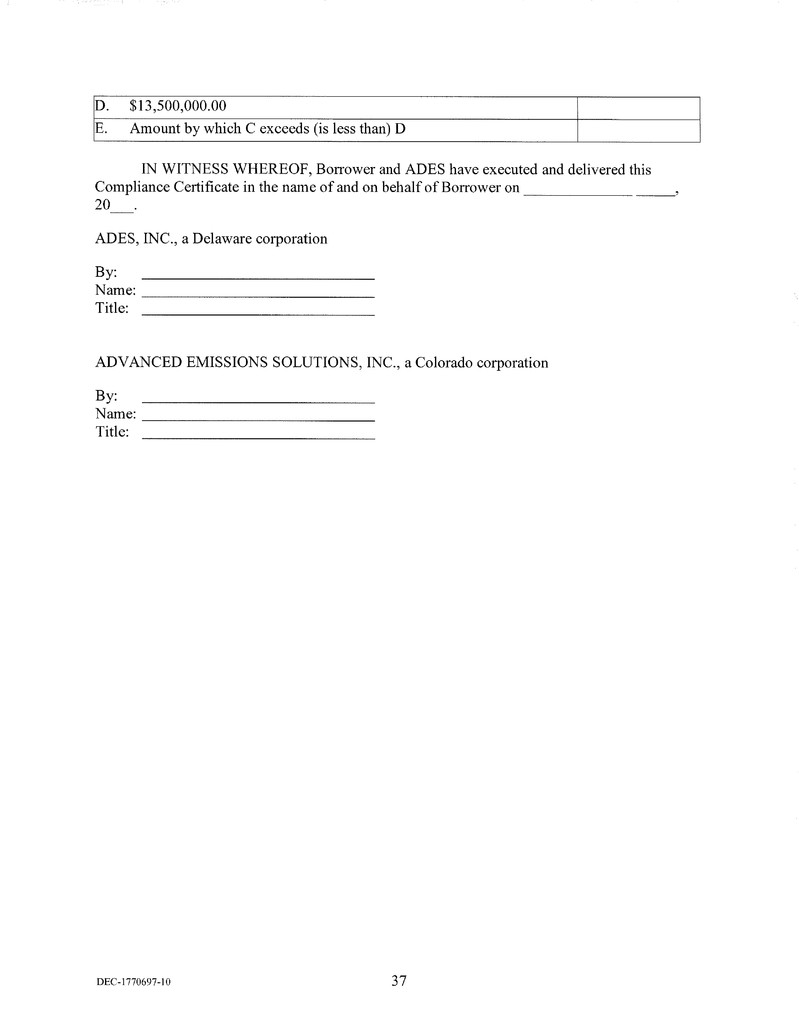

C. ADES’s forty two and one half percent (42.5%) interest in Clean Coal Solutions, LLC current revenues and long term deferred revenues D. A plus B plus C E. Good Will and Intangibles F. D minus E G. Twenty Five Million and No/100 Dollars ($25,000,000.00) H. Amount by which F exceeds (is less than) G IN WITNESS WHEREOF, Borrower and ADES have executed and delivered this Compliance Certificate in the name of and on behalf of Borrower on ______________ _____, 20___. ADES, INC., a Delaware corporation By: Name: Title: ADVANCED EMISSIONS SOLUTIONS, INC., a Colorado corporation By: Name: Title: 7

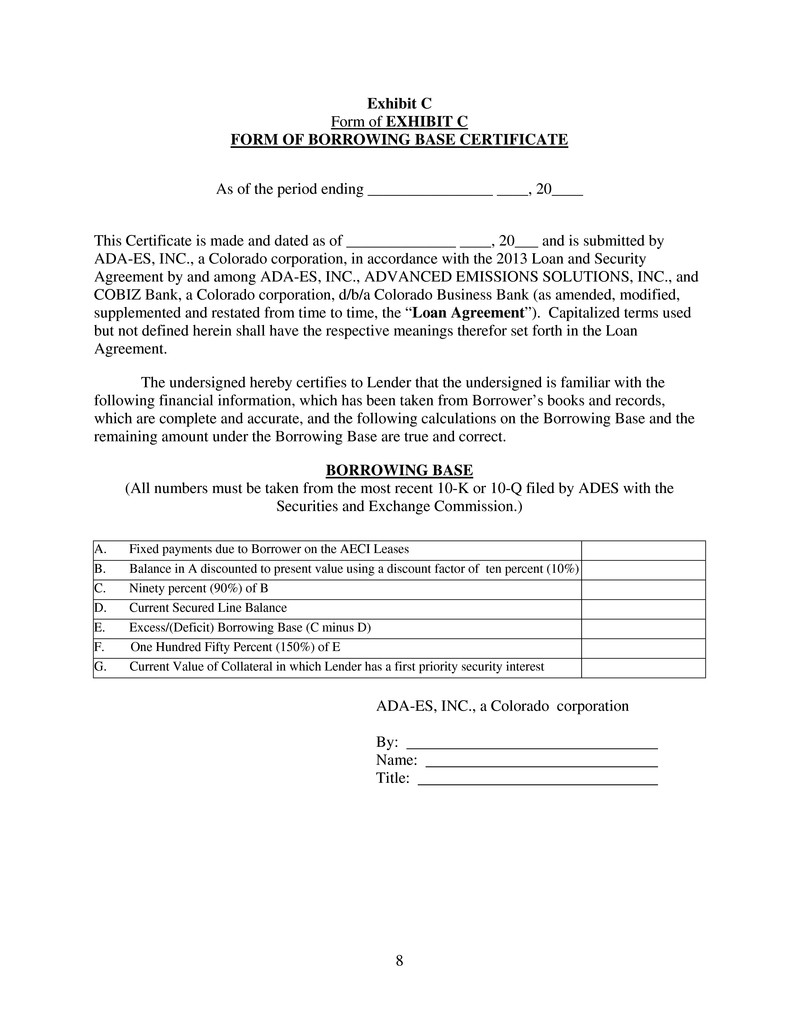

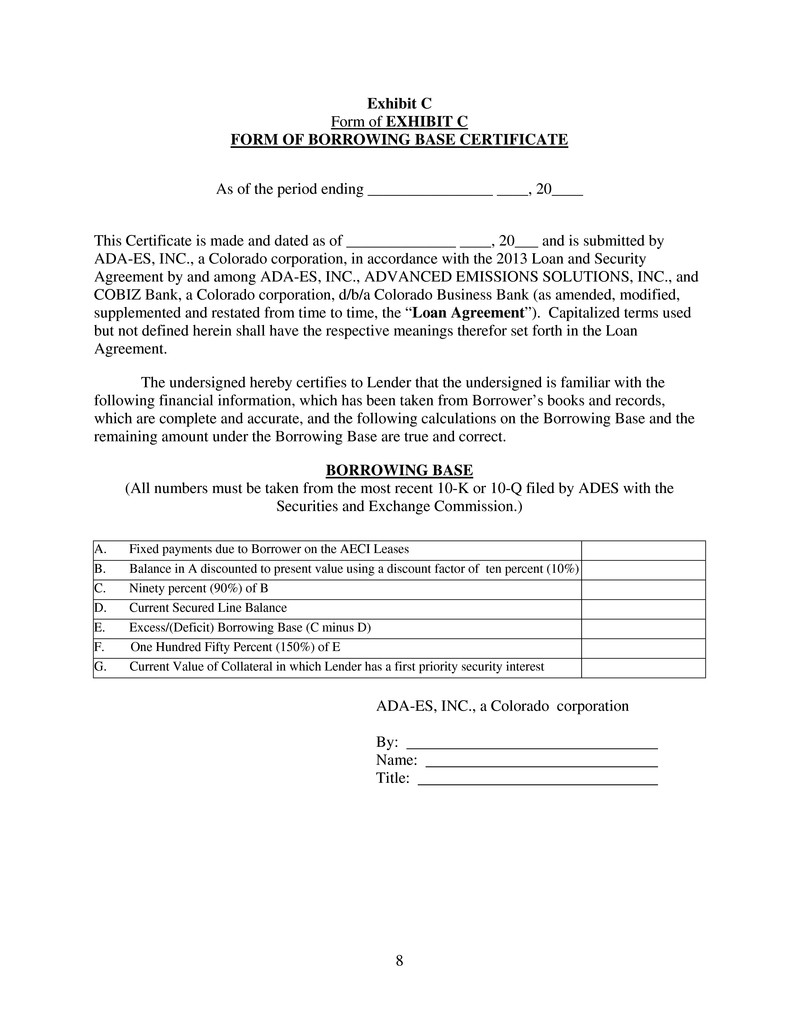

Exhibit C Form of EXHIBIT C FORM OF BORROWING BASE CERTIFICATE As of the period ending ________________ ____, 20____ This Certificate is made and dated as of ______________ ____, 20___ and is submitted by ADA-ES, INC., a Colorado corporation, in accordance with the 2013 Loan and Security Agreement by and among ADA-ES, INC., ADVANCED EMISSIONS SOLUTIONS, INC., and COBIZ Bank, a Colorado corporation, d/b/a Colorado Business Bank (as amended, modified, supplemented and restated from time to time, the “Loan Agreement”). Capitalized terms used but not defined herein shall have the respective meanings therefor set forth in the Loan Agreement. The undersigned hereby certifies to Lender that the undersigned is familiar with the following financial information, which has been taken from Borrower’s books and records, which are complete and accurate, and the following calculations on the Borrowing Base and the remaining amount under the Borrowing Base are true and correct. BORROWING BASE (All numbers must be taken from the most recent 10-K or 10-Q filed by ADES with the Securities and Exchange Commission.) A. Fixed payments due to Borrower on the AECI Leases B. Balance in A discounted to present value using a discount factor of ten percent (10%) C. Ninety percent (90%) of B D. Current Secured Line Balance E. Excess/(Deficit) Borrowing Base (C minus D) F. One Hundred Fifty Percent (150%) of E G. Current Value of Collateral in which Lender has a first priority security interest ADA-ES, INC., a Colorado corporation By: Name: Title: 8

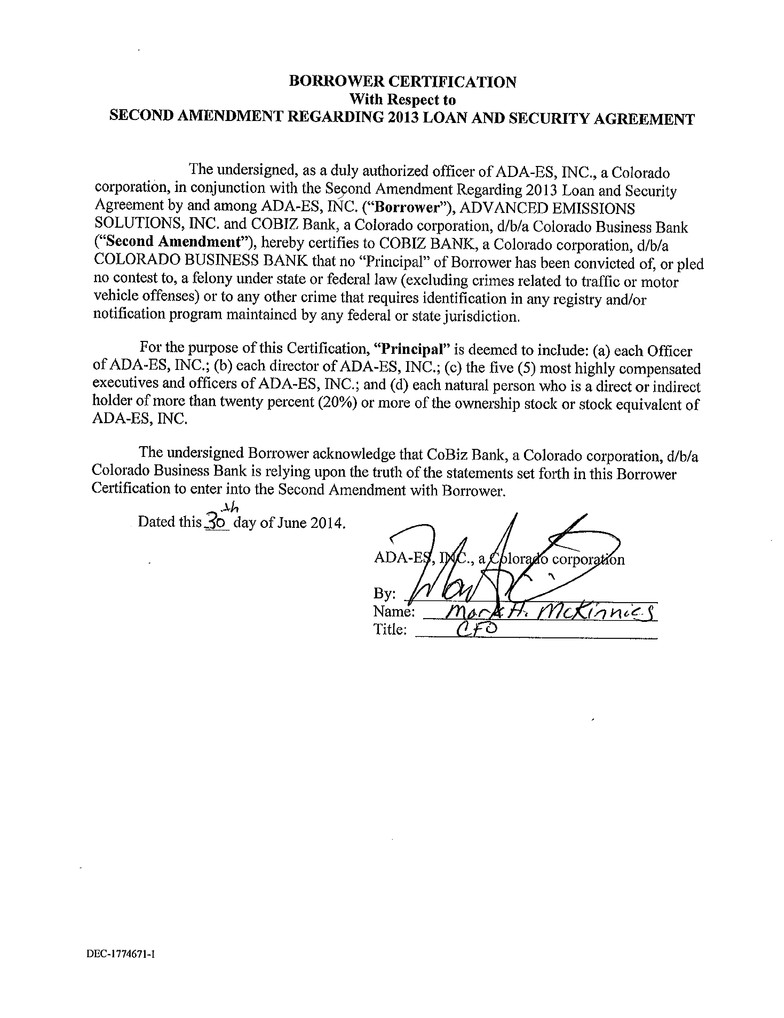

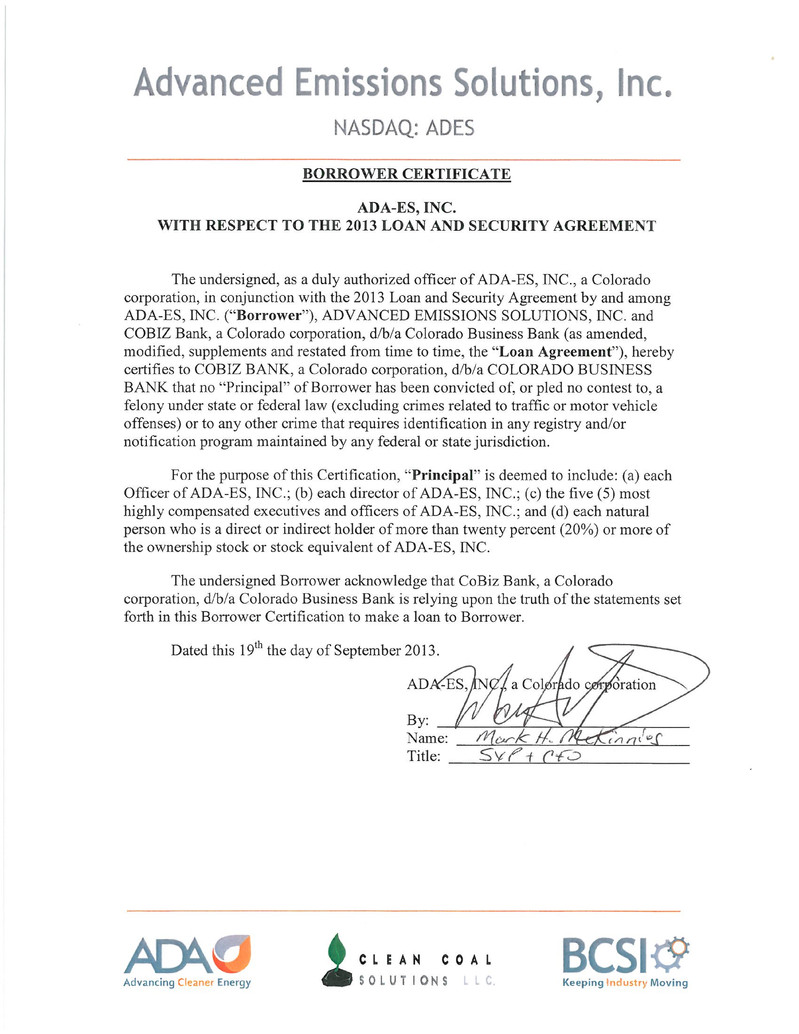

Exhibit D Form of BORROWER CERTIFICATION With Respect to FIRST AMENDMENT AND WAIVER REGARDING 2013 LOAN AND SECURITY AGREEMENT The undersigned, as a duly authorized officer of ADA-ES, INC., a Colorado corporation, in conjunction with the First Amendment and Waiver Regarding 2013 Loan and Security Agreement by and among ADA-ES, INC. (“Borrower”), ADVANCED EMISSIONS SOLUTIONS, INC. and COBIZ Bank, a Colorado corporation, d/b/a Colorado Business Bank (“First Amendment”), hereby certifies to COBIZ BANK, a Colorado corporation, d/b/a COLORADO BUSINESS BANK that no “Principal” of Borrower has been convicted of, or pled no contest to, a felony under state or federal law (excluding crimes related to traffic or motor vehicle offenses) or to any other crime that requires identification in any registry and/or notification program maintained by any federal or state jurisdiction. For the purpose of this Certification, “Principal” is deemed to include: (a) each Officer of ADA-ES, INC.; (b) each director of ADA-ES, INC.; (c) the five (5) most highly compensated executives and officers of ADA-ES, INC.; and (d) each natural person who is a direct or indirect holder of more than twenty percent (20%) or more of the ownership stock or stock equivalent of ADA-ES, INC. The undersigned Borrower acknowledge that CoBiz Bank, a Colorado corporation, d/b/a Colorado Business Bank is relying upon the truth of the statements set forth in this Borrower Certification to enter into the First Amendment with Borrower. Dated this 2nd day of December 2013. ADA-ES, INC., a Colorado corporation By: Name: Title: 9