UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A INFORMATION |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant o |

|

Filed by a Party other than the Registrant x |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

x | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

|

Affinity Gaming |

(Name of Registrant as Specified In Its Charter) |

|

Z Capital Partners, L.L.C. Zenni Holdings, LLC Z Capital Special Situations Adviser, L.P. Z Capital Special Situations GP, L.P. Z Capital Special Situations UGP, L.L.C. James J. Zenni, Jr. Z Capital HG, L.L.C. Z Capital HG-C, L.L.C. Z Capital Special Situations Fund Holdings I, L.L.C. Z Capital Special Situations Fund Holdings II, L.L.C. Z Capital CUAL Co-Invest, L.L.C. |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

On April 23, 2013, the Z Capital Group (whose members are identified below) sent a slide presentation to stockholders of Affinity Gaming (the “Company”) and issued a press release in connection with the Z Capital Group’s solicitation of proxies for the election of its director nominees at the Company’s 2013 Annual Meeting of Stockholders. Copies of the presentation and press release are attached hereto as Exhibits 1 and 2, respectively, and are incorporated herein by reference.

Important Information

The Z Capital Group has nominated James J. Zenni, Jr. and Martin J. Auerbach, Esq. (the “Z Capital Nominees”) as nominees to the board of directors of the Company and is soliciting votes for the election of the Z Capital Nominees as members of the board. The Z Capital Group has sent a definitive proxy statement, GOLD proxy card and related proxy materials to stockholders of the Company seeking their support of the Z Capital Nominees at the Company’s 2013 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and GOLD proxy card because they contain important information about the Z Capital Group, the Z Capital Nominees, the Company and related matters. Stockholders may obtain a free copy of the definitive proxy statement and GOLD proxy card and other documents filed by the Z Capital Group with the Securities and Exchange Commission (“SEC”) at the SEC’s web site at www.sec.gov. The definitive proxy statement and other related documents filed by the Z Capital Group with the SEC may also be obtained free of charge by contacting Innisfree M&A Incorporated by mail at 501 Madison Avenue, 20th Floor, New York, New York 10022 or by telephone at the following numbers: stockholders call toll-free at (888) 750-5834 and banks and brokers call collect at (212) 750-5833.

The Z Capital Group consists of the following persons: Z Capital Partners, L.L.C.; Zenni Holdings, LLC; James J. Zenni, Jr.; Z Capital Special Situations Adviser, L.P.; Z Capital Special Situations GP, L.P.; Z Capital Special Situations UGP, L.L.C.; Z Capital Special Situations Fund Holdings I, L.L.C.; Z Capital HG, L.L.C.; Z Capital Special Situations Fund Holdings II, L.L.C.; Z Capital CUAL Co-Invest, L.L.C.; and Z Capital HG-C, L.L.C. The members of the Z Capital Group and the Z Capital Nominees are participants in the solicitation from the Company’s stockholders of proxies in favor of the Z Capital Nominees. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the definitive proxy statement of the Z Capital Group, filed with the SEC on April 23, 2013 and first disseminated to stockholders on or about April 23, 2013.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe��� or the negatives thereof or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. Due to various risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements.

Exhibit 1

| Z CAPITAL PARTNERS, L.L.C. PRESENTATION TO SHAREHOLDERS OF AFFINITY GAMING APRIL 2013 |

| EXECUTIVE SUMMARY 1 A proper, balanced Board of Affinity Gaming (“Affinity” or the “Company”), reflecting a range of perspectives - shareholders, industry experts, and management – and not dominated by any one single shareholder is best suited to address all of Affinity’s challenges and build shareholder value. We urge you to vote for Z Capital’s two highly qualified nominees and seat a well-balanced Board. A new Board, with seven members, comprised of nominees put forward by Z Capital Partners, L.L.C. (“Z Capital”) and Silver Point Capital L.P. (“SP”) would reflect a range of shareholder perspectives balanced with the industry expertise of independent Board members. Management’s perspective is always important with the CEO, David Ross, remaining on the Board. Z Capital has the operational, financial, corporate governance and industry experience, as well as a deep pool of resources to be a positive force for maximizing shareholder value. Our long and successful track record of working collaboratively with fellow directors and management of our portfolio companies will be critical in addressing the Company’s needs at this crucial stage in its post-bankruptcy recovery. Were Z Capital nominees elected to the Board, they would have a fiduciary duty to all shareholders. The slate proposed by the Company and SP, which does not include nominees from Z Capital, will effectively mean that SP is taking control of the Company. Leaving the Board in the hands of a single shareholder is unwise and does not ensure that all shareholders' interests are protected. In short, Affinity needs its largest constituent, Z Capital, to help maximize shareholder value for all of us. We are happy to answer your questions. CONTACT INFORMATION: James J. Zenni, Jr., CEO of Z Capital Partners, L.L.C. – 847-235-8100 Martin J. Auerbach, Esq., General Counsel of Z Capital Partners, L.L.C. – 212-704-4347 Andrei Scrivens, Managing Director of Z Capital Partners, L.L.C. – 847-235-8100 Scott Winter/Jonathan Salzberger, Innisfree M&A Inc. – 212-750-5833 |

| EXECUTIVE SUMMARY Expanding Affinity’s Board and adding new directors is necessary, however the new Board and the Company will only succeed if we all recognize key issues and elect the right slate of directors. AFFINITY’S BOARD HAS FAILED – The unelected Board has not demonstrated the skill, expertise, or governance best practices Affinity’s shareholders deserve. Under the leadership of Don Kornstein (“Kornstein”), the Board has not held shareholders’ interests as paramount. A series of dubious dealings coupled with a systematic stripping of shareholders’ rights under the guise of a corporate conversion necessitate a Board change. The recent defection of two directors highlights the Board’s dysfunction. A SP DOMINATED BOARD IS NOT IN THE BEST INTEREST OF ALL SHAREHOLDERS – SP was influential in seating the current Board, including Kornstein. The Company’s four new “independent” nominees were all hand-picked by SP. A Board effectively controlled by SP is NOT in the best interest of all shareholders. Z CAPITAL IS NOMINATING TWO HIGHLY QUALIFIED, INDEPENDENT CANDIDATES THAT OFFER NECESSARY BALANCE AND PERSPECTIVE TO ROUND OUT THE SLATE. Z Capital, the Company’s largest investor with over 30% of the outstanding shares, is aligned with the interests of all shareholders and committed to the Company to drive shareholder value. We are seeking to elect only 2 (out of 7) directors in order to have balanced shareholder representation on the Board. We believe a Kornstein/SP Board does not protect the interests of other shareholders. Z Capital’s nominees have had extensive interaction with Affinity’s state gaming regulators (Nevada, Iowa, Missouri, and Colorado) and Z Capital, along with Mr. Zenni, have been “found suitable” in those states. Additionally, Mr. Zenni has nearly two decades of experience investing in gaming companies both large cap and small cap. We have been the most vigilant and vocal shareholder in protecting ALL shareholder rights and scrutinizing Board actions. Our nominees have the skill set and experience needed by the Board at this time. IT IS TIME FOR KORNSTEIN AND THE SP DOMINANCE TO GO AND A WELL-BALANCED BOARD TO BE ELECTED. VOTE GOLD PROXY 2 |

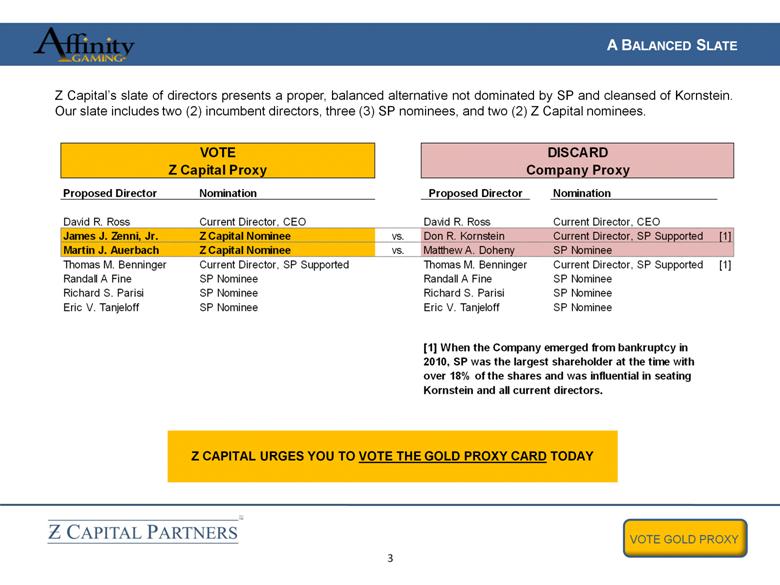

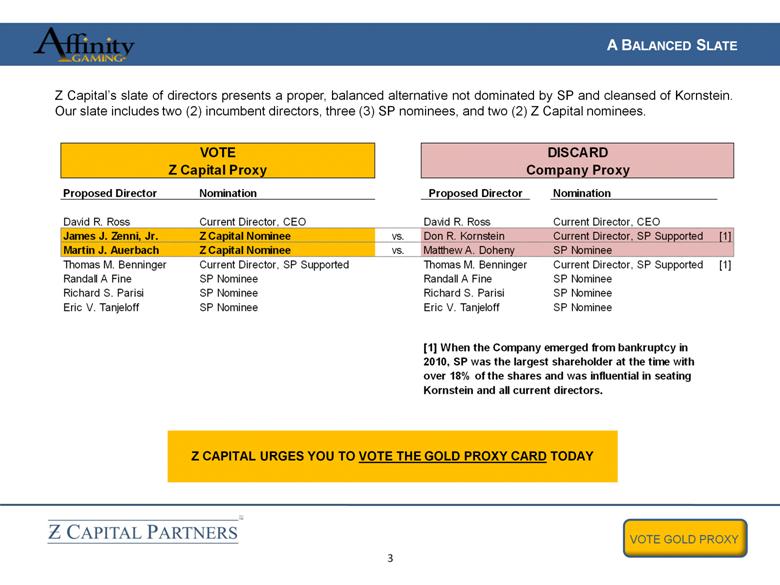

| A BALANCED SLATE 3 Z Capital’s slate of directors presents a proper, balanced alternative not dominated by SP and cleansed of Kornstein. Our slate includes two (2) incumbent directors, three (3) SP nominees, and two (2) Z Capital nominees. Z CAPITAL URGES YOU TO VOTE THE GOLD PROXY CARD TODAY Nomination Nomination David R. Ross Current Director, CEO David R. Ross Current Director, CEO James J. Zenni, Jr. Z Capital Nominee vs. Don R. Kornstein Current Director, SP Supported [1] Martin J. Auerbach Z Capital Nominee vs. Matthew A. Doheny SP Nominee Thomas M. Benninger Current Director, SP Supported Thomas M. Benninger Current Director, SP Supported [1] Randall A Fine SP Nominee Randall A Fine SP Nominee Richard S. Parisi SP Nominee Richard S. Parisi SP Nominee Eric V. Tanjeloff SP Nominee Eric V. Tanjeloff SP Nominee [1] When the Company emerged from bankruptcy in 2010, SP was the largest shareholder at the time with over 18% of the shares and was influential in seating Kornstein and all current directors. DISCARD VOTE Proposed Director Proposed Director Z Capital Proxy Company Proxy |

| Z CAPITAL’S PLAN FOR VALUE CREATION This election provides Affinity's shareholders with the first real seating of directors. There are a number of challenges the new Board will have to face, highlighting why Z Capital must be on the Board. SHAREHOLDER LIQUIDITY- We are cognizant of shareholders’ need for liquidity. A failed sale process and a flawed bond issuance that creates structural impediments to a transaction raises questions as how to best provide that liquidity. Z Capital’s substantial equity commitment aligns our interests directly with fellow shareholders. Z Capital’s nominees are open to ALL strategic alternatives for increasing shareholder liquidity and shareholder value. RESTORE SHAREHOLDER RIGHTS AND BOARD CREDIBILITY - Shareholder rights have been stripped by the Kornstein-led Board. Z Capital nominees are supremely qualified in governance best practices and have every intention of restoring your rights. Z Capital has earned the trust and approval of all of the state regulators (Colorado, Iowa, Missouri, Nevada). Z Capital has been the strongest advocate for the restoration of shareholder rights, benefitting all shareholders – at its own expense. 4 |

| Z CAPITAL’S PLAN FOR VALUE CREATION (CON’T) CLARIFY CORPORATE STRATEGY – Operating in a difficult economic climate takes leadership and vision. The Board’s actions have sent confusing messages to all stakeholders (shareholders, management, customers, regulators) which has been noticed by analysts who sense discord with management. We are concerned about the risk of management defections. Z Capital has a successful track record of working collaboratively with fellow directors and management to reach consensus and unify strategy at our portfolio companies. Z Capital has significant operating, corporate governance, financial and industry experience to augment the skills of other Board nominees. Z Capital has been vocal in its support of Affinity’s management. Z Capital is a private equity firm committed to building shareholder value for all. 5 |

| SHAREHOLDER LIQUIDITY 6 ISSUE: SHAREHOLDER LIQUIDITY The Special Opportunities Committee Has Failed – The Kornstein-led Board and its advisor, Deutsche Bank (“DB”), have failed to present shareholders with any options for maximizing liquidity and value. The formal process of the last 6 months followed informal and unsuccessful efforts to sell the Company that began when it emerged from bankruptcy. The Board Erred in Bond Financing – Instead of obtaining all senior bank financing, the Board, advised by DB, saddled the Company with bonds in 2012 that contain an expensive make-whole provision. Any buyer seeking to utilize the cash on the Company's balance sheet will have to contend with that make-whole. It effectively amounts to $2/share, paid to bondholders – not shareholders. This is clearly a structural impediment and a damaging misstep by the Board and its advisors which will hinder value to shareholders in a near-term transaction. The Board refused to take any input from any shareholders during the negotiations with DB. Z CAPITAL VIEW While we believe in the Company’s long-term, stand-alone prospects and are supportive of current management, we are also cognizant of shareholders’ need for liquidity. If shareholders are not satisfied with the Board’s process to date, we will support a market test and another process to sell the Company or other ways to provide shareholders liquidity. As Affinity’s stock has not traded meaningfully in months, we would also support a listing of the stock. |

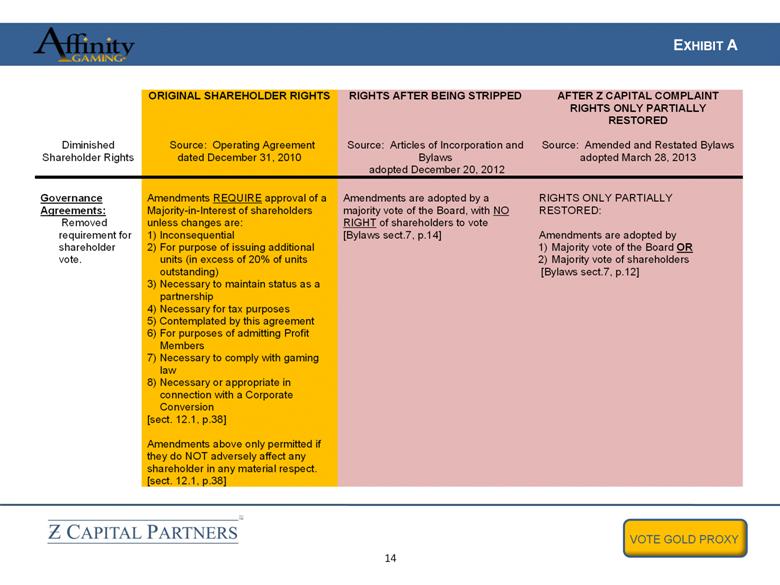

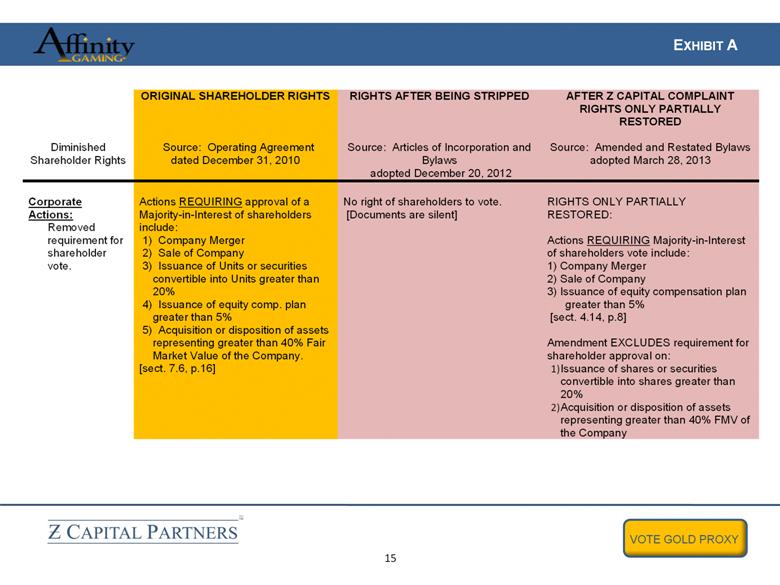

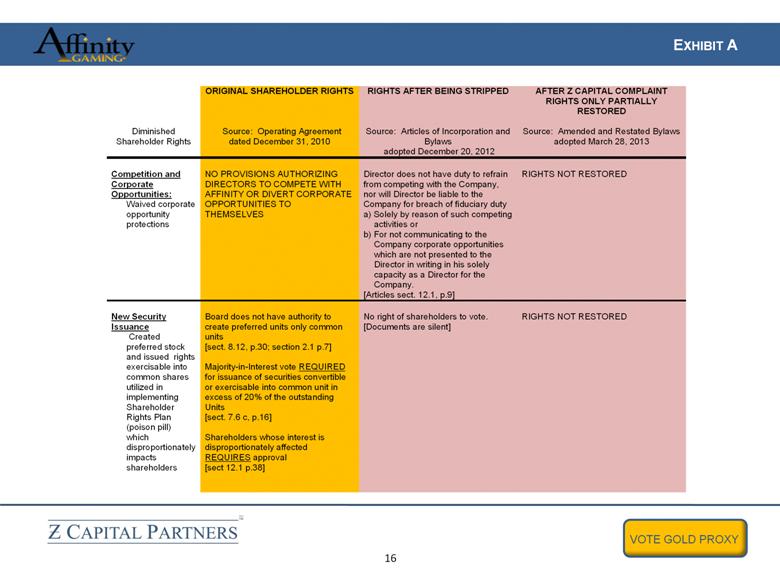

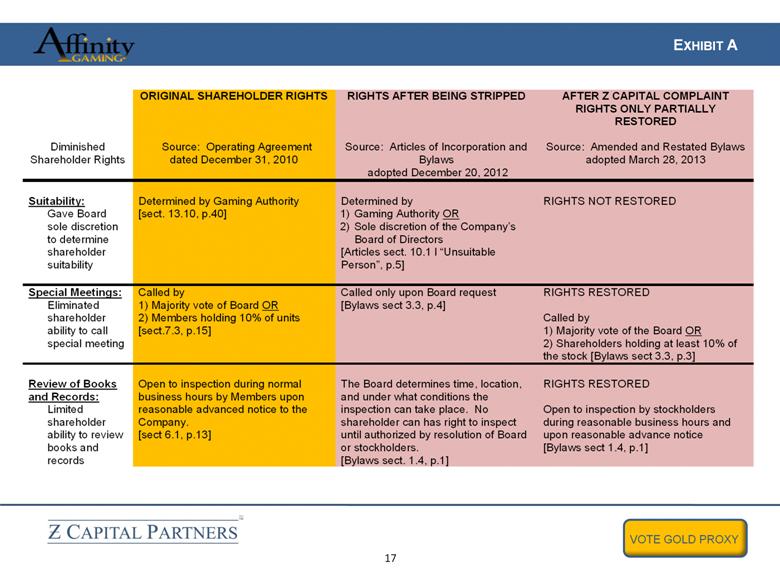

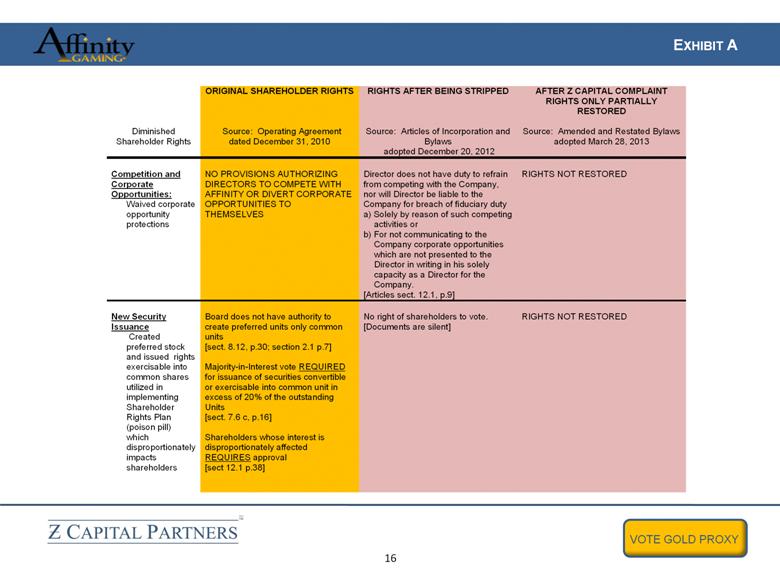

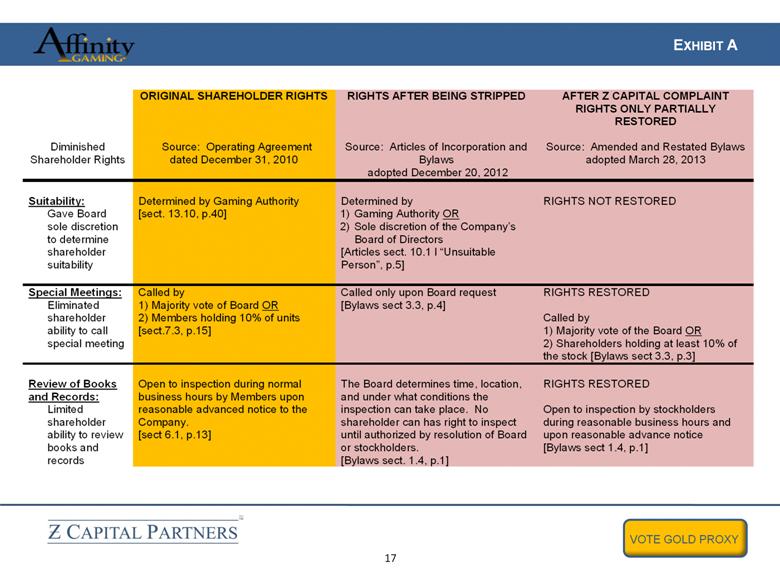

| RESTORE SHAREHOLDER RIGHTS AND BOARD CREDIBILITY 7 ISSUE: POOR CORPORATE GOVERNANCE Sweetheart Deals, Conflicts of Interest, Entrenchment The unelected Board approved an extraordinary special “investment banking” fee of $300,000 to Kornstein, apparently for negotiating the 2012 asset swaps for which it did not retain an outside advisor. The Board did not appear to follow its own conflict of interest procedures with respect to the payment. Kornstein has personal relationships at DB going back decades. DB led the flawed bond financing and is still leading the failed sales process. At the expense of shareholder value, Kornstein is favoring his DB relationship over seeking an alternative financial perspective. The Board failed to hold a single shareholder meeting in over two years while pursuing a series of significant corporate transactions and entrenching the incumbent directors. In an effort to save his position at the Company, we believe Kornstein cut a deal for SP’s support by adding four of SP’s hand-picked nominees. Shareholder Rights Systematically Stripped In a move that the Company’s attorney misrepresented to the Nevada Gaming Control Board as “akin to a name change” the Board adopted new Articles and Bylaws implemented in direct contradiction of the LLC Operating Agreement, that stripped shareholder voting and other rights and authorized self-dealing by board members, all without shareholder input or approval. PLEASE REVIEW EXHIBIT A TO SEE HOW YOUR SHAREHOLDER RIGHTS HAVE BEEN STRIPPED. |

| RESTORE SHAREHOLDER RIGHTS AND BOARD CREDIBILITY (CON’T) 8 Z CAPITAL VIEW Shareholder Rights Paramount - We have been the most attentive, vigilant and vocal champion of the cause on behalf of all shareholders regarding the Board’s highly inappropriate activities. Questioned Fees - On behalf of all shareholders we questioned the extraordinary $300,000 payment to Kornstein. Pending Litigation - Some may misperceive our lawsuit as an effort to impede a sale of the Company, but in fact our complaint is simply a continuation of our efforts to protect and restore our collective shareholder rights that were stripped away by the Board. Only after we complained did the Board partially restore these rights. Credibility with Regulators - With a long track record of adhering to high standards of corporate governance and having gained the trust of the regulators through the licensing process, we believe Z Capital can help restore the Company’s credibility with shareholders and regulators alike. We Have No Intention of Bidding for Affinity – In February 2013, we made a bid for the Company as an alternative to litigation. Negotiations with the Chairman were thwarted. Because of changes in the landscape since our offer, we are not pursuing a bid to buy the Company. We will recuse ourselves from Board decisions where necessary and appropriate. Kornstein Must Not Be Re-elected – As Chairman of the Board, Interim Chairman of the Governance Committee, and Chairman of the Special Opportunities Committee, Kornstein has failed at every turn. Contrived and accepted an extraordinary fee. Led effort to strip shareholder rights. Favored long-standing DB relationship over shareholder value. Created a confused corporate strategy. And now, we believe he has cut a deal with SP (who seated him on the Board two years ago) by adding four of their hand-picked nominees to the Company proxy. |

| CLARIFY CORPORATE STRATEGY 9 ISSUE: CONFUSION & HEADWINDS Lack of Board Leadership Has Created Stakeholder Confusion - In 2012, the Board authorized the issuance of bonds which contain structural impediments to a sale of the Company only to pursue a sale process a few months later. In the meanwhile, shareholders are bearing the negative cost of carry on over $125 million of idle balance sheet cash at a 9% interest rate. Company Credibility at Risk – Customers, management, employees, and shareholders want to know whether the Company is being sold or is pursuing a growth strategy. Revenue Headwinds – In light of 2012 reported results and the economic drag to Affinity’s core customers, we expect a soft Q1 2013 and don’t think current trends are in the Company’s favor. Potential collateral damage from the Federal Investigation at Pilot Flying J may hinder revenues in Iowa. Z CAPITAL VIEW Z Capital has significant operating, turnaround and industry experience which complements the skills of the other Board nominees. We have a long, successful track record of working collaboratively with fellow directors and management in developing a unified value-maximizing strategy for all. A Board focused exclusively on selling the Company will not build management loyalty. Losing Affinity’s highly experienced management leadership would be extremely damaging for all shareholders. Z Capital has been vocal in its support of management and intends to support them while exploring all strategic alternatives to build value for the shareholders and provide liquidity. The Company needs leadership from its largest, highly-qualified constituent – Z Capital. |

| Z CAPITAL NOMINEE James J. Zenni, Jr. Age: 58 Relevant Experience: Mr. Zenni is President, Chief Executive Officer and Managing Principal of Z Capital, having served in such roles since 2006, and is responsible for all portfolio management and business operations. From 1995 to 2006, Mr. Zenni was Managing Principal of Black Diamond Capital Management, L.L.C. ("BDCM"). With over thirty years of experience, Mr. Zenni has had substantial success investing in and overseeing management of companies in multiple industries, and in private equity and related credit strategies. Prior to BDCM, Mr. Zenni had a distinguished career with Kidder and played a significant role in its growth and success and gained significant experience in financial asset engineering, acquisitions, distressed mortgages and real estate. Mr. Zenni was the only non-management/department head in the firm to hold the title of Managing Director. Board Positions: Mr. Zenni is currently a member of the board of directors of private companies Mrs. Fields Famous Brands, LLC, Neways Holdings, Ltd. and Real Mex Restaurants, and was previously a member of the board of directors of Automotive Aftermarket Group, LLC, Bayou Steel Corporation, Smarte Carte Corporation and Sun World International, LLC, all of which were or are portfolio companies. Education: Graduate of Xavier University with a Bachelor of Science degree in economics and attended Xavier University Graduate School of Business and University of Vienna School of Economics and Business Administration. Gaming License: In the states where the Company has been licensed (Colorado, Iowa, Missouri and Nevada), Mr. Zenni has sought approval from, and been "found suitable" by, the respective gaming authorities. Applicable Skill Set: We believe that Mr. Zenni's extensive experience as an investor, manager and director, including experience with the hospitality and gaming industry, will be valuable to the Board. In addition, his depth of experience in financial and operational turnarounds will provide the appropriate perspective as the Board evaluates value maximizing alternatives. 10 |

| Z CAPITAL NOMINEE Martin J. Auerbach, Esq. Age: 61 Relevant Experience: Mr. Auerbach is a Senior Managing Director and General Counsel to Z Capital, having served in such roles since 2011 and 2006, respectively. Mr. Auerbach served as Managing Director of Z Capital from 2006 to 2011 and was previously consulting general counsel to BDCM. Mr. Auerbach has established a distinguished career spanning over thirty-five years. He is an attorney specializing in the representation of financial institutions and their management, and large international companies and their officers and directors, principally in crisis and reputational risk management, regulatory and governmental proceedings, internal inquiries, financial reporting and corporate governance. Some of Mr. Auerbach's recent assignments include: Consulting Special Counsel to the board and corporation of United Rentals Inc., where he managed a range of legal and regulatory issues faced by the company; counsel to Paul Volcker in connection with Arthur Andersen; counsel to the Vice Chair of Cendant; counsel to the President of Global Crossing; counsel to senior Enron bankers; counsel to significant participants in the crises at Computer Associates, Adelphia and Imclone; SEC and NYAG investigations of market timing, research analysts, and insurance industry practices, and internal investigations for Citigroup, Jefferies and in connection with Royal Ahold, among others. Mr. Auerbach also served as a member of the board of directors of the Hope Program. Education: Juris Doctor degree with honors from Harvard Law School and a bachelor's degree with high honors from Harvard College. He is admitted to practice law in the State of New York and in various Federal courts. Prior to entering private practice, Mr. Auerbach served as an Assistant United States Attorney responsible for large-scale tax prosecutions, served as a law clerk for a Senior United States District Judge and served on the Professional Staff of the Energy and Commerce Committee of the United States House of Representatives. Mr. Auerbach has developed wide-ranging experience with complex financial, accounting, compliance, governance and regulatory issues in his over thirty-five years as an attorney and counselor at law. As a result, Mr. Auerbach is acutely sensitive to the need for scrupulous adherence to best practices and the leadership a director must provide to ensure those standards are achieved. Applicable Skill Set: We believe Mr. Auerbach is highly respected in the areas of corporate governance and regulatory compliance as reflected in his extensive resume. We believe his reputation and experience will be valuable to the Board in restoring credibility with shareholders and regulators. 11 |

| 12 EXHIBIT A |

| EXHIBIT A The current Board, with Kornstein on the Governance Committee, used a seemingly innocuous corporate conversion to implement significant amendments to corporate documents which stripped shareholders of their rights. These changes were in direct violation of Section 7.15 of Affinity’s Operating Agreement which governed the conversion and provided that unit holders must receive: “rights in connection with such Corporate Conversionsubstantially equivalent to such economic interest, governance, priority and other rights and privileges as such Member has with respect to its Interests prior to such Corporate Conversion and are consistent with the rights and privileges attendant to such Interests as set forth in this Agreement [the Operating Agreement] as in effect immediately prior to such Corporate Conversion.” The comparison on the following slides highlight the significantly diminished shareholder rights adopted by the Board on December 20, 2012, which they further revised on March 28, 2013 after Z Capital filed its complaint in a Nevada district court seeking the restoration of those rights. As currently written, the Articles of Incorporation and Amended and Restated Bylaws remain woefully short of the rights bargained for and memorialized in the Operating Agreement. 13 |

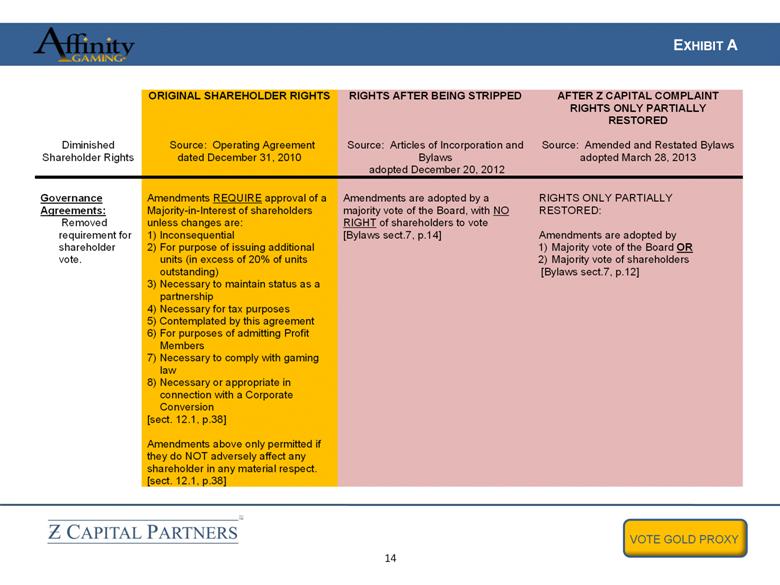

| EXHIBIT A 14 ORIGINAL SHAR E HOLDER RIGHTS RIGHTS AFTER BEING STRIPPED AFTER Z CAPITAL COMPLAINT RIGHTS ONLY PARTIALLY RESTORED Diminished Shareholder Rights Source: Operating Agreement dated December 31, 2010 Source: Articles of Incorporation and Bylaws adopted December 20, 2012 Source: Amended and Restated Bylaws adopted March 28, 2013 Governance Agreements: Removed requirement for shareholder vote. Amendments REQUIRE approval of a Majority - in - Interest of shareholders unless changes are : 1) I nconsequential 2) For purpose of issuing additional units ( in excess of 20% of units outstanding) 3) Necessary to maintain status as a partnership 4) Necessary for tax purposes 5) Contemplated by this agreement 6) For purposes of admitting Profit Members 7) Necessary to comply with gaming law 8) Necessary or appropriate in connection with a Corporate Conversion [sect. 12.1, p.38] Amendments above only permitted if they do NOT adversely affect any shareholder in any material respect . [sect. 12.1, p.38] Amendments are adopted by a majority vote of the Board , with NO RIGHT of shareholders to vote [Bylaws sect.7 , p.14] RIGHTS ONLY PARTIALLY RESTORED: Amendments are adopted by 1) M ajority vote of the Board OR 2) M ajority vote of shareholders [Bylaws sect.7 , p.12 ] |

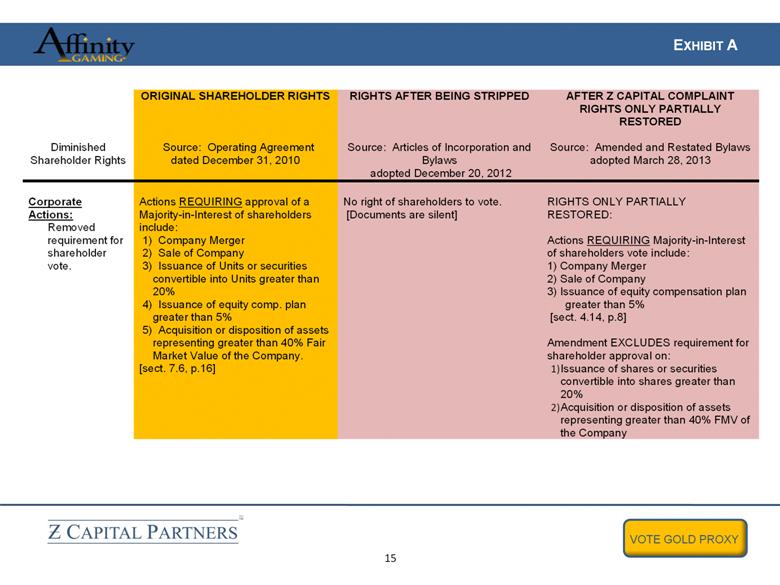

| EXHIBIT A 15 ORIGINAL SHAREHOLDER RIGHTS RIGHTS AFTER BEING STRIPPED AFTER Z CAPITAL COMPLAINT RIGHTS ONLY PARTIALLY RESTORED Diminished Shareholder Rights Source: Operating Agreement dated December 31, 2010 Source: Articles of Incorporation and Bylaws adopted December 20, 2012 Source: Amended and Restated Bylaws adopted March 28, 2013 Corporate Actions: Removed requirement for shareholder vote. Actions REQUIRING approval of a Majority - in - Interest of shareholders include: 1) Company Merger 2) Sale of Company 3) Issuance of Units or securities convertible into Units greater than 20% 4) Issuance of equity comp. plan greater than 5% 5) Acquisition or disposition of assets representing greater than 40% Fair Market Value of the Company. [sect. 7.6, p.16] No right of shareholders to vote. [Documents are silent] RIGHTS ONLY PARTIALLY RESTORED: Actions REQUIRING Majority - in - Interest of shareholders vote include: 1) Company Merger 2) Sale of Company 3) Issuance of equity compensation plan greater than 5% [sect. 4.14, p.8] Amendment EXCLUDES requirement for shareholder approval on: 1) Issuance of shares or securities convertible into shares greater than 20% 2) Acquisition or disposition of assets representing greater than 40% FMV of the Company |

| EXHIBIT A 16 ORIGINAL SHAREHOLDER RIGHTS RIGHTS AFTER BEING STRIPPED AFTER Z CAPITAL COMPLAINT RIGHTS ONLY PARTIALLY RESTORED Diminished Shareholder Rights Source: Operating Agreement dated December 31, 2010 Source: Articles of Incorporation and Bylaws adopted December 20, 2012 Source: Amended and Restated Bylaws adopted March 28, 2013 Competition and Corporate Opportunities: Waived corporate opportunity protections NO PROVISIONS AUTHORIZING DIRECTORS TO COMPETE WITH AFFINITY OR DIVERT CORPORATE OPPORTUNITIES TO THEMSELVES Director does not have duty to refrain from competing with the Company, nor will Director be liable to the Company for breach of fiduciary duty a) Solely by reason of such competing activities or b) For not communicating to the Company corporate opportunities which are not presented to the Director in writing in his solely capacity as a Director for the Company. [Articles sect. 12.1, p.9] RIGHTS NOT RESTORED New Security Issuance Created preferred stock and issued rights exercisable into common shares utilized in implementing Shareholder Rights Plan (poison pill) which disproportionately impacts shareholders Board does not have authority to create preferred units only common units [sect. 8.12, p.30; section 2.1 p.7] Majority - in - Interest vote REQUIRED for issuance of securities convertible or exercisable into common unit in excess of 20% of the outstanding Units [sect. 7.6 c, p.16] Shareholders whose interest is disproportionately affected REQUIRES approval [sect 12.1 p.38] No right of shareholders to vote. [Documents are silent] RIGHTS NOT RESTORED |

| EXHIBIT A 17 ORIGINAL SHAREHOLDER RIGHTS RIGHTS AFTER BEING STRIPPED AFTER Z CAPITAL COMPLAINT RIGHTS ONLY PARTIALLY RESTORED Diminished Shareholder Rights Source: Operating Agreement dated December 31, 2010 Source: Articles of Incorporation and Bylaws adopted December 20, 2012 Source: Amended and Restated Bylaws adopted March 28, 2013 Suitability: Gave Board sole discretion to determine shareholder suitability Determined by Gaming Authority [sect. 13.10, p.40] Determined by 1) Gaming Authority OR 2) Sole discretion of the Company’s Board of Directors [Articles sect. 10.1 l “Unsuitable Person”, p.5] RIGHTS NOT RESTORED Special Meetings: Eliminated shareholder ability to call special meeting Called by 1) Majority vote of Board OR 2) Members holding 10% of units [sect.7.3, p.15] Called only upon Board request [Bylaws sect 3.3, p.4] RIGHTS RESTORED Called by 1) Majority vote of the Board OR 2) Shareholders holding at least 10% of the stock [Bylaws sect 3.3 , p.3] Review of Books and Records: Limited shareholder ability to review books and records Open to inspection during normal business hours by Members upon reasonable advanced notice to the Company. [sect 6.1, p.13] The Board determines time, location, and under what conditions the inspection can take place. No shareholder can has right to inspect until authorized by resolution of Board or stockholders. [Bylaws sect. 1.4, p.1] RIGHTS RESTORED Open to inspection by stockholders during reasonable business hours and upon re asonable advance notice [Bylaws sect 1.4 , p.1] |

Exhibit 2

Z Capital Partners Files Investor Presentation in

Relation to its Proposed Nominees to the Affinity Gaming Board of Directors

Lake Forest, IL April 23, 2013— Z Capital Partners, L.L.C. (“Z Capital”), a Chicago-based private equity firm and the largest shareholder in Affinity Gaming (the “Company” or “Affinity”), with over 30% of outstanding shares, today filed an investor presentation supporting its nomination of two highly qualified, independent candidates to the Affinity Gaming Board. The presentation is available on the “Media Room” tab of Z Capital’s web site at www.zcap.net and will be filed with the Securities and Exchange Commission (“SEC”) later today.

The presentation includes information regarding Z Capital’s proposal for a new Affinity Board consisting of seven members, including nominees from investors Z Capital and Silver Point Capital L.P. (“Silver Point”). Z Capital believes that a proper, balanced Board reflecting a range of perspectives from shareholders, industry experts and management is in the best interests of all Affinity shareholders. In particular, the presentation provides details of Z Capital’s operational, financial, corporate governance and industry experience, as well as its deep pool of resources that will be a catalyst for maximizing shareholder value. Additionally, the Board proposed by the Company and Silver Point, which does not include nominees from Z Capital, will effectively mean that Silver Point is taking control of the Company. Leaving the Board in the hands of a single shareholder is a decision Z Capital believes is unwise and does not ensure that all shareholders’ interests are protected.

Specifically, the presentation illustrates the following key points:

· The Affinity Board has failed to demonstrate the skill, expertise, or governance best practices that Affinity’s shareholders deserve and has not acted in the best interests of shareholders.

· A Silver Point dominated Board is not in the best interest of all shareholders.

· Silver Point was influential in seating the current Board, including Chairman Don Kornstein, and the Company’s four new “independent” nominees were all selected by Silver Point.

· Z Capital is nominating two highly qualified, independent candidates that offer necessary balance and perspective to round out the Board.

· Z Capital has been the most vigilant and vocal shareholder in protecting ALL shareholder rights and in scrutinizing the Board’s actions.

· Z Capital has a long and successful track record of working collaboratively with fellow board members and management at portfolio companies in developing a unified, value-maximizing strategy for all.

· Z Capital’s nominees have had extensive interaction with Affinity’s state gaming regulators (Nevada, Iowa, Missouri, and Colorado) and Z Capital, along with Mr. Zenni, have been “found suitable” in those states. Additionally, Mr. Zenni has nearly two decades of experience investing in gaming companies both large cap and small cap.

· Z Capital’s nominees have the operational, corporate governance and financial skills and experience needed by the Board at this time.

Z Capital believes that if the slate of directors nominated by the Company and Silver Point, with Mr. Kornstein as the Chairman, obtains control, then significant shareholder value will continue to be hindered. Z Capital further notes that now is the time for a well-balanced, highly qualified Board to be elected to protect shareholder value.

Z Capital urges all shareholders to vote the gold proxy card today to maximize their investment in the Company and ensure that the Board and management act in the best interest of shareholders.

About Z Capital Partners

Z Capital Partners, L.L.C. is a leading Chicago-based private equity firm that specializes in making investments in distressed middle market companies utilizing the restructuring and/or bankruptcy process, opportunistic acquisitions and special situations. Z Capital utilizes its operational and restructuring expertise to work with management on enhancing enterprise value and achieving superior risk-adjusted returns for its investors. Z Capital’s investors include prominent global endowments, financial institutions, pension funds, insurance companies, foundations, family offices, and wealth management firms. For more information, please visit www.zcap.net

Additional Information

The Z Capital Group (whose members are identified below) has nominated James J. Zenni, Jr. and Martin J. Auerbach, Esq. (the “Z Capital Nominees”) as nominees to the board of directors of the Company and is soliciting votes for the election of the Z Capital Nominees as members of the board. The Z Capital Group has sent a definitive proxy statement, GOLD proxy card and related proxy materials to stockholders of the Company seeking their support of the Z Capital Nominees at the Company’s 2013 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and GOLD proxy card because they contain important information about the Z Capital Group, the Z Capital Nominees, the Company and related matters. Stockholders may obtain a free copy of the definitive proxy statement and GOLD proxy card and other documents filed by the Z Capital Group with the SEC at the SEC’s web site at www.sec.gov. The definitive proxy statement and other related documents filed by the Z Capital Group with the SEC may also be obtained free of charge by contacting Innisfree M&A Incorporated by mail at 501 Madison Avenue, 20th Floor, New York, New York 10022 or by telephone at the following numbers: stockholders call toll-free at (888) 750-5834 and banks and brokers call collect at (212) 750-5833.

The Z Capital Group consists of the following persons: Z Capital Partners, L.L.C.; Zenni Holdings, LLC; James J. Zenni, Jr.; Z Capital Special Situations Adviser, L.P.; Z Capital Special Situations GP, L.P.; Z Capital Special Situations UGP, L.L.C.; Z Capital Special Situations Fund Holdings I, L.L.C.; Z Capital HG, L.L.C.; Z Capital Special Situations Fund Holdings II, L.L.C.; Z Capital CUAL Co-Invest, L.L.C.; and Z Capital HG-C, L.L.C. The members of the Z Capital Group and the Z Capital Nominees are participants in the solicitation from the Company’s stockholders of proxies in favor of the Z Capital Nominees. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the definitive proxy statement of the Z Capital Group, filed with the SEC on April 23, 2013 and first disseminated to stockholders on or about April 23, 2013.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. Due to various risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements.

CONTACT

Media Jonathan Keehner Joele Frank, Wilkinson Brimmer Katcher 622 Third Avenue, 36th Floor New York, NY 10017 Office: (212) 355-4449 | Investors Scott Winter / Jonathan Salzberger Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, NY 10022 Office: (212) 750-5833 |