UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2012

North American Oil & Gas Corp.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

333-172896

(Commission File Number)

98-087028

(IRS Employer Identification No.)

56 E. Main Street, Suite 202

Ventura, California 93001

(Address of principal executive offices)(Zip Code)

(805) 643-0385

Registrant’s telephone number, including area code

Calendar Dragon, Inc.

Bygaden 31 b. 3250 Gilleleje

Denmark

(Former name or former address, if changed since last report.)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K contains forward looking statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. Such factors include, but are not limited to: the ability to raise sufficient capital to fund exploration and development; the quantity of and future net revenues from the Company’s reserves; oil and natural gas production levels; commodity prices, foreign currency exchange rates and interest rates; capital expenditure programs and other expenditures; supply and demand for oil and natural gas; schedules and timing of certain projects and the Company’s strategy for growth; competitive conditions; the Company’s future operating and financial results; and treatment under governmental and other regulatory regimes and tax, environmental and other laws. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assumes no obligation to update any such forward-looking statements.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Form 8-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Form 8-K to conform our statements to actual results or changed expectations.

Item 1.01 Entry into a Material Definitive Agreement

On November 20, 2012, North American Oil & Gas Corp. (formerly known as, “Calendar Dragon, Inc.”) , a Nevada corporation (the “Company”) entered into an Agreement and Plan of Merger Dated November 16, 2012 (the “Agreement and Plan of Merger”), by and among the Company, Lani Acquisition, LLC, a Nevada limited liability company and a wholly-owned subsidiary of the Company (“Lani Acquisition”), and Lani, LLC, a California limited liability company (“Lani”).

Under the terms and conditions of the Agreement and Plan of Merger, the Company sold 24,300,000 shares of common stock of the Company in consideration for all the issued and outstanding limited liability company membership interests in Lani. Subsequent to the merger, on November 25, 2012, the Company offered and sold in a private offering 5,000,000 shares of common stock to East West Petroleum Corp., at an offering price of $0.10 per share for aggregate offering proceeds of $500,000. The effect of the issuances is that former Lani limited liability company membership interest holders now hold approximately 40.41% of the issued and outstanding shares of common stock of the Company, shareholders of the Company immediately prior to effect of the merger now hold approximately 51.26% of the issued and outstanding shares of common stock of the Company, and East West Petroleum Corp. now holds approximately 8.33% is the issued and outstanding shares of common stock of the Company. Separately, Lani Acquisition merged with Lani, with the effect that Lani is now a wholly-owned subsidiary of the Company. Articles of Merger, effecting the merger of Lani and Lani Acquisition under Nevada law, were filed with the Secretary of State of the State of Nevada on November 20, 2012, and the Certificate of Merger effecting the merger under California law, was filed with the Secretary of State of the State of California on November 20, 2012.

Lani was founded on June 20, 2011, in Ventura, California. Lani is an exploration stage oil and gas enterprise focused on the acquisition, stimulation, rehabilitation and asset improvement of small to medium sized manageable oil and gas fields throughout North America.

Item 2.01 Completion of Acquisition or Disposition of Assets

The information disclosed in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 2.01.

As described in Item 1.01 above, we completed the acquisition of Lani pursuant to the Agreement and Plan of Merger. The disclosures in Item 1.01 of this Form 8-K regarding the transactions contemplated by the Agreement and Plan of Merger are incorporated herein by reference in its entirety.

FORM 10 DISCLOSURE

The Company was a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) immediately before the completion of the transactions contemplated by the Agreement and Plan of Merger. Accordingly, pursuant to the requirements of Item 2.01(f) of Form 8-K, set forth below is the information that would be required if the Company was required to file a general form for registration of securities on Form 10 under the Exchange Act with respect to its common stock (which is the only class of the Company’s securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the transactions contemplated by the Agreement and Plan of Merger ). The information provided below relates to the combined operations of the Company after the acquisition of Lani, except that information relating to periods prior to the date of the reverse acquisition only relate to Lani and its consolidated subsidiaries unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Our Corporate History and Background

We were incorporated as Calendar Dragon, Inc. on July 22, 2008 in the State of Nevada. From inception until we completed our reverse acquisition of Lani, the Company was in the development stage of creating a new calendaring software application. On October 11, 2012, the Company filed an amendment to its Articles of Incorporation changing its name to North American Oil & Gas Corp. During that time, we had no revenue and our operations were limited to capital formation, organization, and development of our business plan and target customer market. As a result of the merger with Lani, on November 20, 2012, we ceased our prior operations and we are now a holding company and our wholly owned subsidiary engages in an exploration stage oil and gas enterprise focused on the acquisition, stimulation, rehabilitation and asset improvement of small to medium sized manageable oil and gas fields throughout North America.

Reverse Acquisition of Lani

Under the terms and conditions of the Agreement and Plan of Merger, the Company sold 24,300,000 shares of common stock of the Company in consideration for all the issued and outstanding limited liability company membership interests in Lani. Subsequent to the merger, on November 25, 2012, the Company offered and sold in a private offering 5,000,000 shares of common stock to East West Petroleum Corp., at an offering price of $0.10 per share for aggregate offering proceeds of $500,000. The effect of the issuances is that former Lani limited liability company membership interest holders now hold approximately 40.41% of the issued and outstanding shares of common stock of the Company, shareholders of the Company immediately prior to effect of the merger now hold approximately 51.26% of the issued and outstanding shares of common stock of the Company, and East West Petroleum Corp. now holds approximately 8.33% in the issued and outstanding shares of common stock of the Company. Separately, Lani Acquisition merged with Lani, with the effect that Lani is now a wholly-owned subsidiary of the Company. Articles of Merger, effecting the merger of Lani and Lani Acquisition under Nevada law, were filed with the Secretary of State of the State of Nevada on November 20, 2012, and the Certificate of Merger effecting the merger under California law, was filed with the Secretary of State of the State of California on November 20, 2012.

The merger transaction with Lani was treated as a reverse acquisition, with Lani as the acquiror and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this Form 8-K to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Lani.

Overview of Lani

Through our wholly owned subsidiary, Lani, we are an exploration stage oil and gas company. Lani was formed on June 20, 2011, to purchase, operate and develop oil and gas properties. We have no developed reserves or production, and have not realized any revenues from our operations. We maintain our principal administrative offices in Ventura, California. The Company is focused on exploration activities of the San Joaquin Basin, onshore California, with existing foundation assets targeting exploration and exploitation of oil and gas projects located near infrastructure and existing discoveries. Through the Company’s wholly owned subsidiary, Lani, the Company commenced drilling its first exploratory well in the Tejon Main leases area on November 27, 2012.

Farm-in Agreement with Avere Energy Corp.

On November 3, 2012, Lani entered into a Farm-in Agreement (the “Farm-in Agreement”) with Avere Energy Corp., a Delaware corporation (“Avere Energy”) and wholly-owned subsidiary of East West Petroleum Corp. Pursuant to the terms and conditions of the Farm-in Agreement:

(i) Lani assigned a 25% working interest in the Tejon Ranch Extension leases, a 21.25% working interest in the Tejon Main Area leases and a 50% working interest in the White Wolf leases;

(ii) Avere Energy is obligated to transfer $2,500,000 to use in Lani’s operations;

(iii) Avere Energy shall pay 100% of the working interest costs associated with drilling and completing one (1) exploration well in the Tejon Ranch Extension area, in an amount of up to a maximum of $1,300,000, and if the well produces in paying quantities, Avere Energy shall be entitled to recover 100% of its total costs for this well (up to $1,300,000) by dividing the revenues equally with Lani on a 50%-50% basis, and after Avere Energy recovers its costs up to an amount of $1,300,000, then all other revenues from the well shall be distributed in accordance with a Joint Operating Agreement between Lani and Avere Energy;

(iv) Avere Energy shall pay 100% of the working interest costs associated with drilling and completing one (1) exploration well in the Tejon Main Area, in an amount of up to a maximum of $552,500, and after such payment of $552,500, Lani and Avere Energy will pay for operations in the Tejon Main Area in proportion to their respective working interests; and

(v) Avere Energy shall provide Lani with $647,500 to be used for lease delay rental payments and for leasing new acreage in the White Wolf area, provided Lani leases an additional 480 acres in the White Wolf area before July 1, 2013, and thereafter if the parties fulfill these terms and obligations, that Lani will assign its interest in the Tejon Ranch Extension leases, the Tejon Main Area leases and the White Wolf leases to a new entity controlled by Lani and Avere Energy or its parent, East West Petroleum Corp., and will purchase a 9% equity interest in such new entity for a purchase price of $500,000.

Activities Completed under Farm-in Agreement with Avere Energy Corp.

Pursuant to the terms and conditions of the Farm-in Agreement:

| | (i) | Lani commenced drilling in the Tejon Main leases area on November 27, 2012; |

| | (ii) | Avere Energy has advanced to Lani approximately $1,300,000 for costs associated with drilling in Tejon Ranch Extension leases area, $300,000 as a general advance, $200,000 for Lani operations in the White Wolf leases, and $60,000 for overhead; |

| | (iii) | The condition in the Farm-in Agreement under item (v) in the “Farm-in Agreement with Avere Energy Corp.” section immediately above, where the Company discloses that “Lani will assign its interest in the Tejon Ranch Extension leases, the Tejon Main Area leases and the White Wolf leases to a new entity controlled by Lani and Avere Energy or its parent, East West Petroleum Corp., will purchase a 9% equity interest in such new entity for a purchase price of $500,000 has been materially completed: (A) all assignments were effected in November 2012, (B) the “new entity” is the Company, and (C) Avere Energy’s parent, East West Petroleum Corp., purchased 5,000,000 shares of common stock of the Company, at an offering price of $0.10 per share for aggregate offering proceeds of $500,000. |

List of Properties

Through our wholly owned subsidiary, Lani, we hold participation oil and gas interests in prospective areas named Tejon Extension and Tejon Main, located in the San Joaquin Basin in California. A summary of our participation interests are as follows:

| PROSPECT | PAR # | LEASE DATE | GROSS CUM ACRES | NET ACRES | NET CUM | INT. % | ANNUAL RENT | CUM. RENT | ROY. | COMMENTS: | DESCRIPTION |

| 11-25 | 3 | 5/16/11 | 159.940 | 79.97000 | 79.9700 | 50.0000% | $1,999.25 | $1,999.25 | 1/6 | 5 Year Term; Rec. 5/26/2011 Doc. #0211068980 | T11N R19W SEC 14: SW4, EXC N 50' OF S. 342' OF W. 55' |

| 11-25 | 11 | 5/24/11 | 169.940 | 1.00000 | 80.9700 | 10.0000% | $125.00 | $2,124.25 | 1/6 | 5 Year Term; Paid up; Annual rental = $25.00; Rec. 6/21/2011 Doc. #0211079831 | T11N R19W SEC 14: NW4 |

| 11-25 | 5 | 6/3/11 | 248.290 | 1.62960 | 82.5996 | 2.0800% | $203.70 | $2,327.95 | 1/6 | 5 Year Term; Paid up; Annual rental = $40.70; Rec. 6/21/2011 Doc. #0211079835 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 11 | 6/3/11 | 248.290 | 1.00000 | 83.5996 | 10.0000% | $125.00 | $2,452.95 | 1/6 | 5 Year Term; Paid up; Annual rental = $25.00; Re. 6/21/2011 Doc. #0211079830 | T11N R19W SEC 20: SE4 NE4 SE4 |

| 11-25 | 4, 12, 13 | 6/3/11 | 346.810 | 24.63000 | 108.2296 | 25.0000% | $862.05 | $3,315.00 | 1/6 | 5 Year Term; Rec. 6/21/2011 Doc. #0211079832 | T11N R19W PCL 1: SEC 20: N2 SW4 PCL 2: SEC 20: NE4 SE4 SE4 & S2 SE4 SE4 SE4 PCL 3: SEC 20: N2 SE4 SE4 SE4 |

| 11-25 | 5 | 6/3/11 | 346.810 | 19.5880 | 127.8176 | 25.0000% | $685.58 | $4,000.58 | 1/6 | 5 Year Term; Rec. 6/21/2011 Doc. #0211079832 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 7 | 5/20/11 | 406.520 | 0.55290 | 128.3705 | 0.9258% | $61.10 | $4,061.68 | 1/6 | 5 Year Term; Paid up; Annual rental = $13.82; Rec. 6/21/2011 Doc. #0211079833 | T11N R19W SEC 20: NW4 SE4 & N2 SW4 SE4, EXC W. 80' OF S. 160' OF N. 383' OF NW4 SE4 |

| 11-25 | 9 | 5/20/11 | 426.520 | 0.22220 | 128.5927 | 1.1110% | $27.80 | $4,089.48 | 1/6 | 5 Year Term; Paid up; Annual rental = $5.56; Rec. 6/21/2011 Doc. #0211079833 | T11N R19W SEC 20: W2 NE4 SE4 |

| 11-25 | 5 | 6/6/11 | 426.520 | 1.62960 | 130.2223 | 2.0800% | $203.70 | $4,293.18 | 1/6 | 5 Year Term; Paid up; Annual rental = $40.70; Rec. 6/21/2011 Doc. #0211079834 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 11 | 6/6/11 | 426.520 | 2.00000 | 132.2223 | 20.0000% | $250.00 | $4,543.18 | 1/6 | 5 Year Term; Paid up; Annual rental = $50.00; Signed in counterparts, Virgina's rec'vd 6/8/11 and paid 6/8/11; Margaret's rec'vd 7/7/11and paid 7/13/11; each paid 1/2; Rec. 7/22/2011 Doc. #0211093135 | T11N R19W SEC 20: SE4 NE4 SE4 |

| 11-25 | 6 | 6/8/11 | 446.520 | 20.0000 | 152.2223 | 100.0000% | $500.00 | $5,043.18 | 1/6 | 5 Year Term; Rec. 6/21/2011 Doc. #0211079827 | T11N R19W SEC 20: S2 SW4 SE4 |

| 11-25 | 4 | 6/9/11 | 446.520 | 4.9075 | 157.1298 | 6.2500% | $122.69 | $5,165.87 | 1/6 | 5 Year Term; Rec. 6/21/2011 Doc. #0211079829 | T11N R19W SEC 20: N2 SW4 |

| 11-25 | 8 | 6/10/11 | 466.520 | 2.5000 | 159.6298 | 12.5000% | $625.00 | $5,790.87 | 3/16 | 5 Year Term; Paid up; Annual Rental = $125.00; Rec. 6/21/2011 Doc. #0211079828 | T11N R19W SEC 20: W2 SE4 SE4 |

| 11-25 | 8 | 6/10/2011 | 466.520 | 2.5000 | 162.1298 | 12.50% | $625.00 | $6,415.87 | 3/16 | 5 Year Term; Paid up; Annual Rental = $125.00; Rec. 7/7/2011 Doc. #0211086461 | T11N R19W SEC 20: W2 SE4 SE4 |

| 11-25 | 4, 5, 12, 13 | 6/16/11 | 466.520 | 44.2180 | 206.3478 | 25.0000% | $1,547.63 | $7,963.50 | 1/6 | 5 Year Term; Rec. 7/7/2011 Doc. #0211086460 | T11N R19W PCL 1:SEC 20: N2 SW4 PCL 2: SEC 20: S2 SW4 PCL 3: SEC 20: NE4 SE4 SE4 & S2 SE4 SE4 SE4 PCL 4: SEC 20: N2 SE4 SE4 SE4 |

| 11-25 | 5 | 6/29/11 | 466.520 | 1.6296 | 207.9774 | 2.0800% | $203.70 | $8,167.20 | 1/6 | 5 Year Term; Paid up; Annual Rental = $40.74; Rec. 7/22/2011 Doc. #0211093134 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 5 | 5/24/11 | 466.520 | 1.0891 | 209.0665 | 1.3900% | $136.14 | $8,303.34 | 1/6 | 5 Year Term; Paid up; Annual Rental = $27.23; Rec. 7/22/2011 Doc. #0211093136 | SEC 20: S2 SW4 |

| 11-25 | 2 | 7/8/11 | 624.700 | 39.5450 | 248.6115 | 25.0000% | $988.63 | $9,291.97 | 1/6 | 5 Year term; Rec. 7/22/2011 Doc. #0211093137 | SEC 14: NW4 |

| 11-25 | 7 | 7/25/11 | 624.700 | 0.5528 | 249.1643 | 0.9258% | $69.10 | $9,361.07 | 1/6 | 5 Year term; Paid up; Annual Rental = $13.82; Rec. 9/16/2011 Doc. #0211121704 | T11N R19W SEC 20: NW4 SE4 & N2 SW4 SE4, EXC W. 80' OF S. 160' OF N. 383' OF NW4 SE4 |

| 11-25 | 9 | 7/25/11 | 624.700 | 0.2222 | 249.3865 | 1.1110% | $27.78 | $9,388.85 | 1/6 | 5 Year term; Paid up; Annual Rental = $5.56 Rec. 9/16/2011 Doc. #0211121704 | T11N R19W SEC 20: W2 NE4 SE4 |

| 11-25 | 5 | 8/3/11 | 624.700 | 0.8148 | 250.2013 | 1.0400% | $101.85 | $9,490.70 | 1/6 | 5 Year term; Paid up; Annual Rental = $20.37; Rec. 9/28/2011 Doc. #0211126445 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 12 | 8/16/11 | 624.700 | 7.5000 | 257.7013 | 50.0000% | $262.50 | $9,753.20 | 1/6 | 5 Year Term w/ addendum; Rec. 9/28/2011 Doc. #0211126446 | T11N R19W SEC 20: NE4 SE4 SE4 & S2 SE4 SE4 SE4 |

| 11-25 | 11 | 9/1/11 | 624.700 | 1.0000 | 258.7013 | 10.0000% | $25.00 | $9,778.20 | 1/6 | 5 Year Term; Rec. 10/20/2011 Doc #0211138480 | T11N R19W SEC 20: SE4 NE4 SE4 |

| 11-25 | 11 | 9/19/11 | 624.700 | 1.0000 | 259.7013 | 10.0000% | $25.00 | $9,803.20 | 1/6 | 5 Year Term; Rec. 10/20/2011 Doc #0211138481 | T11N R19W SEC 20: SE4 NE4 SE4 |

| 11-25 | 5 | 9/2/11 | 624.700 | 1.0891 | 260.7904 | 1.3900% | $136.14 | $9,939.34 | 1/6 | 5 Year Term; Paid up; Annual Rental = $27.23; Rec. 10/20/2011 Doc. #0211138479 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 5 | 10/22/11 | 624.700 | 0.8148 | 261.6052 | 1.0400% | $101.85 | $10,041.19 | 1/6 | 5 Year Term; Paid up; Annual Rental = $20.37; Rec. 11/30/2011 Doc. #0211157052 | T11N R19W SEC 20: S2 SW4 |

| 11-25 | 8 | 10/12/11 | 624.700 | 10.0000 | 271.6052 | 50.0000% | $500.00 | $10,541.19 | 3/16 | 5 Year Term | T11N R19W SEC 20: W2 SE4 SE4 |

| 11-25 | 13 | 12/27/11 | 629.700 | 1.6670 | 273.2722 | 33.3334% | $291.70 | $10,832.89 | 1/6 | 5 Years, Paid up. Rec. 3/12/2012 Doc. #0212033143 | T11N R19W SEC 20: N2 SE4 SE4 SE4 |

| 11-25 | 13 | 1/4/12 | 629.700 | 0.8333 | 274.1055 | 16.6666% | $145.85 | $10,978.74 | 1/6 | 5 Years, Paid up; Annual Rental = $29.17; Rec. 5/15/2012 Doc. #0212065715 | T11N R19W SEC 20: N2 SE4 SE4 SE4 |

| 11-25 | 8 | 5/2/12 | 629.700 | 5.0000 | 279.1055 | 50.0000% | $2,500.00 | $13,478.74 | 1/5 | 5 Years, Paid up; Annual Rental = $500.00; Rec. 6/1/2012 Doc. #0212074383 | T11N R19W SEC 20: W2 SE4 SE4 |

| 11-25 | 7 | 7/2/12 | 629.700 | 58.0515 | 337.1570 | 97.2226% | $4,353.86 | $17,832.60 | 1/6 | 3 Years | T11N R19W SEC 20: NW4 SE4 & N2 SW4 SE4, EXC W. 80' OF S. 160' OF N. 383' OF NW4 SE4 |

| 11-25 | 9 | 7/2/12 | 629.700 | 19.3334 | 356.4904 | 96.6670% | $1,450.01 | $19,282.61 | 1/6 | 3 Years | T11N R19W SEC 20: W2 NE4 SE4 |

| 11-50 | 11 | 8/31/11 | 983.200 | 34.3679770 | 390.8584 | 9.7222% | $859.20 | $20,141.81 | 1/6 | 5 Year Term; Rec. 9/28/2011 Doc. #0211126460 | T11N R20W SEC 12: PCL 1: PTN NW4 & E2 SW4 & N2 SE4; PCL 2: PTN NW4 & NE4 & N2 SE4 |

| 11-50 | 11 | 8/31/11 | 983.200 | 34.3679770 | 425.2264 | 9.7222% | $859.20 | $21,001.01 | 1/6 | 5 Year Term; Rec. 9/28/2011 Doc. #0211126461 | T11N R20W SEC 12: PCL 1: PTN NW4 & E2 SW4 & N2 SE4; PCL 2: PTN NW4 & NE4 & N2 SE4 |

| 11-50 | 11 | 8/31/11 | 983.200 | 34.3679770 | 459.5944 | 9.7222% | $859.20 | $21,860.21 | 1/6 | 5 Year Term; Rec. 9/28/2011 Doc. #0211126462 | T11N R20W SEC 12: PCL 1: PTN NW4 & E2 SW4 & N2 SE4; PCL 2: PTN NW4 & NE4 & N2 SE4 |

| 11-50 | 11 | 9/15/11 | 983.200 | 34.3679770 | 493.9624 | 9.7222% | $859.20 | $22,719.41 | 1/6 | 5 Year Term; Rec. 10/5/2011 Doc. #0211129857 | T11N R20W SEC 12: PCL 1: PTN NW4 & E2 SW4 & N2 SE4; PCL 2: PTN NW4 & NE4 & N2 SE4 |

| 11-50 | 4 | 10/11/11 | 1038.200 | 27.5000000 | 521.4624 | 50.0000% | $687.50 | $23,406.91 | 1/6 | 5 Year Term | T11N R19W SEC 6: W. 55AC OF N2 SE4 |

| 11-59 | 2 | 11/18/11 | 1198.200 | 30.00000000 | 551.4624 | 18.7500% | $750.00 | $24,156.91 | 1/6 | 5 Year Term; Rec. 12/8/2011 Doc. #0211162213 | T32S R29E SEC 3: NW4 |

| 11-59 | 2 | 1/26/12 | 1198.200 | 30.0000 | 581.4624 | 18.7500% | $750.00 | $24,906.91 | 1/6 | 5 Year Term | T32S R29E SEC 3: NE4 |

| 11-59 | 1 | 1/18/12 | 1236.260 | 38.0600 | 619.5224 | 100.0000% | $1,522.40 | $26,429.31 | 1/6 | 5 Year Term | T32S R29E SEC 3: NW4 |

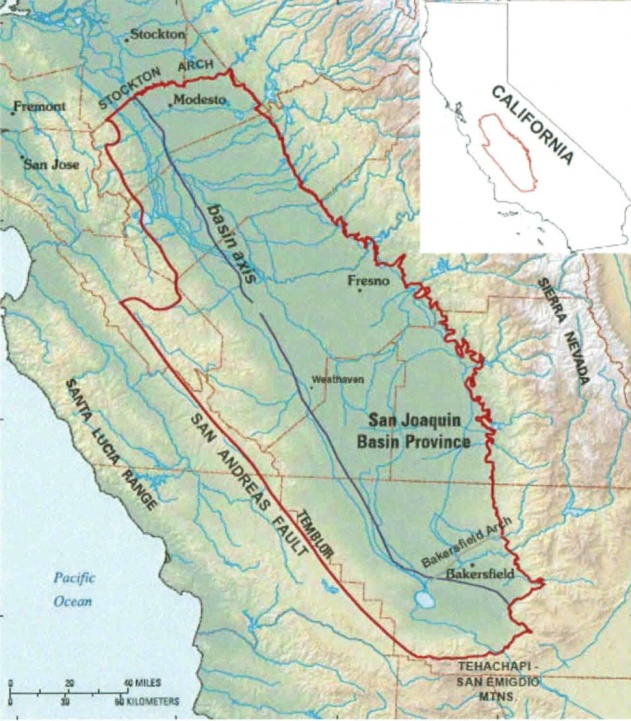

Figure 1: Map of San Joaquin Basin Province

Production

We do not have production data from our oil and gas operations since the formation of Lani in June 2011.

Intellectual Property

We rely on a combination of trademark laws, trade secrets, confidentiality provisions and other contractual provisions to protect our proprietary rights, which are primarily our brand names, product designs and marks. We do not own patents.

Competitive Conditions

The oil and natural gas industry is highly competitive. We compete with private and public companies in all facets of the oil and natural gas business. Numerous independent oil and gas companies, oil and gas syndicators, and major oil and gas companies actively seek out and bid for oil and gas prospects and properties as well as for the services of third-party providers, such as drilling companies, upon which we rely. Many of these companies not only explore for, produce and market oil and natural gas, but also carry out refining operations and market the resultant products worldwide. Most of our competitors have longer operating histories and substantially greater financial and other resources than we do.

Competitive conditions may be affected by various forms of energy legislation and/or regulation considered from time to time by the governments of the United States and the State of California, as well as factors that we cannot control, including international political conditions, overall levels of supply and demand for oil and gas, and the markets for synthetic fuels and alternative energy sources.

Government Regulation and Approvals

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of oil and gas in the United States generally, and in California specifically.

Costs and Effects of Compliance with Environmental Laws

We currently have no costs to comply with environmental laws concerning our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described above. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

Employees

As of the date hereof, we have 5 employees who work full-time.

DESCRIPTION OF PROPERTIES

We do not own any real estate or other physical properties material to our operations. We operate from leased space. Our executive offices are located at 56 E. Main Street, Suite 202, Ventura, California 93001, and our telephone number is (805) 643-0385.

You should carefully consider the risks described below together with all of the other information included in this Form 8-K before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to the Company’s Business

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue operations in which case you could lose your investment.

In their report dated October 17, 2012, our independent registered public accounting firm, Brown Armstrong, stated that Lani’s financial statements for the eight months ended August 31, 2012 and the year ended December 31, 2011 were prepared assuming the company will continue as a going concern. This means that there is substantial doubt that we can continue as an ongoing business. During our recent year ended December 31, 2011 we incurred a net loss of $62,253. Our net loss as of August 31, 2012 is $90,900. Our net loss from June 20, 2011 (inception) to August 31, 2012 is $153,153. We will need to generate significant revenue in order to achieve profitability and we may never become profitable. The going concern paragraph in the independent auditor’s report emphasizes the uncertainty related to our business as well as the level of risk associated with an investment in our common stock.

We require a significant amount of capital for our operations and failure to raise sufficient funds will cause our operations to cease and your investment will be lost.

Oil and gas exploration requires significant outlays of capital and in many situations offers limited probability of success. Our current cash of $4,615 will not be sufficient to complete any part of any initial exploration program of any property interest. We will require additional funding to proceed with exploratory drilling; we have no current plans on how to raise the additional funding. We cannot provide any assurance that we will be able to raise sufficient funds to proceed with the seismic surveying or the exploratory drilling. We need to raise a significant amount of capital to pay for our planned exploration and development activities. If we cannot raise the capital we require or find partners that can fund our required expenditures, we will not be able to drill as necessary and our business will likely fail. Even assuming that we obtain the financing we require, if we do not discover and produce commercial quantities of oil and natural gas, we will not have any products or services to offer and our business could fail.

We have minimal operations, have never had any revenues, have no current prospects for future revenues, and have losses which we expect to continue into the future. As a result, we may have to suspend or cease operations.

We are in the exploration stage as an oil and gas exploration company and are presently engaged in limited oil and gas activities. We had minimal operations and generated no operating revenues since inception. We have no operating history upon which an evaluation of our future success or failure can be made. As of our last quarter ended August 31, 2012, we had an accumulated deficit of $153,153. We have never had any revenues from operations and we do not have any current prospects for future revenues. Our ability to achieve and maintain profitability and positive cash flow is primarily dependent upon our ability to locate oil and gas and our ability to generate revenues from the sale of oil and gas. Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our properties. As a result, we may not generate revenues in the future. Failure to generate revenues will cause us to suspend or cease operations. Further, we have not considered and will not consider any activity beyond our current exploration program until we have completed our exploration program.

Oil and gas prices are volatile and a substantial decrease in oil and gas prices would adversely affect our operations.

Oil and gas prices historically have been volatile and will likely to continue to be volatile in the future. The prices for oil and gas are subject to wide fluctuation in response to relatively minor changes in the supply of and demand for oil and gas, market uncertainty, worldwide economic conditions, weather conditions, and political conditions in major oil producing regions. A significant decrease in price levels for an extended period would negatively affect our operations and you could lose all or part of your investment.

Title to our oil and gas leases could be defective in which case we may not own the interest in a property to conduct operations which would materially affect our business.

It is customary in the oil and gas industry that upon acquiring an interest in a property, that only a preliminary title investigation be done at that time. We intend to follow this custom. If the title to the prospects should prove defective, we could lose the costs of acquisition, or incur substantial costs for curative title work.

If during our exploration activities we discover gas, our wells could be curtailed by lack of market demand and any potential revenues we generate could be curtailed.

Production from gas wells in many geographic areas of California has been curtailed, or shut-in, for considerable periods of time due to a lack of market demand, and such curtailments may continue for a considerable period of time in the future. There may be an excess supply of gas in areas where our operations will be conducted. In such event, it is possible that there will be no market or a very limited market for our gas production. It is customary in many portions of California to shut-in gas wells in the spring and summer when there is not sufficient demand for gas. This could result in suspension of revenues.

Operating and environmental hazards on the properties where we operate could have a negative impact on our business.

We may encounter hazards incident to the operation of oil and gas properties, such as accidental leakage of petroleum liquids and other unforeseen conditions, if we participate in developing a well and, on occasion, substantial liabilities to third parties or governmental entities may be incurred. We could be subject to liability for pollution and other damages or may lose substantial portions of prospects or producing properties due to hazards which cannot be insured against or which have not been insured against due to prohibitive premium costs or for other reasons. We currently do not maintain any insurance for environmental damages. Governmental regulations relating to environmental matters could also increase the cost of doing business or require alteration or cessation of operations in certain areas.

We have no oil or gas reserves, and the probability of an individual prospect ever having oil and gas is extremely remote and therefore any funds we spend on exploration will likely be lost.

The probability of an individual prospect ever having oil and gas is extremely remote. In all probability, the property does not contain any oil and gas. As such, any funds spent on exploration will probably be lost which will have a negative effect on our operations and a loss of your investment.

Our operations are subject to various laws and governmental regulations that could restrict our future operations and increase our operating costs.

Many aspects of our operations are subject to various federal, state and local laws and governmental regulations, including laws and regulations governing the protection of the environment and human health and safety. Environmental laws and regulations are complex and subject to frequent changes. Failure to comply with governmental requirements or inadequate cooperation with governmental authorities could subject a responsible party to administrative, civil or criminal action. In addition, our business depends on the demand for land drilling services from the oil and natural gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and natural gas industry generally, by changes in those laws and by changes in related administrative regulations. It is possible that these laws and regulations may in the future add significantly to our operating costs or those of our customers or otherwise directly or indirectly affect our operations.

We depend upon our executive officers and key personnel.

Our performance depends substantially on the performance of our executive officer, namely our President and Chief Executive Officer, Robert Rosenthal. Management’s decisions and choices may not take into account standard engineering or managerial approaches to oil and gas exploration which may negatively affect our financial results. In addition, the loss of Mr. Rosenthal’s services could cause irreparable harm that would result in the complete loss of your investment.

Our future success will also depend to a large extent our ability to attract, train, retain and motivate qualified employees for expansion of operations. Competition for talented personnel is intense, and we may not be able to attract highly qualified technical or managerial personnel. In addition, market conditions may require us to pay higher compensation to qualified management and technical personnel than we currently anticipate. Any inability to attract and retain qualified personnel in the future could have a material adverse affect on our business, prospects, financial condition and results of operation.

We rely heavily upon reserve estimates when determining whether or not to invest in a particular oil or gas property.

The oil and gas reserve information that we use in evaluating oil and gas prospects is based on reserve estimates involving a great deal of uncertainty. The process of estimating oil and gas reserves and production is complex, and will require us to use significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each property. Different reserve engineers may make different estimates of reserves and cash flows based on the same available data. Reserve estimates depend in large part upon the reliability of available geologic and engineering data, which is inherently imprecise. Geologic and engineering data is used to determine the probability that a reservoir of oil and natural gas exists at a particular location, and whether oil and natural gas are recoverable from a reservoir. Recoverability is ultimately subject to the accuracy of data including, but not limited to, geological characteristics of the reservoir, structure, reservoir fluid properties, the size and boundaries of the drainage area, reservoir pressure, and the anticipated rate of pressure depletion. The evaluation of these and other factors is based upon available seismic data, computer modeling, well tests and information obtained from production of oil and natural gas from adjacent or similar properties, but actual recoveries of proved reserves can differ from estimates.

Reserve estimates also require numerous assumptions relating to operating conditions and economic factors, including the price at which recovered oil and natural gas can be sold, the costs of recovery, assumptions concerning future operating costs, severance and excise taxes, development costs and workover and remedial costs, prevailing environmental conditions associated with drilling and production sites, availability of enhanced recovery techniques, ability to transport oil and natural gas to markets and governmental and other regulatory factors, such as taxes and environmental laws. Economic factors beyond our control, such as interest rates and exchange rates, will also impact the value of our reserves. Some of these assumptions are inherently subjective, and the accuracy of our reserve estimates relies in part on the ability of our management team, engineers and other advisors to make accurate assumptions. As a result, our reserve estimates will be inherently imprecise. A negative change in any one or more of these factors could result in quantities of oil and natural gas previously estimated as proved reserves becoming uneconomic.

If we are unable to find new oil and gas reserves on a regular basis, we will be unable to maintain operations and our business will fail.

As is customary in the oil and gas exploration and production industry, our future success depends upon our ability to find, develop or acquire oil and gas reserves that are economically recoverable. Even if the reserves are acquired and successfully developed, and unless we successfully replace the reserves that we develop through successful identification, analysis, and acquisition, our proved reserves will decline. Recovery of such reserves will require significant capital expenditures and successful drilling operations. If we are not successful in our efforts to find or replace our reserves, our business will fail.

We may incur significant costs to be a public company to ensure compliance with U.S. corporate governance and accounting requirements and we may not be able to absorb such costs.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $75 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

The lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. Securities Laws.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our senior management has little experience in managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including the establishing and maintaining of internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

Our officers and directors have significant control over shareholder matters and the minority shareholders will have little or no control over our affairs.

Our officers and directors currently own approximately 40.4% of our outstanding common stock, and thus have significant control over shareholder matters, such as election of directors, amendments to its Articles of Incorporation, and approval of significant corporate transactions; as a result, the Company’s minority shareholders will have little or no control over its affairs.

Risks Relating to Our Securities

In order to raise sufficient funds to expand our operations, we may have to issue additional securities at prices which may result in substantial dilution to our shareholders.

If we raise additional funds through the sale of equity or convertible debt, our current stockholders’ percentage ownership will be reduced. In addition, these transactions may dilute the value of ordinary shares outstanding. We may have to issue securities that may have rights, preferences and privileges senior to our ordinary shares. We cannot provide assurance that we will be able to raise additional funds on terms acceptable to us, if at all. If future financing is not available or is not available on acceptable terms, we may not be able to fund our future needs, which would have a material adverse effect on our business plans, prospects, results of operations and financial condition.

We have never declared or paid any cash dividends or distributions on our capital stock. And we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

Our shares of common stock are very thinly traded, and the price may not reflect our value and there can be no assurance that there will be an active market for our shares of common stock either now or in the future.

Although our common stock is quoted on the Over-the-Counter Bulletin Board, our shares of common stock do not trade and the price of our common stock, if traded, may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. Market liquidity will depend on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. As a result holders of our securities may not find purchasers our securities should they to sell securities held by them. Consequently, our securities should be purchased only by investors having no need for liquidity in their investment and who can hold our securities for an indefinite period of time.

If a more active market should develop, the price of our shares of common stock may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in our securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

We are subject to the penny stock rules which will make shares of our common stock more difficult to sell.

We are subject now and in the future to the Commission’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-

dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

We may, in the future, issue additional shares of common stock, or preferred stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 200,000,000 shares of common stock. As of November 29 , 2012, the Company had approximately 60,125,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 139,875,000 shares of common stock. We also have 25,000,000 shares of authorized “blank check” preferred stock, none of which have been designated with terms and preferences or issued. The future issuance of common stock or preferred stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock or preferred stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of our Company.

Though not now, in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors: (i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the Company.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the

beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquirer to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of our Company from doing so if it cannot obtain the approval of our board of directors.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition for the fiscal year ended December 31, 2011, and for the period ended August 31, 2012, should be read in conjunction with our financial statements, and the notes to those financial statements that are included elsewhere in this Form 8-K. References in this section to “we,” “us,” “our” or “Lani” are to the consolidated business of Lani.

Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this Form 8-K. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Reverse Acquisition of Lani

On November 20, 2012, we completed a reverse acquisition transaction through a merger with Lani whereby we acquired all of the issued and outstanding limited liability company membership interests of Lani in exchange for 24,300,000 shares of our common stock. Subsequent to the merger, on November 25, 2012, the Company offered and sold in a private offering 5,000,000 shares of common stock to East West Petroleum Corp., at an offering price of $0.10 per share for aggregate offering proceeds of $500,000. The effect of the issuances is that former Lani limited liability company membership interest holders now hold approximately 40.41% of the issued and outstanding shares of common stock of the Company, shareholders of the Company immediately prior to effect of the merger now hold approximately 51.26% of the issued and outstanding shares of common stock of the Company, and East West Petroleum Corp. now holds approximately 8.33% is the issued and outstanding shares of common stock of the Company. As a result of the reverse acquisition, Lani became our wholly owned subsidiary. The share exchange transaction with Lani was treated as a reverse acquisition, with Lani as the acquiror and the Company as the acquired party.

Lani was formed under the laws of the State of California on June 20, 2011, to purchase, operate and develop oil and gas properties. We have no developed reserves or production, and have not realized any revenues from our operations. We maintain our principal administrative offices in Ventura, California.

Results of Operations of Lani, LLC

Results of Operations for the period from June 20, 2011 (Inception) to December 31, 2011, the eight-month period ending August 31, 2012, and cumulative period from June 20, 2011 (Inception) to August 31, 2012.

We recorded no revenues for (i) the period from June 20, 2011 (Inception) to December 31, 2011 (ii) the eight months ended August 31, 2012, and (iii) the period of June 20, 2011 (inception) to August 31, 2012.

For the period from June 20, 2011 (Inception) to December 31, 2011, total expenses were $62,804, of which leasehold costs were $60,804 and general and administrative expenses were $1,449. For the eight months ended August 31, 2012, total expenses were $141,404, of which leasehold costs were $106,571 and general and administrative expenses were $34,833. For the period from June 20, 2011 (Inception) to August 31, 2012, total expenses were $203,657, of which leasehold costs were $167,375 and general and administrative expenses were $36,282.

For the eight months ended August 31, 2012, we had a gain of $50,504 due to a sale of assets.

Liquidity and Capital Resources

At August 31, 2012, we had a cash balance of $4,615. On such date we did not have sufficient cash on hand to commence our exploration program or to fund our ongoing operational expenses beyond 12 months. We will need to raise funds to commence our exploration program and fund our ongoing operational expenses. Additional funding will likely come from equity financing from the sale of our common stock or sale of part of our interest in our mineral claims. If we are successful in completing an equity financing, existing shareholders will experience dilution of their interest in our Company. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our exploration activities and ongoing operational expenses. In the absence of such financing, our business will likely fail. There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our exploration of our minerals claims and our business will fail.

12-month plan of operation

Our plan of operation for the next 12 months is as follows. We plan to:

| | ● | drill, and if exploration results are favorable, complete and put on production our first well within 6 months at an estimated cost of $,125,000; |

| | ● | conduct seismic surveying at a cost of approximately $150,000; |

| | ● | drill, and if exploration results are favorable, complete and put on production our second well within 6 to 12 months at an estimated cost of $322,000; and |

| | ● | acquire leasehold interests in 3,000 acres in California for exploration over the next 12 months at an estimated cost of $150,000 |

Except with respect to approximately $200,000, all costs in our 12-month plan of operation are obligated to be funded by Avere Energy pursuant to our Farm-in Agreement with Avere Energy. We currently do not have any plan on how to obtain the $200,000 funds not covered by our Farm-in Agreement with Avere Energy. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our exploration activities and ongoing operational expenses.

Subsequent Events

Pursuant to our Farm-in Agreement with Avere Energy Corp., a Delaware corporation (“Avere Energy”) and wholly-owned subsidiary of East West Petroleum Corp.Avere Energy has advanced to Lani approximately $1,300,000 for costs associated with drilling in Tejon Ranch Extension leases area, $300,000 as a general advance, $200,000 for Lani operations in the White Wolf leases, and $60,000 for overhead.

On November 20, 2012, the “Company entered into an Agreement and Plan of Merger Dated November 16, 2012, by and among the Company, Lani Acquisition, LLC, a Nevada limited liability company and a wholly-owned subsidiary of the Company, and Lani, LLC, a California limited liability company (“Lani”). The merger was consummated on November 20, 2012, and Lani is now a wholly owned subsidiary of the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of the date hereof with respect to the holdings of: (1) each person known to us to be the beneficial owner of more than 5% of our common stock; (2) each of our directors, nominees for director and named executive officers; and (3) all directors and executive officers as a group. To the best of our knowledge, each of the persons named in the table below as beneficially owning the shares set forth therein has sole voting power and sole investment power with respect to such shares, unless otherwise indicated.

| | Name and Address of Beneficial Owner (1) | | Amount and Nature of Beneficial Ownership | | | Percent of Common Stock (2) | |

| Common Stock | | Robert Rosenthal (3) | | | 8,100,000 | | | | 13.4 | % |

| Common Stock | | Don Boyd (4) | | | 8,100,000 | | | | 13.4 | % |

| Common Stock | | Robert Hoar (5) | | | 8,100,000 | | | | 13.4 | % |

| Common Stock | | East West Petroleum Corp. (6) | | | 5,000,000 | | | | 8.3 | % |

| Common Stock | | Cosimo Damiano (7) | | | 700,000 | | | | * | |

| Common Stock | | Greg Renwick (8) | | | 200,000 | | | | * | |

| Common Stock | | Rishie Khangura (9) | | | 100,000 | | | | * | |

| Common Stock | | Linda Gassaway (10) | | | -0- | | | | * | |

| Common Stock | | Nicolaus Petri (11) | | | -0- | | | | * | |

| | | | | | | | | | | |

| All directors and executive officers as a group (8 persons) | | | 25,300,000 | | | | 42.0 | % |

| (1) | Unless otherwise specified, the address of each of the persons set forth is in care of the Company, at the address of: 56 E. Main Street, Suite 202, Ventura, California 93001. |

| (2) | Immediately after the closing the consummation of our merger with Lani, effective November 20, 2012, we have 60,125,000 shares of common stock outstanding. |

| (3) | Appointed President and Chief Executive Officer, Secretary and Chairman of the Board of Directors on November 16, 2012. All shares held indirectly in ASPS Energy Investments Ltd., voting and investment control of which is held by Mr. Rosenthal. |

| (4) | Appointed Director on November 16, 2012. |

| (5) | Employee of the Company and former 1/3 LLC membership interest holder o . |

| (6) | 4% of the beneficial ownership of East West Petroleum Corp. is held by Greg Renwick, a Director of the Company. |

| (7) | Appointed Director on November 16, 2012. |

| (8) | Appointed Director on November 26, 2012. |

| (9) | Appointed Treasurer on November 16, 2012. |

| (10) | Appointed Chief Executive Officer on November 16, 2012. |

| (11) | Appointed Director on November 26, 2012. |

| *less than 1% |

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names, ages, and positions of our executive officers and directors as of the date of this Form 8-K.

| Name | | Age | | Positions |

| Robert Rosenthal | | 60 | | President and Chief Executive Officer, Secretary and Chairman of the Board of Directors |

| Linda Gassaway | | * | | Chief Financial Officer |

| Rishie Khangura | | * | | Treasurer |

| Don Boyd | | * | | Director |

| Cosimo Damiano | | * | | Director |

| Greg Renwick | | 64 | | Director |

| Nicolaus Petro | | * | | Director |

| *to be disclosed by way of amendment to this Form 8-K |

Robert Rosenthal

President and Chief Executive Officer, Secretary and Chairman of the Board of Directors

Mr. Rosenthal has served as our President and Chief Executive Officer, Secretary and Chairman of the Board of Directors on November 16, 2012. He has also served as manager of Lani, LLC, since its formation on June 20, 2011. He also served as Vice President of New Ventures at Great Bear Petroleum, LLC, from January 2011 through April 2012. Mr. Rosenthal has extensive experience in the Californian oil and gas industry where he has been directly involved in and responsible for evaluations, leasing and drilled discoveries. His career in California spans over 10 years. Mr. Rosenthal was a founding partner in Orchard Petroleum Ltd an ASX listed Californian company that was acquired in 2007 by a private consortium. He previously worked as Exploration Geologist and Exploration Project Supervisor for Sohio Petroleum (U.S.), British Petroleum in London as Global Consultant Exploration. In 1995 he left BP to join Novus Petroleum Ltd as its Head of Exploration, for Indonesia, Australia and Pakistan. From 1999 until present day, Mr. Rosenthal has been actively involved in numerous exploration activities in California, Texas, Louisiana and Alaska where he has made numerous discoveries in both conventional and unconventional plays. More recently, Mr. Rosenthal was one of the principal investors and founders of Great Bear Petroleum an Alaskan shale company. Mr. Rosenthal holds a Master’s Degree in Geology from the University of Southern California. Mr. Rosenthal’s background in the oil and gas industry and his familiarity with Lani, LLC’s operations led to our conclusion that he should serve as a director in light of our business and structure.

Linda Gassaway

Chief Financial Officer

Ms. Gassaway has served as our Chief Financial Officer since November 16, 2012. Ms. Gassaway is the former Chief Financial Officer of Behavioral Healthcare Inc, former Chief Operating Officer of Omega Computer Services (a federal defense software contractor), and held the Controller position with Bentley-Simonson Inc., once one of the top independent Oil and Gas companies in California. Ms. Gassaway has more than ten years of financial experience in the Oil and Gas sector. Besides heading financial operations for Behavioral Healthcare, of Memphis, Tennessee, Ms. Gassaway was also the Director of Finance for Advanced Health Systems Inc. of Irvine, CA, where she was responsible for the finances of 22 hospitals, 5 acute care facilities, and 40 physician practices located around the country. Recruited by Bentley-Simonson in 2000, she headed an accounting department that dealt with more than thirteen thousand royalty holders and accounted for operations at the giant Sansinena and Las Cienegas fields in Southern California. After the sale of these assets to Plains Exploration & Production Company in 2005, Ms. Gassaway continued consulting in California’s Oil and Gas industry, working with Orchard Petroleum Inc. and Solimar Energy LLC. She has extensive experience with federal and state reporting requirements, joint interest accounting, human resources, office management, audit and risk management, royalty management, government reporting, production reporting, and overall financial management and reporting for oil and gas exploration and production efforts.

Rishie Khangura

Treasurer

Mr. Khangura has served as our Treasurer since November 16, 2012. Complete biographical information for Mr. Khangura will be disclosed by way of amendment to this Form 8-K.

Don Boyd

Director

Mr. Boyd has served as a Director since November 16, 2012. Mr. Boyd is an experienced oil field professional who has assisted many internationally known companies with drilling and infield engineering issues throughout the world. Since 1998 he has provided consulting services to companies such as Exxon, Phillips Petroleum, Sun Oil and Texaco and most recently smaller independent operators, such as Exploration Inc., Jackson Exploration and Kindee Oil and Gas. In 2005, he co-founded Sun Resources Texas, Inc. and currently serves as President, a position he has held since 2007. Prior to January 2005 he served as the manager of all offshore operations for drilling and completion for the U.S. Department of the Interior, Oil & Gas Branch. He managed employees with various disciplines, engineers and geologists; certified all foreign offshore drilling units before they could drill in US waters; worked with the

EPA to help write regulations regarding offshore environmental concerns; and worked with the USSR Oil & Gas Department to help them refine their government leasing programs to improve oil and gas secondary recovery. Prior to that, he worked as a drilling engineer for Global Marine and a drilling manager for Peter Bowen and Cal Pacific drilling companies. Mr. Boyd received a Bachelor of Science in Petroleum Engineering from Cal State Long Beach in 1973. Among the many awards and honors that Mr. Boyd received are: The Crosnick Foundation Scholarship for Petroleum Engineers; The Kellps Scholarship Award for Petroleum Engineering; and an Excellence Award from the U.S. Department of the Interior. Mr. Boyd’s background in the oil and gas industry and his familiarity with Lani, LLC’s operations led to our conclusion that he should serve as a director in light of our business and structure.

Cosimo Damiano

Director

Mr. Damiano has served as a Director since November 16, 2012. Mr. Damiano has over 18 years experience in the finance industry and 12 years in the energy industry, most recently as Director of Upstream Investments for Mercuria Energy Group. He spent 8 years in Investment Banking specializing in the energy sector attaining the role of Head of Australian Oil & Gas Research for Merrill Lynch. Mr. Damiano has wide commercial and investment experience in the oil and gas industry in Australia, Asia, United States, Canada and Argentina. In his previous role with Mercuria, Mr. Damiano ‘s duties primarily involved private equity investments and included the reporting on Mercuria’s existing oil and gas investments in Canada, U.S and Argentina and sourcing new investments. It involved the reporting and monitoring of ~10,000boepd of production, setting corporate and financing strategies and Board updates monitoring and evaluating the assets’ performance. In his previous and current roles Mr. Damiano has been periodically undertaking advisory roles for several oil and gas companies as well as energy trading companies most notably relating to, M&A advice, capital structure (debt and equity structuring), strategic planning and marketing. Mr. Damiano holds a Bachelor’s degree in Finance and Economics from Victoria University, Australia. Mr. Damiano’s background in investment banking led to our conclusion that he should serve as a director in light of our business and structure.

Greg Renwick

Director

Mr. Renwick has served as a Director since November 26, 2012. Since 2010, Mr. Renwick has served as President and CEO of East West Petroleum Corporation (TSX-Venture Exchange symbol: EW) which is a junior, Canadian-based exploration and production company pursuing commercial development of unconventional and conventional petroleum resources globally. From 2007 to 2010, Mr. Renwick was Director of Business Development at Dana Gas, Sharjah, United Arab Emirates. Mr. Renwick brings over 30 years of broad, international petroleum experience to the Company. Mr. Renwick began his career with Mobil Oil Canada as a geophysicist. Over the next 25 years, Mr. Renwick held various technical, technical management and progressively senior management positions within Mobil worldwide. Mr. Renwick has been directly involved in the mapping, the discovery, and development of numerous oil and gas fields in western and eastern Canada, the U.S. Gulf Coast, Saudi Arabia, Indonesia and the Former Soviet Union. Mr. Renwick responsibilities have spanned various disciplines, including geophysics, exploration, field appraisal and development, E&P planning, corporate planning, corporate strategic development, commercial analysis and upstream business development. Mr. Renwick holds a BSc. Chemistry, from the University of Western Ontario, London, Ontario, Canada, which he attended from 1967 to 1971, and a MSc. Geology, Dalhousie University, Halifax, Nova Scotia, Canada, which he attended from 1971 to 1973. Mr. Renwick’s background in the oil and gas industry led to our conclusion that he should serve as a director in light of our business and structure.

Nicolaus Petri

Director

Mr. Petri has served as a Director since November 26, 2012. Petri has extensive investment management experience with major oil and gas companies based in Eastern Europe. He is currently Head of Foreign Asset Strategy and Investments for Gazprom Neft and Deputy CEO for Strategy and Investments for Naftna Industrije Serbije (Russia's 5th largest integrated oil company, Serbian national oil company, respectively). His primary responsibilities have

included defining investment strategies, managing and supporting investment projects, implementing and coordinating investment processes, development of long-term business and production plans. Prior to his current role Petri was Head of the Investment Department for SIBUR, the leading Petrochemicals and LPG company in Russia. Petri has previously worked for global consultancy and investment firms such as McKinsey & Co, Bain Capital and Morgan Stanley in various roles including private equity, due diligence and financial advisory. Petri holds a bachelor of Bachelor of Arts and Sciences in Philosophy from Harvard College. Mr. Petri’s background in investment management experience led to our conclusion that he should serve as a director in light of our business and structure.

Employment Agreements

We currently do not have employment agreement with any our directors and executive officers.

Family Relationships

There are no family relationships between any of our directors or executive officers and any other directors or executive officers.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers have been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, or has been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without sanction or settlement.

Code of Ethics

We have not adopted a Code of Ethics but expect to adopt a Code of Ethics and will require that each employee abide by the terms of such Code of Ethics.

Summary Compensation Table

The following table sets forth information regarding each element of compensation that we paid or awarded to our named executive officers for fiscal 2011 and 2010.