| · | The number of shares being offered relative to the number of your currently outstanding shares held by non-affiliates; | | | | · | The relationship of each selling securityholder with the company, including an analysis of whether the selling securityholder is an affiliate of the company; | | | | · | Any relationships among the selling securityholders; | | | | · | The dollar value of the shares registered in relation to the proceeds that the company received from the selling securityholders for the securities, excluding amounts of proceeds that were returned (or will be returned) to the selling securityholders and/or their affiliates in fees or other payments; | | | | · | The discount at which the securityholders will purchase the common stock underlying the convertible notes; and | | | | · | Whether any of the selling securityholders is in the business of buying and selling securities. |

United States Securities and Exchange Commission Division of Corporation Finance March 15, 2016 Page 2 The securities purchase agreement that was filed as Exhibit 10.38 has been amended to (a) reduce the overall size of the offering, and (b) to reduce the number of tranches to five, all five of which have now been completed. Accordingly, the number of shares included in this registration statement has been reduced to 18.6 million, less than one-third of the issuer's outstanding non-affiliate shares, which addresses the primary offering concern. A further analysis of the factors set forth above: | · | the shares included in the registration is less than one-third of the currently outstanding shares held by non-affiliates; | | | | · | none of the selling securityholders are affiliates of the issuer; | | | | · | the two selling securityholders are affiliates of each other; | | | | · | the promissory notes are convertible at a 40% discount to the market price of the stock. Given that the issuer has received an aggregate of $525,000 in cash proceeds, and after taking in account a 5% original issue discount and the conversion discount, the total number of shares that will eventually need to be registered by the issuer has a value of approximately $918,750. However, the number of shares included in this registration statement is only approximately $316,200 (using a market price of $0.017 per share). |

2. We note the securities purchase agreement filed as Exhibit 10.38 provides for the purchase of 10% convertible promissory notes in 14 tranches, of which at least 11 tranches remain outstanding. It is premature to register in a secondary offering common stock underlying convertible securities if the closing of the private placement in which the convertible securities are issued does not occur within a short time after effectiveness of the resale registration statement. For guidance, see the Division of Corporation Finance's Securities Act Sections Compliance and Disclosure Interpretations Question 139.11 available on the Commission's website. Please revise to remove the shares underlying the notes that will not be issued within a short time after effectiveness of this registration statement. The securities purchase agreement that was filed as Exhibit 10.38 has been amended to (a) reduce the overall size of the offering to $525,000, and (b) to reduce the number of tranches to five, all five of which have now been completed. As such, the private placement is closed. Selling Security Holders, page 28 3. Please revise to add a table identifying each individual selling security holder, including the number of shares each holder beneficially owns before and after the offering and the number of shares each is offering pursuant to this prospectus. In this regard, we note that the convertible note issued in the first tranche was issued to Redwood Management, LLC but the second tranche note was issued to Redwood Fund III, Ltd. United States Securities and Exchange Commission Division of Corporation Finance March 15, 2016 Page 3

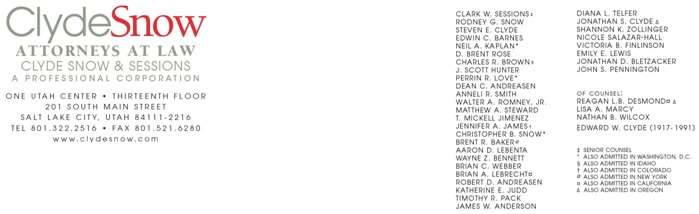

While Redwood Fund III, Ltd. was the purchaser of one of the five notes, the shares underlying conversion of the note to Redwood Fund III, Ltd. are not included in this registration statement. The disclosure was revised accordingly. Executive Compensation, page 66 4. Please update your registration statement to include the disclosures required by Item 402 of Regulation S-K for your last completed fiscal year. For guidance, please refer to Item 217.11 of the Regulation S-K Compliance and Disclosure Interpretations, available on the Commission's website. The requested changes were made. Thank you for your time and attention to this matter. | Very truly yours, | | | | | | | | By: | /s/ Brian A. Lebrecht | | | | Brian A. Lebrecht | | | | | | | | | |

|