Exhibit 99.1

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

AND

MANAGEMENT INFORMATION CIRCULAR

In respect of the

ANNUAL MEETING OF SHAREHOLDERS

OF POSTMEDIA NETWORK CANADA CORP.

TO BE HELD ON

JANUARY 10, 2013

November 23, 2012

POSTMEDIA NETWORK CANADA CORP.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual meeting of shareholders (the “Meeting”) of Postmedia Network Canada Corp. (“Postmedia”) will be held at 1450 Don Mills Road, Toronto, Ontario, M3B 2X7 on January 10, 2013 at 2:00 p.m. (Toronto time), for the following purposes:

| | 1. | to receive our consolidated financial statements, and the independent auditor’s report thereon, for the year ended August 31, 2012; |

| | 2. | to re-appoint PricewaterhouseCoopers LLP as Postmedia’s auditor for the year ending August 31, 2013 and to authorize the Board of Directors to fix the auditor’s remuneration; |

| | 3. | to elect the directors for the coming year; and |

| | 4. | to transact such other business as may properly come before the Meeting or any adjournment thereof. |

The specific details of the matters proposed to be put before the Meeting are set forth in the accompanying management information circular. Shareholders who are unable to attend the Meeting are requested to complete, date, sign and return the enclosed form of proxy so that as large a representation as possible may be had at the Meeting.

Postmedia’s Board of Directors has fixed the close of business on November 26, 2012 as the record date, being the date for the determination of the registered holders of Class C voting shares and Class NC variable voting shares in the capital of Postmedia (collectively, the “Shares”) entitled to receive notice of and vote at the Meeting and any adjournment thereof. Proxies to be used or acted upon at the Meeting or any adjournment thereof must be deposited with Postmedia’s transfer agent, Computershare Investor Services Inc., 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 no later than 2:00 p.m. (Toronto time) on January 8, 2013 or forty-eight hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting. Late proxies may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy.

DATED at Toronto, Ontario this 23rd day of November 2012.

By Order of the Board of Directors

Ronald W. Osborne

Chairman

TABLE OF CONTENTS

| | | | |

GENERAL PROXY INFORMATION | | | 2 | |

| |

VOTING INFORMATION | | | 2 | |

Voting Matters | | | 2 | |

Who Can Vote | | | 2 | |

Voting Your Shares | | | 3 | |

Voting Your Shares by Proxy | | | 3 | |

Voting by Non-Registered Shareholders | | | 4 | |

Additional Matters Presented at the Meeting | | | 4 | |

Description of Shares | | | 4 | |

| |

MATTERS TO BE ACTED UPON AT THE MEETING | | | 6 | |

Financial Statements | | | 6 | |

Re-appointment of Auditor | | | 6 | |

Election of Directors | | | 6 | |

| |

BOARD OF DIRECTORS | | | 9 | |

Cease Trade Orders or Bankruptcies | | | 9 | |

Penalties or Sanctions | | | 10 | |

Conflicts of Interest | | | 11 | |

| |

STATEMENT OF EXECUTIVE COMPENSATION | | | 11 | |

Compensation Discussion and Analysis | | | 11 | |

Summary Compensation Table | | | 20 | |

Performance Graph | | | 21 | |

Incentive Plan Awards | | | 22 | |

Option Plan | | | 22 | |

RSU Plan | | | 24 | |

Employment Agreements | | | 27 | |

DSU Plan | | | 31 | |

Insurance Coverage for Directors and Officers and Indemnification | | | 33 | |

Share Ownership | | | 33 | |

Securities Authorized for Issuance under Equity Compensation Plans | | | 35 | |

| |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES | | | 35 | |

Board of Directors | | | 35 | |

Committees of the Board | | | 39 | |

| |

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | | | 42 | |

Registration Rights Agreement | | | 42 | |

Nominating Agreement | | | 42 | |

Consulting Agreements | | | 42 | |

| |

ADDITIONAL INFORMATION | | | 42 | |

| |

DIRECTORS’ APPROVAL | | | 43 | |

| |

BOARD OF DIRECTORS CHARTER (SCHEDULE “A”) | | | 44 | |

1

POSTMEDIA NETWORK CANADA CORP.

MANAGEMENT INFORMATION CIRCULAR

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation of proxies by and on behalf of the management of Postmedia Network Canada Corp. (“Postmedia”) for use at the annual meeting of shareholders (the “Meeting”) to be held on January 10, 2013 at 2:00 p.m. (Toronto time) at 1450 Don Mills Road, Toronto, Ontario, M3B 2X7 and any adjournment thereof. The Meeting has been called for the purposes set forth in the Notice of Annual Meeting of Shareholders (the “Notice of Meeting”) that accompanies this Circular.

References in this Circular to the “Corporation”, the “Company”, “we”, “us”, “our” and similar terms, as well as references to Postmedia, refer to Postmedia Network Canada Corp. and if the context requires, its subsidiary, Postmedia Network Inc. Unless otherwise indicated, the information in this Circular is given as at November 23, 2012 and all dollar references in this Circular are to Canadian dollars.

GENERAL PROXY INFORMATION

This Circular provides the information you need to vote at the Meeting.

| | • | If you are a registered holder of Class C voting shares in the capital of Postmedia (“Voting Shares”) or Class NC variable voting shares in the capital of Postmedia (“Variable Voting Shares”, and collectively with Voting Shares, the “Shares”), a proxy form is enclosed that you can use to vote at the Meeting. |

| | • | If your Shares are held by a nominee, you should contact that nominee to arrange to receive either a form of proxy or voting instruction form. |

These security holder materials are being sent to both registered and non-registered owners of the Shares. If you are a non-registered owner, and the issuer or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

The solicitation of proxies will be primarily by mail, but proxies may also be solicited in person, by telephone or other form of correspondence. The cost of preparing and mailing this Circular and other material relating to the Meeting and the cost of soliciting proxies has been or will be borne by Postmedia.

VOTING INFORMATION

Voting Matters

At the Meeting, shareholders are voting on: (a) the election of directors for the coming year; and (b) the re-appointment of our auditor for the year ending August 31, 2013 and to authorize the Board of Directors (the “Board”) to fix the auditor’s remuneration.

Who Can Vote

The record date for the Meeting is November 26, 2012. Our transfer agent will prepare a list, as of the close of business on the record date, of the registered holders of the Shares. A holder of the Shares whose name appears on such list is entitled to vote the Shares on such list at the Meeting.

2

Voting Your Shares

If you are a registered shareholder on the record date, you may vote in person at the Meeting or give another person authority to represent you and vote your Shares at the Meeting, as described below under “Voting Your Shares by Proxy”.

Voting Your Shares by Proxy

If you will not be at the Meeting or do not wish to vote in person, you may vote by using the enclosed proxy form. A proxy must be in writing and must be executed by you or by your attorney authorized in writing.

Deadline for Proxies

Any proxy to be used at the Meeting must be received by our transfer agent, Computershare Investor Services Inc., 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 no later than 2:00 p.m. (Toronto time) on January 8, 2013 or forty-eight hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting. Registered shareholders may provide their voting instructions by any of the following means:

| | • | | by mail to the address set forth above (a pre-paid, pre-addressed return envelope is enclosed); or |

| | • | | by hand or by courier to the address set forth above. |

Your Proxy Vote

On the proxy form, you can indicate how you want to vote your Shares, or you can let your proxyholder decide for you.

All Shares represented by properly completed proxies received by our transfer agent, Computershare Investors Services Inc., no later than 2:00 p.m. (Toronto time) on January 8, 2013 or forty-eight hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting will be voted or withheld from voting, in accordance with your instructions as specified in the proxy, on any ballot votes that take place at the Meeting.

If you give directions on how to vote your Shares on your proxy form, your proxyholder must vote your Shares according to your instructions. If you have not specified how to vote on a particular matter on your proxy form, your proxyholder can vote your Shares as he or she sees fit.If neither you nor your proxyholder gives specific instructions, your Shares will be voted: (a) FOR the re-appointment of PricewaterhouseCoopers LLP as our independent auditor for the year ending August 31, 2013 and the authorization of the Board to fix the auditor’s remuneration; and (b) FOR the election of each of the nominees to the Board of Directors listed under the heading “Matters to be Acted Upon at the Meeting – Election of Directors”.

Appointing a Proxyholder

A proxyholder is the person you appoint to act on your behalf at the Meeting (including any continuation after an adjournment of the Meeting) and to vote your Shares.You may choose anyone to be your proxyholder, including someone who is not a shareholder of Postmedia. Simply fill in the name in the blank space provided on the enclosed proxy form. If you leave the space in the proxy form blank, the person designated in the form, who is ourChairman or, failing him, our President and Chief Executive Officer, is appointed to act as your proxyholder.

Revoking Your Proxy

If you give a proxy, you may revoke it at any time before it is used by doing any one of the following:

| | • | | You may send another proxy form with a later date to our transfer agent, Computershare Investor Services Inc., but it must reach Computershare Investor Services Inc. no later than 2:00 p.m. (Toronto time) on January 8, 2013 or forty-eight hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting; |

| | • | | You may deliver a signed written statement, stating that you want to revoke your proxy, to our Corporate Secretary Gillian Akai at any time up to and including the last day preceding the day of the Meeting, or any adjournment thereof, at 1450 Don Mills Road, Toronto, Ontario, M3B 2X7 or by facsimile at (416) 443-6046; |

3

| | • | | You may attend the Meeting and notify the Chairman of the Meeting prior to the commencement of the Meeting that you have revoked your proxy; or |

| | • | | You may revoke your proxy in any other manner permitted by law. |

Voting by Non-Registered Shareholders

You are a non-registered shareholder if your Shares are held in the name of a nominee (such as a bank, trust company or securities broker). Your nominee will generally provide you with a voting instruction form or a proxy form. You should follow the voting instructions provided by your nominee. If you wish to vote in person at the Meeting you must insert your own name in the space provided for the appointment of a proxyholder on the form provided by your nominee and return same by following the instructions provided.

Additional Matters Presented at the Meeting

The enclosed proxy form confers discretionary authority upon the persons named as proxies therein with respect to any amendments or variations to the matters identified in theNotice of Meeting and with respect to other matters that may properly come before the Meeting.

If you sign and return the proxy form and do not appoint a proxyholder by filling in a name, and any matter is presented at the Meeting in addition to, or as an amendment or variation to, the matters described in the Notice of Meeting, the Postmedia representatives named as proxies will vote in their best judgment. Our management is not currently aware of any matters to be considered at the Meeting other than the matters described in theNotice of Meeting, or any amendments or variations to the matters described in such notice.

Description of Shares

Voting Rights

Voting Shares and Variable Voting Shares are the only shares which entitle shareholders to vote at the Meeting. Each Voting Share entitles the holder to one vote on each item of business identified in theNotice of Meeting. Each Variable Voting Share entitles the holder to one vote on each item of business identified in theNotice of Meeting, except if:

| | (a) | the number of issued and outstanding Variable Voting Shares exceeds 49.9% of the total number of all issued and outstanding Shares; or |

| | (b) | the total number of votes that may be cast by or on behalf of holders of Variable Voting Shares present at any meeting of holders of Shares exceeds 49.9% of the total number of votes that may be cast by all holders of Shares present and entitled to vote at such meeting. |

If either of the above-noted thresholds is surpassed at any time, the vote attached to each Variable Voting Share will decrease automatically and without further act or formality, to equal the maximum permitted vote per Variable Voting Share as indicated below. Under the circumstance described in subparagraph (a) above, the Variable Voting Shares as a class cannot carry more than 49.9% of the aggregate votes. Under the circumstance described in subparagraph (b) above, the Variable Voting Shares as a class cannot, for the applicable shareholders’ meeting, carry more than 49.9% of the total number of votes that can be cast at the Meeting.

Conversion of Shares and Coat-tail Provisions

An issued and outstanding Variable Voting Share shall be converted into one Voting Share, automatically and without any further act of Postmedia or the holder, if (a) such Variable Voting Share is not or ceases to be beneficially owned or controlled, directly or indirectly, otherwise than by way of

4

security only, by one or more persons who are citizens or subjects of a country other than Canada or are controlled by one or more citizens or subjects of a country other than Canada (“Non-Canadians”), unless such Variable Voting Share resulted from the exercise of a voluntary election to convert a Voting Share into a Variable Voting Share, or (b)(i) the foreign ownership restrictions of theIncome Tax Act (Canada) (the “Tax Act”) are repealed and not replaced with other similar restrictions in the Tax Act or other applicable legislation and (ii) there is no Canadian federal or provincial law applicable to Postmedia prescribed for the purposes of subsection 46(1) or paragraph 174(1)(c) of theCanada Business Corporations Act (the “CBCA”) or any other similar provision in the CBCA or the CBCA Regulations.

An issued and outstanding Voting Share shall be converted into one Variable Voting Share, automatically and without any further act of Postmedia or the holder, if such Voting Share becomes held or beneficially owned or controlled, directly or indirectly, otherwise than by way of security only, by one or more Non-Canadians. In addition to such automatic conversion feature, a holder of Voting Shares who is not a Non-Canadian shall have the option at any time to convert some or all of such shares into Variable Voting Shares on a one-for-one basis and to convert those shares back to Voting Shares on a one-for-one basis.

In the event that an offer is made to purchase Voting Shares or Variable Voting Shares and the offer is one which must, pursuant to applicable securities legislation or the rules of a stock exchange on which the Shares are then listed, be made to all or substantially all the holders of the Shares of such class, and a concurrent offer at an equal price and with identical terms (subject to certain exceptions) is not made to purchase the Shares of such other class, each Variable Voting Share or Voting Share, as the case may be, shall become convertible at the option of the holder into one Share of the other class that shall be subject to the offer at any time while the offer is in effect. The conversion right may only be exercised in respect of Shares for the purpose of depositing the resulting Shares in response to the offer and a Canadian trustee designated by Postmedia shall deposit the resulting Shares on behalf of the shareholder.

If the Shares resulting from the conversion and deposited pursuant to the offer are withdrawn from the offer or are not taken up by the offeror or if the offer is abandoned or withdrawn, the Shares resulting from the conversion shall be reconverted back into the original class automatically and without further act from Postmedia or the holder.

Quorum and Principal Holders

The presence of at least two people holding or representing by proxy at least 10% of the total number of issued Shares of Postmedia for the time being enjoying voting rights at such meeting is necessary for a quorum at the Meeting. As at November 15, 2012, 1,298,830 Voting Shares and 39,024,340 Variable Voting Shares were issued and outstanding.

To the knowledge of the directors and executive officers of Postmedia, no person owns, directly or indirectly, or exercises control or direction over, voting securities carrying more than 10% of the voting rights attached to any class of our voting securities as at November 15, 2012, other than: (a) for Variable Voting Shares, GoldenTree Asset Management LP (“GoldenTree”) or its affiliates (12,818,106 Variable Voting Shares representing 32.85% of the outstanding Variable Voting Shares), Citibank Canada (5,576,626 Variable Voting Shares representing 14.29% of the outstanding Variable Voting Shares), and Invesco Canada Ltd. (4,602,025 Variable Voting Shares representing 11.79% of the outstanding Variable Voting Shares); and (b) for Voting Shares, Canwest Publishing Inc. (314,069 Voting Shares representing 24.18% of the outstanding Voting Shares) and Electronic Rights Defence Committee (189,479 Voting Shares representing 14.59% of the outstanding Voting Shares).

A majority of the Voting Shares registered in the name of Canwest Publishing Inc. are controlled by FTI Consulting Inc., the court appointed monitor, on account of claims settled with a creditor of Canwest Limited Partnership.

The Voting Shares held by Electronic Rights Defence Committee, are held on behalf of its unnamed and widely dispersed members and are related to a former Canadian class action lawsuit which had asserted claims against Canwest Limited Partnership.

5

MATTERS TO BE ACTED UPON AT THE MEETING

Financial Statements

The annual report which includes the audited consolidated financial statements of the Company for the years ended August 31, 2012 and 2011, accompanying this Circular will be placed before the shareholders at the Meeting. No formal action will be taken at the Meeting to approve the audited consolidated financial statements. If any shareholder has questions regarding such audited consolidated financial statements, such questions may be brought forward at the Meeting.

Re-appointment of Auditor

PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) is the auditor of Postmedia and was first appointed as our auditor in 2010.

Unless authority to do so is withheld, the persons named in the accompanying form of proxy intend to vote for the re-appointment of PricewaterhouseCoopers as our auditor until the close of our next annual meeting of shareholders and to authorize the Board to fix the remuneration of the auditor.

Our Board recommends that you vote FOR the reappointment of PricewaterhouseCoopers as our auditor for the year ending August 31, 2013 and the authorization of the Board to fix the auditor’s remuneration.

Election of Directors

Postmedia is required to have a minimum of three directors and a maximum of 15 directors.

The following table set forth below identifies the names and residence of the persons proposed to be nominated for election by shareholders as directors, their current positions with Postmedia, the date when they first became a director of Postmedia and their principal occupations. David Emerson has decided not to stand for re-election, and therefore, his existing term will end on the date of the Meeting. All of the nominees are currently directors of Postmedia and have been elected for a term ending on the date of the Meeting, or until the election of his or her successor, unless he or she resigns or his or her office becomes vacant by reasons of his or her death, removal or other cause. Each director elected will hold office for a term expiring at the close of the next annual meeting.

The Board has adopted a majority voting policy in director elections that will apply at any meeting of the Postmedia shareholders where an uncontested election of directors is held. Pursuant to this policy, if the number of proxy votes withheld for a particular director nominee is greater than the votes for such director, the director nominee will be required to submit his or her resignation to the Chair of the Board promptly following the applicable shareholders’ meeting. Following receipt of resignation, the Corporate Governance and Nominating Committee will consider whether or not to accept the offer of resignation and make a recommendation to the Board. Within 90 days following the applicable shareholders’ meeting, the Board shall publicly disclose their decision whether to accept the applicable director’s resignation or not, including the reasons for rejecting the resignation, if applicable. A director who tenders his or her resignation pursuant to this policy will not be permitted to participate in any meeting of the Board or the Corporate Governance and Nominating Committee at which the resignation is considered. A copy of the majority voting policy may be found on the Postmedia website at www.postmedia.com.

It is not contemplated that any of the nominees will be unable, or for any reason will become unwilling, to serve as a director but should that occur prior to the election, the persons named in the accompanying form of proxy or voting instruction form reserve the right to vote for another nominee in their discretion, unless the shareholder has specified that his or her shares be withheld from voting on the election of directors.

6

| | | | | | |

Name and Residence | | Position with Postmedia | | Director / Executive Officer Since | | Principal Occupation if Different from Position Held |

| Paul Godfrey | | Director, President and | | April 26, 2010 | | |

| Toronto, Ontario, Canada | | Chief Executive Officer | | | | |

| | | |

| Ronald W. Osborne(1) | | Director and Chair | | June 17, 2010 | | Corporate Director |

| Toronto, Ontario, Canada | | | | | | |

| | | |

| Charlotte Burke(1)(2)(5) | | Director | | September 20, 2010 | | Senior Executive, Accenture and Consultant |

| Toronto, Ontario, Canada | | | | | | |

| | | |

| Hugh F. Dow(1)(4)(5) | | Director | | January 6, 2011 | | Corporate Director |

| Toronto, Ontario, Canada | | | | | | |

| | | |

| John Paton(4)(5) | | Director | | June 17, 2010 | | Chief Executive Officer, Digital First Media Inc. |

| New York, New York, United | | | | | | |

| States | | | | | | |

| | | |

| Graham Savage(1)(2)(4) | | Director | | July 12, 2010 | | Corporate Director |

| Toronto, Ontario, Canada | | | | | | |

| | | |

| Steven Shapiro(3) | | Director | | July 12, 2010 | | Founding Partner and Portfolio Manager, |

| New York, New York, United | | | | | | GoldenTree Asset Management LP |

| States | | | | | | |

| | | |

| Peter Sharpe(1)(3)(4) | | Director | | June 17, 2010 | | Corporate Director |

| Toronto, Ontario, Canada | | | | | | |

| | | |

| Robert Steacy(1)(2)(4) | | Director | | July 14, 2010 | | Corporate Director |

| Toronto, Ontario, Canada | | | | | | |

Notes:

| (1) | Independent member of the Board |

| (2) | Member of the Audit Committee |

| (3) | Member of the Corporate Governance and Nominating Committee |

| (4) | Member of the Compensation and Pension Committee |

| (5) | Member of Digital Oversight Committee |

The following are brief profiles of our directors, including a description of each individual’s principal occupation within the past five years.

Paul Godfrey (Director)

Mr. Godfrey is the President and Chief Executive Officer of Postmedia Network Inc. Prior to this he served as President and Chief Executive Officer of National Post Inc., President and Chief Executive Officer of the Toronto Blue Jays Baseball Club, and spent 16 years with Sun Media Corporation, eventually taking the role of President and Chief Executive Officer. Mr. Godfrey has a proud record of public service including a record four terms (11 years) as the Chairman of the Municipality of Metropolitan Toronto. He is the Chair of the Ontario Lottery and Gaming Corporation, Chairman of the board of RioCan Real Estate Investment Trust and currently serves on various other boards including, Astral Media Inc., Mobilicity (formerly known as Data & Audio Visual Enterprises Mobility), Cargojet Income Fund and serves as Vice Chair of Baycrest Centre for Geriatric Care.

Ronald W. Osborne (Director and Chair)

Mr. Osborne recently retired as Chairman of the board of Sun Life Financial Inc., an international financial services organization, and Sun Life Assurance Company of Canada. Prior to this he was President and Chief Executive Officer of Ontario Power Generation Inc., served as an executive with the BCE group of companies, and held various positions at Maclean Hunter, including that of President and Chief Executive Officer. In addition, Mr. Osborne currently sits on the board of directors of Holcim (Canada) Inc. and Tim Hortons Inc. and is a trustee of RioCan Real Estate Investment Trust.

7

Charlotte Burke (Director)

Ms. Burke is currently a senior executive with Accenture in the communications, media and technology practice. Ms. Burke also operates a consulting firm focused on commercializing technologies for businesses in the mobile, internet and digital media sectors. Prior to assuming her current positions, Ms. Burke was the Senior Vice President of Sales and Marketing, Americas for Hewlett Packard and President of Asurion Canada. In addition, Ms. Burke was an officer and senior vice president with Bell Canada, where she led the Consumer Internet business and also held senior executive roles for new product development and Bell Mobility’s digital cellular business from 1996 to 2008. Ms. Burke is also an advisor with the MaRS Ontario Innovation Center, Next 36, Polar Mobile, Horizon Studios and is on the board of Acadia University.

Hugh F. Dow (Director)

Mr. Dow retired as Chairman of Mediabrands Canada in December 2010. Prior to this, Mr. Dow was President of M2 Universal and held global responsibilities with Universal McCann, of which M2 Universal is the Canadian arm. Mr. Dow has also held many key advertising industry positions including Vice Chairman of BBM Bureau of Measurement, Director and Chairman of Canadian Media Directors’ Council, Chairman of PMB Print Measurement Bureau, Chairman and Director of ABC Audit Bureau of Circulation, and Chairman of Media Medical Audience Committee. Mr. Dow also serves as a Director of Cottage Life Media Inc. and Reshift Media Inc.

John Paton (Director)

In September 2011, Mr. Paton was appointed Chief Executive Officer of Digital First Media Inc., a company that manages the Journal Register Company, MediaNews Group and Digital First Ventures, in addition to his role as Chief Executive Officer of the Journal Register Company. Together these companies represent the second-largest newspaper company in the United States. Mr. Paton also serves as a director of the Journal Register Company, Wanderful Media, and MediaNews Group. Prior to that he was with impreMedia LLC, a media company that he co-founded in 2003, where he served as Chairman, Chief Executive Officer and President. Prior to joining impreMedia, Mr. Paton was the Chief Executive Officer of Canoe Inc. Mr. Paton was also Vice President of Sun Media Corporation and is the former Publisher and Chief Executive Officer of the London Free Press and the Ottawa Sun. Mr. Paton currently serves on the board of directors of the Newspaper Association of America. He also serves on the board of advisors for the City University of New York Graduate School of Journalism.

Graham Savage (Director)

Mr. Savage is the non-executive Chairman and Founding Partner of Callisto Capital, a merchant banking firm. Prior to that, Mr. Savage spent 21 years as a senior officer at Rogers Communications Inc. He is currently a director of Canadian Tire Corp., Canadian Tire Bank, Cott Corporation and Whistler Blackcomb Holdings Inc. Mr. Savage previously served as a director of Rogers Communications Inc., Sun Media Corp., Royal Group Technologies Ltd., Hollinger International Inc., and The Daily Telegraph (UK), among others.

Steven Shapiro (Director)

Mr. Shapiro is a founding partner and portfolio manager at GoldenTree Asset Management, and is a member of its Executive Committee. He is responsible for the firm’s investments in media and communications as well as its investments in distressed assets. Prior to joining GoldenTree, Mr. Shapiro was a Managing Director in the High Yield Group at CIBC World Markets, where he headed Media and Telecommunications Research. He is a member of the boards of various corporate and not-for-profit entities, including Source Home Entertainment, Inc., the holding company of Source Interlink; Granite Broadcasting; Southern Community Newspapers, Inc. and James Cable, LLC.

8

Peter Sharpe (Director)

Mr. Sharpe retired as President and CEO of Cadillac Fairview Corporation in 2010, having served with the company for over 25 years. Mr. Sharpe is currently a Director of Morguard Corporation, First Industrial REIT (US), Allied Property REIT and Sunnybrook Hospital Foundation. Mr. Sharpe is also a past chairman and current trustee of the International Council of Shopping Centers.

Robert Steacy (Director)

Mr. Steacy retired in 2005 after spending more than 16 years as the senior financial officer of Torstar Corporation. Mr. Steacy is a director and chair of the Audit Committees of Domtar Corporation and Cineplex Inc. From 2005 to 2007 he served on the Boards of Alliance Atlantis Communications Inc. and Somerset Entertainment Income Fund, and was a director of Canadian Imperial Bank of Commerce from 2008 to 2012.

BOARD OF DIRECTORS

Cease Trade Orders or Bankruptcies

Other than as described below, no director nominee or executive officer of Postmedia is, or within 10 years before the date hereof, has been a director, chief executive officer or chief financial officer of any company (including Postmedia) that, (i) was subject to an order that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer, or (ii) was subject to an order that was issued after the director or officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.For the purposes of the preceding sentence, “order” means; (a) a cease trade order; (b) an order similar to a cease trade order; or (c) an order that denied the relevant company access to any exemption under securities legislation.

Other than as described below or to the knowledge of the Corporation, no director, executive officer or shareholder holding a sufficient number of securities to affect materially the control of Postmedia: (a) is at the date hereof, or has been within 10 years before the date hereof, a director or executive officer of any company (including Postmedia) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (b) has, or within 10 years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director, executive officer or shareholder.

On October 6, 2009, the subordinate voting shares and the non-voting shares of Canwest Global Communications Corp. (“Canwest Global”) were suspended from trading on the TSX while a review to determine whether the company was meeting the continued listing requirements was conducted. On October 15, 2009, Canwest Global received a notice from the TSX informing the company that its subordinate voting shares and non-voting shares would be delisted from the exchange effective November 13, 2009 for failure to meet the continued listing requirements. In response to this notice, on November 13, 2009, Canwest Global announced that its subordinate voting shares and non-voting shares would begin trading on the TSX Venture Exchange effective November 16, 2009. Messrs. Paul Godfrey, the President and Chief Executive Officer of Postmedia, and Douglas Lamb, Executive Vice President and Chief Financial Officer of Postmedia, were senior officers of certain subsidiaries of Canwest Global throughout the period described above.

9

Prior to their mandates with Postmedia, Messrs. Godfrey, Lamb, Bent (Mr. Bent was an NEO during fiscal 2011) and Ms. Hall were executive officers of Canwest Publishing Inc., Canwest Books Inc., Canwest (Canada) Inc., and Canwest Limited Partnership (the “LP Entities”). On January 8, 2010, the Ontario Superior Court of Justice issued an order that, among other things, granted the LP Entities protection from their creditors under the Companies’ Creditors Arrangement Act, R.S.C. 1985 c. C-36, as amended (the “CCAA”). Postmedia acquired substantially all of the newspaper and online publishing and digital media businesses previously owned by the LP Entities pursuant to a plan of compromise or arrangement that was implemented during the course of the LP Entities’ proceedings under the CCAA (the “Acquisition”). The LP Entities remain under CCAA protection as of the date hereof.

Mr. Osborne served on the board of directors of Air Canada from May 1999 to September 2004. In September 2004 Air Canada completed a court-sanctioned restructuring process and implemented a plan of arrangement under the corporate and insolvency laws of Canada. Mr. Osborne also served on the board of directors of Nortel Networks Corporation and Nortel Networks Limited (collectively, the “Nortel Companies”) from April 1996 to September 1997 and from June 2005 to June 2006. On March 10, 2006 the Nortel Companies announced that the filing of certain 2005 financial statements would be delayed. The Ontario Securities Commission issued a management cease trade order on April 10, 2006, prohibiting all of the directors, officers and certain current and former employees from trading in securities of the Nortel Companies until two business days following the receipt by the Ontario Securities Commission of all of the filings the Nortel Companies were required to make pursuant to Ontario securities laws. The British Columbia Securities Commission and Québec Securities Commission also issued similar orders. Mr. Osborne was not subject to the orders issued by the British Columbia Securities Commission and the Québec Securities Commission. The Ontario Securities Commission lifted the cease trade order effective June 8, 2006. The British Columbia Securities Commission and the Québec Securities Commission also lifted their cease trade orders shortly thereafter.

Mr. Paton is currently the Chief Executive Officer of Journal Register Company (“JRC”) and also serves on its board of directors. On September 5, 2012, JRC filed for protection under Chapter 11 of the United States Bankruptcy Code (the “USBC”).

Mr. Savage was a director of Microcell Inc. when it filed for protection under the CCAA. Mr. Savage was a director of Sun-Times Media Group, Inc. (“Sun Times”), formerly Hollinger International Inc. (“Hollinger”). He served as a director of that company from July, 2003 until November, 2009. On June 1, 2004, the Ontario Securities Commission issued a permanent management cease trade order (the “Ontario Cease Trade Order”) against the insiders of Hollinger for failing to file its interim financial statements and interim MD&A for the three-month period ended March 31, 2004 and its annual financial statements, MD&A and Annual Information Form for the year ended December 31, 2003. In addition, the British Columbia Securities Commission issued a cease trade order against an insider of Hollinger resident in British Columbia on May 21, 2004, as updated on May 31, 2004 (the “BC Cease Trade Order”). The Ontario Cease Trade Order was allowed to expire on January 9, 2006 and is no longer in effect. The BC Cease Trade Order was revoked on February 10, 2006 and is no longer in effect. Sun Times filed for protection under Chapter 11 of the USBC in April 2009.

Mr. Shapiro was a director of Reader’s Digest Association Inc. (“Reader’s Digest”) until August 2009. Reader’s Digest filed for protection under Chapter 11 of the USBC in August 2009, after Mr. Shapiro’s departure from its board.

Penalties or Sanctions

To the knowledge of the Company, no director, executive officer or shareholder, holding a sufficient number of securities to affect materially the control of Postmedia, has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

10

Conflicts of Interest

Mr. Shapiro is a founding partner and portfolio manager at GoldenTree, and is a member of its executive committee. GoldenTree and certain investment funds for which it serves as investment adviser own a portion of the 12.5% Senior Secured Notes due 2018 and the 8.25% Senior Secured Notes due 2017 issued by Postmedia Network Inc. and Variable Voting Shares of Postmedia. GoldenTree’s combined debt and equity holdings may give rise to a potential conflict of interest. GoldenTree is located at 300 Park Avenue, 21st Floor, New York, New York, 10022 USA.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following discussion and analysis examines the compensation earned by the Company’s President and Chief Executive Officer (the “CEO”), the Executive Vice President & Chief Financial Officer (the “CFO”) and the three other most highly compensated executive officers (collectively, the “Named Executive Officers” or “NEOs”), who served as executive officers of the Company for the year ended August 31, 2012 (“Fiscal 2012”). In addition, it describes and explains Postmedia’s compensation philosophy and objectives and the significant elements of compensation of the Company’s NEOs during Fiscal 2012.

Named Executive Officers

The NEOs for Fiscal 2012 were:

| | • | | Paul Godfrey, President and Chief Executive Officer |

| | • | | Douglas Lamb, Executive Vice President and Chief Financial Officer |

| | • | | Wayne Parrish, Chief Operating Officer |

| | • | | Gordon Fisher, President, National Post and Executive Vice President, Eastern Canada |

| | • | | Michelle Hall, Executive Vice President, Human Resources |

Compensation Governance

Role of the Compensation and Pension Committee

The Compensation and Pension Committee of the Board is made up of a majority of independent directors with many years of diverse business experience. The members of the Compensation and Pension Committee are Messrs. Savage (Chair), Dow, Paton, Sharpe and Steacy. Members of the Committee have gained relevant skills and experience with respect to their responsibilities for executive compensation through holding a variety of senior executive management roles, including, for certain members, as CEO of a business with the HR and Finance functions reporting directly to them. In connection with their past roles, most Committee members have managed and implemented a variety of compensation policies and programs. The Compensation and Pension Committee regularly reports to the Board in carrying out its responsibilities and duties relating to compensation matters of the Company. To ensure that an objective process for determining compensation is taken, the Compensation and Pension Committee regularly holds in camera sessions exclusive of management including directors who are members of management and consults with independent advisors in respect of compensation matters (see “Compensation Governance—Role of the Independent Consultant”).

The Compensation and Pension Committee, through meetings, presentations and reports, understands the key drivers and issues affecting the Company and regularly meets with senior management.

11

Consistent with the Compensation and Pension Committee’s charter and based on input from management and the Compensation and Pension Committee’s independent advisor (see “Role of the Independent Consultant”), the Compensation and Pension Committee reviews executive compensation and awards for each of the NEOs.

As part of the executive compensation review, the Compensation and Pension Committee makes recommendations to the Board on compensation levels and incentive plan awards for each of the NEOs based on the guiding principles described below, with particular reference to performance measures. The following outlines the principal responsibilities of the Committee with respect to compensation matters:

| | • | | Review with the CEO at least annually, the long-term goals and objectives of the Company which are relevant to the CEO’s compensation, evaluate the CEO’s performance in light of those goals and objectives, determine and recommend to the independent directors for approval the CEO’s compensation based on that evaluation, and report to the Board of Directors thereon. In determining the CEO’s compensation, the Compensation and Pension Committee shall consider the Company’s performance, the value of similar incentive awards to chief executive officers at comparable companies, the CEO’s existing employment contract and the awards given to the CEO in past years, with a view to maintaining a compensation program for the CEO at a fair and competitive level consistent with the best interests of the Company. |

| | • | | Review and make recommendations to the Board of Directors at least annually (and upon appointment), in consultation with the CEO, on the compensation of those members of senior management that report directly to the CEO (including incentive-compensation plans, equity based plans, the terms of any employment agreements, severance arrangements, and change in control arrangements or provisions, and any special or supplemental benefits), with a view to maintaining a compensation program for the senior management at a fair and competitive level, consistent with the best interests of the Company. |

| | • | | Review all executive compensation packages with annual cash compensation in excess of $300,000. |

| | • | | Fix and determine (and, as it determines to be appropriate, delegate the authority to fix and determine) awards (and the vesting criteria thereof) to employees of stock or stock options or other awards pursuant to any of the Company’s equity-based plans now or from time to time in effect or otherwise as permitted by applicable legislation, regulatory requirements and policies and exercise such other power and authority as may be permitted or required under those plans. |

| | • | | Review the efficacy of incentive compensation programs (including short-term and long-term incentive plans), and equity-based compensation programs for the Company’s directors, officers and employees, including share ownership guidelines and, when necessary, make recommendations to the Board of Directors regarding, the role and design thereof. |

| | • | | Review the financial implications of the Company’s senior compensation plans, including post-retirement benefits and supplemental employee retirement plan and funding thereto, if any. |

| | • | | Review the potential results of its senior compensation programs under a wide variety of scenarios to ensure that the Committee has an understanding of the linkage between shareholder interests and senior management payouts. |

| | • | | Review and approve annually any adjustments and guidelines made in respect of the Company’s compensation plans. |

| | • | | Oversee in co-operation with the Company’s senior management the human resources policies and programs which are of strategic significance to the Company and make recommendations thereon, as required, to the Board of Directors. |

| | • | | Review and make recommendations to the Board of Directors at least annually with respect to compensation of directors, the Chairman and those acting as committee chairs to, among other things, ensure their compensation appropriately reflects the responsibilities they are assuming. |

12

With respect to the Company’s pension plans, the Compensation and Pension Committee’s principal duties are to oversee and monitor the management and overall governance of the pension and retirement plans sponsored and administered by the Company.

The Compensation and Pension Committee follows corporate governance rules and principles in reviewing and determining the executive compensation policies and programs. The Committee recognizes that the business and competitive environment in which the Company operates requires a balanced level of risk-taking to promote growth and achieve the expected financial performance required to provide shareholders with good returns. The Committee is aware that compensation programs, policies and practices should not encourage senior executives to take excessive and unnecessary risks. The Committee monitors this on an ongoing basis by reviewing compensation arrangements to ensure that executives do not make short-term decisions that could be detrimental to long-term shareholder returns. The Committee reviews the performance based compensation for senior executives and in doing so, reviews the compensation mix of base salary to short-term and long-term incentives. The Company promotes adequate risk taking through the use of performance targets for its short-term incentive plan which has predefined payout thresholds. Risk is mitigated under long-term incentives through the grant of stock options that have vesting provisions. Long-term incentives reward executives for taking a balanced focus on long-term performance and the achievement of long-term goals over a ten year period. The Committee is satisfied that current programs, policies and practices, combined with the risk compliance reviews of the organization, promote adequate risk taking with appropriate and reasonable incentive compensation and has not identified any risks that are reasonably likely to have a material adverse effect on the Company.

The Company has a policy of prohibiting its employees from purchasing financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of securities of Postmedia held, directly or indirectly, by such employees, including equity securities granted as compensation. Such policy is contained in the Company’s Timely Disclosure and Confidentiality Policy.

Role of the Independent Consultant

The Compensation and Pension Committee engaged Hugessen Consulting Inc. (“Hugessen”) on November 5, 2010 to act as its independent advisor to provide advice and guidance on compensation issues. All work undertaken by Hugessen is pre-approved by the Chair of the Compensation and Pension Committee. Hugessen provides no other services to Postmedia. Hugessen is directly retained and instructed by and reports to the Compensation and Pension Committee. The decisions made by the Compensation and Pension Committee are the responsibility of the Compensation and Pension Committee and may reflect other factors and considerations in addition to the information and recommendations from Hugessen.

13

Fees paid to Hugessen in Fiscal 2012 and 2011 pertaining to professional consulting services on NEO benchmarking, total compensation performance metrics and analysis of short-term and long-term incentive plans were as follows:

| | | | | | | | |

Year | | Executive

Compensation

Related Fees | | | All Other Fees | |

Fiscal 2012 | | | 85,125 | | | | — | |

Fiscal 2011 | | | 7,034 | | | | — | |

Executive Compensation Guiding Principles

The executive compensation philosophy is based on the following guiding principles:

| | • | | Creating compensation programs with appropriate levels of pay for performance to encourage and motivate performance that drives Postmedia’s business strategy and generates financial results that align with shareholder interests; |

| | • | | Creating a total compensation package that is attractive to leaders, proportional to the executives contribution, and fair to stakeholders within the context of financial and non-financial total rewards; |

| | • | | Creating compensation programs that are consistent with market practices both in terms of value and design, while considering internal value and fit; |

| | • | | Delivering compensation and performance management programs that focus on connecting rewards and the desired/expected behaviors, actions and results that drive a strong return on investment at the organization level, and striving for clarity and transparency of these programs with the goal of simplifying them where possible; |

| | • | | Ensuring good governance of compensation programs, with accountability for design and administration held by appropriate internal stakeholders (including input from internal and external experts) and appropriate oversight by the Compensation and Pension Committee and the Board. |

From the guiding principles, the following design principles are followed:

| | • | | Performance is a key driver of compensation levels, both on short-term and long-term incentives; |

| | • | | Sound performance management processes have been developed to provide for effectiveness and consistency in defining expected performance outcomes (as embedded in accountabilities and related goals) and assessing their achievement; and |

| | • | | Pay at risk, as represented by short-term and long-term incentive compensation, will be proportional to the job’s level of influence on overall business results. The Company continues to review and refine its programs, and recognizes the importance of long-term performance and therefore emphasizes rewards that align to an increase in shareholder value. |

14

Competitive Benchmarking

In October 2011, the Compensation and Pension Committee requested that Hugessen assist the Committee by reviewing the competitiveness of the compensation levels for the CEO, CFO and two of the NEOs, using a comparator group of publicly listed companies. Benchmarking was not performed on one of the NEOs as at the time of the review, that senior executive was not an NEO (a midyear stock option grant placed that senior executive in the NEO group by the end of Fiscal 2012). The compensation of that NEO was reviewed and approved by the Compensation and Pension Committee.

Hugessen selected a comparator group of companies, generally using the following four screening criteria:

| | |

Comparator Group Criteria | | |

| Primary Listing | | Toronto Stock Exchange |

| Geographic Location | | Headquartered in Canada |

| Industry Classification | | Media |

| Financial Criteria | | Latest Total Enterprise Value between approximately $400 million and $2.5 billion |

The screening identified the following eleven companies:

| | • | | AIMIA (formerly Groupe Aeroplan Inc.) |

| | • | | Corus Entertainment Inc. |

| | • | | Canadian Satellite Radio |

The compensation review focused on the total direct compensation (“TDC”) composed of base salary, short-term incentives and long-term incentives received by the NEOs. For benchmarking purposes, Hugessen matched the CEO and CFO positions with the counterparts of the comparator companies. For the remaining two NEO positions, Hugessen matched these positions based on their TDC ranking. Following a review of the benchmarking report, the Committee decided to leave the compensation levels of the CEO, CFO and two NEOs unchanged.

How Postmedia Makes Executive Compensation Decisions

The Board makes decisions on each element of executive compensation as it pertains to base salaries, annual short-term incentives and long-term equity incentive compensation based on recommendations made by the Compensation and Pension Committee for the President and CEO and other NEOs. The Board also approves corporate and divisional goals, targets and objectives relevant to the compensation of the NEOs. In making recommendations for Board approval, the Compensation and Pension Committee reviews the compensation arrangements for the CEO and for the other NEOs based on competitive external benchmarking and peer group comparator information provided by Hugessen.

15

Executive Compensation Components and Their Objectives

Postmedia’s executive compensation program is comprised of the following compensation components:

| | • | | annual short-term incentives (annual bonuses); |

| | • | | long-term management incentives, which include stock options and restricted share units (“RSUs”); |

The primary objective of our executive compensation program is to attract and motivate key executives to carry out business strategies that are aligned with the creation of shareholder value. The level of compensation paid to each NEO is based on the executive’s qualifications, experience, responsibility and performance.

Salary

Base salary remunerates executives for discharging job requirements. The NEOs base salary represents a fixed level of cash compensation and it is reviewed annually by the Compensation and Pension Committee with recommendations to the Board for their approval with the goal of ensuring that each NEO is paid fairly, taking into consideration the requirements of the position, the executive’s performance, knowledge, skills, experience and equity with other executives within Postmedia and compared to the external market for competitiveness. The Company’s policy is to target base salary compensation for the NEOs at the median level or just above, based on external market considerations, organizational and individual performance. The NEOs are also reviewed based upon the comparator group recommended by Hugessen (see “Competitive Benchmarking”).

Annual Short-term Incentive Plan (“STIP”)

The STIP represents variable cash compensation. Short-term incentive targets for the NEOs are expressed as a percentage of base salary and are determined based on competitive market practices and the program is designed to attract and motivate executive performance. The Compensation and Pension Committee recommends for approval by the Board the short-term incentive plan design, performance measures, weightings and targets for each fiscal year.

The Company’s policy is to target short-term incentives at median for the NEOs with the purpose of being externally competitive while incenting for maximum performance to achieve Company goals.

In designing the STIP, the goal is to align the payouts with the business strategy and to motivate plan participants to achieve defined goals. The CEO is eligible for 100% of base salary at target and the other four NEOs are eligible for 50% of base salary at target. The short-term incentives all have a maximum payout opportunity equal to 150% of target.

For Fiscal 2012, the Board provided the CEO with discretion to recommend an adjustment on incentive bonus payments under the STIP subject to the performance of pre-defined and pre-approved criteria (the “Discretionary Payout”). The Discretionary Payout is subject to Board approval and cannot exceed an established fixed percentage of the overall STIP. The payout is capped at 150% of target (including any Discretionary Payout).

16

The CEO STIP plan design for Fiscal 2012 remained the same as the prior fiscal year, with the minimum payout threshold set at 80% of performance target. The payout is capped at 150% when performance reaches 125% of target. Payouts are graduated proportionately for achievements between 80% and 100% and between 100% and 125% of target.

The plan for the other four NEOs remained the same as the prior fiscal year with the minimum payout threshold set at 85% of performance target. The payout is capped at 150% of target when performance achievement reaches 125% of performance target.

In October 2011, the Board approved plan payouts for Fiscal 2012 based upon the level of achievement of targets (established for purposes of the STIP) based on the corporate performance of consolidated operating profit and consolidated digital revenue. The CEO, CFO and two of the NEOs were measured 70% against corporate performance relating to consolidated operating profit before depreciation, amortization and restructuring (the “Consolidated Operating Target”) and 30% against consolidated digital revenue. One other NEO was measured 40% against the Consolidated Operating Target and 60% against similar targets established at the individual operating unit level.

The Consolidated Operating Target and consolidated digital revenue established for the STIP for Fiscal 2012 were $197 million and $112 million, respectively, whereas the actual achievement was $144 million and $89 million, respectively. With respect to the targets for individual operating units, we are relying on the exemption pursuant to the applicable securities laws in order to not disclose such targets, as doing so would be seriously prejudicial to our competitive market position. The level of difficulty in reaching the undisclosed targets is similar to that in meeting the Consolidated Operating Target and consolidated digital revenue. The undisclosed targets for individual operating units apply only to one NEO and represents 20% of such NEOs base salary and STIP.

The threshold performance targets described above were not met for Fiscal 2012. The Board approved a Discretionary Payout of $75,000 (as noted in the table below) for the CFO in recognition of his significant accomplishments on two organizational initiatives for Fiscal 2012.

The short-term incentive award targets and the payout achievement of these targets in Fiscal 2012 for the NEOs of the Company are as follows:

| | | | | | | | | | | | |

Participant Name | | Fiscal 2012

Target Payout

(as a % of base

salary) | | | Fiscal 2012

Target Payout

($) | | | Fiscal 2012

Actual Payout

($) | |

Paul Godfrey | | | 100 | % | | | 950,000 | | | | — | |

| | | |

Douglas Lamb | | | 50 | % | | | 225,000 | | | | 75,000 | |

| | | |

Wayne Parrish | | | 50 | % | | | 237,500 | | | | — | |

| | | |

Gordon Fisher | | | 50 | % | | | 200,000 | | | | — | |

| | | |

Michelle Hall | | | 50 | % | | | 147,500 | | | | — | |

Long-term Management Incentive Plans

The Company has an Option Plan and an RSU Plan that are intended to, among other things, attract, motivate and retain certain executive officers and other grantees and align their interests with the interests of shareholders. The long-term incentive programs are designed to reward performance over a ten year period and vest over a five year period, and are provided to senior leaders in value driven roles and key contributors who are critical to the organization’s future. See“Option Plan” and“RSU Plan”.

17

In Fiscal 2012 the Compensation and Pension Committee made recommendations to the Board for approval of stock option grants to certain NEOs and senior executives, which grants took into account previous grants to such NEOs. The recommendations made to the Board were for senior management who did not already have options including Senior Vice Presidents and Publishers. The allocations of the grants to the NEOs are disclosed under theSummary Compensation Table,theOutstanding Share Based Awards Table and theOption Based Awards Table.

Benefits and Perquisites

Although not considered a primary element of the Compensation Program, the Company provides a comprehensive and market competitive package of executive level benefits and perquisites for its NEOs. The executive group benefits program includes health, dental, life insurance, wellness, short-term and long-term disability coverage. Perquisites provided to the NEOs consist of car allowances and club memberships, with a car lease available to the CEO. The level of benefits and perquisites are determined based on guidelines that have been established under an executive compensation total rewards framework.

Pension Plan

Postmedia maintains a defined benefit pension plan (the “Pension Plan”) for its executives which is the same pension plan offered to a majority of other employees in the Company and does not offer a supplemental executive retirement plan. The benefit formula takes into consideration the member’s pensionable earnings and credited service in the plan along with the maximum Canada Pension Plan levels. The formula is: 1.25% multiplied by the final average earnings up to the average yearly maximum pensionable earnings multiplied by the credited service plus 1.75% multiplied by the final average earnings in excess of the average yearly maximum pensionable earnings multiplied by the credited service. The Pension Plan averages the member’s best five years of pensionable earnings during the last ten years prior to retirement or termination.

The maximum pension payable under the Plan is as prescribed by theIncome Tax Act. An executive officer contributes to the plan an amount of 2.5% of pensionable earnings up to the yearly maximum pensionable earnings and 5% thereafter.

The Pension Plan also provides for an early retirement subsidy for the executive officers and all participants who take early retirement following the attainment of both age 62 and 10 years of continuous service. A participant retiring after age 55 but before age 62 with 10 or more years of continuous years of service may elect to receive an unreduced deferred retirement income payable at age 62. For a participant retiring after age 55 but before age 62 with less than 10 years of continuous employment, the pension is reduced by a factor of one-third of 1% for each complete month by which the early retirement date precedes the normal retirement date.

Messrs. Lamb and Parrish participate in the defined benefit pension plan. Mr. Godfrey is not eligible to participate in the Plan due to his having exceeded the maximum age reached to be eligible to participate in the Plan and Mr. Fisher is in receipt of the pension benefit under the Plan. Ms. Hall has not yet elected to participate in the Plan.

18

Defined Benefit Plan Table as of August 31, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Participant Name | | Number

of Years

Credited

Service

(#) | | | Annual Benefits

Payable ($) | | | Opening

Present Value

of Defined

Benefit

Obligation ($) (2) | | | Compensatory

Change ($) | | | Non-

Compensatory

Change ($)(2) | | | Closing Present

Value of

Defined Benefit

Obligation ($) (2) | |

| | | | | | At Year

End | | | At Age 65 | | | | | | | | | | | | | |

Douglas Lamb | | | 0.7 | | | | 1,800 | | | | 40,600 | | | | — | | | | 8,100 | | | | 14,400 | | | | 22,500 | |

| | | | | | | |

Wayne Parrish | | | 0.8 | | | | 2,200 | | | | 23,800 | | | | — | | | | 11,800 | | | | 18,400 | | | | 30,200 | |

| | | | | | | |

Gordon Fisher(1) | | | 21.3 | | | | 52,600 | | | | 52,600 | | | | 744,700 | | | | — | | | | (63,700 | ) | | | 681,000 | |

Notes:

| (1) | Mr. Fisher is currently receiving annual benefits under this plan of $52,600 based on an election of joint and survivor pension and credited service of 21.3 years at attainment of the pension benefit. |

| (2) | An actuarial valuation of the Plan was completed as at December 31, 2011 for accounting purposes and these results were extrapolated to August 31, 2012. The present value of the obligation was determined using the Projected Unit Credit Method pro-rated on service. Calculations are made based upon a discount rate assumption of 5.45% at the beginning of year and 4.35% at the end of the year. |

19

Summary Compensation Table

The following table summarizes the annual compensation provided for services rendered to Postmedia in respect of its NEOs for Fiscal 2012 and 2011.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and | | | | | | | | Option- | | | | | | | | | Pension | | | All Other | | | Total | |

| Principal | | Fiscal | | | Salary | | | Based | | | Non-Equity Incentive Plan | | | Value (1) | | | Compensation (2) | | | Compensation | |

Position | | Year | | | ($) | | | Awards ($) (8) | | | Compensation ($) | | | ($) | | | ($) | | | ($) (8) | |

| | | | | | | | | | | | Annual Incentive | | | Long-Term | | | | | | | | | | |

| | | | | | | | | | | | Plans (10) | | | Incentive Plans | | | | | | | | | | |

Paul Godfrey | | | 2012 | | | | 950,000 | | | | — | | | | — | | | | — | | | | — | | | | 167,832 | (3) | | | 1,117,832 | |

President and Chief Executive Officer | | | 2011 | | | | 950,000 | | | | — | | | | 465,500 | | | | — | | | | — | | | | 170,525 | (3) | | | 1,586,025 | |

| | | | | | | | |

Douglas Lamb | | | 2012 | | | | 450,000 | | | | — | | | | 75,000 | (6) | | | — | | | | — | | | | — | | | | 525,000 | |

Executive Vice President and Chief Financial Officer | | | 2011 | | | | 452,207 | (5) | | | — | | | | 131,250 | (6) | | | — | | | | — | | | | — | | | | 583,457 | |

| | | | | | | | |

Wayne Parrish | | | 2012 | | | | 475,000 | | | | 584,000 | (12) | | | — | | | | — | | | | — | | | | — | | | | 1,059,000 | |

Chief Operating Officer | | | 2011 | | | | 68,510 | | | | — | | | | 7,421 | | | | — | | | | — | | | | 286,980 | (7) | | | 362,911 | |

| | | | | | | | |

Gordon Fisher | | | 2012 | | | | 400,000 | | | | — | | | | — | | | | — | | | | 52,600 | | | | 98,670 | (4) | | | 551,270 | |

President, National Post and Executive Vice President Eastern Canada | | | 2011 | | | | 400,000 | | | | — | | | | 72,500 | | | | — | | | | 52,600 | | | | 388,642 | (4) | | | 913,742 | |

| | | | | | | | |

Michelle Hall | | | 2012 | | | | 271,878 | (9) | | | 146,000 | (12) | | | — | | | | — | | | | — | | | | — | | | | 417,878 | |

Executive Vice President, Human Resources | | | 2011 | | | | 224,000 | | | | — | | | | 75,000 | (11) | | | — | | | | — | | | | — | | | | 299,000 | |

Notes:

| (1) | Refer to the “Pension Plan – Defined Benefit Plan Table as of August 31, 2012” for additional details. |

| (2) | The value of perquisites and benefits for the NEOs, other than Messrs. Godfrey and Fisher, do not exceed either $50,000 or 10% of the NEOs annual salary, and are therefore not included in All Other Compensation. |

| (3) | This amount includes entertainment expenses totaling $107,831 (2011—$107,474). |

| (4) | This amount includes a discretionary retention bonus of $75,000 (2011—$366,000). The Company may consider similar payments in future years. |

| (5) | The base salary of Mr. Lamb for fiscal 2011 was $450,000. The salary reported in the table for fiscal 2011 included a payment for a retroactive salary increase for the period ending August 31, 2010. |

| (6) | For Fiscal 2012 this amount represents a $75,000 discretionary bonus. For fiscal 2011 this amount includes a discretionary bonus of $75,000. |

| (7) | Mr. Parrish became an employee of the Company on July 11, 2011. Prior to this date he provided executive services to the Company through his management company, Sport Media Enterprises Inc. Mr. Parrish’s compensation recorded as all other compensation for fiscal 2011 consists of amounts paid to Sport Media Enterprises Inc. |

| (8) | The total compensation value includes the estimated value of stock options granted during the year as determined using the Black-Scholes option pricing model as this is an acceptable methodology in accordance with International Financial Reporting Standards and is based on various assumptions as noted below in note 12. This amount only represents an estimated value of the stock options granted and does not represent cash received by the NEO. This amount is at risk and may be equal to zero. Accordingly, the total compensation value does not represent the true cash compensation earned by the NEO. |

| (9) | Effective January 11, 2012, Ms. Hall was promoted to Executive Vice President, Human Resources. Her salary on an annualized basis is $295,000. |

| (10) | The annual incentive plan awards in the above table relating to Fiscal 2012 were accrued in Fiscal 2012 and will be paid in fiscal 2013. The annual incentive plan awards in the above table relating to fiscal 2011 were accrued in fiscal 2011 and paid to the NEOs in Fiscal 2012. |

| (11) | This amount includes a discretionary bonus of $51,900. |

| (12) | Ms. Hall and Mr. Parrish were granted 50,000 and 200,000 stock options, respectively, on January 26, 2012. The stock options had a grant date fair value of $2.92 which was determined using the Black-Scholes option pricing model. Key assumptions used in the model were a weighted average exercise price of Shares of $6.43, risk free rate of interest of 1.33% based on the Bank of Canada five year benchmark bond yield in effect on the date of grant, dividend yield of nil, a volatility factor of 54% based in part on the volatility of the Company’s Shares and the volatility of the shares of similar companies in the media and publishing industry and an expected life of options of 5 years based partly on contractual terms and a published academic study. |

20

Performance Graph

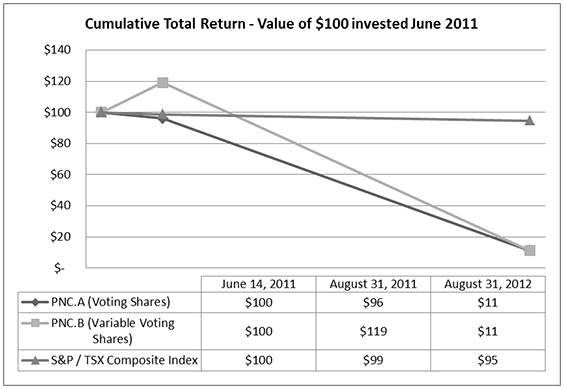

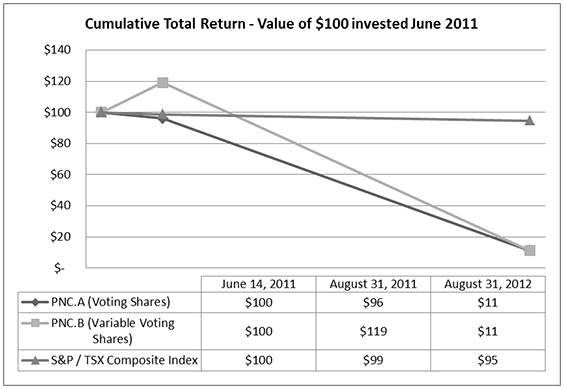

The graph set out below illustrates the cumulative total return over the period from June 14, 2011 (Postmedia’s listing date on the TSX) to August 31, 2012, of a $100 investment in the Voting Shares and Variable Voting Shares of Postmedia as compared to the S&P/TSX Composite Index.

The year-end values of each investment are based solely on the change in the underlying share price as no dividends were paid. The calculations exclude brokerage fees and any applicable taxes. Total shareholder returns from each investment may be calculated from the year-end investment values shown below the graph.

Note

| (1) | The data points in the performance graph above reflect the initial investment of $100 on June 14, 2011; the investment’s performance for the period covering June 14, 2011 to August 31, 2011; and the investment’s performance for the year ending August 31, 2012. |

The Compensation and Pension Committee does not base its compensation decisions on the trading price of the Voting Shares and Variable Voting Shares of the Company. The Compensation and Pension Committee believes that the trading price of the Shares is affected by external factors over which the Company has little or no control over and certain of these external factors do not necessarily reflect the operating performance of the Company.

Further, a portion of the NEOs aggregate compensation, as shown in the“Summary Compensation Table” above, is composed of option-based awards. Accordingly, long-term compensation for the NEOs is largely dependent on the trading price of the Company’s Shares. In this way, the NEOs compensation is linked to the underlying performance of the Shares.

21

Incentive Plan Awards

Option Plan

The Option Plan is intended to assist Postmedia in attracting, motivating and retaining officers and employees by granting the right to purchase Shares (“Options”), as applicable, under the Option Plan (the “Option Plan”), in order to allow them to participate in the long-term success of Postmedia and to promote a greater alignment of their interests with the interests of the shareholders of Postmedia.

Under the Option Plan, Options may be granted to participants in respect of unissued Shares. Participants are current full-time or part-time officers, employees or consultants of Postmedia or certain related entities (herein referred to as “Participants”). The Option Plan is administered by the Board (the “Plan Administrator”). In administering the Option Plan, the Plan Administrator may determine, among other things, Participants to whom Options are granted and the amounts, terms and conditions relating to Options, including the exercise price, and the time(s) when and circumstances under which Options become exercisable.

The maximum number of Shares that may be reserved for issuance at any time for the exercise of Options under the Option Plan is 3,000,000 Shares or 7.44% of the total number of Shares issued and outstanding. As of August 31, 2012, 2,080,000 Options, including 600,000 tandem Options/RSUs, or 69% of the number of Options that are reserved for issuance, have been granted under the Option Plan, representing 5.2% of the total number of Shares issued and outstanding. Therefore, there are currently 920,000 Options available to be granted under the Option Plan representing a maximum of 2.3% of the total number of Shares issued and outstanding. All Options will have a fixed exercise price, which shall not be less than the fair market value at the date of grant, being the volume-weighted average closing price of the applicable Shares on the Toronto Stock Exchange (the “TSX”) for the five trading days in which the Shares have actually traded immediately preceding such date, or if the Shares are not listed and posted for trading on any stock exchange, the fair market value of the Shares as determined by the Board in its sole discretion (“Fair Market Value”). At the election of a Participant, in lieu of exercising an Option a Participant may instead choose to surrender such Option, in whole or in part, in consideration of (i) the difference between the Fair Market Value on the date of exercise of the Shares subject to the Option and the exercise price for such Option (the “Option Value”) in the form of Shares, or (ii) the Option Value in the form of cash, subject to the consent of Postmedia. The term of any Option shall expire on the tenth anniversary of the date of grant, unless otherwise specified by the Plan Administrator at the time of grant, subject to extension of up to ten business days in the event the expiration of an Option would otherwise occur during or within two business days after the end of a Blackout Period (as such term is defined in the Option Plan). Options (including the rights attached thereto) are non-assignable and non-transferable except through devolution by death. The terms and conditions of Options granted under the Option Plan are subject to adjustments in certain circumstances, at the discretion of the Plan Administrator.

The Option Plan limits insider participation such that (i) the number of Shares issuable pursuant to the exercise of Options granted to insiders (as such term is used in the TSX Company Manual) of Postmedia under the Option Plan, together with the number of securities issuable to insiders under Postmedia’s other security based compensation arrangements (as such term is used in the TSX Company Manual), at any time, must not exceed 10% of Postmedia’s issued and outstanding Shares, and (ii) the number of Shares issued to insiders of Postmedia within any one year period pursuant to the exercise of Options, together with the number of securities issued to insiders pursuant to all of Postmedia’s other security based compensation arrangements, shall not exceed 10% of Postmedia’s issued and outstanding Shares.

Under the Option Plan, in the case of the death of a Participant, all outstanding unvested Options granted to such Participant shall immediately and automatically be deemed to be vested and the legal representatives of such Participant shall have the right to exercise part or all of the Participant’s outstanding and vested Options at any time up to and including (but not after) the earlier of the last

22