Exhibit 99.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| | |

In re: Insys Therapeutics, Inc. et al Debtors. | : : : : : : | Chapter 11 Case No. 19-11292 (KG) Jointly Administered |

INITIAL MONTHLY OPERATING REPORT

File report and attachments with Court and submit copy to United States Trustee within 15 days after order for relief.

Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation. Bank accounts and checks must bear the name of the debtor, the case number, and the designation “Debtor in Possession.” Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit agreement/certificate of authority, signature card, and/or corporate checking resolution.

| Document | Explanation |

REQUIRED DOCUMENTS | Attached | Attached |

12-Month Cash Flow Projection (Form IR-1) | Jun – Aug 2019 Cash Forecast Attached | |

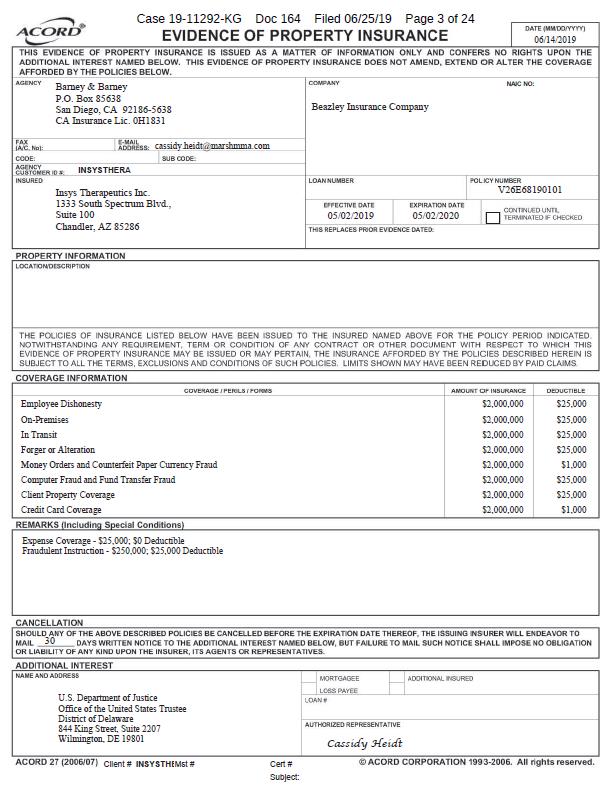

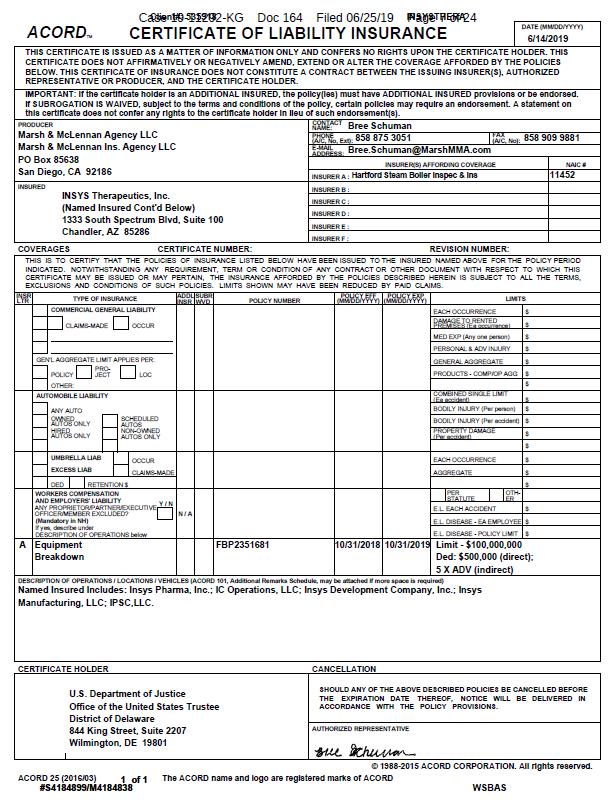

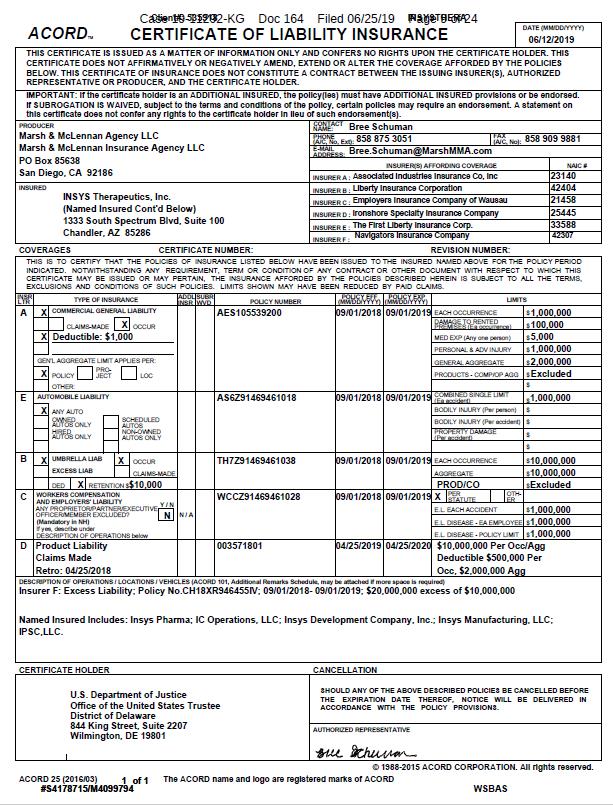

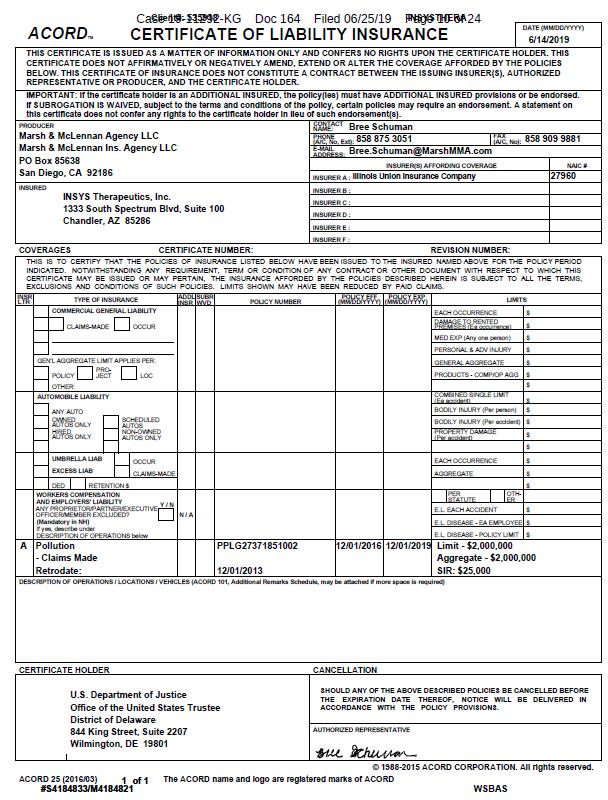

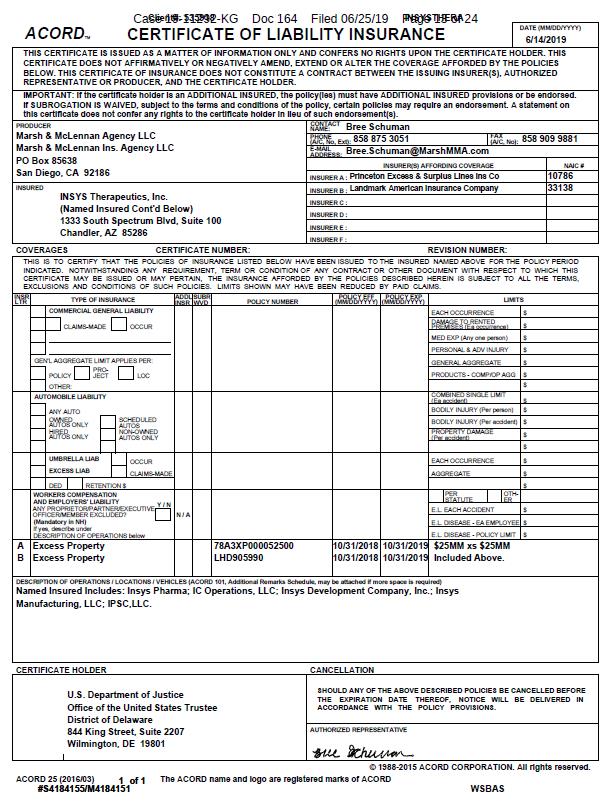

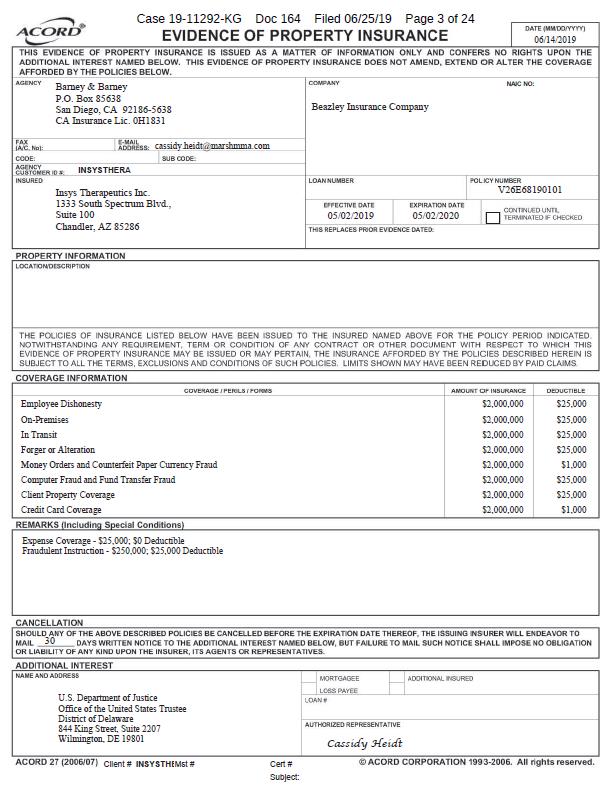

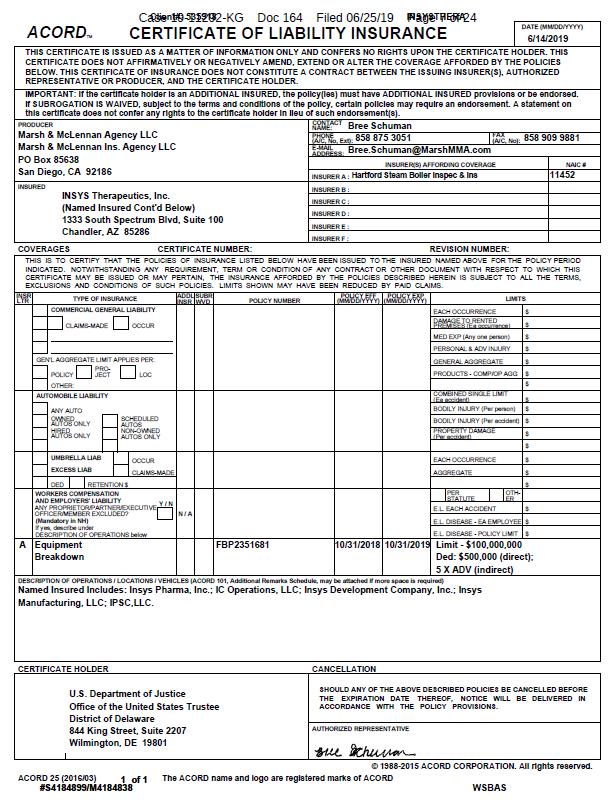

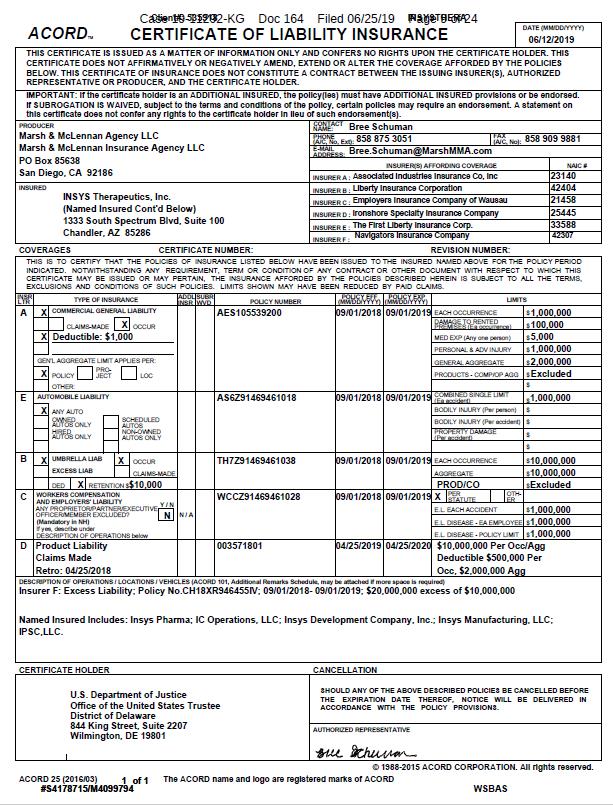

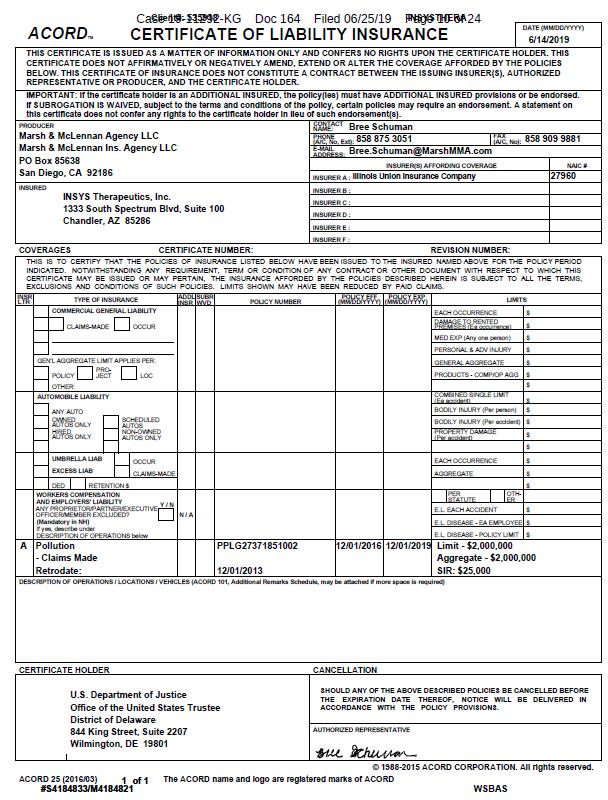

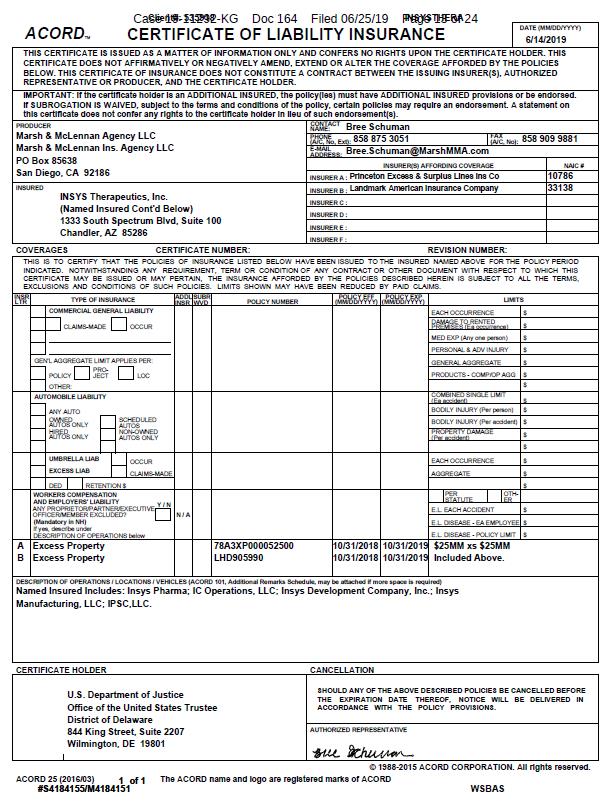

Certificates of Insurance: | | |

Workers Compensation | Attached | |

Property | Attached | |

General Liability | Attached | |

Vehicle | Attached | |

Other: | Attached | |

Identify areas of self-insurance with liability caps | | |

Evidence of Debtor in Possession Bank Accounts | | |

Tax Escrow Account | Cash Management Interim Order Attached | |

General Operating Account | | |

Money Market Account Pursuant to Local Rule 4001-3 for | | |

the District of Delaware only. Refer to: | | |

http://www.deb.uscourts.gov | | |

Other: | | |

Retainers Paid (Form IR-2) | Attached | |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief.

| |

Signature of Debtor

|

Date

|

Signature of Joint Debtor

|

Date

|

/s/ Andrece Housley

Signature of Authorized Individual* | 6/25/19

Date |

| |

Andrece Housley Printed Name of Authorized Individual | Chief Financial Officer Title of Authorized Individual |

*Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company.

Insys Therapeutics, Inc. et al - Case No. 19-11292 (KG)

| | | | | Preliminary Working Draft |

Consolidated Cash Flow Forecast | | | | | DRAFT - Subject to Material Change |

| | | | | | For Discussion Purposes Only |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

($ in Thousands) | | | | | | | | | | | | | | |

| Fiscal Year: | 2019 | | 2019 | | 2019 | | 2019 | | |

| Fiscal Month: | | Month 6 | | | Month 7 | | | Month 8 | | Jun 10 - Aug | | |

| Month Ended: | 6/10 - 6/30 | | Jul-19 | | Aug-19 | | 08/31/19 | | |

| Actual / Forecast: | Forecast | | Forecast | | Forecast | | Forecast | | |

| | | | | | | | | | | | | | | |

| Post-Petition Month: | | Month 1 | | | Month 2 | | | Month 3 | | Total | | |

| Monthly Cash Flow Budget - Consolidated | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Operating Receipts | | | | | | | | | | | | | | |

| Sales Receipts (after Gross-to-Nets settled by credit) | | $ | 4,147 | | $ | 3,676 | | $ | 3,167 | | $ | 10,989 | | |

| | | | | | | | | | | | | | | |

| Total Operating Receipts | | $ | 4,147 | | $ | 3,676 | | $ | 3,167 | | $ | 10,989 | | |

| | | | | | | | | | | | | | | |

| Operating Disbursements | | | | | | | | | | | | | | |

| Employee Related | | | (1,256 | ) | | (1,984 | ) | | (2,651 | ) | | (5,892 | ) | |

| Rent (Equipment & Buildings) & Utilities | | | (145 | ) | | (341 | ) | | (316 | ) | | (803 | ) | |

| Manufacturing Costs | | | (538 | ) | | (15 | ) | | (192 | ) | | (745 | ) | |

| Gross-to-Nets (Direct Pay) | | | (2,384 | ) | | (248 | ) | | (1,341 | ) | | (3,974 | ) | |

| Consulting / Professional Fees | | | (571 | ) | | (534 | ) | | (562 | ) | | (1,667 | ) | |

| Legal | | | - | | | - | | | (1,520 | ) | | (1,520 | ) | |

| Research and Development / Regulatory | | | (3,280 | ) | | (1,878 | ) | | (1,715 | ) | | (6,873 | ) | |

| Sales & Marketing | | | (70 | ) | | (126 | ) | | (103 | ) | | (299 | ) | |

| General and Administrative | | | (460 | ) | | (323 | ) | | (205 | ) | | (988 | ) | |

| Insurance | | | (50 | ) | | (233 | ) | | - | | | (283 | ) | |

| Board of Directors Fees | | | (54 | ) | | (194 | ) | | (194 | ) | | (441 | ) | |

| | | | | | | | | | | | | | | |

| Total Operating Disbursements | | $ | (8,810 | ) | $ | (5,876 | ) | $ | (8,798 | ) | $ | (23,484 | ) | |

| | | | | | | | | | | | | | | |

| Operating Cash Flow | | $ | (4,664 | ) | $ | (2,200 | ) | $ | (5,631 | ) | $ | (12,495 | ) | |

| | | | | | | | | | | | | | | |

| Bankruptcy Related Disbursements | | | | | | | | | | | | | | |

| Professional Fees | | | - | | | - | | | (2,420 | ) | | (2,420 | ) | |

| Utility Deposit | | | (36 | ) | | - | | | - | | | (36 | ) | |

| Vendor Deposits & Critical Vendors | | | (7,254 | ) | | - | | | - | | | (7,254 | ) | |

| | | | | | | | | | | | | | | |

| Total Bankruptcy Related Disbursements | | $ | (7,290 | ) | $ | - | | $ | (2,420 | ) | $ | (9,710 | ) | |

| | | | | | | | | | | | | | | |

| Net Cash Flow | | $ | (11,954 | ) | $ | (2,200 | ) | $ | (8,051 | ) | $ | (22,205 | ) | |

| | | | | | | | | | | | | | | |

| Cash Balance | | | | | | | | | | | | | | |

| Beginning Cash Balance | | | 37,402 | | | 25,447 | | | 23,247 | | | 37,402 | | |

| Net Cash Flow | | | (11,954 | ) | | (2,200 | ) | | (8,051 | ) | | (22,205 | ) | |

| | | | | | | | | | | | | | | |

| Ending Cash Balance before sale proceeds | | $ | 25,447 | | $ | 23,247 | | $ | 15,196 | | $ | 15,196 | | |

| | | | | | | | | | | | | | | |

| Sales proceeds net of sale expenses | | | | | | | | TBD | | TBD | | |

| Ending Cash Balance including sale proceeds | | | | | | | | TBD | | TBD | | |

| | | | | | | | | | | | | | | |

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

------------------------------------------------------x

:

In re:Chapter 11

:

INSYS THERAPEUTICS, INC., et al., :Case No. 19-11292 (KG)

:

Debtors.1:Jointly Administered

:

:Re: D.I. 4

------------------------------------------------------x

INTERIM ORDER PURSUANT TO 11 U.S.C.

§§ 105, 345, 363, 364, 503, AND 507 (I) AUTHORIZING DEBTORS

TO (A) CONTINUE USING EXISTING CASH MANAGEMENT

SYSTEM, BANK ACCOUNTS, AND BUSINESS FORMS, (B) HONOR

OBLIGATIONS RELATING THERETO, AND (C) IMPLEMENT

ORDINARY COURSE CHANGES TO CASH MANAGEMENT SYSTEM,

(II) PROVIDING ADMINISTRATIVE EXPENSE PRIORITY FOR POSTPETITION

INTERCOMPANY CLAIMS, (III) EXTENDING TIME TO COMPLY WITH

REQUIREMENTS OF 11 U.S.C. § 345(b), AND (IV) GRANTING RELATED RELIEF

Upon the motion (the “Motion”),2 dated June 10, 2019, of Insys Therapeutics, Inc. and its affiliated debtors in the above-captioned chapter 11 cases (the “Chapter 11 Cases”), as debtors and debtors in possession (collectively, the “Debtors”), pursuant to section 105, 345, 363, 364, 503, and 507 of title 11 of the United States Code (the “Bankruptcy Code”), for (a) authority, but not direction, to (i) continue their existing cash management system, including, without limitation, the continued maintenance of their existing bank accounts (the “Bank Accounts”) and business forms, (ii) implement changes to their cash management system in the ordinary course of business, including, without limitation, opening new or closing existing Bank Accounts, (iii) continue to perform under and honor postpetition intercompany transactions in the ordinary course of business, and (iv) honor obligations with respect to service fees and chargebacks in connection with existing agreements with the Banks; (b) administrative expense priority for postpetition Intercompany Claims; (c) a waiver or an extension of the time to comply

1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable, are: Insys Therapeutics, Inc. (7886); IC Operations, LLC (9659); Insys Development Company, Inc. (3020); Insys Manufacturing, LLC (0789); Insys Pharma, Inc. (9410); IPSC, LLC (6577); and IPT 355, LLC (0155). The Debtors’ mailing address is 1333 South Spectrum Blvd #100, Chandler, Arizona 85286. |

2 | Capitalized terms used herein but not otherwise defined shall have the meanings ascribed to such terms in the Motion. |

with the requirements of section 345(b) of the Bankruptcy Code to the extent they apply to the Bank Accounts; and (d) related relief, all as more fully set forth in the Motion; and the Court having jurisdiction to consider the Motion and the relief requested therein pursuant to 28 U.S.C. §§ 157 and 1334, and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated February 29, 2012; and consideration of the Motion and the requested relief being a core proceeding pursuant to 28 U.S.C. § 157(b); and venue being proper before the Court pursuant to 28 U.S.C. §§ 1408 and 1409; and due and proper notice of the Motion having been provided to the Notice Parties; and such notice having been adequate and appropriate under the circumstances, and it appearing that no other or further notice need be provided; and the Court having reviewed the Motion; and the Court having held a hearing to consider the relief requested in the Motion on an interim basis (the “Hearing”); and upon the Long Declaration, filed contemporaneously with the Motion, and the record of the Hearing; and the Court having determined that the legal and factual bases set forth in the Motion establish just cause for the relief granted herein; and it appearing that the relief requested in the Motion is necessary to avoid immediate and irreparable harm to the Debtors and their estates as contemplated by Bankruptcy Rule 6003, and is in the best interests of the Debtors, their estates, creditors, and all parties in interest; and upon all of the proceedings had before the Court and after due deliberation and sufficient cause appearing therefor,

IT IS HEREBY ORDERED THAT:

1.The Motion is granted on an interim basis, as provided herein.

2.The Debtors are authorized, but not directed, pursuant to sections 105(a), 363, and 364 of the Bankruptcy Code to continue using and managing their cash pursuant to the Cash Management System maintained by the Debtors before the Petition Date; to collect and disburse cash in accordance with the Cash Management System, including through the Intercompany Transactions; and to make ordinary course changes to their Cash Management System.

3.The Debtors are further authorized to (a) designate, maintain, and continue to use any or all of their existing Bank Accounts in the names and with the account numbers existing immediately before the Petition Date in the

ordinary course and in a manner consistent with prepetition practices; (b) deposit funds in and withdraw funds from such accounts by all usual means, including through check, wire transfer, and ACH payment, and other debits in the ordinary course and in a manner consistent with prepetition practices; (c) pay any Bank Fees or other charges associated with the Bank Accounts, whether arising before or after the Petition Date, in the ordinary course and consistent with the Debtors’ prepetition practice; and (d) treat their prepetition Bank Accounts for all purposes as debtor in possession accounts.

4.The Debtors are authorized pursuant to sections 364(a) and 503(b)(1) of the Bankruptcy Code to continue to engage in the Intercompany Transactions in the ordinary course of business, and all Intercompany Claims arising after the Petition Date shall be accorded administrative expense priority.

5.The Debtors shall maintain accurate records of all transfers within the Cash Management System so that all postpetition transfers and transactions, including intercompany transactions, shall be adequately and promptly documented in, and readily ascertainable from, their books and records, so that all transactions may be readily traced, recorded properly, and distinguished between prepetition and postpetition transactions.

6.The Debtors are authorized to use their existing Business Forms and are not required to (a) obtain new stock reflecting their status as debtors in possession or (b) print “Debtor-in-Possession,” the Debtors’ Chapter 11 Case numbers, or any other information on any of their Business Forms or wire transfers; provided that once the Debtors’ existing Business Forms have been used, the Debtors shall, when re-ordering Business Forms during the pendency of these Chapter 11 Cases, include a legend referencing the Debtors as “Debtors-In-Possession” and the lead Debtor’s bankruptcy case number on all Business Forms; provided, further, that to the extent that the Debtors or their agents print or generate checks themselves during the pendency of these Chapter 11 Cases, such checks shall include the “Debtor-In-Possession” legend and the lead Debtor’s bankruptcy case number within ten (10) business days after the date of entry of this Interim Order

7.The Debtors are further authorized, but not directed, to issue postpetition checks, wire transfers, and ACH payments, or to effect postpetition funds transfer requests, in replacement of any funds transfer requests that are dishonored as a consequence of these Chapter 11 Cases with respect to any prepetition amounts that are authorized to be paid pursuant to this Interim Order.

8.The Debtors are authorized, but not directed, to implement changes to the Cash Management System in the ordinary course of business in accordance with the terms of their existing deposit agreements, including, without limitation, the opening of any new bank accounts and the closing of any Bank Accounts as they may deem necessary and appropriate in their sole discretion, and the Banks and other financial institutions are authorized to honor the Debtors’ request to open or close, as the case may be, the Bank Accounts or additional bank accounts; provided that in the event the Debtors

open or close any Bank Accounts, such opening or closing shall be timely indicated on the Debtors’ monthly operating reports and, within five (5) business days of such opening or closing, written notice thereof shall be provided to the U.S. Trustee and any official committee appointed in these Chapter 11 Cases (subsequent to its appointment); provided, further, that the Debtors shall open any such new Bank Account at banks that have executed a Uniform Depository Agreement (a “UDA”) with the U.S. Trustee, or at such banks that are willing to immediately execute such agreement.

9.The relief, rights, and responsibilities provided for in this Interim Order shall be deemed to apply to any and all Bank Accounts maintained in the Debtors’ names, including, without limitation, any new bank accounts, whether or not such Bank Accounts are identified on Exhibit B to the Motion, and any banks at which new accounts are opened shall be subject to the rights and obligations of this Interim Order.

10.Except as otherwise expressly provided in this Interim Order, the Banks are authorized to continue to maintain, service, and administer the Bank Accounts as accounts of the Debtors as debtors in possession, without interruption and in the ordinary course, in accordance with the terms of the documents governing the Bank Accounts, and to receive, process, honor, and pay, to the extent sufficient funds are available for deposit in the applicable Bank Accounts to cover such payments, any and all checks, drafts, wire transfers, and ACH payments issued by the Debtors and drawn on the Bank Accounts after the Petition Date; provided that any payments drawn, issued or made prior to the Petition Date shall not be honored absent direction of the Debtors consistent with terms of a separate order of the Court authorizing such prepetition payment.

11.Each Bank is authorized to charge, and the Debtors are authorized to pay and honor, both prepetition and postpetition fees, costs, charges, and expenses, including the Bank Fees, to which such Bank may be entitled under the terms of and in accordance with their contractual arrangements with the Debtors.

12.Each Bank is authorized to debit the Bank Accounts in the ordinary course of business without need for further order of this Court for: (a) all checks, wire transfers, ACH payments, and other payment orders drawn on the Bank Accounts that are cashed at a Bank counter or exchanged for cashier’s checks by the payees thereof prior to a Bank’s receipt of notice of the commencement of these Chapter 11 Cases; (b) all checks, wire transfers, ACH payments, and other items deposited or credited to the Bank Accounts prior to Petition Date that have been dishonored, reversed, or returned unpaid for any reason, together with any fees and costs in connection therewith, to the same extent the Debtors were responsible for such costs and fees prior to Petition Date; and (c) all undisputed prepetition amounts outstanding as of the date hereof, if any, owed to a Bank as a Bank Fee for the maintenance of the Cash Management System.

13.Each Bank may rely on the representations of the Debtors with respect to whether any checks, drafts, wire transfers, ACH payments, or other payment order drawn or issued by the Debtors prior to, on, or subsequent to the Petition Date should be honored pursuant to this or any other order of this Court, and such Bank shall not have any liability to any party for relying on such representations by the Debtors as provided for herein, and shall not be liable to any party on account of (a) following the Debtors’ representations, instructions, or presentations as to any order of the Court (without any duty of further inquiry), (b) honoring any prepetition checks, drafts, wire transfers, or ACH payments in a good faith belief or upon a representation by the Debtors that the Court has authorized such prepetition check, draft, wire transfer, or ACH payment, or (c) an innocent mistake made despite implementation of reasonable handling procedures.

14.Those certain existing deposit agreements between the Debtors and the Banks shall continue to govern the postpetition cash management relationship between the Debtors and the Banks, and all of the provisions of such agreements, including, without limitation, the termination and fee provisions, shall remain in full force and effect.

15.The Debtors shall have forty-five (45) days (or such additional time as to which the U.S. Trustee may agree) from the Petition Date within which to either come into compliance with section 345(b) of the Bankruptcy Code or to make such other arrangements as agreed to by the U.S. Trustee, and such extension is without prejudice to the Debtors’ right to request a further extension or waiver of the requirements of section 345(b) of the Bankruptcy Code.

16.For all Banks at which the Debtors maintain Bank Accounts that are party to a UDA with the U.S. Trustee, within fifteen (15) days of the date of entry of this Interim Order, the Debtors shall (a) contact each such Bank; (b) provide each such Bank with each of the Debtors’ employer identification numbers; and (c) identify each of the Bank Accounts held at such Banks as being held by a debtor in possession in a Chapter 11 Case.

17.For all Banks at which the Debtors maintain Bank Accounts that are not party to a UDA with the U.S. Trustee, the Debtors shall use their good faith efforts to cause such Banks to execute a UDA in a form prescribed by the Office of the United States Trustee within forty-five (45) days of the date of entry of this Interim Order.

18.Notwithstanding the Debtors’ use of a consolidated Cash Management System, the Debtors shall calculate quarterly fees under 28 U.S.C. § 1930(a)(6) based on the disbursements of each Debtor, regardless of which entity pays those disbursements.

19.Nothing in the Motion or this Interim Order shall be deemed to authorize the Debtors to accelerate any payments not otherwise due prior to the date of the hearing to consider entry of a final order on the Motion (the “Final Hearing”).

20.Nothing contained in the Motion or this Interim Order, nor any payment made pursuant to the authority granted by this Interim Order, is intended to be or shall be construed as (a) an admission as to the validity of any claim against the Debtors; (b) a waiver of the Debtors’ or any appropriate party in interest’s rights to dispute the amount of, basis for, or validity of any claim against the Debtors; (c) a waiver of any claims or causes of action that may exist against any creditor or interest holder; or (d) an approval, assumption, adoption, or rejection of any agreement, contract, lease, program, or policy between the Debtors and any third party under section 365 of the Bankruptcy Code.

21.The requirements of Bankruptcy Rule 6003(b) have been satisfied.

22.Under the circumstances of these Chapter 11 Cases, notice of the Motion is adequate under Bankruptcy Rule 6004(a) and Local Rule 9013-1(m).

23.Notwithstanding Bankruptcy Rule 6004(h), this Interim Order shall be immediately effective and enforceable upon its entry.

24.The Debtors are authorized to take all actions necessary to implement the relief granted in this Interim Order.

25.The Court shall retain jurisdiction to hear and determine all matters arising from or related to the implementation, interpretation, and/or enforcement of this Interim Order.

26.The Final Hearing on the Motion shall be held on July 8, 2019 at _9_:00 am (Prevailing Eastern Time) and any objections or responses to the Motion shall be in writing, filed with the Court, and served upon (a) the proposed attorneys for the Debtors, (i) Weil, Gotshal & Manges LLP, 767 Fifth Avenue, New York, New York 10153 (Attn: Gary T. Holtzer, Esq., Ronit J. Berkovich, Esq., and Candace M. Arthur, Esq.), and (ii) Richards, Layton & Finger, P.A., One Rodney Square, 920 North King Street, Wilmington, Delaware 19801 (Attn: John H. Knight, Esq., Paul N. Heath, Esq., and Amanda R. Steele, Esq.); and (b) the Notice Parties; in each case, on or prior to July 1, 2019 at 4:00 p.m. (Prevailing Eastern Time).

Dated: June 11, 2019

Wilmington, Delaware

/s/ Kevin Gross

THE HONORABLE KEVIN GROSS

UNITED STATES BANKRUPTCY JUDGE

United States Bankruptcy Court | | | | | | | | | | | | |

District of Delaware | | | | | | | | | | | | |

| | | | | | | | | | | | |

In Re: | | | | | | | | | | | | |

Insys Therapeutics, Inc., et al. | | | | | | | | | | | | |

Debtors | | | | | | | | | | | | |

| | | | | | | | | | | | |

Schedule of Retainers | |

All amounts in USD | | | | | | | | | | | | |

Payee | Name of Payor | Payment Method | Payment Date(s) | Total Retainer | | Total Amount Applied | | Balance of Retainer at June 9, 2019 | |

BDO USA, LLP | Insys Therapeutics, Inc. | Wire | 6/7/2019 | $ | 397,550 | | $ | - | | $ | 397,550 | |

Ernst & Young | Insys Therapeutics, Inc. | Wire | 6/7/2019 | | 25,000 | | | - | | | 25,000 | |

Epiq Corporate Restructuring, LLC | Insys Therapeutics, Inc. | Wire | 5/23/2019 6/7/2019 | | 90,000 | | | 81,039 | | | 8,961 | |

FTI Consulting, LLC | Insys Therapeutics, Inc. | Wire | 4/26/2019 6/7/2019 | | 500,000 | | | 309,119 | | | 190,881 | |

Lazard Freres & Co, LLC | Insys Therapeutics, Inc. | Wire | 6/7/2019 | | 10,000 | | | 10,000 | | | - | |

Richards, Layton, & Finger, PA | Insys Therapeutics, Inc. | Wire | 5/31/2019 6/7/2019 | | 374,909 | | | 374,909 | | | - | |

Weil, Gotshal & Manges LLP1 | Insys Therapeutics, Inc. | Wire | Various | | 9,296,634 | | | 5,846,232 | | | 3,450,402 | |

Wilson, Sonsini, Goodrich & Rosati, P.C. | Insys Therapeutics, Inc. | Wire | Various | | 500,000 | | | - | | | 500,000 | |

| | | | | | | | | | | | |

Total | | | | $ | 11,194,092 | | $ | 6,621,298 | | $ | 4,572,794 | |

| | | | | | | | | | | | |

Footnotes | | | | | | | | | | | | |

1 Per Weil, Gotshal & Manges, LLP, advance retainer amount fluctuated over time. The highest retainer balance preceding petition date equal to $3,450,402. | |