THIS WARRANT AND THE SECURITIES ISSUABLE UPON THE EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED, HYPOTHECATED, OR OTHERWISE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT REGISTRATION IS NOT REQUIRED UNDER SUCH ACT OR UNLESS SOLD PURSUANT TO RULE 144 UNDER SUCH ACT.

| | | | | | | | |

| Date of Issuance | | Expiration Date |

| March 10, 2017 | | March 10, 2027 |

DOXIMITY, INC.

WARRANT TO PURCHASE SHARES OF COMMON STOCK

In consideration for the services performed by U.S. News & World Report, L.P. (“U.S. News”) pursuant to that certain Agreement (the “Agreement”), dated as of March 10, 2017, by and between U.S. News and Doximity, Inc. (the “Company”), the receipt and sufficiency of which is hereby acknowledged, this Warrant is issued to U.S. News or its assigns (the “Holder”) by the Company.

1. Purchase of Shares.

(a) Number of Shares. Subject to the terms and conditions set forth herein, the Holder is entitled, upon surrender of this Warrant at the principal office of the Company (or at such other place as the Company shall notify the Holder in writing), to purchase from the Company up to 125,000 fully paid and nonassessable shares of the Company’s Common Stock, par value $0,001 per share (the “Common Stock”).

(b) Exercise Price. The exercise price for the shares of Common Stock issuable pursuant to this Section 1 (the “Shares”) shall be $1.43 per share (the “Exercise Price”). The Shares and the Exercise Price shall be subject to adjustment pursuant to Section 8 hereof.

2. Exercise Period. The Shares issuable upon exercise of this Warrant shall vest and become exercisable, in whole or in part, as follows: 1/60th of the Shares shall vest and become exercisable on March 1, 2017 and l/60th of the Shares shall vest and become exercisable on the first day each month thereafter, provided that (a) except as provided in the next sentence, the Agreement has not terminated and remains in effect as of each such vesting date and (b) no Shares may be exercised after 5:00 p.m. Pacific Time on the Expiration Date set forth above. If the Agreement is terminated by the Company under Section 8.c. thereof (termination at the Company’s option) or by U.S. News under Section 8.d. thereof (termination due to a material breach by the Company), the Shares issuable upon exercise of the Warrant shall continue to vest monthly in accordance with the previous sentence. Notwithstanding the foregoing, immediately prior to the closing of a Liquidation Event, as such term is defined in the Company’s current Amended and Restated Certificate of Incorporation on file with the Secretary of State of the State of Delaware (a “Liquidation Event”), this Warrant shall automatically, and without any payment by the Holder or any other action required on the part of the Holder, be deemed exercised in full for all Shares, on a net exercise basis pursuant to Section 4, unless Holder shall earlier provide written notice to the Company that the Holder desires to exercise this Warrant by a method described in Section 3(a) or that this Warrant expire unexercised. In such event, the fair market value of

one Share shall mean the fair market value of the consideration to be received by a stockholder in exchange for one share of the same series and class as the Shares in connection with such Liquidation Event. The Company will take all actions reasonably requested by the Holder to effectuate the net issue exercise pursuant to this section.

3. Method of Exercise.

(a) While this Warrant remains outstanding and exercisable in accordance with Section 2 above, the Holder may exercise, in whole or in part, the purchase rights evidenced hereby. Such exercise shall be effected by:

(i) the surrender of the Warrant, together with a duly executed copy of the Notice of Exercise attached hereto, to the Secretary of the Company at its principal office (or at such other place as the Company shall notify the Holder in writing); and

(ii) the payment to the Company of an amount equal to the aggregate Exercise Price for the number of Shares being purchased.

(b) Each exercise of this Warrant shall be deemed to have been effected immediately prior to the close of business on the day on which this Warrant is surrendered to the Company as provided in Section 3(a) above. At such time, the person or persons in whose name or names any certificate for the Shares shall be issuable upon such exercise as provided in Section 3(c) below shall be deemed to have become the holder or holders of record of the Shares represented by such certificate.

(c) As soon as practicable after the exercise of this Warrant in whole or in part, the Company at its expense will cause to be issued in the name of, and delivered to, the Holder, or as such Holder (upon payment by such Holder of any applicable transfer taxes) may direct:

(i) a certificate or certificates for the number of Shares to which such Holder shall be entitled, and

(ii) in case such exercise is in part only, a new warrant or warrants (dated the date hereof) of like tenor, calling in the aggregate on the face or faces thereof for the number of Shares equal to the number of such Shares described in this Warrant minus the number of such Shares purchased by the Holder upon all exercises made in accordance with Section 3(a) above or Section 4 below.

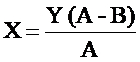

4. Net Exercise. In lieu of exercising this Warrant for cash, the Holder may elect to receive shares equal to the value of this Warrant (or the portion thereof being exercised) by surrender of this Warrant at the principal office of the Company together with notice of such election (a “Net Exercise”). A Holder who Net Exercises shall have the rights described in Sections 3(b) and 3(c) hereof, and the Company shall issue to such Holder a number of Shares computed using the following formula:

Where

X = The number of Shares to be issued to the Holder.

Y = The number of Shares purchasable under this Warrant or, if only a portion of the Warrant is being exercised, the portion of the Warrant being exercised (at the date of such calculation).

A = The fair market value of one (1) Share (at the date of such calculation).

B = The Exercise Price (as adjusted to the date of such calculation).

For purposes of this Warrant, including this Section 4, the fair market value of a Share shall mean (a) if the Common Stock is traded on a U.S. national securities exchange, then the fair market value shall be deemed to be the closing sale price on such exchange on the applicable date of valuation; (b) if the Common Stock is not traded on any national securities exchange nor quoted on any market quotation system, then the fair market value shall be the value as determined in good faith by the Company’s Board of Directors upon a review of relevant factors, including recent sales of the Company’s securities and the then current valuation determined for purposes of Section 409A of the Internal Revenue Code; and (c) if this Warrant is exercised in connection with the consummation of the Company’s sale of its Common Stock or other securities in the Company’s first underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933, as amended (other than a registration statement relating either to sale of securities to employees of the Company pursuant to its stock option, stock purchase or similar plan or a SEC Rule 145 transaction) (such public offering, the “Initial Public Offering”), the fair market value per Share shall be the per share offering price to the public of the Initial Public Offering.

5. Withholding Taxes. In the event that the Company determines that it is required to withhold any tax (including without limitation any income tax, social insurance contributions, payroll tax, payment on account or other tax-related items arising (the “Tax-Related Items”)) as a result of the grant, vesting or exercise of this Warrant, or as a result of the vesting or transfer of shares acquired upon exercise of this Warrant, the Holder, as a condition of this Warrant, shall make arrangements satisfactory to the Company to enable it to satisfy all Tax-Related Items. The Holder acknowledges that the responsibility for all Tax-Related Items is the Holder’s and may exceed the amount actually withheld by the Company (or its affiliate or agent).

6. Representations and Warranties of the Company. In connection with the transactions provided for herein, the Company hereby represents and warrants to the Holder that:

(a) Organization, Good Standing, and Qualification. The Company is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware and has all requisite corporate power and authority to carry on its business as now conducted. The Company is duly qualified to transact business and is in good standing in each jurisdiction in which the failure to so qualify would have a material adverse effect on its business or properties.

(b) Authorization. Except as may be limited by applicable bankruptcy, insolvency, reorganization or similar laws relating to or affecting the enforcement of creditors’ rights, all corporate action has been taken on the part of the Company, its officers, directors, and stockholders necessary for the authorization, execution and delivery of this Warrant. The Company has taken all corporate action required to make all the obligations of the Company reflected in the provisions of this Warrant the valid and enforceable obligations they purport to be. The Company has authorized sufficient shares of Common Stock to allow for the exercise of this Warrant.

7. Representations and Warranties of the Holder. In connection with the transactions provided for herein, the Holder hereby represents and warrants to the Company that:

(a) Authorization. Holder represents that it has full power and authority to enter into this Warrant. This Warrant constitutes the Holder’s valid and legally binding obligation, enforceable in accordance with its terms, except as may be limited by (i) applicable bankruptcy, insolvency, reorganization, or similar laws relating to or affecting the enforcement of creditors’ rights and (ii) laws relating to the availability of specific performance, injunctive relief or other equitable remedies.

(b) Purchase Entirely for Own Account. The Holder acknowledges that this Warrant is entered into by the Holder in reliance upon such Holder’s representation to the Company that the Warrant and the Shares (collectively, the “Securities”) will be acquired for investment for the Holder’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that the Holder has no present intention of selling, granting any participation in or otherwise distributing the same. By acknowledging this Warrant, the Holder further represents that the Holder does not have any contract, undertaking, agreement, or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to the Securities.

(c) Disclosure of Information. The Holder acknowledges that it has received all the information it considers necessary or appropriate for deciding whether to acquire the Securities. The Holder further represents that it has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the offering of the Securities.

(d) Investment Experience. The Holder is an investor in securities of companies in the development stage and acknowledges that it is able to fend for itself, can bear the economic risk of its investment, and has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of the investment in the Securities. If other than an individual, the Holder also represents it has not been organized solely for the purpose of acquiring the Securities.

(e) Accredited Investor. The Holder is an “accredited investor” within the meaning of Rule 501 of Regulation D, as presently in effect, as promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended.

(f) Restricted Securities. The Holder understands that the Securities are characterized as “restricted securities” under the federal securities laws inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that under such laws and applicable regulations such securities may be resold without registration under the Act, only in certain limited circumstances. In this connection, the Holder represents that it is familiar with Rule 144, as presently in effect, as promulgated by the SEC under the Act (“Rule 144”), and understands the resale limitations imposed thereby and by the Act.

(g) Transfers. Subject to compliance with the terms and conditions of this Section 7(g), this Warrant (and the Shares issuable upon exercise) and all rights hereunder are transferable, without charge to the Holder (except for transfer taxes), upon surrender of this Warrant properly endorsed or accompanied by written instructions of transfer. Without in any way limiting the representations set forth above, the Holder further agrees not to make any disposition of all or any portion of the Securities unless and until the transferee has agreed in writing for the benefit of the Company to be bound by the terms of this Warrant, including, without limitation, Section 20 and:

(i) there is then in effect a registration statement under the Act covering such proposed disposition and such disposition is made in accordance with such registration statement; or (ii) the Holder shall have notified the Company of the proposed disposition and shall have furnished the Company with a detailed statement of the circumstances surrounding the proposed disposition, and if reasonably requested by the Company, the Holder shall have furnished the Company with an opinion of counsel, reasonably satisfactory to the Company, that such disposition will not require registration of such shares under the Act. It is agreed that the Company will not require opinions of counsel for transfers to an affiliate of the Holder or for transactions made pursuant to Rule 144 except in extraordinary circumstances.

(h) Legends. It is understood that the Securities may bear the following legend:

“THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED, HYPOTHECATED, OR OTHERWISE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT REGISTRATION IS NOT REQUIRED UNDER SUCH ACT OR UNLESS SOLD PURSUANT TO RULE 144 UNDER SUCH ACT.”

8. Adjustment of Exercise Price and Number of Shares. The number and kind of Shares purchasable upon exercise of this Warrant and the Exercise Price shall be subject to adjustment from time to time as follows:

(a) Subdivisions, Combinations and Other Issuances. If the Company shall at any time after the issuance but prior to the expiration of this Warrant subdivide its Common Stock, by split-up or otherwise, or combine its Common Stock, or issue additional shares of its preferred stock or Common Stock as a dividend with respect to any shares of its Common Stock, the number of Shares issuable on the exercise of this Warrant shall forthwith be proportionately increased in the case of a subdivision or stock dividend, or proportionately decreased in the case of a combination. Appropriate adjustments shall also be made to the Exercise Price payable per share, but the aggregate Exercise Price payable for the total number of Shares purchasable under this Warrant (as adjusted) shall remain the same. Any adjustment under this Section 8(a) shall become effective at the close of business on the date the subdivision or combination becomes effective, or as of the record date of such dividend, or in the event that no record date is fixed, upon the making of such dividend.

(b) Reclassification, Reorganization and Consolidation. In case of any reclassification, capital reorganization or change in the capital stock of the Company (other than as a result of a subdivision, combination or stock dividend provided for in Section 8(a) above), then, as a condition of such reclassification, reorganization or change, lawful provision shall be made, and duly executed documents evidencing the same from the Company or its successor shall be delivered to the Holder, so that the Holder shall have the right at any time prior to the expiration of this Warrant to purchase, at a total price equal to that payable upon the exercise of this Warrant, the kind and amount of shares of stock and other securities or property receivable in connection with such reclassification, reorganization or change by a holder of the same number and type of securities as were purchasable as Shares by the Holder immediately prior to such reclassification, reorganization or change. In any such case appropriate provisions shall be made with respect to the rights and interest of the Holder so that the provisions hereof shall thereafter be applicable with respect to any shares of stock or other securities or

property deliverable upon exercise hereof, and appropriate adjustments shall be made to the Exercise Price per Share payable hereunder, provided the aggregate Exercise Price shall remain the same.

(c) Notice of Adjustment. When any adjustment is required to be made in the number or kind of shares purchasable upon exercise of the Warrant, or in the Exercise Price, the Company shall promptly notify the Holder of such event and of the number of Shares or other securities or property thereafter purchasable upon exercise of this Warrant.

9. No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant, but in lieu of such fractional shares the Company shall make a cash payment therefor on the basis of the Exercise Price then in effect.

10. No Stockholder Rights. Prior to exercise of this Warrant, the Holder shall not be entitled to any rights of a stockholder with respect to the Shares, including (without limitation) the right to vote such Shares, receive dividends or other distributions thereon, exercise preemptive rights or be notified of stockholder meetings, and, except as otherwise provided in this Warrant, such Holder shall not be entitled to any stockholder notice or other communication concerning the business or affairs of the Company.

11. Governing Law. This Warrant shall be governed by and construed under the laws of the State of Delaware as applied to agreements among Delaware residents, made and to be performed entirely within the State of Delaware.

12. Successors and Assigns. The terms and provisions of this Warrant shall inure to the benefit of, and be binding upon, the Company and the holders hereof and their respective successors and assigns.

13. Counterparts. This Warrant may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

14. Titles and Subtitles. The titles and subtitles used in this Warrant are used for convenience only and are not to be considered in construing or interpreting this Warrant.

15. Notices. All notices and other communications given or made pursuant hereto shall be in writing and shall be deemed effectively given: (a) upon personal delivery to the party to be notified, (b) five (5) days after having been sent by registered or certified mail, return receipt requested, postage prepaid, or (c) one (1) day after deposit with a nationally recognized overnight courier, specifying next day delivery, with written verification of receipt. All communications shall be sent to the respective parties at the following addresses (or at such other addresses as shall be specified by notice given in accordance with this Section 16):

If to the Company:

Doximity, Inc.

500 Third Street,

Suite 510 San Francisco, CA 94107

If to Holder:

At the address shown on the signature page hereto.

16. Finder’s Fee. Each party represents that it neither is or will be obligated for any finder’s fee or commission in connection with this transaction. The Holder agrees to indemnify and to hold harmless the Company from any liability for any commission or compensation in the nature of a finder’s fee (and the costs and expenses of defending against such liability or asserted liability) for which the Holder or any of its officers, partners, employees or representatives is responsible. The Company agrees to indemnify and hold harmless the Holder from any liability for any commission or compensation in the nature of a finder’s fee (and the costs and expenses of defending against such liability or asserted liability) for which the Company or any of its officers, employees or representatives is responsible.

17. Expenses. If any action at law or in equity is necessary to enforce or interpret the terms of this Warrant, the prevailing party shall be entitled to reasonable attorneys’ fees, costs and necessary disbursements in addition to any other relief to which such party may be entitled.

18. Entire Agreement; Amendments and Waivers. This Warrant and any other documents delivered pursuant hereto constitute the full and entire understanding and agreement between the parties with regard to the subjects hereof and thereof. Nonetheless, any term of this Warrant may be amended and the observance of any term of this Warrant may be waived (either generally or in a particular instance and either retroactively or prospectively), with the written consent of the Company and the Holder; or if this Warrant has been assigned in part, by the holders or rights to purchase a majority of the shares originally issuable pursuant to this Warrant.

19. Severability. If any provision of this Warrant is held to be unenforceable under applicable law, such provision shall be excluded from this Warrant and the balance of the Warrant shall be interpreted as if such provision were so excluded and shall be enforceable in accordance with its terms.

20. “Market Stand-Off” Agreement. The Holder hereby agrees that it will not, without the prior written consent of the managing underwriter, during the period commencing on the date of the final prospectus relating to the Initial Public Offering and ending on the date specified by the Company and the managing underwriter (such period not to exceed one hundred eighty (180) days) (i) lend, offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any shares of Common Stock or any securities convertible into or exercisable or exchangeable for Common Stock (whether such shares or any such securities are then owned by the Holder or are thereafter acquired), or (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Common Stock, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of Common Stock or other securities, in cash or otherwise. The foregoing provisions of this Section 20. shall apply only to the Initial Public Offering, shall not apply to the sale of any shares to an underwriter pursuant to an underwriting agreement, and shall only be applicable to the Holder if all officers, directors and greater than 1% stockholders of the Company enter into similar agreements. The underwriters in connection with the Initial Public Offering are intended third-party beneficiaries of this Section 20 and shall have the right, power and authority to enforce the provisions hereof as though they were a party hereto. The Holder further agrees to execute such agreements as may be reasonably requested by the underwriters in the Initial Public Offering that are consistent with this Section 20 or that are necessary to give further effect thereto.

In order to enforce the foregoing covenant, the Company may impose stop-transfer instructions with respect to shares of the Company’s capital stock acquired through the exercise of this Warrant (and the shares or securities of every other person subject to the foregoing restriction) until the end of such

period. Notwithstanding the foregoing, if (i) during the last seventeen (17) days of the one hundred eighty (180)-day restricted period, the Company issues an earnings release or material news or a material event relating to the Company occurs; or (ii) prior to the expiration of the one hundred eighty (180)-day restricted period, the Company announces that it will release earnings results during the sixteen (16)-day period beginning on the last day of the one hundred eighty (180)-day period, the restrictions imposed by this Section 21 shall continue to apply until the expiration of the eighteen (18)-day period beginning on the issuance of the earnings release or the occurrence of the material news or material event.

The Holder agrees that a legend reading substantially as follows shall be placed on all certificates representing all shares or securities of the Company of the Holder (and the shares or securities of every other person subject to the restriction contained in this Section 20):

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO A LOCK-UP PERIOD AFTER THE EFFECTIVE DATE OF THE ISSUER’S REGISTRATION STATEMENT FILED UNDER THE ACT, AS AMENDED, AS SET FORTH IN AN AGREEMENT BETWEEN THE COMPANY AND THE ORIGINAL HOLDER OF THESE SECURITIES, A COPY OF WHICH MAY BE OBTAINED AT THE ISSUER’S PRINCIPAL OFFICE. SUCH LOCK-UP PERIOD IS BINDING ON TRANSFEREES OF THESE SHARES.”

IN WITNESS WHEREOF, the parties have executed this Warrant as of the date first written above.

| | | | | |

| DOXIMITY, INC. |

| |

| |

| |

| By: | /s/ Jeff Tangney |

| Name | Jeff Tangney |

| Title: | CEO |

ACKNOWLEDGED AND AGREED:

HOLDER

| | | | | |

| By: | /s/ Peter Dworskin |

| Name | Peter Dworskin |

| Title: | Senior V-P |

NOTICE OF EXERCISE

DOXIMITY, INC.

Attention: Corporate Secretary

The undersigned hereby elects to purchase, pursuant to the provisions of the Warrant, as follows:

☐ shares of Common Stock pursuant to the terms of the attached Warrant, and tenders herewith payment in cash of the Exercise Price of such Shares in full, together with all applicable transfer taxes, if any.

☐ Net Exercise the attached Warrant with respect to Shares.

The undersigned hereby represents and warrants that Representations and Warranties in Section 7 hereof are true and correct as of the date hereof.

| | | | | | | | | | | | | | |

| | | HOLDER: |

| | | | |

| Date: | | | By: | |

| | | | |

| | | Address: | |

| | | | |

| | | | |

| Name in which shares should be registered: | | | |

| | | |