ORIGIN BANCORP, INC. _______ 1Q TWENTY22 INVESTOR PRESENTATION ORIGIN BANCORP, INC.

ORIGIN BANCORP, INC. _______ This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin Bancorp, Inc.'s ("Origin" or the "Company") future financial performance, business and growth strategy, projected plans and objectives, including the Company's loan loss reserves and allowance for credit losses related to the COVID-19 pandemic and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including expectations regarding and efforts to respond to the COVID-19 pandemic and changes to interest rates by the Federal Reserve and the resulting impact on Origin's results of operations, estimated forbearance amounts and expectations regarding the Company's liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin's control. Statements or statistics preceded by, followed by or that otherwise include the words "assumes," "anticipates," "believes," "estimates," "expects," “foresees,” "intends," "plans," "projects," and similar expressions or future or conditional verbs such as "could," "may," “might,” "should," "will," and "would" and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect the Company's future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: deterioration of Origin's asset quality; factors that can impact the performance of Origin's loan portfolio, including real estate values and liquidity in Origin's primary market areas; the financial health of Origin's commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin's loans; Origin's ability to anticipate interest rate changes and manage interest rate risk (including the impact of higher interest rates on macroeconomic conditions, and customer and client behavior); the effectiveness of Origin's risk management framework and quantitative models; the risk of widespread inflation; Origin's inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin's common stockholders, repurchase Origin's shares of common stock and satisfy obligations as they become due; business and economic conditions generally and in the financial services industry, nationally and within Origin's primary market areas, including the impact of supply-chain disruptions and labor pressures; changes in Origin's operation or expansion strategy or Origin's ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin's ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; increasing costs as Origin grows deposits; operational risks associated with Origin's business; volatility and direction of market interest rates; increased competition in the financial services industry, particularly from regional and national institutions; difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin's level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin's loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities, and tax matters; Origin's ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin's non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the transition away from the London Interbank Offered Rate ("LIBOR") and the impact of any replacement alternatives such as the Secured Overnight Financing Rate ("SOFR") on Origin's business; possible changes in trade, monetary, and fiscal policies, laws, and regulations and other activities of governments, agencies and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities (including the impacts related to or resulting from Russia's military action in Ukraine, including the imposition of additional sanctions and export controls, as well as the broader impacts to financial markets and the global macroeconomic and geopolitical environments), regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin's control; and system failures, cybersecurity threats and/or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors" in Origin's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") and any updates to those sections set forth in Origin's subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin's underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise. The risks relating to the proposed BTH merger include, without limitation, failure to obtain the approval of shareholders of BTH and Origin in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Origin and BTH, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; and the difficulties and risks inherent with entering new markets. New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Furthermore, many of these risks and uncertainties are currently amplified by, may continue to be amplified by, or may, in the future, be amplified by the COVID-19 pandemic and the impact of varying governmental responses that affect Origin's customers and the economies where they operate. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin's behalf may issue. Annualized, pro forma, adjusted projected and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results. Certain prior period amounts have been reclassified to conform to the current year financial statement presentations. These reclassifications did not impact previously reported net income or comprehensive income. Origin reports its results in accordance with United States generally accepted accounting principles ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures used in managing its business may provide meaningful information to investors about underlying trends in its business. Management uses these non-GAAP measures to evaluate the Company's operating performance and believes that these non-GAAP measures provide information that is important to investors and that is useful in understanding Origin's results of operations. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: • Tangible common equity is defined as total common stockholders' equity less goodwill and other intangible assets, net • Tangible book value per common share is determined by dividing tangible common equity by common shares outstanding at the end of the period • Pre-tax, pre-provision earnings is calculated by adding provision for credit losses and income tax expense to net income • Pre-tax, pre-provision return on average assets is calculated by dividing pre-tax, pre-provision earnings by number of days in the quarter, multiplying by the number of days in the year, then dividing by total average assets • Pre-tax, pre-provision return on average stockholder's equity is calculated by dividing pre-tax, pre-provision earnings by number of days in the quarter, multiplying by the number of days in the year, then dividing by total average stockholder's equity • Total core deposits is calculated by subtracting brokered deposits and time deposits greater than $250,000 from total deposits. See slides 20-22 in this presentation for a reconciliation between the non-GAAP measures used in this presentation and their comparable GAAP numbers. 2 FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES

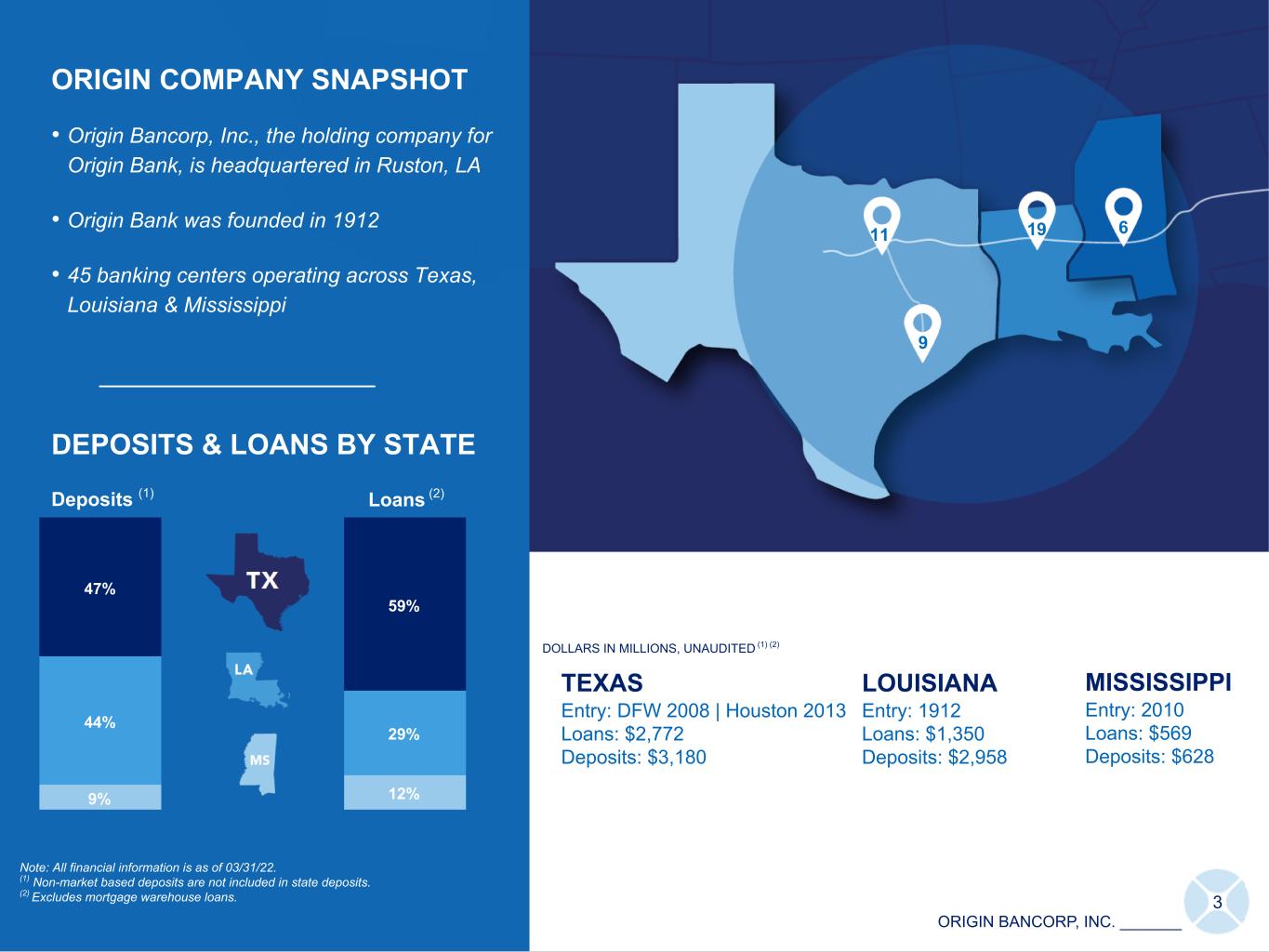

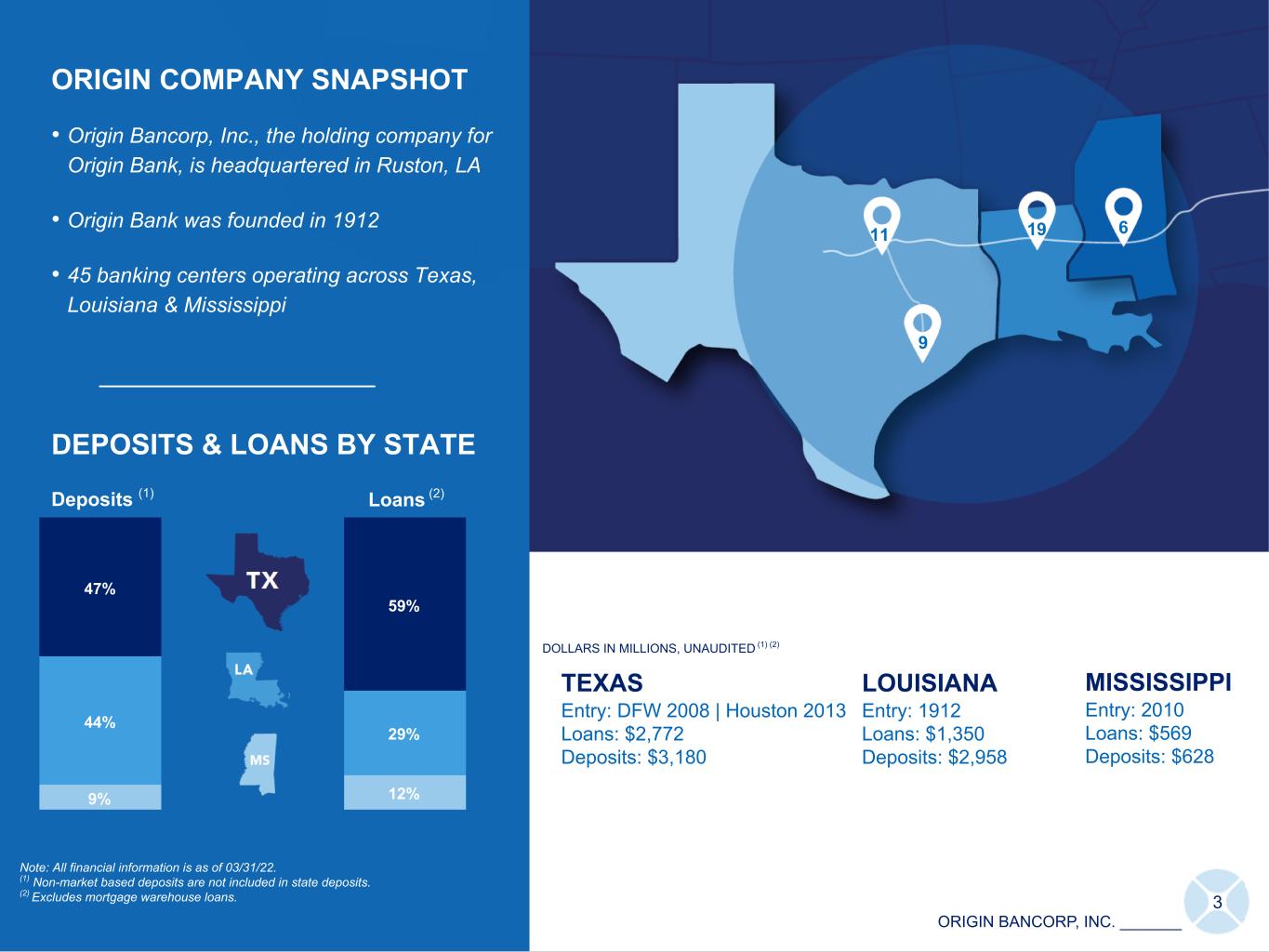

ORIGIN BANCORP, INC. _______ 9 11 19 6 TEXAS Entry: DFW 2008 | Houston 2013 Loans: $2,772 Deposits: $3,180 LOUISIANA Entry: 1912 Loans: $1,350 Deposits: $2,958 DOLLARS IN MILLIONS, UNAUDITED (1) (2) 3 ORIGIN COMPANY SNAPSHOT • Origin Bancorp, Inc., the holding company for Origin Bank, is headquartered in Ruston, LA • Origin Bank was founded in 1912 • 45 banking centers operating across Texas, Louisiana & Mississippi DEPOSITS & LOANS BY STATE Note: All financial information is as of 03/31/22. (1) Non-market based deposits are not included in state deposits. (2) Excludes mortgage warehouse loans. MISSISSIPPI Entry: 2010 Loans: $569 Deposits: $628 9% 12% 44% 29% 47% 59% Loans (2)Deposits (1) ICS ICS

ORIGIN BANCORP, INC. _______ 4 A UNIQUE & DEFINED CULTURE

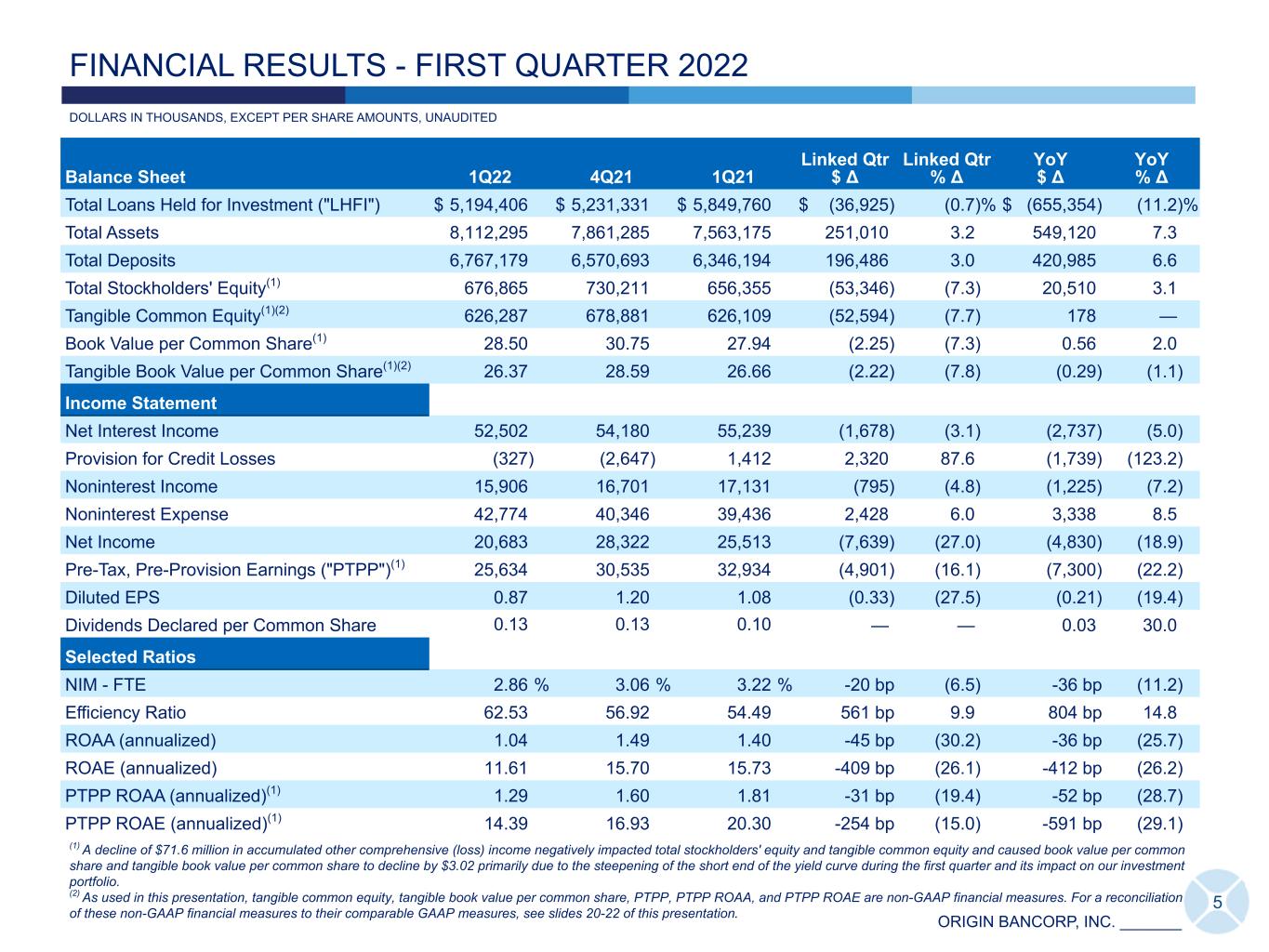

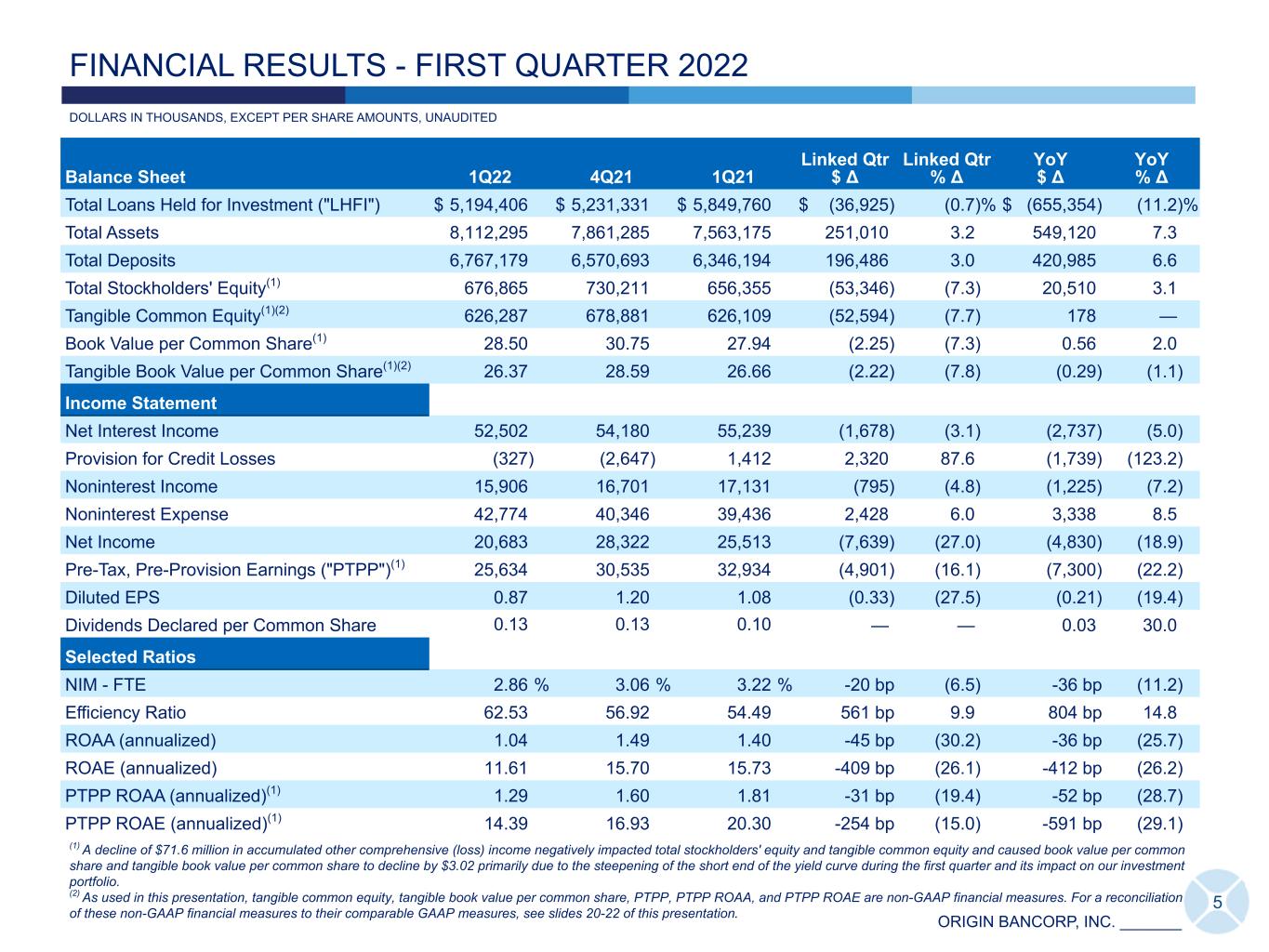

ORIGIN BANCORP, INC. _______ Balance Sheet 1Q22 4Q21 1Q21 Linked Qtr $ Δ Linked Qtr % Δ YoY $ Δ YoY % Δ Total Loans Held for Investment ("LHFI") $ 5,194,406 $ 5,231,331 $ 5,849,760 $ (36,925) (0.7) % $ (655,354) (11.2) % Total Assets 8,112,295 7,861,285 7,563,175 251,010 3.2 549,120 7.3 Total Deposits 6,767,179 6,570,693 6,346,194 196,486 3.0 420,985 6.6 Total Stockholders' Equity(1) 676,865 730,211 656,355 (53,346) (7.3) 20,510 3.1 Tangible Common Equity(1)(2) 626,287 678,881 626,109 (52,594) (7.7) 178 — Book Value per Common Share(1) 28.50 30.75 27.94 (2.25) (7.3) 0.56 2.0 Tangible Book Value per Common Share(1)(2) 26.37 28.59 26.66 (2.22) (7.8) (0.29) (1.1) Income Statement Net Interest Income 52,502 54,180 55,239 (1,678) (3.1) (2,737) (5.0) Provision for Credit Losses (327) (2,647) 1,412 2,320 87.6 (1,739) (123.2) Noninterest Income 15,906 16,701 17,131 (795) (4.8) (1,225) (7.2) Noninterest Expense 42,774 40,346 39,436 2,428 6.0 3,338 8.5 Net Income 20,683 28,322 25,513 (7,639) (27.0) (4,830) (18.9) Pre-Tax, Pre-Provision Earnings ("PTPP")(1) 25,634 30,535 32,934 (4,901) (16.1) (7,300) (22.2) Diluted EPS 0.87 1.20 1.08 (0.33) (27.5) (0.21) (19.4) Dividends Declared per Common Share 0.13 0.13 0.10 — — 0.03 30.0 Selected Ratios NIM - FTE 2.86 % 3.06 % 3.22 % -20 bp (6.5) -36 bp (11.2) Efficiency Ratio 62.53 56.92 54.49 561 bp 9.9 804 bp 14.8 ROAA (annualized) 1.04 1.49 1.40 -45 bp (30.2) -36 bp (25.7) ROAE (annualized) 11.61 15.70 15.73 -409 bp (26.1) -412 bp (26.2) PTPP ROAA (annualized)(1) 1.29 1.60 1.81 -31 bp (19.4) -52 bp (28.7) PTPP ROAE (annualized)(1) 14.39 16.93 20.30 -254 bp (15.0) -591 bp (29.1) DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED 5 (1) A decline of $71.6 million in accumulated other comprehensive (loss) income negatively impacted total stockholders' equity and tangible common equity and caused book value per common share and tangible book value per common share to decline by $3.02 primarily due to the steepening of the short end of the yield curve during the first quarter and its impact on our investment portfolio. (2) As used in this presentation, tangible common equity, tangible book value per common share, PTPP, PTPP ROAA, and PTPP ROAE are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slides 20-22 of this presentation. FINANCIAL RESULTS - FIRST QUARTER 2022

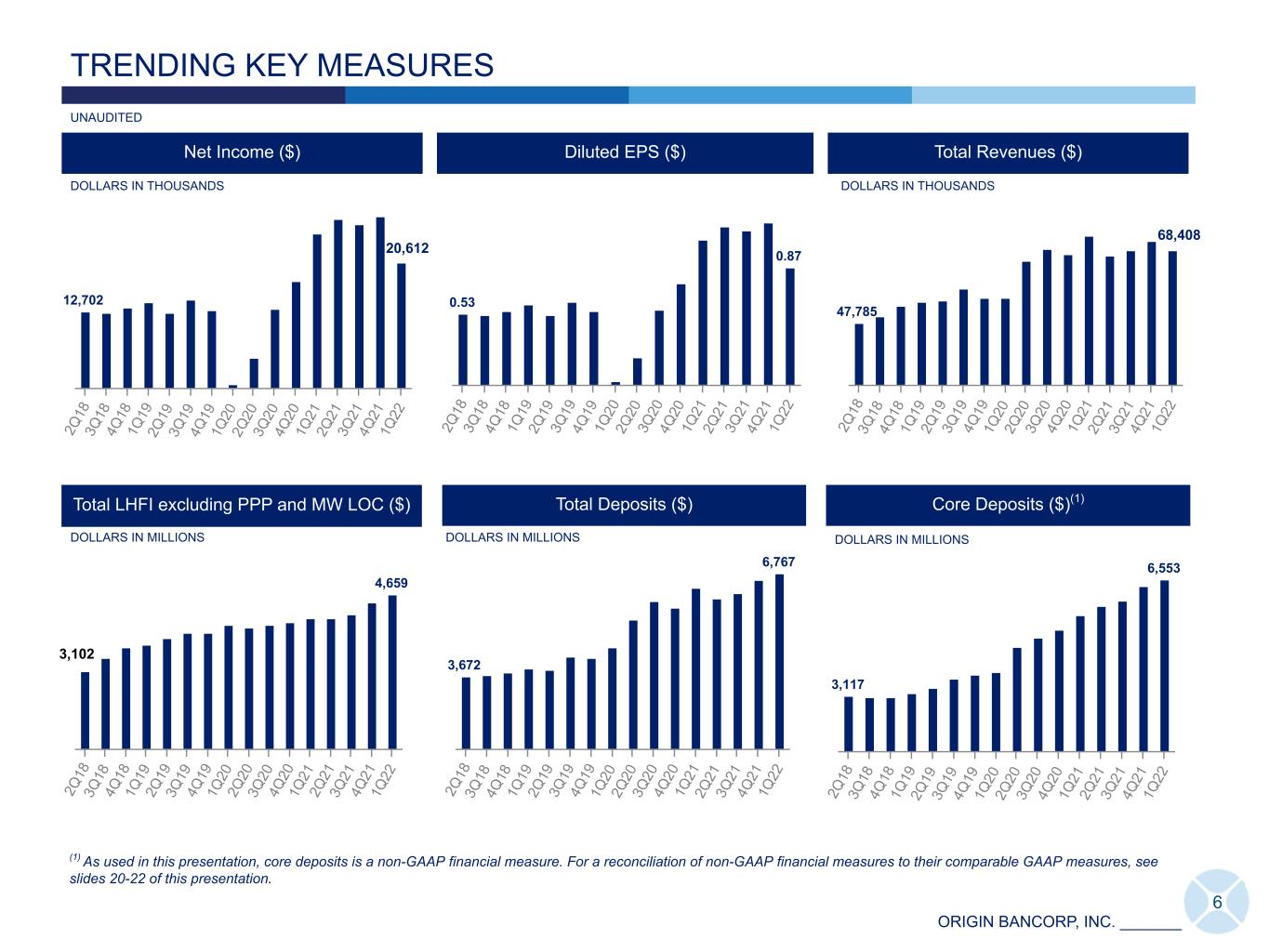

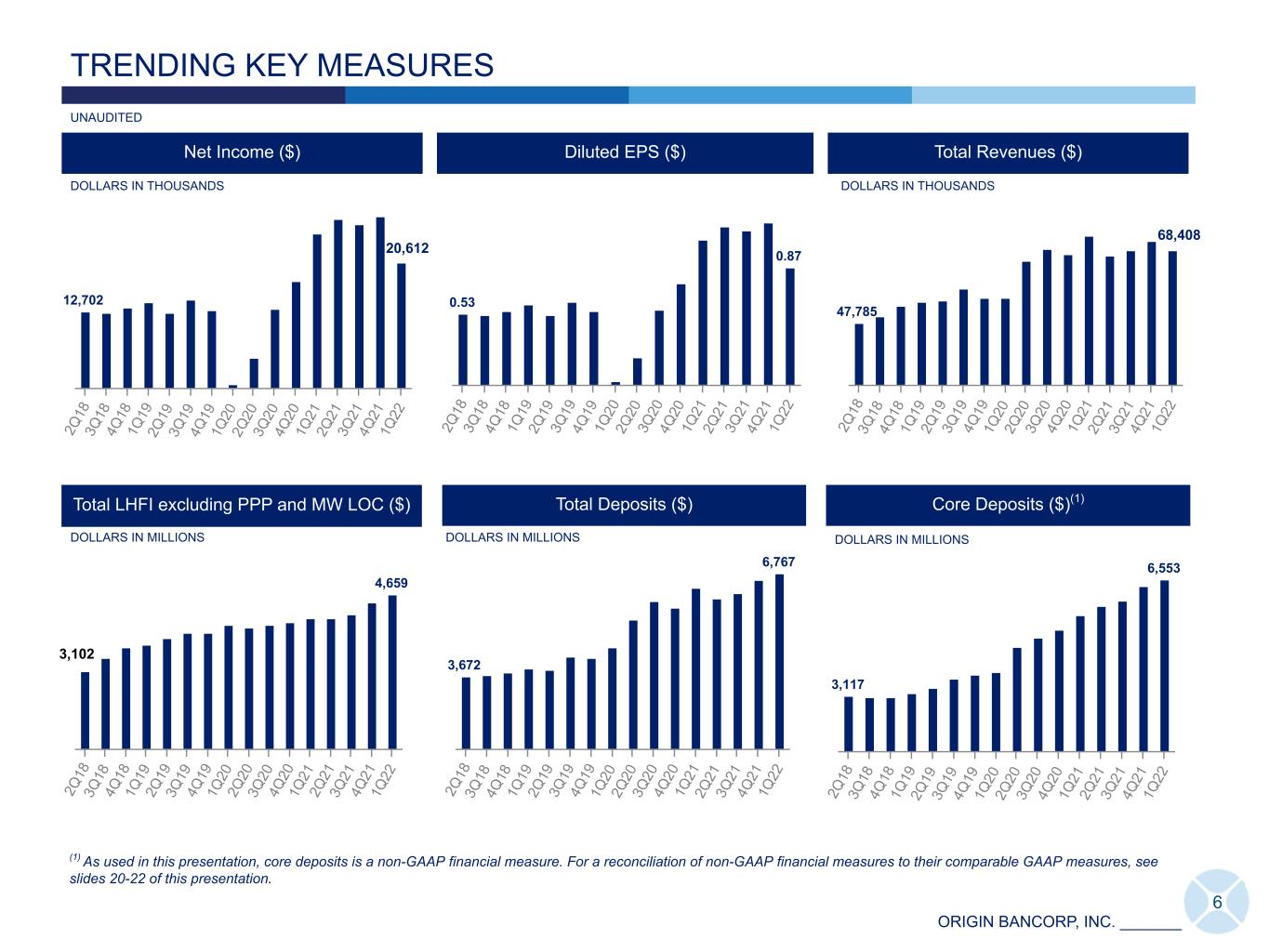

ORIGIN BANCORP, INC. _______ TRENDING KEY MEASURES 47,785 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 Total Revenues ($) UNAUDITED Diluted EPS ($)Net Income ($) Total LHFI excluding PPP and MW LOC ($) Total Deposits ($) 0.53 0.87 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 12,702 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 3,672 6,767 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 4,659 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 DOLLARS IN THOUSANDS DOLLARS IN THOUSANDS DOLLARS IN MILLIONS DOLLARS IN MILLIONS Core Deposits ($)(1) 3,117 6,553 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 DOLLARS IN MILLIONS (1) As used in this presentation, core deposits is a non-GAAP financial measure. For a reconciliation of non-GAAP financial measures to their comparable GAAP measures, see slides 20-22 of this presentation. 6 20,612 68,408 3,102

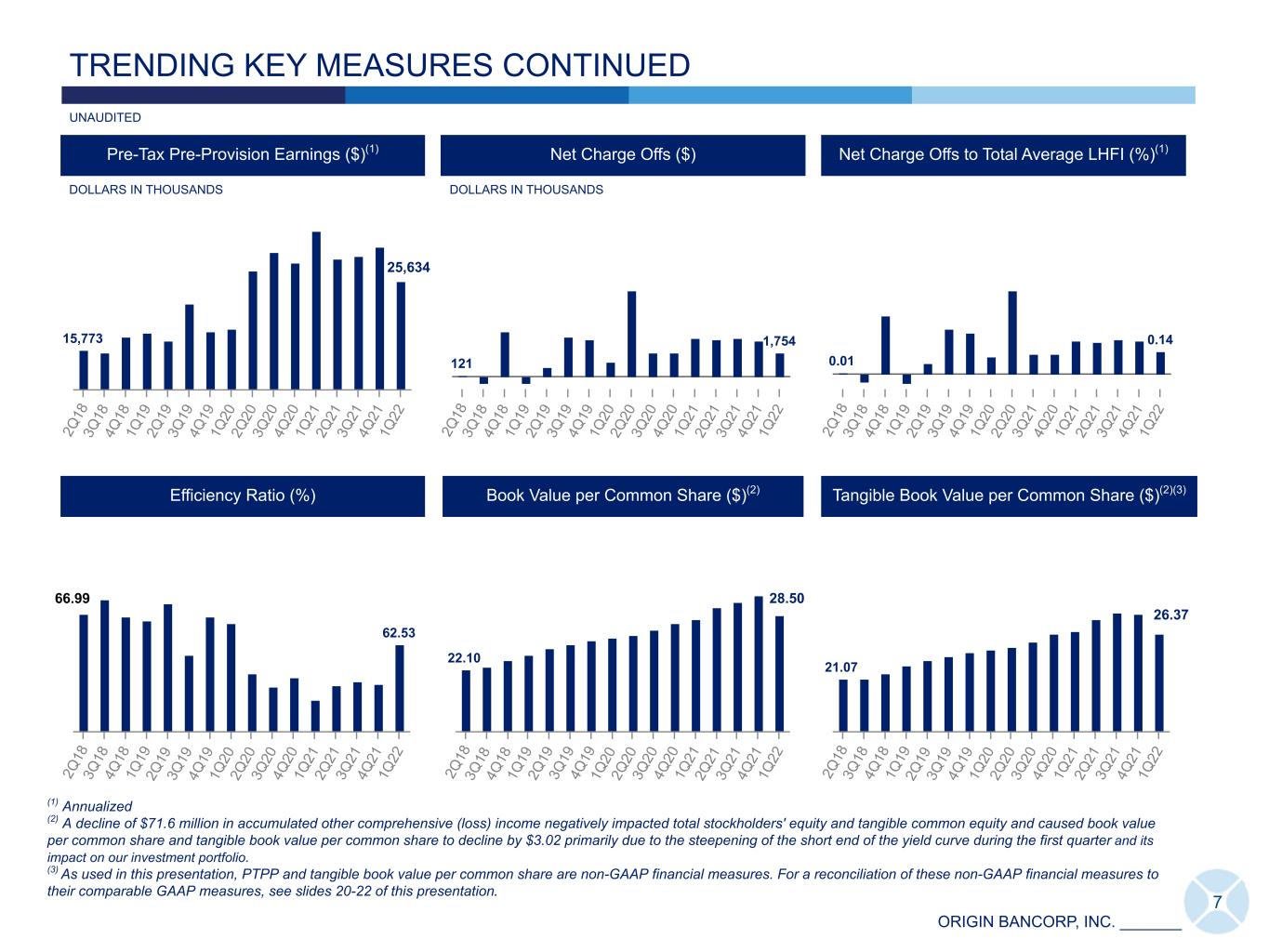

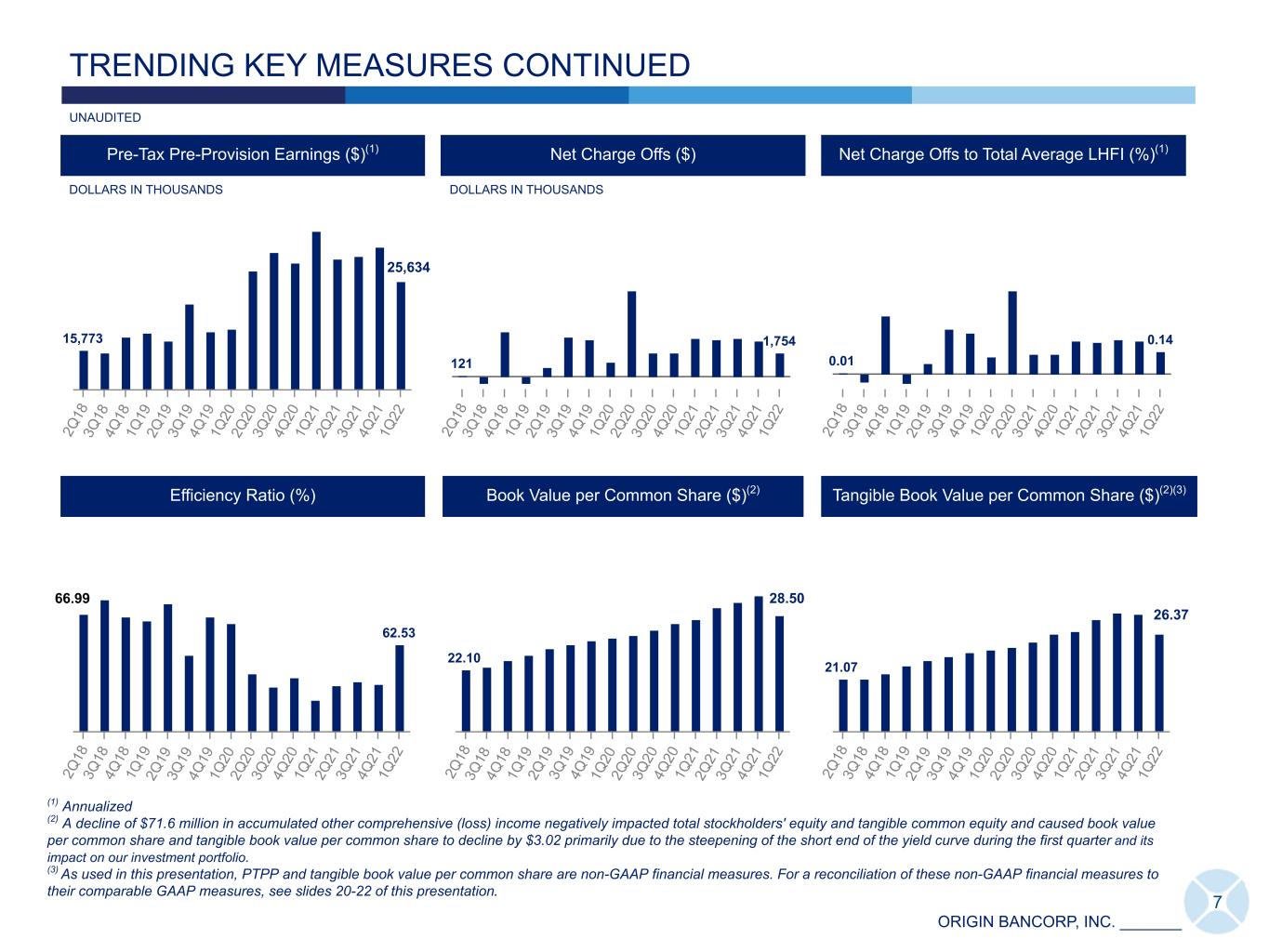

ORIGIN BANCORP, INC. _______ TRENDING KEY MEASURES CONTINUED Pre-Tax Pre-Provision Earnings ($)(1) Efficiency Ratio (%) 62.53 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 UNAUDITED 15,773 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 Net Charge Offs ($) 121 1,754 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 Net Charge Offs to Total Average LHFI (%)(1) 0.01 0.14 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 21 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 DOLLARS IN THOUSANDS DOLLARS IN THOUSANDS Book Value per Common Share ($)(2) 22.10 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 21.07 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 Tangible Book Value per Common Share ($)(2)(3) (1) Annualized (2) A decline of $71.6 million in accumulated other comprehensive (loss) income negatively impacted total stockholders' equity and tangible common equity and caused book value per common share and tangible book value per common share to decline by $3.02 primarily due to the steepening of the short end of the yield curve during the first quarter and its impact on our investment portfolio. (3) As used in this presentation, PTPP and tangible book value per common share are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slides 20-22 of this presentation. 7 25,634 28.50 26.37 66.99

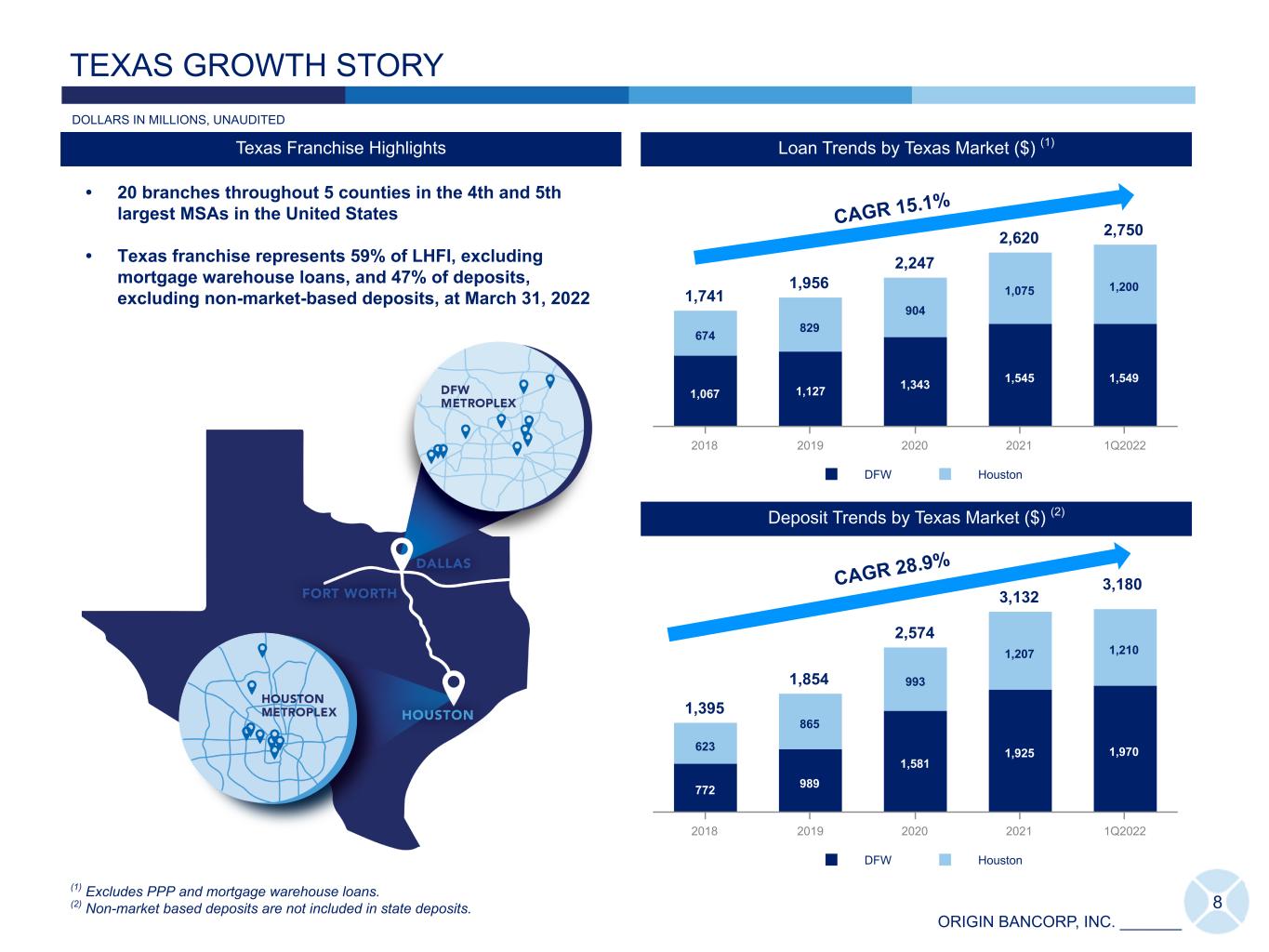

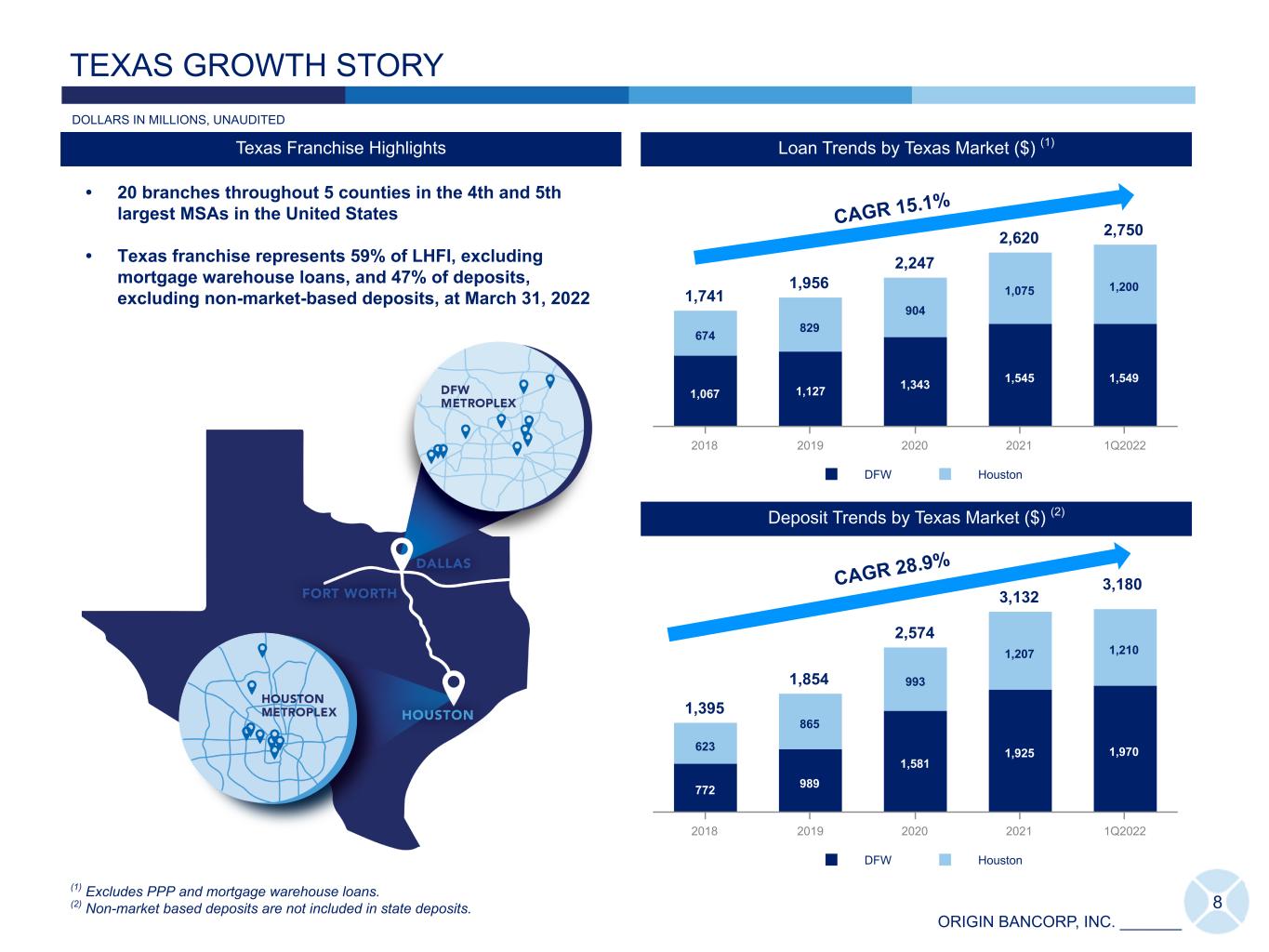

ORIGIN BANCORP, INC. _______ 8 1,741 1,956 2,247 2,620 2,750 1,067 1,127 1,343 1,545 1,549 674 829 904 1,075 1,200 DFW Houston 2018 2019 2020 2021 1Q2022 Deposit Trends by Texas Market ($) (2) Loan Trends by Texas Market ($) (1) TEXAS GROWTH STORY Texas Franchise Highlights DOLLARS IN MILLIONS, UNAUDITED • 20 branches throughout 5 counties in the 4th and 5th largest MSAs in the United States • Texas franchise represents 59% of LHFI, excluding mortgage warehouse loans, and 47% of deposits, excluding non-market-based deposits, at March 31, 2022 1,395 1,854 2,574 3,132 772 989 1,581 1,925 1,970623 865 993 1,207 1,210 DFW Houston 2018 2019 2020 2021 1Q2022 CAGR 15.1% CAGR 28.9% (1) Excludes PPP and mortgage warehouse loans. (2) Non-market based deposits are not included in state deposits. 3,180

ORIGIN BANCORP, INC. _______ 9 ORGANIC LOAN GROWTH 3,581 3,869 4,094 4,498 4,659 2018 2019 2020 2021 1Q2022 2,000 3,000 4,000 5,000 LHFI Key Data DOLLARS IN MILLIONS, UNAUDITED IDT • Remaining net deferred loan fees on PPP: $736,000 • Remaining PPP loan balances: $32.2 million • PPP total loan originations: $767.4 million • PPP percent of loans forgiven at 3/31/2022: 95.8% • Total forgiveness applied for at 3/31/2022: 97.9% 437 582632 • LHFI excluding PPP and mortgage warehouse lines of credit increased 30.1% from 12/31/2018, with a CAGR of 8.4%. Total C&I excluding PPP, owner occupied CRE and C&D increased 16.1% from 12/31/2018, with a CAGR of 4.7%. • Total LHFI at 3/31/2022, excluding mortgage warehouse lines of credit, were $4.66 billion, reflecting a $160.5 million, or 14.5% annualized, increase compared to the linked quarter. • Total mortgage warehouse lines of credit were $503.2 million, or 9.7%, of total LHFI at 3/31/2022. LHFI excluding MW LOC and PPP Growth ($) PPP Highlights CAGR: 8.4% 1,803 1,902 1,833 2,032 2,094 2018 2019 2020 2021 1Q2022 1,000 2,000 437 582632 C&I (excluding PPP), Owner Occupied CRE and C&D Growth ($) CAGR: 4.7%

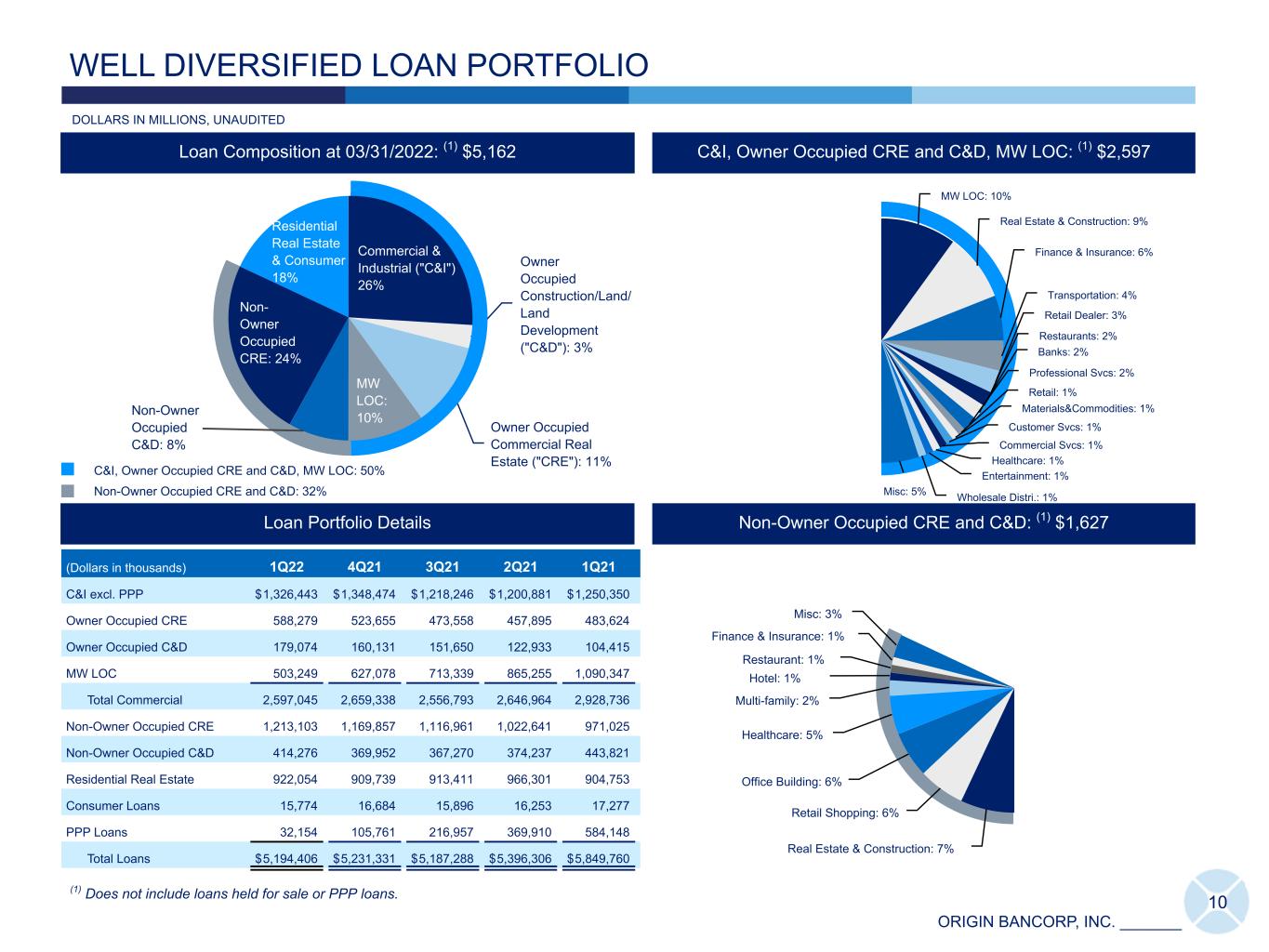

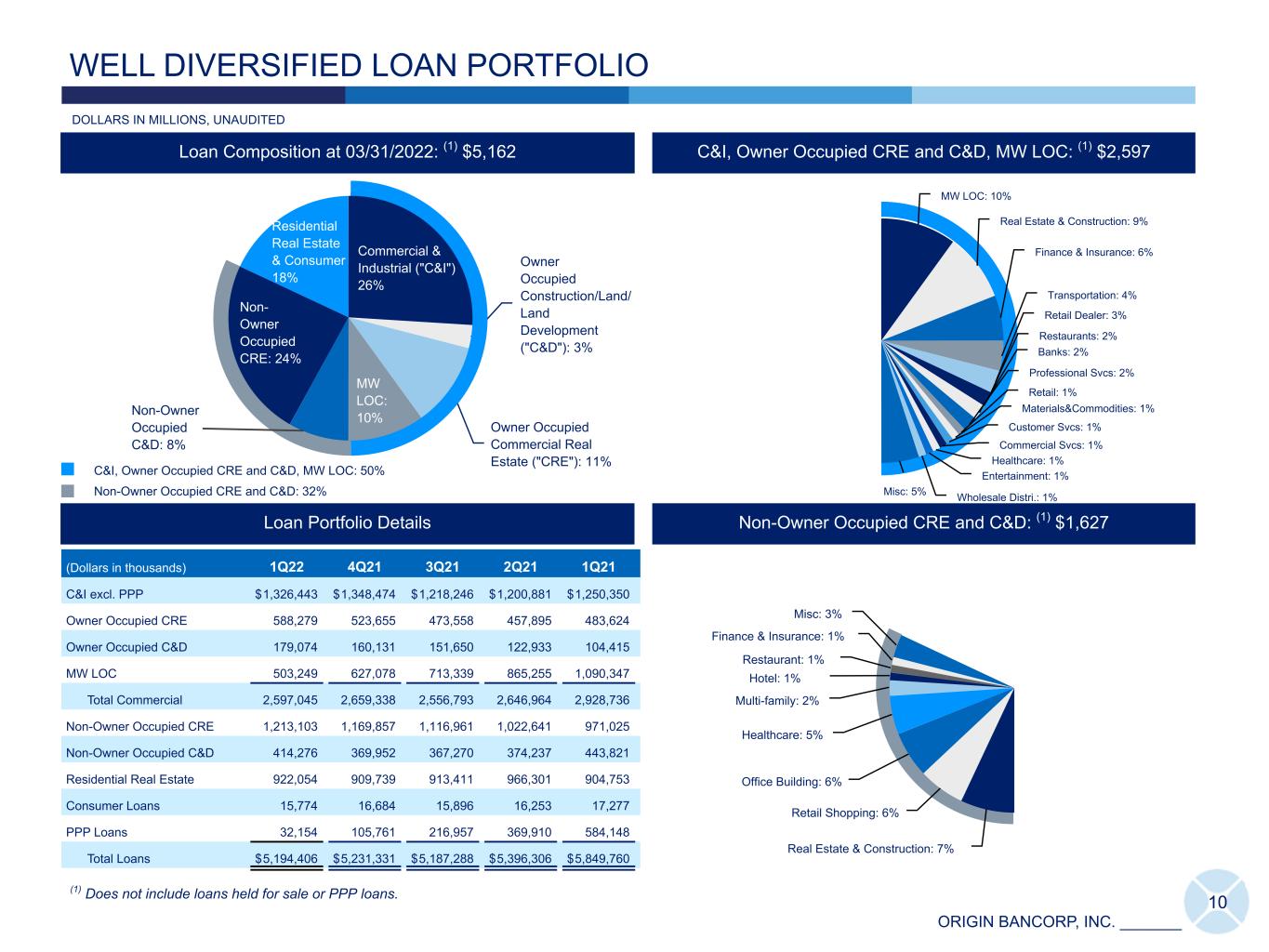

ORIGIN BANCORP, INC. _______ Commercial & Industrial ("C&I") 26% Owner Occupied Construction/Land/ Land Development ("C&D"): 3% Owner Occupied Commercial Real Estate ("CRE"): 11% MW LOC: 10%Non-Owner Occupied C&D: 8% Non- Owner Occupied CRE: 24% Residential Real Estate & Consumer 18% MW LOC: 10% Real Estate & Construction: 9% Finance & Insurance: 6% Transportation: 4% Retail Dealer: 3% Restaurants: 2% Banks: 2% Professional Svcs: 2% Retail: 1% Materials&Commodities: 1% Customer Svcs: 1% Commercial Svcs: 1% Healthcare: 1% Entertainment: 1% Wholesale Distri.: 1%Misc: 5% Real Estate & Construction: 7% Retail Shopping: 6% Office Building: 6% Healthcare: 5% Multi-family: 2% Hotel: 1% Restaurant: 1% Finance & Insurance: 1% Misc: 3% 10 WELL DIVERSIFIED LOAN PORTFOLIO (Dollars in thousands) 1Q22 4Q21 3Q21 2Q21 1Q21 C&I excl. PPP $ 1,326,443 $ 1,348,474 $ 1,218,246 $ 1,200,881 $ 1,250,350 Owner Occupied CRE 588,279 523,655 473,558 457,895 483,624 Owner Occupied C&D 179,074 160,131 151,650 122,933 104,415 MW LOC 503,249 627,078 713,339 865,255 1,090,347 Total Commercial 2,597,045 2,659,338 2,556,793 2,646,964 2,928,736 Non-Owner Occupied CRE 1,213,103 1,169,857 1,116,961 1,022,641 971,025 Non-Owner Occupied C&D 414,276 369,952 367,270 374,237 443,821 Residential Real Estate 922,054 909,739 913,411 966,301 904,753 Consumer Loans 15,774 16,684 15,896 16,253 17,277 PPP Loans 32,154 105,761 216,957 369,910 584,148 Total Loans $ 5,194,406 $ 5,231,331 $ 5,187,288 $ 5,396,306 $ 5,849,760 Loan Portfolio Details Non-Owner Occupied CRE and C&D: (1) $1,627 C&I, Owner Occupied CRE and C&D, MW LOC: (1) $2,597 C&I, Owner Occupied CRE and C&D, MW LOC: 50% Non-Owner Occupied CRE and C&D: 32% (1) Does not include loans held for sale or PPP loans. Loan Composition at 03/31/2022: (1) $5,162 DOLLARS IN MILLIONS, UNAUDITED ILP

ORIGIN BANCORP, INC. _______ 11 3,076 3,547 3,658 3,616 3,976 1,701 1,838 1,966 2,111 2,218656 582 562 5355,870 6,244 6,206 6,289 6,729 Interest-bearing Noninterest-bearing Time Deposits Brokered 1Q21 2Q21 3Q21 4Q21 1Q22 Average Deposits ($) DEPOSIT TRENDS 0.95 0.78 0.67 0.59 0.54 0.37 0.31 0.30 0.28 0.26 0.26 0.22 0.21 0.19 0.17 Time Deposits Cost of Interest-bearing Deposits Cost of Total Deposits 1Q21 2Q21 3Q21 4Q21 1Q22 Deposit Cost Trends (QTD Annualized) (%) Time Deposit Repricing Schedule * Maturity Balance ($) WAR (%) 2Q22 144 0.39 3Q22 136 0.40 4Q22 73 0.46 1Q23 59 0.45 2Q23+ 112 0.88 Total 524 0.51 DOLLARS IN MILLIONS, UNAUDITED IDT * Projection is based upon March 31, 2022, time deposit balances. • Average noninterest-bearing deposits increased $107.3 million compared to the linked quarter and represented 33.0% of total average deposits. • Average brokered deposits were zero for 1Q22, and decreased by $436.6 million compared to 1Q21, based on a strategy to reduce non-core funding sources as PPP and mortgage warehouse balances declined. • Overall cost of total deposits has declined 34.6% since 1Q21. • There were $149.4 million in new and renewed CD's during 1Q22 with a weighted average interest rate of 0.20%. 437 227 632

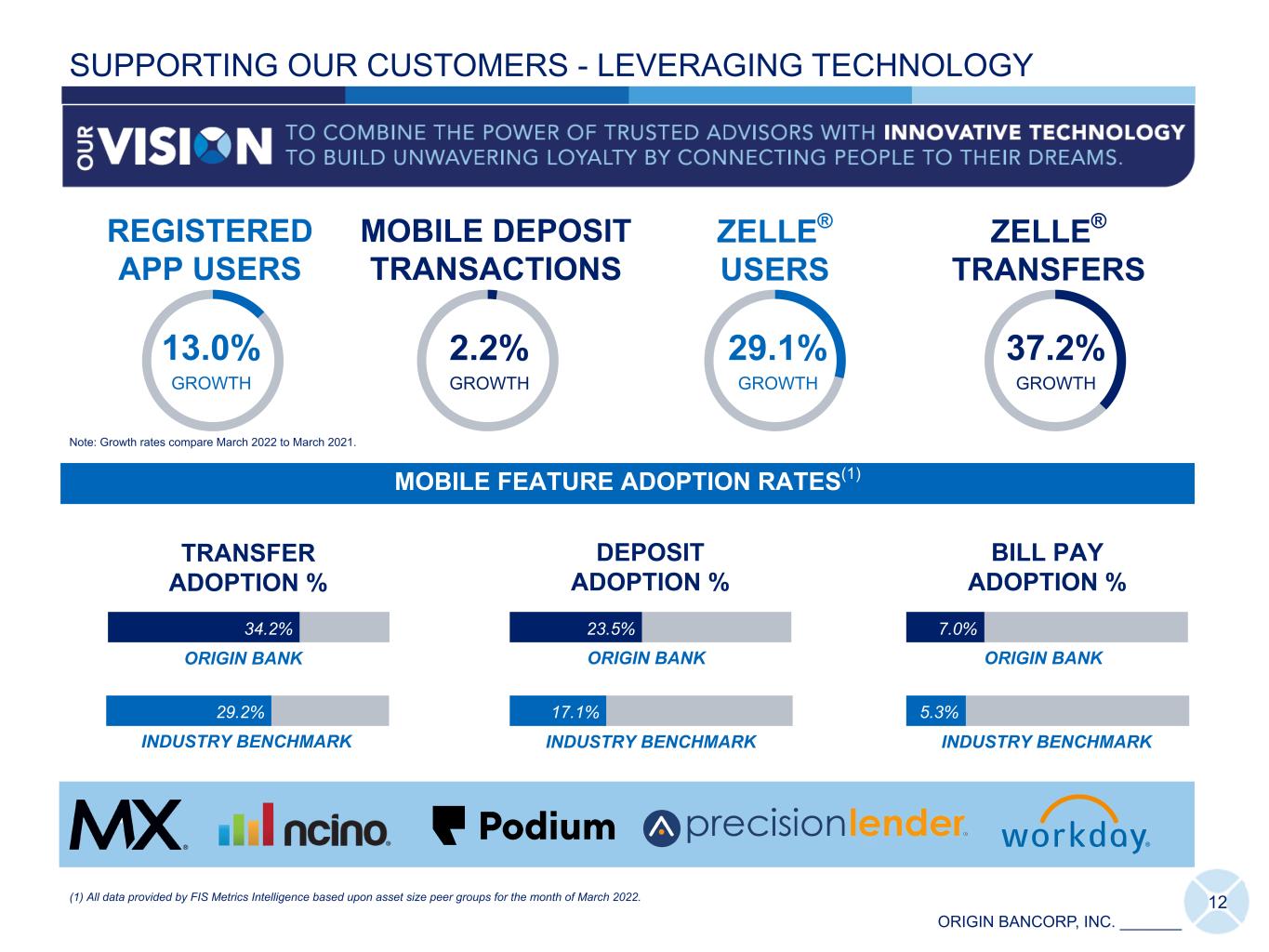

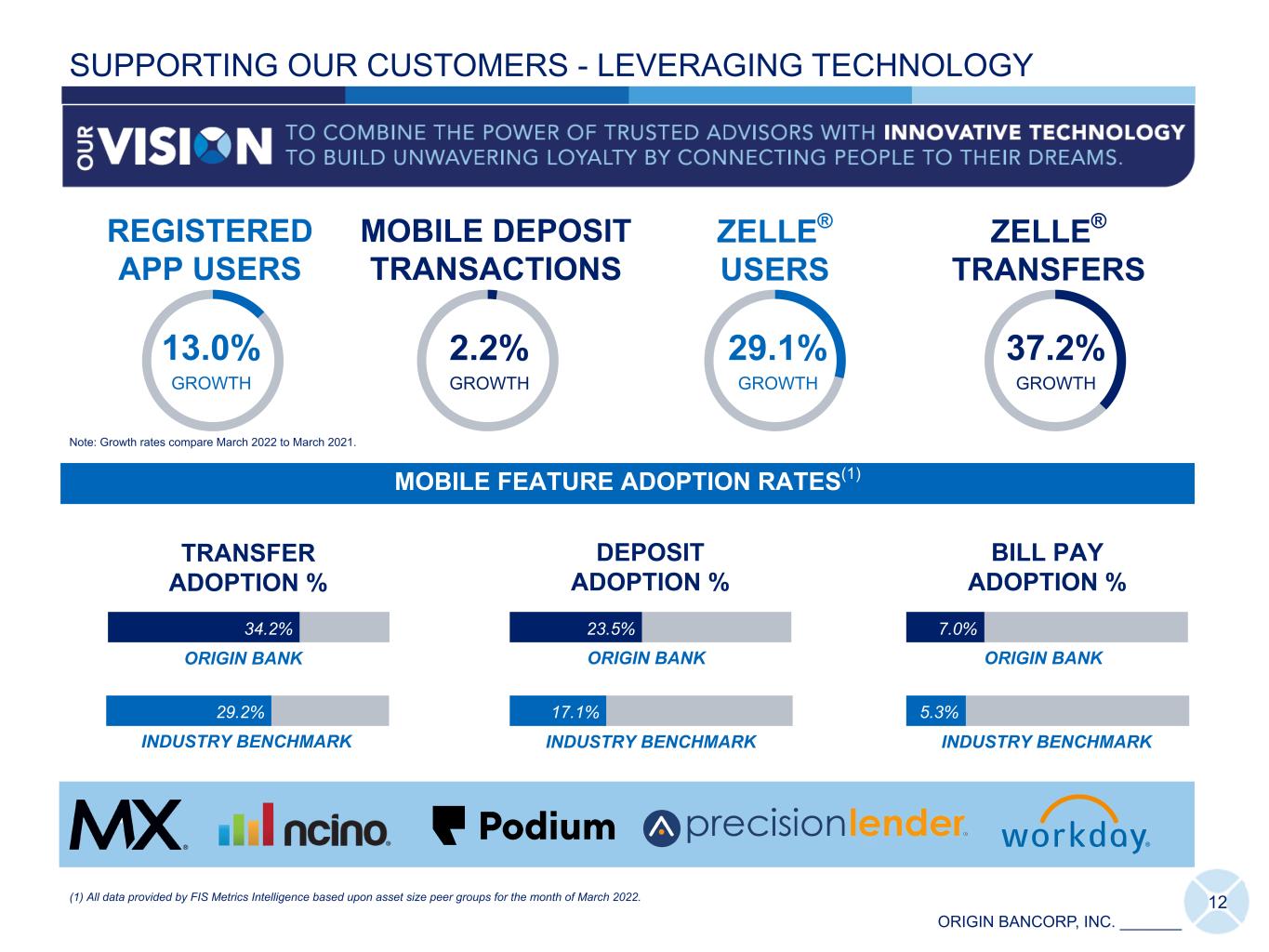

ORIGIN BANCORP, INC. _______ 12 MOBILE FEATURE ADOPTION RATES(1) SUPPORTING OUR CUSTOMERS - LEVERAGING TECHNOLOGY ZELLE® USERS 29.1% GROWTH ZELLE® TRANSFERS 37.2% GROWTH 34.2% TRANSFER ADOPTION % ORIGIN BANK 29.2% INDUSTRY BENCHMARK 23.5% DEPOSIT ADOPTION % ORIGIN BANK 17.1% INDUSTRY BENCHMARK 7.0% BILL PAY ADOPTION % ORIGIN BANK 5.3% INDUSTRY BENCHMARK (1) All data provided by FIS Metrics Intelligence based upon asset size peer groups for the month of March 2022. REGISTERED APP USERS 13.0% GROWTH MOBILE DEPOSIT TRANSACTIONS 2.2% GROWTH Note: Growth rates compare March 2022 to March 2021. ILT

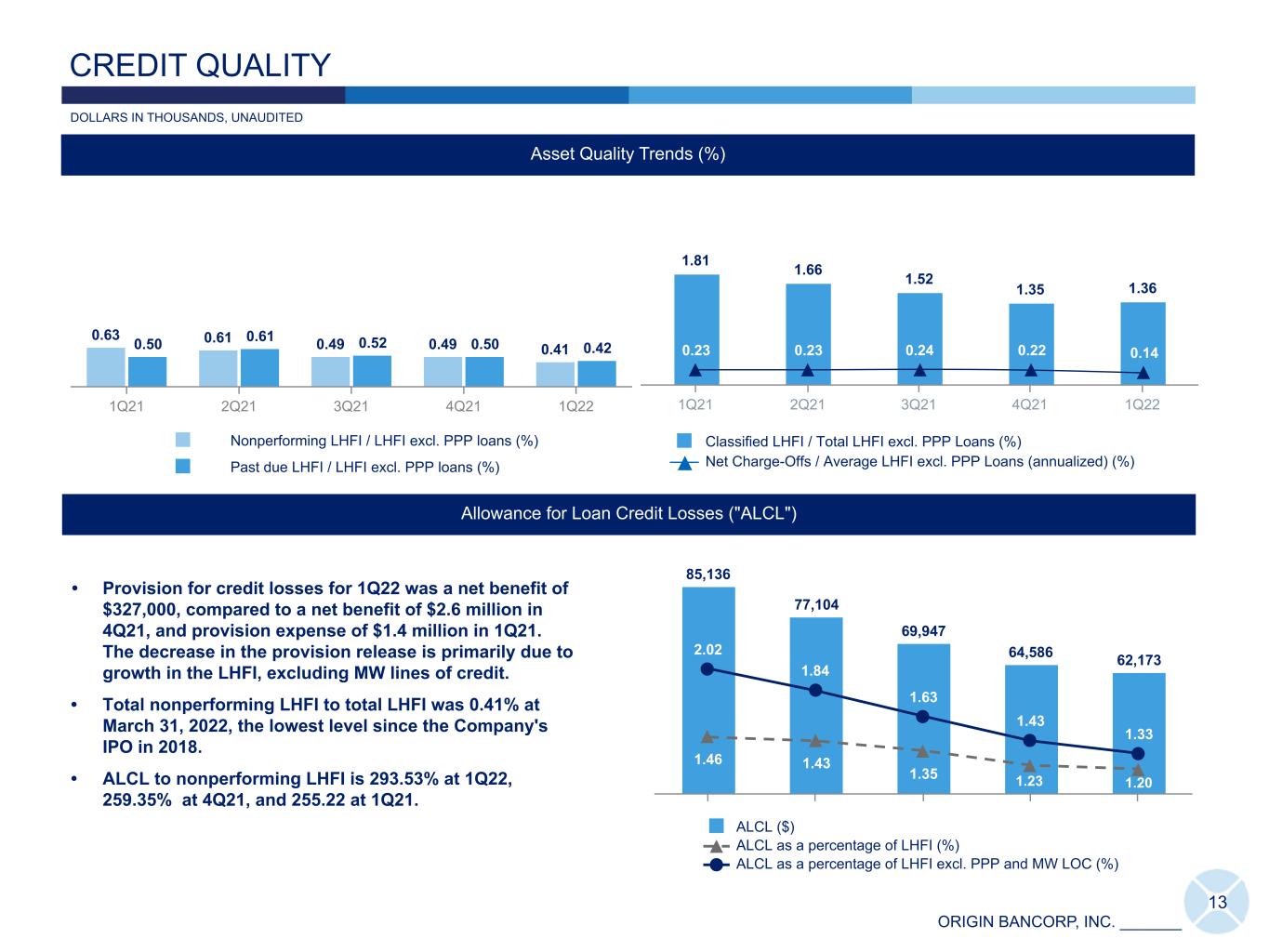

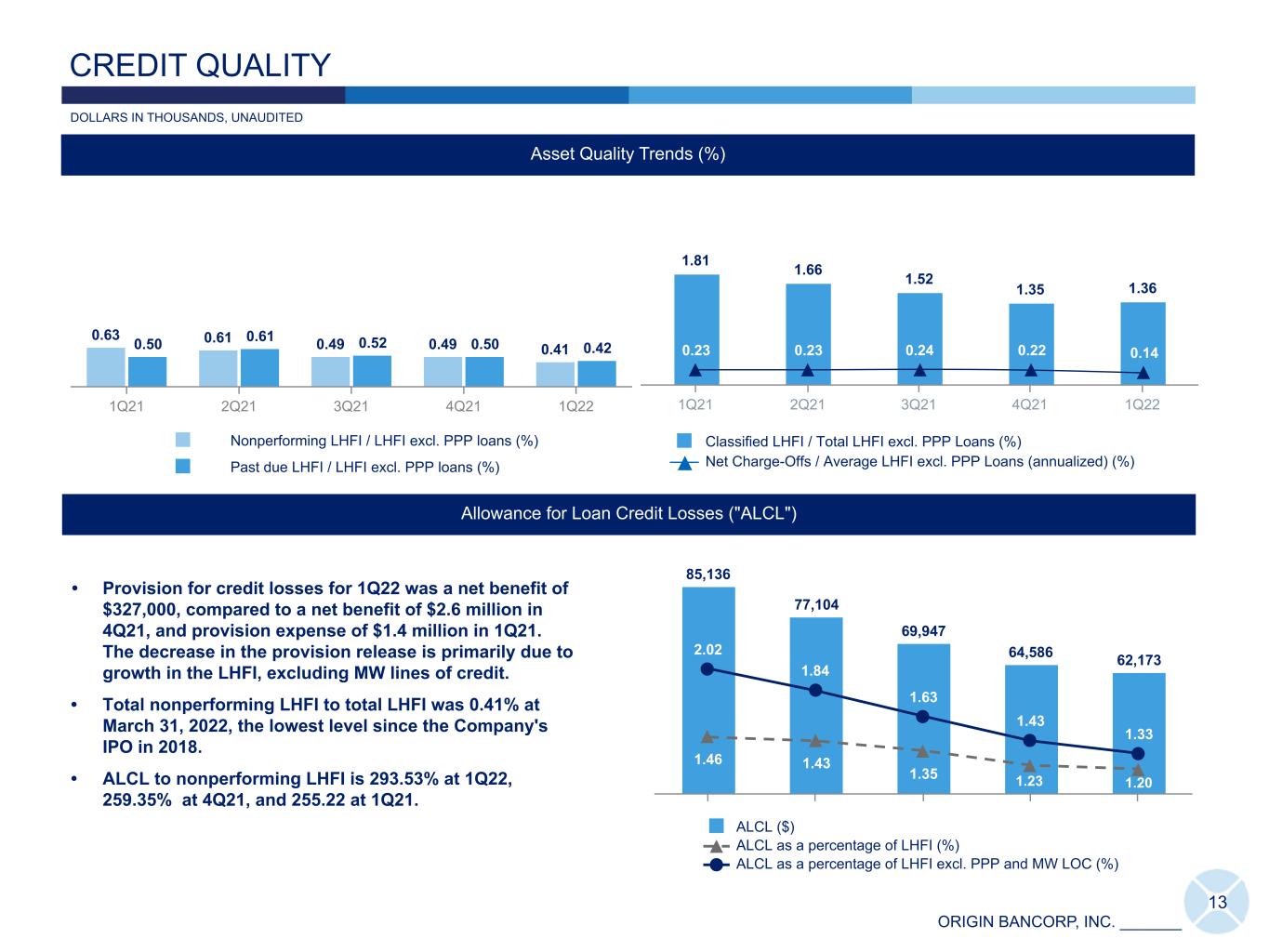

ORIGIN BANCORP, INC. _______ 1.81 1.66 1.52 1.35 1.36 Classified LHFI / Total LHFI excl. PPP Loans (%) Net Charge-Offs / Average LHFI excl. PPP Loans (annualized) (%) 1Q21 2Q21 3Q21 4Q21 1Q22 0.23 0.23 0.24 0.22 0.14 0.63 0.61 0.49 0.49 0.410.50 0.61 0.52 0.50 0.42 Nonperforming LHFI / LHFI excl. PPP loans (%) Past due LHFI / LHFI excl. PPP loans (%) 1Q21 2Q21 3Q21 4Q21 1Q22 13 CREDIT QUALITY Asset Quality Trends (%) Allowance for Loan Credit Losses ("ALCL") 85,136 77,104 69,947 64,586 62,173 1.46 1.43 1.35 2.02 1.84 1.63 1.43 1.33 ALCL ($) ALCL as a percentage of LHFI (%) ALCL as a percentage of LHFI excl. PPP and MW LOC (%) • Provision for credit losses for 1Q22 was a net benefit of $327,000, compared to a net benefit of $2.6 million in 4Q21, and provision expense of $1.4 million in 1Q21. The decrease in the provision release is primarily due to growth in the LHFI, excluding MW lines of credit. • Total nonperforming LHFI to total LHFI was 0.41% at March 31, 2022, the lowest level since the Company's IPO in 2018. • ALCL to nonperforming LHFI is 293.53% at 1Q22, 259.35% at 4Q21, and 255.22 at 1Q21. DOLLARS IN THOUSANDS, UNAUDITED 1.201.23

ORIGIN BANCORP, INC. _______ 14 LHFI: Fixed \ Variable (by Index) at 03/31/2022 Fixed: 45% Floating: 55% YIELDS, COSTS AND LHFI PROFILE Yield on LHFI (%) 4.03 4.00 4.05 4.11 4.08 3.99 3.97 3.98 3.94 3.95 3.25 3.25 3.25 3.25 3.29 0.12 0.10 0.09 0.09 0.23 Yield on LHFI Yield on LHFI excl. PPP Loans Avg. Prime Rate Avg. 1M LIBOR 1Q21 2Q21 3Q21 4Q21 1Q22 Cost of Funds (%) 0.42 0.38 0.37 0.34 0.330.37 0.26 0.26 0.17 Cost of Total Deposits & Borrowings Cost of Interest Bearing Deposits Cost of Total Deposits 1Q21 2Q21 3Q21 4Q21 1Q22 0.22 0.21 Impact of Floors on 1M LIBOR & Prime Indexed Loans(1) $1.95 billion - total $1.32 billion 100% Beta $633 million "in the money" floors 0.19 0.31 0.30 0.28 $1,319 $248 $99 $147 $22 $117 At O r Abo ve Fl oo rs Belo w Fl oo r B y 1-2 5 b ps Belo w Fl oo r B y 26 -50 bp s Belo w Fl oo r B y 51 -75 bp s Belo w Fl oo r B y 76 -10 0 b ps Belo w Fl oo r B y >1 00 bp s $0 $1,000 $2,000 $3,000 67.6% 12.7% 5.1% 7.5% 1.1% 6.0% (1) Excluding Mortgage Warehouse Lines of Credit.

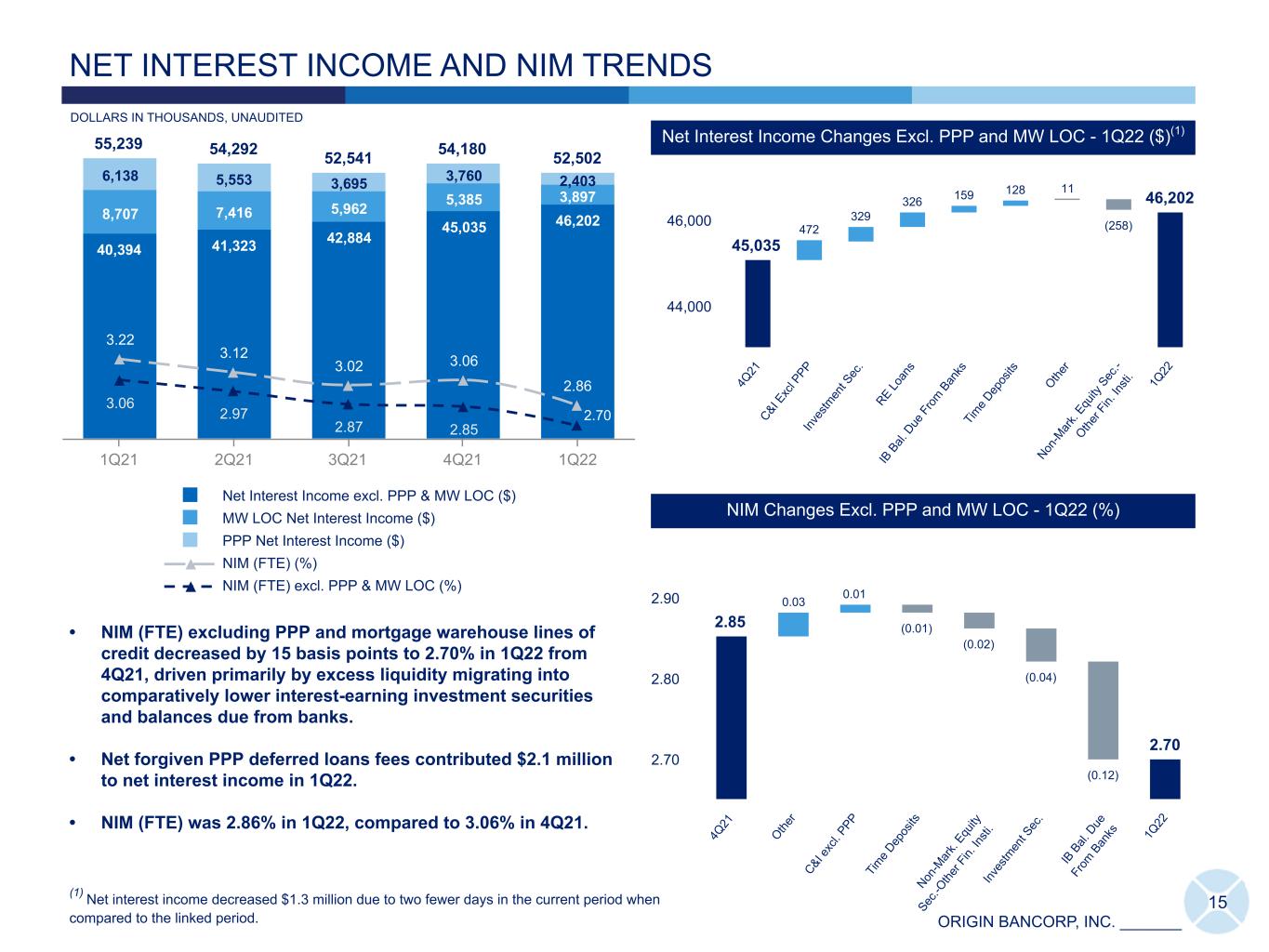

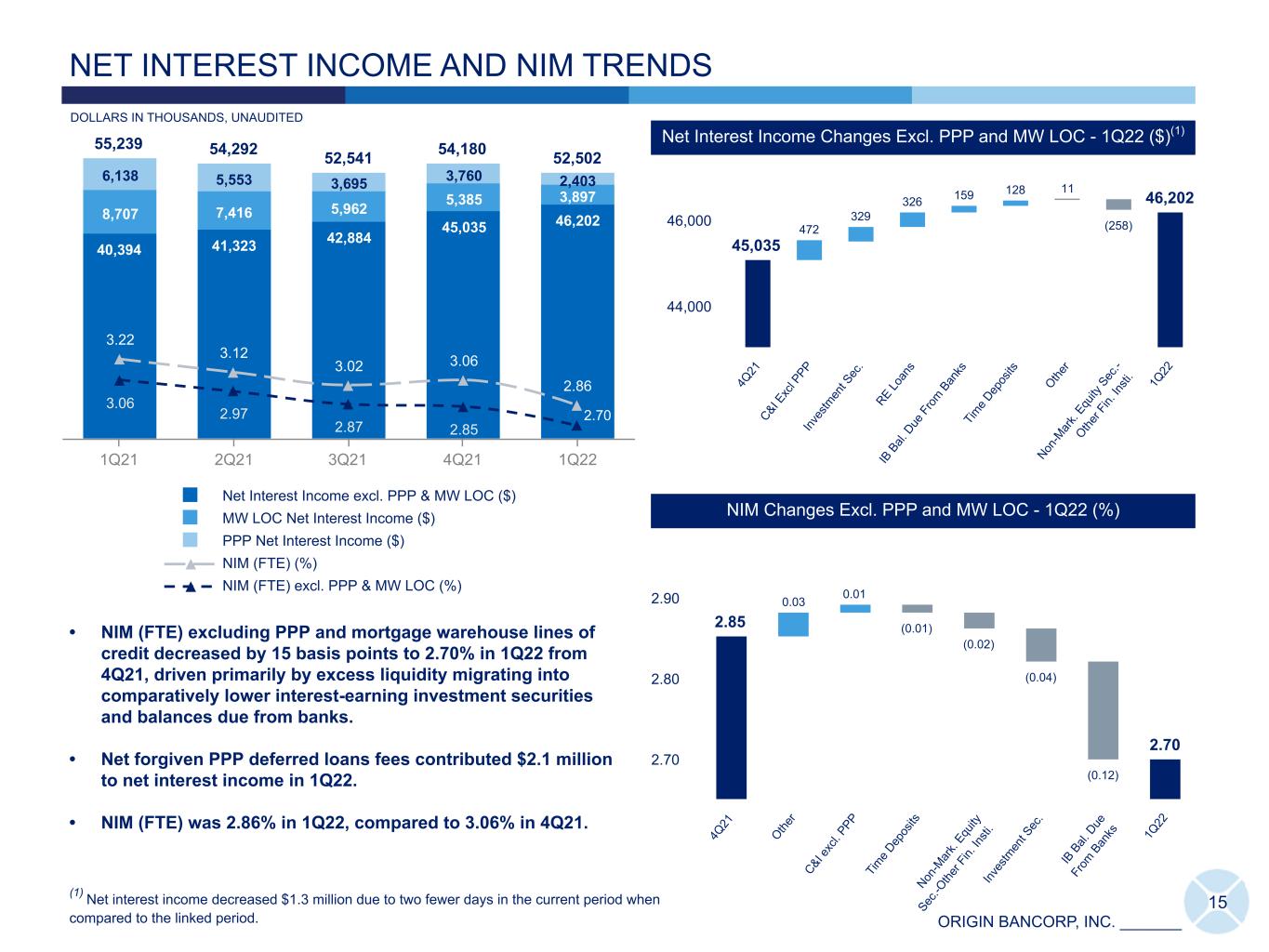

ORIGIN BANCORP, INC. _______ 15 DOLLARS IN THOUSANDS, UNAUDITED 55,239 54,292 52,541 54,180 52,502 40,394 41,323 42,884 45,035 46,2028,707 7,416 5,962 5,385 3,897 6,138 5,553 3,695 3,760 2,403 3.22 3.12 3.02 3.06 2.86 3.06 2.97 2.87 2.85 Net Interest Income excl. PPP & MW LOC ($) MW LOC Net Interest Income ($) PPP Net Interest Income ($) NIM (FTE) (%) NIM (FTE) excl. PPP & MW LOC (%) 1Q21 2Q21 3Q21 4Q21 1Q22 • NIM (FTE) excluding PPP and mortgage warehouse lines of credit decreased by 15 basis points to 2.70% in 1Q22 from 4Q21, driven primarily by excess liquidity migrating into comparatively lower interest-earning investment securities and balances due from banks. • Net forgiven PPP deferred loans fees contributed $2.1 million to net interest income in 1Q22. • NIM (FTE) was 2.86% in 1Q22, compared to 3.06% in 4Q21. NET INTEREST INCOME AND NIM TRENDS 46,202 45,035 472 329 326 159 128 11 (258) 4Q 21 C&I E xc l P PP Inv es tm en t S ec . RE Lo an s IB B al. D ue F ro m B an ks Tim e D ep os its Othe r Non -M ar k. Equ ity S ec .- Othe r F in. In sti . 1Q 22 44,000 46,000 2.70 2.85 0.03 0.01 (0.01) (0.02) (0.04) (0.12) 4Q 21 Othe r C&I e xc l. P PP Tim e D ep os its Non -M ar k. Equ ity Sec .-O the r F in. In sti . Inv es tm en t S ec . IB B al. D ue Fr om B an ks 1Q 22 2.70 2.80 2.90 Net Interest Income Changes Excl. PPP and MW LOC - 1Q22 ($)(1) NIM Changes Excl. PPP and MW LOC - 1Q22 (%) INIM 2.70 (1) Net interest income decreased $1.3 million due to two fewer days in the current period when compared to the linked period.

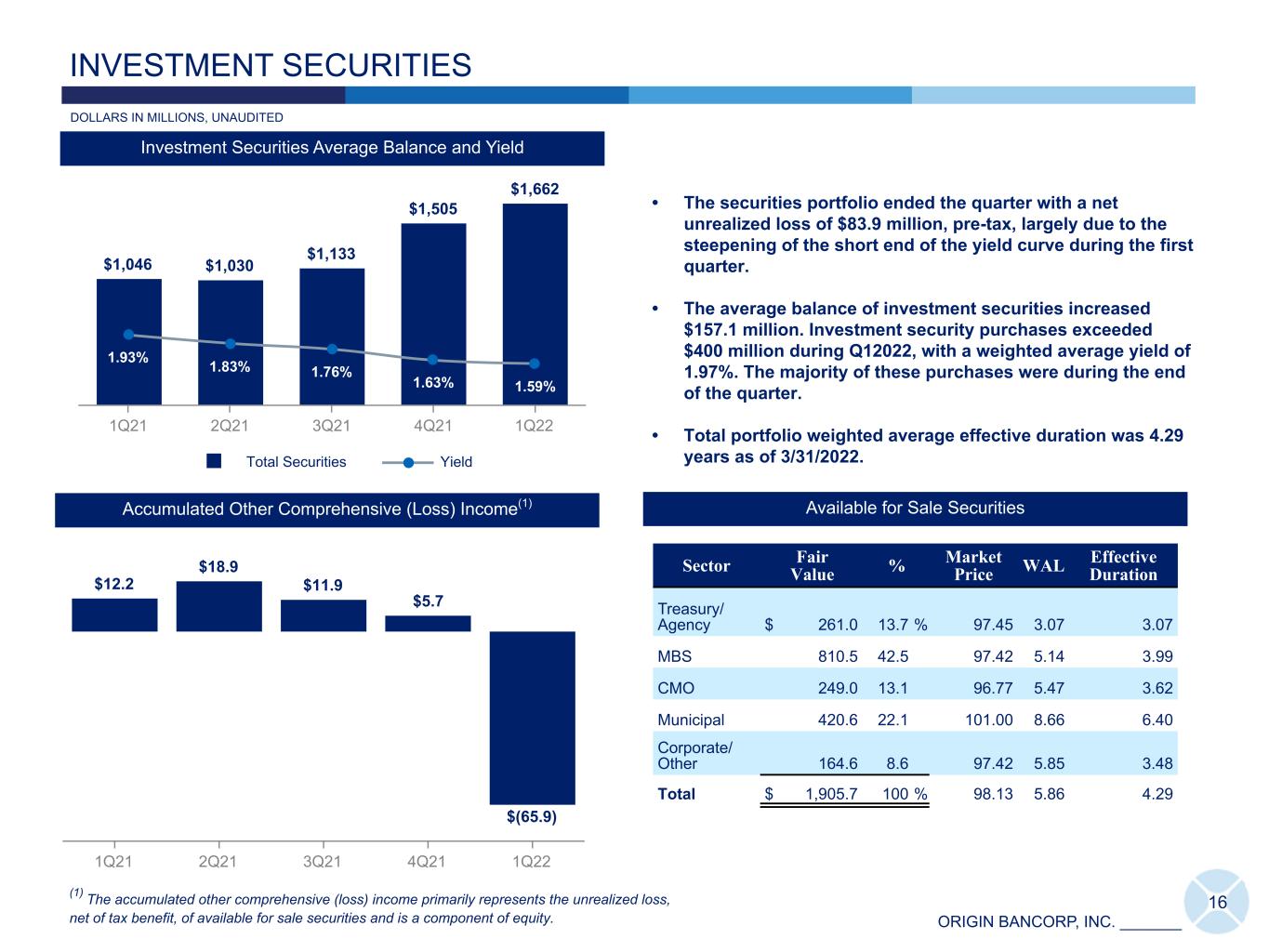

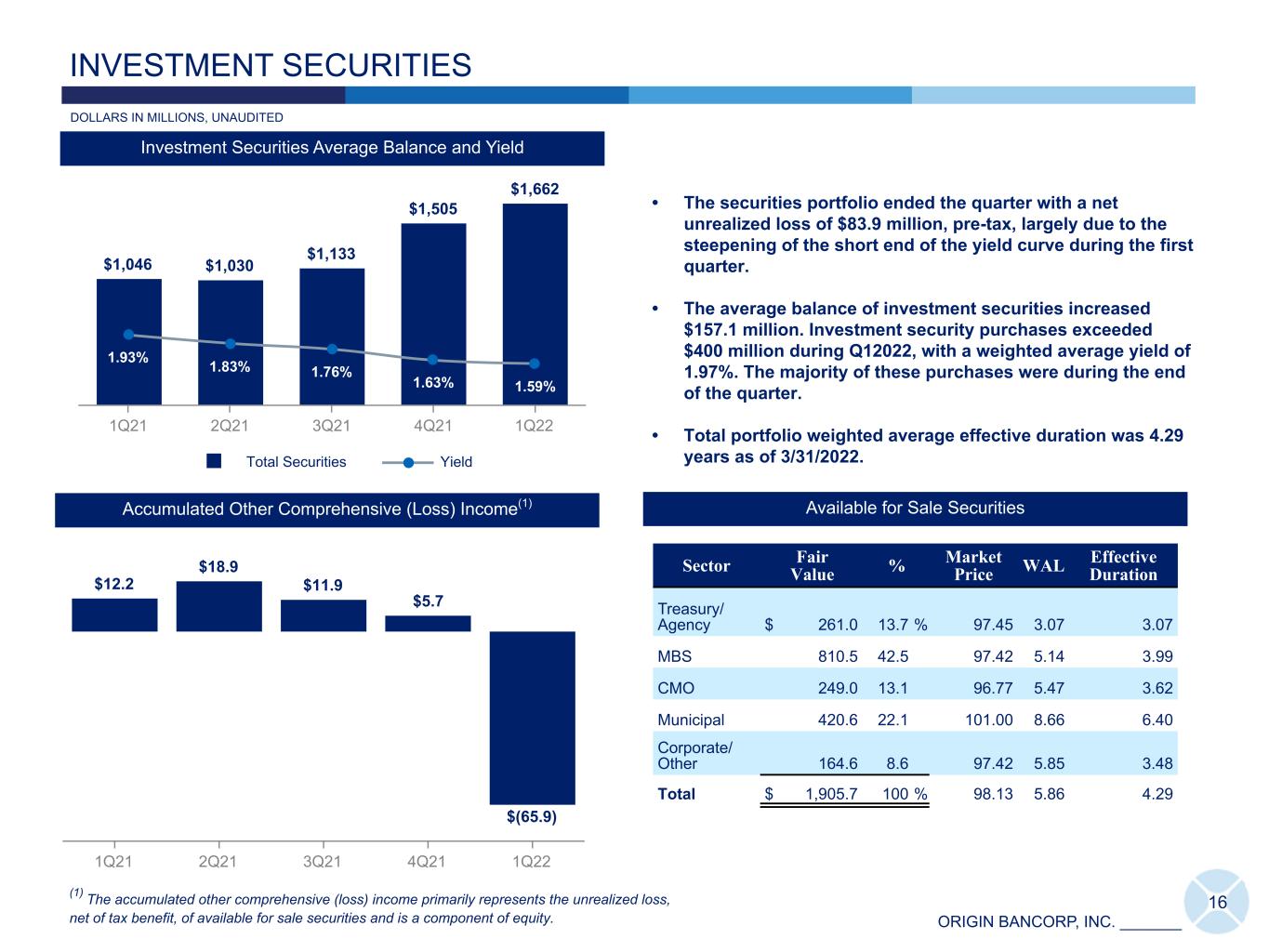

ORIGIN BANCORP, INC. _______ $1,046 $1,030 $1,133 $1,505 $1,662 1.93% 1.83% 1.76% 1.63% 1.59% Total Securities Yield 1Q21 2Q21 3Q21 4Q21 1Q22 Investment Securities Average Balance and Yield INVESTMENT SECURITIES DOLLARS IN MILLIONS, UNAUDITED • The securities portfolio ended the quarter with a net unrealized loss of $83.9 million, pre-tax, largely due to the steepening of the short end of the yield curve during the first quarter. • The average balance of investment securities increased $157.1 million. Investment security purchases exceeded $400 million during Q12022, with a weighted average yield of 1.97%. The majority of these purchases were during the end of the quarter. • Total portfolio weighted average effective duration was 4.29 years as of 3/31/2022. 16 $12.2 $18.9 $11.9 $5.7 $(65.9) 1Q21 2Q21 3Q21 4Q21 1Q22 Accumulated Other Comprehensive (Loss) Income(1) Sector Fair Value % Market Price WAL Effective Duration Treasury/ Agency $ 261.0 13.7 % 97.45 3.07 3.07 MBS 810.5 42.5 97.42 5.14 3.99 CMO 249.0 13.1 96.77 5.47 3.62 Municipal 420.6 22.1 101.00 8.66 6.40 Corporate/ Other 164.6 8.6 97.42 5.85 3.48 Total $ 1,905.7 100 % 98.13 5.86 4.29 Available for Sale Securities (1) The accumulated other comprehensive (loss) income primarily represents the unrealized loss, net of tax benefit, of available for sale securities and is a component of equity.

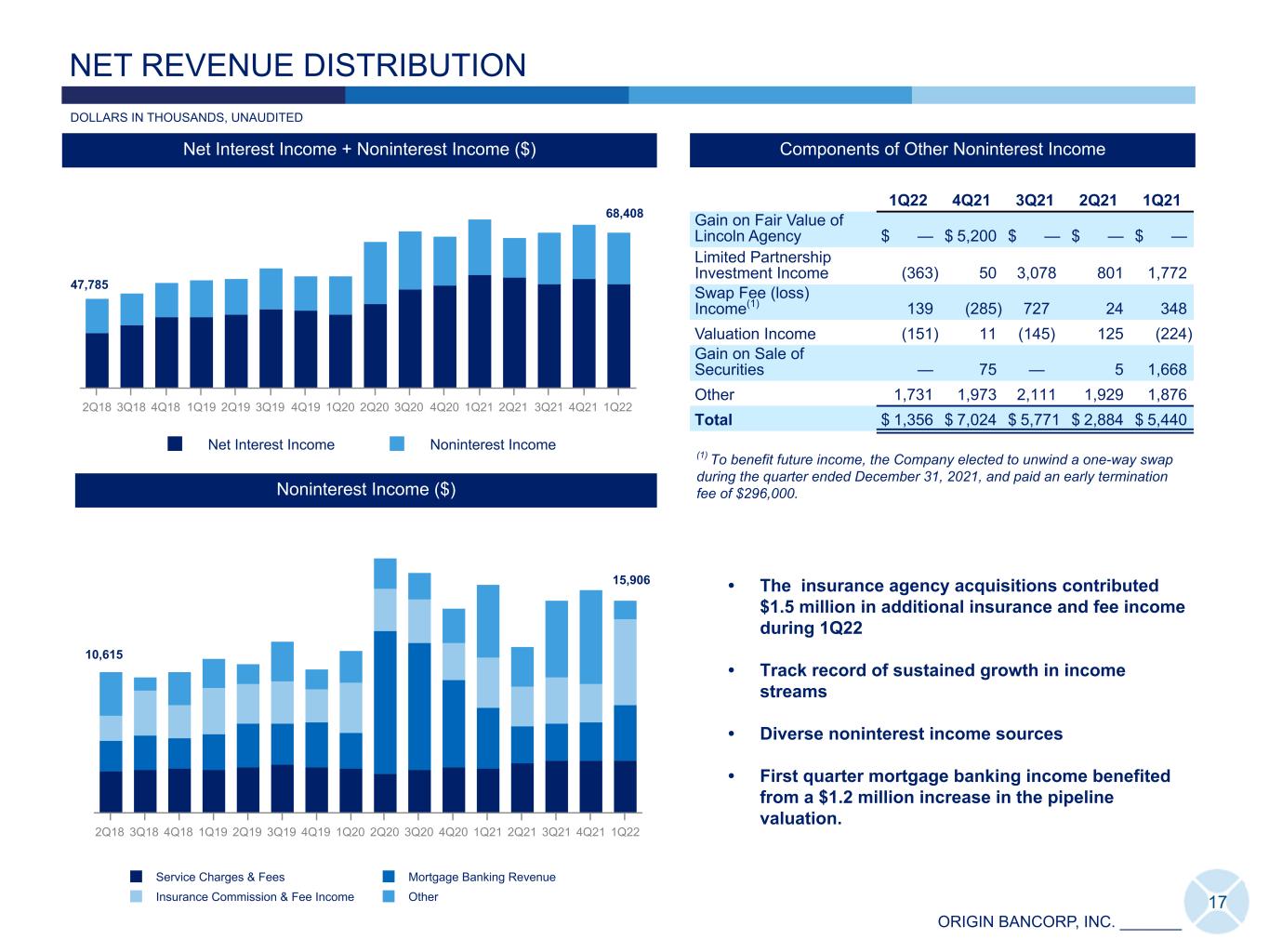

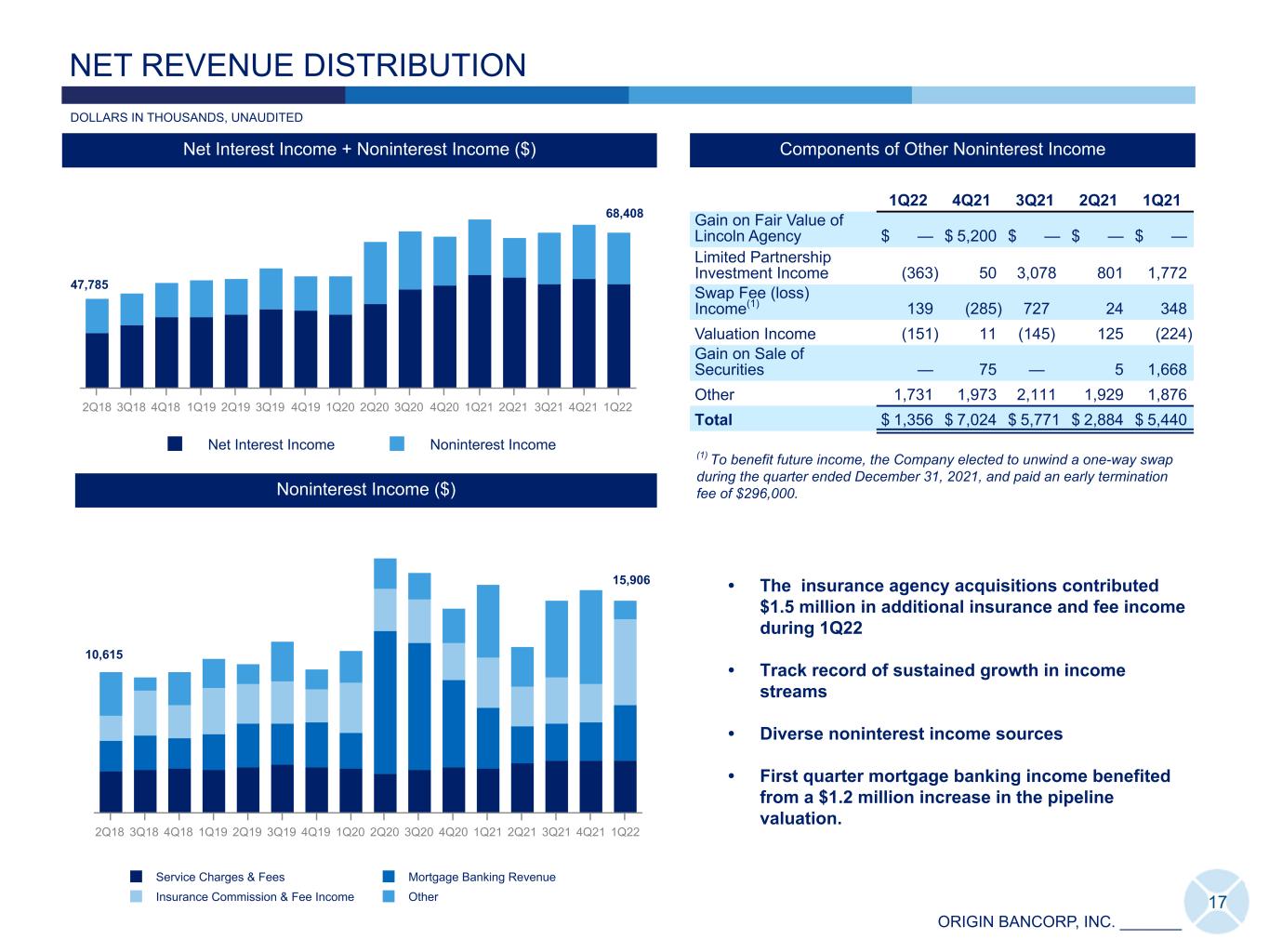

ORIGIN BANCORP, INC. _______ Service Charges & Fees Mortgage Banking Revenue Insurance Commission & Fee Income Other 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 17 Net Interest Income Noninterest Income 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 Noninterest Income ($) Net Interest Income + Noninterest Income ($) NET REVENUE DISTRIBUTION DOLLARS IN THOUSANDS, UNAUDITED Components of Other Noninterest Income • The insurance agency acquisitions contributed $1.5 million in additional insurance and fee income during 1Q22 • Track record of sustained growth in income streams • Diverse noninterest income sources • First quarter mortgage banking income benefited from a $1.2 million increase in the pipeline valuation. 68,408 10,615 1Q22 4Q21 3Q21 2Q21 1Q21 Gain on Fair Value of Lincoln Agency $ — $ 5,200 $ — $ — $ — Limited Partnership Investment Income (363) 50 3,078 801 1,772 Swap Fee (loss) Income(1) 139 (285) 727 24 348 Valuation Income (151) 11 (145) 125 (224) Gain on Sale of Securities — 75 — 5 1,668 Other 1,731 1,973 2,111 1,929 1,876 Total $ 1,356 $ 7,024 $ 5,771 $ 2,884 $ 5,440 (1) To benefit future income, the Company elected to unwind a one-way swap during the quarter ended December 31, 2021, and paid an early termination fee of $296,000. 47,785 15,906

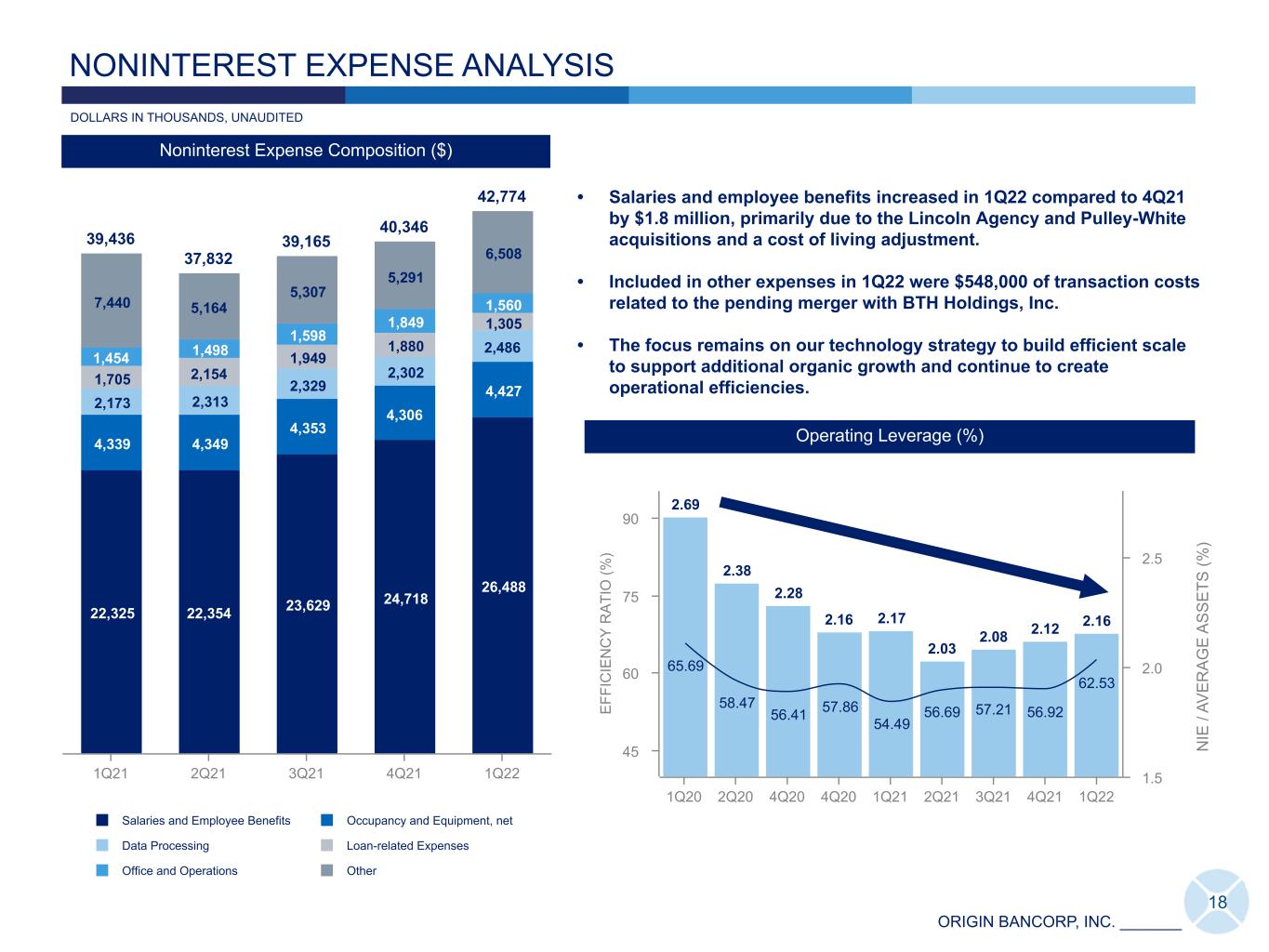

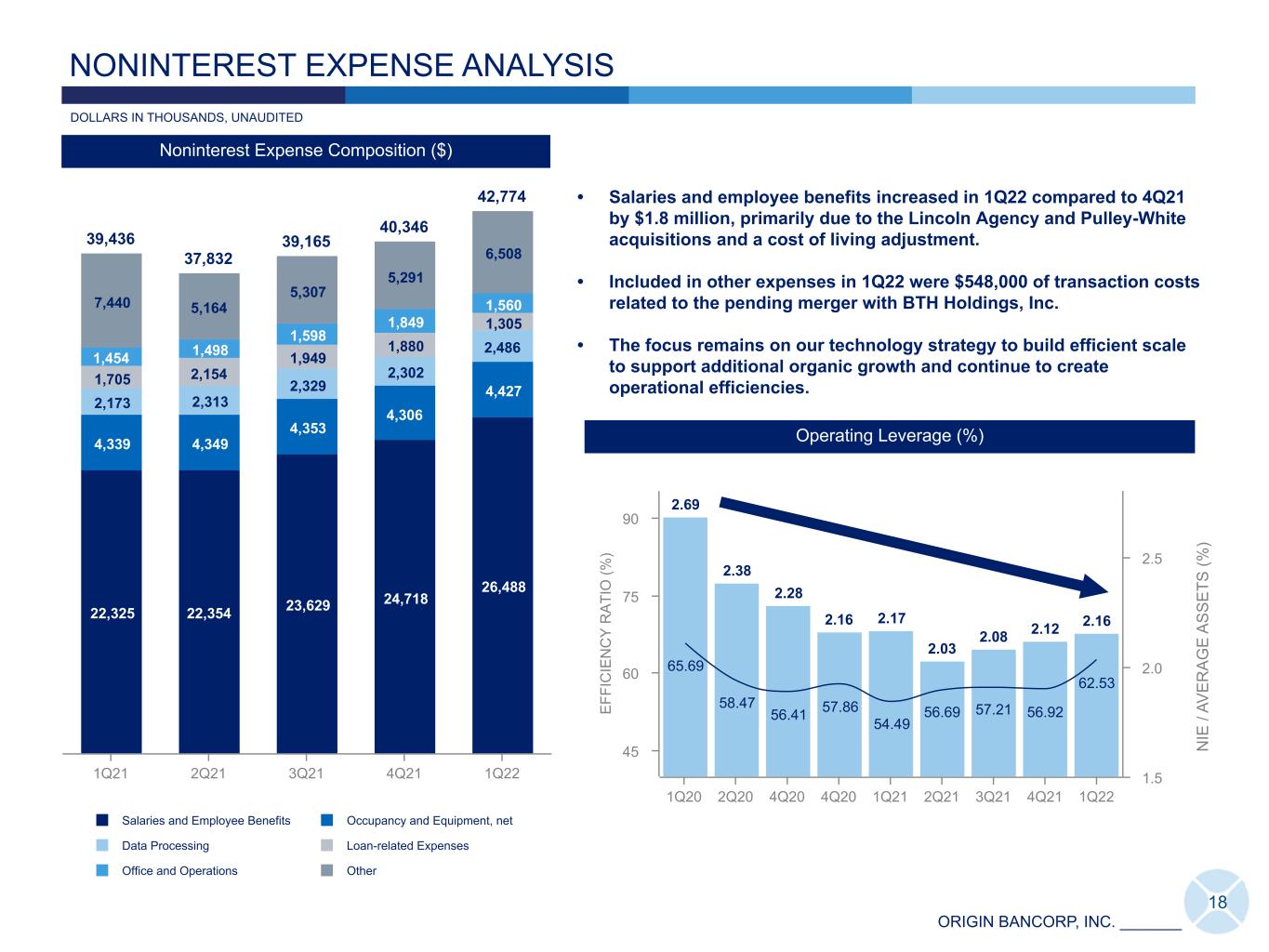

ORIGIN BANCORP, INC. _______ 39,436 37,832 39,165 40,346 42,774 22,325 22,354 23,629 24,718 26,488 4,339 4,349 4,353 4,306 4,427 2,173 2,313 2,329 2,302 2,486 1,705 2,154 1,949 1,880 1,305 1,454 1,498 1,598 1,849 1,5607,440 5,164 5,307 5,291 6,508 Salaries and Employee Benefits Occupancy and Equipment, net Data Processing Loan-related Expenses Office and Operations Other 1Q21 2Q21 3Q21 4Q21 1Q22 18 • Salaries and employee benefits increased in 1Q22 compared to 4Q21 by $1.8 million, primarily due to the Lincoln Agency and Pulley-White acquisitions and a cost of living adjustment. • Included in other expenses in 1Q22 were $548,000 of transaction costs related to the pending merger with BTH Holdings, Inc. • The focus remains on our technology strategy to build efficient scale to support additional organic growth and continue to create operational efficiencies. E FF IC IE N C Y R A TI O (% ) 2.69 2.38 2.28 2.16 2.17 2.03 2.08 2.12 2.16 65.69 58.47 56.41 57.86 54.49 56.69 57.21 56.92 62.53 1Q20 2Q20 4Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 45 60 75 90 1.5 2.0 2.5 Operating Leverage (%) NONINTEREST EXPENSE ANALYSIS N IE / AV E R A G E A S S E TS (% ) DOLLARS IN THOUSANDS, UNAUDITED Noninterest Expense Composition ($)

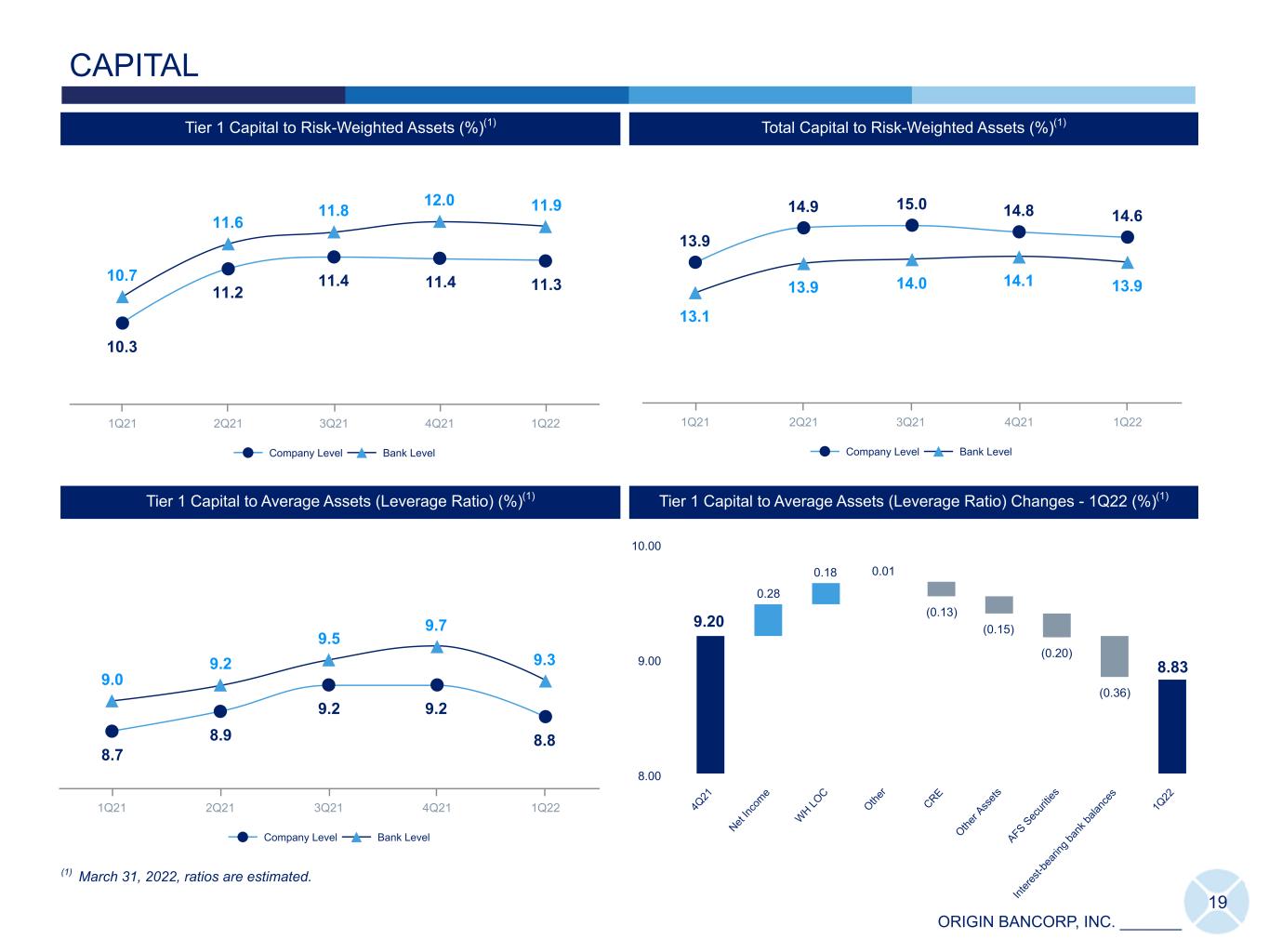

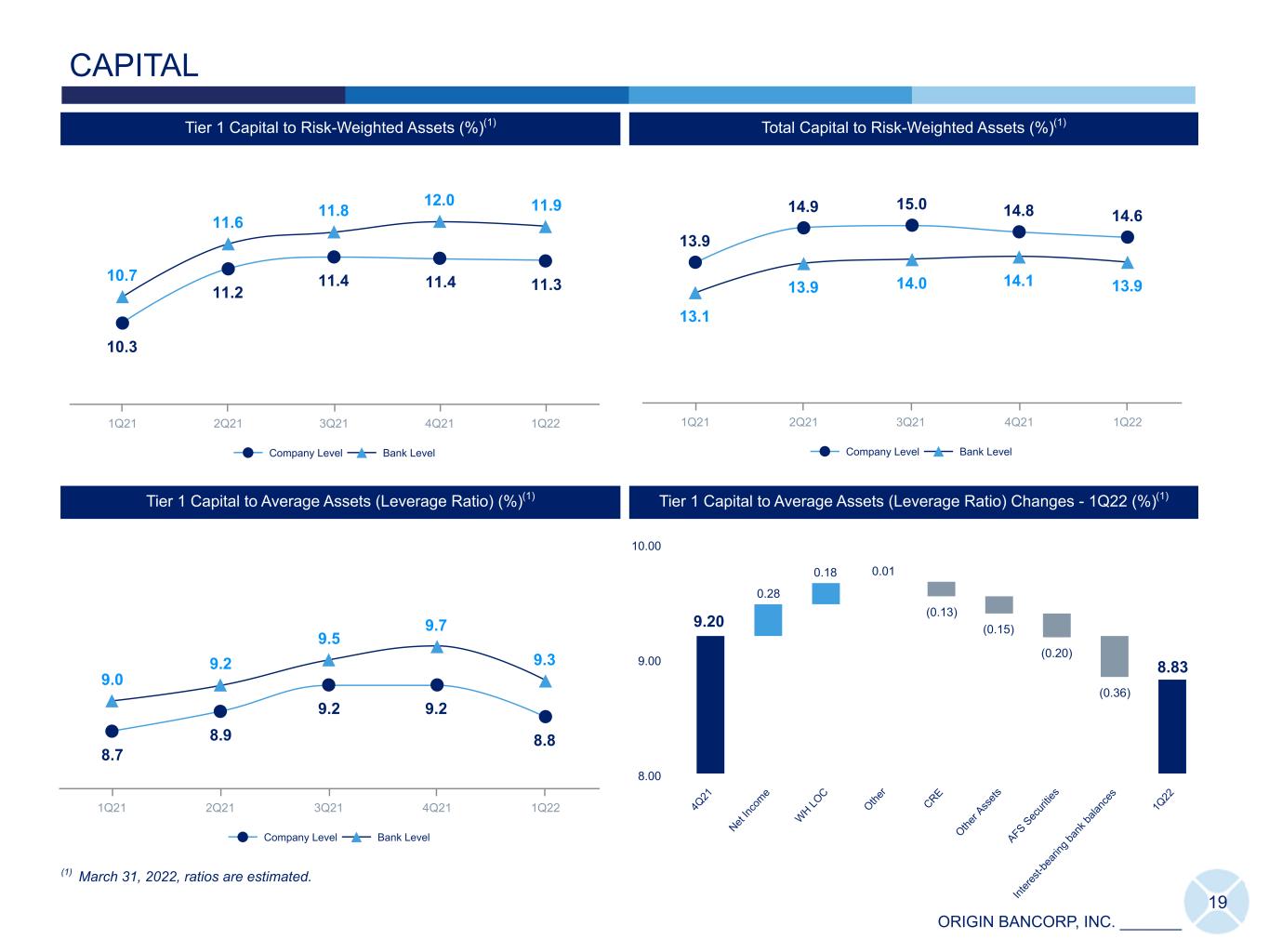

ORIGIN BANCORP, INC. _______ 8.7 8.9 9.2 9.2 8.8 9.0 9.2 9.5 9.7 9.3 Company Level Bank Level 1Q21 2Q21 3Q21 4Q21 1Q22 10.3 11.2 11.4 11.4 11.310.7 11.6 11.8 12.0 11.9 Company Level Bank Level 1Q21 2Q21 3Q21 4Q21 1Q22 19 CAPITAL Bank Level Company Level Sub-debt Impact 13.9 14.9 15.0 14.8 14.6 13.1 13.9 14.0 14.1 13.9 Company Level Bank Level 1Q21 2Q21 3Q21 4Q21 1Q22 Tier 1 Capital to Average Assets (Leverage Ratio) Changes - 1Q22 (%)(1) 9.20 0.28 0.18 0.01 (0.13) (0.15) (0.20) (0.36) 4Q 21 Net Inc om e W H LO C Othe r CRE Othe r A ss ets AFS S ec uri tie s Int ere st- be ari ng ba nk ba lan ce s 1Q 22 8.00 9.00 10.00 ICap ICap Total Capital to Risk-Weighted Assets (%)(1)Tier 1 Capital to Risk-Weighted Assets (%)(1) Tier 1 Capital to Average Assets (Leverage Ratio) (%)(1) (1) March 31, 2022, ratios are estimated. 8.83

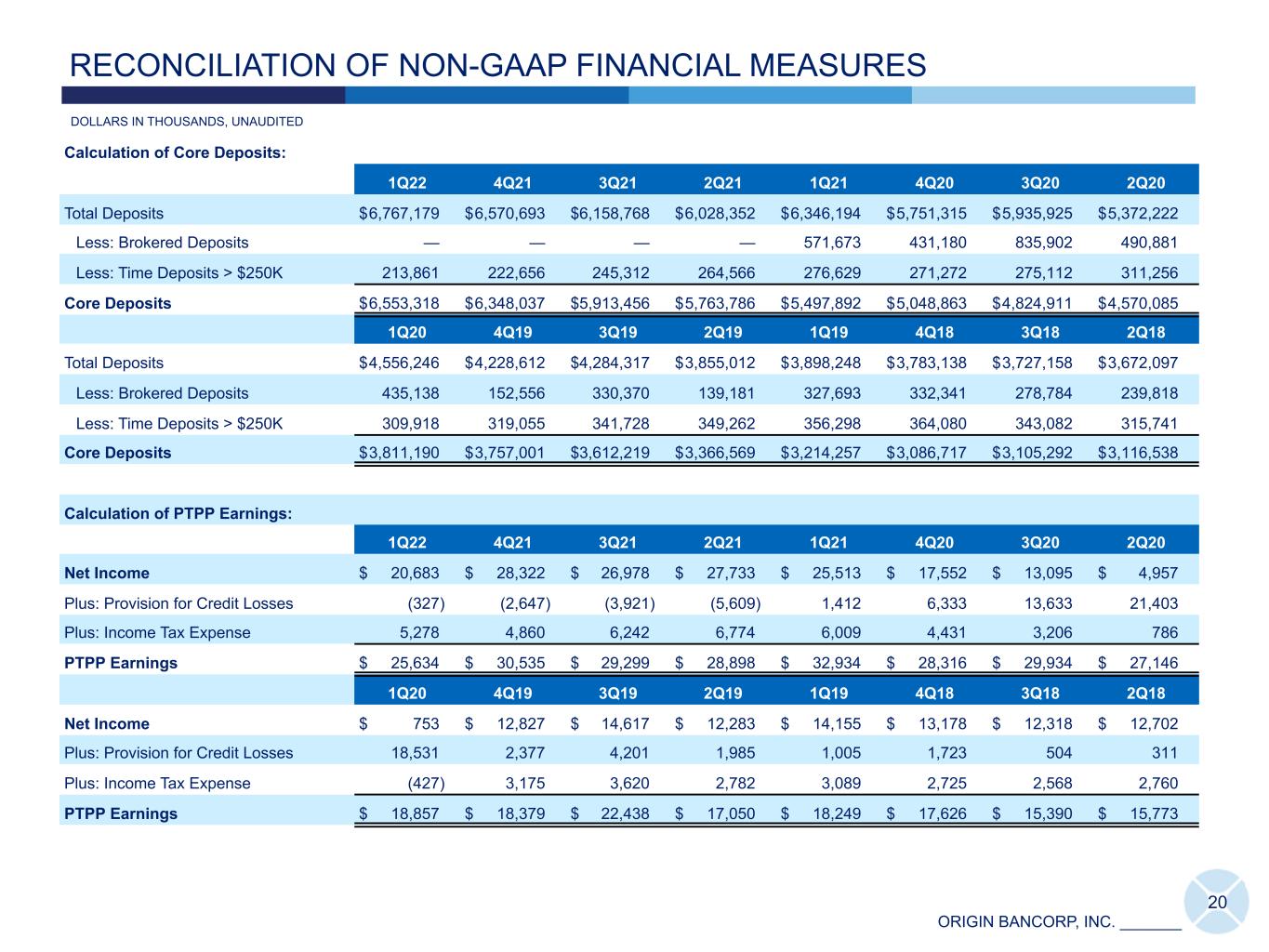

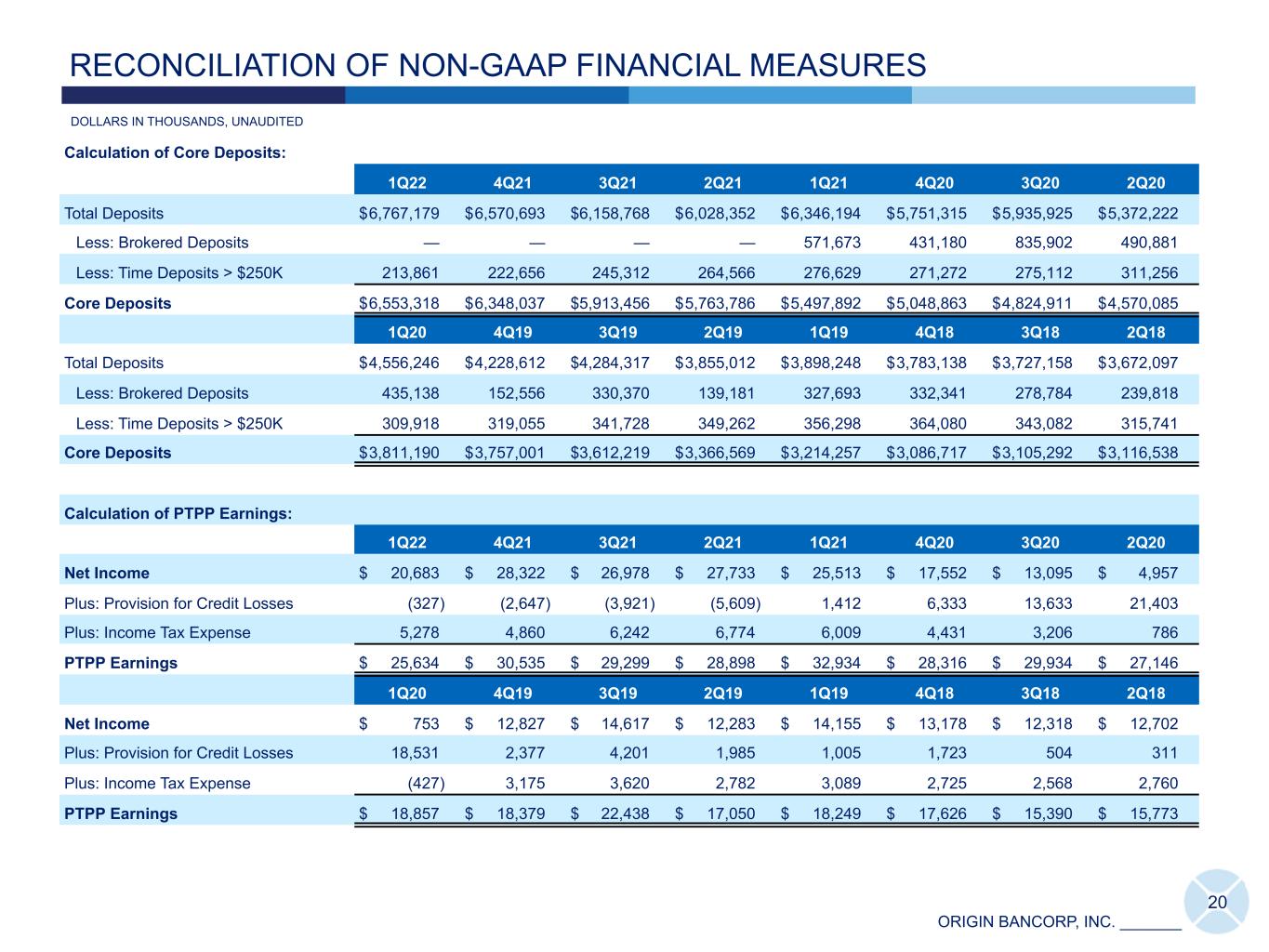

ORIGIN BANCORP, INC. _______ Calculation of Core Deposits: 1Q22 4Q21 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 Total Deposits $ 6,767,179 $ 6,570,693 $ 6,158,768 $ 6,028,352 $ 6,346,194 $ 5,751,315 $ 5,935,925 $ 5,372,222 Less: Brokered Deposits — — — — 571,673 431,180 835,902 490,881 Less: Time Deposits > $250K 213,861 222,656 245,312 264,566 276,629 271,272 275,112 311,256 Core Deposits $ 6,553,318 $ 6,348,037 $ 5,913,456 $ 5,763,786 $ 5,497,892 $ 5,048,863 $ 4,824,911 $ 4,570,085 1Q20 4Q19 3Q19 2Q19 1Q19 4Q18 3Q18 2Q18 Total Deposits $ 4,556,246 $ 4,228,612 $ 4,284,317 $ 3,855,012 $ 3,898,248 $ 3,783,138 $ 3,727,158 $ 3,672,097 Less: Brokered Deposits 435,138 152,556 330,370 139,181 327,693 332,341 278,784 239,818 Less: Time Deposits > $250K 309,918 319,055 341,728 349,262 356,298 364,080 343,082 315,741 Core Deposits $ 3,811,190 $ 3,757,001 $ 3,612,219 $ 3,366,569 $ 3,214,257 $ 3,086,717 $ 3,105,292 $ 3,116,538 Calculation of PTPP Earnings: 1Q22 4Q21 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 Net Income $ 20,683 $ 28,322 $ 26,978 $ 27,733 $ 25,513 $ 17,552 $ 13,095 $ 4,957 Plus: Provision for Credit Losses (327) (2,647) (3,921) (5,609) 1,412 6,333 13,633 21,403 Plus: Income Tax Expense 5,278 4,860 6,242 6,774 6,009 4,431 3,206 786 PTPP Earnings $ 25,634 $ 30,535 $ 29,299 $ 28,898 $ 32,934 $ 28,316 $ 29,934 $ 27,146 1Q20 4Q19 3Q19 2Q19 1Q19 4Q18 3Q18 2Q18 Net Income $ 753 $ 12,827 $ 14,617 $ 12,283 $ 14,155 $ 13,178 $ 12,318 $ 12,702 Plus: Provision for Credit Losses 18,531 2,377 4,201 1,985 1,005 1,723 504 311 Plus: Income Tax Expense (427) 3,175 3,620 2,782 3,089 2,725 2,568 2,760 PTPP Earnings $ 18,857 $ 18,379 $ 22,438 $ 17,050 $ 18,249 $ 17,626 $ 15,390 $ 15,773 20 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

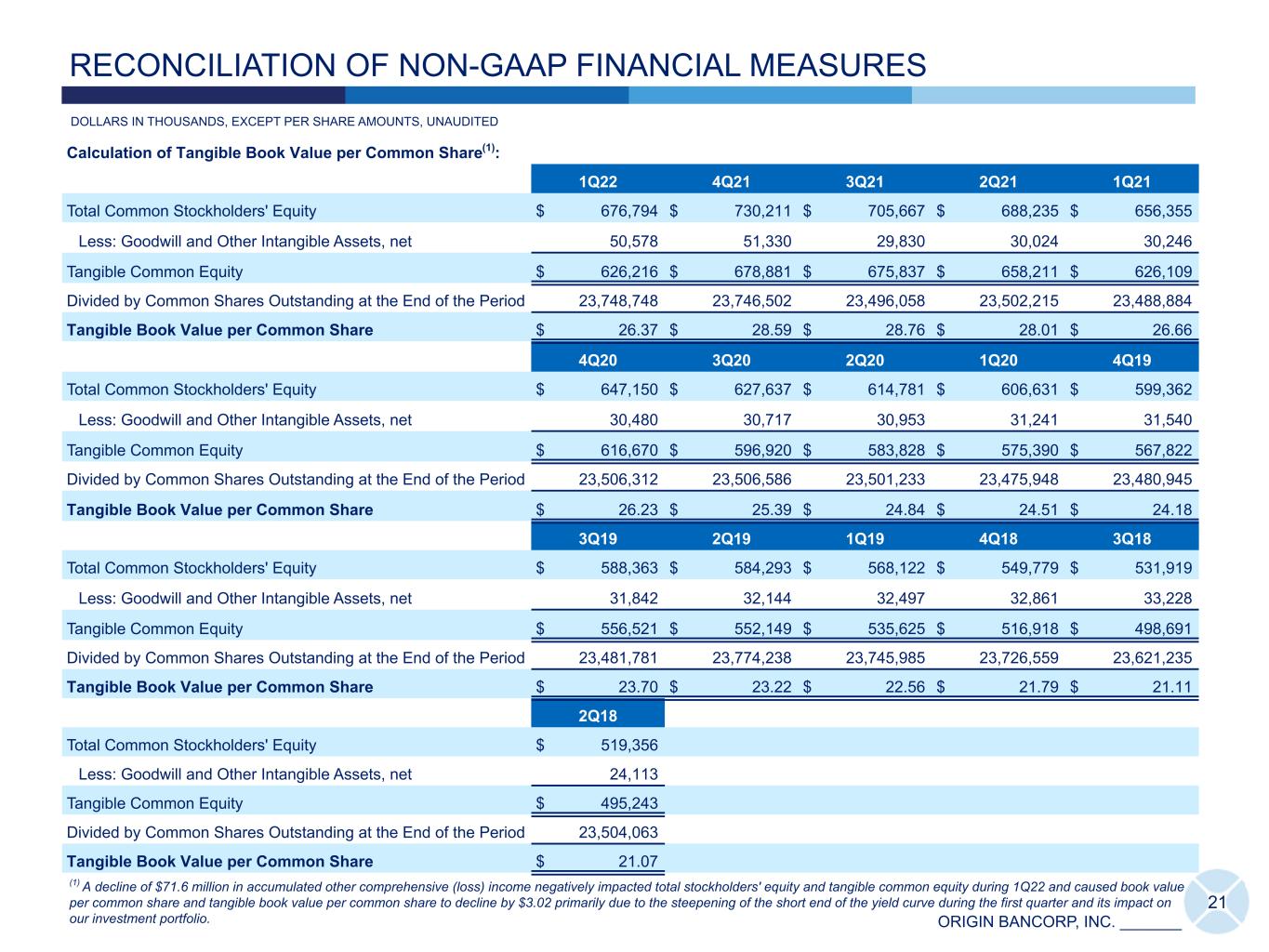

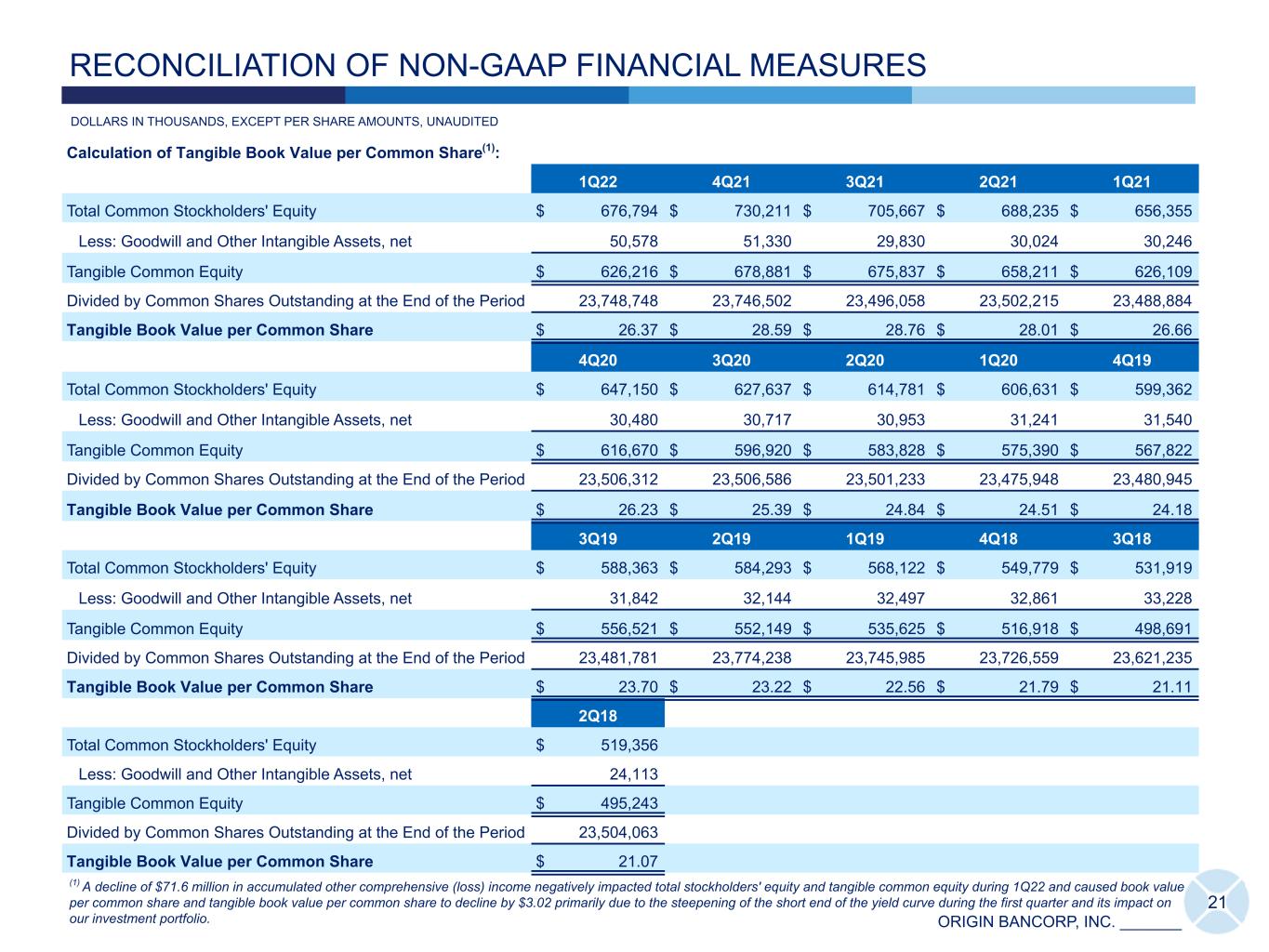

ORIGIN BANCORP, INC. _______ Calculation of Tangible Book Value per Common Share(1): 1Q22 4Q21 3Q21 2Q21 1Q21 Total Common Stockholders' Equity $ 676,794 $ 730,211 $ 705,667 $ 688,235 $ 656,355 Less: Goodwill and Other Intangible Assets, net 50,578 51,330 29,830 30,024 30,246 Tangible Common Equity $ 626,216 $ 678,881 $ 675,837 $ 658,211 $ 626,109 Divided by Common Shares Outstanding at the End of the Period 23,748,748 23,746,502 23,496,058 23,502,215 23,488,884 Tangible Book Value per Common Share $ 26.37 $ 28.59 $ 28.76 $ 28.01 $ 26.66 4Q20 3Q20 2Q20 1Q20 4Q19 Total Common Stockholders' Equity $ 647,150 $ 627,637 $ 614,781 $ 606,631 $ 599,362 Less: Goodwill and Other Intangible Assets, net 30,480 30,717 30,953 31,241 31,540 Tangible Common Equity $ 616,670 $ 596,920 $ 583,828 $ 575,390 $ 567,822 Divided by Common Shares Outstanding at the End of the Period 23,506,312 23,506,586 23,501,233 23,475,948 23,480,945 Tangible Book Value per Common Share $ 26.23 $ 25.39 $ 24.84 $ 24.51 $ 24.18 3Q19 2Q19 1Q19 4Q18 3Q18 Total Common Stockholders' Equity $ 588,363 $ 584,293 $ 568,122 $ 549,779 $ 531,919 Less: Goodwill and Other Intangible Assets, net 31,842 32,144 32,497 32,861 33,228 Tangible Common Equity $ 556,521 $ 552,149 $ 535,625 $ 516,918 $ 498,691 Divided by Common Shares Outstanding at the End of the Period 23,481,781 23,774,238 23,745,985 23,726,559 23,621,235 Tangible Book Value per Common Share $ 23.70 $ 23.22 $ 22.56 $ 21.79 $ 21.11 2Q18 Total Common Stockholders' Equity $ 519,356 Less: Goodwill and Other Intangible Assets, net 24,113 Tangible Common Equity $ 495,243 Divided by Common Shares Outstanding at the End of the Period 23,504,063 Tangible Book Value per Common Share $ 21.07 21 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (1) A decline of $71.6 million in accumulated other comprehensive (loss) income negatively impacted total stockholders' equity and tangible common equity during 1Q22 and caused book value per common share and tangible book value per common share to decline by $3.02 primarily due to the steepening of the short end of the yield curve during the first quarter and its impact on our investment portfolio.

ORIGIN BANCORP, INC. _______ 1Q22 4Q21 1Q21 Calculation of PTPP Earnings: Net Income $ 20,683 $ 28,322 $ 25,513 Plus: Provision for Credit Losses (327) (2,647) 1,412 Plus: Income Tax Expense 5,278 4,860 6,009 PTPP Earnings $ 25,634 $ 30,535 $ 32,934 Calculation of PTPP ROAA and PTPP ROAE: PTPP Earnings $ 25,634 $ 30,535 $ 32,934 Divided by Number of Days in the Quarter 90 92 90 Multiplied by the Number of Days in the Year 365 365 365 Annualized PTPP Earnings $ 103,960 $ 121,144 $ 133,566 Divided by Total Average Assets $ 8,045,246 $ 7,559,570 $ 7,382,495 PTPP ROAA (Annualized) 1.29 % 1.60 % 1.81 % Divided by Total Average Stockholder's Equity $ 722,504 $ 715,614 $ 657,863 PTPP ROAE (Annualized) 14.39 % 16.93 % 20.30 % 22 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ORIGIN BANCORP, INC. _______ IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with Origin’s proposed merger with BT Holdings, Inc. ("BTH") (the “Transaction”), Origin has filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Origin and BTH and a prospectus of Origin, as well as other relevant documents concerning the Transaction. Certain matters in respect of the Transaction involving BTH and Origin will be submitted to BTH’s and Origin’s shareholders for their consideration. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT ORIGIN, BTH AND THE TRANSACTION. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from Origin at its website, www.origin.bank. Documents filed with the SEC by Origin will be available free of charge by accessing Origin’s Investor Relations website at ir.origin.bank or, alternatively, by directing a request by mail or telephone to Origin Bancorp, Inc., 500 South Service Road East, Ruston, Louisiana 71270, Attn: Investor Relations, (318) 497-3177. PARTICIPANTS IN THE SOLICITATION Origin, BTH and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Origin and BTH in connection with the proposed transaction under the rules of the SEC. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about Origin, and its directors and executive officers, may be found in Origin’s definitive proxy statement relating to its 2022 Annual Meeting of Shareholders filed with the SEC on March 16, 2022, and other documents filed by Origin with the SEC. These documents can be obtained free of charge from the sources described above. NO OFFER OR SOLICITATION This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. 23 INFORMATION REGARDING PENDING ACQUISITION OF BT HOLDINGS, INC.