3Q TWENTY23 INVESTOR PRESENTATION ORIGIN BANCORP, INC.

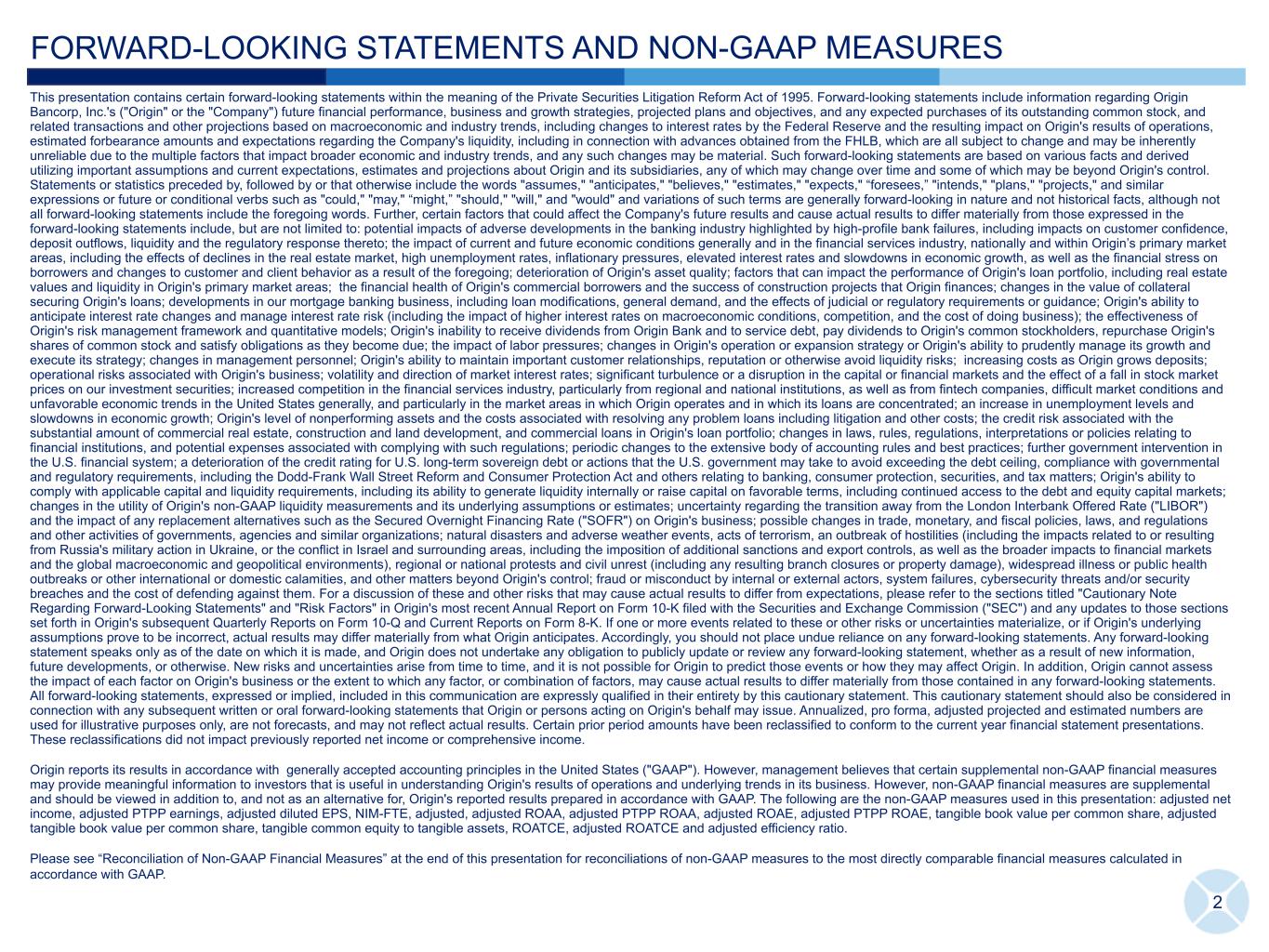

2 FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin Bancorp, Inc.'s ("Origin" or the "Company") future financial performance, business and growth strategies, projected plans and objectives, and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including changes to interest rates by the Federal Reserve and the resulting impact on Origin's results of operations, estimated forbearance amounts and expectations regarding the Company's liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin's control. Statements or statistics preceded by, followed by or that otherwise include the words "assumes," "anticipates," "believes," "estimates," "expects," “foresees,” "intends," "plans," "projects," and similar expressions or future or conditional verbs such as "could," "may," “might,” "should," "will," and "would" and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect the Company's future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: potential impacts of adverse developments in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto; the impact of current and future economic conditions generally and in the financial services industry, nationally and within Origin’s primary market areas, including the effects of declines in the real estate market, high unemployment rates, inflationary pressures, elevated interest rates and slowdowns in economic growth, as well as the financial stress on borrowers and changes to customer and client behavior as a result of the foregoing; deterioration of Origin's asset quality; factors that can impact the performance of Origin's loan portfolio, including real estate values and liquidity in Origin's primary market areas; the financial health of Origin's commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin's loans; developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; Origin's ability to anticipate interest rate changes and manage interest rate risk (including the impact of higher interest rates on macroeconomic conditions, competition, and the cost of doing business); the effectiveness of Origin's risk management framework and quantitative models; Origin's inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin's common stockholders, repurchase Origin's shares of common stock and satisfy obligations as they become due; the impact of labor pressures; changes in Origin's operation or expansion strategy or Origin's ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin's ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; increasing costs as Origin grows deposits; operational risks associated with Origin's business; volatility and direction of market interest rates; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies, difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin's level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin's loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; a deterioration of the credit rating for U.S. long-term sovereign debt or actions that the U.S. government may take to avoid exceeding the debt ceiling, compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities, and tax matters; Origin's ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin's non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the transition away from the London Interbank Offered Rate ("LIBOR") and the impact of any replacement alternatives such as the Secured Overnight Financing Rate ("SOFR") on Origin's business; possible changes in trade, monetary, and fiscal policies, laws, and regulations and other activities of governments, agencies and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities (including the impacts related to or resulting from Russia's military action in Ukraine, or the conflict in Israel and surrounding areas, including the imposition of additional sanctions and export controls, as well as the broader impacts to financial markets and the global macroeconomic and geopolitical environments), regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin's control; fraud or misconduct by internal or external actors, system failures, cybersecurity threats and/or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors" in Origin's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") and any updates to those sections set forth in Origin's subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin's underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise. New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin's behalf may issue. Annualized, pro forma, adjusted projected and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results. Certain prior period amounts have been reclassified to conform to the current year financial statement presentations. These reclassifications did not impact previously reported net income or comprehensive income. Origin reports its results in accordance with generally accepted accounting principles in the United States ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures may provide meaningful information to investors that is useful in understanding Origin's results of operations and underlying trends in its business. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: adjusted net income, adjusted PTPP earnings, adjusted diluted EPS, NIM-FTE, adjusted, adjusted ROAA, adjusted PTPP ROAA, adjusted ROAE, adjusted PTPP ROAE, tangible book value per common share, adjusted tangible book value per common share, tangible common equity to tangible assets, ROATCE, adjusted ROATCE and adjusted efficiency ratio. Please see “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP.

ORIGIN BANCORP, INC. _______ 17 LOUISIANA Entry: 1912 Loans: $1,487 Deposits: $2,815 DOLLARS IN MILLIONS, UNAUDITED (2) (3) 3 ORIGIN COMPANY SNAPSHOT • Origin Bancorp, Inc. is the holding company for Origin Bank. • Origin Bank was founded in 1912 and is headquartered in Choudrant, LA. • 60(1) banking centers operating across Texas, Louisiana & Mississippi DEPOSITS & LOANS BY STATE Note: All financial information is as of September 30, 2023. * Please see slide 30 for all footnote references included above. MISSISSIPPI Entry: 2010 Loans: $572 Deposits: $641 8% 8% 37% 20% 55% 72% Loans (3)Deposits (2) ICS ICS 9 10 18 6 TEXAS Dallas/Fort Worth Houston East Texas Entry: 2008 Entry: 2013 Entry: 2022 Loans: $2,981 Loans: $1,806 Loans: $436 Deposits: $2,103 Deposits: $1,167 Deposits: $861 Total Texas Loans: $5,223 Total Texas Deposits: $4,131

ORIGIN BANCORP, INC. _______ 4 A UNIQUE & DEFINED CULTURE

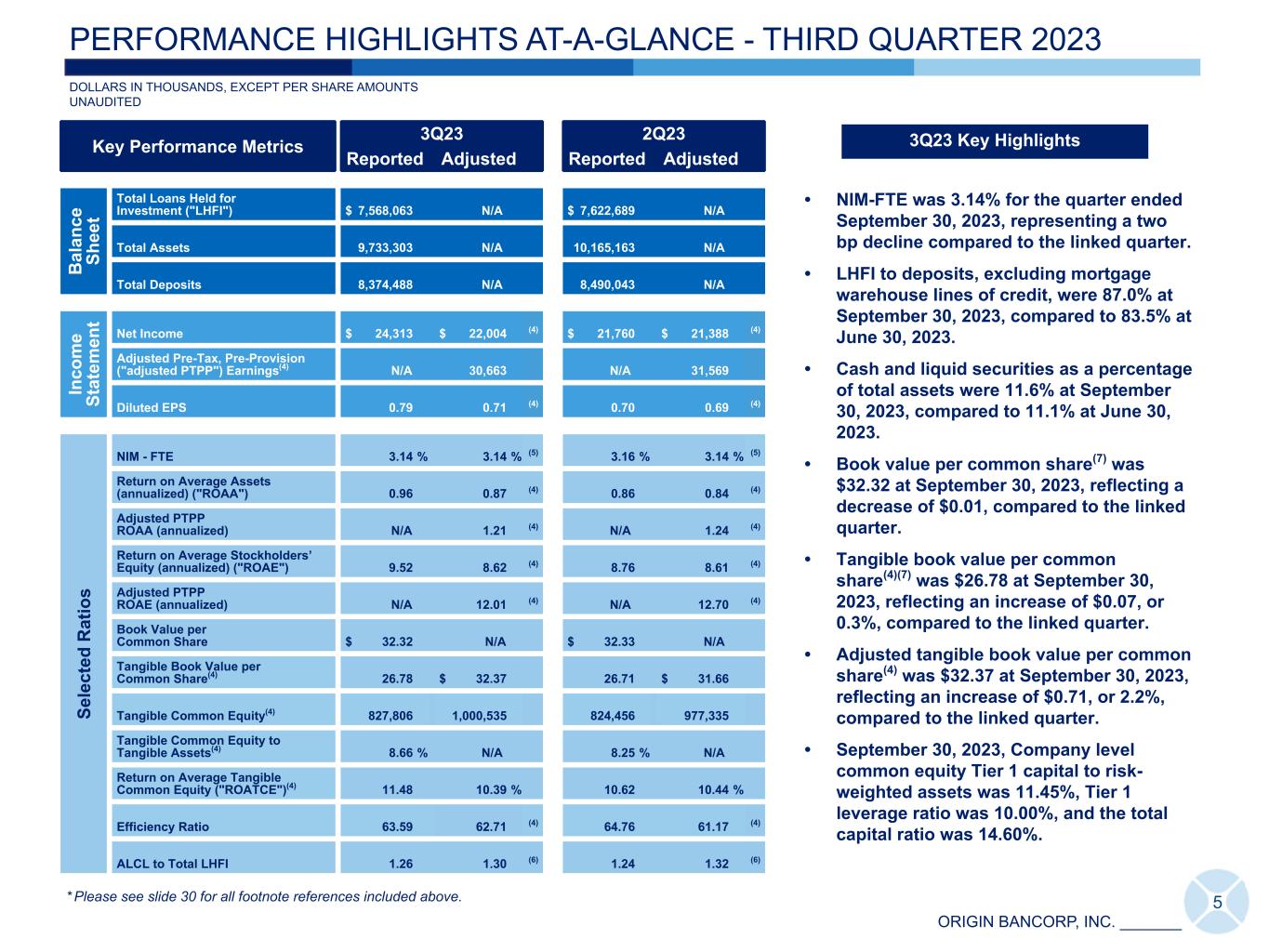

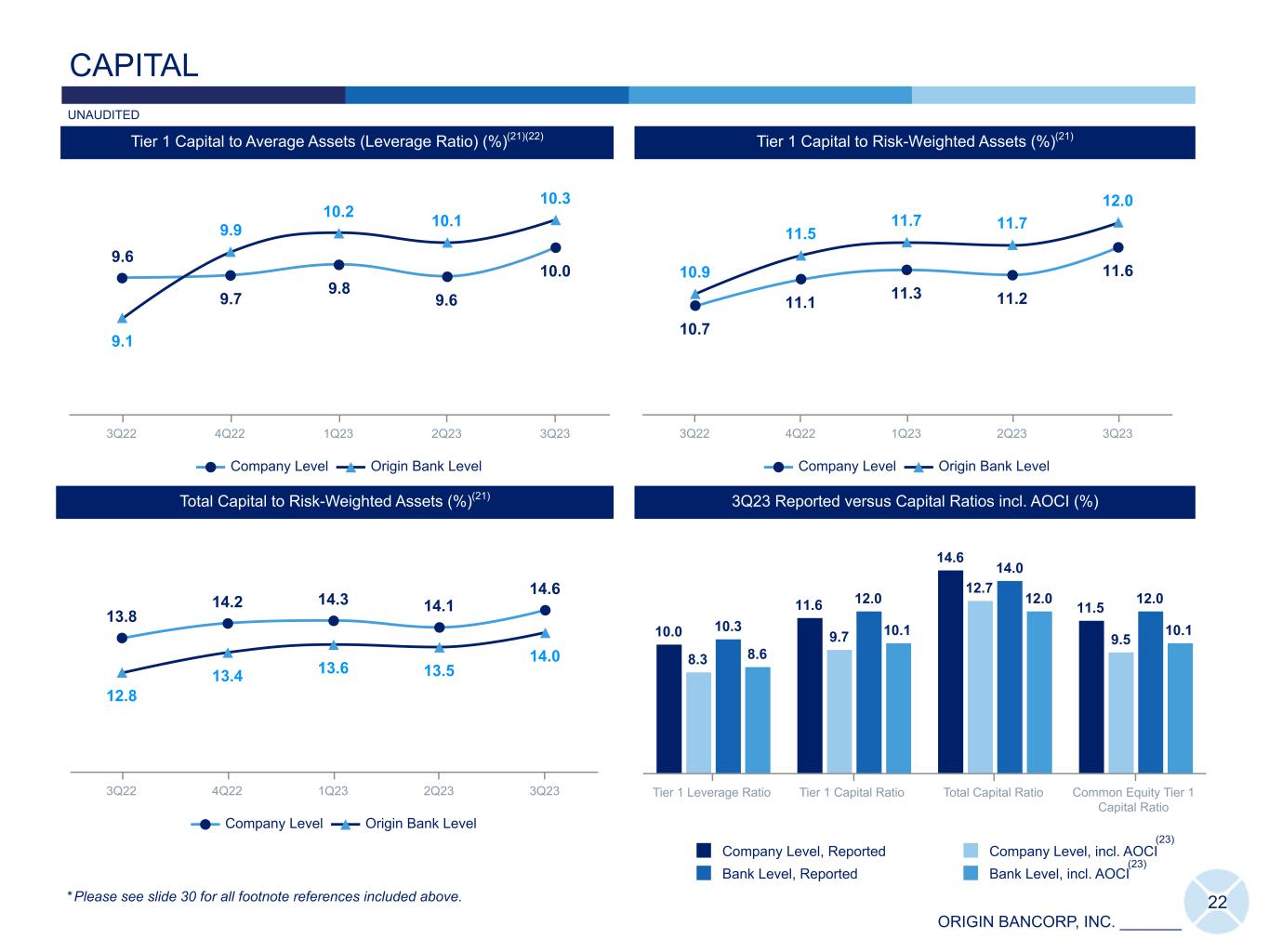

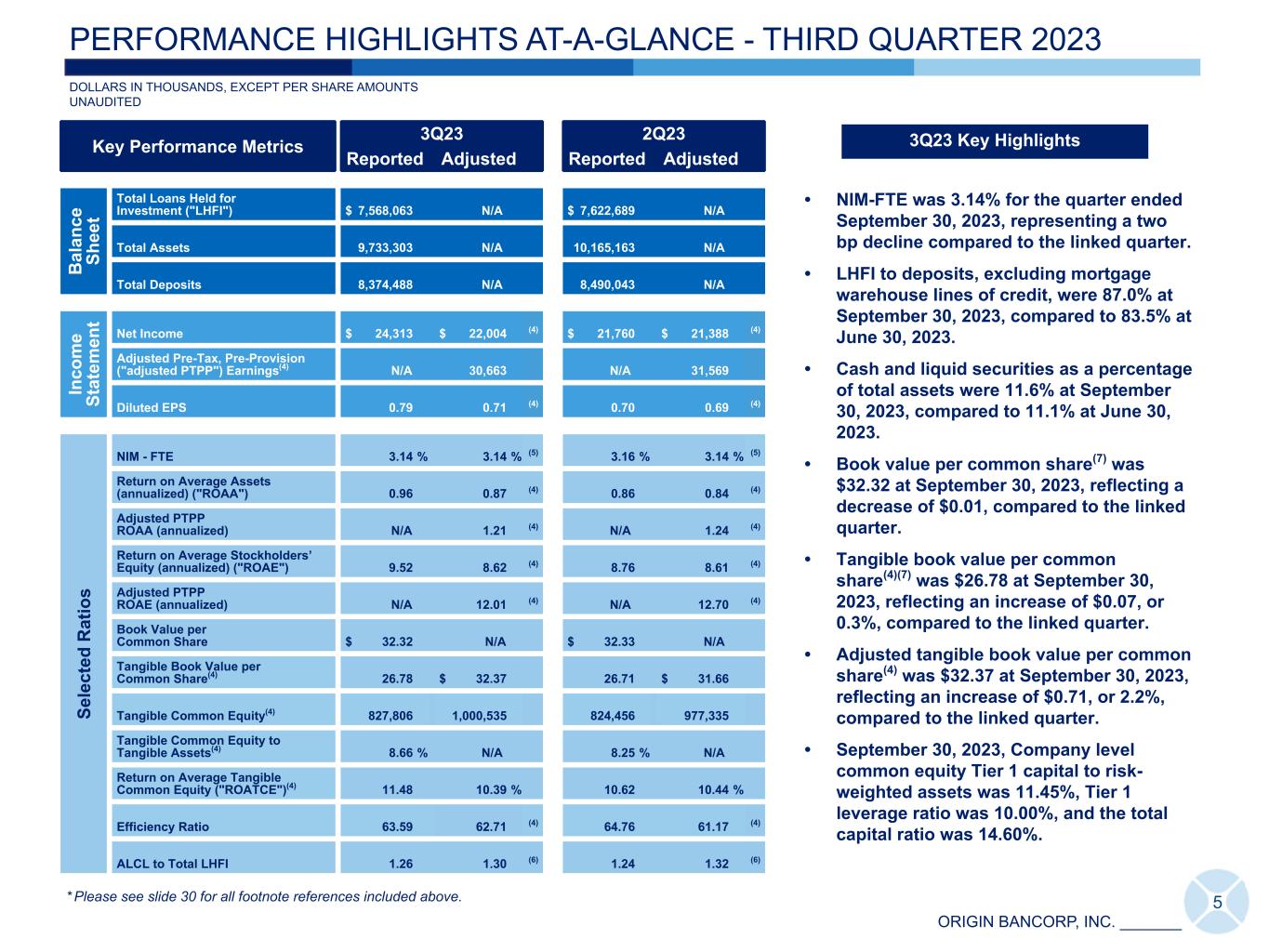

ORIGIN BANCORP, INC. _______ • NIM-FTE was 3.14% for the quarter ended September 30, 2023, representing a two bp decline compared to the linked quarter. • LHFI to deposits, excluding mortgage warehouse lines of credit, were 87.0% at September 30, 2023, compared to 83.5% at June 30, 2023. • Cash and liquid securities as a percentage of total assets were 11.6% at September 30, 2023, compared to 11.1% at June 30, 2023. • Book value per common share(7) was $32.32 at September 30, 2023, reflecting a decrease of $0.01, compared to the linked quarter. • Tangible book value per common share(4)(7) was $26.78 at September 30, 2023, reflecting an increase of $0.07, or 0.3%, compared to the linked quarter. • Adjusted tangible book value per common share(4) was $32.37 at September 30, 2023, reflecting an increase of $0.71, or 2.2%, compared to the linked quarter. • September 30, 2023, Company level common equity Tier 1 capital to risk- weighted assets was 11.45%, Tier 1 leverage ratio was 10.00%, and the total capital ratio was 14.60%. Key Performance Metrics 3Q23 2Q23 Reported Adjusted Reported Adjusted B al an ce Sh ee t Total Loans Held for Investment ("LHFI") $ 7,568,063 N/A $ 7,622,689 N/A Total Assets 9,733,303 N/A 10,165,163 N/A Total Deposits 8,374,488 N/A 8,490,043 N/A In co m e St at em en t Net Income $ 24,313 $ 22,004 (4) $ 21,760 $ 21,388 (4) Adjusted Pre-Tax, Pre-Provision ("adjusted PTPP") Earnings(4) N/A 30,663 N/A 31,569 Diluted EPS 0.79 0.71 (4) 0.70 0.69 (4) Se le ct ed R at io s NIM - FTE 3.14 % 3.14 % (5) 3.16 % 3.14 % (5) Return on Average Assets (annualized) ("ROAA") 0.96 0.87 (4) 0.86 0.84 (4) Adjusted PTPP ROAA (annualized) N/A 1.21 (4) N/A 1.24 (4) Return on Average Stockholders’ Equity (annualized) ("ROAE") 9.52 8.62 (4) 8.76 8.61 (4) Adjusted PTPP ROAE (annualized) N/A 12.01 (4) N/A 12.70 (4) Book Value per Common Share $ 32.32 N/A $ 32.33 N/A Tangible Book Value per Common Share(4) 26.78 $ 32.37 26.71 $ 31.66 Tangible Common Equity(4) 827,806 1,000,535 824,456 977,335 Tangible Common Equity to Tangible Assets(4) 8.66 % N/A 8.25 % N/A Return on Average Tangible Common Equity ("ROATCE")(4) 11.48 10.39 % 10.62 10.44 % Efficiency Ratio 63.59 62.71 (4) 64.76 61.17 (4) ALCL to Total LHFI 1.26 1.30 (6) 1.24 1.32 (6) DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS UNAUDITED 5 PERFORMANCE HIGHLIGHTS AT-A-GLANCE - THIRD QUARTER 2023 3Q23 Key Highlights * Please see slide 30 for all footnote references included above.

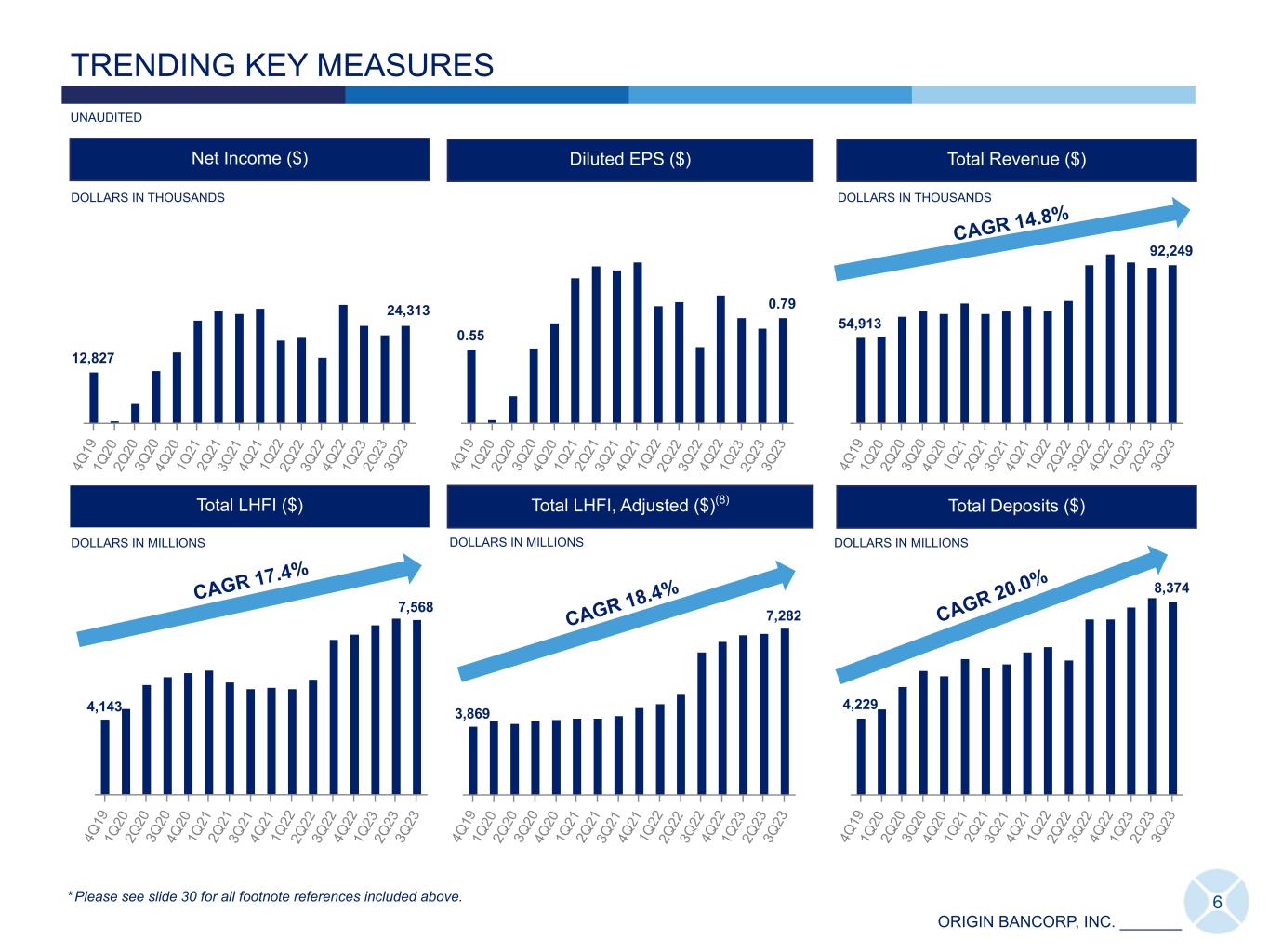

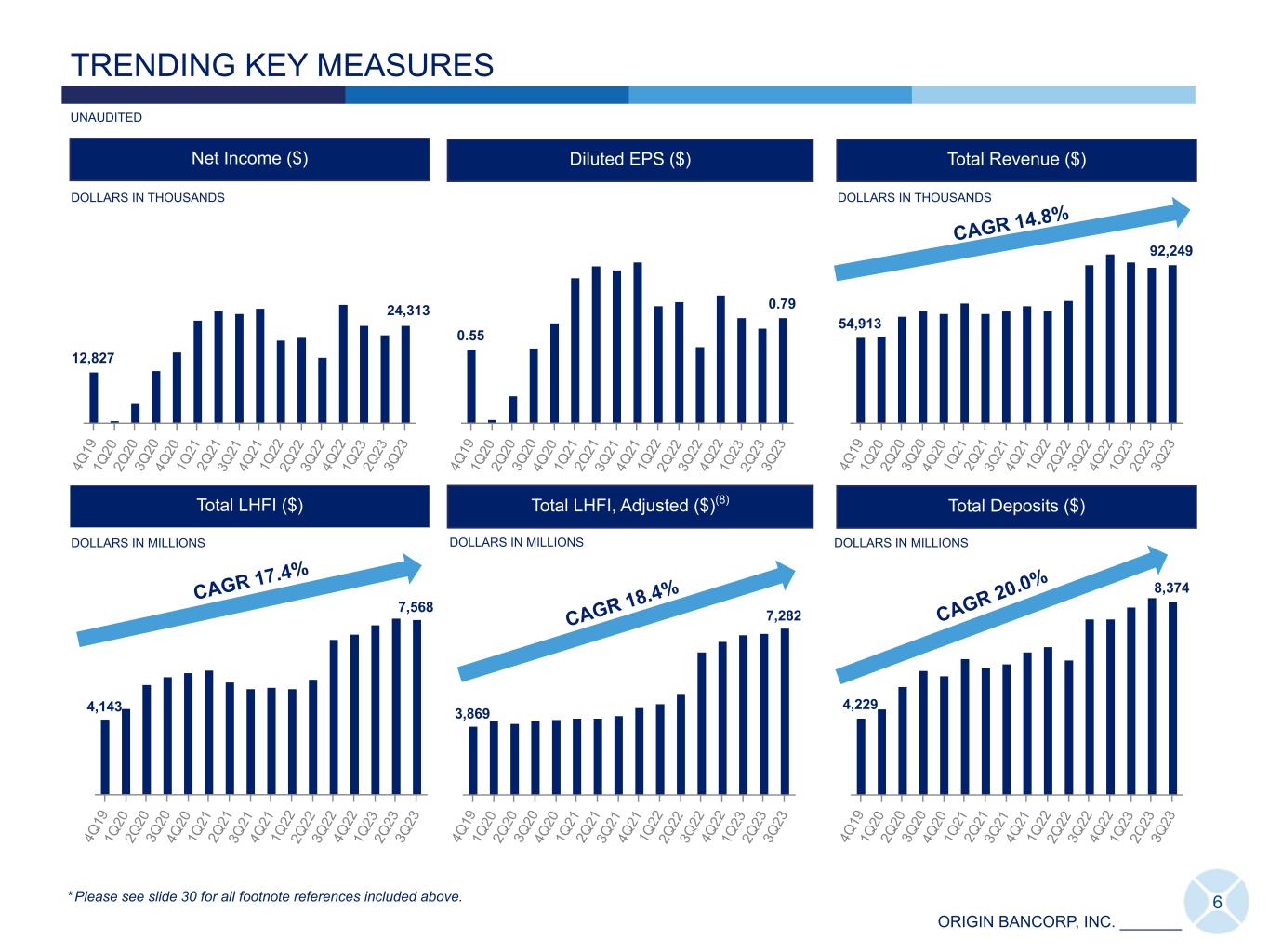

ORIGIN BANCORP, INC. _______ TRENDING KEY MEASURES 54,913 92,249 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 Total Revenue ($) UNAUDITED Diluted EPS ($)Net Income ($) Total LHFI, Adjusted ($)(8) Total Deposits ($) 0.55 0.79 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 12,827 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4,229 8,374 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 3,869 7,282 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 DOLLARS IN THOUSANDS DOLLARS IN THOUSANDS 6 Total LHFI ($) DOLLARS IN MILLIONS 4,143 7,568 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 DOLLARS IN MILLIONSDOLLARS IN MILLIONS * Please see slide 30 for all footnote references included above. CAGR 14.8% CAGR 17.4% CAGR 18.4% CAGR 20.0% 24,313

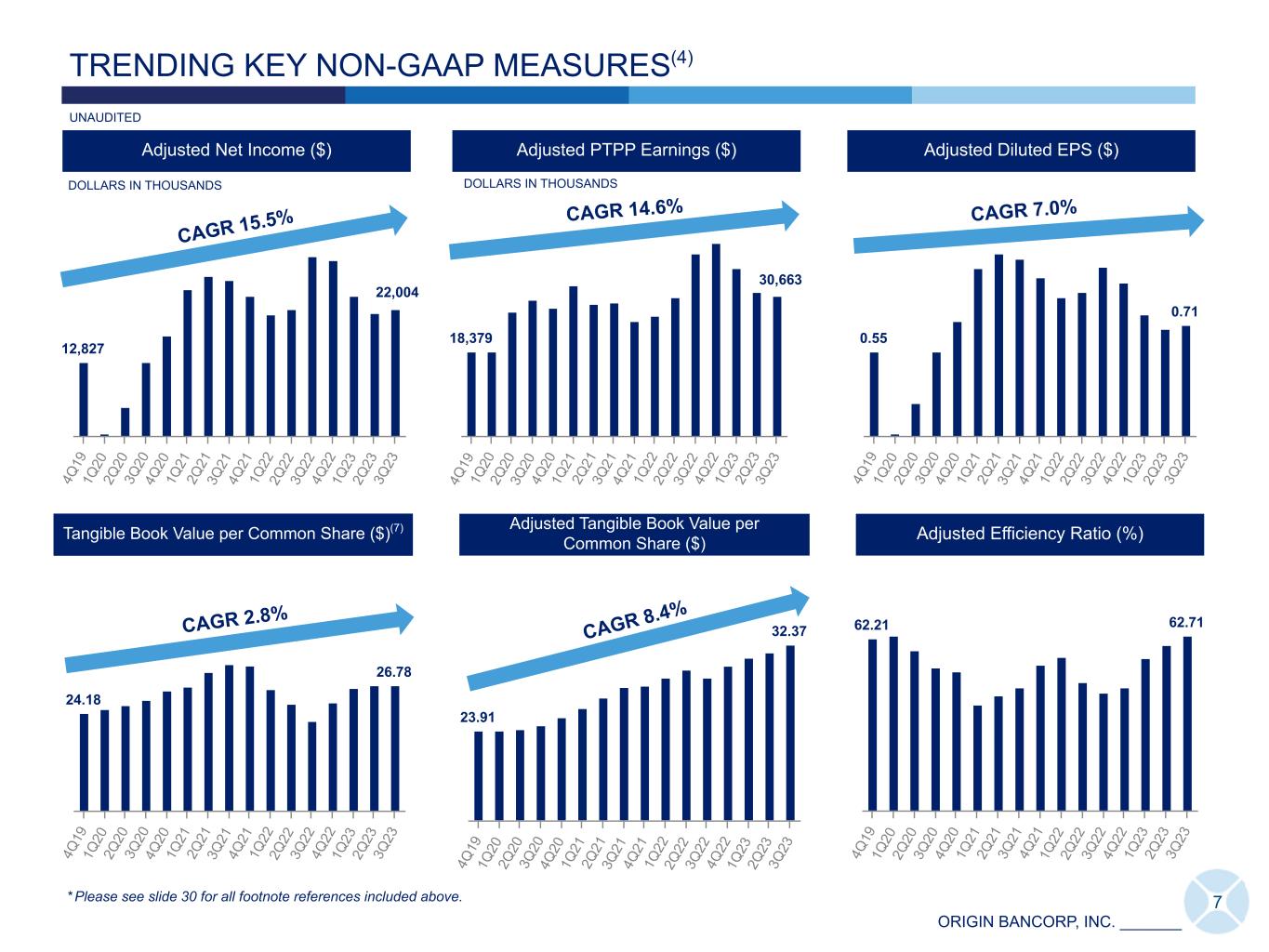

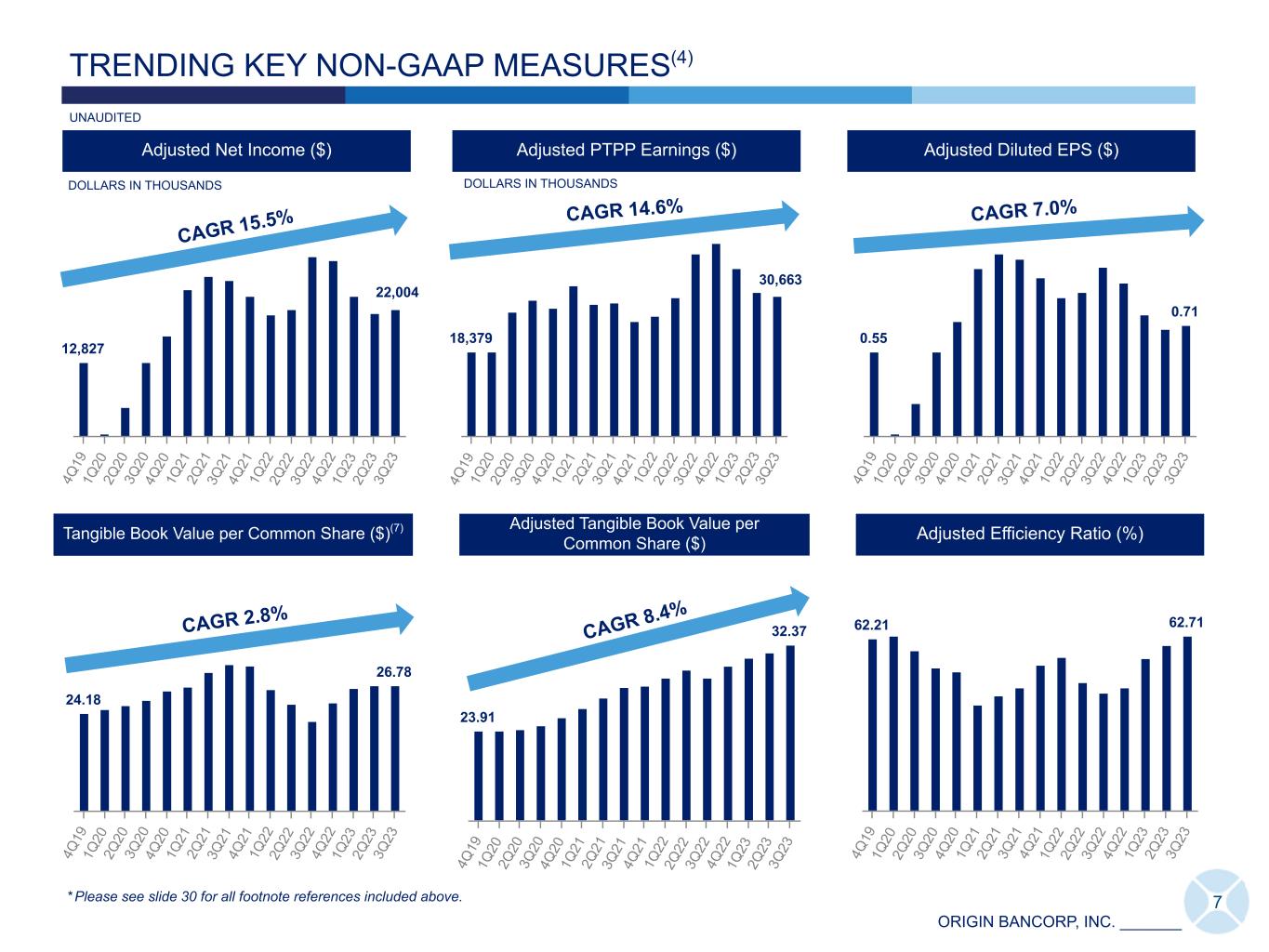

ORIGIN BANCORP, INC. _______ TRENDING KEY NON-GAAP MEASURES(4) Adjusted Diluted EPS ($) UNAUDITED Adjusted Net Income ($) Adjusted PTPP Earnings ($) DOLLARS IN THOUSANDS Adjusted Efficiency Ratio (%) 62.21 62.71 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 24.18 26.78 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 Tangible Book Value per Common Share ($)(7) 7 23.91 32.37 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 Adjusted Tangible Book Value per Common Share ($) 18,379 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 DOLLARS IN THOUSANDS 12,827 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 0.55 0.71 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 * Please see slide 30 for all footnote references included above. CAGR 15.5% CAGR 14.6% CAGR 7.0% CAGR 2.8% CAGR 8.4% 22,004 30,663

ORIGIN BANCORP, INC. _______ ASSET AND STOCKHOLDERS' EQUITY GROWTH 1997 - 3Q23 DOLLARS IN MILLIONS Total Assets ($) 148 9,733 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 3Q 23 Total Stockholders' Equity ($) 11 999 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 3Q 23 CAGR 17.7% CAGR 19.1% 8 1,785 100 1,297 Origin Bancorp, Inc. Cumulative Return ($) KBW Nasdaq Bank Total Return Index ($) 12 /3 1/ 96 12 /3 1/ 97 12 /3 1/ 98 12 /3 1/ 99 12 /3 1/ 00 12 /3 1/ 01 12 /3 1/ 02 12 /3 1/ 03 12 /3 1/ 04 12 /3 1/ 05 12 /3 1/ 06 12 /3 1/ 07 12 /3 1/ 08 12 /3 1/ 09 12 /3 1/ 10 12 /3 1/ 11 12 /3 1/ 12 12 /3 1/ 13 12 /3 1/ 14 12 /3 1/ 15 12 /3 1/ 16 12 /3 1/ 17 12 /3 1/ 18 12 /3 1/ 19 12 /3 1/ 20 12 /3 1/ 21 12 /3 1/ 22 0 500 1,000 1,500 2,000 2,500 Total Shareholder Return ($)(9) IPO * Please see slide 30 for all footnote references included above. DOLLARS IN MILLIONS UNAUDITED

ORIGIN BANCORP, INC. _______ 9 1,956 2,247 2,620 4,747 5,223 1,127 1,343 1,545 2,747 2,981829 904 1,075 1,631 1,806 369 436 DFW Houston East Texas 2019 2020 2021 2022 3Q23 Deposit Trends by Texas Market ($)(2) Loan Trends by Texas Market ($)(3) TEXAS GROWTH STORY Texas Franchise Highlights DOLLARS IN MILLIONS • 36 locations throughout 10 counties including the 4th and 5th largest MSAs in the United States.(10) • Texas franchise represents 72% of LHFI(3) and 55% of deposits(2) at September 30, 2023. 1,854 2,574 3,132 4,261 4,131 989 1,581 1,925 2,196 2,103 865 993 1,207 1,173 1,167 892 861 DFW Houston East Texas 2019 2020 2021 2022 3Q23 CAGR 29.9% CAGR 23.8% * Please see slide 30 for all footnote references included above. DOLLARS IN MILLIONS UNAUDITED

ORIGIN BANCORP, INC. _______ 10 LOAN GROWTH 3,869 4,094 4,498 7,282 6,805 5,593 1,212 Origin BTH 2019 2020 2021 2022 3Q23 0 2,000 4,000 6,000 8,000 LHFI Key Data DOLLARS IN MILLIONS IDT • Total loans held for investment ("LHFI"), excluding mortgage warehouse lines of credit, were $7.28 billion at September 30, 2023, reflecting an increase of $196.7 million, or 2.8%, compared to June 30, 2023. • Total mortgage warehouse lines of credit were $286.3 million, or 3.8%, of total LHFI at September 30, 2023. LHFI Growth excluding MW LOC ($)(11) CAGR: 18.4% 1,902 1,833 2,032 3,2423,160 2,492 668 Origin BTH 2019 2020 2021 2022 3Q23 0 1,000 2,000 3,000 4,000 C&I, Owner Occupied CRE and C&D Growth ($)(11) CAGR: 15.3% * Please see slide 30 for all footnote references included above. DOLLARS IN MILLIONS UNAUDITED

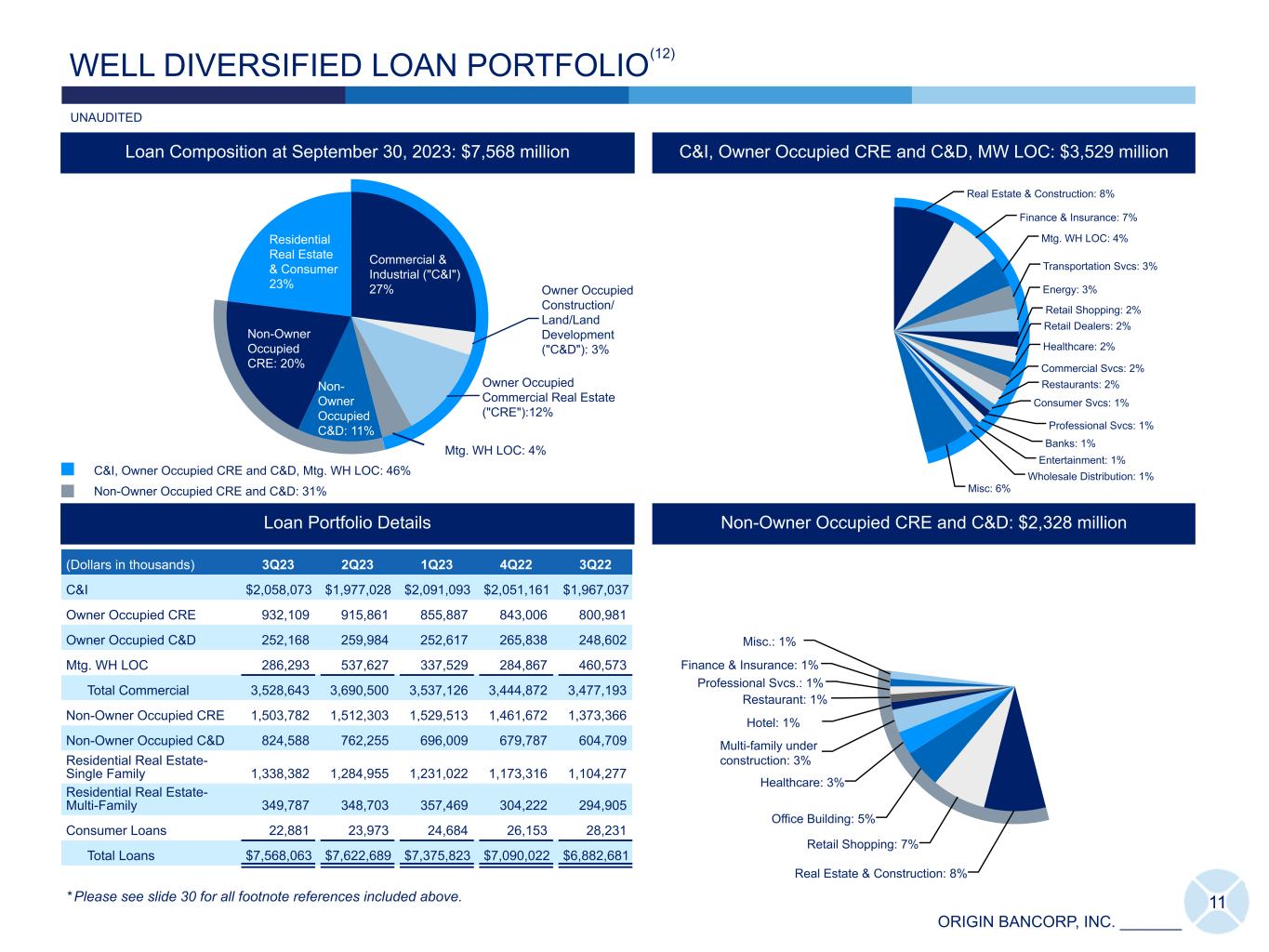

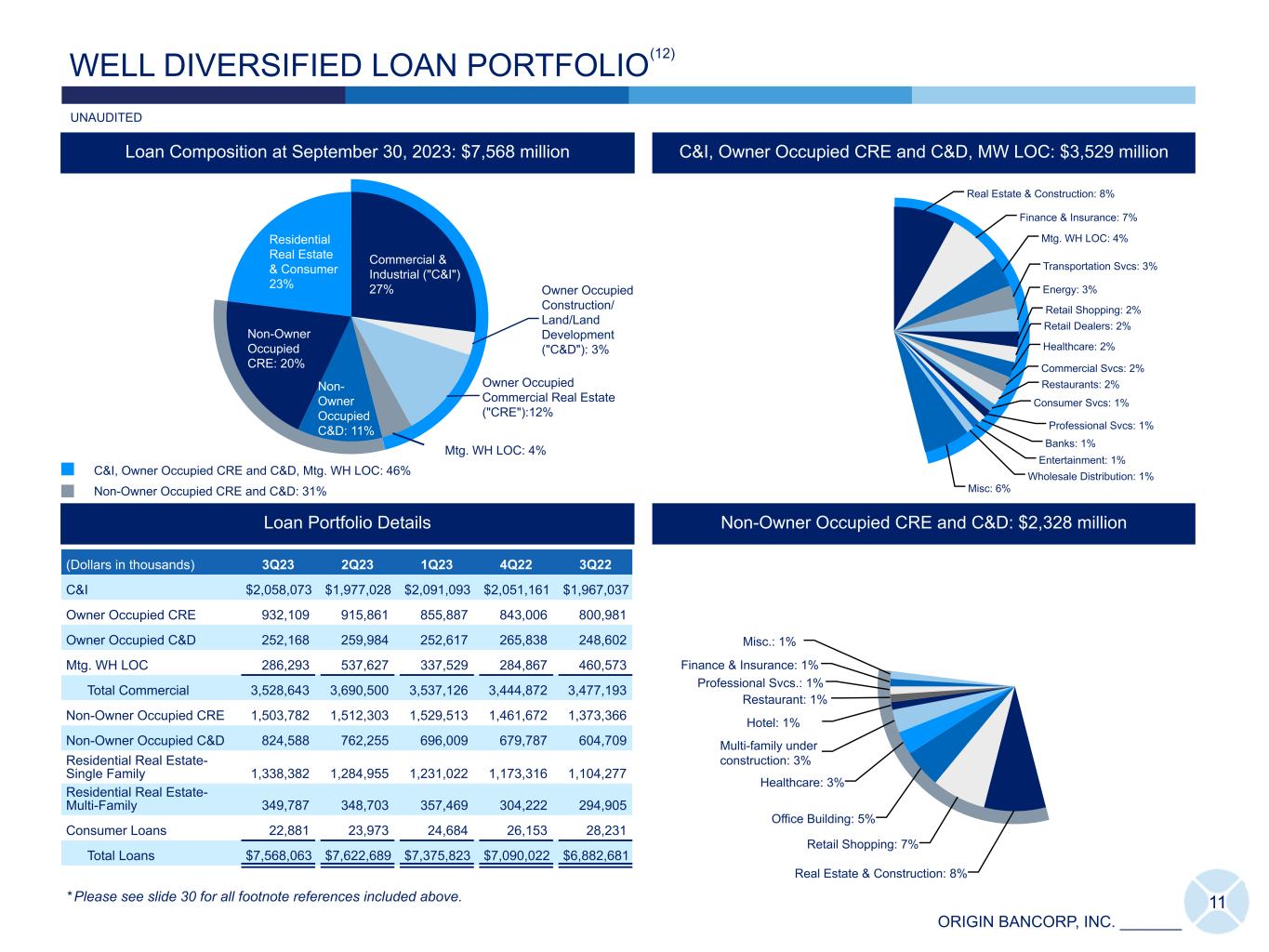

ORIGIN BANCORP, INC. _______ Real Estate & Construction: 8% Retail Shopping: 7% Office Building: 5% Healthcare: 3% Multi-family under construction: 3% Hotel: 1% Restaurant: 1% Professional Svcs.: 1% Finance & Insurance: 1% Misc.: 1% Commercial & Industrial ("C&I") 27% Owner Occupied Construction/ Land/Land Development ("C&D"): 3% Owner Occupied Commercial Real Estate ("CRE"):12% Mtg. WH LOC: 4% Non- Owner Occupied C&D: 11% Non-Owner Occupied CRE: 20% Residential Real Estate & Consumer 23% Real Estate & Construction: 8% Finance & Insurance: 7% Mtg. WH LOC: 4% Transportation Svcs: 3% Energy: 3% Retail Shopping: 2% Retail Dealers: 2% Healthcare: 2% Commercial Svcs: 2% Restaurants: 2% Consumer Svcs: 1% Professional Svcs: 1% Banks: 1% Entertainment: 1% Wholesale Distribution: 1% Misc: 6% 11 WELL DIVERSIFIED LOAN PORTFOLIO (Dollars in thousands) 3Q23 2Q23 1Q23 4Q22 3Q22 C&I $ 2,058,073 $ 1,977,028 $ 2,091,093 $ 2,051,161 $ 1,967,037 Owner Occupied CRE 932,109 915,861 855,887 843,006 800,981 Owner Occupied C&D 252,168 259,984 252,617 265,838 248,602 Mtg. WH LOC 286,293 537,627 337,529 284,867 460,573 Total Commercial 3,528,643 3,690,500 3,537,126 3,444,872 3,477,193 Non-Owner Occupied CRE 1,503,782 1,512,303 1,529,513 1,461,672 1,373,366 Non-Owner Occupied C&D 824,588 762,255 696,009 679,787 604,709 Residential Real Estate- Single Family 1,338,382 1,284,955 1,231,022 1,173,316 1,104,277 Residential Real Estate- Multi-Family 349,787 348,703 357,469 304,222 294,905 Consumer Loans 22,881 23,973 24,684 26,153 28,231 Total Loans $ 7,568,063 $ 7,622,689 $ 7,375,823 $ 7,090,022 $ 6,882,681 Loan Portfolio Details Non-Owner Occupied CRE and C&D: $2,328 million C&I, Owner Occupied CRE and C&D, MW LOC: $3,529 million C&I, Owner Occupied CRE and C&D, Mtg. WH LOC: 46% Non-Owner Occupied CRE and C&D: 31% Loan Composition at September 30, 2023: $7,568 million * Please see slide 30 for all footnote references included above. UNAUDITED (12)

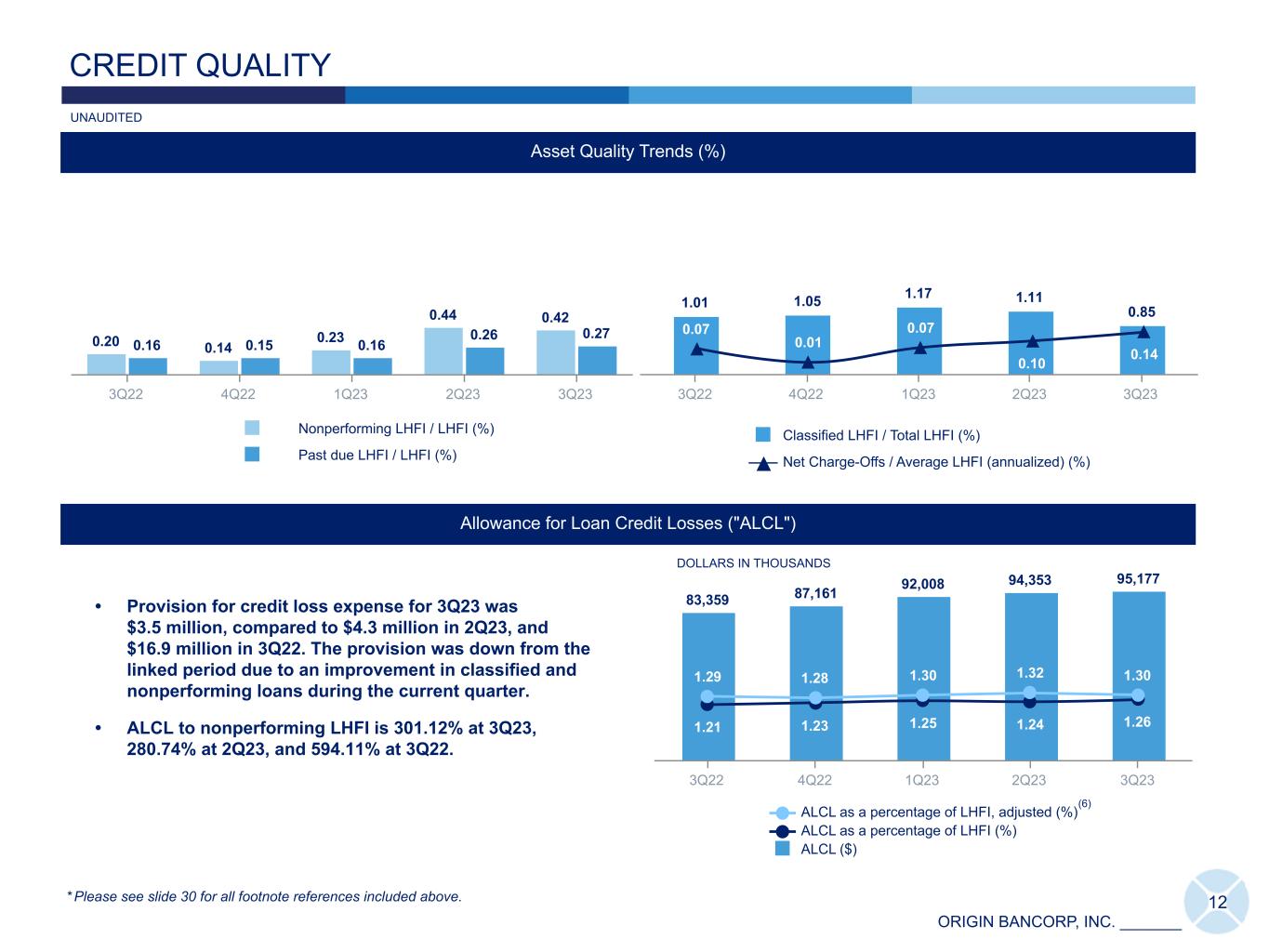

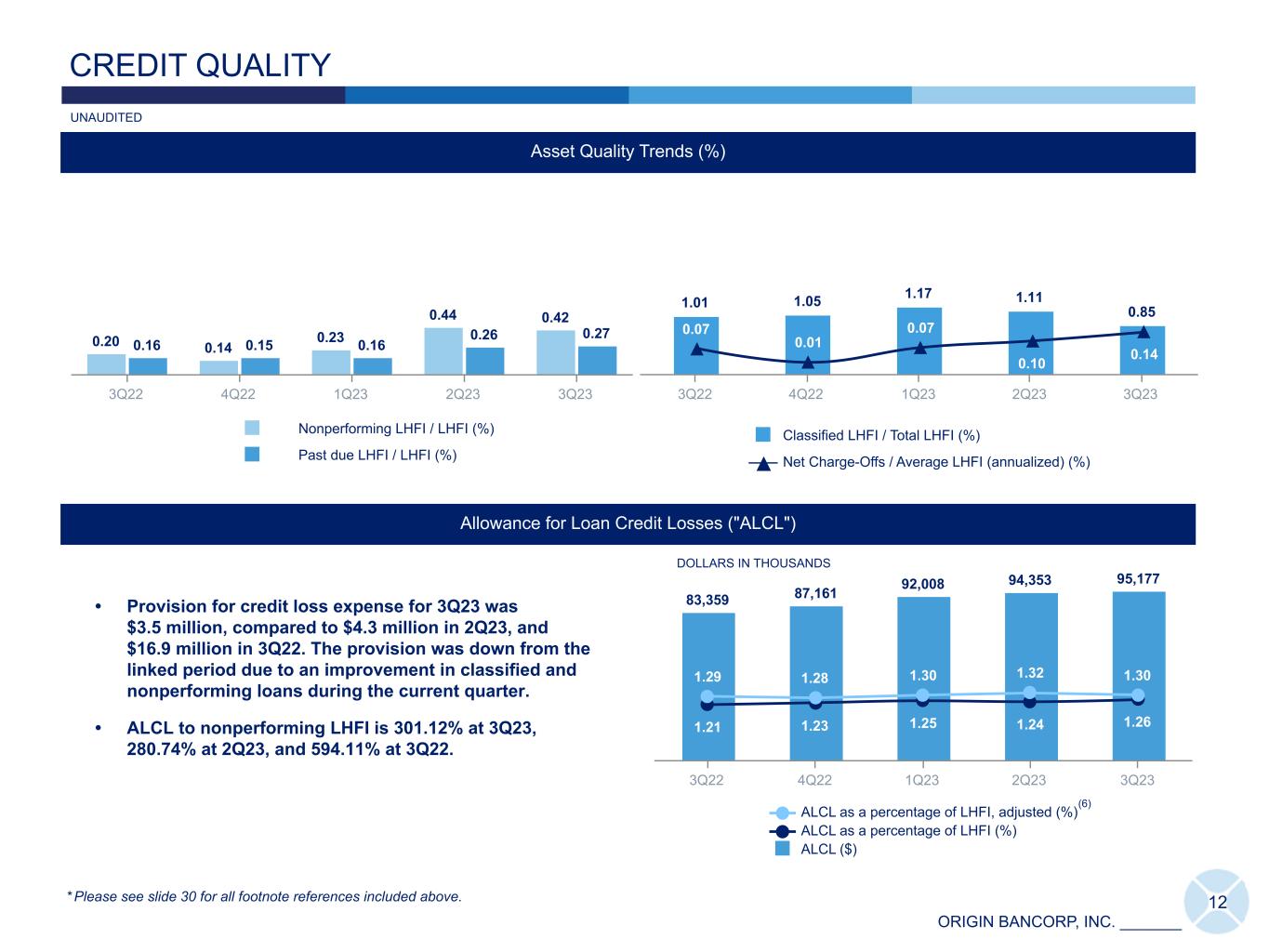

ORIGIN BANCORP, INC. _______ 1.01 1.05 1.17 1.11 0.85 Classified LHFI / Total LHFI (%) Net Charge-Offs / Average LHFI (annualized) (%) 3Q22 4Q22 1Q23 2Q23 3Q23 0.07 0.01 0.07 0.10 0.14 0.20 0.14 0.23 0.44 0.42 0.16 0.15 0.16 0.26 0.27 Nonperforming LHFI / LHFI (%) Past due LHFI / LHFI (%) 3Q22 4Q22 1Q23 2Q23 3Q23 12 CREDIT QUALITY Asset Quality Trends (%) Allowance for Loan Credit Losses ("ALCL") 83,359 87,161 92,008 94,353 95,177 1.21 1.23 1.25 1.24 1.26 1.29 1.28 1.30 1.32 1.30 ALCL as a percentage of LHFI, adjusted (%) ALCL as a percentage of LHFI (%) ALCL ($) 3Q22 4Q22 1Q23 2Q23 3Q23 • Provision for credit loss expense for 3Q23 was $3.5 million, compared to $4.3 million in 2Q23, and $16.9 million in 3Q22. The provision was down from the linked period due to an improvement in classified and nonperforming loans during the current quarter. • ALCL to nonperforming LHFI is 301.12% at 3Q23, 280.74% at 2Q23, and 594.11% at 3Q22. DOLLARS IN THOUSANDS (6) * Please see slide 30 for all footnote references included above. UNAUDITED

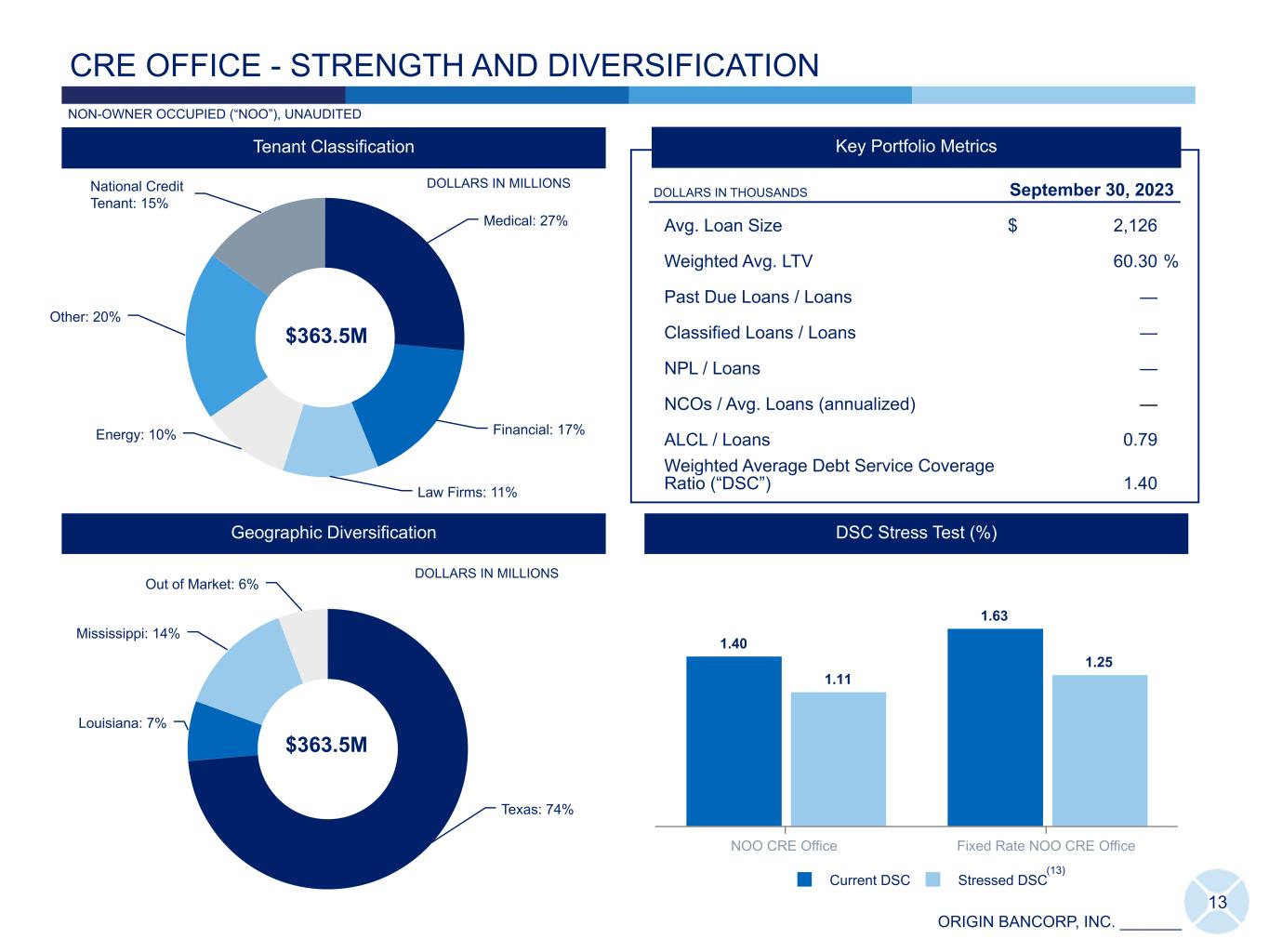

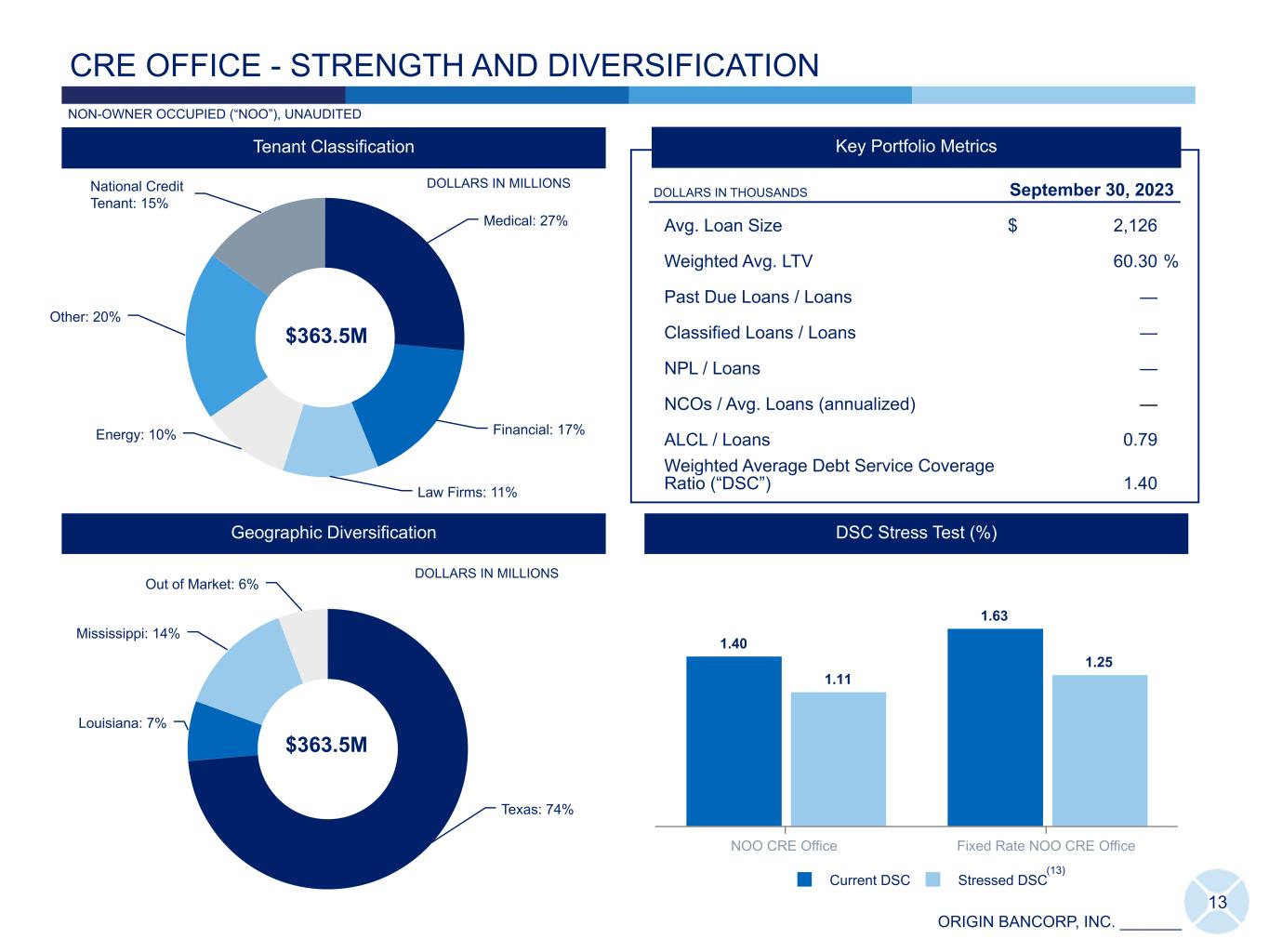

ORIGIN BANCORP, INC. _______ Texas: 74% Louisiana: 7% Mississippi: 14% Out of Market: 6% 13 Medical: 27% Financial: 17% Law Firms: 11% Energy: 10% Other: 20% National Credit Tenant: 15% CRE OFFICE - STRENGTH AND DIVERSIFICATION Tenant Classification $363.5M $363.5M Geographic Diversification DOLLARS IN THOUSANDS September 30, 2023 Avg. Loan Size $ 2,126 Weighted Avg. LTV 60.30 % Past Due Loans / Loans — Classified Loans / Loans — NPL / Loans — NCOs / Avg. Loans (annualized) — ALCL / Loans 0.79 Weighted Average Debt Service Coverage Ratio (“DSC”) 1.40 Key Portfolio Metrics DOLLARS IN MILLIONS DOLLARS IN MILLIONS NON-OWNER OCCUPIED (“NOO”), UNAUDITED DSC Stress Test (%) 1.40 1.63 1.11 1.25 Current DSC Stressed DSC NOO CRE Office Fixed Rate NOO CRE Office (13)

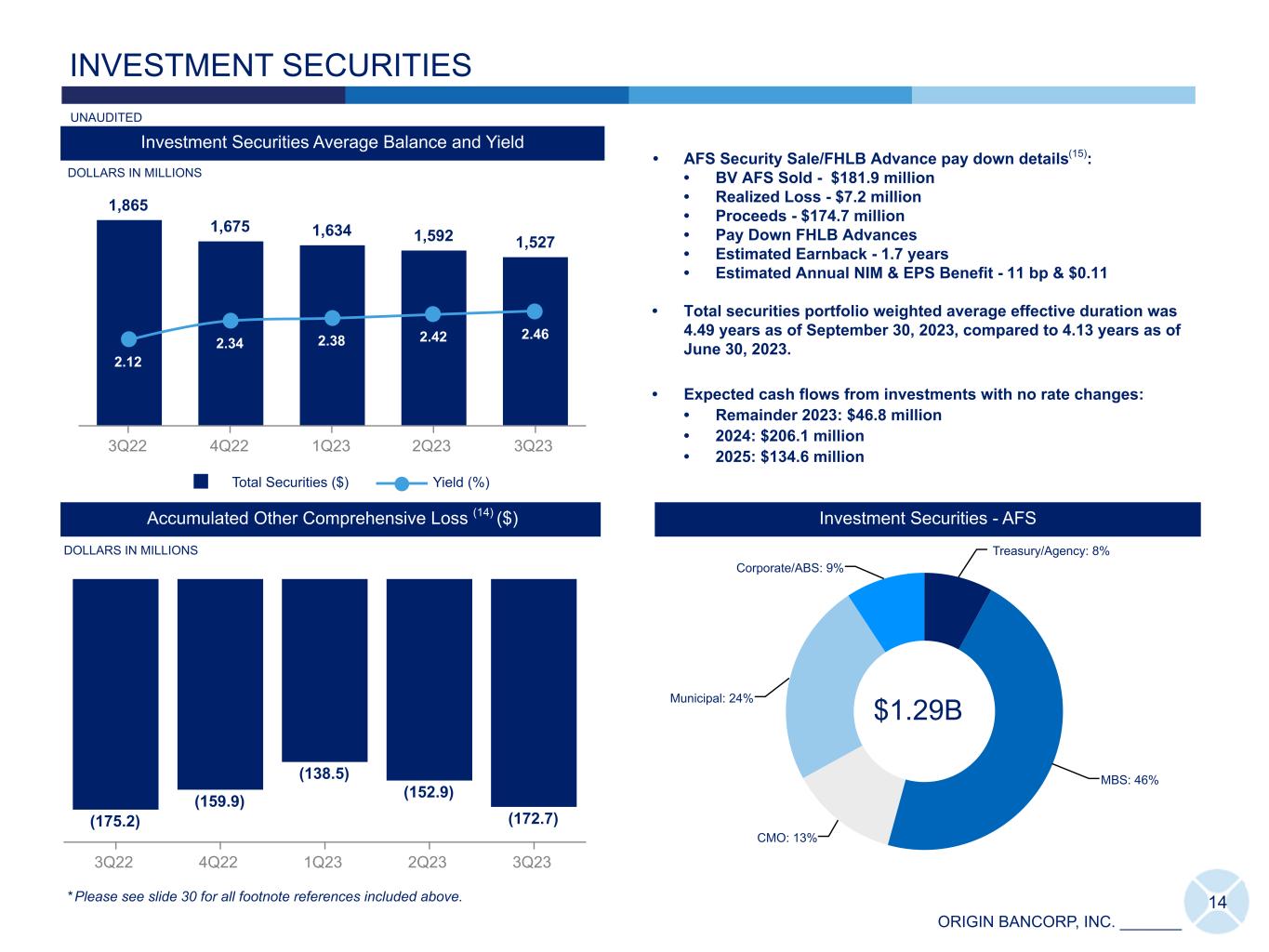

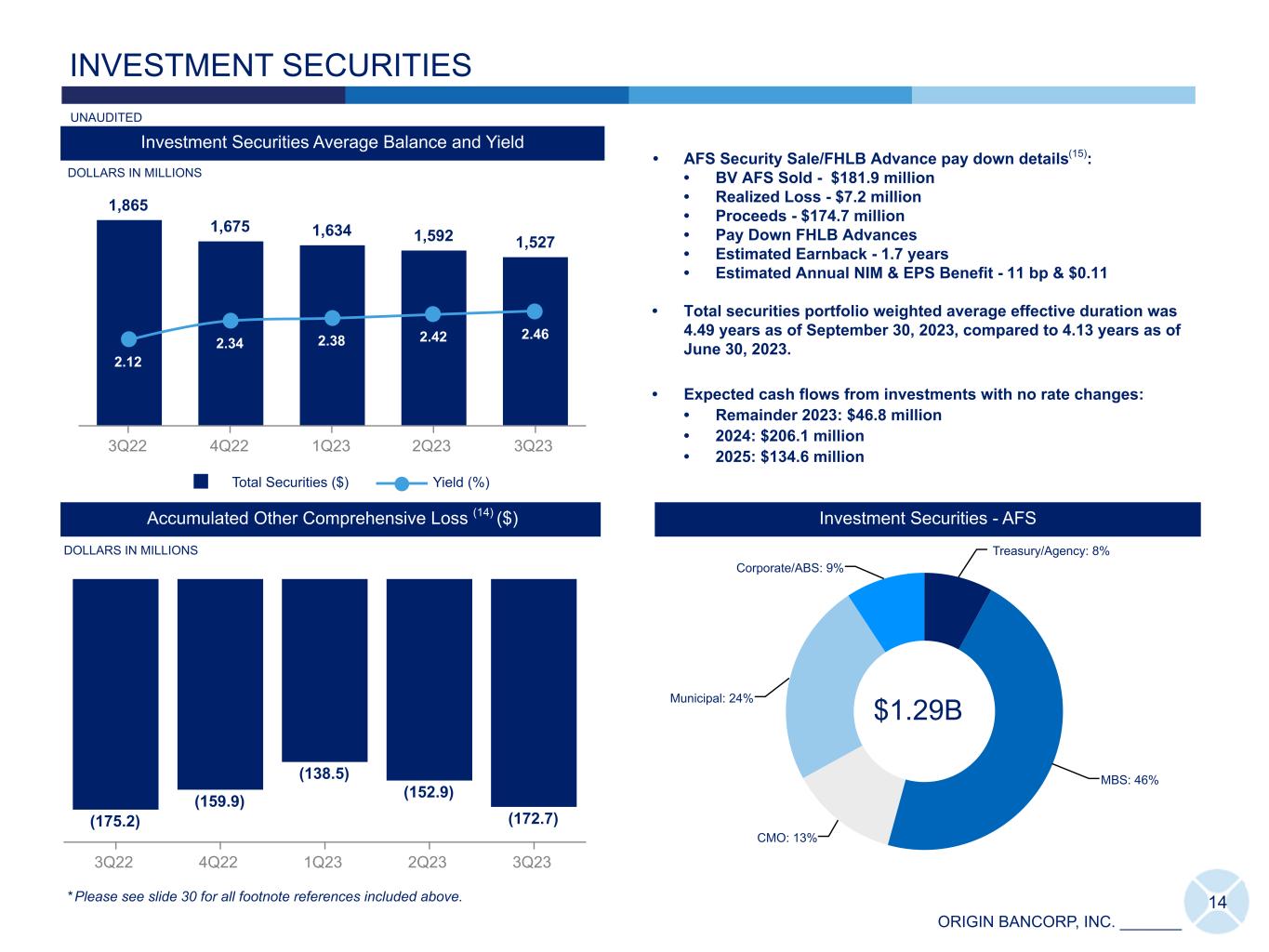

ORIGIN BANCORP, INC. _______ Treasury/Agency: 8% MBS: 46% CMO: 13% Municipal: 24% Corporate/ABS: 9% 1,865 1,675 1,634 1,592 1,527 2.12 2.34 2.38 2.42 2.46 Total Securities ($) Yield (%) 3Q22 4Q22 1Q23 2Q23 3Q23 Investment Securities Average Balance and Yield INVESTMENT SECURITIES DOLLARS IN MILLIONS • AFS Security Sale/FHLB Advance pay down details(15): • BV AFS Sold - $181.9 million • Realized Loss - $7.2 million • Proceeds - $174.7 million • Pay Down FHLB Advances • Estimated Earnback - 1.7 years • Estimated Annual NIM & EPS Benefit - 11 bp & $0.11 • Total securities portfolio weighted average effective duration was 4.49 years as of September 30, 2023, compared to 4.13 years as of June 30, 2023. • Expected cash flows from investments with no rate changes: • Remainder 2023: $46.8 million • 2024: $206.1 million • 2025: $134.6 million 14 (175.2) (159.9) (138.5) (152.9) (172.7) 3Q22 4Q22 1Q23 2Q23 3Q23 Accumulated Other Comprehensive Loss (14) ($) Investment Securities - AFS * Please see slide 30 for all footnote references included above. $1.29B DOLLARS IN MILLIONS UNAUDITED

ORIGIN BANCORP, INC. _______ Total Loans (Dollars in thousands) Repricing and Maturity Term Rate Structure 1 Year or less 1-5 Years 5-15 Years Over 15 Years Total Floating Rate Variable Rate Fixed Rate Commercial real estate $ 760,174 $ 1,272,934 $ 402,783 $ — $ 2,435,891 $ 708,405 $ 10,677 $ 1,716,809 Construction/land/land development 625,250 361,153 88,806 1,547 1,076,756 582,418 45,382 448,956 Residential real estate 248,391 1,005,126 398,165 36,487 1,688,169 228,273 737,800 722,096 Total real estate $ 1,633,815 $ 2,639,213 $ 889,754 $ 38,034 $ 5,200,816 $ 1,519,096 $ 793,859 $ 2,887,861 Commercial and industrial 1,513,575 483,290 61,208 — 2,058,073 1,518,843 2,888 536,342 Mortgage warehouse lines of credit 286,293 — — — 286,293 286,293 — — Consumer 12,012 10,582 287 — 22,881 5,637 134 17,110 Total $ 3,445,695 $ 3,133,085 $ 951,249 $ 38,034 $ 7,568,063 $ 3,329,869 $ 796,881 $ 3,441,313 % of total 46 % 41 % 13 % 1 % 101 % 44 % 11 % 45 % Weighted Average Rate 7.95 % 4.99 % 4.43 % 4.10 % 6.20 % 8.04 % 4.44 % 4.96 % AFS Securities (Dollars in thousands) Maturity & Projected Cash Flow Distribution Total1 Year or less 1 to 3 Years 3 to 5 Years 5 to 10 Years Over 10 Years Projected total cash flow(16) $ 208,682 $ 306,976 $ 339,295 $ 580,977 $ 308,422 $ 1,744,352 % of Total 13 % 17 % 19 % 33 % 18 % 100 % LOANS & SECURITIES- REPRICING AND MATURITY 15* Please see slide 30 for all footnote references included above.

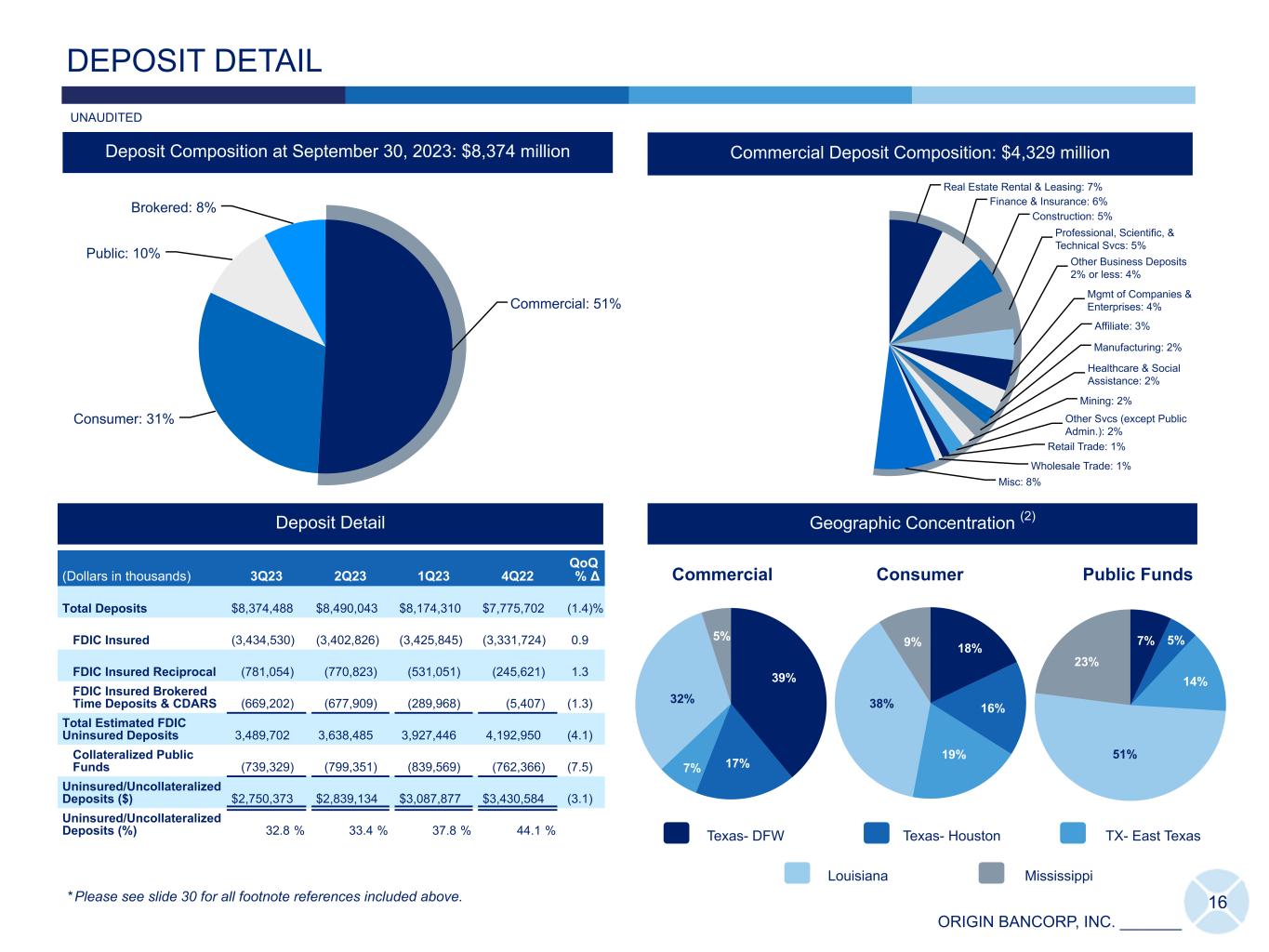

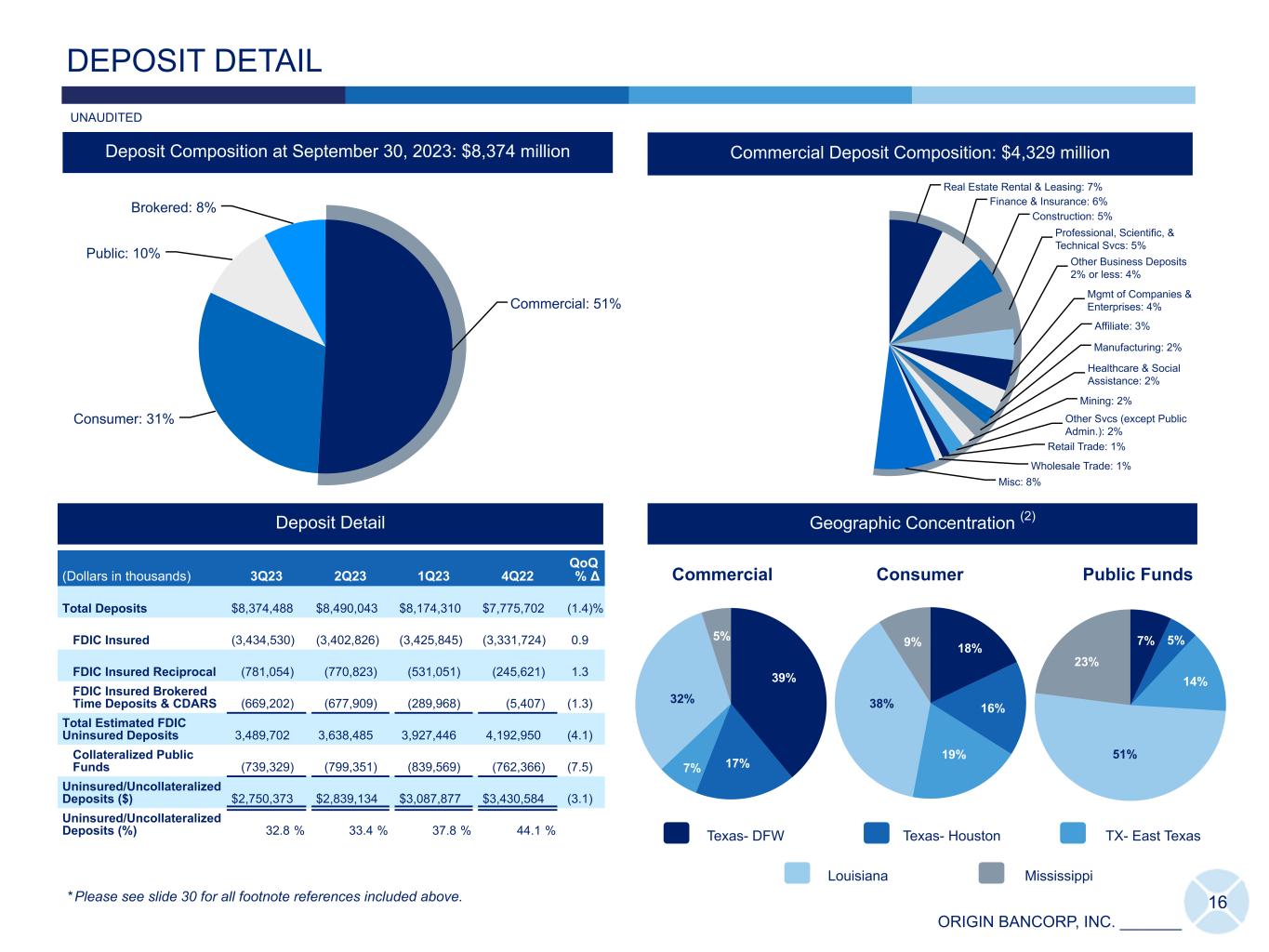

ORIGIN BANCORP, INC. _______ Commercial: 51% Consumer: 31% Public: 10% Brokered: 8% Real Estate Rental & Leasing: 7% Finance & Insurance: 6% Construction: 5% Professional, Scientific, & Technical Svcs: 5% Other Business Deposits 2% or less: 4% Mgmt of Companies & Enterprises: 4% Affiliate: 3% Manufacturing: 2% Healthcare & Social Assistance: 2% Mining: 2% Other Svcs (except Public Admin.): 2% Retail Trade: 1% Wholesale Trade: 1% Misc: 8% 16 DEPOSIT DETAIL (Dollars in thousands) 3Q23 2Q23 1Q23 4Q22 QoQ % Δ Total Deposits $ 8,374,488 $ 8,490,043 $ 8,174,310 $ 7,775,702 (1.4) % FDIC Insured (3,434,530) (3,402,826) (3,425,845) (3,331,724) 0.9 FDIC Insured Reciprocal (781,054) (770,823) (531,051) (245,621) 1.3 FDIC Insured Brokered Time Deposits & CDARS (669,202) (677,909) (289,968) (5,407) (1.3) Total Estimated FDIC Uninsured Deposits 3,489,702 3,638,485 3,927,446 4,192,950 (4.1) Collateralized Public Funds (739,329) (799,351) (839,569) (762,366) (7.5) Uninsured/Uncollateralized Deposits ($) $ 2,750,373 $ 2,839,134 $ 3,087,877 $ 3,430,584 (3.1) Uninsured/Uncollateralized Deposits (%) 32.8 % 33.4 % 37.8 % 44.1 % Deposit Detail Geographic Concentration (2) Commercial Deposit Composition: $4,329 millionDeposit Composition at September 30, 2023: $8,374 million Commercial Public Funds 39% 17%7% 32% 5% Consumer MississippiLouisiana Texas- DFW TX- East TexasTexas- Houston 18% 16% 19% 38% 9% 7% 5% 14% 51% 23% * Please see slide 30 for all footnote references included above. UNAUDITED

ORIGIN BANCORP, INC. _______ 0.51 2.58 3.56 4.04 0.64 1.54 2.49 3.05 3.47 0.41 1.02 1.75 2.26 2.61 Time Deposits Cost of Interest-bearing Deposits Cost of Total Deposits 3Q22 4Q22 1Q23 2Q23 3Q23 17 7,410 7,710 8,017 8,260 8,443 4,157 4,363 4,648 4,741 4,728 2,583 2,593 2,392 2,140 2,088 670 754 977 1,379 1,627 Interest-bearing Demand Noninterest-bearing Time Deposits 3Q22 4Q22 1Q23 2Q23 3Q23 Average Deposits ($) DEPOSIT TRENDS Deposit Cost Trends (QTD Annualized) (%) IDT Total Deposit Beta (%) Full Cycle Total Deposit Betas (%) 44.0 27.029.0 30.0 Peer OBK 2Q2004 - 3Q2006 4Q2015 - 1Q2019 (17) * Please see slide 30 for all footnote references included above. DOLLARS IN MILLIONS -50.00 0.00 10.48 23.25 35.21 42.16 46.72 0.12 0.77 2.18 3.65 4.51 4.99 5.26 Cumulative Deposit Beta Average Quarterly Fed Funds Rate 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 UNAUDITED 1.22

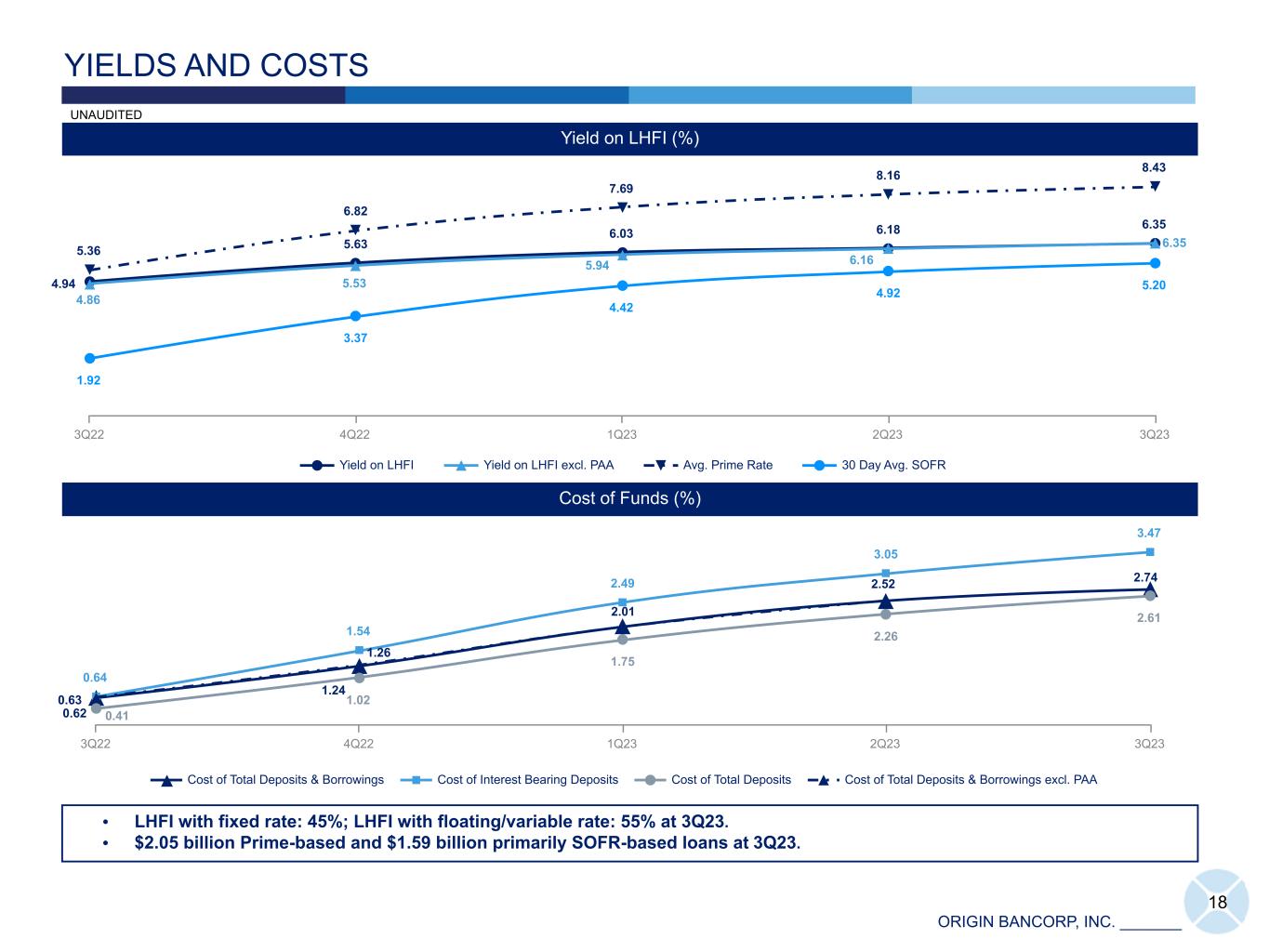

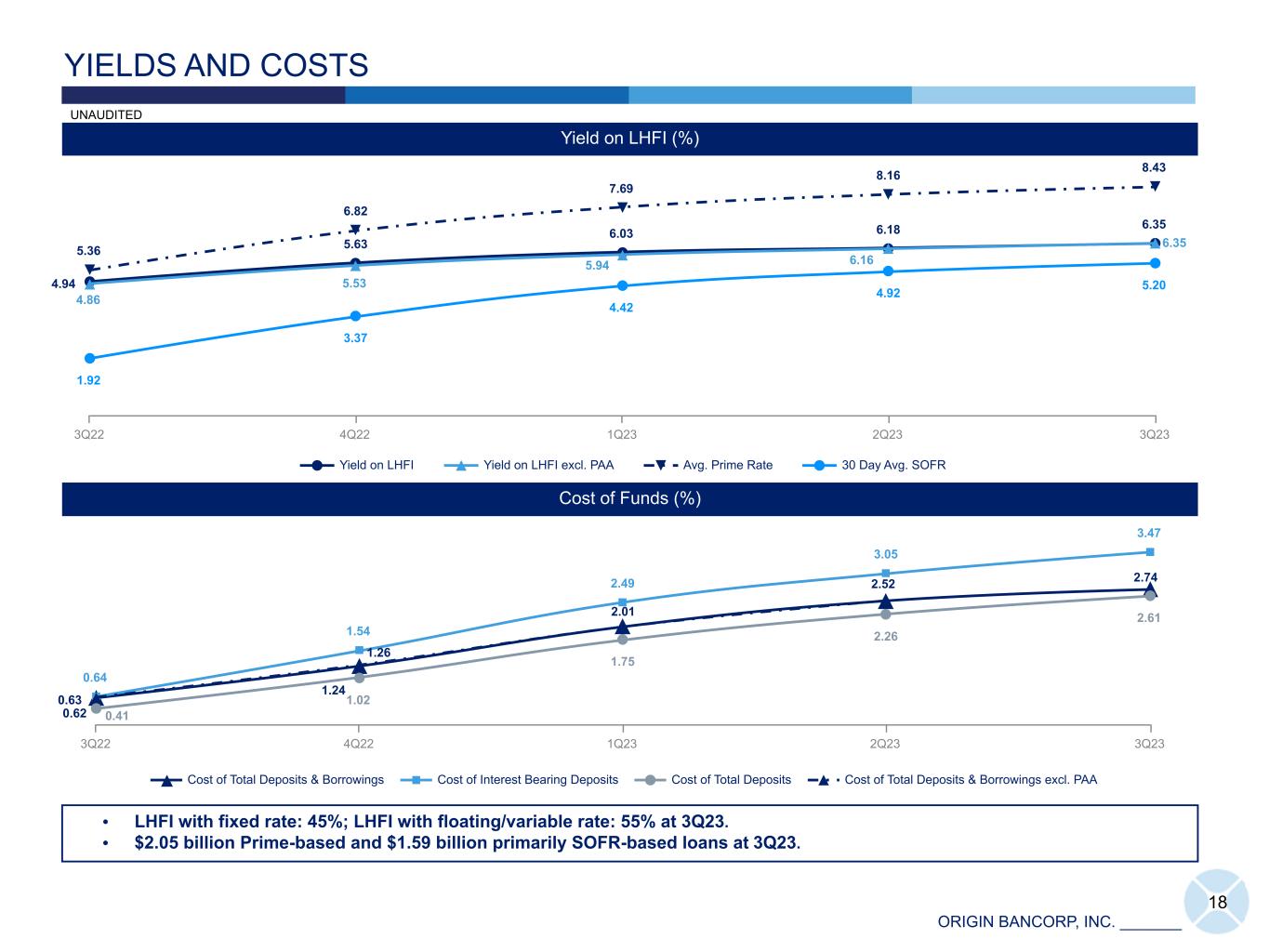

ORIGIN BANCORP, INC. _______ 0.64 1.54 2.49 3.05 3.47 1.02 1.75 2.26 2.61 0.63 Cost of Total Deposits & Borrowings Cost of Interest Bearing Deposits Cost of Total Deposits Cost of Total Deposits & Borrowings excl. PAA 3Q22 4Q22 1Q23 2Q23 3Q23 18 YIELDS AND COSTS Yield on LHFI (%) Cost of Funds (%) 0.41 • LHFI with fixed rate: 45%; LHFI with floating/variable rate: 55% at 3Q23. • $2.05 billion Prime-based and $1.59 billion primarily SOFR-based loans at 3Q23. 4.86 2.52 1.26 6.16 2.01 UNAUDITED 5.94 5.53 6.35 0.62 1.24 4.94 5.63 6.03 6.18 6.35 5.36 6.82 7.69 8.16 8.43 1.92 3.37 4.42 4.92 5.20 Yield on LHFI Yield on LHFI excl. PAA Avg. Prime Rate 30 Day Avg. SOFR 3Q22 4Q22 1Q23 2Q23 3Q23 2.74

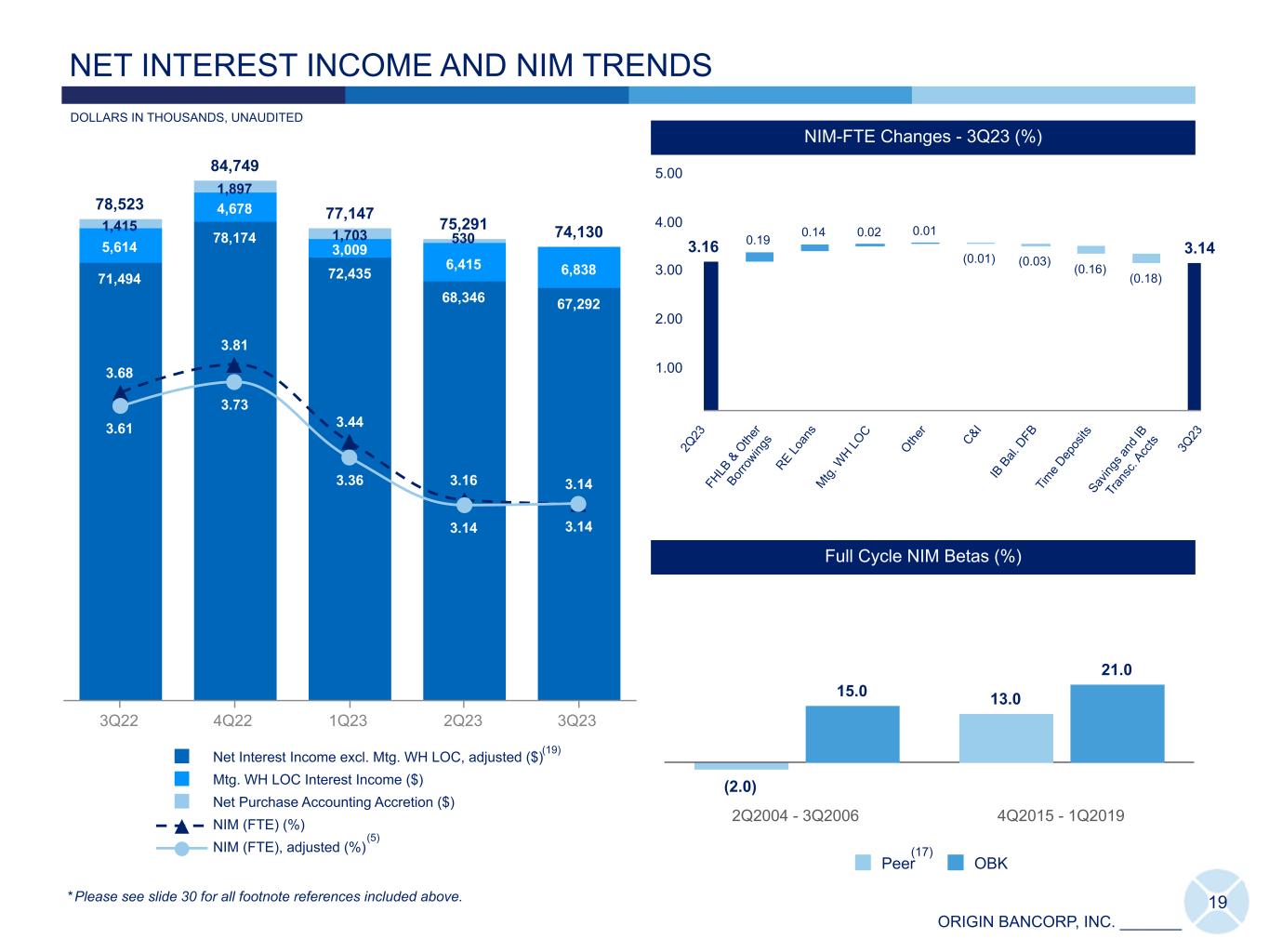

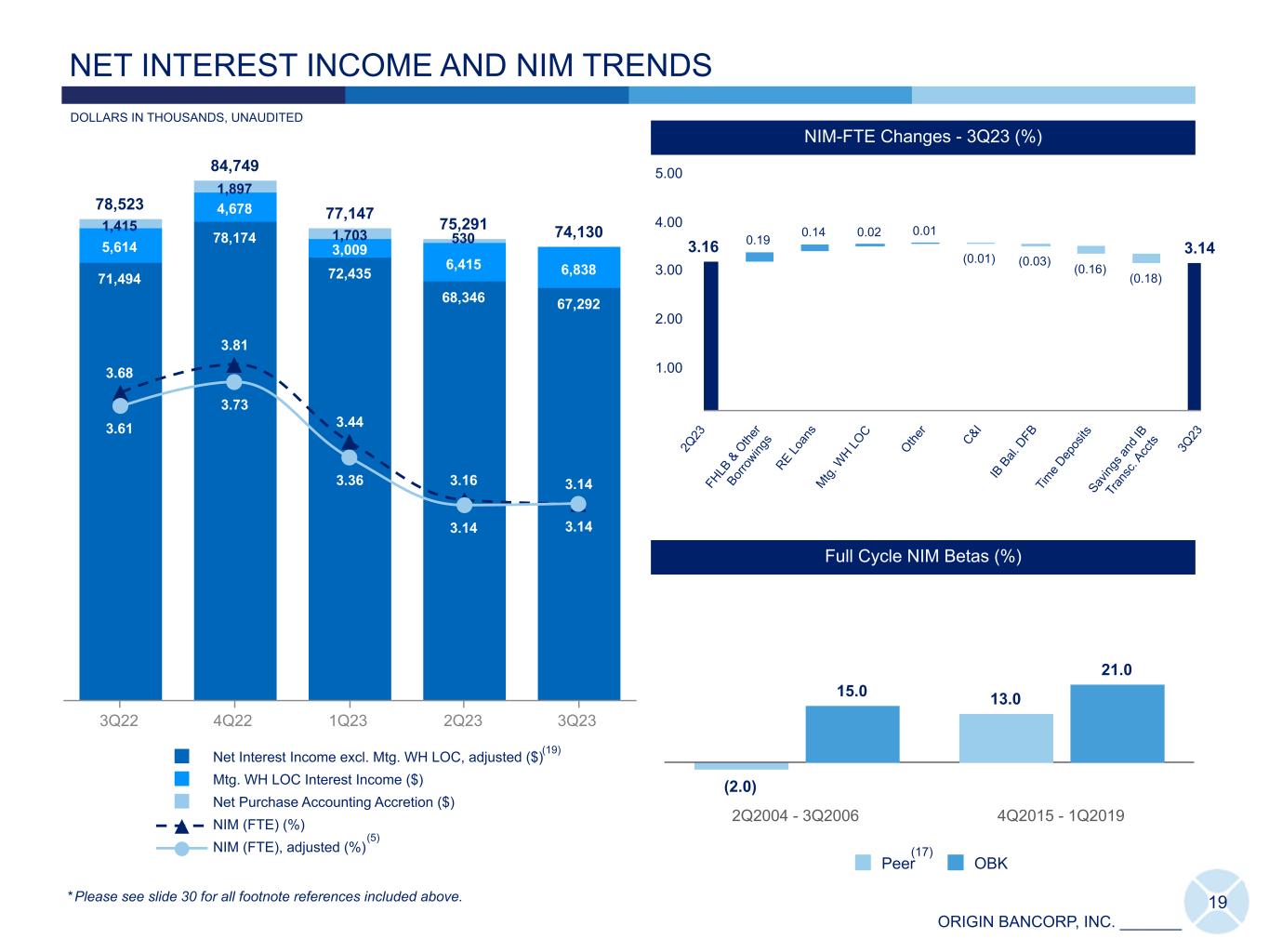

ORIGIN BANCORP, INC. _______ 19 DOLLARS IN THOUSANDS, UNAUDITED 74,130 78,523 84,749 77,147 75,291 71,494 78,174 72,435 68,346 67,292 5,614 4,678 3,009 6,415 6,838 1,415 1,897 1,703 3.68 3.81 3.44 3.16 3.14 3.61 3.73 3.36 3.14 3.14 Net Interest Income excl. Mtg. WH LOC, adjusted ($) Mtg. WH LOC Interest Income ($) Net Purchase Accounting Accretion ($) NIM (FTE) (%) NIM (FTE), adjusted (%) 3Q22 4Q22 1Q23 2Q23 3Q23 NET INTEREST INCOME AND NIM TRENDS 3.143.16 0.19 0.14 0.02 0.01 (0.01) (0.03) (0.16) (0.18) 2Q 23 FH LB & O the r Bor ro wing s RE Lo an s Mtg. W H LO C Othe r C&I IB B al. D FB Tim e D ep os its Sav ing s a nd IB Tr an sc . A cc ts 3Q 23 1.00 2.00 3.00 4.00 5.00 NIM-FTE Changes - 3Q23 (%) Full Cycle NIM Betas (%) (19) (5) (2.0) 13.015.0 21.0 Peer OBK 2Q2004 - 3Q2006 4Q2015 - 1Q2019 (17) * Please see slide 30 for all footnote references included above. 530

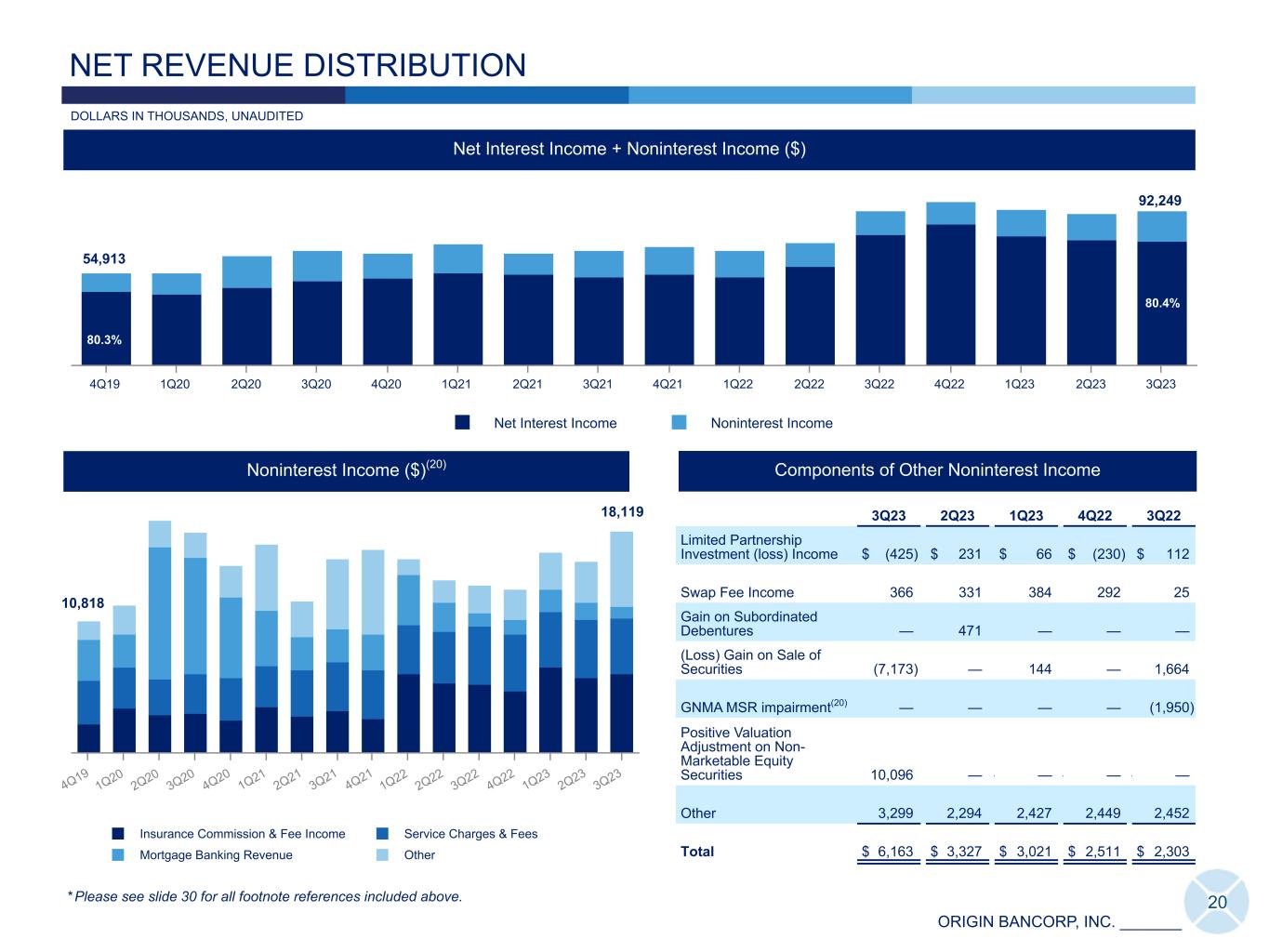

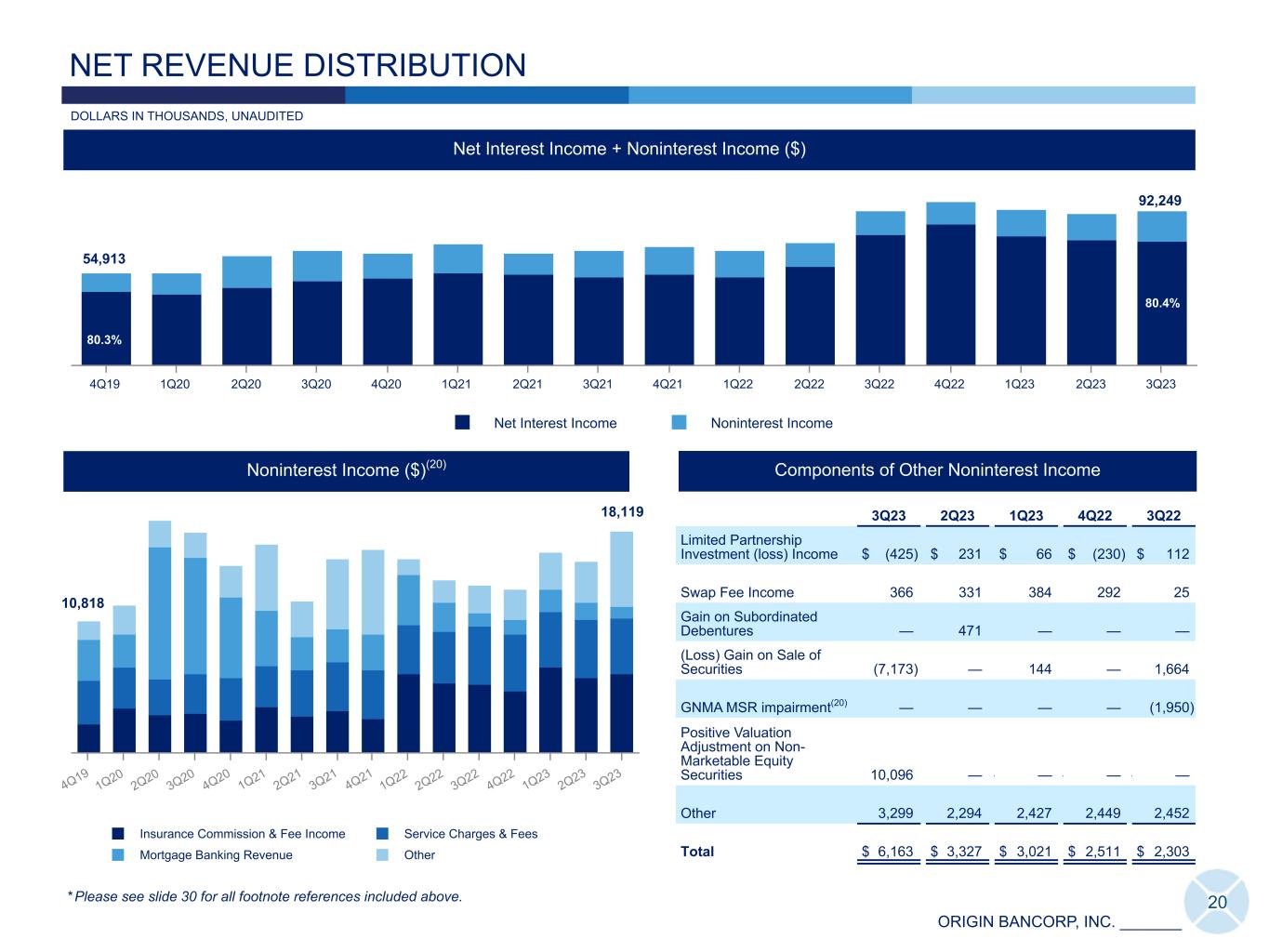

ORIGIN BANCORP, INC. _______ Insurance Commission & Fee Income Service Charges & Fees Mortgage Banking Revenue Other 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 20 Net Interest Income Noninterest Income 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Noninterest Income ($)(20) Net Interest Income + Noninterest Income ($) NET REVENUE DISTRIBUTION Components of Other Noninterest Income 92,249 3Q23 2Q23 1Q23 4Q22 3Q22 Limited Partnership Investment (loss) Income $ (425) $ 231 $ 66 $ (230) $ 112 Swap Fee Income 366 331 384 292 25 Gain on Subordinated Debentures — 471 — — — (Loss) Gain on Sale of Securities (7,173) — 144 — 1,664 GNMA MSR impairment(20) — — — — (1,950) Positive Valuation Adjustment on Non- Marketable Equity Securities 10,096 — — — — — — — Other 3,299 2,294 2,427 2,449 2,452 Total $ 6,163 $ 3,327 $ 3,021 $ 2,511 $ 2,303 54,913 18,119 80.3% 80.4% * Please see slide 30 for all footnote references included above. DOLLARS IN THOUSANDS, UNAUDITED 10,818

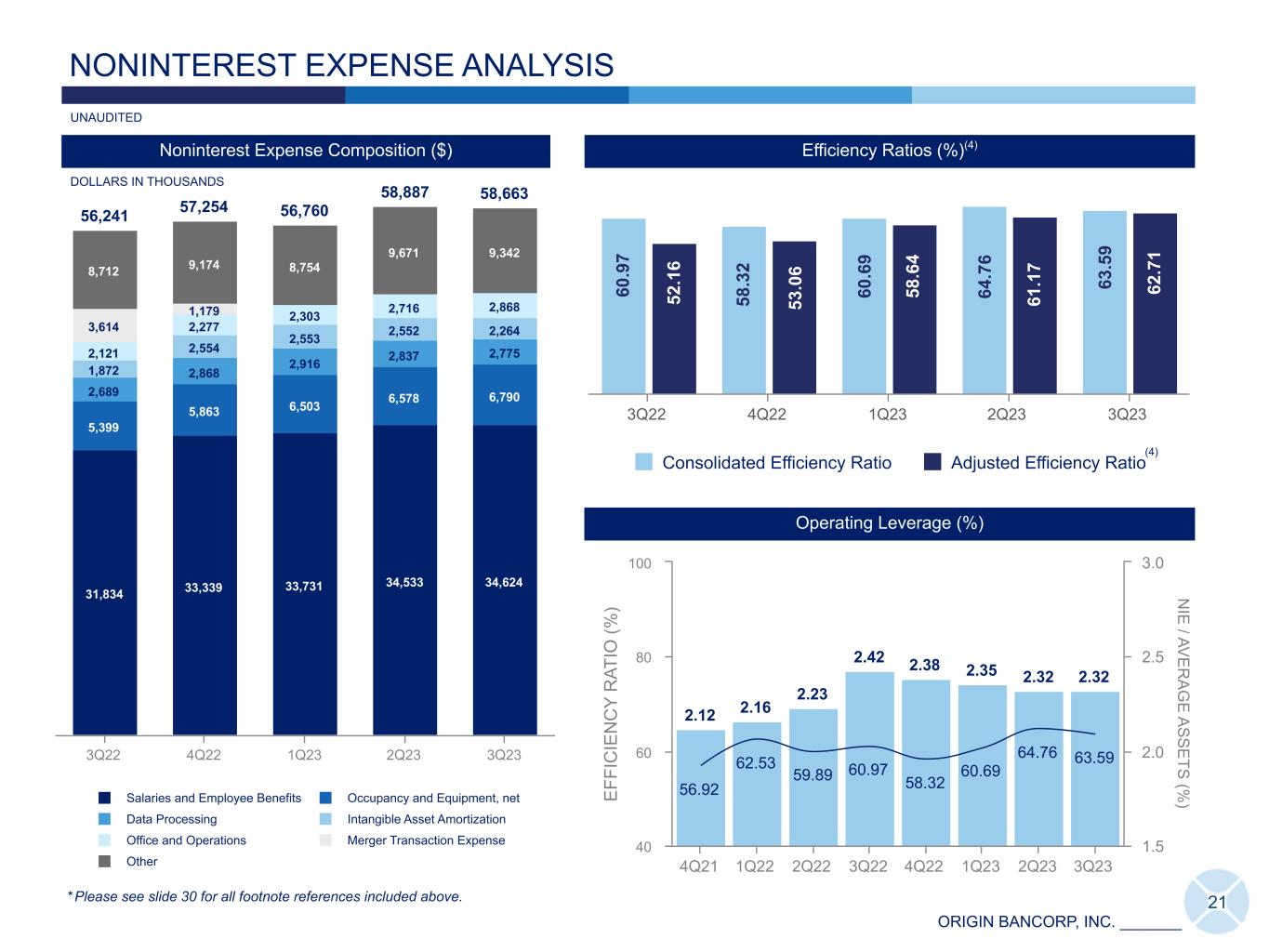

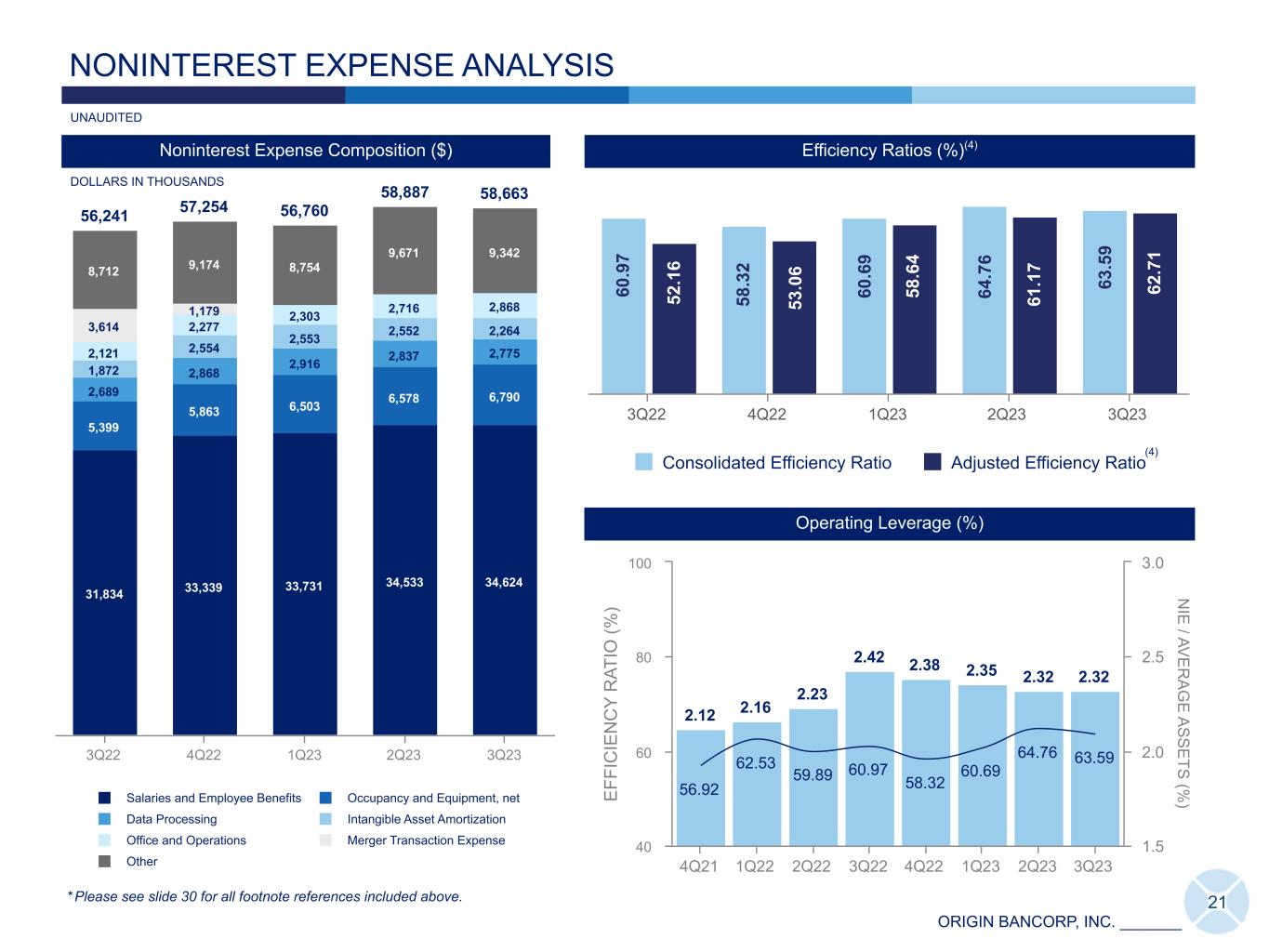

ORIGIN BANCORP, INC. _______ 21 Efficiency Ratios (%)(4) NONINTEREST EXPENSE ANALYSIS DOLLARS IN THOUSANDS Noninterest Expense Composition ($) Consolidated Efficiency Ratio Adjusted Efficiency Ratio 3Q22 4Q22 1Q23 2Q23 3Q23 Operating Leverage (%) E FF IC IE N C Y R AT IO (% ) N IE / AV E R A G E A S S E TS (% ) 2.12 2.16 2.23 2.42 2.38 2.35 2.32 2.32 56.92 62.53 59.89 60.97 58.32 60.69 64.76 63.59 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 40 60 80 100 1.5 2.0 2.5 3.0 60 .9 7 52 .1 6 58 .3 2 53 .0 6 58 .6 4 60 .6 9 * Please see slide 30 for all footnote references included above. 61 .1 7 63 .5 9 (4) UNAUDITED 62 .7 1 64 .7 6 56,241 57,254 56,760 58,887 58,663 31,834 33,339 33,731 34,533 34,624 5,399 5,863 6,503 6,578 6,7902,689 2,868 2,916 2,837 2,775 1,872 2,554 2,553 2,552 2,264 2,121 2,277 2,303 2,716 2,868 3,614 1,179 8,712 9,174 8,754 9,671 9,342 Salaries and Employee Benefits Occupancy and Equipment, net Data Processing Intangible Asset Amortization Office and Operations Merger Transaction Expense Other 3Q22 4Q22 1Q23 2Q23 3Q23

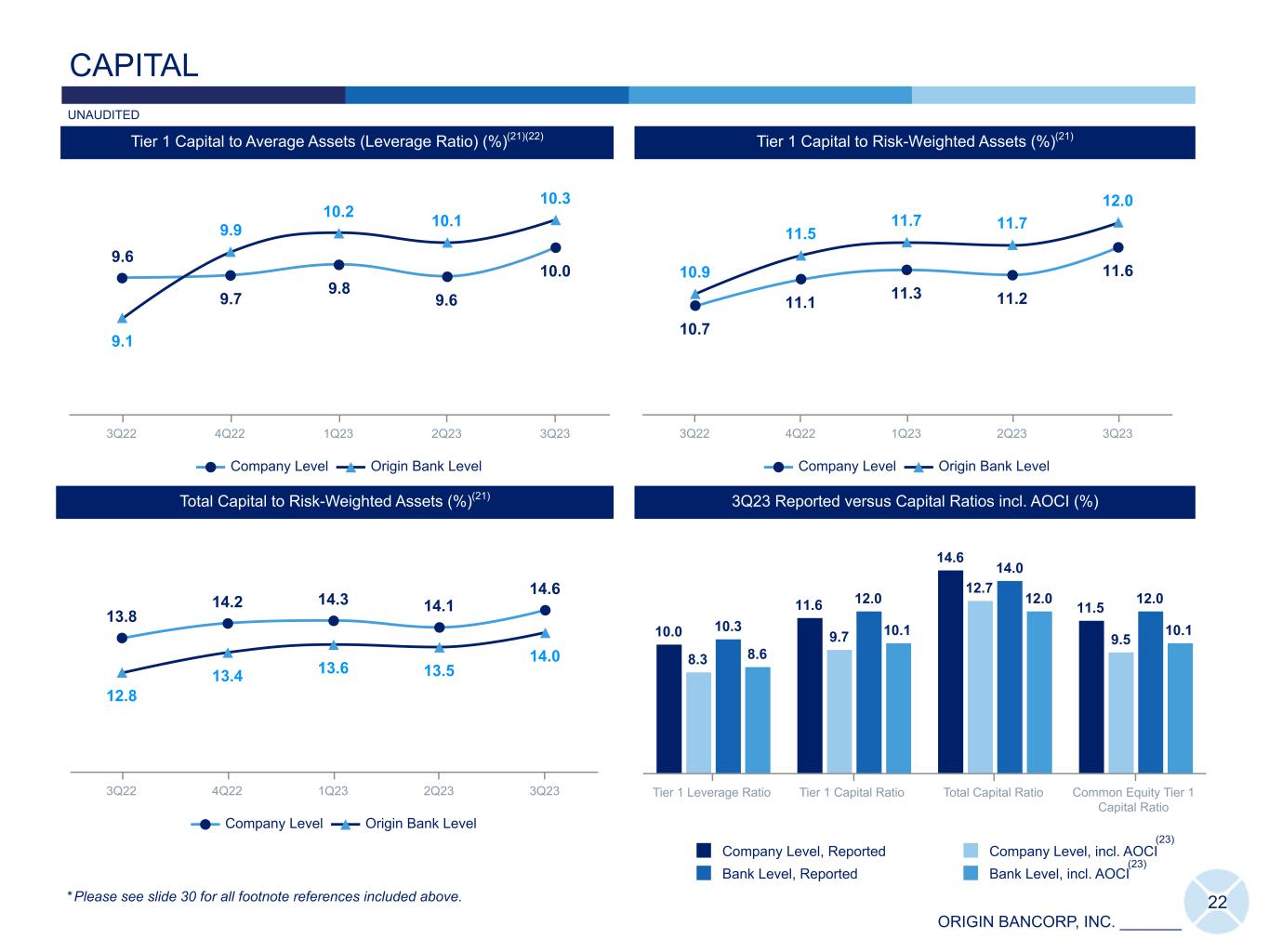

ORIGIN BANCORP, INC. _______ 9.6 9.7 9.8 9.6 10.0 9.1 9.9 10.2 10.1 10.3 Company Level Origin Bank Level 3Q22 4Q22 1Q23 2Q23 3Q23 10.7 11.1 11.3 11.2 11.610.9 11.5 11.7 11.7 12.0 Company Level Origin Bank Level 3Q22 4Q22 1Q23 2Q23 3Q23 22 CAPITAL 13.8 14.2 14.3 14.1 14.6 12.8 13.4 13.6 13.5 14.0 Company Level Origin Bank Level 3Q22 4Q22 1Q23 2Q23 3Q23 3Q23 Reported versus Capital Ratios incl. AOCI (%) ICap ICap Total Capital to Risk-Weighted Assets (%)(21) Tier 1 Capital to Risk-Weighted Assets (%)(21)Tier 1 Capital to Average Assets (Leverage Ratio) (%)(21)(22) * Please see slide 30 for all footnote references included above. 10.0 11.6 14.6 11.5 8.3 9.7 12.7 9.5 10.3 12.0 14.0 12.0 8.6 10.1 12.0 10.1 Company Level, Reported Company Level, incl. AOCI Bank Level, Reported Bank Level, incl. AOCI Tier 1 Leverage Ratio Tier 1 Capital Ratio Total Capital Ratio Common Equity Tier 1 Capital Ratio (23) (23) UNAUDITED

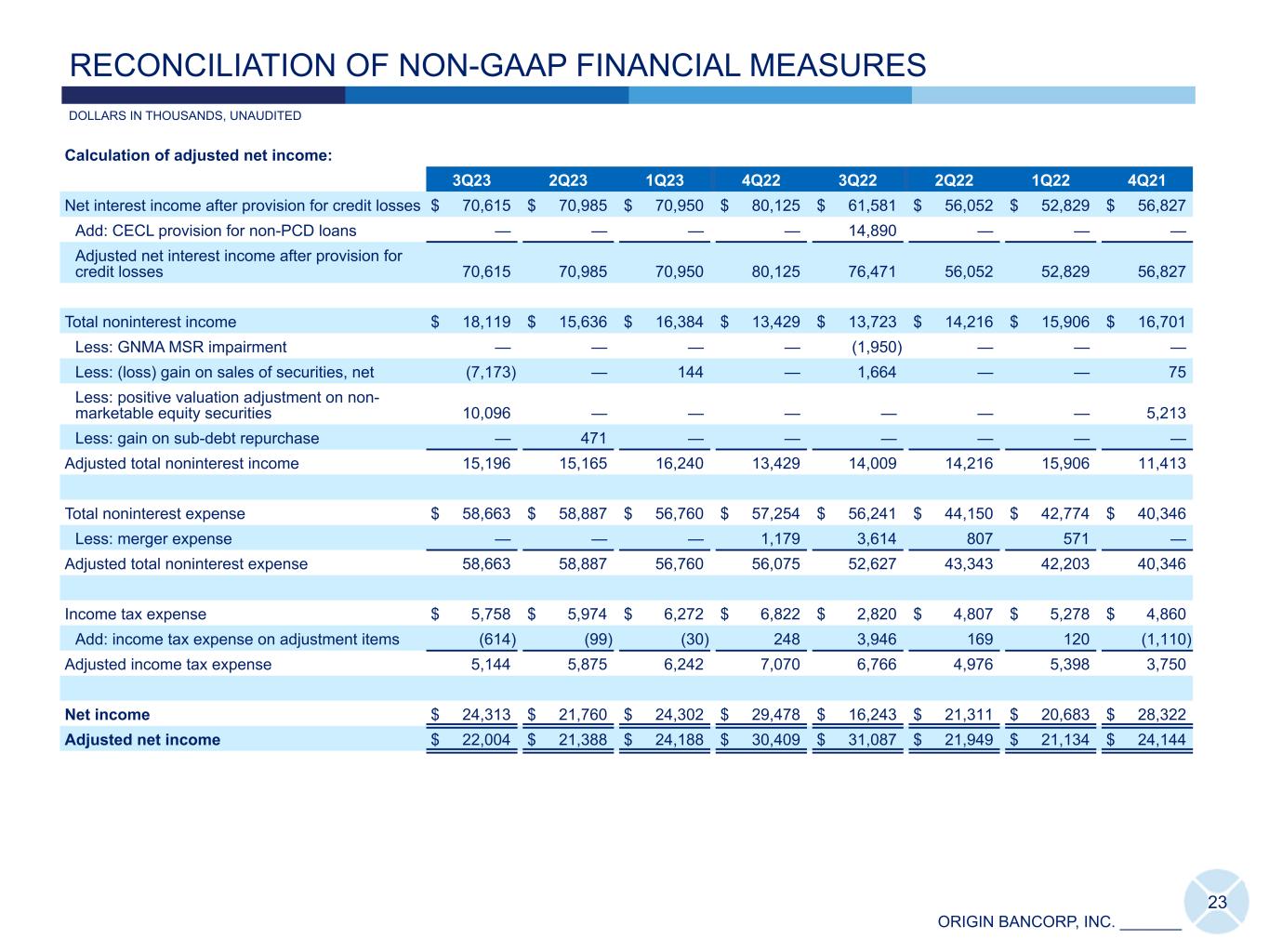

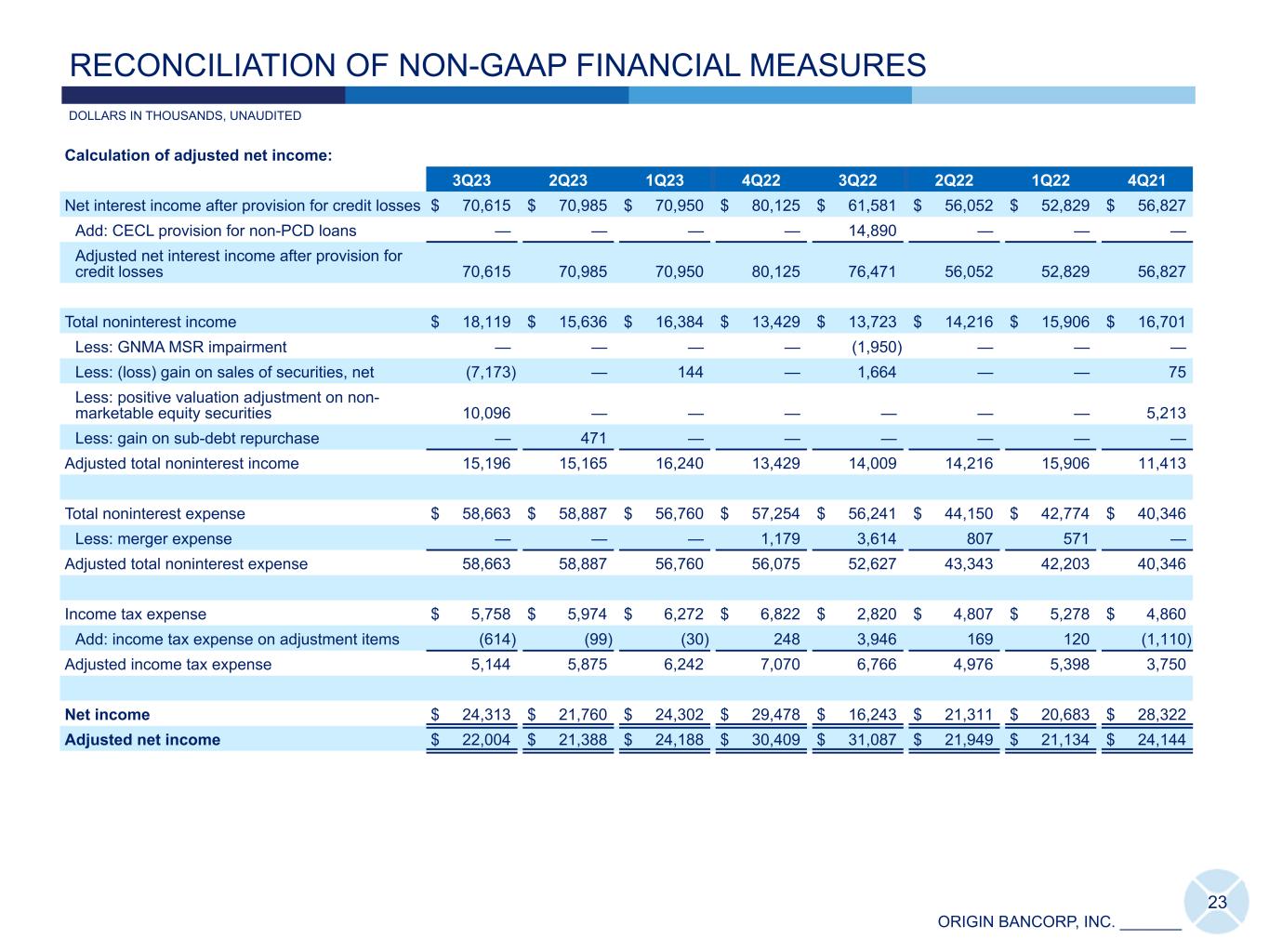

ORIGIN BANCORP, INC. _______ Calculation of adjusted net income: 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Net interest income after provision for credit losses $ 70,615 $ 70,985 $ 70,950 $ 80,125 $ 61,581 $ 56,052 $ 52,829 $ 56,827 Add: CECL provision for non-PCD loans — — — — 14,890 — — — Adjusted net interest income after provision for credit losses 70,615 70,985 70,950 80,125 76,471 56,052 52,829 56,827 Total noninterest income $ 18,119 $ 15,636 $ 16,384 $ 13,429 $ 13,723 $ 14,216 $ 15,906 $ 16,701 Less: GNMA MSR impairment — — — — (1,950) — — — Less: (loss) gain on sales of securities, net (7,173) — 144 — 1,664 — — 75 Less: positive valuation adjustment on non- marketable equity securities 10,096 — — — — — — 5,213 Less: gain on sub-debt repurchase — 471 — — — — — — Adjusted total noninterest income 15,196 15,165 16,240 13,429 14,009 14,216 15,906 11,413 Total noninterest expense $ 58,663 $ 58,887 $ 56,760 $ 57,254 $ 56,241 $ 44,150 $ 42,774 $ 40,346 Less: merger expense — — — 1,179 3,614 807 571 — Adjusted total noninterest expense 58,663 58,887 56,760 56,075 52,627 43,343 42,203 40,346 Income tax expense $ 5,758 $ 5,974 $ 6,272 $ 6,822 $ 2,820 $ 4,807 $ 5,278 $ 4,860 Add: income tax expense on adjustment items (614) (99) (30) 248 3,946 169 120 (1,110) Adjusted income tax expense 5,144 5,875 6,242 7,070 6,766 4,976 5,398 3,750 Net income $ 24,313 $ 21,760 $ 24,302 $ 29,478 $ 16,243 $ 21,311 $ 20,683 $ 28,322 Adjusted net income $ 22,004 $ 21,388 $ 24,188 $ 30,409 $ 31,087 $ 21,949 $ 21,134 $ 24,144 23 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

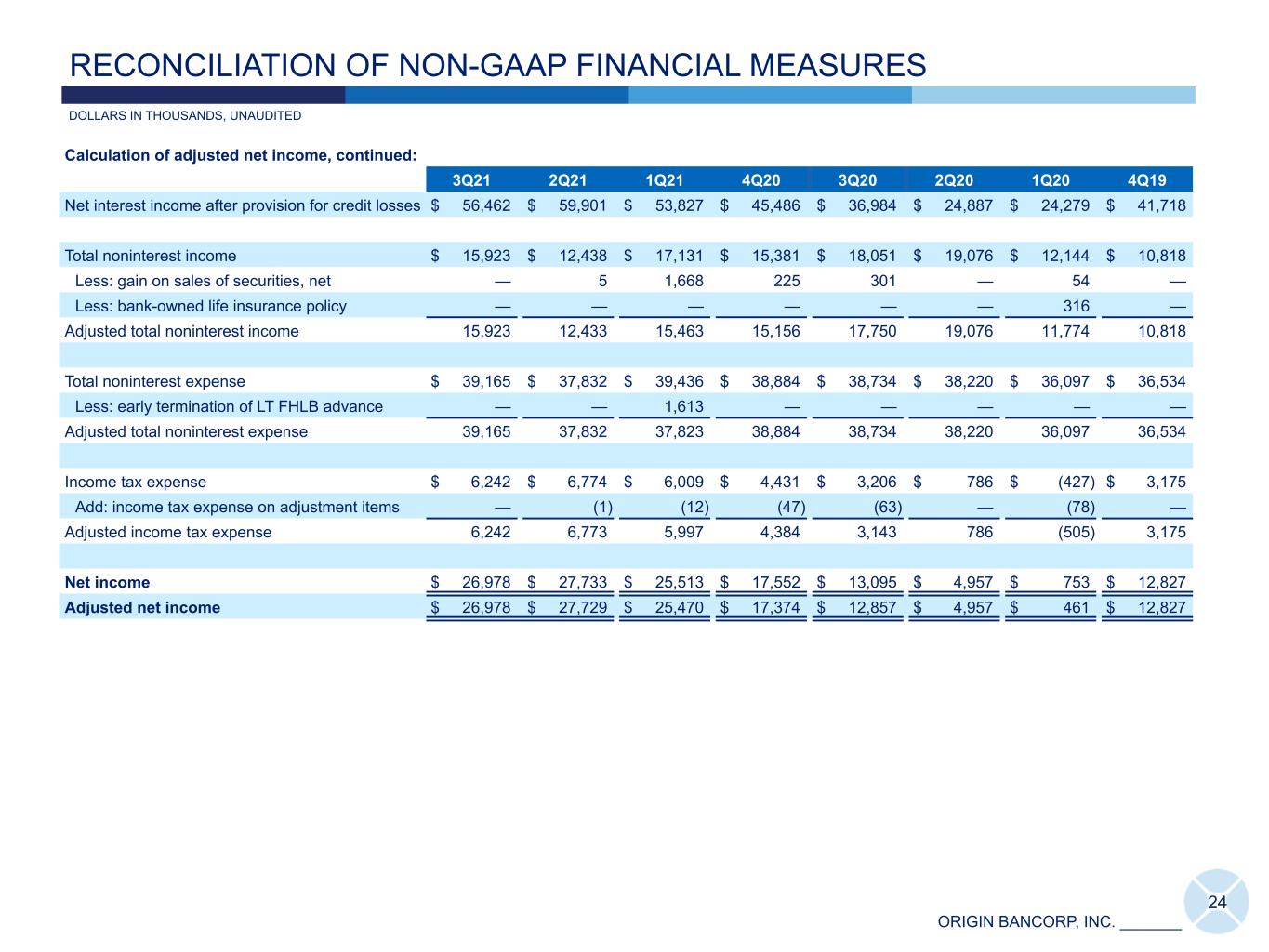

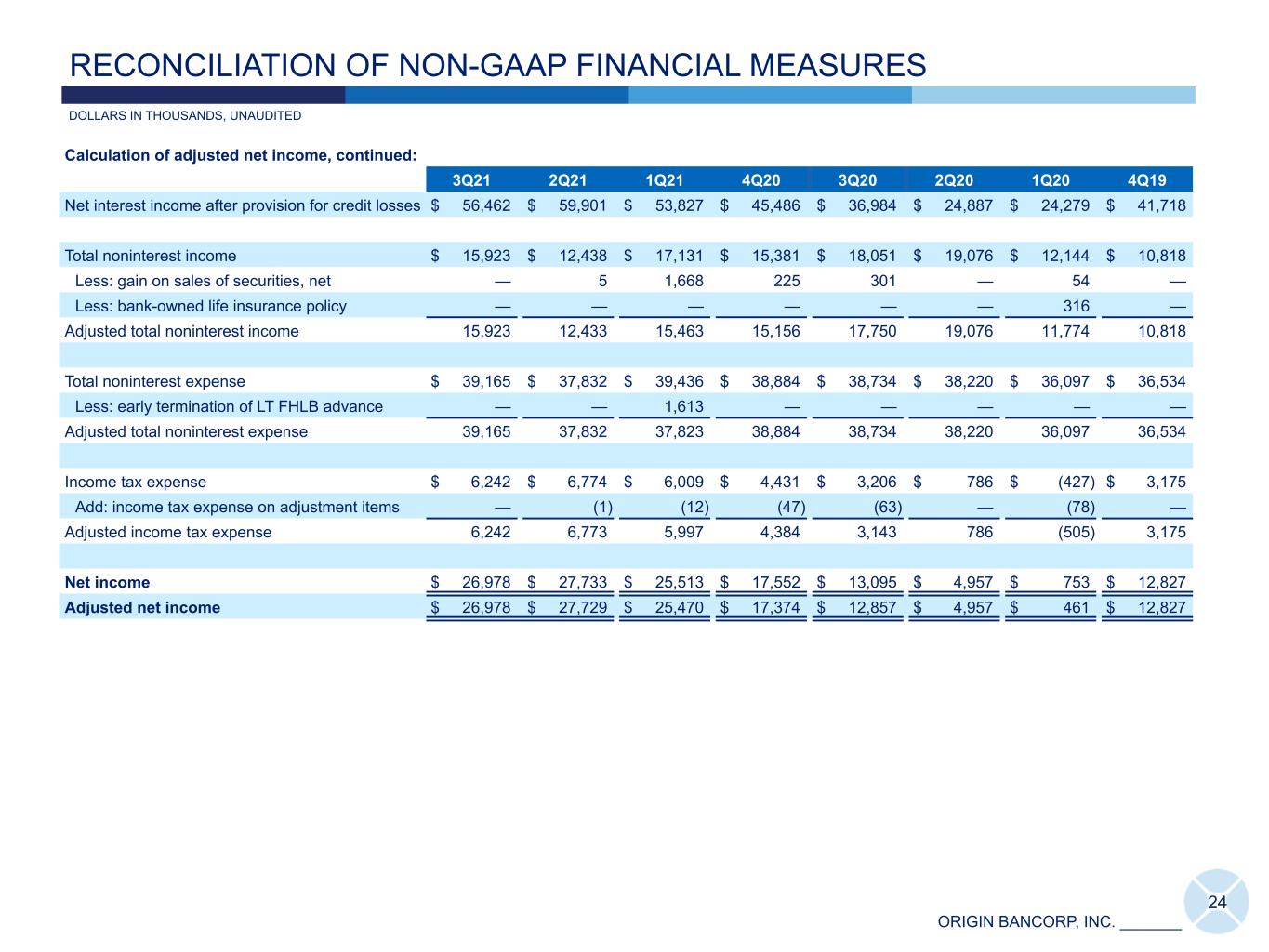

ORIGIN BANCORP, INC. _______ Calculation of adjusted net income, continued: 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 4Q19 Net interest income after provision for credit losses $ 56,462 $ 59,901 $ 53,827 $ 45,486 $ 36,984 $ 24,887 $ 24,279 $ 41,718 Total noninterest income $ 15,923 $ 12,438 $ 17,131 $ 15,381 $ 18,051 $ 19,076 $ 12,144 $ 10,818 Less: gain on sales of securities, net — 5 1,668 225 301 — 54 — Less: bank-owned life insurance policy — — — — — — 316 — Adjusted total noninterest income 15,923 12,433 15,463 15,156 17,750 19,076 11,774 10,818 Total noninterest expense $ 39,165 $ 37,832 $ 39,436 $ 38,884 $ 38,734 $ 38,220 $ 36,097 $ 36,534 Less: early termination of LT FHLB advance — — 1,613 — — — — — Adjusted total noninterest expense 39,165 37,832 37,823 38,884 38,734 38,220 36,097 36,534 Income tax expense $ 6,242 $ 6,774 $ 6,009 $ 4,431 $ 3,206 $ 786 $ (427) $ 3,175 Add: income tax expense on adjustment items — (1) (12) (47) (63) — (78) — Adjusted income tax expense 6,242 6,773 5,997 4,384 3,143 786 (505) 3,175 Net income $ 26,978 $ 27,733 $ 25,513 $ 17,552 $ 13,095 $ 4,957 $ 753 $ 12,827 Adjusted net income $ 26,978 $ 27,729 $ 25,470 $ 17,374 $ 12,857 $ 4,957 $ 461 $ 12,827 24 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ORIGIN BANCORP, INC. _______ Calculation of adjusted PTPP earnings: 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Provision for credit losses $ 3,515 $ 4,306 $ 6,197 $ 4,624 $ 16,942 $ 3,452 $ (327) $ (2,647) Less: CECL provision for non-PCD loans — — — — 14,890 — — — Adjusted provision for credit losses $ 3,515 $ 4,306 $ 6,197 $ 4,624 $ 2,052 $ 3,452 $ (327) $ (2,647) Adjusted net income $ 22,004 $ 21,388 $ 24,188 $ 30,409 $ 31,087 $ 21,949 $ 21,134 $ 24,144 Plus: provision (adjusted) for credit losses 3,515 4,306 6,197 4,624 2,052 3,452 (327) (2,647) Plus: income (adjusted) tax expense 5,144 5,875 6,242 7,070 6,766 4,976 5,398 3,750 Adjusted PTPP earnings $ 30,663 $ 31,569 $ 36,627 $ 42,103 $ 39,905 $ 30,377 $ 26,205 $ 25,247 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 4Q19 Provision for credit losses $ (3,921) $ (5,609) $ 1,412 $ 6,333 $ 13,633 $ 21,403 $ 18,531 $ 2,377 Adjusted net income $ 26,978 $ 27,729 $ 25,470 $ 17,374 $ 12,857 $ 4,957 $ 461 $ 12,827 Plus: provision for credit losses (3,921) (5,609) 1,412 6,333 13,633 21,403 18,531 2,377 Plus: income (adjusted) tax expense 6,242 6,773 5,997 4,384 3,143 786 (505) 3,175 Adjusted PTPP earnings $ 29,299 $ 28,893 $ 32,879 $ 28,091 $ 29,633 $ 27,146 $ 18,487 $ 18,379 25 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

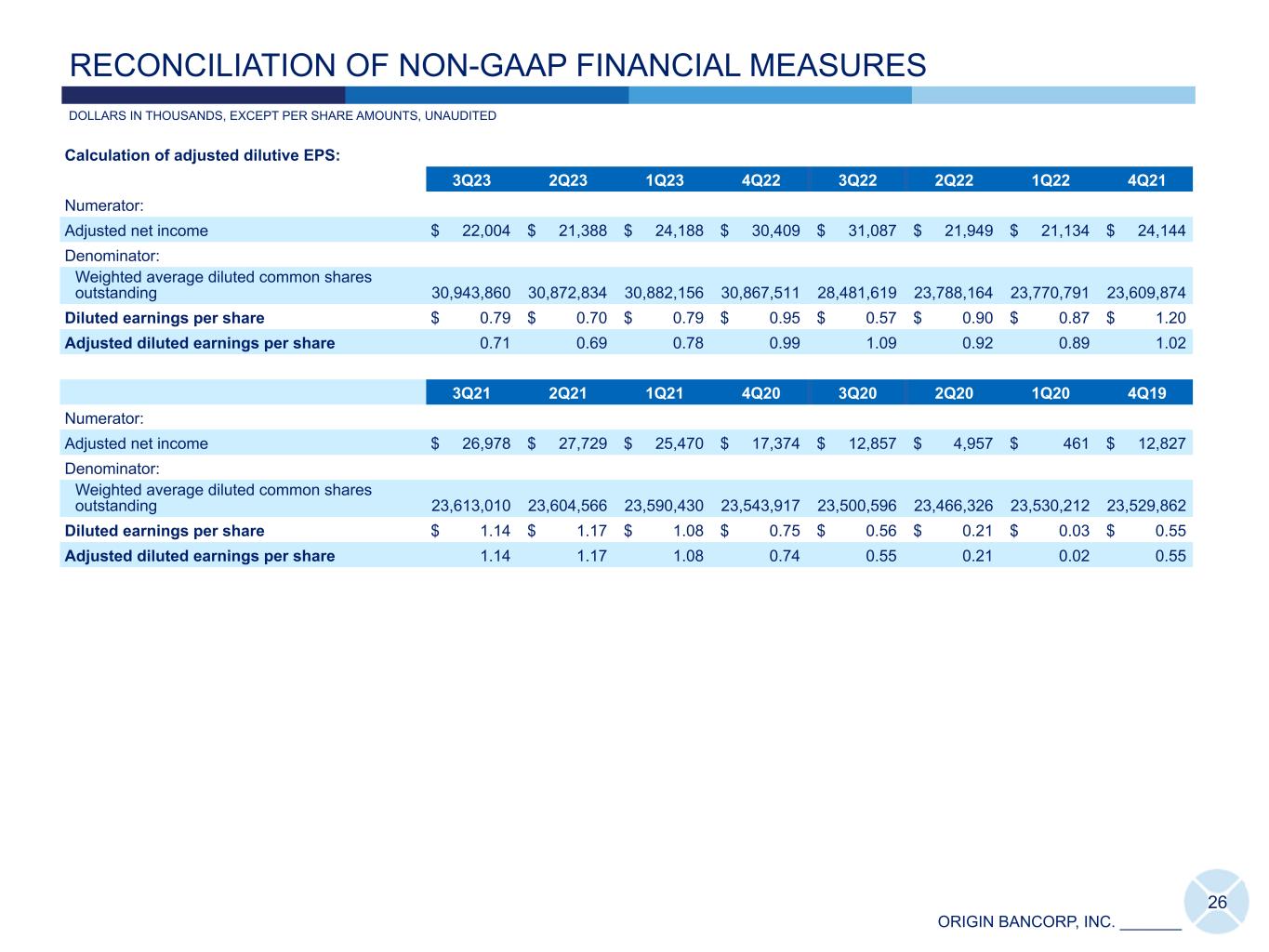

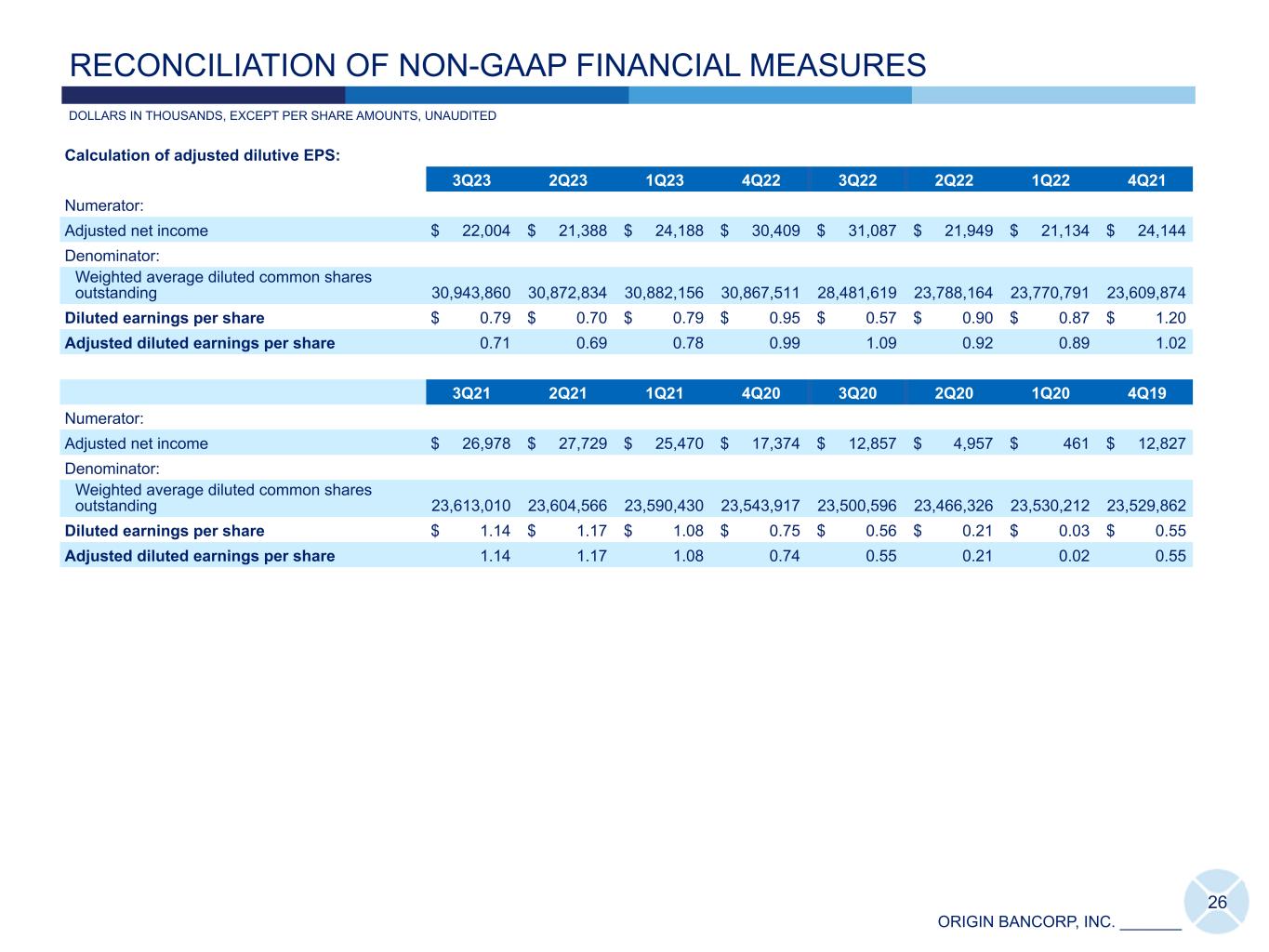

ORIGIN BANCORP, INC. _______ Calculation of adjusted dilutive EPS: 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Numerator: Adjusted net income $ 22,004 $ 21,388 $ 24,188 $ 30,409 $ 31,087 $ 21,949 $ 21,134 $ 24,144 Denominator: Weighted average diluted common shares outstanding 30,943,860 30,872,834 30,882,156 30,867,511 28,481,619 23,788,164 23,770,791 23,609,874 Diluted earnings per share $ 0.79 $ 0.70 $ 0.79 $ 0.95 $ 0.57 $ 0.90 $ 0.87 $ 1.20 Adjusted diluted earnings per share 0.71 0.69 0.78 0.99 1.09 0.92 0.89 1.02 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 4Q19 Numerator: Adjusted net income $ 26,978 $ 27,729 $ 25,470 $ 17,374 $ 12,857 $ 4,957 $ 461 $ 12,827 Denominator: Weighted average diluted common shares outstanding 23,613,010 23,604,566 23,590,430 23,543,917 23,500,596 23,466,326 23,530,212 23,529,862 Diluted earnings per share $ 1.14 $ 1.17 $ 1.08 $ 0.75 $ 0.56 $ 0.21 $ 0.03 $ 0.55 Adjusted diluted earnings per share 1.14 1.17 1.08 0.74 0.55 0.21 0.02 0.55 26 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED

ORIGIN BANCORP, INC. _______ Calculation of tangible book value per common share and adjusted tangible book value per common share: 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Total common stockholders' equity $ 998,945 $ 997,859 $ 992,587 $ 949,943 $ 907,024 $ 646,373 $ 676,865 $ 730,211 Less: goodwill 128,679 128,679 128,679 128,679 136,793 34,153 34,153 34,368 Less: other intangible assets, net 42,460 44,724 47,277 49,829 52,384 15,900 16,425 16,962 Tangible common equity 827,806 824,456 816,631 771,435 717,847 596,320 626,287 678,881 Less: accumulated other comprehensive (loss) income (172,729) (152,879) (138,481) (159,875) (175,233) (115,979) (65,890) 5,729 Adjusted tangible common equity 1,000,535 977,335 955,112 931,310 893,080 712,299 692,177 673,152 Divided by common shares outstanding at period end 30,906,716 30,866,205 30,780,853 30,746,600 30,661,734 23,807,677 23,748,748 23,746,502 Book value per common share(7) $ 32.32 $ 32.33 $ 32.25 $ 30.90 $ 29.58 $ 27.15 $ 28.50 $ 30.75 Tangible book value per common share(7) 26.78 26.71 26.53 25.09 23.41 25.05 26.37 28.59 Adjusted tangible book value per common share 32.37 31.66 31.03 30.29 29.13 29.92 29.15 28.35 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 4Q19 Total common stockholders' equity $ 705,667 $ 688,235 $ 656,355 $ 647,150 $ 627,637 $ 614,781 $ 606,631 $ 599,362 Less: goodwill 26,741 26,741 26,741 26,741 26,741 26,741 26,741 26,741 Less: other intangible assets, net 3,089 3,283 3,505 3,739 3,976 4,212 4,500 4,799 Tangible common equity 675,837 658,211 626,109 616,670 596,920 583,828 575,390 567,822 Less: accumulated other comprehensive income 11,872 18,914 12,185 25,649 21,998 20,613 15,822 6,333 Adjusted tangible common equity 663,965 639,297 613,924 591,021 574,922 563,215 559,568 561,489 Divided by common shares outstanding at period end 23,496,058 23,502,215 23,488,884 23,506,312 23,506,586 23,501,233 23,475,948 23,480,945 Book value per common share(7) $ 30.03 $ 29.28 $ 27.94 $ 27.53 $ 26.70 $ 26.16 $ 25.84 $ 25.52 Tangible book value per common share(7) 28.76 28.01 26.66 26.23 25.39 24.84 24.51 24.18 Adjusted tangible book value per common share 28.26 27.20 26.14 25.14 24.46 23.97 23.84 23.91 27 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES * Please see slide 30 for all footnote references included above. DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED

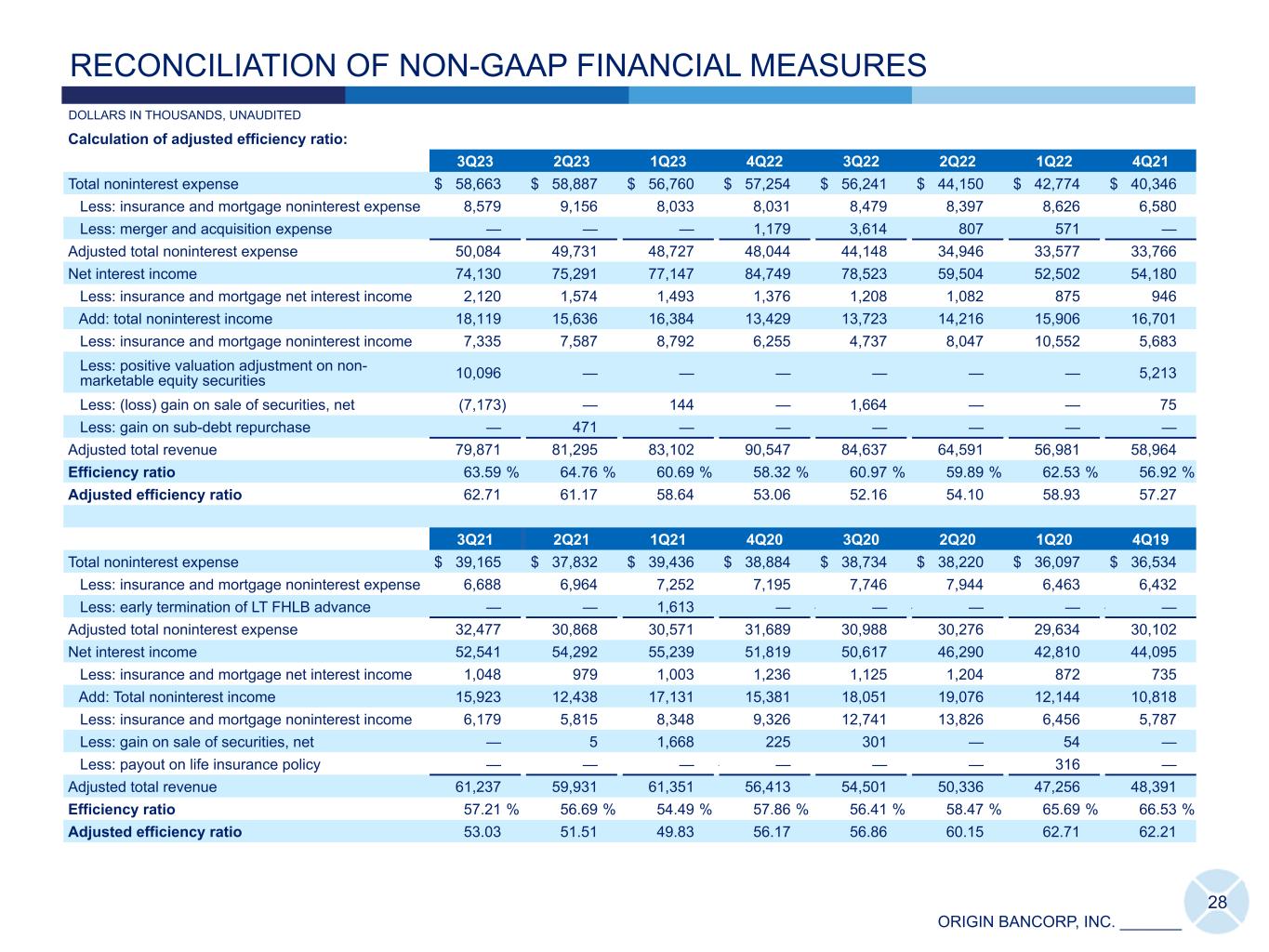

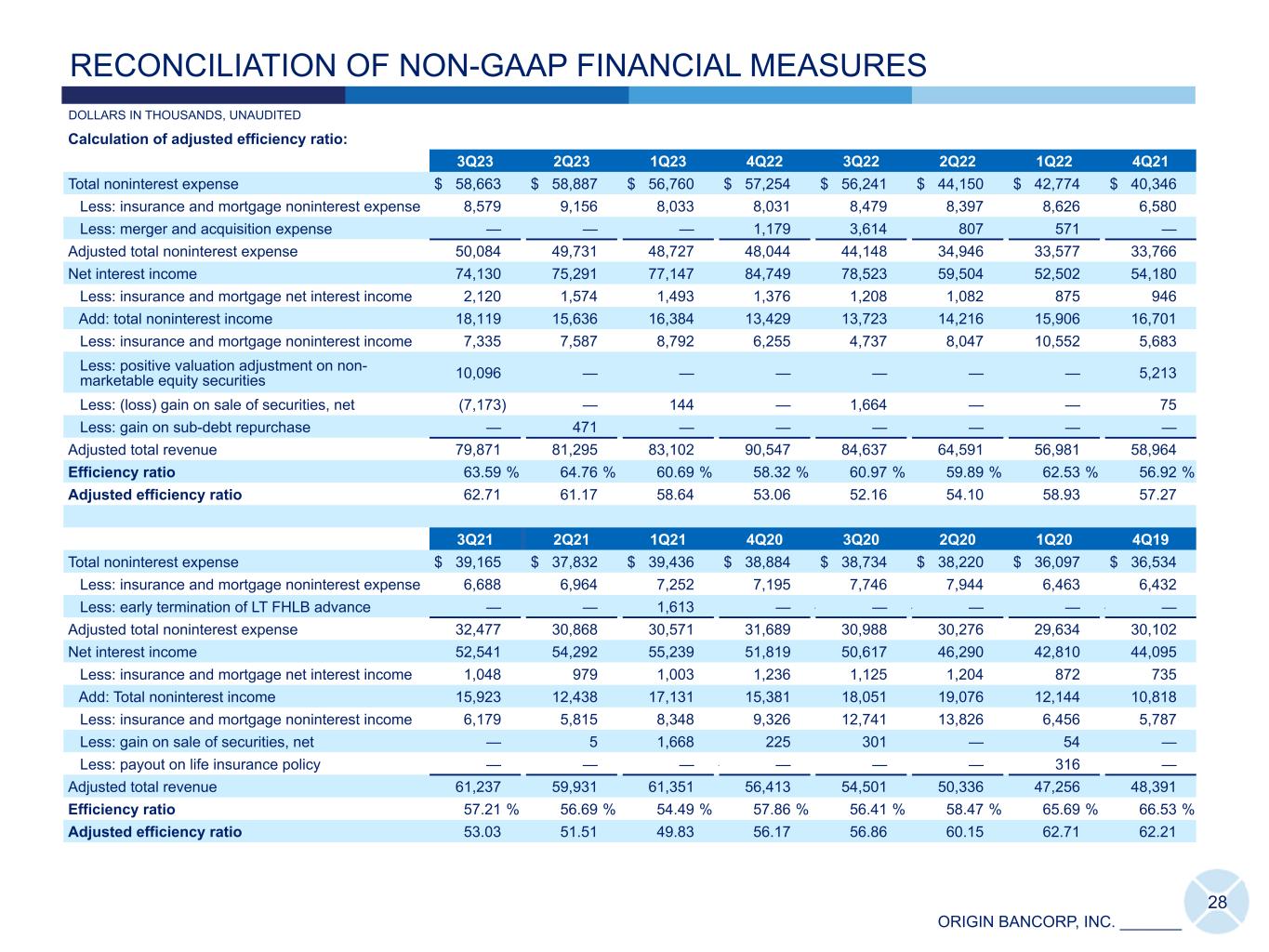

ORIGIN BANCORP, INC. _______ RECONCILIATION OF NON-GAAP FINANCIAL MEASURES DOLLARS IN THOUSANDS, UNAUDITED Calculation of adjusted efficiency ratio: 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Total noninterest expense $ 58,663 $ 58,887 $ 56,760 $ 57,254 $ 56,241 $ 44,150 $ 42,774 $ 40,346 Less: insurance and mortgage noninterest expense 8,579 9,156 8,033 8,031 8,479 8,397 8,626 6,580 Less: merger and acquisition expense — — — 1,179 3,614 807 571 — Adjusted total noninterest expense 50,084 49,731 48,727 48,044 44,148 34,946 33,577 33,766 Net interest income 74,130 75,291 77,147 84,749 78,523 59,504 52,502 54,180 Less: insurance and mortgage net interest income 2,120 1,574 1,493 1,376 1,208 1,082 875 946 Add: total noninterest income 18,119 15,636 16,384 13,429 13,723 14,216 15,906 16,701 Less: insurance and mortgage noninterest income 7,335 7,587 8,792 6,255 4,737 8,047 10,552 5,683 Less: positive valuation adjustment on non- marketable equity securities 10,096 — — — — — — 5,213 Less: (loss) gain on sale of securities, net (7,173) — 144 — 1,664 — — 75 Less: gain on sub-debt repurchase — 471 — — — — — — Adjusted total revenue 79,871 81,295 83,102 90,547 84,637 64,591 56,981 58,964 Efficiency ratio 63.59 % 64.76 % 60.69 % 58.32 % 60.97 % 59.89 % 62.53 % 56.92 % Adjusted efficiency ratio 62.71 61.17 58.64 53.06 52.16 54.10 58.93 57.27 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 4Q19 Total noninterest expense $ 39,165 $ 37,832 $ 39,436 $ 38,884 $ 38,734 $ 38,220 $ 36,097 $ 36,534 Less: insurance and mortgage noninterest expense 6,688 6,964 7,252 7,195 7,746 7,944 6,463 6,432 Less: early termination of LT FHLB advance — — 1,613 — — — — — — — — Adjusted total noninterest expense 32,477 30,868 30,571 31,689 30,988 30,276 29,634 30,102 Net interest income 52,541 54,292 55,239 51,819 50,617 46,290 42,810 44,095 Less: insurance and mortgage net interest income 1,048 979 1,003 1,236 1,125 1,204 872 735 Add: Total noninterest income 15,923 12,438 17,131 15,381 18,051 19,076 12,144 10,818 Less: insurance and mortgage noninterest income 6,179 5,815 8,348 9,326 12,741 13,826 6,456 5,787 Less: gain on sale of securities, net — 5 1,668 225 301 — 54 — Less: payout on life insurance policy — — — — — — — 316 — Adjusted total revenue 61,237 59,931 61,351 56,413 54,501 50,336 47,256 48,391 Efficiency ratio 57.21 % 56.69 % 54.49 % 57.86 % 56.41 % 58.47 % 65.69 % 66.53 % Adjusted efficiency ratio 53.03 51.51 49.83 56.17 56.86 60.15 62.71 62.21 28

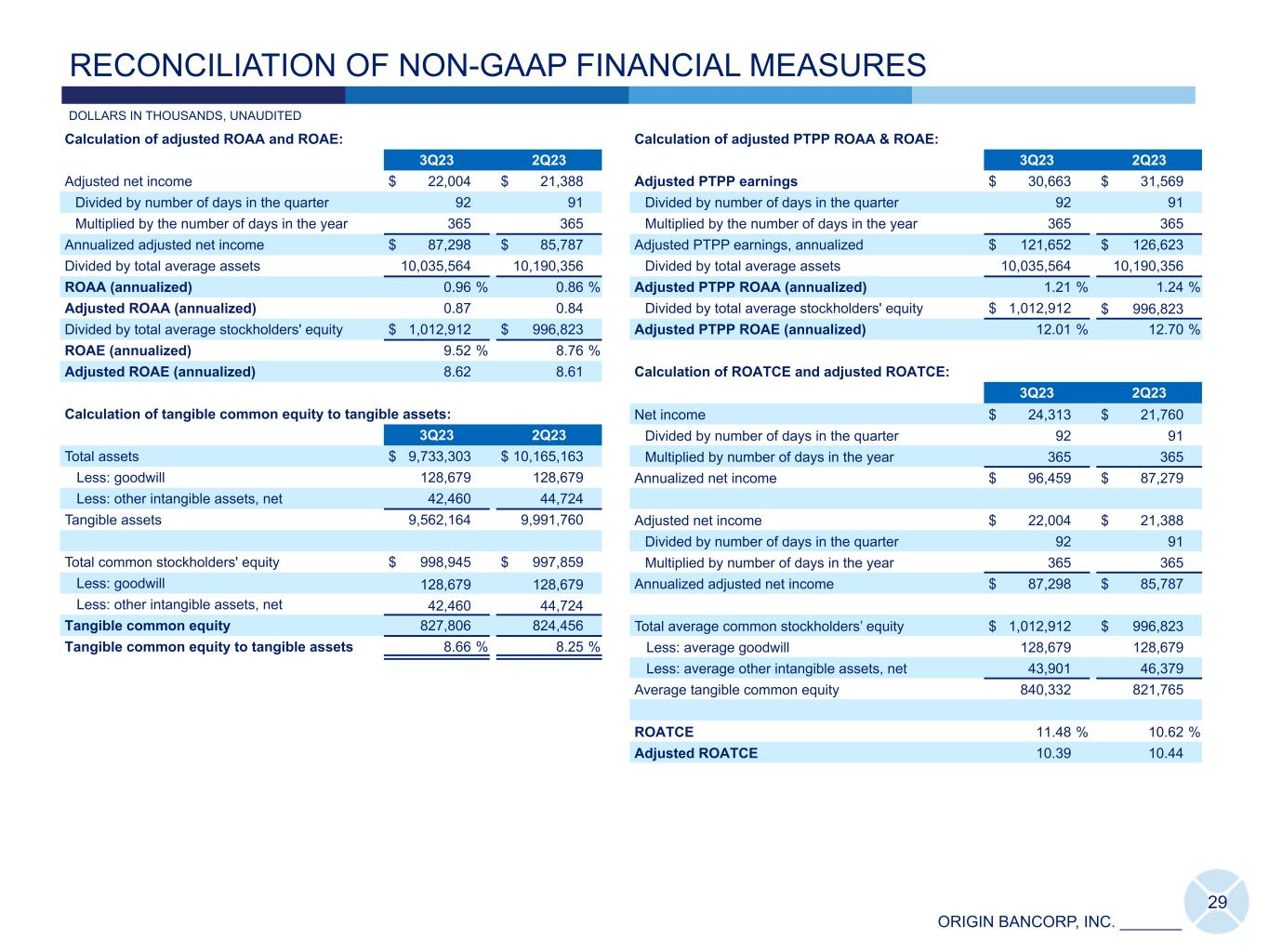

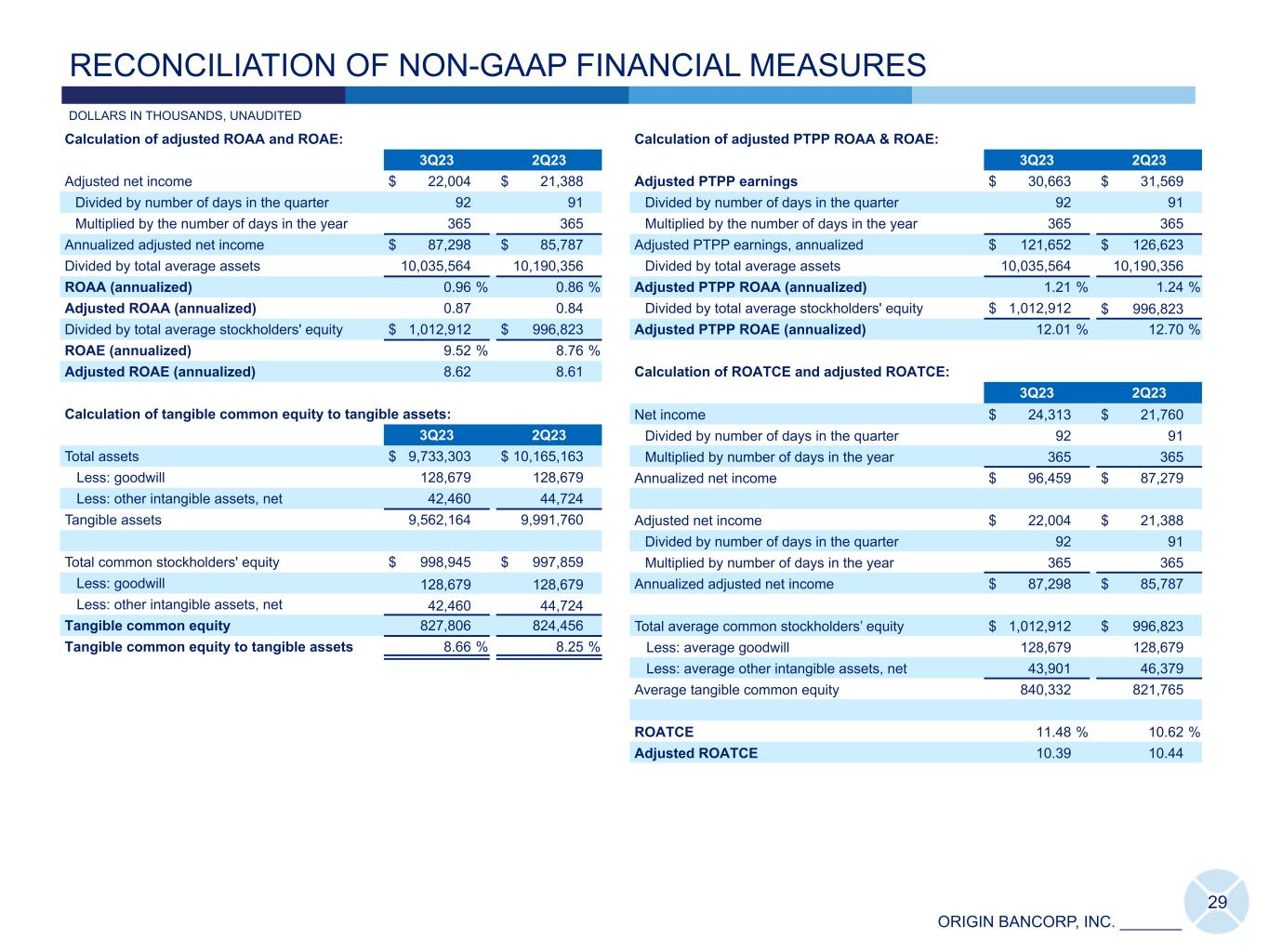

ORIGIN BANCORP, INC. _______ Calculation of adjusted ROAA and ROAE: Calculation of adjusted PTPP ROAA & ROAE: 3Q23 2Q23 3Q23 2Q23 Adjusted net income $ 22,004 $ 21,388 Adjusted PTPP earnings $ 30,663 $ 31,569 Divided by number of days in the quarter 92 91 Divided by number of days in the quarter 92 91 Multiplied by the number of days in the year 365 365 Multiplied by the number of days in the year 365 365 Annualized adjusted net income $ 87,298 $ 85,787 Adjusted PTPP earnings, annualized $ 121,652 $ 126,623 Divided by total average assets 10,035,564 10,190,356 Divided by total average assets 10,035,564 10,190,356 ROAA (annualized) 0.96 % 0.86 % Adjusted PTPP ROAA (annualized) 1.21 % 1.24 % Adjusted ROAA (annualized) 0.87 0.84 Divided by total average stockholders' equity $ 1,012,912 $ 996,823 Divided by total average stockholders' equity $ 1,012,912 $ 996,823 Adjusted PTPP ROAE (annualized) 12.01 % 12.70 % ROAE (annualized) 9.52 % 8.76 % Adjusted ROAE (annualized) 8.62 8.61 Calculation of ROATCE and adjusted ROATCE: 3Q23 2Q23 Calculation of tangible common equity to tangible assets: Net income $ 24,313 $ 21,760 3Q23 2Q23 Divided by number of days in the quarter 92 91 Total assets $ 9,733,303 $ 10,165,163 Multiplied by number of days in the year 365 365 Less: goodwill 128,679 128,679 Annualized net income $ 96,459 $ 87,279 Less: other intangible assets, net 42,460 44,724 Tangible assets 9,562,164 9,991,760 Adjusted net income $ 22,004 $ 21,388 Divided by number of days in the quarter 92 91 Total common stockholders' equity $ 998,945 $ 997,859 Multiplied by number of days in the year 365 365 Less: goodwill 128,679 128,679 Annualized adjusted net income $ 87,298 $ 85,787 Less: other intangible assets, net 42,460 44,724 Tangible common equity 827,806 824,456 Total average common stockholders’ equity $ 1,012,912 $ 996,823 Tangible common equity to tangible assets 8.66 % 8.25 % Less: average goodwill 128,679 128,679 Less: average other intangible assets, net 43,901 46,379 Average tangible common equity 840,332 821,765 ROATCE 11.48 % 10.62 % Adjusted ROATCE 10.39 10.44 29 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ORIGIN BANCORP, INC. _______ 30 PRESENTATION NOTES (1) Does not include loan production offices. Count is as of most practicable date. (2) Does not include non-market based deposits. (3) Excludes mortgage warehouse loans. (4) As used in this presentation, adjusted net income, adjusted PTPP earnings, adjusted diluted EPS, adjusted ROAA, adjusted PTPP ROAA, adjusted ROAE, adjusted PTPP ROAE, tangible book value per common share, adjusted tangible book value per common share, tangible common equity to tangible assets, normalized tangible book value per common share, ROATCE, adjusted ROATCE and adjusted efficiency ratio are either non-GAAP financial measures or use a non-GAAP contributor in the formula. For a reconciliation of these alternative financial measures to their comparable GAAP measures, see slides 23-29 of this presentation. (5) NIM - FTE, adjusted, is calculated by removing the net purchase accounting accretion from the net interest income. (6) The ALCL to total LHFI, adjusted is calculated by excluding the ALCL for warehouse loans from the total LHFI ALCL in the numerator and excluding the warehouse loans from the LHFI in the denominator. Due to their low-risk profile, mortgage warehouse loans require a disproportionately low allocation of the ALCL. (7) An increase in accumulated other comprehensive loss negatively impacted total stockholders' equity, tangible common equity, book value and tangible book value per common share primarily due to the movement of the short end of the yield curve and its impact on our investment portfolio. (8) Total LHFI, adjusted excludes mortgage warehouse loans for all periods presented. (9) Origin Bancorp, Inc. and KBW Nasdaq cumulative total shareholder return assumes $100 Invested on December 31, 1996, and any dividends are reinvested. Data for Origin Bancorp, Inc. cumulative total shareholder return prior to May 9, 2018, is based upon private stock transactions and is not reflective of open market trades. (10) Data obtained from The United States Census Bureau (census.gov). Count is as of most practicable date. (11) Year-to-date periods ended December 31, 2020 and 2021, exclude PPP loans. (12) Does not include loans held for sale. (13) Represents an interest rate sensitivity test for CRE office loans over $2.5 million using interest rate assumptions increased to 8.75% for 2023 maturities, 8.6% for 2024 maturities, 8.1% for 2025 maturities, 6.9% for 2026 maturities and 5.9% for 2027+ maturities. (14) The accumulated other comprehensive loss primarily represents the unrealized loss, net of tax benefit, of available for sale securities and is a component of equity. (15) Estimated metrics of the AFS security sale/FHLB advance paydown are calculated by using our annualized third quarter net income, less any extraordinary items, and adding the estimated annualized tax-effected net interest income using a weighted average tax-effected yield of 3.08% on the securities sold and an expected interest rate of 5.62% on the FHLB advances paid off. (16) Includes projected principal and interest cash flow distributions. (17) Peer represents commercial banks as identified by S&P Global. (18) Yield on LHFI excl. purchase accounting adjustments ("PAA") reflects the exclusion of PAA for all periods shown. (19) Net interest income excl. Mtg. WH LOC, adjusted, excludes PAA net accretion for the 2Q23 and prior periods. (20) Mortgage banking revenue for 3Q22 was adjusted for the $1.9 million impairment on the GNMA MSR portfolio. (21) September 30, 2023, dollars and ratios are estimated. (22) 3Q22 does not include BTH Bank, which elected the Community Bank Leverage Ratio. (23) Capital ratios are calculated by including the accumulated other comprehensive loss in the equity used in the numerator of the respective ratios and including the primarily negative fair value adjustments on the available for sale portfolio in the total risk-weighted assets used in the denominator of the ratio.