Exhibit 99.2

ACCELERATING OUR TEXAS GR WTH STORY FEBRUARY 24, 2022

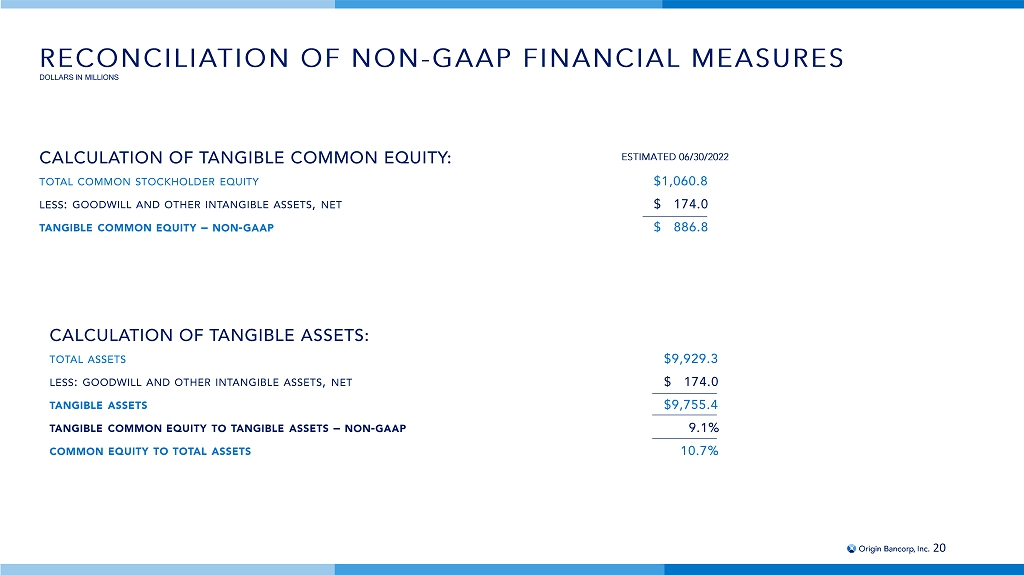

LEGAL DISCLOSURES This communication contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Origin Bancorp, Inc . (“Origin” or the “Company” or “OBNK”) and BT Holdings, Inc . (“BTH”) . Information for periods not yet completed, and words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward - looking statements . These forward - looking statements are based on Origin’s current expectations and assumptions regarding Origin’s and BTH’s businesses, the economy, and other future conditions . Because forward - looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict . Many possible events or factors could affect Origin’s or BTH’s future financial results and performance, and could cause actual results or performance to differ materially from anticipated results or performance . Such risks and uncertainties include, among others : the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Origin and BTH, the outcome of any legal proceedings that may be instituted against Origin or BTH, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Origin and BTH do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of Origin and BTH successfully, and the dilution caused by Origin’s issuance of additional shares of its capital stock in connection with the transaction . Except to the extent required by applicable law or regulation, Origin disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward - looking statements included herein to reflect future events or developments . Further information regarding Origin and factors which could affect the forward - looking statements contained herein can be found in Origin’s Annual Report on Form 10 - K, its Quarterly Reports on Form 10 - Q and its other filings with the Securities and Exchange Commission (“SEC”) . Origin reports its results in accordance with United States generally accepted accounting principles ("GAAP") . However, management believes that certain supplemental non - GAAP financial measures used in managing its business may provide meaningful information to investors about underlying trends in its business . Management uses these non - GAAP measures to evaluate the Company's operating performance and believes that these non - GAAP measures provide information that is important to investors and that is useful in understanding Origin's results of operations . However, non - GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP . The following are the non - GAAP measures used in this presentation : • Tangible common equity, or TCE, is defined as total common stockholders' equity less goodwill and other intangible assets, net • Tangible assets, or TA, is defined as total assets less goodwill and other intangible assets, net • TCE/TA is defined as tangible common equity divided by tangible assets • ROATCE is defined as net income divided by tangible common equity • Tangible book value per common share, or TBVPS, is determined by dividing tangible common equity by common shares outstanding at the end of the period See the last few slides in this presentation for a reconciliation between the non - GAAP measures used in this presentation and their comparable GAAP numbers . 2

LEGAL DISCLOSURES 3 IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction (the “Transaction”), Origin will file with the SEC a registration statement on Form S - 4 that will include a joint proxy statement of Origin and BTH and a prospectus of Origin, as well as other relevant documents concerning the Transaction . Certain matters in respect of the Transaction involving BTH and Origin will be submitted to BTH’s and Origin’s shareholders for their consideration . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S - 4 , THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S - 4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT ORIGIN, BTH AND THE TRANSACTION . Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www . sec . gov or from Origin at its website, www . Origin . bank . Documents filed with the SEC by Origin will be available free of charge by accessing Origin’s Investor Relations website at ir . Origin . bank or, alternatively, by directing a request by mail or telephone to Origin Bancorp, Inc . , 500 South Service Road East, Ruston, Louisiana 71270 , Attn : Investor Relations, ( 318 ) 497 - 3177 . PARTICIPANTS IN THE SOLICITATION Origin , BTH and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Origin and BTH in connection with the proposed transaction under the rules of the SEC . Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available . Additional information about Origin, and its directors and executive officers, may be found in Origin’s definitive proxy statement relating to its 2021 Annual Meeting of Shareholders filed with the SEC on March 17 , 2021 , and other documents filed by Origin with the SEC . These documents can be obtained free of charge from the sources described above . NO OFFER OR SOLICITATION This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, and otherwise in accordance with applicable law .

ENHANCING OUR TEXAS FRANCHISE • Shared cultures and business models focused on relationship banking leading to seamless integration • Compelling footprint expansion along I - 20 corridor in East Texas with meaningful overlap in DFW • Significant opportunity for growth in new and existing markets by building and expanding client relationships • ~ 50% C&I loans, a unique TX opportunity • Financially attractive with double digit earnings accretion and ~2.2 year TBVPS earnback • Pro forma capital ratios remain strong, positioning OBNK for continued, robust organic growth 4

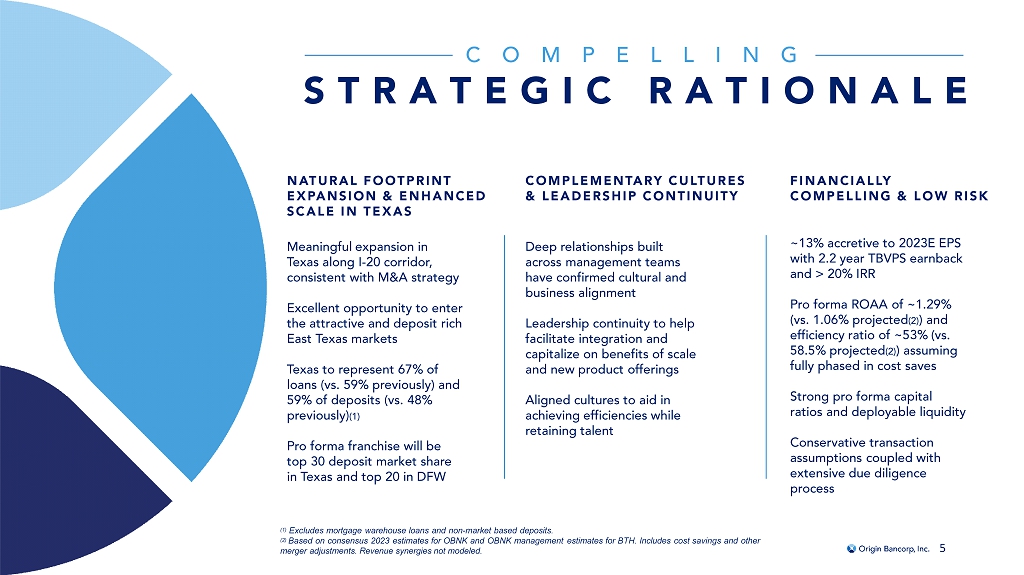

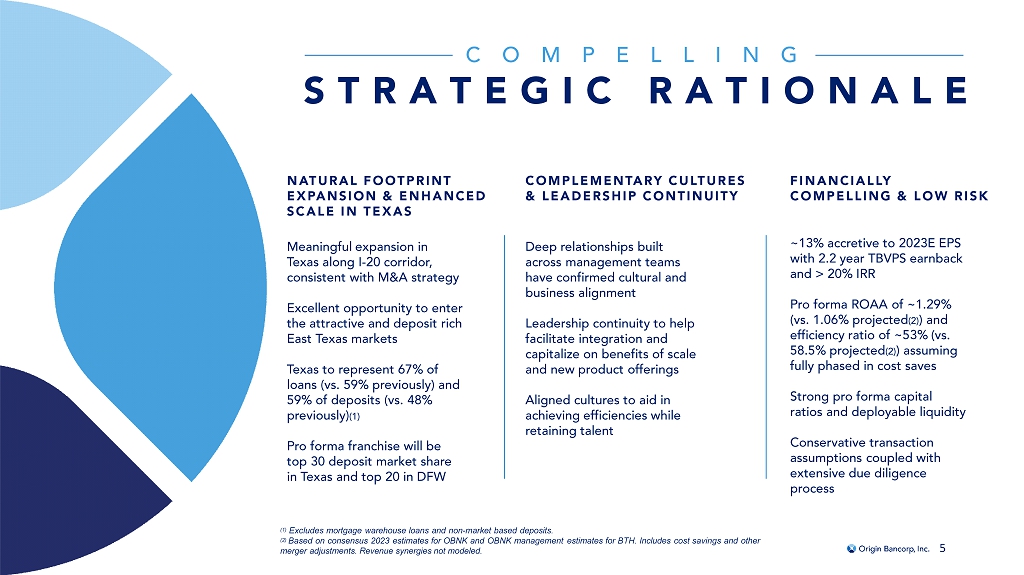

COMPELLING STRATEGIC RATIONALE NATURAL FOOTPRINT EXPANSION & ENHANCED SCALE IN TEXAS COMPLEMENTARY CULTURES & LEADERSHIP CONTINUITY FINANCIALLY COMPELLING & LOW RISK Meaningful expansion in Texas along I - 20 corridor, consistent with M&A strategy E xcellent opportunity to enter the attractive and deposit rich East Texas markets Texas to represent 67% of loans (vs. 59% previously) and 59% of deposits (vs. 48% previously) (1 ) Pro forma franchise will be top 30 deposit market share in Texas and top 20 in DFW Deep relationships built across management teams have confirmed cultural and business alignment Leadership continuity to help facilitate integration and capitalize on benefits of scale and new product offerings Aligned cultures to aid in achieving efficiencies while retaining talent ~13% accretive to 2023E EPS with 2.2 year TBVPS earnback and > 20% IRR Pro forma ROAA of ~1.29% (vs. 1.06% projected (2) ) and efficiency ratio of ~53% (vs. 58.5% projected (2 ) ) assuming fully phased in cost saves Strong pro forma capital ratios and deployable liquidity Conservative transaction assumptions coupled with extensive due diligence process (1) Excludes mortgage warehouse loans and non - market based deposits. (2) Based on consensus 2023 estimates for OBNK and OBNK management estimates for BTH. Includes cost savings and other merger adjustments . Revenue synergies not modeled . 5

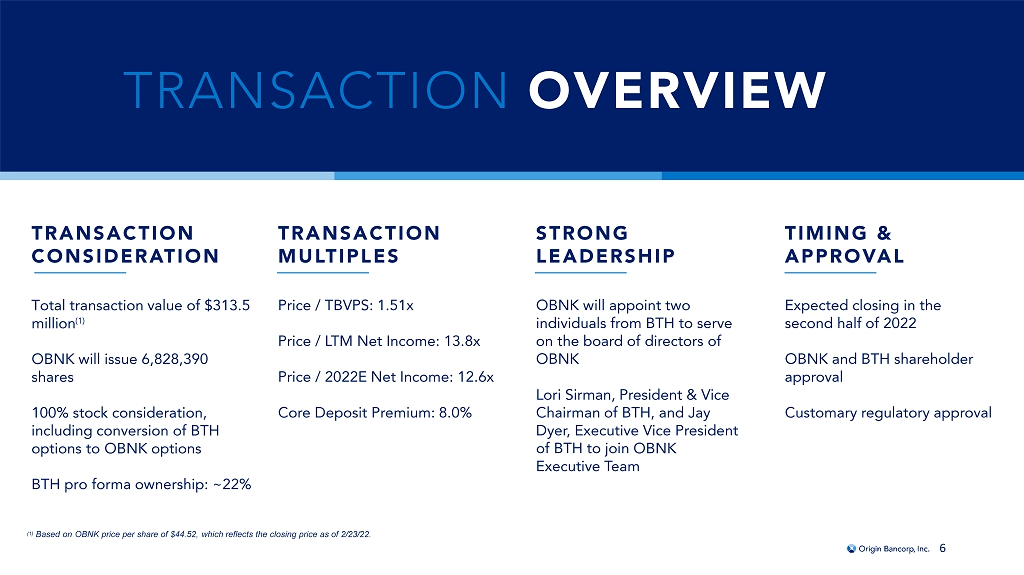

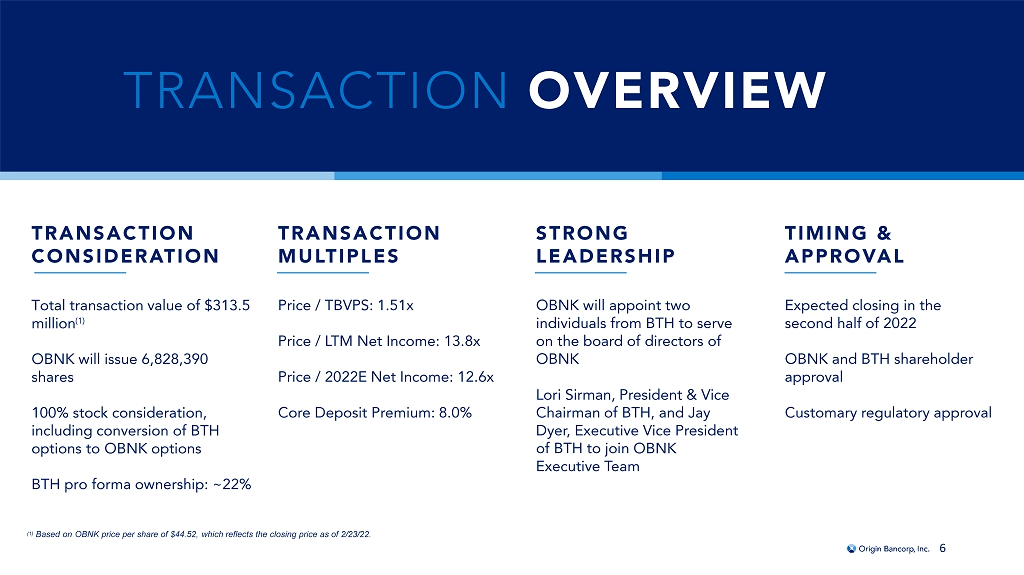

TRANSACTION C ONSIDERATION TRANSACTION MULTIPLES STRONG LEADERSHIP TIMING & $44.52 APPROVAL Total transaction value of $ 315.7 million OBNK will issue 6,828,390 shares 100 % stock consideration, including conversion of BTH options to OBNK options BTH pro forma ownership: ~22 % Price / TBVPS: 1.54x Price / LTM Net Income: 13.9x Price / 2022E Net Income: 12.7x Core Deposit Premium: 8.2% OBNK will appoint two individuals from BTH to serve on the board of directors of OBNK Lori Sirman, President & Vice Chairman of BTH, and Jay Dyer, Executive Vice President of BTH to join OBNK Executive Team Expected closing in the second half of 2022 OBNK and BTH shareholder approval Customary regulatory approval TRANSACTION OVERVIEW (1) Based on OBNK price per share of $44.92, which reflects the closing price as of 2/ 23 /22 . (1) 6

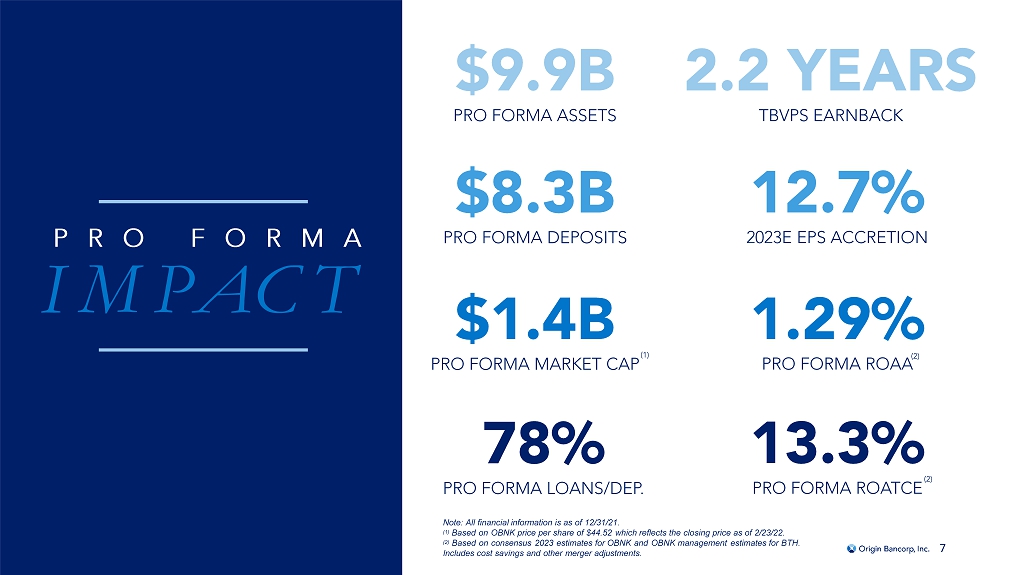

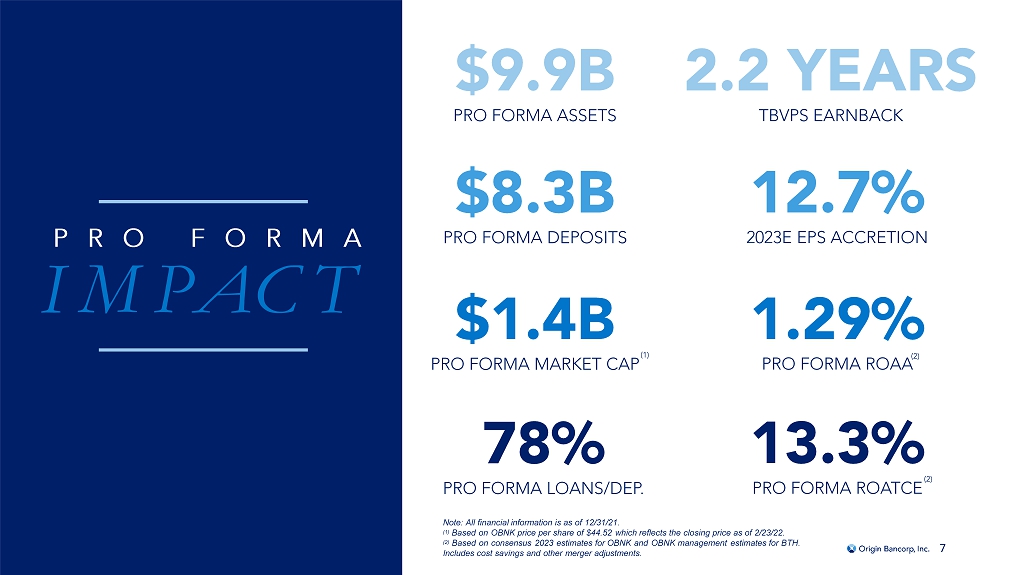

$9.9B PRO FORMA ASSETS $8.3B PRO FORMA DEPOSITS 2.2 YEARS TBVPS EARNBACK 12.7% 2023E EPS ACCRETION $1.4B PRO FORMA MARKET CAP 1.29% PRO FORMA ROAA 78% PRO FORMA LOANS/DEP. 13.3% PRO FORMA ROATCE PRO FORMA IMPACT Note: All financial information is as of 12/31/21. (1) Based on OBNK price per share of $44.52 , which reflects the closing price as of 2/ 23 /22 . (2) Based on consensus 2023 estimates for OBNK and OBNK management estimates for BTH. Includes cost savings and othe r merger adjustments. ( 1 ) ( 2 ) ( 2 ) 7

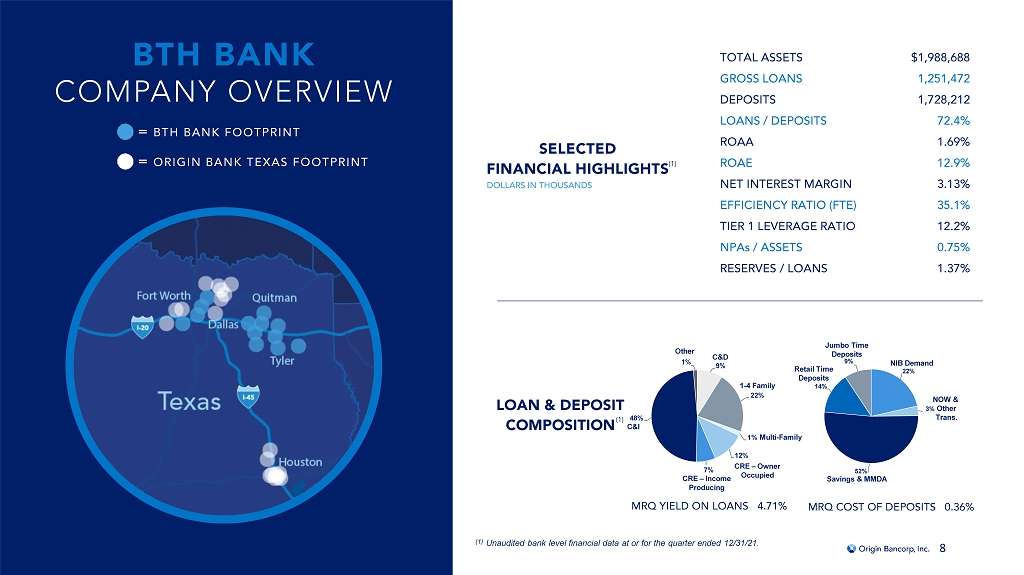

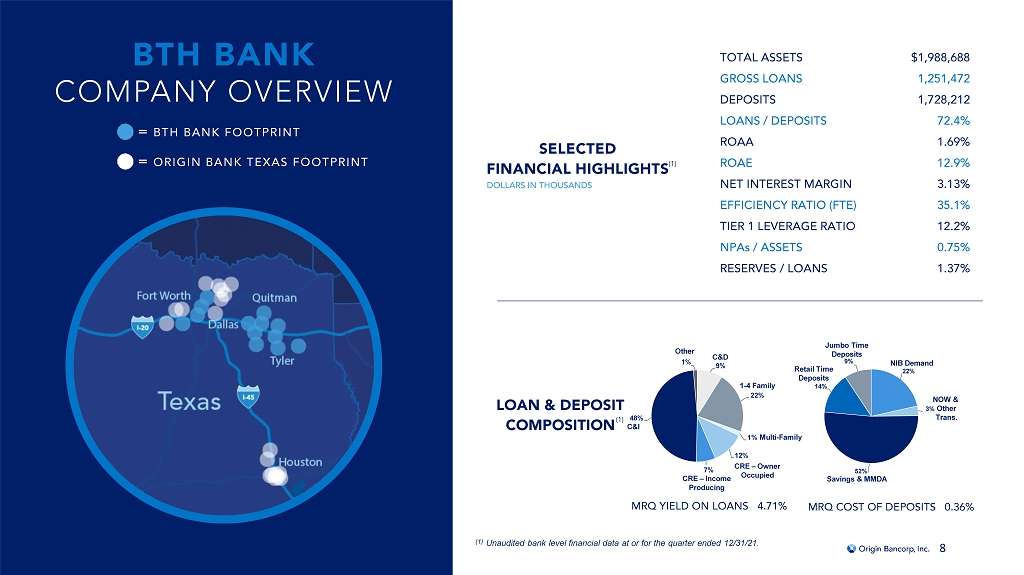

1%22% 3% BTH BANK COMPANY OVERVIEW = BTH BANK FOOTPRINT 9 % 7 % 4 8% C&I NIB Demand 22% 12% CRE – Owner Occupied 1% Multi - Family CRE 1-4 Family 48% – Income Producing 1% 0.7% Consumer & Other C&D NIB Demand 22% 52% Savings & MMDA N O W & 3% Other Trans. Ju m b o Ti m e Deposits 9% Retail Time Deposits 14% TOTAL ASSETS GROSS LOANS DEPOSITS LOANS / DEPOSITS ROAA ROAE NET INTEREST MARGIN EFFICIENCY RATIO (FTE) TIER 1 LEVERAGE RATIO NPAs / ASSETS RESERVES / LOANS $1,988,688 1,251,472 1,728,212 72.4% 1.69% 12.9% 3.13% 35.1% 12.2% 0.75% 1.37% SELECTED FINANCIAL HIGHLIGHTS LOAN & DEPOSIT COMPOSITION (1) Unaudited b ank level financial data at or for the quarter ended 12/31/21. = ORIGIN BANK TEXAS FOOTPRINT 8 MRQ YIELD ON LOANS 4.71% MRQ COST OF DEPOSITS 0.36% DOLLARS IN THOUSANDS (1) (1)

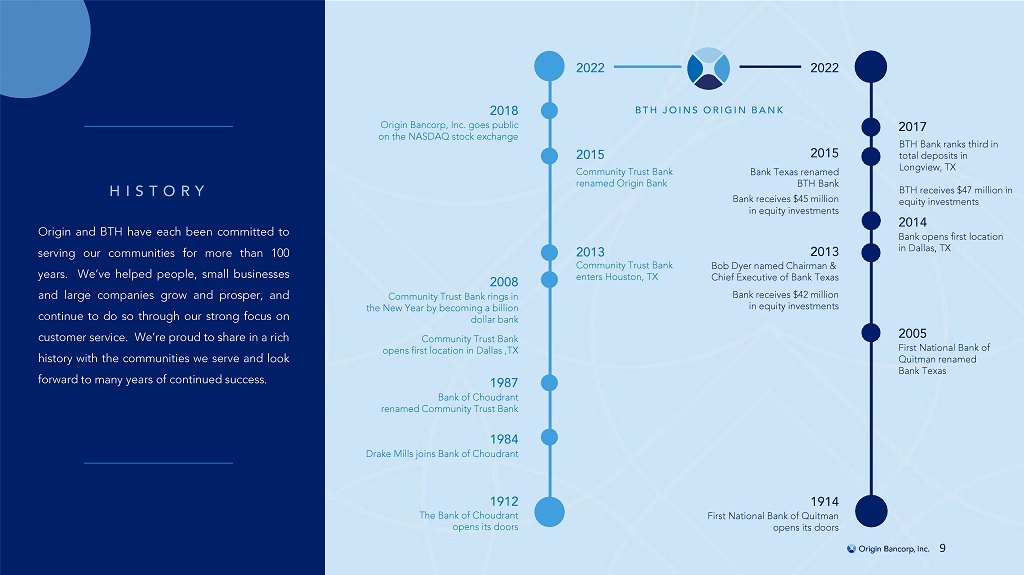

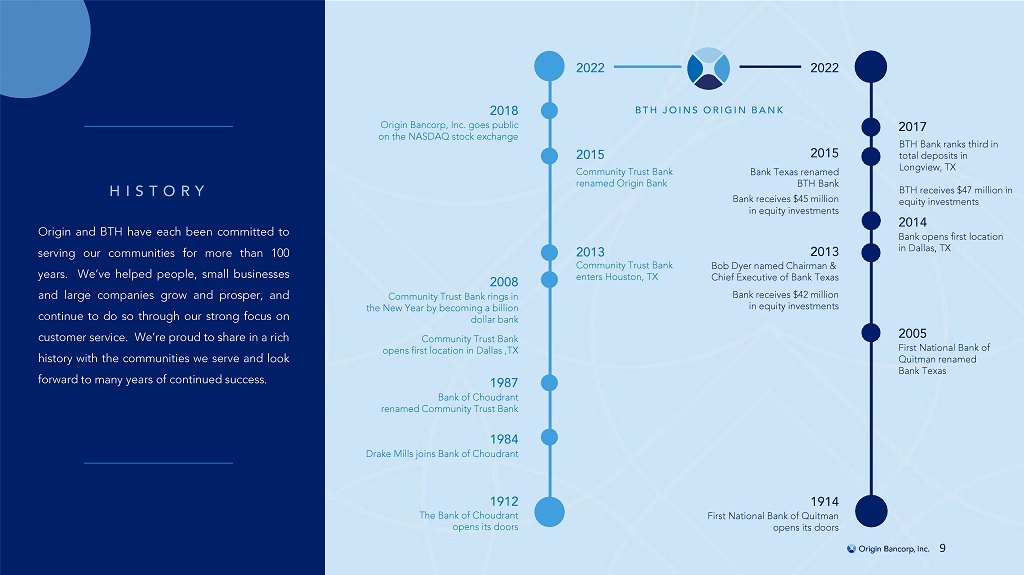

1912 2018 2015 2013 2008 1987 1914 2017 2015 2013 2005 2022 2022 Origin and BTH have each been committed to serving our communities for more than 100 years . We’ve helped people, small businesses and large companies grow and prosper, and continue to do so through our strong focus on customer service . We’re proud to share in a rich history with the communities we serve and look forward to many years of continued success . The Bank of Choudrant opens its doors Bank of Choudrant renamed Community Trust Bank Community Trust Bank rings in the New Year by becoming a billion dollar bank Community Trust Bank o pens first location in Dallas ,TX Community Trust Bank e nters Houston, TX Community Trust Bank renamed Origin Bank Origin Bancorp, Inc. goes public o n the NASDAQ stock exchange BTH JOINS ORIGIN BANK First National Bank of Quitman o pens its doors First National Bank of Quitman renamed Bank Texas Bob Dyer named Chairman & Chief Executive of Bank Texas Bank Texas renamed BTH Bank Bank receives $42 million i n equity investments Bank receives $45 million i n equity investments BTH Bank ranks third in t otal deposits in Longview, TX BTH receives $47 million in equity investments HISTORY 1984 Drake Mills joins Bank of Choudrant 9 2014 Bank opens first location i n Dallas, TX

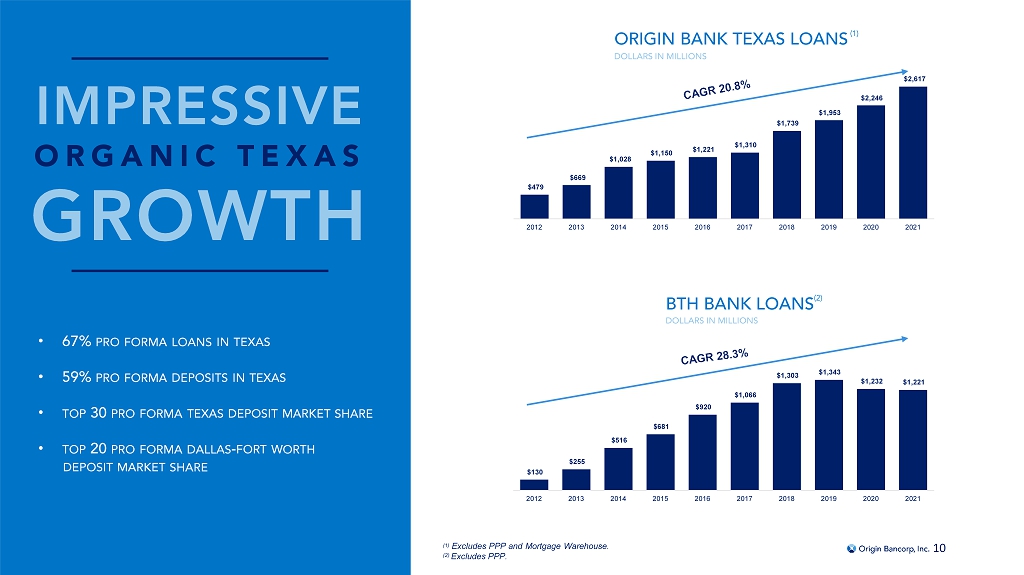

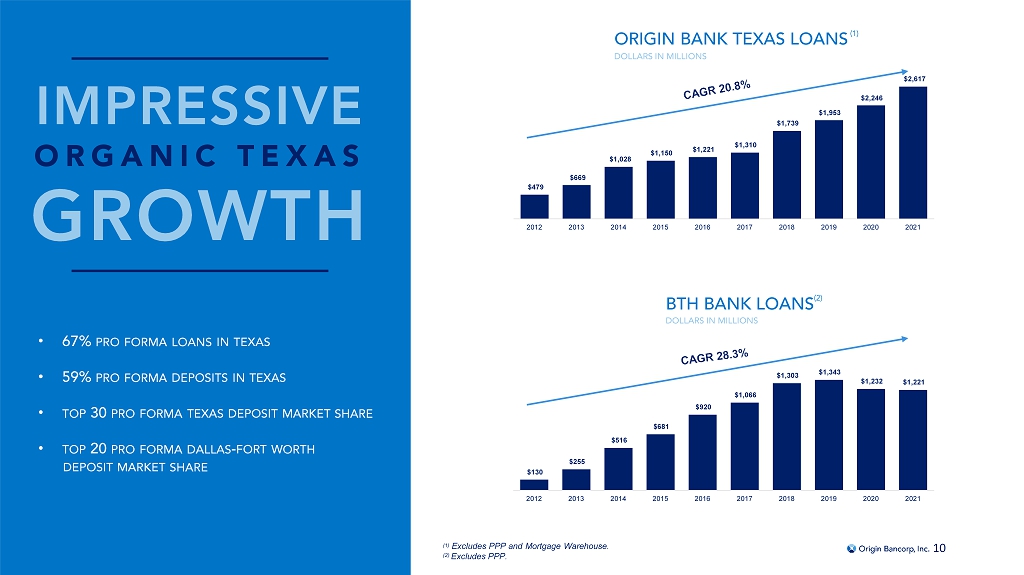

10 IMPRESSIVE ORGANIC TEXAS GROWTH $479 $669 $1,028 $1,150 $1,221 $1,310 $1,739 $1,953 $2,246 $2,617 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 $130 $255 $516 $681 $920 $1,066 $1,303 $1,343 $1,232 $1,221 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 BTH BANK LOANS ORIGIN BANK TEXAS LOANS (1) Excludes PPP and Mortgage Warehouse. (2) Excludes PPP. DOLLARS IN MILLIONS • 67 % P RO FORMA LOANS TEXAS • 59 % PRO F ORMA DEPOSITS IN TEXAS • TOP 30 PRO FORMA TEXAS DEPOSIT MARKET SHARE • T OP 20 PRO FORMA DALLAS - FORT W ORTH DEPOSIT MARKET SHARE ( 1 ) ( 2 ) DOLLARS IN MILLIONS

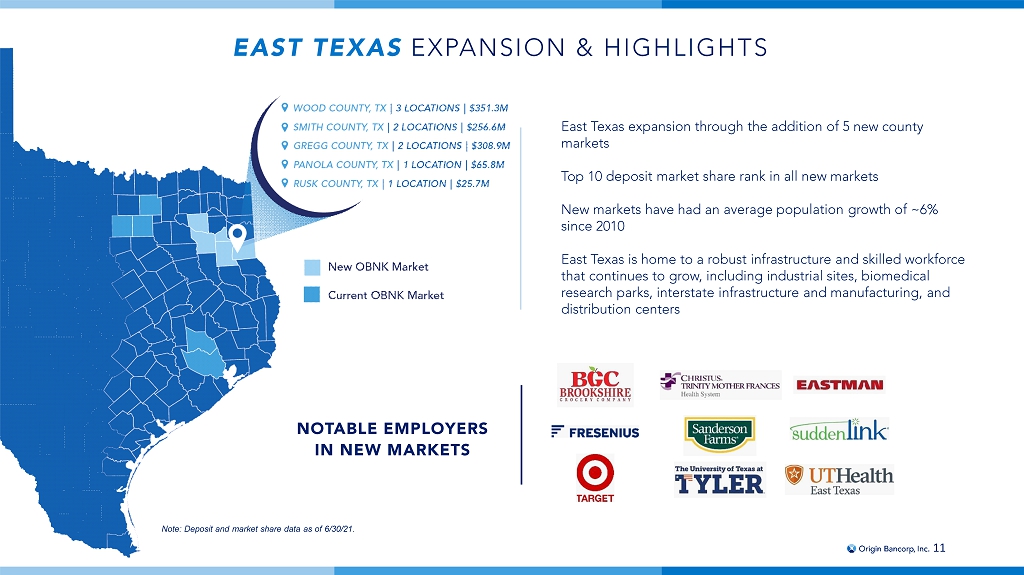

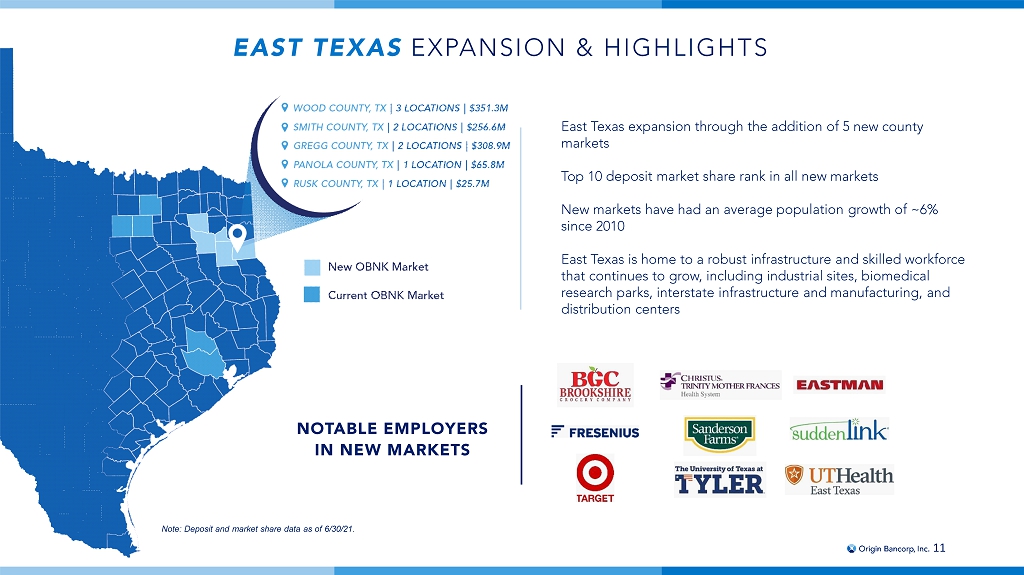

East Texas expansion through the addition of 5 new county markets Top 10 deposit market share rank in all new markets New markets have had an average population growth of ~ 6 % since 2010 East Texas is home to a robust infrastructure and skilled workforce that continues to grow, including industrial sites, biomedical research parks, interstate infrastructure and manufacturing, and distribution centers EAST TEXAS EXPANSION & HIGHLIGHTS NOTABLE EMPLOYERS IN NEW MARKETS Note: Deposit and market share data as of 6/30/21. 11

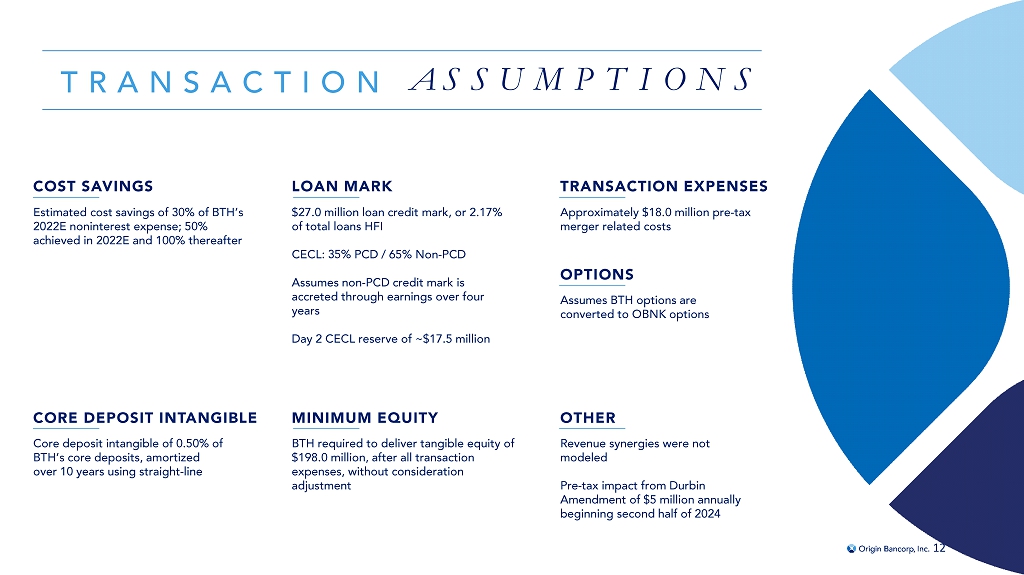

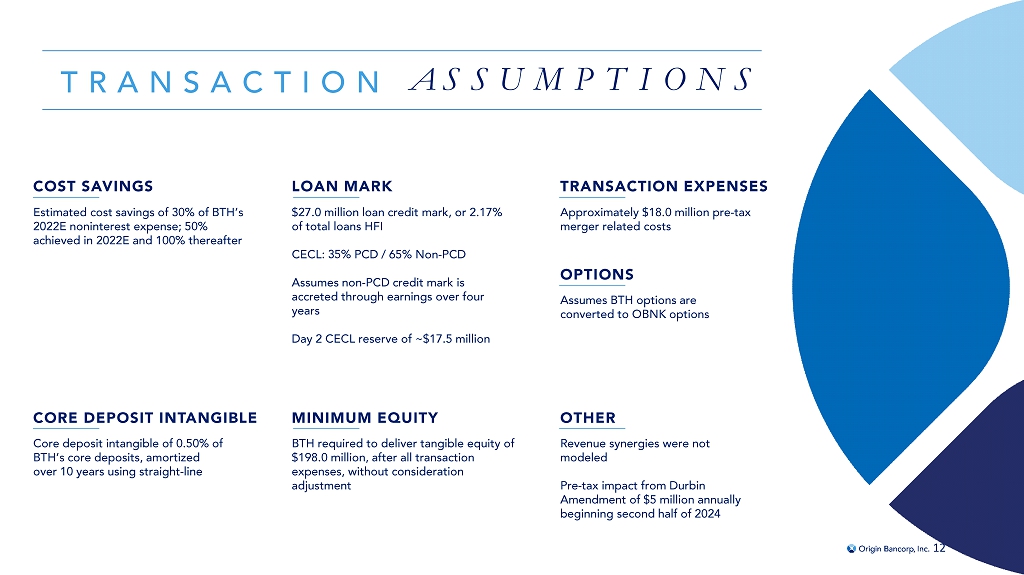

COST SAVINGS LOAN MARK CORE DEPOSIT INTANGIBLE MINIMUM EQUITY TRANSACTION EXPENSES OPTIONS TRANSACTION ASSUMPTIONS Estimated cost savings of 30 % of BTH’s 2022E noninterest expense; 50% achieved in 2022E and 100% thereafter Approximately $18.0 million pre - tax merger related costs $ 27.0 million loan credit mark, or 2.16% of total loans HFI CECL : 35% PCD / 65% Non - PCD Assumes non - PCD credit mark is accreted through earnings over four years Day 2 CECL reserve of ~$17.5 million Core deposit intangible of 0.50 % of BTH’s core deposits, amortized over 10 years using straight - line BTH required to deliver tangible equity of $198.0 million, after all transaction expenses, without consideration adjustment Assumes BTH options are converted to OBNK options OTHER Revenue synergies were not modeled Pre - tax impact from Durbin Amendment of $ 5 million annually b eginning second half of 2024 12

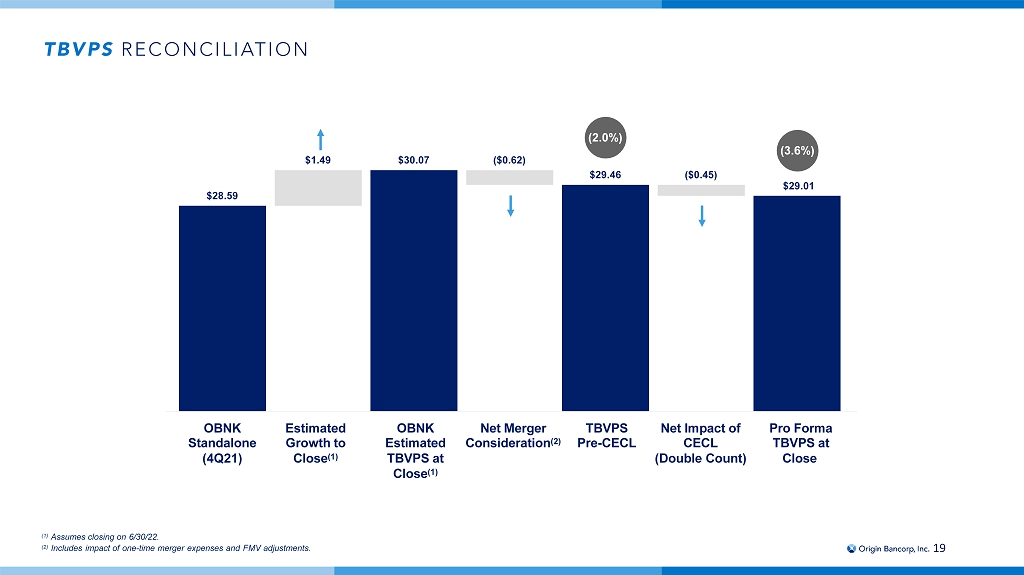

ATTRACTIVE PRO FORMA FINANCIAL METRICS Key Financial Implications KEY FINANCIAL IMPLICATIONS 12.7% DOUBLE DIGIT ‘23 EPS ACCRETION (3.6%) TBVPS DILUTION 2.2 YRS TBVPS EARNBACK >20% IRR 9.1% TCE/TA 14.8% TOTAL CAPITAL RATIO 9.5% LEVERAGE RATIO 11.2% CET1 RATIO PRO FORMA CAPITAL RATIOS (1) 13 (1) Estimated Pro Forma as of 6/30/22.

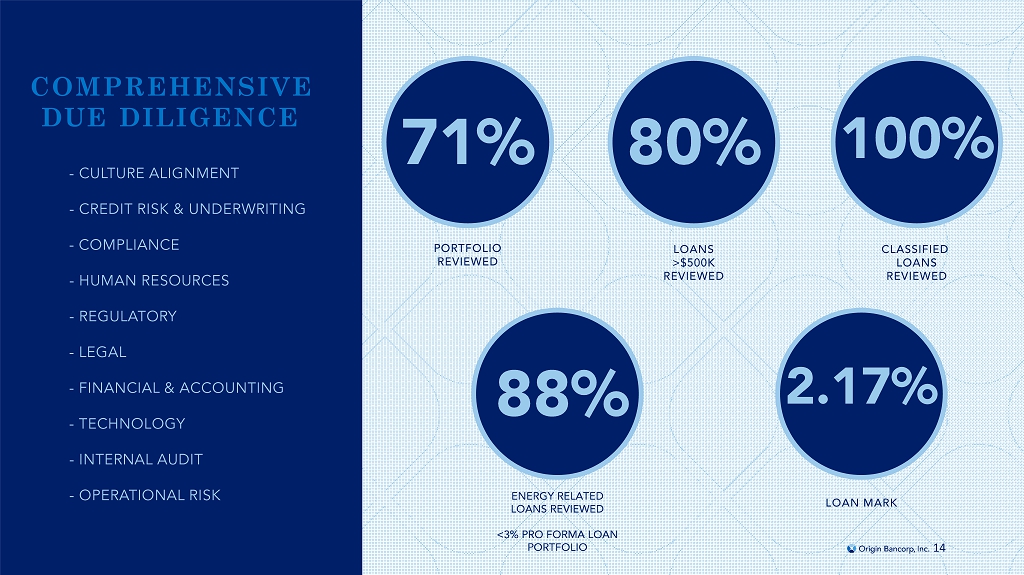

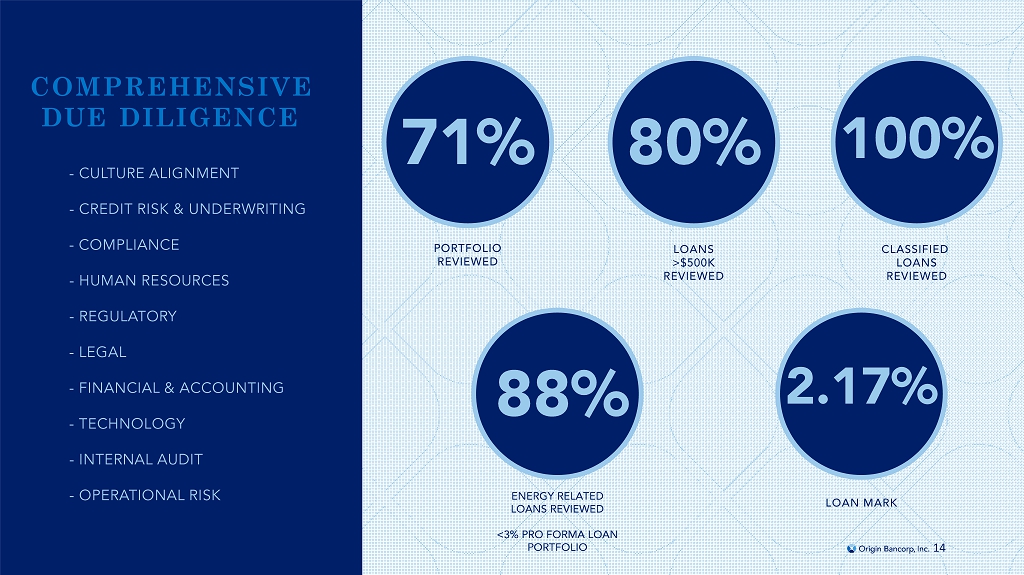

- CULTURE ALIGNMENT - CREDIT RISK & UNDERWRITING - COMPLIANCE - HUMAN RESOURCES - REGULATORY - LEGAL - FINANCIAL & ACCOUNTING - TECHNOLOGY - INTERNAL AUDIT - OPERATIONAL RISK COMPREHENSIVE DUE DILIGENCE 71% 80% 100% 88% 2.16% PORTFOLIO REVIEWED LOANS >$500K REVIEWED CLASSIFIED LOANS REVIEWED ENERGY RELATED LOANS REVIEWED < 3% PRO FORMA LOAN PORTFOLIO LOAN MARK 14

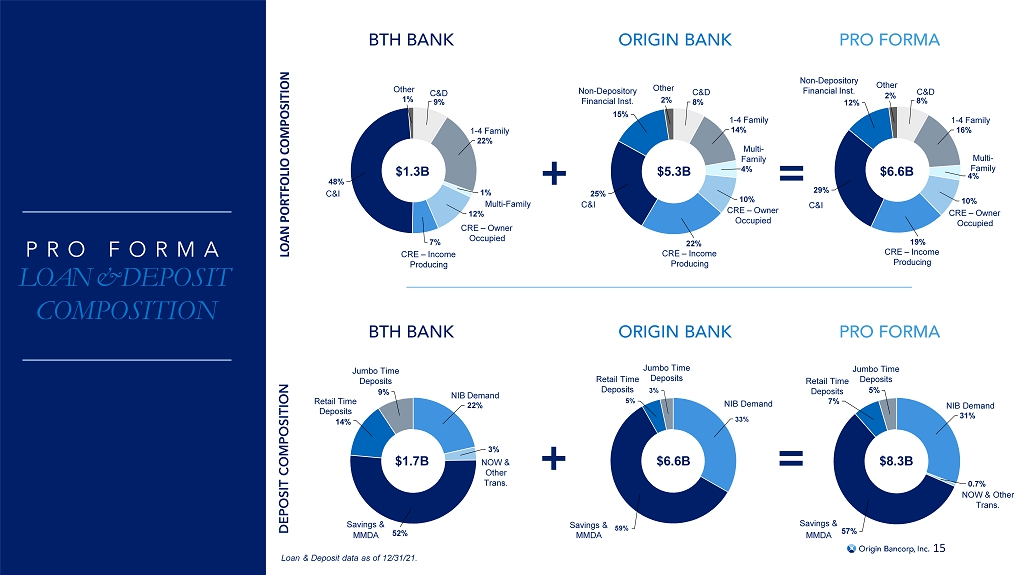

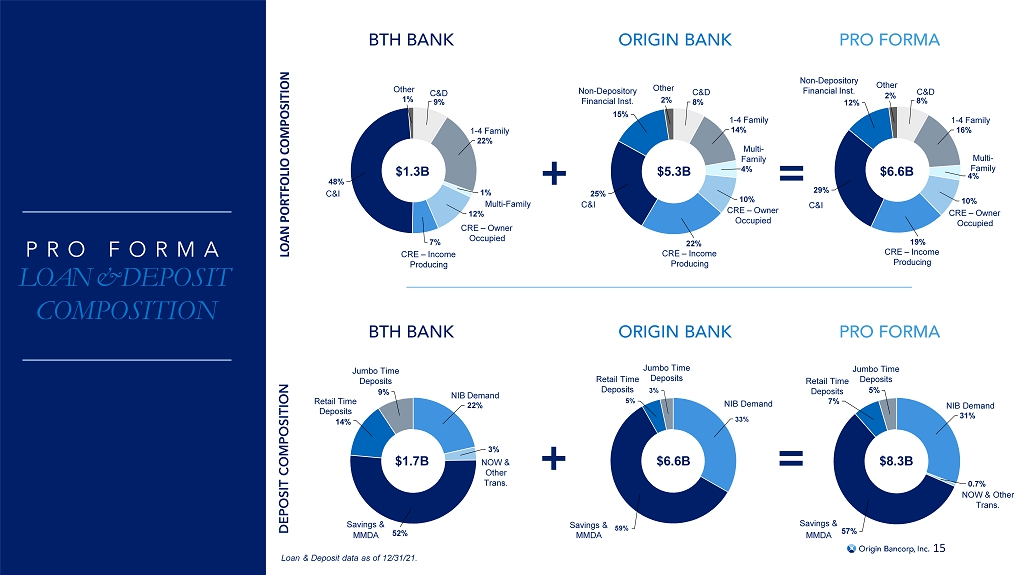

J u m b o Ti m e Deposits 9% Retail Time Deposits 14% 22% CRE – Income Producing 2 5 % C&I Non - Depo s it or y Financial Inst. 15% 1 - 4 Family 14% Farm 2 % 10% CRE – Owner Occupied C &D 8% Multi - Fa m ily 4 % Con s u m e r & Other 0.4% 5 2 % 6 1 % J u m b o Ti m e Deposits 3% $ 1. 7B NIB Demand 22% S a v i ng s & MMDA 3% N OW & Other T ran s . $ 6 . 6B N I B De m an d 31% Re t a il Ti m e Deposits 5% S a v i ng s & MMDA 1 - 4 Family 22% 1% M u l t i - F a m ily 12% CRE – Owner Occupied 7% CRE – Income Producing C &D 9% 4 8% C&I Farm 0 . 7 % $ 5 . 3B Con s u m e r & Ot he r 0.7% $ 1. 3B $ 6 . 6B BTH BANK ORIGIN BANK PRO FORMA BTH BANK ORIGIN BANK PRO FORMA LOAN PORTFOLIO COMPOSITION DEPOSIT COMPOSITION PRO FORMA LOAN & DEPOSIT COMPOSITION Loan & Deposit data as of 12/31/21. 15 $8.3B Savings & MMDA NIB Demand Jumbo Time Deposits Retail Time Deposits NOW & Other Trans. C&I CRE – Income Producing CRE – Owner Occupied Other 1 - 4 Family C&D Multi - Family Non - Depository Financial Inst.

ORIGIN’S UNIQUE & DEFINED CULTURE COMMITMENT TO CUSTOMER JOURNEYS • INVESTMENT IN DIGITAL STRATEGY • RECOGNITION WITHIN MARKETS FOR CUSTOMER SERVICE EXCELLENCE • ALIGNMENT ON THE EXPERIENCE AS THE PRODUCT UNWAVERING COMMITMENT TO CULTURE • LEADERSHIP ACADEMY • EMERGING LEADERS COUNCIL • DREAM MANAGER • GLINT SURVEYS PROJECT ENRICH VOLUNTEER PROGRAM • BANK ON THEIR FUTURE • PORTION OF PPP FEES DONATED TO OUR COMMUNITIES ATTRACTIVE GEOGRAPHIC FOOTPRINT IN STABLE AND GROWING MARKETS • LONG - TERM TRACK RECORD OF ORGANIC GROWTH • EXPERIENCED AND PROVEN LEADERSHIP CUSTOMER EXPERIENCE EMPOWERED EMPLOYEES COMMITTED TO OUR COMMUNITIES DRIVE SHAREHOLDER VALUE RANKED 3 rd BEST BANK TO WORK FOR IN THE NATION 2021 BEST BANKS TO WORK FOR 9 C ONSECUTIVE YEARS 2021 BEST PLACES TO WORK BEST BANK FOR 15 CONSECUTIVE YEARS American Banker & Best Companies Group American Banker & Best Companies Group Dallas Business Journal Monroe News - Star Best of the Delta Award 16

APPENDIX 17

EARNINGS PER SHARE RECONCILIATION DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED FY 2023E PRO FORMA EARNINGS BUILDUP 18 $89,923 $131,256 $29,857 $11,476 OBNK Standalone Net Income BTH Standalone Net Income After - Tax Transaction Adjustments Pro Forma Net Income OBNK Standalone Net Income $89,923 BTH Standalone Net Income 29,857 After - Tax Transaction Adjustments Cost Savings $6,239 Accretable Yield Income 4,858 Recovery of Loan Loss Provision 990 Interest Cost of Cash (43) Amortization of Transaction CDI (516) Pro Forma Net Income $131,309 Pro Forma Diluted Shares 30,901 OBNK Pro Forma EPS $4.25 Accretion ($) $0.48 Accretion (%) 12.7% $3.77 EPS $4.25 EPS

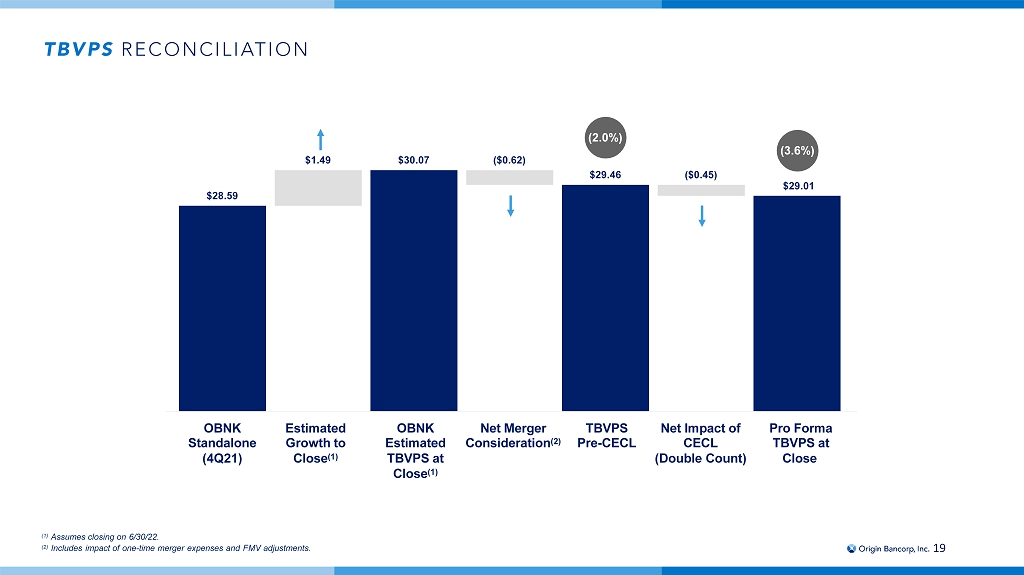

TBVPS RECONCILIATION (1) Assumes closing on 6/30/22 , 2022. (2) Includes impact of one - time merger expenses and FMV adjustments. 19 $28.59 $28.01 $1.49 $30.07 ( $0.62 ) $29.46 ( $0.45 ) OBNK Standalone (4Q21) Estimated Growth to Close (1) OBNK Estimated TBVPS at Close (1) Net Merger Consideration (2) TBVPS Pre - CECL Net Impact of CECL (Double Count) Pro Forma TBVPS at Close (2.2%) (3.7%)

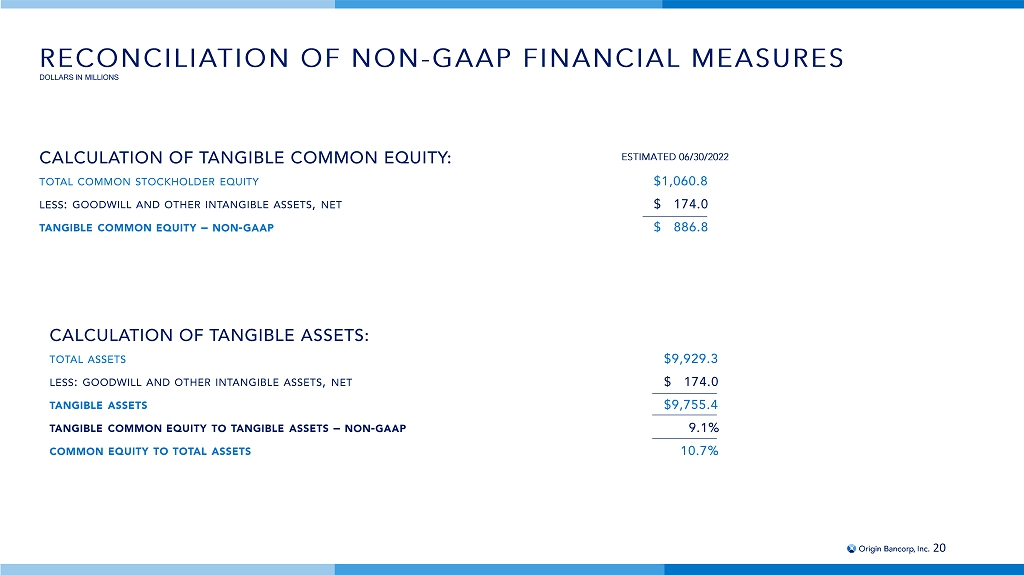

20 RECONCILIATION OF NON - GAAP FINANCIAL MEASURES DOLLARS IN MILLIONS CALCULATION OF TANGIBLE COMMON EQUITY: T OTAL COMMON STOCKHOLDER EQUITY $1,062.8 L ESS : GOODWILL AND OTHER INTANGIBLE ASSETS , NET $ 177.4 T ANGIBLE COMMON EQUITY – NON - GAAP $ 885.4 CALCULATION OF TANGIBLE ASSETS: TOTAL ASSETS $9,931.3 L ESS : GOODWILL AND OTHER INTANGIBLE ASSETS , NET $ 177.4 T ANGIBLE ASSETS $9,753.9 TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS – NON - GAAP 9.1% COMMON EQUITY TO TOTAL ASSETS 10.7% ESTIMATED 06/30/2022

21 RECONCILIATION OF NON - GAAP FINANCIAL MEASURES DOLLARS IN MILLIONS CALCULATION OF RETURN ON AVERAGE TANGIBLE COMMON EQUITY: N ET INCOME AVAILABLE TO COMMON $ 131.3 A MORT . OF INTANGIBLE / ADJ . TO GOODWILL $ 1.2 S TATUTORY TAX RATE 21.0% A DJ . NET INCOME AVAIL . T O COMMON $ 132.2 AVERAGE COMMON EQUITY $1,170.6 A VERAGE INTANGIBLE ASSETS (176.1) A VERAGE TANGIBLE COMMON EQUITY $ 994.5 R OATCE 13.3% 2023E

22 RECONCILIATION OF NON - GAAP FINANCIAL MEASURES DOLLARS IN MILLIONS, EXCEPT PER SHARE CALCULATION OF TANGIBLE COMMON EQUITY: T OTAL COMMON STOCKHOLDERS ’ EQUITY $ 730.2 $765.2 $1,062.8 L ESS : GOODWILL AND OTHER INTANGIBLE ASSETS , NET 51.3 51.0 177.4 T ANGIBLE COMMON EQUITY – NON - GAAP $ 678.9 $714.2 $ 885.4 C OMMON SHARES OUTSTANDING AT END OF PERIOD 23.7 23.7 30.6 T ANGIBLE BOOK VALUE PER COMMON SHARE – NON - GAAP $ 28.59 $30.07 $ 28.96 OBNK STANDALONE 12/31/2022 OBNK ESTIMATED TBVPS 06/30/2022 PRO FORMA TBVPS 06/30/2022