Exhibit 99.1

October 3, 2011

Thomas J. Howatt

President and CEO

Wausau Paper Corp.

100 Paper Place

Mosinee, WI 54455

CC: Board of Directors

Dear Tom,

We enjoyed meeting with you and the rest of the management team during the investor tour of your Harrodsburg, Kentucky tissue facility on August 31st. Starboard Value LP, together with its affiliates, currently owns 7.5% of the outstanding common stock of Wausau Paper Corp. (“Wausau” or the “Company”), making us the Company’s largest shareholder. On July 28, 2011, we delivered a detailed letter (the “July 28 Letter”) to you and the Board of Directors (the “Board”) outlining our thoughts and perspectives on Wausau. A copy of the July 28 Letter is attached hereto for your reference. The purpose of this letter is to provide you and the Board with our updated thoughts and to begin what we hope will be a constructive and productive dialogue regarding corporate strategy and Board composition.

Based on our extensive and ongoing due diligence, we continue to be excited about the prospects for Wausau’s Tissue business. We firmly believe that the Tissue business will continue to produce sustainable growth and solid profitability. In fact, at this time, we believe that the Tissue business alone is likely worth more than the enterprise value of the entire Company. We are also encouraged by your confidence that the $220 million Tissue expansion project should position Wausau to both reduce production costs and enter the high-end premium away-from-home towel and tissue market as the low-cost producer and leader in the green space. However, as outlined in the July 28 Letter, there is uncertainty around the cost and timing of this project and, as currently conceived, it requires the Company to take on significant additional debt, which in turn would dramatically increase the risk profile for shareholders.

To that end, we believe the Company must explore alternative means to finance this project, including the monetization of non-core assets such as the underperforming Paper business, the Company-owned timberlands and the hydroelectric assets. We believe the value of these three non-core assets are not currently reflected in Wausau’s stock price. By divesting these assets, Wausau could unlock significant unrealized value for shareholders and at the same time finance the Tissue expansion project without taking on additional debt. We believe this would result in Wausau becoming a pure-play, well performing and conservatively capitalized Tissue business. We believe the market would put a premium valuation on Wausau if it acts on these opportunities.

We remain concerned with the continued underperformance of the Paper business. We believe this is the primary factor that has weighed on Wausau’s stock and caused it to underperform its peers and the broader equity indices over almost any extended time frame. We have serious doubts that the recently announced headcount reductions in your Brokaw facility will be enough to turn this segment around. This is at least the sixth restructuring action taken in this business since 20051, yet performance continues to suffer and sustainable profitability has proven elusive. Instead of continuing with reactionary measures to stem losses in the Paper business, we believe the Board must be proactive and hire a financial advisor to immediately explore a sale of this business to one of several larger and better capitalized strategic acquirers. Such potential acquirers would be well positioned to realize substantial synergies by merging the Paper business with their own operations. Again, this would solve three problems at once by: (i) removing the drain of the losses in the Paper business, (ii) more conservatively financing the Tissue expansion project and (iii) unlocking value for shareholders.

We recognize that the actions we are proposing are a departure from the Board’s current strategy and as such believe that changes to the composition of the Board are required to best implement a change of strategy at Wausau for the benefit of all shareholders. In these challenging economic times, we believe the Board must demonstrate the flexibility to explore alternative approaches to value creation and new, highly qualified directors are greatly needed to bring a fresh perspective into the boardroom. It is our hope and expectation to work constructively with you to change and improve the composition of the Board to ensure that the best interests of all shareholders are properly represented. As such, we urge you and the Board to engage with us as soon as possible regarding Board composition, director qualifications and required skill sets so that we may propose director candidates who can be most helpful to the Board in evaluating and executing on the opportunities we have proposed.

As we outlined in the July 28 Letter and above, we are confident that Wausau is deeply undervalued and that opportunities exist to significantly improve value for shareholders based on actions within the control of management and the Board. As the largest shareholder of the Company, our interests are directly aligned with those of all shareholders and we will work to ensure that our collective interests are represented on the Board.

We look forward to the opportunity to continue our dialogue with you and remain optimistic about the future of Wausau.

Best Regards,

/s/ Jeffrey C. Smith

Jeffrey C. Smith

Managing Member

Starboard Value LP

1Includes the 2005-2006 restructuring of the Brokaw facility (approximately $39 million in total charges), the 2007-2010 closure of the Groveton mill and related charges ($74 million in total charges), the 2007 exit of the Specialty Roll Wrap business ($1 million gain on sale) and the 2008-2009 closures of the Jay and Appleton Facilities ($37 million in combined total charges).

July 28, 2011

Thomas J. Howatt

President and CEO

Wausau Paper Corp.

100 Paper Place

Mosinee, WI 54455

CC: Board of Directors

Dear Thomas,

Starboard Value LP, together with its affiliates, currently owns 6.3% of the outstanding common stock of Wausau Paper Corp. (“Wausau” or “the Company”), making us one of the Company’s largest stockholders. Although we have not yet had an opportunity to meet with you, we have met with Hank Newell, Scott Doescher and Perry Grueber at your offices and have toured the Brokaw and Mosinee facilities. These meetings have been helpful in gaining a better understanding of Wausau, the challenges it faces and the future opportunities it hopes to capture. We look forward to continuing our dialogue with you, the senior management team, and the Board of Directors.

As we discussed with your team on June 20th, we believe that Wausau is deeply undervalued and that there are tremendous opportunities to significantly improve shareholder value through actions within the control of management and the Board of Directors. Our thesis is driven by the continued success and positive trajectory of the Tissue business, which, in our view, is being offset by dismal performance in the Company’s Paper business. In fact, we believe that the primary reason for the Company’s depressed valuation stems from the continued lack of profitability and low returns on capital of the Paper business. We are also concerned about capital allocation decisions around the expansion project currently slated for the Tissue business, which will require an additional $220 million of capital, or $4.50 per share. We have outlined our views regarding these issues for the benefit of the Board and look forward to actively engaging with you to discuss these and other matters.

Tissue Business

Wausau’s Tissue business, which manufactures and converts towel and tissue products for the industrial and commercial “away-from-home” market, is a growing, highly profitable and stable cash flow business with strong brand recognition. As shown in the table below, over the past five years the Tissue business has generated a compounded annual revenue growth rate of 4.5% while producing average EBITDA margins of 21.6%. This strong performance has been achieved through an extremely challenging period in the US economy, demonstrating the underlying strength of this business. Further, the Tissue business has produced cumulative cash flow of almost $300 million over that time period.

Based on our research, we believe that Wausau has carved out a highly defensible niche market in the Tissue business by focusing on “Green” products while targeting smaller markets with local and regional distributors. We believe that this market focus, coupled with improving employment and population growth, should enable Wausau’s Tissue business to continue to generate consistent revenue growth and EBITDA margins.

Given these favorable characteristics, we believe that Wausau’s Tissue business is highly valuable. Based on our analysis of publicly traded comparable companies and precedent transactions, we believe that Wausau’s Tissue business is worth at least 7.0x – 8.0x EBITDA, or possibly more.1 This would imply a valuation range for the Tissue business of between $490 million and $600 million.

As shown in the table above, this valuation implies that the Tissue business by itself could be worth more than Wausau’s total current enterprise value.

1Publicly traded comparable companies include CLW, TIS and KMB. The most comparable recent transaction was CLW’s purchase of Cellu Tissue in September 2010 for more than 8x EBITDA.

Paper Business and Other Assets

We believe that unlike Wausau’s Tissue business, the Company’s Paper business is struggling due to increasing commoditization and significant competition from larger and more established players. Wausau’s Paper business consists of two separate businesses, Specialty Products and Printing & Writing. While Wausau has been able to penetrate certain profitable niche markets within the Paper business, such as bright colored papers and various specialty papers, the Paper business results have continued to be dominated by the overall decline in volume of the uncoated free sheet market and rising input costs. Unfortunately, as electronic media and storage further reduce paper consumption, we only expect the decline in the uncoated free sheet market to continue.

As shown in the table below, Wausau’s Paper business has been a significant drain on profitability and management resources. Since Wausau began its restructuring initiatives in 2005 to improve profitability in the Paper business, the Company has invested over $100 million of capex in machine upgrades and improvements and has taken $150 million in restructuring charges. However, despite the Company’s numerous attempts to restructure the business and the massive amount of capital spent, the Paper business continues to struggle and is currently operating well below its cost of capital.

We believe the primary reason for the significant underperformance of the Paper segment stems from the continued losses in the Company’s Printing & Writing business, which until 2010 was broken out as a separate segment. Since 2005, the Printing & Writing business has on average lost approximately $15 million in pre-tax cash flow per year. Given the fact that input costs have increased materially since 2009, we believe that losses in the Printing & Writing business have only increased.

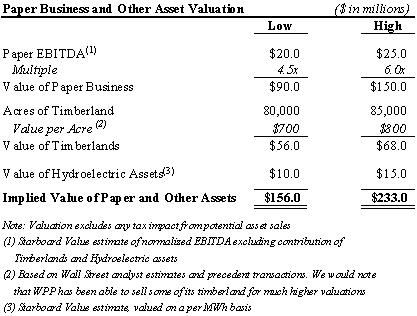

Despite the continued underperformance of Wausau’s Paper business, we believe the business has considerable value. From a valuation perspective, historical transactions for poorly performing paper businesses or mills occur in the 4.0x – 5.5x normalized EBITDA range.2 Given that a considerable amount of Wausau’s revenue in this business comes from niche products with valuable brand recognition, we would expect Wausau’s Paper business to garner higher multiples.

Additionally, the Company also owns Timberland and Hydroelectric assets, which we believe are non-core to Wausau and not factored into the current market valuation of the Company.

We believe that the value of the Paper business and other assets of Wausau, as shown in the table above, are not currently factored into the market valuation of the Company, primarily due to the underperformance of the Paper business and the non-core nature of the Timberlands and Hydroelectric assets. This is demonstrated by the illustrative sum-of-the-parts valuation below.

Tissue Expansion Project

Although we strongly believe that the Tissue business has a bright future, we have significant concerns regarding the capital allocation decision to spend $220 million of shareholder capital to dramatically expand the Tissue business. These concerns are only heightened by the Company’s significant capital allocations for the Paper business, which to date have failed to produce increased profitability and higher returns. While we believe that focusing on the Tissue business is prudent given the superior returns in that business compared to the Paper business, we question the size, timing, and potential return from this aggressive and capital-intensive project.

The proposed $220 million tissue expansion project is the largest capital program in the Company’s history, equivalent to $4.50 per share in capital expenditures, or 61% of the market cap of the entire Company. In order for Wausau’s debt level to stay under its total borrowing capacity of $300 million, the Company must generate free cash flow of at least $60 million by the completion of the project in early 2013.

While it is certainly feasible for the Company to generate the $60 million in free cash flow that is needed based on today’s estimates, the current plan is not without serious execution risks. These risks include further deterioration in the performance of the Paper business, pulp price increases or delays and cost overruns in the tissue expansion project – just to name a few. Any one of these factors could result in Wausau breaching its current $300 million debt cap, adding substantial risk for shareholders.

Based on our current understanding of the expansion project, we are not sure whether the return potential justifies the increased risk. The Company has publicly disclosed a targeted Internal Rate of Return (“IRR”) for the tissue expansion project of only 12%-14%. Based on our conversations with the management team, the Company estimates that it can save approximately $20 million per year by in-sourcing the manufacturing of approximately 75,000 tons of capacity that Wausau currently outsources. However, this cost savings will only get the Company to about half of the stated IRR target. In order to attain the full goal of 12%-14%, the Company will have to expand sales beyond its current customer base into the high end premium market, where the Company does not currently play. Given substantial uncertainty around Wausau’s ability to penetrate this new market, we are not sure whether this high risk investment is justified.

We firmly believe Wausau is undervalued with significant opportunity to improve the value. The purpose of this letter is to outline our concerns regarding the current performance and strategic direction of the Company. Wausau’s stock price has underperformed over almost any time period and we believe it is time for the Board to take action to address the significant concerns highlighted in this letter. We look forward to the opportunity to work with you and the Board of Directors to enhance value while ensuring that Wausau is run with the best interests of all shareholders as the primary objective.

Best Regards,

/s/ Jeffrey C. Smith

Jeffrey C. Smith

Managing Member

Starboard Value LP