Exhibit 99.1

December 21, 2011

Tim Armstrong

Chairman and CEO

AOL Inc.

770 Broadway

New York, NY 10003

CC: Board of Directors

Richard L. Dalzell

Richard L. Dalzell

Karen E. Dykstra

Alberto Ibargüen

Susan M. Lyne

Patricia E. Mitchell

Frederic G. Reynolds

James R. Stengel

Dear Tim,

Starboard Value LP, together with its affiliates (“Starboard”), currently owns approximately 4.5% of the outstanding shares of AOL Inc. (“AOL” or “the Company”), making us one of the Company’s largest shareholders. Over the past several months, we have conducted extensive due diligence on AOL and each of its business units and have concluded that substantial and actionable opportunities exist to dramatically enhance shareholder value at AOL. In this letter, we outline our concerns and hope to have the opportunity to engage with you and the Board of Directors (the “Board”) to discuss our vision for AOL and what should be changed so that the Company can capitalize on its inherent strengths and deliver significant value to its shareholders.

By way of background, Starboard is an investment management firm that seeks to invest in undervalued and underperforming public companies. Our approach to such investments is to actively engage and work closely with management teams and boards of directors in a constructive manner to identify and execute on opportunities to unlock value for the benefit of all shareholders. Our principals and investment team have extensive experience and a successful track record of enhancing value at portfolio companies through a combination of strategic refocusing, improved operational execution, more efficient capital allocation, and stronger management focus.

Executive Summary

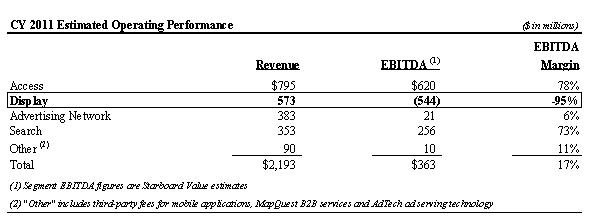

Based on our detailed research and analysis conducted to date, we firmly believe that AOL is deeply undervalued. At the current price, we believe that AOL’s market value reflects only the value of the Company’s highly profitable Access business and its net cash position. This implies that investors are ascribing no value to AOL’s media assets, including its Advertising Network, Search business, and extensive portfolio of Display properties. We believe that this valuation discrepancy is primarily due to the Company’s massive operating losses in its Display business, as well as continued concern over further acquisitions and investments into money-losing growth initiatives like Patch. In fact, as indicated in the table below, it appears that AOL may be currently losing in excess of $500 million per year in its Display business alone, masking what otherwise would be a highly profitable company.

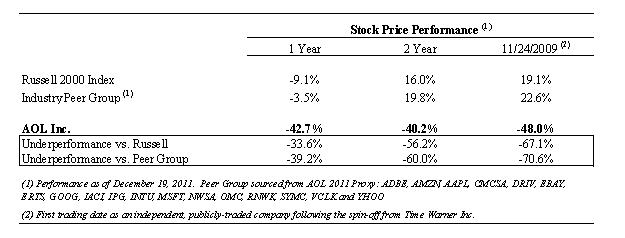

Further, AOL’s dismal absolute and relative stock price performance clearly demonstrates shareholders’ strong frustration with the current performance and future direction of the Company. For example, the stock price declined 32% in the two days following the announcement of second quarter results due to significantly lowered 2011 EBITDA guidance, which was downwardly revised from $440 million to $340-$370 million due to higher than expected Display losses and continued investment in Patch. As shown in the table below, AOL shares have severely underperformed the Russell 2000 and Industry Peer Group over almost any time period and have lost almost half of their value since AOL’s spin-off from Time Warner in late 2009.

While we understand and appreciate that the Company's Access business is in secular decline, we do not believe this serves as justification for continuing to pursue a money-losing growth strategy in the Display business that has repeatedly failed to meet expectations and drained corporate resources. The Access, Search, and Advertising Network businesses continue to produce valuable cash flow which should not be wasted. AOL shareholders have already suffered substantial losses due to the pursuit of the failing Display strategy and immediate action must be taken to address this issue as the Company continues to invest good money after bad without an acceptable return on the investment.

We are confident that there are opportunities to significantly improve overall operating performance and stock price performance and would appreciate the opportunity to engage with you and the Board to discuss our views. We have outlined our preliminary thoughts below based on our analysis of publicly available information. Given that AOL does not currently report segment profitability, we have done our best to estimate the relative contributions of these businesses and their impact on the overall value of AOL.

Access Business

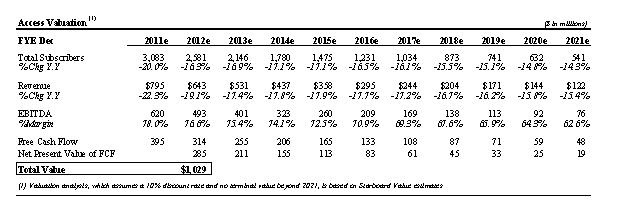

AOL’s legacy Access business, which provides subscription-based dial-up internet access and related services to more than three million subscribers, is a highly profitable business that generates substantial cash flow. Although the business is in secular decline, the cash flow stream that it generates has a long tail due to its declining subscriber churn rates, stable Average Revenue Per User (ARPU) and predominantly variable cost structure.

Based on our research, we believe that churn rates will continue to decline over time as longer tenured subscribers comprise an increasing percentage of the mix of total subscribers. Declining churn rates, coupled with stable ARPU driven by high-margin value-added products and services like anti-virus software, should continue to reduce the rate of revenue decline. Furthermore, since the primary costs of operating the Access business, such as network access, billing and call center services, are minimal and highly variable, we believe that AOL will be able to maintain extremely high EBITDA margins even as the revenue base declines. Based on our own internal analysis, as shown below, we estimate that the net present value of AOL’s Access business could be $1.0 billion, or possibly more.

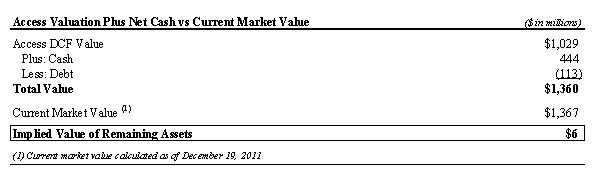

At the current price, we believe the value of the Company’s Access business, combined with its current net cash, is approximately equivalent to the market value of the entire Company. This implies that the market is ascribing essentially no value to AOL’s other assets.

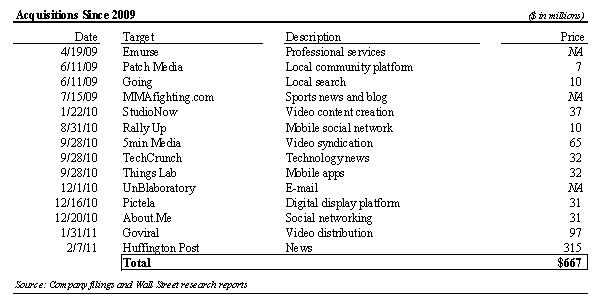

While AOL’s remaining media assets are losing money as a whole, they are worth substantially more than the $6 million implied by the value of the Company’s Access business and net cash position. In fact, since 1999, the Company has spent over $2.3 billion on acquisitions. Over the last two and a half years alone, the Company has spent $667 million on acquisitions. Further, the value of the acquisitions excludes the Company’s Advertising Network, valuable Search agreement with Google, and other media properties such as AOL.com, AOL Mail and AOL Instant Messenger (AIM).

Advertising Network

AOL’s third party advertising network, which operates under the name Advertising.com, is one of the largest advertising networks in the country. Advertising.com buys large volumes of unsold advertising inventory from online publishers at discounted prices and sells this inventory at premium prices to advertisers directly and through advertising agencies.

Despite the emergence of advertising exchanges and demand-side platforms, which have gained market share and reduced the margin profile and economics of the advertising network business, our research indicates that Advertising.com remains a valuable business. It continues to command a strong competitive position and generates attractive margins given its valuable relationships with thousands of third-party online publishers, advertisers and advertising agencies. Furthermore, the business has returned to growth after exiting underperforming European operations and de-emphasizing certain low margin products in 2010.

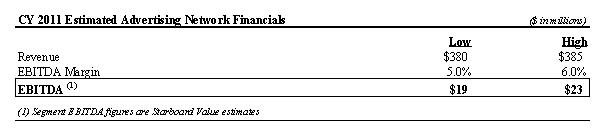

Based on our own internal analysis, we believe that Advertising.com generates EBITDA margins of between 5% and 6%. On estimated revenue of $380 million to $385 million in 2011, this equates to annual EBITDA of between $19 million and $23 million.

Historically, businesses in this segment of online advertising have traded at extremely high multiples of revenue, thereby suggesting that Advertising.com could have considerable value that is not currently reflected in AOL’s stock price.

Search

AOL’s Search business provides consumers with internet search capability through Google’s organic web search results and paid search advertising. AOL collects a fee for advertising revenue generated through users searching the web on AOL properties.

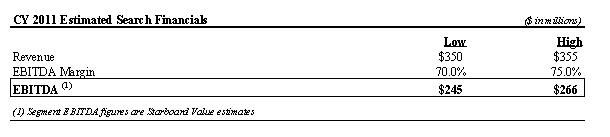

AOL negotiated a new 5-year search agreement with Google effective January 1, 2011. We believe that AOL receives approximately a 90% traffic acquisition cost (TAC) rate, or $0.90, for every dollar of advertising revenue that Google generates through users searching the web on AOL’s properties. Given minimal operating costs, including a modest level of sales staff and developers plus corporate overhead, we believe the Company’s Search business generates EBITDA margins in the 70% to 75% range.

A substantial portion of AOL’s searches occur from its AOL.com search bar, and we believe a majority of traffic to this site originates from AOL Access and email subscribers. As a result, the Search and Access businesses are highly correlated, and we would expect the Search business to decline at a similar rate to the decline in the Access business over the next several years. Based on revenue expectations of $350 million to $355 million in 2011, we believe that AOL’s Search business is generating EBITDA between $245 and $266 million.

Display

AOL’s Display businesses are comprised of its web content properties. The Display business publishes online content for consumers across several Company-owned sites, including AOL.com, Huffington Post, Engadget, TechCrunch, Moviefone, and MapQuest. The Company sells advertising on these sites to monetize its content.

Over the past several years, AOL has shifted its primary strategic focus toward growing its Display business in pursuit of its goal of becoming a premium online media company. Over this time period, the Company has spent approximately $667 million, or $6.85 per share, on acquisitions to develop this business.

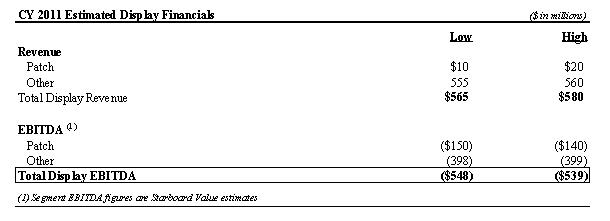

In addition to these acquisitions, prior to 2009, AOL spent approximately $1.7 billion acquiring assets such as MapQuest, Moviefone, and Engadget. However, despite this massive investment, we believe that AOL’s Display assets are generating staggering EBITDA losses of more than $500 million per year.

AOL acquired Patch, a news and information platform for small towns, from an investment firm that you founded. We believe that Patch may alone lose as much as $150 million in 2011 based on heavy fixed expenses of $160 million and immaterial estimated revenue contribution of $10 million to $20 million.

This level of losses in a business that already has reasonable scale is extremely troubling. We are not alone with regard to our serious questions and concerns relating to the Company’s investment in its Display business. Over the past several months, research analysts and media sources have repeatedly written about the serious problems facing AOL’s Display business. We have included below a brief sampling of just some of these reports and articles. It is clear that the losses from the Display business are having a material negative impact on the overall value of AOL.

“The part [of the Company] that is making money – the dial-up operation – is now distinct from the parts that aren’t making money – the “journalism.” It’s the “journalism” that is the problem.” – Seeking Alpha, December 14, 2011

“There is something fundamentally wrong with AOL’s media business, which is the business that the company is betting its future on…. AOL’s media business appears to be losing $500 million a year…. At this level of scale, AOL’s media business should be generating at least a 20% operating profit margin.” – Henry Blodget, BI Research, December 17, 2011

Although there is substantial skepticism about AOL’s Display business, we believe there is significant value embedded in the Company’s content properties. Despite massive losses in the Display segment, AOL’s content properties remain among the top domestic websites. Collectively, these content properties have more than 100 million unique visitors and the scale to compete profitably.

Valuation

We believe the current market price of AOL fails to reflect the substantial value of the sum-of-its-parts. Shareholders have clearly given up hope that the massive investment in the Display business, and most dramatically in Patch, will generate an acceptable return on investment. Shareholders are also clearly concerned about the Company’s track record of capital allocation and how the Company will spend its cash resources going forward.

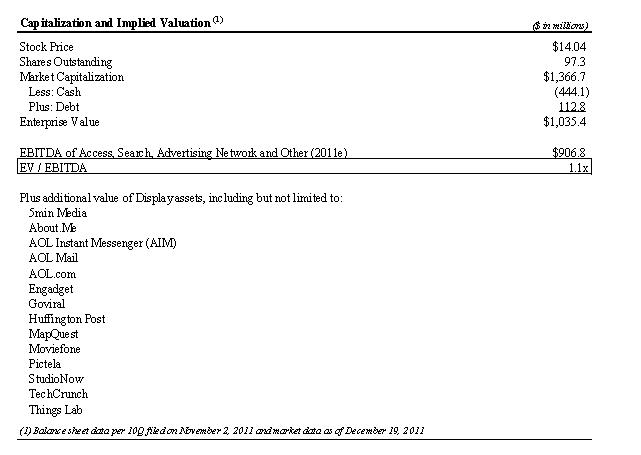

Our analysis suggests that the market is currently ascribing substantial negative value to the Company’s Display business. If AOL were valued solely based on our estimate of 2011 EBITDA from the Access, Search, and Advertising Network business, the market would currently be valuing the Company at only 1.1x EBITDA. However, as discussed previously, this gives no credit to AOL’s Display assets which, we believe, hold considerable value. Again, as a point of reference, the Company spent a total of $667 million and $2.3 billion to acquire Display assets since 2009 and 1999, respectively. Clearly, investors are heavily penalizing AOL for its continued investments and losses in its Display business.

This illustrative valuation framework clearly demonstrates that shareholders are not currently valuing AOL as a going concern. This analysis does not even factor in the potential value of AOL’s approximately $4.0 billion in Net Operating Losses (“NOLs”) or the Company-owned corporate campus and land in Dulles, Virginia. The current situation is unsustainable. The state of AOL is in flux and must be addressed in order to stabilize the Company, its businesses, employees, and customers, in order to position AOL for future success and value creation.

The recent wave of management departures is extremely troubling. Over the past several months, a number of high level executives have left the Company and there have been several articles written in the media regarding the exodus of top leadership at AOL. This clearly indicates a high level of frustration inside the Company over its current strategic direction. In fact, one recent high-level executive of the Company wrote the following upon exiting:

“This fall, all hell broke loose,” wrote Ms. Lacy in her final post for the site on Friday. “You could produce a Lifetime movie-of-the-week about the behind the scenes drama of the last few months. Publicly, I’ve stayed silent during much of it, but it has been every bit as gut-wrenching for me as it’s been for my colleagues.” – Financial Times, November 20, 2011

Conclusion

We strongly believe that AOL is deeply undervalued and that there are opportunities to substantially improve overall operating performance and valuation based on actions within the control of management and the Board. AOL’s stock price has underperformed over almost any time period and we believe it is time for the Board to take immediate action to address the significant concerns highlighted in this letter.

As one of AOL’s largest shareholders, our interests are directly aligned with those of shareholders. We would appreciate the opportunity to engage directly with you and the Board and would request an in-person meeting to discuss our views on how to enhance value for AOL shareholders. We look forward to a constructive dialog as we look to ensure that AOL is run with the best interests of all shareholders as the primary objective.

Best Regards,

/s/ Jeffrey C. Smith

Jeffrey C. Smith

Managing Member

Starboard Value LP