UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

| AOL INC. |

| (Name of Registrant as Specified in Its Charter) |

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD STARBOARD VALUE AND OPPORTUNITY S LLC STARBOARD VALUE LP STARBOARD VALUE GP LLC STARBOARD PRINCIPAL CO LP STARBOARD PRINCIPAL CO GP LLC JEFFREY C. SMITH MARK R. MITCHELL PETER A. FELD RONALD S. EPSTEIN STEVEN B. FINK DENNIS A. MILLER JAMES A. WARNER |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | | |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 10, 2012

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

___________________, 2012

Dear Fellow AOL Stockholder:

Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”) and the other participants in this solicitation (collectively, “Starboard” or “we”) are the beneficial owners of an aggregate of [4,920,691] shares of common stock, par value $0.01 per share (the “Common Stock”) of AOL Inc., a Delaware corporation (“AOL” or the “Company”), representing approximately [5.3]% of the outstanding shares of Common Stock of the Company. We have nominated a slate of highly qualified director candidates for election at AOL’s upcoming 2012 annual meeting of stockholders (the “Annual Meeting”). We did so because we believe the current board of directors (the “Board”) has failed to represent the best interests of stockholders and because we believe that the individuals we have nominated are highly qualified, capable and ready to serve stockholders to help make AOL a stronger, more profitable, and ultimately more valuable company.

For those who may be unfamiliar with us, Starboard is an investment management firm that seeks to invest in undervalued and underperforming public companies. Our approach to such investments is to actively engage and work closely with management teams and boards of directors in a constructive manner to identify and execute on opportunities to unlock value for the benefit of all stockholders. Starboard has established a strong track record of creating stockholder value at many public companies over the past ten years.

We are seeking your support at the Annual Meeting to elect three director candidates in order to ensure that the interests of the stockholders, the true owners of the Company, are appropriately represented in the boardroom. These director candidates are committed to more effectively addressing the critical issues facing the Company and, if elected, will seek to ensure that management and the Board take the necessary actions to enhance value for stockholders.

While the announced sale of the patent portfolio represents a step in the right direction, we believe there are still significant opportunities to create value for AOL stockholders based on actions that are within the Company’s control. For example, AOL’s Display business is currently losing over $500 million per year. We believe this is unacceptable and that the Company should take action to substantially improve the value and profitability of the Display business. Unfortunately, to date, management and the Board have been unable to meaningfully improve profitability in the Display business and unwilling to consider alternative strategies to realize value from these assets.

Our interests are directly aligned with the best interests of all stockholders. We note that the current independent members of the Board directly own just 0.1% of the Company’s outstanding common stock despite substantial director compensation. Even including Mr. Armstrong’s direct ownership of 1.7% of the outstanding shares, most of which resulted from equity grants in connection with the spin-off from Time Warner Inc., the current members of the Board collectively own only 1.8% of the outstanding shares. This compares to our ownership of 5.3% of the outstanding shares of AOL. In addition to the lack of stockholder representation and direct ownership on the Board, we believe AOL has poor corporate governance given the combined role of Chairman and CEO as well as certain potential conflicts of interest regarding AOL’s heavy investments in its money-losing Patch business. We do not believe the Board is currently serving the best interests of all stockholders.

We are seeking to change a significant minority of the Board to ensure that the interests of the stockholders, the true owners of the Company, are appropriately represented in the boardroom. The Board is currently composed of eight directors, all of whom are up for election at the Annual Meeting. Through the attached Proxy Statement, we are soliciting proxies to elect not only our [three] director nominees, but also the candidates who have been nominated by the Company other than _______________, _______________, and _______________. This gives stockholders the ability to vote for the total number of directors up for election at the Annual Meeting. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our nominees are elected.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to the stockholders on or about __________, 2012.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated proxy.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

Thank you for your support.

Jeffrey C. Smith

Starboard Value and Opportunity Master Fund Ltd

| |

If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email listed below. |

| |

|

| |

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Stockholders Call Toll-Free at: 877-869-0171 E-mail: info@okapipartners.com |

| |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 10, 2012

2012 ANNUAL MEETING OF STOCKHOLDERS

OF

AOL INC.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard LLC”), Starboard Value LP (“Starboard Value LP”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Jeffrey C. Smith, Mark R. Mitchell, and Peter A. Feld (collectively, “Starboard” or “we”) are significant stockholders of AOL Inc., a Delaware corporation (“AOL” or the “Company”), owning approximately [5.3]% of the outstanding shares of common stock, par value $0.01 per share (the “Common Stock”) of the Company. We are seeking representation on the Board of Directors of the Company (the “Board”) because we believe that the Board could be improved with directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the annual meeting of stockholders scheduled to be held at ______________ located at ___ ________, ________, _________ _______ on _______, _______, 2012 at __:__ _.m., local time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| | 1. | To elect Starboard V&O Fund’s director nominees1, [Ronald S. Epstein, Steven B. Fink, Dennis A. Miller, Jeffrey C. Smith and James A. Warner] (each a “Nominee” and, collectively, the “Nominees”), to serve as directors of the Company to hold office until the 2013 annual meeting of stockholders and until their respective successors have been duly elected and qualified, in opposition to certain of the Company’s incumbent directors whose terms expire at the Annual Meeting; |

| | 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2012; |

| | 3. | To hold an advisory vote on executive compensation (the “Say-on-Pay Proposal”); |

| | 4. | To approve the Company’s Amended and Restated AOL Inc. 2010 Stock Incentive Plan; |

| | 5. | To approve the AOL Inc. 2012 Employee Stock Purchase Plan; and |

| | 1 In the event the size of the Company’s Board remains set at eight directors as of the date of the Annual Meeting, Starboard presently intends to solicit proxies for the election of only three of director candidates and to revise and/or supplement its proxy materials accordingly, as the case may be. Starboard does not intend to seek to replace a majority of the Board, however, Starboard continues to believe significant change to the composition of the Board is warranted given the qualifications of its nominees and the long-term underperformance of AOL. |

| | 6. | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

This Proxy Statement is soliciting proxies to elect not only our [three] Nominees, but also the candidates who have been nominated by the Company other than _______________, _______________ and _______________. This gives stockholders who wish to vote for our Nominees the ability to vote for a full slate of eight nominees in total.

As of the date hereof, the members of Starboard and the Nominees collectively own [4,920,691] shares of Common Stock. We intend to vote such shares of Common Stock FOR the election of the Nominees, FOR the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2012, [AGAINST] the approval of the Say-on-Pay Proposal, [FOR/AGAINST] the approval the Company’s Amended and Restated AOL Inc. 2010 Stock Incentive Plan and [AGAINST] the approval of the AOL Inc. 2012 Employee Stock Purchase Plan, as described herein.

The Company has set the close of business on April 18, 2012 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 770 Broadway, New York, New York 10003. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [_________] shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE GOLD PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our GOLD proxy card are available at

[http://www.myproxyonline.com/aol]

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed GOLD proxy card today to vote FOR the election of the Nominees.

| | · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed GOLD proxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope today. |

| | · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a GOLD voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| | · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our Nominees only on our GOLD proxy card. So please make certain that the latest dated proxy card you return is the GOLD proxy card.

| |

|

| |

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Stockholders Call Toll-Free at: 877-869-0171 E-mail: info@okapipartners.com |

| |

Background to the Solicitation

The following is a chronology of events leading up to this proxy solicitation. Despite the recent announcement that the Company has agreed to sell 800 of its patents to Microsoft Corporation (“Microsoft”), we are disappointed that the Board has thus far been unwilling to engage with us in a constructive manner and appears to be closed-minded to considering a full range of alternatives to maximize value for stockholders. We are also disappointed that we have been unable to date to reach an amicable resolution relating to the composition of the Board:

| | · | On December 21, 2011, Starboard Value LP delivered a letter to Tim Armstrong, Chairman and CEO of the Company, and the members of the Board stating, among other things, Starboard’s belief that based on its detailed research and analysis, AOL is deeply undervalued and that substantial and actionable opportunities exist to significantly enhance stockholder value. Starboard expressed its belief that this valuation discrepancy is primarily due to the Company’s massive operating losses in its Display business, which Starboard stated could be in excess of $500 million, as well as continued concern over further acquisitions and investments into money-losing growth initiatives like Patch. Starboard urged the Board to take immediate action to address the significant concerns highlighted in its letter and stated it hopes to have an in-person meeting with the Board to more fully discuss Starboard’s views. |

| | · | On December 21, 2011, the Company issued a statement in response to Starboard’s letter. The Company did not address Starboard’s request for an in-person meeting with the Board to discuss Starboard’s concerns. |

| | · | On January 13, 2012, Starboard met with Mr. Armstrong and Board member Fredric Reynolds to discuss the Company’s strategy and business fundamentals. |

| | · | On January 26, 2012, Jeffrey C. Smith met with Fred Reynolds to continue their dialogue regarding the Company’s strategy and business fundamentals. |

| | · | On February 7, 2012, Starboard met again with Messrs. Armstrong and Reynolds to continue their dialogue regarding the Company’s strategy and business fundamentals, including the Company’s intellectual property portfolio, and also to see if a mutually agreeable resolution could be reached regarding Board composition. |

| | · | On February 10, 2012, and several subsequent occasions, Jeffrey C. Smith spoke with Fred Reynolds to continue their dialogue regarding Board representation. |

| | · | On February 16, 2012, Starboard filed a Schedule 13D with the Securities and Exchange Commission (the “SEC”) disclosing ownership of approximately 5.1% of the outstanding shares of Common Stock. The current aggregate ownership of Starboard is [4,916,000] shares of Common Stock, or 5.3% of the outstanding shares of Common Stock, representing one of the largest ownership positions in the Company. |

| | · | On February 24, 2012, Starboard V&O Fund delivered a letter to the Company nominating Ronald S. Epstein, Steven B. Fink, Dennis A. Miller, Jeffrey C. Smith and James A. Warner for election to the Board at the Annual Meeting. |

| | · | Also on February 24, 2012, Starboard delivered a second letter to the Board stating that it is extremely disappointed that its conversations with the Company regarding the issues raised in its December 21, 2011 letter have stalled. Starboard further stated it is troubled that the Company remains closed-minded to alternative value creation initiatives, and that the Company instead appears solely focused on pursuing the status quo. Starboard reiterated its belief that significant opportunities exist to unlock value based on actions within the control of management and the Board. As one specific example, Starboard stated that AOL owns a robust portfolio of extremely valuable and foundational intellectual property that has gone unrecognized and underutilized. Starboard also said in the letter that since its initial public involvement in AOL, multiple parties specializing in intellectual property valuation and monetization have approached Starboard, some of whom believe that (i) a significant number of large internet-related technology companies may be infringing on these patents, and (ii) AOL’s patent portfolio could produce in excess of $1 billion of licensing income if appropriately harvested and monetized. Starboard went on to say that several of these parties have expressed severe frustration that AOL has been entirely unresponsive to their proposals regarding ways to take advantage of this underutilized asset. Starboard said that the Company’s inaction is alarming given that many of the key patents have looming expiration dates over the next several years that could render them worthless if not immediately utilized. |

| | | Starboard also said in the letter it has identified five highly qualified director candidates and submitted the nomination letter to the Company because Starboard has grown increasingly uncomfortable with the direction of the Company and its discussions around Board composition have failed to result in a mutually agreeable resolution. |

| | · | On March 23, 2012, Bloomberg reported that the Company has hired Evercore Partners Inc. (“Evercore”) to find a buyer for its more than 800 patents and explore other strategic options. The Bloomberg article further stated that certain people with knowledge of the situation informed Bloomberg that private-equity firms, including Providence Equity Partners Inc., TPG Capital and Silver Lake, have approached AOL about taking the company private. |

| | · | On March 30, 2012, Starboard delivered a letter to the Board, in which Starboard stated that it appears, based on media reports, that AOL has retained Evercore to find a buyer for the Company’s patent portfolio and to explore other strategic alternatives. Starboard reiterated its belief that the patent portfolio has substantial potential value and that the Company should explore the monetization of the patent portfolio with a sense of urgency due to the relatively short remaining lives of some of the material patents. Starboard went on to say it would be encouraged by the hiring of a financial advisor, if true, and would further request that the Board evaluate any and all strategic options to maximize value for all stockholders. |

Starboard stressed in the letter that in evaluating these strategic options, it is critical that the Board carefully plan and properly assess any asset sale or divestiture to ensure the most tax-efficient outcome. As described in more detail in the letter, Starboard urged the Company to review its portfolio of high tax basis assets and explore opportunities to divest such assets in order to offset the potential tax liability generated from any sale of its low tax basis assets, such as patents or the Access business. Starboard expressed its belief that to achieve the best result, it is crucial that management and the Board work closely with their financial, legal, and tax advisors to ensure that any divestitures are executed in the most tax-advantaged manner and that all alternatives are considered.

Further, Starboard noted in the letter that AOL has now twice reset the record date for the Annual Meeting, most recently from March 26, 2012 to April 18, 2012. Starboard stated its belief that this has the practical implication of pushing back the date of the Annual Meeting from late May until sometime in June, at the earliest, and urged the Company to refrain from taking any actions that may cause any further delay in holding the Annual Meeting. Starboard stated it continues to believe that, during this critical juncture, management and the Board should demonstrate an open mind and willingness to allow stockholders to have a meaningful voice in the boardroom. Starboard concluded the letter by stating it remains ready to have a constructive dialogue with the Board and continues to believe a significant opportunity exists to create value for all stockholders.

| | · | On March 30, 2012, AOL issued the following press statement: |

We are continuing to work on the comeback of AOL and have a plan that isbeneficial for employees, customers and stockholders. We believe strongly thatall of our brands are important to our brand portfolio. We will continue to updateinvestors as we execute on our plan.

| | · | On March 30, 2012, AOL filed a Form 8-K with the SEC disclosing that on March 28, 2012, the Compensation Committee approved a new Employment Agreement with Mr. Armstrong providing for Mr. Armstrong to continue to serve as Chairman and Chief Executive Officer of the Company through March 28, 2016. The Form 8-K further disclosed that on March 28, 2012, the Compensation Committee approved certain award grants to Mr. Armstrong, including (i) a non-qualified option with a ten-year term to purchase shares of the Company’s Common Stock with an aggregate grant date value of $2 million at an exercise price equal to the fair market value of a share of the Company’s Common Stock on the grant date and with vesting over a four-year period and (ii) a non-qualified option with a ten-year term to purchase shares of the Company’s Common Stock with a grant date value of $3 million at an exercise price equal to the fair market value of a share of the Common Stock on the grant date and with vesting in accordance with certain performance criteria. Mr. Armstrong was further granted awards of performance units settled in shares of the Company’s Common Stock subject to the achievement of certain performance criteria. |

| | · | On April 9, 2012, the Company announced that the Company has entered into a definitive agreement to sell over 800 of its patents and their related patent applications to Microsoft and to grant Microsoft a non-exclusive license to its retained patent portfolio for aggregate proceeds of $1.056 billion in cash. |

REASONS FOR THE SOLICITATION

We believe that change is needed now on the AOL Board. Therefore, we are soliciting your support to elect our Nominees at the Annual Meeting. We believe our Nominees would bring significant and relevant experience, new insight and fresh perspectives to the Board. If elected, our Nominees are committed to working constructively with the other members of the Board and using their experience to help effect more prudent and thoughtful decision making, thus helping management to reverse the recent significant underperformance and execute a successful strategic plan for AOL for the benefit of all stockholders.

We believe AOL is deeply undervalued and that the current Board has not taken the necessary steps to adequately address the serious issues facing the Company:

| | · | AOL’s stock price has historically underperformed, both relatively and absolutely; |

| | · | AOL’s market value does not reflect the value of the sum-of-its parts. AOL’s Access and Search businesses generate substantial cash flow and should be valued based on the net present value of their future cash flows. On the other hand, the Display business, including Patch, generates substantial losses, offsetting profits from Access and Search and negatively impacting AOL’s market value. However, AOL’s display business generates substantial web traffic, unique visitors, and page views, which should be quite valuable but is not currently reflected in AOL’s market value; |

| | · | AOL has sustained and continues to generate massive operating losses in its Display business and continues to invest heavily in Patch, which has yet to demonstrate a proven and successful business model. Given the size and scale of AOL’s Display business, action should be taken to dramatically improve profitability or explore other alternatives for these businesses; |

| | · | AOL appears to be closed-minded to considering alternatives to the status quo in its Display business instead of evaluating any and all opportunities to create value for stockholders; |

| | · | AOL maintains certain questionable corporate governance practices, including a combined Chairman and CEO role, as well as questionable executive compensation practices and potential conflicts of interests. |

If elected at the Annual Meeting, the Nominees will, subject to their fiduciary duties as directors, endeavor to work with the other members of the Board to address the substantial valuation discrepancy between the intrinsic value of the Company’s businesses and its current enterprise value and identify immediate actionable value creation initiatives for the Company. We believe significant change to the composition of the Board is warranted given the strong qualifications of our Nominees and the serious issues facing the Company.

We Are Concerned with the Company’s Poor Stock Performance

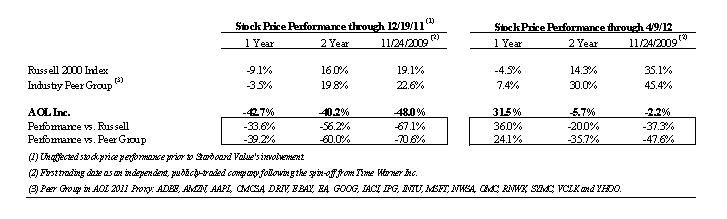

We are concerned with the Company’s dismal absolute and relative stock price performance and believe this demonstrates stockholders’ strong frustration with the current performance and future direction of the Company. As shown in the table below, as of the date of our public letter to the Board on December 21, 2011, AOL shares had severely underperformed the Russell 2000 and Industry Peer Group over almost any time period and had lost almost half of their value since AOL’s spin-off from Time Warner in late 2009. In fact, in the twelve-month period prior to our first public letter to the Board, AOL’s stock declined by almost 43% from $24.49 to $14.04. Further, since the first trading date as an independent, publicly-traded company following the spin-off from Time Warner Inc. on November 24, 2009, until the date of our first public letter, AOL’s stock declined 48.0% while the Russell 2000 Index and the Industry Peer Group increased by 19.1% and 22.6%, respectively. Even after AOL’s announcement to sell a substantial portion of its intellectual property portfolio on April 9, 2012, AOL’s stock has still dramatically underperformed since its first trading date, having declined 2.2%, while the Russell 2000 Index increased 35.1% and the Industry Peer Group increased 45.4% over the same period.

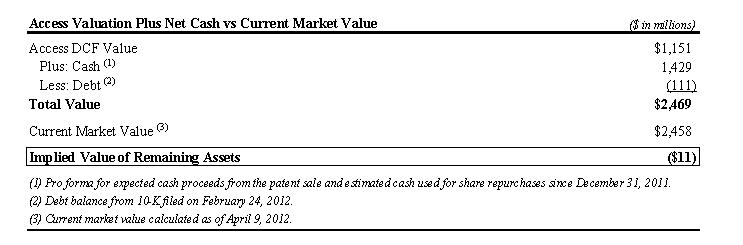

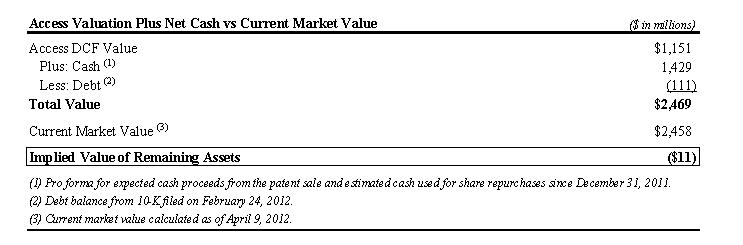

AOL’s Market Value Does Not Reflect the Value of the Sum-of-its Parts

The current market value of AOL does not reflect the significant value of its operating businesses and other assets. We believe this is due primarily to the disparate performance of the different businesses and certain unrecognized non-core assets that have been underutilized. In fact, we believe the value of the Company’s Access business, which provides subscription-based dial-up internet access and related services, combined with its current net cash, is approximately equivalent to the market value of the entire Company. This implies that the market is ascribing essentially no value to AOL’s media assets, including its Advertising Network, Search business, extensive portfolio of Display properties and real estate. We believe that this valuation discrepancy is primarily due to the Company’s massive operating losses in its Display business, as well as continued concern over further acquisitions and investments into money-losing growth initiatives like Patch.

While AOL’s remaining media assets are losing money as a whole, they are worth substantially more than the negative $11 million implied by the value of the Company’s Access business and net cash position. Despite the losses, we believe the Display business has significant value. AOL’s content properties remain among the largest online content destinations. Collectively, these content properties have more than 100 million unique visitors and more than 120 billion page views. In fact, since 1999, the Company has spent over $2.3 billion on acquisitions. This equates to over $24.70 per share. Further, the value of the acquisitions excludes the Company’s Advertising Network, valuable Search agreement with Google, and other media properties such as AOL.com, AOL Mail, and AOL Instant Messenger (AIM).

As shown in the table below, excluding the Display business, we estimate that AOL’s CY 2011 EBITDA would have been approximately $933 million, implying a valuation of 1.2x enterprise value to EBITDA. It clearly appears that stockholders are attributing negative value to AOL’s Display business given its substantial losses and lack of a turnaround plan.

.

This illustrative valuation framework demonstrates that stockholders do not appear to be currently valuing AOL as a going concern or ascribing any value to its Display business. This analysis also does not even factor in the value of AOL’s substantial Net Operating Losses (“NOLs”), or the Company-owned corporate campus and land in Dulles, Virginia. The current situation is unsustainable. The state of AOL is in flux and must be addressed to stabilize the Company, its businesses, employees, and customers, in order to position AOL for future success and value creation.

AOL has Sustained and Continues to Generate Massive Operating Losses in its Display Business and Continues to Invest Heavily in Patch, Which has Yet to Demonstrate a Proven and Successful Business Model

While we understand that the Company’s Access business is in secular decline, we do not believe this serves as justification for continuing to pursue a money-losing growth strategy in the Display business that has repeatedly failed to meet expectations and drained corporate resources. The Access, Search, and Advertising Network businesses continue to produce valuable cash flow that should be cherished and not wasted. The Company’s stockholders have already suffered substantial losses due to the pursuit of the failing Display strategy and immediate action must be taken to address this issue.

If AOL’s Display business was an independent publicly-traded company, without the ability to rely on the substantial cash flow generated by AOL’s other businesses, a rational investor would not choose to invest in an online content business losing hundreds of millions of dollars per year. We believe that the Board should consider this perspective when evaluating any and all options to address the performance of the Display business.

As shown in the table below, AOL generated $573 million in revenue yet lost over $500 million of EBITDA in CY 2011 in its Display business:

As shown above, we estimate based on public disclosure by AOL that Patch may account for $150 million of the losses in the Display business. This is untenable and we believe potential options for Patch should include (1) identifying a joint venture partner to cover the future funding requirements for Patch, thereby removing any additional risk for AOL stockholders, or (2) selling or winding down Patch, as the business does not appear poised to deliver a return on the heavy upfront investment.

If Patch is losing $150 million per year, this implies the remaining Display assets may be losing in excess of $350 million, collectively. Again, this is untenable and we believe potential options for AOL’s premium content Display businesses should include (1) selling underperforming and/or unprofitable web properties, (2) supplementing the high-cost editorial staff with aggregated third-party content and a low-cost community of active bloggers, and/or (3) outsourcing editorial and ad sales operations to a third-party provider, as the Company has already done with Sporting News and Everyday Health.

As a result of the poor performance of the Company’s Display business, we believe the current market price of AOL fails to reflect the substantial value of the sum-of-its-parts. In our view, AOL’s current market price indicates that stockholders have given up hope that the massive investment in the Display business, and even more dramatically in Patch, will generate an acceptable return on investment. We believe stockholders are also concerned about the Company’s historic track record of capital allocation, and just as importantly, how the Company will spend its cash resources going forward.

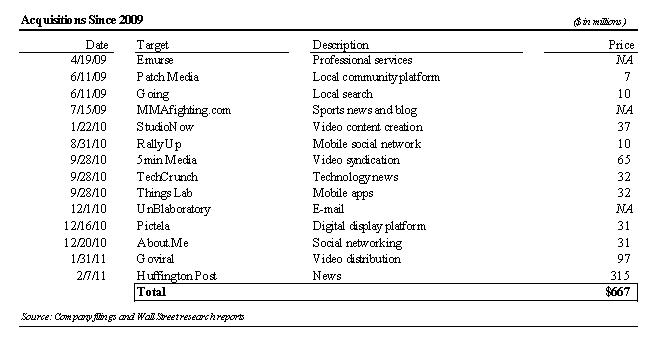

Stockholders have reason to be concerned about capital allocation given AOL’s track record of acquisitions. Since 2009, the Company has spent approximately $667 million, on acquisitions to develop the Display business. Prior to 2009, the Company spent approximately $1.7 billion on acquisitions, primarily for the Display business. Collectively, AOL has spent over $2.3 billion on acquisitions since 1999.

These acquisitions have not gone well. During 2010, AOL recorded an impairment charge of $1.4 billion related to the write-down of goodwill and intangibles from past acquisitions.

The Sale of the Patent Portfolio Represents a Step in the Right Direction, but More Can and Should Be Done to Create Value for Stockholders

On February 24, 2012, we wrote a letter to AOL highlighting its valuable intellectual property that had gone unrecognized and underutilized. In the letter, we stated that AOL’s portfolio of more than 800 patents covered foundational Internet technologies that we believed could produce in excess of $1 billion of licensing income, and that some of the Company’s most valuable patents would expire worthless over the next one to two years if action was not taken. On April 9, 2012, AOL announced that it had reached a deal with Microsoft to sell its patent portfolio for $1.056 billion. This announcement is in line with our publicly announced expectations on value, and also represents a step in the right direction toward creating value for stockholders. However, this announcement also raises serious concerns regarding capital allocation. In the announcement, AOL stated it intends to “return a significant portion of the sale proceeds to shareholders.” Given AOL’s already large cash balance and positive cash flow coupled with its poor track record of capital allocation and acquisitions (as stated above), we believe that AOL should instead commit to returning all of the cash to stockholders either through a special dividend or share buyback. In addition, this announcement does not change the fact that its Display business is currently losing over $500 million per year. We continue to believe that immediate action must be taken to address these massive losses, particularly the continued investments in Patch, which is estimated to have lost $150 million alone.

The Current Board Appears to be Close-Minded to Considering Alternatives to the Status Quo in the Display Business

Since our initial involvement, we have repeatedly tried to engage constructively with management and the Board regarding alternative strategies and options for AOL to enhance stockholder value. As mentioned above, we believe that AOL’s Display business is currently losing over $500 million per year. We believe this is unacceptable and that there are a number of actions within the control of the Company to substantially improve the value and profitability of the Display business. Unfortunately, to date, management and the Board have been unwilling to take the steps necessary to improve the profitability in the Display business. Instead, within hours of our initial public letter on December 21, 2011 outlining the substantial losses of the Display business, the Company responded to our letter with a short press release stating:

“AOL has a clear strategy and operational plan to provide our consumers and customers with exceptional value” and that it will “continue to aggressively execute on [its] strategy.”

Several months later, on March 30, 2012 AOL stated:

“We believe strongly that all of our brands are important to our brand portfolio.”

Most recently, following the sale of AOL’s patent portfolio, the Wall Street Journal noted in an article published on April 9, 2012 that:

“Mr. Armstrong said in an interview Monday that AOL’s strategy will remain ‘the same as it has been.’”

It appears, based on the comments above, that AOL remains committed to the status quo in its Display business. The Company has, thus far, given stockholders no reason to think otherwise.

We Question Certain of AOL’s Corporate Governance Practices

We are concerned that the roles of the Chairman and CEO are not separated and the Company has not appointed an independent Chairman of the Board. We view an independent Chairman as better able to oversee the executives of the Company and set a pro-stockholder agenda without management, and consequently, without conflicts that an executive insider or affiliated director might face. In our view this would, in turn, lead to a more proactive and effective Board.

We believe it is particularly important for AOL to have an independent Chairman because of what we perceive to be a potential conflict of interest for Tim Armstrong, as described below:

On June 10, 2009, AOL purchased Patch, a local online news and information platform that AOL’s Chairman and CEO Tim Armstrong co-founded, for $7.0 million in cash. At the time of closing, Mr. Armstrong held, indirectly, through Polar Capital (a private investment company which he founded), economic interests in Patch that entitled him to receive approximately 75% of the transaction consideration. Mr. Armstrong waived his right to receive any transaction consideration in excess of his original $4.5 million investment, opting to accept only the return of his initial investment in AOL common stock.

Since the time of the acquisition of Patch, we estimate that AOL has spent approximately $235 million of stockholder capital on Patch. For this massive investment, AOL has a business that we estimate generated between $10 million and $15 million of revenue and approximately $150 million of losses in the past twelve months. Clearly, it appears that the investment in Patch to date has failed to yield positive results for stockholders.

Given Mr. Armstrong’s role as the co-founder of this business, we are concerned that he may be conflicted and unable to render dispassionate judgment regarding Patch that is in the best interest of all stockholders. We believe his emotional and personal connection to Patch has clouded his judgment with regards to continuing to fund this money-losing venture.

As a result, it is critical that the full Board assumes this responsibility and carefully evaluates Patch to be sure that strategic decisions regarding this business serve the best interests of all stockholders. We believe an independent Chairman of the Board would help to ensure that issues, such as continued investments in Patch, would be evaluated with an open-mind and with the best interests of all stockholders as the primary objective.

We are Concerned with the Board’s Lack of Sufficient Stock Ownership

Collectively, the members of the Board, other than Mr. Armstrong, directly own approximately 0.1% of the outstanding shares of Common Stock. Together with Mr. Armstrong’s direct ownership of approximately 1.7% of the outstanding shares of Common Stock, which is in large part a result of equity grants in connection with the Company’s spin-off from Time Warner Inc. in 2009, the current members of the Board directly own a collective 1.8% of the outstanding shares of Common Stock. In contrast, Starboard, itself, beneficially owns an aggregate of 4,916,000 shares of Common Stock, or approximately 5.3% of the outstanding shares of Common Stock.

We believe the Board’s collective lack of a substantial vested interest in shares of AOL and the generous cash compensation paid to the outside directors may compromise the Board’s ability to properly evaluate and address the serious challenges facing the Company.

We also believe management’s ability to properly address the issues facing the Company may be compromised by the misalignment between compensation and the Company’s performance. We share the concerns of Glass Lewis & Co., a leading proxy advisory service (“Glass Lewis”) over the poor executive structure. The Company’s long-term incentive awards are not based on performance criteria and instead vest automatically over time. Furthermore, the Company does not utilize an objective, formula-based approach to setting long-term executive compensation levels. Rather, the compensation committee determines equity grant amounts on a purely discretionary basis. We believe that stockholders benefit when equity or long-term incentive awards are determined and vest on the basis of metrics with pre-established goals and are thus demonstrably linked to the performance of the Company, aligning the long-term interests of management with those of stockholders.

Our [Three] Nominees Have the Experience, Qualifications and Commitment Necessary to Fully Explore Available Opportunities to Unlock the Company’s Inherent Value

Our [three] Nominees have valuable and relevant business and financial experience that we believe will allow them to make informed, decisive decisions to explore and identify opportunities to unlock the Company’s inherent value.

[Ronald S. Epstein is the Founder and CEO of Epicenter IP Group LLC, a company dedicated to assisting patent owners in obtaining maximum value for their intellectual property. Previously, Mr. Epstein was Vice President and General Counsel of Brocade Communications Systems, Inc., and Director of Licensing at Intel Corporation. Before joining Intel, Mr. Epstein was a member of the Technology Licensing Group at Wilson, Sonsini, Goodrich and Rosati. Mr. Epstein has more than 20 years of experience in developing, optimizing, and transacting intellectual property asset portfolios, and has delivered significant value to patent owners from the sale or licensing of patents in over 150 transactions.

Steven B. Fink is currently a private investor with extensive experience building and managing technology companies. Mr. Fink is the former CEO of Lawrence Investments, LLC, a venture with Larry Ellison that owns and manages all of Mr. Ellison’s non-Oracle investments. Mr. Fink previously served as Chairman and CEO of Anthony Manufacturing Company, Chairman and Managing Director of Knowledge Universe, and Chairman and CEO of Nextera. Mr. Fink currently serves as Vice Chairman of Heron International, and as a member of the Board of Directors of K-12. Previously, Mr. Fink served as the Chairman of the Board of Leapfrog, Inc., and Spring Group until its sale in 2007.

Dennis A. Miller is a strategic advisor to Lionsgate Entertainment and has been focused primarily on investing at the intersection of media and technology. Previously, he was a General Partner at Spark Capital, a venture fund where he invested in companies including Twitter, CNET, and AdMeld. As a Managing Director for Constellation Ventures, he invested in companies such as Capital IQ. Mr. Miller has also served as Executive Vice President of Lionsgate Entertainment, Executive Vice President of Sony Pictures Entertainment, and Executive Vice President of Turner Network Television.

Jeffrey C. Smith is co-Founder and CEO of Starboard Value, a New York-based investment firm that is one of the largest stockholders of AOL. Mr. Smith has extensive public company board experience. Currently, he serves on the boards of Regis Corp., and SurModics Inc. Previously, he was the Chairman of the Board of Phoenix Technologies Ltd., and a director of Zoran Corporation, Actel Corporation, S1 Corporation, and Kensey Nash Corp. Mr. Smith also served as a member of the Management Committee for Register.com.

James Warner is the principal of Third Floor Enterprises, an advisory firm specializing in digital marketing and media. Previously, he was Executive Vice President of Avenue A | Razorfish, and served on the executive committee of aQuantive, its parent company. He has also served as President of Primedia Magazine Group, President of the CBS Television Network, President of CBS Enterprises, and Vice President at HBO. Mr. Warner served as a director on the board of MediaMind Technologies Inc. until its sale to DG FastChannel, Inc. in July 2011.]

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of eight directors whose terms expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three Nominees in opposition to three of the Company’s director nominees, _______________, _______________ and _______________. Your vote to elect the Nominees will have the legal effect of replacing three incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board and therefore it is not guaranteed that they will have the ability to enhance stockholder value.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company is set forth above in the section entitled “Reasons for the Solicitation.” This information has been furnished to us by the Nominees. The Nominees are citizens of the United States of America.

[Ronald S. Epstein, age 47, is the Founder and Chief Executive Officer of Epicenter IP Group LLC (“Epicenter”), a company that operates as a patent broker helping companies to create, manage, and execute intellectual property strategies. Prior to founding Epicenter in 2010, Mr. Epstein led IPotential, LLC, a provider of complete intellectual property strategy and patent monetization to the technology industry, a company he founded in 2003. Previously, Mr. Epstein was Vice President and General Counsel at Brocade Communications Systems, Inc. (“Brocade”) where he created and executed on the company’s intellectual property strategy, filing for more than 80 patents over a 24-month period and defending the company in several patent litigations filed during that period. Before joining Brocade, Mr. Epstein served as Director of Licensing at Intel Corporation (NASDAQ: INTC) (“Intel”), a multinational semiconductor chip maker, where he was responsible for the company’s IP licensing strategy, including defense against assertions, and the creation of Intel’s value licensing program. Mr. Epstein built his legal career at Wilson, Sonsini, Goodrich and Rosati as a member of the Technology Licensing Group, where he specialized in helping clients minimize liability under the patent portfolios of leading companies, such as IBM (NYSE:IBM), Lucent Technologies, Inc. (n/k/a Alcatel-Lucent USA, Inc.) (NYSE:ALU), and Intel; and negotiate patent cross-license agreements in conjunction with complex patent litigation settlements. Mr. Epstein holds a Bachelor of Science degree from Duke University and a J.D. from the School of Law, University of California, Berkeley. Mr. Epstein is an active member of the Licensing Executives Society. Mr. Epstein’s principal business address is 255 Shoreline Blvd, Suite 300, Redwood City, California 94065.

Steven B. Fink, age 61, is currently a private investor. Mr. Fink is the former Chief Executive Officer, from 1999 through 2008, of Lawrence Investments, LLC (“Lawrence Investments”), a venture with Larry Ellison that owns and manages all of Mr. Ellison’s non-Oracle investments. Lawrence Investments founded and invested in numerous technology, education, medical, and biotechnology companies. Mr. Fink previously served as Chairman and Chief Executive Officer of Anthony Manufacturing Company, Chairman and Managing Director of Knowledge Universe, and Chairman and Chief Executive Officer of Nextera. Mr. Fink currently serves as Vice Chairman of Heron International, one of Europe’s leading property investment and development companies, and has been a member of the Board of Directors of K-12, a technology-based education company (NYSE:LRN), since October 2003. Mr. Fink served as a director of Nobel Learning Communities, Inc., a network of more than 240 private schools, from 2003 to 2011. From 1999 to 2009, Mr. Fink served as a director of Leapfrog, Inc. an educational entertainment company (NYSE:LF), and was its Chairman from 2004 to 2009. Mr. Fink was also Chairman of the Board of Spring Group, a public IT service company headquartered in London which was sold in 2007. Mr. Fink is a director of the Foundation of the University of California, Los Angeles and previously served as a member of The American College of Physicians Foundation Board. Mr. Fink is a member of the Getty Photographs Counsel and a member of the board of the Herb Ritz Foundation. Mr. Fink also serves on the board of directors of Alteryx, a private business intelligence software company, and is the Chairman of UPREIT Partners, a private real estate company in the US. Mr. Fink’s principal business address is 3610 Serra Road, Malibu, California 90265.

Dennis A. Miller, age 54, is a strategic advisor to Lionsgate Entertainment, and has been focused primarily on investing at the intersection of media and technology. Previously, Mr. Miller was a General Partner at Spark Capital since its inception through 2011. Spark Capital has invested in such companies as Twitter, Boxee, Tumblr, Square, 5min, Next New Networks, CNET, AdMeld, and Group Commerce. From 2000 to 2005, Mr. Miller was Managing Director for Constellation Ventures, the venture arm of Bear Stearns. There he led investments in TVONE, College Sports Network, Widevine, K12 and Capital IQ. From 1998 until 2000, Mr. Miller served as Executive Vice President of Lionsgate Entertainment, a leading independent film and television company in the United States. From 1995 until 1998, Mr. Miller was the Executive Vice President of Sony Pictures Entertainment, a subsidiary of Sony Corporation of America and a global motion picture, television and entertainment production and distribution company with operations in 140 countries, where he oversaw the network, cable, syndication and online businesses of the company, domestically and globally. From 1991 to 1995, Mr. Miller was Executive Vice President of Turner Network Television. Mr. Miller began his career in the entertainment and tax department of the law firm of Manatt, Phelps, Rothenberg and Tunney. Mr. Miller serves on the boards of directors of Global Eagle Acquisition Corporation, Radio One Inc. and Fit Orbit. Mr. Miller’s principal business address is 2700 Colorado Blvd, Santa Monica, California 90414.

Jeffrey C. Smith, age 39, is a Managing Member, Chief Executive Officer and Chief Investment Officer of Starboard Value LP (“Starboard Value”). Prior to founding Starboard Value, Mr. Smith was a Partner Managing Director of Ramius LLC, a subsidiary of Cowen Group, Inc. (“Cowen”), and the Chief Investment Officer of Ramius Value and Opportunity Master Fund Ltd. Mr. Smith was also a member of Cowen’s Operating Committee and Cowen’s Investment Committee. Prior to joining Ramius LLC in January 1998, he served as Vice President of Strategic Development for The Fresh Juice Company, Inc. (“The Fresh Juice Company”). Mr. Smith serves on the Board of Directors of Regis Corporation, a global leader in the hair care industry. Mr. Smith has been a member of the Board of Directors of Surmodics, Inc., a leading provider of drug delivery and surface modification technologies to the healthcare industry, since January 2011. Previously he served on the Board of Directors of Zoran Corporation, a leading provider of digital solutions in the digital entertainment and digital imaging market, from March 2011 until its merger with CSR plc in August 2011. Mr. Smith was the Chairman of the Board of Phoenix Technologies Ltd., a provider of core systems software products, services and embedded technologies, from November 2009 until the sale of the company to Marlin Equity Partners in November 2010. He also served as a director of Actel Corporation, a provider of power management solutions, from March 2009 until its sale to Microsemi Corporation in October 2010. Mr. Smith is a former member of the Board of Directors of S1 Corporation and Kensey Nash Corp., and he served as a member of the Management Committee for Register.com, which provides internet domain name registration services. He began his career in the Mergers and Acquisitions department at Société Générale. Mr. Smith’s principal business address is c/o Starboard Value LP, 830 Third Avenue, 3rd Floor, New York, New York 10022.

James A. Warner, age 58, is the principal of Third Floor Enterprises, an advisory firm specializing in digital marketing and media. Previously, Mr. Warner was with Avenue A | Razorfish (now known as Razorfish Inc.), one of the world’s largest digital agencies and provider of digital advertising and content creation services, media buying, strategic counsel, analytics, technology and user experience, from 2000 until 2008, including as its Executive Vice President, from 2004 until 2008. Mr. Warner also served on the executive committee of aQuantive Inc., the parent company of Avenue A | Razorfish, which was acquired by Microsoft in May 2007. Before joining Avenue A | Razorfish, Mr. Warner led the magazine division of Primedia Inc., a publicly held media company. From 1995 until 1998, Mr. Warner was President of the CBS Television Network, and from 1989 until 1994, he served as President of CBS Enterprises, the company’s worldwide syndication and licensing business. From 1986 to 1989, Mr. Warner was Vice President of HBO Enterprises. Mr. Warner currently serves on the boards of directors of Healthline Networks, a healthcare technology and information company; Invision Inc., a leading provider of advertising systems to the media industry; Merkle Inc., the largest independently-owned customer relationship marketing agency; and engage121, Inc, a communications software provider. Mr. Warner was a director of MediaMind Technologies (NASDAQ:MDMD), a global provider of digital advertising solutions, prior to its sale to DG FastChannel, Inc. (NASDAQ:DGIT) in 2011. Mr. Warner also advises Accordant Media, ChaChaAnswers, Criteo, Innovation Interactive, Marchex, and Metamorphic Ventures. Mr. Warner received a B.A. with honors from Yale College and an M.B.A from the Harvard Business School. Mr. Warner’s principal business address is 56 Prospect Avenue, Larchmont, New York 10538.]

As of the date hereof, Mr. Epstein directly owns 850 shares of Common Stock. As of the date hereof, Mr. Fink directly owns 560 shares of Common Stock. As of the date hereof, Mr. Miller owns 2,700 shares of Common Stock. As of the date hereof, Mr. Warner directly owns 581 shares of Common Stock. As a member of Principal GP and as a member of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, Mr. Smith is deemed to beneficially own the 4,916,000 shares of Common Stock owned in the aggregate by Starboard. Each of the Nominees may be deemed to be a member of the Group (as defined below) for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and accordingly may be deemed to beneficially own the shares of Common Stock owned directly by the other members of the Group. Each of the Nominees specifically disclaims beneficial ownership of such shares of Common Stock that he does not directly own. For information regarding purchases and sales during the past two years by the Nominees and by the members of the Group of securities of the Company that may be deemed to be beneficially owned by the Nominees, see Schedule I.

Starboard V&O Fund and certain of its affiliates have signed letter agreements, pursuant to which they agree to indemnify each of Messrs. Epstein, Fink, Miller and Warner against claims arising from the solicitation of proxies from the Company stockholders in connection with the Annual Meeting and any related transactions.

Starboard V&O Fund has signed compensation letter agreements with each of Messrs. Epstein, Fink, Miller and Warner, pursuant to which Starboard V&O Fund agrees to pay each of Messrs. Epstein, Fink, Miller and Warner: (i) $10,000 in cash as a result of the submission by Starboard V&O Fund of its nomination of each of Messrs. Epstein, Fink, Miller and Warner to the Company and (ii) $10,000 in cash upon the filing of a definitive proxy statement with the SEC by Starboard V&O Fund relating to the solicitation of proxies in favor of each of Messrs. Epstein, Fink, Miller and Warner’s election as a director at the Annual Meeting. Pursuant to the compensation letter agreements, each of Messrs. Epstein, Fink, Miller and Warner has agreed to use the after-tax proceeds from such compensation to acquire securities of the Company (the “Nominee Shares”). If elected or appointed to serve as a director of the Board, each of Messrs. Epstein, Fink, Miller and Warner agrees not to sell, transfer or otherwise dispose of any Nominee shares of Common Stock within two years of his election or appointment as a director; provided, however, in the event that the Company enters into a business combination with a third party, each of Messrs. Epstein, Fink, Miller and Warner may sell, transfer or exchange the Nominee shares of Common Stock in accordance with the terms of such business combination.

On February 27, 2012, Starboard V&O Fund, Starboard LLC, Starboard Value LP, Starboard Value GP, Starboard Principal Co, Principal GP, Peter A. Feld, Mark Mitchell, and the Nominees (collectively the “Group”) entered into a Joint Filing and Solicitation Agreement in which, among other things, (a) the Group agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Company to the extent required by applicable law, (b) the Group agreed to solicit proxies or written consents for the election of the Nominees, or any other person(s) nominated by Starboard V&O Fund, to the Board at the Annual Meeting (the “Solicitation”), and (c) Starboard V&O Fund and Starboard LLC agreed to bear all expenses incurred in connection with the Group’s activities, including approved expenses incurred by any of the parties in connection with the Solicitation, subject to certain limitations.

Other than as stated herein, there are no arrangements or understandings between members of Starboard and any of the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees are a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Each Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NYSE listing standards applicable to board composition, including Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

We do not expect that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed GOLD proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by the enclosed GOLD proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Starboard that any attempt to increase the size of the current Board constitutes an unlawful manipulation of the Company’s corporate machinery.

YOU ARE URGED TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED GOLD PROXY CARD.

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2012

As discussed in further detail in the Company’s proxy statement, the Audit and Corporate Governance Committee of the Board has selected Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the 2012 fiscal year and is proposing that stockholders ratify such appointment. The Company is submitting the appointment of Ernst &Young LLP for ratification of the stockholders at the Annual Meeting.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE 2012 FISCAL YEAR AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL NO. 3

APPROVAL OF ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis and the related compensation tables and narrative discussion in the Proxy Statement for the Annual Meeting.”

According to the Company’s proxy statement, the say-on-pay vote is advisory only and not binding on the Company, the Compensation Committee of the Board or the Board.

WE INTEND TO VOTE OUR SHARES [“AGAINST”] THIS PROPOSAL

PROPOSAL NO. 4

CONSIDERATION OF THE AMENDED AND RESTATED AOL INC. 2010 STOCK INCENTIVE PLAN

As discussed in further detail in the Company’s proxy statement, the Company is asking the Company’s stockholders to approve the amendment and restatement of the existing AOL Inc. 2010 Stock Incentive Plan, as amended and restated, effective as of April 29, 2010 (the “Existing Plan”) that will (i) increase the maximum aggregate number of shares of Common Stock in respect of which Awards under the Stock Incentive Plan (as described in the Company’s proxy statement) may be granted under the Stock Incentive Plan by [______] shares, (ii) change the manner in which certain types of Awards under the Stock Incentive Plan count against the number of shares of Common Stock authorized for issuance under the Stock Incentive Plan, and (iii) provide that the number of shares of Common Stock underlying an Award that is settled in cash will again be available for Awards under the Stock Incentive Plan, (iv) provide additional performance criteria pursuant to which performance-based awards may be granted under the Stock Incentive Plan, (v) provide that Awards may be granted under the Stock Incentive Plan for ten years from the date the plan was first adopted by the Board, and (vi) make other clarifying and administrative amendments to the Stock Incentive Plan.

WE INTEND TO VOTE OUR SHARES [“FOR”/”AGAINST”] THIS PROPOSAL2

| | 2AOL’s preliminary proxy statement does not yet specify the maximum aggregate number of shares of Common Stock eligible for issuance under the Stock Incentive Plan, and Starboard reserves judgment as to how it intends to vote its shares until such material information has been provided in the proposal. |

PROPOSAL NO. 5

CONSIDERATION OF AOL INC. 2012 EMPLOYEE STOCK PURCHASE PLAN

As discussed in further detail in the Company’s proxy statement, the Company is asking the Company’s stockholders to approve the AOL Inc. 2012 Employee Stock Purchase Plan (the “ESPP”) that was adopted and approved by the Company’s Compensation Committee on February 22, 2012, subject to stockholder approval.

While we generally encourage employee plans that aim to align the interests of employees with the future success of the company, we note that the ESPP only provides for a ninety (90) day holding period for shares purchased by employees at below market value under the ESPP. We do not believe that such a short holding period adequately aligns the employees’ interests with the long-term future success of the Company, which is a touchstone of such employee stock plans. Unless the Company extends the holding period to one-year or longer, we intend to vote our shares AGAINST this proposal.

WE INTEND TO VOTE OUR SHARES [“AGAINST”] THIS PROPOSAL

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, Starboard believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common Stock represented by properly executed GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, FOR the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2012, [AGAINST] the approval of the Say-on-Pay Proposal, [FOR/AGAINST] the approval the Company’s Amended and Restated AOL Inc. 2010 Stock Incentive Plan and [AGAINST] the approval of the AOL Inc. 2012 Employee Stock Purchase Plan, as described herein.

This Proxy Statement is soliciting proxies to elect not only our [three] Nominees, but also the candidates who have been nominated by the Company other than _______________, _______________ and _______________. This gives stockholders who wish to vote for our [three] Nominees and such other persons the ability to do so. Under applicable proxy rules we are required either to solicit proxies only for our [three] Nominees, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our [three] Nominees and for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our [three] Nominees to also vote for those of the Company’s nominees for whom we are soliciting proxies. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our Nominees are elected.

QUORUM; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least __________ shares of Common Stock, which represents a majority of the ________ shares of Common Stock outstanding as of the Record Date, will be considered a quorum allowing votes to be taken and counted for the matters before the stockholders.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under current NYSE rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on the proposals relating to the election of directors, the advisory vote on executive compensation, the approval of the Stock Incentive Plan or the approval of the ESPP, but will have discretionary authority to vote your shares on the proposal regarding the ratification of the independent registered accounting firm.

If you are a stockholder of record, you must deliver your vote by mail or attend the Annual Meeting in person and vote in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the matters to be presented at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will not count for purposes of attaining a quorum.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ According to the Company’s proxy statement, the directors elected at the meeting will be the eight directors receiving the highest number of votes. With respect to the election of directors, neither an abstention nor a broker non-vote will count as a vote cast “for” or “against” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Stockholders may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on each of the other proposals. Neither an abstention nor a broker non-vote will count as voting with respect to the proposal. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the proposal. If you sign and submit your GOLD proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with Starboard’s recommendations specified herein and in accordance with the discretion of the persons named on the GOLD proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Starboard in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement or to the Company at 770 Broadway, New York, New York 10003 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Starboard in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, Okapi Partners may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Starboard. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Starboard V&O Fund has entered into an agreement with Okapi Partners for solicitation and advisory services in connection with this solicitation, for which Okapi Partners will receive a fee not to exceed $_________, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi Partners will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Starboard V&O Fund has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. Starboard V&O Fund will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Okapi Partners will employ approximately ____ persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Starboard. Costs of this solicitation of proxies are currently estimated to be approximately $___________. Starboard estimates that through the date hereof its expenses in connection with this solicitation are approximately $___________. Starboard intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. Starboard does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION