ISS AND GLASS LEWIS RECOMMEND FOR ALL TWELVE OF STARBOARD’S NOMINEES FOR DARDEN

Starboard is Extremely Gratified that the Two Leading Independent Proxy Voting Advisory Firms Have Recommended Darden Shareholders Vote for All Twelve of Starboard’s World-Class Nominees on Starboard’s WHITE Proxy Card

ISS Concludes that “Significant Board Change Is Warranted” and Glass Lewis States that the Election of all Twelve of Starboard’s Nominees “Is More Likely to Effect Long-Term Improvements and Provide Greater Board Oversight” at Darden

ISS States thatStarboard’s Entire Director Slate “Is Endowed with an Embarrassment of Riches” and Glass Lewis Finds Starboard’s Twelve Supremely Qualified Nominees to be “Far More Compelling” and “Significantly Better-Suited” than Darden’s Proposed Nominees

Corporate Governance Research Firm, Proxy Mosaic, Has Also Now Recommended for All Twelve of Starboard's Nominees for Darden

Starboard Urges All Shareholders to Follow the Lead of ISS, Glass Lewis, and Proxy Mosaic and Vote the WHITE Proxy Card to Support the Election of All Twelve of Starboard’s Highly Qualified Nominees

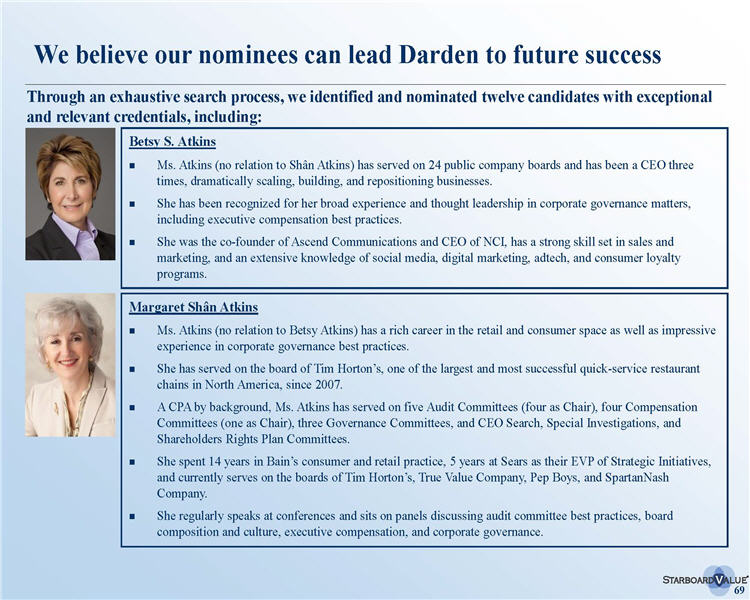

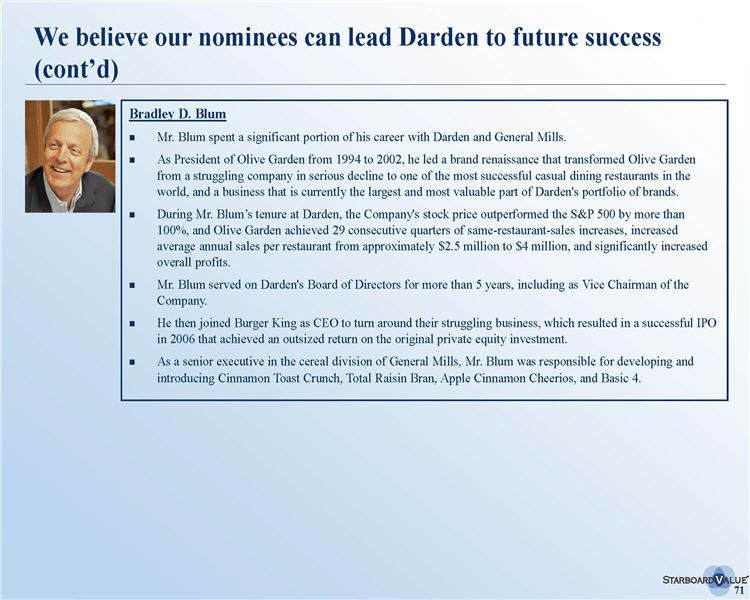

NEW YORK, NY – September 30, 2014 – Starboard Value LP (together with its affiliates, “Starboard“), one of the largest shareholders of Darden Restaurants, Inc. (“Darden” or the “Company”)(NYSE:DRI), with beneficial ownership of approximately 8.8% of the outstanding common stock of the Company, today issued the following statement to Darden shareholders following reports issued by Institutional Shareholder Services (“ISS”) and Glass Lewis & Co., LLC (“Glass Lewis”), the two leading independent proxy voting advisory firms, recommending that Darden shareholders vote on Starboard’s WHITE proxy card to elect all twelve of Starboard’s highly qualified nominees, Betsy S. Atkins, Margaret Shân Atkins, Jean M. Birch, Bradley D. Blum, Peter A. Feld, James P. Fogarty, Cynthia T. Jamison, William H. Lenehan, Lionel L. Nowell, III, Jeffrey C. Smith, Charles M. Sonsteby, and Alan N. Stillman, to the Darden Board of Directors (the “Board”) at the upcoming 2014 Annual Meeting of Shareholders (the “Annual Meeting”).

Starboard also announced today that Proxy Mosaic, a corporate governance research firm, has issued a report recommending that Darden shareholders vote on Starboard’s WHITE proxy card for all twelve of Starboard's highly qualified nominees. Like ISS and Glass Lewis, Proxy Mosaic concluded that Starboard's slate is “far more compelling” and has “superior industry experience.”

Starboard urges all Darden shareholders to support the calls of ISS, Glass Lewis, and Proxy Mosaic for resounding change on the Darden Board by voting the WHITE proxy card TODAY to elect all twelve of Starboard’s world-class nominees at the Annual Meeting.

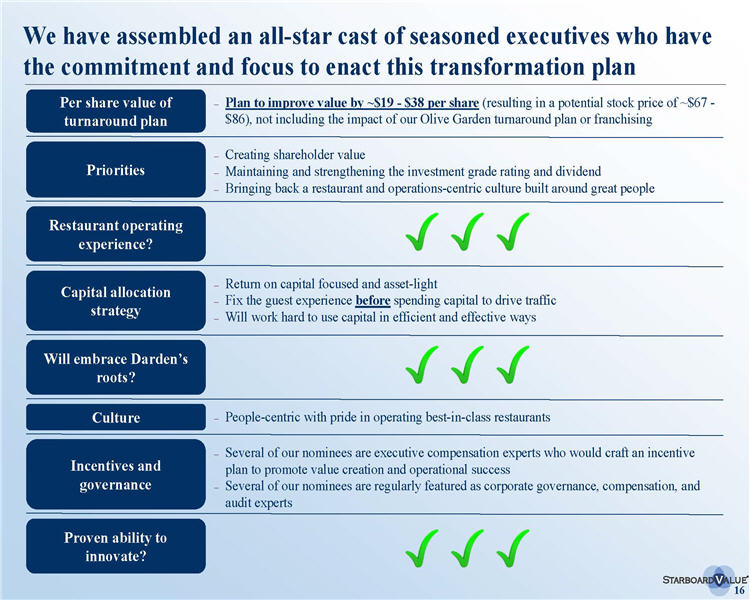

Jeffrey C. Smith, Chief Executive Officer of Starboard Value LP, stated, “We are deeply gratified by the overwhelming support from both ISS and Glass Lewis in recommending that Darden shareholders vote for all twelve of our extremely qualified nominees at the upcoming Annual Meeting. Both leading proxy advisory firms performed an objective, detailed analysis of this election contest, and both concluded that our director nominees are best-suited to oversee Darden. Their overwhelming support for the election of all twelve of our director nominees provides significant validation that our complete board slate will bring the best leadership in order to oversee a successful turnaround of the Company and to select the best possible CEO to lead Darden. We are deeply appreciative that both ISS and Glass Lewis recognized the strong qualifications and depth of experience of our slate of world-class nominees in their respective reports. In fact, both ISS and Glass Lewis went out of their way to point out the superior qualifications of our nominees, with ISS saying that Starboard’s slate is ‘endowed with an embarrassment of riches’, and Glass Lewis concluding that our director nominees have ‘more impressive experience and track records’ than Darden’s proposed nominees. We are confident that shareholders will reach the same conclusion as ISS and Glass Lewis when it comes to whose director slate is the best-suited to lead a transformation of Darden.”

Mr. Smith continued, “We are extremely pleased that both ISS and Glass Lewis have endorsed Starboard and our nominees’ turnaround plan for Darden and have affirmed our ‘more thoughtful approach to board continuity’, which includes adding back to the Board up to two of the most qualified incumbent directors. Our director nominees are prepared and excited to immediately step in at Darden, if elected, and to begin working tirelessly alongside Darden’s dedicated employees to restore excellence throughout the Company and to put our company back on track for long-term value creation for all shareholders. With the prospect of such an incredibly bright future for Darden in mind, we hope that shareholders will follow the lead of the two most highly-respected proxy advisory firms by voting for our twelve supremely qualified nominees on the WHITE proxy card today. We continue to greatly appreciate the strong support from shareholders who have already voted for Starboard’s nominees on the WHITE proxy card.”

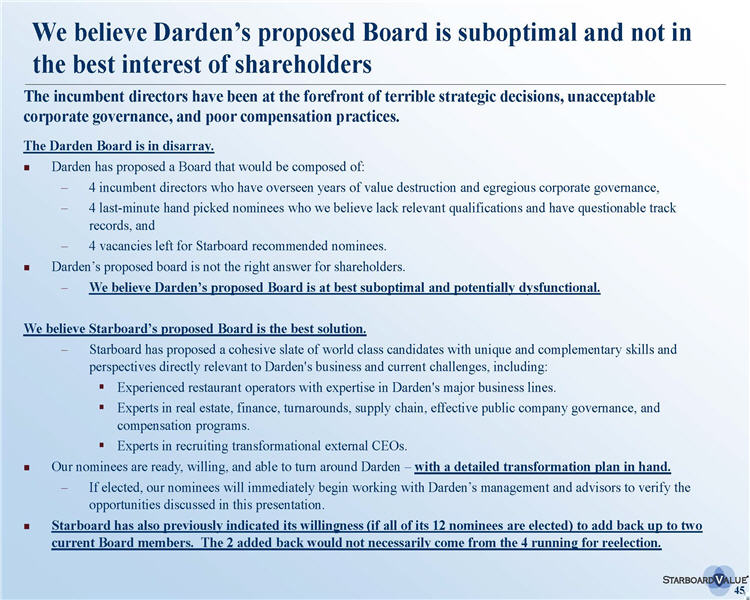

Starboard’s board slate collectively possesses the backgrounds and skill sets necessary to lead Darden and create significant long-term value for the benefit of all stakeholders.

ISS agrees:

“Against that backdrop, the slate the dissidents have assembled is endowed with an embarrassment of riches—in experience on public company boards, in significant restaurant operating experience across a number of concepts (including the experience of developing the Olive Garden concept itself), in turnarounds within and beyond the restaurant sector, in franchised and non-franchised business models, in financial expertise, even in real estate.”

Glass Lewis also agrees:

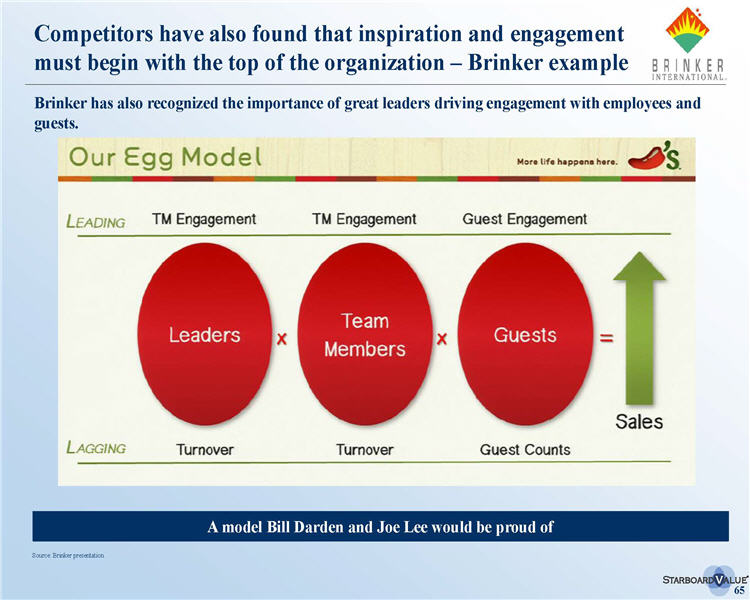

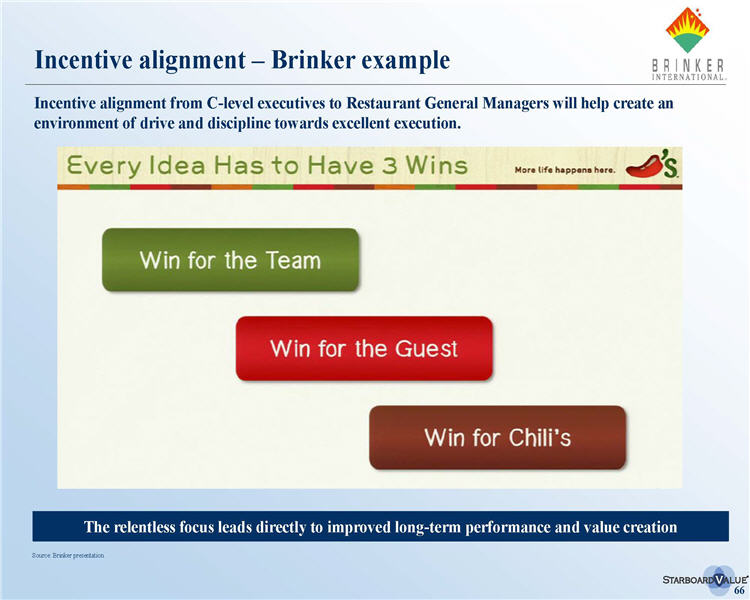

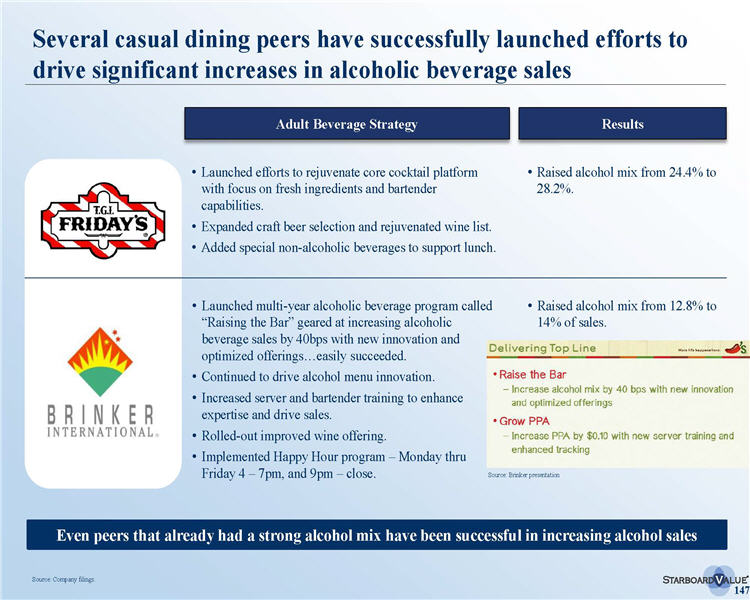

“Looking at the Dissident's slate of nominees, we see a collection of director candidates who possess a well-rounded variety of significant experiences which appear tailored to Darden's current needs. They include restaurant industry veterans who have achieved results as founders, CEOs, CFOs, executives and board members of Darden, Olive Garden, Brinker, T.G.I. Friday's, IHOP, Smith & Wollensky, Burger King, Romano's Macaroni Grill, Taco Bell, Pizza Hut, Cosi, Corner Bakery, Quality Meats, Maloney & Porcelli and Tim Horton's. Further, the Dissident's nominees have significant experience in operational turnarounds, supply-chain management, marketing, finance and real estate. Moreover, the Dissident's nominees include well-respected corporate governance experts, a number of individuals who have participated as directors in CEO search processes and shareholder representatives.”

In fact, Glass Lewis went so far as to individually highlight each of our twelve nominees’ strong qualifications and their direct relevance to Darden. This speaks volumes about the depth and strength of our board slate:

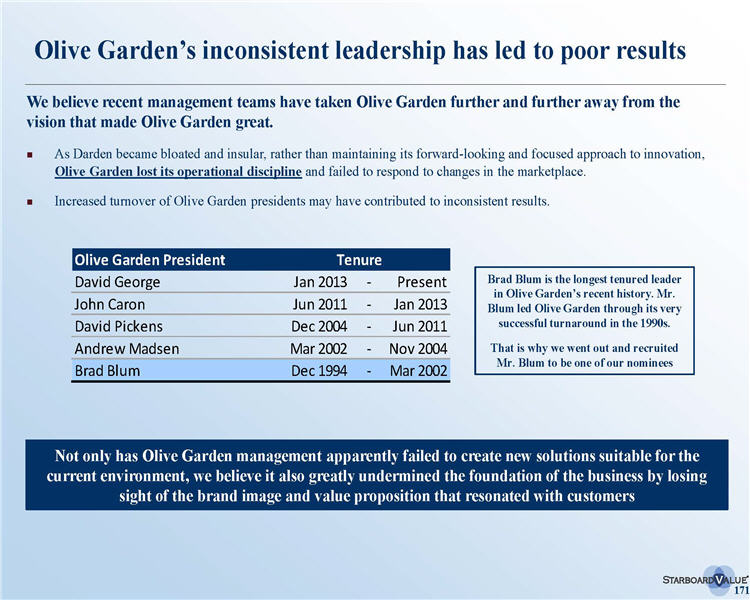

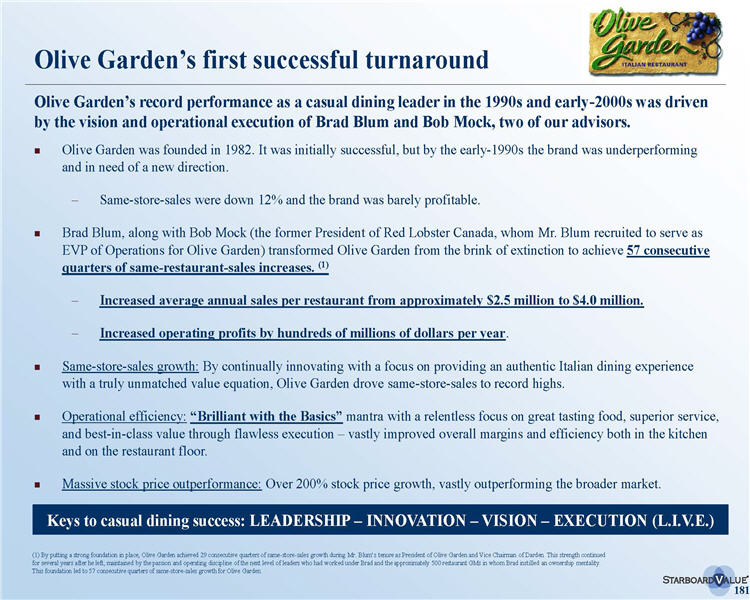

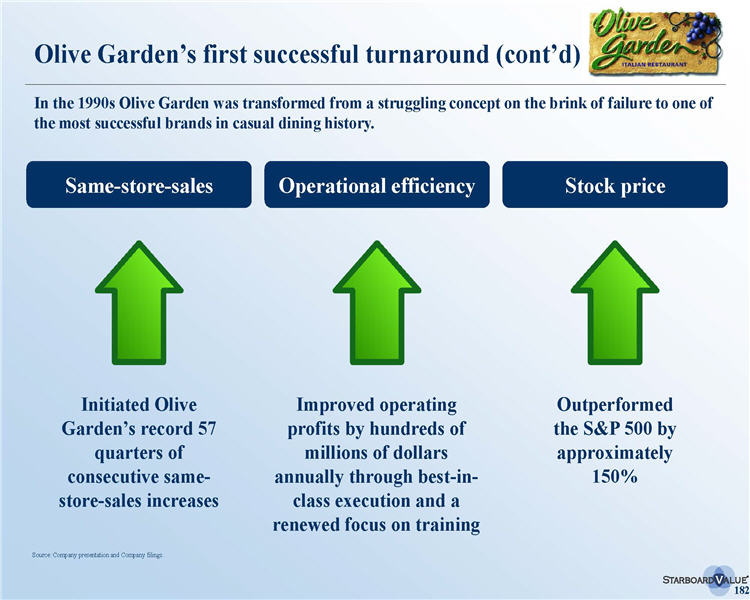

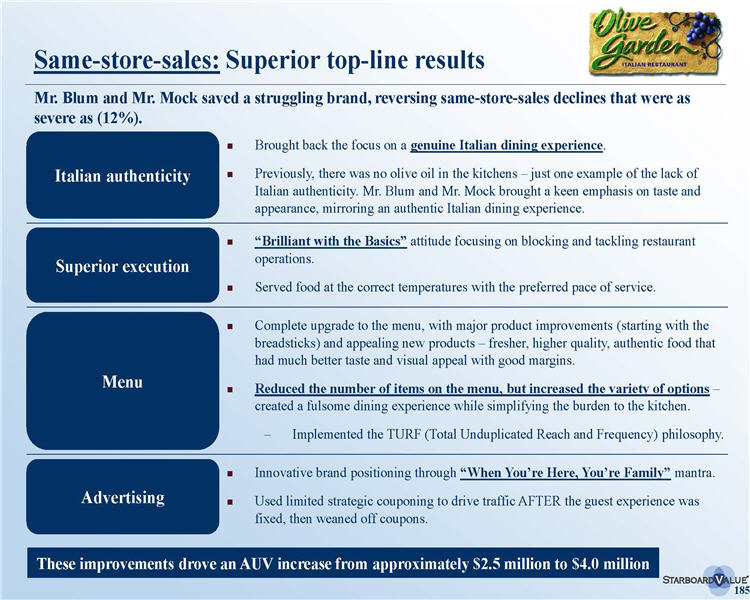

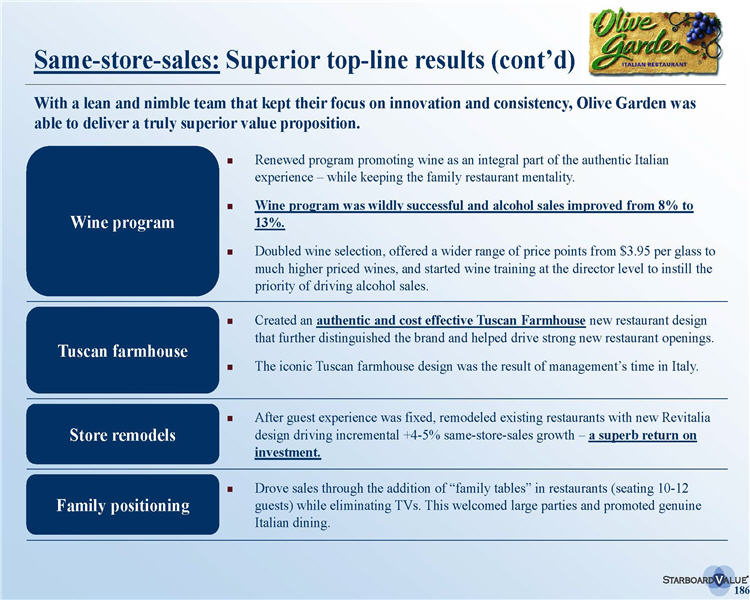

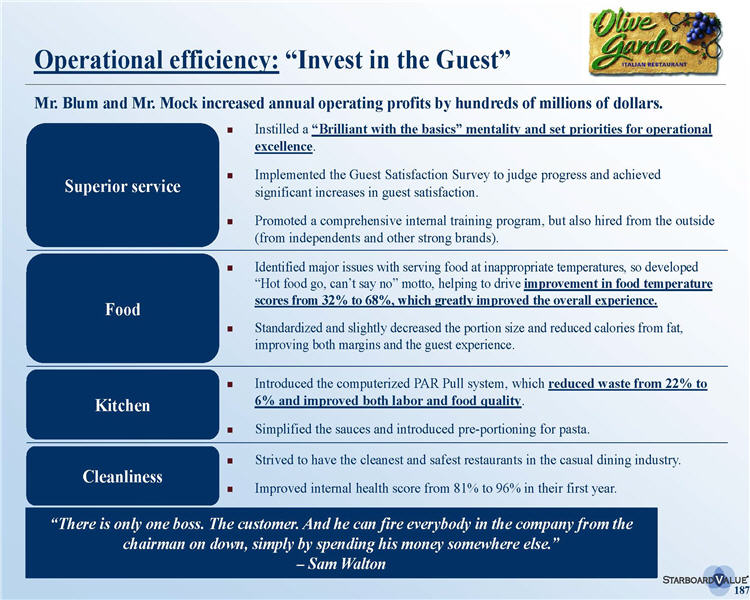

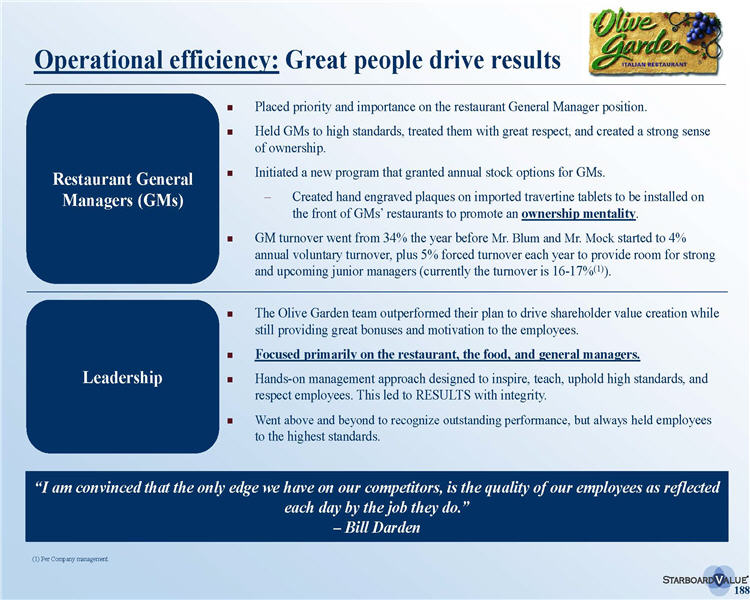

“Notably, Brad Blum previously led Olive Garden for more than seven years from 1994 to 2002, achieving 29 consecutive quarters of same-store sales increases, and increased average annual sales per restaurant from approximately $2.5 million to $4 million while significantly increasing overall profits, according to Starboard.”

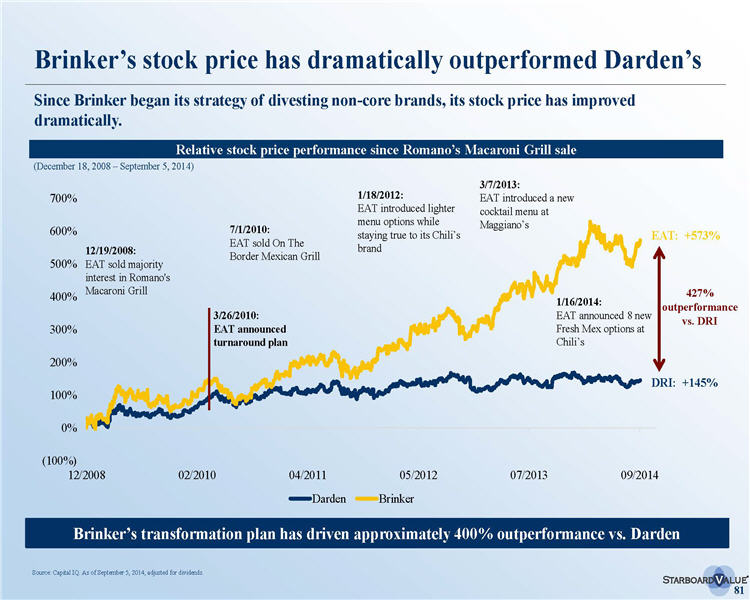

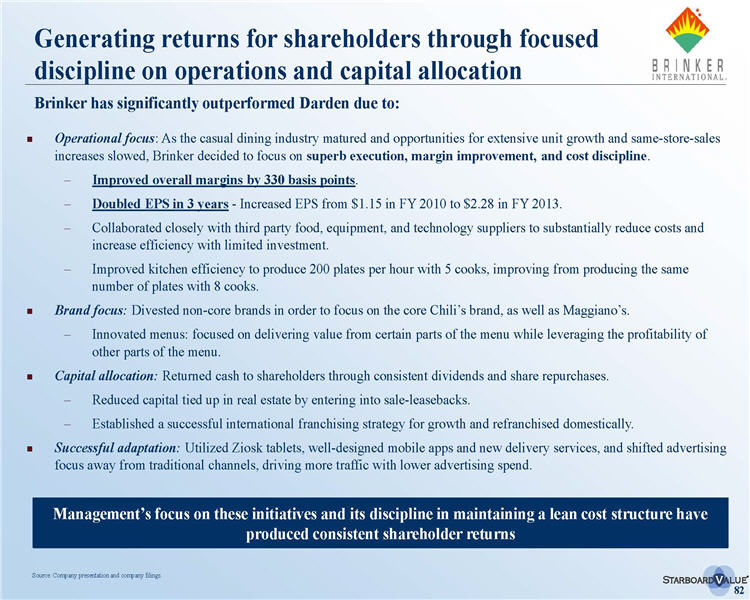

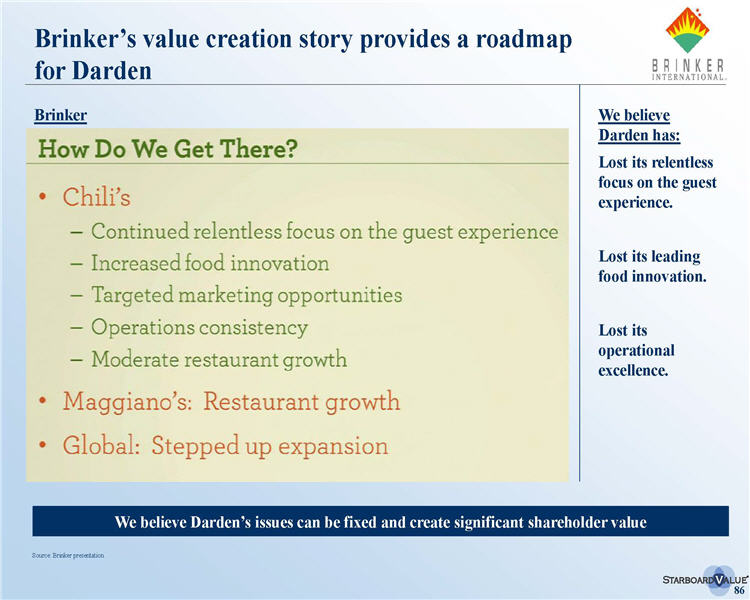

“[Chuck Sonsteby’s] turnaround and restaurant operating experience at one of Darden's closest peers during a very similar period in which Darden now resides would be a strong addition to the new board.”

“[Jean Birch’s] extensive restaurant operating experience appears well-suited for the Darden board, in our view.”

“We believe [Alan] Stillman likely understands the recipe for success of various restaurant concepts, knowledge which Darden could rely upon as it implements a new strategic plan across all of its brands.”

“The Dissident's slate also includes nominees with broader operating, financial or corporate governance experience at various large public companies. . . .Margaret Atkins’ financial and operational expertise, as well as her public board experience, would make her an important asset to the Darden board, in our view. . . [Lionel] Nowell’s accounting, financial reporting and risk management skills at large companies makes him well-suited for the Darden board. . . . We believe Betsy Atkins’ extensive board experience, including as chair or member of multiple compensation committees and corporate governance committees, would be a strong addition to the Darden board from an oversight perspective.”

“[W]e also believe it would behoove shareholders to appoint to the board an individual with extensive real estate experience. [William Lenehan’s] experience as a director of a commercial real estate investment company focused on acquiring and managing net leased office and industrial assets, as well as a director at a real estate development company, seems like a compelling balance of real estate and governance experience in one director candidate.”

“Beyond restaurant operating experience, we note that Dissident nominees Jim Fogarty and Cynthia Jamison have successful turnaround experience at companies in other industries. . . Thus, these director candidates appear well-equipped to oversee the implementation of Olive Garden's turnaround plan.”

“We note that the other Dissident nominees, Jeff Smith and Peter Feld, would give the Darden board a healthy amount of representation, which Darden could likely benefit from in light of recent spats with shareholders -- beyond Starboard -- regarding the Company's performance, strategic direction, sale of Red Lobster and overall leadership.”

ISS has also affirmed that Starboard has presented the “more thoughtful solution” for Board continuity at Darden, stating:

“On the other hand, the dissidents have pledged in their proxy statement that, if all 12 dissident nominees are elected, they will expand the board and reappoint 2 incumbents—thoughtfully addressing any continuity issues by selecting the most appropriate of the incumbent directors, not merely those available at the ballot.”

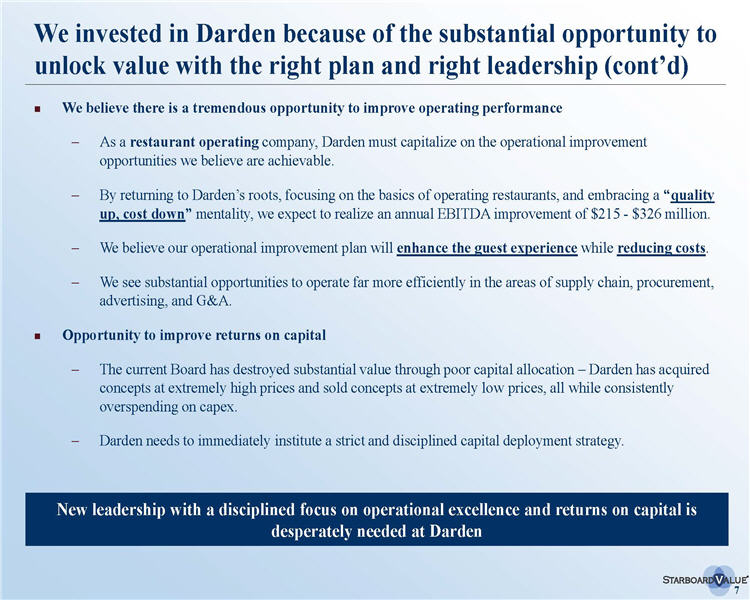

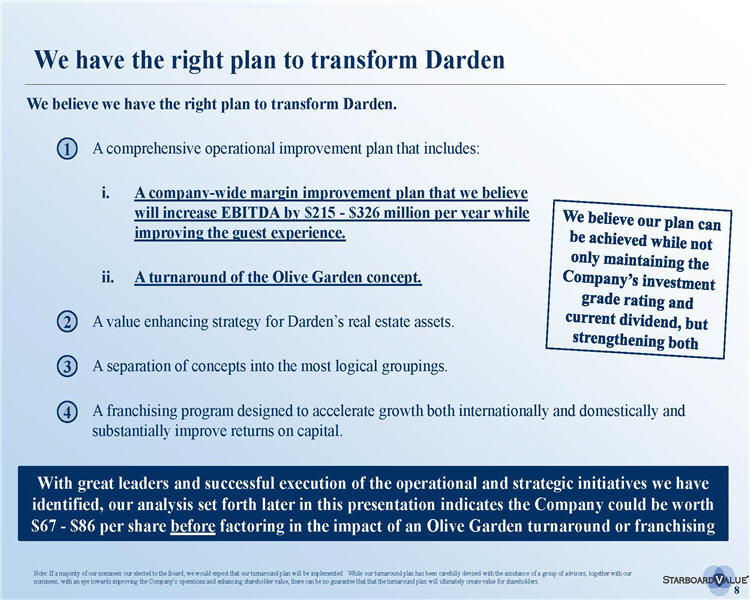

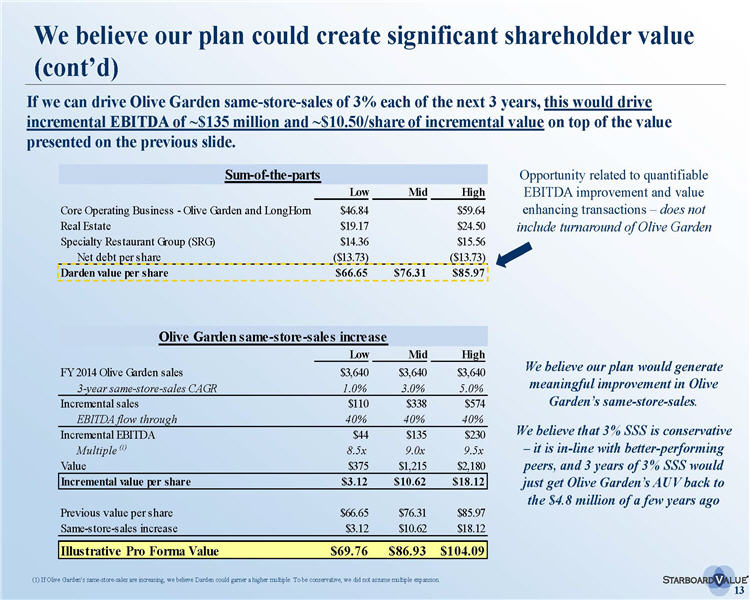

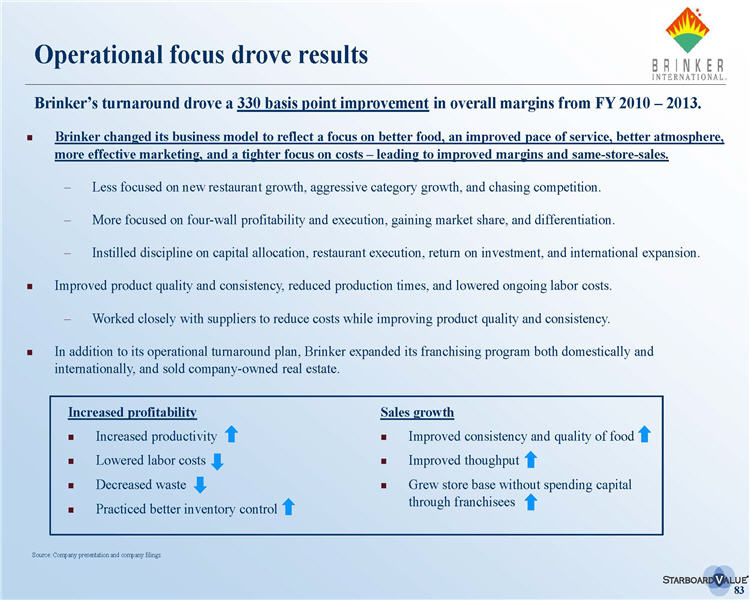

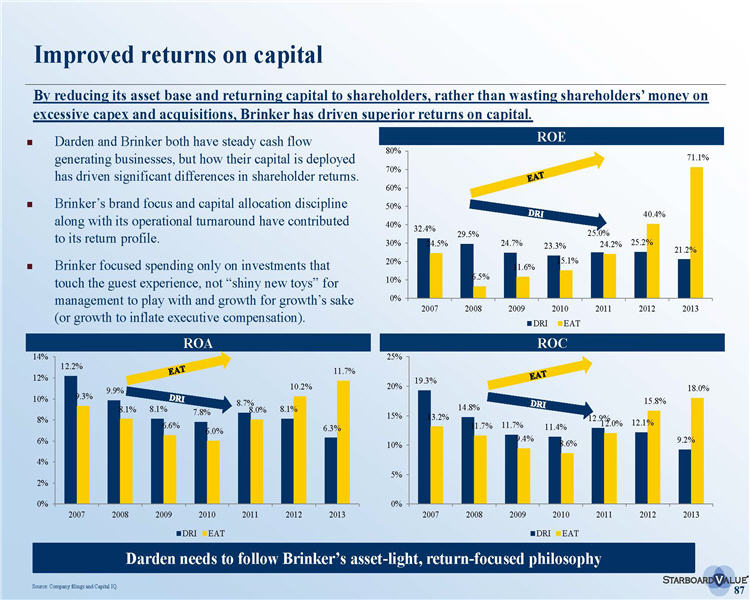

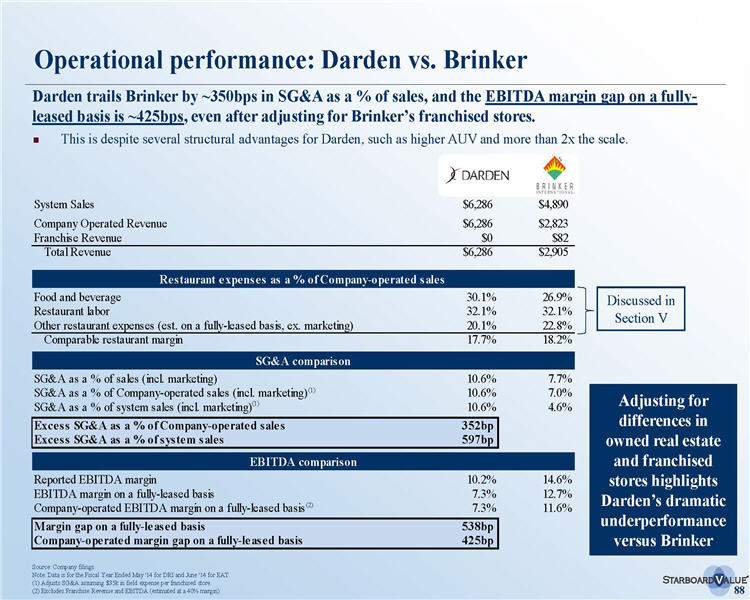

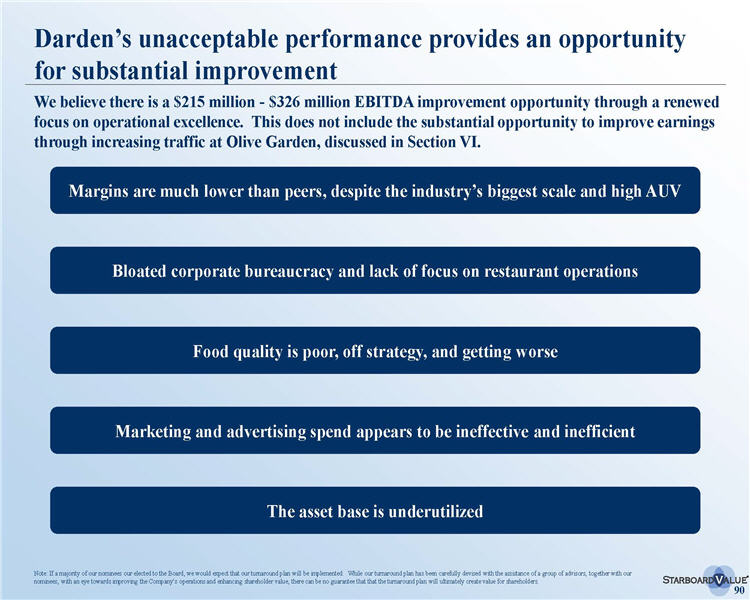

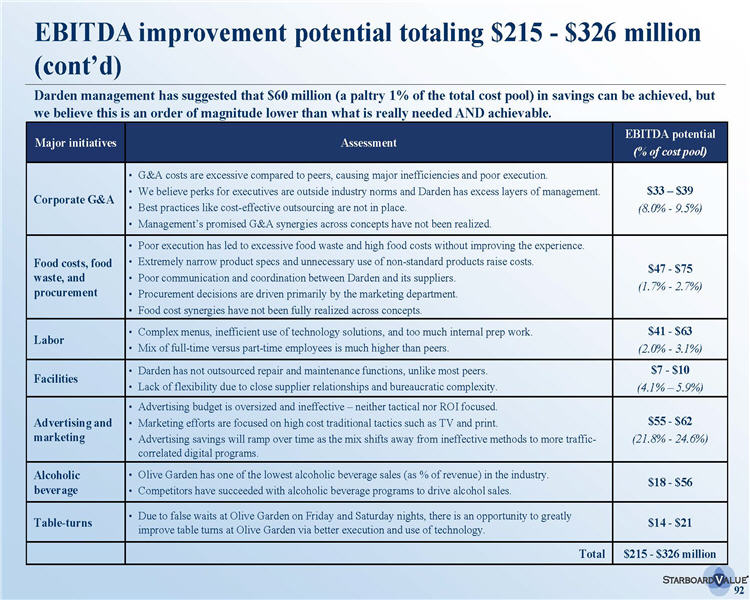

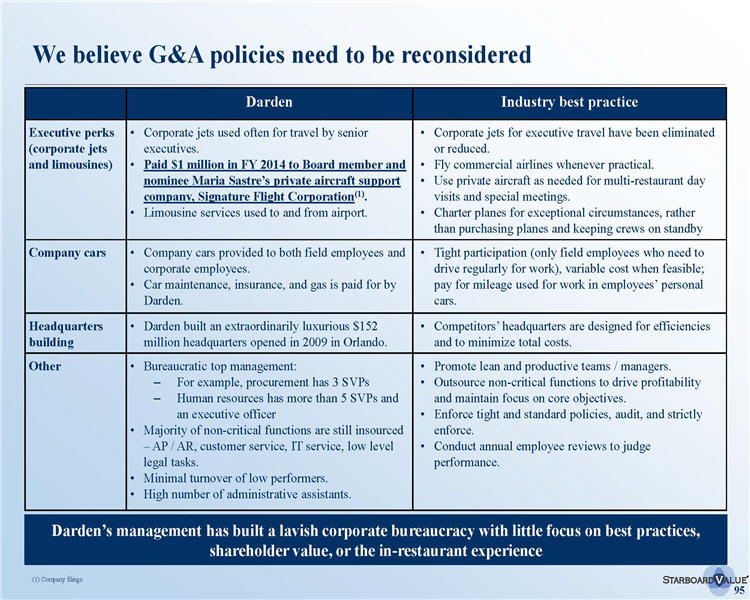

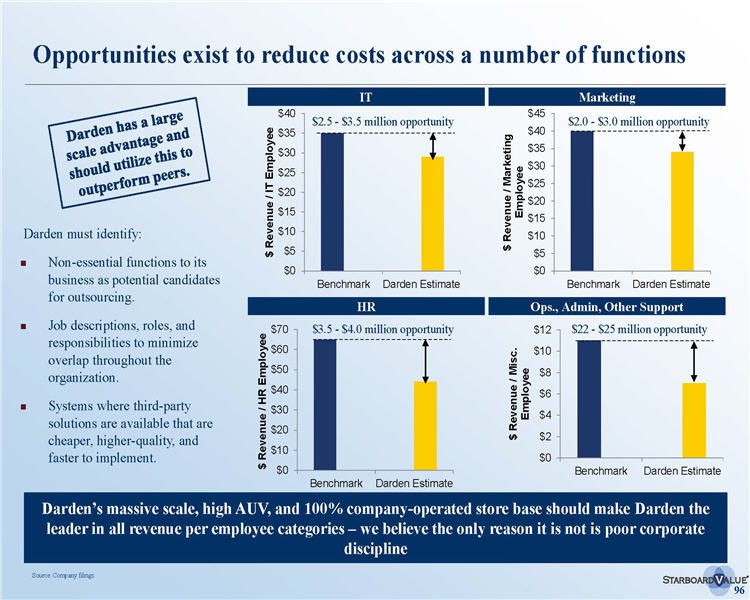

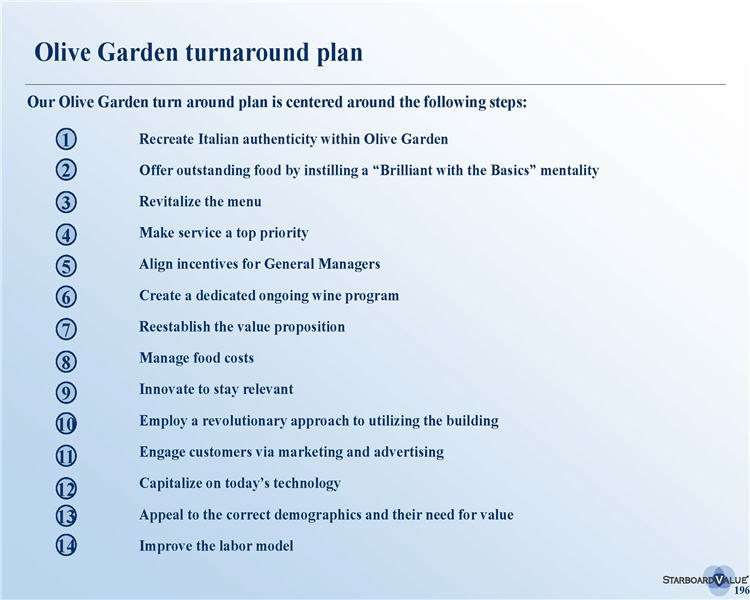

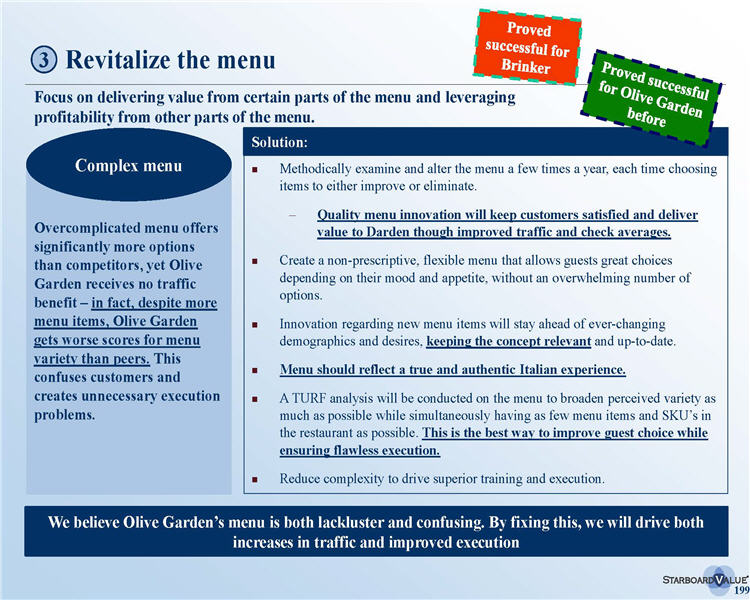

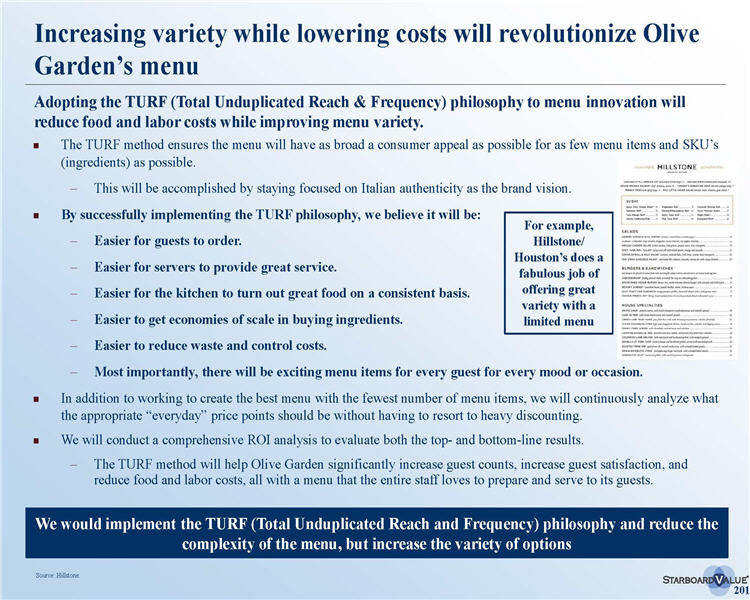

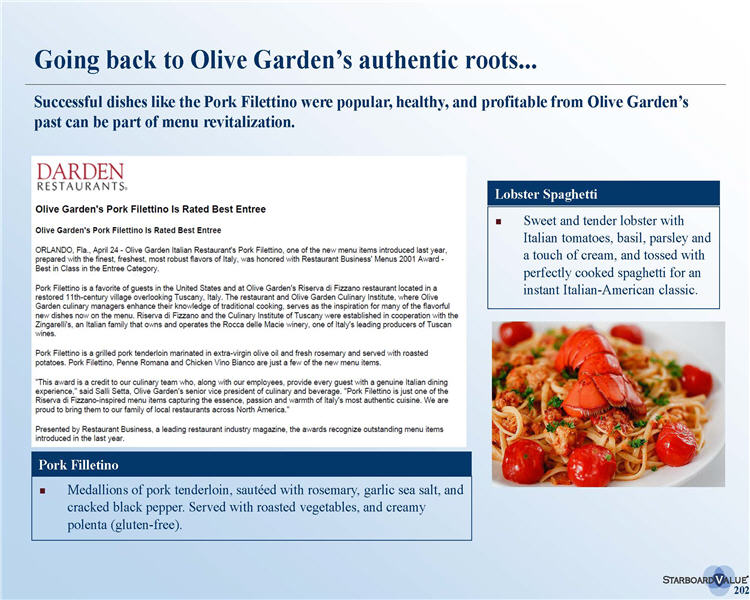

Starboard and its nominees have been collectively working together for many months to develop a comprehensive turnaround plan for Darden, which they believe will transform Darden for the benefit of Darden’s shareholders, guests, and employees. Glass Lewis stated that it is “confident that [Starboard] and its nominees have a strong handle on the situation at Darden, drawing from their experiences as executives and directors at companies that have faced similar challenges.” More importantly, Glass Lewis believes that Starboard and its nominees have presented “a plan filled with specific actions and operational initiatives, the successful implementation of which, under the proper oversight of a qualified and effective board, are likely to lead to substantially improved operational performance and enhanced shareholder value, in our view.”

All shareholders are encouraged to review the full turnaround plan of Starboard and its nominees, entitled Transforming Darden Restaurants, which can be found at http://shareholdersfordarden.com/materials-for-shareholders/

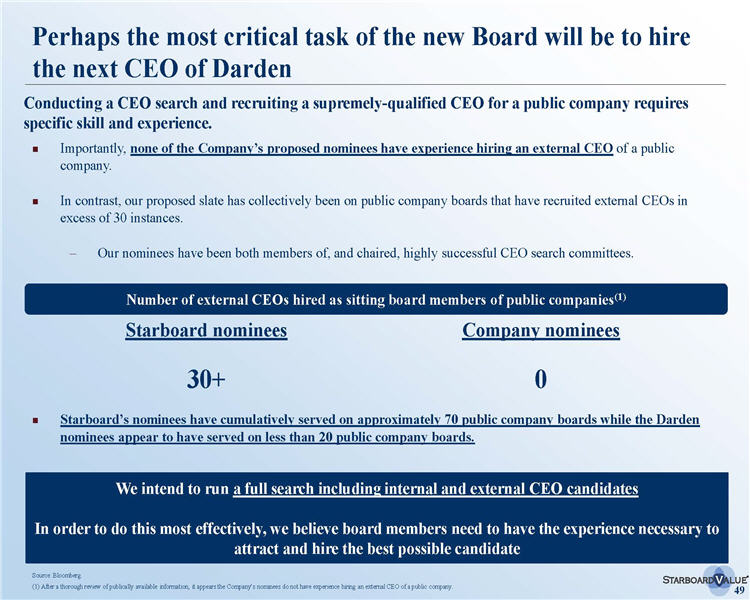

Importantly, Glass Lewis also believes that Starboard’s slate is better suited for hiring a top-tier CEO to lead Darden, stating:

“Notably, though both the Company and the Dissident stress the importance of hiring a top-tier CEO to run Darden, it’s telling that none of the Company’s director nominees have experience as part of a CEO search committee, while Starboard's nominees have collectively served on public company boards that have recruited external CEOs more than 30 times.”

Starboard was also extremely pleased to learn that corporate governance research firm, Proxy Mosaic, has also recommended that Darden shareholders vote for all twelve of Starboard’s highly qualified nominees. Like ISS and Glass Lewis, Proxy Mosaic finds Starboard’s slate of nominees “far more compelling” with “superior industry experience.” Proxy Mosaic spends a considerable portion of its extensive report thoroughly analyzing Starboard’s and management’s plans, and states that it is “overwhelmingly convinced” that Starboard’s “plan is the way forward for the Company.”

Proxy Mosaic stated in its report that the “level of detail in Starboard’s strategic plan is staggering, and illustrates the benefit of working with a slate of nominees with significant industry experience.” Proxy Mosaic also concluded:

“In contrast to the Company’s ‘brand renaissance plan’ which is long on marketing language and short on compelling ideas, the Dissident’s strategic plan has set a new standard for hedge fund activism. It is well-researched, and reflects a deep knowledge of the restaurant industry that the current board lacks.”

In reaching its conclusion that shareholders should vote for all twelve of Starboard’s highly qualified nominees on Starboard’s WHITE proxy card, Proxy Mosaic stated that it is “overwhelmingly convinced that the Dissident’s plan is the way forward for the Company. Proxy Mosaic continued, “The plan is thoughtfully designed and reflects a deep understanding of the casual dining sector that undermines the characterization of activist shareholders as being out-of-touch with industry realities and short-term-focused. . . . Not only has the Dissident presented a compelling argument that change is needed at Darden; it has also developed an insightful plan of action that, if properly executed, should drive shareholder value in the future.”

ISS, GLASS LEWIS, AND PROXY MOSAIC ALL OVERWHELMINGLY AGREE THAT STARBOARD'S COMPLETE BOARD SLATE IS THE RIGHT CHOICE FOR SHAREHOLDERS!

THE ANNUAL MEETING IS LESS THAN TWO WEEKS AWAY!

VOTE FOR THE MOST QUALIFIED SLATE OF DIRECTORS TO RESTORE AND ENHANCE THE VALUE OF YOUR DARDEN INVESTMENT

PLEASE SIGN, DATE, AND MAIL THE WHITE PROXY CARD TODAY

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC at the numbers listed below.

Starboard’s publicly filed investor materials can be accessed at www.shareholdersfordarden.com.

About Starboard Value LP

Starboard Value LP is a New York-based investment adviser with a focused and differentiated fundamental approach to investing in publicly traded U.S. small cap companies. Starboard invests in deeply undervalued small cap companies and actively engages with management teams and boards of directors to identify and execute on opportunities to unlock value for the benefit of all shareholders.

Investor contacts:

Peter Feld, (212) 201-4878

Gavin Molinelli, (212) 201-4828

www.starboardvalue.com

Okapi Partners

Bruce H. Goldfarb/Patrick McHugh

(212) 297-0720

(877) 285-5990 (Toll-Free)