March 31, 2016

VIA EDGAR AND ELECTRONIC MAIL

David L. Orlic

Special Counsel

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| | Soliciting Material on Schedule 14A |

| | Filed March 24, 2016 by Starboard Value LP et al. |

Dear Mr. Orlic:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) dated March 28, 2016 (the “Staff Letter”) with regard to the above-referenced matter filed on March 24, 2016. We have reviewed the Staff Letter with our client, Starboard Value LP (“Starboard”), and provide the following responses on Starboard’s behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meanings ascribed to them in the Soliciting Material.

General

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for such opinion or belief. Please qualify the following types of statements as beliefs in future filings and, where necessary, provide supplemental support for these statements: |

| | · | Yahoo has exhibited “poor management execution, egregious compensation and hiring practices, and general lack of accountability and oversight by the Board.” |

| | · | The sale process “has been publicly criticized repeatedly for being ... fraught with conflicts of interest….” |

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

Starboard acknowledges the Staff’s comment and hereby confirms that in future filings it will characterize Starboard’s statements of opinion or belief as such and where necessary, will provide supplemental support for such statements.

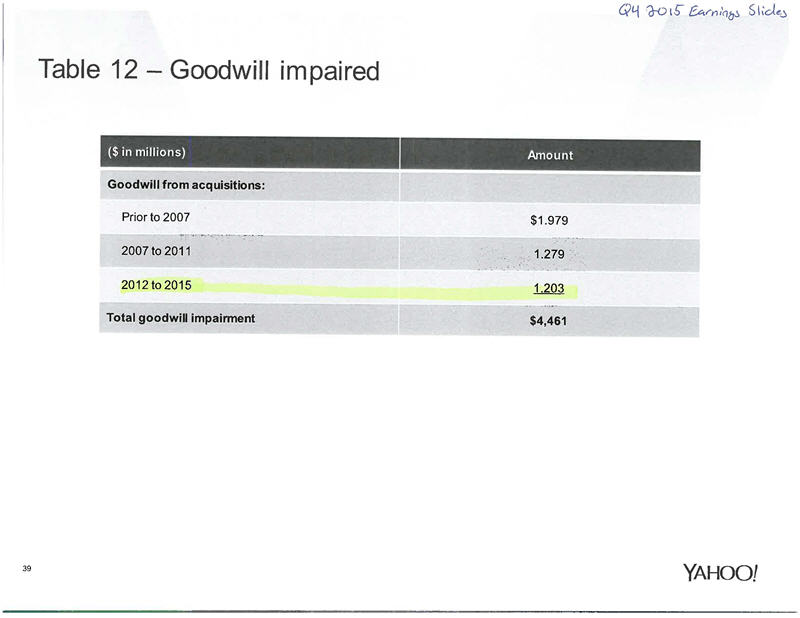

| 2. | We note statements relating to the company’s acquisition expenses since 2012, yet there is only a generic reference to the company’s filings. Please provide additional support. |

Starboard acknowledges the Staff’s comment and on a supplemental basis provides the Staff with the additional support attached hereto on Exhibit A, which includes excerpts from Yahoo’s (i) Form 10-K for the fiscal year ending December 31, 2014, (ii) Form 10-K for the fiscal year ending December 31, 2015 and (ii) Earnings Slides for the fourth quarter 2015, which provide support for Starboard’s statements relating to the Company’s acquisition expenses since 2012.

* * * * *

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

| | Sincerely, |

| | |

| | /s/ Andrew M. Freedman |

| | |

| | Andrew M. Freedman |

Enclosure

cc: Jeffrey C. Smith

Starboard Value LP

ACKNOWLEDGMENT

In connection with responding to the comments of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) in its comment letter dated March 28, 2016 (the “Staff Letter”) relating to the Soliciting Material on Schedule 14A filed by the undersigned on March 24, 2016 (the “Filing”), the undersigned acknowledges the following:

| | · | the undersigned is responsible for the adequacy and accuracy of the disclosure in the Filing; |

| | · | the Staff’s comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the Filing; and |

| | · | the undersigned may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | STARBOARD VALUE LP |

| | |

| | By: | |

| | | Name: | Jeffrey C. Smith |

| | | Title: | Authorized Signatory |

Exhibit A