UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| NEWELL BRANDS INC. |

(Name of Registrant as Specified in Its Charter) |

| |

STARBOARD VALUE LP STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD STARBOARD VALUE AND OPPORTUNITY S LLC STARBOARD VALUE AND OPPORTUNITY C LP STARBOARD LEADERS QUEBEC LLC STARBOARD LEADERS SELECT FUND LP STARBOARD T FUND LP STARBOARD LEADERS SELECT N MASTER FUND LP STARBOARD VALUE R LP STARBOARD VALUE R GP LLC STARBOARD LEADERS FUND LP STARBOARD LEADERS SELECT V GP LLC STARBOARD VALUE A LP STARBOARD VALUE A GP LLC STARBOARD VALUE GP LLC STARBOARD PRINCIPAL CO LP STARBOARD PRINCIPAL CO GP LLC JEFFREY C. SMITH MARK R. MITCHELL PETER A. FELD PAULINE J. BROWN GERARDO I. LOPEZ BRIDGET RYAN BERMAN ROBERT A. STEELE |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

April 10, 2018

Dear Fellow Newell Stockholders:

Starboard Value and Opportunity Master Fund Ltd (together with its affiliates, “Starboard” or “we”) and the other participants in this solicitation are the beneficial owners of an aggregate of 18,587,898 shares of common stock, $1.00 par value per share (the “Common Stock”), of Newell Brands Inc., a Delaware corporation (“Newell” or the “Company”), representing approximately 3.8% of the outstanding shares of Common Stock of the Company. For the reasons set forth in the attached Proxy Statement, we believe changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests. We are seeking your support for the election of our four (4) nominees at the Company’s annual meeting of stockholders scheduled to be held on Tuesday, May 15, 2018, at 9:00 a.m. local time at the W Hotel Hoboken, 225 River Street, Hoboken, New Jersey 07030 (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”).

We are seeking to elect a minority of the Board because we do not believe that the recent changes at the Company, including the agreement with Carl C. Icahn, are sufficient to address Newell’s subpar operating and financial performance. We believe poor execution and a series of operational missteps have resulted in severe share price underperformance compared to both industry peers and the broader market. Therefore, we believe that the current situation is unacceptable.

In addition, we remain disturbed by the turnover at the Board level. In late January 2018, three well-respected directors of Newell, Ian G.H. Ashken, Domenico De Sole and Martin E. Franklin, simultaneously resigned from the Board, indicating to us that there were differences of opinion in the boardroom as to the Company’s strategic direction moving forward. Shortly thereafter, two additional directors, Ros L’Esperance and Kevin C. Conroy, also resigned from the Board. We believe that the departures of these directors left a void in the boardroom and we are not convinced that the agreement with Mr. Icahn, which included the appointment of three of his direct representatives, will result in the necessary change at Newell.

We believe that the following public statement by Mr. Conroy following his resignation from the Board in March demonstrates the need for change at Newell – “I resigned because I do not believe that the current course is the optimal path forward for the company. I am not comfortable with recent events and have come to believe that change is needed.” Based on recent developments, it appears that the Company agrees change is needed. Now, it is about making sure that the right change is effected.

While the agreement with Mr. Icahn gives the appearance of substantial change, and the expanded transformation plan is a step in the right direction, we question the circumstances and motivation that drove such an accord. Our sole motivation is to ensure the most qualified directors are in place to make Newell a stronger, more profitable, and, ultimately, more valuable company, while ensuring that the best interests of all stockholders are appropriately represented in the boardroom. Starboard has nominated an experienced and accomplished group of director candidates with a shared mission of helping to oversee a turnaround of Newell.

As explained in the attached Proxy Statement, our slate of director candidates collectively possess decades of experience serving as CEOs, COOs, senior executives and directors of well-performing public companies directly related to Newell’s business. Our nominees are prepared to work with their fellow Board members, if elected, to continue to refine and implement a comprehensive strategic plan aimed at unlocking the full potential of Newell’s portfolio of industry-leading brands and ensuring that the interests of all stockholders are of paramount importance.

We firmly believe that there is significant value to be realized at Newell, and we are confident that our nominees are the right candidates to help reverse the downward trend in the Company’s performance and deliver this value for stockholders.

The Company has disclosed that there are eleven (11) directorships up for election at the Annual Meeting. Through the attached Proxy Statement, we are seeking your support at the Annual Meeting to elect not only our four (4) nominees, but also the candidates who have been nominated by the Company other than David L. Atchison, Andrew N. Langham, Courtney R. Mather and Michael A. Todman. This gives stockholders who wish to vote for our nominees the ability to vote for all eleven (11) directorships up for election. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. Your vote to elect our nominees will have the legal effect of replacing four (4) incumbent directors with our nominees.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosedBLUE proxy card today. The attached Proxy Statement and the enclosedBLUE proxy card are first being mailed to stockholders on or about April 10, 2018.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later datedBLUE proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support. |

| |

| /s/ Jeffrey C. Smith |

| |

| Jeffrey C. Smith |

| Starboard Value and Opportunity Master Fund Ltd |

If you have any questions, require assistance in voting yourBLUE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

+ 1 (212) 297-0720 (Main)

+ 1 (888) 785-6617 (Toll-Free)

Email: newellinfo@okapipartners.com

2018 ANNUAL MEETING OF STOCKHOLDERS

OF

NEWELL BRANDS INC.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

Starboard Value LP (“Starboard Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Leaders Quebec LLC (“Starboard Quebec LLC”), Starboard Leaders Select Fund LP (“Starboard Select LP”), Starboard T Fund LP (“Starboard T LP”), Starboard Leaders Select N Master Fund LP (“Starboard N LP”), Starboard Leaders Fund LP (“Starboard Leaders Fund”), Starboard Leaders Select V GP LLC (“Starboard V LLC”), Starboard Value A LP (“Starboard A LP”), Starboard Value A GP LLC (“Starboard A GP”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Jeffrey C. Smith, Mark R. Mitchell and Peter A. Feld (collectively, “Starboard” or “we”) are significant stockholders of Newell Brands Inc., a Delaware corporation (“Newell” or the “Company”), who, together with the other participants in this solicitation, beneficially own in the aggregate approximately 3.8% of the outstanding shares of common stock, $1.00 par value per share (the “Common Stock”), of the Company.

We are seeking to elect a slate of nominees to the Company’s Board of Directors (the “Board”) because we believe change in the boardroom is required to reverse the Company’s significant underperformance under current leadership. We have nominated a slate of highly qualified and capable candidates with relevant backgrounds and industry experience who we believe, if elected, will bring the talented leadership and responsible oversight necessary to implement a successful turnaround of Newell. We are seeking your support at the annual meeting of stockholders scheduled to be held on Tuesday, May 15, 2018, at 9:00 a.m. local time at the W Hotel Hoboken, 225 River Street, Hoboken, New Jersey 07030 (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect Starboard’s four (4) director nominees, Pauline J. Brown, Gerardo I. Lopez, Bridget Ryan Berman and Robert A. Steele(each a “Nominee” and collectively, the “Nominees”) to serve until the 2019 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year 2018; |

| 3. | To vote on an advisory resolution to approve executive compensation; |

| 4. | To vote on a stockholder proposal, if properly presented at the Annual Meeting; and |

| 5. | To transact such other business as may properly come before the Annual Meeting. |

The Company has disclosed that there are eleven (11) directorships up for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect not only our four (4) Nominees, but also the candidates who have been nominated by the Company other than David L. Atchison, Andrew N. Langham, Courtney R. Mather and Michael A. Todman. This gives stockholders who wish to vote for our Nominees the ability to vote for all eleven (11) directorships up for election. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. Your vote to elect our Nominees will have the legal effect of replacing four (4) incumbent directors with our Nominees. See “Voting and Proxy Procedures” below for additional information.

The participants in this solicitation intend to vote their shares (the “Starboard Group Shares”)FOR the election of the Nominees,FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year 2018,AGAINSTthe advisory resolution to approve executive compensation andFOR the stockholder proposal regarding action by written consent, as described herein. While we currently intend to vote all of the Starboard Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results at such time, that by voting the Starboard Group Shares we could help elect the Company nominee(s) that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosedBLUEproxy card will be voted at the Annual Meeting as marked.

The Company has set the close of business on March 16, 2018 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 221 River Street, Hoboken, New Jersey 07030. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were approximately 485,656,275 shares of Common Stock outstanding.

This Proxy Statement and the enclosedBLUE proxy card are first being mailed to stockholders on or about April 10, 2018.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSEDBLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THEBLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSEDBLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our BLUE proxy card are available at

www.okapivote.com/newell

www.transformingnewell.com

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed BLUE proxy card today to vote FOR the election of the Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosedBLUEproxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”), in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with aBLUE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our four (4) Nominees only on ourBLUE proxy card. So please make certain that the latest dated proxy card you return is theBLUE proxy card.

If you have any questions, require assistance in voting yourBLUE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

+ 1 (212) 297-0720 (Main)

+ 1 (888) 785-6617 (Toll-Free)

Email: newellinfo@okapipartners.com

BACKGROUND TO THE SOLICITATION

The following is a chronology of events leading up to this proxy solicitation:

| · | On January 21, 2018, Ian G.H. Ashken, Domenico De Sole and Martin E. Franklin notified the Company of their resignations from the Board, effective immediately. |

| · | On January 25, 2018, the Company announced that it will explore a series of strategic initiatives to accelerate its transformation plan, including divestitures of its industrial and commercial product assets as well as its smaller consumer businesses. On the same day, the Company also announced the resignations of Messrs. Ashken, De Sole and Franklin from the Board and that the size of the Board had been reduced to nine (9) members. |

| · | Later on January 25, 2018, representatives of Starboard approached Mr. Franklin to discuss Starboard’s views on the Company, which led to subsequent discussions with Messrs. Ashken, De Sole and Franklin and James E. Lillie, the former Chief Executive Officer of Jarden Corporation (“Jarden”), regarding the changes that Starboard believes would be necessary to create significant value for stockholders at Newell. |

| · | On February 8, 2018, the Group Agreement (as defined and described under the “Proposal No. 1” section below) was entered into by and among (i) Starboard (other than Starboard N LP and Starboard V LLC), (ii)Mariposa Associates, LLC (“Mariposa Associates”) and Messrs. Ashken, Lillie and Franklin (collectively with Mariposa Associates, “Mariposa”) and (iii) Mr. De Sole, Bradley A. Alford, Pauline J. Brown, Gerardo I. Lopez and Charles M. Sonsteby. Also on February 8, 2018, Starboard and Mariposa came to an understanding regarding a suggested compensation arrangement for Mariposa and Messrs. Lillie and Franklin in the event the Nominees are elected to the Board and Messrs. Lillie and Franklin are installed as the Company’s Chief Executive Officer and Chairman, respectively. |

| · | Later on February 8, 2018, Starboard delivered a letter (the “Nomination Letter”) to the Company, in accordance with its organizational documents, nominating Messrs. Alford, Ashken, De Sole, Franklin, Lillie, Lopez and Sonsteby, Ms. Brown, Peter A. Feld and Jeffrey C. Smith for election to the Board at the Annual Meeting. In the Nomination Letter, Starboard stated its belief that the terms of nine (9) directors currently serving on the Board expire at the Annual Meeting, and, if this remains the case, Starboard will withdraw one (1) of its Nominees. Starboard also expressly reserved its right to nominate additional director candidates for any newly created director seats to the extent that the Company increases the size of the Board beyond the current nine (9) director seats that existed as of the date of the Nomination Letter. |

| · | On February 8, 2018, Mr. Smith called Michael B. Polk, Chief Executive Officer of Newell, to discuss the nomination. Mr. Smith also called Michael T. Cowhig, then the Chairman of the Board of Newell, and left him a message to inform him of the nomination. |

| · | On February 9, 2018, Mr. Franklin called Mr. Polk to inform him of the nomination. Mr. Franklin also called Mr. Cowhig and left him a message to inform him of the nomination. |

| · | Also on February 9, 2018, the Company publicly confirmed receipt of the Nomination Letter. |

| · | On February 12, 2018, Starboard issued a public letter to Mr. Polk and the Board expressing Starboard’s serious concerns regarding the Company’s significant underperformance under the current leadership team. In the letter, Starboard confirmed that it nominated a full slate of director candidates (including three former, seasoned operators of Jarden and a former long-time director of Newell) to oversee a turnaround of the Company. Starboard made clear that it is open to engaging in a constructive dialogue with the Company regarding its strategy and leadership, but that Starboard believes that significant changes are necessary to put Newell on a path to creating meaningful value for stockholders. |

| · | On February 22, 2018, the Company announced that, effective on February 21, 2018, the size of the Board was increased from nine (9) to eleven (11) members and James R. Craigie and Debra A. Crew were appointed as directors. The Company also announced that it intends to nominate Judith A. Sprieser to the Board at the Annual Meeting; however, the Company did not specify whether the Board will be further expanded to twelve (12) members to accommodate Ms. Sprieser’s nomination or whether an incumbent director will not stand for re-election at the Annual Meeting. |

| · | On February 27, 2018, Ros L’Esperance notified the Company of her resignation from the Board, effective immediately. |

| · | On March 1, 2018, the Company announced that Ms. L’Esperance had resigned from the Board, but did not make any disclosure concerning the number of director seats that will be up for election at the Annual Meeting. |

| · | On March 3, 2018, Ms. Ryan Berman and Mr. Steele entered into a Joinder Agreement with the other parties to the Group Agreement pursuant to which they agreed to become parties to the Group Agreement and be bound by the terms and conditions thereof. |

| · | Later on March 3, 2018, Starboard delivered a supplemental notice to the Company notifying the Company of its additional nomination of Ms. Ryan Berman and Mr. Steele for election to the Board at the Annual Meeting. |

| · | On March 4, 2018, Kevin C. Conroy notified the Company of his resignation from the Board, effective immediately. |

| · | On March 5, 2018, Starboard issued a public letter to the Company’s stockholders reiterating its serious concerns regarding Newell’s deteriorating operating performance under the current leadership team and noting that its corporate governance concerns have escalated following another incumbent director’s resignation from the Board. In the letter, Starboard also announced its additional nomination of Ms. Ryan Berman and Mr. Steele for election to the Board at the Annual Meeting in response to the Company’s unilateral expansion of the Board. |

| · | Also on March 5, 2018, Starboard delivered a letter to the Board explaining its concerns that, should the result of the election of directors at the Annual Meeting be that Starboard’s candidates constitute a majority of the Board, their appointment could trigger certain change in control provisions under certain of the Company’s material contracts and agreements unless they have been approved by the current Board in advance of such election. Accordingly, in order to maintain a level playing field, and to allow stockholders to make their voting decisions based solely on the merits, the letter requested written confirmation from the Company that, prior to the Annual Meeting, the Board will take all necessary steps to use its discretionary authority under such agreements to certify Starboard’s candidates as “continuing directors” and otherwise approve of their nomination such that the change in control provisions would not be triggered by the election of Starboard’s candidates to serve on the Board. Starboard also noted its belief that the failure to provide such an approval would constitute a breach of the Board’s fiduciary duties under Delaware law. Starboard requested to receive a response no later than March 9, 2018. |

| · | On March 6, 2018, Starboard filed its preliminary proxy statement in connection with the Annual Meeting. |

| · | On March 8, 2018, the Company announced that Mr. Conroy had resigned from the Board, but did not make any disclosure concerning the number of director seats that will be up for election at the Annual Meeting. |

| · | On March 9, 2018, Starboard issued a public letter to the Company’s stockholders commenting on Mr. Conroy’s resignation, which represented the fifth resignation of an incumbent director from the Board since late January 2018. In the letter, Starboard expressed its belief that the recent director departures demonstrate that significant change is required immediately at Newell. |

| · | Also on March 9, 2018, Starboard received a letter from the Company, in response to Starboard’s March 5th letter regarding change in control provisions in certain of the Company’s material agreements, indicating that the Board would give due consideration to the issues implicated by the change in control provisions in certain of the Company’s debt instruments. |

| · | On March 12, 2018, Mr. Conroy publicly indicated his support for Starboard’s efforts to turn around Newell. |

| · | Later on March 12, 2018, Starboard issued a press release commenting on Mr. Conroy’s public support for Starboard’s efforts to effect change at Newell. |

| · | Also on March 12, 2018, Starboard N LP and Starboard V LLC entered into a Joinder Agreement with the other parties to the Group Agreement pursuant to which they agreed to become parties to the Group Agreement and be bound by the terms and conditions thereof. |

| · | On March 14, 2018, Starboard issued a press release announcing that Messrs. Ashken, Franklin and Lillie have committed to purchase an aggregate of $25 million worth of Newell stock with their personal capital in the open market if Starboard successfully replaces the Board at the Annual Meeting. |

| · | Also on March 14, 2018, the independent members of the Board issued an open letter to the Company’s stockholders. |

| · | On March 15, 2018, at Starboard’s request, Mr. Smith and other representatives of Starboard met with Mr. Polk and representatives of Goldman Sachs. During the meeting, the parties discussed the current plans at Newell and Starboard’s belief that there is a need for substantial change. |

| · | On March 16, 2018, Carl C. Icahn and certain of his affiliates (collectively, the “Icahn Group”) filed a Schedule 13D with respect to the Company indicating that the Icahn Group had not decided whether to support management or Starboard. |

| · | On March 18, 2018, Starboard became aware that the Company may be having discussions with Mr. Icahn so Mr. Smith contacted Mr. Polk to inform him that to the extent Newell is having settlement discussions with Mr. Icahn, Starboard would be willing to discuss a broader amicable resolution involving Starboard and Mr. Icahn to avoid a proxy contest. Mr. Polk advised Mr. Smith that he would take this information under consideration and get back to him. Mr. Smith never heard back from Mr. Polk. |

| · | Subsequently on March 18, 2018, the Company and the Icahn Group entered into a Director Appointment and Nomination Agreement (the “Icahn Agreement”) pursuant to which Patrick D. Campbell, Brett Icahn, Andrew Langham and Courtney R. Mather were appointed to the Board (each of whom, other than Mr. Campbell, is an employee/consultant of the Icahn Group) and Mr. Cowhig, Thomas E. Clarke, Scott S. Cowen and Raymond G. Viault resigned from the Board, effective as of March 18, 2018. Mr. Campbell was also appointed as Chairman of the Board and the Company agreed to include another individual designated by the Icahn Group on the Company’s slate of director candidates for election at the Annual Meeting. |

| · | On March 19, 2018, the Company issued a press release announcing the Icahn Agreement and the expansion of its accelerated transformation plan. The Company also disclosed that eleven (11) director seats will be up for election at the Annual Meeting. |

| · | On March 20, 2018, Starboard issued a statement in connection with its investment in the Company. Starboard noted that, since its involvement, eight (8) of the eleven (11) directors who will be on the Board as of the Annual Meeting will be new, including a new Chairman. Starboard also expressed its belief that the Company should explore strategic alternatives for all of its businesses while simultaneously focusing on operational improvements. In addition, Starboard disclosed that Messrs. Ashken, De Sole, Franklin and Lillie would be withdrawing their names from consideration for election to the Board and that, if Starboard decides to move forward with its election contest, it would reduce its slate to a minority of the Board. |

| · | Later on March 20, 2018, the parties to the Group Agreement executed a Termination of Group Agreement pursuant to which Mariposa terminated its participation in the Group Agreement. In connection therewith, the understanding between Starboard and Mariposa regarding a suggested compensation arrangement for Mariposa and Messrs. Lillie and Franklin was similarly terminated. Messrs. Ashken, De Sole, Franklin and Lillie were also removed as parties to the Group Agreement. |

| · | On March 23, 2018, the Company filed its preliminary proxy statement in connection with the Annual Meeting. |

| · | On March 26, 2018, Starboard delivered a notice to the Company formally withdrawing its nominations of Messrs. Ashken, De Sole, Franklin and Lillie for election to the Board at the Annual Meeting. |

| · | On March 27, 2018, Starboard received a letter from the Company in which Newell provided multiple examples of how the reconstituted Board’s views align with those of Starboard. |

| · | On March 28, 2018, at Starboard’s request, Mr. Smith and another representative of Starboard met with Mr. Campbell and a representative of Goldman Sachs. During the meeting, the parties discussed general management philosophy, the substantial challenges and opportunities at Newell and Starboard’s belief that the Icahn Agreement was a disservice to stockholders and employees of the Company. |

| · | On April 2, 2018, the Company announced that David L. Atchison, a director designated by the Icahn Group pursuant to the Icahn Agreement, would be standing for election at the Annual Meeting. |

| · | On April 4, 2018, the Company filed its definitive proxy statement in connection with the Annual Meeting. |

| · | On April 9, 2018, Messrs. Alford and Sonsteby were removed as parties to the Group Agreement. |

| · | On April 10, 2018, Starboard filed its definitive proxy statement in connection with the Annual Meeting. |

REASONS FOR THE SOLICITATION

WE BELIEVE THE TIME FOR CHANGE ISNOW

Newell’s product portfolio consists of many iconic and valuable franchises, representing market-leading brands that operate in both niche and large, growing and unconsolidated global categories. After the acquisition of Jarden in April 2016, Newell formed one of the largest global providers of consumer and commercial products, with pro forma annualized revenues of more than $16 billion and a stated strategy to get larger to drive more economies of scale. This combination was intended to establish a best-in-class brand portfolio with unmatched growth potential and the opportunity to realize sizeable revenue and cost synergies. Unfortunately, Newell’s recent operating and financial performance have fallen well below both the expectations set by the Board and the Company’s true potential. In less than two years, we believe Newell’s current management team has made critical missteps in integrating and operating the businesses, resulting in poor financial performance and disastrous stock price performance.

We do not have confidence that the Board, as currently composed, will take the necessary steps to reverse this underperformance and maximize opportunities for value creation. Notwithstanding recent changes at Newell, we believe further change is needed on the Board to ensure that the interests of all stockholders are appropriately represented in the boardroom. Therefore, we are soliciting your support at the Annual Meeting to elect our Nominees, who we believe would bring significant and relevant experience to the Board along with a commitment to work with their fellow Board members, if elected, to continue to refine and implement a strategic plan to realize Newell’s potential.

The Current Leadership Team has Overseen Tremendous Value Destruction Since the Jarden Acquisition

In April 2016, Newell closed the largest acquisition in its history by purchasing Jarden for more than $18 billion in cash and stock (including debt assumed, net of cash acquired). This was a transformational transaction as Newell more than doubled its revenue, tripled its employee base and significantly increased its financial leverage. At the time of the closing of the Jarden acquisition, the combined Company formed one of the largest global providers of consumer and commercial products, with pro forma revenues of more than $16 billion and a stated strategy to get larger to drive more economies of scale. These aspects of the transaction were memorialized in guidance to stockholders of “strong growth” and significantly improved profitability for the combined business.

While the acquisition of Jarden was intended to establish a best-in-class brand portfolio with unmatched growth potential and the opportunity to realize sizeable revenue and cost synergies, it has proven to be disastrous for Newell stockholders under the current leadership team.

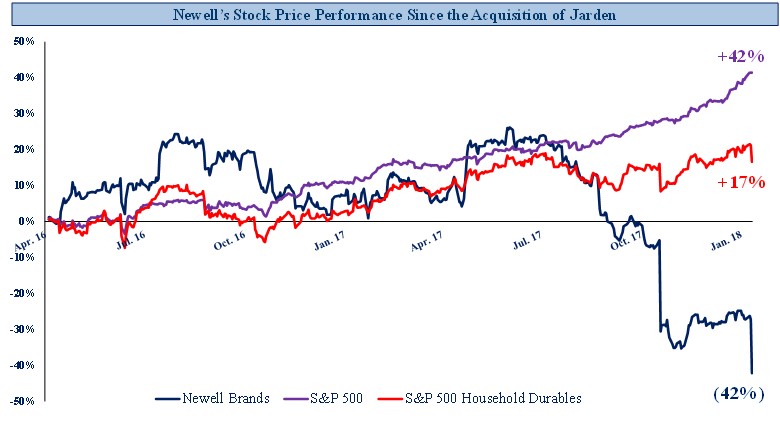

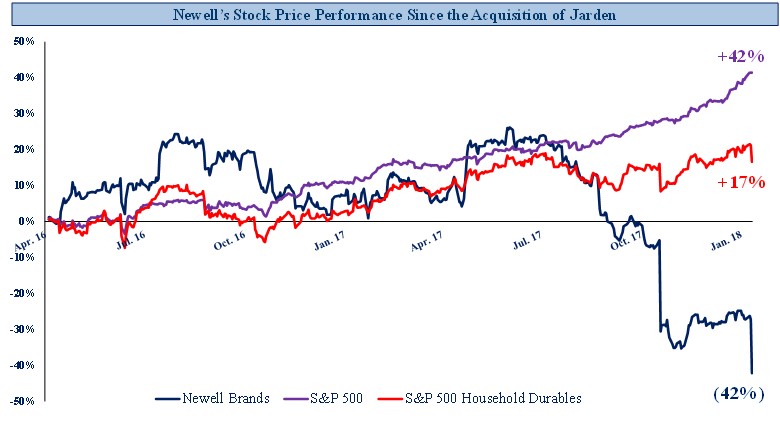

Source: Capital IQ; Stock price performance from April 18, 2016 (first day of trading as a combined company following Jarden acquisition) to January 25, 2018 (day of Newell preannouncement of preliminary 2017 results, initial 2018 guidance and announcement of Board changes)

In fact, since the closing of the Jarden acquisition, Newell’s stock price has declined by over 42% while the S&P 500 has increased by over 41%, resulting in cumulative underperformance of approximately 84%.1This massive share price underperformance has resulted in Newell trading at less than 10x the analyst consensus estimate for 2018 EPS, both a multi-year low and a substantial discount to its peers2 and the broader market. Furthermore, since July 1, 2017, Newell’s stock price has declined by over 53% while the S&P 500 has increased by over 18%, resulting in underperformance of approximately 72%.

Operational Missteps Have Led to Value Destruction at Newell

Unfortunately, in less than two years, we believe Newell’s current management team has made critical missteps in integrating and operating the businesses, resulting in poor financial performance. Stockholders have suffered through several guidance reductions and a worrisome future outlook due to significant declines in profitability. As shown in the chart below, despite projecting, on Newell’s Q4 2015 earnings call, to achieve $3 billion of EBITDA and 20% EBITDA margins within the next few years, the reality has been much worse – revenues have stagnated and margins continue to deteriorate.

1 Calculated from April 18, 2016 (first day of trading as a combined company following Jarden acquisition) to January 25, 2018 (day of Newell preannouncement of preliminary 2017 results, initial 2018 guidance and announcement of Board changes).

2 The Company’s peers referred to herein consist of Tupperware Brands Corporation (TUP), Reckitt Benckiser Group plc (RB LN), Colgate-Palmolive Company (CL), Prestige Brands Holdings, Inc. (PBH), The Procter & Gamble Company (PG), Henkel AG & Co. KGaA (HEN GY), Church & Dwight Co., Inc. (CHD), The Clorox Company (CLX), Stanley Black & Decker, Inc. (SWK), Spectrum Brands Holdings, Inc. (SPB) and Fortune Brands Home & Security, Inc. (FBHS).

Source: Company filings; Newell management commentary; Starboard estimates.

Adjusted EBITDA calculated as: Adjusted Operating Income + Depreciation & Amortization – Amortization of Intangibles. Adjusted EBITDA Margin calculated as: EBITDA / Net Sales.

(1) Starboard estimates based on management guidance as per earnings announcement on February 16, 2018 (assumes (i) Net Sales will be flat to slightly negative in 2018 based on recent historical trends and management commentary, with stabilization in 2019, (ii) slight decrease in Gross Margin based on management commentary, (iii) keeping SG&A in-line with most recent fiscal year and (iv) keeping Depreciation & Amortization at a constant 2.5% of Net Sales).

In fact, following the announcement of full year 2017 results and the Company’s latest 2018 outlook, we estimate that management’s EBITDA guidance for 2018 has fallen 20% below its original post-merger target. Since the consummation of the merger, Newell stockholders have lost more than $11 billion of value despite meaningful gains for the Company’s peer group and the broader market. Moreover, given management’s seeming inability to forecast future performance, we are concerned not only by the quality of the historical earnings, but also by the achievability of the 2018 projections.

These Missteps Have Led to Upheaval at the Board Level

In late January 2018, the resignations of three well-respected directors – Martin E. Franklin, Ian G.H. Ashken and Domenico De Sole, the last of whom had served on the Board of Newell and Newell Rubbermaid Inc. (“Legacy Newell”) for over ten years – signaled to stockholders, in our view, that there was serious discord on the Board. It is an extraordinary step for three directors, who collectively have decades of relevant industry experience, to simultaneously resign from a public company board of directors. Their resignations demonstrated to us that there was Board dysfunction and serious concern regarding the troubling underperformance in 2017 and the future strategy and direction of Newell.

While the extraordinary actions of Messrs. Franklin and Ashken might be spun to be a disagreement between the former directors of Jarden and former directors of Legacy Newell, the resignation of Mr. De Sole, a longtime Legacy Newell director, confirms, to us, the severe governance deficiencies at the Company. To us, these resignations were sufficient to cause serious concern about the functionality of the Board. This concern was exacerbated when, on February 27, 2018, yet another director (Ros L’Esperance) resigned from the Board and then just days later, on March 4, 2018, a fifth director (Kevin C. Conroy) resigned from the Board, further highlighting, in our opinion, the dysfunction and need for substantial change. Again, these were the fourth and fifth directors to abruptly resign from the Board. With the Company’s Annual Meeting expected to take place in approximately two months, the normal course of action, if there was no disagreement, would, in our view, be for a director to simply not stand for reelection. For Mr. Conroy and Ms. L’Esperance to resign within such close proximity to the anticipated date of the Annual Meeting is truly alarming. We believe that the departures of these directors left a void in the boardroom and we are not convinced that the agreement with Carl C. Icahn, which included the appointment of three of his direct representatives, brings about the necessary change at Newell.

We believe that the following public statement by Mr. Conroy following his resignation from the Board in March demonstrates the need for change at Newell – “I resigned because I do not believe that the current course is the optimal path forward for the company. I am not comfortable with recent events and have come to believe that change is needed.”3Based on recent developments, it appears that the Company agrees that change is needed. Now, it is about making sure that the right change is effected.

To be clear, our sole motivation with this election contest is to ensure the most qualified directors are in place to make Newell a stronger, more profitable, and, ultimately, more valuable company, while ensuring that the best interests of all stockholders are appropriately represented in the boardroom.

WE BELIEVE THERE IS A BETTER PATH FORWARD

While these have been extremely challenging times for Newell, we believe that the recent poor financial and stock price performance has created a unique opportunity to invest in an iconic company and embark on a multi-year operational turnaround that can deliver outstanding returns to stockholders. We do not believe that the current management team or Board have followed through on their commitments, and we believe further change is necessary in order to drive stockholder value at Newell.

We are confident that we have assembled the right people to assist in refining and implementing a plan that will result in substantial value creation for the benefit of all Newell stockholders. Our slate consists of executives with unique perspectives directly relevant to the Company’s current businesses and challenges, including consumer operations, finance, mergers and acquisitions, restructuring, strategic transformations, and board governance and oversight who collectively have decades of experience serving as CEOs, COOs, senior executives and directors of well-performing public companies directly related to Newell’s business.

If elected, our Nominees are prepared to work with their fellow Board members to continue to refine and implement a comprehensive strategic plan aimed at unlocking the full potential of Newell's enviable portfolio of industry-leading brands and ensuring that the interests of all stockholders are of paramount importance.

3See Bloomberg article published on March 12, 2018 by Melissa Mittelman and Scott Deveau.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company has disclosed that eleven (11) director seats are up for election at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our Nominees, Pauline J. Brown, Gerardo I. Lopez, Bridget Ryan Berman and Robert A. Steele, in opposition to four (4) of the Company’s director nominees. Your vote to elect the Nominees will have the legal effect of replacing four (4) incumbent directors with the Nominees. If elected, our Nominees will represent a minority of the members of the Board. Accordingly, there can be no assurance that any actions or changes proposed by our Nominees will be adopted or supported by the full Board.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company is set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States of America.

Pauline J. Brown, age 50, is an experienced executive with more than 25 years of experience in consulting, private equity and brand management. Most recently, Ms. Brown was a Senior Lecturer at Harvard Business School during the 2016 and 2017 academic years. Prior to that, Ms. Brown served as Chairman, North America for LVMH Moët Hennessy Louis Vuitton, S.E. (“LVMH”) (EPA:MC), a European multinational leading luxury goods conglomerate, where she worked from January 2013 to December 2015. During her tenure, Ms. Brown focused on strengthening the U.S. performance for LVMH’s brands, including Louis Vuitton, Christian Dior, Sephora, Hennessy, Veuve Clicquot and dozens of other luxury brands. She also served on the board of L Capital, the private equity arm of LVMH. From 2010 to 2013, Ms. Brown served as an independent advisor to investors in premium consumer brands, including NEO Investment Partners LLP (f/k/a Neo Capital), a private equity firm. From 2006 to 2009, Ms. Brown was a Managing Director at The Carlyle Group LP (NASDAQ:CG), a multinational private equity, alternative asset management and financial services firm, where she focused on buyout opportunities in the consumer and retail industries. From 2005 to 2006, she was the Senior Vice President of Corporate Strategy and Global Business Development at Avon Products Inc. (“Avon”) (NYSE:AVP), a direct selling company in beauty, household and personal care categories. While at Avon she was responsible for driving key components of a major turnaround plan and exploring and evaluating business opportunities to reach new markets and new customers. Prior to Avon, Ms. Brown joined Estée Lauder Companies Inc. (“Estee Lauder”) (NYSE:EL), an American manufacturer and marketer of prestige skincare, makeup, fragrance and hair care products, in 1997 and spent more than eight years as the Vice President of Corporate Strategy and New Business Development in charge of all mergers, acquisitions and licensing deals. During her tenure, Ms. Brown helped to expand the Estee Lauder’s portfolio from eight to 25 distinct beauty brands. Before joining Estee Lauder, Ms. Brown was a Management Consultant at Bain & Company, a top management consulting firm. Since April 2017, Ms. Brown has served on the Board of Directors of Del Frisco's Restaurant Group, Inc. (NSADAQ:DFRG), a leader in the full-service steakhouse industry. Ms. Brown also previously served as a director of several private companies including Moncler S.p.A., an Italian apparel company, and Philosophy, Inc., a manufacturer of beauty products. She also is on the Board of Governors of the Parsons School of Design. Since 2008, she has been a Henry Crown Fellow at the Aspen Institute, an international nonprofit think tank, and, in 2013, she was elected to the Henry Crown Board of Overseers. She previously was a director and member of the Executive Committee of the National Retail Federation Inc., the world's largest retail trade association. Ms. Brown earned an M.B.A. from The Wharton School of the University of Pennsylvania, where she is a member of the Executive Alumni Board, and a B.A. from Dartmouth College.

Starboard believes that Ms. Brown’s strategic and business development experience across a wide range of consumer brands will enable her to provide insight regarding developing and implementing strategies for growing the Company’s business, thus making her a valuable addition to the Board.

Gerardo I. Lopez, age 58, served as President, Chief Executive Officer and a director of each of Extended Stay America, Inc. and ESH Hospitality, Inc. (paired together as NYSE:STAY), the largest integrated owner/operator of company-branded hotels in North America, from August 2015 through December 2017. From March 2009 to August 2015, Mr. Lopez was the President, Chief Executive Officer and a director of AMC Entertainment Holdings, Inc. (“AMC”) (NYSE:AMC), the world’s largest theatrical exhibition company. Prior to joining AMC, he served as Executive Vice President of Starbucks Corporation (NASDAQ:SBUX), the premier roaster, marketer and retailer of specialty coffee, where he also served as President of its Global Consumer Products, Seattle’s Best Coffee and Foodservice divisions, from 2004 to 2009. From 2001 to 2004, Mr. Lopez served as President of the Handleman Entertainment Resources division of Handleman Company, a former music distribution company. Mr. Lopez also previously held a variety of executive management positions with International Home Foods, Inc. (formerly NYSE:IHF), the Frito-Lay and Pepsi-Cola divisions of PepsiCo, Inc. (NASDAQ:PEP) and The Procter & Gamble Company (NYSE:PG). Mr. Lopez currently serves as a director of each of Brinker International, Inc. (NYSE:EAT), a casual dining restaurant company that owns the Chili’s and Maggiano’s restaurant brands (since February 2013), and CBRE Group, Inc. (NYSE:CBG), the world’s largest commercial real estate services and investment firm (since October 2015). Mr. Lopez has also previously served as a director of other public and private companies including TXU Corp. (n/k/a Energy Future Holdings Corp.) (formerly NYSE:TXU), an electric utility company (2006-2007); Safeco Corporation (formerly NYSE:SAF), an insurance company (2008); National CineMedia, Inc. (NASDAQ:NCMI), a cinema advertising company (2009-2012), Digital Cinema Implementation Partners, LLC, the largest digital cinema integrator in the world (2009-2015), Recreational Equipment, Inc. (REI), a specialty outdoor retailer (2011-2015), and Open Road Films, LLC, a film production and distribution company (2012-2015). Mr. Lopez holds a B.A. from George Washington University and an M.B.A. from Harvard Business School.

Starboard believes that Mr. Lopez’s deep public-company experience across diverse consumer-focused industries, both as an executive and a director, will allow him to provide valuable insight to the Board.

Bridget Ryan Berman, age 57, has served as the Managing Partner of Ryan Berman Advisory, LLC, a consumer and investment advisory firm, since January 2018. Prior to that, Ms. Ryan Berman worked as the Chief Experience and Strategy Officer at ENJOY Technology, Inc., a provider of setup and training services for tech products, from June 2016 to January 2018, and as a Management Consultant at Google Inc., a multinational technology company and subsidiary of Alphabet Inc. (NASDAQ:GOOG, GOOGL), where she consulted on consumer and retail strategies from February 2016 to June 2016. Ms. Ryan Berman also served as Chief Executive Officer of Victoria’s Secret Direct, LLC, an online and catalogue division of Victoria’s Secret, a specialty retailer of women’s lingerie, beauty products, apparel and accessories, from November 2011 to December 2015. Previously, Ms. Ryan Berman served as a Management Consultant for various retail brands, consulting on business strategy, merchandising, marketing and organizational development from 2008 to 2011, as the Chief Executive Officer of the Giorgio Armani Corporation, a U.S. subsidiary of Giorgio Armani S.p.A., a leading fashion and luxury goods company, from 2006 to 2007, and as Vice President and Chief Operating Officer of Retail Stores for Apple Computer, Inc. (NASDAQ:APPL), a multinational technology company, from 2004 to 2005. She also served in a variety of positions at Polo Ralph Lauren Corporation (NYSE:RL), a lifestyle products company, over a 14-year period beginning in 1992, most recently as Group President of Polo Ralph Lauren Global Retail, and President and Chief Operating Officer at Polo Ralph Lauren Retail. Ms. Ryan Berman has served on the board of directors of Tanger Factory Outlet Centers, Inc. (NYSE:SKT), a real estate company that owns the Tanger Outlets, since 2009. She also is the Founder and Director of MiracleFeet, a non-profit organization. Ms. Ryan Berman has served on the Advisory Council of the Pamplin College of Business at Virginia Tech University since 2005, earned a Distinguished Alumni Award from the University in 2006 and served as the University’s Commencement Speaker. She previously served on the board of directors of J Crew Group, Inc., a multi-brand, multi-channel, specialty retailer, from 2005 to 2006. She holds a B.S. from Virginia Tech University.

Starboard believes that Ms. Ryan Berman’s executive leadership experience, including her expertise as a seasoned operator of several of the world’s largest retail brands, will make her a valuable addition to the Board.

Robert A. Steele, age 62, has served on the board of directors of Berry Global Group, Inc. (NYSE:BERY), a provider of value-added plastic consumer packaging, non-woven specialty materials and engineered materials, since October 2014, on the board of directors of LSI Industries Inc. (NASDAQ:LYTS), a provider of corporate visual image solutions to the petroleum/convenience store industry, since July 2016, as Senior Advisor to CVC Capital Advisors, a division of a private equity and investment advisory firm, since November 2011, and as Founder of STEELE Consulting LLC, a consulting firm, since July 2012. In September 2011, Mr. Steele retired from Procter & Gamble Co. (NYSE:PG), a provider of branded consumer packaged goods, as its Vice Chairman Health Care. During his 35-year tenure with Procter & Gamble, he served in a variety of executive leadership positions, including Vice Chairman Global Health and Well-being, Group President Global Household Care and Group President of North American Operations. Mr. Steele previously served on the board of directors of Beam Inc. (formerly NYSE: BEAM), from December 2011 until its acquisition by Suntory Holdings Limited in April 2014, Keurig Green Mountain Inc. (formerly NASDAQ:GMCR), from June 2013 until its acquisition by a JAB Holding Company led investor group in March 2016, and Kellogg Company (NYSE:K), a multinational food manufacturing company, from July 2007 to January 2012. Mr. Steele also served on the board of directors of the United Negro College Fund from 2008 to 2011, and the Retail Industry Leaders Association from 2001 to 2006. Mr. Steele holds a Bachelor’s Degree in Economics from the College of Wooster and an M.B.A. from Cleveland State University.

Starboard believes that Mr. Steele’s extensive experience with public company corporate governance, his leadership and operating experience, and his in-depth knowledge of the global consumer goods market, will make him a valuable addition to the Board.

The principal business address of Ms. Brown is 30 Elderfields Road, Manhasset, New York 11030. The principal business address of Mr. Lopez is 4613 Jarboe Street, Kansas City, Missouri 64112. The principal business address of Ms. Ryan Berman is c/o Ryan Berman Advisory, LLC, 161 Falcon Road, Guilford, Connecticut 06437. The principal business address of Mr. Steele is 11246 Grandstone Lane, Cincinnati, Ohio 45249.

As of the date hereof, Ms. Brown does not beneficially own any securities of the Company and has not entered into any transactions in securities of the Company during the past two years.

As of the date hereof, Mr. Lopez beneficially owns 2,000 shares of Common Stock. For information regarding transactions in the securities of the Company during the past two years by Mr. Lopez, please seeSchedule I.

As of the date hereof, Ms. Ryan Berman beneficially owns 1,444 shares of Common Stock, including 135 shares of Common Stock held directly by her spouse. For information regarding transactions in the securities of the Company during the past two years by Ms. Ryan Berman, please seeSchedule I.

As of the date hereof, Mr. Steele does not beneficially own any securities of the Company and has not entered into any transactions in securities of the Company during the past two years.

On February 8, 2018, a group agreement (the “Group Agreement”) was entered into by and among (i) Starboard (other than Starboard N LP and Starboard V LLC), (ii) Mariposa and (iii) Messrs. Alford, De Sole, Lopez and Sonsteby and Ms. Brown. Pursuant to the Group Agreement, the parties agreed to form a group for the purpose of (i) soliciting proxies for the election of the candidates nominated by Starboard at the Annual Meeting, (ii) taking such other actions as the parties deem advisable and to which they jointly agree and (iii) taking all other action necessary or advisable to achieve the foregoing. Pursuant to the Group Agreement, Mariposa made several representations to the other parties (collectively, the “Mariposa Representations”) and agreed to indemnify the other parties in connection with claims resulting from breaches of the Mariposa Representations; provided, however, that until such time as a court of competent jurisdiction has made a determination on the matter, or, in the event that a court of competent jurisdiction determines that Mariposa did not breach any Mariposa Representation, Starboard and Mariposa agreed to split pro rata (based upon their respective proportionate ownership percentages in securities of the Company as of the date of the Group Agreement) the damages. Starboard also agreed to indemnify Mariposa against certain claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions. On March 3, 2018, Ms. Ryan Berman and Mr. Steele entered into a Joinder Agreement with the other parties to the Group Agreement pursuant to which they agreed to become parties to the Group Agreement and be bound by the terms and conditions thereof. On March 12, 2018, Starboard N LP and Starboard V LLC entered into a Joinder Agreement with the other parties to the Group Agreement pursuant to which they agreed to become parties to the Group Agreement and be bound by the terms and conditions thereof.

The Group Agreement also provided that, in the event that Starboard’s candidates were elected to the Board at the Annual Meeting, it was the intention of Starboard and Mariposa that such candidates would recommend that the Board consider Mr. Franklin for the position of Chairman of the Board and Mr. Lillie for the position of the Company’s Chief Executive Officer. Starboard and Mariposa also intended to suggest an appropriate compensation arrangement for Mariposa and Messrs. Franklin and Lillie for the Board to consider. However, on March 20, 2018, the parties to the Group Agreement executed a Termination of Group Agreement pursuant to which Mariposa terminated its participation in the Group Agreement. Accordingly, there is no longer any understanding with respect to recommending that the Board consider Mr. Franklin for the position of Chairman of the Board or Mr. Lillie for the position of the Company’s Chief Executive Officer, and there is no intention to suggest any compensation arrangement for such parties. Messrs. Ashken, De Sole, Franklin and Lillie were removed as parties to the Group Agreement on March 20, 2018 and Messrs. Alford and Sonsteby were removed as parties to the Group Agreement on April 9, 2018. The members of Starboard and the Nominees remain as parties to the Group Agreement.

Starboard V&O Fund has signed compensation letter agreements (the “Compensation Letter Agreements”) with each of the Nominees, pursuant to which it has agreed to pay each of such Nominees: (i) $25,000 in cash as a result of the submission by Starboard V&O Fund of its nomination of each of such Nominees to the Company and (ii) $25,000 in cash upon the filing by Starboard V&O Fund of a definitive proxy statement with the SEC relating to the solicitation of proxies in favor of such Nominees’ election as directors of the Company. Pursuant to the Compensation Letter Agreements, each of such Nominees has agreed to use the after-tax proceeds from such compensation to acquire securities of the Company (the “Nominee Shares”) at such time that each of such Nominees shall determine, but in any event no later than fourteen (14) days after receipt of such compensation, subject to Starboard V&O Fund’s right to waive the requirement to purchase the Nominee Shares. Pursuant to the Compensation Letter Agreements, each of such Nominees has agreed not to sell, transfer or otherwise dispose of any Nominee Shares until the earliest to occur of (i) the Company’s appointment or nomination of such Nominee as a director of the Company, (ii) the date of any agreement with the Company in furtherance of such Nominee’s nomination or appointment as a director of the Company, (iii) Starboard V&O Fund’s withdrawal of its nomination of such Nominee for election as a director of the Company and (iv) the date of the Annual Meeting; provided, however, in the event that the Company enters into a business combination with a third party, each of such Nominees, may sell, transfer or exchange the Nominee Shares in accordance with the terms of such business combination.

Starboard V&O Fund has signed separate letter agreements with each of the Nominees pursuant to which it and its affiliates have agreed to indemnify such Nominees against certain claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions.

Other than as stated herein, there are no arrangements or understandings between the participants or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. Other than as stated herein, none of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

Starboard believes that each Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NYSE listing standards applicable to board composition, including Rule 303A.02, and (ii) Section 301 of the Sarbanes-Oxley Act of 2002.

We do not expect that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve, or for good cause will not serve, the shares of Common Stock represented by the enclosedBLUE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s organizational documents and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Company’s organizational documents and applicable law. In any such case, shares of Common Stock represented by the enclosedBLUE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Company’s organizational documents and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Starboard that any attempt to increase the size of the current Board or to reconstitute or reconfigure the classes on which the current directors serve constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee has appointed PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company for the year 2018. The Company is submitting the appointment of PricewaterhouseCoopers LLP for ratification at the Annual Meeting.

The Company has disclosed that if stockholders fail to ratify the selection, the Audit Committee would reconsider the appointment of PricewaterhouseCoopers LLP.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES“for”THIS PROPOSAL.

PROPOSAL NO. 3

ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION

As disclosed in the Company’s proxy statement, pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is required to submit to stockholders a resolution subject to an advisory vote to approve the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby approved.”

As disclosed in the Company’s proxy statement, the stockholder vote on the say-on-pay proposal is an advisory vote only and is not binding on the Company, the Board or the Organizational Development & Compensation Committee; however, the Company has disclosed that the Board and the Organizational Development & Compensation Committee will carefully consider the outcome of the vote when evaluating the Company’s compensation program.

WE MAKE NORECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

PROPOSAL NO. 4

STOCKHOLDER PROPOSAL – STOCKHOLDER RIGHT TO ACT BY WRITTEN CONSENT

As discussed in further detail in the Company’s proxy statement, John Chevedden, a stockholder of the Company, has submitted a proposal to the Company which calls for the Board to take the steps necessary to permit stockholders of the Company to act by written consent. The text of Mr. Chevedden’s proposal follows:

“Proposal 4—Shareholder Right to Act by Written Consent

Shareholders request that our board of directors undertake such steps as may be necessary to permit written consent by shareholders entitled to cast the minimum number of votes that would be necessary to authorize the action at a meeting at which all shareholders entitled to vote thereon were present and voting. This written consent is to be consistent with applicable law and consistent with giving shareholders the fullest power to act by written consent consistent with applicable law. This includes shareholder ability to initiate any topic for written consent consistent with applicable law.

This proposal topic won majority shareholder support at 13 major companies in a single year. This included 67%-support at both Allstate and Sprint. Hundreds of major companies enable shareholder action by written consent.

Taking action by written consent in lieu of a meeting is a means shareholders can use to raise important matters outside the normal annual meeting cycle. A shareholder right to act by written consent and to call a special meeting are 2 complimentary ways to bring an important matter to the attention of both management and shareholders outside the annual meeting cycle. More than 100 Fortune 500 companies provide for shareholders to call special meetings and to act by written consent.

This proposal is of greater importance to Newell shareholders because Newell shareholders do not have the full right to call a special meeting that is available under state law. Written consent would also give shareholders greater standing to have input in improving the makeup of our Board of Directors after the 2018 annual meeting.

For instance, the 4 directors on our executive pay committee received up to 15-times the negative votes of other directors. These directors were:

Domenico De Sole

Scott Cowen

Kevin Conroy

Thomas Clarke

Meanwhile Newell shareholders cast negative votes on 2017 executive pay at 2-times the negative rate as at Clorox and Proctor & Gamble.

Nell Minow, co-author of Power and Accountability (with Robert A. G. Monks) said, ‘If the board can’t get executive compensation right, it’s been shown it won’t get anything else right either.’

Please vote to improve director accountability to shareholders:

Shareholder Right to Act by Written Consent—Proposal 4”

As disclosed in the Company’s proxy statement, the stockholder vote on this proposal is an advisory vote only and is not binding on the Company or the Board; however, the Company has disclosed that if a majority of stockholders approve this proposal, the Board will further review the proposal and determine whether it would be in the best interests of the Company and its stockholders to take further action and present an amendment to the Company’s Restated Certificate of Incorporation at a future annual meeting.

Starboard believes that the ability to act by written consent is a valuable right for stockholders to have because, in Starboard’s view, it enhances their ability to hold directors accountable and seek effective change between annual meetings. Accordingly, we recommend that stockholders vote for this proposal.

WE RECOMMEND A VOTE “FOR” THE APPROVAL OF THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, Starboard believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common Stock represented by properly executedBLUE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be votedFORthe election of the Nominees,FOR the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year 2018,AGAINST the approval of the say-on-pay proposal andFOR the approval of the stockholder proposal regarding action by written consent.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate eleven (11) candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect not only our four (4) Nominees, but also the candidates who have been nominated by the Company other than David L. Atchison, Andrew N. Langham, Courtney R. Mather and Michael A. Todman. This gives stockholders who wish to vote for our Nominees the ability to vote for all eleven (11) directorships up for election. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. In the event that some of the Nominees are elected, there can be no assurance that the Company nominee(s) who get the most votes and are elected to the Board will choose to serve on the Board with the Nominees who are elected.

While we currently intend to vote all of the Starboard Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results at such time, that by voting the Starboard Group Shares we could help elect the Company nominee(s) that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosedBLUE proxy card will be voted at the Annual Meeting as marked.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least a majority of the outstanding shares of Common Stock as of the Record Date will be considered a quorum for the transaction of business.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted on the proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a majority vote standard for non-contested director elections and a plurality vote standard for contested director elections. As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, so the eleven (11) nominees for director receiving the highest vote totals will be elected as directors of the Company. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Neither an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Ratification of the Appointment of Accounting Firm─ According to the Company’s proxy statement, assuming that a quorum is present, for the ratification of the appointment of PricewaterhouseCoopers LLP, the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval. The Company has indicated that abstentions will have the same effect as a vote against this proposal, but broker non-votes will have no effect on the proposal.

Advisory Vote on Executive Compensation─ According to the Company’s proxy statement, although the vote is non-binding, assuming that a quorum is present, for the advisory vote on executive compensation, the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval. The Company has indicated that abstentions will have the same effect as a vote against this proposal, but broker non-votes will have no effect on the proposal.

Stockholder Proposal─ According to the Company’s proxy statement, although the vote is non-binding, assuming that a quorum is present, for the stockholder proposal, the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval. The Company has indicated that abstentions will have the same effect as a vote against this proposal, but broker non-votes will have no effect on the proposal.

Under applicable Delaware law, none of the holders of Common Stock are entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit yourBLUE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with Starboard’s recommendations specified herein and in accordance with the discretion of the persons named on theBLUE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES