UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| GCP APPLIED TECHNOLOGIES INC. |

(Name of Registrant as Specified in Its Charter) |

| |

STARBOARD VALUE LP STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD STARBOARD VALUE AND OPPORTUNITY MASTER FUND L LP STARBOARD VALUE AND OPPORTUNITY S LLC STARBOARD VALUE AND OPPORTUNITY C LP STARBOARD VALUE R LP STARBOARD VALUE R GP LLC STARBOARD VALUE L LP STARBOARD VALUE GP LLC STARBOARD PRINCIPAL CO LP STARBOARD PRINCIPAL CO GP LLC JEFFREY C. SMITH PETER A. FELD KEVIN W. BROWN JANET P. GIESSELMAN CLAY H. KIEFABER GAVIN T. MOLINELLI MARRAN H. OGILVIE ANDREW M. ROSS LINDA J. WELTY ROBERT H. YANKER |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 13, 2020

Starboard Value and Opportunity Master Fund Ltd

_____________, 2020

Dear Fellow GCP Stockholders:

Starboard Value and Opportunity Master Fund Ltd (together with its affiliates, “Starboard” or “we”) and the other participants in this solicitation are the beneficial owners of an aggregate of 6,561,182 shares, or approximately 9.0% of the outstanding common stock, par value $0.01 per share (the “Common Stock”) of GCP Applied Technologies Inc., a Delaware corporation (“GCP” or the “Company”), making us one of the Company’s largest stockholders. For the reasons set forth in the attached Proxy Statement, we believe significant changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests. We have nominated a slate of nine (9) highly-qualified director candidates for election to the Board at the Company’s upcoming 2020 annual meeting of stockholders (the “Annual Meeting”).

GCP is fundamentally a great company with a strong product portfolio and end market positioning, however, we believe it remains deeply undervalued with opportunities to unlock significant value within the control of management and the Board. Despite the Company’s promising future prospects, GCP has suffered from a prolonged period of disappointing operating and financial results, poor corporate governance and troubling compensation practices. It has now been over a year since we first highlighted our serious concerns to the Company and yet not nearly enough has been done to address these issues.

Despite our efforts to engage constructively with the Company, including by reaching an agreement on the appointment of two new independent and highly-qualified director candidates last year, very little progress has been made to put GCP on a better path. It has therefore become clear to us that additional and substantial change on the Board is required to drive the much needed change at GCP and to provide renewed accountability to stockholders.

We believe that GCP needs a new plan, with improved execution and greatly enhanced Board oversight. Starboard has significant experience in these areas with a long, successful track record of driving operational, financial, strategic, and governance changes that benefit employees, customers, and stockholders. We firmly believe that with the right Board in place, GCP can be a best-in-class company in its industry and generate significant value for all stockholders. We are therefore seeking to reconstitute the Board with directors who we believe have appropriate and relevant skill sets, as well as the shared objective of enhancing value for the benefit of all GCP stockholders.

The nine (9) director candidates we have nominated - Kevin W. Brown, Peter A. Feld, Janet P. Giesselman, Clay H. Kiefaber, Gavin T. Molinelli, Marran H. Ogilvie, Andrew M. Ross, Linda J. Welty and Robert H. Yanker - have deeply relevant backgrounds to GCP’s business and current challenges, including backgrounds spanning operations, finance, private equity, mergers and acquisitions, restructuring, strategic transformation, and public company governance. As a group, they have substantial and highly successful experience in the chemical, construction, and broader industrial industries and collectively have decades of experience as CEOs, senior executives, chairmen and directors of well-performing industrial companies.

We acknowledge that Mr. Kiefaber and Ms. Ogilvie currently serve on the Board, with terms expiring at the Annual Meeting. While the Company has not yet announced its slate of nominees for the Annual Meeting, we would expect the Company to nominate Mr. Kiefaber and Ms. Ogilvie for re-election to the Board at the Annual Meeting given their strong backgrounds and expertise and understand that each of Mr. Kiefaber and Ms. Ogilvie will consent to being named and shall be deemed a participant in the Company’s proxy materials in such event. Nonetheless, we believe Mr. Kiefaber’s and Ms. Ogilvie’s continued presence on the Board is essential and in the best interest of all stockholders, and we have obtained their consent to being named in this Proxy Statement as our nominees for election at the Annual Meeting in order to ensure their re-election to the Board.

Biographies of Starboard’s nominees (in alphabetical order):

Kevin W. Brown

| v | Mr. Brown previously served as the Executive Vice President of Manufacturing & Refining at LyondellBasell Industries. Prior to that, he served as a Senior Vice President of Refining at LyondellBasell and as Executive Vice President of Operations at Sinclair Oil Corporation. |

| v | Mr. Brown currently serves as a member of the Board of Managers of JP3 Measurement, as a member of the Executive Advisory Council for RLG International, and as a member of an advisory board for W.R. Grace & Company. |

| v | Mr. Brown previously served as Chairman of the National Petrochemical and Refiners Association (NPRA), as Vice Chairman of the NPRA, and as a member of the Executive Committee of NPRA. |

Peter A. Feld

| v | Mr. Feld is a Managing Member and Head of Research at Starboard Value LP. Prior to founding Starboard, he was a Managing Director at Ramius and a Portfolio Manager at Ramius Value and Opportunity Master Fund Ltd. |

| v | Mr. Feld currently serves as a director of NortonLifeLock, AECOM, and Magellan Health. |

| v | Mr. Feld previously served as a director of Marvell Technology, Brink’s, Darden Restaurants, Insperity, and Integrated Device Technology, among others. |

Janet P. Giesselman

| v | Ms. Giesselman previously served as President of Dow Chemical’s Oil and Gas Division and as Business Vice President of Dow Chemical’s Latex Division. She previously served in a variety of positions at Rohm & Haas, including serving as a Regional Business Director. |

| v | Ms. Giesselman currently serves as a director of Avicanna (TSX), Twin Disc, OMNOVA Solutions, Ag Growth, and McCain Foods (private). |

| v | Ms. Giesselman previously served as a director of a number of private companies and joint ventures, including Retirement Living Inc., Visionary Enterprise Inc., Michigan Surgery Investment Board, Solvay Americas, Indiana Pro Health Network, LLC, Dow Reichhold Spec, Indianapolis University Research Technology, ROHMID, LLC and F&R Agro. |

Gavin T. Molinelli

| v | Mr. Molinelli is a Partner and Portfolio Manager at Starboard Value LP. |

| v | Mr. Molinelli was previously a Director and an Investment Analyst at Ramius and, prior to that, an Analyst in the Technology Investment Banking Group at Banc of America Securities. |

| v | Mr. Molinelli has previously served on the boards of Forest City Realty Trust, Depomed (n/k/a Assertio Therapeutics), Wausau Paper, and Actel. |

Andrew M. Ross

| v | Mr. Ross previously served as President of the Pigments and Additives business of Rockwood Holdings. Prior to that, Mr. Ross served in various management roles at Rockwood, including as President of Color Pigments and Services and as President of Performance Additives. |

| v | Mr. Ross currently serves as a director of Ferro. |

| v | Mr. Ross previously served as an advisor to Huntsman Pigments and Additives. |

Linda J. Welty

| v | Ms. Welty served as COO of Flint Ink and as President of the Specialty Group at H.B. Fuller. Prior to that, she served as a Vice President of Hoechst. |

| v | Ms. Welty serves on the board of Mercer International, and a number of private organizations, including Huber Engineered Materials and St. Mary’s Good Samaritan Hospital Foundation. |

| v | Ms. Welty previously served on the boards of Massey Energy and Vertellus Specialties and as Chairman of the Atlanta Chapter of the National Association of Corporate Directors. |

Rob H. Yanker

| v | Mr. Yanker currently serves as a Director Emeritus at McKinsey & Company, where he also spent more than 27 years advising clients in the industrial, consumer and telecommunications sectors on a full range of issues, including strategy, portfolio assessment, sales and operations transformation, restructuring and capability building. |

| v | Mr. Yanker previously served as a director of Bemis, Aaron’s, and Wausau Paper. |

Biographies of Starboard’s nominees Who Are Current Board Members:

Clay H. Kiefaber

| v | Mr. Kiefaber previously served as CEO and President of Colfax. Prior to Colfax, he also served as Group President of Architectural Coatings and Windows at Masco and as a Senior Manager for PricewaterhouseCoopers. |

| v | Mr. Kiefaber currently serves as a director of a GCP Applied Technologies. |

| v | Mr. Kiefaber previously served as a director of Colfax. |

| v | Mr. Kiefaber also previously served as Special Assistant to the Secretary of Commerce in Finance & Budget. |

Marran H. Ogilvie

| v | Ms. Ogilvie previously served as Chief Operating Officer and General Counsel at Ramius. |

| v | Ms. Ogilvie currently serves as a director of GCP Applied Technologies, Evolution Petroleum, Ferro, and Four Corners Property Trust. |

| v | Ms. Ogilvie previously served as a director of Bemis, Forest City Realty Trust, LSB Industries, Seventy Seven Energy, The Korea Fund, ZAIS Financial, and Southwest Bancorp. |

| v | Ms. Ogilvie also previously served as an Advisor to the Creditors Committee for the Lehman Brothers International (Europe) Administration. |

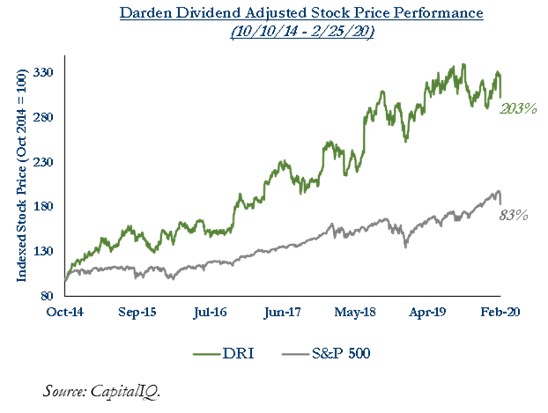

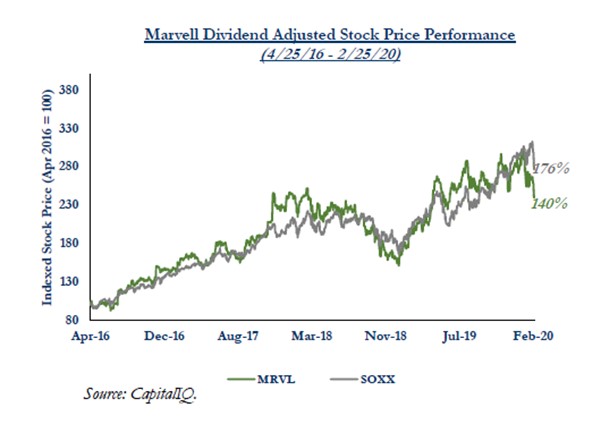

We are mindful that replacing a substantial portion or a majority of an incumbent board of directors represents an extraordinary step, and we take that responsibility very seriously. In the past, we have had tremendous success in similar situations that resulted in a change in a majority of a board. Two examples of such situations, among others, are Darden Restaurants, Inc. (“Darden”) and Marvell Technology Group Ltd (“Marvell”).

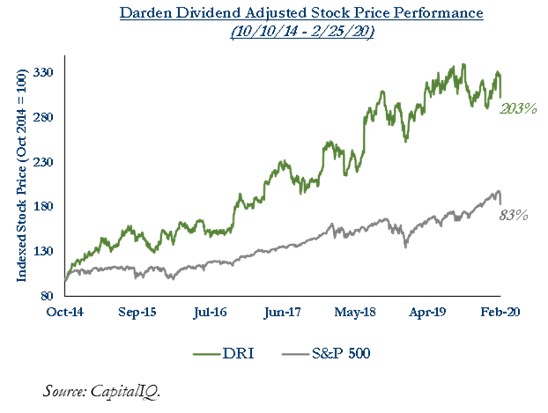

At Darden, stockholders voted to replace the entire board of directors with twelve new board members nominated by Starboard. This new board, along with the new management team, subsequently implemented and oversaw a highly successful turnaround that repositioned Darden and unlocked tremendous stockholder value through a combination of accelerated organic revenue growth, improved margins and cash flow generation, and the separation of non-core assets. Since Darden’s board of directors was entirely refreshed in October 2014, its dividend adjusted share price is up over 200%, excluding the additional appreciation of Four Corners Property Trust Inc. (FCPT), the spin-off of Darden’s real estate assets.

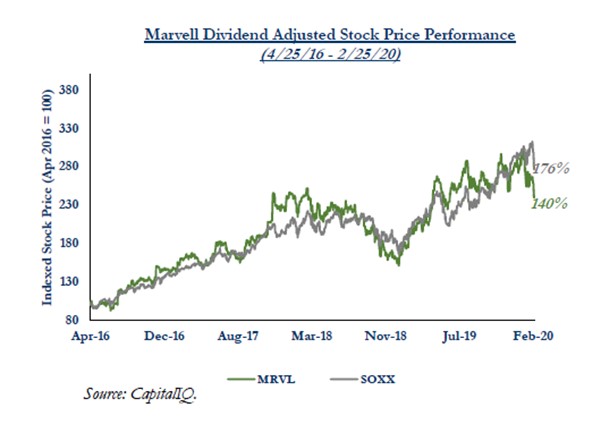

In the case of Marvell, Starboard was instrumental in creating a majority change in the composition of the board of directors, following which the new board hired a new management team and oversaw an incredibly successful turnaround that focused on improving organic revenue growth and operating profit while reducing operating expenditures. Since the time Marvell reached a settlement with Starboard in April 2016, revenue growth, gross margins, and operating margins have all improved substantially, which has led to significant stockholder value creation. Marvell’s dividend adjusted share price has appreciated approximately 140% since Starboard’s settlement in April 2016.

In each of these situations, no more than two direct representatives of Starboard were added to the board of directors, and the vast majority of the board was comprised of independent directors who shared a common goal of driving significant value creation at each of these companies.

As with each of Darden and Marvell, we currently view GCP as having the potential to achieve tremendous improvement in financial, operational, and stock-price performance under the guidance of a newly constituted and highly-esteemed Board committed to serving the best interests of all stockholders.

If elected, our nominees, subject to their fiduciary duties, are committed to implementing a comprehensive turnaround plan aimed at unlocking the full potential of GCP. We look forward to publicly releasing a comprehensive turnaround plan over the coming weeks and months. While we have confidence that our director nominees’ plans for GCP will put the Company on the right path towards substantial stockholder value creation, there can be no assurance that the implementation of this comprehensive turnaround plan will ultimately enhance stockholder value. In the event that our director nominees comprise less than a majority of the Board following the Annual Meeting, there can be no assurance that any actions or changes proposed by our director nominees, including the implementation of any turnaround plan, will be adopted or supported by the Board.

There are currently nine (9) directors serving on the Board, all of whom have terms expiring at the Annual Meeting.1 Through the attached Proxy Statement and enclosed WHITE proxy card, we are soliciting proxies to elect only our nine (9) nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our nominees and does not confer voting power with respect to any of the Company’s director nominees. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

1 The Company has not yet announced its nominees for election at the Annual Meeting, including whether it will re-nominate Mr. Kiefaber and Ms. Ogilvie, or whether it will fill the vacancy created due to Gregory Poling’s retirement from the Board, effective December 31, 2019, thereby maintaining its prior Board size of ten (10) directors. Once the Company announces its nominees and the number of seats up for election at the Annual Meeting, Starboard will make any necessary updates to this cover letter and the attached Proxy Statement.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating, and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being furnished to the stockholders on or about ___________, 2020.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating, and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

| | Thank you for your support. |

| | |

| | |

| | /s/ Peter A. Feld |

| | |

| | Peter A. Feld |

| | Starboard Value and Opportunity Master Fund Ltd |

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Stockholders may call toll-free: (888) 785-6673

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 13, 2020

2020 ANNUAL MEETING OF STOCKHOLDERS

OF

GCP Applied Technologies Inc.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Starboard Value LP (“Starboard Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Value and Opportunity Master Fund L LP (“Starboard L Master”), Starboard Value L LP (“Starboard L GP”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Jeffrey C. Smith and Peter A. Feld (collectively, “Starboard” or “we”) are significant stockholders of GCP Applied Technologies Inc., a Delaware corporation (“GCP” or the “Company”), who, together with the other participants in this solicitation, beneficially own in the aggregate approximately 9.0% of the outstanding shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company.

We are seeking to elect nine (9) nominees to the Company’s Board of Directors (the “Board”) because we believe that the Board must be significantly reconstituted to ensure that the interests of the stockholders, the true owners of GCP, are appropriately represented in the boardroom. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the Company’s 2020 Annual Meeting of Stockholders, scheduled to be held on ____________, 2020 at _______ Eastern Time at _____________________ (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following purposes2:

2As of the date of this Proxy Statement, the Company’s proxy statement has not yet been filed with the SEC. The proposal numbers in this Proxy Statement may not correspond to the proposal numbers that will be used in the Company’s proxy statement. Certain information in this Proxy Statement will be updated after the Company’s proxy statement is filed.

| 1. | To elect Starboard’s director nominees, Kevin W. Brown, Peter A. Feld, Janet P. Giesselman, Clay H. Kiefaber, Gavin T. Molinelli, Marran H. Ogilvie, Andrew M. Ross, Linda J. Welty and Robert H. Yanker (each a “Nominee” and, collectively, the “Nominees”) to hold office until the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”) and until their respective successors have been duly elected and qualified; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2020; |

| 3. | To approve, on an advisory, non-binding basis, the compensation of the Company’s named executive officers; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and the enclosed WHITE proxy card are first being furnished to stockholders on or about [___________], 2020.

There are currently nine (9) directors serving on the Board, all of whom have terms expiring at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our Nominees and does not confer voting power with respect to any of the Company’s director nominees. See the “Voting and Proxy Procedures” section of this Proxy Statement for additional information. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications, and other information concerning the Company’s nominees. If all nine (9) of our Nominees are elected, they will constitute the entire Board.

As of the date hereof, the members of Starboard and the Nominees collectively beneficially own 6,561,182 shares of Common Stock (the “Starboard Group Shares”). We intend to vote all of the Starboard Group Shares FOR the election of the Nominees, [FOR] the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, and [FOR/AGAINST] an advisory (non-binding) proposal concerning the Company’s executive compensation program, as described herein. While we currently intend to vote all of the Starboard Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results at such time, that by voting the Starboard Group Shares we could help elect the Company nominee(s) that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosed WHITE proxy card will be voted at the Annual Meeting as marked.

The Company has set the close of business on ________, 2020 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 62 Whittemore Avenue, Cambridge, Massachusetts 02140. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were ______ shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

[______________________]

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our nine (9) Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Stockholders may call toll-free: (888) 785-6673

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

Background to the Solicitation

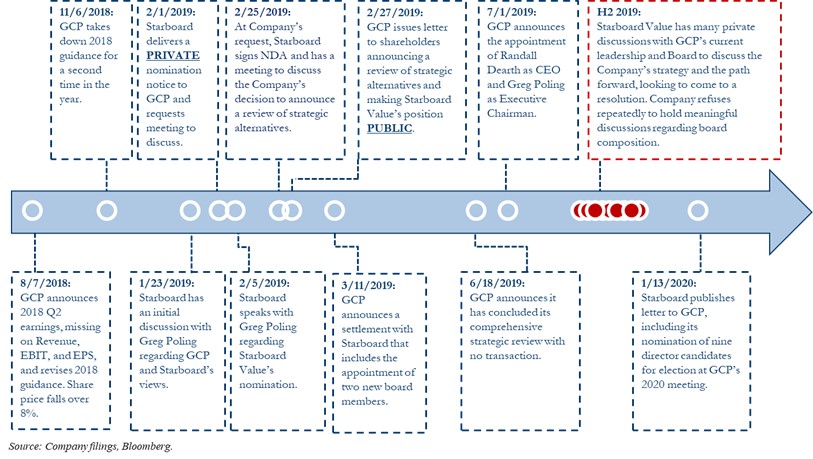

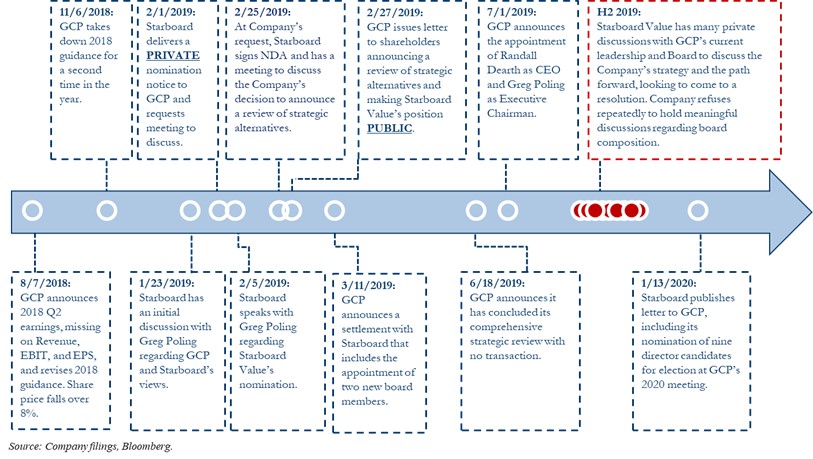

The following is a chronology of material events leading up to this proxy solicitation:

| · | On January 23, 2019, representatives of Starboard had a telephone discussion with Gregory E. Poling, who was then serving as the Company’s Chief Executive Officer, to discuss the Company as well as provide background on Starboard as a new stockholder to GCP. |

| · | On February 1, 2019, Starboard privately delivered a letter (the “2019 Nomination Letter”) to the Company, in accordance with its organizational documents, nominating Kevin W. Brown, Peter A. Feld, Clay H. Kiefaber, Marran H. Ogilvie and Andrew M. Ross for election to the Board at the 2019 annual meeting of stockholders (the “2019 Annual Meeting”). |

| · | On February 5, 2019, representatives of Starboard had a telephone discussion with Mr. Poling to discuss Starboard’s delivery of the 2019 Nomination Letter and its intention to keep such letter private in order to allow for constructive dialogue with the Company. |

| · | On February 24, 2019, at the Company’s request, the Company and Starboard entered into a Non-Disclosure Agreement in order to facilitate discussions between GCP and Starboard regarding the business, strategy and governance of the Company. |

| · | On February 25, 2019, representatives of Starboard had a meeting with Mr. Poling. At the meeting Mr. Poling informed Starboard that the Company intended to publicly announce a comprehensive review of strategic, financial and operational opportunities aimed at selling the Company and that the Company would publicly notify stockholders of Starboard’s ownership and 2019 Nomination Letter. At the meeting, representatives of Starboard indicated that they believed a public strategic review process may not be in the best interest of stockholders and urged the Company to continue private discussions with Starboard. |

| · | On February 27, 2019, the Company issued a press release including an open letter to stockholders notifying them of the Company’s decision to initiate a comprehensive review of strategic, financial and operational opportunities. The letter also disclosed Starboard’s ownership of 4.6% of GCP’s outstanding shares as of February 26, 2019 and announced the Company’s receipt of the 2019 Nomination Letter. |

| · | On March 4, 2019, representatives of Starboard had a meeting with Mr. Poling and Naren Srinivasan, GCP’s Executive Vice President, Global Head of Specialty Building Materials, to discuss a potential agreement between Starboard and the Company relating to the composition of the Board. |

| · | On March 11, 2019, Starboard and the Company entered into an agreement (the “2019 Agreement”), pursuant to which the Company agreed, among other things, to immediately appoint Mr. Kiefaber and Ms. Ogilvie to the Board. Pursuant to the 2019 Agreement, Starboard agreed, among other things, to withdraw the 2019 Nomination Letter and vote all shares of Common Stock beneficially owned by Starboard in favor of the Company’s director nominees and, subject to certain conditions, vote in accordance with the Board’s recommendations on all other proposals at the 2019 Annual Meeting. Starboard also agreed to certain customary standstill provisions during the term of the 2019 Agreement, which has since expired. |

| · | Also on March 11, 2019, the Company issued a press release announcing the 2019 Agreement with Starboard, including the appointment of Mr. Kiefaber and Ms. Ogilvie to the Board. |

| · | On March 15, 2019, GCP announced that it had adopted a stockholder rights plan and that it was continuing to evaluate strategic alternatives. |

| · | On May 13, 2019, representatives of Starboard had a meeting with Mr. Poling, Randall S. Dearth, GCP’s current President and Chief Executive Officer, but who was then serving as its President and Chief Operating Officer, and Dean P. Freeman, who was then serving as the Company’s Vice President and Chief Financial Officer, to discuss the Company’s 2019 first quarter earnings. |

| · | On June 6, 2019, Starboard filed a Schedule 13D with the Securities and Exchange Commission (the “SEC”) disclosing a 6.4% ownership position in GCP. |

| · | On June 18, 2019, the Company issued a press release and open letter to stockholders announcing the conclusion of its previously announced strategic review process and disclosing that no transaction had been entered into and that the Board had determined to pursue the Company’s standalone strategic and financial plan. |

| · | Later on June 18, 2019, representatives of Starboard had a telephone discussion with Mr. Poling to discuss the Company’s announcement of the conclusion of its review process, which did not culminate in a sale of the Company. |

| · | On June 25, 2019, representatives of Starboard had a telephone discussion with members of the Board to discuss the previously announced failed sale process and to provide Starboard’s views on the best path forward for the Company. On this call, Starboard urged the Company to remove Mr. Poling as CEO and to begin a CEO search process that would consider both internal and external CEO candidates to ensure the identification of the best possible CEO. |

| · | On July 1, 2019, the Company announced that Mr. Poling would be retiring from his position as Chief Executive Officer of the Company and would be transitioning to the newly created role of Executive Chairman of the Company, effective August 1, 2019. In addition, the Company announced that Mr. Dearth was appointed President and Chief Executive Officer and member of the Board, effective August 1, 2019, and Elizabeth Mora was named Lead Independent Director, effective August 1, 2019. |

| · | Later on July 1, 2019, representatives of Starboard had a call with the Board to discuss the Company’s appointments of Mr. Dearth as President and Chief Executive Officer, Mr. Poling as Executive Chairman, and Ms. Mora as Lead Independent Director. Among other discussion points, Starboard expressed its strong disagreement with the appointment of Mr. Poling as Executive Chairman. |

| · | Later on July 1, 2019, the Company filed an 8-K with the SEC disclosing the compensation terms for Mr. Poling in his role as Executive Chairman and Mr. Dearth in his role as President and Chief Executive Officer. Such disclosure included that Mr. Poling would continue to be paid as an executive of the Company, indicating the Company’s intention to effectively pay two CEOs. |

| · | On July 2, 2019, representatives of Starboard had a telephone discussion with Mr. Dearth to discuss the Company’s recent management and Board changes. |

| · | On August 7, 2019, representatives of Starboard had a telephone discussion with Messrs. Dearth and Freeman to discuss the Company’s 2019 second quarter earnings. |

| · | On August 16, 2019, representatives of Starboard had a telephone discussion with Mr. Freeman and Joseph DeCristofaro, GCP’s Vice President, Investor Relations, to further discuss the Company’s 2019 second quarter earnings. |

| · | On August 20, 2019, Starboard delivered a private letter to Ms. Mora and the Board outlining its serious concerns with the Company’s path forward in light of the recent failed sale process, the continued poor operating performance at GCP and the recent management and Board changes, which Starboard believes were not made with the best interest of stockholders in mind, including with respect to the appointment of a new internally promoted CEO without consideration of external candidates and the appointment of Mr. Poling as Executive Chairman at great cost to stockholders. |

| · | On August 27, 2019, Starboard filed Amendment No. 1 to its Schedule 13D with the SEC disclosing a 7.7% ownership position in GCP. |

| · | On September 17, 2019, representatives of Starboard had a meeting with Ms. Mora, Mr. Dearth and Janice K. Henry, a member of the Board, to discuss the private letter that Starboard had delivered to the Board as well as the Company’s potential willingness to engage in discussions with Starboard regarding Board composition. |

| · | On October 2, 2019, GCP announced that Mr. Freeman would be resigning from the Company effective October 15, 2019, and Craig A. Merrill, the Company’s Vice President, Finance, Analytics and Strategy, had been appointed Interim Chief Financial Officer. |

| · | On October 15, 2019, representatives of Starboard had a telephone discussion with Ms. Mora to discuss the Board’s view on the composition of the Board and urged the Company to engage constructively with Starboard on such topic. |

| · | On November 6, 2019, representatives of Starboard had a telephone discussion with Mr. Merrill to discuss the Company’s 2019 third quarter earnings. |

| · | On December 2, 2019, representatives of Starboard had a telephone discussion with Mr. Dearth to discuss his views on GCP’s performance. |

| · | On December 3, 2019, GCP announced that Mr. Poling would retire as Executive Chairman and as a member of the Board effective December 31, 2019, and Ms. Mora had been appointed to the role of Chairman of the Board, effective December 31, 2019. |

| · | On January 13, 2020, Starboard delivered a letter (the “2020 Nomination Letter”) to the Company, in accordance with its organizational documents, nominating Messrs. Brown, Feld, Kiefaber, Molinelli, Ross and Yanker and Mses. Giesselman, Ogilvie and Welty for election to the Board at the Annual Meeting. In the 2020 Nomination Letter, Starboard stated its belief that the terms of nine (9) directors currently serving on the Board expire at the Annual Meeting, but noted that the Company has not publicly announced whether it intends on filling the vacancy created due to Mr. Poling’s retirement from the Board, effective December 31, 2019, or whether it will reduce the size of the Board from ten (10) to nine (9) directors. |

| · | Also on January 13, 2020, Starboard issued a press release announcing its nomination of the Nominees and its delivery of a letter to the Board outlining Starboard’s concerns regarding the operating and financial performance and governance and compensation issues at the Company and the need for a reconstituted Board to help put the Company on a better path forward. |

| · | Later on January 13, 2020, Starboard filed Amendment No. 2 to its Schedule 13D with the SEC disclosing a 7.9% ownership position in GCP and disclosing the nomination of the Nominees. |

| · | Also on January 13, 2020, the Company issued a statement in response to the nominations announced by Starboard. |

| · | On January 14, 2020, a representative of Starboard had a meeting with Ms. Mora and Mr. Dearth during which the representative of Starboard again urged the Company to engage with Starboard regarding Board composition. |

| · | On February 24, 2020, Starboard delivered a letter to the Company, demanding the inspection of certain stockholder list materials and related information pursuant to Section 220 of the Delaware General Corporation Law. |

| · | On February 28, 2020, representatives of Starboard had a telephone discussion with Messrs. Merrill and DeCristofaro to discuss the Company’s 2019 fourth quarter earnings. |

| · | As of February 28, 2020, the Company has thus far refused to engage with Starboard in any meaningful way regarding Board composition. |

| · | On February 28, 2020, Starboard filed its preliminary proxy statement with the SEC. |

| · | On March 2, 2020, Starboard issued a press release and delivered a letter to GCP stockholders announcing Starboard’s filing of preliminary proxy materials for the upcoming Annual Meeting and outlining why it believes a reconstituted Board comprised of its highly qualified Nominees is required to put GCP on a better path forward. |

| · | On March 6, 2020, Starboard filed Amendment No. 3 to its Schedule 13D with the SEC disclosing a 9.0% ownership position in GCP. |

| · | On March 13, 2020, Starboard filed this amendment no. 1 to its preliminary proxy statement with the SEC. |

REASONS FOR THE SOLICITATION

WE BELIEVE THE TIME FOR SUBSTANTIAL CHANGE IS NOW

We believe that GCP is deeply undervalued and that significant opportunities exist within the control of management and the Board to unlock substantial value for all stockholders. Unfortunately, we do not have confidence that the Board, as currently composed, will take the necessary steps to reverse the Company’s prolonged underperformance and maximize opportunities for value creation.

We invested in the Company because we believe that GCP has a strong product portfolio with differentiated capabilities and strong end market positioning. Furthermore, our research indicates that the Company has significant opportunities to improve revenue trends, operating margins, and free cash flow generation. However, despite this untapped potential, GCP has suffered from a prolonged period of disappointing operating and financial results, poor corporate governance and excessive executive compensation.

It has now been over a year since we first highlighted our serious concerns to the Board. Unfortunately, despite our prior and continued efforts to engage constructively with the Company, very little progress has been made to put GCP on a better path. Although we were pleased to reach an agreement on the appointment of two new independent and highly-qualified director candidates last year - Mr. Kiefaber and Ms. Ogilvie - who we continue to believe add tremendous value to the Board, it has become clear to us that additional and more substantial change on the Board is required to address the very serious issues plaguing the Company and to ensure that the interests of stockholders are appropriately represented in the boardroom.

We are therefore soliciting your support at the Annual Meeting to elect our highly-qualified Nominees, who we believe would bring significant and relevant experience to the Board along with a commitment to develop and implement a strategic plan to realize GCP’s potential. Our Nominees were carefully selected and possess skill sets in areas directly relevant to GCP’s business and its current challenges and opportunities.

The Board Has Overseen Tremendous Value Destruction Since GCP’s Spin-Off from W.R. Grace

Since the Company’s spin-off from W.R. Grace & Co. on February 3, 2016, GCP has drastically underperformed the overall market and its main competitors.

Although GCP’s stock price is slightly up on an absolute basis since its spin-off from W.R. Grace, GCP has drastically underperformed its Proxy Peers, Direct Peers and the overall S&P 500. As displayed in the chart above, since its spin-off in February 2016, GCP’s TSR has increased 17% versus the S&P 500’s, its Proxy Peers’ and its Direct Peers’ TSRs increasing by 77%, 76% and 101%, respectively. In addition, GCP has underperformed the S&P 500 by 60%, its Proxy Peers by 58% and its Direct Peers by 84%.

We believe a reconstituted Board is required to provide effective oversight of management, instill accountability in the boardroom and ensure actions are taken to reverse this troubling history of underperformance.

We Believe Operational Missteps Have Led to Significant Margin Degradation at GCP

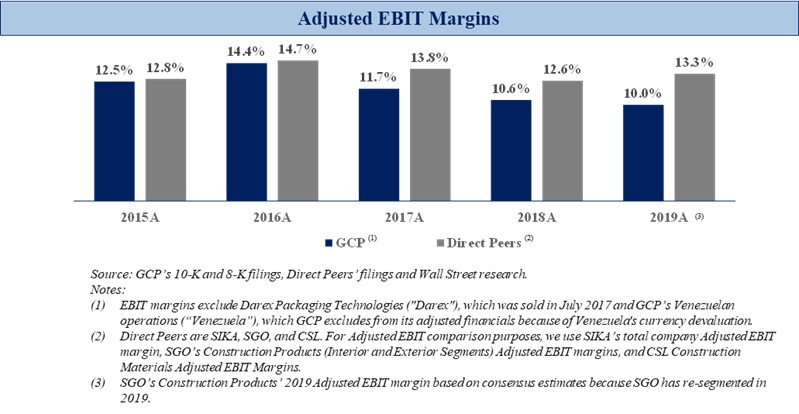

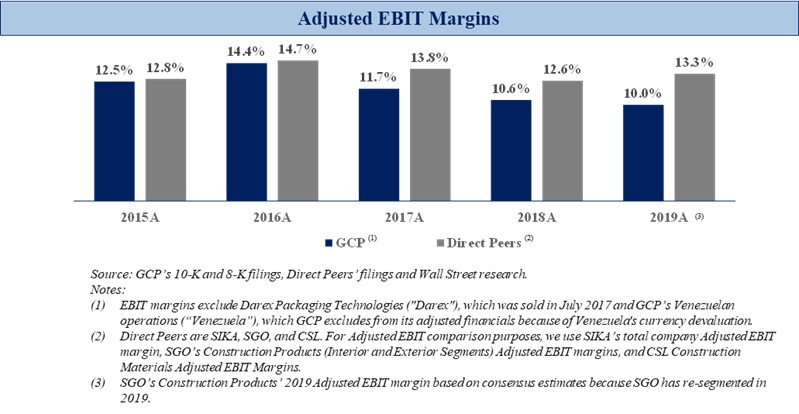

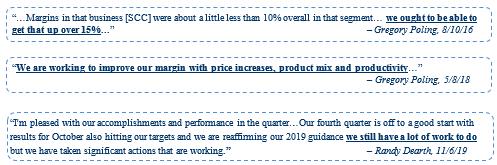

GCP has produced extremely poor results over a prolonged period of time. As shown in the following chart, GCP’s adjusted EBIT margins have declined significantly since 2015, driven by weaknesses across both of the Company’s operating segments. This compares to a healthy backdrop for the broader industry. In fact, most peers over this timeframe have fared significantly better than GCP resulting in the margin gap widening to its highest level since GCP became an independent public company in 2016.

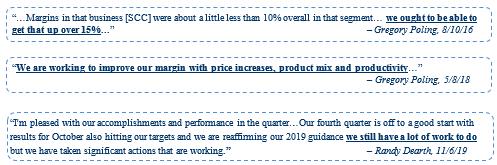

These poor results occurred despite management’s consistent promises to the contrary.

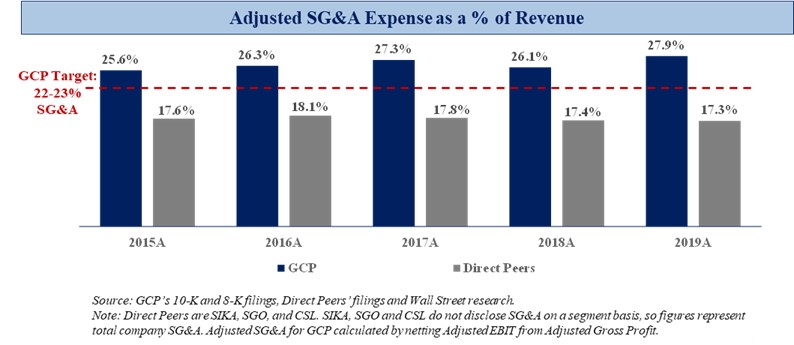

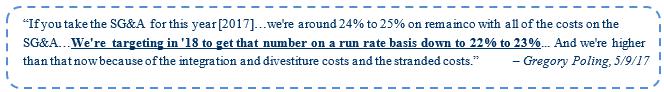

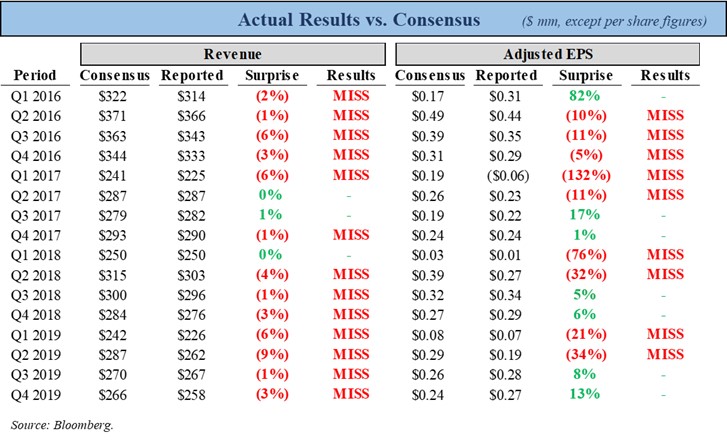

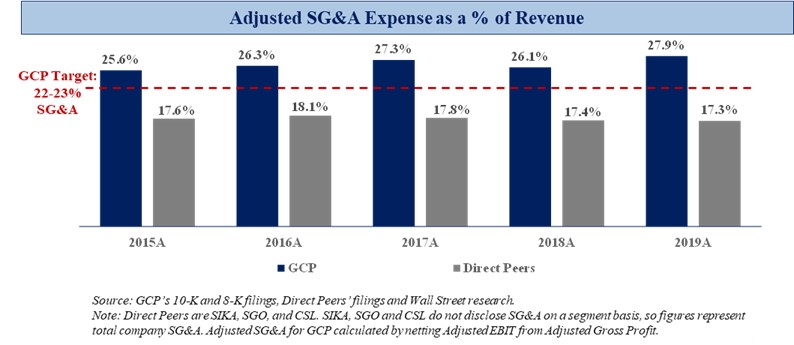

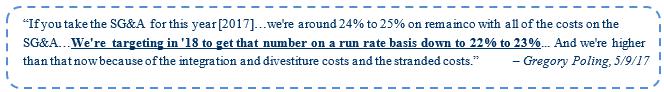

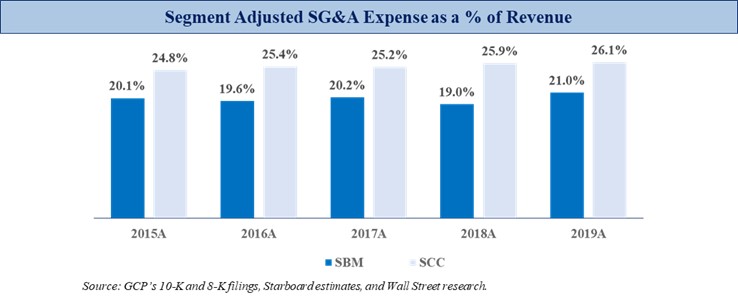

We believe these margin issues are driven in part by a bloated SG&A cost structure and unfortunately, minimal progress has been made to address these inefficiencies. Despite historical actions and slightly higher total revenue, SG&A as a percentage of revenue continues to be substantially higher than management’s target and significantly higher than peers.

We believe the elevated SG&A expense is the result of significant execution issues across both of GCP’s operating segments - the Specialty Construction Chemicals (“SCC”) segment and the Specialty Building Materials (“SBM”) segment. As shown below, the Company has failed to gain SG&A leverage despite years of supposed progress and numerous restructuring programs. Specifically, the SCC segment was burdened with excess SG&A due to GCP’s historical expansion into unprofitable geographies, a strategy which is now being reversed. Within the SBM segment, we believe that the business was not given the proper oversight and investment, which is now manifesting itself in terms of product gaps and increased market competitiveness. In addition, the Company was late to react to changes in the marketplace and readjust its cost structure to adapt to current market conditions.

Despite this prolonged operating underperformance, the Board does not appear to have taken sufficient action to improve operations or hold management accountable.

We Believe the Board Has Demonstrated an Inability to Properly Oversee the Company

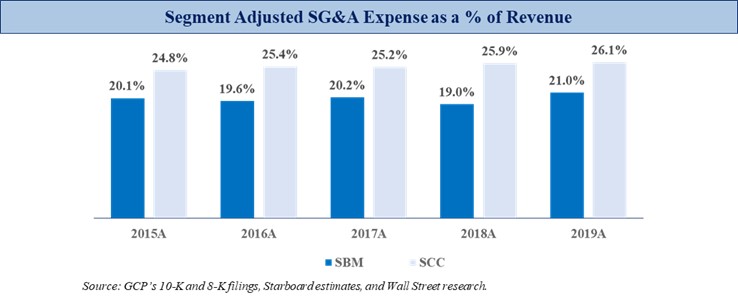

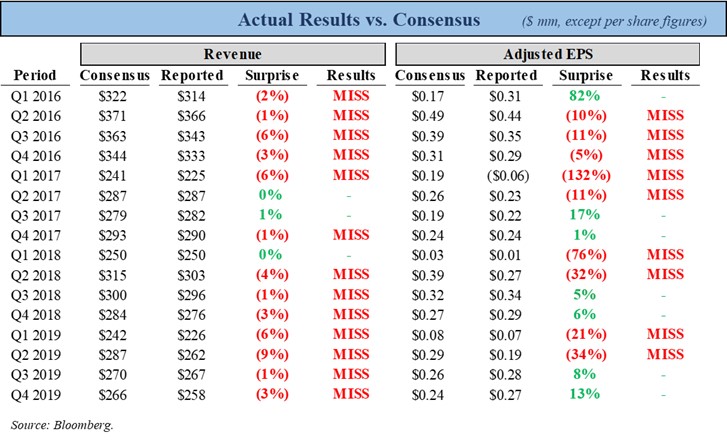

GCP has shown an extraordinary inability to forecast results having now missed either Wall Street consensus revenue or EPS, or both, for fifteen of sixteen quarters since going public in 2016, including the most recent reported results. This was punctuated by a significant reduction in financial guidance causing the stock to decline to multi-year lows. While we appreciate that these businesses are subject to certain end market factors that impact results quarter to quarter, GCP has historically been unable to forecast results with any reasonable accuracy. Again, this is against a backdrop of favorable end market dynamics over the past several years.

These persistent misses, in our view, reflect a poorly executed business plan by management, poor communication of expectations to investors and ultimately, a lack of appropriate Board oversight in allowing this underperformance to continue.

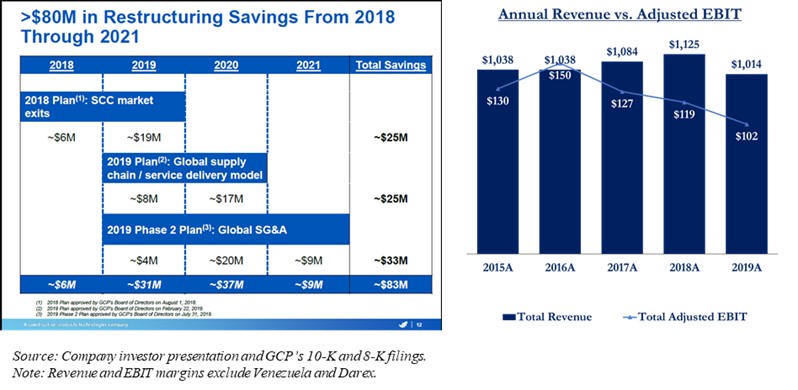

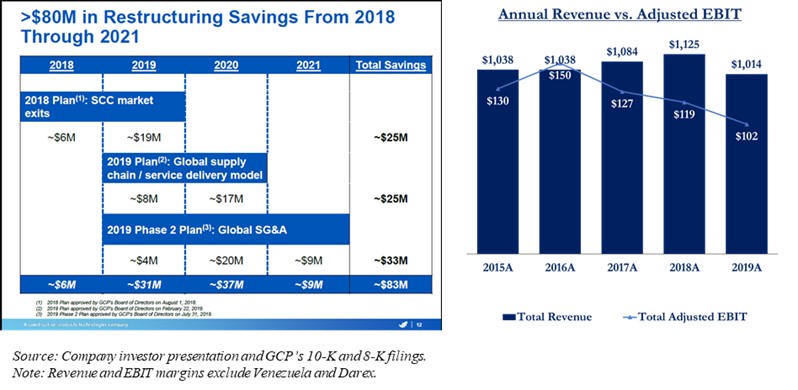

We are Concerned with the Board’s Ability to Properly Oversee and Manage Cost Initiatives

We struggle to understand how GCP claims to have taken significant costs out of the business yet adjusted EBIT continues to decline despite revenue continuing to increase through 2018. Despite a similar revenue base, adjusted EBIT in 2019 was almost 30% less than it was in 2016.

We Believe the Board Has a History of Troubling Executive Compensation Practices

The Company’s poor pay practices started with the separation from W. R. Grace. At that time, the outstanding W. R. Grace stock options and restricted stock units held by named executive officers were converted to Company stock options and restricted stock units; and the named executive officers also received a regular grant of Company stock options, restricted stock units, and performance-based units. These officers also participated in the distribution of Company stock in respect to their W. R. Grace shares, the same as other W. R. Grace stockholders. That all seems expected and quite sufficient.

However, in addition to the regular grant and the conversion of the W.R. Grace stock options, the Company also granted the named executive officers a “Leadership” award equal in value to the regular, annual award (i.e., as if to “double down”). The purpose for this award was to strengthen the officers’ alignment with stockholders and to continue to motivate and retain the officers during the public launch. Given all the shares received at separation, on conversion of the W.R. Grace compensation equity, and in the Company’s regular annual grant, we believe this Leadership grant was excessive. And not only was the award unneeded and excessive, it was primarily a time-based restricted stock award (i.e., 67% of the value) that had executive-friendly vesting provisions for certain of the officers. The heavy use of time-based restricted stock for the CEO was particularly problematic, given the CEO had a combined retirement plan and SERP benefit of over $8 million. The Leadership award was piling on, which the Company hoped to obscure with the claimed need to align with stockholders following the separation transaction with W.R. Grace.

We believe the Company’s declining financial and stock price performance, particularly in 2018 and 2019, is the background for other painful executive compensation errors. In 2018, the Company increased the value of equity awards to the named executive officers by a weighted average of 16%. Also, in 2018, the Company paid an annual incentive plan amount based on the achievement of only an annual revenue goal, even though the company failed to pay any incentive plan amount in respect to either its adjusted EBIT or adjusted free cash flow goals. The payment of an incentive based solely on account of revenue when profitability and free cash flow were below expectations is the wrong priority for the Company. Finally, the Board’s compensation committee retained an advisor that was paid more than $450,000 by management in 2018 for risk management and brokerage services.

More recently, the Board has made other questionable compensation decisions. Although we were pleased to see Gregory Poling step down as CEO of the Company, we were shocked to learn that he would be taking on the newly created role of Executive Chairman given the Company’s dismal performance under his leadership. Further, the need for him in that role seems unlikely as the new CEO, Randall Dearth, had previously been the CEO of a public company, and Messrs. Dearth and Poling had overlapped at the Company for almost one year, with Mr. Dearth having served as GCP’s President and Chief Operating Officer since September 2018. Accordingly, there had been plenty of time to transition Mr. Poling’s work to an experienced CEO, particularly one already familiar with GCP’s business and the inner workings of the Company. Perhaps the reason for such a role was less about the actual needs of the Company, but rather about the benefits Mr. Poling reaped by continuing to serve as an officer of the Company, including continuing to receive executive compensation, equity awards and other benefits to which he was previously entitled, such as his participation in the Company’s Severance Plan for Leadership Team Officers and his existing Change in Control Severance Agreement. By appointing Mr. Poling to this newly created role, the Board effectively committed to paying for two chief executives.

We find it incomprehensible that the dismal operating and financial performance that occurred under Mr. Poling’s leadership – in addition to initiating and shepherding the Company through a failed sale process – would warrant a decision by the Board to appoint him as Executive Chairman. We believe such a decision demonstrates the Board’s inability to act with the best interests of stockholders as the primary objective. Instead, it appears that the Board appointed Mr. Poling as Executive Chairman in order to allow him to continue to receive executive compensation from the Company, in addition to maintaining his change of control severance package were GCP to eventually be sold. Although Mr. Poling retired from the role of Executive Chairman after only five months and as a member of the Board, we believe his departure would not have occurred without severe backlash from stockholders.

We Continue to Have Concerns with the Company’s Corporate Governance Practices

Despite the recent declassification of the Board, we continue to have concerns with various aspects of the Company’s governance structure. Specifically, stockholders are prohibited from taking action by written consent, are barred from calling special meetings and cannot fill vacancies on the Board, which we believe severely limits the ability of stockholders to seek to effect change at GCP. Moreover, these stockholder-unfriendly governance provisions are set forth in the Company’s Certificate of Incorporation, thereby requiring Board approval in order to amend such provisions.

Interestingly, the Board has touted its commitment to best-in-class governance practices yet has apparently failed to recognize two of the most important stockholder rights – the ability to act by written consent and the ability to call a special meeting – both of which are widely considered best-in-class corporate governance practices.

The Current Board Has Been Largely Unreceptive to Stockholders’ Input

For more than a year we have tried to meaningfully engage with the Company and voice our concerns. Unfortunately, despite our prior and continued efforts to engage constructively with the Company, the Company has seemingly been resistant to our efforts and dismissive of our views. We believe this lack of engagement with us, one of the Company’s largest stockholders, is both troubling and demonstrates that the current leadership does not appropriately value stockholder feedback.

We Believe That Additional Stockholder Representation on the Board Is Necessary

We believe the Board’s collective lack of a substantial vested interest in shares of GCP may compromise the Board’s ability to properly evaluate and address the opportunities to enhance stockholder value at the Company with the best interests of stockholders in mind. According to public filings, the entire Board collectively owns less than 1% of the Company’s outstanding shares of Common Stock. Accordingly, there is no significant stockholder representation on the Board. We believe the stockholders, as the true owners of the Company, need to have a strong voice at the Board level. Such a voice promotes greater accountability and creates an environment that forces other directors to consider new and innovative ways to positively impact stockholder value.

Conversely, our Nominees collectively beneficially own approximately 9.0% of the Company’s outstanding shares of Common Stock. It seems apparent to us that with so little “skin in the game” and not enough confidence in the Company to engage in meaningful stock purchases, the Board does not have the same commitment to stockholder value as we do. We believe a culture focused on long-term value creation and stockholder accountability requires placing stockholder representatives on the Board who have a significant financial commitment to the Company along with relevant experience. This requirement ensures the proper alignment of interests between the Board and stockholders.

We Believe There is a Better Path Forward for GCP

While GCP has experienced significant challenges, we believe its poor financial and stock price performance has created a unique opportunity to invest in a market leader and embark on a multi-year operational turnaround that can deliver outstanding returns to stockholders. We do not believe that the Company’s management team or Board have followed through on their past commitments to grow revenue and cut costs, and we believe it is time for substantial change in order to chart a new course for GCP.

Despite its recent problems, GCP is fundamentally a great company with promising future prospects. We believe the SCC business should be a market leader and with the appropriate focus and execution, we believe SCC can drive meaningful profitability improvements while continuing to drive improved revenue trends. Similarly, in the Company’s SBM segment, GCP is also a market leader and frequently designed into some of the largest and most visible construction projects globally. Our diligence has indicated that there is significant untapped potential in this business through further product line expansion and development.

We believe that GCP needs a new plan, with improved execution and greatly enhanced board oversight. Starboard has significant experience in these areas with a long, successful track record of driving operational, financial, strategic, and governance changes that benefit employees, customers, and stockholders. We firmly believe that with the right Board in place, GCP can be a best-in-class company in its industry and generate significant value for all stockholders.

We are confident that you will find the slate of professionals we are nominating to be incredibly well-qualified to serve as directors of GCP. As you can see from our Nominees’ detailed biographies in the following pages, this group of extremely impressive director candidates has backgrounds spanning operations, finance, private equity, mergers and acquisitions, restructuring, strategic transformation, and public company governance as well as substantial experience in the chemical, construction, and broader industrial industries. Collectively, they have decades of experience as CEOs, senior executives, chairmen and directors of well-performing industrial companies.

If elected, our Nominees, subject to their fiduciary duties, are committed to implementing a comprehensive turnaround plan aimed at unlocking the full potential of GCP. We look forward to publicly releasing a comprehensive turnaround plan over the coming weeks and months. While we have confidence that our director nominees’ plans for GCP will put the Company on the right path towards substantial stockholder value creation, there can be no assurance that the implementation of this comprehensive turnaround plan will ultimately enhance stockholder value. In the event that our director nominees comprise less than a majority of the Board following the Annual Meeting, there can be no assurance that any actions or changes proposed by our director nominees, including the implementation of any turnaround plan, will be adopted or supported by the Board.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of nine (9) directors, each with terms expiring at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our nine (9) Nominees, Kevin W. Brown, Peter A. Feld, Janet P. Giesselman, Clay H. Kiefaber, Gavin T. Molinelli, Marran H. Ogilvie, Andrew M. Ross, Linda J. Welty and Robert H. Yanker, who, if elected at the Annual Meeting would constitute the entire Board. Your vote to elect our nominees will have the legal effect of replacing seven (7) incumbent directors of the Company since Mr. Kiefaber and Ms. Ogilvie currently serve on the Board. If at least five (5) of our nominees are elected, they will constitute a majority of the Board.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States.

Kevin W. Brown, age 62, is currently on the Board of Managers at JP3 Measurement, LLC, a gas identification and liquid analysis and sampling company, since November 2017. Previously, Mr. Brown served as Executive Vice President, Manufacturing & Refining and as a member of the Management Board of LyondellBasell Industries N.V. (NYSE:LYB) (“LyondellBasell”), a chemical company, from January 2015 until February 2017. Prior to that, he served as Senior Vice President, Refining for LyondellBasell from October 2009 through January 2015. Mr. Brown spent 22 years at Sinclair Oil Corporation (“Sinclair”), an American petroleum corporation, in various roles, including having served as the Executive and Senior Vice President of Operations, from 1994 to 2009, where he also served as a director from 2006 to 2009. From 1987 to 1994, Mr. Brown served as the Technical Manager, Operations Manager and Refinery Manager at Tulsa Oklahoma Refinery, a refinery. Additionally, Mr. Brown held a variety of positions at Texaco USA (n/k/a Texaco, Inc.), from 1981 to 1987. Additionally, Mr. Brown serves as a member of the Executive Advisory Council for RLG International, an international management-consulting firm, since April 2017 and has also served on an advisory board for W.R. Grace & Company (NYSE: GRA), a chemical conglomerate, since June 2017. Mr. Brown had previously served as Chairman of the National Petrochemical and Refiners Association (NPRA) (2008-2009), Vice Chairman of the NPRA (2008) and Member of the Executive Committee of NPRA and AFPM (NPRA renamed)(2005-2017). Mr. Brown also serves as Chairman of the Dean’s Advisory Council for College of Engineering and on the Campaign Arkansas Steering Committee at the University of Arkansas. Mr. Brown received his BSChE degree from the University of Arkansas.

Starboard believes that Mr. Brown’s extensive industry experience coupled with his operational expertise would make him a valuable addition to the Board.

Peter A. Feld, age 40, is a Managing Member and Head of Research of Starboard Value LP, a New York-based investment adviser with a focused and fundamental approach to investing primarily in publicly traded U.S. companies, a position he has held since April 2011. From November 2008 to April 2011, Mr. Feld served as a Managing Director of Ramius LLC and a Portfolio Manager of Ramius Value and Opportunity Master Fund Ltd. From February 2007 to November 2008, he served as a director at Ramius LLC. Mr. Feld currently serves as a member of the Board of Directors of each of AECOM (NYSE:ACM), a multinational infrastructure firm, since November 2019, Magellan Health, Inc. (NASDAQ: MGLN), a healthcare company, since March 2019 and NortonLifeLock Inc. (NASDAQ: NLOK) (f/k/a Symantec Corporation), a cybersecurity software and services company, since September 2018. He previously served as a member of the Board of Directors of each of Marvell Technology Group Ltd. (NASDAQ: MRVL), a leader in storage, networking and connectivity semiconductor solutions, from May 2016 to June 2018, The Brink’s Company (NYSE: BCO), a global leader in security-related services, from January 2016 to November 2017, Insperity, Inc. (NYSE: NSP), an industry-leading HR services provider, from March 2015 to June 2017, Darden Restaurants, Inc. (NYSE: DRI), a full-service restaurant company, from October 2014 to September 2015, Tessera Technologies, Inc. (formerly NASDAQ: TSRA) (n/k/a Xperi Corporation), a leading product and technology licensing company, from June 2013 to April 2014 and Integrated Device Technology, Inc. (NASDAQ: IDTI), a company that designs, develops, manufactures and markets a range of semiconductor solutions for the advanced communications, computing and consumer industries, from June 2012 to February 2014. Mr. Feld received a BA in Economics from Tufts University.

Starboard believes Mr. Feld’s extensive knowledge of the capital markets, corporate finance, and public company governance practices as a result of his investment experience, together with his significant public company board experience, would make him a valuable asset to the Board.

Janet P. Giesselman, age 65, most recently served as an independent consultant with NH Enterprise, focusing on strategic planning and execution for companies with international growth objectives, from 2010 to May 2017. Prior to that, Ms. Giesselman held a number of senior leadership positions for The Dow Chemical Company (formerly NYSE: DOW), a global manufacturer of agriculture, energy, specialty and commodity chemicals, from 2001 to 2010, including Business Vice President of Dow Latex from 2006 to 2007 and President and General Manager of Dow Oil & Gas, from 2007 to 2010. From 1981 to 2001, Ms. Giesselman worked in a variety of sales, marketing and strategic planning roles at Rohm & Haas Company (formerly NYSE: ROH), a specialty and performance materials company, including Regional Business Director, Agricultural Division, from 1998 to 2001. Currently, Ms. Giesselman serves on the board of directors of each of OMNOVA Solutions Inc. (NYSE: OMN), a global provider of emulsion polymers, specialty chemicals and decorative & functional surfaces, since March 2015, Twin Disc, Inc. (NASDAQ: TWIN), a global provider of power transmissions for marine, oil & gas and industrial uses, since June 2015, Ag Growth International, Inc. (TSX: AFN), a leading manufacturer of grain handling, storage and conditioning equipment, since 2013, Avicanna Inc. (TSX: AVCN), a leader in innovative biopharmaceutical advances using cannabinoids, since June 2019 and McCain Foods, a privately held leading manufacturer of frozen french fries and potato specialties, since 2014. Previously, Ms. Giesselman served on the board of directors of a number of privately held companies and joint ventures, including Retirement Living Inc., Visionary Enterprise Inc., Michigan Surgery Investment Board, Solvay Americas, Indiana Pro Health Network, LLC, Dow Reichhold Spec, Indianapolis University Research Technology, ROHMID, LLC and F&R Agro. Ms. Giesselman received her B.S. in Biology from Pennsylvania State University and her M.S. in Plant Pathology from the University of Florida.

Starboard believes that Ms. Giesselman’s significant leadership experience as a senior executive in the specialty chemicals industry and her expertise in growth strategies and innovation, as well as her service on a number of public company boards would make her a valuable addition to the Board.

Clay H. Kiefaber, age 64, currently serves on the Board of GCP (NYSE: GCP), a leading global provider of construction products technologies, since March 2019. Previously, Mr. Kiefaber served as Special Assistant to the Secretary of Commerce: Finance and Budget from January 2017 until May 2017. Prior to that, he served as Interim CEO and on the Board of Directors for Premier Fixtures, a manufacturer that provides retail fixture solutions, from June 2016 to September 2016. Mr. Kiefaber served as President and CEO of Colfax Corporation (NYSE: CFX), a leading global manufacturer of gas and fluid-handling and fabrication technology (“Colfax”), from January 2010 to April 2012 and CEO of ESAB at Colfax, one of the world’s largest manufacturers of welding consumables, welding and cutting equipment and associated automation, from January 2012 to December 2016, following Colfax’s transformational acquisition of Charter International plc. Mr. Kiefaber also served on the Board of Directors of Colfax from May 2008 until August 2015. Prior to that, Mr. Kiefaber worked at Masco Corporation (NYSE: MAS), a manufacturer of products for home improvement and construction, in a variety of senior executive roles from 1989 until 2007, including Group President of architectural coatings and windows group from December 2005 to 2007. He also worked as a Senior Manager for Price Waterhouse (n/k/a PricewaterhouseCoopers), a multinational professional services network, from 1987 until 1989. Before that, Mr. Kiefaber worked as both a Corporate Manager and Materials Manager for Harris Corporation (NYSE: HRS), a technology company & defense contractor, from 1985 until 1987. Previously, Mr. Kiefaber had worked in sales at Digital Equipment Corporation, a leading vendor of computer systems, from 1981 to 1983, and then at Hewlett-Packard (NYSE: HPQ) (n/k/a HP Inc.), a multinational information technology company, from 1983 until 1985. Mr. Kiefaber received his Bachelor’s degree from Miami of Ohio and his MBA from the University of Colorado – Boulder.

Starboard believes that Mr. Kiefaber’s substantive experience from serving in a variety of senior executive positions as well as his industry specific knowledge makes him a valuable asset to the Board.

Gavin T. Molinelli, age 36, is a Partner and Co-Portfolio Manager of Starboard Value LP, a New York-based investment adviser with a focused and fundamental approach to investing primarily in publicly traded U.S. companies. Prior to Starboard Value LP’s formation in 2011, as part of the spin-off from Ramius LLC, Mr. Molinelli was a Director and an Investment Analyst at Ramius LLC for the funds that comprised the Value and Opportunity investment platform. Prior to joining Ramius LLC in October 2006, Mr. Molinelli was a member of the Technology Investment Banking group at Banc of America Securities LLC. Mr. Molinelli previously served on the Board of Directors of each of Forest City Realty Trust, Inc. (formerly NYSE: FCEA), a real estate investment trust, from April 2018 until its acquisition by Brookfield Asset Management Inc. (NYSE: BAM) in December 2018, Depomed, Inc. (n/k/a Assertio Therapeutics, Inc. (NASDAQ: ASRT)), a specialty pharmaceutical company, from March 2017 to August 2017 and Wausau Paper Corp. (formerly NYSE: WPP), a then leading provider of away from home towel and tissue products, from July 2014 until it was acquired by SCA Tissue North America LLC in January 2016. Mr. Molinelli also previously served on the Board of Directors of Actel Corporation (formerly NASDAQ: ACTL), a semi-conductor company. Mr. Molinelli received a B.A. in Economics from Washington and Lee University.

Starboard believes that Mr. Molinelli’s public company board experience and financial expertise, together with his experience serving in various managerial roles, would make him a valuable addition to the Board.

Marran H. Ogilvie, age 51, currently serves on the Board of Directors of each of GCP (NYSE: GCP), a leading global provider of construction products technologies, since March 2019, Evolution Petroleum Corporation (NYSE:EPM), a developer and producer of oil and gas reserves, since December 2017, Ferro Corporation (NYSE:FOE), a supplier of functional coatings and color solutions, since October 2017 and Four Corners Property Trust, Inc. (NYSE:FCPT), a real estate investment trust that invests in restaurant properties in the U.S., since November 2015. Previously, Ms. Ogilvie served as an Advisor to the Creditors Committee for the Lehman Brothers International (Europe) Administration (the “Creditors Committee”) from June 2010 until July 2018, which assisted the Administrators in finding solutions to the significant issues affecting the estate. She also previously served as a Representative of a Member of the Creditors Committee from January 2008 until June 2010. Ms. Ogilvie has also served on the Board of Directors of Bemis Company, Inc. (formerly NYSE: BMS), a global manufacturer of flexible packaging products and pressure sensitive materials, from March 2018 until it was acquired in June 2019, Forest City Realty Trust, Inc. (formerly NYSE: FCEA), a real estate investment trust that was later acquired, from April 2018 to December 2018, LSB Industries, Inc. (NYSE:LXU), a chemical manufacturing company, from April 2015 to April 2018, Seventy Seven Energy Inc. (formerly NYSE:SSE), an oil field services company that was later acquired, from July 2014 to July 2016, The Korea Fund, Inc. (NYSE:KF), an investment company that invests in Korean public equities, from November 2012 to December 2017, ZAIS Financial Corp. (formerly NYSE:ZFC)(n/k/a Sutherland Asset Management Corp.), a real estate investment trust, from February 2013 to October 2016, and Southwest Bancorp, Inc. (formerly NASDAQ:OKSB), a regional commercial bank that was later acquired (“Southwest”), from January 2012 to April 2015. She also previously served as Southwest’s Advisor from September 2011 to January 2012. Prior to that, Ms. Ogilvie was a member of Ramius, LLC, an investment management firm, where she served in various capacities from 1994 to 2009 before the firm’s merger with Cowen Group, Inc. (“Cowen Group”), including as Chief Operating Officer from 2007 to 2009 and General Counsel and Chief Compliance Officer from 1997 to 2007. Following the merger in 2009, Ms. Ogilvie became Chief of Staff at Cowen Group until 2010. Ms. Ogilvie received a Bachelor’s degree from the University of Oklahoma and a Juris Doctorate from St. John’s University School of Law.

Starboard believes that Ms. Ogilvie’s substantial business experience and financial background coupled with her extensive experience serving as a director of public companies make her a valuable addition to the Board.

Andrew M. Ross, age 58, has served on the Board of Directors of Ferro Corporation (NYSE:FOE), a producer of technology-based performance materials for manufacturers, since October 2016, where he serves as a member of its Audit and Governance & Nomination Committees. Previously, Mr. Ross was the Chief Executive Officer of Rolland-Fox Holdings, LLC, a producer of sustainable paper products, from January 2016 to March 2016. Prior to that, Mr. Ross served as an advisor to Huntsman Pigments and Additives (“Huntsman Pigments”)(f/k/a Rockwood Pigments), a primary manufacturer and processor of powder, liquid and granulated forms of color pigments including iron oxides, mixed-metal colors, transparent iron oxides, high heat-stable pigments, natural colors and corrosion inhibiting pigments, from October 2014 to December 2014. Mr. Ross is the former President of the Pigments and Additives business at Rockwood Holdings, Inc. (“Rockwood”)(formerly NYSE:ROC), a performance additives and titanium dioxide business, from January 2013 until its acquisition by Huntsman Pigments in October 2014. Mr. Ross joined Rockwood in 1990, and during his tenure he served in various management roles, including President of Color Pigments and Services from 2007 to 2010 and President of Performance Additives from 2010 to 2013. While at Rockwood, he led a number of initiatives that significantly increased sales and profitability of its color pigments business, including several multi-national acquisitions, acquisition integrations, and operational efficiency optimization projects. Prior to Rockwood, Mr. Ross worked in corporate finance at Smith Barney & Co. (n/k/a Morgan Stanley Wealth Management), a multinational financial services corporation from 1985 to 1987. Currently, he also serves as a director of Bartek Ingredients, Inc., a specialty chemical manufacturer serving food & beverage and industrial end markets, since November 2018. He also served as a director for Viance, LLC, a provider of an extensive range of advanced wood treatment technologies and services to the global wood preservation industry, from August 2010 until February 2014. Mr. Ross received his B.A. from Tufts University and his MBA from the Kellogg School of Management at Northwestern University. He also studied at the Institut d’Etudes Politiques in Paris.

Starboard believes that Mr. Ross’ extensive senior leadership roles at family-owned, private equity sponsored and publicly-owned companies coupled with his operational expertise would make him a well-qualified addition to the Board.

Linda J. Welty, age 64, currently serves as the President and Chief Executive Officer of Welty Strategic Consulting, LLC, an advisory firm focused on the development and execution of value creation strategies, since 2005. Previously, Ms. Welty was the President and Chief Operating Officer of Flint Ink Corp., the world’s second largest manufacturer of printing ink for publication and packaging, from 2003 to 2005. Prior to that, Ms. Welty was the President of the Specialty Group and member of the Executive Committee of H.B. Fuller Company (NYSE: FUL), a global manufacturer of adhesives, sealants and coatings, from 1998 to 2003. From 1977 to 1998, Ms. Welty served in a variety of global leadership roles for Hoechst AG, a global chemical provider, and its former U.S. subsidiary, Celanese (NYSE: CE). Currently, Ms. Welty serves on the board of directors at Mercer International, Inc. (NASDAQ: MERC), a global provider of sustainably-sourced forest products, bio-based renewable energy and chemicals, since June 2018. Previously, Ms. Welty served on the board of directors of Massey Energy (formerly NYSE: MEE), a mining company and coal extractor, from 2010 until its sale to Alpha Natural Resources in 2011. She also serves on the board of directors of Huber Engineered Materials, a portfolio company of privately-held J.M. Huber Corporation, a global manufacturer of engineered specialty ingredients. Previously, Ms. Welty served on the board of directors of Vertellus Specialties, Inc., a global manufacturer of specialty ingredients owned by private equity firm, Wind Point Partners, from 2007 to October 2016. In addition, she also served as Chairman of the Atlanta Chapter of the National Association of Corporate Directors from 2018 to 2019, as Vice-Chairman from 2015 to 2017, and Director from 2012 to 2019 whose mission is to advance excellence in corporate governance through world-class programs and leading boardroom practices and as a founding director of St. Mary’s Good Samaritan Hospital Foundation, which successfully raised philanthropic capital to construct an award-winning, state of the art hospital in rural Georgia. Ms. Welty holds a Bachelor of Science in Chemical Engineering from the University of Kansas.

Starboard believes that Ms. Welty’s extensive global industrial experience, including her C-suite executive leadership roles in the chemical, natural resource and energy industries will allow Ms. Welty to provide strategic, financial and corporate governance insight making her a valuable addition to the Board.

Robert H. Yanker, age 61, has served as Director Emeritus at McKinsey & Company (“McKinsey”), a worldwide management consulting firm, since September 2013. Mr. Yanker served at McKinsey for 27 years, from 1986 to 2013, where he worked with a variety of clients in the industrial, consumer and telecommunications sectors on a full range of issues from strategy, portfolio assessment, sales and operations transformation, restructuring and capability building. He previously served as a director of Bemis Company, Inc. (formerly NYSE: BMS), a global manufacturer of flexible packaging products and pressure sensitive materials, from March 2018 until it was acquired in June 2019, Aaron’s Inc. (NYSE:AAN), a leading omnichannel provider of lease-purchase solutions, from May 2016 until May 2019, and Wausau Paper Corp. (formerly NYSE:WPP), a manufacturer of away-from-home towel and tissue products, from July 2015 until January 2016 when the company was acquired by a subsidiary of SCA Americas, Inc. Mr. Yanker received both his B.A. and his M.B.A. from Harvard University.

Starboard believes that Mr. Yanker’s significant managerial and operational expertise gained from his extensive experience advising and consulting for senior management teams, together with his public board experience, well qualifies him to serve as a director of the Company.