| O L S H A N | 1325 AVENUE OF THE AMERICAS ● NEW YORK, NEW YORK 10019

TELEPHONE: 212.451.2300 ● FACSIMILE: 212.451.2222 |

EMAIL: AFREEDMAN@OLSHANLAW.COM

DIRECT DIAL: 212.451.2250

March 13, 2020

VIA EDGAR AND ELECTRONIC MAIL

Perry J. Hindin

Special Counsel

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| Re: | GCP Applied Technologies Inc. (“GCP” or the “Company”)

Preliminary Proxy Statement on Schedule 14A (the “Proxy Statement”)

Filed February 28, 2020 by Starboard Value LP et al. (collectively, “Starboard”)

File No. 001-37533

Soliciting Material filed pursuant to Exchange Act Rule 14a-12

Filed March 2, 2020 by Starboard

File No. 001-37533 |

Dear Mr. Hindin:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission, dated March 5, 2020 (the “Staff Letter”), with regard to the above-referenced matters. We have reviewed the Staff Letter with Starboard and provide the following responses on its behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meanings ascribed to them in the Proxy Statement.

Preliminary Proxy Statement

Cover Letter

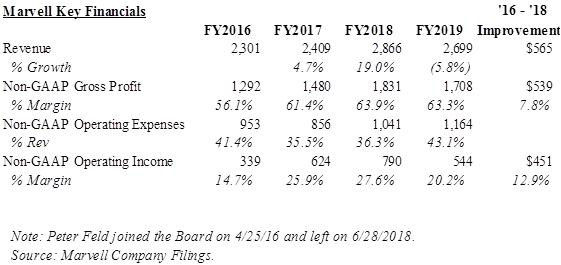

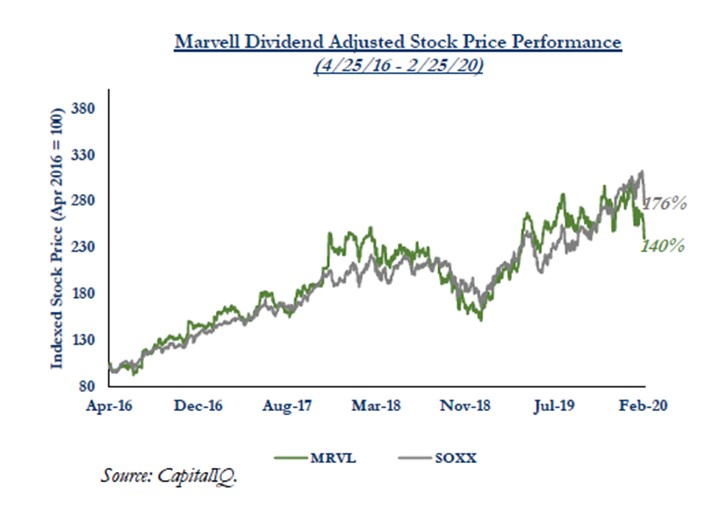

| 1. | We note your statements that Darden’s new board “unlocked tremendous stockholder value through a combination of accelerated organic revenue growth, improved margins and cash flow generation” and that Marvell’s “revenue growth, gross margins, and operating margins have all improved substantially.” With a view towards disclosure, please provide support for such statements. |

Starboard acknowledges the Staff’s comment and offers the Staff the following information on a supplemental basis in support of such statements.

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

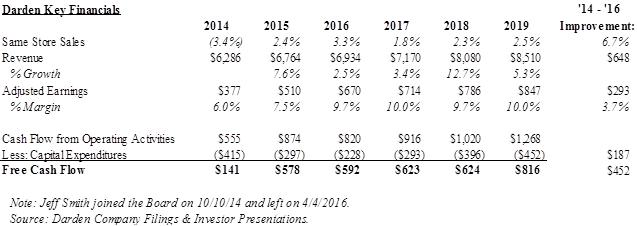

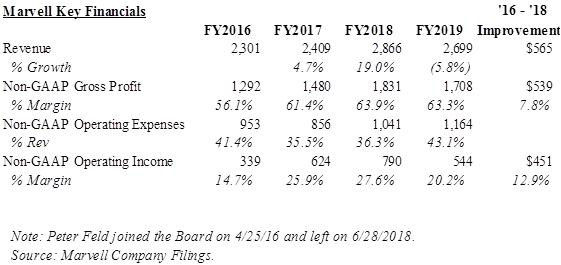

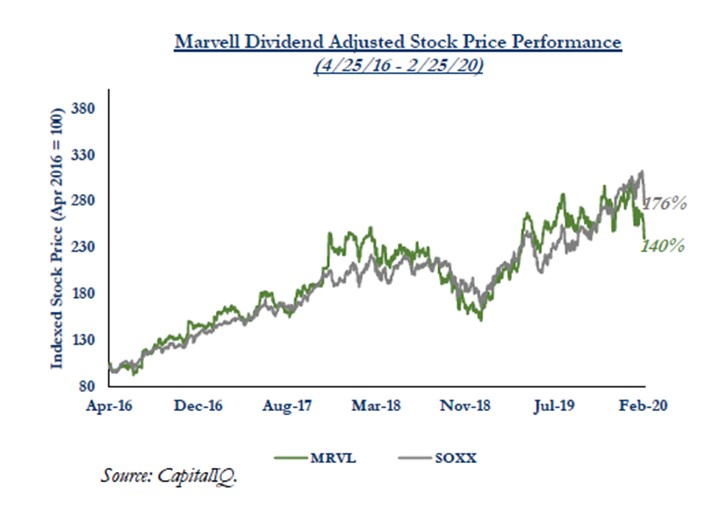

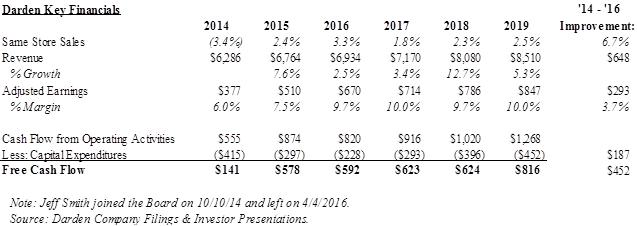

As illustrated in the charts above, each of Darden and Marvell experienced a successful turnaround following the reconstitution of the board of directors, including the appointment of Starboard’s Jeff Smith and Peter Feld, respectively, leading to significant revenue growth, improved margins and substantial shareholder value creation.

In addition, as disclosed in the Proxy Statement, since Darden’s board of directors was entirely refreshed in October 2014, its dividend adjusted share price is up over 200%, excluding the additional appreciation of Four Corners Property Trust Inc. (FCPT), the spin-off of Darden’s real estate assets and Marvell’s dividend adjusted share price has appreciated approximately 140% since Starboard’s settlement in April 2016. Starboard has revised the Proxy Statement to include the Dividend Adjusted Stock Price Performance charts above for each of Darden and Marvell. See the cover letter to the Proxy Statement.

Background to the Solicitation, pages 5-9

| 2. | We note your disclosures on pages 7 and 8 indicating that, from June 2019 through December 2019, you sought certain changes in the Company’s management and Board composition. We further note that the information set forth under Item 4 in your Schedule 13D was not amended to reflect these actions, notwithstanding your statement that “no Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D.” Please advise why you believe the aforementioned disclosures do not constitute material changes such that an amendment to your Schedule 13D was required to be filed pursuant to Exchange Act Rule 13d-2(a). |

Starboard acknowledges the Staff’s comment and offers the Staff the following explanation on a supplemental basis in support of its belief that the disclosures on pages 7 and 8 of the Proxy Statement do not constitute material changes such that an amendment to Starboard’s Schedule 13D was required to be filed pursuant to Exchange Act Rule 13d-2(a).

As disclosed in Starboard’s Schedule 13D filed with the SEC on June 6, 2019 (the “Schedule 13D”), on March 11, 2019, Starboard entered into an agreement with the Company (the “Agreement”) regarding the composition of the Board and certain other matters. Pursuant to the terms of the Agreement, Starboard was subject to certain standstill obligations that prevented Starboard from formulating, or acting on, any plans or proposals with respect to GCP other than through non-public communications with the Board and such standstill obligations did not terminate until early January 2020. Following entry into the Agreement, it was understood that Starboard was privately communicating its views to management and the Board as part of an ongoing private dialogue, rather than as threats of public action or proposals should the Company not address these requests. As such, Starboard had not, at the time of these discussions, formulated any specific proposals or plans for how to address the matters that were being discussed between Starboard and the Company, including with respect to changes to management and/or the Board. The purpose of such private discussions was to help Starboard determine whether it would need to formulate any future specific plans or proposals following the termination of its standstill obligations under the Agreement in January 2020. The Agreement was summarized in Item 4 of the Schedule 13D, including the standstill provisions and a copy of the Agreement was filed as Exhibit 99.1 to the Schedule 13D.

In addition, Starboard respectfully advises the Staff that the quoted Item 4 language (“no Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D”) from the Schedule 13D was qualified by the following language: “[e]xcept as set forth above or as would occur upon or in connection with completion of, or following, any of the actions set forth below, . . .”. The Agreement was summarized in the paragraphs preceding this quoted Item 4 language and therefore covered Starboard’s standstill restrictions under the Agreement. With respect to any future actions and specifically, with respect to the quoted “actions set forth below”, the last paragraph of Item 4 covered the possibility of Starboard engaging in discussions with management and the Board, among other delineated actions.

Accordingly, Starboard believes that its private communications with the Company relating to management and/or Board composition change were under the purview, and consistent with, the actions disclosed in Item 4 of the Schedule 13D, including with respect to Starboard’s standstill obligations under the Agreement. As such, Starboard does not believe that such private ongoing dialogue with the Company following the Agreement constituted a material change to the information previously disclosed in the Schedule 13D.

Reasons for the Solicitation, pages 10-20

| 3. | With a view towards disclosure, please advise us how the “Proxy Peers,” “Direct Peers” and other peer companies examined in this section were selected as peers of the Company. For example, please advise why the peer group on page 12 is different than the peer group on page 11. |

Starboard acknowledges the Staff’s comment and offers the Staff the following explanation on a supplemental basis regarding its selection of the peer companies referenced in this section of the Proxy Statement.

The peers identified by Starboard as “Proxy Peers” and the companies listed in the corresponding footnote as “Proxy Peers” are the peers disclosed by the Company in its 2019 proxy statement filed with the SEC on March 21, 2019. According to the Company’s 2019 proxy statement, such peer group consists of companies within similarly situated industries as GCP (i.e., building products, specialty chemicals, and construction materials) and which were of comparable size based on revenue and market capitalization.

With respect to Starboard’s selection of “Direct Peers”, because the Proxy Peers reflect a broad set of industrials and construction companies, Starboard believes a more narrowly tailored peer group composed of companies that are more similarly situated to GCP, particularly as it relates to GCP’s industry subsectors and operating segments, is helpful in providing a more realistic comparison of GCP’s performance for certain metrics. Specifically, for margin comparison purposes (i.e., SG&A, EBIT), Starboard identified three companies as GCP’s “Direct Peers” - SIKA, SGO and CSL – all of which are active in the same industry subsectors as GCP and directly compete with GCP. Each of these Direct Peers directly compete with GCP in the concrete additives, concrete admixtures, or building waterproofing subsectors, and therefore make a good point of comparison for GCP’s fundamental business performance. Starboard therefore included only the Direct Peers in the charts on pages 12 and 13 of the Proxy Statement.

In order to help clarify Starboard’s selection of these peer groups and address the Staff’s comment, Starboard has revised the updated Total Shareholder Return chart on page 11 of the Proxy Statement.

| 4. | We note your disclosures in the footnotes to the various charts in this section that the peers “include” certain enumerated companies. With a view towards disclosure, please advise us whether the word “include” in this context is intended to indicate whether there are additional peer companies not explicitly identified in such footnotes. Please also advise us whether the criteria used to determine each peer group were consistently applied, and if any company was deliberately excluded from a peer group, briefly indicate the reasoning behind such exclusion. |

Starboard acknowledges the Staff’s comment and respectfully advises the Staff that the word “include” in this context is not intended to indicate there are additional peer companies not explicitly identified in such footnotes. Starboard has revised the footnotes in the various charts to replace the word “include” with “are” when referencing the specific peers listed.

Starboard also respectfully advises the Staff that the criteria used to determine each peer group were consistently applied, such that each time “Proxy Peers” or “Direct Peers” is used throughout the Proxy Statement, it refers to the same companies identified in each such peer group. Notwithstanding the foregoing, Starboard further advises the Staff that Proxy Peer CPBX was excluded from the Proxy Peers’ average returns in the “Dividend Adjusted Share Price Returns” chart because CPBX was purchased in November of 2019 pursuant to an Agreement and Plan of Merger, which closed on February 3, 2020. Starboard also advises the Staff that it subsequently realized that Proxy Peer USCR’s share price returns were unintentionally excluded from the Proxy Peers’ average returns for a certain duration covered by the chart due to CapitalIQ not capturing USCR’s transition from Nasdaq Capital Markets to Nasdaq Global Select. Starboard has therefore revised the chart on page 11 of the Proxy Statement (now titled “Total Shareholder Return”) to clarify the exclusion of Proxy Peer CPBX in light of the sale and to include USCR’s share price returns for the entire time period covered by the chart.

| 5. | We note the following header on page 10: “The Board has Overseen Tremendous Value Destruction Since GCP’s Spin-Off from W.R. Grace.” We further note, however, that although the chart on page 11 displays the Company’s dividend adjusted share price returns as lower than the “2019 Proxy Peers,” the S&P 500 and the “Direct Peers,” such returns appear to be positive as of February 2020 as compared to the date of the Company’s spin-off from W.R. Grace & Co. (February 2016) and above the Company’s peers and the S&P 500 during the period from February 2016 to August 2018. As such, please advise how the chart demonstrates that the Company has suffered “tremendous value destruction” since its spin-off from W.R. Grace & Co., or revise this statement. |

Starboard acknowledges the Staff’s comment and offers the Staff the following explanation on a supplemental basis.

Although GCP’s stock price is slightly up on an absolute basis since its spin-off from W.R. Grace, GCP has drastically underperformed its Proxy Peers, Direct Peers and the overall S&P 500. Specifically, since its spin-off in February 2016 through February 25, 2020, GCP’s TSR was up 17% versus the S&P 500’s, its Proxy Peers’ and its Direct Peers’ TSRs up 77%, 76% and 101%, respectively. In addition, during this timeframe, GCP has underperformed the S&P 500 by 60%, its Proxy Peers by 58% and its Direct Peers by 84%. This significant underperformance relative to GCP’s Proxy Peers, Direct Peers and the overall S&P 500 represents the destruction of tremendous value relative to GCP’s peer groups and the market.

Starboard has revised the Proxy Statement to include the additional support referenced above. See page 11 of the Proxy Statement.

Starboard also respectfully refers the Staff to GCP’s operational underperformance as detailed in the section of the Proxy Statement that directly follows, which demonstrates how operational missteps and execution failures under the oversight of the Board have led to significant margin degradation at GCP. These issues have collectively impacted the Company’s ability to reach its full potential, culminating in significant underperformance compared to peers and the destruction of significant stockholder value.

| 6. | We note that the charts on pages 12 and 13 indicate that the revenue, adjusted EBIT margin and adjusted SG&A expense figures for the Company are based on estimated amounts for fiscal year 2019. We further note that the charts on pages 14 and 16 indicate that the revenue, adjusted EBIT and adjusted SG&A expense figures for the Company are based on actual amounts for fiscal year 2019. Please advise us, with an eye towards revising your disclosure, as to why there is a discrepancy between the various charts’ uses of estimated and actual amounts for fiscal year 2019. |

Starboard acknowledges the Staff’s comment and offers the Staff the following explanation on a supplemental basis regarding its use of estimated versus actual amounts for fiscal year 2019 on certain charts.

The charts in the Proxy Statement disclosing the revenue, adjusted EBIT margin and adjusted SG&A calculations should have included estimates for fiscal year 2019 only for peer Saint-Gobain Construction Products (SGO), as it had not reported its relevant financials at the time the Proxy Statement was filed on February 28, 2020, and should have otherwise reflected actual amounts for each of GCP and the other peer companies identified (i.e., SIKA and CSL).

Since the filing of the Proxy Statement, however, SGO has filed its annual financials and Starboard has therefore updated the Adjusted SG&A chart to reflect actual amounts for each of GCP and the other peer companies identified, including SGO. Notwithstanding the foregoing, in the Adjusted EBIT margins’ chart, SGO’s Construction Products’ 2019 Adjusted EBIT margin reflects 2019 consensus estimates because SGO has re-segmented in 2019.

Starboard has revised the Proxy Statement to reflect the actual amounts noted above and to otherwise clarify the use of 2019 consensus estimates for SGO. Please see pages 12 and 13 of the Proxy Statement. Starboard also confirms that the charts on pages 14 and 16 of the Proxy Statement disclosing the revenue, adjusted EBIT and adjusted SG&A expense figures for the Company are based on actual amounts for fiscal year 2019.

| 7. | Please revise your disclosures to either clarify how you derived the adjusted EBIT, adjusted EBIT margin and adjusted SG&A expense figures or cite the Company filings in which such figures were disclosed. |

Starboard acknowledges the Staff’s comment and has revised the Proxy Statement accordingly. Please see pages 12 and 13 of the Proxy Statement.

| 8. | We note your footnote to the charts on pages 12 and 16 that the revenue and EBIT margin figures “exclude Venezuela and Darex.” Please revise your disclosure to clarify the references to Venezuela and Darex and to explain why they were excluded from such figures. |

Starboard acknowledges the Staff’s comment and has revised the Proxy Statement accordingly. Please see page 12 of the Proxy Statement.

| 9. | Please either provide support for, or recharacterize as a belief or opinion, your statement on page 17 that the 2018 increase in the value of equity awards to the named executive officers and the $450,000 fee paid to the compensation committee’s advisor constituted “painful executive compensation errors.” |

Starboard acknowledges the Staff’s comment and has revised the Proxy Statement to re-characterize this statement as Starboard’s belief. Please see page 17 of the Proxy Statement.

| 10. | The following statements appear to impugn the character, integrity and personal reputation of the Board without adequate factual foundation: |

| · | “Perhaps the reason for such a role was less about the actual needs of the Company, but rather about the benefits Mr. Poling reaped by continuing to serve as an officer of the Company, including continuing to receive executive compensation, equity awards and other benefits to which he was previously entitled, such as his participation in the Company’s Severance Plan for Leadership Team Officers and his existing Change in Control Severance Agreement.” (page 17) |

| · | “We believe such a decision demonstrates the Board’s inability to act with the best interests of stockholders as the primary objective. Instead, it appears that the Board appointed Mr. Poling as Executive Chairman in order to allow him to continue to receive excessive compensation from the Company, in addition to maintaining his change of control severance package were GCP to eventually be sold.” (page 18) |

Please do not make such statements without providing a proper factual foundation for the statements. In addition, as to matters for which you do have a proper factual foundation, please avoid making statements about those matters that go beyond the scope of what is reasonably supported by the factual foundation. Please note that characterizing a statement as one’s opinion or belief does not eliminate the need to provide a proper factual foundation for the statement; there must be a reasonable basis for each opinion or belief that the filing persons express. Please refer to Note (b) to Rule 14a-9. To the extent you are unable to provide adequate support, please revise these disclosures and refrain from including such statements in future soliciting materials.

Starboard acknowledges the Staff’s comment and respectfully advises the Staff that it believes there is adequate factual foundation for these statements. Starboard offers the Staff the following explanation on a supplemental basis in support of such statements.

During Mr. Poling’s tenure as Chief Executive Officer of GCP from February 2016 to August 2019, the Company experienced a dismal period of disappointing operating and financial results, poor corporate governance and troubling compensation practices, as detailed throughout the Proxy Statement. Starboard therefore finds it extremely difficult to justify how the Board could approve the continued employment of Mr. Poling and importantly, his appointment to the newly created leadership role of Executive Chairman given the Company’s dismal results under his leadership. Indeed, the Board’s own troubling track record as detailed throughout the Proxy Statement, including its apparent failure to hold Mr. Poling accountable for his shortcomings as CEO, has caused Starboard to seriously question the Board’s general ability to act with the best interests of stockholders in mind, particularly as it relates to decisions involving Mr. Poling’s employment.

Furthermore, as disclosed in the Proxy Statement, Starboard does not believe there was a need to appoint Mr. Poling as Executive Chairman upon his retirement as CEO for purposes of transitioning Randall S. Dearth to the position of GCP’s new CEO. Mr. Dearth not only had prior experience as a CEO of a public company but Mr. Poling and Mr. Dearth worked together at GCP for almost a year, with Mr. Dearth having served as GCP’s President and Chief Operating Officer since September 2018. This provided ample time for the Company and Mr. Poling to facilitate a smooth transition from his leadership to Mr. Dearth’s without disrupting the Company or the loss of valuable institutional knowledge, particularly given Mr. Dearth’s CEO experience and familiarity with GCP’s business given his role as an executive officer of the Company.

In light of the Company’s underperformance under Mr. Poling’s stewardship and the abundant amount of time the Company had to implement a transition in the CEO role from Mr. Poling to Mr. Dearth, Starboard cannot think of any reasonable explanation or business objective for Mr. Poling’s appointment as Executive Chairman that would support such a decision being made with the best interests of GCP or its stockholders as the primary objective, particularly given that such role was created at great expense to the Company, as Mr. Poling would continue to be paid as an executive of the Company.

Notwithstanding Starboard’s belief that there is adequate support for these statements, Starboard has revised the Proxy Statement to further clarify these statements in light of the Staff’s comment. Please see pages 17 and 18 of the Proxy Statement.

| 11. | Please provide support for the following statements: |

| · | “In contrast to our Nominees who possess decades of experience across the chemical, construction, and broader industrial industries, the current Board appears to have limited executive experience in these same industries.” (emphasis added, page 20) |

| · | “Furthermore, there are a number of instances of current GCP Board members serving on outside boards together, potentially indicating a lack of independence amongst certain of the current Board members.” (emphasis added, page 20) |

Starboard acknowledges the Staff’s comment and has decided to remove these statements from the Proxy Statement.

Proposal No. 1 Election of Directors, pages 21-31

| 12. | Please clarify the reference to “the spin-off” in Gavin T. Molinelli’s biography on page 23. |

Starboard acknowledges the Staff’s comment and has revised the Proxy Statement to clarify that “the spin-off” referenced in Mr. Molinelli’s biography refers to Starboard Value LP’s spin-off from Ramius LLC. Please see page 23 of the Proxy Statement.

| 13. | We note your disclosure on page 26 that “Ms. Ogilvie does not currently have a principal business address.” We further note, however, that in its 2019 annual proxy statement, filed on March 21, 2019, the Company stated that the address of each of its directors (which, presumably, included Ms. Ogilvie) was c/o Corporate Secretary, GCP Applied Technologies Inc., 62 Whittemore Avenue, Cambridge, Massachusetts 02140. Please advise whether this address may serve as Ms. Ogilvie’s principal business address given her position as a current member of the Board. |

Starboard acknowledges the Staff’s comment and has revised the Proxy Statement to reflect c/o Corporate Secretary, GCP Applied Technologies Inc., 62 Whittemore Avenue, Cambridge, Massachusetts 02140 as Ms. Ogilvie’s principal business address. Please see page 26 of the Proxy Statement.

| 14. | Please confirm in response letter that in the event you select a substitute nominee prior to the Annual Meeting (as provided on page 31), you will file an amended proxy statement that (1) identifies the substitute nominee, (2) discloses whether the nominee has consented to being named in the revised proxy statement and to serve if elected and (3) includes disclosure required by Items 5(b) and 7 of Schedule 14A with respect to the nominee. |

Starboard acknowledges the Staff’s comment and hereby confirms that in the event Starboard selects a substitute nominee prior to the Annual Meeting, Starboard will file an amended proxy statement that (1) identifies the substitute nominee, (2) discloses whether such nominee has consented to being named in the revised proxy statement and to serve if elected and (3) includes disclosure required by Items 5(b) and 7 of Schedule 14A with respect to such nominee.

Voting and Proxy Procedures, page 34

| 15. | We note your statement that “the enclosed WHITE proxy card may only be voted for our Nominees and does not confer voting power with respect to the Company’s nominees.” Please qualify this statement to reflect your stated expectation that the Company will include two of your nominees (Clay H. Kiefaber and Marran H. Ogilvie) amongst its nominees as well. Please also make conforming changes where similar statements appear elsewhere in the cover letter and preliminary proxy statement. |

Starboard acknowledges the Staff’s comment and respectfully refers the Staff to the footnote included in the cover letter to the Proxy Statement, which states that once the Company announces its nominees, including whether it will re-nominate Mr. Kiefaber and Ms. Ogilvie for election at the Annual Meeting, Starboard will make any necessary updates to the cover letter and the attached Proxy Statement.

The Company has still not filed a proxy statement in connection with the Annual Meeting or otherwise announced its slate of nominees and as such, Starboard cannot yet be certain as to whether the Company will nominate Mr. Kiefaber and Ms. Ogilvie. Accordingly, after the Company files its proxy statement disclosing the identities of the Company’s nominees or otherwise publicly announces its nominees for election at the Annual Meeting, Starboard will make all necessary revisions to the cover letter, the Proxy Statement and accompanying Proxy Card.

Soliciting Material Filed on March 2, 2020 pursuant to Exchange Act Rule 14a-12

| 16. | We note your disclosures in this filing that Starboard beneficially owns approximately 8.1% of the Company’s outstanding shares, whereas the preliminary proxy statement discloses that Starboard and the other participants beneficially own approximately 8.2% of the Company’s outstanding shares. In your response letter, please explain this discrepancy. |

Starboard acknowledges the Staff’s comment and respectfully advises the Staff that there was no discrepancy in the beneficial ownership disclosed in the Proxy Statement and the Soliciting Material Filed on March 2, 2020 pursuant to Exchange Act Rule 14a-12. The Soliciting Material Filed on March 2, 2020 referenced the beneficial ownership percentage of only certain of the participants, as specified therein (i.e., Starboard Value LP and its affiliates), whereas the beneficial ownership percentage disclosed in the Proxy Statement reflected the aggregate ownership of all of the participants, including Starboard’s nominees. Starboard also notes that both the Proxy Statement and Soliciting Material Filed on March 2, 2020 included full disclosures on the ownership of all of the participants.

* * * * *

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

Sincerely,

/s/ Andrew M. Freedman

Andrew M. Freedman