UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| LIVEPERSON, INC. |

(Name of Registrant as Specified in Its Charter) |

| |

STARBOARD VALUE LP STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD Starboard Value and Opportunity S LLC Starboard Value and Opportunity C LP STARBOARD VALUE R LP Starboard Value and Opportunity Master Fund L LP Starboard Value L LP Starboard Value R GP LLC Starboard x master Fund LTD STARBOARD VALUE GP LLC STARBOARD PRINCIPAL CO LP STARBOARD PRINCIPAL CO GP LLC JEFFREY C. SMITH PETER A. FELD JOHN R. MCCORMACK VANESSA PEGUEROS YAEL ZHENG |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Starboard Value LP, together with the other participants named herein (collectively, “Starboard”), has filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of stockholders (the “Annual Meeting”) of LivePerson, Inc., a Delaware corporation (the “Company”).

On May 9, 2022, Starboard issued the following press release announcing its delivery of a letter to the Company’s stockholders. The full text of the letter is included below and is also attached hereto as Exhibit 1.

STARBOARD DELIVERS OPEN LETTER TO LIVEPERSON STOCKHOLDERS

Continues to Believe that Significant Change is Needed at the Company

Highlights Concerns with the Company’s Corporate Culture and Governance

Believes a Reconstituted Board that Includes Starboard’s Highly Qualified Nominees is Required to Drive Improved Performance, Accountability, and Best-in Class Governance Practices

NEW YORK, NY – May 9, 2022 /PRNewswire/ -- Starboard Value LP (together with its affiliates, “Starboard”), one of the largest stockholders of LivePerson, Inc. (“LivePerson” or the “Company”) (NASDAQ: LPSN), with an ownership interest of approximately 9.7% of the Company’s outstanding shares, today announced that it has delivered an open letter to LivePerson stockholders.

The full text of the letter to the Company’s stockholders can be viewed at the following link: https://www.starboardvalue.com/wp-content/uploads/Starboard_Value_LP_Letter_to_LPSN_Stockholders_05.09.2022.pdf

May 9, 2022

Dear Fellow LivePerson Stockholders:

Starboard Value LP (together with its affiliates, “Starboard”) currently owns approximately 9.7% of the outstanding shares of LivePerson, Inc. (“LivePerson” or the “Company”), making us one of the Company’s largest stockholders. We have a long history of creating stockholder value in our portfolio companies through active engagement and working closely with the boards of directors and management teams to identify and execute on opportunities to unlock value for all stockholders.

As we have communicated previously, we invested in LivePerson because we believe the Company has strong products, terrific underlying technology, and a world-class customer base. However, despite this enviable position, the Company has struggled to execute on a consistent strategy, deliver on its commitments, and produce acceptable financial results. We believe the Company has tremendous unmet potential and our goal is to help drive improved performance, accountability, best-in-class governance practices, and to create value for the benefit of all stockholders.

On April 20, 2022, we filed preliminary proxy materials with the Securities and Exchange Commission in connection with our nomination of a slate of highly qualified director candidates for election to the Company’s Board of Directors (the “Board”) at the LivePerson 2022 Annual Meeting of Stockholders (the “Annual Meeting”). We have taken this step because it remains clear to us that serious issues exist, and that management and the Board do not recognize the need for real change at LivePerson.

As highlighted in our preliminary proxy statement and letter to the Board dated April 7, 2022, LivePerson has been challenged with deteriorating growth and profitability resulting in a recent and severe collapse in its share price. Unfortunately, this is not the first instance of aggressive commitments followed by substantial misses that lead to constant strategy shifts, executive turnover, and frustrated stockholders. We believe this repeated behavior is the outcome of broader and more systemic problems, including a poor corporate culture that appears to reward loyalty to the founder over performance, a Board that has failed to provide true accountability for delivering on results, and a broader organization that we believe has failed to make diversity of views, gender, and ethnicity a key priority. These views have been consistently expressed by various stakeholders with whom we have engaged – current and former executives, competitors, customers, and partners.

The Company’s widespread corporate culture problems are further exemplified by poor ratings and commentary posted on Glassdoor, a leading independent website that allows employees to rate and provide reviews of their employer. Based on these Glassdoor ratings, the founder and CEO of LivePerson, Robert LoCascio, has among the lowest approval ratings in the entire Proxy Peer group with an approval rating that is 14% below the average of the Proxy Peer group.1 Furthermore, LivePerson even ranks dead last among Proxy Peers on whether employees would recommend the Company to a friend.2

Beyond these survey results, we believe a sampling of the Glassdoor reviews from anonymous employees of LivePerson provides ample evidence of the severe issues with corporate culture:

“Being a part of LivePerson right now is like watching a plane crash in slow motion. The CEO is investing in the most random stuff like a health app to test for COVID despite no need for it anymore and a whole BANK? It's a chatbot company, we have no business being in those fields. We have a Chief Coaching Executive for some reason who just gives random "motivational" speeches while the company has layoffs of genuinely enjoyable employees and budget cuts out the wazoo. …. Advice to Management: Get it together, work on what you know and stop trying to do random crap that doesn't apply to our core business model.” (April 14, 2022)

1 Proxy Peers defined as the Company’s peers as published on page 26 of the Company’s 2021 proxy statement. Reflects the approval ratings of LivePerson and its Proxy Peers on Glassdoor as of May 4, 2022.

2 Reflects the rankings of LivePerson and its Proxy Peers on Glassdoor as of May 4, 2022.

“Sometimes I have to just tell friends about how this company is run and the incredibly bizarre things that happen here to make sure I'm not going crazy. As in, "we just hired a celebrity life coach who coaches Kanye and Oprah even though I have no idea how to get a raise or promotion, that's weird, right?"… CEO wants to make the company a consumer brand. Desperate to be famous and the new ventures seem driven by that… Advice to Management: For the love of all things, focus on the core business. Things were going SO WELL, can't we double down there? Really discouraging for employees to achieve that success and then be dragged into what seems like an impossible dream. Stop promoting that our company/ tech is built on love and then rule by fear.” (April 11, 2022)

“And then there is the CEO. Oh...man. Here's his deal...he is a very good salesman. Could sell bottled saltwater to native Hawaiians. Except the problem is, HE would have been the one who came up with the idea to actually bottle saltwater, which is a TERRIBLE business idea! He does this all the time. And then, since he is NOT someone who can actually operate a business, he'll push his bad ideas to the team, but can never get them off the ground. He wastes time, money and human capital. You'd think the Board would see this stuff and force either the CEO to get his act together, or change CEOs. But this Board is a collection of wet noodles you have never heard of and aren't really that successful either (again, mediocrity...see the recurring theme here??)... (And if you can figure out why the CEO is wasting time worrying about crypto, you get a gold star. It has nothing to do with his business. But, it is the buzzy, shiny object that has caught his attention, so of course, it is all he talks about).” (September 27, 2021)

Interestingly, since our involvement in LivePerson became public, we have received unsolicited inbound calls and emails from current employees of the Company. Their concerns closely echo many of the issues highlighted in the quotes above and center around poor corporate culture, a lack of focus on the core business, and challenges with leadership and board oversight.

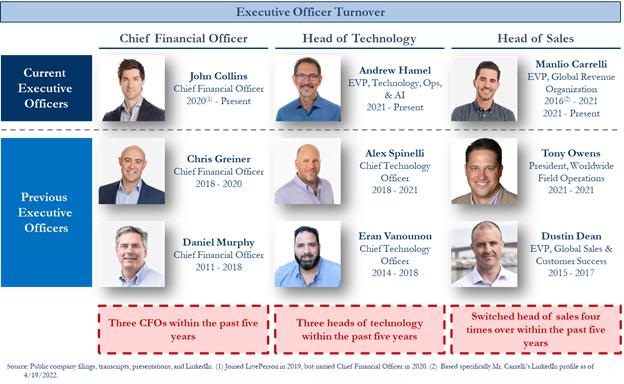

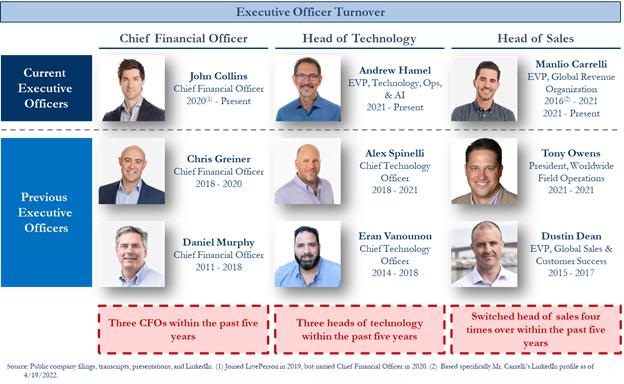

We believe these issues have contributed to the excessive executive turnover at LivePerson. As we noted in our preliminary proxy statement, the Company has alternated four times between three heads of sales and has had three Chief Financial Officers and three heads of technology in just the last five years.

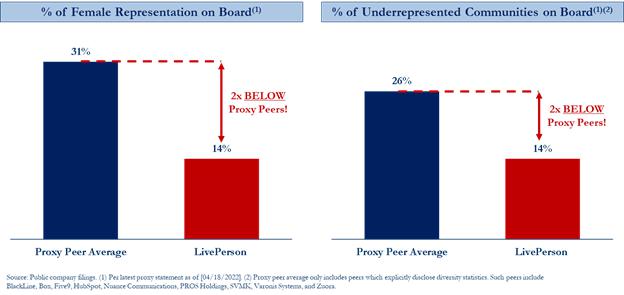

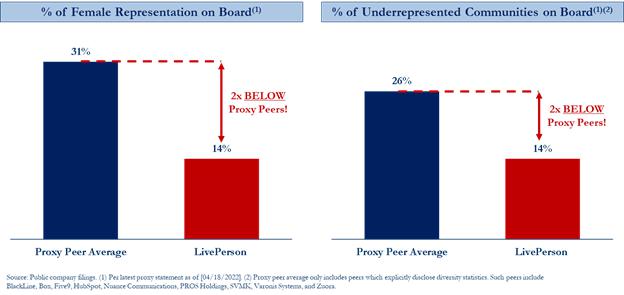

In addition, the Company’s corporate culture appears to be one that does not embrace, encourage, or champion fresh perspectives, diverse views, and experiences. We believe this problem stems from the top as the Board has an average tenure of 13 years and currently has only one female member and one member of another underrepresented community – a level of diverse representation that is significantly below generally acceptable levels and well below that of the Company’s Proxy Peer group.

Informed by the online reviews from anonymous current and former employees on Glassdoor, we believe the Board’s lack of diversity has permeated throughout the Company, resulting in broader issues which exacerbate the Company’s cultural problems.

“Fun place, poor leadership, male dominated… There’s a mold- white men and young women. Lacks diversity in tight and leadership. Unsupportive over the pandemic in various ways… Advice to Management: Rob and the leadership team lack empathy and diversity - which is oh so needed especially during a pandemic. Get on board mentality or else.” (January 14, 2022)

“Poor Culture… Toxic culture that started with the senior leadership. Lack of diversity in leadership roles. Unrealistic expectations about work/life balance.” (June 19, 2020)

“Employees are treated poorly, you will be squeezed to give a lot without any positive feedback or anything, and as soon as you are not of any use you will be treated even worse ( Most of the people that left the company had to legal up - so make sure you have legal insurance). Lastly there is a lot about equality being advertised at the company level, but the reality is very different. Women are not treated as well (promotion, hire ) which is a real discussion in between the employees globally.” (February 25, 2019)

Upon further investigation, we have found that these issues do not seem to be new. In addition to the employees that have recently reached out to us to voice their concerns about the current corporate culture at LivePerson, we have also found evidence that these are long-standing issues.

In 2006, a lawsuit was brought against the Company for gender discrimination, retaliation, wrongful termination, and fraudulent inducement/misrepresentation. 3 In this lawsuit, the plaintiff (a former female employee) raised concerns of discrimination and unfair treatment by Mr. LoCascio, among others, to current Board member William Wesemann. The lawsuit alleges that although Mr. Wesemann was under the obligation to report and investigate these claims without prejudice or fear of retaliation, instead he ultimately deferred the handling of the matter to Mr. LoCascio who promptly terminated the plaintiff shortly after the concerns were raised. We are deeply troubled not only by the plaintiff’s serious allegations of misconduct, but also the manner in which they were allegedly dealt with by the Board. We believe this incident illustrates both the Company’s cultural issues as well as the Board’s failure to instill accountability and provide effective oversight of the Company. This lawsuit seems to have been settled quickly and without any disclosure regarding remuneration to the plaintiff or other terms.

Beyond the serious cultural issues highlighted in this letter and the operational and financial issues we have previously disclosed, we continue to believe there are also significant issues with corporate governance, compensation practices, and overall board function. We believe the Board’s ineffectiveness may be in part due to the unchecked power of the founder, Rob LoCascio, who serves as CEO and Board Chair. Despite extremely poor results, Mr. LoCascio retains these combined roles, which is out of touch with best-in-class governance practices. To make matters worse, the Board does not even have a lead independent director, which we find entirely inexcusable. We believe this may be the result of the Board not knowing what good governance looks like, as not a single member of the Board has ever served on another U.S. public company board or has any meaningful enterprise software experience.

While the Company’s directors have stood idly by tacitly endorsing management’s stewardship of the Company, they have been actively liquidating their holdings in the Company. During 2020 and 2021, while promising accelerating growth, profit, and value creation for stockholders, the directors and officers collectively sold almost $40 million of the Company’s stock.4 Remarkably, there has not been a single officer or director who has demonstrated his or her faith in the Company by purchasing shares on the open market at any time in the past three years, even following the fourth quarter 2021 earnings release on February 24, 2022, when the Company’s stock price declined 26% on the following day and over 70% from its peak.5

3 See Cash v. LivePerson, Inc., et al., Index No. 106522/06 (N.Y. Sup. Ct. May 11, 2006).

4 Source: Public company filings. Represents the aggregate value of stock sold on the open market by the Company’s Board of Directors, John Collins, and Monica Greenberg. Includes transactions made pursuant to Rule 10b5-1 trading plans as well as stock sold to cover personal tax liabilities incurred in connection with the vesting of stock grants.

5 Officers and Directors defined as the current Board of Directors, John Collins, and Monica Greenberg.

Collectively, we believe these issues can be fixed, however, a critical first step is reconstituting the Board with new, highly qualified and independent directors who have relevant experience and who are committed to providing effective oversight and instilling accountability in the boardroom. Despite our sincere desire to reach a mutual resolution with the Company, to date, the Board appears unwilling to accept any settlement that would include the level of change we believe is absolutely necessary to put LivePerson on a path to long-term success.

Over the coming weeks leading up to the Annual Meeting, we will publish detailed materials outlining our views on the opportunities at LivePerson and we look forward to speaking directly with you, our fellow stockholders.

Sincerely,

Peter Feld

Managing Member

Starboard Value LP

About Starboard Value LP

Starboard Value LP is a New York-based investment adviser with a focused and differentiated fundamental approach to investing primarily in publicly traded U.S. companies. Starboard invests in deeply undervalued companies and actively engages with management teams and boards of directors to identify and execute on opportunities to unlock value for the benefit of all shareholders.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Starboard Value LP, together with the other participants named herein (collectively, "Starboard"), has filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission ("SEC") to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of stockholders of LivePerson, Inc., a Delaware corporation (the "Company").

STARBOARD STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard R Value R LP (“Starboard R LP”) , Starboard Value and Opportunity Master Fund L LP (“Starboard L Master”), Starboard Value L LP (“Starboard L GP”), Starboard Value R GP LLC (“Starboard R GP”), Starboard X Master Fund Ltd (“Starboard X Master”), Starboard Value LP, Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Jeffrey C. Smith, Peter A. Feld, John R. McCormack, Vanessa Pegueros and Yael Zheng.

As of the close of business on May 9, 2022, Starboard V&O Fund beneficially owned directly 4,098,775 shares of Common Stock, par value $0.001 per share, of the Company (the “Common Stock”). As of the close of business on May 9, 2022, Starboard S LLC directly owned 589,370 shares of Common Stock. As of the close of business on May 9, 2022, Starboard C LP directly owned 364,260 shares of Common Stock. Starboard R LP, as the general partner of Starboard C LP may be deemed the beneficial owner of an aggregate of 364,260 shares of Common Stock owned by Starboard C LP. As of the close of business on May 9, 2022, Starboard L Master directly owned 253,094 shares of Common Stock. Starboard L GP, as the general partner of Starboard L Master, may be deemed the beneficial owner of the 253,094 shares of Common Stock owned by Starboard L Master. Starboard R GP, as the general partner of Starboard R LP and Starboard L GP, may be deemed the beneficial owner of an aggregate of 617,354 shares of Common Stock owned by Starboard C LP and Starboard L Master. As of the close of business on May 9, 2022, Starboard X Master directly owned 945,388 shares of Common Stock. As of the close of business on May 9, 2022, 754,113 of Common Stock were held in an account managed by Starboard Value LP (the “Starboard Value LP Account”). Starboard Value LP, as the investment manager of each of Starboard V&O Fund, Starboard C LP, Starboard L Master, Starboard X Master and the Starboard Value LP Account and the manager of Starboard S LLC, may be deemed the beneficial owner of an aggregate of 7,005,000 shares of Common Stock directly owned by Starboard V&O Fund, Starboard S LLC, Starboard C LP, Starboard L Master, Starboard X Master and held in the Starboard Value LP Account. Each of Starboard Value GP, as the general partner of Starboard Value LP, Principal Co, as a member of Starboard Value GP, Principal GP, as the general partner of Principal Co, and Messrs. Smith and Feld, as members of Principal GP and as members of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed the beneficial owner of 7,005,000 shares of Common Stock directly owned by Starboard V&O Fund, Starboard S LLC, Starboard C LP, Starboard L Master, Starboard X Master and held in the Starboard Value LP Account. As of the close of business on May 9, 2022, Mr. McCormack directly beneficially owned 950 shares of Common Stock. As of the close of business on May 9, 2022, Ms. Pegueros directly beneficially owned 1,349 shares of Common Stock. As of the close of business on May 9, 2022, Ms. Zheng directly beneficially owned 3,000 shares of Common Stock held in a revocable trust she serves as co-trustee for with her husband.

Investor contacts:

Peter Feld, (212) 201-4878

Prithvi Reddy, (212) 201-6231

www.starboardvalue.com