UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

KENVUE INC. |

(Name of Registrant as Specified In Its Charter) |

| |

STARBOARD VALUE LP STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD STARBOARD VALUE AND OPPORTUNITY S LLC STARBOARD VALUE AND OPPORTUNITY C LP STARBOARD VALUE R LP STARBOARD VALUE AND OPPORTUNITY MASTER FUND L LP STARBOARD VALUE L LP STARBOARD VALUE R GP LLC STARBOARD G FUND, L.P. STARBOARD VALUE G GP, LLC STARBOARD VALUE A LP STARBOARD VALUE A GP LLC STARBOARD X MASTER FUND LTD STARBOARD VALUE GP LLC STARBOARD PRINCIPAL CO LP STARBOARD PRINCIPAL CO GP LLC JEFFREY C. SMITH PETER A. FELD MICHELLE MILLSTONE-SHROFF CARA ROBINSON BINDU SHAH |

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED FEBRUARY 5, 2025

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_____________, 2025

Dear Fellow Kenvue Stockholders:

Starboard Value and Opportunity Master Fund Ltd (together with its affiliates, “Starboard” or “we”) and the other participants in this solicitation are the beneficial owners of an aggregate of 22,031,711.682 shares of the outstanding common stock, par value $0.01 per share (the “Common Stock”) of Kenvue Inc., a Delaware corporation (“KVUE”, “Kenvue” or the “Company”), making us one of the Company’s largest stockholders. For the reasons set forth in the attached Proxy Statement, we believe significant changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is managed and overseen in a manner consistent with your best interests. We have nominated a slate of highly-qualified director candidates for election to the Board at the Company’s upcoming 2025 Annual Meeting of Stockholders (the “Annual Meeting”).

We believe Kenvue is fundamentally a great company with the potential to be the preeminent consumer health company due to its iconic brand portfolio, market-leading position, and exposure to attractive markets. Despite the Company’s promising future prospects, Kenvue has suffered from persistent disappointing and deteriorating financial results, missed commitments, and ineffective Board oversight, resulting in stock price underperformance and a significant valuation discount compared to peers. We believe that meaningful change is required on the Board in order to provide renewed accountability to stockholders and unlock the Company’s trapped potential. We firmly believe that with the right Board in place, Kenvue can become a best-in-class company in its industry.

We are therefore seeking to reconstitute the Board with directors who we believe have appropriate and relevant skill sets, as well as the shared objective of enhancing value for the benefit of all Kenvue stockholders. The four (4) director candidates we have nominated – Michelle Millstone-Shroff, Cara Robinson, Bindu Shah and Jeffrey C. Smith – have backgrounds spanning consumer products, healthcare, retail, digital transformation, marketing, management consulting, operations, finance, strategic transformation and public company governance. Collectively, they have substantial and highly successful experience in the consumer products, retail and healthcare sectors, including decades of experience as CEOs, senior executives and directors of well-performing public and private companies.

Biographies of Starboard’s nominees (in alphabetical order):

Michelle Millstone-Shroff |

Operating Experience

Ms. Millstone has served as a Senior Advisor at McKinsey & Company since April 2019. Previously, Ms. Millstone-Shroff served as the Chief Customer Experience Officer of Bed Bath & Beyond Inc. (formerly NASDAQ: BBBY) from 2015 to 2018, as the President & Chief Operating Officer of buybuy BABY, a $1+ billion subsidiary of Bed Bath & Beyond and a retailer of items for infants and toddlers, from 2007 to 2018, and as Head of Business Development at Bed Bath & Beyond, from 2003 to 2007. Public Board Experience Ms. Millstone-Shroff previously served as a director of Public Storage and Party City Holdco Inc. |

Cara Robinson |

Operating Experience

Ms. Robinson previously served as the Chief Executive Officer of Beauty & Wellbeing, North America of Unilever plc (NYSE: UL) from July 2022 to December 2023, and Chief Executive Officer of Sundial Brands, a personal care products subsidiary of Unilever plc, from December 2019 to December 2023. Prior to that, Ms. Robinson served as Vice President of Marketing, Americas of NARS Cosmetics from January 2019 to December 2019; as Vice President of Global Marketing of Clinique, from January 2014 to January 2019. Public Board Experience Ms. Robinson currently serves as a director of Citi Trends, Inc. |

Bindu Shah |

Operating Experience

Ms. Shah currently serves as Executive Vice President, Global Chief Marketing Officer & Chief Digital Officer of Tory Burch LLC since June 2019. Previously, Ms. Shah served as Vice President, Digital Marketing & Media of Sephora, a subsidiary of LVMH Moët Hennessy Louis Vuitton, a publicly traded global luxury products company, from 2015 to April 2019. Public Board Experience N/A |

Jeffrey C. Smith |

Operating Experience

Mr. Smith is a Managing Member, Chief Executive Officer, and Chief Investment Officer of Starboard Value LP. Prior to founding Starboard, Mr. Smith was a Partner and Managing Director of Ramius LLC, Chief Investment Officer of the Ramius Value and Opportunity Master Fund and a member of Cowen’s Operating Committee and Cowen’s Investment Committee. Public Board Experience Previously, Mr. Smith served as Chair of the board of directors of Papa John’s International, Advance Auto Parts, Darden Restaurants, and Phoenix Technologies, and has served as a director on a number of other public company boards. |

Our goal is to create value for the benefit of all stockholders. The individuals we have nominated are highly-qualified, extraordinarily capable, and ready to serve stockholders to help make Kenvue a stronger, more profitable, and, ultimately, more valuable company. Over the coming weeks and months, we look forward to sharing our detailed views and plans for Kenvue and look forward to engaging with you as we approach the Annual Meeting.

The Board is currently composed of eleven (11) directors, each with a term expiring at the Annual Meeting.1 Through the accompanying Proxy Statement and enclosed [COLOR] universal proxy card, we are soliciting proxies to elect not only our four (4) nominees, Michelle Millstone-Shroff, Cara Robinson, Bindu Shah and Jeffrey C. Smith, but also seven (7) of the Company’s nominees whose election we do not oppose. Starboard and the Company will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Stockholders will have the ability to vote for up to eleven (11) nominees on Starboard’s enclosed [COLOR] universal proxy card. Any stockholder who wishes to vote for any combination of the Company’s nominees and our nominees may do so on Starboard’s enclosed [COLOR] universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote. In any case, we recommend that the stockholders vote in favor of Starboard’s nominees, who we believe are most qualified to serve as directors in order to achieve a Board composition that we believe is in the best interest of all stockholders.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating, and returning the enclosed [COLOR] universal proxy card today.

If you have already voted for the incumbent management slate on the Company’s proxy card, you have every right to change yosur vote by signing, dating, marking your vote and returning a later dated [COLOR] universal proxy card or by voting at the Annual Meeting. The attached Proxy Statement and the enclosed [COLOR] universal proxy card are first being sent to the stockholders on or about [●], 2025.

If you have any questions or require any assistance with your vote, please contact [_____], which is assisting us, at its address and toll-free numbers listed below.

Thank you for your support.

/s/ Jeffrey C. Smith

Jeffrey C. Smith

Starboard Value and Opportunity Master Fund Ltd

1 Based upon publicly available information, however, the Company has not yet announced its nominees for election at the Annual Meeting. Once the Company announces its nominees and the number of seats up for election at the Annual Meeting, Starboard will make any necessary updates to this cover letter and the attached Proxy Statement.

If you have any questions, require assistance in voting your [COLOR] universal proxy card, or need additional copies of Starboard’s proxy materials, please contact [_____] at the phone numbers or email address listed below.

[______]

[______]

[______]

Stockholders may call toll-free: [_____]

Banks and brokers call: [_____]

E-mail: [_____]

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED FEBRUARY 5, 2025

2025 ANNUAL MEETING OF STOCKHOLDERS

OF

KENVUE INC.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED [COLOR] UNIVERSAL PROXY CARD TODAY

Starboard Value LP (“Starboard Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Value R LP (“Starboard R LP”), Starboard Value and Opportunity Master Fund L LP (“Starboard L Master”), Starboard Value L LP (“Starboard L GP”), Starboard Value R GP LLC (“Starboard R GP”), Starboard X Master Fund Ltd (“Starboard X Master”), Starboard G Fund, L.P. (“Starboard G LP”), Starboard Value G GP, LLC (“Starboard G GP”), Starboard Value A LP (“Starboard A LP”), Starboard Value A GP LLC (“Starboard A GP”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Jeffrey C. Smith and Peter A. Feld (collectively, “Starboard” or “we”), are significant stockholders of Kenvue Inc., a Delaware corporation (“KVUE”, “Kenvue” or the “Company”), who, together with the other participants in this solicitation, collectively beneficially own an aggregate of 22,031,711.682 shares of common stock, par value $0.01 per share (the “Common Stock”), of the Company, representing approximately 1.1% of the outstanding shares of Common Stock.

We believe that the Board of Directors of the Company (the “Board”) must be meaningfully reconstituted to ensure that the interests of the stockholders, the true owners of KVUE, are appropriately represented in the boardroom. To that end, we have nominated four (4) highly-qualified director candidates for election at the Company’s 2025 Annual Meeting of Stockholders (including any adjournments, postponements or continuations thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. The Annual Meeting will be held in virtual format on [•], 2025 at [•] [•].m. Eastern Time, online at [www.virtualshareholdermeeting.com/KVUE2025], where stockholders will have an opportunity:2

| 1. | To elect Starboard’s four (4) director nominees, Michelle Millstone-Shroff, Cara Robinson, Bindu Shah and Jeffrey C. Smith (each a “Starboard Nominee” and, collectively, the “Starboard Nominees”), to hold office until the Company’s 2026 Annual Meeting of Stockholders (the “2026 Annual Meeting”) and until their respective successors have been duly elected and qualified; |

2 As of the date of this Proxy Statement, the Company’s proxy statement has not yet been filed with the Securities and Exchange Commission (the “SEC”). The proposal numbers in this Proxy Statement may not correspond to the proposal numbers that will be used in the Company’s proxy statement. Certain information in this Proxy Statement, including whether the meeting will be held in a virtual only format, will be updated after the Company’s proxy statement is filed with the SEC.

| 2. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (“say-on-pay”); |

| 3. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2025; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and the enclosed [COLOR] universal proxy card are first being furnished to stockholders on or about [__], 2025.

The Company has disclosed that the Annual Meeting will take place in a virtual meeting format only. Stockholders will not be able to attend the Annual Meeting in person. For further information on how to attend and vote virtually at the Annual Meeting and by proxy please see the “VOTING AND PROXY PROCEDURES” and “VIRTUAL MEETING” sections of this Proxy Statement.

The Board is currently composed of eleven (11) directors, each with a term expiring at the Annual Meeting. Through this Proxy Statement and enclosed [COLOR] universal proxy card, we are soliciting proxies to elect not only the four (4) Starboard Nominees, but also seven (7) of the Company’s nominees whose election we do not oppose, [ ], [ ], [ ], [ ], [ ], [ ] and [ ] (the “Unopposed Company Nominees”). Starboard and Kenvue will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Stockholders will have the ability to vote for up to eleven (11) nominees on Starboard’s enclosed [COLOR] universal proxy card. Any stockholder who wishes to vote for seven (7) Company nominees in addition to the Starboard Nominees may do so on Starboard’s [COLOR] universal proxy card. There is no need to use the Company’s white universal proxy card or voting instruction form, regardless of how you wish to vote.

Your vote to elect the Starboard Nominees will have the legal effect of replacing four (4) incumbent directors. If elected, the Starboard Nominees, subject to their fiduciary duties as directors, will seek to work with the other members of the Board to evaluate all opportunities to enhance stockholder value. However, the Starboard Nominees will constitute a minority of the Board and there can be no guarantee that they will be able to implement the actions that they believe are necessary to unlock stockholder value. There is no assurance that any of the Company’s nominees will serve as directors if all or some of the Starboard Nominees are elected. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement.

Stockholders are permitted to vote for fewer than eleven (11) nominees or for any combination (up to eleven (11) total) of the Starboard Nominees and the Company’s nominees on the enclosed [COLOR] universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we recommend that stockholders vote in favor of only the Company nominees who we believe are the most qualified to serve as directors – the Unopposed Company Nominees – to help achieve a Board composition that we believe is in the best interest of all stockholders. We recommend that stockholders do not vote for any of the Company’s nominees other than the Unopposed Company Nominees. Among other potential consequences, voting for Company nominees other than the Unopposed Company Nominees may result in the failure of one or all of the Starboard Nominees to be elected to the Board. Starboard urges stockholders using our [COLOR] universal proxy card to vote “FOR” all of the Starboard Nominees and “FOR” the Unopposed Company Nominees.

IF YOU MARK FEWER THAN ELEVEN (11) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR [COLOR] UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL VOTE SUCH SHARES “FOR” THE FOUR (4) STARBOARD NOMINEES AND “FOR” THE SEVEN (7) UNOPPOSED COMPANY NOMINEES.

IMPORTANTLY, IF YOU MARK MORE THAN ELEVEN (11) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

The Company has set the close of business on [_______], 2025 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The address of the principal executive offices of the Company is 199 Grandview Road, Skillman, New Jersey 08558. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [_______] shares of Common Stock outstanding and entitled to vote at the Annual Meeting, and each share of Common Stock is entitled to one vote.

As of the date hereof, the members of Starboard and the Starboard Nominees collectively beneficially own an aggregate of 22,031,711.682 shares of Common Stock (the “Starboard Group Shares”). We intend to vote all of the Starboard Group Shares FOR the election of the Starboard Nominees and the Unopposed Company Nominees, [FOR/AGAINST] the advisory (non-binding) vote on the compensation of the Company’s named executive officers, and [FOR] the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, as described herein.

We urge you to carefully consider the information contained in this Proxy Statement and then support our efforts by signing, dating and returning the enclosed [COLOR] universal proxy card today.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED [COLOR] UNIVERSAL PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE [COLOR] UNIVERSAL PROXY CARD IN FAVOR OF THE ELECTION OF THE STARBOARD NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED [COLOR] UNIVERSAL PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our [COLOR] universal proxy card are available at

[ ]

IMPORTANT

Your vote is important, no matter the number of shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed [COLOR] universal proxy card today to vote FOR the election of the Starboard Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed [COLOR] universal proxy card and return it to Starboard, c/o [_____] in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a [COLOR] voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. As a beneficial owner, you may vote the shares at the Annual Meeting only if you obtain a legal proxy from the broker or bank giving you the right to vote the shares. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed [COLOR] voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed [COLOR] voting form. |

| · | You may vote your shares virtually at the Annual Meeting. Even if you plan to attend the Annual Meeting virtually, we recommend that you submit your [COLOR] universal proxy card by mail by the applicable deadline so that your vote will be counted if you later decide not to attend the Annual Meeting. |

As Starboard is using a “universal” proxy card, which includes the Starboard Nominees as well as the Company’s nominees, there is no need to use any other proxy card regardless of how you intend to vote. However, Starboard strongly urges you NOT to sign or return any white proxy cards or voting instruction forms that you may receive from the Company. Even if you return the white management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. So please make certain that the latest dated proxy card you return is the [COLOR] universal proxy card.

If you have any questions, require assistance in voting your [COLOR] universal proxy card, or need additional copies of Starboard’s proxy materials, please contact [______] at the phone numbers or email address listed below.

[______]

[______]

[______]

Stockholders may call toll-free: [_____]

Banks and brokers call: [_____]

E-mail: [_____]

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this proxy solicitation:

| · | On October 20, 2024, representatives of Starboard emailed Kenvue’s Investor Relations department as well as Thibaut Mongon, Kenvue’s Chief Executive Officer (“CEO”), requesting a call to discuss Starboard’s investment in Kenvue. A call was scheduled for the following day, October 21, 2024. |

| · | On October 21, 2024, a call was held between representatives of Starboard and the Company where Starboard informed Mr. Mongon and Larry Merlo, Chair of the Board, that Starboard held a stake in the Company and intended to publicly discuss its investment at the 13D Monitor Active-Passive Investor Summit being held on October 22, 2024. |

| · | On October 22, 2024, Mr. Smith presented Starboard’s investment in Kenvue at the 13D Monitor Active-Passive Investor Summit in New York City. |

| · | On October 28, 2024, Starboard reached out to the Company to schedule an in-person meeting, which was ultimately scheduled for November 14, 2024. |

| · | On November 14, 2024, representatives from Starboard met with Mr. Mongon and Paul Ruh, the Company’s Chief Financial Officer (“CFO”), at the Company’s headquarters in Skillman, New Jersey. |

| · | Following a conversation between Mr. Smith and Mr. Merlo, representatives from the Company reached out to Starboard on December 2, 2024 to schedule a meeting with the Board, which was ultimately scheduled for December 10, 2024. |

| · | On December 10, 2024, representatives from Starboard met virtually with the Board and presented materials outlining issues with the Company’s performance. |

| · | Later on December 10, 2024, Starboard delivered a letter to the Company, in accordance with the Company's organizational documents, nominating five (5) director candidates, including the Starboard Nominees, for election to the Board at the Annual Meeting (the “Nomination Notice”). Starboard thereafter delivered a letter to the Company, dated December 13, 2024, notifying the Company that Starboard had elected to withdraw its nomination of one (1) of its director nominees for election to the Board at the Annual Meeting. |

| · | On December 16, 2024, Starboard delivered a supplement to its Nomination Notice notifying the Company of certain updates to the information set forth in the Nomination Notice and certain Starboard Nominee questionnaires required under the Company’s Amended and Restated Bylaws (the “Bylaws”). Starboard thereafter delivered additional supplements to its Nomination Notice, dated December 20, 2024, December 27, 2024, January 7, 2025, January 10, 2025, January 24, 2025 and January 31, 2025. |

| · | In December 2024 and January 2025, Mr. Smith and Mr. Merlo connected several times discussing Starboard’s presentation and Nomination Notice. |

| · | Several times during January 2024, Mr. Smith and Robert Pruzan connected to discuss Starboard’s nomination where Mr. Smith reiterated the need for significant change at Kenvue. |

| · | On February 5, 2025, Starboard filed this preliminary proxy statement with the SEC. |

REASONS FOR THE SOLICITATION

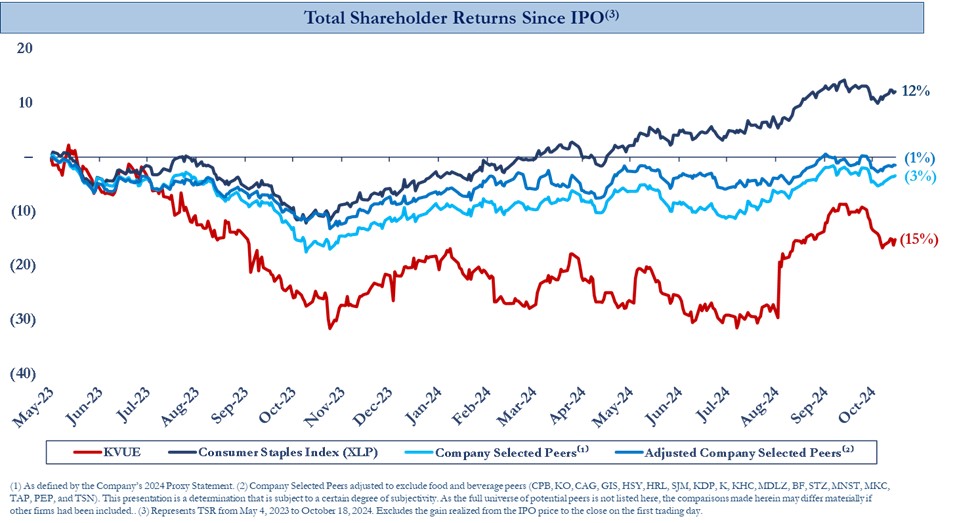

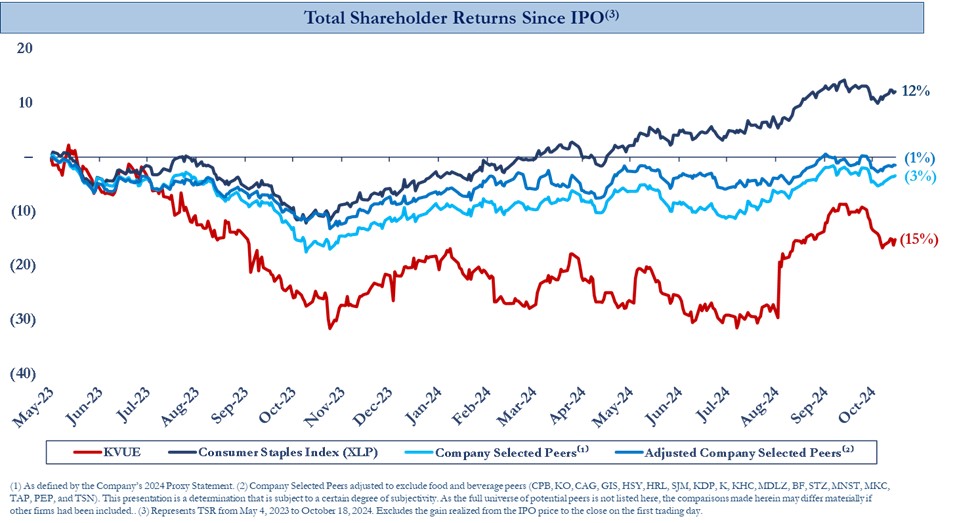

We believe Kenvue has tremendous potential but has significantly underperformed as evidenced by total shareholder returns well below peers and market indices as well as a significant valuation discount to peers. Since the Company’s initial public offering (“IPO”) in May 2023, the Board has overseen deteriorating financial performance, missed commitments, and growth deceleration, among other issues, despite Kenvue’s world-class brand portfolio and market-leading position. We believe there is a clear need for meaningful change at the Company.

As background, Kenvue was created through the separation of Johnson & Johnson’s (“J&J”) Consumer Health business (the “Spin”) in 2023. Kenvue’s business spans three segments - Self Care, Essential Health, and Skin Health and Beauty - and includes a world-class portfolio of brands such as Tylenol, Benadryl, Motrin, Listerine, BAND-AID, Neutrogena, and Aveeno, among others. Across the three segments, Kenvue’s brands have leadership positions within attractive categories, which we believe are poised to benefit from long-term demand drivers while facing less exposure to private label threats. We invested in Kenvue based on our firm belief that the Company has the potential to be a preeminent consumer health company due to its iconic brand portfolio, market-leading position, and exposure to attractive markets.

Unfortunately, we believe Kenvue has fallen far short of its enormous potential. Kenvue’s history of financial underperformance dates back to when it was a segment of J&J. From 2019 to 2022, J&J Consumer Health grew at an annualized organic rate of ~3%, meaningfully below its end markets which grew ~5%.3 Underlying J&J Consumer Health’s below-market growth rate from 2019 to 2022 were considerable market share losses in two of its three segments - Skin Health and Beauty and Essential Health.4 During this period of organic growth underperformance, the Company embarked on a self-described “transformation journey” aimed at improving J&J Consumer Health’s competitive positioning which culminated in the separation and creation of Kenvue in May 2023.5

We believe the Spin carried many benefits which should have improved performance. Namely, the Spin allowed for a dedicated management team with a singular and unobstructed focus on Kenvue’s business, proper resource allocation, increased brand investments, and the opportunity to embrace a marketing-first strategy. Regrettably, the Company’s financial performance has only worsened since the Spin. As outlined below, the Company has repeatedly missed financial commitments, continued to lose market share, and experienced further growth deceleration since the IPO – all of which have resulted in a languishing share price. Notably, the Company’s share price performance has been negative on an absolute and relative basis since the IPO, severely underperforming its peers and the broader market.6 The Company’s underperformance is further evidenced by a significant valuation discount to peers.7

We believe the Company’s widespread and worsening underperformance clearly demonstrates that the Board has failed to provide effective oversight, safeguard shareholders’ interests, or instill any real accountability. We believe stockholders deserve a Board that demands accountability and is committed to taking proactive measures with the best interests of stockholders in mind at all times. We are deeply concerned that the Board’s continued complacency and deference to management will jeopardize the tremendous value creation opportunity we believe is possible at Kenvue.

3 Source: Public company filings.

4 Source: Wall Street research.

5 Source: Public company transcript.

6 Share price performance measured from May 4, 2023 and excludes the gain realized from the IPO price to the close on the first trading day.

7 Compared to Household & Personal Care peers (PG, CL, HLN, CLX, CHD, and KMB).

We are therefore soliciting your support at the Annual Meeting to elect our four (4) highly qualified Starboard Nominees – Ms. Robinson, Mr. Smith, Ms. Shroff, and Ms. Shah, who we believe would not only bring significant and relevant experience to the Board, but also help restore credibility, demand accountability, and ensure a results-driven culture at Kenvue. Our candidates were carefully selected and possess skill sets in areas that we believe are directly relevant to Kenvue’s business and its current challenges and opportunities.

Stockholders Have Suffered From Significant Stock Price Underperformance

Despite a world-class brand portfolio, prized market position, and attractive categories, the Company’s stock price has significantly underperformed its Proxy Performance Peers and broader market indices since its IPO.

The Company’s Organic Growth Has Fallen Short of Commitments to Shareholders

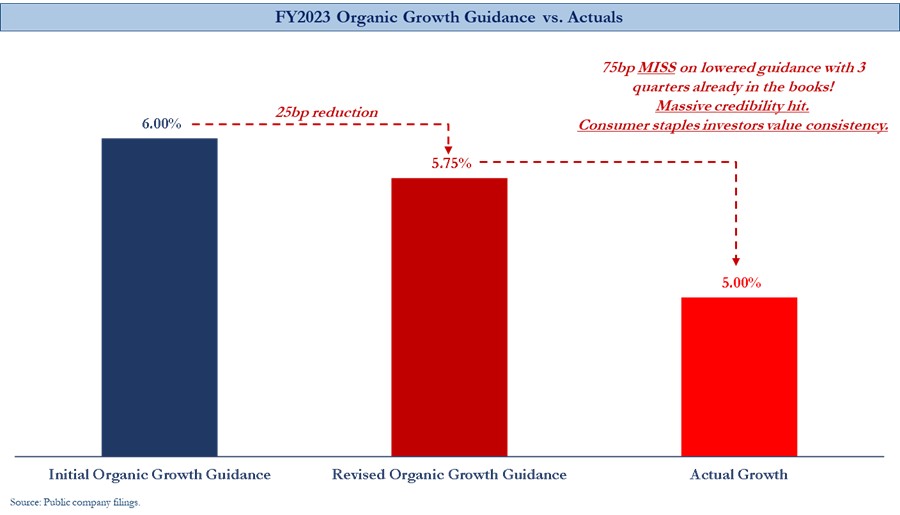

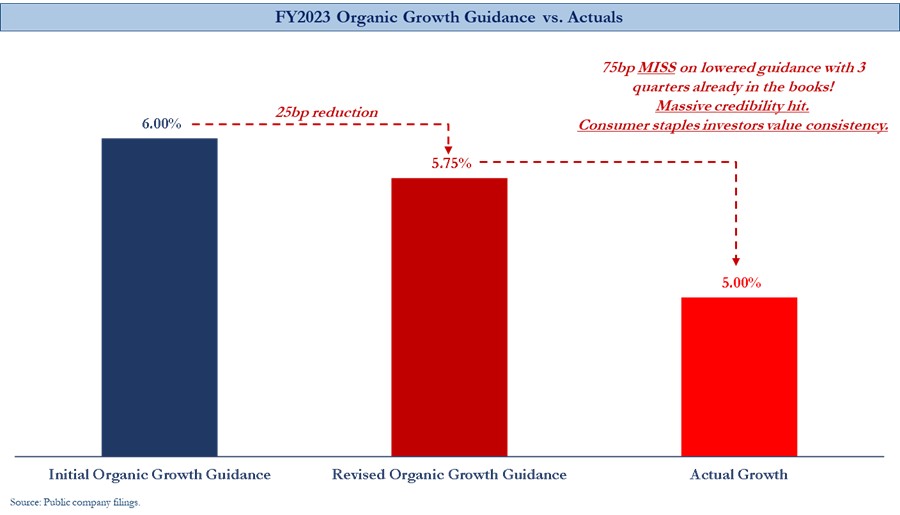

In July 2023, shortly after the May 2023 Spin, the Company committed to delivering total organic growth in the range of 5.5% to 6.5% for FY2023 or 6.0% at the midpoint. The following quarter, just three months later in November 2023, the Company lowered its organic growth guidance by 25bp at the midpoint to a range of to 5.5% to 6.0%, citing a lower-than-expected cough, cold, and flu season.

Importantly, the Company had the benefit of three-quarters of the year’s results when setting its updated guidance – thereby significantly de-risking the full year expected organic growth. Still, the Company’s FY2023 organic growth ultimately missed the Company’s guidance by a significant margin. While management committed to FY2023 organic growth of 5.75% (at the midpoint) in November 2023, the Company shockingly only delivered FY2023 organic growth of 5.0%.

After failing to deliver FY2023 organic growth within expectations, the Company then set FY2024 organic growth guidance in the range of 2.0% to 4.0%, or 3.0% at the midpoint, in February 2024. The Company reiterated this guidance the following two quarters before again reducing the midpoint of expectations in November 2024, noting it expected organic growth “towards the low end of the [guidance] range.” As a result, consensus sell-side research analysts expect FY2024 organic growth of just 1.83% - well below management’s original guidance range.8

Notably, the Company is once again expected to continue losing market share in FY2025 based on consensus sell-side estimates for organic growth versus peers. Specifically, while Kenvue’s long-term annualized end market growth is estimated to be approximately ~4% through 2030 per Wall Street research, Kenvue is expected to underperform and only grow 3.2% in FY2025, signaling further expected share loss.9

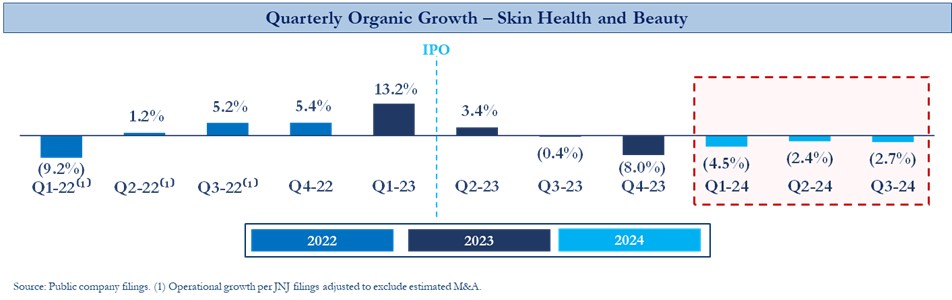

The Company Has Repeatedly Missed Commitments to Improve Skin Health and Beauty Performance

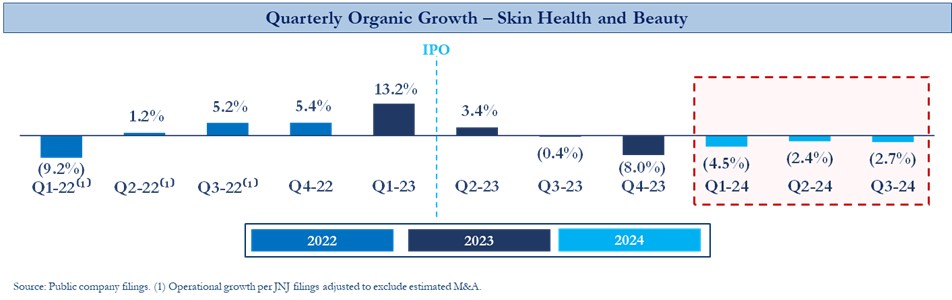

The Company’s financial performance issues have most acutely been concentrated within its Skin Health and Beauty segment, which includes leading brands such as Neutrogena, Aveeno, and OGX. From 2019 to 2022, Skin Health and Beauty lost nearly 150bps of market share and adjusted segment margins declined over 500bps.10 Skin Health and Beauty’s performance has continued to deteriorate following the Spin even despite the Company’s repeated commitments to turnaround the segment.

Immediately following the Spin, in June 2023, the Company excused prior poor Skin Health and Beauty performance as being “impacted last year by supply chain issues” and noting the segment was expected to experience “sequential improvement over time.” The Company again echoed commitments to improve Skin Health and Beauty in October 2023 stating “But are we confident that the cadence of our recovery plan is on track? Absolutely.” Unfortunately, just a few months later, Skin Health and Beauty FY2023 organic growth ultimately fell short of expectations by a wide margin due “specific missteps around in-store execution.”

8 Source: Wall Street research per Bloomberg as of February 3, 2025.

9 Source: Wall Street research per Bloomberg as of February 3, 2025.

10 Source: Wall Street research and public company filings.

Undeterred by FY2023’s failures, in February 2024, the Company again committed to improving Skin Health and Beauty performance: “Additionally, we believe our strong partnerships with retailers, coupled with increased investment and a higher level of precision in our execution, will enable us to stabilize [Skin Health and Beauty] in the U.S. and deliver stronger growth in 2024.”

Yet again, actual results varied significantly from management’s promises –despite easy FY2023 comparables. Skin Health and Beauty’s FY2024 organic growth – or lack thereof – has largely proved disappointing with year-over-year organic sales declines in the first three quarters of the year as shown below. For FY2024, Wall Street research analysts expect Skin Health and Beauty organic sales declines of 2.2%, a sharp deceleration from FY2023 organic growth of 1.8%.11

We Believe Kenvue Needs a Reconstituted Board to Instill Accountability and Restore Credibility with Stockholders

Our goal is to create value for the benefit of all stockholders. We believe Kenvue has the potential to become the preeminent consumer health company. Kenvue has an iconic portfolio of world-class brands that seems impossible to replicate and market-leading positions within attractive end-markets that are expected to grow durably through 2030. However, deteriorating financial performance, missed investor commitments, and poor Board oversight have created a credibility issue for Kenvue as exhibited by its large valuation discount versus peers.

Notwithstanding Kenvue’s poor financial performance and repeatedly missed commitments, management is once again promising improved performance to investors. While we are confident Kenvue’s market-leading brands are capable of outperforming the competing brands, we believe Kenvue needs improved Board oversight in order to meet its potential.

As such, we are seeking to elect four (4) highly qualified and experienced individuals to serve on the Board, who we believe are committed to maximizing value for all stockholders and ensuring your interests remain paramount in the boardroom at all times. Over the coming weeks and months, we look forward to sharing our detailed views and plans for Kenvue and look forward to engaging with you as we approach the Annual Meeting.

11 Source: Wall Street research per Bloomberg as of February 3, 2025.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of eleven (11) directors, each with a term expiring at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our four (4) Starboard Nominees, Michelle Millstone-Shroff, Cara Robinson, Bindu Shah and Jeffrey C. Smith, for terms expiring at the 2026 Annual Meeting. Your vote to elect the Starboard Nominees will have the legal effect of replacing four (4) incumbent directors of the Company with the Starboard Nominees. If elected, our Starboard Nominees will constitute a minority of the Board and there can be no guarantee that the Starboard Nominees will be able to implement the actions that they believe are necessary to unlock stockholder value. However, we believe the election of our Starboard Nominees is an important step in the right direction for enhancing long-term value at the Company.

This Proxy Statement is soliciting proxies to elect not only our four (4) Starboard Nominees, but also the seven (7) Unopposed Company Nominees. We have provided the required notice to the Company pursuant to the Universal Proxy Rules, including Rule 14a-19(a)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and intend to solicit the holders of Common Stock representing at least 67% of the voting power of Common Stock entitled to vote on the election of directors in support of director nominees other than the Company’s nominees. There is no assurance that any of the Company’s nominees will serve as a director if any of the Starboard Nominees are elected to the Board. You should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

THE STARBOARD NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Starboard Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Starboard Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Starboard Nominees. All of the Starboard Nominees are citizens of the United States of America.

Michelle Millstone-Shroff, age 49, has served as a Senior Advisor at McKinsey & Company (“McKinsey”), a global management consulting firm, since April 2019. Previously, Ms. Millstone-Shroff served as the Chief Customer Experience Officer of Bed Bath & Beyond Inc. (formerly NASDAQ: BBBY) (“Bed Bath & Beyond”), a chain of domestic merchandise retail stores, from 2015 to 2018, as the President & Chief Operating Officer of buybuy BABY, a $1+ billion subsidiary of Bed Bath & Beyond and a retailer of items for infants and toddlers, from 2007 to 2018, and as Head of Business Development at Bed Bath & Beyond, from 2003 to 2007. Prior to that, she worked at McKinsey, with a focus on retail- and consumer-oriented companies. Additionally, Ms. Millstone-Shroff has served on the Boards of Directors of Athletico, a private chain of physical therapy clinics, since September 2021; InMarket Media, LLC, a privately held digital marketing and analytics platform, since June 2022; and Halo Dream, Inc. (f/k/a Aden & Anais, Inc.), a privately held global provider of baby and lifestyle products, since August 2023. Previously, Ms. Millstone-Shroff served on the Board of Directors of Neiman Marcus Group Inc., a luxury retailer, from September 2020 until it was acquired by Saks Global, a leading luxury retail and real estate company, in December 2024 and the Board of Trustees of Public Storage (NYSE: PSA), a self-storage owner and operator, from January 2021 to June 2023. She also previously served as a member of the Boards of Directors of Party City Holdco Inc. (formerly NYSE: PRTY), a vertically-integrated party goods supplier, from February 2019 to October 2023 and Nanit, an AI-powered company focused on family sleep solutions, from December 2019 to July 2023. Ms. Millstone-Shroff received a B.S. in Strategic Management from The Wharton School and a B.A. in Psychology at The University of Pennsylvania as well as an M.B.A. from Harvard Business School.

Starboard believes Ms. Millstone-Shroff’s significant leadership experience and service on numerous public and private company boards, combined with her expertise in retail, digital transformation, and corporate governance, would make her a valuable addition to the Board.

Cara Robinson, age 55, has served as a director of Citi Trends, Inc. (NASDAQ: CTRN), a specialty retailer of apparel, accessories and home trends, since November 2021. Previously, Ms. Robinson served as the Chief Executive Officer of Beauty & Wellbeing, North America of Unilever plc (NYSE: UL), a global consumer products company, from July 2022 to December 2023, and Chief Executive Officer of Sundial Brands, a personal care products subsidiary of Unilever plc, from December 2019 to December 2023. Prior to that, she served as Vice President of Marketing, Americas of NARS Cosmetics, a subsidiary of Shiseido Company, Limited, a multinational publicly traded cosmetics company, from January 2019 to December 2019; as Vice President of Global Marketing of Clinique, a subsidiary of The Estée Lauder Companies Inc. (NYSE: EL), a cosmetics and skincare products company, from January 2014 to January 2019; as Vice President of the Footwear Division of Totes Isotoner Corporation, a weather-related products company, from 2012 to 2014; and Group Brand Director of Neutrogena Corporation, a subsidiary of Johnson & Johnson (n/k/a Kenvue Inc. (NYSE: KVUE)), a personal care products company, from 2008 to 2011. Earlier in her career, she served as Executive Director, U.S. Marketing at Avon Products, Inc., a multinational personal care products company, from 2006 to 2008; in various roles of increasing responsibility at L'Oréal S.A., a publicly traded global consumer products company, including as Assistant Vice President, Haircare Marketing Group, Director of the Vive and L’Oreal Kids brands and Sr. Brand Manager of Vive haircare, from 2003 to 2006; Group Brand Manager of Capital One Financial Corporation (NYSE: COF), a financial services company, from 2000 to 2003; and Senior Associate Brand Manager of Kraft Foods, Inc. (n/k/a The Kraft Heinz Company (NYSE: KHC)), a multinational food and beverage company, from 1998 to 2000. Ms. Robinson serves on the Board of Visitors for Duke University’s Fuqua School of Business; Board of Trustees for the Alvin Ailey Dance Theater; and the Executive Committee and Board of the Ad Council. She is the recipient of numerous awards, including the Cosmetic Executive Women (CEW) Achiever Award 2021 and Well + Good Changemaker 2021. Ms. Robinson received a B.A. from the University of Virginia and an M.B.A. from Duke University’s Fuqua School of Business.

Starboard believes Ms. Robinson’s significant leadership and senior executive experience, coupled with her expertise in consumer products, would make her a valuable addition to the Board.

Bindu Shah, age 45, currently serves as Executive Vice President, Global Chief Marketing Officer & Chief Digital Officer of Tory Burch LLC, a luxury fashion brand, since June 2019. In this role, Ms. Shah has been instrumental in expanding the brand’s digital presence, strengthening customer loyalty, and accelerating e-commerce growth, particularly in the U.S. and Asia. Under her leadership, the company has driven significant social and customer engagement and enhanced awareness of its brand transformation. Previously, Ms. Shah served as Vice President, Digital Marketing & Media of Sephora, a subsidiary of LVMH Moët Hennessy Louis Vuitton, a publicly traded global luxury products company, from 2015 to April 2019. At Sephora, she oversaw all marketing channels and the media budget, driving significant growth in customer acquisition, retention, and omni-channel sales. Ms. Shah spearheaded digital initiatives, including the development of Sephora’s YouTube channel, the launch of its Beauty Insider Community, and the scaling of personalization strategies, solidifying the company’s position as a leader in the beauty industry. Prior to that, Ms. Shah held various marketing roles of increasing responsibility at Gilt Groupe, an online retailer, including as Vice President, Analytics, Marketing and Innovation during 2014; Vice President, Brand and Integrated Marketing from 2012 to 2014; Senior Director, Marketing Strategy and Planning from 2011 to 2012; and Director, Channel Management during 2011. During her tenure, she developed expertise in integrated marketing, e-commerce, and brand strategy, contributing to Gilt Groupe’s significant revenue growth. Ms. Shah also worked at The McGraw-Hill Companies, a global publishing and education company, serving as Director, eCommerce Product Management and Customer Experience during 2010 and as Associate Director, Management Development Program from 2008 to 2010. Earlier in her career, Ms. Shah served as Senior Financial Analyst of Edison Schools, Inc. (n/k/a EdisonLearning Inc.), an education management organization, from 2003 to 2006, and as an Investment Banking Analyst in the Retail and Consumer Products Group of Morgan Stanley (NYSE: MS), a global financial services company, from 2001 to 2003. Ms. Shah received a B.A. in Economics and Mathematics from Barnard College, Columbia University, and an M.B.A. from Harvard Business School.

Starboard believes Ms. Shah’s significant leadership experience, combined with her expertise in marketing, retail, and e-commerce, would make her a valuable addition to the Board.

Jeffrey C. Smith, age 52, is a Managing Member, Chief Executive Officer and Chief Investment Officer of Starboard Value LP, an investment adviser with a focused and fundamental approach to investing primarily in publicly traded U.S. companies. Prior to founding Starboard Value LP in April 2011, Mr. Smith served as the Chief Investment Officer for the funds that comprised the Value and Opportunity investment platform at Ramius LLC (“Ramius”), a subsidiary of the Cowen Group, Inc., where he was a Partner Managing Director. Before joining Ramius in January 1998, he served as Vice President of Strategic Development and a member of the Board of Directors of The Fresh Juice Company, Inc. (formerly NASDAQ: FRSH). Mr. Smith began his career in the Mergers and Acquisitions department at Société Générale. Mr. Smith serves on the Board of Advisors for First Generation Investors, Inc., a non-profit with a mission to help first-generation investors learn about wealth generation, as well as on the Shaquille O’Neal Foundation, a foundation creating pathways for underserved youth to help them achieve their full potential. Mr. Smith graduated from The Wharton School of Business at The University of Pennsylvania, where he received a B.S. in Economics.

Starboard believes Mr. Smith’s extensive knowledge of the capital markets, corporate finance, and public company governance practices, together with his significant public company board experience, would make him a valuable asset to the Board.

Previously, Mr. Smith served as Chair of the Boards of Directors of Papa John’s International, Inc. (NASDAQ: PZZA), a leading pizza delivery company, from February 2019 to March 2023; Starboard Value Acquisition Corp. (formerly NASDAQ: SVAC), a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, from November 2019 until it merged with Cyxtera (as defined below) in July 2021; Advance Auto Parts, Inc. (NYSE: AAP), one of the largest retailers of automotive replacement parts and accessories in the United States, from May 2016 to May 2020; Darden Restaurants, Inc. (NYSE: DRI), a multi-brand restaurant operator, from October 2014 to April 2016; and Phoenix Technologies Ltd. (formerly NASDAQ: PTEC), a provider of core systems software products, services, and embedded technologies, from November 2009 until the sale of the company to Marlin Equity Partners in November 2010. He also previously served on the Boards of Directors of numerous other public companies, including RB Global, Inc. (NSYE: RBA), a leading global marketplace that connects sellers and buyers of commercial assets and vehicles, from March 2023 to November 2024; Cyxtera Technologies, Inc. (NYSE: CYXT) (“Cyxtera”), a provider of data center colocation, enterprise bare metal, and interconnectivity services, from July 2021 to March 2023; Perrigo Company plc (NYSE; TASE: PRGO), a leading global healthcare company, from February 2017 to August 2019; Yahoo! Inc. (formerly NASDAQ: YHOO), a web services provider, from April 2016 until its operating business was sold to Verizon Communications Inc. in June 2017; Quantum Corporation (NASDAQ: QMCO) (formerly NYSE: QTM), a global expert in data protection and big data management, from May 2013 to May 2015; Office Depot, Inc. (formerly NYSE: ODP) (n/k/a The ODP Corporation) (NASDAQ: ODP), an office supply company, from August 2013 to September 2014; Regis Corporation (NASDAQ: RGS), a global leader in beauty salons, hair restoration centers and cosmetology education, from October 2011 to October 2013; Surmodics, Inc. (NASDAQ: SRDX), a leading provider of drug delivery and surface modification technologies to the healthcare industry, from January 2011 to August 2012; Zoran Corporation (formerly NASDAQ: ZRAN), a provider of digital solutions in the digital entertainment and digital imaging market, from March 2011 until its merger with CSR plc in August 2011; Actel Corporation (formerly NASDAQ: ACTL), a provider of power management solutions, from March 2009 until its sale to Microsemi Corporation in October 2010; Kensey Nash Corporation (formerly NASDAQ: KNSY), a medical technology company, from December 2007 to February 2009; S1 Corporation (formerly NASDAQ: SONE), a then provider of customer interaction software for financial and payment services, from May 2006 to September 2008; and The Fresh Juice Company, Inc., from 1996 until its sale to the Saratoga Beverage Group, Inc. in 1998.

The principal business address of each of Ms. Millstone-Shroff and Ms. Robinson is a personal residence which has been retained in the files of Olshan Frome Wolosky LLP, 1325 Avenue of the Americas, New York, New York 10019. The principal business address of Ms. Shah is 11 West 19th Street, 9th Floor, New York, New York 10011. The principal business address of Mr. Smith is c/o Starboard Value LP, 201 E Las Olas Boulevard, Suite 1000, Fort Lauderdale, Florida 33301.

As of the date hereof, Ms. Millstone-Shroff directly beneficially owns 1,000 shares of Common Stock. For information regarding transactions in securities of the Company during the past two years by Ms. Millstone-Shroff, please see Schedule I. The shares of Common Stock purchased by Ms. Millstone-Shroff were purchased with personal funds in the open market.

As of the date hereof, Ms. Robinson directly beneficially owns 577.124 shares of Common Stock. For information regarding transactions in securities of the Company during the past two years by Ms. Robinson, please see Schedule I. The shares of Common Stock purchased by Ms. Robinson were purchased with personal funds in the open market.

As of the date hereof, Ms. Shah directly beneficially owns 1,134.558 shares of Common Stock. For information regarding transactions in securities of the Company during the past two years by Ms. Shah, please see Schedule I. The shares of Common Stock beneficially owned by Ms. Shah were purchased with personal funds in the open market.

As of the date hereof, Mr. Smith does not directly own any securities of the Company and has not directly entered into any transactions in securities of the Company during the past two years. Mr. Smith, by virtue of his relationship with Starboard Value LP and its affiliates described elsewhere in this Proxy Statement, may be deemed the beneficial owner of the 22,029,000 shares of Common Stock beneficially owned in the aggregate by Starboard Value LP and its affiliates. Mr. Smith disclaims beneficial ownership of such shares of Common Stock, except to the extent of his pecuniary interest therein. For information regarding transactions in securities of the Company during the past two years by Starboard, please see Schedule I attached hereto.

Starboard V&O Fund, Starboard S LLC, Starboard C LP, Starboard R LP, Starboard L Master, Starboard L GP, Starboard R GP, Starboard X Master, Starboard G LP, Starboard G GP, Starboard A LP, Starboard A GP, Starboard Value LP, Starboard Value GP, Principal Co, Principal GP, Mr. Feld and the Starboard Nominees (collectively, the “Group”) entered into a group agreement (the “Group Agreement”) in which, among other things, (i) the Group agreed to solicit proxies or written consents for the election of the Starboard Nominees, or any other person(s) nominated by Starboard V&O Fund, to the Board at the Annual Meeting, (ii) the Group agreed to take all other action the Group deems necessary or advisable to achieve the foregoing, (iii) each of the Starboard Nominees (other than Mr. Smith) agreed that he or she will not undertake or effect any purchase, sale, acquisition or disposition of any securities of the Company without the prior written consent of Starboard and its affiliates who are parties to the Group Agreement, (iv) Starboard V&O Fund, Starboard S LLC, Starboard C LP, Starboard L Master, Starboard X Master, Starboard G LP and Starboard Value LP through the Starboard Value LP Account (as defined below) agreed to bear all expenses incurred in connection with the Group’s activities, including approved expenses incurred by any of the parties in connection with the solicitation, subject to certain limitations, and (v) in the event that the Group becomes obligated to file a statement on Schedule 13D in accordance with Rule 13d-1(k)(1)(iii) under the Exchange Act, the Group agreed to the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company.

Each of the Starboard Nominees has consented to being named as a nominee of Starboard in any proxy statement relating to the Annual Meeting and serving as a director of the Company if elected.

Starboard V&O Fund has signed separate letter agreements with each of the Starboard Nominees (other than Mr. Smith) pursuant to which it and its affiliates have agreed to indemnify such Starboard Nominees against certain claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any claims made against such Starboard Nominees in their capacities as directors of the Company, if so elected.

Starboard V&O Fund has signed compensation letter agreements (the “Compensation Letter Agreements”) with each of the Starboard Nominees (other than Mr. Smith), pursuant to which it has agreed to pay each of such Starboard Nominees: (i) $25,000 in cash as a result of the submission by Starboard V&O Fund of its nomination of each of such Starboard Nominees to the Company and (ii) $25,000 in cash upon the filing by Starboard V&O Fund of a definitive proxy statement with the SEC relating to the solicitation of proxies in favor of such Starboard Nominees’ election as directors of the Company. Pursuant to the Compensation Letter Agreements, each of such Starboard Nominees has agreed to use the after-tax proceeds from such compensation to acquire securities of the Company (the “Nominee Shares”) at such time that each of such Starboard Nominees shall determine, but in any event no later than fourteen (14) days after receipt of such compensation, subject to Starboard V&O Fund’s right to waive the requirement to purchase the Nominee Shares. Pursuant to the Compensation Letter Agreements, each of such Starboard Nominees has agreed not to sell, transfer or otherwise dispose of any Nominee Shares until the earliest to occur of (i) the Company’s appointment or nomination of such Starboard Nominee as a director of the Company, (ii) the date of any agreement with the Company in furtherance of such Starboard Nominee’s nomination or appointment as a director of the Company, (iii) Starboard V&O Fund’s withdrawal of its nomination of such Starboard Nominee for election as a director of the Company, and (iv) the date of the Annual Meeting; provided, however, in the event that the Company enters into a business combination with a third party, each of such Starboard Nominees, may sell, transfer or exchange the Nominee Shares in accordance with the terms of such business combination.

Starboard believes that each Starboard Nominee presently is, and if elected as a director of the Company, each of the Starboard Nominees would be, an “independent director” within the meaning of (i) applicable New York Stock Exchange (“NYSE”) listing standards applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, Starboard acknowledges that no director of a NYSE listed company qualifies as “independent” under the NYSE listing standards unless the board of directors affirmatively determines that such director is independent under such standards. Accordingly, Starboard acknowledges that if any Nominee is elected, the determination of the Starboard Nominee’s independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board. No Starboard Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

Except as otherwise set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Starboard Nominee has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Starboard Nominee directly or indirectly beneficially owns any securities of the Company; (iii) no Starboard Nominee owns any securities of the Company which are owned of record but not beneficially; (iv) no Starboard Nominee has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any Starboard Nominee is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no Starboard Nominee is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any Starboard Nominee owns beneficially, directly or indirectly, any securities of the Company; (viii) no Starboard Nominee owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Starboard Nominee or any of his or her associates or immediate family members was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Starboard Nominee or any of his or her associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no Starboard Nominee has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting; (xii) no Starboard Nominee holds any positions or offices with the Company; (xiii) no Starboard Nominee has a family relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer, (xiv) no companies or organizations, with which any of the Starboard Nominees has been employed in the past five years, is a parent, subsidiary or other affiliate of the Company and (xv) there are no material proceedings to which any Starboard Nominee or any of his or her associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. Except as disclosed herein, with respect to each of the Starboard Nominees, (a) none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act (“Regulation S-K”) occurred during the past 10 years, (b) there are no relationships involving any Starboard Nominee or any of such Starboard Nominee’s associates that would have required disclosure under Item 407(e)(4) of Regulation S-K had such Starboard Nominee been a director of the Company, and (c) none of the Starboard Nominees nor any of their associates has received any fees earned or paid in cash, stock awards, option awards, non-equity incentive plan compensation, changes in pension value or nonqualified deferred compensation earnings or any other compensation from the Company during the Company’s last completed fiscal year, or was subject to any other compensation arrangement described in Item 402 of Regulation S-K.

Other than as stated herein, and except for compensation received by Mr. Smith as an employee of Starboard Value LP, there are no arrangements or understandings between Starboard and any of the Starboard Nominees or any other person or persons pursuant to which the nominations of the Starboard Nominees described herein are to be made, other than the consent by each of the Starboard Nominees to be named as a nominee of Starboard in any proxy statement relating to the Annual Meeting and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Starboard Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

We do not expect that any of the Starboard Nominees will be unable to stand for election, but, in the event any Starboard Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed [COLOR] universal proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Starboard Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by the enclosed [COLOR] universal proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size.

Starboard and Kenvue will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Each of the Starboard Nominees has consented to being named as a nominee for election as a director of the Company in any proxy statement relating to the Annual Meeting. Stockholders will have the ability to vote for up to eleven (11) nominees on Starboard’s enclosed [COLOR] universal proxy card. Any stockholder who wishes to vote for any combination of the Company’s nominees and the Starboard Nominees may do so on Starboard’s enclosed [COLOR] universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote.

Stockholders are permitted to vote for fewer than eleven (11) nominees or for any combination (up to eleven (11) total) of the Starboard Nominees and the Company’s nominees on the [COLOR] universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we recommend that stockholders vote in favor of the Unopposed Company Nominees, who we believe are sufficiently qualified to serve as directors, to help achieve a Board composition that we believe is in the best interest of all stockholders. There is no need to use the Company’s white universal proxy card or voting instruction form, regardless of how you wish to vote. However, Starboard urges stockholders to vote using our [COLOR] universal proxy card “FOR” all of the Starboard Nominees and “FOR” the Unopposed Company Nominees.

The Company nominees that Starboard does not oppose and believes are sufficiently qualified to serve as directors with the Starboard Nominees are the Unopposed Company Nominees. Certain information about the Unopposed Company Nominees is set forth in the Company’s proxy statement. Starboard is not responsible for the accuracy of any information provided by or relating to Kenvue or its nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Kenvue or any other statements that Kenvue or its representatives have made or may otherwise make.

IF YOU MARK FEWER THAN ELEVEN (11) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR [COLOR] UNIVERSAL PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES NAMED THEREIN WILL VOTE SUCH SHARES “FOR” THE FOUR (4) STARBOARD NOMINEES AND THE SEVEN (7) UNOPPOSED COMPANY NOMINEES.

IMPORTANTLY, IF YOU MARK MORE THAN ELEVEN (11) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

WE STRONGLY URGE YOU TO VOTE FOR THE ELECTION OF THE STARBOARD NOMINEES ON THE ENCLOSED [COLOR] UNIVERSAL PROXY CARD.

PROPOSAL NO. 2

NON-BINDING ADVISORY VOTE TO APPROVE THE

COMPENSATION OF KENVUE’S NAMED EXECUTIVE OFFICERS

As disclosed in the Company’s proxy statement, under Section 14A of the Exchange Act, the Company’s stockholders are entitled to vote on a proposal to approve on an advisory (non-binding) basis, the compensation of the named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the shareholders of Kenvue Inc. approve, on a non-binding advisory basis, the compensation paid to the named executive officers, including as disclosed in the Compensation Discussion & Analysis, compensation tables, and related narrative discussion.”

According to the Company’s proxy statement, as an advisory vote, this proposal is not binding upon the Board or the Compensation & Human Capital Committee of the Board. However, the Board and Compensation & Human Capital Committee will consider the outcome of the vote when evaluating its executive compensation program and making future executive compensation decisions. The affirmative vote of a majority of the voting power of Common Stock present in person or represented by proxy at the Annual Meeting is required to approve this proposal.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL] AND INTEND TO VOTE OUR SHARES [“FOR”/“AGAINST”] THIS PROPOSAL.

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has appointed PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for 2025. The Company is submitting its selection of PricewaterhouseCoopers LLP to stockholders for ratification at the Annual Meeting.

According to the Company’s proxy statement, if stockholders do not ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, the Audit Committee will reconsider its appointment of PricewaterhouseCoopers LLP. The affirmative vote of a majority of the voting power of Common Stock present in person or represented by proxy at the Annual Meeting is required to approve this proposal

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL] AND INTEND TO VOTE OUR SHARES [“FOR”] THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record Date. Each share entitles the holder to one vote on each of the matters to be voted upon at the Annual Meeting. Based on publicly available information, Starboard believes that the only class of stock of the Company entitled to vote at the Annual Meeting is its Common Stock.

Shares of Common Stock represented by properly executed [COLOR] universal proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Starboard Nominees and the Unopposed Company Nominees, [FOR/AGAINST] the advisory (non-binding) vote on the compensation of the Company’s named executive officers, and [FOR] the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

The Company has an annually elected Board with eleven (11) directors standing for election at the Annual Meeting. We are soliciting proxies to elect not only the four (4) Starboard Nominees, but also the seven (7) Unopposed Company Nominees. Starboard and Kenvue will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees for election to the Board. Stockholders will have the ability to vote for up to eleven (11) nominees on Starboard’s enclosed [COLOR] universal proxy card. Any stockholder who wishes to vote for any combination of the Company’s nominees and the Starboard Nominees may do so on Starboard’s [COLOR] universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote.

Stockholders are permitted to vote for fewer than eleven (11) nominees or for any combination (up to eleven (11) total) of the Starboard Nominees and the Company’s nominees on the [COLOR] universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we recommend that stockholders vote in favor of only the Company’s nominees who we believe are most qualified to serve as directors – the “Unopposed Company Nominees” – to help achieve a Board composition that we believe is in the best interest of all stockholders. We recommend that stockholders do not vote for any of the Company’s nominees other than the Unopposed Company Nominees. Among other potential consequences, voting for Company nominees other than the Unopposed Company Nominees may result in the failure of one or more of the Starboard Nominees to be elected to the Board.

We believe that voting on the [COLOR] universal proxy card provides the best opportunity for stockholders to elect all of the Starboard Nominees and achieve the best Board composition overall. Starboard therefore urges stockholders to use our [COLOR] universal proxy card to vote “FOR” the four (4) Starboard Nominees and “FOR” the seven (7) Unopposed Company Nominees.

IMPORTANTLY, IF YOU MARK MORE THAN ELEVEN (11) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

VIRTUAL MEETING

The Company has disclosed that the Annual Meeting will take place in a virtual meeting format only. Stockholders will not be able to attend the Annual Meeting in person. According to the Company’s proxy statement, stockholders can attend the Annual Meeting by visiting [www.virtualshareholdermeeting.com/KVUE2025], where they will be able to listen to the meeting live, submit questions, and vote online. Only stockholders of record as of the Record Date and their proxy holders may submit questions.

The Annual Meeting will start at [•] [•].m. Eastern Time on [•], 2025. We encourage you to access the meeting site prior to the start time to ensure you are logged in when the Annual Meeting starts. The Company has disclosed that online check-in will begin at [•] [•].m. Eastern Time. To enter the Annual Meeting, stockholders will need the 16-digit control number, which is included on the proxy card if you are a stockholder of record, or included with the voting instruction card and voting instructions received from your broker, bank, trustee, or other holder of record if you hold your shares of common stock in “street name.”

Stockholders of record as of the Record Date may also vote during the Annual Meeting (up until the closing of the polls) by visiting [www.virtualshareholdermeeting.com/KVUE2025], entering the 16-digit control number found on the proxy card or voting instruction form and following the instructions available on the website. If you hold your shares in a brokerage account in your broker’s name (“street name”), you will receive voting instructions provided by your broker, bank, trustee or nominee. If you would like to vote your shares at the virtual Annual Meeting, you will need to obtain a valid proxy from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, we urge you to sign, date and return the enclosed [COLOR] universal proxy card in the postage-paid envelope provided, or vote via the Internet or by telephone as instructed on the [COLOR] universal proxy card.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. According to the Company’s proxy statement, the presence in person or by proxy of the holders of record of a majority of voting power of the outstanding capital stock entitled to vote at the Annual Meeting constitutes a quorum to call the Annual Meeting. Abstentions, withheld votes, and broker non-votes, if any (as described below), will be counted for the purpose of determining the presence or absence of a quorum.

If you are a stockholder of record, you must deliver your vote by Internet, telephone or mail or attend the Annual Meeting virtually and vote in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. A broker non-vote occurs when a broker holding shares for a beneficial owner has discretionary authority to vote on “routine” matters brought before a stockholder meeting, but the beneficial owner of the shares fails to provide the broker with specific instructions on how to vote on any “non-routine” matters brought to a vote at the stockholder meeting. Under the rules governing brokers’ discretionary authority, if a stockholder receives proxy materials from or on behalf of both us and the Company, then brokers holding shares in such stockholder’s account will not be permitted to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting, whether “routine” or not. As a result, there would be no broker non-votes by such brokers. In such case, if you do not submit any voting instructions to your broker, then your shares will not be counted in determining the outcome of any of the proposals at the Annual Meeting, nor will your shares be counted for purposes of determining whether a quorum exists. However, if you receive proxy materials only from the Company, then brokers will be entitled to vote your shares on “routine” matters without instructions from you. The only proposal that would be considered “routine” in such event is Proposal 3 (ratification of the Company’s independent registered public accounting firm). A broker will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. We urge you to instruct your broker about how you wish your shares to be voted.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ According to the Company’s proxy statement, as a result of our nomination of the Starboard Nominees, the election of directors to the Board at the Annual Meeting is contested and the Company has a plurality vote standard for contested elections. Accordingly, the eleven (11) director nominees receiving the highest number of “FOR” votes will be elected as directors. Withhold votes and broker non-votes, if any, will not affect the outcome of the vote on the election of directors.