UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

CENTRE FUNDS

(Exact name of registrant as specified in charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of principal executive offices) (Zip code)

James A. Abate

48 Wall Street, Suite 1100

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 918-4705

Date of fiscal year end: September 30

Date of reporting period: October 1, 2019 – September 30, 2020

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| | PAGE |

| SHAREHOLDER LETTER | 1 |

| MANAGER COMMENTARY | 2 |

| Centre American Select Equity Fund | 2 |

| Centre Global Infrastructure Fund | 8 |

| DISCLOSURE OF FUND EXPENSES | 12 |

| SCHEDULE OF INVESTMENTS | 13 |

| Centre American Select Equity Fund | 13 |

| Centre Global Infrastructure Fund | 15 |

| STATEMENTS OF ASSETS AND LIABILITIES | 18 |

| STATEMENTS OF OPERATIONS | 19 |

| STATEMENTS OF CHANGES IN NET ASSETS | 20 |

| Centre American Select Equity Fund | 20 |

| Centre Global Infrastructure Fund | 21 |

| FINANCIAL HIGHLIGHTS | 22 |

| Centre American Select Equity Fund | 22 |

| Centre Global Infrastructure Fund | 24 |

| NOTES TO FINANCIAL STATEMENTS | 26 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 36 |

| ADDITIONAL INFORMATION | 37 |

| TRUSTEES AND OFFICERS | 40 |

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Trust’s website at www.centrefunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call (855) 298-4236 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary or, if you are a direct investor, by enrolling at www.centrefunds.com.

| Centre Funds | Shareholder Letter |

September 30, 2020 (Unaudited)

Dear Shareholders,

It is with my pleasure that we publish the Centre Funds Annual Report covering the one-year period ended September 30, 2020. I want to thank my fellow shareholders for their continued support and confidence in Centre Funds. The Centre Funds offer a select series of fundamentally-driven, actively managed funds to choose from, each available in investor and institutional share classes. We are passionate about active management.

Centre American Select Equity Fund

The Fund is a U.S. large capitalization valuation sensitive core growth stock fund that seeks long-term growth of capital and is focused on risk adjusted returns through active and pragmatic management; the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed appropriate. The Fund is intended to be a risk managed core growth fund.

Centre Global Infrastructure Fund

The Fund is for investors seeking to potentially benefit from a renewed focus on infrastructure spending but wish to have liquidity in publicly traded investments in developed global markets rather than illiquid private investments. The Fund pursues a bottom-up, active management approach and invests in what we deem the most attractive infrastructure-related companies from the United States and developed international economies. Also, the Fund seeks to balance its exposures to where the weights of the Telecommunication, Utilities, Energy, Transportation, and Social Infrastructure industries are broadly represented. The Fund focuses on higher dividend yielding assets and distributes dividend and interest income monthly.

Our aim at Centre Funds is to deliver strong, long-term performance results for investors through an exceptional focus on producing returns and managing risk and downside volatility in select investment strategies. We want investors to associate Centre Funds with high-conviction, differentiated fund strategies that may not be available elsewhere and are tactical, pragmatic, and opportunistic. Each investment strategy aims to capitalize on defined market opportunities with consistent and repeatable investment processes to achieve differentiated returns and risk profiles. We remain focused on fundamentally-driven investment approaches within truly active, high conviction, disciplined and research intensive processes. At Centre Funds, we place service excellence at the core of everything that we do and are committed to providing useful information on all of the Funds. Again, I want to thank my fellow shareholders for their continued support and confidence in the Centre Funds.

Sincerely,

James Abate

President, Centre Funds

| Annual Report | September 30, 2020 | 1 |

| Centre American Select Equity Fund | Manager Commentary |

September 30, 2020 (Unaudited)

Performance & Strategy Summary

For the one-year period ended September 30, 2020, the Centre American Select Equity Fund (the “Fund”), Investor Share Class, delivered a total return of 23.82 percent; the Institutional Share Class delivered a total return of 24.42 percent.

During the same one-year period, the key barometer of the U.S. stock market as a whole, as measured by the S&P 500 Index1, delivered a total return of 15.15 percent. Companies that were deemed able to maintain sales growth and profit margin stability during the onset of recession in the early part of 2020 as COVID-192 pandemic lockdowns were put in place globally, mainly in the traditional high and stable growth sectors such as Information Technology, Consumer, Health Care, and Communication Services, performed relatively better than the more economically sensitive sectors such as Energy, Financials, and Real Estate.

The strongest contributors to performance within the Fund over the one-year period ended September 30, 2020 included the Fund’s investments within the Technology sector, Apple, Microsoft, Maxim, and NVidia; within the Consumer sectors, Amazon, Home Depot, and Hain Celestial; within the Health Care sector, Eli Lilly and Abbott; and within the Materials sector, Barrick Gold, LyondellBasell, and Eastman Chemical. In general, both stock selection and sectoral biases, particularly our underweight postures in the Financials, Real Estate, Industrials, and certain industries within the Consumer Discretionary sector, contributed to the relative outperformance over the period. Stock investments that contributed negatively to relative underperformance over the period included AT&T, Medtronic, Molson Coors, Discovery, Treehouse Foods, Schlumberger, Twitter, and SS&C Technologies. Fund performance was impacted positively from a total return and risk perspective by the net realized gains from certain hedges and other investments that Centre Asset Management, LLC, the investment adviser to the Fund (“Centre,” the “Adviser”, “we”, or “the Fund’s portfolio manager”), viewed, as capital protective in nature. These hedges, namely put options3 on the S&P 500 Index, performed as expected during the stock market’s sharp correction beginning in February 2020 and, over the longer-term, have insulated the Fund from the same magnitude of maximum drawdown4 experienced by the overall stock market over prior volatile5 episodes, namely in August 2015, January 2016, February 2018, and December 2018. Given the continued presence of certain potentially de-stabilizing factors that we believe could negatively impact the value of underlying equity securities held in the Fund’s portfolio, the Fund will continue the strategy of tactically and opportunistically purchasing put options on the S&P 500 Index as a potential hedge against its underlying stock holdings in the event of a material stock market correction.

The process used by Centre to manage the Fund focuses on each individual portfolio company's growth outlook and capacity to create shareholder value, utilizing our bottom-up fundamental stock selection process. We utilize a disciplined, Economic Value Added (EVA)6 framework to select investments. The framework focuses on the fundamentals of wealth creation or wealth destruction similar to the way a traditional, long-term focused corporate investor looking at all aspects of the business would assess a company's value. Our experience is, in the shorter-term, markets may often undervalue or overvalue a company's ability to create or destroy wealth. The framework seeks to identify and capture these investment opportunities. The approach is designed to capture excess returns when a business is creating shareholder wealth and the market price of the stock converges toward our fundamentally-derived target price. Centre not only analyzes earnings but also strives to understand and link the capital allocation decisions being made today by each portfolio company and how they may lead to future earnings growth. In other words, we expect that the companies in which the Fund invests in will themselves invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. The key is that we look at the company drivers that create true shareholder wealth: capital spending or alternative capital allocations such as acquisitions, stock buybacks, or dividends; company-specific risk levels of a business to determine appropriate hurdle rates7; and whether the company is generating positive or excess returns on its underlying assets vis-à-vis the cost of capital. Wealth creation from growth or from wise contraction – that’s how we believe companies create shareholder value.

| 1 | S&P 500 is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. |

| 2 | In COVID-19, 'CO' stands for 'corona,' 'VI' for 'virus,' and 'D' for disease. Formerly, this disease was referred to as “2019 novel coronavirus” or “2019-nCoV”. There are many types of human coronaviruses including some that commonly cause mild upper-respiratory tract illnesses. |

| 3 | A put option is a contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. |

| 4 | Maximum drawdown is the maximum loss from a peak to a trough of a portfolio, before a new peak is attained. |

| 5 | Volatility is a measure of systematic risk of a security or a portfolio in comparison to the market as a whole. |

| 6 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| 7 | A hurdle rate is the minimum rate of return on a project or investment required by a manager or investor. The hurdle rate denotes appropriate compensation for the level of risk present; riskier projects generally have higher hurdle rate than those that are deemed to be less risky. |

| Centre American Select Equity Fund | Manager Commentary |

September 30, 2020 (Unaudited)

To meet its objective as a risk-managed growth fund, the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed tactically appropriate by Centre. While the use of hedging and certain investment techniques involve risk the Adviser may tactically employ hedges and other capital preservation strategies on up to 100 percent of the value of the Fund’s underlying securities positions when the Adviser’s assessment of market valuation indicates forward returns for the stock market, as a whole, are low relative to downside risk and the cost to upside potential from portfolio preservation tools is deemed reasonable in order to respond to adverse market, economic, political, or other conditions. The Adviser may also tactically employ hedges to reduce volatility. For example, through the tactical use of purchased put options, the Fund may have enhanced performance and more limited risk. Index put options are designed to hedge the Fund from significant market declines that may occur over short periods of time. The value of an index put option generally increases as the underlying securities in the Fund decrease in price and decreases as those securities increase in price. The Adviser may also seek to enhance returns by writing (selling) out of the money call options tailored with exercise prices generally above the current market prices of stocks held in the Fund. As the seller of the call option8, the Fund receives cash (the premium) from the purchaser. The Adviser varies its hedging strategy and defensive positions across changing market cycles but has generally employed such strategies within the Fund since late 2014.

Market Review & Outlook

At the time of writing, the Presidential election was still a couple of weeks away and the acrimony between the Trump and Biden camps was reaching a feverish pitch. To us, the outcome of the election is less important than the business cycle trajectory that the global economy is moving forward on and we don’t foresee the major policy initiatives that the respective political parties have put forward being enacted in such a way to change or take place quick enough to change the direction, nor perhaps more importantly, implement the major reforms to overcome the longer-lasting structural problems. There’s no doubt that the near and long-term challenges to the incoming President are monumental, which is why we secretly wished that the actor Morgan Freeman was nominated on one of the third party ballots as he’s in our mind the go to person to serve as President (or the Almighty) whenever there’s a major environmental, terrorist, or economic calamity, and get us through (in the movies at least) safely and unified in purpose as Americans. Unfortunately, we’re not in a movie with a happy ending, the current reality is more like a story with some coming relative pleasantness after the calamities of early 2020 but simply hasn’t ended yet, and unfortunately is likely to be very disruptive to investors.

The year 2020 was one where actively managed funds had the opportunity to truly distinguish themselves as stock markets tumbled at the fastest pace ever in February and March, followed then by one of the sharpest rallies in history. A key contributing dynamic was the exceptionally strong relative price performance of large-cap technology companies (FAANGs)9. As we articulated at the outset of the market’s correction, if the FAANGs could truly demonstrate earnings resilience during the recession, we believed that these leadership stocks would get re-rated even higher and to unprecedented valuation levels given record low interest rates and lack of growth elsewhere. Frankly, not having adequate ownership of the FAANGs within a portfolio would all but guarantee underperformance against broad market indexes; fortunately, the Fund featured such companies prominently. Furthermore, unlike nearly all previous historical periods, the stock market gains since the market trough have not been led by lower-quality, cyclical, value-oriented names as a whole but by those higher-quality, growth-oriented companies that have exhibited superior profitability, growth, and leverage characteristics such as the FAANGs and the Health Care sector. Aside from the deteriorating fundamental performance, the relative valuation of so-called more cyclical value stocks never reached the trough levels seen at other past episodes of recession. We pointed out then, rightly in hindsight, that the economy historically needs to be in recession for cyclical stocks to assume leadership away from defensives and, more importantly, only when cyclicals have suffered the double hit of an earnings collapse as well as a significant de-rating reflecting deep pessimism on any type of imminent recovery is when their relative attractiveness becomes overwhelmingly compelling. This never happened, except in very select industries such as Chemicals and Mining. Again, being highly selective and staying patient to enter these cyclical companies served the Fund well.

The backdrop moving forward is that the market’s current leadership stocks, in general, are extremely expensive when looking at traditional valuation metrics such as price to sales or price to cash flow, with implied growth rates of future earnings well in excess of even the halcyon period of the double digit growth experienced over the past five years. On the other hand, across most cyclical industries, we’ve seen stock prices of such companies move ahead sharply in anticipation of sales growth and profit margin recoveries to levels that make their upside, i.e., what’s not priced into the stocks, leaving little to no room for delay or underachievement. Furthermore, many cyclical companies, particularly those with consumer focus, have emerged from the recession weakened and left with structurally higher debt loads. The uncertainties of a COVID-19 vaccine and more individual stimulus from the government further strains business confidence. Our task is particularly challenging at this juncture as we need to be pragmatic in trimming or outright selling those leadership stocks that reach valuation levels that we can no longer fundamentally justify and, at the same time, remain very selective and patient in initiating positions in those cyclical companies that truly represent contrarian opportunities with positive inflections in fundamental performance with commensurate future return opportunities, given the cyclical risks, not yet reflected into their stock prices.

| 8 | A covered call is an options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. |

| 9 | “FAANG” is an acronym that refers to the stocks of five prominent American technology companies: Facebook, Amazon, Apple, Netflix, and Alphabet (formerly known as Google). |

| Annual Report | September 30, 2020 | 3 |

| Centre American Select Equity Fund | Manager Commentary |

September 30, 2020 (Unaudited)

In managing the Fund in a market-oriented and pragmatic fashion, I frequently use the story of Dave Wottle, an American middle-distance track athlete who was the gold medalist in the 800 meter run at the 1972 Summer Olympics in Munich, to explain our integration of stock selection and portfolio construction. Wottle was firstly known for wearing a golf cap while running and forgetting to remove it during the playing of the national anthem on the medals podium. More important than his headgear was his strategy. In the 800 meter final at the Olympics as well as his other events, Wottle dropped to the middle or rear of the field, and stayed there for the first 500 meters, at which point he started to pass runner after runner up in the final turn and, finally seizing the lead in the final straightaway stretch to win. The distinguishing skill to me (more appreciative now as an adult than as a kid watching the Olympics) was not so much Wottle’s relative acceleration ability in the final moments of the race but his recognition that he could only fall so far back out of the lead and needed to stay in the field for most of the race, before he could execute his unique speed advantage in the final turn; otherwise his comeback would come up short and be for naught. Our skills as a portfolio manager have historically allowed us to be disciplined in applying an analytical focus on each individual portfolio company's growth outlook and capacity to create shareholder value, utilizing our Economic Value Added (EVA) bottom-up fundamental stock selection process, across the entire large-capitalization investment universe to find companies that create true shareholder wealth, regardless of whatever accounting-driven metric style box the stock populates. We then manage the sizing of each individual securities position by merging our differentiated fundamental stock selection with structured portfolio construction in an attempt to add the most appreciation potential per unit of risk. The reason why we highlight our pragmatism within our Review & Outlook is that we believe that we may be entering a period, due to extreme implied expectations in the largest index components, and an already priced in earnings recovery for most cyclical companies, where overall stock market returns are asymmetric, meaning low index or passive upside with significant downside risks but increasing opportunity for unprecedented heterogeneity in markets that will give the best opportunity for active stock selection in quite some time after a period when being benchmark and market-oriented aware for a dedicated portion of the Fund was not only wise but essential for staying with the running field. In essence, the period to use our unique analytical advantage to be pragmatic, know when to sell on valuation grounds as well as an identified change in cyclical fundamentals, and become more rotational with an even higher active share in the final stretch to win is right now and compound on a successful past one year.

There are a number of insights and expectations that we envision gaining prominence over the next couple of years that give us a high degree of optimism despite what we feel may be a poor investment climate for passive, non-alpha seeking, strategies. The first is that the global disruption to production and consumption related to COVID-19 may take years to unfold and it’s only being appreciated in hindsight that the industrial economy was already facing declining fundamentals prior to COVID-19 and the reliance on services for growth in the U.S. left things unbalanced. Secondly, the debt multiplier10 is becoming weaker, meaning that borrowed money, at the governmental and company level, is producing less real growth per dollar so already record setting debt levels will move exponentially higher to produce diminishing levels of real growth. Thirdly, the adoption of modern monetary theory (MMT)11 or debt monetization by the Federal Reserve, up until recently only espoused by the likes of socialists Jeremy Corbyn in the U.K. and Bernie Sanders in the U.S., has become the official policy of nearly every developed country. Fourth, it is beyond ironic that the progenitor of the COID-19 virus, China, has emerged from the deepest part of the global recession in better shape than any other developed country and the risks to it from re-shoring of manufacturing and supply chains from China and its mercantilist approach to export have receded during the economic disruption, as well as giving China the window to amplify its efforts to increase domestic consumption, and changing its former wariness to now not backing down in political and strategic provocations from the West. Fifth, the same centerpieces of the 1930’s New Deal programs that were in an effort to purposely maintain high prices and wages and which prolonged the Great Depression are exactly the same drivers in the most recent fiscal stimulus packages (and the many more that we expect to follow) to offset the lockdown put in place to stem the spread of COVID-19; handouts, subsidized loans, and adverse federal actions towards businesses that disrupt the normal supply and demand equilibrium. Rather than war however, we believe the path of escape and attempt to remain solvent will be more policies geared toward stoking and being tolerant of higher inflation, a marked departure from the investment landscape since the early 1990’s. Following the deflationary demand shock from the COVID-19 lockdowns, we foresee higher inflation gaining increased traction and creating an upside down environment of winners and losers relative to the past thirty years and, frankly, one not experienced by the current generation of investors and expect a historically-aware approach such as ours to be relatively successful in appreciating the potential inflection.

The potential shift within a structural disinflationary12 environment to one where short to intermediate-term cyclical inflation is encouraged is one that we ourselves were highly skeptical about gaining traction until this year. We remain believers in our long-held thesis that demography is destiny; this holds that population trends determine the future growth rates of a country, region or even the entire world. For example, if working age populations increase too fast or too slowly, or if there are too many young or old people, then certain outcomes are likely to follow, such as economic boom or bust, inflation, or even political unrest. Low fertility and an aging population are two of our greatest concerns, and nearly all developed countries now have to depend on immigrants to make up for the decline in native populations, for without them, the U.S. and nearly every country in Europe face the prospect of a shrinking workforce and a stagnant economy akin to the Japanese experience over the recent decades. Thus, the debt crises witnessed in Greece, Puerto Rico, Italy, Spain, etc., where population declines have been most pronounced and leading but on a smaller scale, are the literal canaries in the coal mine for future experiences and are likely to occur across larger countries or even regions. Nearly all developed countries have reached the point where productivity must compensate for the decline in populations (sorry but the invention and widespread adoption of TikTok and Zoom are not going to solve the decline in productivity) or allow mass migration, which in Europe and the U.S. is one of the most argumentative and politically volatile topics and will only intensify with time. From an economic perspective, we remain convinced that lower real economic growth will be consistent with continued low or negative real interest rates and demography, more than globalization, automation, or even de-unionization. All of this said, in the absence of real growth and the unprecedented increase in debt, particularly since 2009, we see continued monetary expansion and new policies geared towards increasing monetary velocity, i.e., inflation, as the only remedying alleviate to jumpstart nominal growth that can potentially forestall another bank credit crisis and a long depression-like downturn. The amount of debt at the governmental and company level is simply too high to allow a deflationary reset of rents, wages, commodity prices, and nominal profits despite the Federal Reserve’s policies of essentially capping interest rates across the yield curve at unprecedented low levels. In other words, we expect a period of negative real interest rates to persist indefinitely and the Keynesian policies being put in place today and the next few years, regardless of who wins the Presidency, having similar unexpected inflationary results as those unforeseen by the hubristic policy makers of the early 1960’s. Simply put, structural reforms are kicked down the road, and nominal economic growth and inflation may replace real growth and productivity as the objectives of policymakers.

| 10 | The debt multiplier includes the effects of a temporary and pure change in government debt on economic activity, and depends on the level of debt-to-GDP ratio. When nominal interest rates are positive, the debt multiplier is generally small. However, the debt multiplier is much larger when the nominal interest rate is at the zero lower bound. |

| 11 | Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desire. MMT argues that governments create new money by using fiscal policy. According to advocates, the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sector. |

| 12 | Disinflation is a temporary slowing of the pace of price inflation. It is used to describe instances when the inflation rate has reduced marginally over the short term. It should not be confused with deflation, which can be harmful to the economy. |

| Centre American Select Equity Fund | Manager Commentary |

September 30, 2020 (Unaudited)

The shift from disinflation to inflation could be epochal given the false realization of inflation following the first implementation of quantitative easing (QE)13 after the 2008 financial crisis14, making this time wholly unexpected and catching most investors off guard. While the monetary base spiked back then, the velocity of money, the number of times one dollar is spent to buy goods and services, fell after that initial episode of QE and has now collapsed further to historically unprecedented low levels. The most recent earnings reports from the major money center banks confirm the acuteness of the problem in that deposits are significantly greater than loans outstanding with the unprecedented divergence between deposits and loans growing in proportion to the Federal Reserve’s QE programs since 2008. This partly explains the inability to reconcile the economy to the stock market as most of these excess deposits have had an impact on inflating asset prices, mainly in the capital markets. Ironically, the strength on Wall Street is now driven by weakness in the broader economy. The divergent fortunes of larger companies versus smaller enterprises during the COVID-19 lockdowns has created such an imbalance that it stimulated a change in policies. Even the slightest increase of velocity from increased loan demand, given the massive increase in excess reserves injected by the Federal Reserve, will finally result in the meaningful increase in inflation, which for the first time in generations will be tolerated as there is no other solution to the broad indebtedness and the alternative of outright deflation and prolonged depression. It may sound as the worst prescription for an already over-indebted public and private sector but the short-term focus of politicians of both major parties, most corporate CEOs, and overleveraged consumers, will be to borrow even more in an effort to service existing debt and attempt to grow or, in many cases, just remain solvent. Banks will be encouraged to relax credit standards or, as we’ve seen with the Paycheck Protection Program (PPP), the government will assume the credit risks and use banks as conduits for direct payments. Once banks increase their lending efforts, it is then that the true inflation from what the Federal Reserve’s QE programs has desired all along will finally rear its consequences. Furthermore, the ascendancy of the Chinese renminbi as a genuine alternative to the dollar is finally becoming a reality for global trade and transactions given China’s newfound assertiveness and increased economic clout aided by its impressive COVID-19 recovery and targeted aid to those countries suffering during the ordeal, and the end of the aura of American exceptionalism leading to the broad dollar index to fall and perhaps materially so; the only point at which we believe the Federal Reserve will recognize (too late though) that it has unleashed an inflation and currency debasement genie that will not easily go back into a bottle and temper its QE and debt monetization policies.

As always, it’s critical to reconcile the top-down15 viewpoints we express with the bottom-up16 financial analysis we’re undertaking. In fact, it’s usually the bottom-up informational mosaic as we call it that helps us articulate our bigger picture views. From a bottom-up perspective, the aggregate valuation levels of the market and for the average company are elevated with certain industries extremely expensive. Most companies continue to see top line sales pressure, profit margins continuing to contract (in place well before COVID-19), and high levels of capital intensity leading to negative EVA momentum as a whole. With those companies who’ve been able to remain resilient and maintain positive EVA momentum during the recession now being valued at levels that have or are becoming in some cases absurd, and the fact that we consider valuation or the price one pays at purchase as the most critical element of successful investment, we’ve concentrated new purchases since the spring on those companies who have taken the steps to reduce their capital intensity, or as we say, wisely contract through the restructuring of their assets and other resources to regain their footing for future shareholder value creation through asset efficiency gains and increased pricing. Examples of recent purchases or additions to the Fund meeting our criteria of wise contraction include food product producers such as Bunge and Archer Daniels Midland; oil & gas producers and transporters such as Exxon Mobil, Williams, Chevron, and Cimarex; power generating utilities such as AES, PPL, and Sempra Energy; chemical producers such as Olin, LyondellBasell, and Eastman Chemical; and metals and mining company Barrick Gold. Not only do each of these companies currently demonstrate positive fundamental performance inflections from their recent capital allocation decisions but they demonstrate a very low future growth reliance or implied growth well below historical levels at their current stock prices. Furthermore, most have dividend paying yields well in excess of the overall market, high relative to their unique histories, and are deemed sustainable. Lastly, the linkage back to the top-down concerns over increasing inflation and potential fall in the U.S. dollar would be a tremendous catalyst to sales, nominally, for each of these companies as they are direct beneficiaries to a reflating economy.

| 13 | Quantitative easing (QE) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment. Buying these securities adds new money to the economy, and also serves to lower interest rates by bidding up fixed-income securities. It also expands the central bank’s balance sheet. |

| 14 | The financial crisis of 2007-2008, also known as the global financial crisis, was a severe worldwide financial crisis. Excessive risk-taking by banks combined with the bursting of the United States housing bubble caused the values of securities tied to U.S. real estate to plummet, damaging financial institutions globally, culminating with the bankruptcy of Lehman Brothers on September 15, 2008, and an international banking crisis. |

| 15 | Top-down investing is an investment analysis approach that involves looking first at the macro picture of the economy and then looking sequentially at smaller factors in finer detail. These approaches prioritize macroeconomic, national, or market-level factors most. |

| 16 | Bottom-up investing is an investment approach that focuses on the analysis of individual stocks and de-emphasizes the significance of macroeconomic cycles and market cycles. In bottom-up investing, the investor focuses his attention on a specific company and its fundamentals, rather than on the industry in which that company operates or on the greater economy as a whole. |

| Annual Report | September 30, 2020 | 5 |

| Centre American Select Equity Fund | Manager Commentary |

September 30, 2020 (Unaudited)

Currently, the consensus driver to enable the stock market in aggregate to move higher is continued accommodative Federal Reserve policy whereby liquidity is being injected into the banking sector and capital markets rather than the “real” economy. Furthermore, there is unprecedented concentration and reliance upon already stratospheric valuation multiples re-rating higher still for the largest technology stocks that can somehow maintain resilience to the pressures impacting most other companies. We, however, see fragility and major stock market indexes are vulnerable to either standing still as fundamentals catch up to implied expectations or further significant dislocations. From a macro perspective, we believe that the onset of a stagflationary environment is the new emerging potential danger to the markets but currently this is a very small minority view by professional investors which makes its potential impact much more profound. The Fund currently continues to concentrate the number of positions in its portfolio in an attempt to maximize individual stock risk rather than market risk and use derivative instruments intended to hedge the risks its underlying stock holdings, namely put options on the S&P 500 Index, as a potential hedge against in the event of a material market-wide correction. We continue to emphasize a barbell of secular growth stocks, cognizant of valuation risk, with contrarian, opportunistic cyclical, and mostly commodity-related producing companies in the midst of business restructurings who should benefit tremendously from their company specific actions to reduce supply and committed capital investment, as well as what we feel will be a reflationary-driven recovery in economies. In addition, dividend yield is now the highest positive relative active risk exposure in the Fund further highlighting the focus on return opportunities and risk in the current environment. We believe that our pragmatic, large-capitalization, valuation-sensitive growth and concentrated, high-conviction approach to stock selection, with a cognizance of risk management that includes tactically implementing capital protective investments, seems positioned to perform well relative to less risk aware and less historically appreciative strategies.

The market outlook is the opinion of the author and can change at any time.

| Centre American Select Equity Fund | Manager Commentary |

September 30, 2020 (Unaudited)

SECTOR WEIGHTINGS

As a percentage of Net Assets

| Information Technology | 27.46% |

| Consumer Staples | 18.20% |

| Energy | 11.34% |

| Materials | 10.89% |

| Communication Services | 10.64% |

| Utilities | 10.49% |

| Consumer Discretionary | 8.49% |

| Health Care | 2.03% |

| Purchased Options | 0.47% |

| Cash and Cash Equivalents | -0.01% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

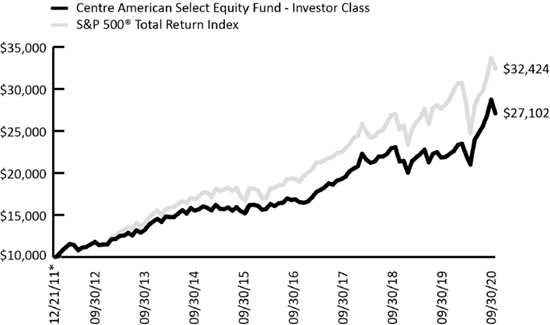

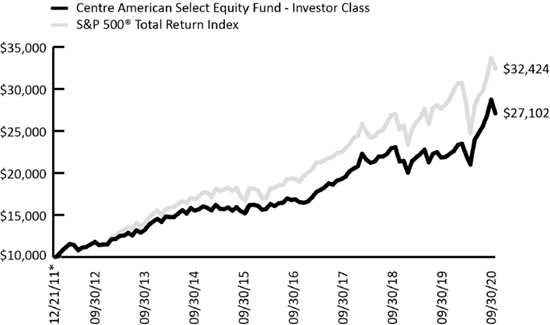

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH SEPTEMBER 30, 2020

This graph assumes an initial investment of $10,000 at December 21, 2011, the inception date for Investor Class shares, which have the longest period of annual returns, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund's Investor Class versus the S&P 500® Total Return Index. Taxes on Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

The line graph above shows the performance of Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

TOTAL RETURNS – FOR THE PERIOD ENDED SEPTEMBER 30, 2020

| | 1

Month | 3

Month | YTD | 1

Year | 3 Year

Average

Annualized | 5 Year

Average

Annualized | Since

Inception*

Average

Annualized |

| Centre American Select Equity Fund – Investor Class | -5.64% | 5.98% | 16.13% | 23.82% | 11.53% | 12.25% | 12.03% |

| S&P 500® Total Return Index | -3.80% | 8.93% | 5.57% | 15.15% | 12.28% | 14.15% | 14.34% |

| Centre American Select Equity Fund – Institutional Class | -5.56% | 6.07% | 16.52% | 24.42% | 12.05% | 12.61% | 9.93% |

| S&P 500® Total Return Index | -3.80% | 8.93% | 5.57% | 15.15% | 12.28% | 14.15% | 11.65% |

| * | Inception date of December 21, 2011 for Investor Class. Inception date of January 21, 2014 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

Per the prospectus dated January 28, 2020, the Fund had total gross annual operating expenses of 1.58% and 1.30% and net annual operating expenses of 1.45% and 0.97% for the Investor and Institutional Class, respectively.

The S&P 500® Total Return Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index.

| Annual Report | September 30, 2020 | 7 |

| Centre Global Infrastructure Fund | Manager Commentary |

September 30, 2020 (Unaudited)

Performance & Strategy Summary

For the one-year period ended September 30, 2020, the Centre Global Infrastructure Fund (the “Fund”), Investor Share Class, delivered a total return of -11.49 percent; the Institutional Share Class delivered a total return of -11.30 percent.

During the same one-year period, the MSCI World Infrastructure Index1 and MSCI World Index2 delivered a total return of -5.81 percent and positive 10.41, respectively. The strongest contributors to relative performance within the Fund over the one-year period ended September 30, 2020 included investments within the Telecom sector, Bezeq Israeli Telecom, Spark New Zealand, Hellenic Telecom, NTT Docomo, and T-Mobile; and within the Utilities sector NextEra Energy and Enel Spa. Stock investments that contributed negatively to relative underperformance over the period were mainly in the Energy sector and included ONEOK, Kinder Morgan, Pembina Pipeline, Cheniere Energy, as well as Grupo Aeroportuario del Pacífico. From a sector allocation standpoint, overweight exposures to Energy and Industrials, due to the Fund’s balanced portfolio construction approach across infrastructure-related industries, detracted from the Fund’s performance during the period versus the MSCI World Infrastructure Index. The Fund is diversified across regions and developed countries as well as structurally balanced in a disciplined manner across Telecommunication Infrastructure; Utilities; and the Energy, Transportation, and Social Infrastructure sectors.

Over the past 20 years, global listed infrastructure securities as an asset class have demonstrated upside capture versus global equities of 83.8 percent while only capturing 61.7 percent of the global equity market downside3 . During the previous market sell-off during the quarter September 30, 2018 to December 31, 2018, the Fund exhibited only a 49.6 percent downside capture and then, during the 9-month period of recovery from December 31, 2018 to September 30, 2019, the Fund realized a 107.8 percent upside capture. However, and disappointingly, during the most recent market selloff that began in February 2020, Technology, Health Care and other traditional growth (non-infrastructure related) areas of the broader market performed relatively strong while more value-oriented and cyclical sectors such as Industrials and Energy, in particular, fared quite poorly. In addition, despite the traditional defensive attributes of the Utilities sector, nearly all utility industry areas fared relatively poorly during the drawdown episode in the spring of 2020 and lagged on the subsequent rebound in stock market indexes. Global listed infrastructure securities remain a compelling investment option, characterized by high dividend yields, stable cash flows and attractive long-term risk-adjusted performance while offering a potential hedge against inflation.

Despite significant funding gaps for infrastructure in developed markets, and the years of debate about replacing outdated backbone systems, infrastructure investment has declined as a share of GDP4 in more than half of the G205 economies since the global financial crisis. Years of underinvestment in critical areas such as transportation, water treatment, and power grids could erode future growth potential and productivity. Municipalities are now focusing efforts on connecting companies and private investors with projects that need their capital as well as creating an expanded role for public-private partnerships and tax and other incentives to undertake infrastructure investment. We believe the majority of the infrastructure funding gap will likely be financed by the private sector, creating significant opportunities within publicly traded global listed infrastructure assets, especially in the Telecom and other innovative areas where much intellectual capital resides.

Infrastructure is normally also a defensive asset class because of the characteristics of the underlying assets owned by many global listed infrastructure companies as a result of: 1) inelastic demand due to the essential nature of the assets used in everyday life; 2) high barriers to entry due to the critical and often irreplaceable nature of the assets; and 3) contracted revenue streams that offer inflation protection in many cases. Conventional wisdom holds that you invest in bonds for yield and equities for capital appreciation. While this might be true historically, with 10-Year Treasury yields collapsing over the past 12 months, infrastructure related stocks now offer the best of both. Currently, the 4.49% underlying yield6 of the Fund supersedes the S&P 500 Index’s dividend yield of 1.7% as well as all maturities of Treasury bond yields. From a sector perspective, Infrastructure related areas such as Telecom (4.4%), Energy (7.1%), Industrials (5.1%), and Utilities (4.1%) are all well above the market yield7 .

| 1 | MSCI World Infrastructure Index captures the global opportunity set of companies that are owners or operators of infrastructure assets. Constituents are selected from the equity universe of MSCI World, the parent index. |

| 2 | MSCI World Index is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. |

| 3 | Data from MSCI and Bloomberg based on MSCI World Infrastructure Index. |

| 4 | Gross Domestic Product meaning: Gross Domestic Product, abbreviated as GDP, is the total value of goods and services produced in a country. |

| 5 | The Group of 20, also called the G-20, is a group of finance ministers and central bank governors from 19 of the world's largest economies, including those of many developing nations, along with the European Union. |

| 6 | Underlying yield reflects the annualized income net of expenses of the fund as a percentage of the market unit price of the fund as at the day shown. It is based on a snapshot of the fund on that day. It does not include any preliminary charge and investors may be subject to tax on distributions. As of September 30, 2020, the Centre Global Infrastructure Fund had an underlying yield of 4.49%. |

| 7 | Source: Bloomberg, based upon the Fund’s underlying holdings as of September 30, 2020. |

| Centre Global Infrastructure Fund | Manager Commentary |

September 30, 2020 (Unaudited)

The Fund offers several key differentiators from the broader global equity set of investable companies, as well as passive infrastructure universe indexes including: 1) historically, the MSCI Global Infrastructure Index has generated a dividend yield greater than the yield on conventional core equity indices like the MSCI World Index with the Fund, in turn, having a higher underlying yield than the MSCI Global Infrastructure Index8 ; 2) the Fund pays distributions of dividend and interest income monthly rather than annually; 3) hard assets like infrastructure assets tend to retain their “real” value through the long-term; 4) historically, infrastructure indices’ volatility is lower than on conventional equity indices like the MSCI World Index; 5) historically, high Economic Value Added9 (EVA) companies have outperformed low EVA ones and provides the foundation of our stock selection methodology; and 6) many infrastructure assets have concession agreements or long-term contracts that link to inflation in the long run. In identifying firms with sustainable pricing power, the Fund seeks investments that exhibit high barriers to entry in their segments and that create positive externalities in their regions. The Fund focuses on industries with lower volatility such as toll roads, power stations, hospitals and schools. Also, by targeting high EVA growth companies, the Fund narrows its focus to high quality infrastructure firms that make wise capital allocation decisions. Through our “bottoms-up” analysis, we seek to avoid names that destroy shareholder wealth by either “empire building” or under-investment of capital. Additionally, the stock-selection approach standardizes accounting across countries which facilitates cross-border comparisons between the best U.S. infrastructure companies and international firms. From a portfolio management perspective, the Fund is able take active stock selection positions based on the opportunity sets we see in the market structurally whilst balanced in a disciplined manner across Telecommunication Infrastructure; Utilities; and the Energy, Transportation, and Social Infrastructure sectors.

Market Review & Outlook

European Telecom stocks sold off significantly in February/March (SXKP10 -32% vs SXXP11 -34%); a similar sell-off in magnitude took place in 2008-09 however, at that time, Telecom stocks as a whole outperformed on a relative basis. While equity markets have generally recovered from their initial precipitous declines, US Telecom stocks continue to underperform the broader market, with industry leaders Verizon and AT&T still in negative territory year-to-date. That said, the sector today has a greater portion of revenues that are contracted than was the case in 2008 and work from home has increased the demand for connectivity for higher margin customers. Fixed line was defensive in the last recession as consumers saw broadband as essential. Unlimited mobile data is now the “new” essential for many customers, and recently reported mobile and fixed traffic growth of 60-70% could lead to the upsell of bigger bundles and faster premium priced connections (e.g., 5G). Our bottom-up expectations are optimistic for AT&T, Verizon, Telecom Italia, Deutsche Telekom, Orange, T-Mobile, and Vodafone. As an example, we believe that the current work from home environment highlights the value of AT&T's B2B connectivity solutions, and we believe that more large enterprises are leaning into digitalization and remote work trends. We find the risk/reward around AT&T favorable at these levels given the company's strong free cash flow (FCF) generation, 7% dividend yield, and attractive valuation. We believe AT&T's dividend provides support for the stock price and is well covered (we estimate a 60% dividend payout ratio on $25B in 2020 FCF), which is increasingly attractive in today's historically low interest rate environment. Should a broader theme that 'the worst is over' emerge, which we expect it might, then we would expect a significant positive re-rating of Telecom stocks.

Globally, appreciation for Telecom assets is only intensifying as deal-making has continued without pause through this pandemic. We note billions in Telecom deals globally, despite the pandemic, with Google publicly seeking to buy a stake of about 5% in Vodafone Idea, the second largest telecom operator in India. Google has also held talks with Reliance Jio Platforms, a telecom operator that has raised $10.3 billion in the last couple of months from Facebook and private equity firms Silver Lake, KKR, General Atlantic and Vista. In July, KKR purchased a minority stake in Telecom Italia's secondary grid - the last-mile, copper and fiber network linking to customers' homes. The overarching point, as it concerns telecom investment and secular demand, is that between growth in data usage and 5G rollout, Telecom will continue to be one of the global epicenters of technology investment over the next 20 years. In 2021, we believe Telecom stocks globally will demonstrate better top line growth alongside more M&A and rising recognition of infrastructure values (fiber as well as towers). In the meantime, Masmovil has been acquired, Liberty Global moved to acquire Sunrise, Altice and a UK internet service provider received firm offers to be taken private and we note press speculation (e.g., Bloomberg) of similar for KPN. The industry and private equity see value in Telecom stocks, but public markets don't. We expect that the recent Telecom stock weakness thus far in 2020 will unwind in a low interest-rate world (the incumbent Telecom stocks collectively yield 6%).

Energy stocks have underperformed the S&P 500 index for ten consecutive quarters. The XLE Energy Index12 , fell 50% so far in 2020 compared to a 3% rise in the S&P 500 index. After erasing all their summer gains in the first week of September, oil prices are rebounding, and we believe the year-end Brent forecast of $49/bbl is possible. We believe the dismal days of the second quarter in the sector and the crash in oil prices are behind us. With a return in oil prices to the current $40 level, thoughts have shifted from trying to survive to making sure operations are cash flow positive. Within energy infrastructure, we are focused on low-cost producers with good balance sheets. We continue to position the Fund’s energy exposure to companies with manageable debt and sufficient liquidity to continue to drill, low lifting costs per barrel, and a supportive ownership group with a long investment timeframe. We favor LNG exporters ONEOK (OKE) and Cheniere (LNG) longer-term as cash flows increasingly resemble utility stability, which should result in the shares re-rating higher. As the macro environment improves OKE's ability to grow cash flow, we continue to view OKE and its leading NGL footprint favorably. Additionally, OKE’s ability to flex capital expenditures down allows the company to generate incremental free cash flow in an uncertain environment, which could be used to pay down debt and fund it’s attractive 13% dividend yield.

| 9 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| 10 | The STOXX Europe 600 Telecommunications, also called SXKP, aims to track the performance of the European Telecommunications sector as defined by the Industry Classification Benchmark (ICB). It is a sub index of the STOXX Europe 600 Index. |

| 11 | The STOXX Europe 600, also called STOXX 600 or SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone). |

| 12 | The Energy Select Sector SPDR (XLE) invests in companies that primarily develop and produce crude oil and natural gas, and provide drilling and other energy-related services. |

| Annual Report | September 30, 2020 | 9 |

| Centre Global Infrastructure Fund | Manager Commentary |

September 30, 2020 (Unaudited)

Assuming OPEC+13 production remains stable next year at its 2021 quota, current Dec-21 Brent forward contracts at $46/bbl. reflect both (1) a linear full recovery of Iran production by 2 mb/d through 2021, and (2) end-2021 oil demand still 3 mb/d below pre-COVID levels - both too pessimistic in our view. At our more optimistic demand path (back to pre-COVID level by 4Q20), such a 2021 ramp-up in Iran production with OPEC+ stable at its 2021 quota would bring Dec-21 prices up to $60/bbl, still well above market forwards. The expected additional dollar weakness that would likely come alongside further fiscal stimulus and accommodative monetary policies in the U.S. will create additional upside risk to this estimate. Given the negativity on 2022 balances priced by current oil market forwards, we reiterate our long Dec-21 Brent trade recommendation, which would significantly benefit the Fund’s energy holdings. The recent gyration in oil prices, rallying on days of higher expected stimulus and weakening dollar, suggests a further bullish catalyst for oil. While natural gas would likely rally as well, we already forecast a further rapid appreciation in prices in coming months given the lack of a US gas producer response to high 2021 prices. Net, we reiterate our bullish 2021 call for both gas and oil companies, with the drivers for higher prices superseding the potential outcomes of the US election, even under a split House and Senate.

The turn in earnings cycle, increasing confidence in utilities’ investments, low bond yields and enthusiasm for ESG plays have propelled certain segments of the utility sector higher and it remains the most positive structural backdrop since the 2008-09 financial crisis. Within the utility sector there has been a sharp divergence with perceived quality being rewarded, although with much lower valuation multiples for utilities with a more mixed track record, or in some cases cyclicality. We continue to orient to high quality integrated utilities and regulated networks. The share prices of Iberdrola and Enel have risen sharply over the last eighteen months and Iberdrola is trading on a high absolute multiple. However, our analysis of Iberdrola’s long-term track record convinces us that a premium is justified. These utilities remain attractive plays on long-term renewable and electricity distribution network growth. We also view National Grid favorably even as its shares have dropped since early April in spite of an almost 20% rally in the sector, and we feel that risks around its challenging regulatory review in the UK are already priced in.

As most utilities are declared an essential service, earnings of companies in the utility sector are relatively insulated from the COVID-19 lockdown compared to other sectors. As a highly regulated business, the sector has minor exposure to demand trends (mainly in electricity transmission and gas transportation) and predictable revenues. Utilities will continue to supply power, supported by long-term power purchase agreements (PPA), however demand for power has fallen in certain areas as industrial clients and commercial consumers have temporarily reduced demand from the electrical network. Regulated utility networks remain resilient to the near-term volatility, given that their cash flows are protected by regulations and long-term contracts. This is evident in the outperformance of Duke Energy, NextEra, and Xcel Energy. Pure play regulated utilities appear well-positioned for a challenging market as companies like Consolidated Edison and Eversource have virtually no commodity exposure and sell primarily to residential customers. American Electric Power has more industrial sales, including in the oil patch, yet also boasts a strong balance sheet, diversified territories and growth potential. The Chinese utility sector has outperformed the Hang Seng Index (HSI)14 as it did during the spread of SARS15 in 2003, especially the gas distributors and independent power producers (IPP). The dent to energy retailers and waste companies' profit will likely be front-end loaded while hedging should soften the hit for power generators.

We believe the Fund will perform relatively well with exposure to favorable areas of the world’s equity markets. Also, undervalued international infrastructure-related stocks with strong balance sheets and free cash flows, solid dividend yields, and cyclically depressed profits are poised to outperform in our opinion. The Fund is positioned by targeting energy, telecom, industrials, and other undervalued areas of globally listed infrastructure industries and sub-sectors. The combination of low embedded growth and a robust stream of income payments effectively lowers the duration of the portfolio and, if interest rates rise, this will help protect against a broader based contraction in valuation multiples. Lastly, the Fund’s unique exposure to next-generation global infrastructure adjacencies, including public cloud deployments, data center monitoring, cybersecurity, and IIoT (Industrial Internet of Things) is a key differentiator against legacy managed infrastructure portfolios, which overlook these powerful trends within the industry. Despite the negative performance drag from the Energy sector in 2020, we continue to believe that our combined approach of differentiated stock selection and portfolio construction, whereby the Fund is diversified across regions and developed countries as well as balanced across Telecommunication Infrastructure; Utilities; and the Energy, Transportation, and Social Infrastructure sectors is the most favorable for investors seeking to feature listed infrastructure investments as part of an overall balanced portfolio.

The market outlook is the opinion of the author and can change at any time.

| 13 | OPEC+ is a group of 24 oil-producing nations, made up of the 14 members of the Organization of Petroleum Exporting Countries (OPEC), and 10 other non-OPEC members, including Russia. The format was born in 2017 with a deal to coordinate oil production among the countries in a bid to stabilize prices. |

| 14 | The Hang Seng Index, or HIS, is market capitalization-weighted index of the largest companies that trade on the Hong Kong Exchange. |

| 15 | SARS is a contagious and sometimes fatal respiratory illness caused by a coronavirus. SARS appeared in 2002 in China. It spread worldwide within a few months, though it was quickly contained. |

| Centre Global Infrastructure Fund | Manager Commentary |

September 30, 2020 (Unaudited)

INDUSTRY WEIGHTINGS

As a percentage of Net Assets

| Diversified Telecommunication Services | 25.46% |

| Electric Utilities | 20.16% |

| Oil, Gas & Consumable Fuels | 19.66% |

| Wireless Telecommunication Services | 9.46% |

| Multi-Utilities | 8.33% |

| Health Care Providers & Services | 5.42% |

| Transportation Infrastructure | 4.89% |

| Independent Power and Renewable Electricity Producers | 2.87% |

| Water Utilities | 0.63% |

| Cash and Cash Equivalents | 3.12% |

| Totals | 100.00% |

COUNTRY WEIGHTINGS

As a percentage of Net Assets

| United States | 50.45% |

| Canada | 10.63% |

| Japan | 7.22% |

| Australia | 6.19% |

| Italy | 3.82% |

| Spain | 3.28% |

| France | 2.40% |

| Germany | 2.38% |

| Great Britain | 2.11% |

| Israel | 1.90% |

| Greece | 1.56% |

| Hong Kong | 1.56% |

| New Zealand | 1.52% |

| China | 1.13% |

| Denmark | 0.73% |

| Cash and Cash Equivalents | 3.12% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

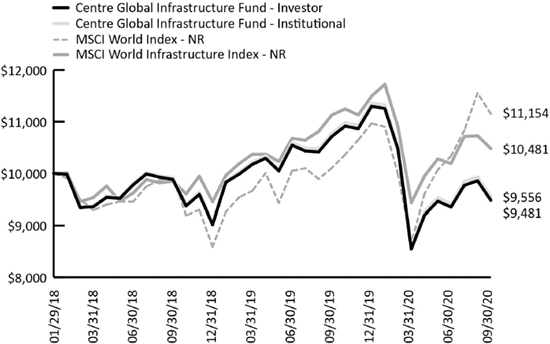

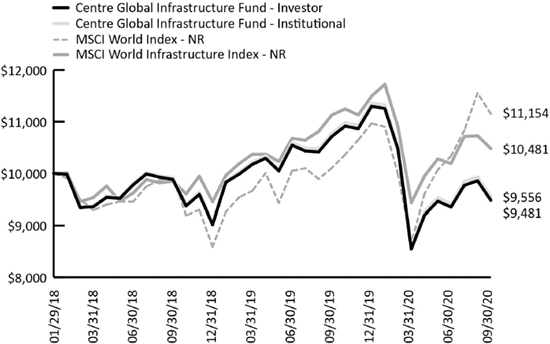

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH SEPTEMBER 30, 2020

This graph assumes an initial investment of $10,000 at January 29, 2018, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the MSCI World Index and the MSCI World Infrastructure Index. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED SEPTEMBER 30, 2020

| | 1 Month | 3 Month | YTD | 1 Year | Since Inception

(January 29, 2018) |

| Centre Global Infrastructure Fund – Investor | -3.80% | 1.43% | -16.06% | -11.49% | -1.98% |

| Centre Global Infrastructure Fund – Institutional | -3.79% | 1.59% | -15.85% | -11.30% | -1.69% |

| MSCI World Index – NR | -3.45% | 7.93% | 1.70% | 10.41% | 4.18% |

| MSCI World Infrastructure Index – NR | -2.30% | 2.84% | -8.79% | -5.81% | 1.78% |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

Per the prospectus dated January 28, 2020, as supplemented August 21, 2020, the Fund had total gross annual operating expenses of 1.83% and 1.55% and net annual operating expenses of 1.37% and 1.14% for the Investor and Institutional Class, respectively.

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World Index does not offer exposure to emerging markets.

MSCI World Infrastructure Index captures the global opportunity set of companies that are owners or operators of infrastructure assets. Constituents are selected from the equity universe of MSCI World, the parent index.

You cannot invest directly in an index.

| Annual Report | September 30, 2020 | 11 |

| Centre Funds | Disclosure of Fund Expenses |

September 30, 2020 (Unaudited)

Example. As a shareholder of a series of Centre Funds (each series, a “Fund” and together, the “Funds”), you will incur two types of costs: (1) transaction costs, including any applicable redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable) and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on April 1, 2020 and held through September 30, 2020.

Actual Expenses. The first line under each class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period 4/01/2020 – 09/30/2020” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees, if any. Therefore, the second line under each class of the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

04/01/2020 | | | Ending

Account Value

09/30/2020 | | | Expense Ratio(a) | | | Expenses Paid

During Period

4/1/2020-9/30/2020(b) | |

| Centre American Select Equity Fund | | | | | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,289.90 | | | | 1.48 | % | | $ | 8.47 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.60 | | | | 1.48 | % | | $ | 7.47 | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,292.60 | | | | 0.99 | % | | $ | 5.67 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.05 | | | | 0.99 | % | | $ | 5.00 | |

| Centre Global Infrastructure Fund | | | | | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,109.40 | | | | 1.31 | % | | $ | 6.91 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.45 | | | | 1.31 | % | | $ | 6.61 | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,110.60 | | | | 1.08 | % | | $ | 5.70 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.60 | | | | 1.08 | % | | $ | 5.45 | |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses less any waivers/reimbursements. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 366. |

| Centre American Select Equity Fund | Schedule of Investments |

September 30, 2020

| | | Shares | | | Value | |

| COMMON STOCKS (99.54%) | | | | | | | | |

| Communication Services (10.64%) | | | | | | | | |

| Diversified Telecommunication Services (1.74%) | | | | | | | | |

| AT&T, Inc. | | | 99,600 | | | $ | 2,839,596 | |

| | | | | | | | | |

| Entertainment (1.11%) | | | | | | | | |

| Netflix, Inc.(a) | | | 3,620 | | | | 1,810,109 | |

| | | | | | | | | |

| Interactive Media & Services (7.79%) | | | | | | | | |

| Alphabet, Inc. Class A, Class A(a) | | | 2,550 | | | | 3,737,280 | |

| Alphabet, Inc. Class C, Class C(a) | | | 2,485 | | | | 3,651,956 | |

| Facebook, Inc., Class A(a) | | | 20,260 | | | | 5,306,094 | |

| | | | | | | | 12,695,330 | |

| Total Communication Services | | | | | | | 17,345,035 | |

| | | | | | | | | |

| Consumer Discretionary (8.49%) | | | | | | | | |

| Internet & Direct Marketing Retail (7.42%) | | | | | | | | |

| Amazon.com, Inc.(a) | | | 3,840 | | | | 12,091,123 | |

| | | | | | | | | |

| Specialty Retail (1.07%) | | | | | | | | |

| The Home Depot, Inc. | | | 6,320 | | | | 1,755,127 | |

| | | | | | | | | |

| Total Consumer Discretionary | | | | | | | 13,846,250 | |

| | | | | | | | | |

| Consumer Staples (18.20%) | | | | | | | | |

| Food Products (12.37%) | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 90,930 | | | | 4,227,336 | |

| Bunge, Ltd. | | | 101,150 | | | | 4,622,555 | |

| Hain Celestial Group, Inc.(a) | | | 113,510 | | | | 3,893,393 | |

| JM Smucker Co. | | | 28,540 | | | | 3,296,941 | |

| Kraft Heinz Co. | | | 137,970 | | | | 4,132,201 | |

| | | | | | | | 20,172,426 | |

| Household Products (1.07%) | | | | | | | | |

| Procter & Gamble Co. | | | 12,500 | | | | 1,737,375 | |

| | | | | | | | | |

| Tobacco (4.76%) | | | | | | | | |

| Altria Group, Inc. | | | 88,410 | | | | 3,416,163 | |

| Philip Morris International, Inc. | | | 57,860 | | | | 4,338,921 | |

| | | | | | | | 7,755,084 | |

| Total Consumer Staples | | | | | | | 29,664,885 | |

| | | | | | | | | |

| Energy (11.34%) | | | | | | | | |

| Oil, Gas & Consumable Fuels (11.34%) | | | | | | | | |

| Chevron Corp. | | | 45,800 | | | | 3,297,600 | |

| Cimarex Energy Co. | | | 121,000 | | | | 2,943,930 | |

| Exxon Mobil Corp. | | | 175,400 | | | | 6,021,482 | |

| Kinder Morgan, Inc. | | | 206,490 | | | | 2,546,022 | |

| The Williams Cos., Inc. | | | 187,530 | | | | 3,684,964 | |

| | | | | | | | 18,493,998 | |

| Total Energy | | | | | | | 18,493,998 | |

| | | | | | | | | |

| Health Care (2.03%) | | | | | | | | |

| Life Sciences Tools & Services (1.03%) | | | | | | | | |

| Thermo Fisher Scientific, Inc. | | | 3,800 | | | | 1,677,776 | |

| | | Shares | | | Value | |

| Health Care (continued) | | | | | | | | |

| Pharmaceuticals (1.00%) | | | | | | | | |

| Johnson & Johnson | | | 10,950 | | | $ | 1,630,236 | |

| | | | | | | | | |

| Total Health Care | | | | | | | 3,308,012 | |

| | | | | | | | | |

| Information Technology (27.46%) | | | | | | | | |

| IT Services (4.49%) | | | | | | | | |

| Mastercard, Inc., Class A | | | 7,400 | | | | 2,502,458 | |

| PayPal Holdings, Inc.(a) | | | 9,800 | | | | 1,930,894 | |

| Visa, Inc., Class A | | | 14,410 | | | | 2,881,568 | |

| | | | | | | | 7,314,920 | |

| Semiconductors & Semiconductor Equipment (3.27%) | | | | | | | | |

| Maxim Integrated Products, Inc. | | | 38,000 | | | | 2,569,180 | |

| NVIDIA Corp. | | | 5,110 | | | | 2,765,634 | |

| | | | | | | | 5,334,814 | |

| Software (10.32%) | | | | | | | | |

| Adobe Systems, Inc.(a) | | | 3,990 | | | | 1,956,816 | |

| Microsoft Corp. | | | 61,997 | | | | 13,039,829 | |

| salesforce.com, Inc.(a) | | | 7,300 | | | | 1,834,636 | |

| | | | | | | | 16,831,281 | |

| Technology Hardware, Storage & Peripherals (9.38%) | | | | | | | | |

| Apple, Inc. | | | 132,000 | | | | 15,286,920 | |

| | | | | | | | | |

| Total Information Technology | | | | | | | 44,767,935 | |

| | | | | | | | | |

| Materials (10.89%) | | | | | | | | |

| Chemicals (6.11%) | | | | | | | | |

| Eastman Chemical Co. | | | 42,100 | | | | 3,288,852 | |

| LyondellBasell Industries, Class A | | | 46,070 | | | | 3,247,474 | |

| Olin Corp. | | | 276,140 | | | | 3,418,613 | |

| | | | | | | | 9,954,939 | |

| Metals & Mining (4.78%) | | | | | | | | |

| Barrick Gold Corp. | | | 277,160 | | | | 7,790,968 | |

| | | | | | | | | |

| Total Materials | | | | | | | 17,745,907 | |

| | | | | | | | | |

| Utilities (10.49%) | | | | | | | | |

| Electric Utilities (5.82%) | | | | | | | | |

| Edison International | | | 57,110 | | | | 2,903,472 | |

| OGE Energy Corp. | | | 84,500 | | | | 2,534,155 | |

| PPL Corp. | | | 148,690 | | | | 4,045,855 | |

| | | | | | | | 9,483,482 | |

| Independent Power and Renewable Electricity Producers(2.60%) | | | | | | | | |

| AES Corp. | | | 233,750 | | | | 4,233,213 | |

| | | | | | | | | |

| Multi-Utilities (2.07%) | | | | | | | | |

| Sempra Energy | | | 28,600 | | | | 3,385,096 | |

| | | | | | | | | |

| Total Utilities | | | | | | | 17,101,791 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $118,010,578) | | | | | | | 162,273,813 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2020 | 13 |

| Centre American Select Equity Fund | Schedule of Investments |

September 30, 2020

| Expiration Date | | Exercise Price | | | Contracts | | | Notional Value | | | Value | |

| PURCHASED OPTIONS (0.47%) | | | | | | | | | | | | | | | | |

| S&P 500® Index: | | | | | | | | | | | | | | | | |

| 12/18/2020 | | $ | 2,525.00 | | | | 465 | | | $ | 156,379,500 | | | $ | 769,575 | |

| | | | | | | | | | | | | | | | | |

| TOTAL PURCHASED OPTIONS | | | | | | | | | | | | | | | | |

| (Cost $2,227,888) | | | | | | | | | | | | | | | 769,575 | |

| | | 7-Day | | | | | | | |

| | | Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.02%) | | | | | | | | | | | | |

| Money Market Fund (0.02%) | | | | | | | | | | | | |

| Dreyfus Treasury Prime Cash Management, Institutional Class | | | 0.010 | % | | | 28,538 | | | | 28,538 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |