Investor Presentation May 12, 2015

Certain statements and information contained in this presentation (and oral statements made regarding the subjects of this presentation) constitute “forward‐looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Where any forward‐looking statement includes a statement about the assumptions of bases underlying the forward‐looking statement, we caution that, while we believe these assumptions or bases to be reasonable and made in good faith, assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. Where, in any forward‐looking statement, our management expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith and is believed to have a reasonable basis. We cannot assure you, however, that the statement of expectation or belief will result or be achieved or accomplished. These statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our future prospects, developments and business strategies. Forward‐looking statements typically include words or phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “foresee,” “intend,” “our ability to,” “plan,” “potential,” “project,” “should,” “tends to,” “target,” “will,” “would,” or other similar words, or negatives of such words, which are generally not historical in nature. Such forward‐looking statements specifically include statements involving: client contract opportunities; contract dayrate amounts; future operational performance and cashflow; contract backlog; revenue efficiency levels; estimated duration of client contracts; future contract commencement dates and locations; construction, timing and delivery of newbuild drillships; capital expenditures; market conditions; cost adjustments; estimated rig availability; future distributions to shareholders; new rig commitments; the expected time and number of rigs in a shipyard for repairs, maintenance, enhancement or construction; expected direct rig operating costs; shore based support costs; selling, general and administrative expenses; income tax expense; expected amortization of deferred revenue and deferred mobilization expenses; and expected depreciation and interest expense for our existing credit facilities and senior bonds. These forward‐looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward‐looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. In particular, our forward looking statements regarding future distributions to shareholders and share repurchases are subject to the discretion of our Board of Directors, additional laws of Luxemburg, and the funding of any such distribution or repurchase is heavily dependent on our ability to achieve projected cashflows, which could be materially impacted by numerous factors, including those listed below. There can be no assurance that we will make distributions or share repurchases within the period or in the amount forecasted or at all. All comments concerning our expectations for future revenue and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward‐looking statements involve significant risks and uncertainties (many of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations, plans or projections. Important factors that could cause actual results to differ materially from projected cashflows and other projections in our forward‐looking statements include, but are not limited to: our ability to secure and maintain drilling contracts, including possible cancellation, renegotiation or suspension of drilling contracts as a result of mechanical difficulties, performance, market changes, regulatory or other approvals, or other reasons; changes in worldwide rig supply and demand, competition and technology; levels of offshore drilling activity and general market conditions; risks inherent to shipyard rig construction, repair, maintenance or enhancement, including delays; unplanned downtime and other risks associated with offshore rig operations, including unscheduled repairs or extended maintenance; governmental action, strikes, public health threats, civil unrest and political and economic uncertainties; relocations, severe weather or hurricanes; actual contract commencement dates; environmental or other liabilities, risks or losses; governmental regulatory, legislative and permitting requirements affecting drilling operations; our ability to attract and retain skilled personnel on commercially reasonable terms; impact of potential licensing or patent litigation; terrorism, piracy and military action; and the outcome of litigation, legal proceedings, investigations or other claims or contract disputes. For additional information regarding known material risk factors that could cause our actual results to differ from our projected results, please see our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 20‐F and Current Reports on Form 6‐K. These documents are available through our website at www.pacificdrilling.com or through the SEC’s Electronic Data and Analysis Retrieval System at www.sec.gov. Existing and prospective investors are cautioned not to place undue reliance on forward‐looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward‐looking statements after the date they are made, whether as a result of new information, future events or otherwise. Forward looking statements

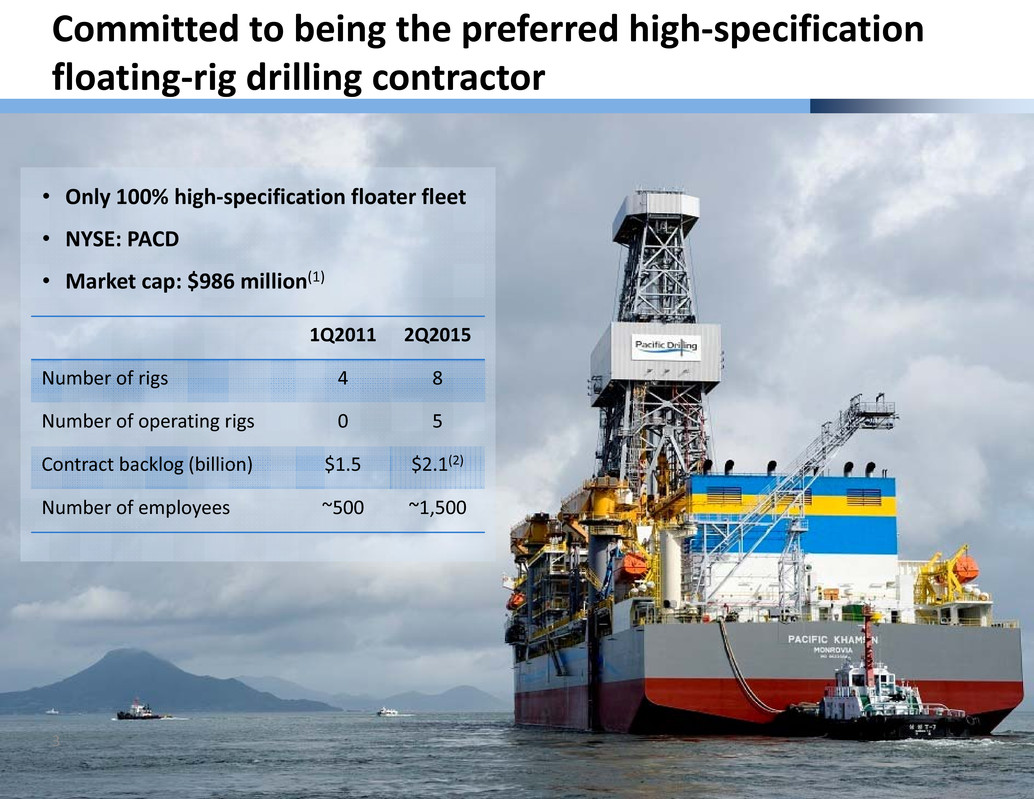

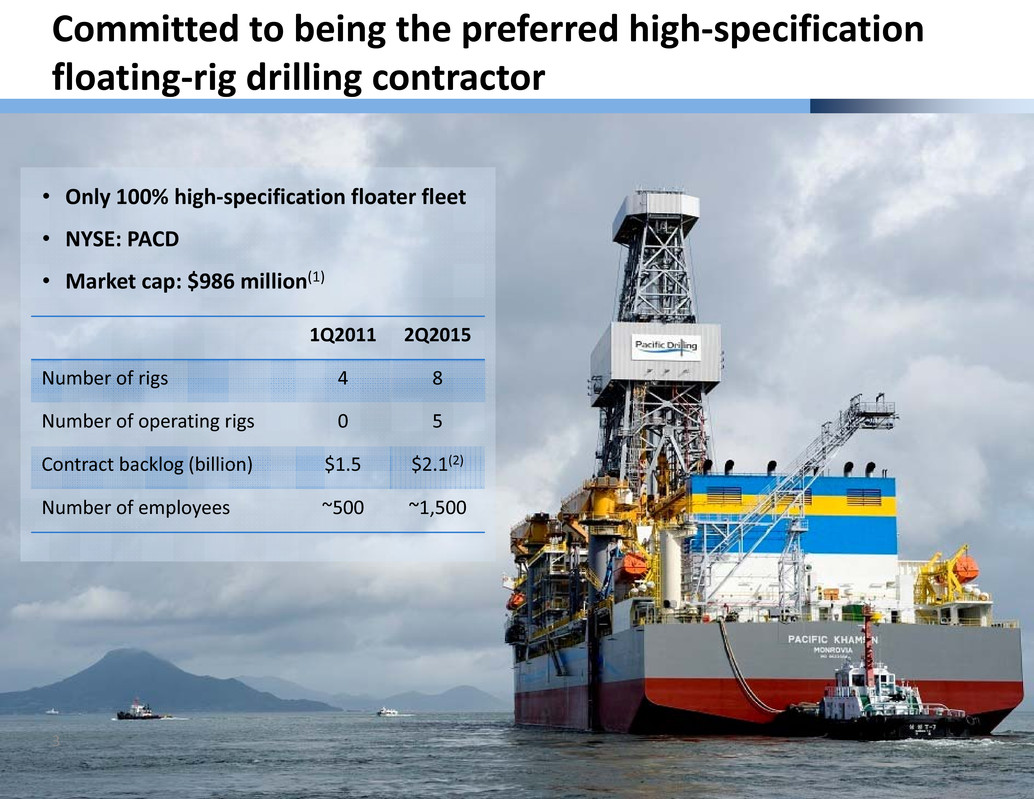

3 Committed to being the preferred high‐specification floating‐rig drilling contractor • Only 100% high‐specification floater fleet • NYSE: PACD • Market cap: $986 million(1) 1Q2011 2Q2015 Number of rigs 4 8 Number of operating rigs 0 5 Contract backlog (billion) $1.5 $2.1(2) Number of employees ~500 ~1,500

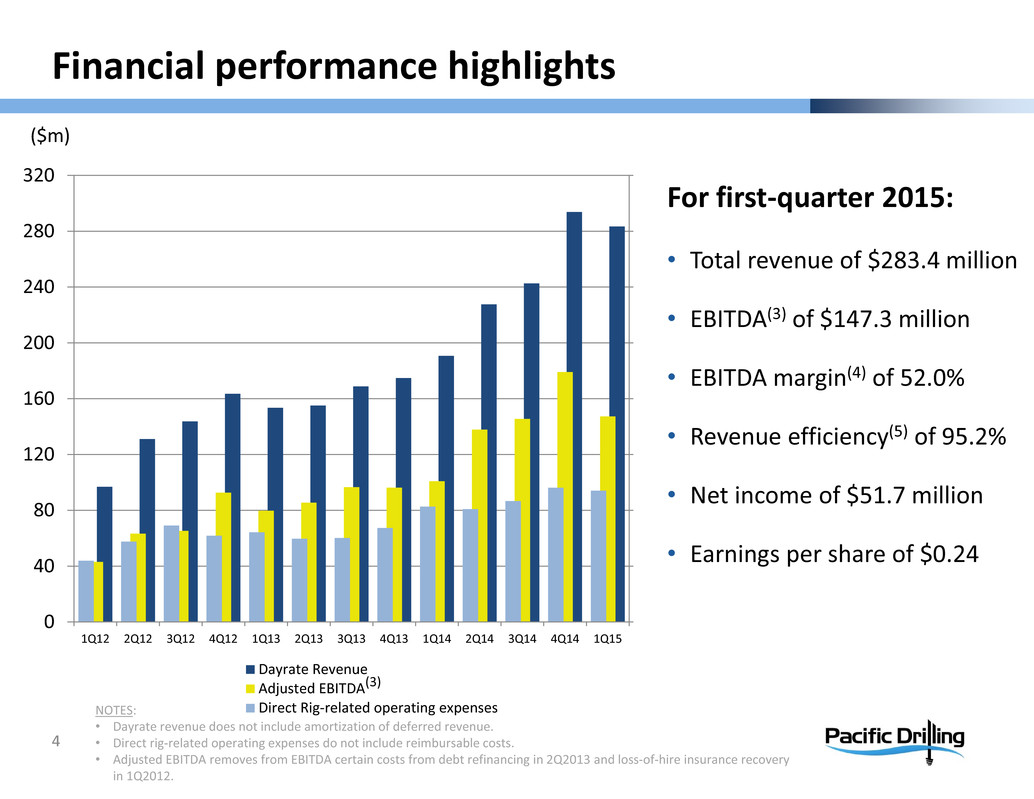

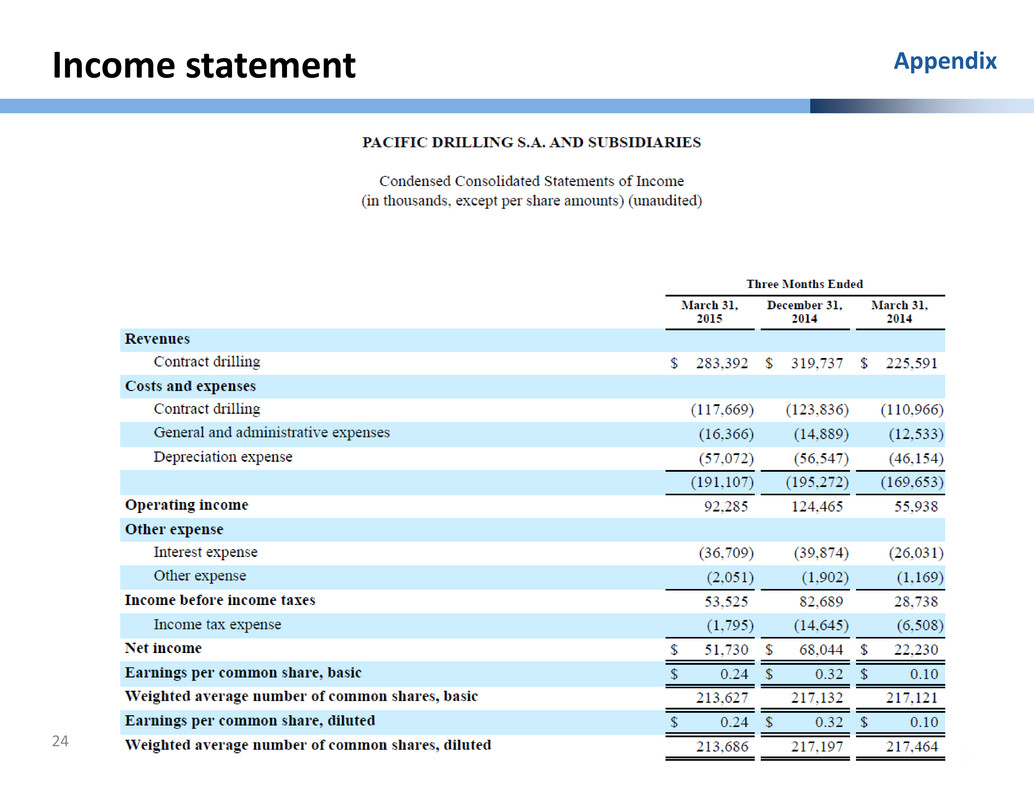

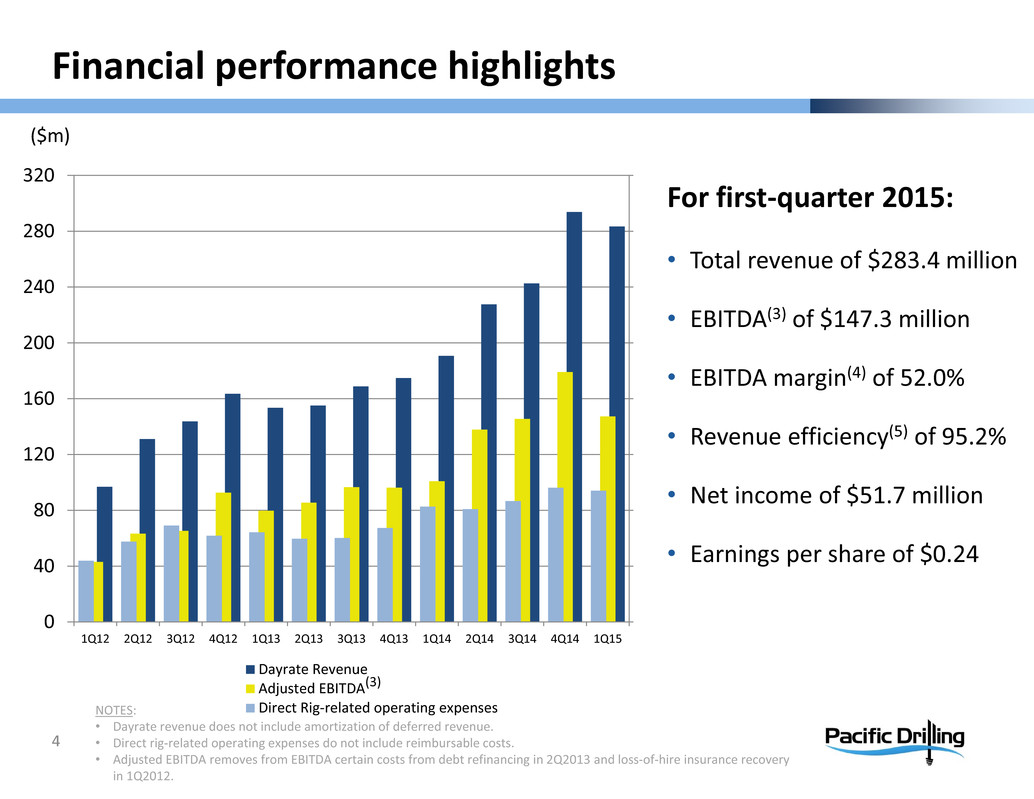

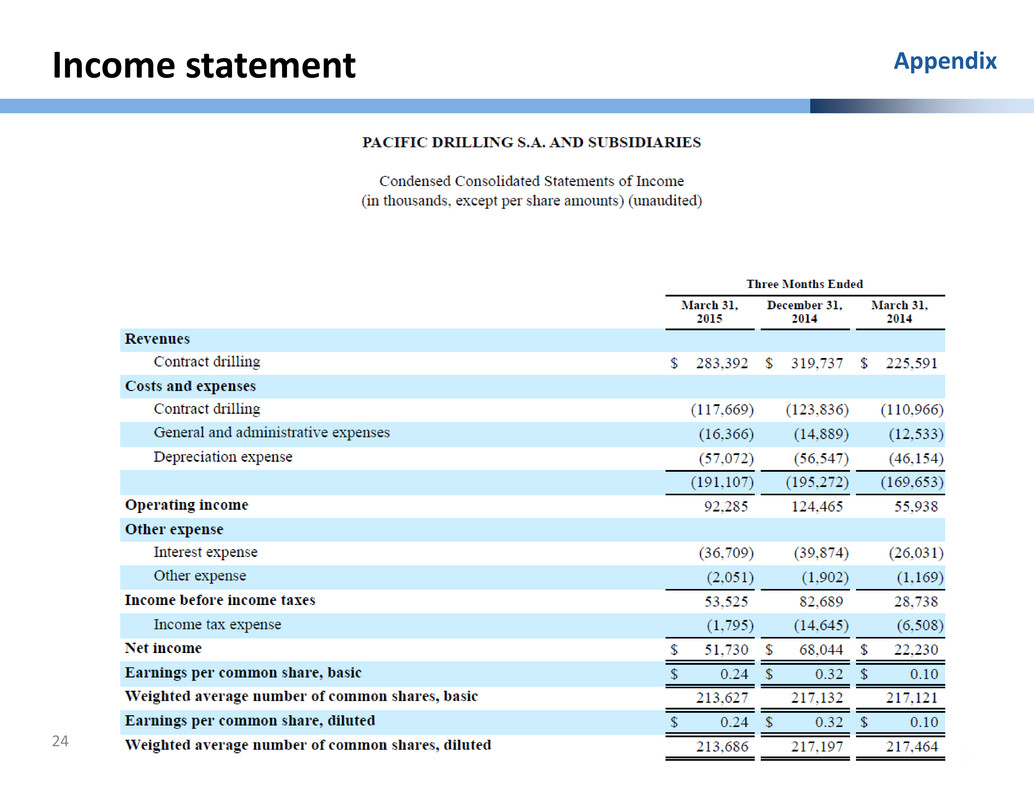

Financial performance highlights 4 For first‐quarter 2015: • Total revenue of $283.4 million • EBITDA(3) of $147.3 million • EBITDA margin(4) of 52.0% • Revenue efficiency(5) of 95.2% • Net income of $51.7 million • Earnings per share of $0.24 ($m) NOTES: • Dayrate revenue does not include amortization of deferred revenue. • Direct rig‐related operating expenses do not include reimbursable costs. • Adjusted EBITDA removes from EBITDA certain costs from debt refinancing in 2Q2013 and loss‐of‐hire insurance recovery in 1Q2012. 0 40 80 120 160 200 240 280 320 0 40 80 120 160 200 240 280 320 1Q154Q143Q142Q141Q144Q133Q132Q131Q134Q123Q122Q121Q12 Dayrate Revenue Adjusted EBITDA Direct Rig‐related operating expenses (3)

Strategically positioned for long‐term success MARKET DYNAMICS • Increasingly challenging offshore drilling activities in all water depths • High‐specification drillships meet client demands OPERATIONAL EXCELLENCE • Strong operational performance • Relationships with high‐quality clients • Industry‐leading EBITDA margins FINANCIAL STRENGTH • Contracted backlog provides baseline liquidity • Financing in place for all commitments until late 2017

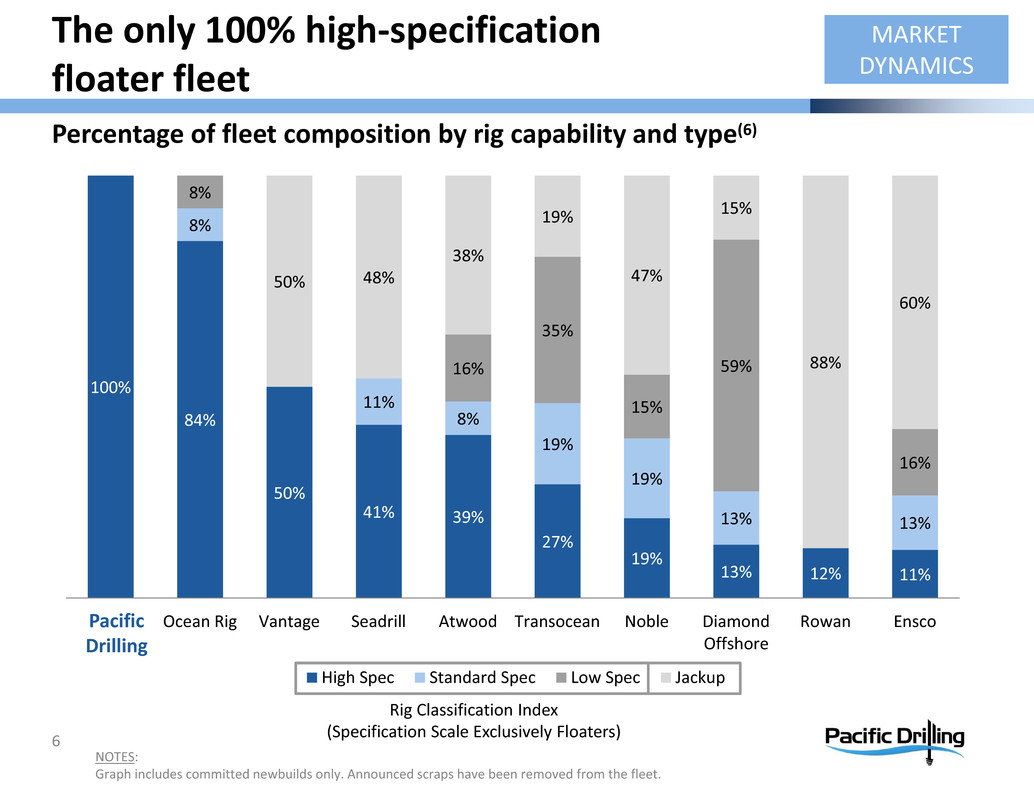

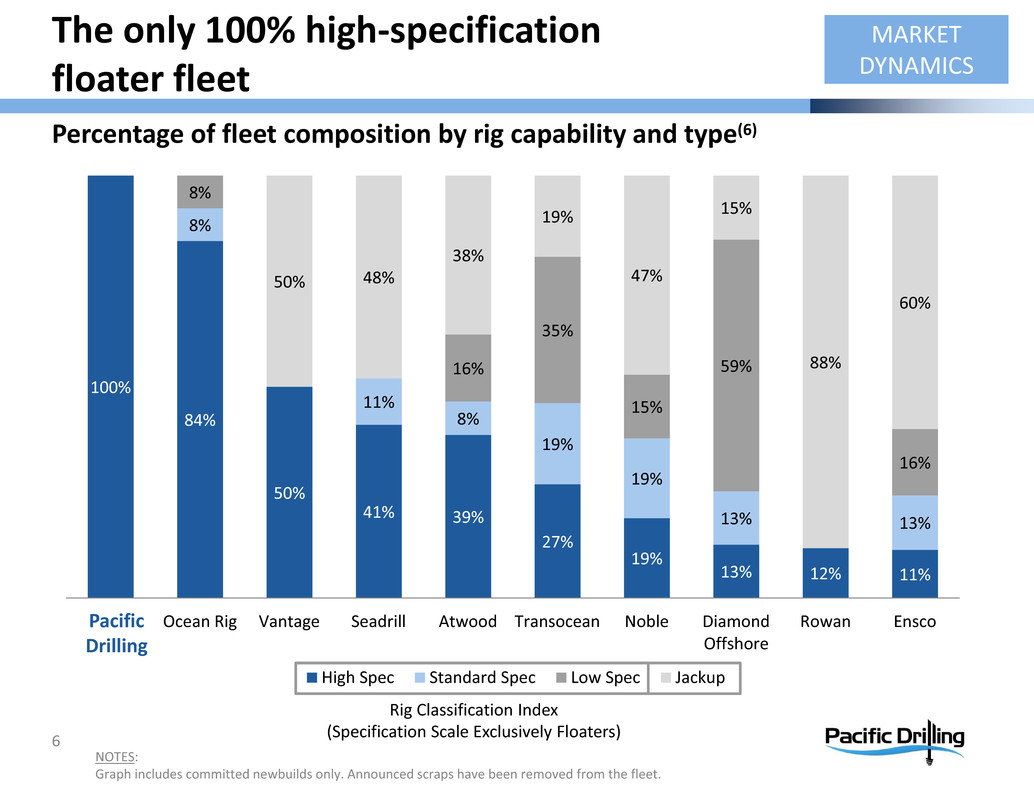

100% 84% 50% 41% 39% 27% 19% 13% 12% 11% 8% 11% 8% 19% 19% 13% 13% 8% 16% 35% 15% 59% 16% 50% 48% 38% 19% 47% 15% 88% 60% Pacific Drilling Ocean Rig Vantage Seadrill Atwood Transocean Noble Diamond Offshore Rowan Ensco High Spec Standard Spec Low Spec Jackup The only 100% high‐specification floater fleet NOTES: Graph includes committed newbuilds only. Announced scraps have been removed from the fleet. 6 Percentage of fleet composition by rig capability and type(6) cific Drilling MARKET DYNAMICS Rig Classification Index (Specification Scale Exclusively Floaters)

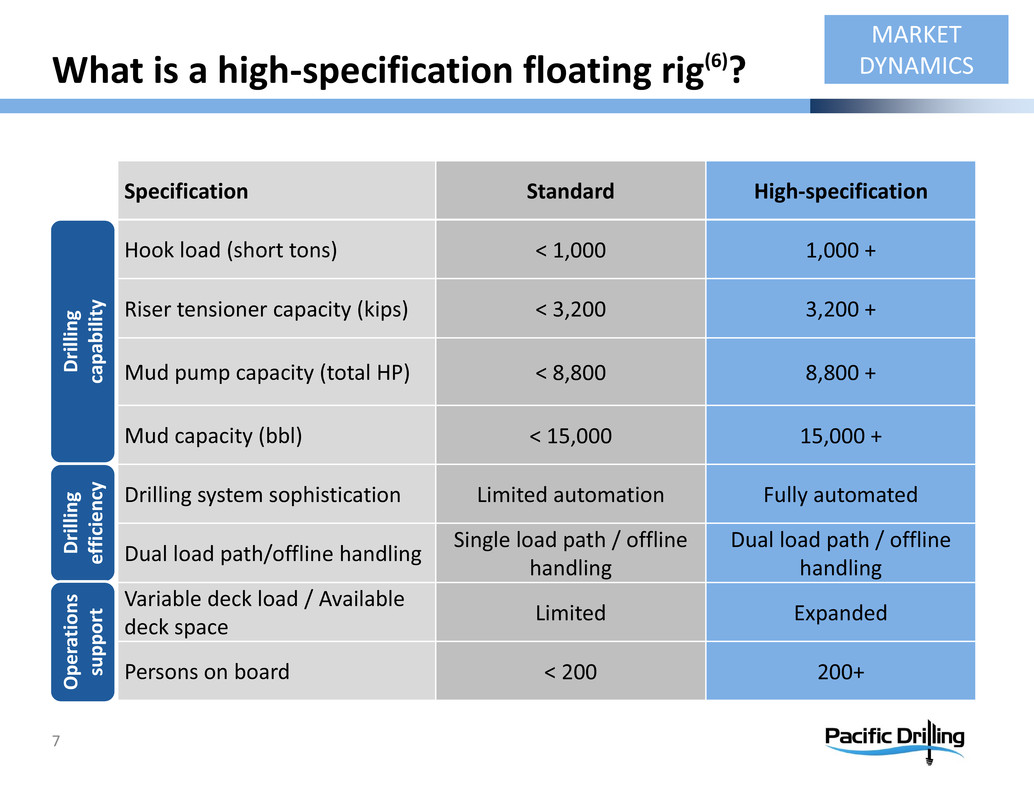

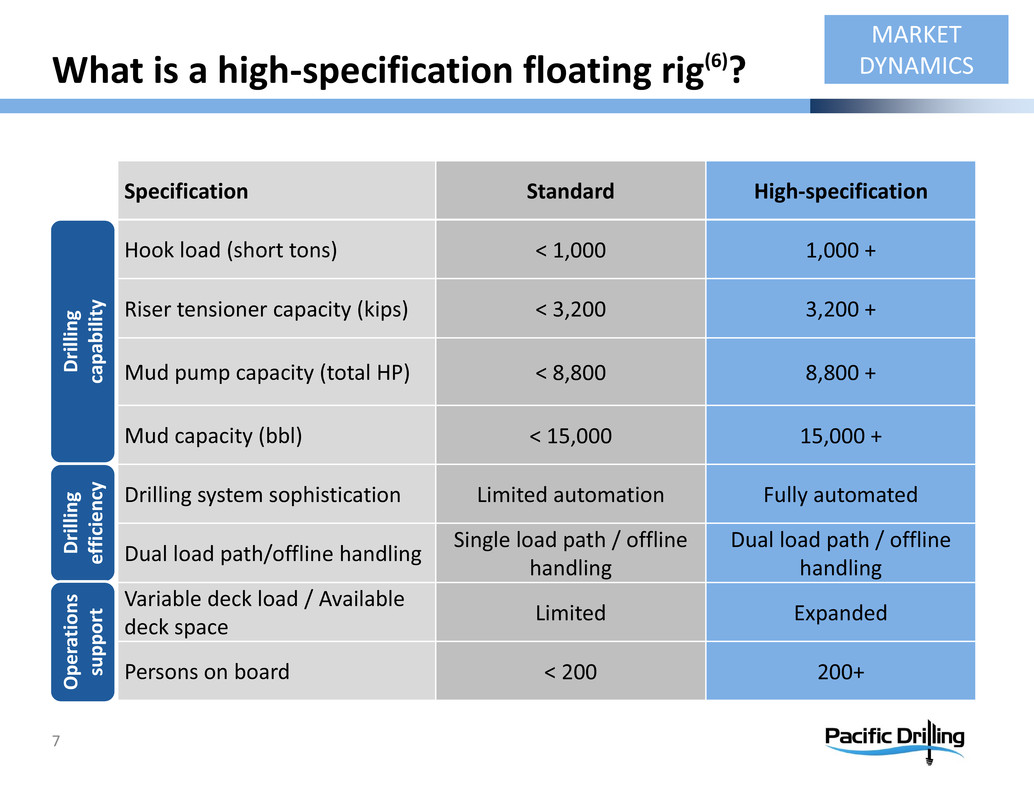

7 What is a high‐specification floating rig(6)? MARKET DYNAMICS Specification Standard High‐specification Hook load (short tons) < 1,000 1,000 + Riser tensioner capacity (kips) < 3,200 3,200 + Mud pump capacity (total HP) < 8,800 8,800 + Mud capacity (bbl) < 15,000 15,000 + Drilling system sophistication Limited automation Fully automated Dual load path/offline handling Single load path / offline handling Dual load path / offline handling Variable deck load / Available deck space Limited Expanded Persons on board < 200 200+ Drillin g c a p a b i l i t y Drillin g e fficienc y O p e r a t i o n s s u p p o r t

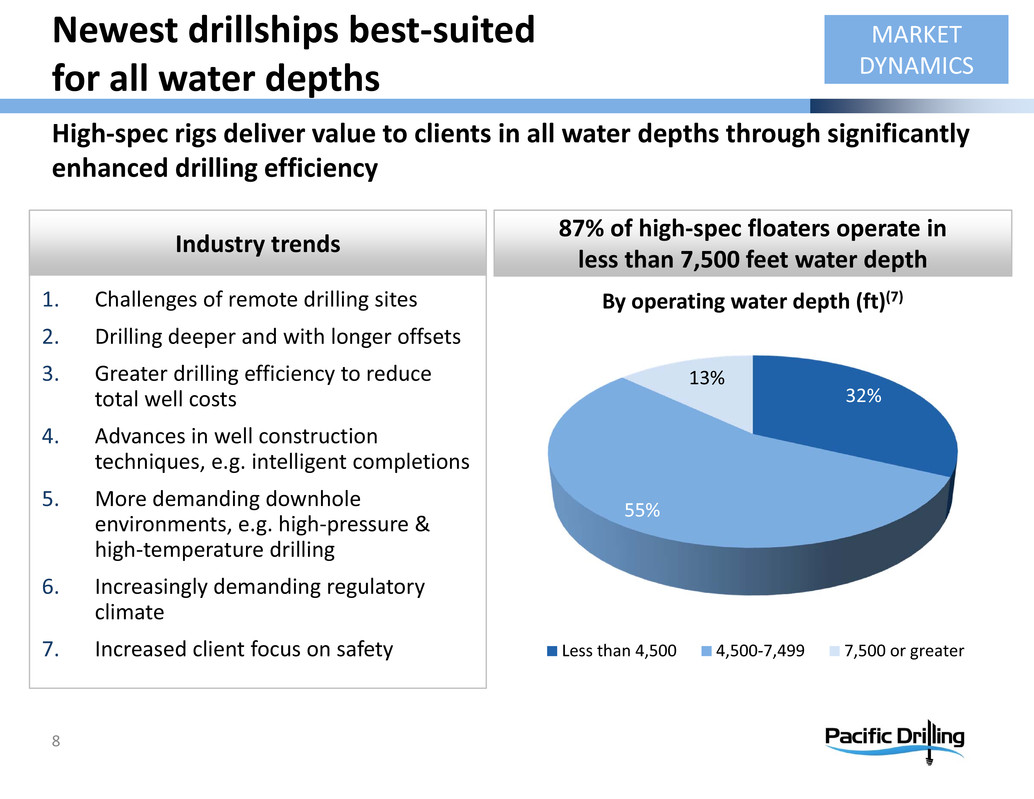

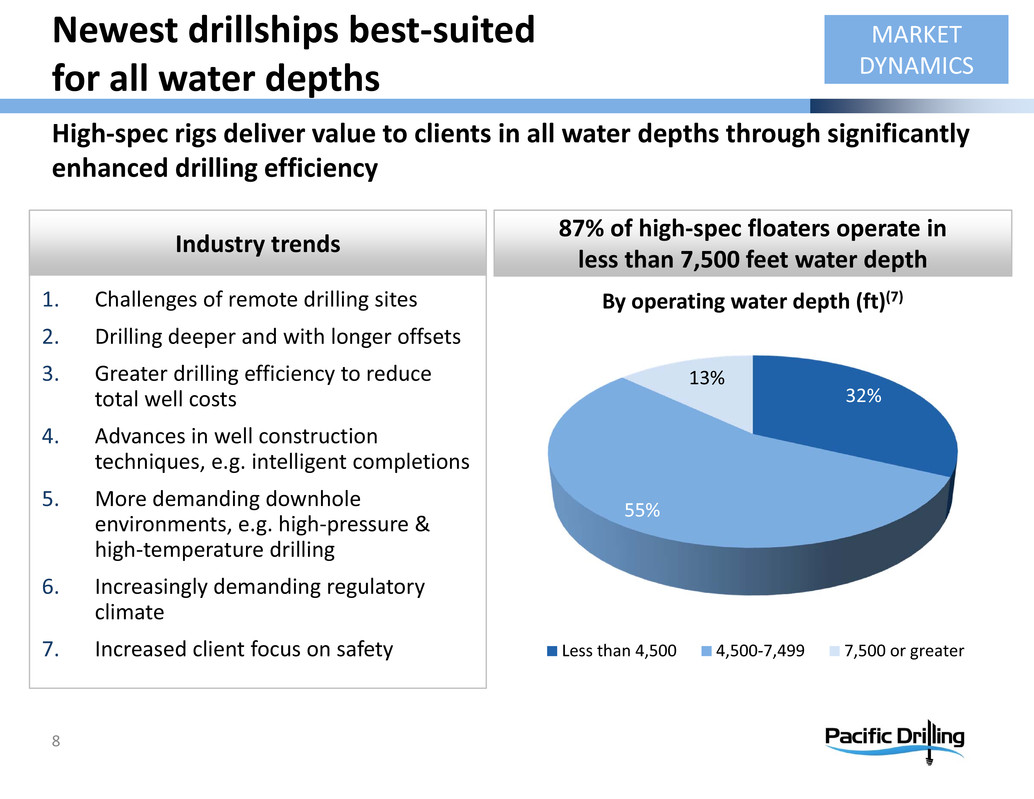

Newest drillships best‐suited for all water depths Industry trends 87% of high‐spec floaters operate in less than 7,500 feet water depth 8 1. Challenges of remote drilling sites 2. Drilling deeper and with longer offsets 3. Greater drilling efficiency to reduce total well costs 4. Advances in well construction techniques, e.g. intelligent completions 5. More demanding downhole environments, e.g. high‐pressure & high‐temperature drilling 6. Increasingly demanding regulatory climate 7. Increased client focus on safety High‐spec rigs deliver value to clients in all water depths through significantly enhanced drilling efficiency 32% 55% 13% By operating water depth (ft)(7) Less than 4,500 4,500‐7,499 7,500 or greater MARKET DYNAMICS

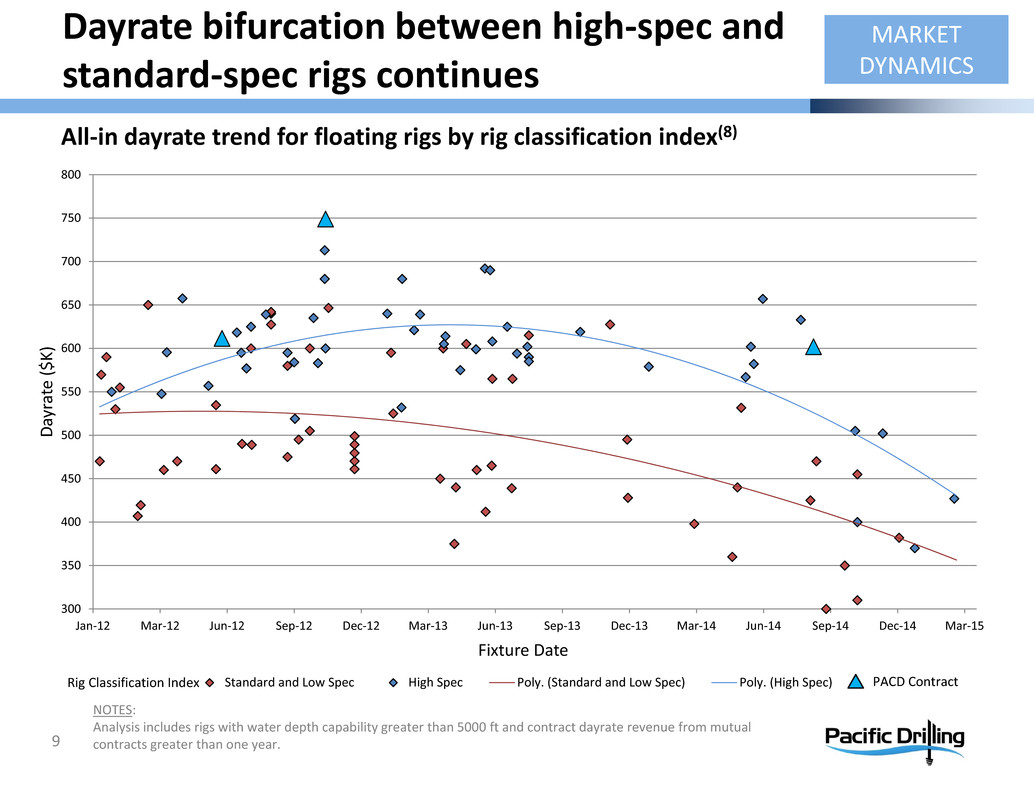

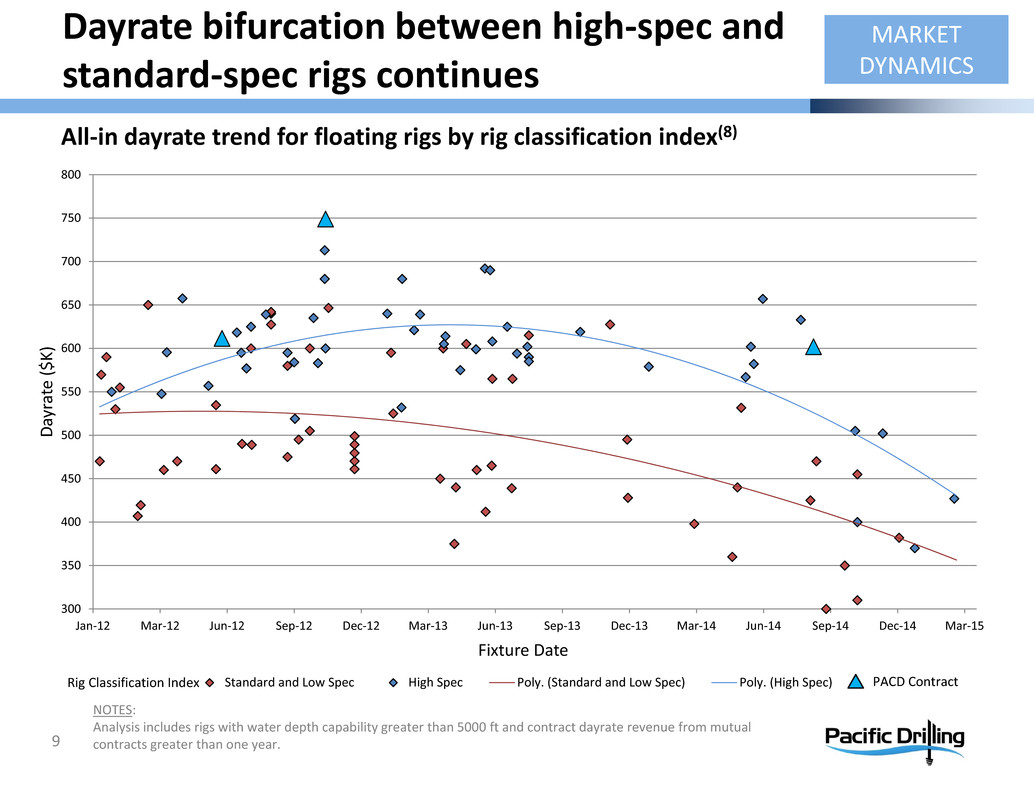

300 350 400 450 500 550 600 650 700 750 800 Jan‐12 Mar‐12 Jun‐12 Sep‐12 Dec‐12 Mar‐13 Jun‐13 Sep‐13 Dec‐13 Mar‐14 Jun‐14 Sep‐14 Dec‐14 Mar‐15 D a y r a t e ( $ K ) Fixture Date Standard and Low Spec High Spec Poly. (Standard and Low Spec) Poly. (High Spec) All‐in dayrate trend for floating rigs by rig classification index(8) NOTES: Analysis includes rigs with water depth capability greater than 5000 ft and contract dayrate revenue from mutual contracts greater than one year.9 Rig Classification Index Dayrate bifurcation between high‐spec and standard‐spec rigs continues MARKET DYNAMICS PACD Contract

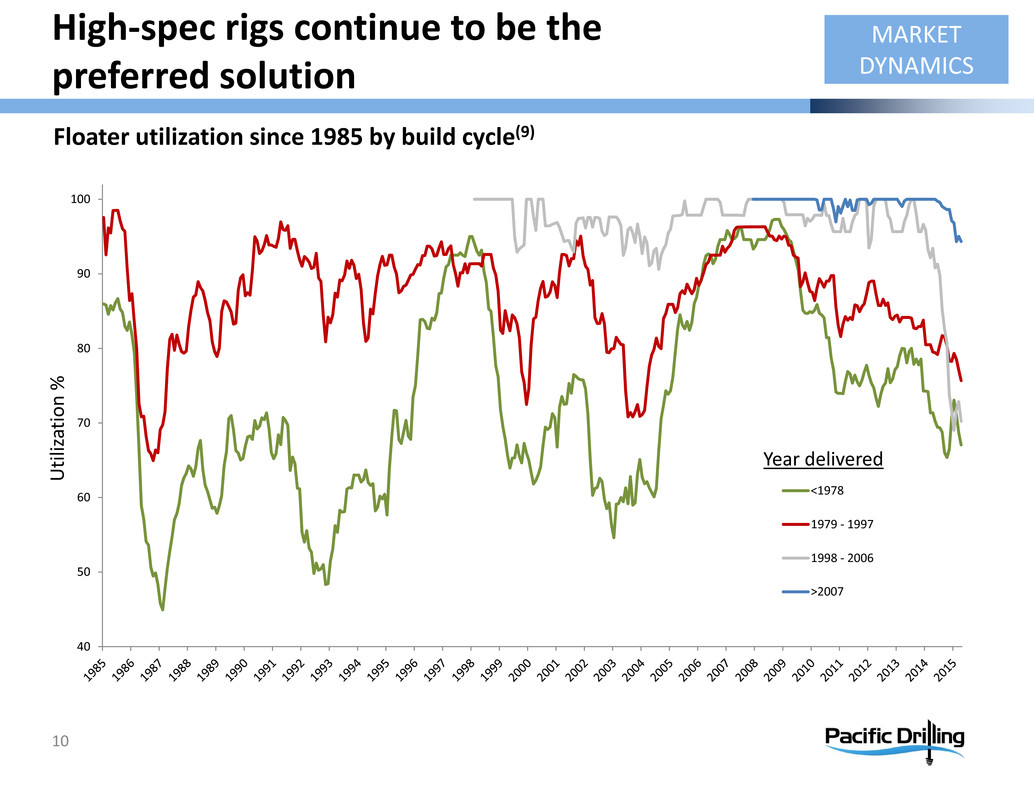

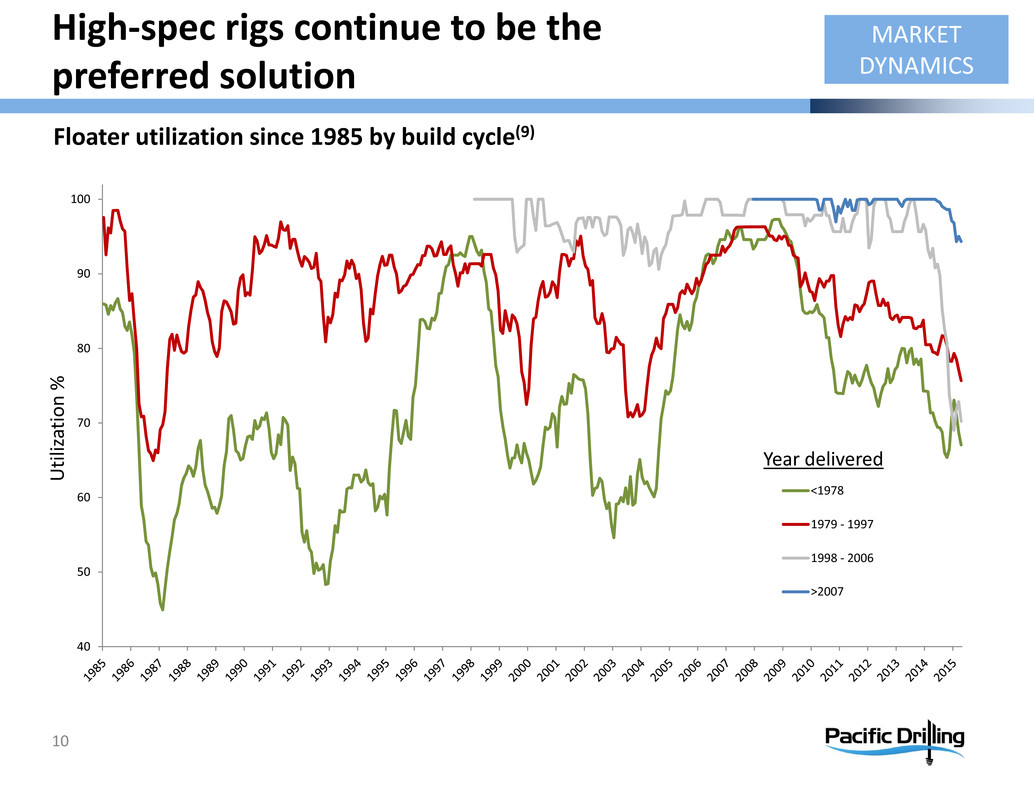

High‐spec rigs continue to be the preferred solution 10 40 50 60 70 80 90 100 <1978 1979 ‐ 1997 1998 ‐ 2006 >2007 U t i l i z a t i o n % MARKET DYNAMICS Year delivered Floater utilization since 1985 by build cycle(9)

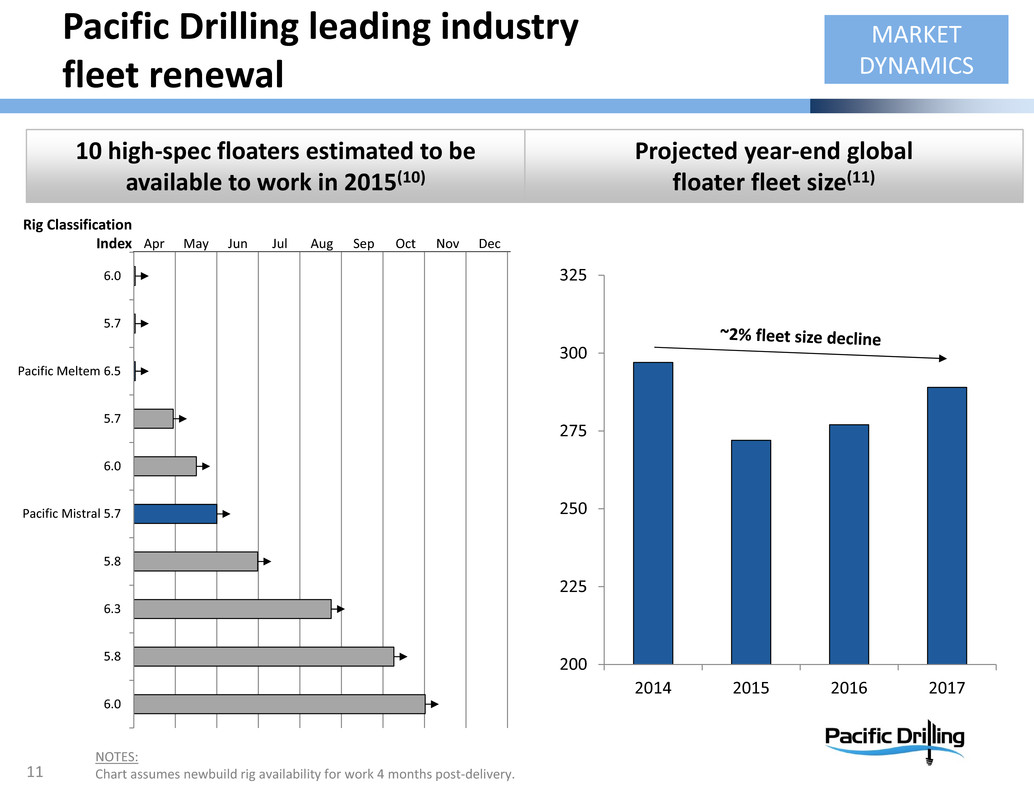

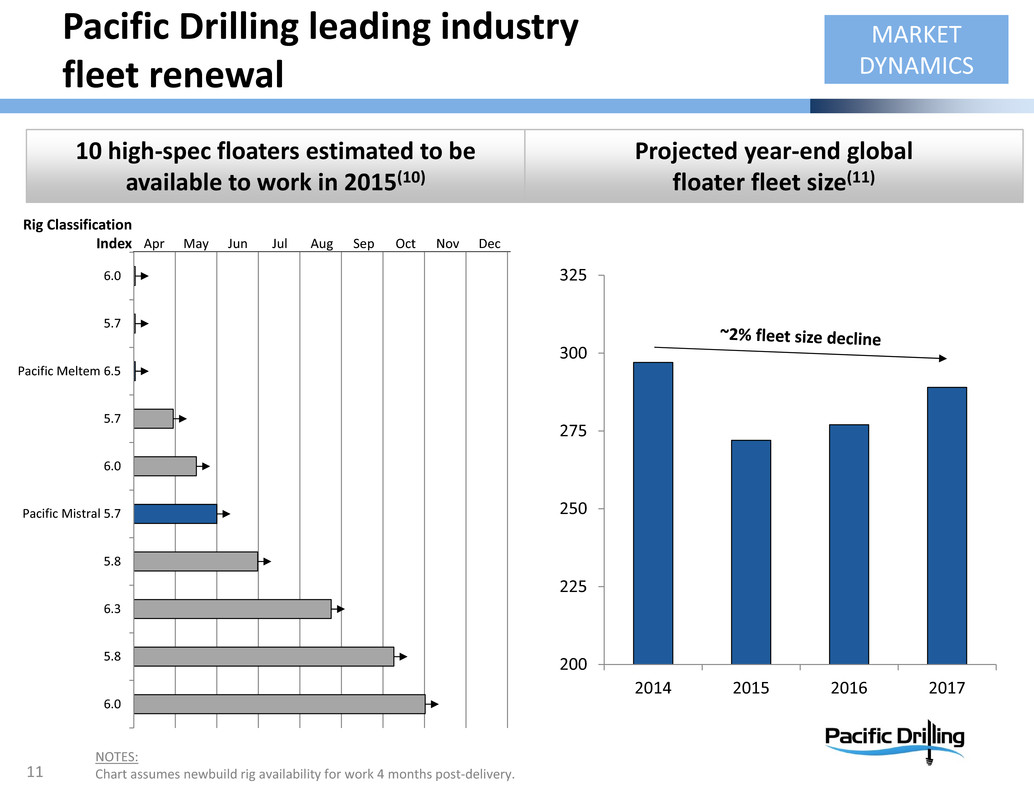

Pacific Drilling leading industry fleet renewal 10 high‐spec floaters estimated to be available to work in 2015(10) 11 MARKET DYNAMICS Projected year‐end global floater fleet size(11) NOTES: Chart assumes newbuild rig availability for work 4 months post‐delivery. 200 225 250 275 300 325 2014 2015 2016 2017 6.0 5.8 6.3 5.8 Pacific Mistral 5.7 6.0 5.7 Pacific Meltem 6.5 5.7 6.0 Rig Classification Index Apr May Jun Jul Aug Sep Oct Nov Dec

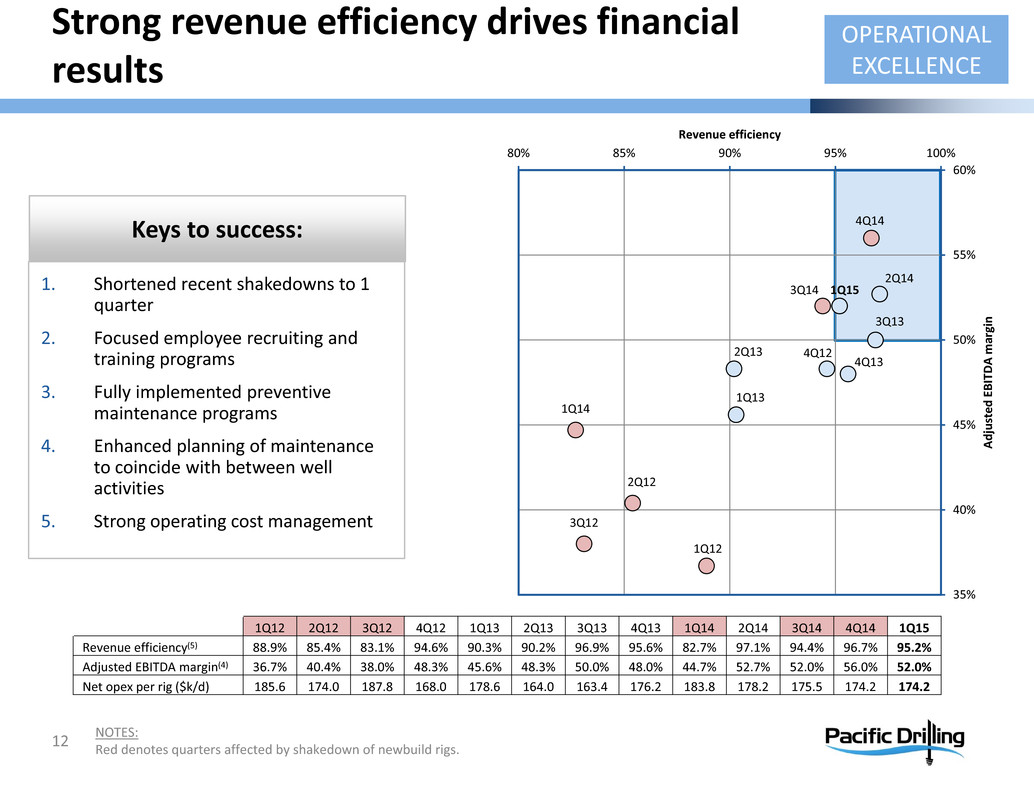

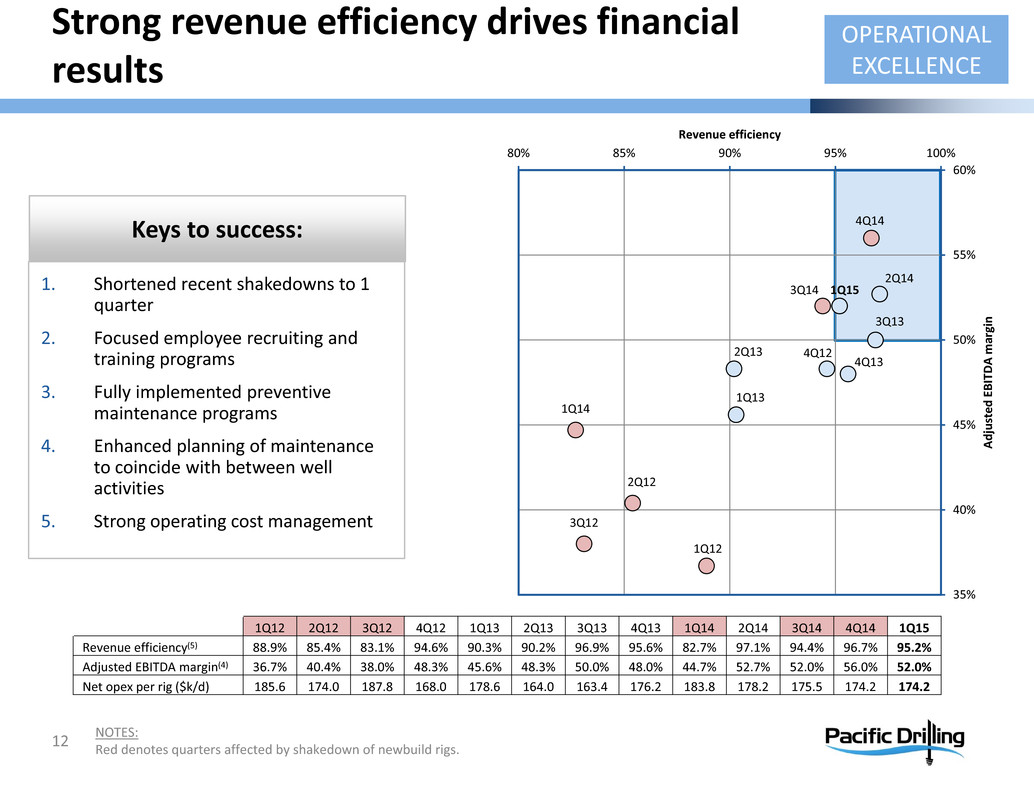

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 35% 40% 45% 50% 55% 60% 80% 85% 90% 95% 100% A d j u s t e d E B I T D A m a r g i n Revenue efficiency Strong revenue efficiency drives financial results 12 OPERATIONAL EXCELLENCE 1. Shortened recent shakedowns to 1 quarter 2. Focused employee recruiting and training programs 3. Fully implemented preventive maintenance programs 4. Enhanced planning of maintenance to coincide with between well activities 5. Strong operating cost management Keys to success: 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Revenue efficiency(5) 88.9% 85.4% 83.1% 94.6% 90.3% 90.2% 96.9% 95.6% 82.7% 97.1% 94.4% 96.7% 95.2% Adjusted EBITDA margin(4) 36.7% 40.4% 38.0% 48.3% 45.6% 48.3% 50.0% 48.0% 44.7% 52.7% 52.0% 56.0% 52.0% Net opex per rig ($k/d) 185.6 174.0 187.8 168.0 178.6 164.0 163.4 176.2 183.8 178.2 175.5 174.2 174.2 NOTES: Red denotes quarters affected by shakedown of newbuild rigs.

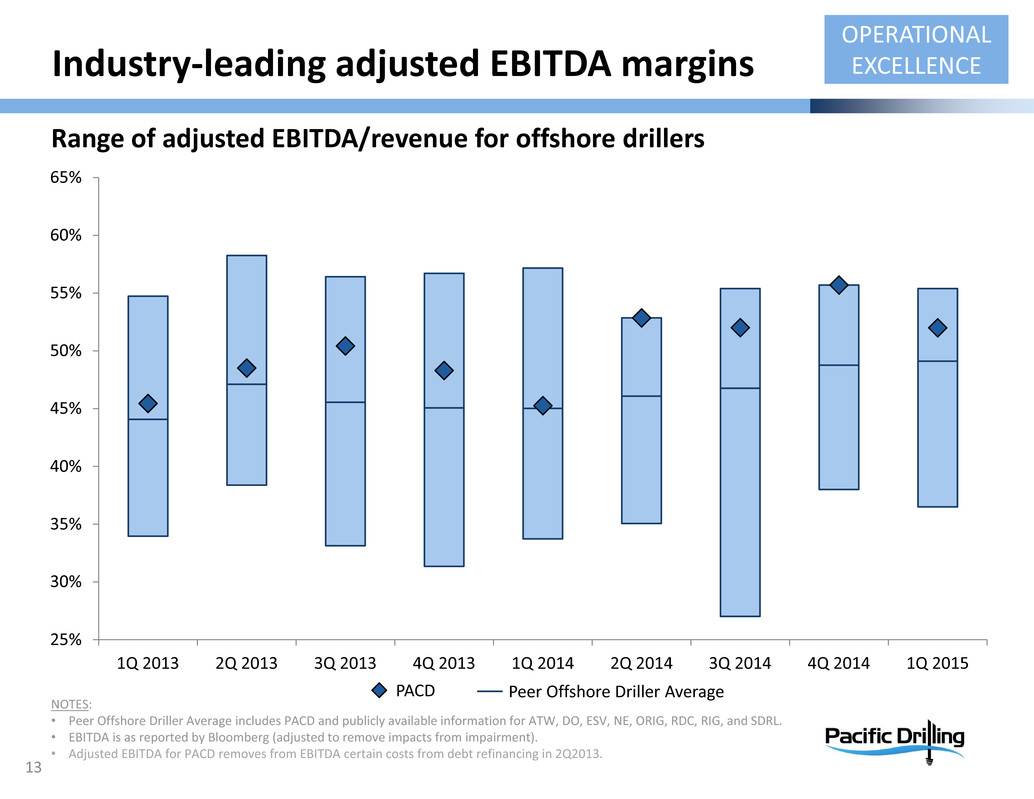

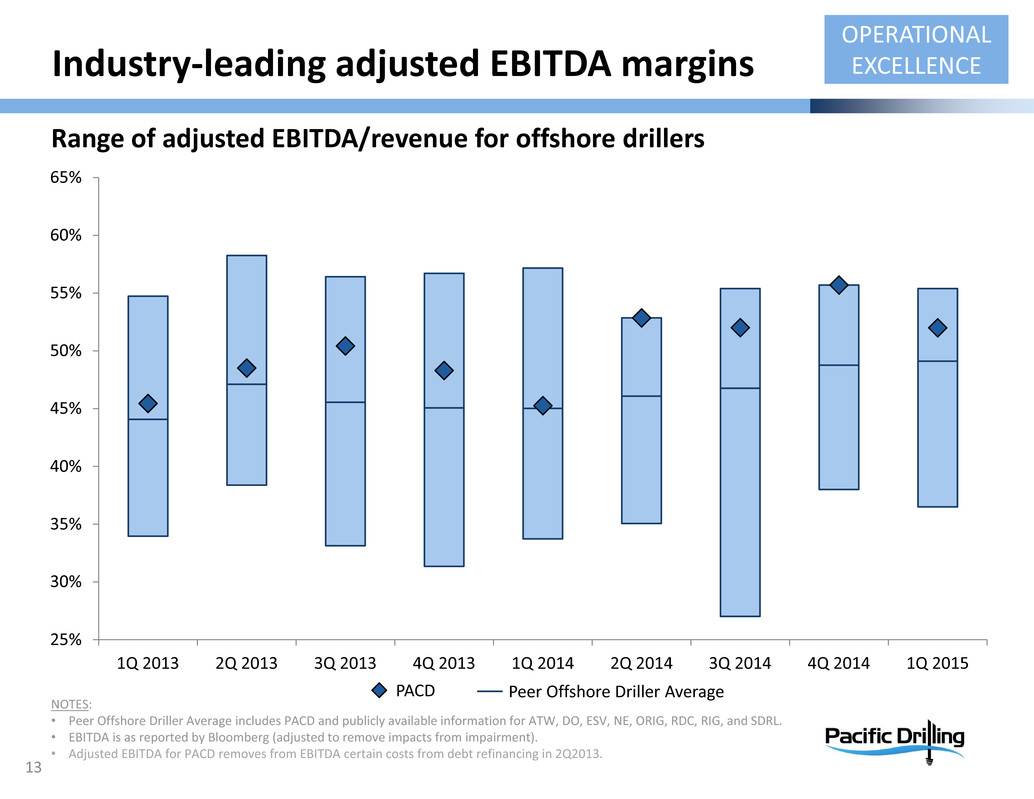

13 Industry‐leading adjusted EBITDA margins OPERATIONAL EXCELLENCE Range of adjusted EBITDA/revenue for offshore drillers 25% 30% 35% 40% 45% 50% 55% 60% 65% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 PACD Peer Offshore Driller Average NOTES: • Peer Offshore Driller Average includes PACD and publicly available information for ATW, DO, ESV, NE, ORIG, RDC, RIG, and SDRL. • EBITDA is as reported by Bloomberg (adjusted to remove impacts from impairment). • Adjusted EBITDA for PACD removes from EBITDA certain costs from debt refinancing in 2Q2013.

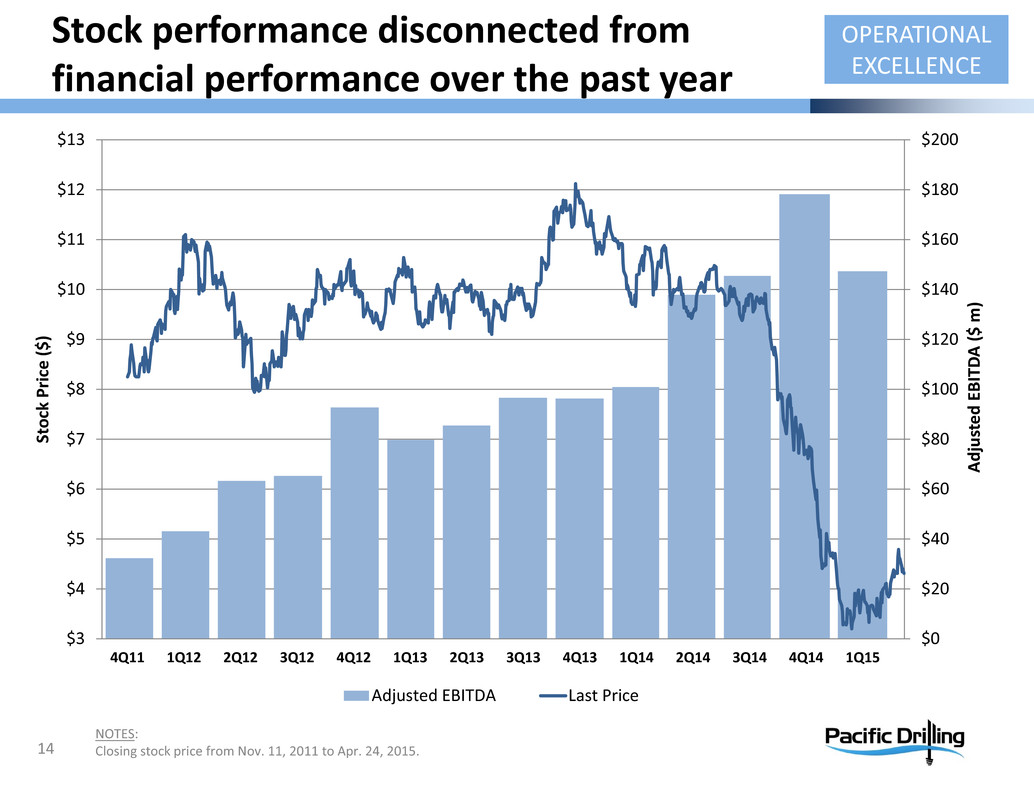

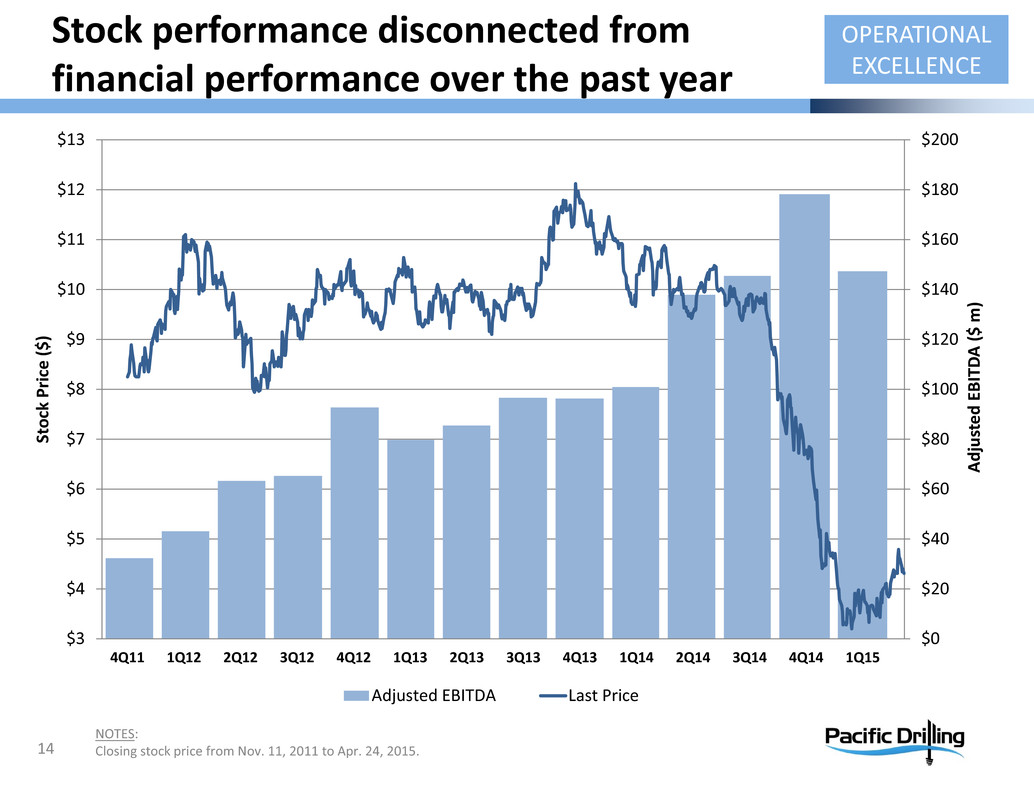

$0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 $3 $4 $5 $6 $7 $8 $9 $10 $11 $12 $13 A d j u s t e d E B I T D A ( $ m ) S t o c k P r i c e ( $ ) Adjusted EBITDA Last Price 14 NOTES: Closing stock price from Nov. 11, 2011 to Apr. 24, 2015. OPERATIONAL EXCELLENCE Stock performance disconnected from financial performance over the past year 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15

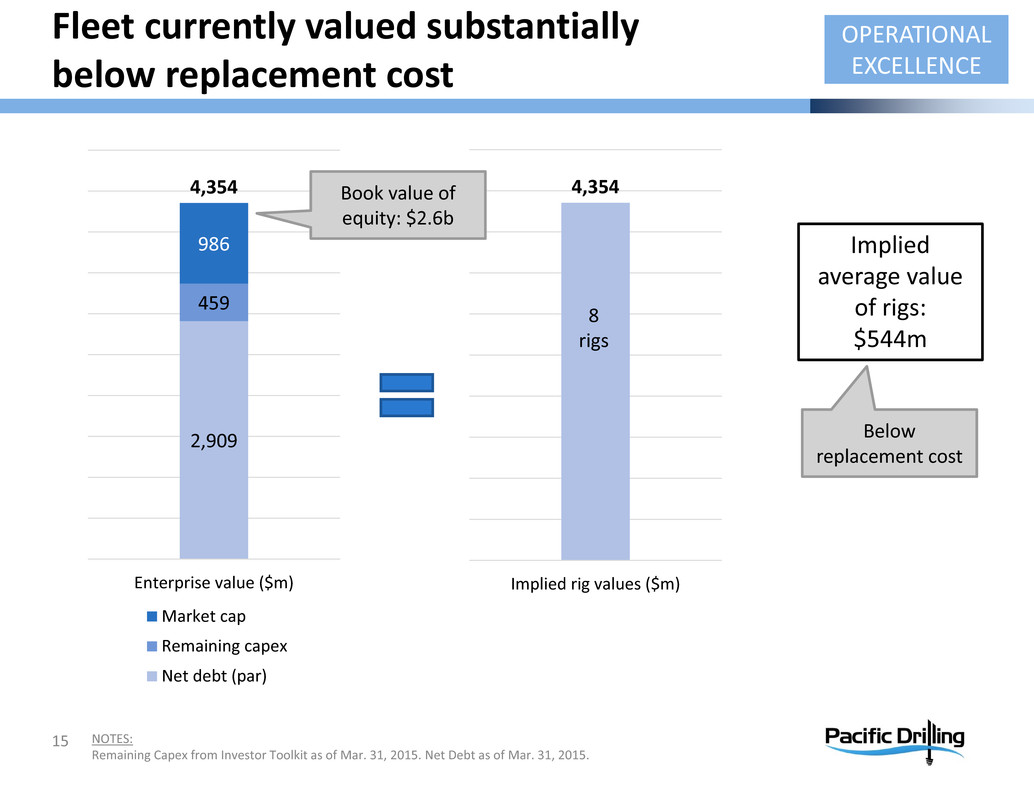

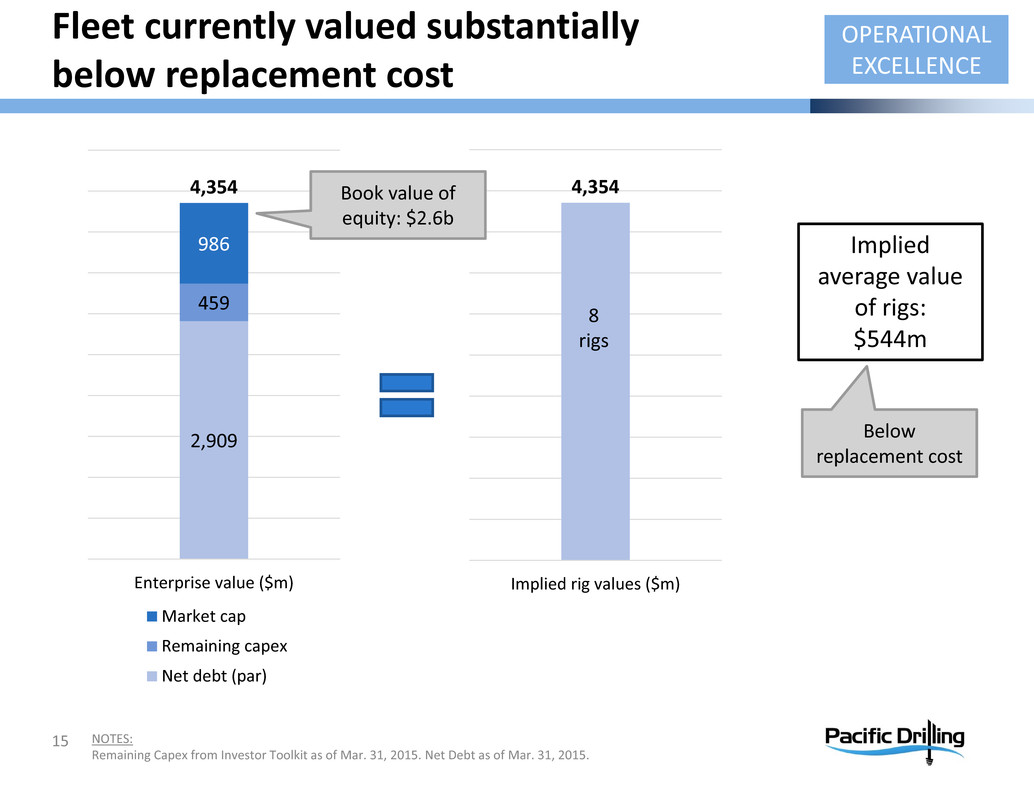

15 Fleet currently valued substantially below replacement cost OPERATIONAL EXCELLENCE 2,909 459 986 4,354 Enterprise value ($m) Market cap Remaining capex Net debt (par) 4,354 Implied rig values ($m) Implied average value of rigs: $544m Below replacement cost NOTES: Remaining Capex from Investor Toolkit as of Mar. 31, 2015. Net Debt as of Mar. 31, 2015. 8 rigs Book value of equity: $2.6b

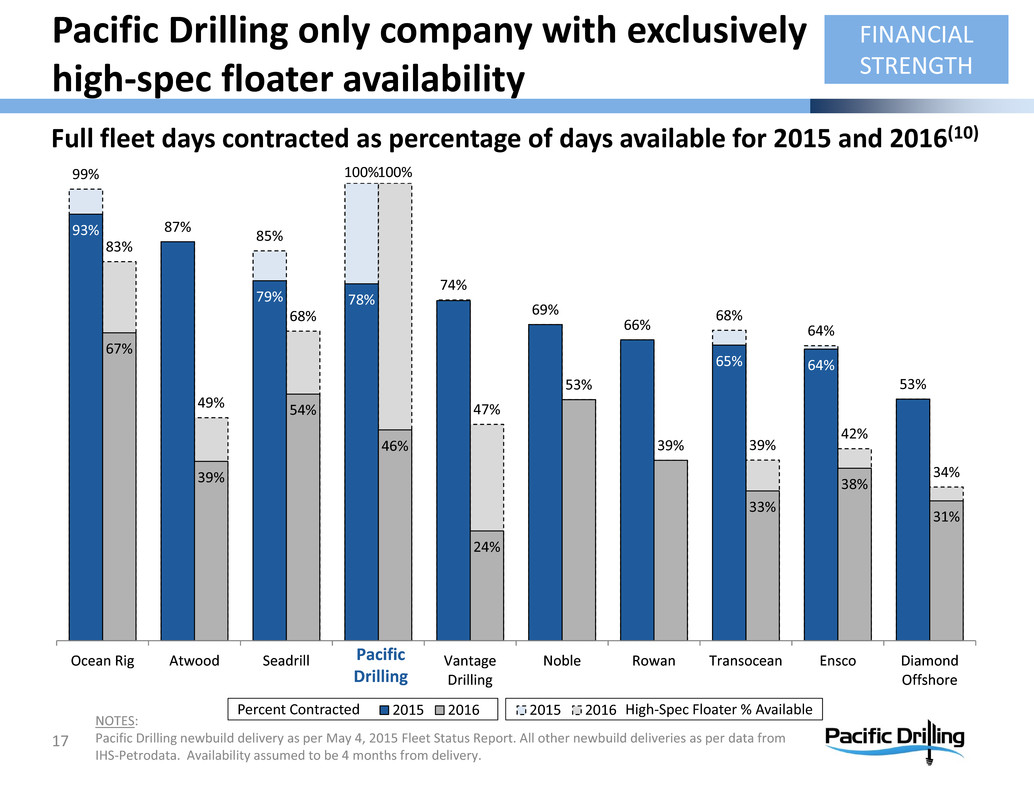

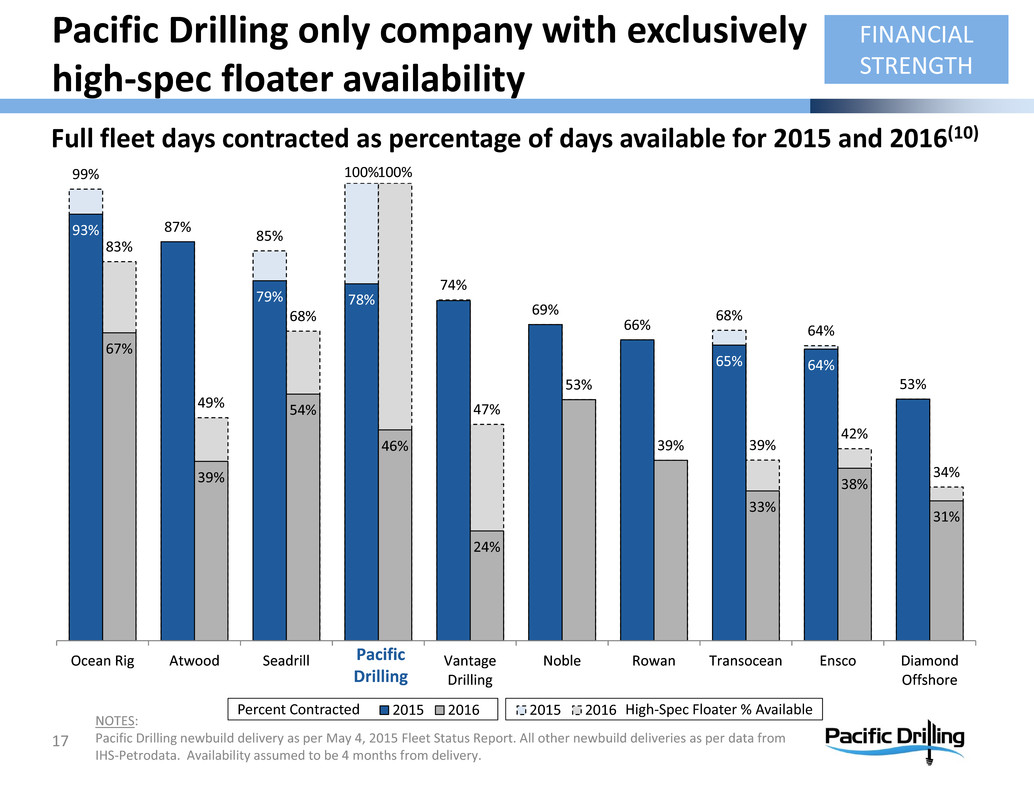

93% 87% 79% 78% 74% 69% 66% 65% 64% 53% 67% 39% 54% 46% 24% 53% 39% 33% 38% 31% Ocean Rig Atwood Seadrill Vantage Drilling Noble Rowan Transocean Ensco Diamond Offshore 2015 2016 Pacific Drilling 16 NOTES: Pacific Drilling newbuild delivery as per May 4, 2015 Fleet Status Report. All other newbuild deliveries as per data from IHS‐Petrodata. Availability assumed to be 4 months from delivery. Full fleet days contracted as percentage of days available for 2015 and 2016(10) FINANCIAL STRENGTHContract coverage provides stability

Percent Contracted High‐Spec Floater % Available 99% 87% 85% 100% 74% 69% 66% 68% 64% 53% 83% 49% 68% 100% 47% 53% 39% 39% 42% 34% Ocean Rig Atwood Seadrill Vantage Drilling Noble Rowan Transocean Ensco Diamond Offshore 2015 2016 Pacific Drilling 93% 79% 78% 65% 64% 67% 39% 54% 46% 24% 33% 38% 31% 2015 2016 17 NOTES: Pacific Drilling newbuild delivery as per May 4, 2015 Fleet Status Report. All other newbuild deliveries as per data from IHS‐Petrodata. Availability assumed to be 4 months from delivery. Full fleet days contracted as percentage of days available for 2015 and 2016(10) FINANCIAL STRENGTH Pacific Drilling only company with exclusively high‐spec floater availability

$2.1 billion contract backlog 18 Contract status as of May 4, 2015 FINANCIAL STRENGTH Total NGA, $495k/d 1 year extension Petrobras Brazil, $458k/d 3 year contract Chevron USGoM, $490k/d 5 year contract Chevron Nigeria, $660k/d 2 year contract Chevron USGoM, $558k/d 5 year contract Delivered: November 2014 Expected Delivery: Third Quarter 2015 Construction Mobilization & Contract Preparation Firm Contract Pacific Zonda Pacific Mistral Pacific Santa Ana Pacific Khamsin Pacific Sharav Pacific Meltem 2015 2016 Pacific Bora Pacific Scirocco Total Nigeria, $499k/d 2 year extension Chevron Nigeria, $586k/d 2 year extension 2014

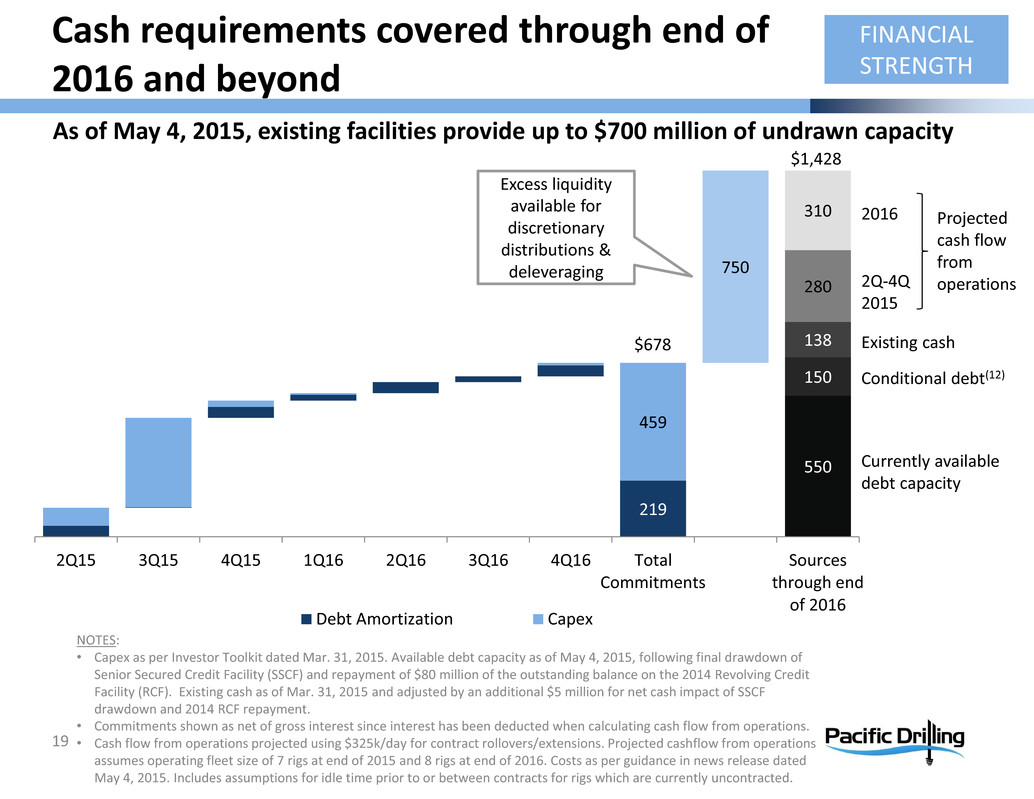

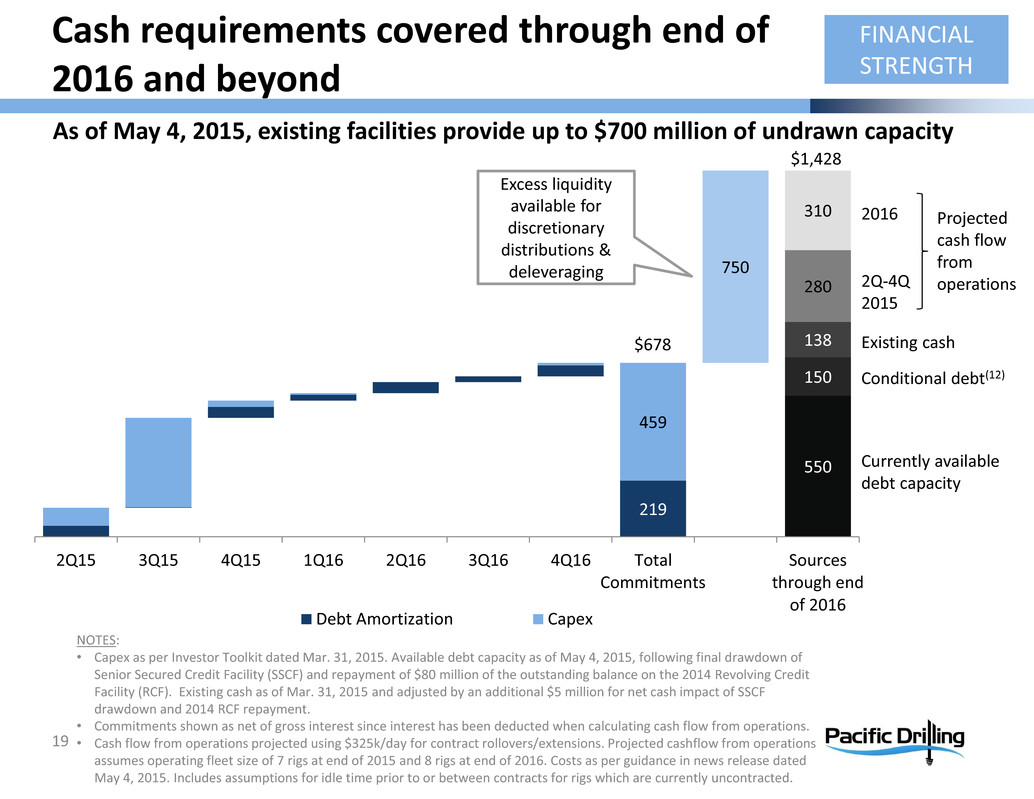

Cash requirements covered through end of 2016 and beyond 19 550 219 150 459 138 280 750 310 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 Total Commitments Sources through end of 2016 Debt Amortization Capex FINANCIAL STRENGTH NOTES: • Capex as per Investor Toolkit dated Mar. 31, 2015. Available debt capacity as of May 4, 2015, following final drawdown of Senior Secured Credit Facility (SSCF) and repayment of $80 million of the outstanding balance on the 2014 Revolving Credit Facility (RCF). Existing cash as of Mar. 31, 2015 and adjusted by an additional $5 million for net cash impact of SSCF drawdown and 2014 RCF repayment. • Commitments shown as net of gross interest since interest has been deducted when calculating cash flow from operations. • Cash flow from operations projected using $325k/day for contract rollovers/extensions. Projected cashflow from operations assumes operating fleet size of 7 rigs at end of 2015 and 8 rigs at end of 2016. Costs as per guidance in news release dated May 4, 2015. Includes assumptions for idle time prior to or between contracts for rigs which are currently uncontracted. As of May 4, 2015, existing facilities provide up to $700 million of undrawn capacity Excess liquidity available for discretionary distributions & deleveraging $678 $1,428 Existing cash Projected cash flow from operations Conditional debt(12) Currently available debt capacity 2Q‐4Q 2015 2016

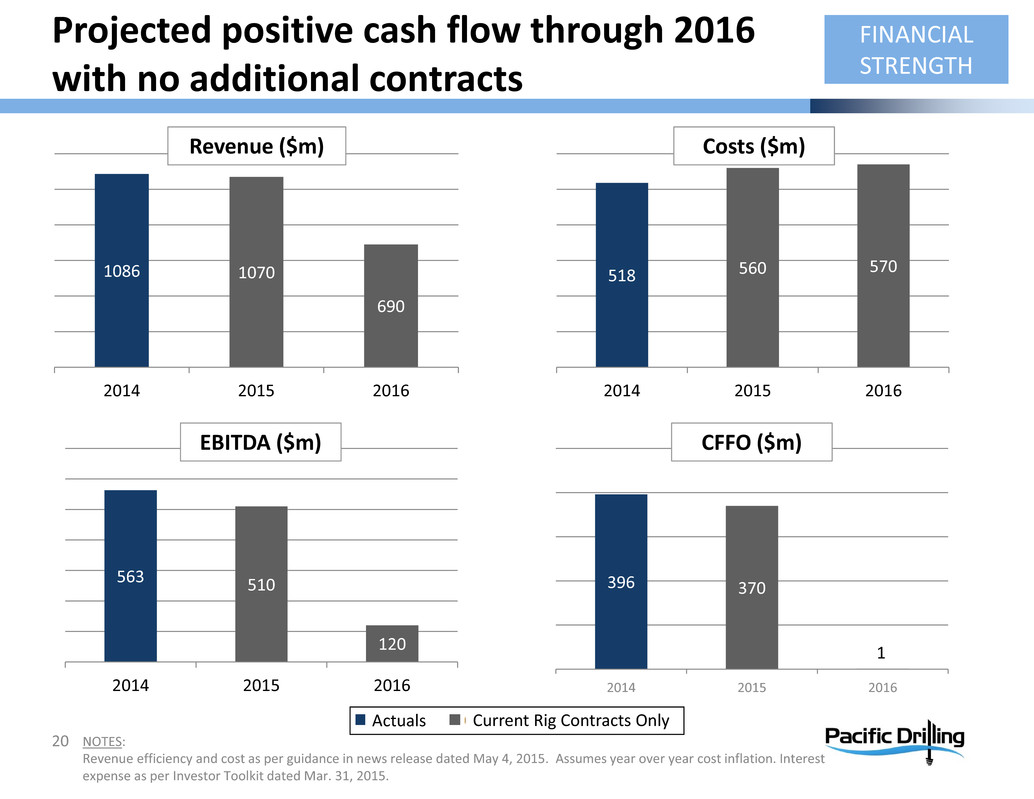

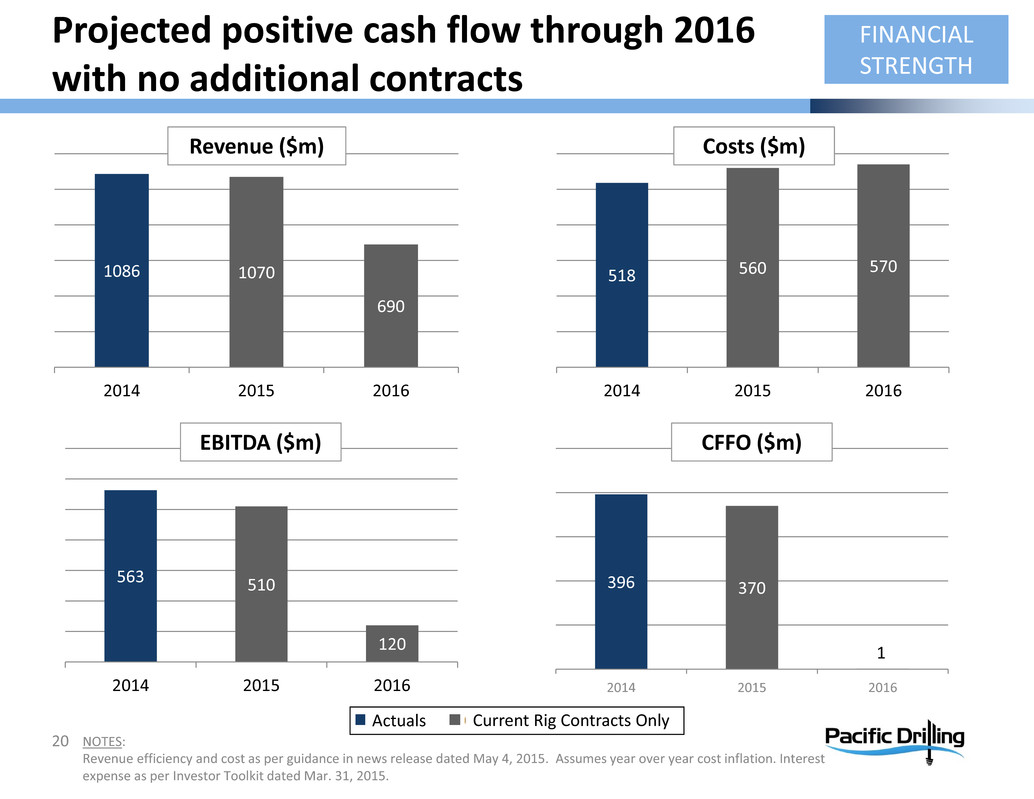

20 Projected positive cash flow through 2016 with no additional contracts FINANCIAL STRENGTH 1086 1070 690 2014 2015 2016 518 560 570 2014 2015 2016 563 510 120 2014 2015 2016 EBITDA ($m) 396 370 2014 2015 2016 1 CFFO ($m) Costs ($m)Revenue ($m) Actuals Current Rig Contracts Only NOTES: Revenue efficiency and cost as per guidance in news release dated May 4, 2015. Assumes year over year cost inflation. Interest expense as per Investor Toolkit dated Mar. 31, 2015.

21 Questions

Investor contact Pacific Drilling Amy Roddy VP Investor Relations & Communications 11700 Katy Freeway Suite 175 Houston, Texas 77079 USA Phone: +1 832‐255‐0502 Email: Investor@pacificdrilling.com www.pacificdrilling.com 22

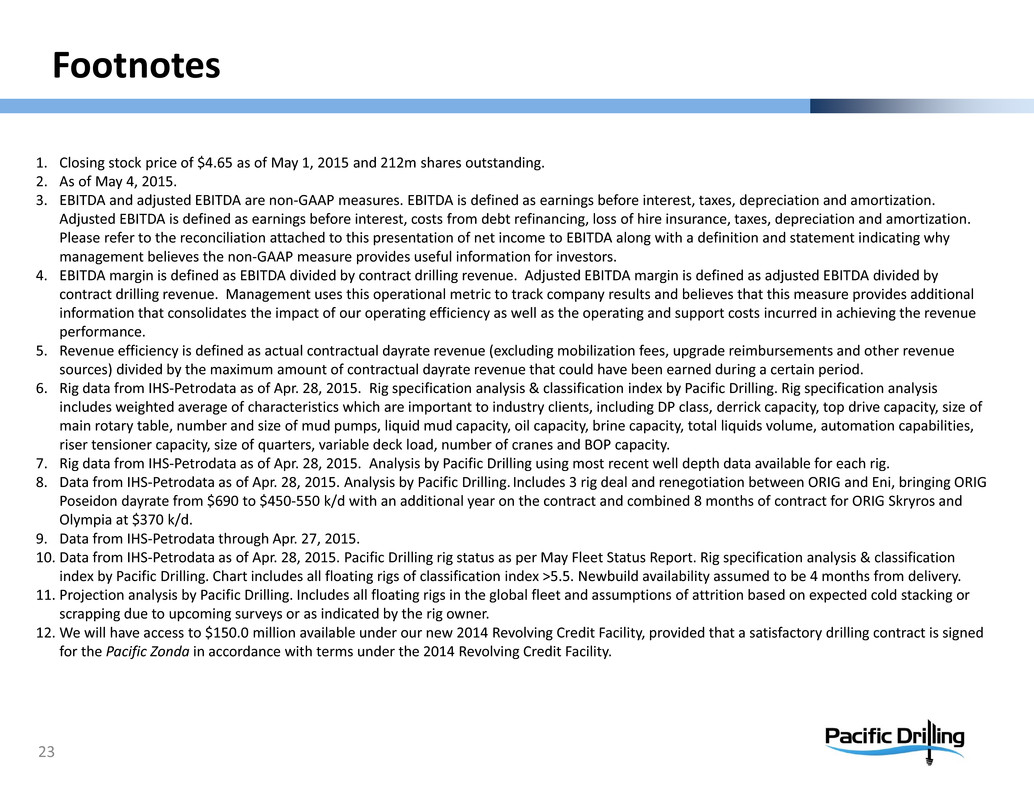

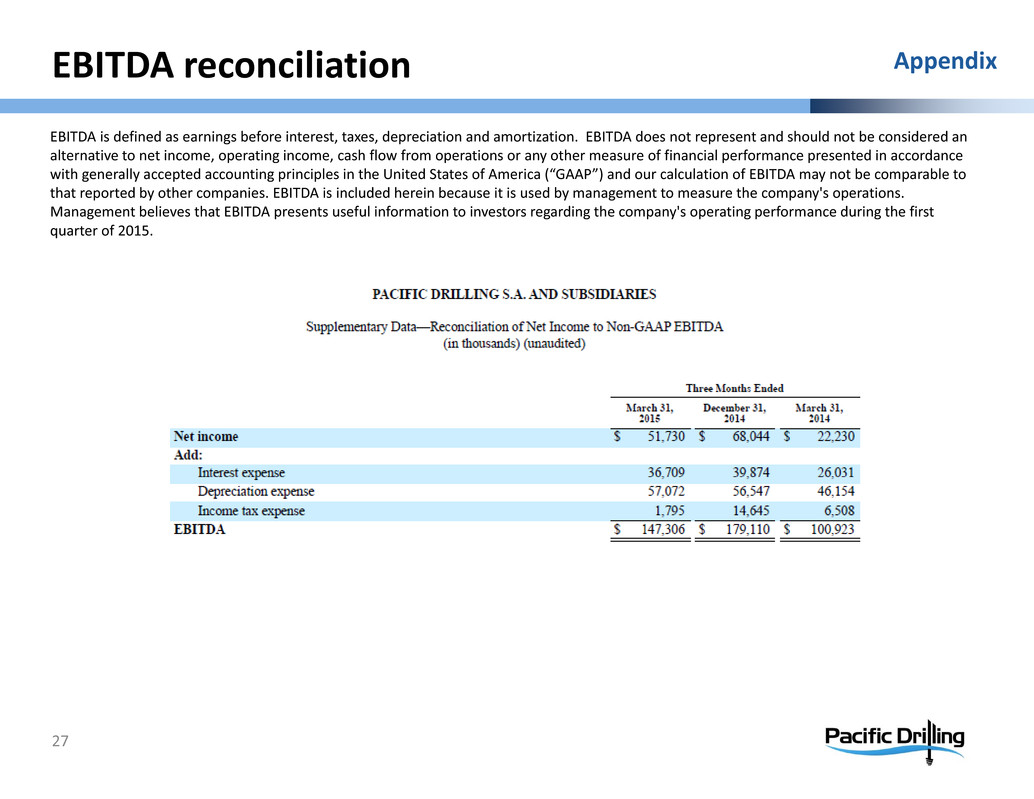

Footnotes 23 1. Closing stock price of $4.65 as of May 1, 2015 and 212m shares outstanding. 2. As of May 4, 2015. 3. EBITDA and adjusted EBITDA are non‐GAAP measures. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as earnings before interest, costs from debt refinancing, loss of hire insurance, taxes, depreciation and amortization. Please refer to the reconciliation attached to this presentation of net income to EBITDA along with a definition and statement indicating why management believes the non‐GAAP measure provides useful information for investors. 4. EBITDA margin is defined as EBITDA divided by contract drilling revenue. Adjusted EBITDA margin is defined as adjusted EBITDA divided by contract drilling revenue. Management uses this operational metric to track company results and believes that this measure provides additional information that consolidates the impact of our operating efficiency as well as the operating and support costs incurred in achieving the revenue performance. 5. Revenue efficiency is defined as actual contractual dayrate revenue (excluding mobilization fees, upgrade reimbursements and other revenue sources) divided by the maximum amount of contractual dayrate revenue that could have been earned during a certain period. 6. Rig data from IHS‐Petrodata as of Apr. 28, 2015. Rig specification analysis & classification index by Pacific Drilling. Rig specification analysis includes weighted average of characteristics which are important to industry clients, including DP class, derrick capacity, top drive capacity, size of main rotary table, number and size of mud pumps, liquid mud capacity, oil capacity, brine capacity, total liquids volume, automation capabilities, riser tensioner capacity, size of quarters, variable deck load, number of cranes and BOP capacity. 7. Rig data from IHS‐Petrodata as of Apr. 28, 2015. Analysis by Pacific Drilling using most recent well depth data available for each rig. 8. Data from IHS‐Petrodata as of Apr. 28, 2015. Analysis by Pacific Drilling. Includes 3 rig deal and renegotiation between ORIG and Eni, bringing ORIG Poseidon dayrate from $690 to $450‐550 k/d with an additional year on the contract and combined 8 months of contract for ORIG Skryros and Olympia at $370 k/d. 9. Data from IHS‐Petrodata through Apr. 27, 2015. 10. Data from IHS‐Petrodata as of Apr. 28, 2015. Pacific Drilling rig status as per May Fleet Status Report. Rig specification analysis & classification index by Pacific Drilling. Chart includes all floating rigs of classification index >5.5. Newbuild availability assumed to be 4 months from delivery. 11. Projection analysis by Pacific Drilling. Includes all floating rigs in the global fleet and assumptions of attrition based on expected cold stacking or scrapping due to upcoming surveys or as indicated by the rig owner. 12. We will have access to $150.0 million available under our new 2014 Revolving Credit Facility, provided that a satisfactory drilling contract is signed for the Pacific Zonda in accordance with terms under the 2014 Revolving Credit Facility.

Income statement 24 Appendix

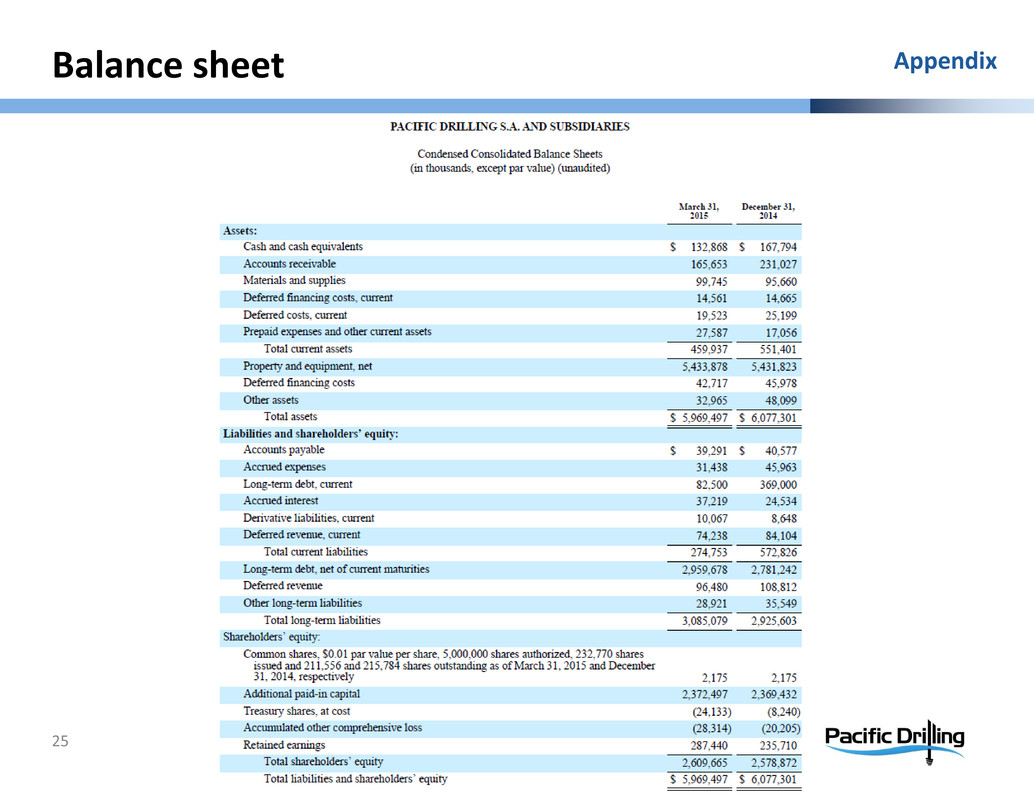

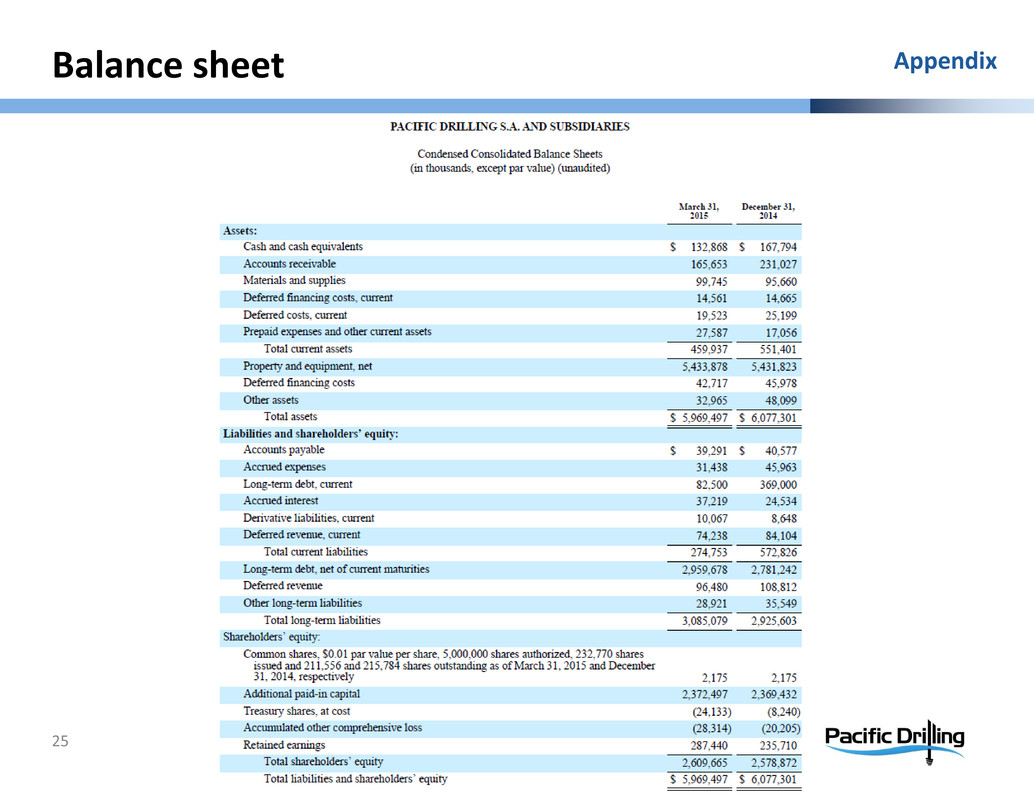

Balance sheet 25 Appendix

Cash flow statement 26 Appendix

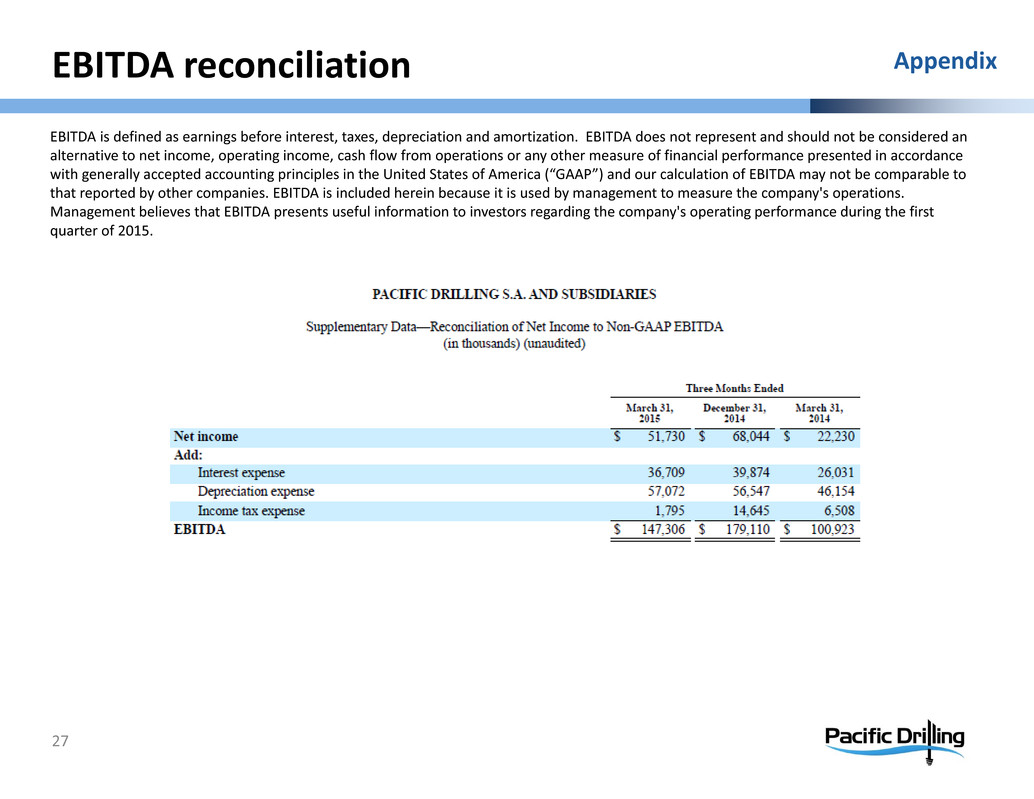

EBITDA reconciliation 27 Appendix EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA does not represent and should not be considered an alternative to net income, operating income, cash flow from operations or any other measure of financial performance presented in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and our calculation of EBITDA may not be comparable to that reported by other companies. EBITDA is included herein because it is used by management to measure the company's operations. Management believes that EBITDA presents useful information to investors regarding the company's operating performance during the first quarter of 2015.

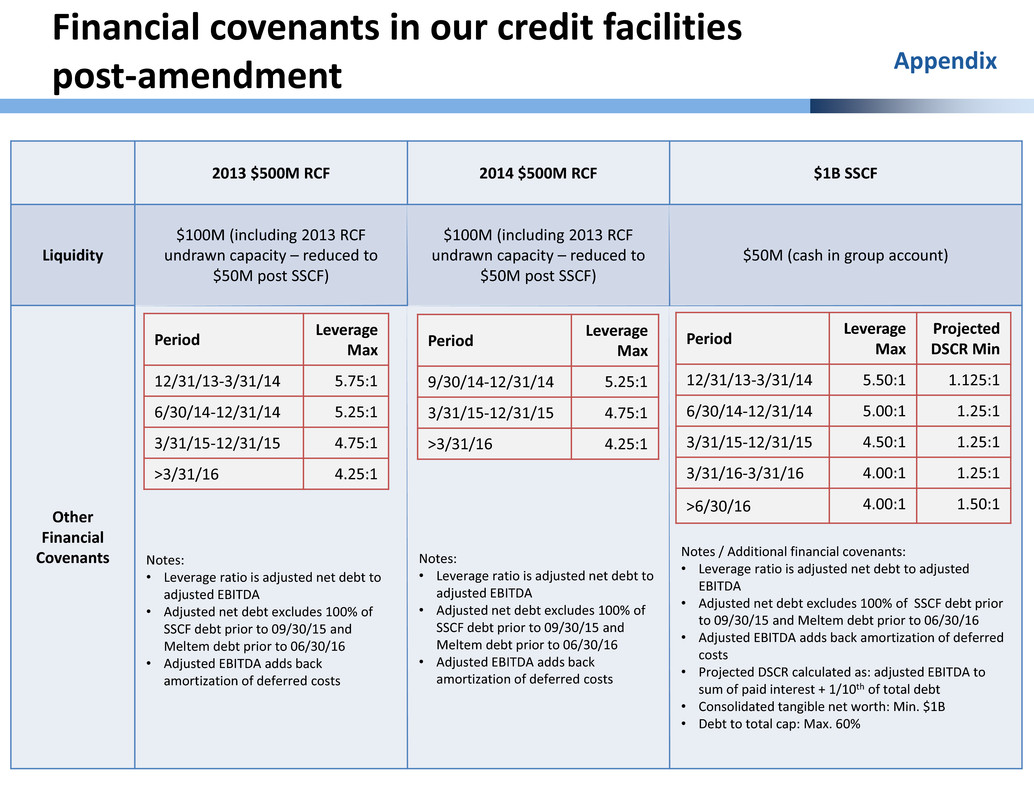

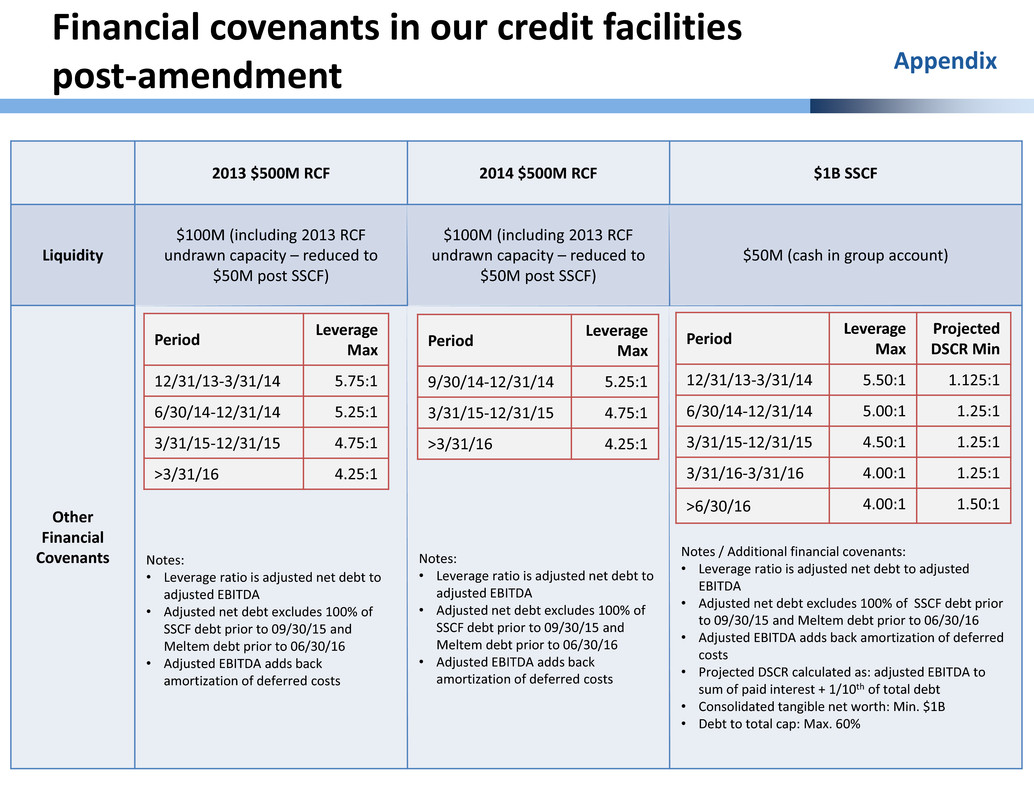

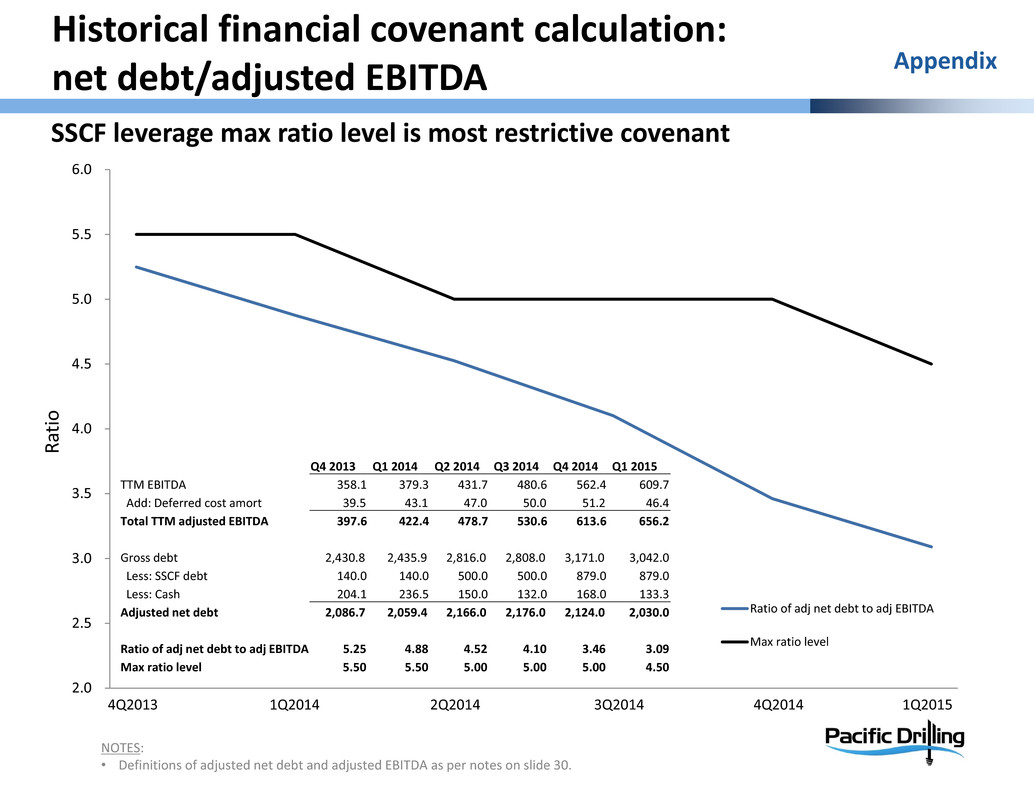

Financial covenants in our credit facilities post‐amendment 28 2013 $500M RCF 2014 $500M RCF $1B SSCF Liquidity $100M (including 2013 RCF undrawn capacity – reduced to $50M post SSCF) $100M (including 2013 RCF undrawn capacity – reduced to $50M post SSCF) $50M (cash in group account) Other Financial Covenants Notes: • Leverage ratio is adjusted net debt to adjusted EBITDA • Adjusted net debt excludes 100% of SSCF debt prior to 09/30/15 and Meltem debt prior to 06/30/16 • Adjusted EBITDA adds back amortization of deferred costs Notes: • Leverage ratio is adjusted net debt to adjusted EBITDA • Adjusted net debt excludes 100% of SSCF debt prior to 09/30/15 and Meltem debt prior to 06/30/16 • Adjusted EBITDA adds back amortization of deferred costs Notes / Additional financial covenants: • Leverage ratio is adjusted net debt to adjusted EBITDA • Adjusted net debt excludes 100% of SSCF debt prior to 09/30/15 and Meltem debt prior to 06/30/16 • Adjusted EBITDA adds back amortization of deferred costs • Projected DSCR calculated as: adjusted EBITDA to sum of paid interest + 1/10th of total debt • Consolidated tangible net worth: Min. $1B • Debt to total cap: Max. 60% Period Leverage Max 12/31/13‐3/31/14 5.75:1 6/30/14‐12/31/14 5.25:1 3/31/15‐12/31/15 4.75:1 >3/31/16 4.25:1 Period Leverage Max 9/30/14‐12/31/14 5.25:1 3/31/15‐12/31/15 4.75:1 >3/31/16 4.25:1 Period Leverage Max Projected DSCR Min 12/31/13‐3/31/14 5.50:1 1.125:1 6/30/14‐12/31/14 5.00:1 1.25:1 3/31/15‐12/31/15 4.50:1 1.25:1 3/31/16‐3/31/16 4.00:1 1.25:1 >6/30/16 4.00:1 1.50:1 Appendix

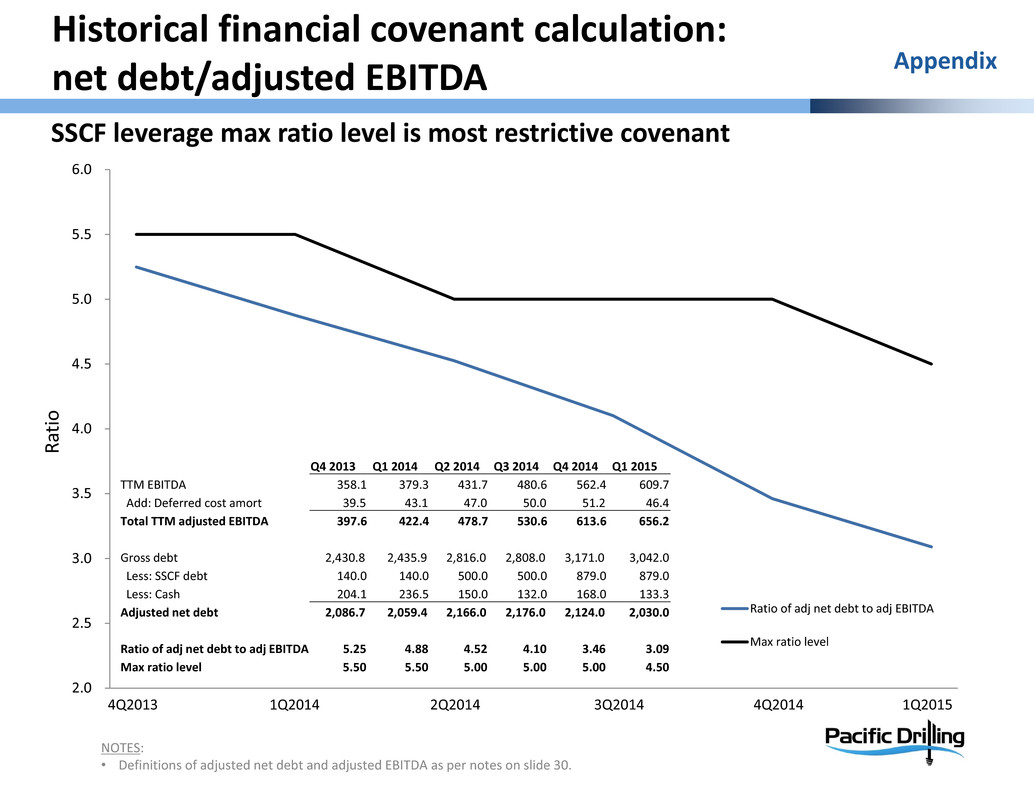

Historical financial covenant calculation: net debt/adjusted EBITDA 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 Ratio of adj net debt to adj EBITDA Max ratio level Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 TTM EBITDA 358.1 379.3 431.7 480.6 562.4 609.7 Add: Deferred cost amort 39.5 43.1 47.0 50.0 51.2 46.4 Total TTM adjusted EBITDA 397.6 422.4 478.7 530.6 613.6 656.2 Gross debt 2,430.8 2,435.9 2,816.0 2,808.0 3,171.0 3,042.0 Less: SSCF debt 140.0 140.0 500.0 500.0 879.0 879.0 Less: Cash 204.1 236.5 150.0 132.0 168.0 133.3 Adjusted net debt 2,086.7 2,059.4 2,166.0 2,176.0 2,124.0 2,030.0 Ratio of adj net debt to adj EBITDA 5.25 4.88 4.52 4.10 3.46 3.09 Max ratio level 5.50 5.50 5.00 5.00 5.00 4.50 4Q2013 4Q20142Q20141Q2014 3Q2014 Appendix SSCF leverage max ratio level is most restrictive covenant R a t i o NOTES: • Definitions of adjusted net debt and adjusted EBITDA as per notes on slide 30. 1Q2015

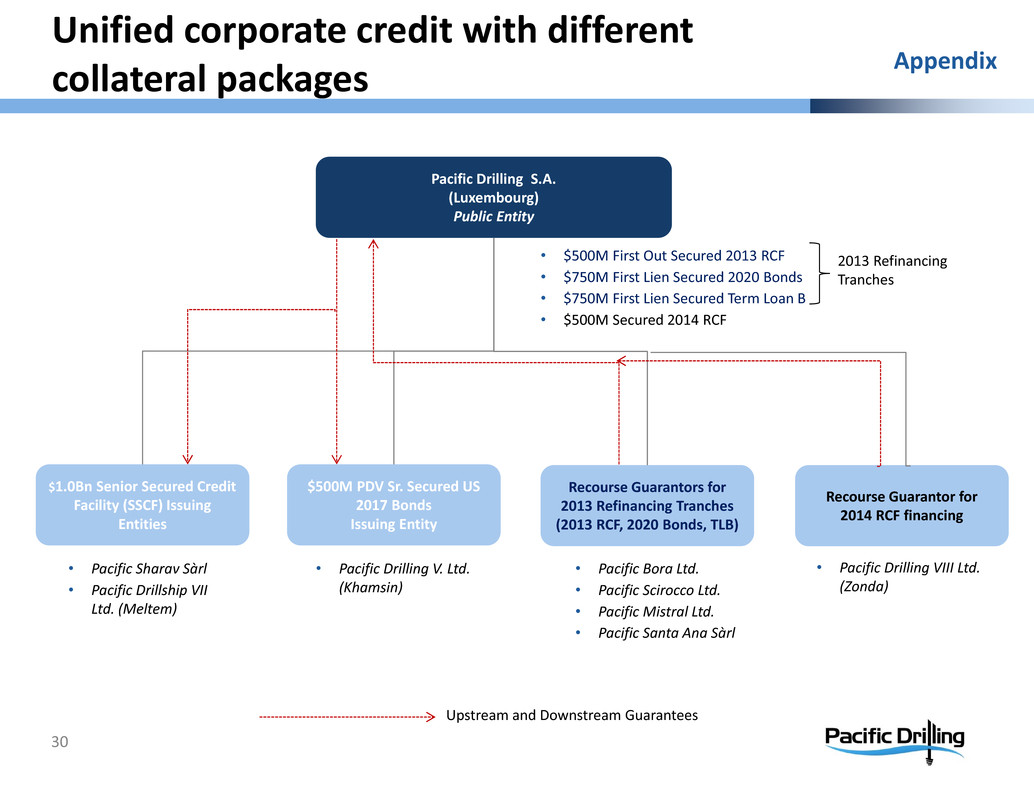

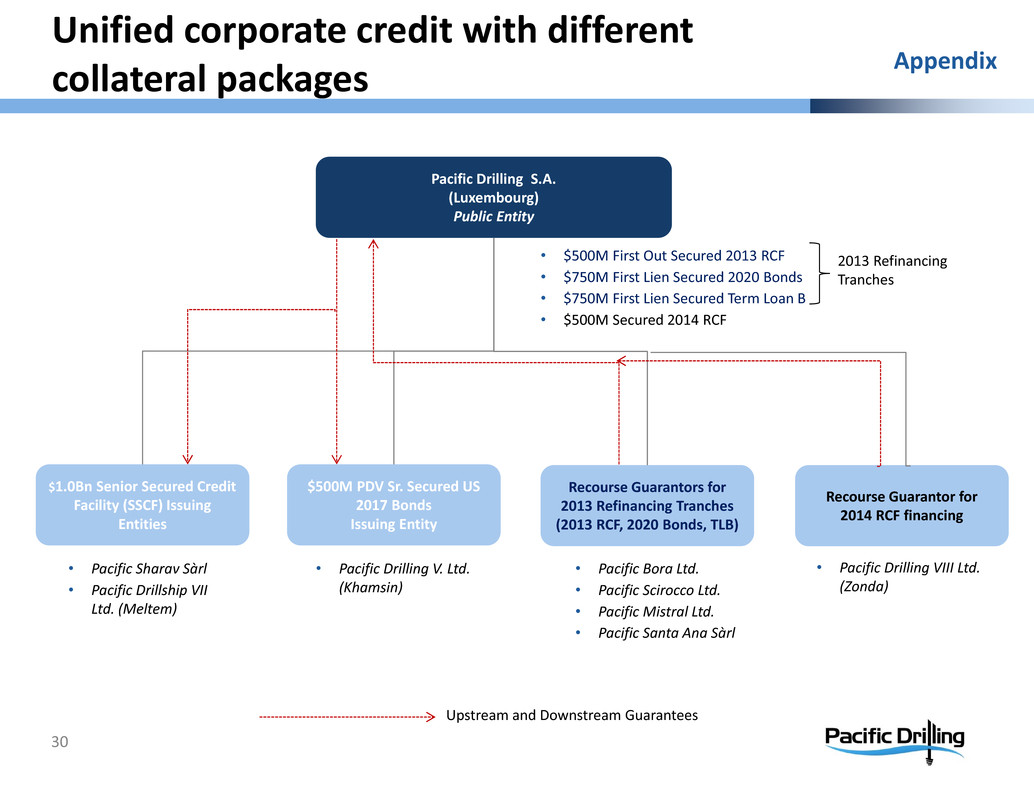

Upstream and Downstream Guarantees Pacific Drilling S.A. (Luxembourg) Public Entity $1.0Bn Senior Secured Credit Facility (SSCF) Issuing Entities $500M PDV Sr. Secured US 2017 Bonds Issuing Entity Recourse Guarantors for 2013 Refinancing Tranches (2013 RCF, 2020 Bonds, TLB) • Pacific Sharav Sàrl • Pacific Drillship VII Ltd. (Meltem) • $500M First Out Secured 2013 RCF • $750M First Lien Secured 2020 Bonds • $750M First Lien Secured Term Loan B • $500M Secured 2014 RCF • Pacific Drilling V. Ltd. (Khamsin) • Pacific Bora Ltd. • Pacific Scirocco Ltd. • Pacific Mistral Ltd. • Pacific Santa Ana Sàrl Recourse Guarantor for 2014 RCF financing • Pacific Drilling VIII Ltd. (Zonda) 2013 Refinancing Tranches 30 Unified corporate credit with different collateral packages Appendix

$88 $131 $131 $126 $42 $21 $500 $714 $636 $750 $300 $313 Remaining 2015 2016 2017 2018 2019 2020 Mandatory Amortization Scheduled Maturities RCF Debt Commitments Raised Outstanding Amortization Maturity Margin/Rate Collateral Vessels 7.25% Sr. Secured Notes $500m $500m Balloon Dec 2017 7.25% fixed Khamsin Sr. Secured Credit Facility $1,000m $964m 12 years May 2019 LIBOR + 3.375% Sharav, Meltem 5.375% Sr. Secured Notes $750m $750m Balloon Jun 2020 5.375% fixed Bora, Mistral, Scirocco, Santa Ana Term Loan B $750m $736m 1% per year Jun 2018 LIBOR + 3.50% Bora, Mistral, Scirocco, Santa Ana 2013 Revolving Credit Facility $500m Footnote Balloon Jun 2018 LIBOR + (2.50% to 3.25%) Bora, Mistral, Scirocco, Santa Ana 2014 Revolving Credit Facility(12) $500m $100m 12 years Jun 2020 LIBOR + (1.75% to 2.50%) Zonda Total $4,000m $3,050m NOTES: • 2013 Revolving Credit Facility (matures in 2018): $300m maximum cash sublimit (currently undrawn) and $300m maximum sublimit for letters of credit, not to exceed $500m in aggregate • 2014 Revolving Credit Facility: Matures 5 years after the delivery date of the Pacific Zonda (2020) • Amounts shown in bar chart include projected drawdowns on 2014 RCF, a portion of which is not currently outstanding 31 No additional funding needs until December 2017, when 7.25% bonds mature Appendix As of May 4, 2015