of the Plan in accordance with the Plan and the procedures governing the solicitation process, subject to the RSA Definitive Document Requirements.

12.“Bankruptcy Code” means title 11 of the United States Code, 11 U.S.C. §§ 101-1532, as amended from time to time.

13.“Bankruptcy Court” means the United States Bankruptcy Court for the Southern District of Texas—Houston Division or such other court having jurisdiction over the Chapter 11 Cases.

14.“Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure as promulgated by the United States Supreme Court under Section 2075 of title 28 of the United States Code, 28 U.S.C. § 2075, as applicable to the Chapter 11 Cases and the general, local, and chambers rules of the Bankruptcy Court.

15.“Beneficial Interest” means any economic interest, such as the right to share in gains and losses, other than legal title, of the Holder of an Interest held through a bank, broker, or agent.

16.“Business Day” means any day, other than a Saturday, Sunday, or a legal holiday in New York, as defined in Bankruptcy Rule 9006(a).

17.“Cash” means the legal tender of the United States of America or the equivalent thereof, including bank deposits and checks.

18.“Cash Collateral” means all of the Debtors’ “cash collateral” as defined under Section 363 of the Bankruptcy Code, in which the First Lien Noteholders and the Second Lien Noteholders have valid, perfected security interests, liens, or mortgages.

19.“Cash Collateral Motion” means the motion filed with the Bankruptcy Court for entry of the Cash Collateral Order, which motion shall be in accordance with the Restructuring Support Agreement and subject to the RSA Definitive Document Requirements.

20.“Cash Collateral Order” means an order governing the use of Cash Collateral, which order shall be in accordance with the Restructuring Support Agreement and subject to the RSA Definitive Document Requirements.

21.“Causes of Action” means any claims, interests, damages, remedies, causes of action, demands, rights, actions, suits, obligations, liabilities, accounts, defenses, offsets, powers, privileges, licenses, liens, indemnities, guaranties, and franchises of any kind or character whatsoever, whether known or unknown, choate or inchoate, foreseen or unforeseen, existing or hereinafter arising, contingent or non-contingent, liquidated or unliquidated, secured or unsecured, assertable, directly or derivatively, matured or unmatured, suspected or unsuspected, in contract, tort, law, equity, or otherwise. Causes of Action also include: (a) all rights of setoff, counterclaim, or recoupment and claims under contracts or for breaches of duties imposed by law; (b) any claim based on or relating to, or in any manner arising from, in whole or in part, breach of fiduciary duty, violation of local, state, federal, or foreign law, or breach of any duty imposed by law or in equity, including securities laws, negligence, and gross negligence; (c) the right to object to or otherwise contest Claims or Interests; (d) claims pursuant to Sections 362, 510, 542, 543, 544 through 550, or 553 of the Bankruptcy Code; and (e) such claims and defenses as fraud, mistake, duress, and usury, and any other defenses set forth in Section 558 of the Bankruptcy Code.

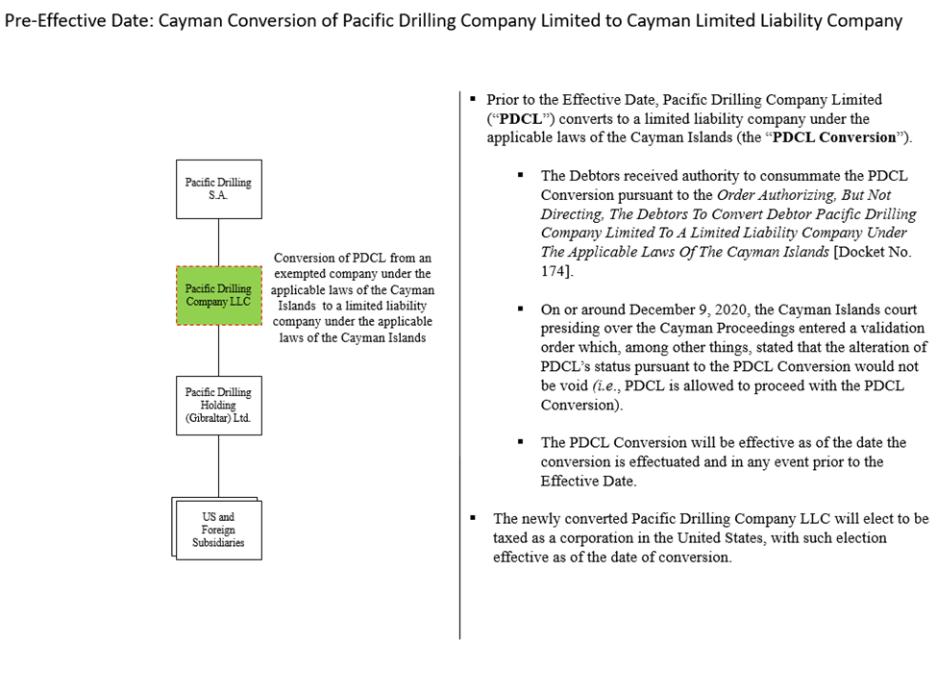

22.“Cayman Proceeding” means a parallel insolvency proceeding of PDCL in a court of competent jurisdiction in the Cayman Islands, commenced substantially simultaneously with the Chapter 11 Cases.

23.“Cayman Restructuring Documents” means the winding up petition (petition); the ex parte summons; the affidavit verifying the winding up petition; the affidavit in support of the ex parte summons; the affidavits of consents from each of the proposed joint provisional liquidators; the joint provisional liquidation order; the summons seeking validation orders; the affidavit in support of validation order