Make additive work for you Q4 and FY 2024 Results Speakers Dr. Yoav Zeif, CEO Eitan Zamir, CFO Yonah Lloyd, CCO & VP IR March 5, 2025

Conference Call and Webcast Link US Toll-Free Dial-In 1-877-407-0619 International Dial-In +1-412-902-1012 Make additive work for you Live Webcast and Replay

Forward-Looking Statements Cautionary Statement Regarding Forward- Looking Statements The statements in this slide presentation regarding Stratasys' strategy, and the statements regarding its projected future financial performance, including the financial guidance concerning its expected results for 2025, are forward- looking statements reflecting management's current expectations and beliefs. These forward-looking statements are based on current information that is, by its nature, subject to rapid and even abrupt change. Due to risks and uncertainties associated with Stratasys' business, actual results could differ materially from those projected or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the degree of our success at introducing new or improved products and solutions that gain market share; the extent of growth of the 3D printing sector generally; global macro-economic trends that have been adversely affecting, and may continue to adversely affect, our results, including relatively high interest rates that reduce capital expenditures; changes in our overall strategy, including as related to the focused restructuring actions that we have implemented to streamline operations and enhance our go-to-market strategy; the impact of potential shifts in the prices or margins of the products that we sell or services that we provide, including due to a shift towards lower margin products or services; the impact of competition, new technologies, and M&A activity among our competitors; whether we successfully complete the PIPE transaction whereby Fortissimo Capital will invest $120 million in our company, which could impact our available capital for value-enhancing, inorganic opportunities in the 3D printing industry; potential further charges against earnings that we could be required to take due to impairment of additional goodwill or other intangible assets that we have recently acquired or may acquire in the future; the extent of our success at successfully integrating into our existing business, or making additional, acquisitions or investments in new businesses, technologies, products or services; potential adverse impact that recent global interruptions involving freight carriers and other third parties may have on our supply chain and distribution network; potential changes in our management and board of directors; global market, political and economic conditions, in the countries in which we operate in particular (including risks stemming from Russia’s invasion of Ukraine); the degree of impact of Israel’s war and military conflicts against Hamas and other regional terrorist organizations and regimes, given our Israeli headquarters, factories and significant operations; costs and potential liability relating to litigation and regulatory proceedings; risks related to infringement of our intellectual property rights by others or infringement of others' intellectual property rights by us; potential cyber attacks against, or other breaches to, our information technologies systems; the extent of our success at maintaining our liquidity and financing our operations and capital needs; the impact of tax regulations on our results of operations and financial condition; and those additional factors referred to in Item 3.D “Key Information - Risk Factors”, Item 4, “Information on the Company”, Item 5, “Operating and Financial Review and Prospects,” and all other parts of our Annual Report on Form 20-F for the year ended December 31, 2024, to be filed with the SEC in early March 2025 (the “2024 Annual Report”). Readers are urged to carefully review and consider the various disclosures made throughout our 2024 Annual Report (once it is filed) and the Reports of Foreign Private Issuer on Form 6-K that will attach Stratasys’ unaudited, condensed consolidated financial statements and its review of its results of operations and financial condition on a quarterly basis, which Stratasys will furnish to the SEC throughout 2025, and our other reports filed with or furnished to the SEC, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects. Any guidance provided, and other forward- looking statements made, in this slide presentation are made as of the date hereof, and Stratasys undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Make additive work for you

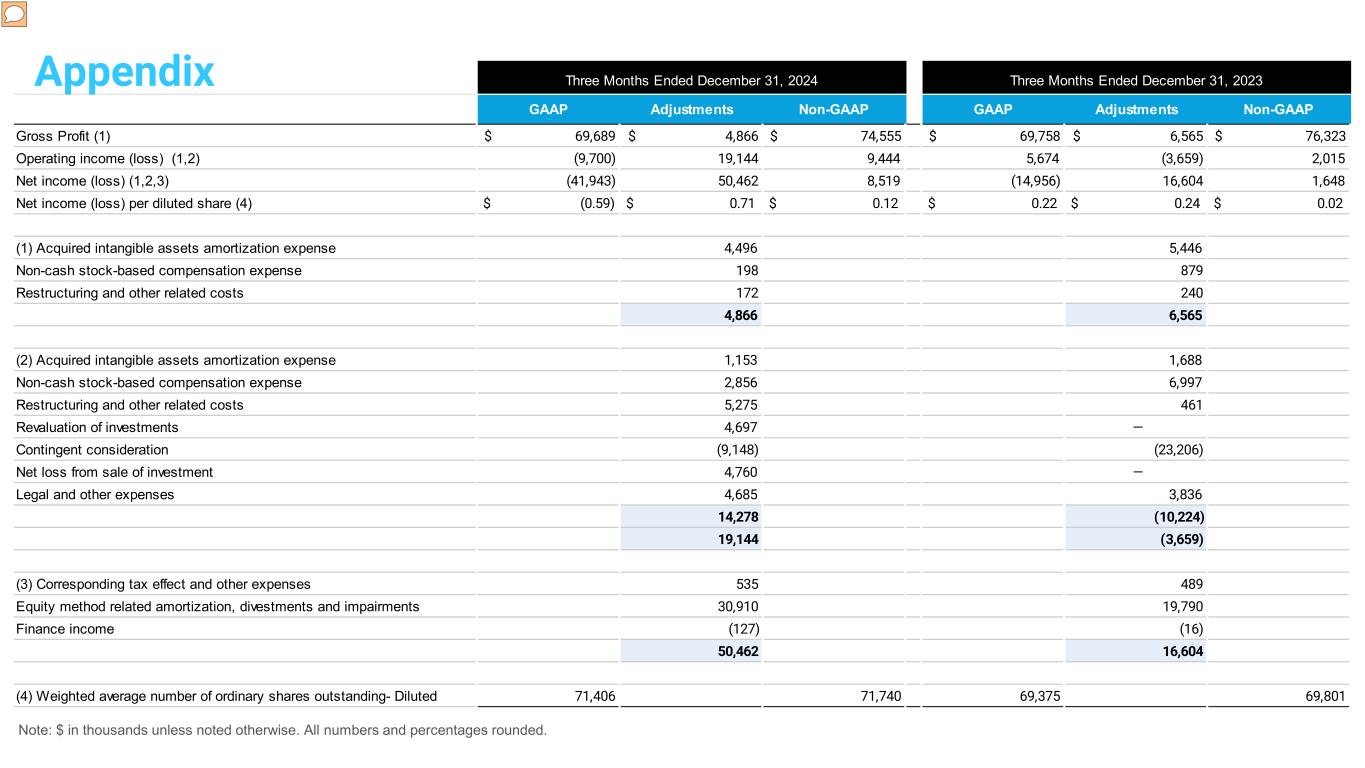

Use of Non-GAAP Financial Information Use of Non-GAAP Financial Measures The non-GAAP data included herein, which excludes certain items as described below, are non-GAAP financial measures. Our management believes that these non-GAAP financial measures are useful information for investors and shareholders of our Company in gauging our results of operations (i) on an ongoing basis after excluding mergers, acquisitions, divestments and strategic process-related expense or gains and reorganization-related charges or gains, legal provisions, and (ii) excluding non- cash items such as stock-based compensation expenses, acquired intangible assets amortization, including intangible assets amortization related to equity method investments, impairment of long- lived assets and goodwill, revaluation of our investments and the corresponding tax effect of those items. The items eliminated via these non-GAAP adjustments either do not reflect actual cash outlays that impact our liquidity and our financial condition or have a non-recurring impact on the statement of operations, as assessed by management. These non-GAAP financial measures are presented to permit investors to more fully understand how management assesses our performance for internal planning and forecasting purposes. The limitations of using these non-GAAP financial measures as performance measures are that they provide a view of our results of operations without including all items indicated above during a period, which may not provide a comparable view of our performance to other companies in our industry. Investors and other readers should consider non-GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with GAAP. Reconciliation between results on a GAAP and non-GAAP basis is provided in a table later in this slide presentation. Make additive work for you

CEO Dr. Yoav Zeif Took leadership-enhancing steps to strengthen our position at the forefront of additive manufacturing Successfully executed plan to generate profits and cash Laser-focused strategy around compelling applications centered around full-scale production 36% revenue from manufacturing in 2024, up from 34% in 2023 and just over 25% in 2020 – expect continued growth Best-in-class solutions are growth engines that will drive revenue and profits as customer engagement remains strong Challenging macro environment saw 6.9% YoY revenue decline for 2024 after divestments, but GM improved 100bps Q4 Adj. EBITDA $14.5M / 9.6%, Adj. EPS $0.12 – operational efficiencies should result in sustainably higher profitability in the coming years Healthy, debt-free operating cash of $150.7M to be bolstered by $120M cash investment by Fortissimo Capital Make additive work for you

Make additive work for you More than 30 new materials for Origin P3 DLP, including validating a Forward AM material specifically designed for injection molding tooling, positioning P3 to deliver injection molding-quality results across various applications. Launched FDC filament drying cabinet using patented FDM® technology, increases printer uptime by up to 2.7x. A continuous operation breakthrough in efficiency for large-scale production - a key addition to our end-to-end solution that our customers have asked us to deliver. Introduced PC-ESD material for parts requiring electrostatic discharge protection. Enhanced Ultem 9085 with expanded layer height capabilities and new colors, a significant enabler for Defense partners manufacturing spare parts – already led to increased sales to US Air Force. Technology Update

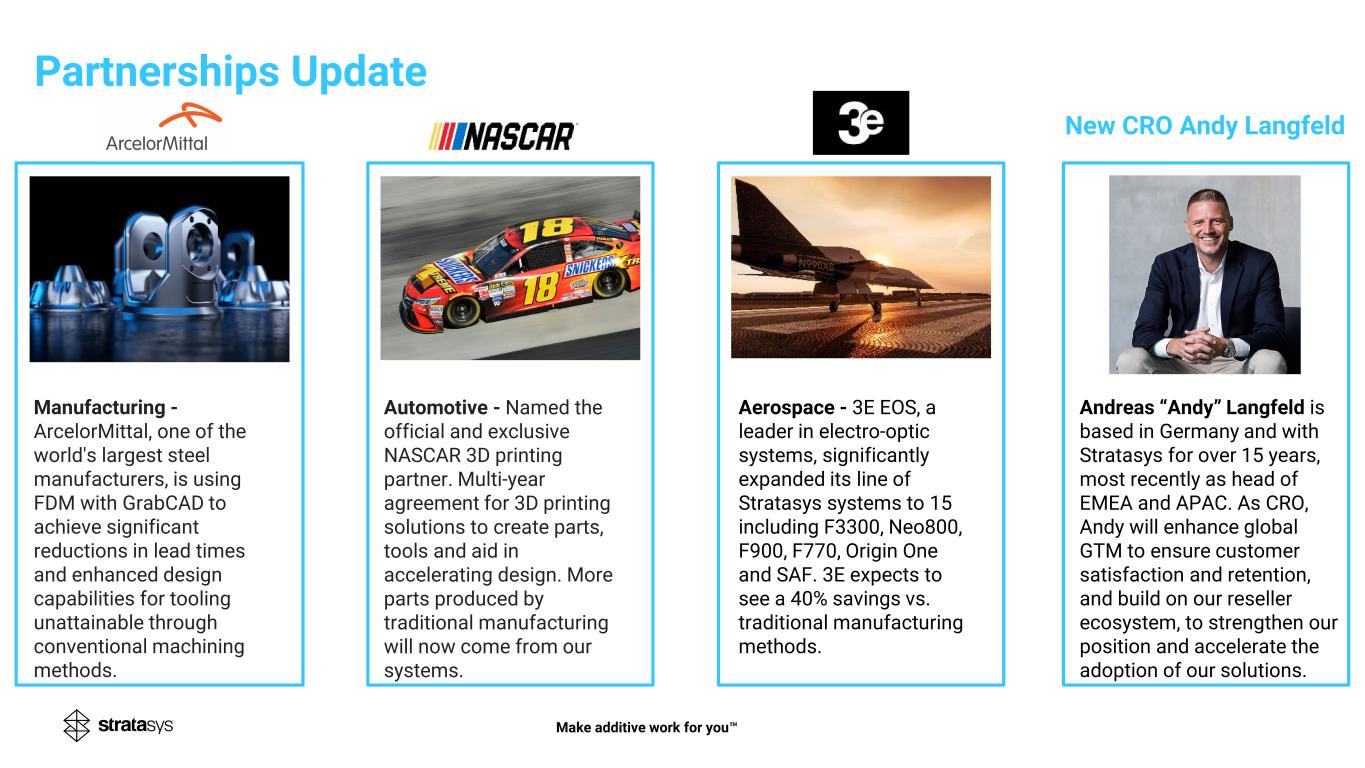

Make additive work for you Aerospace - 3E EOS, a leader in electro-optic systems, significantly expanded its line of Stratasys systems to 15 including F3300, Neo800, F900, F770, Origin One and SAF. 3E expects to see a 40% savings vs. traditional manufacturing methods. Manufacturing - ArcelorMittal, one of the world's largest steel manufacturers, is using FDM with GrabCAD to achieve significant reductions in lead times and enhanced design capabilities for tooling unattainable through conventional machining methods. Automotive - Named the official and exclusive NASCAR 3D printing partner. Multi-year agreement for 3D printing solutions to create parts, tools and aid in accelerating design. More parts produced by traditional manufacturing will now come from our systems. Partnerships Update Andreas “Andy” Langfeld is based in Germany and with Stratasys for over 15 years, most recently as head of EMEA and APAC. As CRO, Andy will enhance global GTM to ensure customer satisfaction and retention, and build on our reseller ecosystem, to strengthen our position and accelerate the adoption of our solutions. New CRO Andy Langfeld

Make additive work for you Medical - Joint research with Siemens Healthineers demonstrated the unprecedented accuracy of 3D-printed imaging phantoms to replicate human anatomy. Patient-specific, anatomical models accurately replicate anatomy and pathologies, enhancing the performance of CT scanners, ensuring more accurate diagnostics, improved patient outcomes and lower costs. Dental - TrueDent-D resin is available for sale in Europe as a CE Mark Class 1 medical device. TrueDent is now set to deliver a scalable, efficient, and high-quality solution for denture production across Europe, with dentures expected to be nearly a $2.5 billion opportunity by 2028. Many customers already committed for early 2025. Dental / Medical Update

Make additive work for you Full Portfolio Integration - GrabCAD print software suite now supports all five of our technologies. Unified software approach streamlines operations for our customers and reinforces our position as a comprehensive end-to-end solutions provider. Software Update Innovation - Unveiled new GrabCAD IoT Platform, a transformative solution to improve utilization and uptime, providing accurate, real-time data, predictive maintenance and a more efficient support plan – helping digitize customer interactions across our entire ecosystem.

CFO Eitan Zamir Solid execution in Q4 against the ongoing backdrop of adverse macroeconomic factors and related pressures Customer engagements remain strong, and we believe will translate into meaningful growth once headwinds abate Cost-savings initiatives we announced last year took effect primarily in the fourth quarter. Fourth quarter results are more indicative of the future impact of these initiatives on an annualized basis Results demonstrate resilience our diversified offering provides throughout the cycle 2025 Outlook – Raising profits and cash flow for the full year Make additive work for you

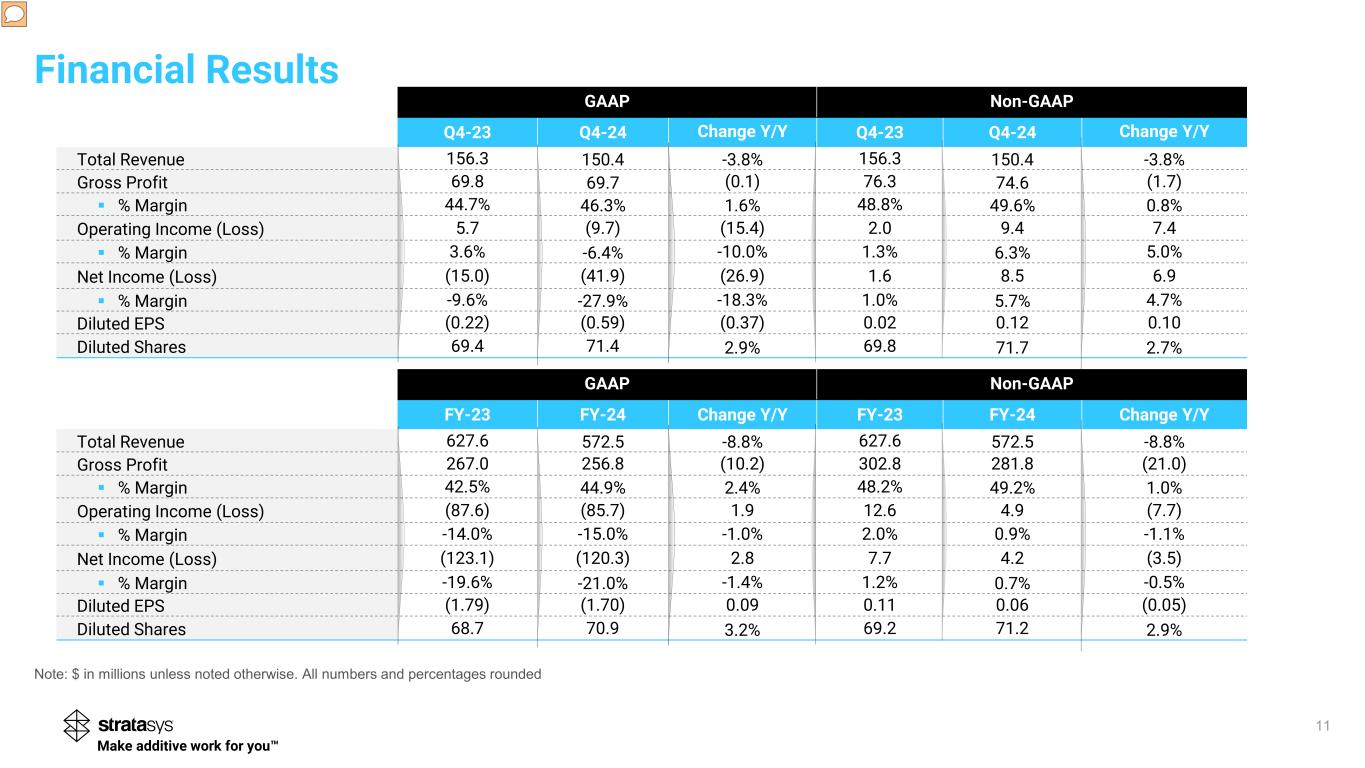

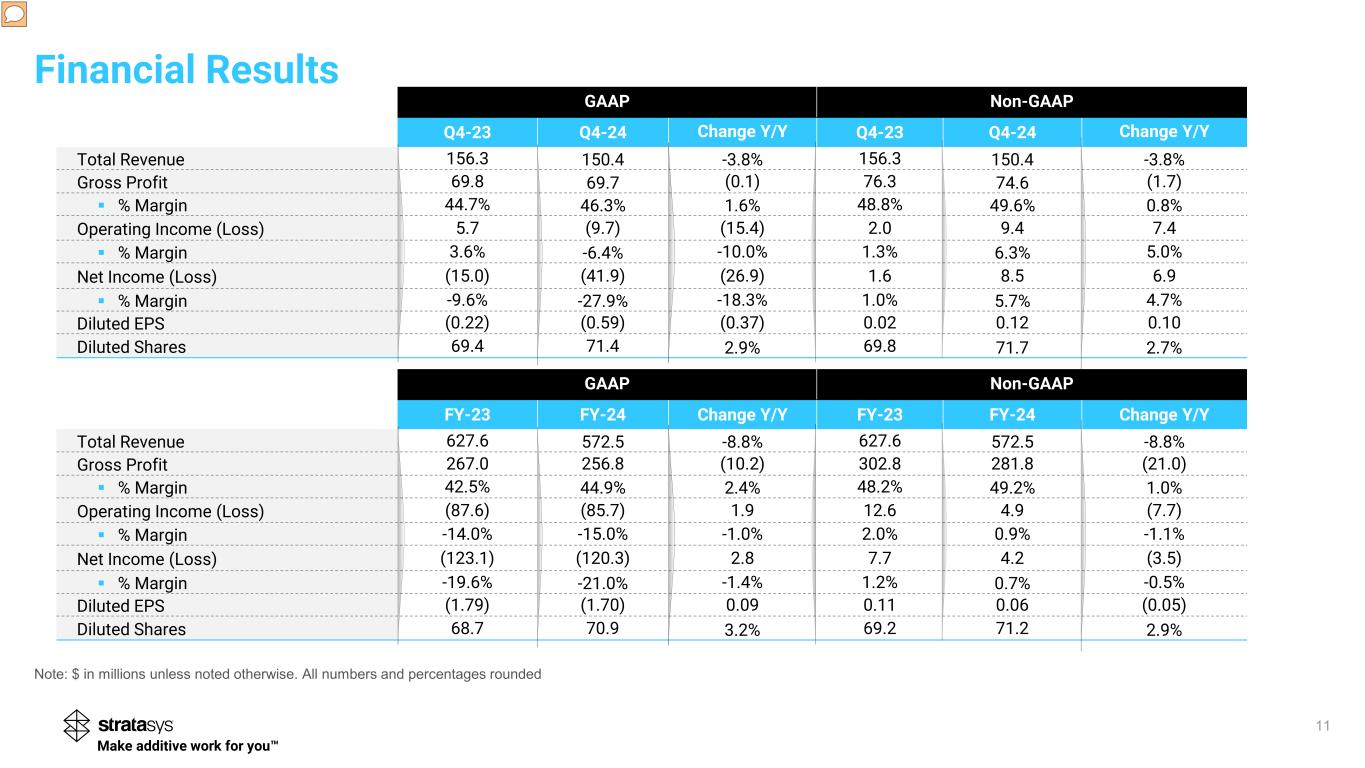

11 GAAP Non-GAAP Q4-23 Q4-24 Change Y/Y Q4-23 Q4-24 Change Y/Y Total Revenue 156.3 150.4 -3.8% 156.3 150.4 -3.8% Gross Profit 69.8 69.7 (0.1) 76.3 74.6 (1.7) % Margin 44.7% 46.3% 1.6% 48.8% 49.6% 0.8% Operating Income (Loss) 5.7 (9.7) (15.4) 2.0 9.4 7.4 % Margin 3.6% -6.4% -10.0% 1.3% 6.3% 5.0% Net Income (Loss) (15.0) (41.9) (26.9) 1.6 8.5 6.9 % Margin -9.6% -27.9% -18.3% 1.0% 5.7% 4.7% Diluted EPS (0.22) (0.59) (0.37) 0.02 0.12 0.10 Diluted Shares 69.4 71.4 2.9% 69.8 71.7 2.7% Note: $ in millions unless noted otherwise. All numbers and percentages rounded Financial Results Make additive work for you GAAP Non-GAAP FY-23 FY-24 Change Y/Y FY-23 FY-24 Change Y/Y Total Revenue 627.6 572.5 -8.8% 627.6 572.5 -8.8% Gross Profit 267.0 256.8 (10.2) 302.8 281.8 (21.0) % Margin 42.5% 44.9% 2.4% 48.2% 49.2% 1.0% Operating Income (Loss) (87.6) (85.7) 1.9 12.6 4.9 (7.7) % Margin -14.0% -15.0% -1.0% 2.0% 0.9% -1.1% Net Income (Loss) (123.1) (120.3) 2.8 7.7 4.2 (3.5) % Margin -19.6% -21.0% -1.4% 1.2% 0.7% -0.5% Diluted EPS (1.79) (1.70) 0.09 0.11 0.06 (0.05) Diluted Shares 68.7 70.9 3.2% 69.2 71.2 2.9%

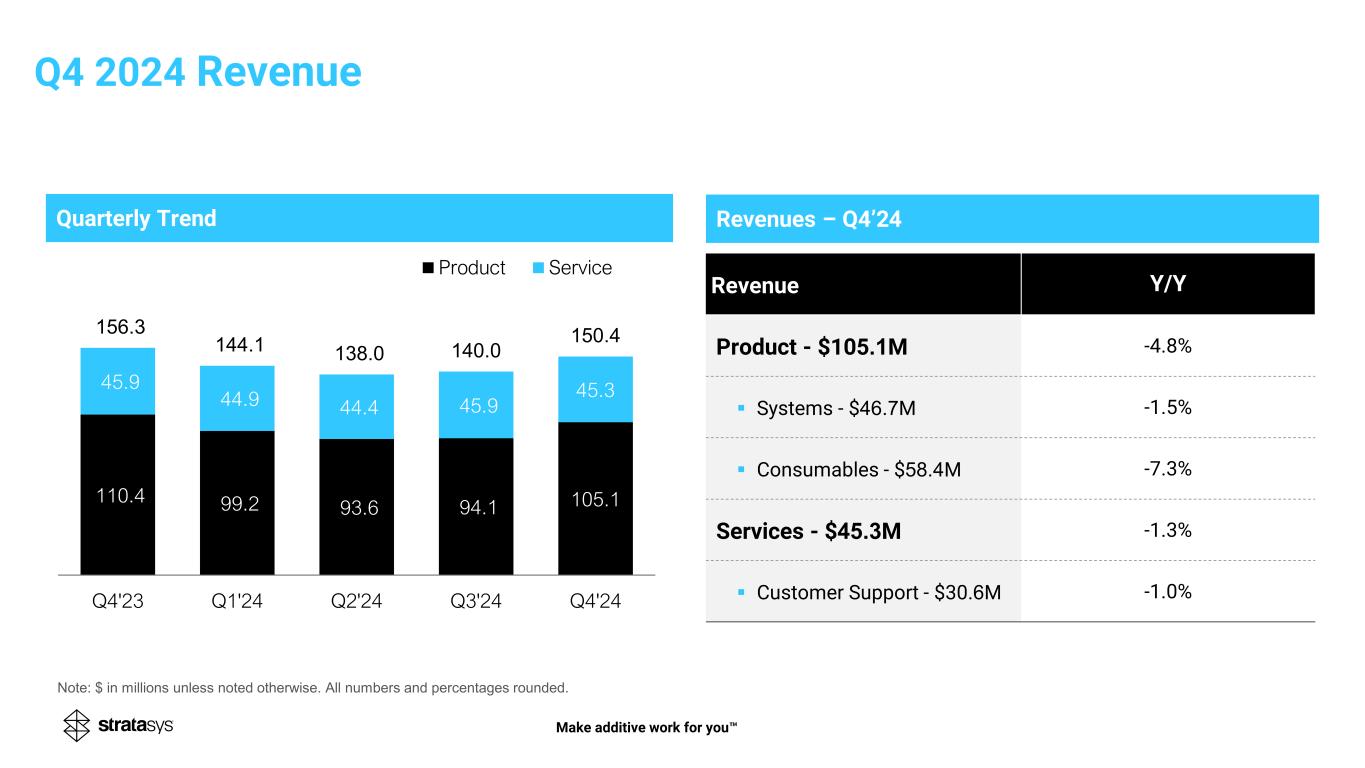

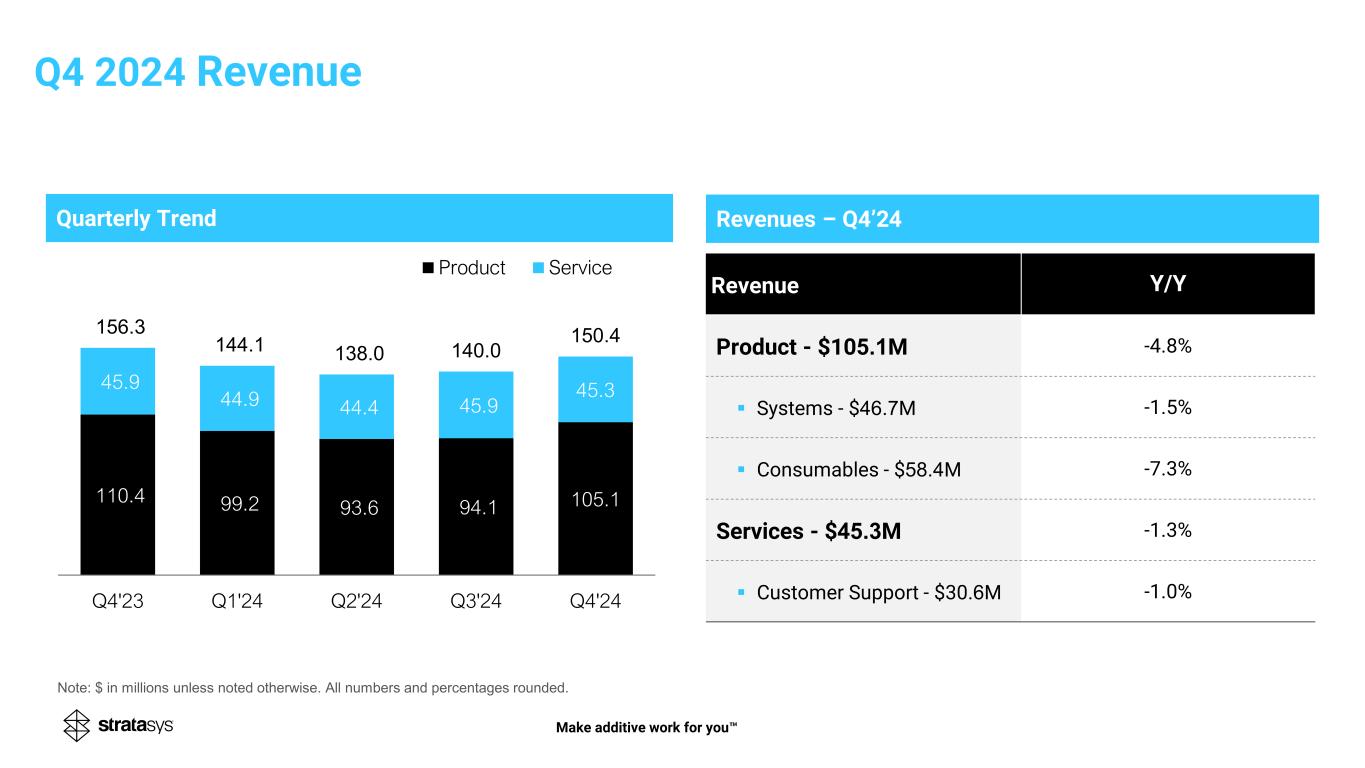

Quarterly Trend 110.4 99.2 93.6 94.1 105.1 45.9 44.9 44.4 45.9 45.3 156.3 144.1 138.0 140.0 150.4 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Product Service Q4 2024 Revenue Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Make additive work for you Revenues – Q4’24 Revenue Y/Y Product - $105.1M -4.8% Systems - $46.7M -1.5% Consumables - $58.4M -7.3% Services - $45.3M -1.3% Customer Support - $30.6M -1.0%

Revenues – 2024 Revenue Y/Y Product - $392.0M -9.6% Systems - $140.3M -25.3% Consumables - $251.7M 2.3% Services - $180.5M -6.9% Customer Support - $124.7M 0.4% FY 2024 Revenue Make additive work for you Yearly Trend 339.8 417.6 452.1 433.7 392.0 181.0 189.7 199.4 193.9 180.5 520.8 607.2 651.5 627.6 572.5 2020 2021 2022 2023 2024 Product Service * * Reflects ~$26M of MakerBot revenue. Excluding divestment, 2022 revenues of ~$625.5M Note: $ in millions unless noted otherwise. All numbers and percentages rounded

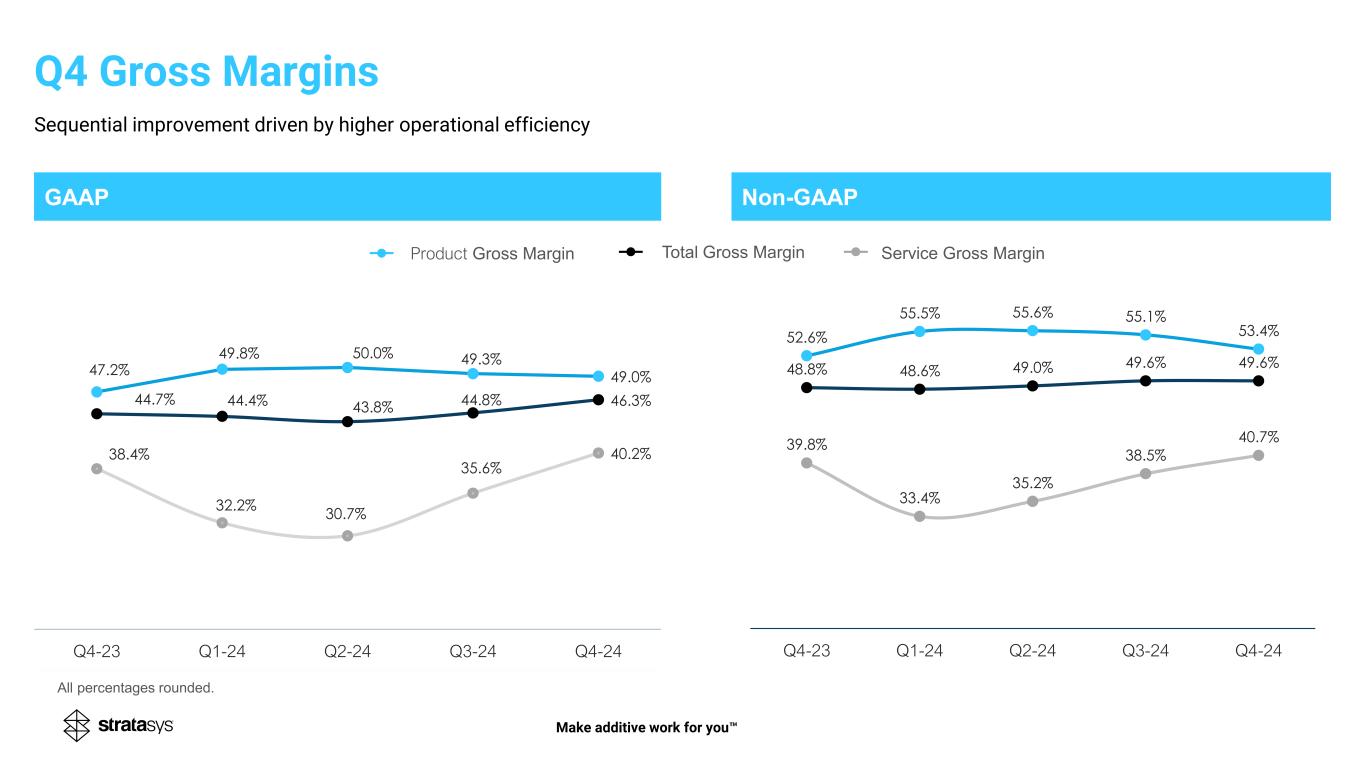

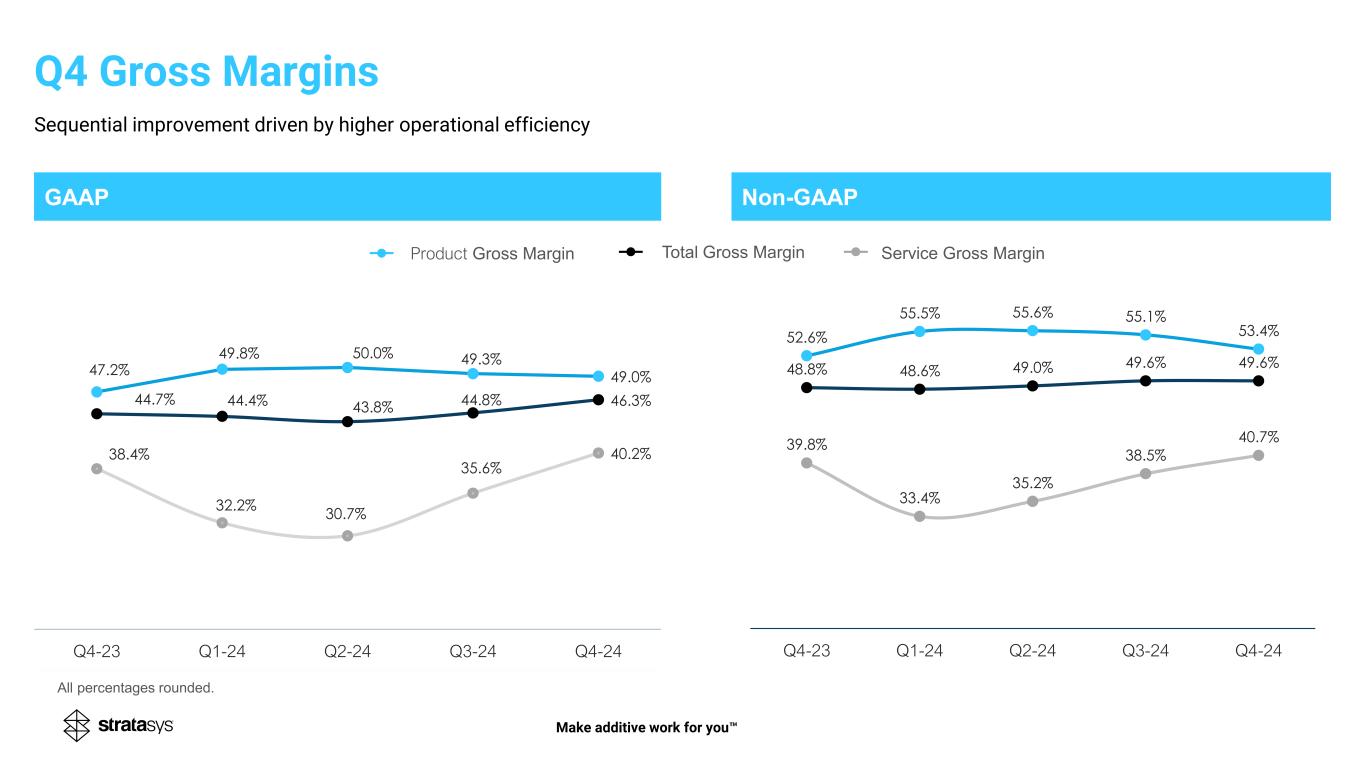

GAAP Non-GAAP 47.4% 47.2% 49.8% 50.0% 49.3% 24.4% 38.4% 32.2% 30.7% 35.6% 40.5% 44.6% 44.4% 43.8% 44.8% Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 48.8% 48.6% 49.0% 49.6% 49.6% 52.6% 55.5% 55.6% 55.1% 53.4% 39.8% 33.4% 35.2% 38.5% 40.7% Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Service Gross MarginProduct Gross Margin Total Gross Margin Q4 Gross Margins Make additive work for you All percentages rounded. . . . . . . . . . . . . . . . - - - - - 47.4% 47.2% 49.8% 50.0% 49.3% 24.4% 38.4% 32.2% 30.7% 35.6% 40.5% 44.6% 44.4% 43.8% 44.8% Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 47.2% 49.8% 50.0% 49.3% 49.0% 38.4% 32.2% 30.7% 35.6% 40.2% 44.7% 44.4% 43.8% 44.8% 46.3% Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Sequential improvement driven by higher operational efficiency

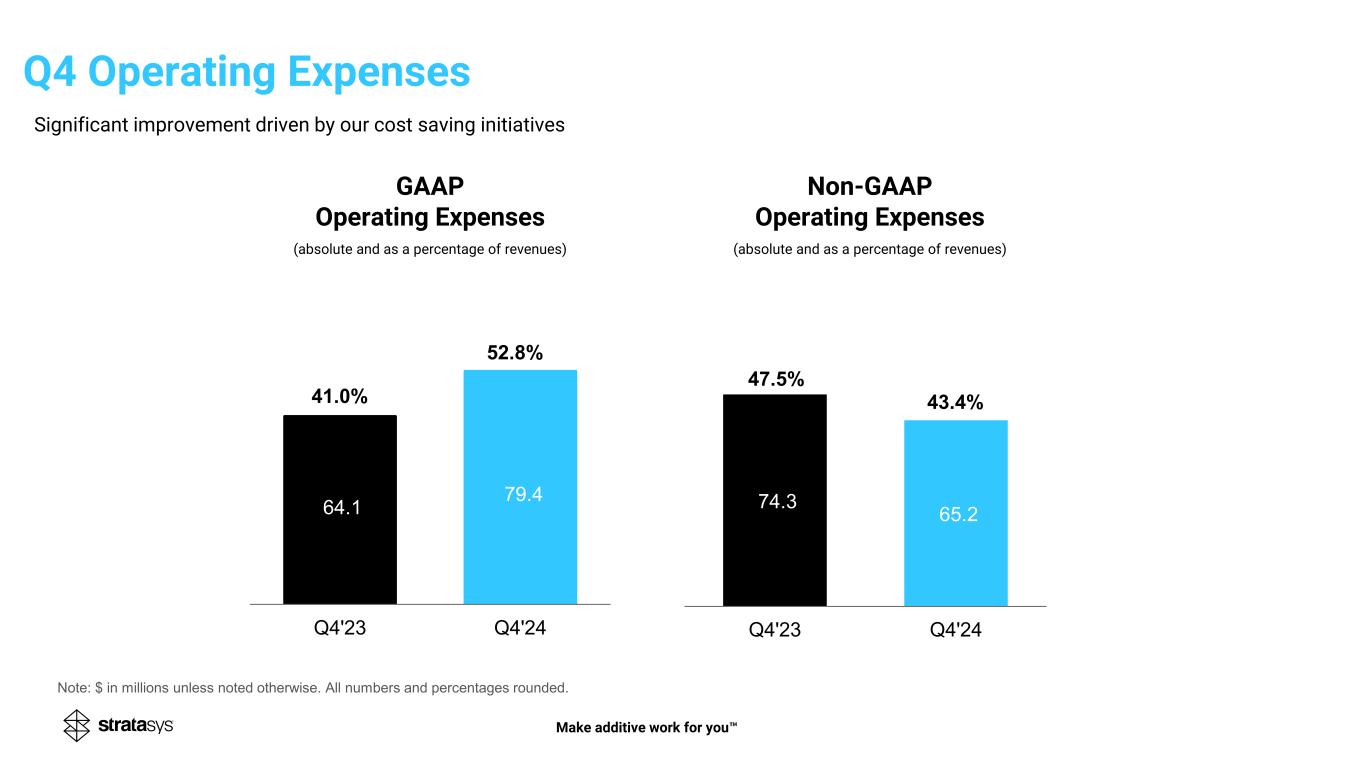

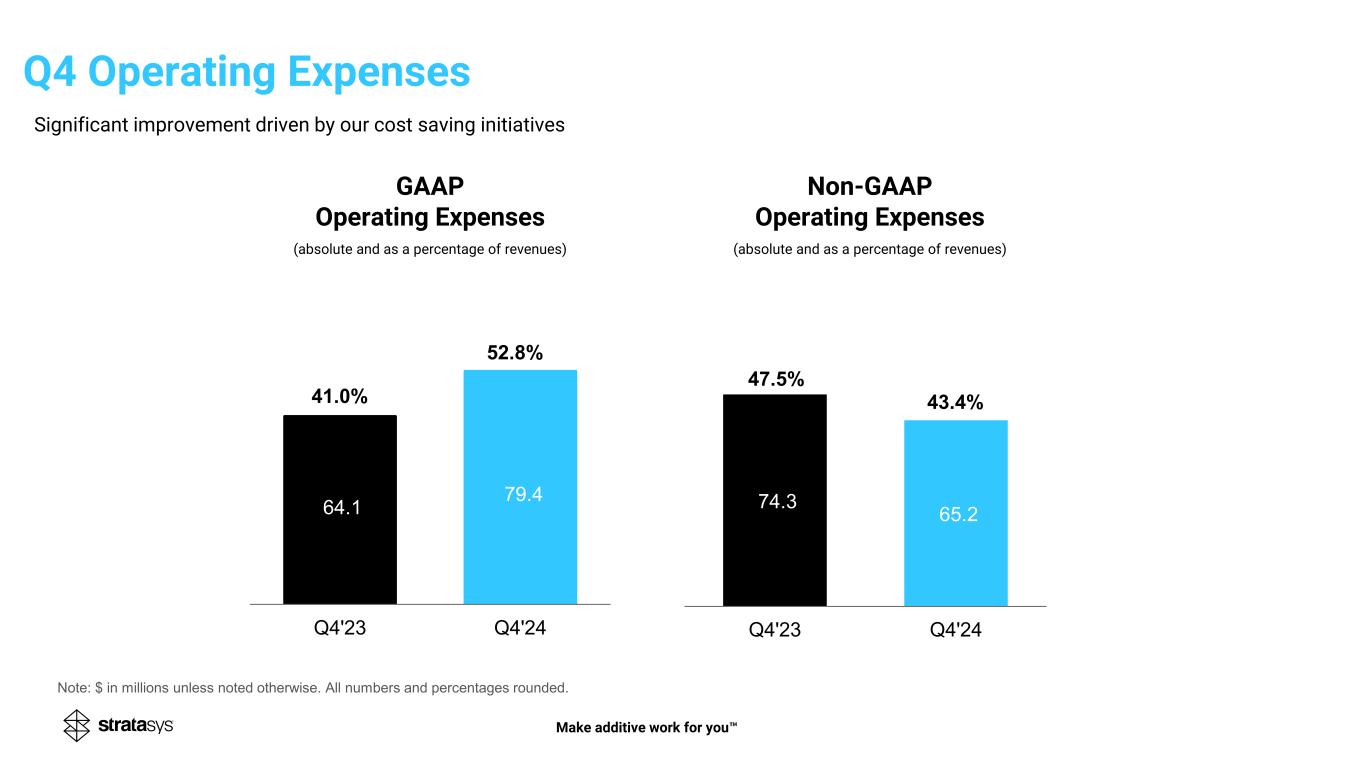

GAAP Operating Expenses (absolute and as a percentage of revenues) Non-GAAP Operating Expenses (absolute and as a percentage of revenues) 64.1 79.4 52.8% Q4'23 Q4'24 74.3 65.2 Q4'23 Q4'24 43.4%41.0% 47.5% Make additive work for you Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Q4 Operating Expenses Significant improvement driven by our cost saving initiatives

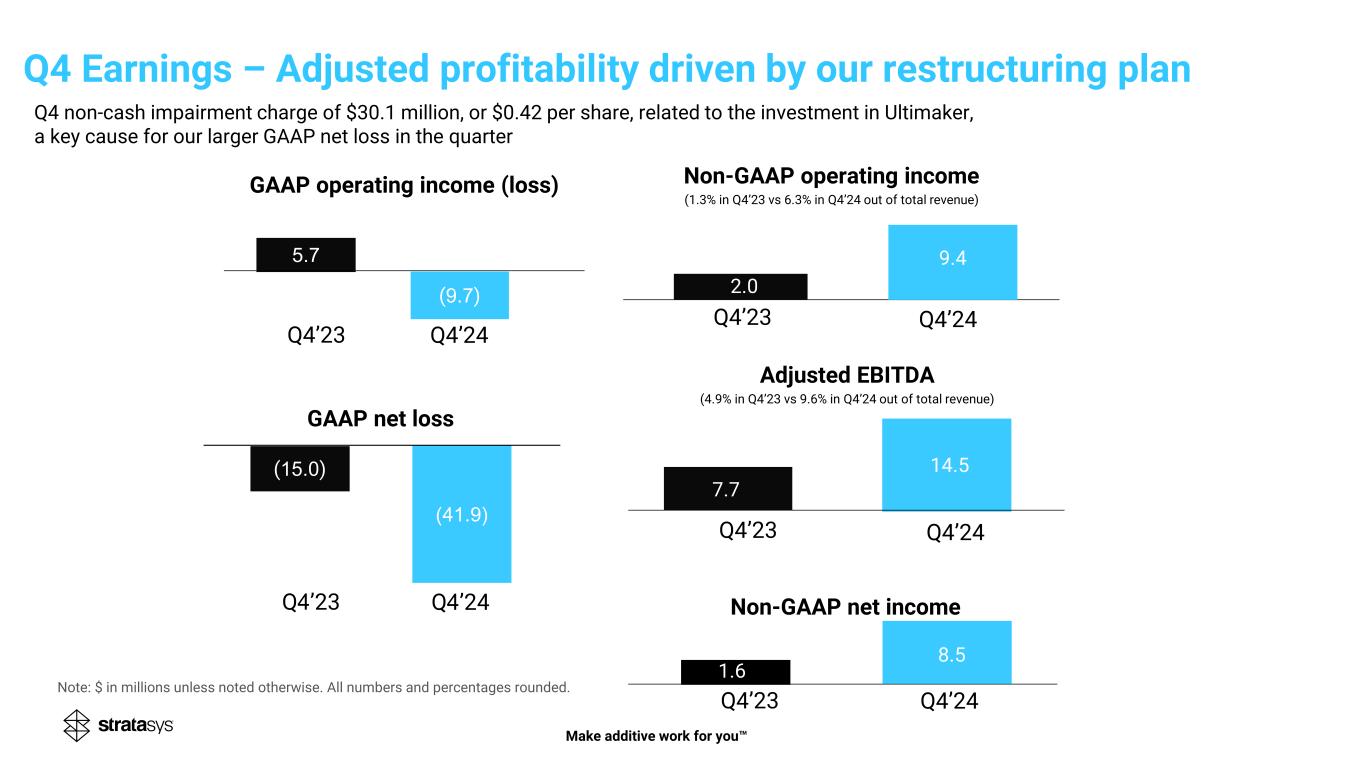

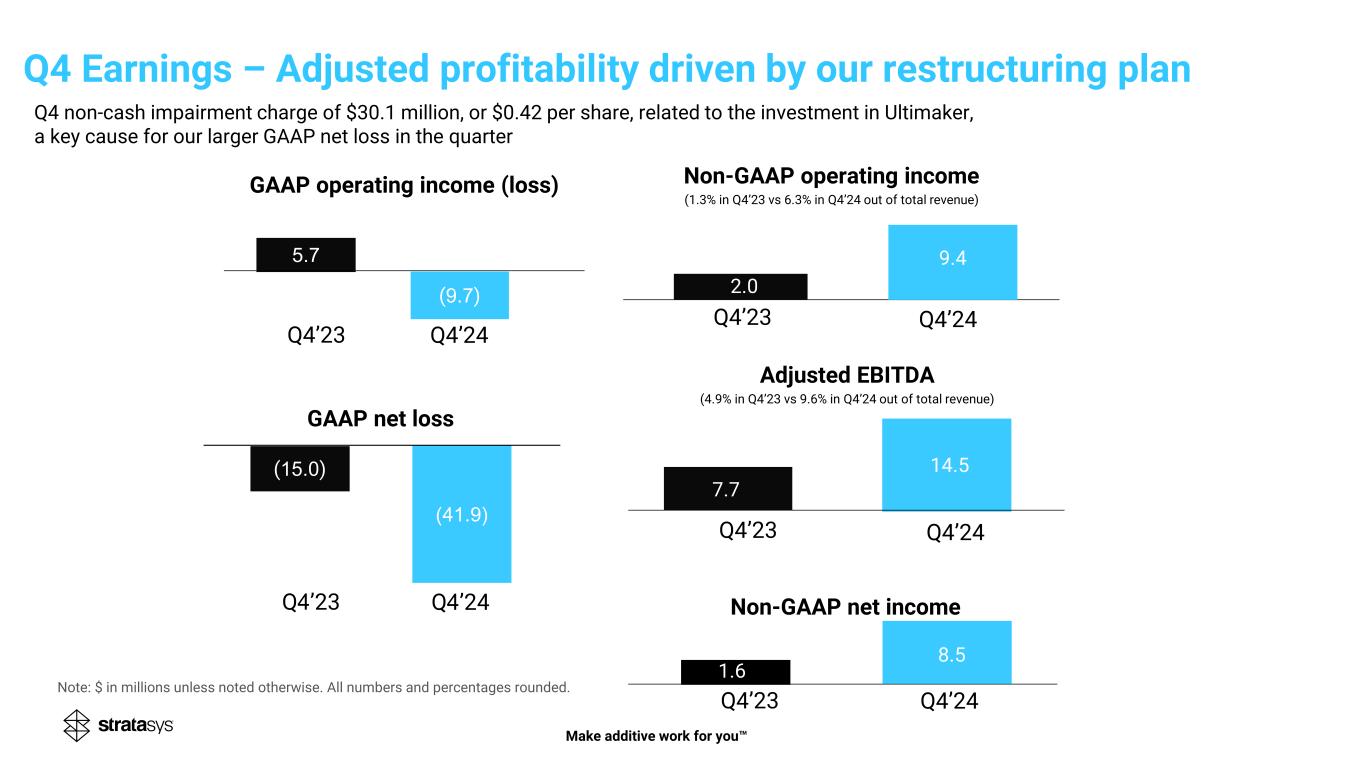

(15.0) )41.9( 5.7 (9.7) Non-GAAP operating income (1.3% in Q4’23 vs 6.3% in Q4’24 out of total revenue) GAAP operating income (loss) Non-GAAP net income GAAP net loss Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Q4’23 Q4’24 14.5 7.7 8.5 Adjusted EBITDA (4.9% in Q4’23 vs 9.6% in Q4’24 out of total revenue) 2.0 9.4 1.6 Q4’23 Q4’24 Q4’23 Q4’24 Q4’23 Q4’24 Make additive work for you Q4 Earnings – Adjusted profitability driven by our restructuring plan Q4’23 Q4’24 Q4 non-cash impairment charge of $30.1 million, or $0.42 per share, related to the investment in Ultimaker, a key cause for our larger GAAP net loss in the quarter

Balance sheet items Cash flow from operating activities 17 Note: $ in millions unless noted otherwise. All numbers and percentages rounded Make additive work for you (7.7) 7.4 (61.6) 7.8 Q4-23 Q4-24 2023 2024 Healthy Balance Sheet Positioned for Value-Enhancing Opportunities Q4-23 Q3-24 Q4-24 Cash and Cash Equivalents and Short-term deposits 162.6 144.0 150.7 Accounts Receivable 172.0 153.7 153.0 Inventories 193.0 195.2 179.8 Net Working Capital 383.3 349.9 345.7 Strong balance sheet and cash position are set to be further enhanced with the prospective $120 million investment from Fortissimo

Revenue Growing sequentially each quarter through the year Non-GAAP Gross Margins Non-GAAP Operating Expenses Non-GAAP Operating Margins Adjusted EPS diluted ($0.93)-($0.72) GAAP EPS diluted CAPEX Adjusted EBITDA 7.8%-8.5% of Revenue $570M – $585M 48.8% – 49.2% $254M – $257M $25M – $30M$44M – $50M Make additive work for you 2025 Outlook $0.28 – $0.354.0% – 5.0% Improved operating and free cash flow at higher levels than 2024

CEO Dr. Yoav Zeif Summary Acknowledge and thank our global team whose professionalism, dedication and hard work continues to drive strong customer engagement and excitement for our solutions Resounding message from our key customers, many of whom I have met over the past months, is that the increased use of additive manufacturing in their businesses is most certainly expected, once spending constraints lift Enthusiasm and excitement at the largest trade shows indicates that when our solutions ramp and deliver their exceptional capabilities, significant growth and corresponding operating leverage and margin expansion will follow Right-sized the business for today, without sacrificing R&D resources for innovation and maintaining the ability to scale quickly as capital spending eases. We believe as the next growth phase of additive manufacturing emerges, we are well- positioned to lead, for today and the future Make additive work for you

Make additive work for you THANK YOU

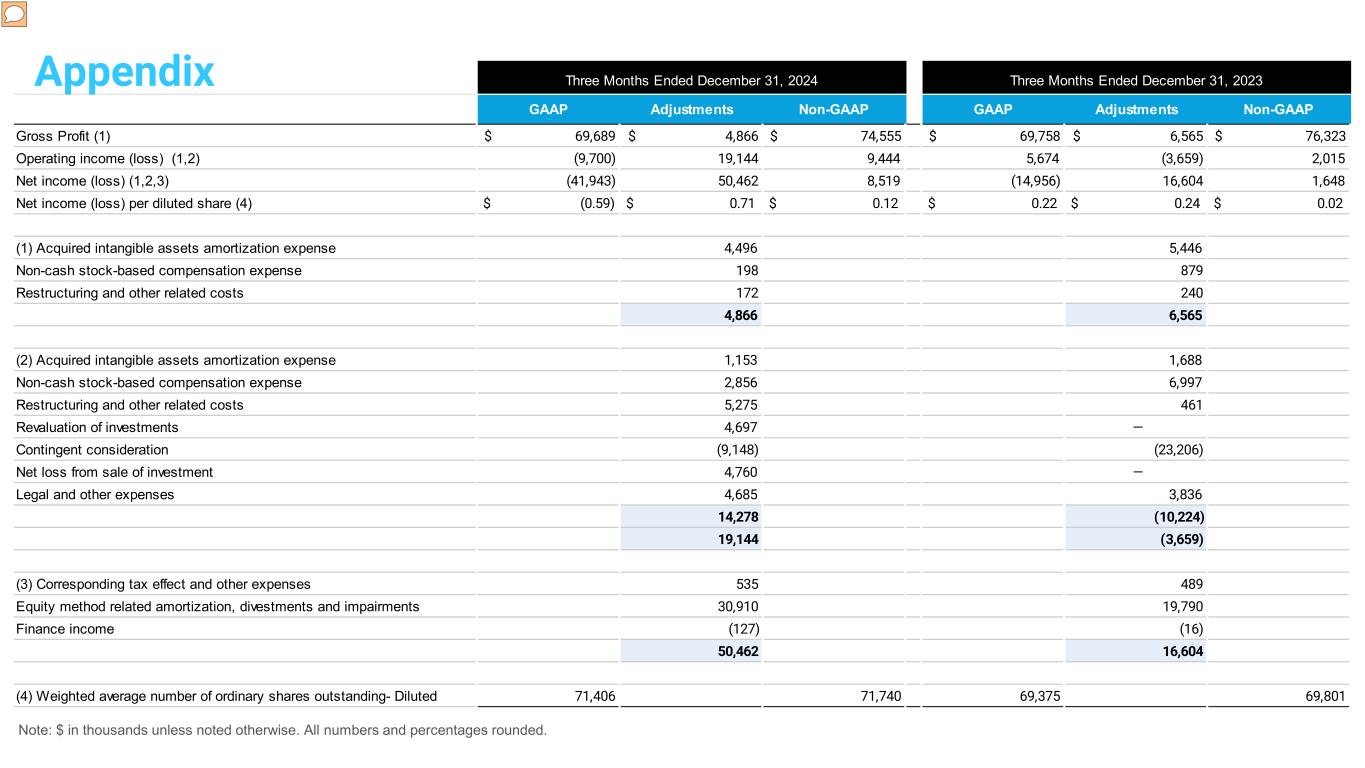

GAAP Adjustments Non-GAAP GAAP Adjustments Non-GAAP Gross Profit (1) $ 69,689 $ 4,866 $ 74,555 $ 69,758 $ 6,565 $ 76,323 Operating income (loss) (1,2) (9,700) 19,144 9,444 5,674 (3,659) 2,015 Net income (loss) (1,2,3) (41,943) 50,462 8,519 (14,956) 16,604 1,648 Net income (loss) per diluted share (4) $ (0.59) $ 0.71 $ 0.12 $ 0.22 $ 0.24 $ 0.02 (1) Acquired intangible assets amortization expense 4,496 5,446 Non-cash stock-based compensation expense 198 879 Restructuring and other related costs 172 240 4,866 6,565 (2) Acquired intangible assets amortization expense 1,153 1,688 Non-cash stock-based compensation expense 2,856 6,997 Restructuring and other related costs 5,275 461 Revaluation of investments 4,697 — Contingent consideration (9,148) (23,206) Net loss from sale of investment 4,760 — Legal and other expenses 4,685 3,836 14,278 (10,224) 19,144 (3,659) (3) Corresponding tax effect and other expenses 535 489 Equity method related amortization, divestments and impairments 30,910 19,790 Finance income (127) (16) 50,462 16,604 (4) Weighted average number of ordinary shares outstanding- Diluted 71,406 71,740 69,375 69,801 Three Months Ended December 31, 2024 Three Months Ended December 31, 2023 Note: $ in thousands unless noted otherwise. All numbers and percentages rounded. Appendix

Note: $ in thousands unless noted otherwise. All numbers and percentages rounded. Appendix - Reconciliation of GAAP Net Loss to Adjusted EBITDA 2024 2023 Net loss $ (41,943) $ (14,956) Financial income, net (176) (846) Income tax expenses 653 637 Share in losses of associated companies 31,766 20,839 Depreciation expense 5,033 5,653 Amortization expense 5,649 7,134 Non-cash stock-based compensation expense 3,054 7,876 Revaluation of investments 4,697 - Net loss from sale of investment 4,760 - Contingent consideration (9,148) (23,206) Legal and other expenses 4,685 3,836 Restructuring and other related costs 5,447 701 Adjusted EBITDA $ 14,477 $ 7,668 Three Months Ended December 31,