Strong 2020 Results with Q4 Revenue up 40% Year-Over-Year

Continued Demand for Fastly’s Compute and Security Offerings

Q4 2020 (includes Signal Sciences)1

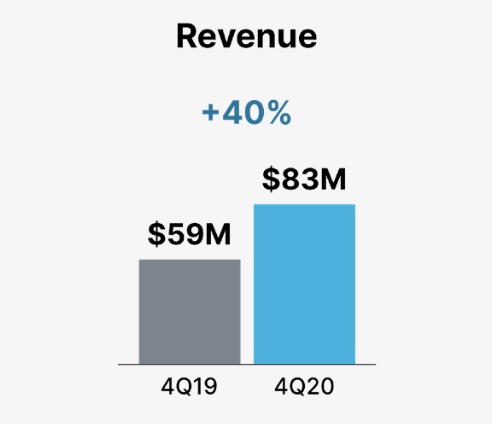

•Strong top-line growth of 40% year-over-year with revenue of nearly $83 million, net of a $2 million deferred revenue write-down related to the purchase accounting adjustments from the Signal Sciences acquisition

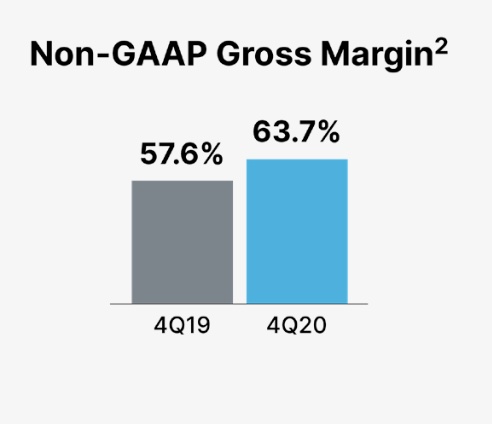

•GAAP gross margin of 59.2%, up from 56.7% in Q4 2019; non-GAAP gross margin2 of 63.7%, which excludes stock-based compensation and amortization of acquired intangible assets, up from 57.6% in Q4 2019

•GAAP operating loss of $57 million, compared to GAAP operating loss of $14 million for Q4 2019; non-GAAP operating loss2 of $9 million, which excludes stock-based compensation, amortization of acquired intangible assets and acquisition-related costs, compared to non-GAAP operating loss of $9 million for Q4 2019

•GAAP basic and diluted net loss per share of $0.40, compared to GAAP basic and diluted net loss per share of $0.15 for Q4 2019; non-GAAP basic and diluted net loss per share2 of $0.09, compared to non-GAAP basic and diluted net loss per share of $0.10 for Q4 2019

•Capital expenditures3 of $9 million, or 11% of revenue

Full Year 2020 (includes Signal Sciences)1

•Total revenue of $291 million, up 45% year-over-year

•GAAP gross margin of 58.7%, up from 55.9% in 2019; non-GAAP gross margin2 of 60.9%, up from 56.6% in 2019

•GAAP operating loss of $107 million, compared to GAAP operating loss of $47 million for 2019; non-GAAP operating loss2 of $17 million, compared to non-GAAP operating loss of $34 million for 2019

•GAAP basic and diluted net loss per share of $0.93, compared to GAAP basic and diluted net loss per share of $0.75 for 2019; non-GAAP basic and diluted net loss per share2 of $0.18, up from non-GAAP basic and diluted net loss per share of $0.52 for 2019

•Capital expenditures3 of $37 million, or 13% of revenue

__________

1 The contribution of Signal Sciences following our acquisition of them has been consolidated into our fourth quarter and full year 2020 financial information. We have not included Signal Sciences in most of our key metrics this quarter and intend to report consolidated key metrics later in 2021. In order to see the incremental contribution on customer growth from Signal Sciences, we have provided their total customer counts and number of enterprise customers for Q4 2020.

2 For a reconciliation of non-GAAP financial measures to their corresponding GAAP measures, please refer to the reconciliation table at the end of this letter.

3 Capital Expenditures are defined as cash used for purchases of property and equipment and capitalized internal-use software, as reflected in our statement of cash flows.

Key Metrics (excludes Signal Sciences)1

•Strong enterprise customer growth and continued execution of land and expand strategy:

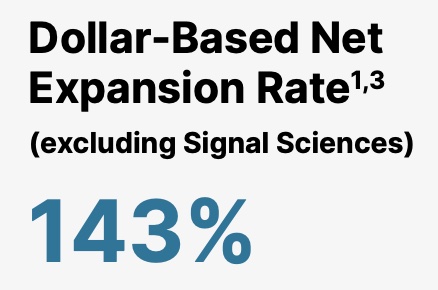

◦Dollar-Based Net Expansion Rate (DBNER)2 of 143%, compared to 147% in Q3 2020

◦Net Retention Rate (NRR)3 of 115%, compared to 122% in Q3 2020

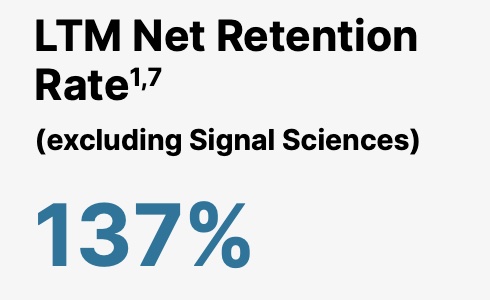

▪Last-twelve-month (LTM) NRR4 of 137%, compared to 141% in Q3 2020

◦Total customer count increased to 2,084 from 2,047 in Q3 2020

▪Enterprise customer count of 324, up from 313 in Q3 2020

◦Average enterprise customer spend5 of approximately $782,000, up from $753,000 in Q3 2020

◦Enterprise customers generated 89% of our trailing twelve-month total revenue, compared to 88% in Q3 2020

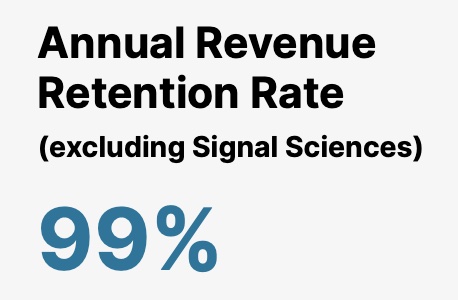

◦2020 annual revenue retention rate of 99%6

Signal Sciences Key Metrics1

•Total customer count of 280 at the end of Q4 2020

•Enterprise customer count7 of 78 at the end of Q4 2020, approximately 25% overlap with existing Fastly enterprise customers

__________

1 The contribution of Signal Sciences following our acquisition of them has been consolidated into our fourth quarter and full year 2020 financial information. We have not included Signal Sciences in most of our key metrics this quarter and intend to report consolidated key metrics later in 2021. In order to see the incremental contribution on customer growth from Signal Sciences, we have provided their total customer counts and number of enterprise customers for Q4 2020.

2 We calculate Dollar-Based Net Expansion Rate by dividing the revenue for a given period from customers who remained customers as of the last day of the given period (the “current” period) by the revenue from the same customers for the same period measured one year prior (the “base” period). The revenue included in the current period excludes revenue from (i) customers that churned after the end of the base period and (ii) new customers that entered into a customer agreement after the end of the base period.

3 Net Retention Rate measures the net change in monthly revenue from existing customers in the last month of the period (the “current" period month) compared to the last month of the same period one year prior (the “prior" period month). The revenue included in the current period month includes revenue from (i) revenue contraction due to billing decreases or customer churn, (ii) revenue expansion due to billing increases, but excludes revenue from new customers. We calculate Net Retention Rate by dividing the revenue from the current period month by the revenue in the prior period month.

4 Our LTM Net Retention Rate, intended to be supplemental to our Net Retention Rate, was 137% for the period ended December 31, 2020. We calculate LTM Net Retention Rate by dividing the total customer revenue for the prior twelve-month period (“prior 12-month period”) ending at the beginning of the last twelve-month period (“LTM period”) minus revenue contraction due to billing decreases or customer churn, plus revenue expansion due to billing increases during the LTM period from the same customers by the total prior 12-month period revenue. We believe the LTM Net Retention Rate is supplemental as it removes some of the volatility that is inherent in a usage-based business model.

5 Calculated based on trailing twelve-months.

6 Annual revenue retention rate is calculated by multiplying the final full month of revenue from a customer that terminated its contract with us (a Churned Customer) by the number of months remaining in the same calendar year (Annual Revenue Churn). The quotient of the Annual Revenue Churn from all of our Churned Customers divided by our annual revenue of the same calendar year is then subtracted from 100% to determine our annual revenue retention rate.

7 Signal Sciences enterprise customers are defined as customers that spend $100,000 or more on an annualized basis, in other words, spending $8,333.34 or more per month as of December 31, 2020.

To Our Shareholders,

We closed out 2020 with strong execution and performance, delivering fourth quarter revenue of nearly $83 million (net a $2 million deferred revenue write-down related to the purchase accounting adjustments from the Signal Sciences acquisition), up 40% year-over-year. This growth was driven by continued demand for our edge platform by both new and existing customers. Our ability to continue capturing additional business from our existing customers is evidenced by our growing average enterprise customer spend of $782,0001,4, up from $753,0001,4 in the last quarter, and a strong DBNER of 143%2.

Our Q4 2020 non-GAAP gross margin3 was 63.7%, which reflects continued scale and our recent acquisition of Signal Sciences. We believe we have a tremendous opportunity to invest in growth in 2021, and plan to do so in a disciplined manner while keeping long- term profitability in mind.

This quarter’s results reflect the continued increase in reliance upon our platform to deliver fast and reliable digital experiences, and the greater importance of security, scale, and performance, as companies continue to accelerate their digital transformations to adapt to lasting trends. Over the past year, we have expanded our platform capabilities to meet these expectations, including the launch of our Compute@Edge offering and the addition of Signal Sciences’ powerful security products to further enhance our security offering at a time when data protection has never been more critical. The welcoming response from both Fastly’s and Signal Sciences’ customers to our expanded combined offerings also had a positive impact on our new bookings for this quarter. Today, we enable our customers to build with speed and confidence as they meet this moment, transform their enterprises, and position themselves to stay ahead of the competitive curve.

Looking ahead, we will continue to invest in growing our global network and product capabilities as we expand our Edge Cloud Platform into a robust solution for building, securing, and delivering experiences at the edge of the Internet. This year, we will focus on adding capabilities and use cases to Compute@Edge, as well as augmenting the most robust, integrated, and simple web application and API protection security solution on the market by leveraging the award-winning technology and talent we gained through our Signal Sciences acquisition. Despite the ongoing uncertainties facing the world in 2021, we are confident in the growing demand for our platform and the future of our business, which is guided by our aspiring product vision.

__________

1 Excludes Signal Sciences (see footnote 1 on page 2).

2 We calculate Dollar-Based Net Expansion Rate by dividing the revenue for a given period from customers who remained customers as of the last day of the given period (the “current” period) by the revenue from the same customers for the same period measured one year prior (the “base” period). The revenue included in the current period excludes revenue from (i) customers that churned after the end of the base period and (ii) new customers that entered into a customer agreement after the end of the base period.

3 For a reconciliation of non-GAAP financial measures to their corresponding GAAP measures, please refer to the reconciliation table at the end of this letter.

4 Calculated based on trailing twelve-months.

Brett Shirk named Chief Revenue Officer

As we work to build on this momentum, we are excited to welcome Brett Shirk to Fastly as our new Chief Revenue Officer (CRO). Brett will be joining us effective February 22. He brings extensive experience in building and scaling sales teams at cloud and security companies, and has more than 25 years of technology experience, having most recently served as CRO at Rubrik. Prior to that, he served as Senior Vice President and General Manager at VMware and also spent 14 years at Symantec and Veritas following its separation from Symantec. Brett is a highly experienced, purpose-driven executive and is acutely aligned with our values and mission. We are happy to have him on board as we continue to grow the organization and provide our customers with a fast, reliable, and secure edge cloud platform.

Executing Well Against Our Product Roadmap

We are excited by the continued progress of both our compute and security offerings, as well as the enthusiastic customer feedback and interest we are receiving across the board. While these offerings have been a key focus for us — and will remain so — we are also continuing to enhance our delivery solutions and deepen our relationships with existing customers, giving us great confidence in demand for our multi-product Edge Cloud Platform.

Signal Sciences Integration − Better Together

Our integration efforts for a unified product offering and go-to-market teams are well underway. We believe security will be a key strategic selling wedge and is essential to our multi-product strategy in 2021 and beyond.

The cross sell and upsell of our new security portfolio driven by the respective Fastly and Signal Sciences customer bases exceeded our expectations in the quarter and the pipeline is strong. Notably, we saw existing Fastly customers beginning to adopt Signal Sciences products in Q4, and we are seeing strong demand in the market for purchasing application protection and delivery from a single vendor. For example,

an existing Fastly consumer goods customer, who was experiencing production outages due to ongoing cyber-attacks, experienced the strength of the combined portfolio by adding Signal Sciences’ Web Application and API Protection (WAAP). By choosing us over other legacy solutions currently on the market, this customer was able to quickly identify and block subsequent attacks, successfully eliminating their customer impacting outages. In a similar vein, an existing Fastly Fortune 500 global retail customer, which began its digital transformation three years ago, recently conducted further replacements of its legacy web security and edge delivery solution with Signal Sciences’ WAAP and Fastly’s Edge Platform. They selected Fastly and Signal Sciences because of our real-time control, visibility, and the overall strong performance of the full suite of Fastly edge products. The combination of Signal Sciences’ and Fastly’s edge platform allowed this customer to have a single partner to accelerate its digital transformation, furthering the adoption of DevOps practices in their engineering and security teams.

We are also seeing numerous opportunities to sell Fastly products within the existing Signal Sciences customer base. We believe this provides a pathway for stronger renewals and increased annual contract value per customer, opening the door to continued demand for future products from our combined portfolio, especially when competing against long-time incumbents. For instance, a leading analytics and business intelligence platform that has used Signal Sciences over the past two years to protect SaaS solutions and secure IT applications recently added Fastly’s Edge Delivery to their enterprise marketing and education initiatives. Fastly's single vendor, integrated, holistic security and edge acceleration and delivery solutions anchored this upsell, adding Fastly's edge delivery capabilities and Cloud WAF product to their services.

Signal Sciences was recognized as a visionary in Gartner’s Magic Quadrant for Web Application Firewalls (WAF) in Q4, and continues to see excellent customer reviews on Gartner Peer Insights, a popular peer-driven ratings and review platform.

Compute@Edge in Production

With Compute@Edge now in production, Fastly is delivering on the promise of a modern, programmable edge for developers. When designing Compute@Edge, we worked with our partners in the Bytecode Alliance to deploy a WebAssembly (Wasm) runtime on our global edge, differentiating Compute@Edge from other products on the market as the more performant and secure serverless offering. We’ve seen some incredibly innovative use cases from developers. I recently saw an edge-native, multiplayer version of the popular video game Doom, a machine- learning product used to identify objects in an image at the edge, and a system that automatically simplifies the text on a website for new language learners. One of the most compelling use cases I’ve seen is a dynamic ad insertion product focused on personalizing ads based on user-specific criteria in real-time at the edge. Developers used three key languages to build out these use cases: AssemblyScript (which is a great entry point for JavaScript and TypeScript developers), as well as C, and Rust.

In Q4 we also increased support and ease-of-use features for Compute@Edge customers through several enhancements to our Developer Hub, a central place where developers can easily access the tools needed to build on our edge cloud platform. We created several new Compute@Edge starter kits, designed to

help customers get started faster. We also released additional code examples designed to make it easier for them to build and execute code to address specific use cases like feature flagging, waiting rooms and various types of authentication at the edge.

Landing and Expanding Across Multiple Verticals

While 2020 brought with it some unexpected turns, the continued demand for Fastly’s platform remained strong. In addition to focusing on their respective digital transformation, companies are also beginning to realize the tremendous potential at the edge. This quarter we saw usage expansion and new business wins across multiple verticals including gaming, education, financial services, ecommerce, high technology, telecommunications, and media.

Key customer highlights:

•Gaming — Our efforts in this rapidly-growing vertical saw significant expansion with a large gaming company, who is leveraging our platform to deliver new titles and support the launch of the next-generation consoles. We also added a leading interactive gaming company to our customer base, supporting their storefront for games available via the web. These two leading gaming brands chose Fastly’s edge platform for our consistent, exceptional performance in delivering gaming experiences to their customers.

•Education — With remote learning becoming an increasingly important part of the education landscape, we saw adoption by Blackboard, a top-tier Learning Management System. Blackboard is leveraging our platform to secure, accelerate, and deliver interactive remote learning experiences to students. In addition to Blackboard, higher education institution UC Davis also joined Fastly’s platform in Q4. UC Davis chose Fastly’s secure edge platform for our capabilities in WAF, Image Optimization, and performance at the edge.

•Financial Services — With more transactions happening online than ever before, financial services have been a critical part of the infrastructure during these times. A leading enterprise technology provider of software and services, selected Fastly Edge Delivery and Image Optimization to power a new generation of modern commerce and point-of-sale applications. Fastly also won new business from a diversified financial services group of companies for individuals of the public sector. They selected Fastly to become less dependent on a single, legacy CDN provider. They leveraged Fastly’s edge platform to deliver traffic for specific domains, effectively providing fast-growing, new products, vanity sites, microsites, and co- marketed sites. This customers’ multi-year contract with us includes Full Site Delivery, Security Bundle, Image Optimization, Origin Connect, Enterprise Support, Designated Technical Specialists, and Concierge TLS, all part of their new multi-CDN strategy.

•Telecommunications/Media — One of the world’s largest telecommunications companies expanded its use of Fastly’s edge platform while leveraging an existing Signal Sciences deployment to securely accelerate web performance across their diverse set of sports and news platforms. This customer’s news properties grew to historic heights in 2020 due to heightened demand for quality news in real time with little impact to origin servers. One of their leading sports properties relies on Fastly to shield their origins from consistent but unpredictable large spikes driven by live sports events. This creates opportunities to expand our relationship and support other business units inside of this company, and demonstrates Fastly’s ability to deliver consistent, exceptional performance at scale. Additionally, customers like

AtresMedia have also increased their usage with us, leveraging our non-metered egress relationships with Microsoft Azure and our edge shielding capabilities to reduce cost of access to origin by 60%.

Google Cloud Marketplace Partnership Gaining Traction

As we announced last September, we joined the Google Cloud Marketplace as its first edge cloud-based CDN solution partner. Under a single billing arrangement and using Google Cloud committed spend, Google Cloud customers can now purchase our edge offerings as part of their modern technology stack. This partnership provides an important new route to market for our platform. We are encouraged by the momentum we are seeing from new and existing customers who are able to take advantage of Google Marketplace benefits. These opportunities span multiple verticals — including ecommerce, media, and high tech — and regions across the globe.

Driving Robust Engagement from Existing Enterprise Customers

In addition to growing our core customer base, we also saw increased engagement and further expansion of our enterprise customer base (defined as spending $100,000 or more in a twelve-month period). We increased our enterprise customer count to 3241 from 3131, excluding Signal Sciences, in the previous quarter. This expansion was driven by the further adoption of our platform by both new and existing large customers. As of December 31, 2020, Signal Sciences’ enterprise customer count was 782, of which approximately 25% overlaps with existing Fastly enterprise customers.

We have continued to capture additional business from existing enterprise customers. This is evidenced by an increase in our average enterprise customer spend of $782,0001, up from $753,0001 in the previous quarter, and our strong Dollar-Based Net Expansion Rate (DBNER) of 143%3, which measures the change in revenue from existing customers over a twelve-month period. The increase in spend and strong DBNER highlight the continued strength of our platform and relationships with our enterprise customers, which represented 89%1 of our trailing twelve-months revenue compared to 88% in Q3 2020.

Despite customer challenges that we faced in the second half of last year, we’ve continued to demonstrate the stickiness of our Edge Cloud Platform by delivering an annual revenue retention rate1,4 of 99% for the full year 2020 and another strong Net Retention Rate1 (NRR) of 115% in Q4 2020 (137% on a last-twelve-month (LTM) basis). We believe the LTM NRR removes some of the volatility that is inherent in a usage-based business model. NRR measures the net change in monthly revenue from existing customers in the last month of the period compared to the last month of the same period one year prior. It includes revenue contraction due to billing decreases or customer churn and revenue expansion due to billing increases, but excludes revenue from net new customers. We measure NRR in addition to DBNER in an effort to provide insight into our customer base in a similar fashion to what is commonly found with traditional SaaS companies. DBNER is a mutually exclusive calculation and differs from NRR in that DBNER only includes existing customers that have been on the platform at least 13 months, and excludes churn.

__________

1 Excludes Signal Sciences (see footnote 1 on page 2).

2 Signal Sciences enterprise customers are defined as customers that spend $100,000 or more on an annualized basis, in other words, spending $8,333.34 or more per month as of December 31, 2020.

3 We calculate Dollar-Based Net Expansion Rate by dividing the revenue for a given period from customers who remained customers as of the last day of the given period (the “current” period) by the revenue from the same customers for the same period measured one year prior (the “base” period). The revenue included in the current period excludes revenue from (i) customers that churned after the end of the base period and (ii) new customers that entered into a customer agreement after the end of the base period.

4 Annual revenue retention rate is calculated by multiplying the final full month of revenue from a customer that terminated its contract with us (a Churned Customer) by the number of months remaining in the same calendar year (Annual Revenue Churn). The quotient of the Annual Revenue Churn from all of our Churned Customers divided by our annual revenue of the same calendar year is then subtracted from 100% to determine our annual revenue retention rate.

5 Net Retention Rate measures the net change in monthly revenue from existing customers in the last month of the period (the “current" period month) compared to the last month of the same period one year prior (the “prior" period month). The revenue included in the current period month includes revenue from (i) revenue contraction due to billing decreases or customer churn, (ii) revenue expansion due to billing increases, but excludes revenue from new customers. We calculate Net Retention Rate by dividing the revenue from the current period month by the revenue in the prior period month.

6 Calculated based on trailing twelve-months.

7 Our LTM Net Retention Rate, intended to be supplemental to our Net Retention Rate, was 137% for the period ended December 31, 2020. We calculate LTM Net Retention Rate by dividing the total customer revenue for the prior twelve-month period (“prior 12-month period”) ending at the beginning of the last twelve-month period (“LTM period”) minus revenue contraction due to billing decreases or customer churn, plus revenue expansion due to billing increases during the LTM period from the same customers by the total prior 12-month.

It includes revenue contraction due to billing decreases or customer churn and revenue expansion due to billing increases, but excludes revenue from net new customers. We measure NRR in addition to DBNER in an effort to provide insight into our customer base in a similar fashion to what is commonly found with traditional SaaS companies. DBNER differs from NRR in that DBNER only includes existing customers that have been on the platform at least 13 months, and excludes churn.

Scaling our Edge Cloud Platform to Meet Tomorrow’s Demand

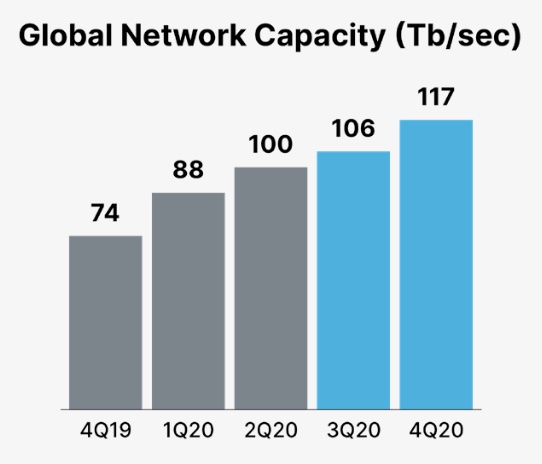

We are continuing to innovate and scale our platform efficiently and build capacity to meet market demand, even in these uncertain times. In Q4 2020, we entered one new market in France and now have a presence in 56 markets, providing access to 117 Tb/sec. of global network capacity. To ensure the safety of our employees, adhere to travel restrictions, and minimize operational constraints, we primarily focused on augmenting our capacity in established markets in the fourth quarter. While we did not experience any negative supply chain impacts during the quarter, we will continue to closely monitor and are prepared to make any necessary adjustments should today’s macro challenges continue for an extended period.

With companies’ and consumers’ increased reliance on online businesses now more than ever, we remain focused on investing in our network and protecting our customers from the impacts of ‘Internet weather’ so that we can deliver fast and reliable end-user experiences. We recently released two new features to support this goal:

•Precision Path introduces smart self-healing capabilities into our network. It applies cutting edge discovery and failover techniques to select the best performing path for customer’s traffic to avoid internet weather disruptions. Precision Path is key to increasing our network availability and performance, even when the problem lies with a third-party network. This can be particularly valuable to rapidly-growing gaming vertical – both for game developers and publishers, who are focused on performance and high quality of experience for their gamers.

•HTTP/s and QUIC support enables faster response times, better network performance and built-in encryption (TLS 1.3). Support for modern network protocols HTTP/3 and QUIC allows our customers to provide an enhanced digital experience for their end users, specifically mobile subscribers and subscribers in parts of the world that have spotty Internet access.

Financial Discussion

Revenue

Total revenue for Q4 2020 increased 40% year-over-year to nearly $83 million, net of a $2 million deferred revenue write-down associated with the acquisition of Signal Sciences. Revenue growth was driven by further adoption of our modern edge platform by new and existing enterprise organizations around the world and across multiple verticals, such as gaming, financial services, ecommerce, and telecommunications/media. Additionally, we have developed methods to leverage our unique platform to deliver streaming traffic in a more scalable and profitable manner. For the full year 2020, total revenue was $291 million, up 45% year-over-year.

Customer Count

As of December 31, 2020, 3241 of our 2,0841 customers, excluding Signal Sciences’ customers, were enterprise customers, which accounted for 89% of our trailing twelve-month total revenue. Signal Sciences had a total of 280 customers, including 78 enterprise customers2 of which approximately 25% overlap with Fastly enterprise customers.

Gross Margin

We are pleased with the progress we’re making as we continue to drive leverage in the business. GAAP gross margin was 59.2% for Q4 2020, up from 56.7% in the same quarter a year ago. Excluding stock-based compensation and amortization of acquired intangible assets, our non-GAAP gross margin3 was 63.7% for Q4 2020, compared to 57.6% in the same quarter a year ago. For the full-year 2020, GAAP gross margin was 58.7%, compared to 55.9% for 2019. Non-GAAP gross margin3 was 60.9% for 2020, compared to 56.6% for 2019.

Our gross margin reflects additional scale, our recent acquisition of Signal Sciences, the timing of personnel and infrastructure investments, and seasonal usage by customers on our platform. In 2021, we will be focused on further investing in the business to accelerate the expansion of our Edge Cloud Platform. We also remain confident in our ability to deliver incremental annual gross margin expansion.

__________

1 Excludes Signal Sciences (see footnote 1 on page 2).

2 Signal Sciences enterprise customers are defined as customers that spend $100,000 or more on an annualized basis, in other words, spending $8,333.34 or more per month as of 3 December 31, 2020.

3 For a reconciliation of non-GAAP financial measures to their corresponding GAAP measures, please refer to the reconciliation table at the end of this letter.

Expenses

Research and development expenses were $26 million in Q4 2020, or 31% of revenue, up from $13 million, or 22% of revenue in Q4 2019. Full-year 2020 research and development expenses were $75 million, or 26% of revenue, up from $46 million, or 23% of revenue in 2019. The increase is primarily driven by personnel-related costs from additional headcount, including the Signal Sciences acquisition, and other personnel-related investments in order to further develop new products and features for next-generation edge computing solutions.

Sales and marketing expenses were $35 million in Q4 2020, representing 42% of revenue, up from $22 million, or 37% of revenue in Q4 2019. The increase is primarily driven by personnel- related costs from additional headcount, including the Signal Sciences acquisition, and other personnel-related investments in order to drive new enterprise customer acquisition. The increase was also driven by amortization of acquired intangible assets. Full-year 2020 sales and marketing expenses were $101 million, representing 35% of revenue, up from $71 million, which also represented 35% of revenue for full-year 2019.

General and administrative expenses were $46 million in Q4 2020, or 56% of revenue, up from $13 million, or 22% of revenue in Q4 2019. Full-year 2020 general and administrative expenses were $102 million, or 35% of revenue, up from $41 million, or 21% of revenue in 2019. The increase is primarily driven by personnel-related costs from additional headcount, other personnel-related investments to support our future growth, professional services related to ongoing compliance costs as a public company, as well as acquisition-related expenses.

In total, our operating expenses for Q4 2020 were $106 million, compared to $47 million in Q4 2019. Full-year 2020 operating expenses were $278 million, compared to $159 million in 2019. The increase was primarily due to costs related to personnel investments, professional services for ongoing compliance costs as a public company, acquisition-related expenses, and amortization of acquired intangible assets.

We generated a GAAP operating loss for Q4 2020 of $57 million, or 69% of revenue, compared to GAAP operating loss of $14 million, or 24% of revenue in Q4 2019. Full-year 2020 GAAP operating loss was $107 million, or 37% of revenue, compared to GAAP operating loss of $47 million, or 23% of revenue in 2019.

Non-GAAP operating loss for Q4 2020 was $9 million, or 11% of revenue, compared to non-GAAP operating loss of $9 million, or 16% of revenue in Q4 2019. Non-GAAP operating loss for full-year 2020 was $17 million, or 6% of revenue, compared to non-GAAP operating loss of $34 million, or 17% of revenue in 2019.

Net Loss

Net loss for Q4 2020 was $46 million, or $0.40 loss per basic and diluted shares, compared to $14 million and $0.15 loss per basic and diluted shares in Q4 2019. Non-GAAP net loss for Q4 2020 was $10 million, or $0.09 loss per basic and diluted shares, compared to $9 million and $0.10 loss per basic and diluted shares in Q4 2019.

Full-year 2020 net loss was $96 million, or $0.93 loss per basic and diluted shares, compared to $52 million, or $0.75 loss per basic and diluted shares in 2019. Non-GAAP net loss for full-year 2020 was $19 million, or $0.18 loss per basic and diluted shares, compared to $35 million for full-year 2019, or $0.52 per basic and diluted shares for

2019. For a reconciliation of non-GAAP financial measures to their corresponding GAAP measures, please refer to the reconciliation table at the end of this letter.

Balance Sheet, Capital Expenditures, and Cash Flow

We ended Q4 2020 with $216 million in cash, restricted cash, and investments, including those classified as long-term. Cash used in operations was $31 million in the quarter. Capital expenditures, or cash used for purchases of property and equipment and capitalized internal-use software, were $9 million in Q4 2020, representing 11% of total revenue in Q4 2020. Free Cash Flow was ($40) million in Q4 2020.

We recently entered into a revolving line of credit with Silicon Valley Bank allowing us to borrow up to $100 million and we describe the material terms of this line of credit on a Form 8-K.

Net cash used in operations was $20 million for the full year 2020, compared to $31 million last year. Capital expenditures, or cash used for purchases of property and equipment and capitalized internal-use software, in 2020 totaled $37 million, representing 13% of total revenue. For additional context, please refer to the free cash flow table at the end of this letter.

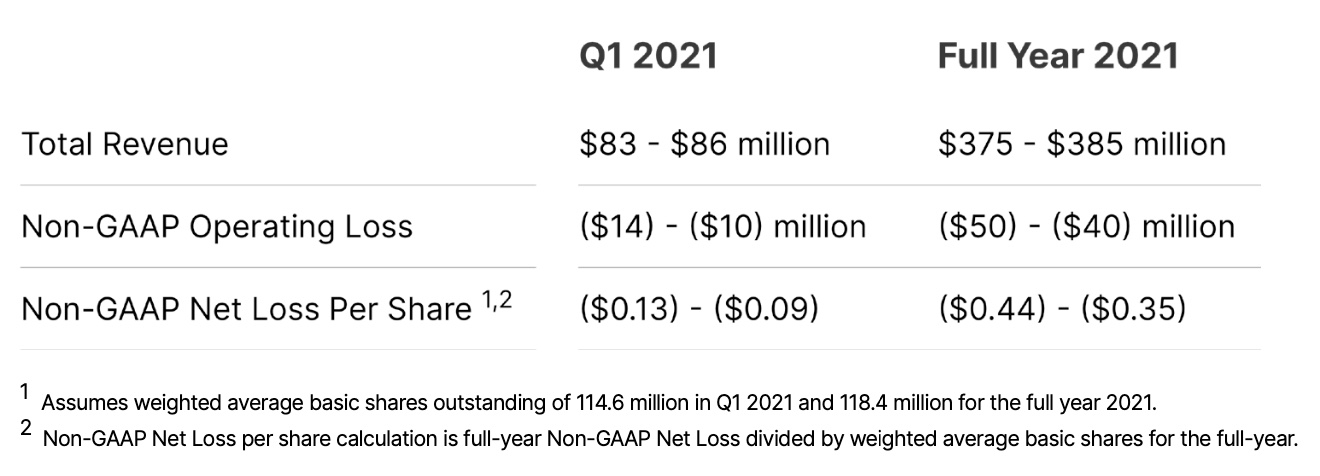

Q1 and Full-Year 2021 Business Outlook

Our 2021 outlook reflects our continued ability to deliver strong top-line growth, our ongoing commitment to annual gross margin expansion, our ongoing investments in cloud computing and security, and the expense of our expanded team from the Signal Sciences acquisition. Similar to last year’s approach, our revenue guidance is based on the visibility that we have today, and given our usage-based business model, we expect to gain additional visibility as the year progresses.

As previously mentioned, our gross margin reflects scale, the recent acquisition of Signal Sciences, the timing of personnel and infrastructure investments, and seasonal usage by customers on our platform. In 2021, we will be focused on further investing in the business to accelerate the expansion of our Edge Cloud Platform. We remain confident in our ability to deliver incremental annual gross margin expansion.

Additionally, as we continue to invest in the business in 2021 through global platform expansion, we expect capital expenditures as a percentage of revenue to be approximately 13% to 14% of revenue — similar to full-year 2020. Long-term, we expect capital expenditures to approach 10% of revenue on a calendar year basis.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures for our Q4 and Full Year 2021 Business Outlook is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of these costs and expenses that may be incurred in the future. We have provided a reconciliation of GAAP to non-GAAP financial measures for Q4 2020 in the reconciliation table at the end of this letter.

Quarterly Conference Call

We will host a live Q&A session at 2:00 p.m. PT / 5:00 p.m. ET on Thursday, February 17, 2021 to discuss these financial results. To participate in the live call, please dial (833) 968-2077 (U.S. / Canada) or (236) 714-2139 (international) and provide conference ID 8627545. A live webcast of the call will be available at https://investors.fastly.com and will be archived on our site following the call.

Reflecting on this past year, I am extremely proud of all that our team has accomplished

to expand our offering under such uniquely challenging circumstances. We are gaining momentum with both our compute and security offerings, and delivering on our edge cloud mission. I look forward to seeing where 2021 will take us as our work to help builders create a more trustworthy internet continues.

Thank you for taking the time to read our letter, and we look forward to your questions on our call this afternoon.

Sincerely,

Joshua Bixby

CEO

Forward-Looking Statements

This letter to shareholders contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section

21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or Fastly's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates,” “going to,” "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," or the negative of these words or other similar terms or expressions that concern Fastly's expectations, strategy, priorities, plans, or intentions. Forward-looking statements in this letter to shareholders include, but are not limited to, statements regarding Fastly’s future financial and operating performance, including its outlook and guidance; Fastly's strategies, product and business plans, including its ability to scale and further invest in the business to expand its Edge Cloud Platform; statements regarding the integration and success of Signal Sciences; statements regarding Fastly's investments in revenue, marketing and demand generation, and the impact of such investments on its business; statements regarding the performance of Fastly's platform; and statements regarding Fastly's expectations regarding the expansion of its customer base, including anticipated enterprise customer deals, the growth and usage of its customers, continued demand for future products from the combined Signal Sciences portfolio, and its ability to leverage the technology and talent gained through the Signal Sciences acquisition. Fastly's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the possibility that: Fastly is unable to attract and retain customers; Fastly's existing customers and partners do not maintain or increase usage of Fastly's platform; Fastly's platform and product features do not meet expectations, including due to interruptions, security breaches, delays in performance or other similar problems; Fastly is unable to adapt to meet evolving market and customer demands and rapid technological change; Fastly is unable to comply with modified or new industry standards, laws and regulations; Fastly is unable to generate sufficient revenues to achieve or sustain profitability; Fastly’s limited operating history makes it difficult to evaluate its prospects and future operating results; Fastly is unable to effectively manage its growth; and Fastly is unable to compete effectively. The forward- looking statements contained in this shareholder letter are also subject to other risks and uncertainties, including those more fully described in Fastly’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, and additional information that will be set forth on Fastly's Annual Report on Form 10-K for the year ended December 31, 2020 and other filings and reports that we may file from time to time with the SEC. The forward-looking statements in this letter to shareholders are based on information available to Fastly as of the date hereof, and Fastly disclaims any obligation to update any forward-looking statements, except as required by law.

Non-GAAP Financial Measures:

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with accounting principles generally accepted in the United States ("GAAP"), the Company uses the following non-GAAP measures of financial performance: non-GAAP gross profit, non-GAAP net loss, non-GAAP basic and diluted net loss per common share, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, and adjusted EBITDA. The presentation of this additional financial information is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. These non- GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. In addition, these non-GAAP financial measures may be different from the non-GAAP financial measures used by other companies. These non-GAAP measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. Management compensates for these limitations by reconciling these non-GAAP financial measures to the most comparable GAAP financial measures within our earnings releases.

Non-GAAP gross profit, non-GAAP research and development, non-GAAP sales and marketing, and non-GAAP general and administrative differ from GAAP in that they exclude stock-based compensation expense, amortization of acquired intangibles assets, and acquisition-related expenses. Non-GAAP net loss and non-GAAP basic and diluted net loss per common share differ from GAAP in that they exclude stock-based compensation expense, amortization of acquired intangibles assets, acquisition-related expenses, acquisition-related tax benefit, interest expense related to the acceleration of deferred debt issuance costs due to the early repayment of debt, and other expense related to the mark-to-market of our convertible preferred warrant liability immediately prior to our initial public offering ("IPO").

Adjusted EBITDA: Adjusted EBITDA excludes stock-based compensation expense, depreciation and other amortization expenses, amortization of acquired intangibles assets, acquisition-related expenses, acquisition-related tax benefit, interest income, interest expense, other expense, (net), and income taxes.

Capital Expenditures: cash used for purchases of property and equipment and capitalized internal-use software, as reflected in our statement of cash flows.

Depreciation and Other Amortization Expense: consists of non-cash charges that can be affected by the timing and magnitude of asset purchases. Depreciation and amortization expense is included in the following cost and expense line items of our GAAP presentation: cost of revenue, research and development, sales and marketing, and general and administrative. Management considers its operating results without the amortization expense of our intangible assets when evaluating its ongoing non-GAAP performance and without depreciation and other amortization expense when evaluating its ongoing adjusted EBITDA performance because these charges are non-cash expenses that can be affected by the timing and magnitude of asset purchases and may not be reflective of our core business, ongoing operating results, or future outlook.

Non-GAAP Financial Measures:

Amortization of Acquired Intangible Assets: consists of non-cash charges that can be affected by the timing and magnitude of asset purchases and acquisitions. Amortization of acquired intangible assets is included in the following cost and expense line items of our GAAP presentation: cost of revenue and sales and marketing. Management considers its operating results without the amortization expense of our acquired intangible assets when evaluating its ongoing non-GAAP performance and without the amortization expense of our acquired intangible assets when evaluating its ongoing adjusted EBITDA performance because these charges are non-cash expenses that can be affected by the timing and magnitude of asset purchases and acquisitions and may not be reflective of our core business, ongoing operating results, or future outlook.

Free Cash Flow: calculated as net cash used in operating activities less capital expenditures.

Interest Expense: consists primarily of interest expense related to our debt instruments. Management considers its operating results without interest expense associated with the acceleration of deferred debt issuance costs associated with early repayment of debt when evaluating its ongoing non-GAAP performance and without total interest expense when evaluating its ongoing adjusted EBITDA performance because it is not believed by management to be reflective of our core business, ongoing operating results or future outlook.

Acquisition-related Expense: consists of one-time expenses related to the acquisition related activities. Management considers its operating results without the one-time acquisition- related expense when evaluating its ongoing non-GAAP performance and without the one- time acquisition-related expense when evaluating its ongoing adjusted EBITDA performance because these charges are one-time and may not be reflective of our core business, ongoing operating results, or future outlook.

Acquisition-related Tax Benefit: consists primarily of a tax benefit related to acquired intangible assets. Management considers its operating results without the one-time acquisition-related tax benefit when evaluating its ongoing non-GAAP performance and without the one-time acquisition-related tax benefit when evaluating its ongoing adjusted EBITDA performance because these charges are one-time and may not be reflective of our core business, ongoing operating results, or future outlook.

Interest Income: consists primarily of interest income related to our marketable securities. Management considers its adjusted EBITDA results without this activity when evaluating its ongoing performance because it is not believed by management to be reflective of our core business, ongoing operating results or future outlook.

Income Taxes: consists of expense recognized related to state and foreign income taxes. Management considers its adjusted EBITDA results without these charges when evaluating its ongoing performance because it is not believed by management to be reflective of our core business, ongoing operating results or future outlook.

Non-GAAP Operating Loss: calculated as GAAP revenue less non-GAAP cost of revenue and non-GAAP operating expenses.

Non-GAAP Financial Measures:

Other Expense, Net: consists primarily of other expenses related to mark-to-market adjustments of our convertible preferred stock warrant liabilities. Upon the closing of the IPO, the warrants to purchase shares of preferred stock were converted into warrants to purchase shares of our common stock. As a result, the warrant liability was remeasured a final time immediately prior to the IPO and reclassified to additional paid in capital within stockholders' deficit. Management considers its operating results without other expense associated with the mark-to-market adjustments included in other expense, net, when evaluating its ongoing non-GAAP performance and without total other expense, net when evaluating its ongoing adjusted EBITDA performance because it is not believed by management to be reflective of our core business, ongoing operating results or future outlook.

Stock-based Compensation Expense: consists of expenses for stock options, restricted stock units, performance awards, restricted stock awards and Employee Stock Purchase Plan ("ESPP") under our equity incentive plans. Stock-based compensation is included in the following cost and expense line items of our GAAP presentation: cost of revenue, research and development, sales and marketing, and general and administrative.

Although stock-based compensation is an expense for the Company and is viewed as a form of compensation, management excludes stock-based compensation from our non-GAAP measures and adjusted EBITDA results for purposes of evaluating our continuing operating performance primarily because it is a non-cash expense not believed by management to be reflective of our core business, ongoing operating results, or future outlook. In addition, the value of some stock-based instruments is determined using formulas that incorporate variables, such as market volatility, that are beyond our control.

Management believes these non-GAAP financial measures and adjusted EBITDA serve as useful metrics for our management and investors because they enable a better understanding of the long-term performance of our core business and facilitate comparisons of our operating results over multiple periods and to those of peer companies, and when taken together with the corresponding GAAP financial measures and our reconciliations, enhance investors' overall understanding of our current financial performance.

In the financial tables below, the Company provides a reconciliation of the most comparable GAAP financial measure to the historical non-GAAP financial measures used in this shareholder letter.

Condensed Consolidated Statements of Operations

(in thousands, except per share amounts, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Year ended

December 31, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Revenue | | $ | 82,649 | | | $ | 58,936 | | | $ | 290,874 | | | $ | 200,462 | |

Cost of revenue(1) | | 33,753 | | | 25,528 | | | 120,007 | | | 88,322 | |

| Gross profit | | 48,896 | | | 33,408 | | | 170,867 | | | 112,140 | |

| Operating expenses: | | | | | | | | |

Research and development(1) | | 25,590 | | | 12,951 | | | 74,814 | | | 46,492 | |

Sales and marketing(1) | | 34,765 | | | 21,592 | | | 101,181 | | | 71,097 | |

General and administrative(1) | | 45,885 | | | 12,896 | | | 102,084 | | | 41,099 | |

| Total operating expenses | | 106,240 | | | 47,439 | | | 278,079 | | | 158,688 | |

| Loss from operations | | (57,344) | | | (14,031) | | | (107,212) | | | (46,548) | |

| Interest income | | 178 | | | 856 | | | 1,628 | | | 3,287 | |

| Interest expense | | (452) | | | (391) | | | (1,549) | | | (5,236) | |

| Other expense, net | | (697) | | | (198) | | | (279) | | | (2,561) | |

| Loss before income tax expense (benefit) | | (58,315) | | | (13,764) | | | (107,412) | | | (51,058) | |

| Income tax expense (benefit) | | (12,611) | | | 309 | | | (11,480) | | | 492 | |

| Net loss | | $ | (45,704) | | | $ | (14,073) | | | $ | (95,932) | | | $ | (51,550) | |

| Net loss per share attributable to common stockholders, basic and diluted | | $ | (0.40) | | | $ | (0.15) | | | $ | (0.93) | | | $ | (0.75) | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | | 112,902 | | | 94,045 | | | 103,552 | | | 68,350 | |

__________

(1)Includes stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Year ended

December 31, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Cost of revenue | | $ | 1,255 | | | $ | 535 | | | $ | 3,889 | | | $ | 1,410 | |

| Research and development | | 7,017 | | | 806 | | | 17,112 | | | 2,920 | |

| Sales and marketing | | 5,275 | | | 1,603 | | | 17,028 | | | 3,497 | |

| General and administrative | | 16,134 | | | 1,651 | | | 26,404 | | | 4,318 | |

| Total | | $ | 29,681 | | | $ | 4,595 | | | $ | 64,433 | | | $ | 12,145 | |

Condensed Consolidated Balance Sheets

(in thousands, unaudited)

| | | | | | | | | | | | | | |

| | As of December 31, 2020 | | As of December 31, 2019 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 62,900 | | | $ | 16,142 | |

| Marketable securities | | 131,283 | | | 114,967 | |

| Accounts receivable, net | | 50,258 | | | 37,136 | |

| Restricted cash | | 87 | | | 70,087 | |

| Prepaid expenses and other current assets | | 16,728 | | | 10,991 | |

| Total current assets | | 261,256 | | | 249,323 | |

| Property and equipment, net | | 95,979 | | | 60,037 | |

| Operating lease right-of-use assets, net | | 60,019 | | | — | |

| Goodwill | | 578,235 | | | 372 | |

| Intangible assets, net | | 121,742 | | | 1,125 | |

| Other assets | | 45,365 | | | 10,112 | |

| Total assets | | $ | 1,162,596 | | | $ | 320,969 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 9,150 | | | $ | 4,602 | |

| Accrued expenses | | 34,334 | | | 19,878 | |

| Finance lease liabilities | | 11,033 | | | 4,472 | |

| Operating lease liabilities | | 19,895 | | | — | |

| Other current liabilities | | 19,677 | | | 8,169 | |

| Total current liabilities | | 94,089 | | | 37,121 | |

| Long-term debt, less current portion | | — | | | 20,081 | |

| Finance lease liabilities, noncurrent | | 14,707 | | | 5,077 | |

| Operating lease liabilities, noncurrent | | 44,890 | | | — | |

| Other long-term liabilities | | 4,400 | | | 1,038 | |

| Total liabilities | | 158,086 | | | 63,317 | |

| Stockholders’ equity: | | | | |

| Class A and Class B common stock | | 2 | | | 2 | |

| Additional paid-in capital | | 1,292,695 | | | 449,463 | |

| Accumulated other comprehensive income | | 6 | | | 196 | |

| Accumulated deficit | | (288,193) | | | (192,009) | |

| Total stockholders’ equity | | 1,004,510 | | | 257,652 | |

| Total liabilities and stockholders’ equity | | $ | 1,162,596 | | | $ | 320,969 | |

Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)

| | | | | | | | | | | | | | |

| | Year ended

December 31, |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (95,932) | | | $ | (51,550) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization | | 19,979 | | | 16,553 | |

| Amortization of acquired intangibles | | 5,078 | | | — | |

| Amortization of right-of-use assets and other | | 21,765 | | | — | |

| Amortization of deferred rent | | — | | | (711) | |

| Amortization of debt issuance costs | | 219 | | | 1,909 | |

| Amortization of deferred contract costs | | 3,516 | | | 2,294 | |

| Stock-based compensation | | 64,433 | | | 12,145 | |

| Provision for doubtful accounts | | 1,719 | | | 360 | |

| Change in fair value of preferred stock warrant liabilities | | — | | | 2,404 | |

| Interest paid on capital leases | | (688) | | | (364) | |

| Loss on disposal of property and equipment | | 653 | | | 108 | |

| Tax benefit related to release of valuation allowance | | (13,154) | | | — | |

| Other adjustments | | 624 | | | (591) | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable | | (9,264) | | | (12,767) | |

| Prepaid expenses and other current assets | | (5,550) | | | (2,666) | |

| Other assets | | (17,162) | | | (3,945) | |

| Accounts payable | | 4,059 | | | 2,391 | |

| Accrued expenses | | 12,992 | | | 4,401 | |

| Operating lease liabilities | | (18,264) | | | — | |

| Other liabilities | | 5,061 | | | (1,274) | |

| Net cash used in operating activities | | (19,916) | | | (31,303) | |

| Cash flows from investing activities: | | | | |

| Purchase of marketable securities | | (269,059) | | | (190,980) | |

| Sale of marketable securities | | 143,241 | | | 52,589 | |

| Maturities of marketable securities | | 88,719 | | | 70,813 | |

| Business acquisitions, net of cash acquired | | (200,988) | | | — | |

| Proceeds from sale of property and equipment | | 575 | | | — | |

| Purchases of property and equipment | | (31,228) | | | (14,609) | |

| Capitalized internal-use software | | (6,131) | | | (4,856) | |

| Purchases of intangible assets | | (1,811) | | | (635) | |

| Net cash used in investing activities | | (276,682) | | | (87,678) | |

| Cash flows from financing activities: | | | | |

| Proceeds from initial public offering, net of underwriting discounts | | — | | | 192,510 | |

| Payments of costs related to initial public offering | | — | | | (5,469) | |

| Proceeds from follow-on public offering, net of underwriting fees | | 274,896 | | | — | |

| Payments of costs related to follow-on public offering | | (675) | | | — | |

| Proceeds from borrowings under notes payable | | — | | | 20,300 | |

| Payments of debt issuance costs | | — | | | (231) | |

| Repayments of notes payable | | (20,300) | | | (49,167) | |

| Repayments of capital leases | | (4,114) | | | (1,370) | |

| Proceeds from Employee Stock Purchase Plan | | 9,318 | | | 5,402 | |

| Proceeds from exercise of vested stock options | | 15,273 | | | 5,579 | |

| Proceeds from early exercise of stock options | | — | | | 520 | |

| Proceeds from payment of stockholder note | | — | | | 74 | |

| Net cash provided by financing activities | | 274,398 | | | 168,148 | |

| Effects of exchange rate changes on cash, cash equivalents, and restricted cash | | (149) | | | 99 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | | (22,349) | | | 49,266 | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 86,229 | | | 36,963 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 63,880 | | | $ | 86,229 | |

Condensed Consolidated Statements of Cash Flows—Continued

(in thousands, unaudited)

| | | | | | | | | | | | | | |

| | Year ended

December 31, |

| | 2020 | | 2019 |

| Supplemental disclosure of cash flow information: | | | | |

| Cash paid for interest | | $ | 1,590 | | | $ | 5,422 | |

| Cash paid for income taxes, net of refunds received | | $ | 1,219 | | | $ | 361 | |

| Property and equipment additions not yet paid in cash | | $ | 3,184 | | | $ | 7,071 | |

| Vesting of early-exercised stock options | | $ | 467 | | | $ | 620 | |

| Capital lease outstanding from current year addition | | $ | — | | | $ | 7,380 | |

| Change in other assets from change in accounting principle | | $ | — | | | $ | 5,727 | |

| Conversion of convertible preferred stock warrants into common stock warrants | | $ | — | | | $ | 5,665 | |

| Cashless exercise of common stock warrants | | $ | 1,557 | | | $ | 1,036 | |

| Costs related to the initial public offering, accrued but not yet paid | | $ | — | | | $ | 130 | |

| Stock-based compensation capitalized to internal-use software | | $ | 2,034 | | | $ | 441 | |

| Assets obtained in exchange for operating lease obligations | | $ | 23,827 | | | $ | — | |

| Assets obtained in exchange for finance lease obligations | | $ | 22,541 | | | $ | — | |

| Fair value of common stock issued as consideration for a business combination | | $ | 479,077 | | | $ | — | |

| | | | |

| Reconciliation of cash, cash equivalents, and restricted cash as shown in the statements of cash flows | | | | |

| Cash and cash equivalents | | $ | 62,900 | | | $ | 16,142 | |

| Restricted cash in prepaid and other current assets | | 87 | | | 70,087 | |

| Restricted cash included in other assets | | 893 | | | — | |

Total cash, cash equivalents, and restricted cash

| | $ | 63,880 | | | $ | 86,229 | |

Free Cash Flow

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | Year ended | | Quarter ended | | Year ended |

| | Q1 2019 | | Q2 2019 | | Q3 2019 | | Q4 2019 | | 2019 | | Q1 2020 | | Q2 2020 | | Q3 2020 | | Q4 2020 | | 2020 |

| | | | | | | | | | | | | | | | | | | | |

| Cash flow provided by (used in) operations | | $ | (10,083) | | | $ | (5,565) | | | $ | (12,595) | | | $ | (3,060) | | | $ | (31,303) | | | $ | (7,186) | | | $ | (8,781) | | | $ | 27,200 | | | $ | (31,149) | | | $ | (19,916) | |

Capital expenditures(1) | | (4,784) | | | (4,445) | | | (4,389) | | | (5,847) | | | (19,465) | | | (11,658) | | | (3,073) | | | (13,794) | | | (8,834) | | | (37,359) | |

| Free Cash Flow | | $ | (14,867) | | | $ | (10,010) | | | $ | (16,984) | | | $ | (8,907) | | | $ | (50,768) | | | $ | (18,844) | | | $ | (11,854) | | | $ | 13,406 | | | $ | (39,983) | | | $ | (57,275) | |

__________

(1)Capital expenditures are defined as cash used for purchases of property and equipment and capitalized internal-use software, as reflected in our statements of cash flows.

Reconciliation of GAAP to Non-GAAP Financial Measures

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Year ended

December 31, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Gross Profit | | | | | | | | |

| GAAP gross Profit | | $ | 48,896 | | | $ | 33,408 | | | $ | 170,867 | | | $ | 112,140 | |

| Stock-based compensation—Cost of revenue | | 1,255 | | | 535 | | | 3,889 | | | 1,410 | |

| Amortization of acquired intangible assets | | 2,475 | | | — | | | 2,475 | | | — | |

| Non-GAAP gross profit | | $ | 52,626 | | | $ | 33,943 | | | $ | 177,231 | | | $ | 113,550 | |

| GAAP gross margin | | 59.2 | % | | 56.7 | % | | 58.7 | % | | 55.9 | % |

| Non-GAAP gross margin | | 63.7 | % | | 57.6 | % | | 60.9 | % | | 56.6 | % |

| | | | | | | | |

| Research and development | | | | | | | | |

| GAAP research and development | | $ | 25,590 | | | $ | 12,951 | | | $ | 74,814 | | | $ | 46,492 | |

| Stock-based compensation | | (7,017) | | | (806) | | | (17,112) | | | (2,920) | |

| Non-GAAP research and development | | $ | 18,573 | | | $ | 12,145 | | | $ | 57,702 | | | $ | 43,572 | |

| | | | | | | | |

| Sales and marketing | | | | | | | | |

| GAAP sales and marketing | | $ | 34,765 | | | $ | 21,592 | | | $ | 101,181 | | | $ | 71,097 | |

| Stock-based compensation | | (5,275) | | | (1,603) | | | (17,028) | | | (3,497) | |

| Amortization of acquired intangible assets | | (2,603) | | | — | | | (2,603) | | | — | |

| Non-GAAP sales and marketing | | $ | 26,887 | | | $ | 19,989 | | | $ | 81,550 | | | $ | 67,600 | |

| | | | | | | | |

| General and administrative | | | | | | | | |

| GAAP general and administrative | | $ | 45,885 | | | $ | 12,896 | | | $ | 102,084 | | | $ | 41,099 | |

| Stock-based compensation | | (16,134) | | | (1,651) | | | (26,404) | | | (4,318) | |

| Acquisition-related expenses | | (13,625) | | | — | | | (20,783) | | | — | |

| Non-GAAP general and administrative | | $ | 16,126 | | | $ | 11,245 | | | $ | 54,897 | | | $ | 36,781 | |

| | | | | | | | |

| Operating loss | | | | | | | | |

| GAAP operating loss | | $ | (57,344) | | | $ | (14,031) | | | $ | (107,212) | | | $ | (46,548) | |

| Stock-based compensation | | 29,681 | | | 4,595 | | | 64,433 | | | 12,145 | |

| Amortization of acquired intangible assets | | 5,078 | | | — | | | 5,078 | | | — | |

| Acquisition-related expenses | | 13,625 | | | — | | | 20,783 | | | — | |

| Non-GAAP operating loss | | $ | (8,960) | | | $ | (9,436) | | | $ | (16,918) | | | $ | (34,403) | |

| | | | | | | | |

| Net loss | | | | | | | | |

| GAAP net loss | | $ | (45,704) | | | $ | (14,073) | | | $ | (95,932) | | | $ | (51,550) | |

| Stock-based compensation | | 29,681 | | | 4,595 | | | 64,433 | | | 12,145 | |

| Amortization of acquired intangible assets | | 5,078 | | | — | | | 5,078 | | | — | |

| Acquisition-related expenses | | 13,625 | | | — | | | 20,783 | | | — | |

| Acquisition-related tax benefit | | (13,154) | | | — | | | (13,154) | | | — | |

| Interest expense—acceleration of deferred debt costs due to early repayment | | — | | | — | | | — | | | 1,785 | |

| Other expense—mark-to-market warrant liability | | — | | | — | | | — | | | 2,404 | |

| Non-GAAP net loss | | $ | (10,474) | | | $ | (9,478) | | | $ | (18,792) | | | $ | (35,216) | |

| | | | | | | | |

| Non-GAAP net loss per common share—basic and diluted | | $ | (0.09) | | | $ | (0.10) | | | $ | (0.18) | | | $ | (0.52) | |

| Weighted average basic and diluted common shares | | 112,902 | | | 94,045 | | | 103,552 | | | 68,350 | |

| | | | | | | | |

| Adjusted EBITDA | | | | | | | | |

| GAAP net loss | | $ | (45,704) | | | $ | (14,073) | | | $ | (95,932) | | | $ | (51,550) | |

| Stock-based compensation | | 29,681 | | | 4,595 | | | 64,433 | | | 12,145 | |

| Depreciation and other amortization | | 5,568 | | | 4,860 | | | 19,979 | | | 16,553 | |

| Amortization of acquired intangible assets | | 5,078 | | | — | | | 5,078 | | | — | |

| Interest income | | (178) | | | (856) | | | (1,628) | | | (3,287) | |

| Interest expense | | 452 | | | 391 | | | 1,549 | | | 5,236 | |

| Other (income) expense, net | | 697 | | | 198 | | | 279 | | | 2,561 | |

| Income taxes | | 543 | | | 309 | | | 1,674 | | | 492 | |

| Acquisition-related expenses | | 13,625 | | | — | | | 20,783 | | | — | |

| Acquisition-related tax benefit | | (13,154) | | | — | | | (13,154) | | | — | |

| Adjusted EBITDA | | $ | (3,392) | | | $ | (4,576) | | | $ | 3,061 | | | $ | (17,850) | |