Blue Wolf Investor Presentation April 2013

[ 1 ] FORWARD - LOOKING INFORMATION Some of the statements in this presentation may constitute forward - looking statements . Words such as “believe,” “expect,” “anticipate,” “project,” “target,” “optimistic,” “intend,” “aim,” “will” or similar expressions are intended to identify forward - looking statements . Forward - looking statements include, but are not limited to : statements about the benefits of a transaction involving Blue Wolf and Li 3 Energy, Inc .; Blue Wolf’s and Li 3 Energy’s plans, objectives, expectations and intentions ; the expected timing of completion of a definitive agreement or the business combination ; and other statements relating to the foregoing that are not historical facts . Forward - looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties . There can be no assurance that actual results will not materially differ from expectations . Important factors could cause actual results to differ materially from those indicated by such forward - looking statements . These factors, as well as the risks associated with the proposed extension of Blue Wolf’s existence, are identified and discussed in the Schedule TO that Blue Wolf has filed with the Securities and Exchange Commission (the “SEC”) in connection with its tender offer for up to 7 , 006 , 515 of its ordinary shares and in Blue Wolf’s reports filed or to be filed with the SEC, which are or will be available at the SEC’s website at www . sec . gov . Forward - looking statements included in this release speak only as of the date of this presentation . If any of these risks or uncertainties materializes or if any assumptions prove incorrect, results could differ materially from those expressed by such forward - looking statements . Blue Wolf undertakes and assumes no obligation, and does not intend, to update these forward - looking statements, except as required under applicable securities laws . This presentation is for informational purposes only and does not constitute an offer to purchase nor a solicitation of an offer to sell ordinary shares of Blue Wolf . The solicitation of offers to buy ordinary shares of Blue Wolf will only be made pursuant to the Offer to Purchase, dated March 20 , 2013 (as amended or supplemented), the Letter of Transmittal and other related documents that Blue Wolf has sent to its shareholders . The tender offer materials contain important information that should be read carefully before any decision is made with respect to the tender offer . Those materials have been and as required, will continue to be, distributed by Blue Wolf to Blue Wolf’s shareholders at no expense to them . In addition, all of those materials (and all other tender offer documents filed with the SEC) will be available at no charge on the SEC’s website at www . sec . gov and from Morrow & Co . , LLC, Blue Wolf’s information agent for the tender offer . Strictly Private and Confidential Disclaimer

[ 2 ] Li3 (OTCBB: LIEG) is a US - listed exploration stage public company in the lithium and mining sector with lithium brine deposits and projects in Chile Pursuant to the MOU, BW intends to merge a wholly - owned subsidiary with and into Li3 - The merger will provide funds for the development of Li3’s projects in Chile and position the company as a consolidator in the global lithium mining industry At this time, BW is seeking shareholder approval to amend and restate its memorandum and articles of association (“Charter”) and to amend its trust agreement (the “Amendments”) - BW has launched a proxy solicitation in order to obtain shareholder approval for the Amendments that will eliminate certain restrictions and give BW more time to effect a business combination - Concurrent with the proxy solicitation, BW is conducting a tender offer (the “Extension Tender Offer”) for up to 7,006,515 of its ordinary shares at $9.97/share of cash from BW’s trust account - Approval of the shareholder proposals and completion of the Extension Tender Offer will satisfy the Extension Conditions of the MOU The Amendments and the MOU have received unanimous approval by the Board of Directors of BW; The Board of Directors recommends that shareholders: 1) Vote in favor of the proposed Amendments in the proxy statement 2) D o NOT tender shares for cash in the concurrent tender offer Strictly Private and Confidential On March 20, 2013 Blue Wolf Mongolia Holdings Corp. (“BW”) announced the execution of a Memorandum of Understanding (“MOU”) for a business combination with Li3 Energy, Inc. (“Li3”) Transaction Overview

[ 3 ] Li3 (OTCBB: LIEG), a Nevada corporation, is a South America - based exploration stage company in the lithium mining and energy sector - Currently focused on exploring, developing and commercializing its 60% controlling interest in its flagship Maricunga Project located in the northeast section of the Salar de Maricunga in Region III of Atacama in northern Chile - Assets consist of 6,338 hectares of prospective Chilean land holdings, including 1,438 hectares located within Salar de Maricunga - Completed an NI 43 - 101 Compliant Measured Resource Report for the Maricunga Project in May 2012 - Li3 believes it is one of the only companies with an advanced stage lithium and potassium project within Salar de Maricunga Li3’s goals are to: - Advance the Maricunga Project to the Feasibility Stage - Support the global implementation of clean and green energy initiatives - Meet the growing demand for lithium - Become a low cost supplier of lithium, potassium nitrate and other strategic minerals, serving global clients in the energy, fertilizer and specialty chemical industries Additional information regarding Li3 can be found in its filings with the SEC as well as on its website at www.li3energy.com - None of the information on Li3’s website shall be deemed to be part of this presentation Strictly Private and Confidential Li3 is strategically positioned to become an emerging lithium producer and a consolidator in the lithium industry Li3 Energy

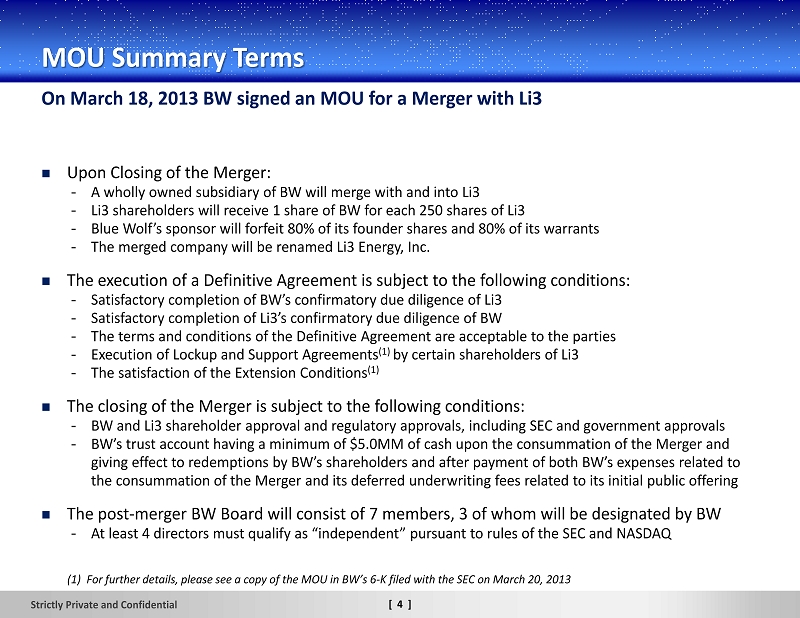

[ 4 ] Upon Closing of the Merger: - A wholly owned subsidiary of BW will merge with and into Li3 - Li3 shareholders will receive 1 share of BW for each 250 shares of Li3 - Blue Wolf’s sponsor will forfeit 80% of its founder shares and 80% of its warrants - The merged company will be renamed Li3 Energy, Inc. The execution of a Definitive Agreement is subject to the following conditions: - Satisfactory completion of BW’s confirmatory due diligence of Li3 - Satisfactory completion of Li3’s confirmatory due diligence of BW - The terms and conditions of the Definitive Agreement are acceptable to the parties - Execution of Lockup and Support Agreements (1) by certain shareholders of Li3 - The satisfaction of the Extension Conditions (1) The closing of the Merger is subject to the following conditions: - BW and Li3 shareholder approval and regulatory approvals, including SEC and government approvals - BW’s t rust account having a minimum of $5.0MM of cash upon the consummation of the Merger and giving effect to redemptions by BW’s shareholders and after payment of both BW’s expenses related to the consummation of the Merger and its deferred underwriting fees related to its initial public offering The post - merger BW Board will consist of 7 members, 3 of whom will be designated by BW - At least 4 directors must qualify as “independent” pursuant to rules of the SEC and NASDAQ Strictly Private and Confidential On March 18, 2013 BW signed an MOU for a Merger with Li3 MOU Summary Terms (1) For further details, please see a copy of the MOU in BW’s 6 - K filed with the SEC on March 20, 2013

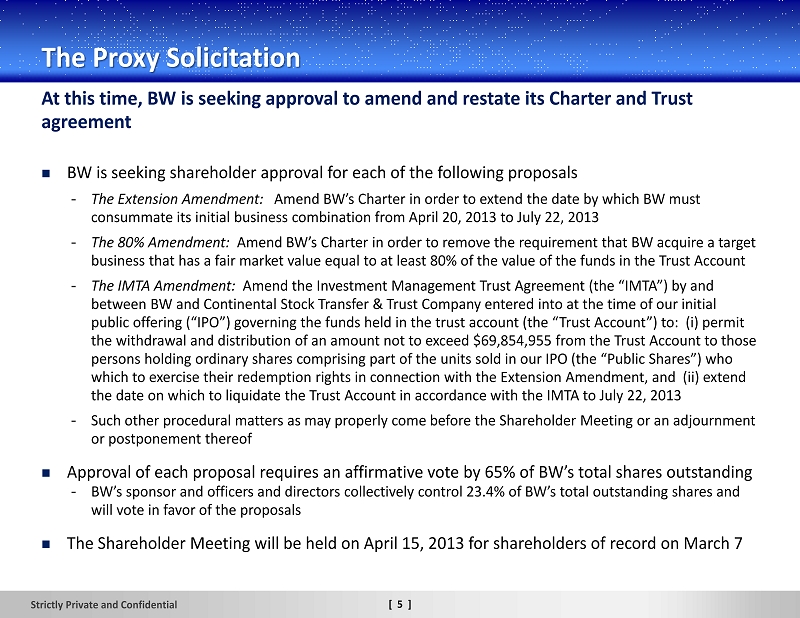

[ 5 ] BW is seeking shareholder approval for each of the following proposals - The Extension Amendment: Amend BW’s Charter in order to extend the date by which BW must consummate its initial business combination from April 20, 2013 to July 22, 2013 - The 80% Amendment: Amend BW’s Charter in order to remove the requirement that BW acquire a target business that has a fair market value equal to at least 80% of the value of the funds in the Trust Account - The IMTA Amendment: Amend the Investment Management Trust Agreement (the “IMTA”) by and between BW and Continental Stock Transfer & Trust Company entered into at the time of our initial public offering (“IPO”) governing the funds held in the trust account (the “Trust Account”) to: (i) permit the withdrawal and distribution of an amount not to exceed $69,854,955 from the Trust Account to those persons holding ordinary shares comprising part of the units sold in our IPO (the “Public Shares”) who which to exercise their redemption rights in connection with the Extension Amendment, and (ii) extend the date on which to liquidate the Trust Account in accordance with the IMTA to July 22, 2013 - Such other procedural matters as may properly come before the Shareholder Meeting or an adjournment or postponement thereof Approval of each proposal requires an affirmative vote by 65% of BW’s total shares outstanding - BW’s sponsor and officers and directors collectively control 23.4% of BW’s total outstanding shares and will vote in favor of the proposals The Shareholder Meeting will be held on April 15, 2013 for shareholders of record on March 7 Strictly Private and Confidential At this time, BW is seeking approval to amend and restate its Charter and Trust agreement The Proxy Solicitation

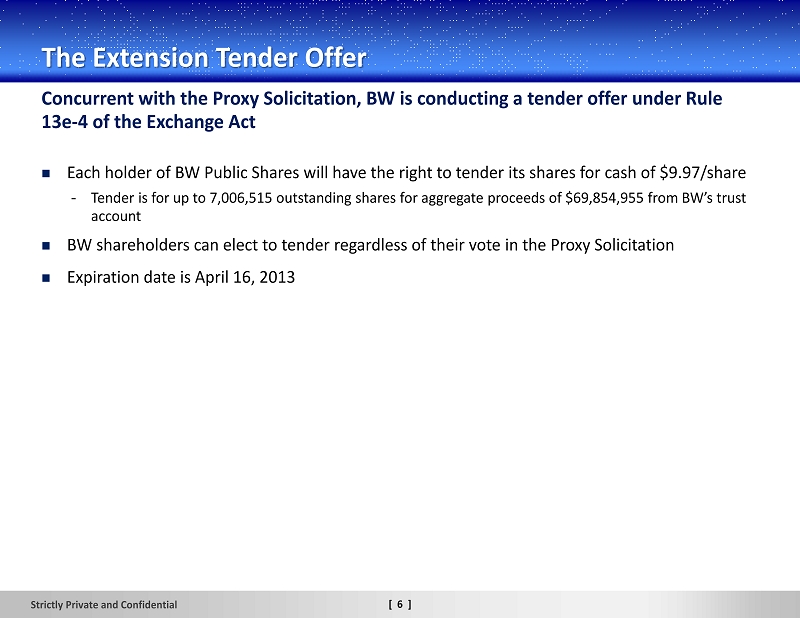

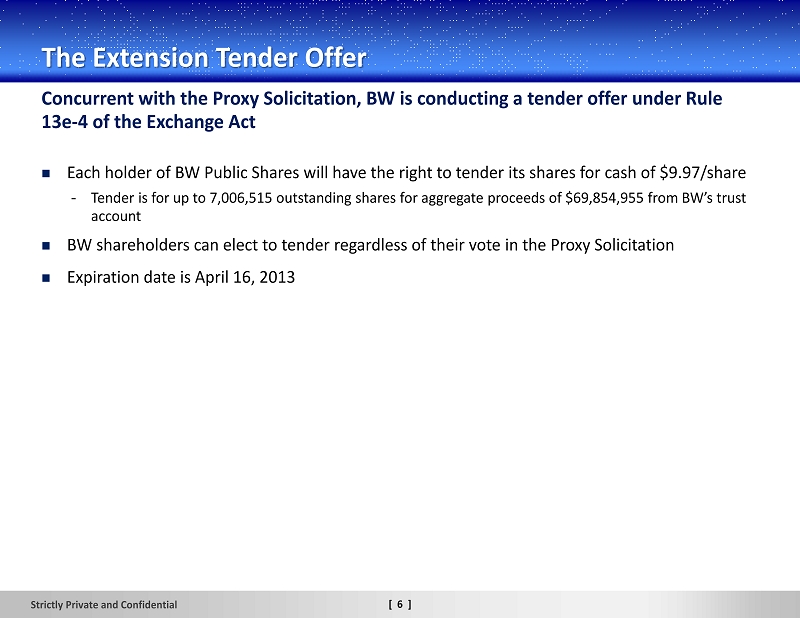

[ 6 ] E ach holder of BW Public Shares will have the right to tender its shares for cash of $9.97/share - Tender is for up to 7,006,515 outstanding shares for aggregate proceeds of $69,854,955 from BW’s trust account BW shareholders can elect to tender regardless of their vote in the Proxy Solicitation Expiration date is April 16, 2013 Strictly Private and Confidential Concurrent with the Proxy Solicitation, BW is conducting a tender offer under Rule 13e - 4 of the Exchange Act The Extension Tender Offer

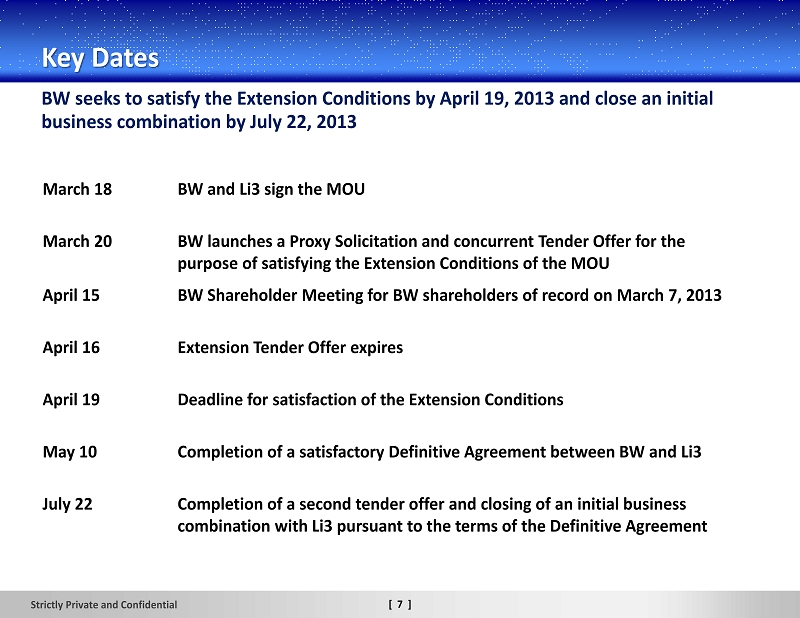

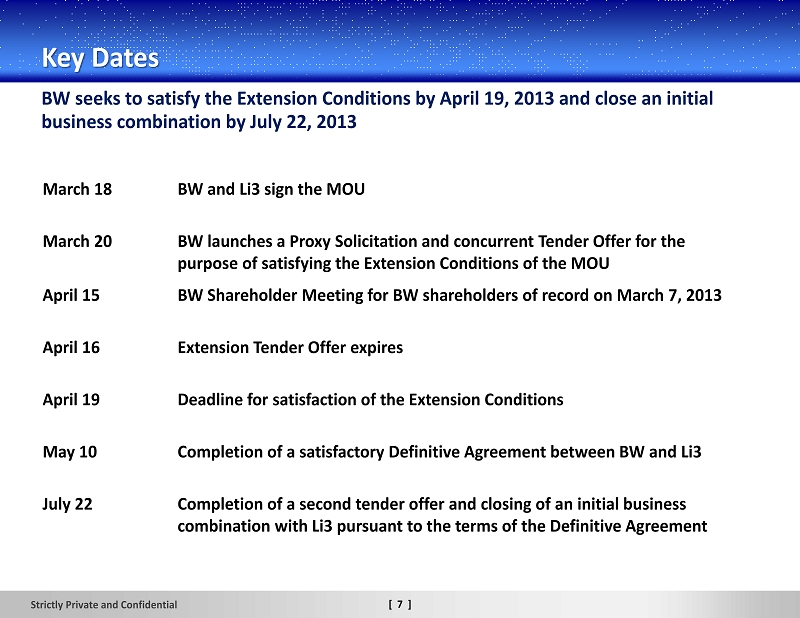

[ 7 ] Strictly Private and Confidential BW seeks to satisfy the Extension Conditions by April 19, 2013 and close an initial business combination by July 22, 2013 Key Dates March 18 BW and Li3 sign the MOU March 20 BW launches a Proxy Solicitation and concurrent Tender Offer for the purpose of satisfying the Extension Conditions of the MOU April 15 BW Shareholder Meeting for BW shareholders of record on March 7, 2013 April 16 Extension Tender Offer expires April 19 Deadline for satisfaction of the Extension Conditions May 10 Completion of a satisfactory Definitive Agreement between BW and Li3 July 22 Completion of a second tender offer and closing of an initial business combination with Li3 pursuant to the terms of the Definitive Agreement

[ 8 ] Lee O. Kraus, CEO & Chairman Phone: (203) 622 - 4903 Information Agent: Morrow & Co., LLC 470 West Avenue, 3rd Floor Stamford, Connecticut 06902 Telephone: (800) 662 - 5200 Banks and Brokerage Firms: (203) 685 - 9400 mngl.info@morrowco.com Strictly Private and Confidential For more information, please contact: Contacts

Blue Wolf Investor Presentation April 2013