Exhibit (a)(1)(F)

Amended and Restated Offer to Purchase for Cash

by

BLUE WOLF MONGOLIA HOLDINGS CORP.

of

Up to 1,467,970 of its Ordinary Shares

at a Purchase Price of $9.97 Per Share

In Connection with its Consummation of a Proposed Business Combination

| THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 11:59 P.M., NEW YORK CITY TIME, |

| ON THURSDAY, JULY 11, 2013 UNLESS THE OFFER IS EXTENDED. |

If you support Blue Wolf Mongolia Holdings Corp.’s proposed acquisition of Li3 Energy, Inc.,

do not tender your Ordinary Shares in the Offer because if more than 1,467,970 Ordinary Shares

are tendered in the Offer, we will not be able to consummate the Transaction.

Blue Wolf Mongolia Holdings Corp., a British Virgin Islands business company limited by shares (“Blue Wolf,” “we,” “us” or “our”) hereby offers to purchase up to 1,467,970 of Blue Wolf’s issued and outstanding ordinary shares, no par value (the “Ordinary Shares”), at a purchase price of $9.97 per share, net to the seller in cash, without interest (the “Share Purchase Price” or “Purchase Price”), for a total Purchase Price of up to $14,635,661 upon the terms and subject to certain conditions described in this Amended and Restated Offer to Purchase for Cash (the “Offer to Purchase”) and in the amended and restated letter of transmittal for the Ordinary Shares (the “Letter of Transmittal”) (which, together with this Offer to Purchase as they may be amended or supplemented from time to time, constitute the “Offer”). In accordance with the rules of the Securities and Exchange Commission (the “SEC”), in the event that more than 1,467,970 Ordinary Shares are so tendered, we may, and we expressly reserve our right to, accept for payment an additional amount of shares not to exceed 2% of our issued and outstanding Ordinary Shares without amending the Offer or extending the Expiration Date (such amount, the “2% Increase”). However, if more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, and we do not exercise our right pursuant to the 2% Increase to purchase additional Ordinary Shares, or if we are unable to satisfy the Merger Condition (as defined herein), we may amend, terminate or extend the Offer.Accordingly, there will be no proration in the event that more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn in the Offer. If we terminate the Offer, we will NOT: (i) purchase any Ordinary Shares pursuant to the Offer or (ii) consummate the Transaction (as defined below) in accordance with the terms of the Agreement and Plan of Merger described in this Offer to Purchase.

The Share Purchase Price of $9.97 is equal to the per share amount of the Ordinary Shares sold in our initial public offering (“IPO”) on deposit in the trust account established to hold the proceeds of our IPO (the “Trust Account”) as of two business days prior to the commencement of the Offer. See “The Offer — Number of Ordinary Shares; Share Purchase Price; No Proration.”

The Offer is being made pursuant to the terms of an Agreement and Plan of Merger dated as of May 21, 2013 (as may be amended from time-to-time, the “Agreement and Plan of Merger”), by and among Blue Wolf, Blue Wolf Acquisition Sub, Inc., a wholly owned subsidiary of Blue Wolf (“Merger Sub”), and Li3 Energy, Inc.,a Nevada corporation (“Li3”)pursuant to which, subject to the terms, conditions, and transactions contemplated therein including, but not limited to approval by Li3’s shareholders of such transaction, Merger Sub will merge with and into Li3(the “Transaction”). Pursuant to its Amended and Restated Memorandum and Articles of Association (the “Charter”), Blue Wolf is required, in connection with its business combination, to provide all holders of its Ordinary Shares with the opportunity to redeem their Ordinary Shares through a tender offer pursuant to the tender offer rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Offer is being made to provide Blue Wolf shareholders with such opportunity to redeem their Ordinary Shares. Upon consummation of the Transaction, Blue Wolf intends to change its name to “Li3 Energy Corp.” by resolution of its board. See “The Offer — Purpose of the Offer; Certain Effects of the Offer.”

Li3 will separately solicit its shareholders for approval of the Transaction. Blue Wolf will file a Registration Statement on Form F-4 with the Securities and Exchange Commission (“SEC”) to register the distribution of the Ordinary Shares issuable by Blue Wolf to Li3’s stockholders. The Registration Statement, which shall include a proxy statement/prospectus for Li3’s stockholders, must be declared effective by the SEC before the Transaction can be approved by Li3’s shareholders.

THE OFFER IS CONDITIONED ON SATISFACTION OF THE MAXIMUM TENDER CONDITION AND THE MERGER CONDITION (EACH AS FURTHER DESCRIBED IN THIS OFFER TO PURCHASE) AND CERTAIN OTHER CONDITIONS. SEE “THE OFFER — CONDITIONS OF THE OFFER.”

Only Ordinary Shares validly tendered and not properly withdrawn will be purchased pursuant to the Offer. Ordinary Shares tendered pursuant to the Offer but not purchased in the Offer will be returned at our expense promptly following the expiration of the Offer. See “The Offer — Procedures for Tendering Shares.”

We will fund the purchase of Ordinary Shares in the Offer with cash available to us from the Trust Account. Except as otherwise set forth in the Agreement and Plan of Merger, all expenses (including, without limitation, each party’s respective legal, accounting and roadshow travel expenses) incurred in connection with the Agreement and Plan of Merger and the transactions contemplated thereby shall be paid by the party incurring such expenses, whether or not the Transaction is consummated. As of April 30, 2013, Blue Wolf had approximately $76,000 of cash and cash equivalents held outside the Trust Account (which amounts reflect the balance of loan proceeds received from the Sponsor). See “The Offer — Source and Amount of Funds.” The Offer is not conditioned on any minimum number of Ordinary Shares being tendered. The Offer is, however, subject to certain other conditions, including the Maximum Tender Condition and the satisfaction of the Merger Condition.See “The Offer — Purchase of Shares and Payment of Purchase Price” and “—Conditions of the Offer.”

Blue Wolf’s Ordinary Shares are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “MNGL.” As of July 3, 2013, the last reported closing price of the Ordinary Shares was $10.00 per share.Shareholders are urged to obtain current market quotations for the Ordinary Shares before deciding whether to tender their Ordinary Shares pursuant to the Offer. See “Price Range of Securities and Dividends.”

We also have outstanding Units comprised of one Ordinary Share and one warrant to acquire one Ordinary Share (a “Warrant” and, together with one Ordinary Share, “Units”). Blue Wolf’s Warrants and Units also are listed on Nasdaq under the symbols “MNGLW” and “MNGLU,” respectively. The Offer is only open for our Ordinary Shares, but not those together as part of our Units. You may tender Ordinary Shares that are included in Units, but to do so you must separate such Ordinary Shares from the Warrants prior to tendering such Ordinary Shares. While this is typically done electronically the same business day, you should allow at least one full business day to accomplish the separation. See “The Offer — Procedures for Tendering Shares.”

Our intention is to consummate the Transaction. Our board of directors has unanimously (i) approved our making the Offer, (ii) declared the advisability of the Transaction and approved the Agreement and Plan of Mergerand the Transaction, and (iii) determined that the Transaction is in the best interests of the shareholders of Blue Wolf and, if consummated, would constitute our initial business combination pursuant to our Charter. If you tender your Ordinary Shares in the Offer, you will not be participating in the Transaction because you will no longer hold such Ordinary Shares in Blue Wolf upon the consummation of the Transaction. Further, if more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, subject to the 2% Increase, we will not be able to consummate the Transaction. See “Price Range of Securities and Dividends” and “The Offer.”

THEREFORE, OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU DONOT ACCEPT THE OFFER WITH RESPECT TO YOUR ORDINARY SHARES.

The members of our board of directors will directly benefit fromthe Transactionand have interests in the Transaction that may be different from, or in addition to, the interests of Blue Wolf shareholders. See “The Transaction — Certain Benefits of Blue Wolf’s Directors and Officers and Others in the Transaction.” You must make your own decision as to whether to tender your Ordinary Shares and, if so, how many Ordinary Shares to tender. In doing so, you should read carefully the information in this Offer to Purchase and in the Letter of Transmittal, including the purposes and effects of the Offer. See “The Offer — Purpose of the Offer; Certain Effects of the Offer.” You should discuss whether to tender your Ordinary Shares with your broker, if any, or other financial advisor. See “Risk Factors” for a discussion of risks that you should consider before participating in the Offer.

Blue Wolf MHC, Ltd., our Sponsor, which is owned by certain of our officers, directors, advisors, their respective affiliates and other non-affiliates, and each of our officers and directors in their individual capacities, has agreed not to tender any Ordinary Shares pursuant to the Offer. See “The Offer — Purpose of the Offer; Certain Effects of the Offer” and “Certain Relationships and Related Transactions — Blue Wolf.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these Ordinary Shares or passed upon the accuracy or adequacy of this Offer to Purchase or related documents. Any representation to the contrary is a criminal offense.

Questions and requests for assistance regarding the Offer may be directed to Morrow & Co., LLC, the information agent for the Offer (the “Information Agent”), at the telephone numbers set forth on the back cover of this Offer to Purchase. You may request additional copies of this Offer to Purchase, the Letter of Transmittal, and the other Offer documents from the Information Agent at the telephone numbers and address on the back cover of this Offer to Purchase. You may also contact your broker, dealer, commercial bank, trust company or nominee for copies of these documents.

July 5, 2013

IMPORTANT

If you desire to tender all or any portion of your Ordinary Shares, you must do one of the following before the Offer expires:

| · | if your Ordinary Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact the nominee and have the nominee tender your Ordinary Shares for you; |

| · | if you hold certificates for Ordinary Shares registered in your own name, you must complete and sign the accompanying Letter of Transmittal according to its instructions and deliver it, together with any required signature guarantees, the certificates for your Ordinary Shares and any other documents required by the Letter of Transmittal, to Continental Stock Transfer & Trust Company (the “Depositary”) at the address shown on the back cover of this Offer to Purchase. Do not send such materials to Blue Wolf or the Information Agent; |

| · | if you are an institution participating in The Depository Trust Company, you must tender your Ordinary Shares according to the procedure for book-entry transfer described in “The Offer — Procedures for Tendering Shares;” or |

| · | if you are the holder of Units and wish to tender Ordinary Shares included in such Units, you must separate the Ordinary Shares from the Units prior to tendering such Ordinary Shares pursuant to the Offer. You must instruct your broker to do so, or if you hold Units registered in your own name, you must contact the Depositary directly and instruct them to do so. If you fail to cause your Ordinary Shares to be separated in a timely manner before the Offer expires, you will likely not be able to validly tender such Ordinary Shares prior to the expiration of the Offer. |

Li3 will separately solicit its shareholders for approval of the Transaction. Blue Wolf will file a Registration Statement on Form F-4 with theSEC to register the distribution of the Merger Consideration Shares issuable by Blue Wolf to Li3’s stockholders. The Registration Statement, which will include a proxy statement/prospectus for Li3’s stockholders, must be declared effective by the SEC before the Transaction can be approved by Li3’s shareholders.

To validly tender Ordinary Shares pursuant to the Offer, other than Ordinary Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must properly complete and duly execute the Letter of Transmittal.

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your Ordinary Shares pursuant to the Offer. You should rely only on the information contained in this Offer to Purchase and in the Letter of Transmittal or to which we have referred you. We have not authorized anyone to provide you with information or to make any representation in connection with the Offer other than those contained in this Offer to Purchase or in the Letter of Transmittal. If anyone makes any recommendation or gives any information or representation regarding the Offer, you must not rely upon that recommendation, information or representation as having been authorized by us, our board of directors, the Depositary or the Information Agent. You should not assume that the information provided in this Offer to Purchase is accurate as of any date other than the date as of which it is shown, or if no date is otherwise indicated, the date of this Offer to Purchase.

Questions and requests for assistance should be directed to Morrow & Co., LLC, the Information Agent for the Offer, at its address and telephone numbers set forth below and on the back cover of this Offer to Purchase. Additional copies of this Offer to Purchase, the Letter of Transmittal, and other materials related to the Offer may also be obtained for free from Morrow & Co., LLC. Copies of this Offer to Purchase, the Letter of Transmittal, and any other material related to the Offer may also be obtained at the website maintained by the Securities and Exchange Commission atwww.sec.gov. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance. See “Where You Can Find More Information.”

Table of Contents

| | Page |

| Summary Term Sheet and Questions and Answers | 1 |

| Forward-Looking Statements | 11 |

| Risk Factors | 12 |

| Information About the Companies | 25 |

| Selected Historical Financial Information | 26 |

| Selected Unaudited Condensed Combined Pro Forma Financial Information | 29 |

| Comparative Share Information | 31 |

| The Transaction | 32 |

| The Agreement and Plan of Merger | 38 |

| Related Agreements | 43 |

| The Offer | 44 |

| Description of Securities | 57 |

| Material Differences in the Rights of Blue Wolf Shareholders Following the Transaction | 68 |

| Price Range of Securities and Dividends | 69 |

| Business of Blue Wolf | 72 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations of Blue Wolf | 75 |

| Management of Blue Wolf | 78 |

| Business of Li3 | 83 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations of Li3 | 99 |

| Management of Li3 | 110 |

| Executive Compensation of Li3 | 115 |

| Management Following the Transaction | 121 |

| Unaudited Condensed Combined Pro Forma Financial Statements | 124 |

| Beneficial Ownership of Securities | 128 |

| Certain Relationships and Related Transactions | 131 |

| Appraisal Rights | 134 |

| Where You Can Find More Information | 134 |

| Index to Financial Statements | F-1 |

Annex I — Agreement and Plan of Merger, dated as of May 21, 2013 by and among Blue Wolf Mongolia Holdings Corp.,Blue Wolf Acquisition Sub, Inc., a wholly-owned subsidiary of Blue Wolf, and Li3 Energy, Inc.

Certain Definitions

Unless otherwise specified in this Offer to Purchase or the context otherwise requires:

| · | references to “Blue Wolf” are to Blue Wolf Mongolia Holdings Corp., a British Virgin Islands business company; |

| · | references to “Li3” are to Li3 Energy, Inc., a Nevada corporation; |

| · | references to “combined company” are to Blue Wolf andLi3following the Transaction; |

| · | references to “we,” “our” and “us” prior to consummation of the Transaction are to Blue Wolf and Li3, as applicable; and |

| · | References to “we,” “our” and “us” following the consummation of the Transaction are to Blue Wolf and its wholly owned subsidiary, Li3. |

Summary Term Sheet and Questions and Answers

This summary term sheet highlights important information contained in the Blue Wolf Mongolia Holdings Corp., a British Virgin Islands business company limited by shares (“Blue Wolf,” “we,” “us” or “our”), Amended and Restated Offer to Purchase for Cash (the “Offer to Purchase”) the Ordinary Shares (as defined below) and the Transaction (as defined below). To understand the Offer (as defined below) and the Transaction fully and for a more complete description of the terms of the Offer and the Transaction, you should carefully read this entire Offer to Purchase, including any Annexes hereto, and the amended and restated letter of transmittal (the “Letter of Transmittal”), which collectively constitute the “Offer.” We have included references to the sections of this Offer to Purchase where you will find a more complete description of the topics addressed in this summary term sheet.

| Ordinary Shares Subject of the Offer | | Up to 1,467,970 ordinary shares, no par value (the Ordinary Shares”) of Blue Wolf. However, in accordance with the rules of the Securities and Exchange Commission (the “SEC”), in the event that more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, we may, and we expressly reserve our right to, accept for payment an additional amount of shares not to exceed 2% of our issued and outstanding Ordinary Shares without amending the Offer or extending the Expiration Date (such amount, the “2% Increase”), if it permits us to accept for payment all Ordinary Shares validly tendered in this Offer. |

| | | |

| Price Offered Per Ordinary Share | | $9.97 net to the seller in cash, without interest thereon (the “Share Purchase Price” or “Purchase Price”). |

| | | |

| Scheduled Expiration of Offer | | 11:59 p.m., New York City time, on July 11, 2013, unless the Offer is otherwise extended, which may depend on the timing and process of Securities and Exchange Commission (“SEC”) review of this Offer to Purchase and the Registration Statement on Form F-4 to be filed separately by Blue Wolf or terminated (the “Expiration Date”). |

| | | |

| Party Making the Offer | | Blue Wolf Mongolia Holdings Corp. |

For further information regarding the Offer, see “The Offer.”

Who is offering to purchase the Ordinary Shares?

Blue Wolf is offering to purchase the Ordinary Shares. See “Business of Blue Wolf” and “The Offer.”

What Ordinary Shares are sought?

We are offering to purchase up to 1,467,970 outstanding Ordinary Shares validly tendered and not properly withdrawn pursuant to the Offer.However, in accordance with the rules of the SEC, in the event that more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, we may, and we expressly reserve our right to, accept for payment an additional amount of shares pursuant to the 2% Increase without amending the Offer or extending the Expiration Date. Any such purchases would only be made if it permitted us to accept for payment all Ordinary Shares validly tendered in this Offer.

Unless otherwise expressly stated, this Offer to Purchase assumes that no more than 1,467,970 Ordinary Shares will be accepted for payment in this Offer, and that Blue Wolf will not elect to exercise its rights pursuant to the 2% Increase to purchase any additional shares.

Why is the Offer for 1,467,970 Ordinary Shares?

Pursuant to our Charter, Blue Wolf is required, in connection with its business combination, to provide all holders of its Public Shares with the opportunity to redeem their Ordinary Shares through a tender offer pursuant to the tender offer rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Offer is being made to provide Blue Wolf shareholders with such opportunity to redeem their Ordinary Shares in connection with consideration of our initial business combination. See “The Offer — Purpose of the Offer; Certain Effects of the Offer.” Of the approximately $80 million originally held in the trust account (the “Trust Account”) established to hold the proceeds of our initial public offering (the “IPO”), approximately $22.5 million remains therein, after approximately $57.8 million was released from the Trust Account and used to purchase approximately 5.8 million Ordinary Shares tendered by our shareholders in connection with the approval of the amendment of our Amended and Restated Memorandum and Articles of Association (the “Charter”) and the agreement governing the funds in the Trust Account. Also, as contemplated in our IPO prospectus, an aggregate of $2,415,000 of the underwriting commissions were deferred and deposited in the Trust Account, which fees have been modified to provide for a minimum fee of $1.0 million and a maximum fee of up to approximately $1.4 million payable upon consummation of our initial business combination. In addition, as of April 30, 2013, Blue Wolf had approximately $76,000 of cash and cash equivalents on hand outside of the Trust Account (which amounts reflect the balance of loan proceeds received from the Sponsor). Accordingly, $14,635,661 will be available to us to purchase 1,467,970 Ordinary Shares, and consistent with our Charter and the disclosure set forth in our IPO prospectus. As further required by the terms of the Agreement and Plan of Merger, we cannot consummate the Transaction unless the shareholders of Li3 approve the Transaction and retain an amount of cash no less than $5 million after payment of the Purchase Price for shares validly tendered in the Offer and after payment of our expenses. Therefore, and subject to the 2% Increase, if more than 1,467,970 Ordinary Shares (or approximately 34.5% of our publicly held Ordinary Shares) are validly tendered and not properly withdrawn, we will be unable to consummate the Transaction.

What if more than1,467,970 Ordinary Shares are validly tendered in this Offer?

In the event that more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, we may, and we expressly reserve our right to, accept for payment an additional amount of shares pursuant to the 2% Increase without amending the Offer or extending the Expiration Date. Any such purchases would only be made if it permitted us to accept for payment all Ordinary Shares validly tendered in this Offer. However, if more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, and we do not exercise our right pursuant to the 2% Increase to purchase additional Ordinary Shares, or if we are unable to satisfy the Merger Condition (as defined herein), we may amend, terminate or extend the Offer. If we terminate the Offer, we willNOT: (i) purchase any Ordinary Shares pursuant to this Offer or (ii) consummate the Transaction in accordance with the terms of the Agreement and Plan of Merger described in this Offer to Purchase. Ordinary Shares tendered pursuant to the Offer but not purchased in the Offer will be returned at our expense promptly following the expiration or termination of the Offer.

What will be the purchase price for the Ordinary Shares and what will be the form of payment?

The Share Purchase Price for the Offer is $9.97 per share. All Ordinary Shares we purchase pursuant to the Offer will be purchased at the Share Purchase Price. See “The Offer — Number of Ordinary Shares; Share Purchase Price; No Proration.” If your Ordinary Shares are purchased in the Offer, you will be paid the Share Purchase Price, in cash, without interest, promptly after the Expiration Date. Our Charter requires that we offer a price per Ordinary Share equal to the amount held in the Trust Account pending completion by Blue Wolf of an initial business combination as of the date that is two business days prior to commencement of the Offer but net of taxes payable, divided by the 2,255,881 Ordinary Shares sold as part of the Units in our IPO that are still outstanding (the “Public Shares”). Although we do not anticipate any change to the Share Purchase Price, if we need to adjust the Share Purchase Price to comply with our Charter, we will amend the Offer and, if necessary, extend the Expiration Date for at least 10 business days. Under no circumstances will we pay interest on the Share Purchase Price including but not limited to, by reason of any delay in making payment. See “The Offer — Number of Ordinary Shares; Share Purchase Price; No Proration” and “— Purchase of Shares and Payment of Purchase Price.”

Why is Blue Wolf tendering for the Ordinary Shares if Blue Wolf’s board recommends that I DO NOT tender my shares?

Blue Wolf cannot consummate the Transaction if the Maximum Tender Condition is not satisfied. Accordingly, Blue Wolf’s board recommends that youdo not tender your Ordinary Shares so the acquisition of Li3 can be consummated. However, Blue Wolf commenced this Offer to Purchase because Blue Wolf is required pursuant to its Charter to allow shareholders who do not support the Transaction an opportunity to tender their Ordinary Shares to us for purchase.

How is the Offer different from typical tender offers?

Typically an issuer or a third party commencing a tender offer wants to purchase the entire amount of the securities they are offering to purchase.In this case, Blue Wolf does not want its shareholders to tender any Ordinary Shares, and Blue Wolf’s board of directors recommends that existing shareholders not tender their Ordinary Shares after they review this Offer to Purchase. In fact, unlike most tender offers where an offeror’s purchase of securities enables them to consummate a business combination, here, your decision to tender your Ordinary Shares may make it less likely that we can consummate the Transaction with Li3 because if more than 1,467,970 Ordinary Share are validly tendered and not properly withdrawn in the Offer and our rights pursuant to the 2% Increase are not exercised, we will not be able to consummate the Transaction. In essence, the Offer functions as a “reverse” tender offer in which a shareholder can exercise their redemption rights for Ordinary Shares and we will only be able to consummate the Transaction if the Maximum Tender Condition is not satisfied. Accordingly, your decision to tender your Ordinary Shares in the Offer would make it less likely that we will be able to consummate the Transaction.

In addition, unlike a typical tender offer, there will be no proration in the event more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn in the Offer. Assuming no shares are purchased pursuant to the 2% Increase, if more than 1,467,970 Ordinary Shares are validly tendered and not properly withdrawn, we will terminate or extend the Offer. Shareholders have the right, pursuant to our Charter, to a pro rata portion of our Trust Account, absent a business combination, only in the event of our liquidation. Consequently, if we terminate the Offer, we will NOT: (i) purchase any Ordinary Shares pursuant to the Offer or (ii) consummate the Transaction in accordance with the terms of the Agreement and Plan of Merger, and we will promptly return all Ordinary Shares delivered pursuant to the Offer at our expense upon expiration or termination of the Offer.

What is the background of Blue Wolf?

Blue Wolf was formed on March 11, 2011, pursuant to the laws of the British Virgin Islands for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation or contractual control arrangement with, purchasing all or substantially all of the assets of, or engaging in any other similar business combination with one or more operating businesses. Blue Wolf consummated its IPO of 8,050,000 units, each unit consisting of one Ordinary Share and one warrant to purchase one Ordinary Share (a “Warrant” and, together with one Ordinary Share, a “Unit”) on July 20, 2011.The net proceeds of the IPO, together with $3,125,000from Blue Wolf’s sale of 4,166,667 Warrants (the “Sponsor Warrants”) to Blue Wolf MHC Ltd., an exempt company incorporated in the Cayman Islands with limited liability which is owned by certain of our officers, directors, advisors and their respective affiliates (our “Sponsor”), plus deferred underwriting fees in connection with our IPO for an aggregate of approximately $80 million, were deposited in the Trust Account.

On April 15, 2013, Blue Wolf’s shareholders approved the amendment of our Charter to provide an extension of Blue Wolf’s corporate existence until July 22, 2013. Blue Wolf conducted a tender offer, funded with the proceeds then held in the Trust Account, in connection with the Charter amendment, pursuant to which it purchased approximately 5.8 million Public Shares for approximately $57.8 million. As a result, approximately $22.5 million remains in the Trust Account. If Blue Wolf does not consummate its initial business combination by July 22, 2013, it must liquidate the Trust Account to the holders of the Ordinary Shares issued in its IPO and dissolve.

Is there an Agreement and Plan of Merger related to the Offer?

Yes. On May 21, 2013, Blue Wolf and Blue Wolf Acquisition Sub, Inc., a wholly-ownedsubsidiary of Blue Wolf (“Merger Sub”), entered into an Agreement and Plan of Merger (as it may be amended from time to time, the “Agreement and Plan of Merger”) withLi3 Energy, Inc., a Nevada corporation (“Li3”) and, pursuant to which, among other things and subject to the terms and conditions contained in the Agreement and Plan of Merger, Merger Sub will merge with and into Li3 with Li3 surviving. Upon consummation of the Transaction, Blue Wolf intends to change its name to “Li3 Energy Corp.” by resolution of its board. Li3 will be required to obtain its shareholder approval of the Transaction. Blue Wolf will file a Registration Statement on Form F-4 with the SEC to register the distribution of the Ordinary Shares issuable by Blue Wolf to Li3’s stockholders. The Registration Statement, which will include a proxy statement/prospectus for Li3’s stockholders, must be declared effective by the SEC before the Transaction can be approved by Li3’s shareholders. Pursuant to its Charter, Blue Wolf is required, in connection with its business combination, to provide all holders of its Public Shares with the opportunity to redeem their Ordinary Shares through a tender offer pursuant to the tender offer rules promulgated under the Exchange Act. See “The Transaction” and “The Agreement and Plan of Merger.”

Who is Li3?

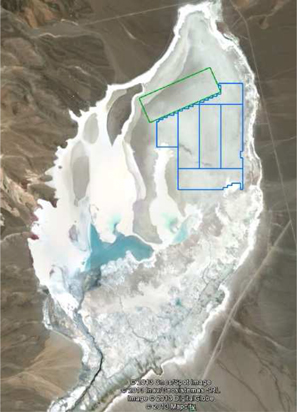

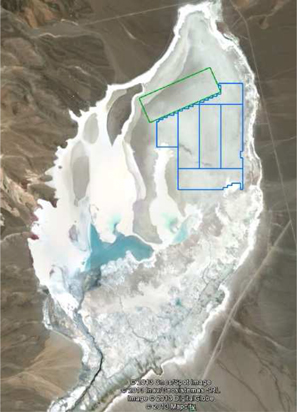

Li3 (OTCBB: LIEG), a Nevada corporation, is a South America-based exploration stage company in the lithium mining and energy sector which files public reports with the SEC. Li3 aims to acquire, develop and commercialize a significant portfolio of lithium brine deposits in the Americas. It is currently focused on exploring, developing and commercializing its 60% controlling interest in its flagship Maricunga Project located in the northeast section of the Salar de Maricunga in Region III of Atacama, in northern Chile. In Chile, its assets consist of 1,888 hectares exploitation mining concessions located within the Salar de Maricunga as well as 4,900 hectares of exploration mining concessions that are strategically located within close proximity to the salar that could serve as potential processing sites for the project. Together, its total Chilean land holdings consist of 6,788 hectares, and it believes it is one of the only companies with an advanced stage lithium and potassium project within the Salar de Maricunga. Li3 plans to continue exploring other synergistic opportunities to further augment and strengthen this property and its land portfolio throughout the region. With the completion of the NI 43–101 Compliant Measured Resource Report in May 2012, Li3’s goals are to: (a) advance Maricunga to the Feasibility Stage; (b) support the global implementation of clean and green energy initiatives; (c) meet growing lithium market demand; and (d) become a mid-tier, low cost supplier of lithium, potassium nitrate, and other strategic minerals, serving global clients in the energy, fertilizer and specialty chemical industries. See “Business of Li3.”

What is the Structure of the Transaction and the Merger Consideration?

Pursuant to the terms of the Agreement and Plan of Merger, among other things, Li3 will seek approval from its stockholders for the Transaction, in which Merger Sub will merge with and into Li3 with Li3 surviving as a wholly-owned subsidiary of Blue Wolf in exchange for consideration in the form of newly-issued Ordinary Shares of Blue Wolf. Concurrently with the Closing, Merger Sub and Li3 will file articles of merger with the Secretary of State of the State of Nevada, in accordance with the relevant provisions of the Nevada Revised Statutes (the “NRS”). The time when the Transaction shall become effective is herein referred to as the “Effective Time.”

In connection with the Transaction, at the Effective Time, Blue Wolf shall cause to be issued to the shareholders of record of Li3 one Ordinary Share for every 250 shares of Li3 common stock owned by them (the “Merger Consideration”). In addition, each option and warrant to purchase shares of Li3 common stock which is outstanding immediately prior to the Effective Time shall be converted into a right to acquire one Ordinary Share for every 250 shares of Li3 common stock subject to each such Li3 option (the “Converted Option”) or warrant (the “Converted Warrant”) and on the same contractual terms and conditions as were in effect immediately prior to the Effective Time.

Li3 will separately solicit its shareholders for approval of the Transaction. Blue Wolf will file a Registration Statement on Form F-4 with theSEC to register the distribution of the Merger Consideration. The Registration Statement, which will include a proxy statement/prospectus for Li3’s stockholders, must be declared effective by the SEC before the Transaction can be approved by Li3’s shareholders.

See “The Transaction,” “The Agreement and Plan of Merger,” “Description of Securities” and “Price Range of Securities and Dividends.”

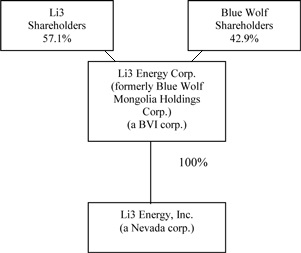

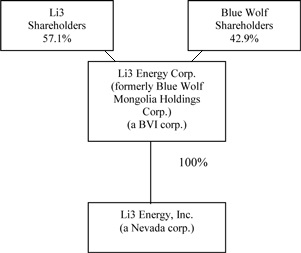

The diagram below depicts our organizational structure immediately following the consummation of the Offer and the Transaction. The voting percentages provided below assume the following: (i) the issuance of 1,581,990 registered Ordinary Shares to Li3 shareholders as the Merger Consideration; (ii)that no Warrants are exercised (including the Sponsor Warrants and the Converted Warrants);(iii) that1,610,000 founder shares and 3,333,333Sponsor Warrants are forfeited pursuant to the Sponsor Agreement; (iv) that no Li3 Options are exercised;and (v) that the maximum number of Ordinary Shares are validly tendered in the Offer.

Are there any restrictions on the transfer of the Merger Consideration?

Management believes, based upon discussions with Li3 and their largest individual stockholders, that stockholders of Li3 holding a majority of the issued and outstanding Li3 common stock will support and agree to approve the Transaction, and that such stockholders will further agree to lock up any Merger Consideration received by them in connection with the Transaction in accordance with the proposed terms of such an agreement (the “Lock-Up and Support Agreement”). These stockholders will agree to lock-up such shares for the earlier of (1) one year following the closing of the Transaction or (2)the date on which we consummate a liquidation, merger, share exchange or other similar transaction after the Transaction that results in all of our shareholders having the right to exchange their Ordinary Shares for cash, securities or other property(subject to earlier release if the stock price meets certain price targets). Pursuant to the Lock-Up and Support Agreements, during this period, none of such shareholders nor any permitted transferee will be able to(i) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Exchange Act, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any of the Merger Consideration, whether any such transaction is to be settled by delivery of securities, cash or otherwise, or (iii) publicly announce any intention to effect any transaction specified in clause (i) or (ii). Execution of the Lock-Up and Support Agreements is a closing condition of the Agreement and Plan of Merger. See “The Agreement and Plan of Merger–Closing Conditions of the Transaction” for a further description of the proposed Lock-Up and Support Agreements.

Are there other agreements that will be entered into in connection with the Transaction?

Yes. In addition to the Agreement and Plan of Merger, on May 21, 2013, Blue Wolf and its Sponsor entered into the Sponsor Agreement.Additionally, on June 13, 2013, Blue Wolf and Li3 entered into the Investor Rights Agreement and a Lock-up and Support Agreement with POSCO. Li3 is in the process of obtaining executed Lock-Up and Support Agreements from holders of a majority of its issued and outstanding shares of common stock. The terms of such agreements aredescribed in greater detail below under the heading “Related Agreements.”

What assumptions have we made when disclosing ownership information?

Unless otherwise expressly stated, this Offer to Purchase assumes that no more than 1,467,970 Ordinary Shares will be accepted for payment in this Offer, and that Blue Wolf will not elect to exercise its rights pursuant to the 2% Increase to purchase any additional shares.

We have made several assumptions with respect to ownership of our Ordinary Shares following the consummation of the Transaction. These assumptions impact certain calculations of post-transaction ownership and voting rights throughout this Offer to Purchase. Unless otherwise expressly stated, all such calculations relating to beneficial ownership and voting rights post-transaction assume: (i) the issuance of 1,581,990registered Ordinary Shares as Merger Consideration to Li3 shareholders; (ii) that no Warrants (including the Sponsor Warrants and Converted Warrants) are exercised; (iii) that 1,610,000 founder shares and 3,333,333 Sponsor Warrants are forfeited pursuant to the Sponsor Agreement; (iv) that no Converted Options are exercised; and (v) that 1,467,970 Ordinary Shares are validly tendered pursuant to the Offer.

Are the Offer and the Transaction conditioned on one another?

Yes. Pursuant to the Agreement and Plan of Merger, it is a condition to the consummation of the Transaction that Blue Wolf shall have conducted the Offer and satisfied each of the Maximum Tender Condition and the Merger Condition. If the Merger Condition is not satisfied upon a then scheduled Expiration Date, we will terminate or extend the Offer. In the event the Offer is terminated, we will promptly return any Ordinary Shares, at our expense, that were delivered pursuant to the Offer upon the expiration or termination of the Offer and we will not consummate the Transaction. See “The Agreement and Plan of Merger.”

What are the most significant conditions to the Offer?

Our obligation to purchase Ordinary Shares validly tendered and not properly withdrawn, subject to our right to accept for payment an additional amount of shares pursuant to the 2% Increase,prior to the Expiration Date is conditioned upon, among other things:

| · | no more than 1,467,970 Ordinary Shares having been validly tendered and not properly withdrawn prior to the Expiration Date. We refer to this condition, which is not waivable, as the “Maximum Tender Condition.” |

| · | the Transaction, in our reasonable judgment to be determined immediately prior to the Expiration Date, is capable of being consummated by July 22, 2013. We refer to this condition, which is not waivable, as the “Merger Condition.” |

We refer to the conditions to the Offer, including the Merger Condition, as the “offer conditions.” See “The Agreement and Plan of Merger — Conditions to the Closing of the Transaction” and “The Offer — Conditions of the Offer.”

What are the most significant conditions to the Transaction?

Pursuant to the Agreement and Plan of Merger, the consummation of the Transaction is conditioned upon, among other things, (i) Blue Wolf shall have completed the Offer and accepted for payment all Ordinary Shares that have been validly tendered and not properly withdrawn in the Offer; (ii) approval of the Transaction by Li3’s stockholders and (iii) standard transaction closing conditions (e.g., representations and warranties are true and correct, covenants and agreements have been performed, certificates and other instruments have been executed and delivered, antitrust and regulatory approvals have been obtained, no material adverse effect has occurred with respect to Blue Wolf or Li3, and no law or order is in effect prohibiting the Transaction). Additionally, the Transaction is conditioned upon the parties entering an Investor Rights Agreement with POSCO as well as Lock-up and Support Agreements with holders of a majority of Li3’s outstanding shares of common stock. On June 13, 2013, POSCO executed the Investor Rights Agreement and a Lock-Up and Support Agreement. Li3 is in the process of obtaining executed Lock-Up and Support Agreements from holders of a majority of its issued and outstanding shares of common stock. Li3 has determined that no additional third party consents are required to consummate the Transaction. If any of the conditions to the Transaction are not met, Li3 or Blue Wolf may choose to exercise any applicable right to terminate the Agreement and Plan of Merger. See “Risk Factors — Risks Related to the Transaction” and “The Agreement and Plan of Merger — Conditions to the Closing of the Transaction.”

Does the Transaction require the approval of Li3’s stockholders?

Li3 will separately solicit its shareholders, and convene a meeting of its stockholders, for approval of the Transaction. Blue Wolf will file a Registration Statement on Form F-4 with theSEC to register the distribution of the Merger Consideration. The Registration Statement, which will include a proxy statement/prospectus for Li3’s stockholders, must be declared effective by the SEC before the Transaction can be approved by Li3’s shareholders. However, management believes, based upon discussions with Li3 and their largest individual stockholders, that stockholders of Li3 holding a majority of the issued and outstanding Li3 common stock will support and agree to approve the Transaction.

Will there be a single controlling shareholder of Blue Wolf following the completion of the Transaction?

No. However, immediately following the Transaction,the existing Blue Wolf shareholderswill hold voting securities representing between approximately 62.7% of our voting power, in the event no Ordinary Shares are validly tendered in the Offer, and approximately 42.9% of our voting power in the event 1,467,970 Ordinary Shares are accepted for payment in the Offer (in each case not including outstanding options and warrants). In addition, POSCO, an existing Li3 stockholder, will hold voting securities representing between approximately 9.5% of our voting power, in the event no Ordinary Shares are validly tendered in the Offer, and approximately 14.5% of our voting power in the event 1,467,970 Ordinary Shares are accepted for payment in the Offer.

See “Beneficial Ownership of Securities” for more information regarding our beneficial ownership following the Transaction.

Why are we making the Offer?

We are making the Offer in connection with the Transaction because the provisions of our Charter, as disclosed in the prospectus related to our IPO, and the Agreement and Plan of Merger require us to conduct the Offer to provide our shareholders an opportunity to redeem their Ordinary Shares for a pro-rata portion of our Trust Account upon our consummation of a business combination. We also represented that in connection with this redemption opportunity, we would provide our shareholders with offering documents that contained substantially the same financial and other information about our proposed business combination and redemption rights that would otherwise be required under Regulation 14A of the Exchange Act, which regulates the solicitation of proxies. Accordingly, we are making the Offer so that we may provide our shareholders with appropriate disclosure regarding the business and finances of Blue Wolf, Li3 and the post-transaction company so that our shareholders can decide whether to hold their Ordinary Shares, or ask that they be redeemed by us pursuant to this Offer if the offer conditions are satisfied.

Promptly following the scheduled Expiration Date, we will publicly announce whether the Maximum Tender Condition and Merger Condition, and the other conditions to this Offer have been satisfied or waived (as applicable) and whether the Offer has been completed, extended or terminated. If such conditions are satisfied or waived, promptly after the Expiration Date Blue wolf shall purchase and pay the Purchase Price for each Ordinary Share validly tendered and not properly withdrawn. Upon consummation of the Transaction, which shall occur no later than July 22, 2013, Li3 will become a wholly-owned subsidiary of Blue Wolf. The Transaction would be completed without a meeting of Blue Wolf’s shareholders pursuant to our Charter and BVI law. See “The Transaction”.

Why must we complete our business combination by July 22, 2013?

Pursuant to our Charter, we have until July 22, 2013 to complete a business combination. If we do not consummate a business combination within such time, we (i) will distribute the Trust Account, pro rata, to holders of our Public Shares by way of redemption and (ii) cease all operations except for the purposes of any winding up of our affairs. Consequently, if we do not consummate the Transaction, we will not be able to consummate a different business combination by July 22, 2013 because we will not have enough time to identify another target, perform due diligence, negotiate a definitive agreement related to the business combination and complete a new tender offer.

How will Blue Wolf fund the payment for the Ordinary Shares?

Blue Wolf will use a portion of the approximately $22.5 million which is currently held in the Trust Account to purchase the Ordinary Shares tendered in the Offer. See “The Offer — Source and Amount of Funds” and “The Agreement and Plan of Merger.”

How does Blue Wolf intend to allocate the approximate $22.5 million in the Trust Account and approximately $76,000 cash on hand?

Of the approximate $22.5 million in the Trust Account, Blue Wolf intends to: (i) retain an amount of cash no less than $5 million to satisfy the Merger Condition; (ii) use between $1.0 million and $1.4 million to pay the deferred IPO underwriting fees; (iii) use approximately $1.4 million to pay the fees and expenses in connection with the Offer and Transaction, although we may subsequently seek to defer a portion of such fees and expenses if needed to facilitate the consummation of the Transaction; and (iv) use up to $14,635,661 to purchase Ordinary Shares validly tendered and not properly withdrawn in this Offer. If sufficient cash is available from the Trust Account subsequent to the above payments, we would also intend to use approximately $400,000 to repay loans from our Sponsor before the remaining balance, if any, is allocated pursuant to the direction of the combined company, for general working capital or other purposes.

Depending on the results of the Offer, we expect that at least approximately $7,836,737 million (if 1,467,970 Ordinary Shares are tendered) to approximately $22,472,398 million (if no Ordinary Shares are tendered) of cash will be released to us from the Trust Account upon consummation of the Transaction.

As of April 30, 2013, Blue Wolf had approximately $76,000 of cash on hand outside of the Trust Account (which amounts reflect the balance of loan proceeds received from the Sponsor), which amount can be used for any purpose, including satisfaction of the Merger Condition, at the direction of Blue Wolf.

See “The Offer — Source and Amount of Funds.”

How long do I have to tender my Ordinary Shares?

You may tender your Ordinary Shares pursuant to the Offer until the Offer expires on the Expiration Date. Consistent with a condition of the Offer, Blue Wolf may need to extend the Offer depending on the timing and process of the SEC’s staff review of this Offer to Purchase and related materials. The Offer will expire on Thursday, July 11, 2013, at 11:59 p.m., New York City time, unless we terminate or extend the Offer. We may extend the Offer for various reasons, including to provide sufficient time to enable Blue Wolf’s Registration Statement on Form F-4 to be declared effective or to enable Li3 to convene a meeting of its stockholders to approve the Transaction. See “The Offer — Number of Ordinary Shares; Share Purchase Price; No Proration” and “— Extension of the Offer; Termination; Amendment.” If a broker, dealer, commercial bank, trust company or other nominee holds your Ordinary Shares, it is likely the nominee has established an earlier deadline for you to act to instruct the nominee to accept the Offer on your behalf. We urge you to contact the broker, dealer, commercial bank, trust company or other nominee to find out the nominee’s deadline. See “The Offer — Procedures for Tendering Shares.”

Can the Offer be extended, amended or terminated and, if so, under what circumstances?

We may extend or amend the Offer to the extent we determine such extension or amendment is necessary or is required by applicable law or regulation, subject to certain restrictions in the Agreement and Plan of Merger. We may extend the Offer for various reasons, including to provide sufficient time to enable Blue Wolf’s Registration Statement on Form F-4 to be declared effective or to enable Li3 to convene a meeting of its stockholders to approve the Transaction. If we extend the Offer, we will delay the acceptance of any Ordinary Shares that have been validly tendered and not properly withdrawn pursuant to the Offer. We can also terminate the Offer if any of the offer conditions listed in “The Offer — Conditions of the Offer” occur, or the occurrence thereof has not been waived. See “The Offer — Extension of the Offer; Termination; Amendment.”

How will I be notified if the Offer is extended, amended or terminated?

If the Offer is extended, we will make a public announcement of the extension no later than 9:00 a.m., New York City time, on the first business day after the previously scheduled Expiration Date. We will announce any amendment to or termination of the Offer by promptly making a public announcement of the amendment or termination. See “The Offer — Extension of the Offer; Termination; Amendment.”

How do I tender my Ordinary Shares?

If you hold your Ordinary Shares in your own name as a holder of record and decide to tender your Ordinary Shares, you must deliver your Ordinary Shares by mail or physical delivery and deliver a completed and signed Letter ofTransmittal or an Agent’s Message (as defined in “The Offer — Procedures for Tendering Shares”) to Continental Stock Transfer & Trust Company (the “Depositary”) before 11:59 p.m., New York City time, on Thursday, July 11, 2013, or such later time and date to which we may extend the Offer. Shareholders should not deliver any such materials to Blue Wolf or the Information Agent .

If you hold your Ordinary Shares in a brokerage account or otherwise through a broker, dealer, commercial bank, trust company or other nominee (i.e., in “street name”), you must contact your broker or other nominee if you wish to tender your Ordinary Shares. See “The Offer — Procedures for Tendering Shares” and the instructions to the Letter of Transmittal.

If you are an institution participating in The Depository Trust Company, you must tender your Ordinary Shares according to the procedure for book-entry transfer described in “The Offer — Procedures for Tendering Shares.”

You may contact Morrow & Co., LLC, the information agent for the Offer (the “Information Agent”), or your broker for assistance. The telephone numbers for the Information Agent are set forth on the back cover of this Offer to Purchase. See “The Offer — Procedures for Tendering Shares” and the instructions to the Letter of Transmittal.

Can I tender my Units or Warrants?

No. If you hold Units, comprised of one Ordinary Share and a Warrant, and desire to tender the Ordinary Shares included in such Units, you must separate the Ordinary Shares from the Warrants that comprise the Units prior to tendering your Ordinary Shares pursuant to the Offer. You may instruct your broker to do so, or if you hold Units registered in your own name, you must contact the Depositary directly and instruct them to do so. While this is typically done electronically the same business day, you should allow at least one full business day to accomplish the separation. If you fail to cause your Ordinary Shares to be separated in a timely manner before the Offer expires you will likely not be able to validly tender those Ordinary Shares prior to the expiration of the Offer. See “The Offer — Procedures for Tendering Shares.

Furthermore, our Warrants are not exercisable until 30 days after the consummation of the Transaction and therefore a Warrant holder will not be able to exercise his, her or its Warrants to purchase Ordinary Shares and then tender the Ordinary Shares pursuant to the Offer.

Until what time can I withdraw previously tendered Ordinary Shares?

You may withdraw Ordinary Shares that you have previously tendered pursuant to the Offer at any time prior to the Expiration Date, namely 11:59 p.m. on Thursday, July 11, 2013. Although pursuant to Rule 13e-4(f)(2)(ii) promulgated under the Exchange Act, you would also have the right to withdraw your previously tendered Ordinary Shares at any time after 11:59 p.m., New York City time, on Wednesday, July 17, 2013 if not accepted prior to such time, we will cease operations, distribute the proceeds held in our Trust Account to the holders of our Ordinary Shares purchased in our IPO and begin to liquidate Blue Wolf if we do not consummate the Transaction by July 22, 2013. Except as otherwise provided in “The Offer — Withdrawal Rights,” tenders of Ordinary Shares are irrevocable.

How do I properly withdraw Ordinary Shares previously tendered?

You must deliver, on a timely basis, a written notice of your withdrawal to the Depositary at the address appearing on the back cover page of this Offer to Purchase. Your notice of withdrawal must specify your name, the number of Ordinary Shares to be withdrawn and the name of the registered holder of such Ordinary Shares. Certain additional requirements apply if the certificates for Ordinary Shares to be withdrawn have been delivered to the Depositary or if your Ordinary Shares have been tendered under the procedure for book-entry transfer set forth in “The Offer — Procedures for Tendering Shares.” See “The Offer — Withdrawal Rights.”

Has Blue Wolf or its board of directors adopted a position on the Offer?

Our intention is to consummate the Transaction. Our board of directors has unanimously (i) approved our making the Offer, (ii) declared the advisability of and approved the Transaction, and (iii) determined that the Transaction is in the best interests of the shareholders of Blue Wolf and, if consummated, would constitute our initial business combination pursuant to our Charter. If the Maximum Tender Condition is not satisfied, we will be unable to consummate the Transaction. Our board of directors therefore unanimously recommends that you do not tender your Ordinary Shares pursuant to the Offer. If you tender your Ordinary Shares pursuant to the Offer, you will not be participating in the Transaction because you will no longer hold such Ordinary Shares in Blue Wolf upon the consummation of the Transaction. Because we can only satisfy the Merger Condition (assuming the Transaction is approved by Li3’s shareholders) and therefore consummate the Transaction if the Maximum Tender Condition is not satisfied, each Ordinary Share tendered may make it less likely that we can consummate the Transaction. The members of our board of directors will directly benefit from the Transaction and have interests in the Transaction that may be different from, or in addition to, the interests of holders of our Public Shares. See “Risk Factors — Risks Related to the Transaction” and “The Transaction — Certain Benefits of Blue Wolf’s Directors and Officers and Others in the Transaction.” You must make your own decision as to whether to tender your Ordinary Shares and, if so, how many Ordinary Shares to tender. In doing so, you should read carefully the information in this Offer to Purchase and in the Letter of Transmittal.

When and how will Blue Wolf pay for the Ordinary Shares I tender that are accepted for payment?

Blue Wolf will pay the Share Purchase Price in cash, without interest, for the Ordinary Shares accepted for payment by depositing the aggregate Purchase Price with the Depositary promptly after the expiration of the Offer provided that the offer conditions are satisfied or, if waivable, waived. The Depositary will act as your agent and will transmit to you the payment for all of your Ordinary Shares accepted for payment. See “The Offer — Purchase of Shares and Payment of Purchase Price.”

Will I have to pay brokerage fees and commissions if I tender my Ordinary Shares?

If you are a holder of record of your Ordinary Shares and you tender your Ordinary Shares directly to the Depositary, you will not incur any brokerage fees or commissions. If you hold your Ordinary Shares in street name through a broker, bank or other nominee and your broker tenders Ordinary Shares on your behalf, your broker may charge you a fee for doing so. We urge you to consult your broker or nominee to determine whether any charges will apply. See “The Offer — Procedures for Tendering Shares.”

What are the U.S. federal income tax consequences if I tender my Ordinary Shares?

The receipt of cash for your tendered Ordinary Shares will generally be treated for U.S. federal income tax purposes either as (i) a sale of your tendered Ordinary Shares or (ii) a corporate distribution. See “The Offer — Material U.S. Federal Income Tax Considerations.”

How will the Transaction be treated for U.S. federal income tax purposes?

It is expected by the parties to the Transaction that the Transaction will qualify as a “reorganization” within the meaning of Section 368(a)(2)(E) of the Internal Revenue Code, with the further expectation that Section 367(a) of the Internal Revenue Code should also apply to the Transaction requiring U.S. Holders of Li3 common stock to recognize gain (but not loss) on the exchange of the Li3 shares. The amount of gain recognized should equal the excess, if any, of the fair market value of the Blue Wolf Ordinary Shares received in the Transaction over the U.S. stockholder's adjusted tax basis in the shares of Li3 common stock surrendered. See the section entitled “The Offer - Material U.S. Federal Income Tax Considerations to Li3 Shareholders.”

What will be the accounting treatment for the Transaction?

Blue Wolf’s management has concluded that Li3 will be the accounting acquirer and the Transaction will be accounted for as a recapitalization by Li3 based on the evaluation of the facts and circumstances of the Transaction. See the section entitled “The Transaction — Accounting Treatment.”

Will there be any differences in the rights of Li3 shareholders as a result of the Transaction?

Yes. As a result of the Transaction, there will be several differences in the rights of Li3 shareholders as they will become shareholders of Blue Wolf. These differences include, but are not limited to, notice requirements for shareholder meetings, approval requirements for charter amendments, and rights relating to dividends and other distributions. See “Material Differences in the Rights of Blue Wolf Shareholders Following the Offering — Nevada Company Considerations” for detailed information on the various differences.

Will I have to pay stock transfer tax if I tender my Ordinary Shares?

We will not pay any stock transfer taxes in connection with this Offer. If you instruct the Depositary in the Letter of Transmittal to make the payment for the Ordinary Shares to the registered holder, you may incur domestic stock transfer tax. See “The Offer — Purchase of Shares and Payment of Purchase Price.”

Who do I contact if I have questions about the Offer?

For additional information or assistance, you may contact the Information Agent at the telephone numbers set forth on the back cover of this Offer to Purchase. You may request additional copies of the Offer, the Letter of Transmittal and other Offer documents from the Information Agent at Morrow & Co., LLC, 470 West Avenue, 3rd Floor, Stamford, CT 06902; telephone (800) 662-5200 (banks and brokerage firms: (203) 658-9400); email:mngl.info@morrowco.com.

How will the Offer and issuance of the Merger Consideration affect the number of our outstanding shares and holders?

Immediately following the Transaction, we will have 4,240,371Ordinary Shares outstanding in the event no Ordinary Shares are tendered in this Offer, and 2,772,401 Ordinary Shares outstandingin the event 1,467,970 Ordinary Shares are accepted in the Offer.See “The Offer — Purpose of the Offer; Certain Effects of the Offer” and “Beneficial Ownership of Securities.”

To the extent any of our shareholders validly tender their Ordinary Shares (without subsequently properly withdrawing such tendered Ordinary Shares) and that tender is accepted, the number of our holders following the Transaction would be reduced. See “The Offer — Purpose of the Offer; Certain Effects of the Offer.”

Will our Sponsor, officers or directors tender their Ordinary Shares in the Offer?

No. Our Sponsor, and each of our officers and directors in their individual capacities, has agreed not to tender any Ordinary Shares pursuant to the Offer. See “The Offer — Purpose of the Offer; Certain Effects of the Offer” and “Related Agreements—Sponsor Agreement.”

What will happen if I do not tender my Ordinary Shares?

Shareholders who choose not to tender their Ordinary Shares will retain their Ordinary Shares. However, such shareholders’ ownership interests will be diluted following the completion of the Offer and the consummation of the Transaction as a result of the issuance of the Merger Consideration to Li3’s shareholders. See “The Offer — Purpose of the Offer; Certain Effects of the Offer” and “Beneficial Ownership of Securities.”

If I object to the price being offered for my Ordinary Shares, will I have appraisal rights?

No. No appraisal rights will be available to you in connection with the Offer or the Transaction. See “Appraisal Rights.” Li3’s public stockholders will have dissenters’ rights in connection with the business combination in accordance with the provisions of Nevada law.

What is the recent market price for the Ordinary Shares?

As of July 3, 2013, the last reported closing price on the Nasdaq Capital Market (“Nasdaq”) of Blue Wolf’s Ordinary Shares was $10.00. You are urged to obtain current market quotations for the Ordinary Shares before deciding whether to tender your Ordinary Shares. See “Price Range of Securities and Dividends.”

Will the Ordinary Shares be listed on a stock exchange following the Transaction?

Blue Wolf’s Ordinary Shares are currently listed on Nasdaq. Although there can be no assurance concerning our ability to meet Nasdaq’s continued qualification standards in the future, we commenced this Offer pursuant to our Charter to provide our shareholders with an opportunity to redeem their Ordinary Shares in connection with the Transaction, and not for the purpose of causing our Ordinary Shares to be delisted from Nasdaq. We intend for our securities to continue to be listed on Nasdaq subsequent to the consummation of the Transaction.We also intend to apply for the listing of our securities on the TSX or TSX Venture in Canada subsequent to the closing of the Transaction. See “Risk Factors — Risks Related to the Offer” and “— Risks Related to Blue Wolf.”

What interests do the directors and executive officers of Blue Wolf have in the Transaction?

Directors and executive officers of Blue Wolf have interests in the Transaction that may be different from, or in addition to, the interests of Blue Wolf shareholders. These interests include:

| · | Our Sponsor owns 2,012,500 Ordinary Shares, which it acquired for $25,000 and which have an aggregate value of $20,125,000 based on the closing price of the Ordinary Shares on Nasdaq of $10.00 as of July 3, 2013. It has waived its right to receive distributions with respect to its shares upon Blue Wolf’s liquidation, which will occur if Blue Wolf is unable to consummate the Transaction by July 22, 2013. Accordingly, the Sponsor’s Ordinary Shares will be worthless if Blue Wolf is forced to liquidate. |

| · | Our Sponsor owns 4,166,667 Sponsor Warrants, which it acquired for $3,125,000 and which have an aggregate value of $1,250,000 based on the closing price of the Warrants on Nasdaq of $0.30 as of July 3, 2013. In the event of Blue Wolf’s liquidation, the Sponsor Warrants will expire worthless. |

| · | As of the date of this Offer to Purchase, our Sponsor has made loans to us in the aggregate amount of $400,000. In the event of liquidation, we will not be able to repay the loans to our Sponsor. |

| · | Each of our current directors and officers will be reimbursed from our funds held outside of the Trust Account for out-of-pocket expenses incurred by him in connection with activities on our behalf, such as identifying potential target businesses and performing due diligence on suitable business combinations, but only if the business combination is consummated. In the event we consummate the Transaction, all such expenses will be paid by us in full. |

| · | If Blue Wolf liquidates in the event it is unable to consummate the Transaction, Messrs. Kraus and Edwards may be liable to us in the event any claims by a vendor for services rendered or a prospective target business with which we have discussed entering into a business combination reduce the amounts in the Trust Account below $9.97 per share except in certain circumstances. See “Certain Relationships and Related Transactions.” |

These interests may influence the Blue Wolf directors and executive officers in the negotiation of the Agreement and Plan of Merger, the Related Agreements and the approval of the Transaction. See “Risk Factors — Risks Related to the Transaction,” “The Transaction — Certain Benefits of Blue Wolf’s Directors and Officers and Others in the Transaction.”

Who do I contact if I have questions about the Offer?

For additional information or assistance, you may contact the Information Agent at the address and telephone numbers set forth on the back cover of this Offer to Purchase. You may request additional copies of this Offer to Purchase, the Letter of Transmittal and other Offer documents from the Information Agent at Morrow & Co., LLC, 470 West Avenue, 3rd Floor, Stamford, CT 06902; telephone (800) 662-5200 (banks and brokerage firms: (203) 658-9400); email:mngl.info@morrowco.com.

FORWARD-LOOKING STATEMENTS

Some of the statements in this Offer to Purchase constitute “forward-looking statements.” When used in this Offer to Purchase, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “potential” and “should,” as they relate to us are intended to identify these forward-looking statements. All statements by us regarding our possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives and similar matters are forward-looking statements.

Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors (many of which are beyond our control), set forth in this section and elsewhere in this Offer to Purchase, that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Our future results may differ materially from those expressed in these forward-looking statements.

We undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of the Offer to Purchase, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

These risks, uncertainties and other important factors include, but are not limited to, the statements set forth under “Risk Factors” and the following:

| · | the risk that more than 1,467,970 Ordinary Shares will be validly tendered and not properly withdrawn prior to the Expiration Date which would then cause us to (i) be unable to satisfy the Maximum Tender Condition and the Merger Condition, (ii) be unable to consummate the Transaction and (iii) withdraw the Offer; |

| · | the risk that Blue Wolf’s Registration Statement on Form F-4 is not declared effective prior to July 22, 2013, or even if effective, Li3 may not have sufficient time subsequent to effectiveness to seek stockholder approval of the Transaction under Nevada law, or even if so, that Li3 stockholders do not approve the Transaction. |

| · | the risk that governmental and regulatory review of the tender offer documents may delay the Transaction or result in the inability of the Transaction to be consummated by July 22, 2013and the length of time necessary to consummate the proposed Transaction; |

| · | the risk that a condition to consummation of the Transaction may not be satisfied or waived; |

| · | the risk that the anticipated benefits of the Transaction may not be fully realized or may take longer to realize than expected; |

| · | the risk that any projections, including earnings, revenues, expenses, margins, mineral reserve estimates or any other financial items are not realized; |

| · | changing legislation and regulatory environments including those in foreign jurisdictions in which Li3 intends to operate; |

| · | the ability to list and comply with Nasdaq’s continuing listing standards, including having the requisite number of round lot holders or stockholders and meeting the independent director requirements for the board of directors and its committees; |

| · | Li3’s mineral operations are subject to Chilean law and government regulation. Even if Li3 discovers lithium in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of lithium; |

| · | the risk that lithium, iodine and nitrates prices are subject to unpredictable fluctuations; and |

| · | the risk that Li3 may be unable to amend the mining claims that it is seeking to acquire to cover the primary minerals that Li3 plans to develop. |

You should carefully consider these risks, in addition to the risks factors set forth in the section titled “Risk Factors” and other information in this Offer to Purchase and in (i) Blue Wolf’s other filings with the SEC, includingthe final prospectus related to our IPO dated July 14, 2011 (Registration No. 333-173419) and our Annual Report on Form 10-K/A (File No. 001-35234) for the fiscal year ended February 29, 2012 and (ii) Li3’s filings with the SEC, includingits Registration Statement on Form S-1 (Registration No. 333-175329), Registration Statement on Form S-1 (Registration No. 333-185714) and its Annual Report on Form 10-K (File No. 000-54303) for the fiscal year ended June 30, 2012. The documents filed with the SEC, including those referred to above, also discuss some of the risks that could cause actual results to differ from those contained or implied in the forward-looking statements. See “Where You Can Find More Information.”

RISK FACTORS

You should carefully consider the following risk factors in addition to the other information included in this Offer to Purchase, including matters addressed in the section entitled “Forward-Looking Statements” before you decide whether to tender Ordinary Shares in the Offer. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business. The following discussion should be read in conjunction with the financial statements and notes to the financial statements included herein, as well as in the final prospectus related to our IPO dated July 14, 2011 (Registration No. 333-173419) and our Annual Report on Form 10-K for the fiscal year ended February 29, 2012 (File No. 001-35234).

Risks Related to the Offer

Holders of our Ordinary Shares may fail to understand that they should NOT tender their Ordinary Shares if they support the Transaction. To the extent the Maximum Tender Condition is not satisfied, we will be unable to consummate the Transaction.

There is a risk that holders of Ordinary Shares will tender their Ordinary Shares despite the fact that they support the Transaction. We are a blank check, or special purpose acquisition company (“SPAC”), and the Offer is designed to afford holders of Ordinary Shares with the opportunity to redeem their shares if they do not approve of our proposed business combination, Unlike a typical third party or issuer tender offer in which the offeror desires that shareholders tender securities that are the subject of the tender offer, confusion may arise stemming from the fact that we have commenced the Offer but we do not want our shareholders to tender their Ordinary Shares in the Offer. Furthermore, our board of directors recommends that shareholders not tender Ordinary Shares pursuant to the Offer. If shareholders approve of the proposed Transaction and desire to retain their Ordinary Shares, the shareholders should not tender any of their Ordinary Shares which results in more than 1,467,970 Ordinary Shares being validly tendered and not properly withdrawn, we will terminate or extend the Offer. If we terminate the Offer, we will be unable to consummate the Transaction and be required to liquidate if we cannot consummate a business combination by July 22, 2013.

There is no guarantee that your decision whether or not to tender your Ordinary Shares will put you in a better future economic position.

We can give no assurance as to the price at which a shareholder may be able to sell its Ordinary Shares in the future following the completion of the Offer. Certain events following the consummation of the Transaction may cause an increase in our share price, and may result in a lower value realized now than you might realize in the future had you not agreed to tender your Ordinary Shares. Similarly, if you do not tender your Ordinary Shares, you will bear the risk of ownership of your Ordinary Shares after the consummation of the Transaction, and there can be no assurance that you can sell your shares in the future for a greater amount than the Share Purchase Price. You should consult your own individual tax and/or financial advisor for assistance on how this may affect your individual situation.

If certain conditions to the Offer are not met, Blue Wolf will not have access to the funds in the Trust Account to purchase any shares which are validly tendered and not properly withdrawn and will terminate the Offer.

We plan to use the cash available from the funds held in the Trust Account to purchase the Ordinary Shares validly tendered and not properly withdrawn pursuant to the Offer. Accordingly, if the conditions to the Offer are not satisfied, including the Maximum Tender Condition and the Merger Condition, we will not be able to access the funds held in the Trust Account and thus will terminate or extend the Offer. See “The Tender Offer — Conditions of the Offer.”

Following the Offer, the amount of cash available to us for working capital purposes may be reduced, additional sources of financing may not be available and our purchase of shares in the Offer will cause our public float to be reduced. As a result, our stock price could decline and our shareholders may be disadvantaged by reduced liquidity in our securities.

Although our board of directors has unanimously determined that the Transaction and making the Offer are in the best interests of our shareholders, the Offer exposes us to a number of risks including:

| · | use of funds to purchase Ordinary Shares in the Offer and to pay expenses of the IPO, Offer and Transaction will reduce the funds available as working capital for the continuation of Li3’s business through the combined company; |

| · | we may not be able to replenish our cash reserves by raising debt or equity financing in the future on termsacceptable to us, or at all; and |