UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ Preliminary Proxy Statement |

| ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ Definitive Proxy Statement |

| ☐ Definitive Additional Materials |

| ☒ Soliciting Material Pursuant to Section 240.14a-12 |

INTERACTIVE INTELLIGENCE GROUP, INC.

(Name of Registrant as Specified in its Charter)

______________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11.

| (1 | ) | Title of each class of securities to which transaction applies: |

| _______________________________________________________________________________ | ||

| (2 | ) | Aggregate number of securities to which transaction applies: |

| _______________________________________________________________________________ | ||

| (3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| _______________________________________________________________________________ | ||

| (4 | ) | Proposed maximum aggregate value of transaction: |

| _______________________________________________________________________________ | ||

| (5 | ) | Total fee paid: |

| _______________________________________________________________________________ | ||

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1 | ) | Amount Previously Paid: |

| _______________________________________________________________________________ | ||

| (2 | ) | Form, Schedule or Registration Statement No.: |

| _______________________________________________________________________________ | ||

| (3 | ) | Filing Party: |

| _______________________________________________________________________________ | ||

| (4 | ) | Date Filed: |

| _______________________________________________________________________________ | ||

This filing consists of communications Interactive Intelligence Group, Inc. (the “Company” or “Interactive Intelligence”) has prepared for use (1) with its employees, (2) with its customers, (3) with its partners, and (4) on its website, all related to the Agreement and Plan of Merger, dated as of August 30, 2016, (the “Merger Agreement”), by and among the Company, Genesys Telecommunications Laboratories, Inc., Giant Merger Sub Inc. and, solely for the purposes of Section 5.16 of the Merger Agreement, Greeneden Lux 3 S.àR.L., Greeneden U.S. Holdings I, LLC and Greeneden U.S. Holdings II, LLC.

On August 31, 2016, Donald E. Brown, the Company’s President and Chief Executive Officer, delivered the following communications and FAQs to employees of the Company via email distribution:

To: All Employees

From: Don Brown

Subject: Important Update

We had an important announcement this morning. Today we announced that we’ve entered into a definitive agreement to be acquired by Genesys. Here is a link to the press release: http://genesys.com/acquisition-inin.

This year, our board of directors and myself, assisted by advisors, considered several opportunities for Interactive Intelligence moving forward and unanimously decided that combining with Genesys offers our employees, customers and partners the best path for growth and is in the best interest of our shareholders.

Genesys is historically known for high-end solutions for call center customers. This complements our CIC, CaaS, and PureCloud portfolio very well. To support continued innovation, the combined company will be investing approaching $200 million per year in R&D across the full portfolio.

The question you are probably asking is what next? First, as is customary for a transaction of this size, the transaction still needs to pass normal requirements like shareholder and regulatory approvals. We expect the transaction will close by the end of the year. Until it closes, we are operating as separate companies. This means we need to stay focused and continue our business as normal in our current roles.

Over the coming weeks, individuals from Interactive Intelligence and Genesys will meet to create the integration plan and, after the acquisition closes, we will continue to develop the strategy including how the product roadmaps will be combined.

If it seems like there are more questions than answers right now, don’t be frustrated. The big picture is that Interactive Intelligence, combined with Genesys will be the clear leader in the customer engagement space, which will create tremendous opportunities for growth.

We will have an employee all hands meeting at 10:00 AM Eastern Time this morning in HQ4 and via [XXXX] for those of you not in Indy. Paul Segre, Genesys’ CEO, and Tom Eggemeier, Genesys’ President will be joining us for this meeting. We’ve also put together an employee FAQ that outlines the answers we do have today. Of course, we will share more information as it is finalized.

It is important you do not share any information that is not in the press release, this email, or the FAQ. Lastly, if a member of the media, analyst, or anyone else contacts you about the transaction, please direct them to Christine Holley (christine.holley@inin.com) for media and Investor Relations (investorrelations@inin.com) for any other inquires.

I am very excited about the innovation that will come out of the combined company and the direction forward.

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

Employee FAQ:

General:

What we can say about the acquisition:

| • | We (Interactive Intelligence and Genesys) come from similar backgrounds of breaking into an established market and demonstrating success. |

| • | We share a similar DNA and reputation of innovation, software excellence and customer focus. |

| • | Both of our results during the past five years have shown continued growth. |

| • | Both companies have significant products for both the on-premise and cloud markets. |

| • | We are both perceived as market leaders in terms of industry analyst positioning, customer satisfaction, financial strength, and growth. |

| • | Unlike some of our peers, we have a consistent go-to-market approach and history of working with partners to achieve growth and uniquely serve customers. |

| • | Interactive Intelligence is known for great all-in-one solutions for a wide range of customers. Genesys is historically known for high-end solutions catering to the sophisticated needs of the most complicated call center customers. The best of both companies can be used to improve and cross-pollinate technology and go-to-market strengths. |

| • | All major products of the two companies, including CIC, CaaS, PureCloud and Genesys’ Customer Experience Platform will continue with significant R&D investment and actively sold to the market. |

| • | This is a huge, exciting leap forward in our ability to serve the entire market. |

Questions and Answers:

Q: How does this combination help our customers?

A: The combined Interactive Intelligence and Genesys will offer our customers a complete portfolio that spans the needs of organizations of all sizes and complexity. Our products are very complimentary across customer segments so the combined portfolio will broaden the customer base we can serve.

Q: What does this mean for employees?

A: Our board of directors and management team, assisted by advisors, considered several opportunities for Interactive Intelligence moving forward and unanimously decided that combining with Genesys offers our employees, customers, partners, and investors the best path for growth. Together, we will be the clear leader in the customer engagement space and we expect there will be new opportunities for career growth and professional development.

Until it closes, we are operating as separate companies. This means we need to stay focused and continue our business as normal in our current roles.

Q: What does “close” mean? Could this not happen?

A: While we do not expect any issues during the closing process, the transition is subject to a number of typical requirements like a shareholder vote and regulatory approvals. Until the deal closes, we are separate companies so it is important to stay focused on running our business independently until the closing.

Q: Will there be any changes to employee salaries, compensation or benefits as a result of the transaction?

A: Until the transaction closes, we remain a separate, independent company and will continue to operate as usual; there will be no new changes to employee salaries, compensation or benefits. When you combine two companies, there are always similarities and differences between benefit plans. Over the coming months, as part of the integration planning work, we will be looking at these kinds of details to determine what makes sense for the combined company. To the extent there are changes, we will communicate with you. We remain committed to competitive compensation and benefits programs that incent and reward success.

Q: I am enrolled in the ESPP, what happens to my contributions?

A: The current ESPP purchase period, which is scheduled to end September 30, 2016, will continue until the earlier of (1) September 30, 2016 or (2) 10 business days prior to the closing of the transaction.

The accumulated payroll deductions of participants under the ESPP will be used to purchase shares on that date. The purchase price of these shares will be 95% of the fair market value on the first business day following the end of the purchase period.

No new purchase periods will begin under the ESPP. In addition, as of today, you are no longer permitted to increase your contribution rate under the ESPP for the current purchase period, except those made in accordance with payroll deduction elections that already are in effect.

Q: What will happen with RSUs or options?

A: For those employees that are participants in our equity program, your vested options will be converted into cash equal to $60.50 per share minus the exercise price of the applicable option upon closing. Your unvested equity awards (including Options and RSUs) will be converted into unvested cash, which will be paid out partially at closing and partially over time consistent with your original time vesting schedule. We will contact holders of unvested equity awards with further details. If you have RSUs that have vested, they were settled in shares of Interactive Intelligence common stock. Those shares are treated as any other shares outstanding and converted into cash at $60.50 per share.

Q: Can I trade any shares that I currently own?

A: If you are currently not in a restricted trading window, then the trading window is open to you and you can trade. If you had material, non-public information about this transaction and were not able to trade prior to the announcement, then the window will open for you beginning on Tuesday, September 6, 2016. As always, if at any time, you have material non-public information you should not buy or sell stock in Interactive Intelligence, subject to our insider trading policy. If you have any questions, please contact the Chief Financial Officer.

You may always exercise your options, even when the window is closed, by paying the exercise price in cash to the company.

As long as the trading window is closed for you, however you may not sell the shares you acquire from the exercise of your options. We understand that many of you execute a “same day sale” of the shares you acquire from exercising your options in order to cover the exercise price. However, you may not do a “same day sale” of the shares you acquire from exercising your options when the trading window is closed. You also may not sell any shares of ININ stock that you own.

Q: When can we start integration activities? What is the timeline for the integration?

A: Both companies will operate as separate businesses and brands until closing. It is important that we all remain focused on our business priorities and day-to-day responsibilities.

In coming weeks, once we have received antitrust approval from regulatory authorities and can begin the integration process, we will build an integration planning team with members from both Genesys and Interactive Intelligence to address how we bring our companies together. As this transaction was just announced, we are early in the planning process and it is premature to discuss specifics now. However, our focus will be on maximizing the strengths of both companies. We will communicate with you as details are available.

Q: Will there be changes to our workforce?

A: While this question can’t be answered definitively today for every employee, it is important to know that our merger with Genesys is about melding the strengths of both companies to accelerate our combined growth in the customer engagement market. Pursuit of this goal requires people, and new opportunities for career growth and professional development are expected for as much of the combined workforce as possible. A staff integration plan will be communicated after the transaction is complete. Until closing, it is business as usual as we continue to operate as a separate company.

Q: Will there be any office closures as a result of the acquisition? What happens in Indianapolis, Raleigh, and other Interactive offices both in the USA and Internationally?

A: We and Genesys have a strong and talented team based in Indianapolis, Raleigh and other offices. We expect to retain and grow our presence in these locations. During the transition, we will evaluate overlapping office locations to determine the optimal geographic coverage. We will determine the appropriate facilities plan and communicate as available.

Q: What should I say to our customers?

A: It is very important that you provide our customers with the confidence that Interactive Intelligence has industry leading on-premise and cloud solutions and there is no risk in our ability to continue to support them. In addition, it is important that our customers understand the benefits they will receive from the acquisition. After the transaction is completed, the ability to support our customers will only be further enhanced. With this transaction, our customers gain access to more innovative solutions that span the needs of organizations of all sizes and every level of sophistication.

We expect the transaction to be completed by the end of the year. Until that time, Interactive Intelligence and Genesys will remain separate, independent companies. We will continue to conduct business as usual.

Q: What does this mean about our current strategy and our Q3 and Q4 targets?

A: Until the transaction closes, it is business as usual at Interactive Intelligence. Maintaining our strong performance and achieving our targets for the quarter continue to be our main priority. We should remain focused on our daily responsibilities.

Q: What can’t I say to our customers?

Do not make recommendations or assumptions about the future of joint products or services. You should not offer opinions or make projections about the future product portfolio, or imply that we are operating as one company until after the close. Only talk about our products and Interactive Intelligence.

Q: What happens to the Interactive Intelligence brand? What about PureCloud?

We will be considering brands as part of the integration planning. Both parties recognize the value and pedigree of the Interactive Intelligence and PureCloud brands and will work to ensure that value is maximized.

Q: What should I do if a member of the media and anyone else contacts me about the transaction?

A: Please direct all media and analyst inquiries to Christine Holley (christine.holley@inin.com). Any investor or any other questions should be forwarded to Investor Relations (investorrelations@inin.com).

Q: I have business travel or customer meetings planned, what should I do?

A: Until the transaction closes, it is business as usual at Interactive Intelligence. We want to make this transaction as smooth as possible for our employees, customers, prospects, and partners.

Q: Will we still have Interactions APAC

A: Yes, we will still have Interactions APAC.

Q: What can I tell friends and family?

A: You can tell friends and family the same thing we have told you. You can also direct them to the press release issued on August 31st for additional information.

Q: Can I mention this acquisition on LinkedIn, Facebook, Twitter, or other social media?

A: We are all very proud of this news. We ask that you only repost approved messages from our Marketing team without additional commentary. As always, do not share confidential Company information, and remember that social media is a public forum.

Q: When will the transaction close?

A: We expect the transaction to close by the end of the year following the satisfaction of customary closing conditions, including regulatory approvals and approval by Interactive Intelligence shareholders.

Until it closes, we are operating as separate companies. This means we need to stay focused and continue our business as normal in our current roles.

Q: Who is Genesys?

A: Genesys empowers companies to create exceptional omnichannel experiences, journeys and relationships and is a leader in the contact center market. For over 25 years, they have put the customer at the center of all they do, and they passionately believe that great customer engagement drives great business outcomes. Genesys is trusted by over 4,700 customers in 120 countries, to orchestrate 25 billion contact center interactions per year in the cloud and on premises. Genesys is headquartered in Daly City California (in the San Francisco Bay Area).

Q: Who should I ask if I have any other questions?

A: You should direct any additional questions to your manager or Suanna Downs (suanna.downs@inin.com)

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

To: All Employees

From: Don Brown

Subject: FW: Message from Paul Segre

I'm happy to pass along this message from the CEO of Genesys, Paul Segre.

Hello Interactive Intelligence Team;

At Genesys, we have long admired Interactive Intelligence. You are a talented team and have accomplished many great things. This transaction is a huge milestone for both of our companies, and I look forward to working with you to achieve our common goal of enabling lasting customer relationships, accelerating innovation and driving growth.

Our businesses are highly complementary, and by joining together, we will be able to provide the broadest customer experience solutions for organizations of all sizes around the world that support billions of customer interactions each year across a range of industries. To do this, we will significantly invest across the entire Interactive Intelligence product portfolio to support the continued momentum of PureCloud, CaaS and CIC in addition to the rich portfolio of products offered by Genesys today.

Bringing Genesys and Interactive Intelligence together offers a compelling value proposition for our customers and also leads to benefits for employees including new opportunities for career growth and professional development as the combined company grows together. We are looking forward to working with you as one team following the close of the transaction, which we expect to close by the end of the year.

Tom Eggemeier and I will be in the Indianapolis office today, where we will conduct a Town Hall with Don. Tomorrow, Tom will travel to Raleigh to speak with the team there while I will return to San Francisco to talk with the Genesys team. We look forward to meeting many of you in person and hearing your views about our future partnership, opportunities for growth and collaboration, and the path in front of us.

It is clear to me that our companies have a shared passion for innovation and helping businesses deliver exceptional experiences. I’m confident that our combined time will innovate, collaborate and inspire each other to realize even greater success.

Paul Segre

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

On August 31, 2016, the Company delivered the following communication and FAQs to customers of the Company via email distribution:

To: All Customers

From: Don Brown

Subject: Exciting Update from Interactive Intelligence

Today we announced that we’ve entered a definitive agreement to be acquired by Genesys. Here is a link to the press release: http://genesys.com/acquisition-inin.

Genesys is historically known for high-end solutions catering to the most sophisticated needs of call center customers. This complements our CIC, CaaS, and PureCloud portfolio very well. To support innovation, the combined company will be investing approaching $200M per year in R&D across the portfolios of both companies.

I am excited for what the future brings in the continued innovation of CIC, CaaS, and PureCloud while still providing you with the level of service and commitment you have come to expect from Interactive Intelligence.

We expect the transaction to close by the end of the year. Until closing, we continue to operate as an independent company and it remains business as usual. We will continue to update you as appropriate. In the meantime, if you have any questions, please reach out to your regular Interactive Intelligence contact.

Sincerely,

Don

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

CUSTOMER FAQ

Q: What is the rationale for this transaction?

A: Interactive Intelligence and Genesys are highly complementary companies focused on improving the customer experience as leaders serving adjacent market segments with complementary solutions. This positions the combined company to deliver more innovative, omnichannel solutions that span the needs of customers of all sizes and every level of sophistication, including complementary Interactive products such as unified communications and collaboration tools.

Q: Will you continue to support existing Interactive Intelligence and Genesys products?

A: All three of the Interactive Intelligence product lines (PureCloud®, Cloud Communications-as-a-Service℠ (CaaS) and Customer Interaction Center™ (CIC)) will be important go-forward products offered by the combined company. Protecting and supporting our customers’ technology investments is a priority. Investment in the full product portfolio of both companies is important to realize a common mission of powering the world’s best customer experiences at scale, anytime, anywhere - over any channel, in the cloud and on-premise. Once the transaction has closed, the combined teams will work together to develop a unified roadmap that draws from the best capabilities and strengths of both companies, providing enhanced offerings to our customers.

Q: Where do you see the two portfolios complementing one another?

A: Our primary success has been in related, but adjacent market segments. One organization, with a combined product portfolio, will further drive that growth and success.

Interactive Intelligence brings a broad product portfolio as well as key technical R&D and support talent. We are known for our all-in-one solutions that offer stability and simplicity for a wide range of customer sizes. Genesys is historically known for high-end solutions. The best of both companies will be leveraged, cross-pollinating technology and go-to-market strengths.

Q: How does your sales strategy and approach change as of today?

A: Prior to the transaction closing, Interactive Intelligence and Genesys will continue to operate as separate businesses. Until that time, our sales strategy and approach will not change. We will take appropriate steps to ensure our customers continue to receive excellent service and support.

The opportunity with this transaction is to vastly expand the market reach for products and services provided by the combined product portfolio. Together, we will be able to offer a broader and more compelling set of solutions with strong sales and support teams in place to deliver on this opportunity.

Q: What about your company positioning - does it change and if so, how?

A: Until the transaction closes, Interactive Intelligence and Genesys will continue to operate as separate businesses. We strongly believe that this transaction best positions us to deliver on a joint mission of powering the world’s best customer experiences at scale, anytime, anywhere - over any channel, in the cloud and on-premise.

Q: What can customers expect during the coming months?

A: We expect the transaction to close by the end of the year. Until that time, Interactive Intelligence and Genesys will remain separate, independent companies, and we will continue to conduct business as usual.

We are committed to maintaining business continuity and open, transparent communication. We will give this objective great thought and care in our integration planning process. Over time, we remain committed to upgrading processes and systems as a normal course of business to continually improve and serve customers better.

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

On August 31, 2016, the Company delivered the following communication and FAQs to partners of the Company via email distribution:

To: All Partners

From: Don Brown

Subject: Important Update from Interactive Intelligence

Today we announced that we’ve entered into a definitive agreement to be acquired by Genesys. Here is a link to the press release: http://genesys.com/acquisition-inin.

Genesys is historically known for high-end solutions catering to the most sophisticated needs of call center customers. This complements our CIC, CaaS, and PureCloud portfolio very well. To support innovation, the combined company will be investing approaching $200M per year in R&D across the portfolios of both companies.

Both Interactive Intelligence and Genesys consider the partner community critical to our service delivery strategy.

I am excited for what the future brings in the continued innovation of CIC, CaaS, and PureCloud.

We expect the transaction to close by the end of the year. Until closing, we continue to operate as an independent company and it remains business as usual. We will continue to update you as appropriate. If you have any questions, please reach out to your regular Interactive Intelligence contact.

Sincerely,

Don

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

PARTNERS FAQ

Q: Will our partners be able to resell Genesys?

A: Until closing, it will be business as usual. Therefore, our partners will continue to sell Interactive Intelligence products only.

Q: Does this change our go-to-market strategy?

A: After closing, we will offer a broader portfolio to the market. Genesys has a strong partner network as well. Partners have been and will continue to be a fundamental part of our strategy for both cloud and on-premise offerings.

Q: What happens to our pricing?

A: Until closing, it will be business as usual. We are always evaluating our pricing to make sure it is competitive and reflects market value and we do not expect this to change.

Q: What happens to the product roadmap?

A: We intend to continue to invest in the entire product portfolio of both companies to realize our common mission of powering the world’s best customer experiences at scale, anytime, anywhere - over any channel, in the cloud and on-premise.

Once the transaction has closed, the combined teams will work together to develop a unified product roadmap that draws from the best capabilities and strengths of both companies, providing enhanced offerings to partners.

Q: What should I do during the pre-closing phase?

A: Until closing, we are still an independent company who needs to meet our financial goals. Please stay focused during the closing period to make sure we are executing on all aspects of our business.

Q: What happens to our existing partner contracts?

A: It is business as usual.

Q: What will the partner strategy be going forward, particularly in relation to cloud?

A: Partners are a fundamental part of the go-to-market strategies for Interactive Intelligence and Genesys, for both cloud and on-premise solutions. We intend for that to continue. Further details will be determined as integration planning continues.

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.

On August 31, 2016, the following communications were published on the Company’s website:

Genesys to Acquire Interactive Intelligence to Create the World’s Premier Omnichannel Customer Experience Company

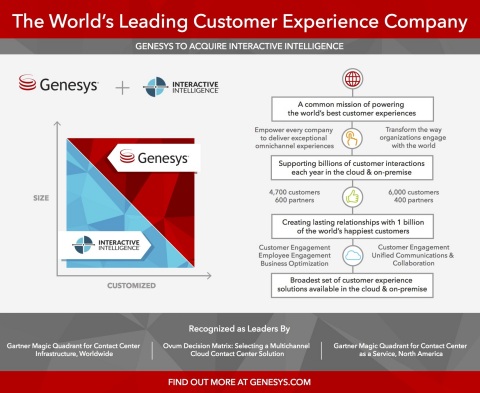

Genesys, a market leader in omnichannel customer experience and contact center solutions, and Interactive Intelligence, a global leader of cloud and on-premise solutions for customer engagement, communications and collaboration, announced that they have entered into a definitive agreement under which Genesys will acquire Interactive Intelligence.

Read the Press Release (http://investors.inin.com/releasedetail.cfm?ReleaseID=987197)

A Powerful Combination

This transaction will accelerate the ability for the combined company to execute on its mission of powering the world's best customer experiences at scale, anytime, anywhere - over any channel, in the cloud and on-premise.

Image:

Information For Customers and Partners

Customer FAQs (https://www.inin.com/sites/default/files/uploaded/Documents/customersfaq.pdf)

Partner FAQs (https://www.inin.com/sites/default/files/uploaded/Documents/partnersfaq.pdf)

“We can't say enough about the value our PureCloudR services have brought us - from improved service to increased efficiencies. It will certainly be a selling point in the future as we potentially expand the properties we service.”

Dr. Don Brown, Chairman, President and Chief Executive Officer, Interactive Intelligence

Important Additional Information

In connection with the proposed merger, Interactive Intelligence intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Interactive Intelligence will mail proxy materials to each shareholder entitled to vote at the special meeting relating to the proposed merger. Shareholders are urged to carefully read the proxy statement and any other proxy materials in their entirety (including any amendments or supplements thereto) and any other relevant documents that Interactive Intelligence will file with the SEC when they become available because they will contain important information. The proxy statement and other relevant materials (when available), and any and all documents filed by Interactive Intelligence with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Interactive Intelligence via the Investor Relations section of its website at http://investors.inin.com, or copies may be obtained, without charge, by directing a request to Chief Financial Officer, Interactive Intelligence Group, Inc., 7601 Interactive Way, Indianapolis, Indiana 46278 or by calling (317) 715-8265.

Participants in the Solicitation

This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Interactive Intelligence, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the shareholders of Interactive Intelligence in connection with the proposed merger. Information about the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Interactive Intelligence’s shareholders in connection with the proposed merger, and any interest they have in the proposed merger, will be set forth in the definitive proxy statement when it is filed with the SEC. Information regarding Interactive Intelligence’s directors and officers is set forth in Interactive Intelligence’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2016, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on February 29, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov, and via Interactive Intelligence’s Investor Relations section of its website at http://investors.inin.com.

Cautionary Note Regarding Forward-Looking Statements

This document may include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Forward-looking statements can usually be identified by the use of terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and similar words or expression. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including: (1) Interactive Intelligence may be unable to obtain shareholder approval as required for the merger; (2) conditions to the closing of the merger, including the obtaining of required regulatory approvals, may not be satisfied; (3) the merger may involve unexpected costs, liabilities or delays; (4) the business or stock price of Interactive Intelligence may suffer as a result of uncertainty surrounding the merger; (5) the outcome of any legal proceedings related to the merger; (6) Interactive Intelligence may be adversely affected by other economic, business, and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (8) the ability to recognize benefits of the merger; (9) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (10) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all; (11) the risks described from time to time in Interactive Intelligence’s reports filed with the SEC under the heading “Risk Factors,” including the Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Interactive Intelligence’s filings with the SEC; and (12) general industry and economic conditions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, Interactive Intelligence undertakes no obligation to update forward-looking statements to reflect events or circumstances arising after such date.