As filed with the Securities and Exchange Commission on February 24, 2017

Registration No. 333-215559

UNITED STATES

|SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PRE-EFFECTIVE AMENDMENT NO. 1

POST-EFFECTIVE AMENDMENT NO.____

Northern Lights Fund Trust II

(Exact Name of Registrant as Specified in Charter)

17605 Wright Street

Omaha, NE 68130

Attention: Brian Nielsen

(Address of Principal Executive Offices)

(402) 895-1600

(Registrant’s Telephone Number)

The Corporation Trust Company

Corporate Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and Address of Agent for Service)

With a copy to:

David J. Baum, Esq. Alston & Bird, LLP 950 F Street NW Washington, DC 20004 (202) 239-3346 | James P. Ash, Esq. Senior Vice President Gemini Fund Services, LLC 80 Arkay Drive, Suite 110 Hauppauge, New York 11788 (631) 470-2619 |

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933.

No filing fee is due because the Registrant has previously registered an indefinite number of shares under the Securities Act of 1933 pursuant to Section 24(f) under the Investment Company Act of 1940.

Title of Securities Being Registered............................................... Investor Class and Advisor Class Shares of the Al Frank Fund, no par value per share, of the Registrant

Northern Lights Fund Trust II

Al Frank FUND

17605 Wright Street

Omaha, NE 68130

February 24, 2017

Dear Shareholder:

We wish to provide you with some important information concerning your investment. The Board of Trustees (the “Board”) of Northern Lights Fund Trust II (the “Trust”), after careful consideration, has approved the reorganization (the “Reorganization”) of the Al Frank Dividend Value Fund (the “Dividend Value Fund”), a series of the Trust, into the Al Frank Fund (together with the Dividend Value Fund are collectively referred to as the “Funds”), also a series of the Trust. These two Funds have substantially similar fundamental and non-fundamental investment policies, as well as similar but not identical investment objectives and substantially similar principal investment strategies. Moreover, the Funds’ principal investment risks are substantially the same. As a result of the Reorganization, shareholders of the Dividend Value Fund will become shareholders of the Al Frank Fund.

In proposing the Reorganization, AFAM Capital, Inc., the investment adviser to both Funds reasoned, among other things, that the Reorganization might increase the combined Fund’s prospects for increased sales and economies of scale perhaps further lowering the total annual operating expense ratio as certain fixed fees would be spread across a larger asset base. AFAM also took the view that the Reorganization represented the most effective use of investment resources and could create an environment with the best opportunity for successful long-term investing on behalf of shareholders.

In approving the Reorganization, the Board considered, among other things, the similarities between the Funds’ investment objectives and policies, the fact that the Reorganization will result in expense savings for shareholders as the Al Frank Fund has a lower expense ratio (before and after waiver) than the Dividend Value Fund, that the costs of the Reorganization will be borne by AFAM Capital, Inc., the investment adviser to both Funds, and the anticipated tax-free nature of the Reorganization. While the Board acknowledges that the investment adviser to both Funds could benefit through the Reorganization from a reduction in the amount of fees it waives, the Board believes that the Reorganization overall will be in the best interest of the combined Fund’s shareholders. Additionally, to the extent that the investment adviser has waived any fees for the Dividend Value Fund, the investment adviser confirms that such waived fees will not be subject to reimbursement/recapture following the Reorganization.

Effective April 21, 2017 (the “Closing Date”), the Dividend Value Fund will transfer its assets to the Al Frank Fund. In connection with the Reorganization, you will receive Investor Class or Advisor Class shares of the Al Frank Fund equal in aggregate net asset value to the aggregate net asset value of your Investor Class or Advisor Class shares of the Dividend Value Fund, respectively. The enclosed Combined Prospectus/Proxy Statement describes the Reorganization in greater detail and contains important information about the Al Frank Fund.

If you have questions, please contact the Funds at 1-888-263-6443.

Sincerely,

/s/ Kevin E. Wolf

Kevin E. Wolf

President

Northern Lights Fund Trust II

Northern Lights Fund Trust II

Al Frank FUND

17605 Wright Street

Omaha, NE 68130

---------------------------

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on April 20, 2017

---------------------------

To the Shareholders of the Al Frank Dividend Value Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Special Meeting”) of the Al Frank Dividend Value Fund (the “Dividend Value Fund”), a series of Northern Lights Fund Trust II (“NLFT II”), is to be held at 10:00 a.m. Eastern time on April 20, 2017, at the offices of Gemini Fund Services, LLC, at 80 Arkay Drive, Hauppauge, NY 11788.

The Special Meeting is being held to consider an Agreement and Plan of Reorganization (the “Plan”) providing for the transfer of all of the assets of the Dividend Value Fund to the Al Frank Fund, a series of NLFT II.

The transfer effectively would be an exchange of your shares of the Dividend Value Fund for shares of the Al Frank Fund, which would be distributed pro rata by the Dividend Value Fund to holders of its shares in complete liquidation of the Dividend Value Fund, and the Al Frank Fund’s assumption of the Dividend Value Fund’s liabilities.

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof. Holders of record of the shares of beneficial interest in the Dividend Value Fund as of the close of business on February 14, 2017, are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

If the necessary quorum to transact business or the vote required to approve the Plan is not obtained at the Special Meeting, or if a quorum is obtained but sufficient votes required to approve the Plan are not obtained, the persons named as proxies on the enclosed proxy card may propose one or more adjournments of the Special Meeting to permit, in accordance with applicable law, further solicitation of proxies with respect to the proposal. Whether or not a quorum is present, any such adjournment as to a matter will require the affirmative vote of the holders of a majority of the shares represented at that meeting, either in person or by proxy. The persons designated as proxies may use their discretionary authority to vote on questions of adjournment and on any other proposals raised at the Special Meeting to the extent permitted by the proxy rules of the Securities and Exchange Commission (the “SEC”), including proposals for which timely notice was not received, as set forth in the SEC’s proxy rules.

By order of the Board of Trustees of NLFT II,

Sincerely,

/s/ Kevin E. Wolf

Kevin E. Wolf

President

Northern Lights Fund Trust II

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be Held on April 20, 2017 or any adjournment or postponement thereof. This Notice and Combined Proxy Statement and Prospectus are available on the internet at www.alfrankfunds.com. On this website, you will be able to access this Notice, the Combined Proxy Statement and Prospectus, any accompanying materials and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

IMPORTANT — We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope, which requires no postage and is intended for your convenience. You also may vote in person at the time and at the address indicated on your proxy card; through the internet, by visiting the website address on your proxy card; or by telephone, by using the toll-free number on your proxy card. Your prompt vote may save the Dividend Value Fund the necessity of further solicitations to ensure a quorum at the Special Meeting.

QUESTIONS AND ANSWERS

We recommend that you read the complete Combined Prospectus/Proxy Statement. The following Questions and Answers provide an overview of the key features of the Reorganization and of the information contained in this Combined Prospectus/Proxy Statement.

Q. What is this document and why did we send it to you?

| A. | This is a Combined Prospectus/Proxy Statement that provides you with information about a plan of reorganization between the Al Frank Dividend Value Fund (the “Dividend Value Fund”) and the Al Frank Fund (the “Al Frank Fund”). Both the Dividend Value Fund and the Al Frank Fund are series of the Northern Lights Fund Trust II (the “Trust”). The Dividend Value Fund and the Al Frank Fund are sometimes each referred to separately as a “Fund”, and together as the “Funds.” The investment objectives of the Funds are similar but not identical: the investment objective of the Al Frank Fund is long-term capital appreciation; the investment objectives of the Dividend Value Fund are long-term total return from both capital appreciation and, secondarily, dividend income. In addition, the Funds have substantially similar fundamental investment policies (i.e., those that cannot be changed without shareholder approval) and identical non-fundamental investment policies (i.e., those that do not require shareholder approval to change), as well as substantially similar principal investment strategies. There are some differences, however, and these are described under “Summary of Investment Objectives, Strategies and Risks” in this Prospectus/Proxy Statement. When the reorganization (the “Reorganization”) is completed, your shares of the Dividend Value Fund will be exchanged for shares of the Al Frank Fund, and the Dividend Value Fund will be terminated as a series of the Trust. Please refer to the Combined Prospectus/Proxy Statement for a detailed explanation of the Reorganization, and a more complete description of the Al Frank Fund. |

You are receiving this Combined Prospectus/Proxy Statement because you own shares of the Dividend Value Fund as of February 14, 2017.

| Q. | What are shareholders being asked to vote on at the upcoming Special Meeting on April 20, 2017? |

| A. | The Board of Trustees of the Trust (the “Board”) has called the Special Meeting at which you will be asked to vote on the Reorganization. If shareholders of the Dividend Value Fund do not vote to approve the Reorganization, the Board will consider other possible courses of action in the best interests of shareholders, including continuation of the Dividend Value Fund as is, the Dividend Value Fund’s liquidation or seeking shareholder approval of amended proposals. |

Q. Has the Board of Trustees approved the Reorganization?

| A. | Yes, the Board has approved the Reorganization. After careful consideration, the Board, including all of the Trustees who are not “interested persons” of the Trust (as defined in the Investment Company Act of 1940 (the “1940 Act”)) (the “Independent Trustees”), determined that the Reorganization is in the best interests of the Dividend Value Fund’s shareholders and that the Dividend Value Fund’s existing |

shareholders interests will not be diluted as a result of the Reorganization. It is expected that the Dividend Value Fund will benefit from the possible operating efficiencies and economies of scale that may result from combining the assets of the Dividend Value Fund with the assets of the Al Frank Fund.

| Q. | Why is the Reorganization occurring? |

| A. | The Board has determined that Dividend Value Fund shareholders may benefit from an investment in the Al Frank Fund in the following ways: |

| (i) | Shareholders of the Dividend Value Fund will remain invested in an open-end fund that has greater net assets at the time of and following the Reorganization; |

| (ii) | Shareholders of the Dividend Value Fund will experience expense savings as the Al Frank Fund has a lower expense ratio (before and after waiver) than the Dividend Value Fund. |

| (iii) | The Reorganization may increase the combined Al Frank Fund’s prospects for increased sales and economies of scale perhaps further lowering the total annual operating expense ratio as certain fixed fees are spread across a larger asset base. |

| (iv) | The Reorganization may represent the most effective use of investment resources and may create an environment with the best opportunity for successful long-term investing on behalf of shareholders. |

| Q. | How will the Reorganization affect me as a shareholder? |

| A. | Upon the closing of the Reorganization, Dividend Value Fund shareholders will become shareholders of the Al Frank Fund. With the Reorganization, all of the assets and the liabilities of the Dividend Value Fund will be combined with those of the Al Frank Fund. You will receive shares of the Al Frank Fund of the same class as the shares you own of the Dividend Value Fund. An account will be created for each shareholder that will be credited with shares of the Al Frank Fund with an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Dividend Value Fund shares at the time of the Reorganization. |

The number of shares a shareholder receives (and thus the number of shares allocated to a shareholder) will depend on the relative net asset values per share of the two Funds immediately prior to the Reorganization. Thus, although the aggregate net asset value in a shareholder’s account will be the same, a shareholder may receive a greater or lesser number of shares than it currently holds in the Dividend Value Fund. No physical share certificates will be issued to shareholders. As a result of the Reorganization, a Dividend Value Fund shareholder will hold a smaller percentage of ownership in the Al Frank Fund than such shareholder held in the Dividend Value Fund prior to the Reorganization.

Although the Dividend Value Fund and Al Frank Fund have similar but not identical investment objectives, each achieve their objectives with slightly different strategies and investment in different portfolios of investments which may carry different risks. For more information about each Fund’s strategy and risks, please refer to the respective Fund’s current prospectus available at www.alfrankfunds.com.

| Q. | Will the Reorganization result in new or higher fees for shareholders? |

| A. | The Reorganization is not expected to result in higher fees for shareholders. The Al Frank Fund’s advisory fee is the same as that of the Dividend Value Fund, and the Al Frank Fund’s total operating expenses are lower than those of the Dividend Value Fund. AFAM Capital, Inc. (“AFAM” or the “Adviser”), the investment adviser to both Funds will be paid an investment advisory fee equal to 1.00% of the Al Frank Fund’s average daily net assets which is the same as the 1.00% advisory fee paid by the Dividend Value Fund. Estimated Other Expenses of the Al Frank Fund are lower than those of the Dividend Value Fund. Each Fund’s Investor Class and Advisor Class pay 0.25% and 0.00%, respectively in 12b-1 fees. |

AFAM has contractually agreed to waive management fees and to make payments to limit the Al Frank Fund expenses, until at least April 30, 2018 so that the total annual operating expenses (exclusive of certain fees or expenses) do not exceed 1.49% and 1.24% of average daily net assets attributable to Investor Class and Advisor Class shares, respectively. Additionally, AFAM has contractually agreed to waive

management fees and to make payments to limit the Dividend Value Fund expenses, until at least April 30, 2018 so that the total annual operating expenses (exclusive of certain fees or expenses) do not exceed 1.98% and 1.73% of average daily net assets attributable to Investor Class and Advisor Class shares, respectively. The agreement excludes any front-end or contingent deferred sales loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes and extraordinary or non-recurring expenses, including, but not limited to, litigation). This operating expense limitation agreement can be terminated only by, or with the consent of, the Board. AFAM is permitted to receive reimbursement of any excess expense payments paid by it pursuant to the operating expense limitation agreement subject to the limitation that: (1) the reimbursement for fees and expenses will be made only if payable within three years from the date on which they were incurred; and (2) the reimbursement may not be made if it would cause the expense limitation in effect at the time of the waiver or currently in effect, whichever is lower, to be exceeded. Fee waiver and reimbursement arrangements can decrease the Funds’ expenses and increase its performance.

| Q. | When will the Reorganization occur? |

| A. | The Reorganization is expected to take effect on or about April 21, 2017, or as soon as possible thereafter. |

| Q. | Who will pay for the Reorganization? |

| A. | The costs of the Reorganization will be borne by AFAM, each Fund’s investment adviser, and such costs will not impact either Fund’s net asset value. |

| Q. | Will the Reorganization result in any federal tax liability to me? |

| A. | The Reorganization is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes and will not take place unless the Dividend Value Fund and the Al Frank Fund receive an opinion of counsel to the Al Frank Fund to that effect. Assuming the Reorganization so qualifies, Dividend Value Fund shareholders should not recognize any gain or loss on their exchanges of shares of the Dividend Value Fund for shares of the Al Frank Fund. Shareholders of the Dividend Value Fund may receive a special dividend prior to the closing of the Reorganization that will be taxable. AFAM, each Fund’s investment adviser, does not presently anticipate selling off portfolio securities of the Dividend Value Fund prior to the Reorganization, or selling assets to adjust the portfolio of the Al Frank Fund after the Reorganization, although it is possible the adviser may have to sell some smaller positions of the Al Frank Fund after the Reorganization if redemption trends require greater liquidity in the portfolio. |

| Q. | Can I redeem my shares of the Dividend Value Fund before the Reorganization takes place? |

| A. | Yes. You may redeem your shares, at any time before the Reorganization takes place, as set forth in the Dividend Value Fund’s prospectus. If you choose to do so, your request will be treated as a normal exchange or redemption of shares. Shares that are held as of April 21, 2017 will be exchanged for shares of the Al Frank Fund. |

| Q. | Will shareholders have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| A. | No. Shareholders will not pay any sales load, commission or other similar fee in connection with the Reorganization, and thus Dividend Value Fund shareholders will not pay any such fee indirectly. |

| Q. | Whom do I contact for further information? |

| A. | You can contact your financial adviser for further information. You may also contact the Funds at 1-888-263-6443. You may also visit our website at www.alfrankfunds.com. |

Q. What will happen if shareholders do not approve the Reorganization?

| A. | If shareholders do not vote to approve the Reorganization, the Board will consider other possible courses of action in the best interests of shareholders, including continuation of the Dividend Value Fund as is, the Dividend Value Fund’s liquidation or seeking shareholder approval of amended proposals. |

Q. May I revoke my proxy?

| A. | Any shareholder who has given a proxy has the right to revoke it any time prior to its exercise by attending the Special Meeting and voting his or her shares in person, or by submitting a letter of revocation or a later-dated proxy card at the address indicated on the enclosed envelope provided with this Proxy Statement/Prospectus. Any letter of revocation or later-dated proxy card must be received prior to the Special Meeting and must indicate your name and account number to be effective. Proxies voted by telephone or internet may be revoked at any time before they are voted at the Special Meeting in the same manner that proxies voted by mail may be revoked (i.e., the shareholder may attend the Special Meeting and revoke their vote or submit a letter of revocation any time prior to the Special Meeting, or the shareholder may submit a new vote (in any capacity) to change their vote as only the shareholder’s most recent vote counts). |

PLEASE VOTE THE ENCLOSED PROXY BALLOT CARD.

YOUR VOTE IS VERY IMPORTANT

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and will avoid the time and expense to Northern Lights Fund Trust II in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Each party must sign the proxy card. Each party should sign exactly as shown in the registration on the proxy card. |

| 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

Registration Valid Signature

Corporate Accounts

| 2. | ABC Corp. John Doe, Treasurer |

c/o John Doe, Treasurer

| 4. | ABC Corp. Profit Sharing Plan John Doe, Trustee |

Trust Accounts

| 1. | ABC Trust Jane B. Doe, Trustee |

| 2. | Jane B. Doe, Trustee Jane B. Doe |

u/t/d 12/28/78

Custodial or Estate Accounts

| 1. | John B. Smith, Cust. John B. Smith |

f/b/o John B. Smith, Jr. UGMA

| 2. | Estate of John B. Smith John B. Smith, Jr. Executor |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be Held on April 20, 2017 or any adjournment or postponement thereof. This Notice and Combined Proxy Statement and Prospectus are available on the internet at www.alfrankfunds.com. On this website, you will be able to access this Notice, the Combined Proxy Statement and Prospectus, any accompanying materials and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

COMBINED PROSPECTUS/PROXY STATEMENT

RELATING TO THE ACQUISITION OF ASSETS OF THE

Al frank Dividend Value FUND,

a series of Northern Lights Fund Trust II

BY AND IN EXCHANGE FOR

Investor Class And Advisor Class SHARES OF THE

AL FRANK FUND,

a series of Northern Lights Fund Trust II

Managed by:

AFAM Capital, Inc.

12117 FM 2244, Building 3, Suite 170

Austin, TX 78738

1-888-263-6443

February 24, 2017

This Combined Prospectus/Proxy Statement is being furnished to shareholders of the Al Frank Dividend Value Fund (the “Dividend Value Fund”), a series of Northern Lights Fund Trust II (the “Trust”), in connection with an Agreement and Plan of Reorganization (the “Plan”) that has been approved by the Board of Trustees of the Trust (the “Board”). Under the Plan, shareholders of Investor Class and Advisor Class shares of the Dividend Value Fund will receive Investor Class and Advisor Class shares of the Al Frank Fund (the “Al Frank Fund”), also a series of the Trust, equivalent in aggregate net asset value to the aggregate net asset value of their shares, in their respective classes, of the Dividend Value Fund, as of the closing date of the reorganization (the “Reorganization”) for use at a Special Meeting of Shareholders (the “Special Meeting”) of the Dividend Value Fund, at the offices of Gemini Fund Services, LLC, the Trust’s administrator, at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788 on April 20, 2017, at 10:00 a.m. Eastern Time. At the Special Meeting, shareholders of the Dividend Value Fund will be asked to consider and approve the Reorganization Agreement. Upon completion of the Reorganization, the Dividend Value Fund will be terminated as a series of the Trust and the Al Frank Fund will continue as the surviving fund. The Reorganization is expected to be consummated on April 21, 2017. Failure of any of the conditions to closing as described herein will result in the Reorganization not being completed. If the Reorganization is not completed, it is expected that the Dividend Value Fund and the Al Frank Fund will continue to operate as separate series of the Trust.

The Board believes that the Reorganization is in the best interests of the Dividend Value Fund and the Al Frank Fund (together, the “Funds”), and that the interests of the Funds’ shareholders will not be diluted as a result of the Reorganization.

For federal income tax purposes, the Reorganization will be structured as a tax-free transaction for the Funds and their shareholders.

The investment objectives of the Funds are similar but not identical: the investment objective of the Al Frank Fund is long-term capital appreciation; the investment objectives of the Dividend Value Fund are long-term total return from both capital appreciation and, secondarily, dividend income. In addition, the Funds have substantially similar fundamental investment policies (i.e., those that cannot be changed without shareholder approval) and identical non-fundamental investment policies (i.e., those that do not require shareholder approval to change), as well as substantially similar principal investment strategies. There are some differences, however, and these are described under “Summary of Investment Objectives, Strategies and Risks” in this Prospectus/Proxy Statement.

This Combined Prospectus/Proxy Statement sets forth concisely the information about the Al Frank Fund that shareholders of the Dividend Value Fund should know before investing and should be read and retained by investors for future reference.

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated into this Combined Prospectus/Proxy Statement by reference:

| · | Reorganization-Related Document: the Statement of Additional Information relating to the Reorganization dated the same date as this Combined Prospectus/Proxy Statement (the “Merger SAI”), filed on February 24, 2017; |

| · | Dividend Value Fund Documents: the Prospectus and Statement of Additional Information of Northern Lights Fund Trust II dated May 1, 2016, as supplemented, filed on April 22, 2016 (File Nos. 333-174926; 811-22549); and |

| · | Al Frank Fund Documents: the Prospectus and Statement of Additional Information of Northern Lights Fund Trust II dated May 1, 2016, as supplemented, filed on April 22, 2016 (File Nos. 333-174926; 811-22549). |

Copies of these documents are available without charge and can be obtained by writing to the Trust at c/o Gemini Fund Services, LLC, 17605 Wright Street, Suite 2, Omaha, NE 68130, or by calling, toll free, 1-888-263-6443.

Each Fund is subject to the information requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. These reports, proxy materials and other information can be inspected and copied at the Public Reference Room maintained by the SEC. Copies may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov, or by writing to the Public Reference Branch of the SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, D.C. 20549-0102. In addition, copies of these documents may be viewed online or downloaded from the SEC’s website at www.sec.gov.

Please note that investments in the Funds are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that either Fund will achieve its investment objectives.

AS WITH ALL OPEN-END MUTUAL FUNDS, THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED ON THE ADEQUACY OF THIS COMBINED PROSPECTUS/PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| A. Overview | 1 |

| B. Summary of the Reorganization | 1 |

| C. Summary Comparison of Funds and Principal Risks | 2 |

| D. Comparison Fee Table and Example; Portfolio Turnover | 9 |

| E. Comparison of Performance | 11 |

| F. Key Information About the Reorganization | 13 |

| Description of the Shares to be Issued | 13 |

| Reasons for the Reorganization | 14 |

| Federal Income Tax Consequences | 14 |

| Comparison of Shareholder Rights | 16 |

| Comparison of Valuation Procedures | 16 |

| Capitalization | 17 |

| Investment Adviser | 17 |

| Distribution | 18 |

| Purchase and Redemption Procedures. | 19 |

| Control Persons and Principal Holders of Securities | 22 |

| Service Providers | 23 |

| Financial Highlights | 24 |

| APPENDIX A | 30 |

At a meeting held on October 24-25, 2016, the Board of Trustees (the “Board”) of Northern Lights Fund Trust II (the “Trust”), including all of the trustees who are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), considered and approved an Agreement and Plan of Reorganization dated April 21, 2017 (the “Plan of Reorganization”), a copy of which is attached to this Combined Prospectus/Proxy Statement as Appendix A. Under the Plan of Reorganization, subject to satisfaction of certain closing conditions described below (the “Closing Conditions”), the Dividend Value Fund (the “Dividend Value Fund”) will transfer all of its assets and liabilities to the Al Frank Fund (the “Al Frank Fund”) in exchange for that number of Investor Class and Advisor Class shares of the Al Frank Fund equivalent in aggregate net asset value to the aggregate net asset value of the Investor Class and Advisor Class shares of the Dividend Value Fund outstanding immediately prior to the Closing Date (as defined below). This will be followed by a distribution of those shares to Dividend Value Fund Investor Class and Advisor Class shareholders so that each Dividend Value Fund shareholder will receive shares of the Al Frank Fund equivalent to the value of Dividend Value Fund shares held by such shareholder as of the Valuation Time (as defined below). Unless delayed for any reason, the Valuation Time is expected to occur as of the close of regular trading on the New York Stock Exchange on April 20, 2017, and the Closing Date is expected to occur on the following business day, which is April 21, 2017. The Dividend Value Fund will then be liquidated and terminated as a series of the Trust and the Al Frank Fund will continue as the surviving fund (the transactions described in this paragraph are collectively referred to as the “Reorganization”). The expenses associated with the Reorganization include costs of printing, costs of mailing the Combined Prospectus/Proxy Statement, the costs of holding the Special Meeting, EDGAR filings fees and legal expenses.

As set forth in the Plan of Reorganization, the Reorganization is subject to certain normal and customary closing conditions as described therein. Failure of any of the Closing Conditions will result in the Reorganization not being completed. Such Closing Conditions include, that the Dividend Value Fund and the Al Frank Fund receive an opinion from Alston & Bird LLP, dated as of the Closing Date, regarding the characterization of the Reorganization as a “reorganization” within the meaning of Section 368(a) of the Code; this N-14 will have been declared effective; all service provided certifications and other certifications as required by the Plan of Reorganization will be executed and delivered; and obtaining the requisite shareholder approval and satisfying other conditions outlined in the Plan of Reorganization.

AFAM Capital, Inc. (“AFAM” or the “Adviser”), the investment adviser to both Funds, and/or an affiliate thereof, will be responsible for the costs of the Reorganization.

| B. | Summary of the Reorganization |

On October 24-25, 2016, the Board, on behalf of the Dividend Value Fund and the Al Frank Fund, approved the Plan of Reorganization that contemplates the transfer to the Al Frank Fund of all of the assets and liabilities of the Dividend Value Fund solely in exchange for shares of beneficial interest of the Al Frank Fund. Following the transfer, Investor Class and Advisor Class shares of the Al Frank Fund will be distributed to Investor Class and Advisor Class shareholders of the Dividend Value Fund in liquidation of the Dividend Value Fund and the Dividend Value Fund will subsequently be terminated as a series of the Trust.

Both Funds are equity funds with similar but not identical investment objectives and substantially similar investment strategies. The Trust’s Board and the Funds’ investment adviser, AFAM, recognize that greater economies of scale and efficiencies can be attained by combining the assets of the Funds.

As a result of the Reorganization, each shareholder of the Dividend Value Fund will receive full and fractional Investor Class and Advisor Class shares of the Al Frank Fund equal in aggregate net asset value at the time of the Reorganization to the aggregate net asset value of such shareholder’s Investor Class and Advisor Class shares of the Dividend Value Fund immediately prior to the Reorganization. The Board has determined that the interests of existing shareholders of the Dividend Value Fund will not be diluted as a result of the transactions contemplated by the Reorganization. For the reasons set forth below under “Reasons for the Reorganization,” the

Board (including the independent trustees) concluded that the Reorganization would be in the best interest of the Dividend Value Fund and its shareholders.

| C. | Summary Comparison of Funds and Principal Risks |

Investment Objectives. The investment objectives of the Funds are similar, although the Al Frank Fund’s objective does not include a dividend income component: the investment objective of the Al Frank Fund is long-term capital appreciation; the investment objectives of the Dividend Value Fund are long-term total return from both capital appreciation and, secondarily, dividend income.

Principal Investment Strategies. Each Fund seeks to achieve its investment objective by using the principal investment strategies discussed below, which, you will note, are substantially similar for the two Funds. After the Reorganization, the combined Fund will follow the principal investment strategies of the Al Frank Fund.

The following discussion comparing the investment strategies and principal risks of each Fund is based upon and qualified in its entirety by the respective investment strategies and principal risks sections of the Funds’ prospectus dated May 1, 2016, as supplemented.

| | Dividend Value Fund | Al Frank Fund |

| Principal Investment Strategies | Under normal market conditions, the Dividend Value Fund invests at least 80% of its net assets in equity securities that pay or are expected to pay dividends. The Fund may invest in companies of any size, from larger, well-established companies to smaller companies. The Adviser selects dividend-paying equity securities consisting of common stocks and securities having the characteristics of common stocks, such as preferred stocks, convertible securities, rights and warrants, on the basis of fundamental corporate analysis. The Dividend Value Fund may also invest in foreign securities, provided that they are publicly traded in the United States, including in ADRs. The Adviser screens a universe of more than 6,000 stocks in order to identify those with a dividend paying history, low price-to-earnings ratios, price-to-book values, and price-to-revenues ratios relative to their historical norms, their industry peers or the overall market. The Adviser utilizes these and other fundamental valuation metrics as well as its assessments of a company’s long-term growth prospects and risk characteristics, in order to establish a target price for each stock. The target price represents the price at which the Adviser believes the stock is fairly valued. Those stocks with significant appreciation potential relative to these target prices and perceived risk characteristics become available for selection. The Dividend Value Fund’s portfolio seeks broad diversification via exposure to a significant number of major market sectors and industry groups. The Adviser may sell positions as they reach or approach their target price, if a lower target price results from a reassessment of earnings or valuation multiples, or if a more attractive stock is identified. | Under normal market conditions, the Adviser selects equity securities that it believes are out of favor and undervalued. The Adviser then attempts to purchase the securities and hold them until it believes that the securities have reached their fair value. The Adviser selects equity securities consisting of common stocks and securities having the characteristics of common stocks, such as preferred stocks, convertible securities, rights and warrants. The Al Frank Fund may invest in securities of foreign issuers (“foreign securities”), provided that they are publicly traded in the United States, including in American Depositary Receipts (“ADRs”). The Adviser screens a universe of more than 6,000 stocks in order to identify those with low price-to-earnings ratios, price-to-book values, and price-to-revenues ratios relative to its historical norms, its industry peers or the overall market. The Adviser utilizes these and other fundamental valuation metrics as well as its assessments of a company’s long-term growth prospects and risk characteristics, in order to establish a target price for each stock. The target price represents the price at which the Adviser believes the stock is fairly valued. Those stocks with significant appreciation potential relative to these target prices and perceived risk characteristics become available for selection. The Adviser employs a go-anywhere style focused on uncovering undervalued stocks independent of market capitalization. The Al Frank Fund’s portfolio is expected to hold both dividend and nondividend paying stocks and seeks broad market diversification via exposure to a significant number of major market sectors and industry groups. The Adviser may sell positions as they reach or approach their target price, if a lower target price results from a reassessment of earnings or valuation multiples, or if a more attractive stock is identified. To earn additional income, the Al Frank Fund, through its agent, may lend its portfolio securities to broker-dealers amounting to no more than 33-1/3% of the total assets of the Fund (including any collateral posted) or 50% of the total assets of the Fund (excluding any collateral posted). When the Al Frank Fund loans its portfolio securities, it will receive collateral equal to at least 102% of the value of the loaned securities. |

For each Fund, the Adviser selects equity securities consisting of common stocks and securities having the characteristics of common stocks. The Funds may also invest in foreign securities, provided that they are publicly traded in the United States, including in ADRs. The Adviser screens a universe of more than 6,000 stocks in order to identify those with a dividend paying history, low price-to-earnings ratios, price-to-book values, and price-to-revenues ratios relative to its historical norms, its industry peers or the overall market. The Funds’ portfolios seek broad diversification via exposure to a significant number of major market sectors and industry groups. The Adviser employs a go-anywhere style focused on uncovering undervalued stocks independent of market capitalization. Stock selection is driven by bottom-up fundamental analysis in the context of macroeconomic and industry data. The Adviser distills company fundamentals and growth prospects into earnings and cash flow estimates applied against a determination of fair-value multiples to arrive at target prices. Stocks with significant appreciation potential relative to these target prices and perceived risk characteristics become available for selection.

While these two Funds have substantially similar fundamental and non-fundamental investment policies, as well as similar but not identical investment objectives and substantially similar principal investment strategies, the two Funds have two primary differences. The first difference is that the Dividend Value Fund’s investment strategy requires seeking dividend producing stocks that absolutely produce a dividend, while the Al Frank Fund’s investment strategy does not mandate this same approach. The Al Frank Fund is not required by its strategy to seek dividend producing stocks, however, the types of stocks that it does invest in frequently are dividend producing stocks. The second primary difference pertains to each Fund’s borrowing policy. Specifically, the policies are identical except that the Al Frank Fund policy does not contain (i) the clause “except as the 1940 Act, any rule thereunder, or SEC staff interpretation thereof, may permit,”’ and (ii) an explicit clause regarding the current regulatory limit.

The Adviser may sell positions as they reach or approach their target price, if a lower target price results from a reassessment of earnings or valuation multiples, or if a more attractive stock is identified.

For temporary defensive purposes, the Adviser may invest without limit in high-quality, short-term debt securities and money market instruments. These short-term debt securities and money market instruments include shares of other mutual funds, commercial paper, certificates of deposit, bankers’ acceptances, U.S. Government

securities and repurchase agreements. Taking a temporary defensive position may result in the Funds not achieving their investment objectives. Furthermore, to the extent that a Fund invests in money market mutual funds for its cash position, there will be some duplication of expenses because the Fund would bear its pro rata portion of such money market funds’ management fees and operational expenses.

Disclosure of Portfolio Holdings. A description of the Funds’ policies and procedures with respect to the disclosure of the portfolio securities is available in the statement of additional information for the Funds, which is incorporated by reference.

Distribution. Northern Lights Distributors, LLC, located at 17605 Wright Street, Omaha, NE 68130 (the "Distributor") serves as the principal underwriter and national distributor for the shares of the Fund pursuant to an underwriting agreement with the Trust (the "Underwriting Agreement"). The Distributor is registered as a broker-dealer under the Securities Exchange Act of 1934 and each state's securities laws and is a member of FINRA.

Distribution and Service Plan (Rule 12b-1)

Each Fund has adopted a Distribution and Shareholder Servicing Plan pursuant to Rule 12b-1 (the “12b-1 Plan”) under the 1940 Act. Under the 12b-1 Plan, each Fund is authorized to pay the Fund’s distributor, or such other entities as approved by the Board, a fee for the promotion and distribution of the Fund and the provision of personal services to shareholders. The maximum amount of the fee authorized is 0.25% of each Fund’s Investor Class shares average daily net assets annually. The distributor may pay any or all amounts received under the 12b-1 Plan to other persons, including the Adviser, for any distribution or service activity. Because these fees are paid out of a Fund’s assets on an on-going basis, over time these fees will increase the cost of your investment in the Fund and may cost you more than paying other types of sales charges.

In addition to the fees paid under the 12b-1 Plan, each Fund may pay service fees to intermediaries such as banks, broker-dealers, financial advisors or other financial institutions, including the Adviser and affiliates of the Adviser, for sub-administration, sub-transfer agency and other shareholder services associated with shareholders whose shares are held of record in omnibus, other group accounts or accounts traded through registered securities clearing agents.

Purchase and Redemption Procedures.

Purchasing Information. Investor Class and Advisor Class shares of both Funds are offered for purchase by mail, through brokers or agents who have entered into selling agreements with the Funds’ distributor, by wire (the Funds will normally accept wired funds for investment on the day received if they are received by the Fund’s designated bank before the close of regular trading on the NYSE) or shareholders may participate in the Funds’ Automatic Investment Plan, an investment plan that automatically moves money from your bank account and invests it in a Fund through the use of electronic funds transfers or automatic bank drafts. Each Fund, however, reserves the right, in its sole discretion, to reject any application to purchase shares.

Minimum Investments. Investor Class shares of both Funds has the same investment minimums. The minimum initial investment in Investor Class shares of the Fund is $1,000. The minimum subsequent investment in Investor Class shares of a Fund is $100. The minimum initial investment in Advisor Class shares of the Fund is $100,000. The minimum subsequent investment in Advisor Class shares of a Fund is $100. If at any time a shareholder’s account balance in one of the Funds falls below $1,000, the Fund may notify the shareholder that, unless the account is brought up to at least $1,000 within 60 days of the notice; the account could be closed. After the notice period, the Fund may redeem all of the shares and close the account by sending a check to the address of record. An account will not be closed if the account balance drops below required minimum due to a decline in NAV.

Redemption Information. Shares of both Funds are redeemed at a price equal to the NAV next determined after the redemption request is accepted in good order by the Funds. The Funds do not impose any contingent

deferred sales charges. Both Funds have reserved the right to redeem shares “in-kind” under certain circumstances. The Funds do impose a redemption fee as described above.

Purchasing Shares by Exchange. Shares of one Class of a Fund will not be exchangeable for shares of the other Class.

Limitations on Purchase. Applications will not be accepted unless they are accompanied by a check drawn on a U.S. bank, thrift institutions, or credit union in U.S. funds for the full amount of the shares to be purchased. Gemini Fund Services, LLC, the Funds’ transfer agent, will charge a $25 fee against a shareholder’s account, in addition to any loss sustained by a Fund, for any check returned to the transfer agent for insufficient funds. The Funds will not accept payment in cash, including cashier’s checks or money orders. Also, to prevent check fraud, the Funds will not accept third party checks, U.S. Treasury checks, credit card checks or starter checks for the purchase of shares.

Execution of Requests. Each Fund is open on those days when the NYSE is open, typically Monday through Friday. Buy and sell requests are executed at the next NAV calculated after your request is received in good order by the Trust. In unusual circumstances, a Fund may temporarily suspend the processing of sell requests, or may postpone payment of proceeds for up to seven business days or longer, as allowed by federal securities law.

Frequent Trading. The Funds discourage and do not accommodate market timing. Frequent trading into and out of a Fund can harm all Fund shareholders by disrupting a Fund’s investment strategies, increasing Fund expenses, decreasing tax efficiency and diluting the value of shares held by long-term shareholders. The Funds are designed for long-term investors and are not intended for market timing or other disruptive trading activities. Accordingly, the Board has approved policies that seek to curb these disruptive activities while recognizing that shareholders may have a legitimate need to adjust their Fund investments as their financial needs or circumstances change. The Funds currently use several methods to reduce the risk of market timing. These methods include:

| · | Committing staff to review, on a continuing basis, recent trading activity in order to identify trading activity that may be contrary to the Fund’s “Market Timing Trading Policy;” |

| · | Rejecting or limiting specific purchase requests; and |

| · | Charging a 2% redemption charge if shares are held less than 60 days. |

Though these methods involve judgments that are inherently subjective and involve some selectivity in their application, the Funds seek to make judgments and applications that are consistent with the interests of each Fund’s shareholders.

The Funds reserve the right to reject or restrict purchase or exchange requests for any reason, particularly when the shareholder’s trading activity suggests that the shareholder may be engaged in market timing or other disruptive trading activities. Neither the Funds nor the Adviser will be liable for any losses resulting from rejected purchase or exchange orders. The Adviser may also bar an investor who has violated these policies (and the investor’s financial adviser) from opening new accounts with the Funds.

Although the Funds attempt to limit disruptive trading activities, some investors use a variety of strategies to hide their identities and their trading practices. There can be no guarantee that the Funds will be able to identify or limit these activities. Omnibus account arrangements are common forms of holding shares of the Funds. While the Funds will encourage financial intermediaries to apply the Funds’ Market Timing Trading Policy to their customers who invest indirectly in the Funds, the Funds are limited in their ability to monitor the trading activity or enforce the Funds’ Market Timing Trading Policy with respect to customers of financial intermediaries. For example, should it occur, the Funds may not be able to detect market timing that may be facilitated by financial intermediaries or made difficult to identify in the omnibus accounts used by those intermediaries for aggregated purchases, exchanges and redemptions on behalf of all their customers. More specifically, unless the financial intermediaries have the ability to apply the Funds’ Market Timing Trading Policy to their customers through such methods as implementing short-term trading limitations or restrictions and monitoring trading activity for what might be market timing, the Funds

may not be able to determine whether trading by customers of financial intermediaries is contrary to the Funds’ Market Timing Trading Policy. Brokers maintaining omnibus accounts with the Funds have agreed to provide shareholder transaction information to the extent known to the broker to the Funds upon request. If the Funds or their transfer agent or shareholder servicing agent suspects there is market timing activity in the account, the Funds will seek full cooperation from the service provider maintaining the account to identify the underlying participant. At the request of the Adviser, the service providers may take immediate action to stop any further short-term trading by such participants.

Distributions and Taxes. Both Funds distribute most or all of their net investment income and capital gains annually, typically in December. Many investors have their distribution payments reinvested in additional shares of the same Fund and class. If you choose this option, or if you do not indicate any choice, your distribution payments will be reinvested on the payment date. Alternatively, you can choose to have a check for your distribution payments mailed to you. However, if, for any reason, the check is not deliverable, your distribution payments will be reinvested and no interest will be paid on amounts represented by the check. All distributions that you receive from the Funds are generally taxable, whether reinvested or received in cash. In addition, your redemption of Fund shares may result in a taxable gain or loss to you, depending on whether the redemption proceeds are more or less than what you paid for the redeemed shares.

Investment Restrictions and Limitations. With the exception of the policy on borrowing, the Funds have identical fundamental and non-fundamental investment restrictions. The policy on borrowing, for both Funds is substantially similar. Specifically, the policies are identical except that the Al Frank Fund policy does not contain (i) the clause “except as the 1940 Act, any rule thereunder, or SEC staff interpretation thereof, may permit,”’ and (ii) an explicit clause regarding the current regulatory limit. Set forth below is a summary of these restrictions. After the Reorganization, the combined Fund will follow the investment restrictions of the Al Frank Fund. Fundamental investment restrictions may only be changed by shareholder vote, while non-fundamental investment restrictions may be changed by action of the Board alone.

Each Fund’s investment objectives are fundamental.

In addition, the Al Frank Fund may not:

| | 1. | Issue senior securities, borrow money or pledge its assets, except that (i) the Fund may borrow from banks in amounts not exceeding one-third of its total assets (including the amount borrowed); and (ii) this restriction shall not prohibit the Fund from engaging in options transactions or short sales; |

| | 2. | Purchase securities on margin, except such short-term credits as may be necessary for the clearance of transactions and except that the Fund may borrow money from banks to purchase securities; |

| | 3. | Act as underwriter (except to the extent the Fund may be deemed to be an underwriter in connection with the sale of securities in its investment portfolio); |

| | 4. | Invest 25% or more of its total assets, calculated at the time of purchase and taken at market value, in any one industry (other than U.S. Government securities); |

| | 5. | Purchase or sell real estate or interests in real estate or real estate limited partnerships (although the Fund may purchase and sell securities which are secured by real estate and securities of companies which invest or deal in real estate); |

| | 6. | Purchase or sell commodities or commodity futures contracts, except that the Fund may purchase and sell foreign currency contracts in accordance with any rules of the Commodity Futures Trading Commission; |

| | 7. | Make loans of money (except for purchases of debt securities consistent with the investment policies of the Fund and except for repurchase agreements); or |

| | 8. | Make investments for the purpose of exercising control or management. |

In addition, the Dividend Value Fund may not:

| | 1. | Issue senior securities, borrow money or pledge its assets, except that (i) the Fund may borrow from banks in amounts not exceeding one-third of its total assets (including the amount borrowed); and (ii) this restriction shall not prohibit the Fund from engaging in options transactions or short sales; except as the 1940 Act, any rule thereunder, or SEC staff interpretation thereof, may permit; the regulatory limits allow the Fund to borrow up to 5% of its total assets for temporary purposes and to borrow from banks, provided that if borrowings exceed 5%, the Fund must have assets totaling at least 300% of the borrowing when the amount of the borrowing is added to the Fund’s other assets; the effect of this provision is to allow the Fund to borrow from banks amounts up to one-third (33-1/3%) of its total assets, including those assets represented by the borrowing; |

| | 2. | Purchase securities on margin, except such short-term credits as may be necessary for the clearance of transactions and except that the Fund may borrow money from banks to purchase securities; |

| | 3. | Act as underwriter (except to the extent the Fund may be deemed to be an underwriter in connection with the sale of securities in its investment portfolio); |

| | 4. | Invest 25% or more of its total assets, calculated at the time of purchase and taken at market value, in any one industry (other than U.S. Government securities); |

| | 5. | Purchase or sell real estate or interests in real estate or real estate limited partnerships (although the Fund may purchase and sell securities which are secured by real estate and securities of companies which invest or deal in real estate); |

| | 6. | Purchase or sell commodities or commodity futures contracts, except that the Fund may purchase and sell foreign currency contracts in accordance with any rules of the Commodity Futures Trading Commission; |

| | 7. | Make loans of money (except for purchases of debt securities consistent with the investment policies of the Fund and except for repurchase agreements); or |

| | 8. | Make investments for the purpose of exercising control or management. |

The Funds observe the following restrictions as a matter of operating but not fundamental policy, pursuant to positions taken by federal regulatory authorities:

Each Fund may not:

| | 1. | Invest in the securities of other investment companies or purchase any other investment company’s voting securities or make any other investment in other investment companies except to the extent permitted by federal securities law; |

| | 2. | Hold, in the aggregate, more than 15% of its net assets in securities with legal or contractual restrictions on resale, securities that are not readily marketable and repurchase agreements with more than seven days to maturity; or |

| | 3. | Purchase or sell futures contracts. |

| | | |

Principal Investment Risks. Because their investment objectives are similar but not identical and their principal investment strategies are substantially similar, the Dividend Value Fund and the Al Frank Fund are subject to substantially the same risks. A summary of the principal risks of investing in each Fund is set forth below. This summary is qualified in its entirety by the more extensive discussion of risk factors set forth in the prospectus and statement of additional information of the Funds, which are incorporated by reference. After the Reorganization, the combined Fund will have the same risks as the Al Frank Fund.

The Dividend Value Fund and Al Frank Fund have the following identical risks: Management Risk, Market Risk, Small- and Medium-Sized Companies Risk, Equity Risk, Value Style Investing Risk, Foreign Securities Risk and Cyber Securities Risk. The Al Frank Fund additionally has Securities Lending Risk as set forth below.

Management Risk. The skill of the Adviser will play a significant role in the Funds’ ability to achieve their investment objectives. The Funds’ ability to achieve their investment objectives depends on the ability of the Adviser to correctly identify economic trends, especially with regard to accurately forecasting inflationary and deflationary periods. In addition, the Funds’ ability to achieve their investment objectives depends on the Adviser’s ability to select stocks, particularly in volatile stock markets. The Adviser could be incorrect in its analysis of industries, companies and the relative attractiveness of growth and value stocks and other matters.

Market Risk. The Funds are designed for long-term investors who can accept the risks of investing in a portfolio with significant common stock holdings. Common stocks tend to be more volatile than other investment choices such as bonds and money market instruments. The value of the Funds’ shares will fluctuate due to the movement of the overall stock market or the value of the individual securities held by the Funds.

Small- and Medium-Sized Companies Risk. Investing in securities of small- and medium-sized companies may involve greater volatility than investing in larger and more established companies, because they can be subject to more abrupt or erratic share price changes than larger, more established companies. Smaller companies may have limited product lines, markets or financial resources and their management may be dependent on a limited number of key individuals. Securities of those companies may have limited market liquidity, and their prices may be more volatile.

Equity Risk. The risks that could affect the value of the Funds’ shares and the total return on your investment include the possibility that the equity securities held in the Funds’ portfolios may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect the securities market in general, such as adverse changes in economic conditions, the general outlook for corporate earnings, interest rates or investor sentiment. Equity securities may also lose value because of factors affecting an entire industry or sector, such as increases in production costs, or factors directly related to a specific company, such as decisions made by its management. This risk is greater for small- and medium-sized companies, which tend to be more vulnerable to adverse developments than larger companies.

Securities Lending Risk (Al Frank Fund Only). When the Al Frank Fund loans its portfolio securities, it will receive collateral consisting of cash or cash equivalents, securities issued or guaranteed by the U.S. Government or one of its agencies or instrumentalities, an irrevocable bank letter of credit, or any combination thereof. Nevertheless, the Al Frank Fund risks a delay in the recovery of the loaned securities, or even the loss of rights in the collateral deposited by the borrower if the borrower should fail financially. In addition, if the Al Frank Fund’s securities are sold while out on loan and the securities are not returned timely by the borrower, there is a possibility that the sale transaction will not settle in the usual manner and cause unintended market exposure and additional trade and other expenses to the Al Frank Fund. As well, any investments made with the collateral received are subject to the risks associated with such investments. If such investments lose value, the Al Frank Fund will have to cover the loss when repaying the collateral.

Value Style Investing Risk. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks may be purchased based upon the belief that a given security may be out of favor. Value investing seeks to identify stocks that have depressed valuations, based upon a number of factors which are thought to be temporary in nature, and to sell them at superior profits when their prices rise in response to resolution of the issues which caused the valuation of the stock to be depressed. While certain value stocks may increase in value more quickly during periods of anticipated economic upturn, they may also lose value more quickly in periods of anticipated economic downturn. Furthermore, there is the risk that the factors which caused the depressed valuations are longer term or even permanent in nature, and that there will not be any rise in valuation. Finally, there is the increased risk in such situations that such companies may not have sufficient resources to continue as ongoing businesses, which would result in the stock of such companies potentially becoming worthless.

Foreign Securities Risk. The Funds may also invest in foreign securities, including ADRs, which may be subject to special risks not usually associated with owning securities of U.S. issuers. The Funds’ returns and NAVs may be affected by several factors, including those described below.

Foreign securities are also subject to higher political, social and economic risks. These risks include, but are not limited to, a downturn in the country’s economy, excessive taxation, political instability, and expropriation of assets by foreign governments. Compared to the U.S., foreign governments and markets often have less stringent accounting, disclosure, and financial reporting requirements.

Foreign securities can be more volatile than domestic (U.S.) securities. Securities markets of other countries are generally smaller than U.S. securities markets. Many foreign securities may be less liquid and more volatile than U.S. securities, which could affect the Funds’ investments. The exchange rates between the U.S. dollar and foreign currencies might fluctuate, which could negatively affect the value of the Funds’ investments.

Cyber Security Risk. As the use of technology has become more prevalent in the course of business, each Fund has become more susceptible to operational, financial and information security risks resulting from cyber-attacks and/or technological malfunctions. Cyber-attacks include, among other things, the attempted theft, loss, misuse, improper release, corruption or destruction of, or unauthorized access to, confidential or highly restricted data relating to each Fund and its shareholders; and attempted compromises or failures to systems, networks, devices and applications relating to the operations of the Funds and its service providers. Cyber security breaches may result from unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) or from outside attacks, such as denial-of-service attacks on websites (i.e., efforts to make network services unavailable to intended users).

| D. | Comparison Fee Table and Example; Portfolio Turnover |

Fee Table. The management fee for each Fund is identical. The shareholder fees (fees paid directly from your investment) are the same for each Fund and will not change as a result of the merger. Annual fund operating expenses (expenses that are deducted from fund assets) are described in the table below, and, as shown, the annual fund operating expenses of the Al Frank Fund and the combined Fund are expected to be lower than the current annual fund operating expenses for the Dividend Fund.

The following table shows the comparative fees and expenses of the Funds as of June 30, 2016 (adjusted to account for changes in fee waiver agreements since that time). The table also reflects the pro forma combined fees for the Al Frank Fund after giving effect to the Reorganization.

| | | | | | | | | |

| | Dividend Value Fund (Current) | Al Frank Fund (Current) | Al Frank Fund (Pro Forma Combined) |

| Shareholder Fees (fees paid directly from your investment) | Investor Class | Advisor Class | Investor Class | Advisor Class | Investor Class | Advisor Class |

| Maximum sales charge (load) | None | None | None | None | None | None |

| Redemption fee | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| Exchange fee | None | None | None | None | None | None |

| Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment) | | | |

| Management fees | 1.00% | 1.00% | 1.00% | 1.00% | 1.00% | 1.00% |

| Distribution and/or service (12b-1) fees | 0.25% | None | 0.25% | None | 0.25% | None |

| Other expenses | 0.84%(1) | 0.86%(1) | 0.36%(2) | 0.36%(2) | 0.29% | 0.29% |

| Total annual fund operating expenses | 2.09% | 1.86% | 1.61% | 1.36% | 1.54% | 1.29% |

| Less: Fee waivers and/or expense reimbursements | (0.11)% | (0.13)% | (0.12)% | (0.12)% | (0.05)% | (0.05)% |

| Total net annual fund operating expenses (after waivers/reimbursements) | 1.98%(3) | 1.73%(3) | 1.49%(3) | 1.24%(3) | 1.49%(3) | 1.24%(3) |

| | | | | | | | | | | | |

| 1) | This number includes the combined total fees and operating expenses of the Acquired Funds owned by the Dividend Value Fund and is not a direct expense incurred by the Dividend Value Fund or deducted from the Dividend Value Fund assets. Acquired fund fees and expenses amounted to less than 0.01%. Since this number does not represent a direct operating expense of the Dividend Value Fund, the operating expenses set forth in the Dividend Value Fund’s financial highlights do not include this figure. |

| 2) | This number includes the combined total fees and operating expenses of the Acquired Funds owned by the Al Frank Fund and is not a direct expense incurred by the Al Frank Fund or deducted from the Fund assets. |

Acquired fund fees and expenses amounted to less than 0.01%. Since this number does not represent a direct operating expense of the Al Frank Fund, the operating expenses set forth in the Fund’s financial highlights do not include this figure.

| 3) | Pursuant to an operating expense limitation agreement between AFAM and the each Fund, AFAM has agreed to reduce its management fees and/or pay expenses of the Funds to ensure that the total amount of Fund operating (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes and extraordinary expenses such as litigation) do not exceed 1.49% and 1.24% of the Al Frank Fund’s average net assets for Investor Class and Advisor Class shares respectively, and 1.98% and 1.73% of the Dividend Value Fund’s average net assets for Investor Class and Advisor Class shares respectively, through April 30, 2018, subject thereafter to annual re-approval of the agreement by the Board. AFAM is permitted to receive reimbursement of any excess expense payments paid by it pursuant to the operating expense limitation agreement in future years on a rolling three year basis, as long as the reimbursement does not cause the Fund’s annual operating expenses to exceed the expense cap. Each Fund must pay its current ordinary operating expenses before AFAM is entitled to any reimbursement of management fees and/or expenses. This Operating Expense Limitation Agreement can be terminated only by, or with the consent, of the Board. |

Expense Example. The following example is intended to help you compare the cost of investing in each Fund with the cost of investing in other mutual funds. The example assumes you invest $10,000 in each Fund for the time periods indicated and then redeem your shares at the end of the period. The example also assumes that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Fund | Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| Dividend Value Fund1 | Investor Class | $201 | $644 | $1,114 | $2,412 |

| | Advisor Class | $176 | $572 | $994 | $2,169 |

| Al Frank Fund1 | Investor Class | $152 | $496 | $865 | $1,901 |

| | Advisor Class | $126 | $419 | $733 | $1,625 |

| Al Frank Fund Pro Forma Combined | Investor Class | $152 | $482 | $835 | $1,830 |

| | Advisor Class | $126 | $404 | $703 | $1,552 |

1Data shown for Investor Class and Advisor Class shares reflects year 1 at the current fee caps of 1.98% for Investor Class and 1.73% for Advisor Class for the Dividend Value Fund, and 1.49% for Investor Class and 1.24% for Advisor Class for the Al Frank Fund, with years 3, 5 and 10 reflecting the fees without the caps of 1.98% for Investor Class and 1.73% for Advisor Class for the Dividend Value Fund, and 1.49% for Investor Class and 1.24% for Advisor Class for the Al Frank Fund.

Portfolio Turnover. Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Those costs, which are not reflected in annual Fund operating expenses or in the example expenses, affect a Fund’s performance. During the fiscal year ended December 31, 2015, each Fund’s portfolio turnover rate was the following percentage of the average value of the Fund’s portfolio:

| Fund | Percentage of the Average Value of the Fund’s Portfolio |

| Dividend Value Fund | 15.05% |

| Al Frank Fund | 12.38% |

| | |

| |

| E. | Comparison of Performance |

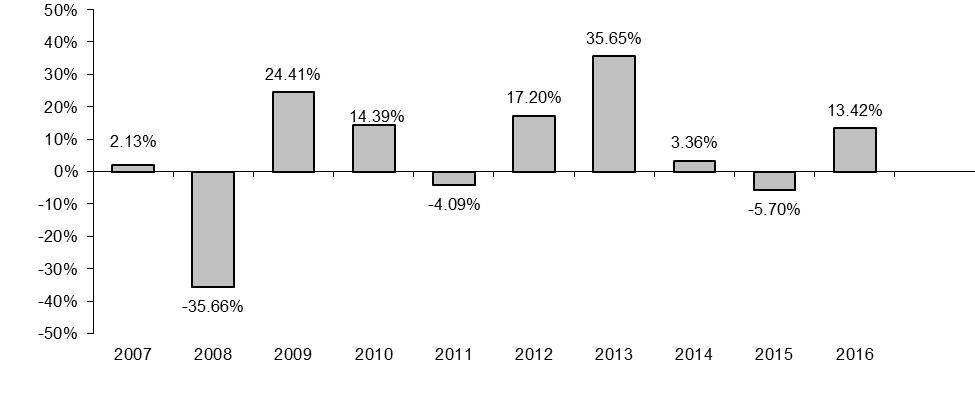

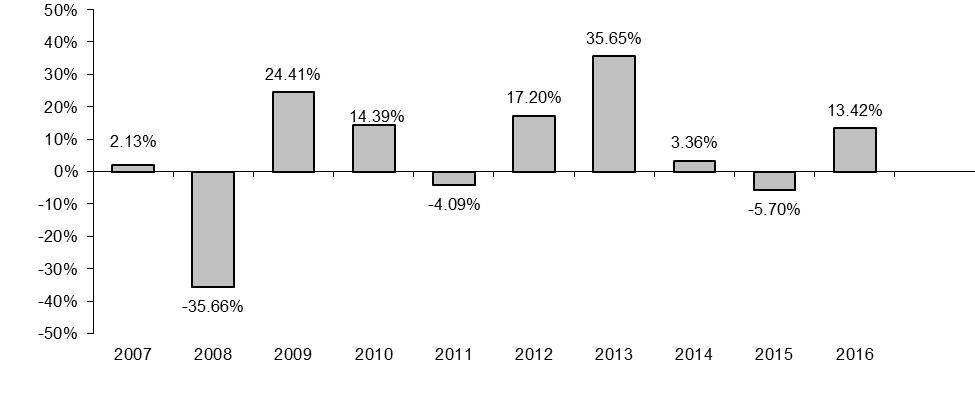

Dividend Value Fund. Annual total returns for the Investor Class shares of the Dividend Value Fund as of December 31, 2016 were as follows for each year shown.

The Dividend Value Fund was reorganized on January 18, 2013 from a series of the Advisors Series Trust (the “Dividend Value Predecessor Fund”), a Delaware statutory trust to a series of Northern Lights Fund Trust II, also a Delaware statutory trust (the “Reorganization”). The Dividend Value Fund is a continuation of the Dividend Value Predecessor Fund and, therefore, the performance information below includes the performance of Investor Class and Advisor Class shares of the Dividend Value Predecessor Fund.

Dividend Value Fund – Investor Class

Calendar Year Total Returns as of December 31,

During the period of time shown in the bar chart, the Fund’s highest quarterly return was 16.69% for the quarter ended September 30, 2009, and the lowest quarterly return was -22.00% for the quarter ended December 31, 2008.

The table below shows the average annual total return of the Dividend Value Fund as of December 31, 2016 compared with the performance of a broad-based market index.

Average Annual Total Returns for the periods ended December 31, 2016

| | One Year | Five Years | Ten Years | Since Inception(1) |

| Investor Class | | | | |

| Return Before Taxes | 13.42% | 11.94% | 4.66% | 6.52% |

| Return After Taxes on Distributions | 12.82% | 9.84% | 3.54% | 5.55% |

| Return After Taxes on Distributions and Sale of Fund Shares | 7.60% | 9.27% | 3.59% | 5.23% |

| Advisor Class | | | | |

| Return Before Taxes | 13.61% | 12.20% | 4.90% | 4.96% |

| S&P 500 Index® (reflects no deduction for fees, expenses or taxes) | 11.96% | 14.66% | 6.95% | 8.10% |

| Russell 3000® (reflects no deduction for fees, expenses or taxes) | 12.74% | 14.67% | 7.07% | 8.38% |

| | (1) | Investor Class shares of the Dividend Value Predecessor Fund commenced operations on September 30, 2004; Advisor Class shares of the Dividend Value Predecessor Fund commenced operations on April 30, 2006. Performance shown prior to the inception of the Advisor Class reflects the performance of the Investor Class and includes expenses that are not applicable to and are higher than those of the Advisor Class. |

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After tax returns are shown for only Investor Class shares and after tax returns for Advisor Class shares will vary.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7 trillion benchmarked to the index, with index assets comprising approximately USD 1.9 trillion of this total. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected.

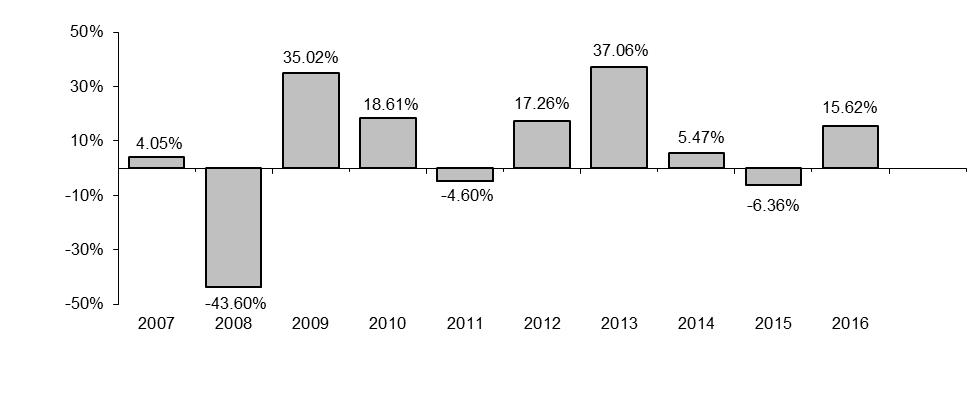

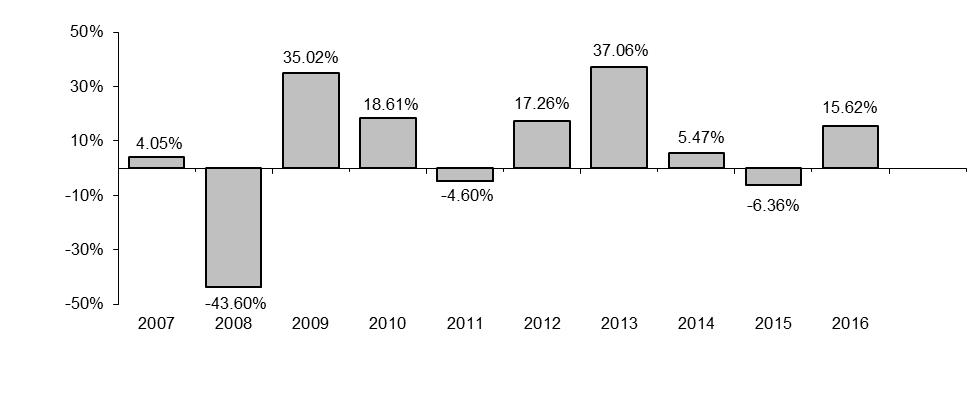

Al Frank Fund. Annual total returns for the Investor Class shares of the Al Frank Fund as of December 31, 2016 were as follows for each year shown (returns do not reflect sales charges and would be lower if they did).

The Al Frank Fund was reorganized on January 18, 2013 from a series of the Advisors Series Trust (the “Al Frank Predecessor Fund” and together with the Dividend Value Predecessor Fund, the “Predecessor Funds”)), a Delaware statutory trust to a series of Northern Lights Fund Trust II, also a Delaware statutory trust (the “Reorganization”). The Al Frank Fund is a continuation of the Al Frank Predecessor Fund and, therefore, the performance information below includes the performance of Investor Class and Advisor Class shares of the Al Frank Predecessor Fund.

Al Frank Fund – Investor Class

Calendar Year Total Returns as of December 31,

During the period of time shown in the bar chart, the Al Frank Fund’s highest quarterly return was 19.38% for the quarter ended September 30, 2009, and the lowest quarterly return was -25.74% for the quarter ended December 31, 2008.

The table below shows the average annual return of the Al Frank Fund as of December 31, 2016 compared with the performance of a broad-based market index.

Average Annual Total Returns for the periods ended December 31, 2016

| | One Year | Five Years | Ten Years | Since Inception(1) |

| Investor Class | | | | |

| Return Before Taxes | 15.62% | 12.91% | 5.11% | 10.08% |

| Return After Taxes on Distributions | 13.96% | 10.45% | 3.43% | 9.02% |

| Return After Taxes on Distributions and Sale of Fund Shares | 9.60% | 10.02% | 3.94% | 8.65% |

| Advisor Class | | | | |