united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22549 |

| Northern Lights Fund Trust II |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| Kevin Wolf, Ultimus Fund Solutions, LLC |

| 80 Arkay Drive, Hauppauge, NY 11788 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-470-2600 | |

| Date of fiscal year end: | 3/31 | |

| | | |

| Date of reporting period: | 9/30/24 | |

Item 1. Reports to Stockholders.

Hodges Blue Chip Equity Income Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about Hodges Blue Chip Equity Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.hodgescapital.com/mutual-funds/resources-applications. You can also request this information by contacting us at 1-866-811-0224.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $70 | 1.32% |

How did the Fund perform during the reporting period?

The Hodges Blue Chip Equity Income Fund was up 12.13% in the six months ending September 30, 2024, compared to 9.87% for its benchmark, the Russell 1000 Total Return Index. The Blue Chip Fund's one year return amounted to 36.59% compared to 35.68% for the Russell 1000 Total Return Index. Positive relative performance in the recent quarter and year-to-date period was attributed to stock selection and sector allocation. Vistra (VST) and Walmart (WMT) were among the top stocks contributing to the Fund's recent relative performance.

We believe the current investment landscape offers ample opportunities among high-quality, dividend-paying stocks with solid upside potential. We expect underleveraged balance sheets and corporate profits across most blue-chip stocks to support stable dividends over the next several years. The Blue Chip Equity Income Fund remains well-diversified in companies that we believe can generate above-average income and total returns on a risk-adjusted basis. The number of positions held in the Fund at the end of the recent quarter was 28. The top ten holdings at the end of the quarter represented 49.58% of the Fund's holdings and included Apple Inc (AAPL), Nvidia (NVDA), Walmart Inc (WMT), Microsoft Corp (MSFT), Caterpillar Inc (CAT), Taiwan Semiconductor (TSM), Broadcom Inc (AVGO), Morgan Stanley (M.S.), Exxon Mobil Corp (XOM), and Amazon.com Inc (AMZN).

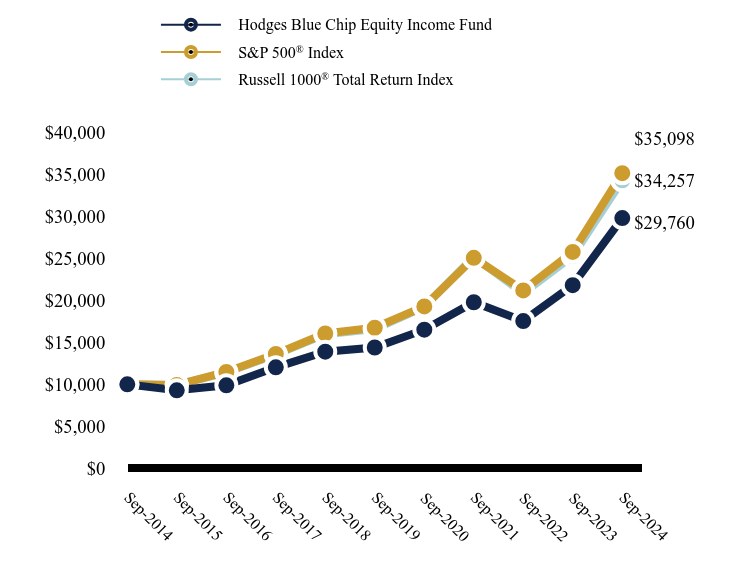

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Hodges Blue Chip Equity Income Fund | S&P 500® Index | Russell 1000® Total Return Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $9,296 | $9,939 | $9,939 |

| Sep-2016 | $9,888 | $11,472 | $11,423 |

| Sep-2017 | $12,027 | $13,607 | $13,540 |

| Sep-2018 | $13,887 | $16,044 | $15,946 |

| Sep-2019 | $14,385 | $16,727 | $16,563 |

| Sep-2020 | $16,501 | $19,260 | $19,215 |

| Sep-2021 | $19,762 | $25,040 | $25,165 |

| Sep-2022 | $17,519 | $21,165 | $20,833 |

| Sep-2023 | $21,787 | $25,741 | $25,248 |

| Sep-2024 | $29,760 | $35,098 | $34,257 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Hodges Blue Chip Equity Income Fund | 12.13% | 36.59% | 15.65% | 11.52% |

S&P 500® Index | 10.42% | 36.35% | 15.98% | 13.38% |

Russell 1000® Total Return Index | 9.87% | 35.68% | 15.64% | 13.10% |

| Net Assets | $39,621,186 |

| Number of Portfolio Holdings | 28 |

| Advisory Fee (net of waivers) | $116,769 |

| Portfolio Turnover | 31% |

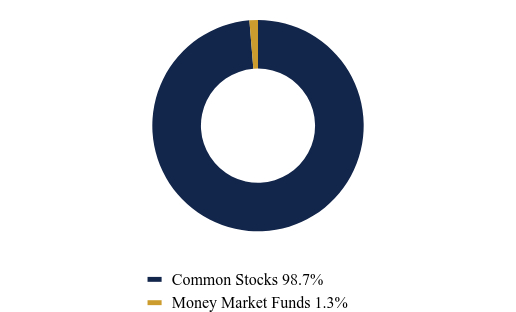

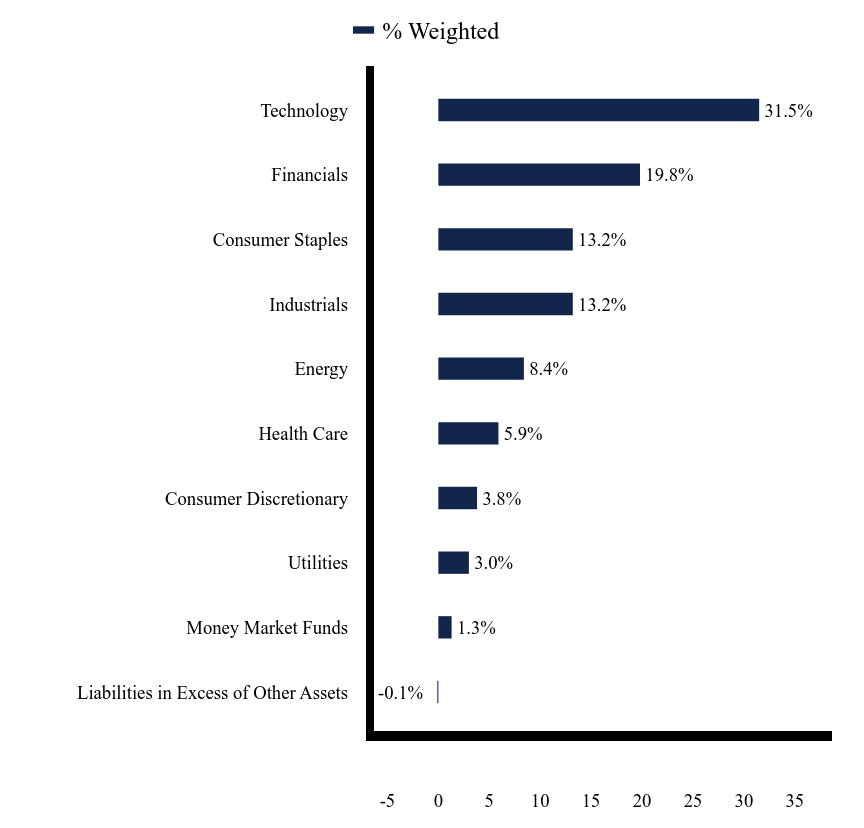

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 98.7% |

| Money Market Funds | 1.3% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Money Market Funds | 1.3% |

| Utilities | 3.0% |

| Consumer Discretionary | 3.8% |

| Health Care | 5.9% |

| Energy | 8.4% |

| Industrials | 13.2% |

| Consumer Staples | 13.2% |

| Financials | 19.8% |

| Technology | 31.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Apple, Inc. | 7.1% |

| NVIDIA Corporation | 6.9% |

| Walmart, Inc. | 5.5% |

| Microsoft Corporation | 5.4% |

| Caterpillar, Inc. | 4.4% |

| Taiwan Semiconductor Manufacturing Company Ltd. | 4.4% |

| Broadcom, Inc. | 4.4% |

| Morgan Stanley | 3.9% |

| Exxon Mobil Corporation | 3.8% |

| Amazon.com, Inc. | 3.8% |

No material changes occurred during the period ended September 30, 2024.

Hodges Blue Chip Equity Income Fund - Retail (HDPBX)

Semi-Annual Shareholder Report - September 30, 2024

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about Hodges Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.hodgescapital.com/mutual-funds/resources-applications. You can also request this information by contacting us at 1-866-811-0224.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $59 | 1.18% |

How did the Fund perform during the reporting period?

The Hodges Fund's six-month return amounted to a loss of -1.06% compared to a gain of 10.42% for the S&P 500 Index. The one-year return for the period ending September 30, 2024, amounted to a gain of 23.61% compared to an increase of 36.35% for the S&P 500 Index. Over the year, underperformance has been attributed to the portfolio's underweight exposure to the seven largest momentum stocks in the S&P 500. The Hodges Fund's turnover was average in the recent quarter as we have carefully updated the portfolio holdings, moving into stocks that we believe offer above-average returns relative to their downside risks over the next twelve to eighteen months.

The Hodges Fund's portfolio managers remain focused on investments where we have the highest conviction based on fundamentals and relative valuations. The number of positions held in the Fund at the end of the recent quarter was 41. On September 30, 2024, the top ten holdings represented 45.70% of the Fund's holdings. They included Uber Technologies (UBER), Texas Pacific Land Corp (TPL), Matador Resources Co (MTDR), DraftKings Inc (DKNG), Freeport McMoran Inc (FCX), Norwegian Cruise Line Holdings (NCLH), SharkNinja, Inc. (SN), On Holding (ONON), Wynn Resorts (WYNN), and Nvidia Corp (NVDA).

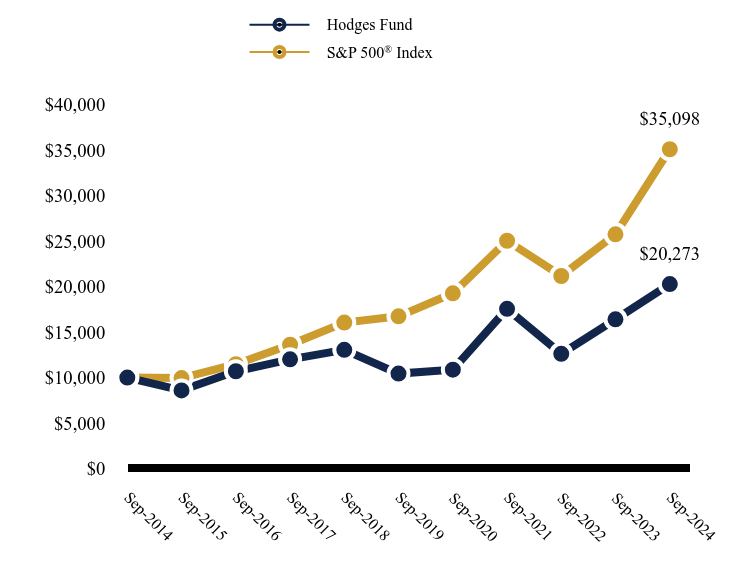

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Hodges Fund | S&P 500® Index |

|---|

| Sep-2014 | $10,000 | $10,000 |

| Sep-2015 | $8,589 | $9,939 |

| Sep-2016 | $10,691 | $11,472 |

| Sep-2017 | $12,005 | $13,607 |

| Sep-2018 | $13,045 | $16,044 |

| Sep-2019 | $10,434 | $16,727 |

| Sep-2020 | $10,862 | $19,260 |

| Sep-2021 | $17,553 | $25,040 |

| Sep-2022 | $12,605 | $21,165 |

| Sep-2023 | $16,400 | $25,741 |

| Sep-2024 | $20,273 | $35,098 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Hodges Fund | -1.06% | 23.61% | 14.21% | 7.32% |

S&P 500® Index | 10.42% | 36.35% | 15.98% | 13.38% |

| Net Assets | $176,330,684 |

| Number of Portfolio Holdings | 41 |

| Advisory Fee (net of waivers) | $700,365 |

| Portfolio Turnover | 41% |

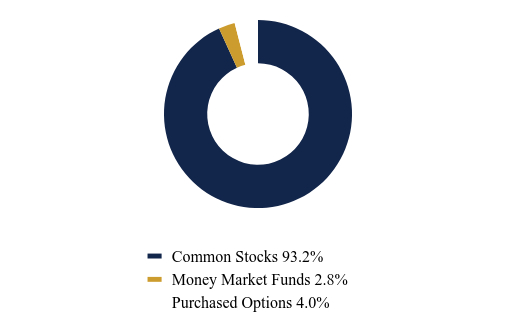

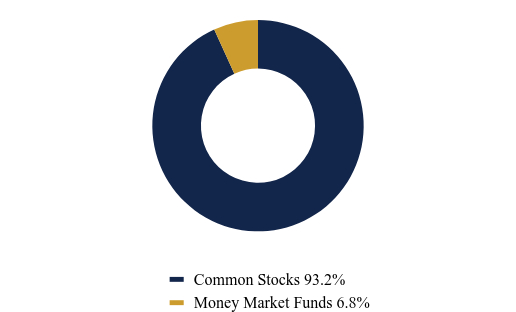

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 93.2% |

| Money Market Funds | 2.8% |

| Purchased Options | 4.0% |

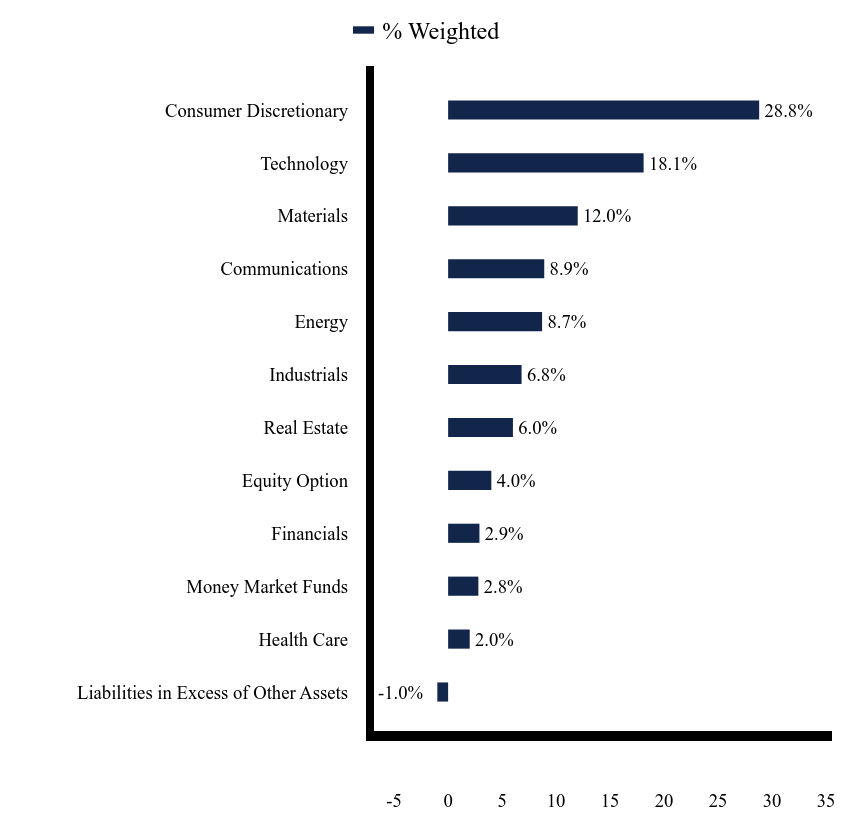

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -1.0% |

| Health Care | 2.0% |

| Money Market Funds | 2.8% |

| Financials | 2.9% |

| Equity Option | 4.0% |

| Real Estate | 6.0% |

| Industrials | 6.8% |

| Energy | 8.7% |

| Communications | 8.9% |

| Materials | 12.0% |

| Technology | 18.1% |

| Consumer Discretionary | 28.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Uber Technologies, Inc. | 6.4% |

| Texas Pacific Land Corporation | 6.0% |

| Matador Resources Company | 5.6% |

| DraftKings, Inc., Class A | 5.0% |

| Freeport-McMoRan, Inc. | 4.2% |

| Norwegian Cruise Line Holdings Ltd. | 4.1% |

| SharkNinja, Inc. | 4.0% |

| On Holding A.G. | 3.8% |

| Wynn Resorts Ltd. | 3.5% |

| NVIDIA Corporation | 3.4% |

No material changes occurred during the period ended September 30, 2024.

Hodges Fund - Retail (HDPMX)

Semi-Annual Shareholder Report - September 30, 2024

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about Hodges Small Cap Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.hodgescapital.com/mutual-funds/resources-applications. You can also request this information by contacting us at 1-866-811-0224.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $53 | 1.03% |

How did the Fund perform during the reporting period?

The return for the Hodges Small Cap Fund amounted to a gain of 5.21% in the past six months, compared to an increase of 5.69% for the Russell 2000 Index. The Small Cap Fund's one-year performance on September 30, 2024, amounted to a gain of 26.64% compared to 26.76% for the Russell 2000 Index during the same period. Although small-cap stocks have now underperformed large-cap stocks for the better part of the past decade, we still consider the current risk/reward for holding quality small-cap stocks attractive. While small-cap stocks tend to experience greater volatility during market turmoil, we expect this segment to generate above-average relative risk-adjusted returns over the long term.

The Hodges Small Cap Fund remains well diversified across industrials, transportation, healthcare, technology, and consumer-related names, which we expect to contribute to the Fund's long-term performance. The Fund recently took profits in several stocks that appeared overvalued relative to their underlying fundamentals and established new positions with an attractive risk/reward profile. The Fund had a total of 51 positions on September 30, 2024. The top ten holdings amounted to 35.49% of the Fund's holdings and included Matador Resources (MTDR), Texas Pacific Land Corp (TPL), Eagle Materials Inc (EXP), Taylor Morrison Home Corp (TMHC), SunOpta Inc. (STKL), On Holding Ltd (ONON), Norwegian Cruise Line Holdings (NCLH), Shoe Carnival Inc (SCVL), Halozyme Therapeutics (HALO) and Cleveland-Cliffs Inc (CLF).

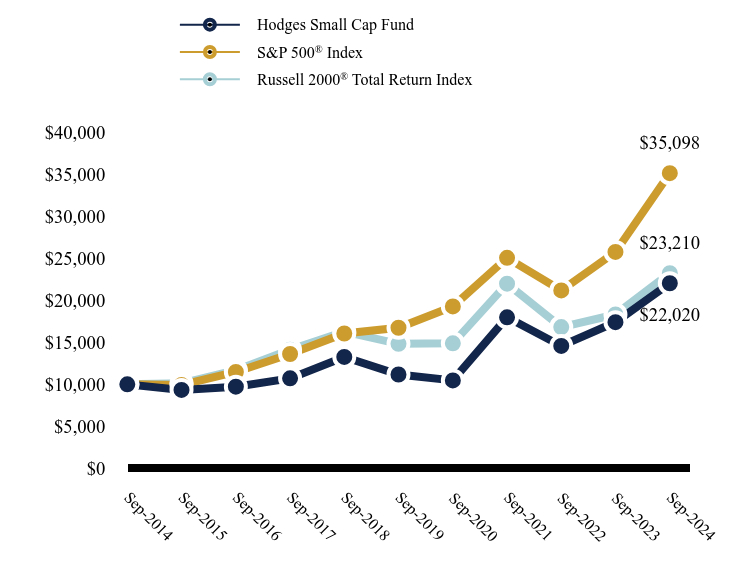

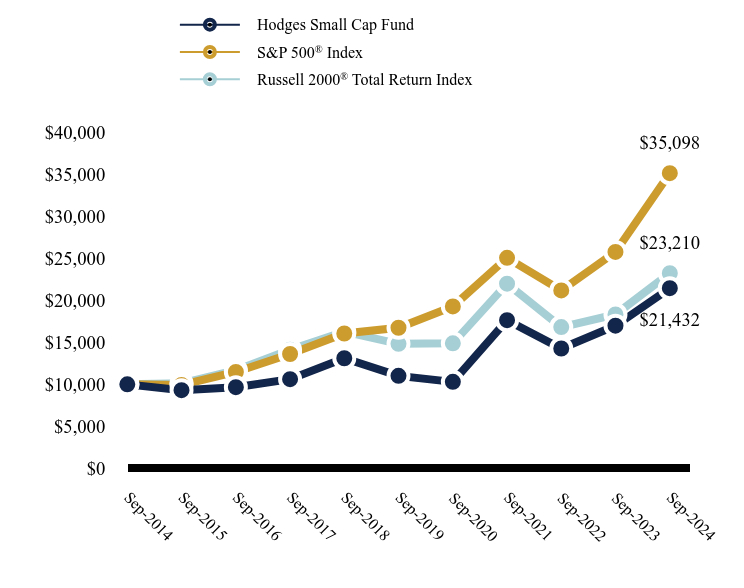

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Hodges Small Cap Fund | S&P 500® Index | Russell 2000® Total Return Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $9,341 | $9,939 | $10,125 |

| Sep-2016 | $9,729 | $11,472 | $11,691 |

| Sep-2017 | $10,716 | $13,607 | $14,115 |

| Sep-2018 | $13,262 | $16,044 | $16,266 |

| Sep-2019 | $11,171 | $16,727 | $14,820 |

| Sep-2020 | $10,470 | $19,260 | $14,878 |

| Sep-2021 | $17,971 | $25,040 | $21,972 |

| Sep-2022 | $14,571 | $21,165 | $16,809 |

| Sep-2023 | $17,388 | $25,741 | $18,310 |

| Sep-2024 | $22,020 | $35,098 | $23,210 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Hodges Small Cap Fund | 5.21% | 26.64% | 14.54% | 8.21% |

S&P 500® Index | 10.42% | 36.35% | 15.98% | 13.38% |

Russell 2000® Total Return Index | 5.69% | 26.76% | 9.39% | 8.78% |

| Net Assets | $182,501,471 |

| Number of Portfolio Holdings | 51 |

| Advisory Fee | $755,154 |

| Portfolio Turnover | 30% |

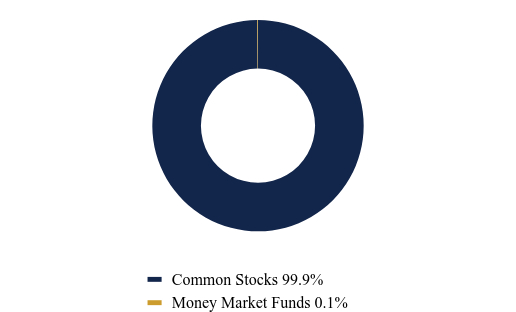

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.9% |

| Money Market Funds | 0.1% |

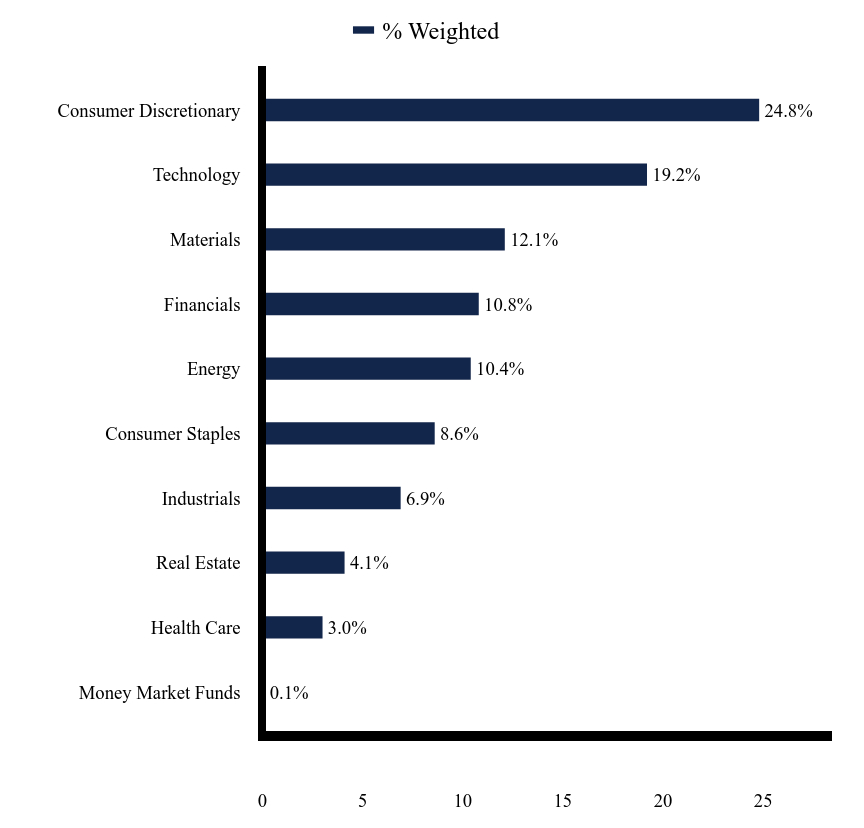

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.1% |

| Health Care | 3.0% |

| Real Estate | 4.1% |

| Industrials | 6.9% |

| Consumer Staples | 8.6% |

| Energy | 10.4% |

| Financials | 10.8% |

| Materials | 12.1% |

| Technology | 19.2% |

| Consumer Discretionary | 24.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Matador Resources Company | 4.7% |

| Texas Pacific Land Corporation | 4.1% |

| Eagle Materials, Inc. | 4.1% |

| Taylor Morrison Home Corporation | 3.8% |

| SunOpta, Inc. | 3.5% |

| On Holding A.G. | 3.3% |

| Norwegian Cruise Line Holdings Ltd. | 3.1% |

| Shoe Carnival, Inc. | 3.0% |

| Halozyme Therapeutics, Inc. | 3.0% |

| Cleveland-Cliffs, Inc. | 2.8% |

No material changes occurred during the period ended September 30, 2024.

Semi-Annual Shareholder Report - September 30, 2024

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about Hodges Small Cap Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.hodgescapital.com/mutual-funds/resources-applications. You can also request this information by contacting us at 1-866-811-0224.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $66 | 1.28% |

How did the Fund perform during the reporting period?

The return for the Hodges Small Cap Fund amounted to a gain of 5.06% in the past six months, compared to an increase of 5.69% for the Russell 2000 Index. The Small Cap Fund's one-year performance on September 30, 2024, amounted to a gain of 26.25% compared to 26.76% for the Russell 2000 Index during the same period. Although small-cap stocks have now underperformed large-cap stocks for the better part of the past decade, we still consider the current risk/reward for holding quality small-cap stocks attractive. While small-cap stocks tend to experience greater volatility during market turmoil, we expect this segment to generate above-average relative risk-adjusted returns over the long term.

The Hodges Small Cap Fund remains well diversified across industrials, transportation, healthcare, technology, and consumer-related names, which we expect to contribute to the Fund's long-term performance. The Fund recently took profits in several stocks that appeared overvalued relative to their underlying fundamentals and established new positions with an attractive risk/reward profile. The Fund had a total of 51 positions on September 30, 2024. The top ten holdings amounted to 35.49% of the Fund's holdings and included Matador Resources (MTDR), Texas Pacific Land Corp (TPL), Eagle Materials Inc (EXP), Taylor Morrison Home Corp (TMHC), SunOpta Inc. (STKL), On Holding Ltd (ONON), Norwegian Cruise Line Holdings (NCLH), Shoe Carnival Inc (SCVL), Halozyme Therapeutics (HALO) and Cleveland-Cliffs Inc (CLF).

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Hodges Small Cap Fund | S&P 500® Index | Russell 2000® Total Return Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $9,306 | $9,939 | $10,125 |

| Sep-2016 | $9,666 | $11,472 | $11,691 |

| Sep-2017 | $10,618 | $13,607 | $14,115 |

| Sep-2018 | $13,107 | $16,044 | $16,266 |

| Sep-2019 | $11,012 | $16,727 | $14,820 |

| Sep-2020 | $10,297 | $19,260 | $14,878 |

| Sep-2021 | $17,631 | $25,040 | $21,972 |

| Sep-2022 | $14,263 | $21,165 | $16,809 |

| Sep-2023 | $16,976 | $25,741 | $18,310 |

| Sep-2024 | $21,432 | $35,098 | $23,210 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Hodges Small Cap Fund | 5.06% | 26.25% | 14.25% | 7.92% |

S&P 500® Index | 10.42% | 36.35% | 15.98% | 13.38% |

Russell 2000® Total Return Index | 5.69% | 26.76% | 9.39% | 8.78% |

| Net Assets | $182,501,471 |

| Number of Portfolio Holdings | 51 |

| Advisory Fee | $755,154 |

| Portfolio Turnover | 30% |

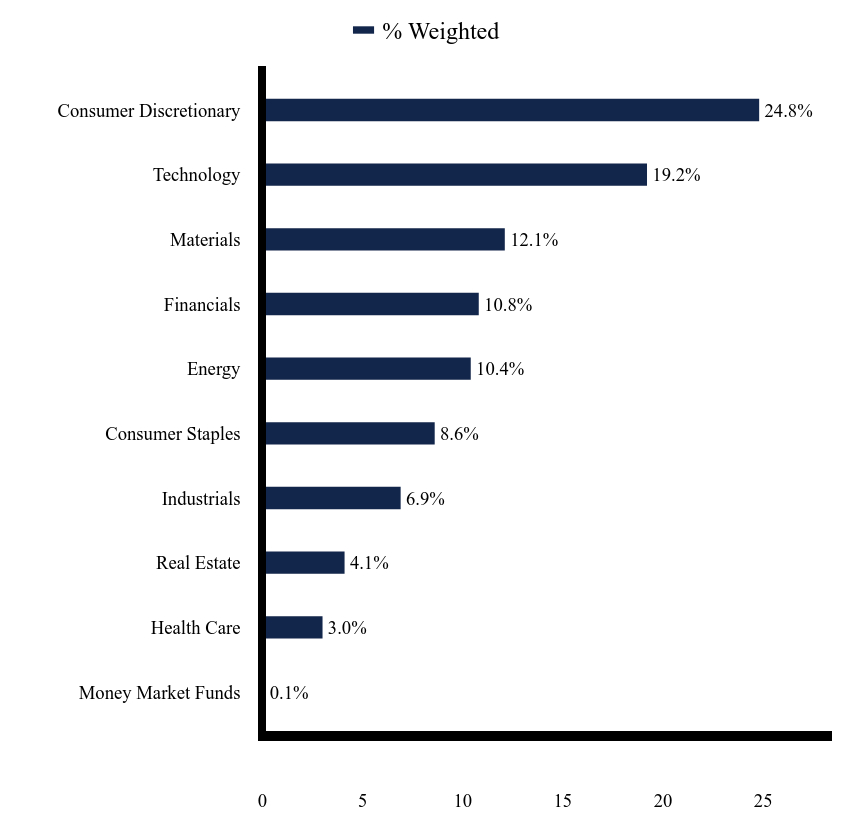

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.9% |

| Money Market Funds | 0.1% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Money Market Funds | 0.1% |

| Health Care | 3.0% |

| Real Estate | 4.1% |

| Industrials | 6.9% |

| Consumer Staples | 8.6% |

| Energy | 10.4% |

| Financials | 10.8% |

| Materials | 12.1% |

| Technology | 19.2% |

| Consumer Discretionary | 24.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Matador Resources Company | 4.7% |

| Texas Pacific Land Corporation | 4.1% |

| Eagle Materials, Inc. | 4.1% |

| Taylor Morrison Home Corporation | 3.8% |

| SunOpta, Inc. | 3.5% |

| On Holding A.G. | 3.3% |

| Norwegian Cruise Line Holdings Ltd. | 3.1% |

| Shoe Carnival, Inc. | 3.0% |

| Halozyme Therapeutics, Inc. | 3.0% |

| Cleveland-Cliffs, Inc. | 2.8% |

No material changes occurred during the period ended September 30, 2024.

Semi-Annual Shareholder Report - September 30, 2024

Prospectus

Financial information

Holdings

Proxy voting information

Hodges Small Intrinsic Value Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about Hodges Small Intrinsic Value Fund for the period of July 30, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.hodgescapital.com/mutual-funds/resources-applications. You can also request this information by contacting us at 1-866-811-0224.

What were the Fund’s costs for the reporting period?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $19 | 1.12% |

How did the Fund perform during the reporting period?

The Hodges Small Intrinsic Value Fund experienced a loss of -1.54% from July 30, 2024 (inception of the share class) through September 30, 2024 compared to a decrease of -1.51% for its benchmark, the Russell 2000 Value Index. The Russell 2000 index returned -0.30% during the same period. The Fund's recent underperformance relative to the benchmark was impacted by lagging performance among a handful of consumer discretionary and energy stocks that were out of favor in the quarter. The number of positions held in the Fund decreased by one, resulting in 46 holdings at the end of the recent quarter. On September 30, 2024, the top holdings represented 33.51% of the Fund's holdings. They included Eagle Materials Inc (EXP), Shoe Carnival Inc (SCVL), SunOpta (STKL), Banc of California (BANC), Triumph Financial (TFIN), Ethan Allen Interiors Inc (ETD), Taylor Morrison Home Corp (TMHC), Texas Capital Bancshares (TCBI), Halozyme Therapeutics (HALO), and Home Bancshares (HOMB).

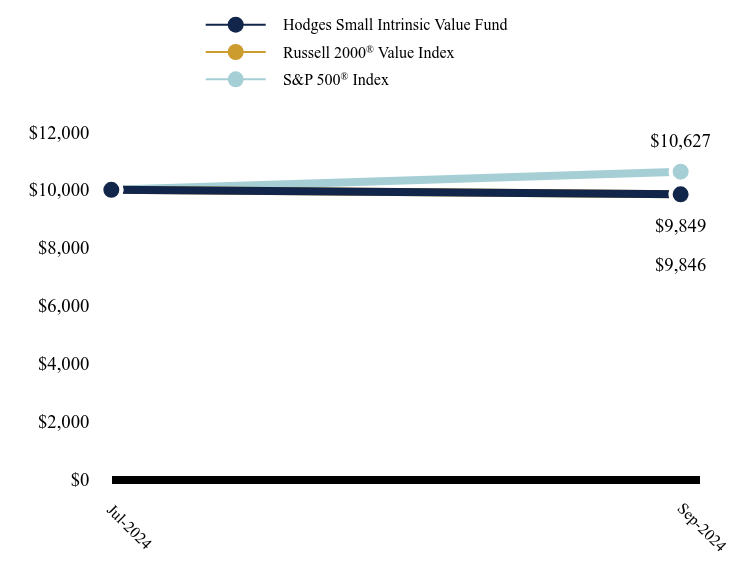

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Hodges Small Intrinsic Value Fund | Russell 2000® Value Index | S&P 500® Index |

|---|

| Jul-2024 | $10,000 | $10,000 | $10,000 |

| Sep-2024 | $9,846 | $9,849 | $10,627 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Average Annual Total Returns

| Since Inception (July 30, 2024) |

|---|

| Hodges Small Intrinsic Value Fund | -1.54% |

S&P 500® Index | 6.27% |

Russell 2000® Value Index | -1.51% |

| Net Assets | $63,577,599 |

| Number of Portfolio Holdings | 46 |

| Advisory Fee (net of waivers) | $214,375 |

| Portfolio Turnover | 22% |

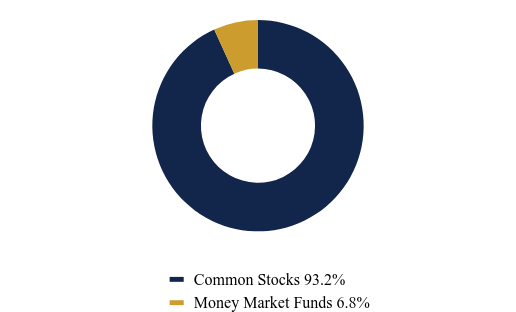

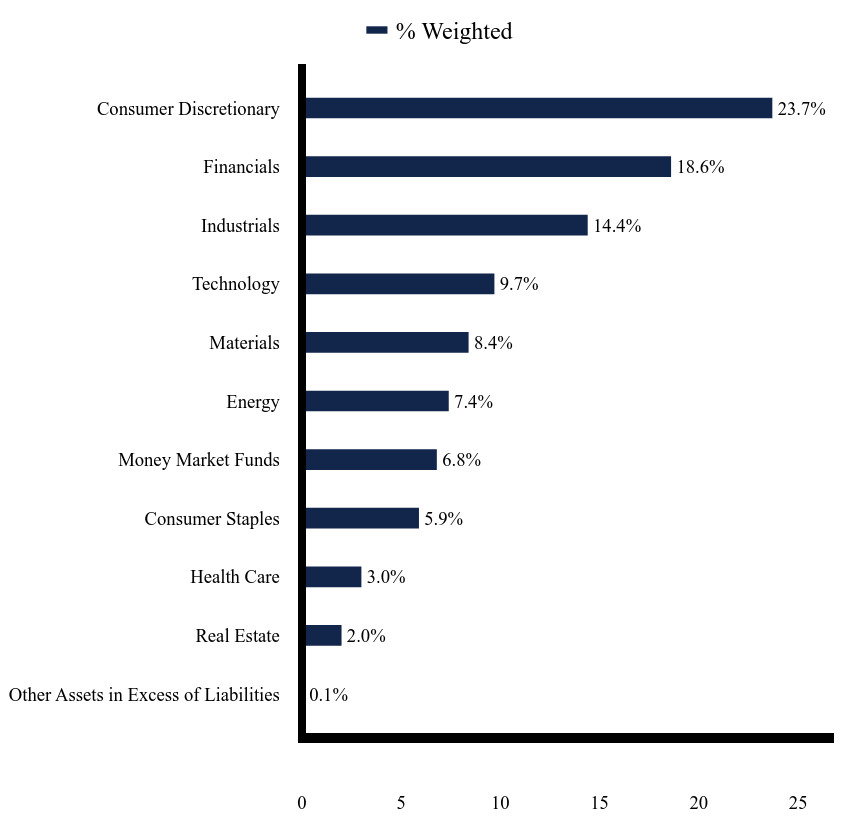

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 93.2% |

| Money Market Funds | 6.8% |

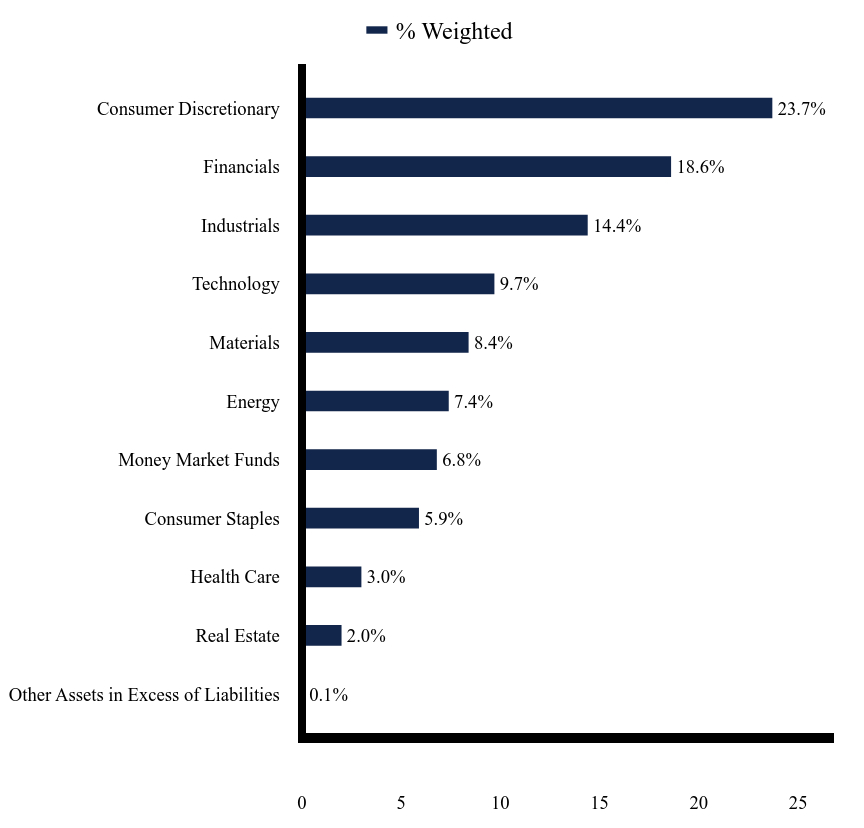

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Real Estate | 2.0% |

| Health Care | 3.0% |

| Consumer Staples | 5.9% |

| Money Market Funds | 6.8% |

| Energy | 7.4% |

| Materials | 8.4% |

| Technology | 9.7% |

| Industrials | 14.4% |

| Financials | 18.6% |

| Consumer Discretionary | 23.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 6.8% |

| Eagle Materials, Inc. | 4.4% |

| Shoe Carnival, Inc. | 4.0% |

| SunOpta, Inc. | 3.5% |

| Banc of California, Inc. | 3.3% |

| Triumph Financial, Inc. | 3.3% |

| Ethan Allen Interiors, Inc. | 3.2% |

| Taylor Morrison Home Corporation | 3.0% |

| Texas Capital Bancshares, Inc. | 3.0% |

| Halozyme Therapeutics, Inc. | 3.0% |

No material changes occurred during the period ended September 30, 2024.

Hodges Small Intrinsic Value Fund - Institutional (HSVIX)

Semi-Annual Shareholder Report - September 30, 2024

Prospectus

Financial information

Holdings

Proxy voting information

Hodges Small Intrinsic Value Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about Hodges Small Intrinsic Value Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://www.hodgescapital.com/mutual-funds/resources-applications. You can also request this information by contacting us at 1-866-811-0224.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $64 | 1.29% |

How did the Fund perform during the reporting period?

The Hodges Small Intrinsic Value Fund experienced a loss of -1.59% in the six months ending September 30, 2024 compared to an increase of 6.14% for its benchmark, the Russell 2000 Value Index. The Small Intrinsic Value Fund's one year return amounted to 15.92% compared to 25.88% for the Russell 2000 Index during the same period. The Fund's recent underperformance relative to the benchmark was impacted by lagging performance among a handful of consumer discretionary and energy stocks that were out of favor in the quarter. The number of positions held in the Fund decreased by one, resulting in 46 holdings at the end of the recent quarter. On September 30, 2024, the top holdings represented 33.51% of the Fund's holdings. They included Eagle Materials Inc (EXP), Shoe Carnival Inc (SCVL), SunOpta (STKL), Banc of California (BANC), Triumph Financial (TFIN), Ethan Allen Interiors Inc (ETD), Taylor Morrison Home Corp (TMHC), Texas Capital Bancshares (TCBI), Halozyme Therapeutics (HALO), and Home Bancshares (HOMB).

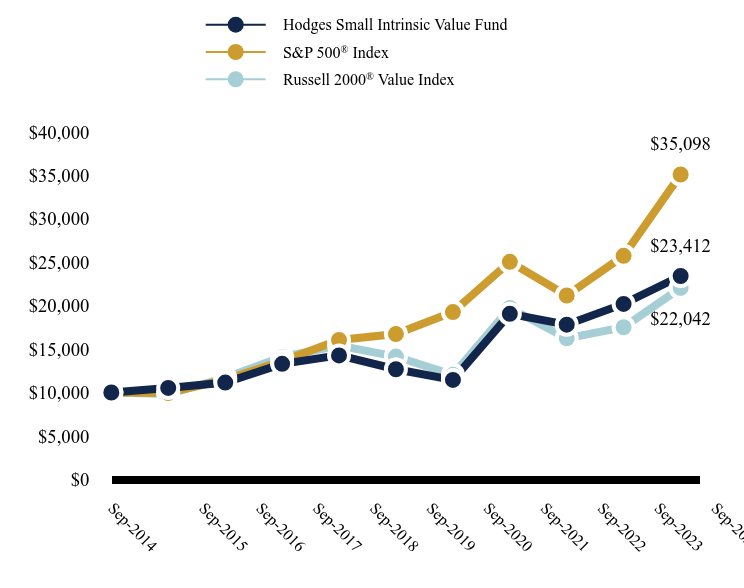

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Hodges Small Intrinsic Value Fund | S&P 500® Index | Russell 2000® Value Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $10,523 | $9,939 | $9,840 |

| Sep-2016 | $11,144 | $11,472 | $11,691 |

| Sep-2017 | $13,295 | $13,607 | $14,093 |

| Sep-2018 | $14,272 | $16,044 | $15,407 |

| Sep-2019 | $12,677 | $16,727 | $14,137 |

| Sep-2020 | $11,448 | $19,260 | $12,033 |

| Sep-2021 | $19,052 | $25,040 | $19,726 |

| Sep-2022 | $17,808 | $21,165 | $16,237 |

| Sep-2023 | $20,197 | $25,741 | $17,510 |

| Sep-2024 | $23,412 | $35,098 | $22,042 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Hodges Small Intrinsic Value Fund | -1.59% | 15.92% | 13.05% | 8.88% |

S&P 500® Index | 10.42% | 36.35% | 15.98% | 13.38% |

Russell 2000® Value Index | 6.14% | 25.88% | 9.29% | 8.22% |

| Net Assets | $63,577,599 |

| Number of Portfolio Holdings | 46 |

| Advisory Fee (net of waivers) | $214,375 |

| Portfolio Turnover | 22% |

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 93.2% |

| Money Market Funds | 6.8% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Real Estate | 2.0% |

| Health Care | 3.0% |

| Consumer Staples | 5.9% |

| Money Market Funds | 6.8% |

| Energy | 7.4% |

| Materials | 8.4% |

| Technology | 9.7% |

| Industrials | 14.4% |

| Financials | 18.6% |

| Consumer Discretionary | 23.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 6.8% |

| Eagle Materials, Inc. | 4.4% |

| Shoe Carnival, Inc. | 4.0% |

| SunOpta, Inc. | 3.5% |

| Banc of California, Inc. | 3.3% |

| Triumph Financial, Inc. | 3.3% |

| Ethan Allen Interiors, Inc. | 3.2% |

| Taylor Morrison Home Corporation | 3.0% |

| Texas Capital Bancshares, Inc. | 3.0% |

| Halozyme Therapeutics, Inc. | 3.0% |

No material changes occurred during the period ended September 30, 2024.

Hodges Small Intrinsic Value Fund - Retail (HDSVX)

Semi-Annual Shareholder Report - September 30, 2024

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics. Not applicable.

Item 3. Audit Committee Financial Expert. Not applicable.

Item 4. Principal Accountant Fees and Services. Not applicable.

Item 5. Audit Committee of Listed Registrants. Not applicable to open-end investment companies.

Item 6. Investments. Schedule of investments in securities of unaffiliated issuers is included under Item 7.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

| |

| |

| |

|

| |

| |

| Hodges Fund |

| |

| Retail Class (Symbol: HDPMX) |

| |

| |

| Small Cap Fund |

| |

| Retail Class (Symbol: HDPSX) |

| |

| Institutional Class (Symbol: HDSIX) |

| |

| |

| Small Intrinsic Value Fund |

| |

| Retail Class (Symbol: HDSVX) |

| |

| Institutional Class (Symbol: HSVIX) |

| |

| |

| Blue Chip Equity Income Fund |

| |

| Retail Class (Symbol: HDPBX) |

| |

| |

| |

| |

| Semi-Annual Financial Statements | September 30, 2024 |

| | Advised by: |

| | Hodges Capital Management |

| | 2905 Maple Avenue |

| | Dallas, Texas 75201 |

| https://www.hodgesfunds.com/ | 1-866-811-0224 |

The U.S. Securities and Exchange Commission (“SEC”) has not approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Table of Contents

| Schedules of Investments | 1 |

| | |

| Statements of Assets and Liabilities | 14 |

| | |

| Statements of Operations | 15 |

| | |

| Statements of Changes in Net Assets | 16 |

| | |

| Financial Highlights | 20 |

| | |

| Notes to Financial Statements | 26 |

| | |

| Additional Information | 36 |

| HODGES FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 94.2% | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 3.8% | | | | |

| | 135,000 | | | On Holding A.G.(a) | | $ | 6,770,250 | |

| | | | | | | | | |

| | | | | BANKING - 2.9% | | | | |

| | 350,000 | | | Banc of California, Inc. | | | 5,155,500 | |

| | | | | | | | | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 2.0% | | | | |

| | 125,000 | | | Ironwood Pharmaceuticals, Inc.(a) | | | 515,000 | |

| | 25,000 | | | Novo Nordisk A/S - ADR | | | 2,976,750 | |

| | | | | | | | 3,491,750 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 2.6% | | | | |

| | 350,000 | | | GEO Group, Inc. (The)(a) | | | 4,497,500 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 4.5% | | | | |

| | 15,000 | | | Eagle Materials, Inc. | | | 4,314,750 | |

| | 20,000 | | | Owens Corning | | | 3,530,400 | |

| | | | | | | | 7,845,150 | |

| | | | | E-COMMERCE DISCRETIONARY - 1.8% | | | | |

| | 1,150,000 | | | Stitch Fix, Inc., Class A(a) | | | 3,243,000 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 3.2% | | | | |

| | 35,000 | | | Generac Holdings, Inc.(a) | | | 5,560,800 | |

| | | | | | | | | |

| | | | | HOME & OFFICE PRODUCTS - 4.0% | | | | |

| | 65,000 | | | SharkNinja, Inc. | | | 7,066,150 | |

| | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES - 8.9% | | | | |

| | 35,000 | | | Airbnb, Inc., Class A(a) | | | 4,438,350 | |

| | 150,000 | | | Uber Technologies, Inc.(a) | | | 11,274,000 | |

| | | | | | | | 15,712,350 | |

| | | | | LEISURE FACILITIES & SERVICES - 15.3% | | | | |

| | 225,000 | | | DraftKings, Inc., Class A(a) | | | 8,820,000 | |

| | 350,000 | | | Norwegian Cruise Line Holdings Ltd.(a) | | | 7,178,500 | |

| | 350,000 | | | Portillo’s, Inc.(a) | | | 4,714,500 | |

See accompanying notes to financial statements.

| HODGES FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 94.2% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 15.3% (Continued) | | | | |

| | 65,000 | | | Wynn Resorts Ltd. | | $ | 6,232,200 | |

| | | | | | | | 26,945,200 | |

| | | | | LEISURE PRODUCTS - 1.2% | | | | |

| | 200,000 | | | Topgolf Callaway Brands Corporation(a) | | | 2,196,000 | |

| | | | | | | | | |

| | | | | MACHINERY - 0.7% | | | | |

| | 50,000 | | | Symbotic, Inc.(a) | | | 1,219,500 | |

| | | | | | | | | |

| | | | | METALS & MINING - 7.5% | | | | |

| | 450,000 | | | Cleveland-Cliffs, Inc.(a) | | | 5,746,500 | |

| | 150,000 | | | Freeport-McMoRan, Inc. | | | 7,488,000 | |

| | | | | | | | 13,234,500 | |

| | | | | OIL & GAS PRODUCERS - 8.7% | | | | |

| | 25,000 | | | Expand Energy Corporation | | | 2,056,250 | |

| | 200,000 | | | Matador Resources Company | | | 9,884,000 | |

| | 250,000 | | | Permian Resources Corporation | | | 3,402,500 | |

| | | | | | | | 15,342,750 | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 6.0% | | | | |

| | 12,000 | | | Texas Pacific Land Corporation | | | 10,616,880 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.6% | | | | |

| | 250,000 | | | Sleep Number Corporation(a) | | | 4,580,000 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 11.0% | | | | |

| | 25,000 | | | Coherent Corporation(a) | | | 2,222,750 | |

| | 30,000 | | | Micron Technology, Inc. | | | 3,111,300 | |

| | 50,000 | | | NVIDIA Corporation | | | 6,072,000 | |

| | 50,000 | | | ON Semiconductor Corporation(a) | | | 3,630,500 | |

| | 25,000 | | | Taiwan Semiconductor Manufacturing Company Ltd. - ADR | | | 4,341,750 | |

| | | | | | | | 19,378,300 | |

| | | | | SOFTWARE - 4.1% | | | | |

| | 15,000 | | | CyberArk Software Ltd.(a) | | | 4,374,150 | |

| | 100,000 | | | Evolent Health, Inc., Class A(a) | | | 2,828,000 | |

| | | | | | | | 7,202,150 | |

See accompanying notes to financial statements.

| HODGES FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 94.2% (Continued) | | | | |

| | | | | TECHNOLOGY HARDWARE - 3.0% | | | | |

| | 175,000 | | | Hewlett Packard Enterprise Company | | $ | 3,580,500 | |

| | 350,000 | | | Powerfleet Inc NJ(a) | | | 1,750,000 | |

| | | | | | | | 5,330,500 | |

| | | | | TRANSPORTATION & LOGISTICS - 0.4% | | | | |

| | 5,000 | | | Matson, Inc. | | | 713,100 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $105,214,996) | | | 166,101,330 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 2.8% | | | | |

| | | | | MONEY MARKET FUND - 2.8% | | | | |

| | 4,909,738 | | | First American Treasury Obligations Fund, Class X, 4.79% (Cost $4,909,738)(b) | | | 4,909,738 | |

| Contracts(c) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | | |

| | | | | EQUITY OPTIONS PURCHASED - 4.0% | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 4.0% | | | | | | | | | | | | | | | | |

| | 500 | | | Alphabet, Inc. | | WFC | | 12/20/2024 | | $ | 150 | | | $ | 8,359,500 | | | | 1,061,500 | |

| | 1,000 | | | Amazon.com, Inc. | | WFC | | 11/15/2024 | | | 175 | | | | 18,633,000 | | | | 1,683,000 | |

| | 450 | | | Boeing Company (The) | | WFC | | 01/17/2025 | | | 140 | | | | 6,841,800 | | | | 956,250 | |

| | 200 | | | Chubb Ltd. | | WFC | | 02/21/2025 | | | 250 | | | | 5,767,800 | | | | 886,000 | |

| | 800 | | | Wynn Resorts Ltd. | | WFC | | 10/18/2024 | | | 65 | | | | 7,670,400 | | | | 2,456,000 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $7,432,553) | | | | | 7,042,750 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 101.0% (Cost $117,557,287) | | | | | $ | 178,053,818 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (1.0)% | | | | | (1,723,134 | ) |

| | | | | NET ASSETS - 100.0% | | | | | | | | | | | | | | $ | 176,330,684 | |

| ADR | - American Depositary Receipt |

| | |

| A/S | - Anonim Sirketi |

| | |

| LTD | - Limited Company |

| | |

| REIT | - Real Estate Investment Trust |

| | |

| WFC | - Wells Fargo & Co. |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

| (c) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

See accompanying notes to financial statements.

| HODGES SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.9% | | | | |

| | | | | AEROSPACE & DEFENSE - 1.0% | | | | |

| | 80,000 | | | Kratos Defense & Security Solutions, Inc.(a) | | $ | 1,864,000 | |

| | | | | | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 3.3% | | | | |

| | 120,000 | | | On Holding A.G.(a) | | | 6,018,000 | |

| | | | | | | | | |

| | | | | BANKING - 8.5% | | | | |

| | 263,200 | | | Banc of California, Inc. | | | 3,876,936 | |

| | 113,351 | | | Hilltop Holdings, Inc. | | | 3,645,368 | |

| | 67,000 | | | Prosperity Bancshares, Inc. | | | 4,828,690 | |

| | 45,000 | | | Texas Capital Bancshares, Inc.(a) | | | 3,215,700 | |

| | | | | | | | 15,566,694 | |

| | | | | BIOTECHNOLOGY& PHARMACEUTICALS - 3.0% | | | | |

| | 95,000 | | | Halozyme Therapeutics, Inc.(a) | | | 5,437,800 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 4.1% | | | | |

| | 26,000 | | | Eagle Materials, Inc. | | | 7,478,900 | |

| | | | | | | | | |

| | | | | CONTAINERS & PACKAGING - 2.7% | | | | |

| | 165,000 | | | Graphic Packaging Holding Company | | | 4,882,350 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 1.0% | | | | |

| | 100,000 | | | Kimball Electronics, Inc.(a) | | | 1,851,000 | |

| | | | | | | | | |

| | | | | FOOD - 7.0% | | | | |

| | 45,000 | | | BellRing Brands, Inc.(a) | | | 2,732,400 | |

| | 50,000 | | | Cal-Maine Foods, Inc. | | | 3,742,000 | |

| | 1,000,000 | | | SunOpta, Inc.(a) | | | 6,380,000 | |

| | | | | | | | 12,854,400 | |

| | | | | HOME CONSTRUCTION - 3.8% | | | | |

| | 100,000 | | | Taylor Morrison Home Corporation(a) | | | 7,026,000 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 1.6% | | | | |

| | 26,500 | | | elf Beauty, Inc.(a) | | | 2,889,295 | |

See accompanying notes to financial statements.

| HODGES SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.9% (Continued) | | | | |

| | | | | INSURANCE - 1.4% | | | | |

| | 17,000 | | | Hanover Insurance Group, Inc. (The) | | $ | 2,517,870 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 6.1% | | | | |

| | 85,000 | | | Cinemark Holdings, Inc.(a) | | | 2,366,400 | |

| | 275,000 | | | Norwegian Cruise Line Holdings Ltd.(a) | | | 5,640,250 | |

| | 17,500 | | | Texas Roadhouse, Inc. | | | 3,090,500 | |

| | | | | | | | 11,097,150 | |

| | | | | LEISURE PRODUCTS - 1.1% | | | | |

| | 25,000 | | | Brunswick Corporation | | | 2,095,500 | |

| | | | | | | | | |

| | | | | METALS & MINING - 2.8% | | | | |

| | 400,000 | | | Cleveland-Cliffs, Inc.(a) | | | 5,108,000 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 8.5% | | | | |

| | 175,000 | | | Matador Resources Company | | | 8,648,500 | |

| | 300,000 | | | Permian Resources Corporation | | | 4,083,000 | |

| | 70,000 | | | SM Energy Company | | | 2,797,900 | |

| | | | | | | | 15,529,400 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.9% | | | | |

| | 85,000 | | | Seadrill Ltd.(a) | | | 3,377,900 | |

| | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 4.1% | | | | |

| | 8,500 | | | Texas Pacific Land Corporation | | | 7,520,290 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 10.4% | | | | |

| | 70,000 | | | Academy Sports & Outdoors, Inc. | | | 4,085,200 | |

| | 98,600 | | | Ethan Allen Interiors, Inc. | | | 3,144,354 | |

| | 10,000 | | | Group 1 Automotive, Inc. | | | 3,830,400 | |

| | 7,500 | | | RH(a) | | | 2,508,225 | |

| | 125,000 | | | Shoe Carnival, Inc. | | | 5,481,250 | |

| | | | | | | | 19,049,429 | |

| | | | | SEMICONDUCTORS - 3.9% | | | | |

| | 55,000 | | | Diodes, Inc.(a) | | | 3,524,950 | |

See accompanying notes to financial statements.

| HODGES SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 99.9% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 3.9% (Continued) | | | | |

| | 80,000 | | | Tower Semiconductor Ltd.(a) | | $ | 3,540,800 | |

| | | | | | | | 7,065,750 | |

| | | | | SOFTWARE - 10.1% | | | | |

| | 100,000 | | | Alkami Technology, Inc.(a) | | | 3,154,000 | |

| | 40,000 | | | C3.ai, Inc.(a) | | | 969,200 | |

| | 125,000 | | | Clear Secure, Inc. | | | 4,142,500 | |

| | 68,500 | | | Digi International, Inc.(a) | | | 1,885,805 | |

| | 30,000 | | | Pegasystems, Inc. | | | 2,192,700 | |

| | 65,000 | | | Varonis Systems, Inc.(a) | | | 3,672,500 | |

| | 80,000 | | | Zeta Global Holdings Corporation(a) | | | 2,386,400 | |

| | | | | | | | 18,403,105 | |

| | | | | SPECIALTY FINANCE - 0.9% | | | | |

| | 15,000 | | | FirstCash Holdings, Inc. | | | 1,722,000 | |

| | | | | | | | | |

| | | | | STEEL - 2.5% | | | | |

| | 13,000 | | | Carpenter Technology Corporation | | | 2,074,540 | |

| | 45,000 | | | Commercial Metals Company | | | 2,473,200 | |

| | | | | | | | 4,547,740 | |

| | | | | TECHNOLOGY HARDWARE - 5.3% | | | | |

| | 100,000 | | | Aviat Networks, Inc.(a) | | | 2,163,000 | |

| | 38,000 | | | Lumentum Holdings, Inc.(a) | | | 2,408,440 | |

| | 70,000 | | | PAR Technology Corporation(a) | | | 3,645,600 | |

| | 275,000 | | | Powerfleet Inc NJ(a) | | | 1,375,000 | |

| | | | | | | | 9,592,040 | |

| | | | | TRANSPORTATION & LOGISTICS - 2.5% | | | | |

| | 20,000 | | | Kirby Corporation(a) | | | 2,448,600 | |

| | 130,000 | | | Navigator Holdings Ltd. | | | 2,089,100 | |

| | | | | | | | 4,537,700 | |

| | | | | TRANSPORTATION EQUIPMENT - 2.4% | | | | |

| | 85,000 | | | Greenbrier Companies, Inc. (The) | | | 4,325,650 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $116,678,996) | | | 182,357,963 | |

See accompanying notes to financial statements.

| HODGES SMALL CAP FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENT — 0.1% | | | | |

| | | | | MONEY MARKET FUND - 0.1% | | | | |

| | 175,922 | | | First American Treasury Obligations Fund, Class X, 4.79% (Cost $175,922)(b) | | $ | 175,922 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $116,854,918) | | $ | 182,533,885 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.0% | | | (32,414 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 182,501,471 | |

| LTD | - Limited Company |

| | |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

See accompanying notes to financial statements.

| HODGES SMALL INTRINSIC VALUE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 93.1% | | | | |

| | | | | BANKING - 16.5% | | | | |

| | 141,000 | | | Banc of California, Inc. | | $ | 2,076,930 | |

| | 11,000 | | | BancFirst Corporation | | | 1,157,750 | |

| | 45,600 | | | Hilltop Holdings, Inc. | | | 1,466,496 | |

| | 67,200 | | | Home BancShares, Inc. | | | 1,820,448 | |

| | 27,000 | | | Texas Capital Bancshares, Inc.(a) | | | 1,929,420 | |

| | 26,000 | | | Triumph Financial, Inc.(a) | | | 2,068,040 | |

| | | | | | | | 10,519,084 | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 3.0% | | | | |

| | 32,900 | | | Halozyme Therapeutics, Inc.(a) | | | 1,883,196 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 4.4% | | | | |

| | 9,685 | | | Eagle Materials, Inc. | | | 2,785,890 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 1.2% | | | | |

| | 265,000 | | | Stitch Fix, Inc., Class A(a) | | | 747,300 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 3.7% | | | | |

| | 21,065 | | | Bel Fuse, Inc., Class B | | | 1,653,813 | |

| | 37,900 | | | Kimball Electronics, Inc.(a) | | | 701,529 | |

| | | | | | | | 2,355,342 | |

| | | | | ENGINEERING & CONSTRUCTION - 0.6% | | | | |

| | 110,000 | | | Southland Holdings, Inc.(a) | | | 407,000 | |

| | | | | | | | | |

| | | | | FOOD - 5.9% | | | | |

| | 20,600 | | | Cal-Maine Foods, Inc. | | | 1,541,704 | |

| | 347,000 | | | SunOpta, Inc.(a) | | | 2,213,860 | |

| | | | | | | | 3,755,564 | |

| | | | | HOME CONSTRUCTION - 3.0% | | | | |

| | 27,500 | | | Taylor Morrison Home Corporation(a) | | | 1,932,150 | |

| | | | | | | | | |

| | | | | INSURANCE - 2.1% | | | | |

| | 4,305 | | | Hanover Insurance Group, Inc. (The) | | | 637,614 | |

| | 34,350 | | | Tiptree, Inc. | | | 672,229 | |

| | | | | | | | 1,309,843 | |

See accompanying notes to financial statements.

| HODGES SMALL INTRINSIC VALUE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 93.1% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 2.8% | | | | |

| | 34,080 | | | Cinemark Holdings, Inc.(a) | | $ | 948,787 | |

| | 100,700 | | | Potbelly Corporation(a) | | | 839,838 | |

| | | | | | | | 1,788,625 | |

| | | | | LEISURE PRODUCTS - 2.3% | | | | |

| | 17,300 | | | Brunswick Corporation | | | 1,450,086 | |

| | | | | | | | | |

| | | | | MACHINERY - 3.0% | | | | |

| | 39,500 | | | Ichor Holdings Ltd.(a) | | | 1,256,495 | |

| | 65,980 | | | Manitowoc Company, Inc. (The)(a) | | | 634,728 | |

| | | | | | | | 1,891,223 | |

| | | | | METALS & MINING - 2.3% | | | | |

| | 115,400 | | | Cleveland-Cliffs, Inc.(a) | | | 1,473,658 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 3.9% | | | | |

| | 9,200 | | | Chord Energy Corporation | | | 1,198,116 | |

| | 8,400 | | | Gulfport Energy Corporation(a) | | | 1,271,340 | |

| | | | | | | | 2,469,456 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 3.5% | | | | |

| | 36,800 | | | Atlas Energy Solutions, Inc. | | | 802,240 | |

| | 64,000 | | | ProPetro Holding Corporation(a) | | | 490,240 | |

| | 13,400 | | | Tidewater, Inc.(a) | | | 961,986 | |

| | | | | | | | 2,254,466 | |

| | | | | REAL ESTATE OWNERS & DEVELOPERS - 2.0% | | | | |

| | 49,000 | | | Stratus Properties, Inc.(a) | | | 1,273,510 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 14.4% | | | | |

| | 26,800 | | | Academy Sports & Outdoors, Inc. | | | 1,564,048 | |

| | 9,000 | | | Builders FirstSource, Inc.(a) | | | 1,744,740 | |

| | 63,700 | | | Ethan Allen Interiors, Inc. | | | 2,031,393 | |

| | 58,000 | | | Shoe Carnival, Inc. | | | 2,543,301 | |

| | 69,000 | | | Sleep Number Corporation(a) | | | 1,264,080 | |

| | | | | | | | 9,147,562 | |

| | | | | SEMICONDUCTORS - 5.4% | | | | |

| | 14,336 | | | Diodes, Inc.(a) | | | 918,794 | |

See accompanying notes to financial statements.

| HODGES SMALL INTRINSIC VALUE FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 93.1% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 5.4% (Continued) | | | | |

| | 41,820 | | | Photronics, Inc.(a) | | $ | 1,035,463 | |

| | 32,790 | | | Tower Semiconductor Ltd.(a) | | | 1,451,286 | |

| | | | | | | | 3,405,543 | |

| | | | | STEEL - 1.7% | | | | |

| | 20,000 | | | Commercial Metals Company | | | 1,099,200 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 3.7% | | | | |

| | 62,330 | | | Aviat Networks, Inc.(a) | | | 1,348,197 | |

| | 37,900 | | | Kornit Digital Ltd.(a) | | | 979,147 | |

| | | | | | | | 2,327,344 | |

| | | | | TECHNOLOGY SERVICES - 0.6% | | | | |

| | 150,000 | | | Research Solutions, Inc.(a) | | | 409,500 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.8% | | | | |

| | 33,000 | | | Marten Transport Ltd. | | | 584,100 | |

| | 73,600 | | | Navigator Holdings Ltd. | | | 1,182,752 | |

| | | | | | | | 1,766,852 | |

| | | | | TRANSPORTATION EQUIPMENT - 4.3% | | | | |

| | 19,500 | | | Blue Bird Corporation(a) | | | 935,220 | |

| | 35,200 | | | Greenbrier Companies, Inc. (The) | | | 1,791,328 | |

| | | | | | | | 2,726,548 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $48,663,274) | | | 59,178,942 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 6.8% | | | | |

| | | | | MONEY MARKET FUND - 6.8% | | | | |

| | 4,345,833 | | | First American Treasury Obligations Fund, Class X, 4.79% (Cost $4,345,833)(b) | | | 4,345,833 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.9% (Cost $53,009,107) | | $ | 63,524,775 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.1% | | | 52,824 | |

| | | | | NET ASSETS - 100.0% | | $ | 63,577,599 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

See accompanying notes to financial statements.

| HODGES BLUE CHIP EQUITY INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.8% | | | | |

| | | | | BANKING - 9.2% | | | | |

| | 30,000 | | | Bank of America Corporation | | $ | 1,190,400 | |

| | 5,000 | | | JPMorgan Chase & Company | | | 1,054,300 | |

| | 25,000 | | | Wells Fargo & Company | | | 1,412,250 | |

| | | | | | | | 3,656,950 | |

| | | | | BEVERAGES - 3.0% | | | | |

| | 7,000 | | | PepsiCo, Inc. | | | 1,190,350 | |

| | | | | | | | | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 5.9% | | | | |

| | 6,000 | | | AbbVie, Inc. | | | 1,184,880 | |

| | 10,000 | | | Merck & Company, Inc. | | | 1,135,600 | |

| | | | | | | | 2,320,480 | |

| | | | | E-COMMERCE DISCRETIONARY - 3.8% | | | | |

| | 8,000 | | | Amazon.com, Inc.(a) | | | 1,490,640 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 3.0% | | | | |

| | 10,000 | | | Vistra Corporation | | | 1,185,400 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 7.7% | | | | |

| | 3,000 | | | Goldman Sachs Group, Inc. (The) | | | 1,485,330 | |

| | 15,000 | | | Morgan Stanley | | | 1,563,600 | |

| | | | | | | | 3,048,930 | |

| | | | | INSURANCE - 2.9% | | | | |

| | 2,500 | | | Berkshire Hathaway, Inc., Class B(a) | | | 1,150,650 | |

| | | | | | | | | |

| | | | | MACHINERY - 6.4% | | | | |

| | 4,500 | | | Caterpillar, Inc. | | | 1,760,040 | |

| | 7,000 | | | Stanley Black & Decker, Inc. | | | 770,910 | |

| | | | | | | | 2,530,950 | |

| | | | | OIL & GAS PRODUCERS - 7.3% | | | | |

| | 13,000 | | | Exxon Mobil Corporation | | | 1,523,860 | |

| | 15,000 | | | ONEOK, Inc. | | | 1,366,950 | |

| | | | | | | | 2,890,810 | |

See accompanying notes to financial statements.

| HODGES BLUE CHIP EQUITY INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.8% (Continued) | | | | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.1% | | | | |

| | 10,000 | | | Schlumberger N.V. | | $ | 419,500 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 7.2% | | | | |

| | 750 | | | Costco Wholesale Corporation | | | 664,890 | |

| | 27,000 | | | Walmart, Inc. | | | 2,180,250 | |

| | | | | | | | 2,845,140 | |

| | | | | SEMICONDUCTORS - 15.6% | | | | |

| | 10,000 | | | Broadcom, Inc. | | | 1,725,000 | |

| | 22,500 | | | NVIDIA Corporation | | | 2,732,400 | |

| | 10,000 | | | Taiwan Semiconductor Manufacturing Company Ltd. - ADR | | | 1,736,700 | |

| | | | | | | | 6,194,100 | |

| | | | | SOFTWARE - 5.4% | | | | |

| | 5,000 | | | Microsoft Corporation | | | 2,151,500 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 7.1% | | | | |

| | 12,000 | | | Apple, Inc. | | | 2,796,000 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 3.4% | | | | |

| | 6,000 | | | International Business Machines Corporation | | | 1,326,480 | |

| | | | | | | | | |

| | | | | TOBACCO & CANNABIS - 3.1% | | | | |

| | 10,000 | | | Philip Morris International, Inc. | | | 1,214,000 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 6.7% | | | | |

| | 5,500 | | | Union Pacific Corporation | | | 1,355,640 | |

| | 10,000 | | | United Parcel Service, Inc., B | | | 1,363,400 | |

| | | | | | | | 2,719,040 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $23,007,959) | | | 39,130,920 | |

See accompanying notes to financial statements.

| HODGES BLUE CHIP EQUITY INCOME FUND |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENT — 1.3% | | | | |

| | | | | MONEY MARKET FUND - 1.3% | | | | |

| | 513,978 | | | First American Treasury Obligations Fund, Class X, 4.79% (Cost $513,978)(b) | | $ | 513,978 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.1% (Cost $23,521,937) | | $ | 39,644,898 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.1)% | | | (23,712 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 39,621,186 | |

| ADR | - American Depositary Receipt |

| | |

| LTD | - Limited Company |

| | |

| NV | - Naamioze Vennootschap |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| September 30, 2024 |

| | | | | | | | | Small Intrinsic | | | Blue Chip Equity | |

| | | Hodges Fund | | | Small Cap Fund | | | Value Fund | | | Income Fund | |

| ASSETS: | | | | | | | | | | | | | | | | |

| Investments in securities, at cost | | $ | 117,557,287 | | | $ | 116,854,918 | | | $ | 53,009,107 | | | $ | 23,521,937 | |

| Investments in securities, at value | | | 178,053,818 | | | | 182,533,885 | | | | 63,524,775 | | | | 39,644,898 | |

| Receivable for fund shares sold | | | 3,235 | | | | 24,285 | | | | 35,553 | | | | 5,000 | |

| Dividends and interest receivable | | | 129,643 | | | | 97,210 | | | | 40,380 | | | | 31,679 | |

| Receivable for securities sold | | | 495,861 | | | | — | | | | 288,120 | | | | — | |

| Other assets | | | 47,134 | | | | 97,454 | | | | 13,267 | | | | 22,479 | |

| Total Assets | | | 178,729,691 | | | | 182,752,834 | | | | 63,902,095 | | | | 39,704,056 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | |

| Payable for fund shares redeemed | | | 22,067 | | | | 39,431 | | | | 68,528 | | | | 8,005 | |

| Payable for securities purchased | | | 2,236,119 | | | | — | | | | 200,739 | | | | — | |

| Accrued advisory fee | | | 105,934 | | | | 159,039 | | | | 25,489 | | | | 18,241 | |

| Payable to related parties | | | — | | | | 2,517 | | | | 1,506 | | | | 11,177 | |

| Distribution (12b-1) fees payable | | | 34,642 | | | | 28,243 | | | | 12,708 | | | | 7,863 | |

| Other accrued expenses | | | 245 | | | | 22,133 | | | | 15,526 | | | | 37,584 | |

| Total Liabilities | | | 2,399,007 | | | | 251,363 | | | | 324,496 | | | | 82,870 | |

| NET ASSETS | | $ | 176,330,684 | | | $ | 182,501,471 | | | $ | 63,577,599 | | | $ | 39,621,186 | |

| | | | | | | | | | | | | | | | | |

| COMPONENTS OF NET ASSETS | | | | | | | | | | | | | | | | |

| Paid in capital | | $ | 102,533,915 | | | $ | 86,578,087 | | | $ | 51,425,189 | | | $ | 18,595,942 | |

| Total distributable earnings | | | 73,796,769 | | | | 95,923,384 | | | | 12,152,410 | | | | 21,025,244 | |

| NET ASSETS | | $ | 176,330,684 | | | $ | 182,501,471 | | | $ | 63,577,599 | | | $ | 39,621,186 | |

| | | | | | | | | | | | | | | | | |

| NET ASSET VALUE PER SHARE | | | | | | | | | | | | | | | | |

| RETAIL CLASS SHARES | | | | | | | | | | | | | | | | |

| Net assets | | $ | 176,330,684 | | | $ | 140,266,679 | | | $ | 63,085,273 | | | $ | 39,621,186 | |

| Shares of Beneficial Interest Outstanding ($0.01 par value, unlimited authorized shares) | | | 2,618,267 | | | | 6,032,148 | | | | 3,184,562 | | | | 1,556,309 | |

| Net asset value, offering and redemption price per share | | $ | 67.35 | | | $ | 23.25 | | | $ | 19.81 | | | $ | 25.46 | |

| INSISTUTIONAL CLASS SHARES | | | | | | | | | | | | | | | | |

| Net assets | | $ | — | | | $ | 42,234,792 | | | $ | 492,326 | | | $ | — | |

| Shares of Beneficial Interest Outstanding ($0.01 par value, unlimited authorized shares) | | | — | | | | 1,688,169 | | | | 24,839 | | | | — | |

| Net asset value, offering and redemption price per share | | $ | — | | | $ | 25.02 | | | $ | 19.82 | | | $ | — | |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| STATEMENTS OF OPERATIONS (Unaudited) |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2024 |

| | | | | | | | | Small Intrinsic | | | Blue Chip Equity | |

| | | Hodges Fund | | | Small Cap Fund | | | Value Fund | | | Income Fund | |

| INVESTMENT INCOME: | | | | | | | | | | | | | | | | |

| Dividends and interest net of $2,313, $-, $-, and $2,711 foreign withholding tax, respectively | | $ | 805,257 | | | $ | 1,003,452 | | | $ | 464,355 | | | $ | 339,671 | |

| Total investment income | | | 805,257 | | | | 1,003,452 | | | | 464,355 | | | | 339,671 | |

| | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Investment advisory fees | | | 736,269 | | | | 755,154 | | | | 260,322 | | | | 124,390 | |

| Distribution (12b-1) fees: | | | | | | | | | | | | | | | | |

| Retail Class | | | 216,550 | | | | 171,796 | | | | 76,366 | | | | 47,842 | |

| Shareholder Servicing fees | | | 16,530 | | | | 28,376 | | | | 16,290 | | | | 9,962 | |

| Administration fees | | | 12,736 | | | | 22,259 | | | | 14,506 | | | | 9,907 | |

| Transfer agent fees | | | 11,957 | | | | 18,772 | | | | 10,801 | | | | 11,821 | |

| Registration fees | | | 6,698 | | | | 13,795 | | | | 11,120 | | | | 3,782 | |

| Accounting fees | | | 10,808 | | | | 17,341 | | | | 6,513 | | | | 3,383 | |

| Shareholder reports | | | 2,568 | | | | 4,523 | | | | 2,193 | | | | 3,825 | |

| Legal fees | | | 11,537 | | | | 12,362 | | | | 11,816 | | | | 11,874 | |

| Audit and tax fees | | | 10,222 | | | | 10,222 | | | | 9,223 | | | | 9,231 | |

| Trustee fees and expenses | | | 9,784 | | | | 9,782 | | | | 9,836 | | | | 9,787 | |

| Custody fees | | | 4,253 | | | | 7,417 | | | | 3,728 | | | | 8,546 | |

| Professional fees | | | 7,823 | | | | 7,750 | | | | 4,642 | | | | 3,960 | |

| Other expenses | | | 78 | | | | 3,208 | | | | 2,237 | | | | 1,135 | |

| Total expenses | | | 1,057,813 | | | | 1,082,757 | | | | 439,593 | | | | 259,445 | |

| Expenses waived | | | (35,904 | ) | | | — | | | | (45,947 | ) | | | (7,621 | ) |

| Net expenses | | | 1,021,909 | | | | 1,082,757 | | | | 393,646 | | | | 251,824 | |

| NET INVESTMENT INCOME/(LOSS) | | | (216,652 | ) | | | (79,305 | ) | | | 70,709 | | | | 87,847 | |

| | | | | | | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | | | | | | | | | | |

| Net realized gain/(loss) from: | | | | | | | | | | | | | | | | |

| Investments | | | 10,746,435 | | | | 15,713,644 | | | | 892,451 | | | | 4,608,598 | |

| Net realized gain | | | 10,746,435 | | | | 15,713,644 | | | | 892,451 | | | | 4,608,598 | |

| | | | | | | | | | | | | | | | | |

| Net change in unrealized depreciation on investments | | | (12,909,294 | ) | | | (7,038,251 | ) | | | (1,883,009 | ) | | | (281,810 | ) |

| | | | | | | | | | | | | | | | | |

| Net realized and unrealized gain/(loss) on investments | | | (2,162,859 | ) | | | 8,675,393 | | | | (990,558 | ) | | | 4,326,788 | |

| | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (2,379,511 | ) | | $ | 8,596,088 | | | $ | (919,849 | ) | | $ | 4,414,635 | |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Hodges Fund | |

| | | Six Months Ended | | | Year Ended | |

| | | September 30, 2024 | | | March 31, | |

| | | (Unaudited) | | | 2024 | |

| NET ASSETS - BEGINNING OF YEAR/PERIOD | | $ | 186,511,499 | | | $ | 150,935,481 | |

| | | | | | | | | |

| OPERATIONS | | | | | | | | |

| Net investment loss | | | (216,652 | ) | | | (1,023,241 | ) |

| Net realized gain from investments | | | 10,746,435 | | | | 5,354,445 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (12,909,294 | ) | | | 42,839,828 | |

| Net increase/(decrease) in net assets resulting from operations | | | (2,379,511 | ) | | | 47,171,032 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Retail Class | | | — | | | | (1,229,355 | ) |

| Total distributions to shareholders | | | — | | | | (1,229,355 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares - Retail Shares | | | 1,516,186 | | | | 9,585,251 | |

| Reinvestment of distributions - Retail Class | | | — | | | | 1,193,387 | |

| Redemption of shares - Retail Class* | | | (9,317,490 | ) | | | (21,144,297 | ) |

| | | | | | | | | |

| Net decrease from capital share transactions | | | (7,801,304 | ) | | | (10,365,659 | ) |

| | | | | | | | | |

| Total increase/(decrease) in net assets | | | (10,180,815 | ) | | | 35,576,018 | |

| | | | | | | | | |

| NET ASSETS - END OF YEAR/PERIOD | | $ | 176,330,684 | | | $ | 186,511,499 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Retail Class: | | | | | | | | |

| Sold | | | 23,360 | | | | 165,916 | |

| Issued on reinvestment of distributions | | | — | | | | 20,508 | |

| Redeemed | | | (145,411 | ) | | | (384,056 | ) |

| Net decrease | | | (122,051 | ) | | | (197,632 | ) |

| * | Net of redemption fees of $26 and $7,192, respectively. |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Small Cap Fund | |

| | | Six Months Ended | | | Year Ended | |

| | | September 30, 2024 | | | March 31, | |

| | | (Unaudited) | | | 2024 | |

| NET ASSETS - BEGINNING OF YEAR/PERIOD | | $ | 187,943,561 | | | $ | 177,544,856 | |

| | | | | | | | | |

| OPERATIONS | | | | | | | | |

| Net investment loss | | | (79,305 | ) | | | (843,249 | ) |

| Net realized gain from investments | | | 15,713,644 | | | | 18,633,049 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (7,038,251 | ) | | | 16,655,533 | |

| Net increase in net assets resulting from operations | | | 8,596,088 | | | | 34,445,333 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Retail Class | | | — | | | | (6,568,359 | ) |

| Institutional Class | | | — | | | | (1,770,930 | ) |

| Total distributions to shareholders | | | — | | | | (8,339,289 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares - Retail Shares | | | 1,373,862 | | | | 3,594,547 | |

| Sale of shares - Institutional Shares | | | 1,878,067 | | | | 6,978,959 | |

| Reinvestment of distributions - Retail Class | | | — | | | | 6,466,865 | |

| Reinvestment of distributions - Institutional Class | | | — | | | | 1,722,703 | |

| Redemption of shares - Retail Class* | | | (13,629,124 | ) | | | (23,671,458 | ) |

| Redemption of shares - Institutional Class^ | | | (3,660,983 | ) | | | (10,798,955 | ) |

| | | | | | | | | |

| Net decrease from capital share transactions | | | (14,038,178 | ) | | | (15,707,339 | ) |

| | | | | | | | | |

| Total increase/(decrease) in net assets | | | (5,442,090 | ) | | | 10,398,705 | |

| | | | | | | | | |

| NET ASSETS - END OF YEAR/PERIOD | | $ | 182,501,471 | | | $ | 187,943,561 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Retail Class: | | | | | | | | |

| Sold | | | 62,976 | | | | 181,529 | |

| Issued on reinvestment of distributions | | | — | | | | 349,560 | |

| Redeemed | | | (628,537 | ) | | | (1,213,486 | ) |

| Net decrease | | | (565,561 | ) | | | (682,397 | ) |

| | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Sold | | | 80,668 | | | | 331,447 | |

| Issued on reinvestment of distributions | | | — | | | | 86,742 | |

| Redeemed | | | (157,689 | ) | | | (516,473 | ) |

| Net decrease | | | (77,021 | ) | | | (98,284 | ) |

| * | Net of redemption fees of $142 and $5,885, respectively. |

| ^ | Net of redemption fees of $41 and $1,623, respectively. |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Small Intrinsic Value Fund | |

| | | Six Months Ended | | | Year Ended | |

| | | September 30, 2024 | | | March 31, | |

| | | (Unaudited)# | | | 2024 | |

| NET ASSETS - BEGINNING OF YEAR/PERIOD | | $ | 63,088,775 | | | $ | 38,374,072 | |

| | | | | | | | | |

| OPERATIONS | | | | | | | | |

| Net investment income/(loss) | | | 70,709 | | | | (94,684 | ) |

| Net realized gain from investments | | | 892,451 | | | | 906,338 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (1,883,009 | ) | | | 8,455,776 | |

| Net increase/(decrease) in net assets resulting from operations | | | (919,849 | ) | | | 9,267,430 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Retail Class | | | — | | | | (26,803 | ) |

| Total distributions to shareholders | | | — | | | | (26,803 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares - Retail Shares | | | 6,137,467 | | | | 21,179,948 | |

| Sale of shares - Institutional Shares | | | 500,004 | | | | — | |

| Reinvestment of distributions - Retail Class | | | — | | | | 26,546 | |

| Redemption of shares - Retail Class* | | | (5,228,798 | ) | | | (5,732,418 | ) |

| | | | | | | | | |

| Net increase from capital share transactions | | | 1,408,673 | | | | 15,474,076 | |

| | | | | | | | | |

| Total increase in net assets | | | 488,824 | | | | 24,714,703 | |

| | | | | | | | | |

| NET ASSETS - END OF YEAR/PERIOD | | $ | 63,577,599 | | | $ | 63,088,775 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Retail Class: | | | | | | | | |

| Sold | | | 321,847 | | | | 1,164,839 | |

| Issued on reinvestment of distributions | | | — | | | | 1,520 | |

| Redeemed | | | (271,902 | ) | | | (317,209 | ) |

| Net increase | | | 49,945 | | | | 849,150 | |

| | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Sold | | | 24,839 | | | | | |

| Issued on reinvestment of distributions | | | — | | | | | |

| Redeemed | | | — | | | | | |

| Net decrease | | | 24,839 | | | | | |

| # | The Small Intrinsic Value Fund Institutional Class commenced investment operations on July 30, 2024. |

| * | Net of redemption fees of $1878 and $4,782, respectively. |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Blue Chip Equity Income Fund | |

| | | Six Months Ended | | | Year Ended | |

| | | September 30, 2024 | | | March 31, | |

| | | (Unaudited) | | | 2024 | |

| NET ASSETS - BEGINNING OF YEAR/PERIOD | | $ | 41,341,369 | | | $ | 27,929,273 | |

| | | | | | | | | |

| OPERATIONS | | | | | | | | |

| Net investment income | | | 87,847 | | | | 256,359 | |

| Net realized gain from investments | | | 4,608,598 | | | | 1,108,590 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (281,810 | ) | | | 7,230,017 | |

| Net increase in net assets resulting from operations | | | 4,414,635 | | | | 8,594,966 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Retail Class | | | (109,766 | ) | | | (257,271 | ) |

| Total distributions to shareholders | | | (109,766 | ) | | | (257,271 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares - Retail Shares | | | 1,851,805 | | | | 10,239,945 | |

| Reinvestment of distributions - Retail Class | | | 104,266 | | | | 246,346 | |

| Redemption of shares - Retail Class* | | | (7,981,123 | ) | | | (5,411,890 | ) |

| | | | | | | | | |

| Net increase/(decrease) from capital share transactions | | | (6,025,052 | ) | | | 5,074,401 | |

| | | | | | | | | |

| Total increase/(decrease) in net assets | | | (1,720,183 | ) | | | 13,412,096 | |

| | | | | | | | | |

| NET ASSETS - END OF YEAR/PERIOD | | $ | 39,621,186 | | | $ | 41,341,369 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Retail Class: | | | | | | | | |

| Sold | | | 79,387 | | | | 526,091 | |

| Issued on reinvestment of distributions | | | 4,214 | | | | 12,089 | |

| Redeemed | | | (343,396 | ) | | | (272,598 | ) |

| Net increase/(decrease) | | | (259,795 | ) | | | 265,582 | |

| * | Net of redemption fees of $55 and $22, respectively. |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| FINANCIAL HIGHLIGHTS |

| |

| Per Share Data and Ratios for a Share of Beneficial Interest Oustanding Throughout Each Year/Period |

| | | Hodges Fund - Retail Shares | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | | | | |

| | | September 30, 2024 | | | For the years ended March 31, | |

| | | (Unaudited)1 | | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net Asset Value - Beginning of Year/Period | | $ | 68.06 | | | $ | 51.37 | | | $ | 58.91 | | | $ | 57.39 | | | $ | 20.36 | | | $ | 37.76 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss1 | | | (0.08 | ) | | | (0.36 | ) | | | (0.14 | ) | | | (0.46 | ) | | | (0.31 | ) | | | (0.19 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.63 | ) | | | 17.49 | | | | (7.17 | ) | | | 1.98 | | | | 37.34 | | | | (17.21 | ) |

| Total from investment operations | | | (0.71 | ) | | | 17.13 | | | | (7.31 | ) | | | 1.52 | | | | 37.03 | | | | (17.40 | ) |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net realized gain on investments | | | — | | | | (0.44 | ) | | | (0.23 | ) | | | — | | | | — | | | | — | |

| Total distributions to shareholders | | | — | | | | (0.44 | ) | | | (0.23 | ) | | | — | | | | — | | | | — | |

| Paid in capital from redemption fees2 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Net Asset Value - End of Year/Period | | $ | 67.35 | | | $ | 68.06 | | | $ | 51.37 | | | $ | 58.91 | | | $ | 57.39 | | | $ | 20.36 | |

| Total return | | | -1.06 | % 3,5 | | | 33.50 | % 3 | | | (12.44 | )% | | | 2.70 | % | | | 181.74 | % | | | (46.05 | )% |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 1.22 | % 6 | | | 1.32 | % | | | 1.37 | % | | | 1.35 | % | | | 1.40 | % | | | 1.37 | % |

| After fees waived and expenses absorbed4 | | | 1.18 | % 6 | | | 1.18 | % | | | 1.18 | % | | | 1.17 | % | | | 1.16 | % | | | 1.18 | % |

| Ratios of net investment loss to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (0.29 | )% 6 | | | (0.78 | )% | | | (0.48 | )% | | | (0.93 | )% | | | (1.03 | )% | | | (0.75 | )% |

| After fees waived and expenses absorbed4 | | | (0.25 | )% 6 | | | (0.64 | )% | | | (0.29 | )% | | | (0.76 | )% | | | (0.79 | )% | | | (0.56 | )% |

| Portfolio turnover rate | | | 41 | % 5 | | | 103 | % | | | 74 | % | | | 96 | % | | | 220 | % | | | 107 | % |

| Net Assets at end of year/period (millions) | | $ | 176.3 | | | $ | 186.5 | | | $ | 150.9 | | | $ | 186.4 | | | $ | 210.7 | | | $ | 73.9 | |

| 1 | Calculated using the average shares method. |

| 2 | Represents less than $0.005. |

| 3 | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently, the net asset value for financial statement reporting purposes and the returns based upon those net assets may differ from the net asset values and returns for shareholder processing. |

| 4 | Effective September 1, 2020, the Advisor contractually agreed to limit the Retail Class shares’ annual ratio of expenses to 1.15% of the Retail Class’ daily net assets. Effective September 1, 2021, the annual ratio of expenses returned to 1.18% of the Retail Class’ daily net assets. See Note 3. |

See accompanying notes to financial statements.

| HODGES MUTUAL FUNDS |

| FINANCIAL HIGHLIGHTS |

| |

| Per Share Data and Ratios for a Share of Beneficial Interest Oustanding Throughout Each Year/Period |

| | | Small Cap Fund - Retail Shares | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | | | | |

| | | September 30, 2024 | | | For the years ended March 31, | |

| | | (Unaudited)1 | | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net Asset Value - Beginning of Year/Period | | $ | 22.13 | | | $ | 19.15 | | | $ | 21.35 | | | $ | 25.28 | | | $ | 10.10 | | | $ | 18.13 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss1 | | | (0.02 | ) | | | (0.11 | ) | | | (0.01 | ) | | | (0.15 | ) | | | (0.13 | ) | | | (0.07 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 1.14 | | | | 4.09 | | | | (1.01 | ) | | | 0.56 | | | | 15.31 | | | | (6.58 | ) |

| Total from investment operations | | | 1.12 | | | | 3.98 | | | | (1.02 | ) | | | 0.41 | | | | 15.18 | | | | (6.65 | ) |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net realized gain on investments | | | — | | | | (1.00 | ) | | | (1.18 | ) | | | (4.34 | ) | | | — | | | | (1.38 | ) |

| Total distributions to shareholders | | | — | | | | (1.00 | ) | | | (1.18 | ) | | | (4.34 | ) | | | — | | | | (1.38 | ) |

| Paid in capital from redemption fees2 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Net Asset Value - End of Year/Period | | $ | 23.25 | | | $ | 22.13 | | | $ | 19.15 | | | $ | 21.35 | | | $ | 25.28 | | | $ | 10.10 | |

| Total return | | | 5.06 | % 4 | | | 21.80 | % | | | (4.68 | )% | | | 1.12 | % | | | 150.30 | % | | | (39.59 | )% |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 1.28 | % 5 | | | 1.36 | % | | | 1.40 | % | | | 1.38 | % | | | 1.40 | % | | | 1.33 | % |