UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-22549 |

| Northern Lights Fund Trust II |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Dr, Ste 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| Kevin E. Wolf, Ultimus Fund Solutions, LLC. |

| 80 Arkay Drive, Suite 110., Hauppauge, NY 11788 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-470-2600 | |

| Date of fiscal year end: | 10/31 | |

| | | |

| Date of reporting period: | 10/31/24 | |

Item 1. Reports to Stockholders.

| (a) | Insert Tailored Shareholder Report |

Institutional Class (BIVIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Invenomic Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.invenomic.com. You can also request this information by contacting us at 1-855-466-3406.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $299 | 3.16% |

How did the Fund perform during the reporting period?

The long portfolio contributed 28.77% while the short portfolio detracted approximately -40.54%, both on a gross basis. During this period, we averaged 109.93% long and -92.39% short resulting in average net exposure of 17.54% and average gross exposure 202.32%.

From a sector perspective, our biggest contributors on the long side were Information Industrials (+6.30%), Financials (+6.17%) and Consumer Discretionary (+5.10%). On the short side, the sectors that detracted the most were Information Technology (-13.22%), Consumer Discretionary (-8.20%) and Financials (-8.09%). From a total portfolio perspective, the top ten contributed 9.79% and the top ten detractors cost -10.62%, both on a gross basis.

Our strategy faced two substantial market headwinds during the year which negatively impacted performance. The first is underperformance of value relative to growth. The Russell 1000 Value/Growth Index was down -10.57% during the period, which is the fifth worst year in the last 25 years. The second and most substantial headwind was the momentum factor which as of October 31, 2024, had its second strongest year in the last 25 years as measured by the Bloomberg US Pure Momentum Factor Index. Considering the strength of the headwinds we faced, we believe we managed risk as well as can be expected. We feel like our portfolio is well positioned for what is likely to be a volatile period going forward.

We expect the market environment to remain volatile for the foreseeable future. The outcome of the U.S. election will create opportunities on the long and the short side regardless of who is elected. Equity valuations remain at extremely elevated levels, and as a result, we will continue to proceed cautiously relying on our investment process, which has served us well over time.

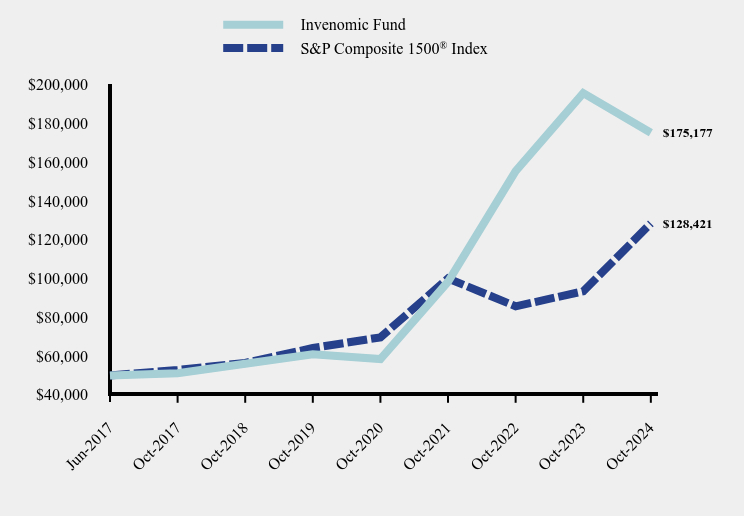

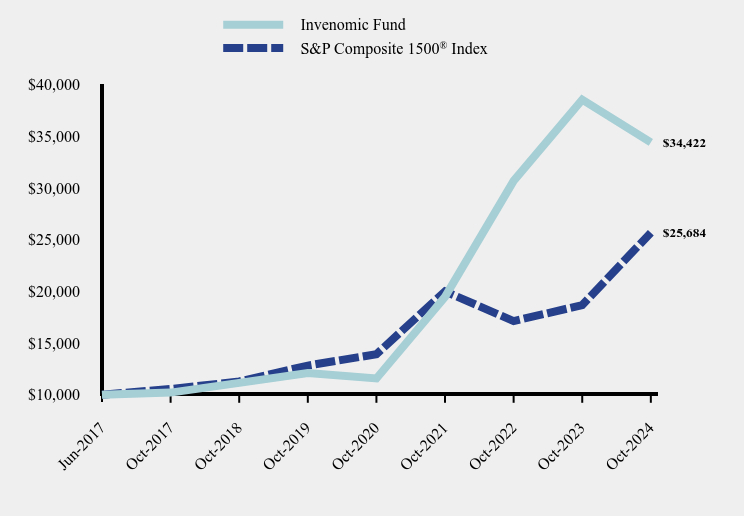

How has the Fund performed since inception?

Total Return Based on $50,000 Investment

| Invenomic Fund | S&P Composite 1500® Index |

|---|

| Jun-2017 | $50,000 | $50,000 |

| Oct-2017 | $51,100 | $52,807 |

| Oct-2018 | $56,023 | $56,429 |

| Oct-2019 | $60,883 | $64,136 |

| Oct-2020 | $58,412 | $69,628 |

| Oct-2021 | $98,310 | $100,022 |

| Oct-2022 | $155,348 | $85,648 |

| Oct-2023 | $195,635 | $93,367 |

| Oct-2024 | $175,177 | $128,421 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (June 19, 2017) |

|---|

| Invenomic Fund | -10.46% | 23.54% | 18.55% |

S&P Composite 1500® Index | 37.54% | 14.90% | 13.66% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$984,405,991

- Number of Portfolio Holdings324

- Advisory Fee $22,612,478

- Portfolio Turnover170%

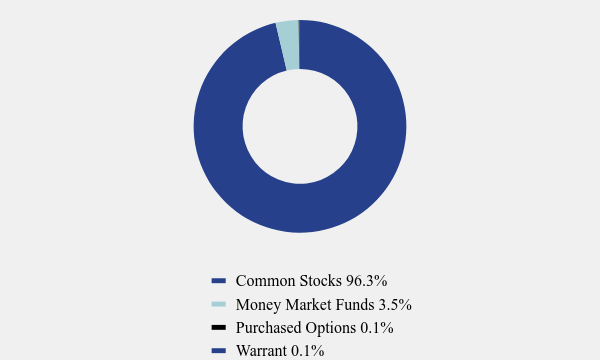

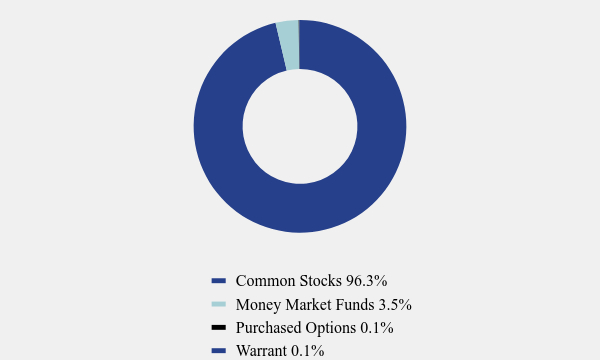

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 96.3% |

| Money Market Funds | 3.5% |

| Purchased Options | 0.1% |

| Warrant | 0.1% |

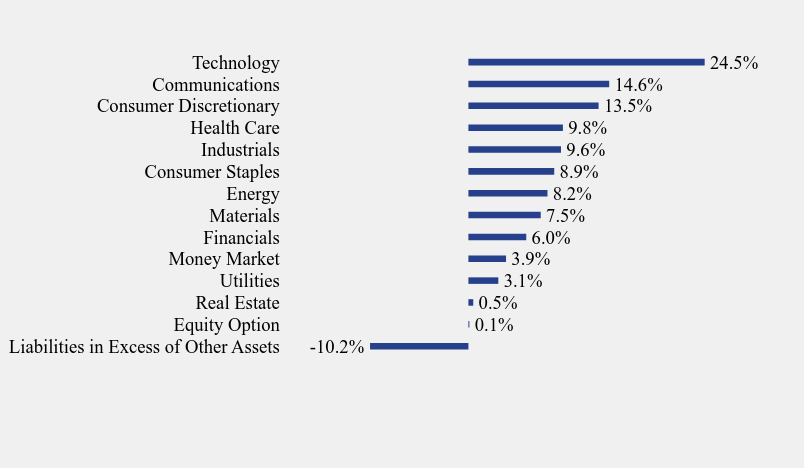

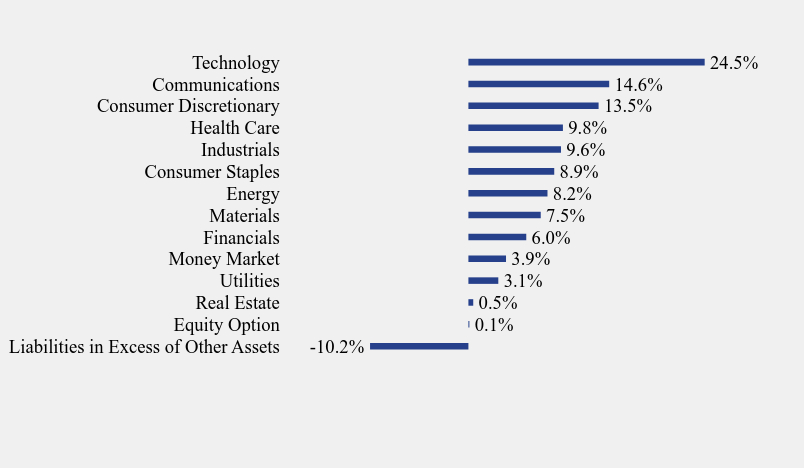

What did the Fund invest in?

Long Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.2% |

| Equity Option | 0.1% |

| Real Estate | 0.5% |

| Utilities | 3.1% |

| Money Market | 3.9% |

| Financials | 6.0% |

| Materials | 7.5% |

| Energy | 8.2% |

| Consumer Staples | 8.9% |

| Industrials | 9.6% |

| Health Care | 9.8% |

| Consumer Discretionary | 13.5% |

| Communications | 14.6% |

| Technology | 24.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Government Obligations Fund | 3.9% |

| Zoom Video Communications, Inc., Class A | 3.1% |

| Global Payments, Inc. | 3.0% |

| Lyft, Inc. | 3.0% |

| M&T Bank Corporation | 2.4% |

| AT&T, Inc. | 2.3% |

| Upwork, Inc. | 2.2% |

| Viatris, Inc. | 1.9% |

| Solventum Corporation | 1.8% |

| Eversource Energy | 1.8% |

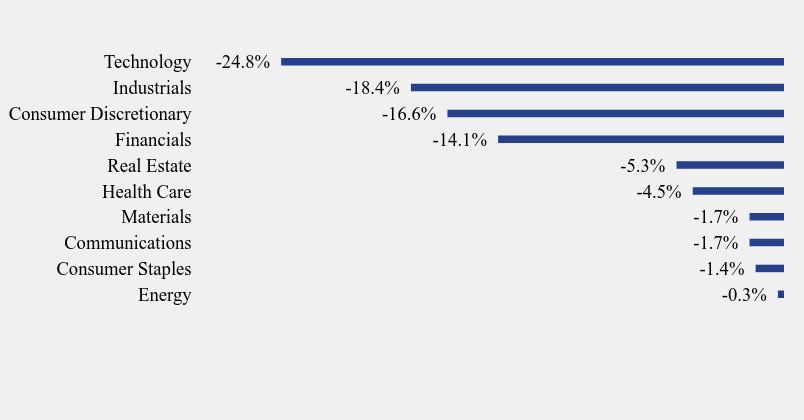

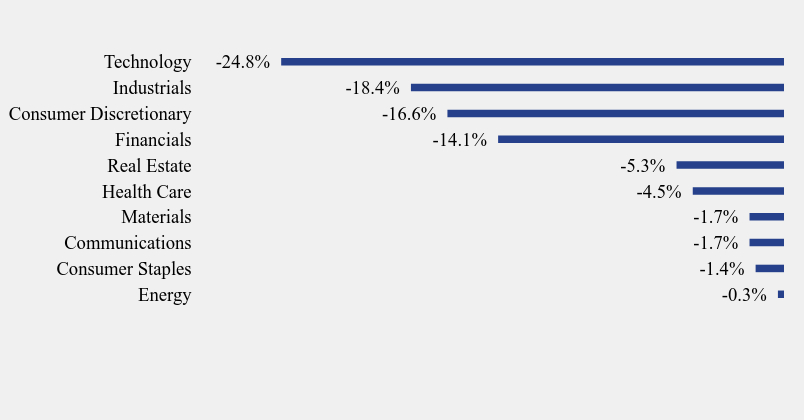

Short Sector Weighting (% of net assets)

| Value | Value |

|---|

| Energy | -0.3% |

| Consumer Staples | -1.4% |

| Communications | -1.7% |

| Materials | -1.7% |

| Health Care | -4.5% |

| Real Estate | -5.3% |

| Financials | -14.1% |

| Consumer Discretionary | -16.6% |

| Industrials | -18.4% |

| Technology | -24.8% |

No material changes occurred during the year ended October 31, 2024.

Invenomic Fund - Institutional Class (BIVIX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.invenomic.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Super Institutional Class (BIVSX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Invenomic Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.invenomic.com. You can also request this information by contacting us at 1-855-466-3406.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Super Institutional Class | $276 | 2.91% |

How did the Fund perform during the reporting period?

The long portfolio contributed 28.77% while the short portfolio detracted approximately -40.54%, both on a gross basis. During this period, we averaged 109.93% long and -92.39% short resulting in average net exposure of 17.54% and average gross exposure 202.32%.

From a sector perspective, our biggest contributors on the long side were Information Industrials (+6.30%), Financials (+6.17%) and Consumer Discretionary (+5.10%). On the short side, the sectors that detracted the most were Information Technology (-13.22%), Consumer Discretionary (-8.20%) and Financials (-8.09%). From a total portfolio perspective, the top ten contributed 9.79% and the top ten detractors cost -10.62%, both on a gross basis.

Our strategy faced two substantial market headwinds during the year which negatively impacted performance. The first is underperformance of value relative to growth. The Russell 1000 Value/Growth Index was down -10.57% during the period, which is the fifth worst year in the last 25 years. The second and most substantial headwind was the momentum factor which as of October 31, 2024, had its second strongest year in the last 25 years as measured by the Bloomberg US Pure Momentum Factor Index. Considering the strength of the headwinds we faced, we believe we managed risk as well as can be expected. We feel like our portfolio is well positioned for what is likely to be a volatile period going forward.

We expect the market environment to remain volatile for the foreseeable future. The outcome of the U.S. election will create opportunities on the long and the short side regardless of who is elected. Equity valuations remain at extremely elevated levels, and as a result, we will continue to proceed cautiously relying on our investment process, which has served us well over time.

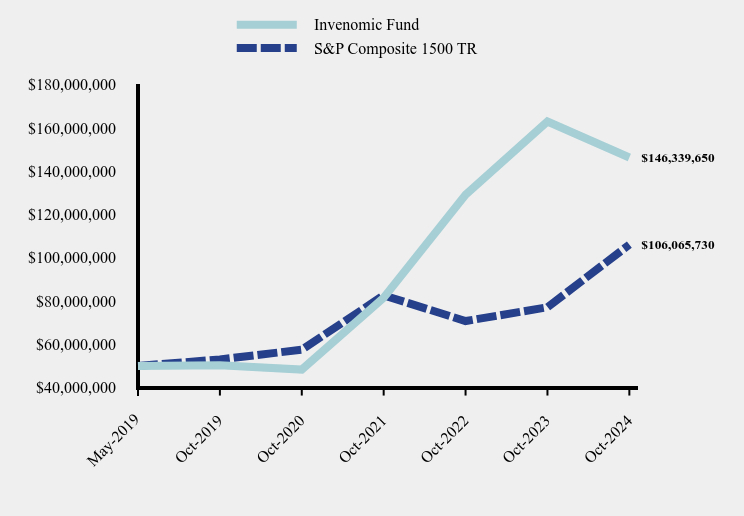

How has the Fund performed since inception?

Total Return Based on a $50,000,000 Investment

| Invenomic Fund | S&P Composite 1500 TR |

|---|

| May-2019 | $50,000,000 | $50,000,000 |

| Oct-2019 | $50,262,467 | $52,971,862 |

| Oct-2020 | $48,313,675 | $57,507,229 |

| Oct-2021 | $81,496,033 | $82,610,742 |

| Oct-2022 | $129,141,535 | $70,739,147 |

| Oct-2023 | $162,954,258 | $77,114,215 |

| Oct-2024 | $146,339,650 | $106,065,730 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (May 10, 2019) |

|---|

| Invenomic Fund | -10.20% | 23.83% | 21.66% |

S&P Composite 1500® Index | 37.54% | 14.90% | 14.72% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$984,405,991

- Number of Portfolio Holdings324

- Advisory Fee $22,612,478

- Portfolio Turnover170%

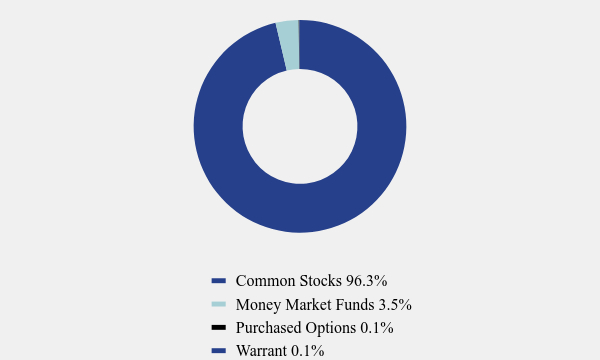

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 96.3% |

| Money Market Funds | 3.5% |

| Purchased Options | 0.1% |

| Warrant | 0.1% |

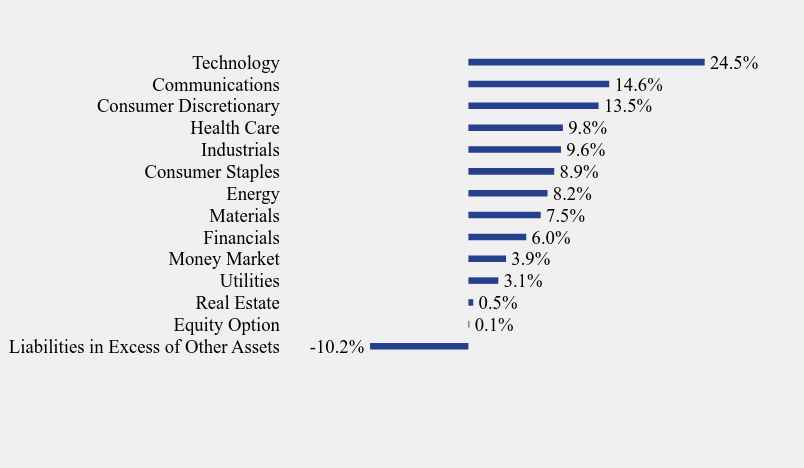

What did the Fund invest in?

Long Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.2% |

| Equity Option | 0.1% |

| Real Estate | 0.5% |

| Utilities | 3.1% |

| Money Market | 3.9% |

| Financials | 6.0% |

| Materials | 7.5% |

| Energy | 8.2% |

| Consumer Staples | 8.9% |

| Industrials | 9.6% |

| Health Care | 9.8% |

| Consumer Discretionary | 13.5% |

| Communications | 14.6% |

| Technology | 24.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Government Obligations Fund | 3.9% |

| Zoom Video Communications, Inc., Class A | 3.1% |

| Global Payments, Inc. | 3.0% |

| Lyft, Inc. | 3.0% |

| M&T Bank Corporation | 2.4% |

| AT&T, Inc. | 2.3% |

| Upwork, Inc. | 2.2% |

| Viatris, Inc. | 1.9% |

| Solventum Corporation | 1.8% |

| Eversource Energy | 1.8% |

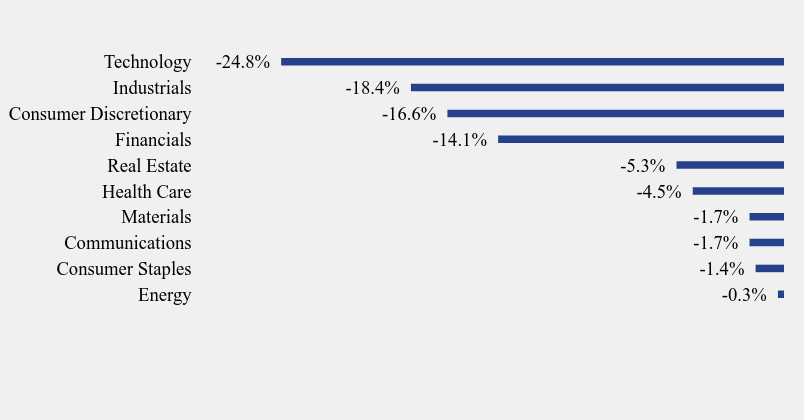

Short Sector Weighting (% of net assets)

| Value | Value |

|---|

| Energy | -0.3% |

| Consumer Staples | -1.4% |

| Communications | -1.7% |

| Materials | -1.7% |

| Health Care | -4.5% |

| Real Estate | -5.3% |

| Financials | -14.1% |

| Consumer Discretionary | -16.6% |

| Industrials | -18.4% |

| Technology | -24.8% |

No material changes occurred during the year ended October 31, 2024.

Invenomic Fund - Super Institutional Class (BIVSX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.invenomic.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Invenomic Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.invenomic.com. You can also request this information by contacting us at 1-855-466-3406.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $323 | 3.41% |

How did the Fund perform during the reporting period?

The long portfolio contributed 28.77% while the short portfolio detracted approximately -40.54%, both on a gross basis. During this period, we averaged 109.93% long and -92.39% short resulting in average net exposure of 17.54% and average gross exposure 202.32%.

From a sector perspective, our biggest contributors on the long side were Information Industrials (+6.30%), Financials (+6.17%) and Consumer Discretionary (+5.10%). On the short side, the sectors that detracted the most were Information Technology (-13.22%), Consumer Discretionary (-8.20%) and Financials (-8.09%). From a total portfolio perspective, the top ten contributed 9.79% and the top ten detractors cost -10.62%, both on a gross basis.

Our strategy faced two substantial market headwinds during the year which negatively impacted performance. The first is underperformance of value relative to growth. The Russell 1000 Value/Growth Index was down -10.57% during the period, which is the fifth worst year in the last 25 years. The second and most substantial headwind was the momentum factor which as of October 31, 2024, had its second strongest year in the last 25 years as measured by the Bloomberg US Pure Momentum Factor Index. Considering the strength of the headwinds we faced, we believe we managed risk as well as can be expected. We feel like our portfolio is well positioned for what is likely to be a volatile period going forward.

We expect the market environment to remain volatile for the foreseeable future. The outcome of the U.S. election will create opportunities on the long and the short side regardless of who is elected. Equity valuations remain at extremely elevated levels, and as a result, we will continue to proceed cautiously relying on our investment process, which has served us well over time.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Invenomic Fund | S&P Composite 1500® Index |

|---|

| Jun-2017 | $10,000 | $10,000 |

| Oct-2017 | $10,210 | $10,561 |

| Oct-2018 | $11,154 | $11,286 |

| Oct-2019 | $12,095 | $12,827 |

| Oct-2020 | $11,578 | $13,926 |

| Oct-2021 | $19,473 | $20,004 |

| Oct-2022 | $30,693 | $17,130 |

| Oct-2023 | $38,552 | $18,673 |

| Oct-2024 | $34,422 | $25,684 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (June 19, 2017) |

|---|

| Invenomic Fund | -10.71% | 23.27% | 18.27% |

S&P Composite 1500® Index | 37.54% | 14.90% | 13.66% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$984,405,991

- Number of Portfolio Holdings324

- Advisory Fee $22,612,478

- Portfolio Turnover170%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 96.3% |

| Money Market Funds | 3.5% |

| Purchased Options | 0.1% |

| Warrant | 0.1% |

What did the Fund invest in?

Long Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.2% |

| Equity Option | 0.1% |

| Real Estate | 0.5% |

| Utilities | 3.1% |

| Money Market | 3.9% |

| Financials | 6.0% |

| Materials | 7.5% |

| Energy | 8.2% |

| Consumer Staples | 8.9% |

| Industrials | 9.6% |

| Health Care | 9.8% |

| Consumer Discretionary | 13.5% |

| Communications | 14.6% |

| Technology | 24.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Government Obligations Fund | 3.9% |

| Zoom Video Communications, Inc., Class A | 3.1% |

| Global Payments, Inc. | 3.0% |

| Lyft, Inc. | 3.0% |

| M&T Bank Corporation | 2.4% |

| AT&T, Inc. | 2.3% |

| Upwork, Inc. | 2.2% |

| Viatris, Inc. | 1.9% |

| Solventum Corporation | 1.8% |

| Eversource Energy | 1.8% |

Short Sector Weighting (% of net assets)

| Value | Value |

|---|

| Energy | -0.3% |

| Consumer Staples | -1.4% |

| Communications | -1.7% |

| Materials | -1.7% |

| Health Care | -4.5% |

| Real Estate | -5.3% |

| Financials | -14.1% |

| Consumer Discretionary | -16.6% |

| Industrials | -18.4% |

| Technology | -24.8% |

No material changes occurred during the year ended October 31, 2024.

Invenomic Fund - Investor Class (BIVRX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.invenomic.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | N/A |

| | |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | N/A |

| | |

| (f) | See Item 19(a)(1) |

Item 3. Audit Committee Financial Expert.

| | (a)(1) The Registrant’s board of trustees has determined that Keith Rhoades is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Rhoades is independent for purposes of this Item. (a)(2) Not applicable. (a)(3) Not applicable. |

| | |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

| | |

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| | |

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

| | |

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended October 31, 2024 and 2023 respectively. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended October 31, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

| | |

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Invenomic Fund |

| Institutional Class |

| BIVIX |

| Investor Class |

| BIVRX |

| Super Institutional Class |

| BIVSX |

| |

| |

| |

| |

| |

| Annual Financial Statements |

| October 31, 2024 |

| |

| |

| |

| |

| |

| 1-855-466-3406 |

| www.Invenomic.com |

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% | | | | |

| | | | | AEROSPACE & DEFENSE - 0.9% | | | | |

| | 15,184 | | | Airbus S.E. | | $ | 2,314,759 | |

| | 155,375 | | | CAE, Inc.(a) | | | 2,734,002 | |

| | 30,507 | | | Hexcel Corporation | | | 1,790,456 | |

| | 10,104 | | | Huntington Ingalls Industries, Inc. | | | 1,868,836 | |

| | | | | | | | 8,708,053 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 1.4% | | | | |

| | 198,265 | | | Burberry Group PLC | | | 2,002,434 | |

| | 10,455 | | | Oxford Industries, Inc. | | | 759,242 | |

| | 106,718 | | | Puma S.E. | | | 4,849,552 | |

| | 201,346 | | | Salvatore Ferragamo SpA | | | 1,345,738 | |

| | 1,282,311 | | | Samsonite International S.A. | | | 3,011,994 | |

| | 250,551 | | | Unifi, Inc.(a) | | | 1,533,372 | |

| | | | | | | | 13,502,332 | |

| | | | | ASSET MANAGEMENT - 0.2% | | | | |

| | 129,020 | | | Cannae Holdings, Inc. | | | 2,561,047 | |

| | | | | | | | | |

| | | | | AUTOMOTIVE - 1.8% | | | | |

| | 89,607 | | | Continental A.G. | | | 5,580,701 | |

| | 1,373,106 | | | Dowlais Group plc | | | 867,065 | |

| | 120,664 | | | Garrett Motion, Inc.(a) | | | 896,534 | |

| | 62,064 | | | Gentex Corporation | | | 1,881,160 | |

| | 55,035 | | | Rivian Automotive, Inc.(a) | | | 555,854 | |

| | 70,714 | | | Standard Motor Products, Inc. | | | 2,276,284 | |

| | 396,115 | | | Toyo Tire Corporation | | | 5,706,811 | |

| | | | | | | | 17,764,409 | |

| | | | | BANKING - 2.7% | | | | |

| | 547,810 | | | First Foundation, Inc.(b) | | | 3,686,761 | |

| | 119,196 | | | M&T Bank Corporation(b) | | | 23,205,078 | |

| | | | | | | | 26,891,839 | |

| | | | | BEVERAGES - 1.6% | | | | |

| | 85,568 | | | Fevertree Drinks PLC | | | 819,651 | |

| | 274,052 | | | Molson Coors Beverage Company, Class B(b) | | | 14,927,612 | |

| | | | | | | | 15,747,263 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | BIOTECH & PHARMA - 2.7% | | | | |

| | 37,567 | | | Incyte Corporation(a) | | $ | 2,784,466 | |

| | 200,648 | | | Lexaria Bioscience Corporation(a)(b) | | | 431,393 | |

| | 185,306 | | | Perrigo Company PLC(b) | | | 4,749,393 | |

| | 1,594,488 | | | Viatris, Inc.(b) | | | 18,496,060 | |

| | | | | | | | 26,461,312 | |

| | | | | CHEMICALS - 1.2% | | | | |

| | 494,317 | | | American Vanguard Corporation(b) | | | 2,585,278 | |

| | 29,760 | | | Eastman Chemical Company(b) | | | 3,127,478 | |

| | 57,092 | | | Ingevity Corporation(a) | | | 2,385,875 | |

| | 46,734 | | | Nutrien Ltd.(b) | | | 2,228,277 | |

| | 18,134 | | | Rogers Corporation(a) | | | 1,818,478 | |

| | | | | | | | 12,145,386 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 4.3% | | | | |

| | 32,632 | | | AMN Healthcare Services, Inc.(a) | | | 1,238,058 | |

| | 667,729 | | | CoreCivic, Inc.(a)(b) | | | 9,221,337 | |

| | 125,784 | | | Forrester Research, Inc.(a) | | | 1,845,251 | |

| | 232,886 | | | Healthcare Services Group, Inc.(a) | | | 2,554,759 | |

| | 128,112 | | | Heidrick & Struggles International, Inc.(b) | | | 5,004,055 | |

| | 402,538 | | | ISS A/S | | | 7,730,550 | |

| | 459,792 | | | Resources Connection, Inc. | | | 3,701,326 | |

| | 809,177 | | | Securitas A.B., Class B | | | 9,493,728 | |

| | 265,605 | | | TrueBlue, Inc.(a) | | | 1,989,381 | |

| | | | | | | | 42,778,445 | |

| | | | | CONSUMER SERVICES - 2.1% | | | | |

| | 1,804,327 | | | Coursera, Inc.(a)(b) | | | 12,540,073 | |

| | 1,060,249 | | | Udemy, Inc.(a)(b) | | | 8,312,352 | |

| | | | | | | | 20,852,425 | |

| | | | | CONTAINERS & PACKAGING - 1.3% | | | | |

| | 79,570 | | | Myers Industries, Inc. | | | 937,335 | |

| | 46,582 | | | Sealed Air Corporation(b) | | | 1,685,337 | |

| | 184,950 | | | Sonoco Products Company(b) | | | 9,713,573 | |

| | | | | | | | 12,336,245 | |

| | | | | E-COMMERCE DISCRETIONARY - 0.7% | | | | |

| | 26,945 | | | Alibaba Group Holding Ltd. - ADR(b) | | | 2,640,071 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.7% (Continued) | | | | |

| | 65,732 | | | Etsy, Inc.(a)(b) | | $ | 3,381,254 | |

| | 115,853 | | | PetMed Express, Inc.(a) | | | 474,997 | |

| | | | | | | | 6,496,322 | |

| | | | | ELECTRIC UTILITIES - 2.8% | | | | |

| | 116,717 | | | Avista Corporation(b) | | | 4,374,553 | |

| | 90,689 | | | Black Hills Corporation(b) | | | 5,367,882 | |

| | 264,140 | | | Eversource Energy(b) | | | 17,393,619 | |

| | | | | | | | 27,136,054 | |

| | | | | ELECTRICAL EQUIPMENT - 1.6% | | | | |

| | 167,329 | | | FARO Technologies, Inc.(a) | | | 2,934,951 | |

| | 363,382 | | | Sensata Technologies Holding PLC(b) | | | 12,478,538 | |

| | | | | | | | 15,413,489 | |

| | | | | ENGINEERING & CONSTRUCTION - 0.1% | | | | |

| | 138,322 | | | Mistras Group, Inc.(a)(b) | | | 1,168,821 | |

| | | | | | | | | |

| | | | | FOOD - 4.5% | | | | |

| | 110,451 | | | Conagra Brands, Inc.(b) | | | 3,196,452 | |

| | 133,015 | | | Fresh Del Monte Produce, Inc. | | | 4,271,112 | |

| | 987,502 | | | Hain Celestial Group, Inc. (The)(a)(b) | | | 8,620,892 | |

| | 439,807 | | | Kraft Heinz Company (The)(b) | | | 14,715,942 | |

| | 19,570 | | | Nestle S.A. | | | 1,848,959 | |

| | 668,137 | | | Nomad Foods Ltd.(b) | | | 11,725,804 | |

| | | | | | | | 44,379,161 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.1% | | | | |

| | 87,373 | | | Canfor Corporation(a) | | | 1,042,314 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 0.3% | | | | |

| | 118,974 | | | UGI Corporation | | | 2,844,668 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 3.0% | | | | |

| | 99,830 | | | Concentra Group Holdings Parent, Inc.(a) | | | 2,023,554 | |

| | 449,922 | | | Evotec S.E.(a) | | | 3,469,596 | |

| | 194,590 | | | Fulgent Genetics, Inc.(a) | | | 4,173,956 | |

| | 159,147 | | | Pediatrix Medical Group, Inc.(a)(b) | | | 1,960,691 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 3.0% (Continued) | | | | |

| | 746,848 | | | Progyny, Inc.(a)(b) | | $ | 11,240,062 | |

| | 756,187 | | | Teladoc Health, Inc.(a)(b) | | | 6,805,683 | |

| | | | | | | | 29,673,542 | |

| | | | | HOME & OFFICE PRODUCTS - 0.7% | | | | |

| | 558,537 | | | Leggett & Platt, Inc.(b) | | | 6,702,444 | |

| | | | | | | | | |

| | | | | HOUSEHOLD PRODUCTS - 1.2% | | | | |

| | 259,351 | | | Coty, Inc., Class A(a) | | | 1,929,571 | |

| | 155,291 | | | Helen of Troy Ltd.(a) | | | 9,884,273 | |

| | | | | | | | 11,813,844 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 0.4% | | | | |

| | 182,454 | | | Resideo Technologies, Inc.(a)(b) | | | 3,588,870 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 2.3% | | | | |

| | 50,101 | | | Euronext N.V. | | | 5,525,605 | |

| | 185,599 | | | State Street Corporation(b) | | | 17,223,587 | |

| | | | | | | | 22,749,192 | |

| | | | | INTERNET MEDIA & SERVICES – 10.9% | | | | |

| | 35,411 | | | Airbnb, Inc., Class A(a)(b) | | | 4,773,049 | |

| | 92,169 | | | Expedia Group, Inc.(a)(b) | | | 14,406,936 | |

| | 94,618 | | | Fiverr International Ltd.(a) | | | 2,768,523 | |

| | 2,299,350 | | | Lyft, Inc.(a)(b) | | | 29,822,570 | |

| | 128,284 | | | Maplebear, Inc.(a)(b) | | | 5,657,324 | |

| | 373,896 | | | Match Group, Inc.(a)(b) | | | 13,471,473 | |

| | 287,086 | | | Shutterstock, Inc.(b) | | | 9,212,590 | |

| | 216,371 | | | Snap, Inc., Class A(a) | | | 2,631,071 | |

| | 1,567,054 | | | Upwork, Inc.(a)(b) | | | 21,249,252 | |

| | 780,408 | | | Vivid Seats, Inc.(a) | | | 3,176,261 | |

| | | | | | | | 107,169,049 | |

| | | | | LEISURE FACILITIES & SERVICES - 2.7% | | | | |

| | 144,434 | | | Jack in the Box, Inc.(b) | | | 7,113,375 | |

| | 585,150 | | | Melco Resorts & Entertainment Ltd. - ADR(a)(b) | | | 3,932,208 | |

| | 769,992 | | | Penn Entertainment, Inc.(a)(b) | | | 15,207,341 | |

| | | | | | | | 26,252,924 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | LEISURE PRODUCTS - 0.2% | | | | |

| | 33,592 | | | Johnson Outdoors, Inc., Class A | | $ | 1,062,179 | |

| | 39,102 | | | Spin Master Corporation 144A(c) | | | 827,619 | |

| | | | | | | | 1,889,798 | |

| | | | | MACHINERY - 1.1% | | | | |

| | 40,073 | | | Albany International Corporation | | | 2,721,758 | |

| | 90,412 | | | Douglas Dynamics, Inc. | | | 2,047,832 | |

| | 69,834 | | | Enovis Corporation(a) | | | 2,882,049 | |

| | 703,216 | | | GrafTech International Ltd.(a) | | | 1,195,467 | |

| | 73,150 | | | Hurco Companies, Inc. | | | 1,536,882 | |

| | | | | | | | 10,383,988 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 4.0% | | | | |

| | 79,841 | | | 10X Genomics, Inc., Class A(a) | | | 1,279,851 | |

| | 747,935 | | | DENTSPLY SIRONA, Inc.(b) | | | 17,329,654 | |

| | 165,396 | | | Inmode Ltd.(a) | | | 2,824,964 | |

| | 246,929 | | | Solventum Corporation(a)(b) | | | 17,922,106 | |

| | | | | | | | 39,356,575 | |

| | | | | METALS & MINING - 4.4% | | | | |

| | 866,790 | | | B2Gold Corporation | | | 2,877,743 | |

| | 410,264 | | | Compass Minerals International, Inc. | | | 5,050,350 | |

| | 487,475 | | | Eldorado Gold Corporation(a) | | | 8,467,441 | |

| | 597,275 | | | Equinox Gold Corporation(a) | | | 3,308,904 | |

| | 1,003,566 | | | Kinross Gold Corporation(b) | | | 10,115,944 | |

| | 1,645,405 | | | New Gold, Inc.(a) | | | 4,524,864 | |

| | 99,415 | | | Newmont Corporation | | | 4,517,418 | |

| | 2,812,193 | | | Northern Dynasty Minerals Ltd.(a) | | | 1,143,156 | |

| | 135,788 | | | Torex Gold Resources, Inc.(a) | | | 2,928,656 | |

| | | | | | | | 42,934,476 | |

| | | | | OIL & GAS PRODUCERS - 6.7% | | | | |

| | 120,330 | | | Chord Energy Corporation(b) | | | 15,053,283 | |

| | 167,075 | | | Civitas Resources, Inc.(b) | | | 8,151,589 | |

| | 48,313 | | | ConocoPhillips(b) | | | 5,292,206 | |

| | 115,951 | | | Enterprise Products Partners, L.P.(b) | | | 3,323,156 | |

| | 85,008 | | | Expand Energy Corporation(b) | | | 7,201,878 | |

| | 205,714 | | | Murphy Oil Corporation(b) | | | 6,475,877 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | OIL & GAS PRODUCERS - 6.7% (Continued) | | | | |

| | 325,310 | | | Ovintiv, Inc.(b) | | $ | 12,752,152 | |

| | 764,694 | | | Veren, Inc.(b) | | | 3,945,821 | |

| | 422,973 | | | Vermilion Energy, Inc. | | | 3,943,110 | |

| | | | | | | | 66,139,072 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.5% | | | | |

| | 95,903 | | | DMC Global, Inc.(a) | | | 967,661 | |

| | 104,679 | | | Schlumberger N.V. | | | 4,194,488 | |

| | | | | | | | 5,162,149 | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 0.5% | | | | |

| | 363,023 | | | Allied Properties Real Estate Investment Trust | | | 4,789,552 | |

| | | | | | | | | |

| | | | | RENEWABLE ENERGY - 1.0% | | | | |

| | 398,888 | | | Array Technologies, Inc.(a) | | | 2,604,739 | |

| | 832,980 | | | Shoals Technologies Group, Inc., Class A(a)(b) | | | 4,506,421 | |

| | 156,862 | | | SolarEdge Technologies, Inc.(a)(b) | | | 2,676,066 | |

| | | | | | | | 9,787,226 | |

| | | | | RETAIL - CONSUMER STAPLES - 1.6% | | | | |

| | 366,135 | | | Carrefour S.A. | | | 5,788,310 | |

| | 84,145 | | | Five Below, Inc.(a)(b) | | | 7,976,105 | |

| | 53,032 | | | Koninklijke Ahold Delhaize N.V. | | | 1,748,314 | |

| | | | | | | | 15,512,729 | |

| | | | | RETAIL - DISCRETIONARY - 3.8% | | | | |

| | 36,258 | | | Advance Auto Parts, Inc. | | | 1,294,048 | |

| | 40,682 | | | Foot Locker, Inc. | | | 943,416 | |

| | 106,333 | | | HUGO BOSS A.G. | | | 4,866,753 | |

| | 438,233 | | | Kohl’s Corporation(b) | | | 8,098,546 | |

| | 339,527 | | | Macy’s, Inc.(b) | | | 5,208,344 | |

| | 375,174 | | | Monro, Inc.(b) | | | 10,283,519 | |

| | 213,921 | | | Sally Beauty Holdings, Inc.(a)(b) | | | 2,780,973 | |

| | 256,663 | | | Warby Parker, Inc.(a)(b) | | | 4,345,305 | |

| | | | | | | | 37,820,904 | |

| | | | | SEMICONDUCTORS - 1.2% | | | | |

| | 34,219 | | | AIXTRON S.E. | | | 542,278 | |

| | 1,326,894 | | | Alphawave IP Group PLC(a) | | | 1,905,680 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 1.2% (Continued) | | | | |

| | 97,091 | | | Intel Corporation | | $ | 2,089,398 | |

| | 24,500 | | | IPG Photonics Corporation(a) | | | 1,983,520 | |

| | 215,335 | | | Rohm Company Ltd. | | | 2,432,679 | |

| | 164,332 | | | Vishay Intertechnology, Inc. | | | 2,787,071 | |

| | | | | | | | 11,740,626 | |

| | | | | SOFTWARE - 12.5% | | | | |

| | 3,467,113 | | | 8x8, Inc.(a)(b) | | | 7,731,662 | |

| | 74,408 | | | Akamai Technologies, Inc.(a)(b) | | | 7,521,161 | |

| | 121,727 | | | BILL Holdings, Inc.(a)(b) | | | 7,103,988 | |

| | 2,510,505 | | | Clarivate PLC(a)(b) | | | 16,569,333 | |

| | 241,809 | | | Concentrix Corporation(b) | | | 10,279,301 | |

| | 171,820 | | | Domo, Inc.(a) | | | 1,365,969 | |

| | 194,044 | | | Freshworks, Inc.(a) | | | 2,270,315 | |

| | 12,065 | | | Ingram Micro Holding Corporation(a) | | | 292,576 | |

| | 193,282 | | | Mitek Systems, Inc.(a) | | | 1,660,292 | |

| | 144,522 | | | Perion Network Ltd.(a) | | | 1,177,854 | |

| | 504,908 | | | Riskified Ltd.(a) | | | 2,256,939 | |

| | 26,297 | | | Salesforce, Inc.(b) | | | 7,662,157 | |

| | 180,950 | | | SS&C Technologies Holdings, Inc.(b) | | | 12,653,833 | |

| | 445,491 | | | TeamViewer A.G.(a) | | | 6,437,185 | |

| | 132,642 | | | TruBridge, Inc.(a) | | | 1,701,797 | |

| | 238,226 | | | UiPath, Inc., Class A(a) | | | 2,944,473 | |

| | 67,894 | | | Ziff Davis, Inc.(a) | | | 3,141,455 | |

| | 410,602 | | | Zoom Video Communications, Inc., Class A(a)(b) | | | 30,688,392 | |

| | | | | | | | 123,458,682 | |

| | | | | SPECIALTY FINANCE - 0.7% | | | | |

| | 207,053 | | | EZCORP, Inc., Class A(a) | | | 2,379,039 | |

| | 279,839 | | | Flywire Corporation(a)(b) | | | 4,874,795 | |

| | | | | | | | 7,253,834 | |

| | | | | STEEL - 0.5% | | | | |

| | 412,116 | | | Algoma Steel Group, Inc.(b) | | | 4,265,401 | |

| | 67,515 | | | Metallus, Inc.(a) | | | 951,286 | |

| | | | | | | | 5,216,687 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 106.1% (Continued) | | | | |

| | | | | TECHNOLOGY HARDWARE - 2.7% | | | | |

| | 309,511 | | | Comtech Telecommunications Corporation(a) | | $ | 1,151,381 | |

| | 67,404 | | | Crane NXT Company(b) | | | 3,658,015 | |

| | 7,112 | | | Samsung Electronics Company Ltd. | | | 7,531,608 | |

| | 567,677 | | | Stratasys Ltd.(a) | | | 4,058,891 | |

| | 79,537 | | | TD SYNNEX Corporation(b) | | | 9,174,593 | |

| | 37,390 | | | Vishay Precision Group, Inc.(a) | | | 867,822 | |

| | | | | | | | 26,442,310 | |

| | | | | TECHNOLOGY SERVICES - 8.0% | | | | |

| | 45,856 | | | Block, Inc., Class A(a)(b) | | | 3,316,306 | |

| | 1,203,429 | | | Converge Technology Solutions Corporation | | | 2,592,945 | |

| | 1,411,950 | | | Dun & Bradstreet Holdings, Inc.(b) | | | 16,788,085 | |

| | 78,695 | | | EVERTEC, Inc. | | | 2,578,048 | |

| | 288,803 | | | Global Payments, Inc.(b) | | | 29,951,760 | |

| | 392,875 | | | Integral Ad Science Holding Corporation(a)(b) | | | 4,651,640 | |

| | 138,239 | | | LiveRamp Holdings, Inc.(a)(b) | | | 3,460,122 | |

| | 113,951 | | | PayPal Holdings, Inc.(a)(b) | | | 9,036,314 | |

| | 39,803 | | | WEX, Inc.(a) | | | 6,869,998 | |

| | | | | | | | 79,245,218 | |

| | | | | TELECOMMUNICATIONS - 3.7% | | | | |

| | 3,065,785 | | | Airtel Africa PLC | | | 4,031,535 | |

| | 1,024,462 | | | AT&T, Inc.(b) | | | 23,091,374 | |

| | 222,209 | | | Verizon Communications, Inc.(b) | | | 9,361,666 | |

| | | | | | | | 36,484,575 | |

| | | | | TRANSPORTATION & LOGISTICS - 1.3% | | | | |

| | 25,460 | | | Copa Holdings S.A., Class A(b) | | | 2,477,258 | |

| | 1,222,956 | | | Deutsche Lufthansa A.G. | | | 8,462,526 | |

| | 181,429 | | | Mullen Group Ltd. | | | 1,962,381 | |

| | | | | | | | 12,902,165 | |

| | | | | WHOLESALE - DISCRETIONARY - 0.2% | | | | |

| | 50,297 | | | LKQ Corporation | | | 1,850,427 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $968,385,253) | | | 1,044,550,443 | |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Expiration Date | | Exercise Price | | | | | | | Fair Value | |

| | | | | WARRANT — 0.1% | | | | | | | | | | | | | | |

| | | | | BIOTECH & PHARMA - 0.1% | | | | | | | | | | | | | | |

| | 320,380 | | | Lexaria Bioscience Corporation Warrants | | 05/12/2028 | | $ | 0.95 | | | | | | | $ | 566,303 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL WARRANT (Cost $3,204) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 3.9% | | | | | | | | | | | | | | |

| | | | | MONEY MARKET FUNDS - 3.9% | | | | | | | | | | | | | | |

| | 38,474,636 | | | First American Government Obligations Fund, Class X, 4.78% (Cost $38,474,636)(d) | | | | | | | | | | | | | 38,474,636 | |

| | | | | | | | | | | | | | | | | | | |

| Contracts(e) | | | | | Expiration Date | | Exercise Price | | | Notional Value | | | | |

| | | | | EQUITY OPTIONS PURCHASED - 0.1% | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.1% | | | | | | | | | | | | | | |

| | 3,353 | | | Lyft, Inc. | | 01/17/2025 | | $ | 15 | | | $ | 4,348,841 | | | $ | 291,711 | |

| | 1,257 | | | Lyft, Inc. | | 05/16/2025 | | | 15 | | | | 1,630,329 | | | | 230,031 | |

| | 838 | | | Lyft, Inc. | | 06/20/2025 | | | 15 | | | | 1,086,886 | | | | 175,980 | |

| | | | | TOTAL EQUITY OPTIONS PURCHASED (Cost - $324,662) | | | | | | | | | | | | | 697,722 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 110.2% (Cost $1,007,187,755) | | | | | | | | | | | | $ | 1,084,289,104 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (10.2)% | | | | | | | | | | | | | (99,883,113 | ) |

| | | | | NET ASSETS - 100.0% | | | | | | | | | | | | $ | 984,405,991 | |

| | | | | | | | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% | | | | | |

| | | | | AEROSPACE & DEFENSE - (1.6)% | | | | | | | | | |

| | (36,496 | ) | | AeroVironment, Inc. | | | | | | | $ | (7,845,181 | ) |

| | (15,575 | ) | | HEICO Corporation | | | | | | | | (3,815,096 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% (Continued) | | | | |

| | | | | AEROSPACE & DEFENSE - (1.6)% (Continued) | | | | |

| | (241,170 | ) | | Joby Aviation, Inc. | | $ | (1,157,616 | ) |

| | (32,241 | ) | | Loar Holdings, Inc. | | | (2,778,529 | ) |

| | | | | | | | (15,596,422 | ) |

| | | | | | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - (1.2)% | | | | |

| | (155,484 | ) | | Birkenstock Holding PLC | | | (7,152,265 | ) |

| | (11,188 | ) | | Kontoor Brands, Inc. | | | (958,028 | ) |

| | (80,714 | ) | | On Holding A.G. | | | (3,827,458 | ) |

| | | | | | | | (11,937,751 | ) |

| | | | | ASSET MANAGEMENT - (6.8)% | | | | |

| | (92,952 | ) | | Ares Management Corporation, CLASS A | | | (15,586,191 | ) |

| | (114,850 | ) | | Blackstone, Inc. | | | (19,266,087 | ) |

| | (507,487 | ) | | Blue Owl Capital, Inc. | | | (11,347,409 | ) |

| | (36,905 | ) | | Cohen & Steers, Inc. | | | (3,645,107 | ) |

| | (67,465 | ) | | StepStone Group, Inc., Class A | | | (4,056,670 | ) |

| | (188,245 | ) | | TPG, Inc. | | | (12,740,422 | ) |

| | | | | | | | (66,641,886 | ) |

| | | | | AUTOMOTIVE - (0.9)% | | | | |

| | (138,793 | ) | | Aurora Innovation, Inc. | | | (721,030 | ) |

| | (7,412 | ) | | Modine Manufacturing Company | | | (872,911 | ) |

| | (30,681 | ) | | Tesla, Inc. | | | (7,665,649 | ) |

| | | | | | | | (9,259,590 | ) |

| | | | | BANKING - (1.4)% | | | | |

| | (168,589 | ) | | Fulton Financial Corporation | | | (3,053,147 | ) |

| | (94,396 | ) | | Triumph Financial, Inc. | | | (8,341,775 | ) |

| | (71,800 | ) | | United Bankshares, Inc. | | | (2,705,424 | ) |

| | | | | | | | (14,100,346 | ) |

| | | | | BIOTECH & PHARMA - (0.1)% | | | | |

| | (15,384 | ) | | TransMedics Group, Inc. | | | (1,261,026 | ) |

| | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - (2.8)% | | | | |

| | (109,075 | ) | | Casella Waste Systems, Inc. | | | (10,676,261 | ) |

| | (3,946 | ) | | Cintas Corporation | | | (812,126 | ) |

| | (18,700 | ) | | CorVel Corporation | | | (5,569,234 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% (Continued) | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - (2.8)% (Continued) | | | | |

| | (212,556 | ) | | Rollins, Inc. | | $ | (10,019,890 | ) |

| | | | | | | | (27,077,511 | ) |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - (0.4)% | | | | |

| | (23,027 | ) | | Simpson Manufacturing Company, Inc. | | | (4,140,024 | ) |

| | | | | | | | | |

| | | | | CONSUMER SERVICES - (0.3)% | | | | |

| | (7,435 | ) | | Bright Horizons Family Solutions, Inc. | | | (992,349 | ) |

| | (68,591 | ) | | KinderCare Learning Companies, Inc. | | | (2,000,114 | ) |

| | | | | | | | (2,992,463 | ) |

| | | | | CONTAINERS & PACKAGING - (0.3)% | | | | |

| | (10,517 | ) | | UFP Technologies, Inc. | | | (2,808,039 | ) |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - (2.7)% | | | | |

| | (49,775 | ) | | AAON, Inc. | | | (5,685,300 | ) |

| | (34,839 | ) | | Badger Meter, Inc. | | | (6,969,542 | ) |

| | (148,601 | ) | | Bloom Energy Corporation, Class A | | | (1,426,570 | ) |

| | (52,925 | ) | | Napco Security Technologies, Inc. | | | (2,036,554 | ) |

| | (44,595 | ) | | Novanta, Inc. | | | (7,591,853 | ) |

| | (10,683 | ) | | Powell Industries, Inc. | | | (2,723,951 | ) |

| | | | | | | | (26,433,770 | ) |

| | | | | ENGINEERING & CONSTRUCTION - (8.1)% | | | | |

| | | | | | | | | |

| | (39,562 | ) | | Comfort Systems USA, Inc. | | | (15,470,324 | ) |

| | (157,226 | ) | | Construction Partners, Inc., Class A | | | (12,378,403 | ) |

| | (28,707 | ) | | Dycom Industries, Inc. | | | (5,004,491 | ) |

| | (97,429 | ) | | Exponent, Inc. | | | (9,195,349 | ) |

| | (13,119 | ) | | IES Holdings, Inc. | | | (2,868,666 | ) |

| | (80,064 | ) | | Installed Building Products, Inc. | | | (17,365,882 | ) |

| | (49,989 | ) | | TopBuild Corporation | | | (17,665,113 | ) |

| | | | | | | | (79,948,228 | ) |

| | | | | FOOD - (1.4)% | | | | |

| | (122,862 | ) | | BellRing Brands, Inc. | | | (8,088,005 | ) |

| | (42,525 | ) | | Cal-Maine Foods, Inc. | | | (3,732,844 | ) |

| | (134 | ) | | Lotus Bakeries N.V. | | | (1,751,882 | ) |

| | | | | | | | (13,572,731 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% (Continued) | | | | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - (0.7)% | | | | |

| | (97,985 | ) | | Trex Company, Inc. | | $ | (6,942,238 | ) |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - (1.0)% | | | | |

| | (7,478 | ) | | Lonza Group A.G. | | | (4,612,532 | ) |

| | (1,779 | ) | | Medpace Holdings, Inc. | | | (558,997 | ) |

| | (71,308 | ) | | RadNet, Inc. | | | (4,637,872 | ) |

| | | | | | | | (9,809,401 | ) |

| | | | | HOME & OFFICE PRODUCTS - (0.5)% | | | | |

| | (101,763 | ) | | Tempur Sealy International, Inc. | | | (4,875,465 | ) |

| | | | | | | | | |

| | | | | HOME CONSTRUCTION - (1.2)% | | | | |

| | (84,291 | ) | | Dream Finders Homes, Inc. | | | (2,516,086 | ) |

| | (47,104 | ) | | Green Brick Partners, Inc. | | | (3,250,647 | ) |

| | (19,758 | ) | | LGI Homes, Inc. | | | (2,006,622 | ) |

| | (28,430 | ) | | Patrick Industries, Inc. | | | (3,581,612 | ) |

| | | | | | | | (11,354,967 | ) |

| | | | | INSURANCE - (2.8)% | | | | |

| | (72,487 | ) | | Baldwin Insurance Group, Inc. (The) | | | (3,353,249 | ) |

| | (23,869 | ) | | Erie Indemnity Company, Class A | | | (10,713,362 | ) |

| | (126,176 | ) | | Goosehead Insurance, Inc., Class A | | | (13,740,566 | ) |

| | | | | | | | (27,807,177 | ) |

| | | | | INTERNET MEDIA & SERVICES - (0.8)% | | | | |

| | (7,873 | ) | | Spotify Technology S.A. | | | (3,031,892 | ) |

| | (62,312 | ) | | Uber Technologies, Inc. | | | (4,489,580 | ) |

| | | | | | | | (7,521,472 | ) |

| | | | | LEISURE FACILITIES & SERVICES - (4.5)% | | | | |

| | (73,134 | ) | | Cava Group, Inc. | | | (9,767,777 | ) |

| | (5,474 | ) | | Churchill Downs, Inc. | | | (766,907 | ) |

| | (9,104 | ) | | Evolution A.B. | | | (858,779 | ) |

| | (84,422 | ) | | Planet Fitness, Inc., Class A | | | (6,628,815 | ) |

| | (13,799 | ) | | Red Rock Resorts, Inc., Class A | | | (710,097 | ) |

| | (97,658 | ) | | Shake Shack, Inc., Class A | | | (11,882,049 | ) |

| | (76,467 | ) | | Sweetgreen, Inc., Class A | | | (2,760,459 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - (4.5)% (Continued) | | | | |

| | (39,240 | ) | | Wingstop, Inc. | | $ | (11,288,956 | ) |

| | | | | | | | (44,663,839 | ) |

| | | | | LEISURE PRODUCTS - (0.5)% | | | | |

| | (29,301 | ) | | Brunswick Corporation | | | (2,336,462 | ) |

| | (24,247 | ) | | LCI Industries | | | (2,698,205 | ) |

| | | | | | | | (5,034,667 | ) |

| | | | | MACHINERY - (2.3)% | | | | |

| | (96,637 | ) | | Ingersoll Rand, Inc. | | | (9,277,152 | ) |

| | (36,460 | ) | | Kadant, Inc. | | | (12,143,368 | ) |

| | (42,197 | ) | | Mueller Water Products, Inc. | | | (911,033 | ) |

| | | | | | | | (22,331,553 | ) |

| | | | | MEDICAL EQUIPMENT & DEVICES - (3.4)% | | | | |

| | (53,383 | ) | | Establishment Labs Holdings, Inc. | | | (2,300,273 | ) |

| | (19,385 | ) | | Glaukos Corporation | | | (2,563,666 | ) |

| | (5,325 | ) | | Intuitive Surgical, Inc. | | | (2,682,948 | ) |

| | (60,557 | ) | | LeMaitre Vascular, Inc. | | | (5,352,633 | ) |

| | (65,248 | ) | | Repligen Corporation | | | (8,760,849 | ) |

| | (3,768 | ) | | ResMed, Inc. | | | (913,627 | ) |

| | (162,338 | ) | | RxSight, Inc. | | | (8,224,043 | ) |

| | (57,128 | ) | | Vericel Corporation | | | (2,515,917 | ) |

| | | | | | | | (33,313,956 | ) |

| | | | | METALS & MINING - (0.3)% | | | | |

| | (26,125 | ) | | Southern Copper Corporation | | | (2,861,994 | ) |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - (0.3)% | | | | |

| | (80,184 | ) | | CNX Resources Corporation | | | (2,728,662 | ) |

| | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - (4.6)% | | | | |

| | (65,072 | ) | | American Tower Corporation | | | (13,895,475 | ) |

| | (156,907 | ) | | Iron Mountain, Inc. | | | (19,414,103 | ) |

| | (19,987 | ) | | SBA Communications Corporation | | | (4,586,417 | ) |

| | (39,208 | ) | | Simon Property Group, Inc. | | | (6,630,857 | ) |

| | | | | | | | (44,526,852 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% (Continued) | | | | |

| | | | | REAL ESTATE SERVICES - (0.8)% | | | | |

| | (52,225 | ) | | Colliers International Group, Inc. | | $ | (7,971,624 | ) |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - (7.3)% | | | | |

| | (70,762 | ) | | Boot Barn Holdings, Inc. | | | (8,813,407 | ) |

| | (57,990 | ) | | Builders FirstSource, Inc. | | | (9,939,486 | ) |

| | (53,509 | ) | | Carvana Company | | | (13,233,311 | ) |

| | (11,025 | ) | | Fast Retailing Company Ltd. | | | (3,593,235 | ) |

| | (16,338 | ) | | Freshpet, Inc. | | | (2,165,439 | ) |

| | (63,572 | ) | | GameStop Corporation, Class A | | | (1,410,027 | ) |

| | (24,633 | ) | | Pandora A/S | | | (3,714,117 | ) |

| | (30,225 | ) | | RH | | | (9,613,061 | ) |

| | (53,563 | ) | | Tractor Supply Company | | | (14,221,512 | ) |

| | (47,320 | ) | | Williams-Sonoma, Inc. | | | (6,347,032 | ) |

| | | | | | | | (73,050,627 | ) |

| | | | | SEMICONDUCTORS - (9.2)% | | | | |

| | (41,648 | ) | | Ambarella, Inc. | | | (2,340,201 | ) |

| | (62,651 | ) | | Analog Devices, Inc. | | | (13,978,065 | ) |

| | (14,409 | ) | | ARM Holdings plc - ADR | | | (2,035,992 | ) |

| | (86,586 | ) | | Impinj, Inc. | | | (16,450,474 | ) |

| | (32,853 | ) | | MACOM Technology Solutions Holdings, Inc. | | | (3,692,677 | ) |

| | (11,139 | ) | | Microchip Technology, Inc. | | | (817,268 | ) |

| | (138,292 | ) | | NVIDIA Corporation | | | (18,359,646 | ) |

| | (19,439 | ) | | SiTime Corporation | | | (3,285,385 | ) |

| | (77,812 | ) | | Texas Instruments, Inc. | | | (15,808,286 | ) |

| | (76,495 | ) | | Universal Display Corporation | | | (13,793,578 | ) |

| | | | | | | | (90,561,572 | ) |

| | | | | SOFTWARE - (9.6)% | | | | |

| | (19,703 | ) | | Agilysys, Inc. | | | (1,971,088 | ) |

| | (47,838 | ) | | Altair Engineering, Inc., Class A | | | (4,974,674 | ) |

| | (144,417 | ) | | Bentley Systems, Inc., Class B | | | (6,969,564 | ) |

| | (108,844 | ) | | Cloudflare, Inc., Class A | | | (9,546,707 | ) |

| | (92,825 | ) | | Global-e Online Ltd. | | | (3,568,193 | ) |

| | (58,336 | ) | | Guidewire Software, Inc. | | | (10,865,663 | ) |

| | (9,648 | ) | | Manhattan Associates, Inc. | | | (2,540,897 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS SOLD SHORT — (88.8)% (Continued) | | | | |

| | | | | SOFTWARE - (9.6)% (Continued) | | | | |

| | (176,813 | ) | | Palantir Technologies, Inc., Class A | | $ | (7,348,348 | ) |

| | (39,838 | ) | | Palo Alto Networks, Inc. | | | (14,354,827 | ) |

| | (46,213 | ) | | Pro Medicus Ltd. | | | (5,924,642 | ) |

| | (23,769 | ) | | Q2 Holdings, Inc. | | | (2,012,284 | ) |

| | (271,494 | ) | | Samsara, Inc., Class A | | | (12,974,698 | ) |

| | (20,515 | ) | | Snowflake, Inc. | | | (2,355,532 | ) |

| | (10,085 | ) | | Tyler Technologies, Inc. | | | (6,107,375 | ) |

| | (67,407 | ) | | Varonis Systems, Inc. | | | (3,395,291 | ) |

| | | | | | | | (94,909,783 | ) |

| | | | | SPECIALTY FINANCE - (3.0)% | | | | |

| | (46,005 | ) | | American Express Company | | | (12,425,030 | ) |

| | (20,623 | ) | | Credit Acceptance Corporation | | | (8,764,775 | ) |

| | (234,057 | ) | | Rocket Companies, Inc. | | | (3,768,318 | ) |

| | (471,953 | ) | | UWM Holdings Corporation | | | (3,039,377 | ) |

| | (18,662 | ) | | Walker & Dunlop, Inc. | | | (2,041,063 | ) |

| | | | | | | | (30,038,563 | ) |

| | | | | TECHNOLOGY HARDWARE - (2.5)% | | | | |

| | (73,694 | ) | | Apple, Inc. | | | (16,648,212 | ) |

| | (20,422 | ) | | Arista Networks, Inc. | | | (7,891,878 | ) |

| | | | | | | | (24,540,090 | ) |

| | | | | TECHNOLOGY SERVICES - (3.4)% | | | | |

| | (9,064 | ) | | Fair Isaac Corporation | | | (18,065,549 | ) |

| | (24,902 | ) | | Insight Enterprises, Inc. | | | (4,355,858 | ) |

| | (24,989 | ) | | Jack Henry & Associates, Inc. | | | (4,546,249 | ) |

| | (598,580 | ) | | Payoneer Global, Inc. | | | (5,159,760 | ) |

| | (321,061 | ) | | Terawulf, Inc. | | | (2,093,318 | ) |

| | | | | | | | (34,220,734 | ) |

| | | | | TELECOMMUNICATIONS - (1.0)% | | | | |

| | (33,233 | ) | | AST SpaceMobile, Inc. | | | (791,278 | ) |

| | (111,495 | ) | | Cogent Communications Holdings, Inc. | | | (8,949,704 | ) |

| | | | | | | | (9,740,982 | ) |

| | | | | TRANSPORTATION & LOGISTICS - (1.1)% | | | | |

| | (48,608 | ) | | Old Dominion Freight Line, Inc. | | | (9,785,763 | ) |

See accompanying notes to financial statements.

| INVENOMIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | TOTAL SECURITIES SOLD SHORT - (Proceeds - $787,225,676) | | $ | (874,361,768 | ) |

| A.B. | - Aktiebolag |

| | |

| ADR | - American Depositary Receipt |

| | |

| A.G. | - Aktiengesellschaft |

| | |

| A/S | - Anonim Sirketi |

| | |

| L.P. | - Limited Partnership |

| | |

| Ltd. | - Limited Company |

| | |

| N.V. | - Naamioze Vennootschap |

| | |

| PLC | - Public Limited Company |

| | |

| S.A. | - Société Anonyme |

| | |

| S.E. | - Societas Europeae |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is segregated as collateral for short sales. |

| (c) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2024 the total market value of 144A securities is 827,619 or 0.1% of net assets. |

| (d) | Rate disclosed is the seven-day effective yield as of October 31, 2024. |

| (e) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

See accompanying notes to financial statements.

| Invenomic Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2024 |

| ASSETS | | | | |

| Investment securities: | | | | |

| At cost | | $ | 1,007,187,755 | |

| At value | | $ | 1,084,289,104 | |

| Cash collateral segregated for short sales | | | 758,449,685 | |

| Foreign Currency (Cost $22,766,366) | | | 22,632,696 | |

| Receivable for securities sold | | | 8,169,983 | |

| Receivable for Fund shares sold | | | 1,248,788 | |

| Dividends and interest receivable | | | 3,265,478 | |

| Prepaid expenses and other assets | | | 103,989 | |

| TOTAL ASSETS | | | 1,878,159,723 | |

| | | | | |

| LIABILITIES | | | | |

| Securities sold short (Proceeds - $787,225,676) | | | 874,361,768 | |

| Payable for investments purchased | | | 15,269,428 | |

| Payable for Fund shares redeemed | | | 1,655,623 | |

| Investment advisory fees payable | | | 1,487,614 | |

| Dividends payable on securities sold short | | | 366,242 | |

| Shareholder servicing fees payable | | | 158,430 | |

| Payable to related parties | | | 227,912 | |

| Distribution (12b-1) fees payable | | | 14,914 | |

| Accrued expenses and other liabilities | | | 211,801 | |

| TOTAL LIABILITIES | | | 893,753,732 | |

| NET ASSETS | | $ | 984,405,991 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid in capital | | $ | 1,138,502,511 | |

| Accumulated loss | | | (154,096,520 | ) |

| NET ASSETS | | $ | 984,405,991 | |

| | | | | |

| NET ASSET VALUE PER SHARE: | | | | |

| Institutional Class: | | | | |

| Net Assets | | $ | 674,365,275 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 38,515,933 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | | $ | 17.51 | |

| | | | | |

| Investor Class: | | | | |

| Net Assets | | $ | 71,061,898 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 4,156,728 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | | $ | 17.10 | |

| | | | | |

| Super Institutional Class: | | | | |

| Net Assets | | $ | 238,978,818 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 13,435,597 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | | $ | 17.79 | |

| (a) | Redemptions made within 60 days of purchases may be assessed a redemption fee of 1.00%. |

See accompanying notes to financial statements.

| Invenomic Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended October 31, 2024 |

| INVESTMENT INCOME | | | | |

| Dividends (net of foreign tax withheld of $551,676) | | $ | 30,421,772 | |

| Interest | | | 52,610,541 | |

| TOTAL INVESTMENT INCOME | | | 83,032,313 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 22,612,478 | |

| Distribution (12b-1) fees: | | | | |

| Investor Class | | | 233,187 | |

| Shareholder service fees - Institutional Class | | | 2,044,892 | |

| Shareholder service fees - Investor Class | | | 233,187 | |

| Dividends on securities sold short | | | 12,137,163 | |

| Third party administrative servicing fees | | | 1,224,676 | |

| Administration fees | | | 1,065,736 | |

| Registration fees | | | 122,493 | |

| Custodian fees | | | 188,899 | |

| Printing expense | | | 81,610 | |

| Compliance officer fees | | | 59,638 | |

| Insurance expense | | | 46,624 | |

| Legal fees | | | 33,581 | |

| Trustees fees and expenses | | | 26,565 | |

| Audit fees | | | 19,050 | |

| Other expenses | | | 73,467 | |

| TOTAL EXPENSES | | | 40,203,246 | |

| | | | | |

| NET INVESTMENT INCOME | | | 42,829,067 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 226,872,995 | |

| Foreign currency transactions | | | (1,367,358 | ) |

| Options purchased | | | (2,788,476 | ) |

| Securities sold short | | | (364,274,047 | ) |

| | | | (141,556,886 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 157,455,544 | |

| Foreign currency translations | | | 266,548 | |

| Options purchased | | | 2,535,869 | |

| Securities sold short | | | (215,551,772 | ) |

| | | | (55,293,811 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (196,850,697 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS | | $ | (154,021,630 | ) |

See accompanying notes to financial statements.

| Invenomic Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2024 | | | October 31, 2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 42,829,067 | | | $ | 29,792,801 | |

| Net realized gain(loss) from investments, foreign currency transactions, options purchased, and securities sold short | | | (141,556,886 | ) | | | 209,066,827 | |

| Net change in unrealized appreciation (depreciation) on investments, securities sold short, options purchased and foreign currency translations | | | (55,293,811 | ) | | | 36,351,364 | |

| Net increase(decrease) in net assets resulting from operations | | | (154,021,630 | ) | | | 275,210,992 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributions Paid: | | | | | | | | |

| Institutional Class | | | (158,947,676 | ) | | | (142,528,065 | ) |

| Investor Class | | | (19,856,687 | ) | | | (25,232,777 | ) |

| Super Institutional Class | | | (55,468,730 | ) | | | (55,976,146 | ) |

| Net decrease in net assets resulting from distributions to shareholders | | | (234,273,093 | ) | | | (223,736,988 | ) |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Institutional Class | | | 258,493,247 | | | | 576,337,066 | |

| Investor Class | | | 34,495,104 | | | | 57,066,337 | |

| Super Institutional Class | | | 279,860,491 | | | | 245,855,532 | |

| Net asset value of shares issued in reinvestment of distributions: | | | | | | | | |

| Institutional Class | | | 139,769,810 | | | | 124,676,221 | |

| Investor Class | | | 18,387,517 | | | | 23,529,179 | |

| Super Institutional Class | | | 54,990,787 | | | | 55,867,621 | |

| Redemption fee proceeds: | | | | | | | | |

| Institutional Class | | | 80,058 | | | | 46,627 | |

| Investor Class | | | 9,636 | | | | 7,099 | |

| Super Institutional Class | | | 32,736 | | | | 20,212 | |

| Payments for shares redeemed: | | | | | | | | |

| Institutional Class | | | (436,371,519 | ) | | | (387,560,879 | ) |

| Investor Class | | | (72,013,847 | ) | | | (72,163,731 | ) |

| Super Institutional Class | | | (444,984,082 | ) | | | (125,782,840 | ) |

| Net increase(decrease) in net assets from shares of beneficial interest | | | (167,250,062 | ) | | | 497,898,444 | |

| | | | | | | | | |

| TOTAL INCREASE(DECREASE) IN NET ASSETS | | | (555,544,785 | ) | | | 549,372,448 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Year | | | 1,539,950,776 | | | | 990,578,328 | |

| End of Year | | $ | 984,405,991 | | | $ | 1,539,950,776 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Shares Sold | | | 13,663,208 | | | | 26,228,196 | |

| Shares Reinvested | | | 7,120,214 | | | | 6,212,069 | |

| Shares Redeemed | | | (23,361,050 | ) | | | (17,231,356 | ) |

| Net increase(decrease) in shares of beneficial interest outstanding | | | (2,577,628 | ) | | | 15,208,909 | |

| | | | | | | | | |

| Investor Class: | | | | | | | | |

| Shares Sold | | | 1,821,274 | | | | 2,590,115 | |

| Shares Reinvested | | | 957,185 | | | | 1,194,375 | |

| Shares Redeemed | | | (3,905,989 | ) | | | (3,261,155 | ) |

| Net increase(decrease) in shares of beneficial interest outstanding | | | (1,127,530 | ) | | | 523,335 | |

| | | | | | | | | |

| Super Institutional Class: | | | | | | | | |

| Shares Sold | | | 14,486,460 | | | | 11,024,368 | |

| Shares Reinvested | | | 2,764,745 | | | | 2,753,456 | |

| Shares Redeemed | | | (22,765,877 | ) | | | (5,450,336 | ) |

| Net increase(decrease) in shares of beneficial interest outstanding | | | (5,514,672 | ) | | | 8,327,488 | |

See accompanying notes to financial statements.

| Invenomic Fund |

| FINANCIAL HIGHLIGHTS |

| |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year |

| | | Institutional Class | |

| | | | | | | | | | | | | | | | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, 2024 | | | October 31, 2023 | | | October 31, 2022 | | | October 31, 2021 | | | October 31, 2020 | |

| Net asset value, beginning of year | | $ | 23.52 | | | $ | 23.99 | | | $ | 17.40 | | | $ | 10.67 | | | $ | 11.48 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (1) | | | 0.61 | | | | 0.49 | | | | (0.27 | ) | | | (0.21 | ) | | | (0.08 | ) |

| Net realized and unrealized gain (loss) on investments | | | (2.64 | ) | | | 4.73 | | | | 9.35 | | | | 7.32 | | | | (0.36 | ) |

| Total from investment operations | | | (2.03 | ) | | | 5.22 | | | | 9.08 | | | | 7.11 | | | | (0.44 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.57 | ) | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Net realized gains | | | (3.41 | ) | | | (5.69 | ) | | | (2.50 | ) | | | (0.38 | ) | | | (0.37 | ) |

| Total distributions | | | (3.98 | ) | | | (5.69 | ) | | | (2.50 | ) | | | (0.39 | ) | | | (0.37 | ) |

| Paid-in-Capital From Redemption Fees | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.01 | | | | 0.00 | (2) |

| Net asset value, end of year | | $ | 17.51 | | | $ | 23.52 | | | $ | 23.99 | | | $ | 17.40 | | | $ | 10.67 | |

| Total return (3) | | | (10.46 | )% | | | 25.83 | % (6) | | | 58.24 | % | | | 68.21 | % | | | (4.06 | )% |

| Net assets, at end of year (000’s) | | $ | 674,365 | | | $ | 966,505 | | | $ | 620,954 | | | $ | 265,308 | | | $ | 122,105 | |

| Ratio of gross expenses to average net assets (4,5) | | | 3.16 | % | | | 3.05 | % | | | 2.89 | % | | | 3.25 | % | | | 2.97 | % |

| Ratio of net expenses to average net assets (5) | | | 3.16 | % | | | 3.07 | % | | | 2.92 | % | | | 3.15 | % | | | 2.83 | % |

| Ratio of net investment income (loss) to average net assets | | | 3.22 | % | | | 2.15 | % | | | (1.19 | )% | | | (1.31 | )% | | | (0.76 | )% |

| Portfolio Turnover Rate | | | 170 | % | | | 140 | % | | | 149 | % | | | 179 | % | | | 153 | % |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (4) | Represents the ratio of expenses to average net assets absent advisory fees waived or recaptured by the Advisor. |

| (5) | Excluding dividends from securities sold short and interest expense, the ratio of expenses to average net assets would have been: |

| Before fees waived/recaptured | 2.22% | 2.20% | 2.20% | 2.33% | 2.37% |

| After fees waived/recaptured | 2.22% | 2.22% | 2.23% | 2.23% | 2.23% |

| (6) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

| Invenomic Fund |

| FINANCIAL HIGHLIGHTS |

| |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year |

| | | Investor Class | |

| | | | | | | | | | | | | | | | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, 2024 | | | October 31, 2023 | | | October 31, 2022 | | | October 31, 2021 | | | October 31, 2020 | |

| Net asset value, beginning of year | | $ | 23.04 | | | $ | 23.66 | | | $ | 17.23 | | | $ | 10.57 | | | $ | 11.40 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (1) | | | 0.55 | | | | 0.41 | | | | (0.32 | ) | | | (0.26 | ) | | | (0.11 | ) |

| Net realized and unrealized gain (loss) on investments | | | (2.57 | ) | | | 4.66 | | | | 9.24 | | | | 7.24 | | | | (0.36 | ) |

| Total from investment operations | | | (2.02 | ) | | | 5.07 | | | | 8.92 | | | | 6.98 | | | | (0.47 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.51 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | (3.41 | ) | | | (5.69 | ) | | | (2.50 | ) | | | (0.38 | ) | | | (0.37 | ) |

| Total distributions | | | (3.92 | ) | | | (5.69 | ) | | | (2.50 | ) | | | (0.38 | ) | | | (0.37 | ) |

| Paid-in-Capital From Redemption Fees | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.06 | | | | 0.01 | |

| Net asset value, end of year | | $ | 17.10 | | | $ | 23.04 | | | $ | 23.66 | | | $ | 17.23 | | | $ | 10.57 | |

| Total return (3) | | | (10.66 | )% (6) | | | 25.50 | % (6) | | | 57.85 | % | | | 68.09 | % | | | (4.27 | )% |

| Net assets, at end of year (000’s) | | $ | 71,062 | | | $ | 121,751 | | | $ | 112,627 | | | $ | 27,457 | | | $ | 5,933 | |

| Ratio of gross expenses to average net assets (4,5) | | | 3.41 | % | | | 3.30 | % | | | 3.14 | % | | | 3.50 | % | | | 3.22 | % |

| Ratio of net expenses to average net assets (5) | | | 3.41 | % | | | 3.32 | % | | | 3.17 | % | | | 3.40 | % | | | 3.08 | % |

| Ratio of net investment income (loss) to average net assets | | | 2.97 | % | | | 1.85 | % | | | (1.41 | )% | | | (1.56 | )% | | | (0.99 | )% |

| Portfolio Turnover Rate | | | 170 | % | | | 140 | % | | | 149 | % | | | 179 | % | | | 153 | % |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (4) | Represents the ratio of expenses to average net assets absent advisory fees waived or recaptured by the Advisor. |

| (5) | Excluding dividends from securities sold short and interest expense, the ratio of expenses to average net assets would have been: |

| Before fees waived/recaptured | 2.47% | 2.45% | 2.45% | 2.58% | 2.62% |

| After fees waived/recaptured | 2.47% | 2.47% | 2.48% | 2.48% | 2.48% |

| (6) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

| Invenomic Fund |

| FINANCIAL HIGHLIGHTS |

| |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year |

| | | Super Institutional Class | |

| | | | | | | | | | | | | | | | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, 2024 | | | October 31, 2023 | | | October 31, 2022 | | | October 31, 2021 | | | October 31, 2020 | |

| Net asset value, beginning of year | | $ | 23.84 | | | $ | 24.19 | | | $ | 17.49 | | | $ | 10.70 | | | $ | 11.49 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (1) | | | 0.67 | | | | 0.57 | | | | (0.19 | ) | | | (0.16 | ) | | | (0.07 | ) |

| Net realized and unrealized gain (loss) on investments | | | (2.68 | ) | | | 4.77 | | | | 9.38 | | | | 7.33 | | | | (0.35 | ) |

| Total from investment operations | | | (2.01 | ) | | | 5.34 | | | | 9.19 | | | | 7.17 | | | | (0.42 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.63 | ) | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Net realized gains | | | (3.41 | ) | | | (5.69 | ) | | | (2.50 | ) | | | (0.38 | ) | | | (0.37 | ) |

| Total distributions | | | (4.04 | ) | | | (5.69 | ) | | | (2.50 | ) | | | (0.39 | ) | | | (0.37 | ) |

| Paid-in-Capital From Redemption Fees | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.01 | | | | 0.00 | (2) |

| Net asset value, end of year | | $ | 17.79 | | | $ | 23.84 | | | $ | 24.19 | | | $ | 17.49 | | | $ | 10.70 | |

| Total return (3) | | | (10.23 | )% (6) | | | 26.18 | % (6) | | | 58.62 | % | | | 68.58 | % | | | (3.88 | )% |

| Net assets, at end of year (000’s) | | $ | 238,979 | | | $ | 451,696 | | | $ | 256,997 | | | $ | 60 | | | $ | 36 | |

| Ratio of gross expenses to average net assets (4,5) | | | 2.91 | % | | | 2.80 | % | | | 2.64 | % | | | 3.00 | % | | | 2.72 | % |

| Ratio of net expenses to average net assets (5) | | | 2.91 | % | | | 2.82 | % | | | 2.67 | % | | | 2.90 | % | | | 2.58 | % |

| Ratio of net investment income (loss) to average net assets | | | 3.53 | % | | | 2.45 | % | | | (0.77 | )% | | | (1.04 | )% | | | (0.59 | )% |

| Portfolio Turnover Rate | | | 170 | % | | | 140 | % | | | 149 | % | | | 179 | % | | | 153 | % |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Represents less than $0.01 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (4) | Represents the ratio of expenses to average net assets absent advisory fees waived or recaptured by the Advisor. |