EARNINGS PRESENTATION Fourth Quarter & Full Year 2017 Aleris Corporation March 19, 2018

2 Forward-Looking and Other Information IMPORTANT INFORMATION This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This information contains certain forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any representation or warranty that this information is accurate or complete. See “Forward-Looking Information” below. BASIS OF PRESENTATION We are a direct wholly owned subsidiary of Aleris Corporation. Aleris Corporation currently conducts its business and operations through us and our consolidated subsidiaries. As used in this presentation, unless otherwise specified or the context otherwise requires, “Aleris,” “we,” “our,” “us,” “ and the “Company” refer to Aleris International, Inc. and its consolidated subsidiaries. Notwithstanding the foregoing, with respect to the historical financial information and other data presented in this presentation, unless otherwise specified or the context requires, “Aleris,” “we,” “our,” “us,” and the “Company’ refer to Aleris Corporation. We completed the sale of our recycling and specification alloys and extrusions businesses in the first quarter of 2015. We have reported these businesses as discontinued operations for all periods presented, and reclassified the results of operations of these businesses as discontinued operations. Except as otherwise indicated, the discussion of the Company’s business and financial information throughout this presentation refers to the Company’s continuing operations and the financial position and results of operations of its continuing operations. FORWARD-LOOKING INFORMATION Certain statements contained in this presentation are “forward-looking statements” within the meaning of the federal securities laws. Statements under headings with “Outlook” in the title and statements about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “look forward to,” “intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include statements about, among other things, future costs and prices of commodities, production volumes, industry trends, anticipated cost savings, anticipated benefits from new products, facilities, acquisitions or divestitures, projected results of operations, achievement of production efficiencies, capacity expansions, future prices and demand for our products and estimated cash flows and sufficiency of cash flows to fund operations, capital expenditures and debt service obligations. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in or implied by any forward-looking statement. Important factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, the following: (1) our ability to successfully implement our business strategy; (2) the success of past and future acquisitions or divestitures; (3) the cyclical nature of the aluminum industry, material adverse changes in the aluminum industry or our end-uses, such as global and regional supply and demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (4) increases in the cost, or limited availability, of raw materials and energy; (5) our ability to enter into effective metal, energy and other commodity derivatives or arrangements with customers to manage effectively our exposure to commodity price fluctuations and changes in the pricing of metals, especially London Metal Exchange-based aluminum prices; (6) our ability to generate sufficient cash flows to fund our operations and capital expenditure requirements and to meet our debt obligations; (7) competitor pricing activity, competition of aluminum with alternative materials and the general impact of competition in the industry end-uses we serve; (8) our ability to retain the services of certain members of our management; (9) the loss of order volumes from any of our largest customers; (10) our ability to retain customers, a substantial number of whom do not have long-term contractual arrangements with us; (11) risks of investing in and conducting operations on a global basis, including political, social, economic, currency and regulatory factors; (12) variability in general economic or political conditions on a global or regional basis; (13) current environmental liabilities and the cost of compliance with and liabilities under health and safety laws; (14) labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; (15) our internal controls over financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur; (16) our levels of indebtedness and debt service obligations, including changes in our credit ratings, material increases in our cost of borrowing or the failure of financial institutions to fulfill their commitments to us under committed facilities; (17) our ability to access credit or capital markets; (18) the possibility that we may incur additional indebtedness in the future; (19) limitations on operating our business and incurring additional indebtedness as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under our outstanding indebtedness; and (20) other factors discussed in our filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” contained therein. Investors, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether in response to new information, futures events or otherwise, except as otherwise required by law. NON-GAAP INFORMATION The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of financial performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income and loss attributable to Aleris Corporation or any other performance measure derived in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non- GAAP measures have limitations as analytical tools and should be considered in addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP. Management believes that certain non-GAAP financial measures may provide investors with additional meaningful comparisons between current results and results in prior periods. Management uses non-GAAP financial measures as performance metrics and believes these measures provide additional information commonly used by the holders of our senior debt securities and parties to the ABL Facility with respect to the ongoing performance of our underlying business activities, as well as our ability to meet our future debt service, capital expenditure and working capital needs. We calculate our non-GAAP financial measures by eliminating the impact of a number of items we do not consider indicative of our ongoing operating performance, and certain other items. You are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis. See “Appendix.” INDUSTRY INFORMATION Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain assumptions and our knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties and are subject to changes based on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission. WEBSITE POSTING We use our investor website (investor.aleris.com) as a channel of distribution of Company information. The information we post through this channel may be deemed material. Accordingly, investors should monitor this channel, in addition to following our press releases, Securities and Exchange Commission ("SEC") filings, and public conference calls and webcasts. The content of our website is not, however, a part of this presentation.

3 Outlook and Other Information OUTLOOK AND FORWARD LOOKING STATEMENTS The “Outlook” section in this presentation contains various forward-looking statements about our industry, the demand for our products and services and our projected results. See “Forward- Looking Information” on prior slide. In particular, statements contained in the “Outlook” section regarding the future financial impact of customer purchase commitments and capital expenditure projects, including our North America ABS Project and certain aerospace projects, are forward-looking statements (the “outlook statements”). These outlook statements are subject to various risks and uncertainties, many of which are beyond our control. For example, we have estimated the future financial impact of certain customer purchase commitments net of their expected costs. Actual costs may exceed our projections, including as a result of increased aluminum, energy, labor or other operating costs or other factors, which could limit the benefits we expect to realize from these customer purchase commitments. We have also made certain assumptions regarding customer purchase commitments based on our historical experience with such customers and industry practice. Some of these commitments are not subject to contractual arrangements, and to the extent these customers seek to reduce or delay their commitments, we will not realize the benefits expected from these commitments. In addition, certain of the anticipated benefits contained in or implied by the outlook statements are not expected to be realized until the successful ramp-up of ABS production at our Lewisport facility and of certain aerospace production at our Koblenz and Zhenjiang facilities. As a result, we expect to realize only a portion of the anticipated benefits contained in or implied by these outlook statements during the year ending December 31, 2018, as ramp-up at these facilities is expected to occur over the next several years. See “Risk Factors” discussed in our filings with the Securities and Exchange Commission for a discussion of additional risks, uncertainties and other factors that may cause our actual results to differ materially from those expressed in our outlook statements. OUTLOOK SEGMENT INCOME AND ADJUSTED EBITDA The segment income and Adjusted EBITDA impacts discussed in “Outlook” and elsewhere within this presentation have been provided for illustrative purposes only. These impacts are presented, in part, to demonstrate the potential incremental improvements to 2017 Adjusted EBITDA we believe we would have realized if the planned outage at our Lewisport facility and the allocation of equipment run time at our Duffel, Koblenz and Zhenjiang facilities as discussed above did not occur in 2017, and to demonstrate the benefits we expect to receive from certain existing customer commitments in future years. Estimates of the segment income and Adjusted EBITDA impact from certain existing commitments have been determined using a range of expected customer nominated volumes based on existing customer commitments and applying an appropriate estimate of average profitability per ton. To determine an estimate of average North America segment income and Adjusted EBITDA per ton we used the range of rolling margins per ton included in the pricing terms of our existing customer arrangements. These rolling margins were then compared to Lewisport’s average rolling margin per ton in 2017. Profitability per ton also reflects an estimate of incremental cash conversion costs. The estimate of average Europe and Asia Pacific segment income and Adjusted EBITDA per ton was determined using the 2017 Company-wide average Adjusted EBITDA per ton for aerospace products plus an estimate of profitability benefits from fixed cost leverage, which was based on our 2017 aerospace fixed cost absorption and adjusted for the higher production volumes expected to be realized in the future under certain aerospace contracts.

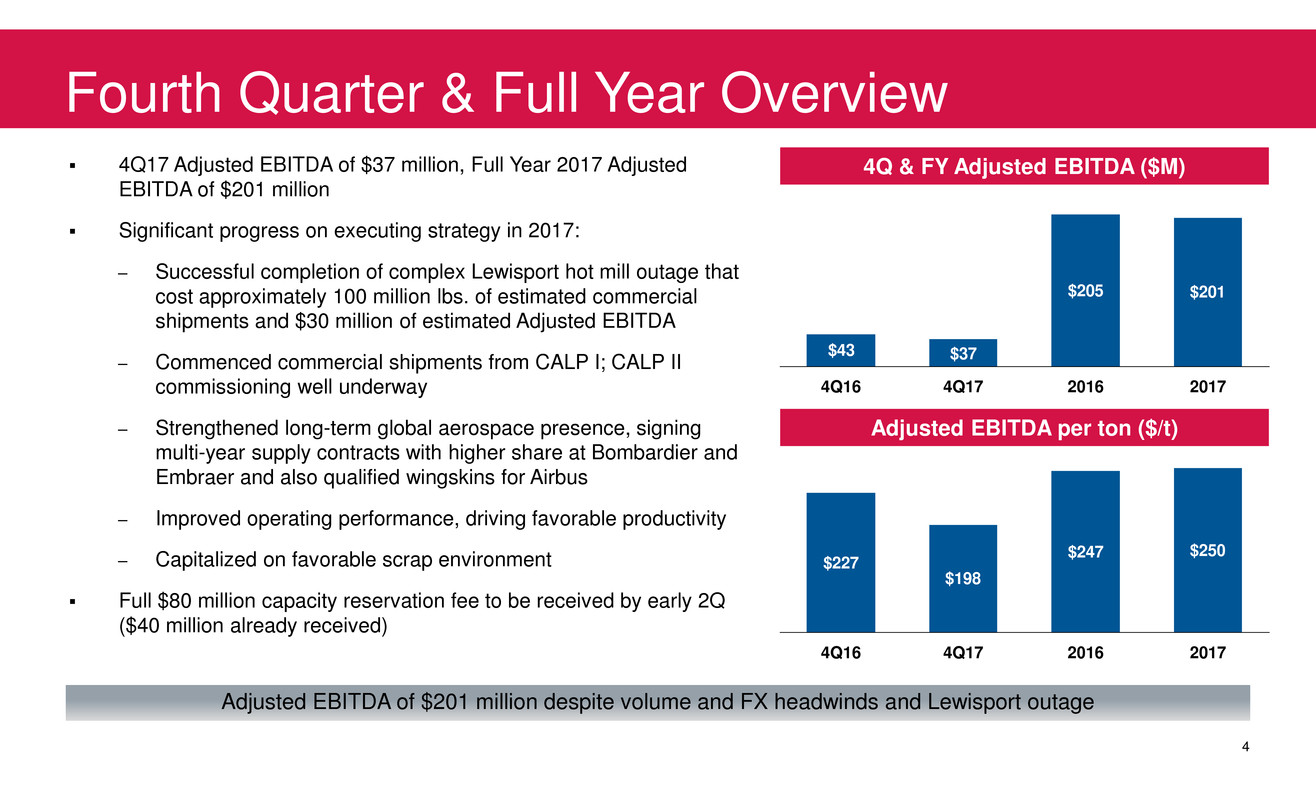

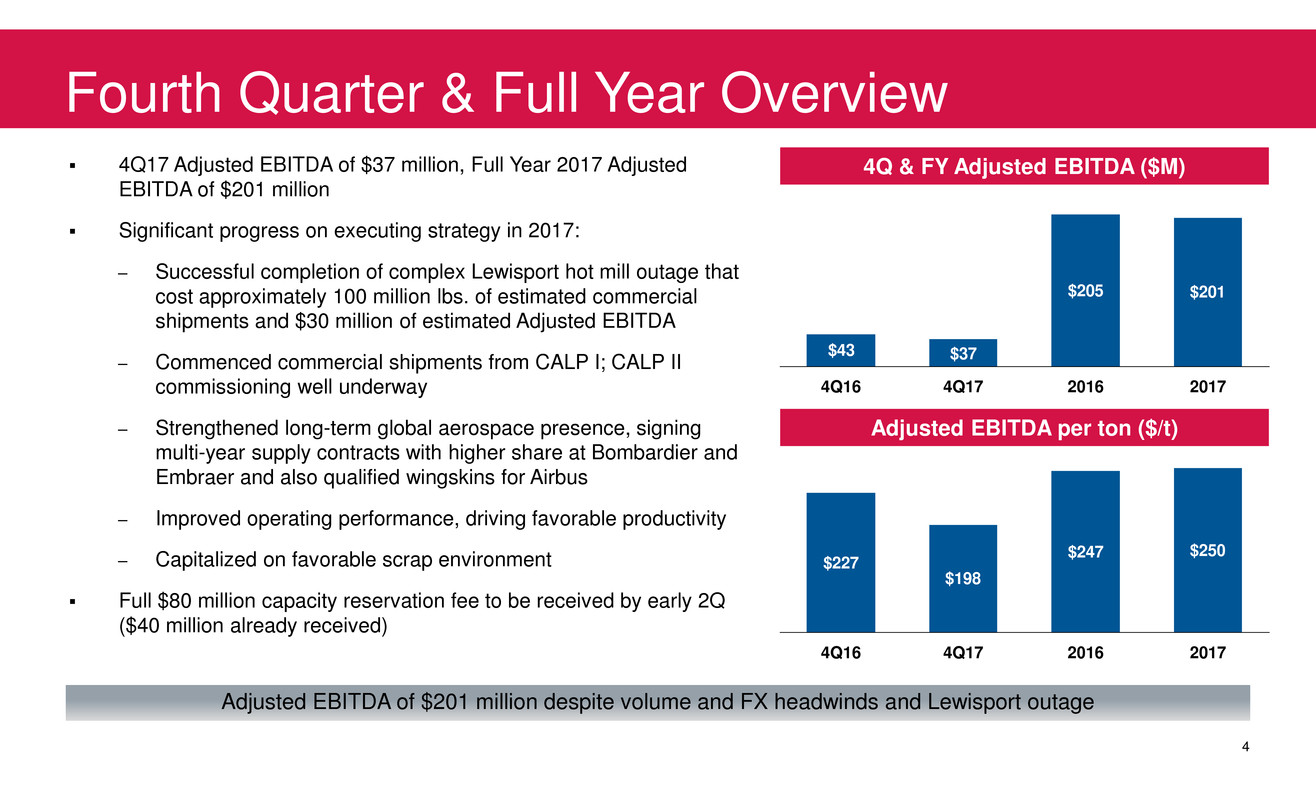

4 Fourth Quarter & Full Year Overview � 4Q17 Adjusted EBITDA of $37 million, Full Year 2017 Adjusted EBITDA of $201 million � Significant progress on executing strategy in 2017: – Successful completion of complex Lewisport hot mill outage that cost approximately 100 million lbs. of estimated commercial shipments and $30 million of estimated Adjusted EBITDA – Commenced commercial shipments from CALP I; CALP II commissioning well underway – Strengthened long-term global aerospace presence, signing multi-year supply contracts with higher share at Bombardier and Embraer and also qualified wingskins for Airbus – Improved operating performance, driving favorable productivity – Capitalized on favorable scrap environment � Full $80 million capacity reservation fee to be received by early 2Q ($40 million already received) Adjusted EBITDA of $201 million despite volume and FX headwinds and Lewisport outage 4Q & FY Adjusted EBITDA ($M) $205 $201 $43 $37 201720164Q174Q16 Adjusted EBITDA per ton ($/t) $247 $250 $198 $227 20174Q16 20164Q17

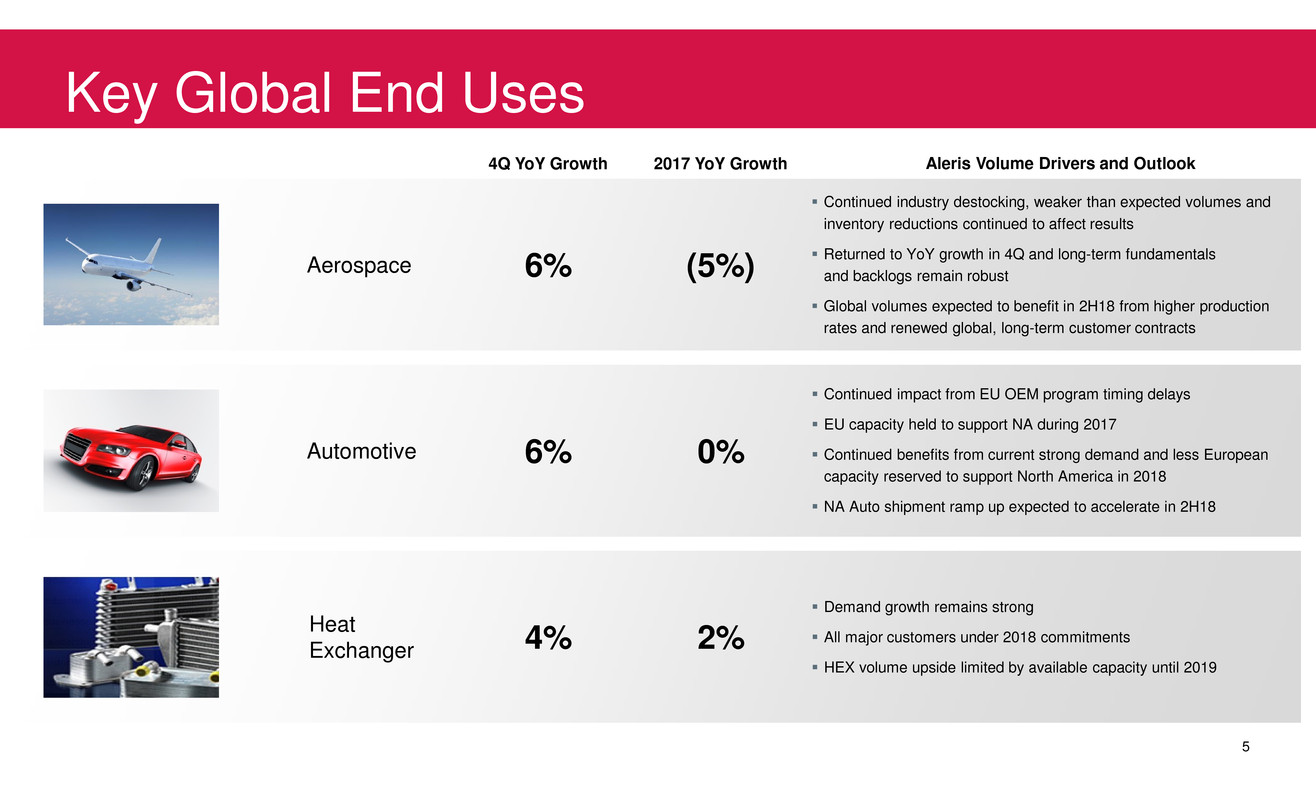

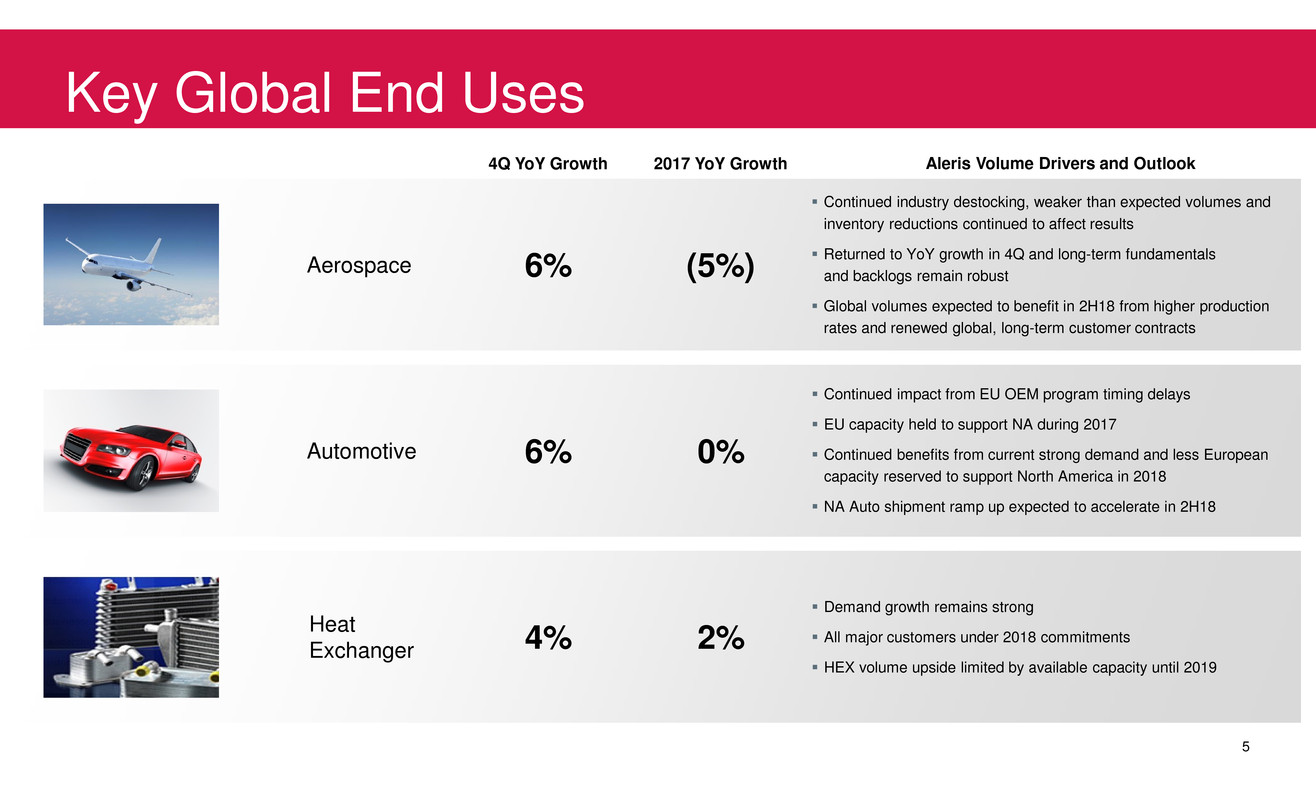

5 Key Global End Uses Aleris Volume Drivers and Outlook � Demand growth remains strong � All major customers under 2018 commitments � HEX volume upside limited by available capacity until 2019 � Continued impact from EU OEM program timing delays � EU capacity held to support NA during 2017 � Continued benefits from current strong demand and less European capacity reserved to support North America in 2018 � NA Auto shipment ramp up expected to accelerate in 2H18 Heat Exchanger Automotive 4Q YoY Growth 4% 6% 2017 YoY Growth 2% � Continued industry destocking, weaker than expected volumes and inventory reductions continued to affect results � Returned to YoY growth in 4Q and long-term fundamentals and backlogs remain robust � Global volumes expected to benefit in 2H18 from higher production rates and renewed global, long-term customer contracts Aerospace 6% (5%) 0%

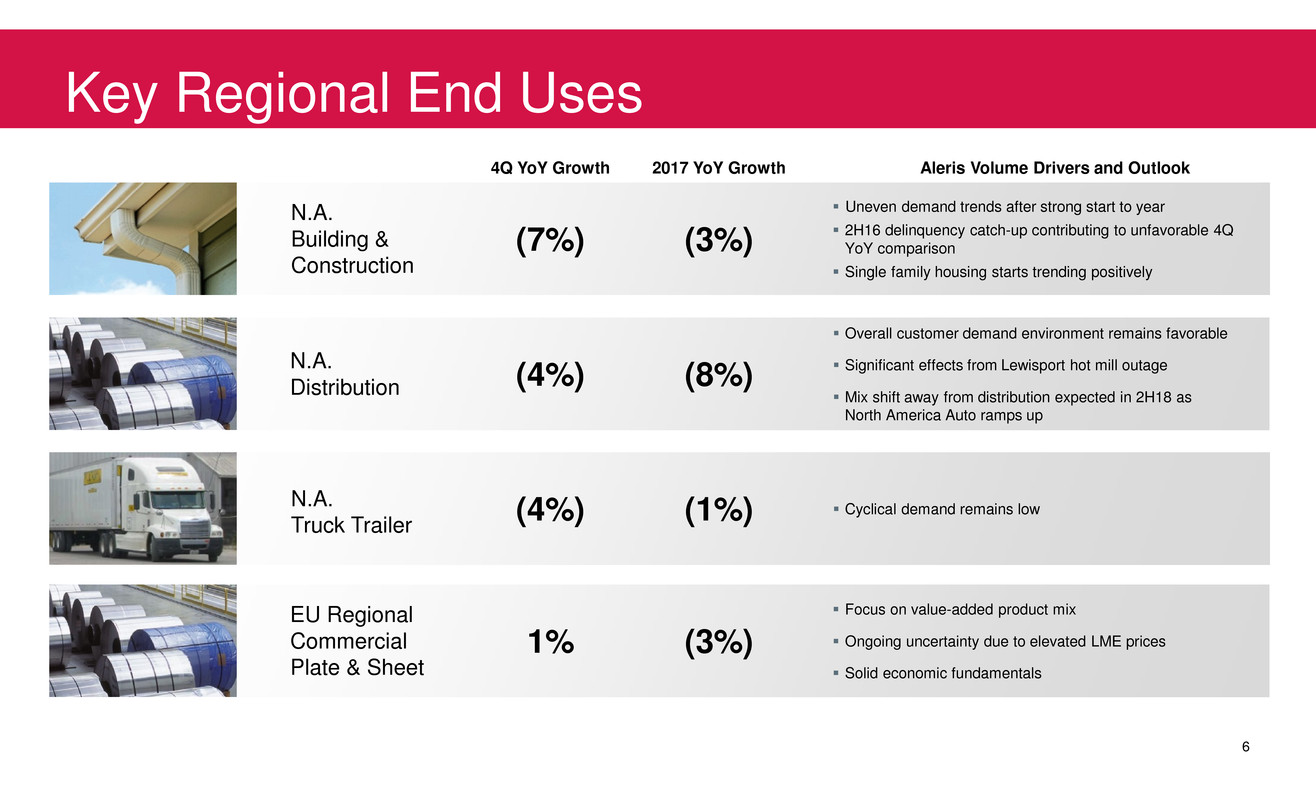

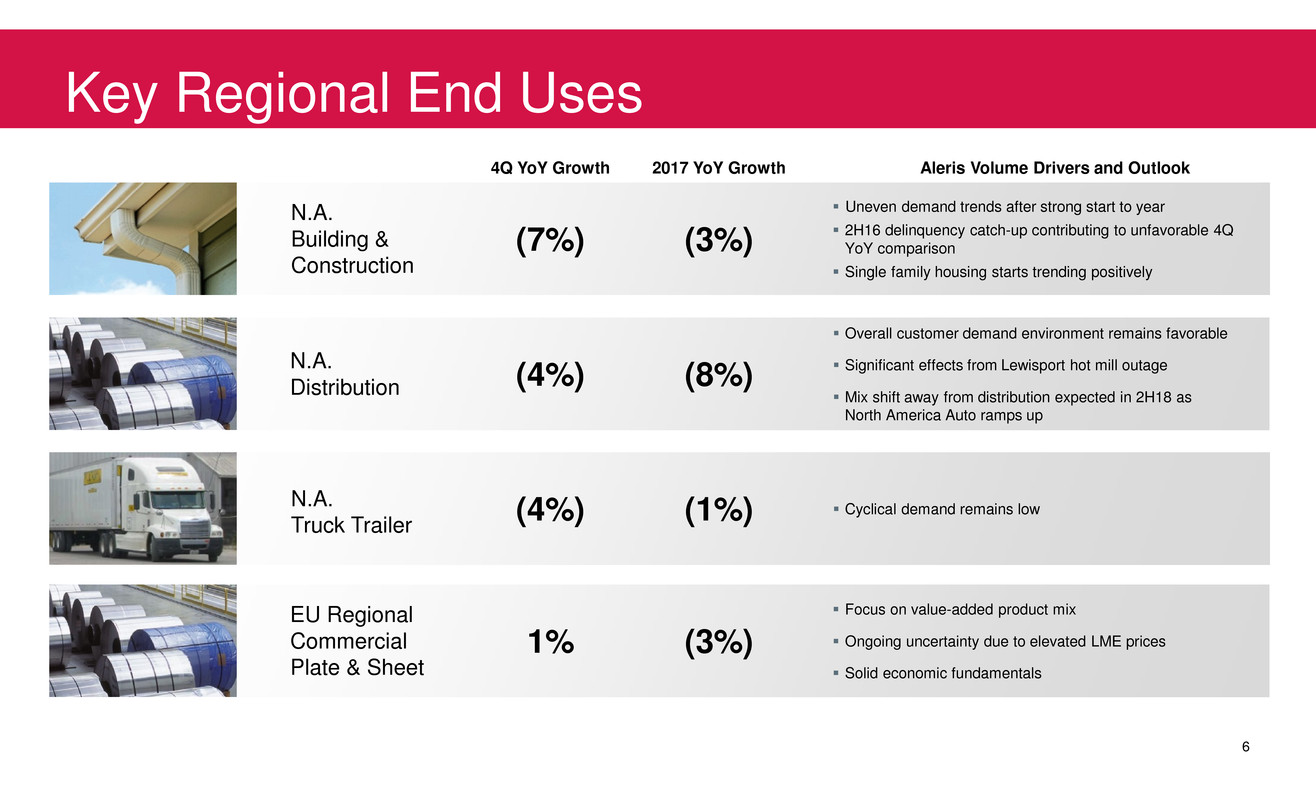

6 � Uneven demand trends after strong start to year � 2H16 delinquency catch-up contributing to unfavorable 4Q YoY comparison � Single family housing starts trending positively N.A. Building & Construction � Cyclical demand remains lowN.A. Truck Trailer � Focus on value-added product mix � Ongoing uncertainty due to elevated LME prices � Solid economic fundamentals EU Regional Commercial Plate & Sheet � Overall customer demand environment remains favorable � Significant effects from Lewisport hot mill outage � Mix shift away from distribution expected in 2H18 as North America Auto ramps up N.A. Distribution (7%) (4%) (4%) 1% 4Q YoY Growth Key Regional End Uses (3%) (8%) (1%) (3%) 2017 YoY Growth Aleris Volume Drivers and Outlook

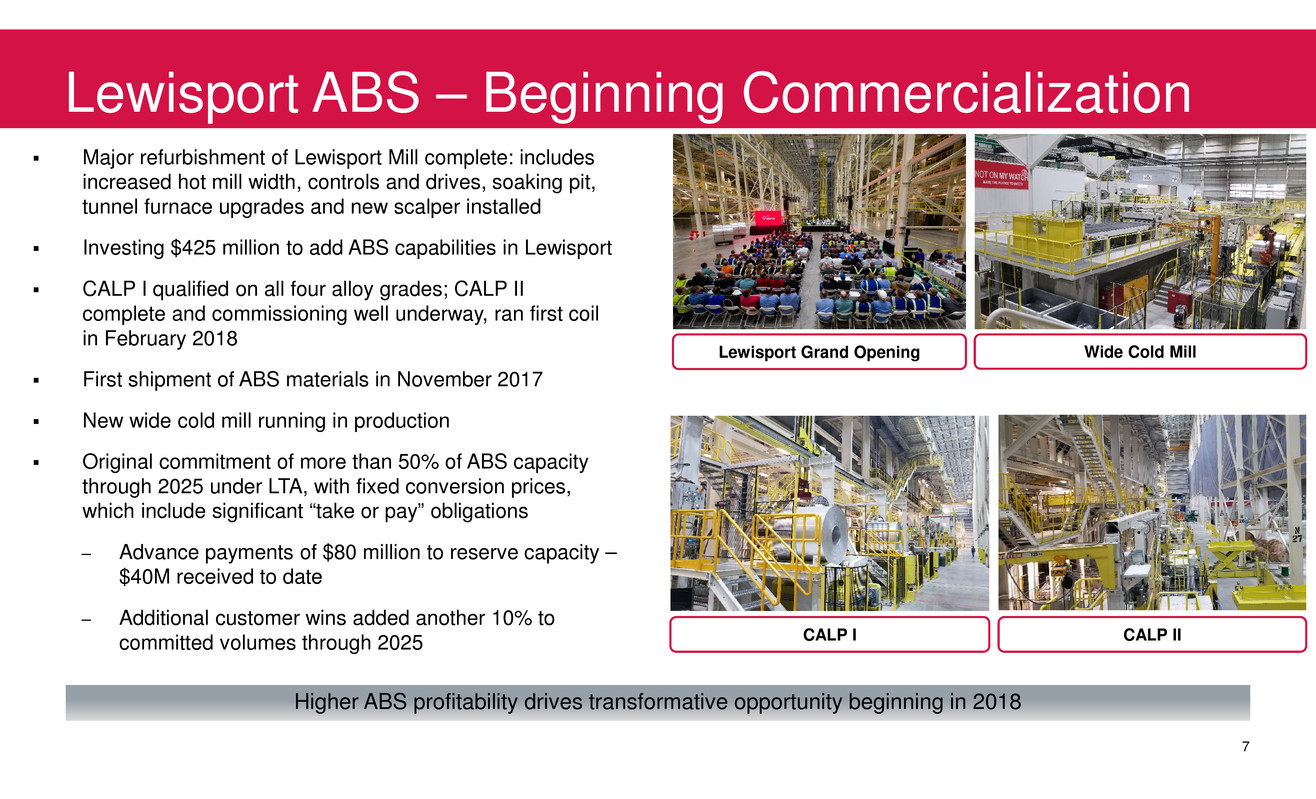

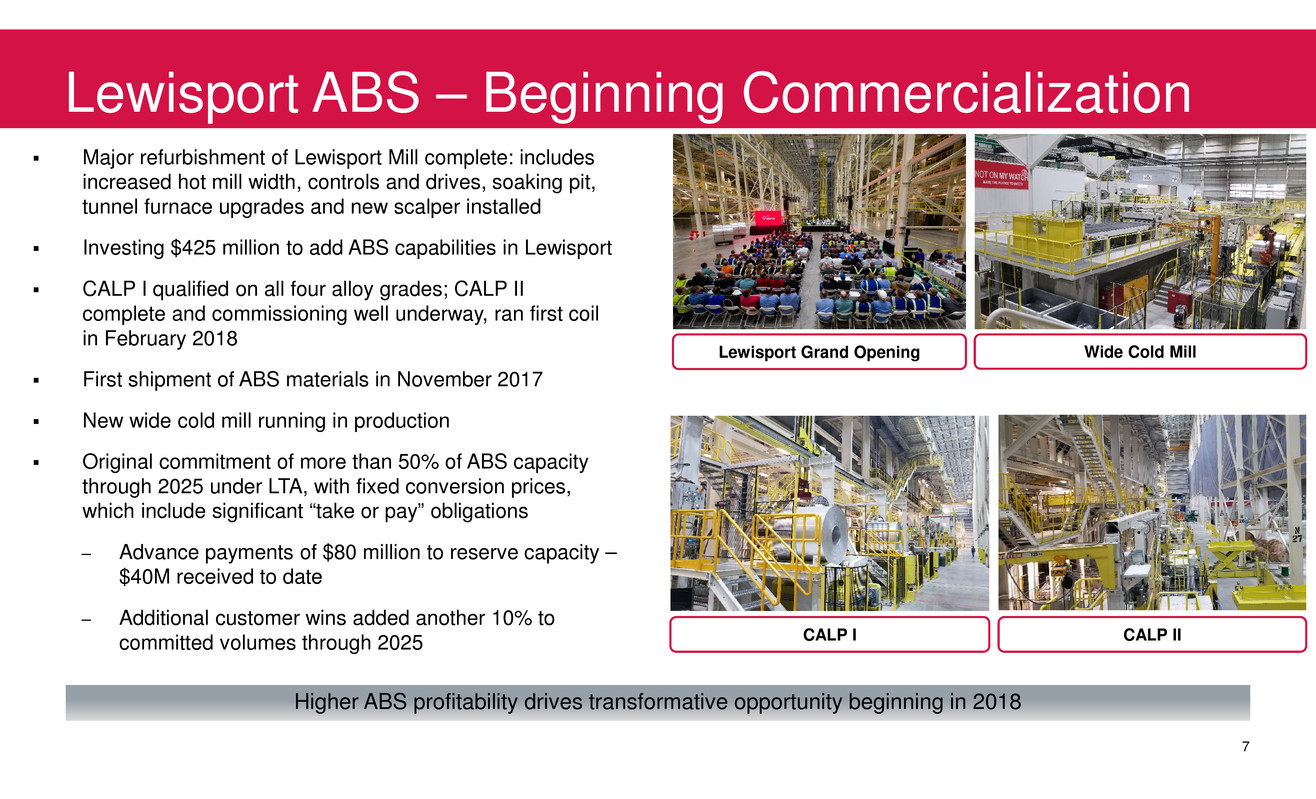

7 Higher ABS profitability drives transformative opportunity beginning in 2018 � Major refurbishment of Lewisport Mill complete: includes increased hot mill width, controls and drives, soaking pit, tunnel furnace upgrades and new scalper installed � Investing $425 million to add ABS capabilities in Lewisport � CALP I qualified on all four alloy grades; CALP II complete and commissioning well underway, ran first coil in February 2018 � First shipment of ABS materials in November 2017 � New wide cold mill running in production � Original commitment of more than 50% of ABS capacity through 2025 under LTA, with fixed conversion prices, which include significant “take or pay” obligations – Advance payments of $80 million to reserve capacity – $40M received to date – Additional customer wins added another 10% to committed volumes through 2025 Wide Cold MillLewisport Grand Opening CALP I CALP II Lewisport ABS – Beginning Commercialization

8 Adjusted EBITDA Bridges $9 $37 $9 $43 20 30 40 50 Base Inflation 4Q17Currency/ Translation/ Other ($6) ($7) ProductivityCommodity Inflation Volume/Mix ($7) ($3) Metal Spreads4Q16 ($1) Price 4Q17 YTD vs. 4Q16 YTD $205 $201 $21 $18 220 200 120 140 180 160 Volume/Mix4Q16 YTD ($9) 4Q17 YTD ($6) ($7) ProductivityMetal Spreads Commodity Inflation Price $2 Currency/ Translation/ Other Base Inflation ($23) 4Q17 vs. 4Q16($M)

9 North America Segment Adjusted EBITDA ($M)Volume (kT) 4Q17 Performance4Q Adjusted EBITDA Bridge ($M) 486 462 102110 (5%) 4Q162017 4Q172016 (7%) $96 $14 $81 $15 2017 4Q162016 4Q17 Adj. EBITDA / ton $167 $209 $129 $151 � Volume decline resulting from commissioning period following planned Lewisport outage, uneven B&C demand and an unfavorable comparison period � Favorable scrap spreads resulting from rising aluminum prices, improved scrap availability and strategic metal purchasing � Improved operational stability and better Adjusted EBITDA/ton$14 $15 $2 $10 0 5 10 15 20 4Q17Commodity Inflation Metal Spreads ($3) Price $0 ProductivityBase Inflation ($2) Volume/Mix4Q16 ($6)

10 $0.30 $0.40 $0.95 $1.05 $1.10 $0.35 $0.20 $1.00 $0.90 $0.80 $0.75 $0.70 $0.25 $0.85 $0.15 $1.15 Mar 2017 Mar 2015 Jun 2017 Dec 2016 Sep 2015 Dec 2017 Jun 2016 Jun 2015 Dec 2014 Sep 2017 Dec 2015 Sep 2016 Mar 2016 Metal Update Ongoing historically high metal spreads and favorable scrap trends Weighted Painted Siding, Mixed Low Copper, Sheet SpreadP1020 (left axis) 1Platts, Aleris Management Analysis, January 2018

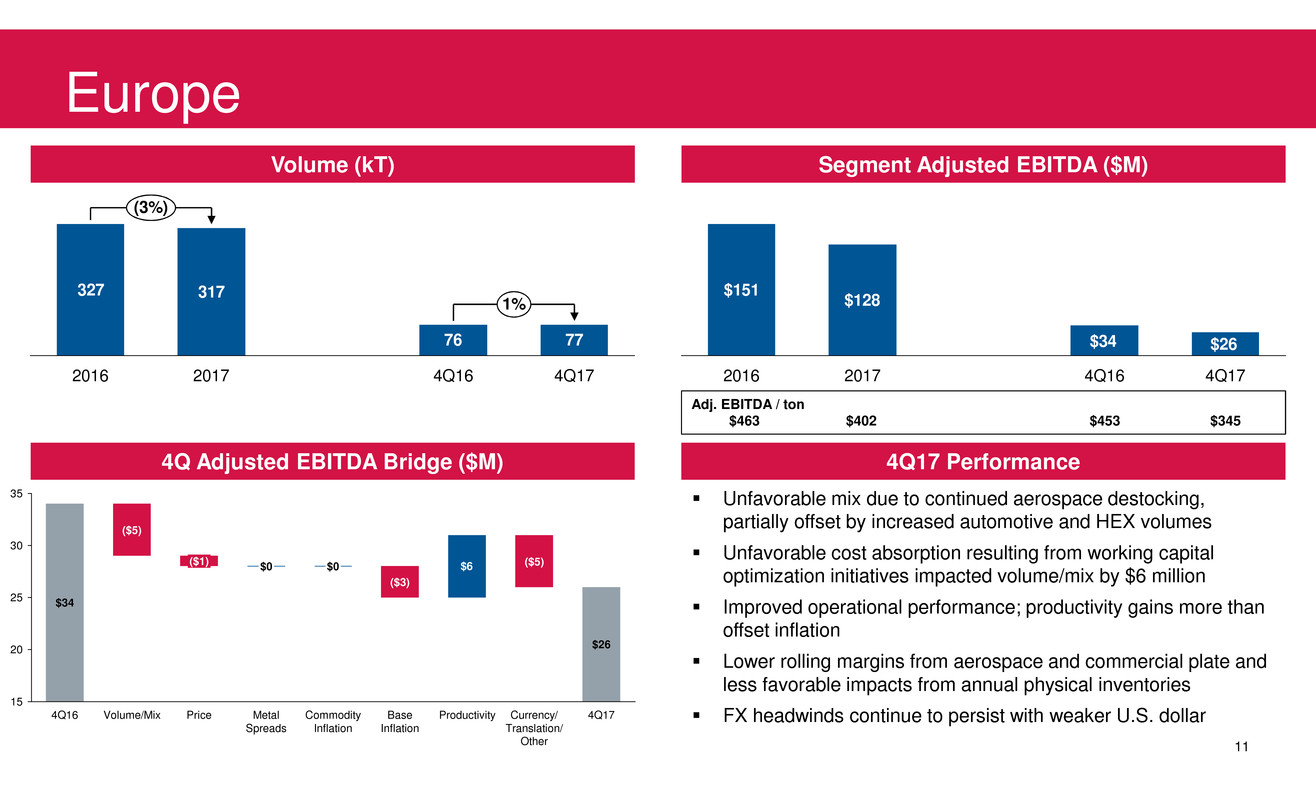

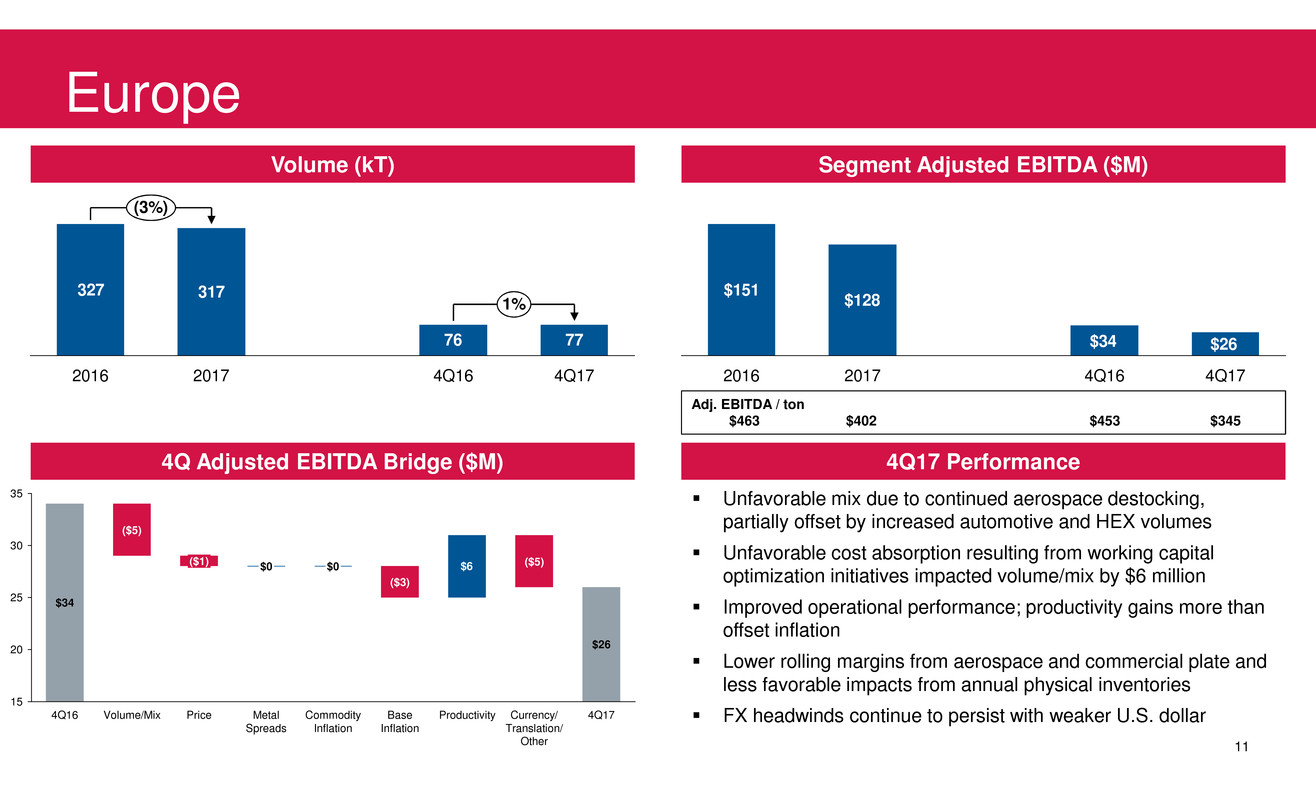

11 Europe Segment Adjusted EBITDA ($M)Volume (kT) 4Q17 Performance4Q Adjusted EBITDA Bridge ($M) 327 317 7776 1% 4Q16 4Q1720172016 (3%) $151 $128 $26 $34 4Q174Q162016 2017 Adj. EBITDA / ton $463 $402 $453 $345 � Unfavorable mix due to continued aerospace destocking, partially offset by increased automotive and HEX volumes � Unfavorable cost absorption resulting from working capital optimization initiatives impacted volume/mix by $6 million � Improved operational performance; productivity gains more than offset inflation � Lower rolling margins from aerospace and commercial plate and less favorable impacts from annual physical inventories � FX headwinds continue to persist with weaker U.S. dollar $34 $26 $6 15 20 25 30 35 ($5) Currency/ Translation/ Other 4Q17Commodity Inflation $0 Metal Spreads $0 Productivity ($3) Base Inflation ($1) Volume/Mix ($5) Price4Q16

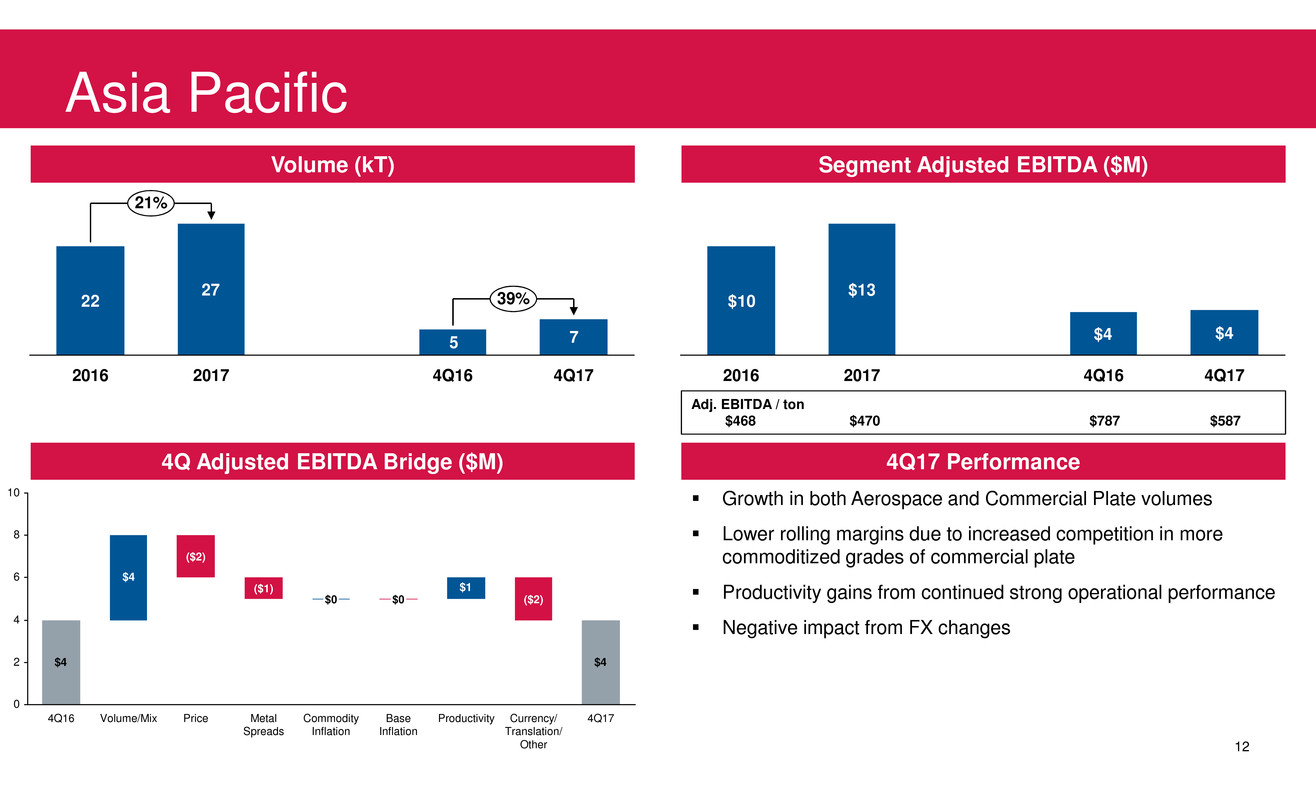

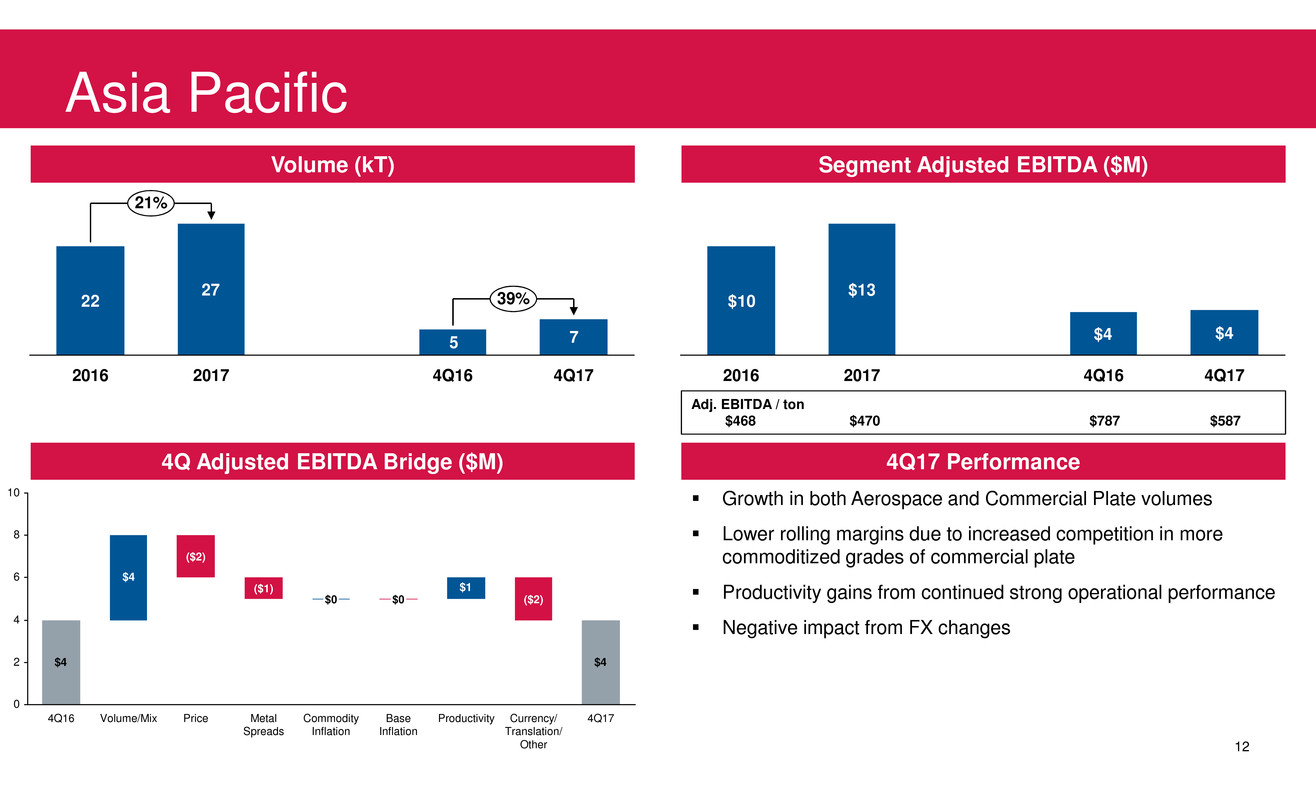

12 Asia Pacific Segment Adjusted EBITDA ($M)Volume (kT) 4Q17 Performance4Q Adjusted EBITDA Bridge ($M) 27 7 22 5 4Q162016 2017 39% 21% 4Q17 $10 $13 $4 $4 20172016 4Q174Q16 Adj. EBITDA / ton $468 $470 $787 $587 � Growth in both Aerospace and Commercial Plate volumes � Lower rolling margins due to increased competition in more commoditized grades of commercial plate � Productivity gains from continued strong operational performance � Negative impact from FX changes $4$4 $1 $4 0 2 4 6 8 10 Currency/ Translation/ Other ($2) Productivity 4Q17 $0$0 Metal Spreads ($2) Volume/Mix ($1) Commodity Inflation Price Base Inflation 4Q16

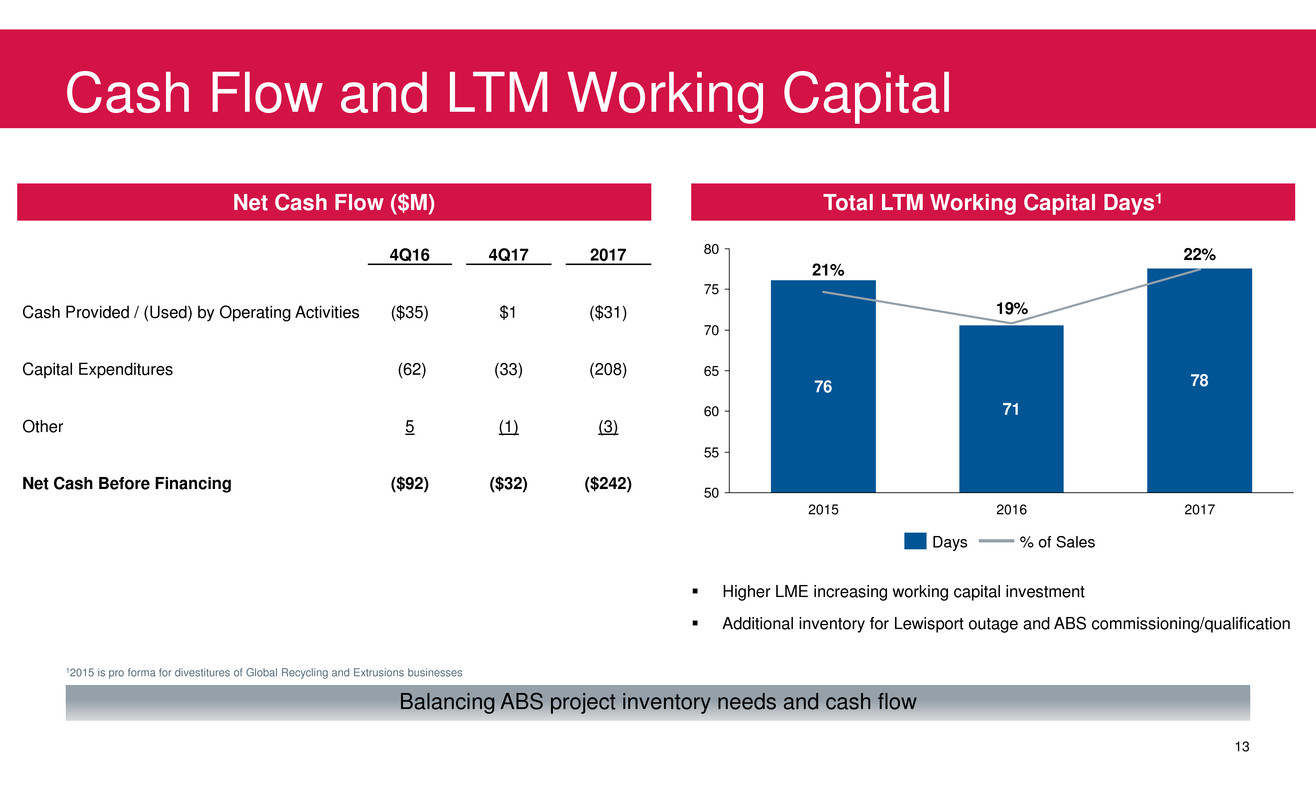

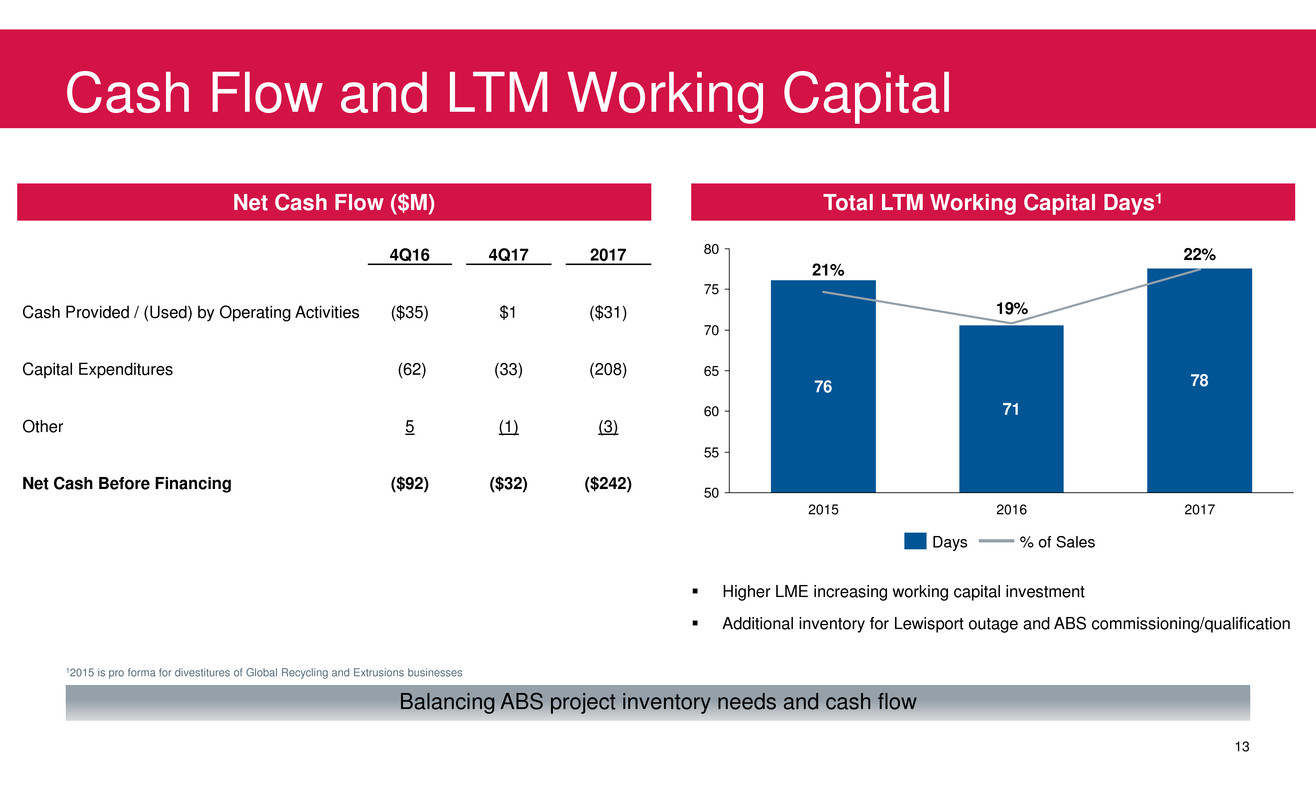

13 Cash Flow and LTM Working Capital Balancing ABS project inventory needs and cash flow Total LTM Working Capital Days1Net Cash Flow ($M) 4Q16 4Q17 2017 Cash Provided / (Used) by Operating Activities ($35) $1 ($31) Capital Expenditures (62) (33) (208) Other 5 (1) (3) Net Cash Before Financing ($92) ($32) ($242) 76 71 78 22% 19% 21% 50 55 60 65 70 75 80 201720162015 Days % of Sales � Higher LME increasing working capital investment � Additional inventory for Lewisport outage and ABS commissioning/qualification 12015 is pro forma for divestitures of Global Recycling and Extrusions businesses

14 Capital & Liquidity Overview CapEx continuing to ramp down, expect $80 million capacity reservation benefits to be fully realized early in 2Q18 Liquidity Summary ($M)Capital Expenditures Summary ($M)1 Capital Structure ($M) $82 $96 $88 $74 $201 $276 $148 $53 $20 $107 $208 2016 $358 $2 2017 $8 $125 - $1402 $11 2015 $298 4Q17 $33 $7 $10 2018E2014 $121 $14 2013 $188 Other Growth MaintenanceNorth America ABS Project & Other Upgrades 1Excludes discontinued operations CapEx of $50M, $43M, $15M in 2013-2015 2Guidance does not include capitalized interest 3Includes $6M of restricted cash for payoff of China Loan Facility 4Does not include benefit of $40M of customer capacity reservation fees received to date; remainder of $80M expected to be received early in 2Q18 5Amounts exclude applicable premiums and discounts 6Other excludes $45M of exchangeable notes 7See prior SEC filing for applicable reconciliations to GAAP financial measures 8Excludes Non-Recourse China Loan Facilities 9Secured debt includes outstanding ABL Facility balance and 2021 Secured Notes Note: Certain amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in these charts and tables 12/31/2017 Cash and Restricted Cash3 $108 Availability under ABL Facility 123 Liquidity $231 12/31/2017 Cash and Restricted Cash3 $108 ABL 319 Notes5 1,240 Non-Recourse China Loan Facilities5 170 Other5,6 9 Net Debt $1,631 LTM Adjusted EBITDA7 $201 Net Debt / LTM Adj. EBITDA 8.1x Net Recourse Debt8 / LTM Adj. EBITDA 7.3x Net Secured Debt9 / LTM Adj. EBITDA 5.6x 4

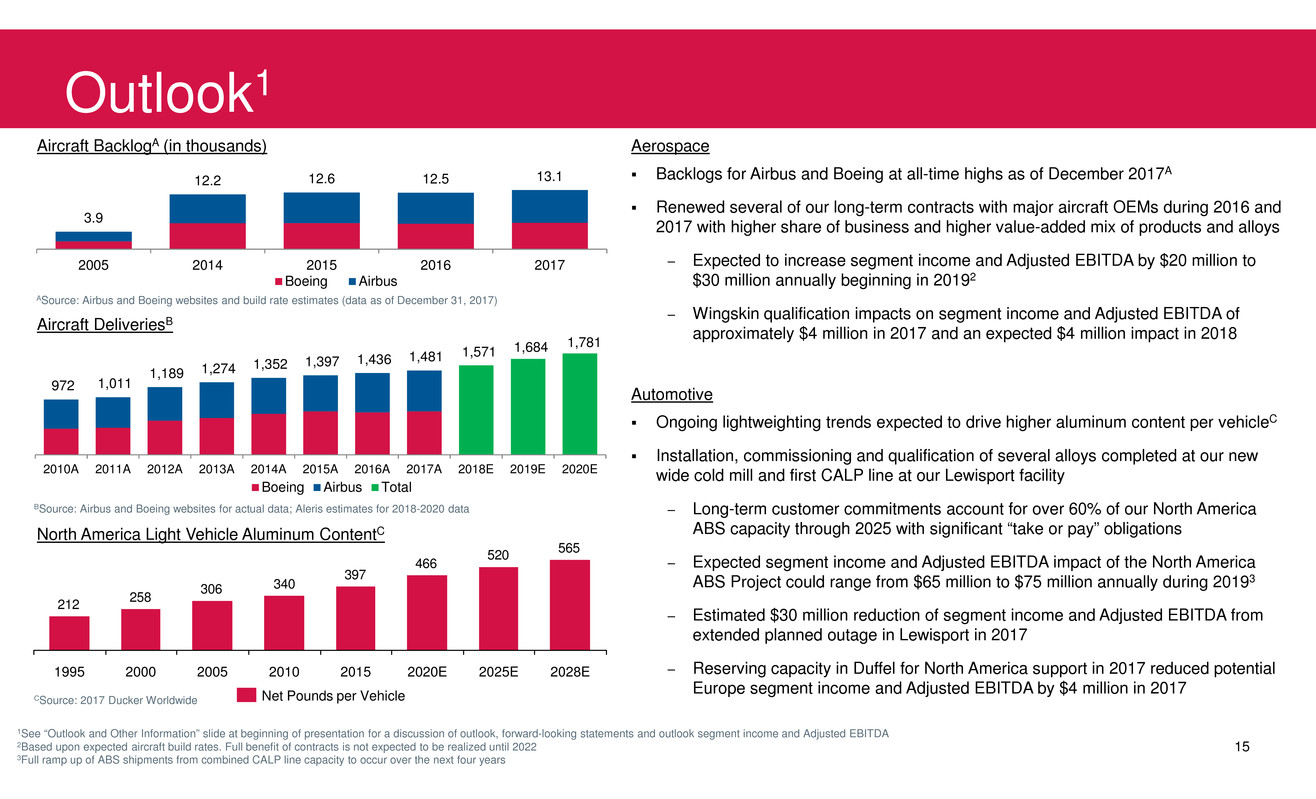

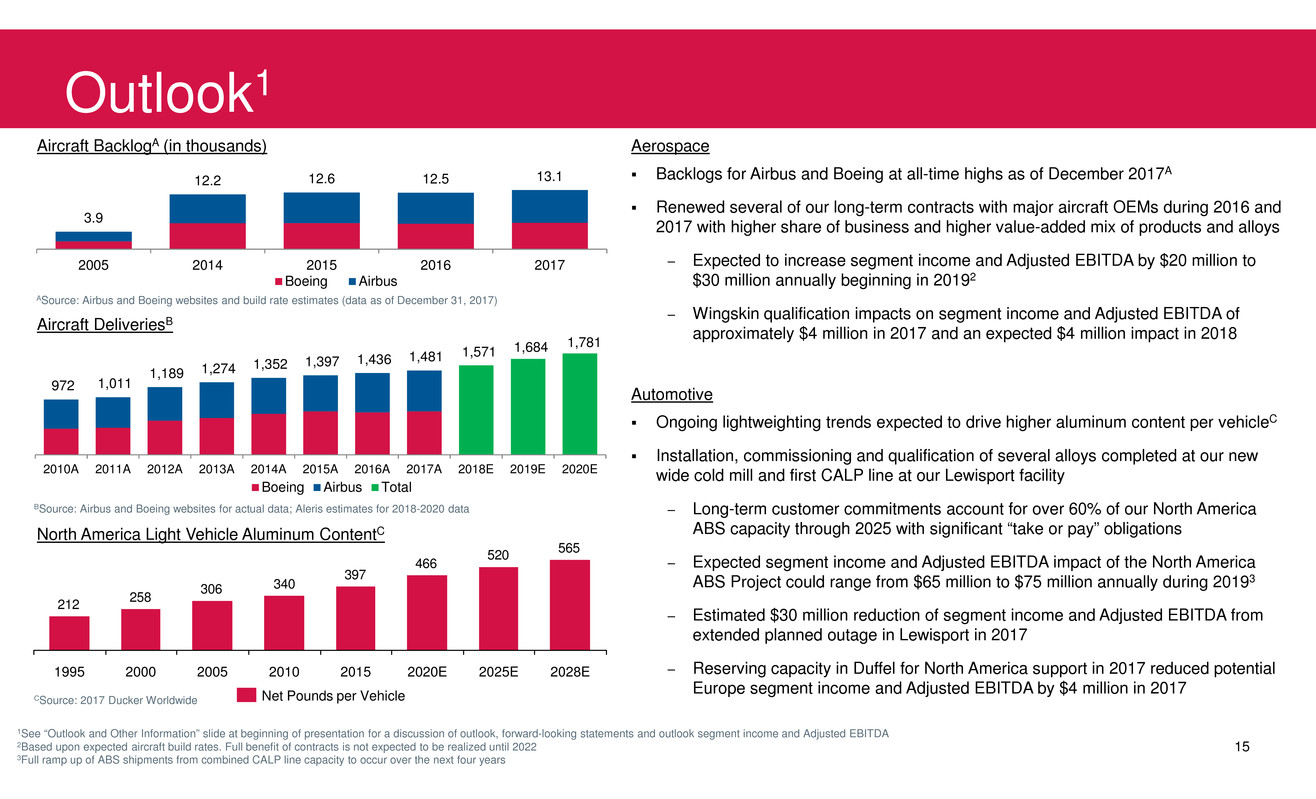

15 972 1,011 1,189 1,274 1,352 1,397 1,436 1,481 1,571 1,684 1,781 2010A 2011A 2012A 2013A 2014A 2015A 2016A 2017A 2018E 2019E 2020E Boeing Airbus Total Outlook1 Aircraft BacklogA (in thousands) Aircraft DeliveriesB North America Light Vehicle Aluminum ContentC 3.9 12.2 12.6 12.5 13.1 2005 2014 2015 2016 2017 Boeing Airbus 565520466 397340306258212 2025E2020E 2028E200520001995 20152010 Net Pounds per Vehicle Aerospace � Backlogs for Airbus and Boeing at all-time highs as of December 2017A � Renewed several of our long-term contracts with major aircraft OEMs during 2016 and 2017 with higher share of business and higher value-added mix of products and alloys – Expected to increase segment income and Adjusted EBITDA by $20 million to $30 million annually beginning in 20192 – Wingskin qualification impacts on segment income and Adjusted EBITDA of approximately $4 million in 2017 and an expected $4 million impact in 2018 Automotive � Ongoing lightweighting trends expected to drive higher aluminum content per vehicleC � Installation, commissioning and qualification of several alloys completed at our new wide cold mill and first CALP line at our Lewisport facility – Long-term customer commitments account for over 60% of our North America ABS capacity through 2025 with significant “take or pay” obligations – Expected segment income and Adjusted EBITDA impact of the North America ABS Project could range from $65 million to $75 million annually during 20193 – Estimated $30 million reduction of segment income and Adjusted EBITDA from extended planned outage in Lewisport in 2017 – Reserving capacity in Duffel for North America support in 2017 reduced potential Europe segment income and Adjusted EBITDA by $4 million in 2017 1See “Outlook and Other Information” slide at beginning of presentation for a discussion of outlook, forward-looking statements and outlook segment income and Adjusted EBITDA 2Based upon expected aircraft build rates. Full benefit of contracts is not expected to be realized until 2022 3Full ramp up of ABS shipments from combined CALP line capacity to occur over the next four years ASource: Airbus and Boeing websites and build rate estimates (data as of December 31, 2017) CSource: 2017 Ducker Worldwide BSource: Airbus and Boeing websites for actual data; Aleris estimates for 2018-2020 data

16 Outlook � 2018 full year segment income and Adjusted EBITDA expected to be substantially higher than prior year with meaningful improvements beginning in the second quarter � North America volumes expected to more than recover from outage, with commercial shipments from first Lewisport CALP expected to show significant ramp up in second half of 2018 based on committed volumes � Global aerospace volumes expected to benefit from higher aircraft production rates and renewed global, long-term customer contracts after inventory destocking subsides � European automotive demand expected to benefit from new model launches and less capacity reserved to support Lewisport’s ramp up � Favorable year-over-year scrap spreads expected in North America, particularly in the first half of 2018 � A weaker U.S. dollar will negatively impact results in 2018 � Beginning in 2018, common alloys used in products made by our North America segment may potentially benefit from trade case activity � We expect full year capital expenditures of approximately $125 million to $140 million

17 APPENDIX

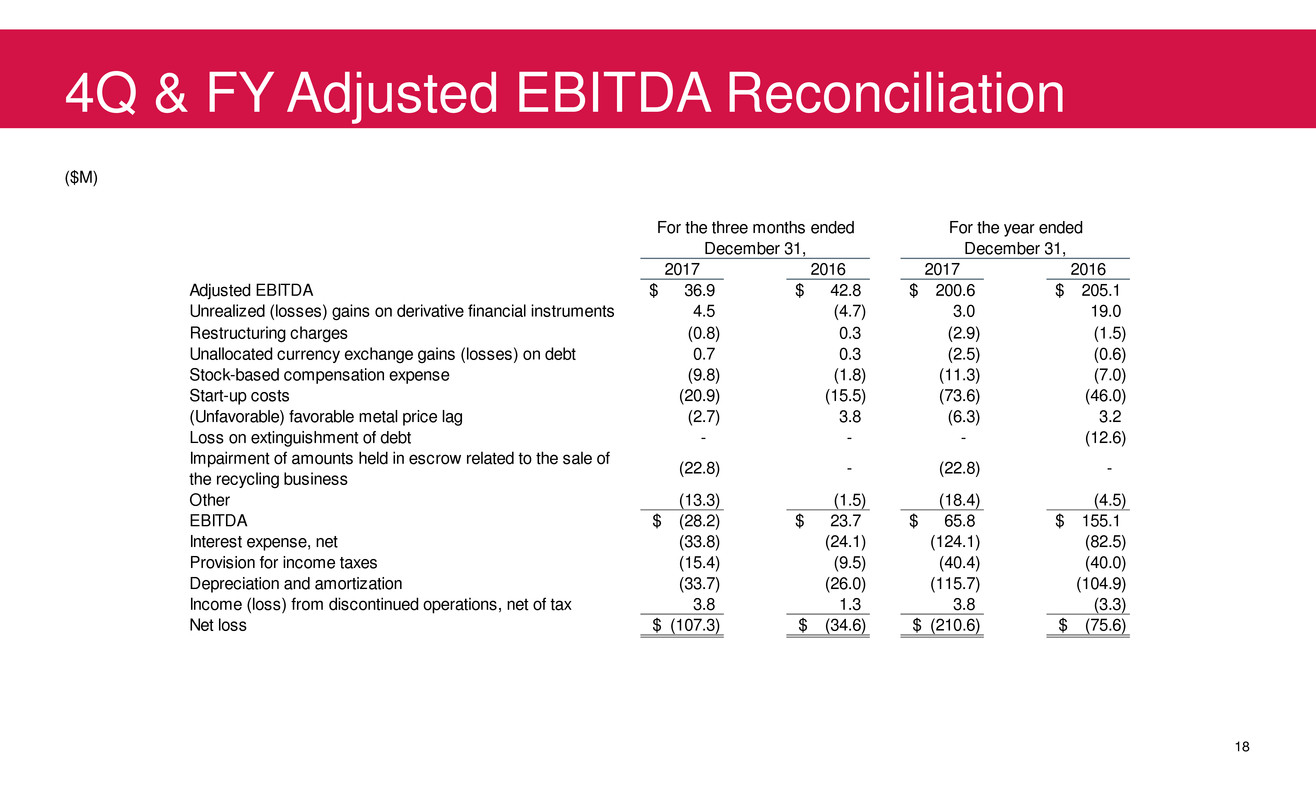

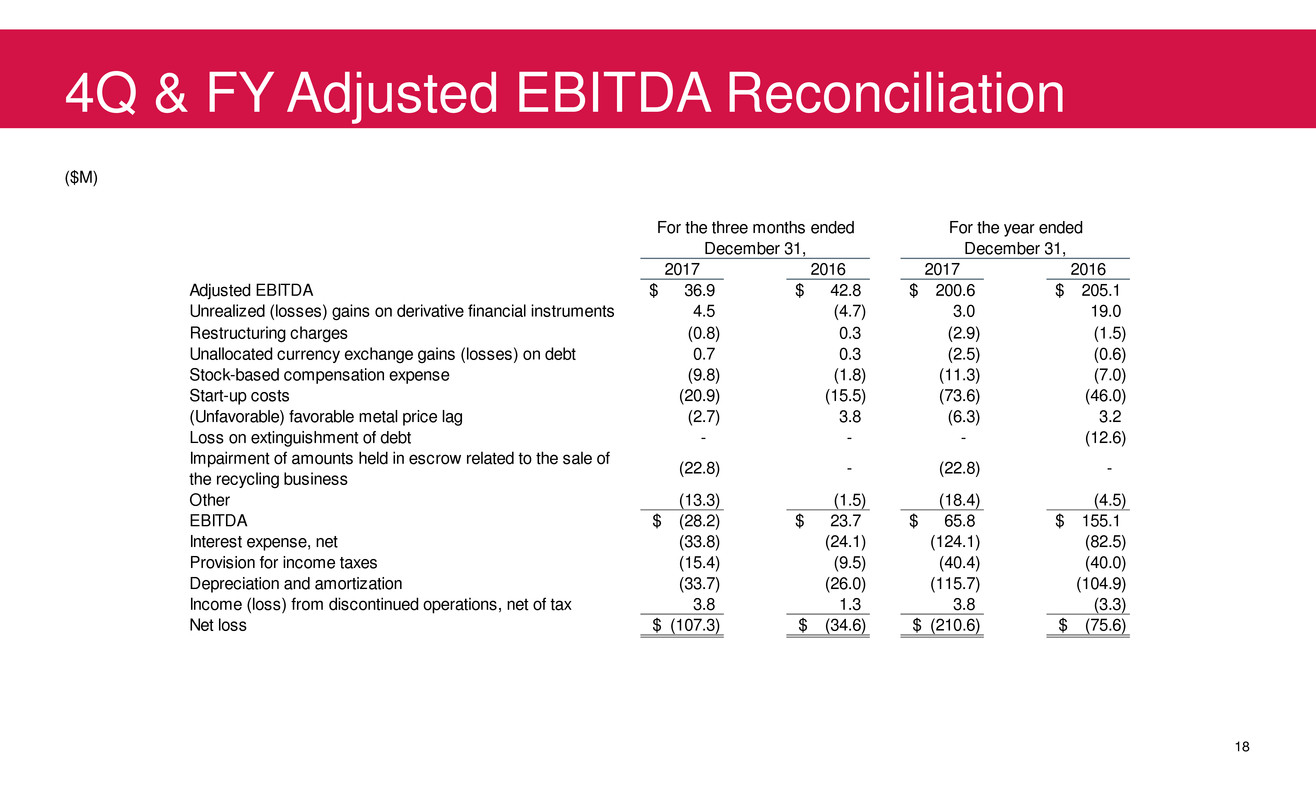

18 2017 2016 2017 2016 Adjusted EBITDA 36.9$ 42.8$ 200.6$ 205.1$ Unrealized (losses) gains on derivative financial instruments 4.5 (4.7) 3.0 19.0 Restructuring charges (0.8) 0.3 (2.9) (1.5) Unallocated currency exchange gains (losses) on debt 0.7 0.3 (2.5) (0.6) Stock-based compensation expense (9.8) (1.8) (11.3) (7.0) Start-up costs (20.9) (15.5) (73.6) (46.0) (Unfavorable) favorable metal price lag (2.7) 3.8 (6.3) 3.2 Loss on extinguishment of debt - - - (12.6) Impairment of amounts held in escrow related to the sale of the recycling business (22.8) - (22.8) - Other (13.3) (1.5) (18.4) (4.5) EBITDA (28.2)$ 23.7$ 65.8$ 155.1$ Interest expense, net (33.8) (24.1) (124.1) (82.5) Provision for income taxes (15.4) (9.5) (40.4) (40.0) Depreciation and amortization (33.7) (26.0) (115.7) (104.9) Income (loss) from discontinued operations, net of tax 3.8 1.3 3.8 (3.3) Net loss (107.3)$ (34.6)$ (210.6)$ (75.6)$ For the three months ended December 31, For the year ended December 31, 4Q & FY Adjusted EBITDA Reconciliation ($M)

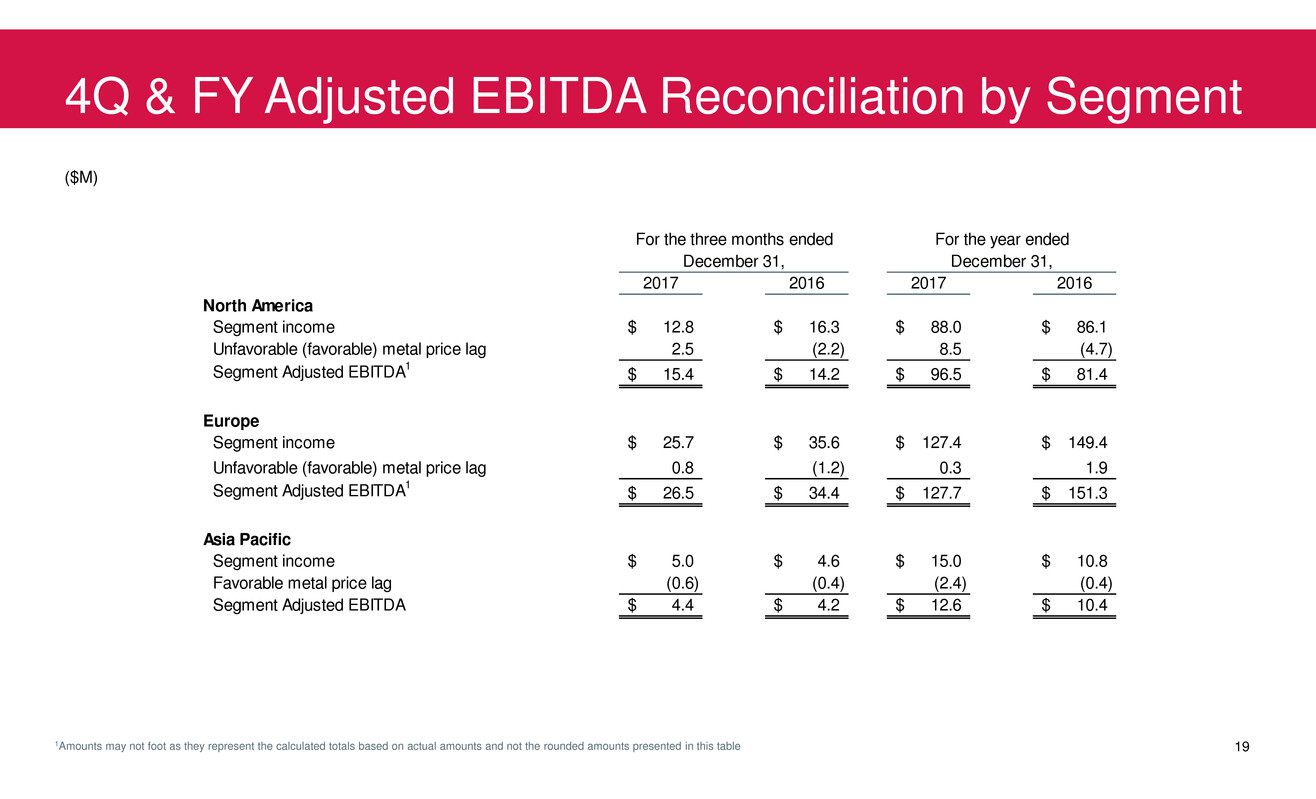

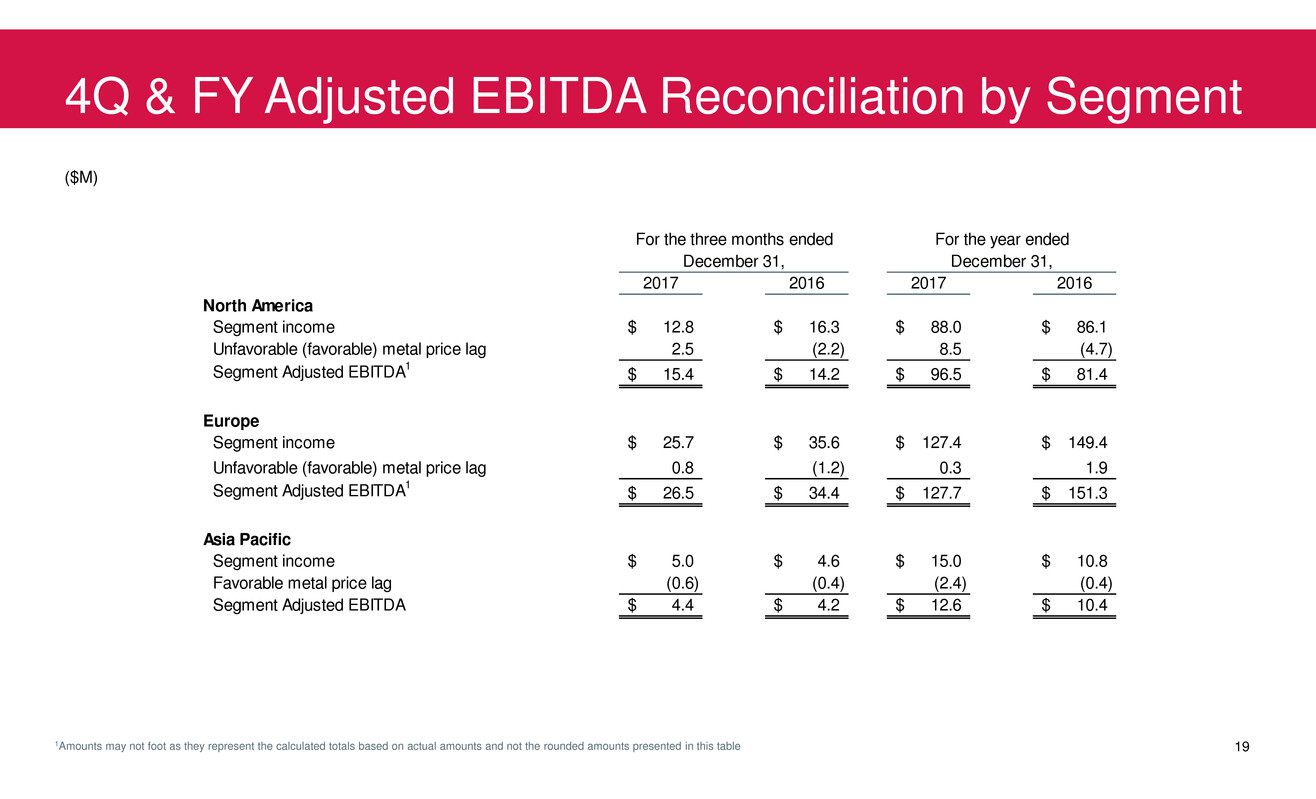

19 4Q & FY Adjusted EBITDA Reconciliation by Segment ($M) 1Amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in this table 2017 2016 2017 2016 North America Segment income 12.8$ 16.3$ 88.0$ 86.1$ Unfavorable (favorable) metal price lag 2.5 (2.2) 8.5 (4.7) Segment Adjusted EBITDA1 15.4$ 14.2$ 96.5$ 81.4$ Europe Segment income 25.7$ 35.6$ 127.4$ 149.4$ Unfavorable (favorable) metal price lag 0.8 (1.2) 0.3 1.9 Segment Adjusted EBITDA1 26.5$ 34.4$ 127.7$ 151.3$ Asia Pacific Segment income 5.0$ 4.6$ 15.0$ 10.8$ Favorable metal price lag (0.6) (0.4) (2.4) (0.4) Segment Adjusted EBITDA 4.4$ 4.2$ 12.6$ 10.4$ For the three months ended December 31, For the year ended December 31,

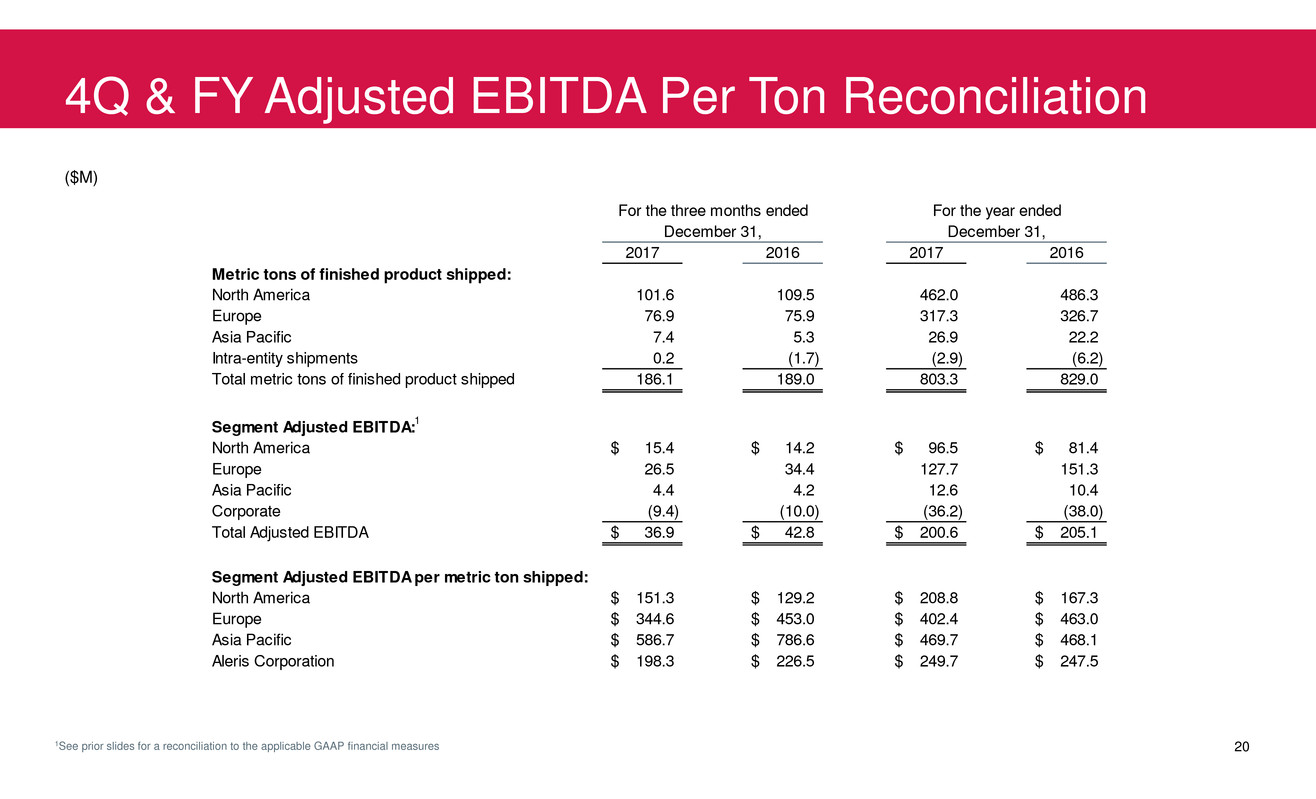

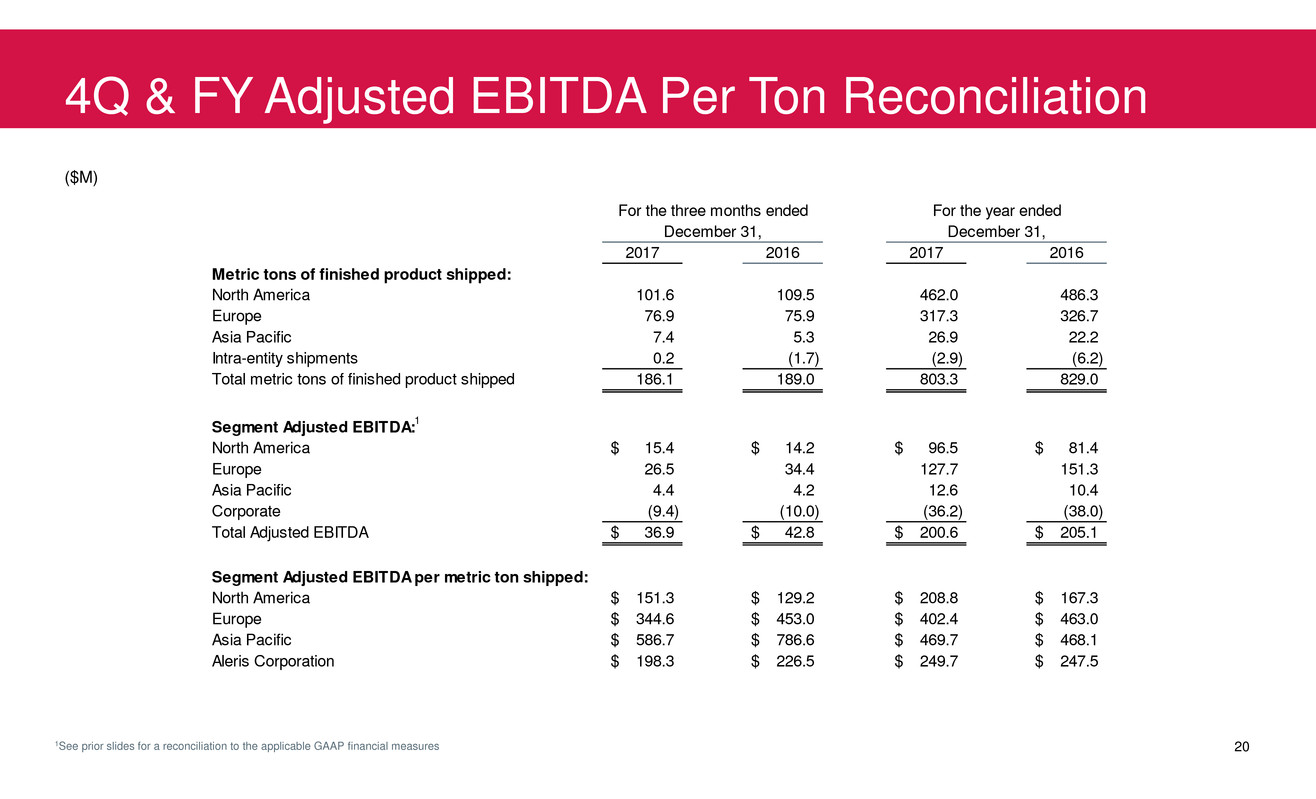

20 2017 2016 2017 2016 Metric tons of finished product shipped: North America 101.6 109.5 462.0 486.3 Europe 76.9 75.9 317.3 326.7 Asia Pacific 7.4 5.3 26.9 22.2 Intra-entity shipments 0.2 (1.7) (2.9) (6.2) Total metric tons of finished product shipped 186.1 189.0 803.3 829.0 Segment Adjusted EBITDA:1 North America 15.4$ 14.2$ 96.5$ 81.4$ Europe 26.5 34.4 127.7 151.3 Asia Pacific 4.4 4.2 12.6 10.4 Corporate (9.4) (10.0) (36.2) (38.0) Total Adjusted EBITDA 36.9$ 42.8$ 200.6$ 205.1$ Segment Adjusted EBITDA per metric ton shipped: North America 151.3$ 129.2$ 208.8$ 167.3$ Europe 344.6$ 453.0$ 402.4$ 463.0$ Asia Pacific 586.7$ 786.6$ 469.7$ 468.1$ Aleris Corporation 198.3$ 226.5$ 249.7$ 247.5$ For the three months ended December 31, For the year ended December 31, 4Q & FY Adjusted EBITDA Per Ton Reconciliation 1See prior slides for a reconciliation to the applicable GAAP financial measures ($M)

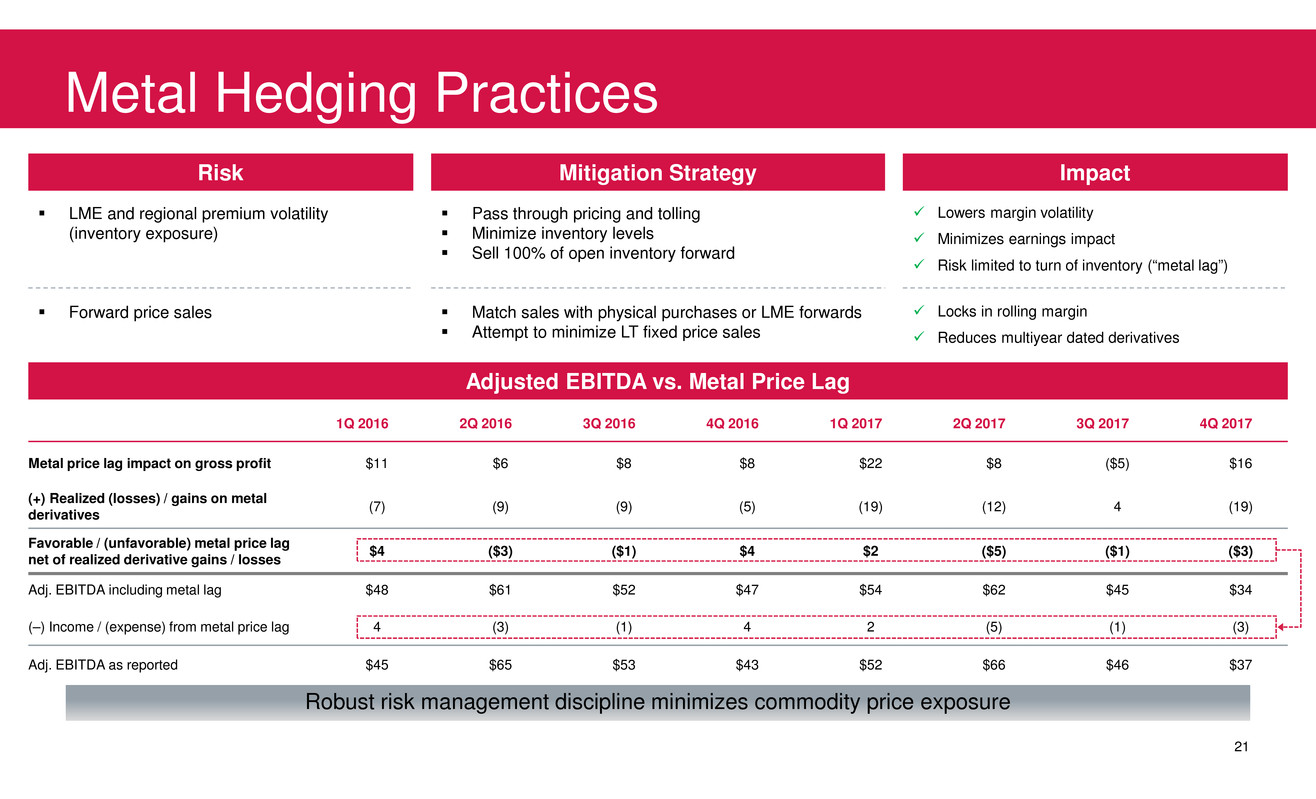

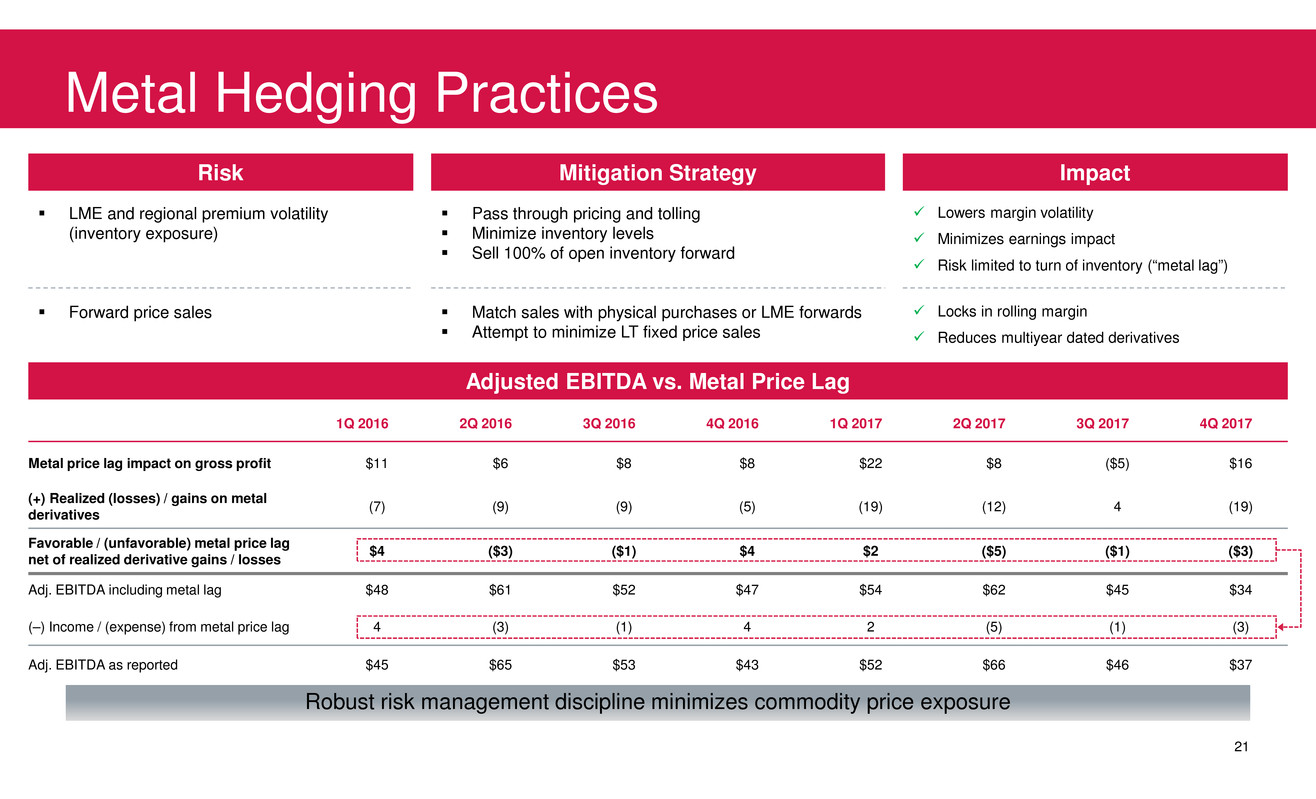

21 Metal Hedging Practices Robust risk management discipline minimizes commodity price exposure Risk Mitigation Strategy Impact � LME and regional premium volatility (inventory exposure) � Forward price sales � Pass through pricing and tolling � Minimize inventory levels � Sell 100% of open inventory forward � Match sales with physical purchases or LME forwards � Attempt to minimize LT fixed price sales � Lowers margin volatility � Minimizes earnings impact � Risk limited to turn of inventory (“metal lag”) � Locks in rolling margin � Reduces multiyear dated derivatives Adjusted EBITDA vs. Metal Price Lag 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017 4Q 2017 Metal price lag impact on gross profit $11 $6 $8 $8 $22 $8 ($5) $16 (+) Realized (losses) / gains on metal derivatives (7) (9) (9) (5) (19) (12) 4 (19) Favorable / (unfavorable) metal price lag net of realized derivative gains / losses $4 ($3) ($1) $4 $2 ($5) ($1) ($3) Adj. EBITDA including metal lag $48 $61 $52 $47 $54 $62 $45 $34 (–) Income / (expense) from metal price lag 4 (3) (1) 4 2 (5) (1) (3) Adj. EBITDA as reported $45 $65 $53 $43 $52 $66 $46 $37