Exhibit 99.1

Exhibit 99.1

Management Update – August 2012 NASDAQ:HMST

Important Disclosures

Forward-Looking Statements

We may make forward-looking statements during today’s presentation that are subject to many risks and uncertainties. These forward-looking statements are based on the Company’s current expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our 2011 annual report on form 10-K, our proxy statement and the form 8-K containing our earnings release, many of which are outside of the Company’s control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. Actual results may differ materially from those expressed or implied and there can be no assurance that estimated returns or projections will be realized or that actual returns will not be materially different than estimated herein. Accordingly you are cautioned not to place undue reliance on such forward-looking statements. All forward looking statements are based on information available to the Company as of the date hereof and the Company assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward looking statements, for any reason.

Basis of Presentation of Financial Data

Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending June 30, 2012.

Non-GAAP Financial Measures

Information on any non-GAAP financial measures referenced in today’s presentation, including a reconciliation of those measures to GAAP measures, may also be found in our SEC filings and in the earnings release available on our web site.

2

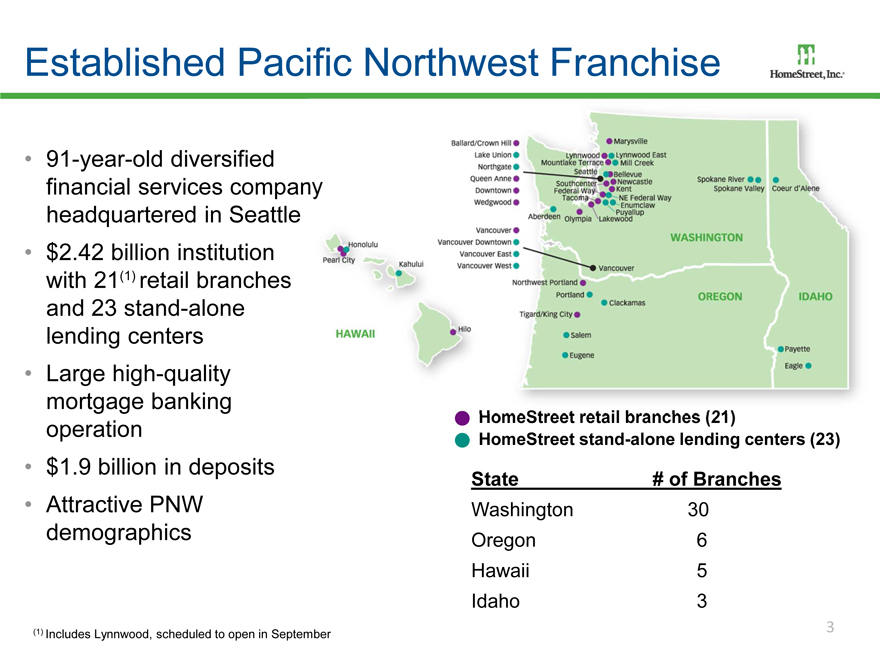

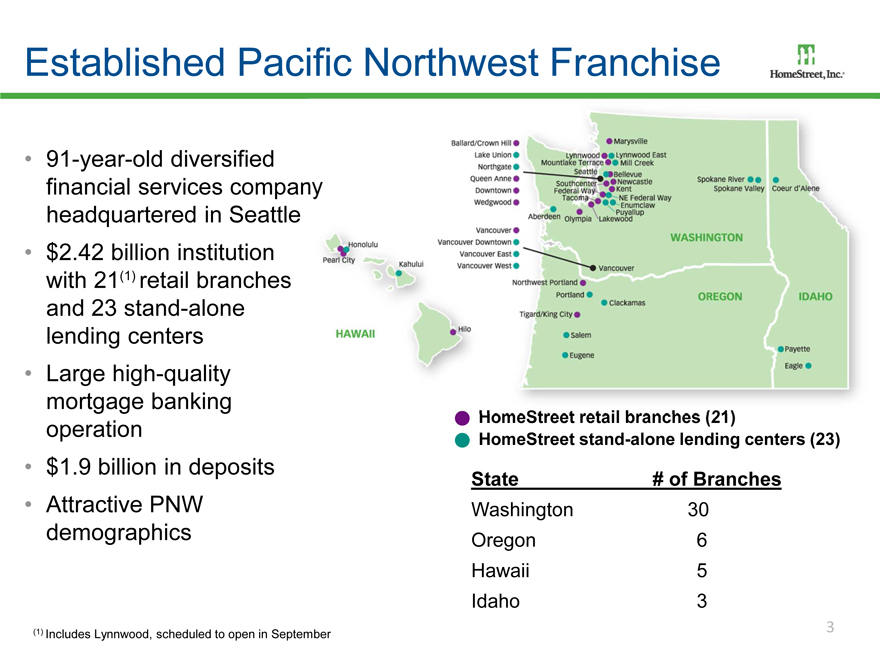

Established Pacific Northwest Franchise

91-year-old diversified financial services company headquartered in Seattle

$2.42 billion institution with 21(1) retail branches and 23 stand-alone lending centers

Large high-quality mortgage banking operation

$1.9 billion in deposits

Attractive PNW demographics

HomeStreet retail branches (21)

HomeStreet stand-alone lending centers (23)

State # of Branches

Washington 30

Oregon 6

Hawaii 5

Idaho 3

(1) | | Includes Lynnwood, scheduled to open in September |

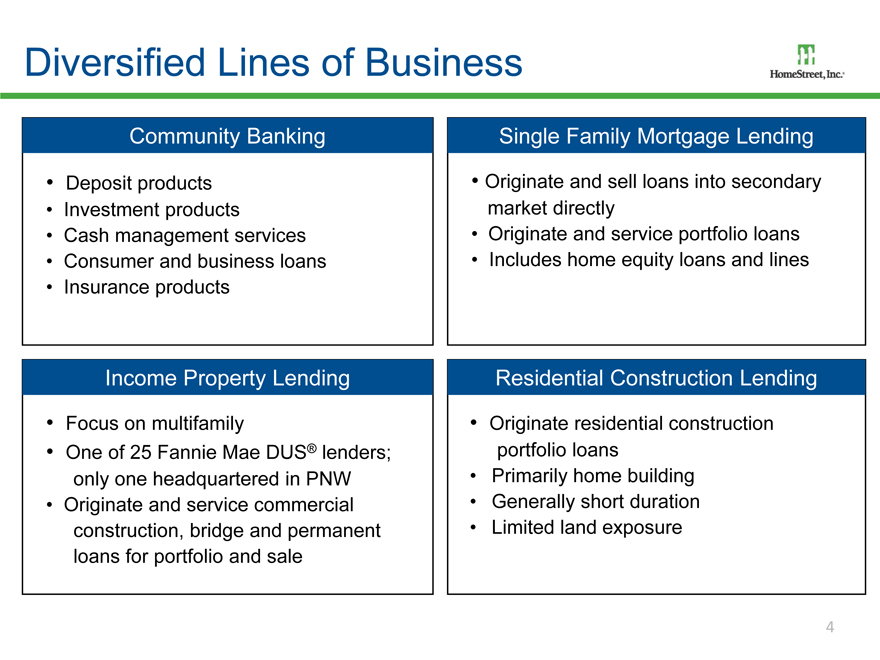

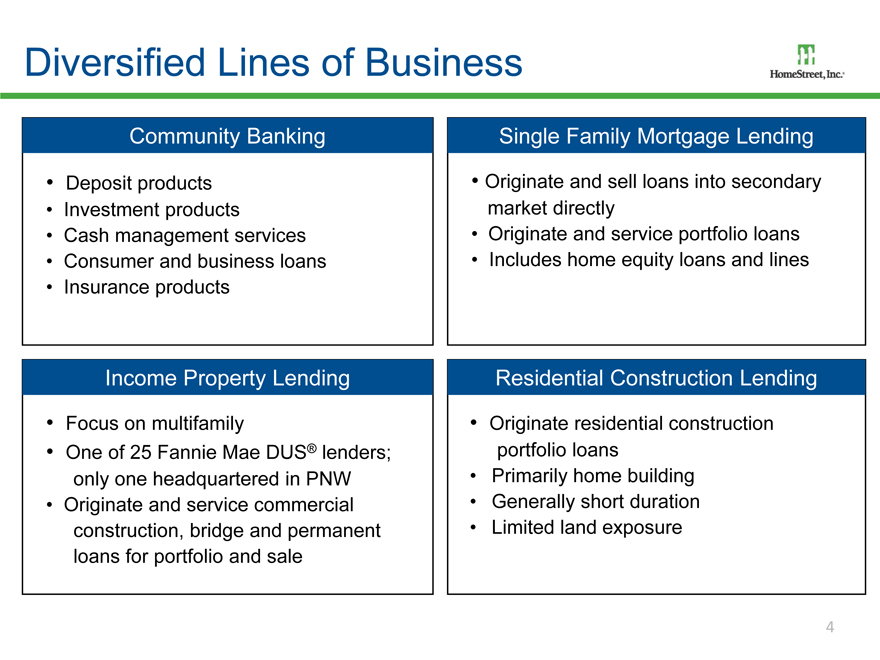

Diversified Lines of Business

Community Banking Single Family Mortgage Lending

Deposit products Originate and sell loans into secondary

Investment products market directly

Cash management services Originate and service portfolio loans

Consumer and business loans Includes home equity loans and lines

Insurance products

Income Property Lending Residential Construction Lending

Focus on multifamily Originate residential construction

One of 25 Fannie Mae DUS® lenders; portfolio loans

only one headquartered in PNW Primarily home building

Originate and service commercial Generally short duration

construction, bridge and permanent Limited land exposure

loans for portfolio and sale

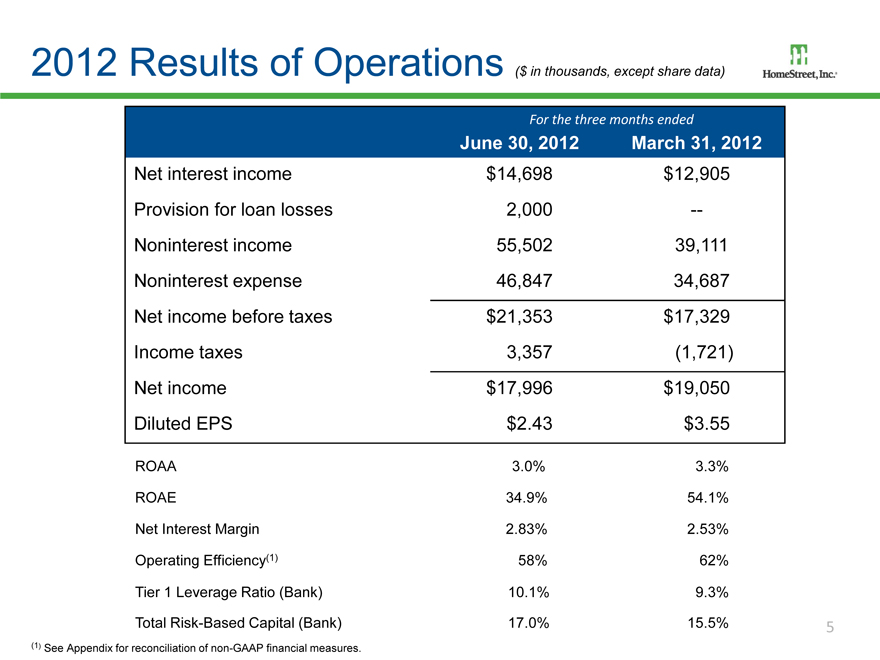

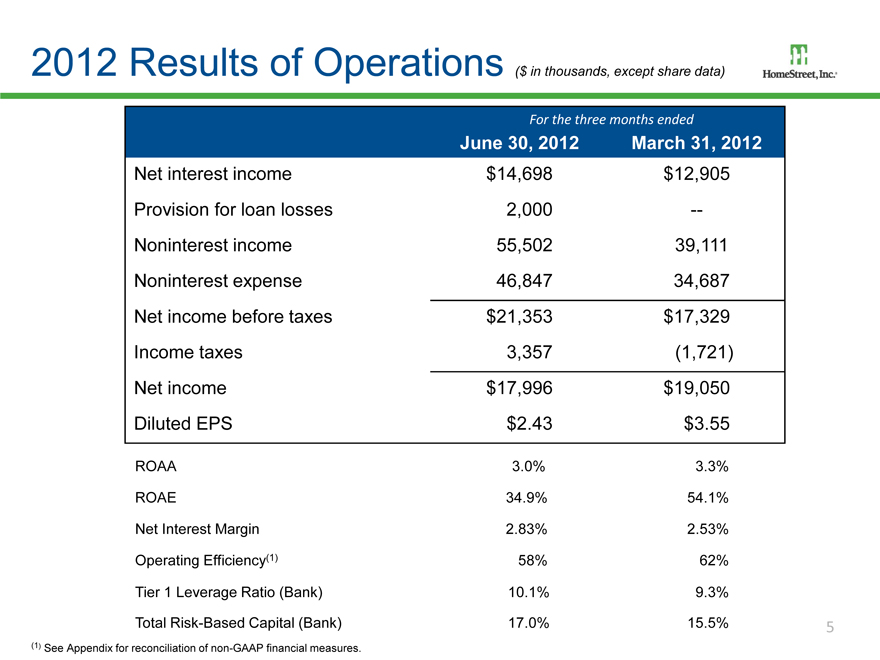

2012 Results of Operations ($ in thousands, except share data)

For the three months ended

June 30, 2012 March 31, 2012

Net interest income $14,698 $12,905

Provision for loan losses 2,000 —

Noninterest income 55,502 39,111

Noninterest expense 46,847 34,687

Net income before taxes $21,353 $17,329

Income taxes 3,357 (1,721)

Net income $17,996 $19,050

Diluted EPS $2.43 $3.55

ROAA 3.0% 3.3%

ROAE 34.9% 54.1%

Net Interest Margin 2.83% 2.53%

Operating Efficiency(1) 58% 62%

Tier 1 Leverage Ratio (Bank) 10.1% 9.3%

Total Risk-Based Capital (Bank) 17.0% 15.5%

(1) | | See Appendix for reconciliation of non-GAAP financial measures. |

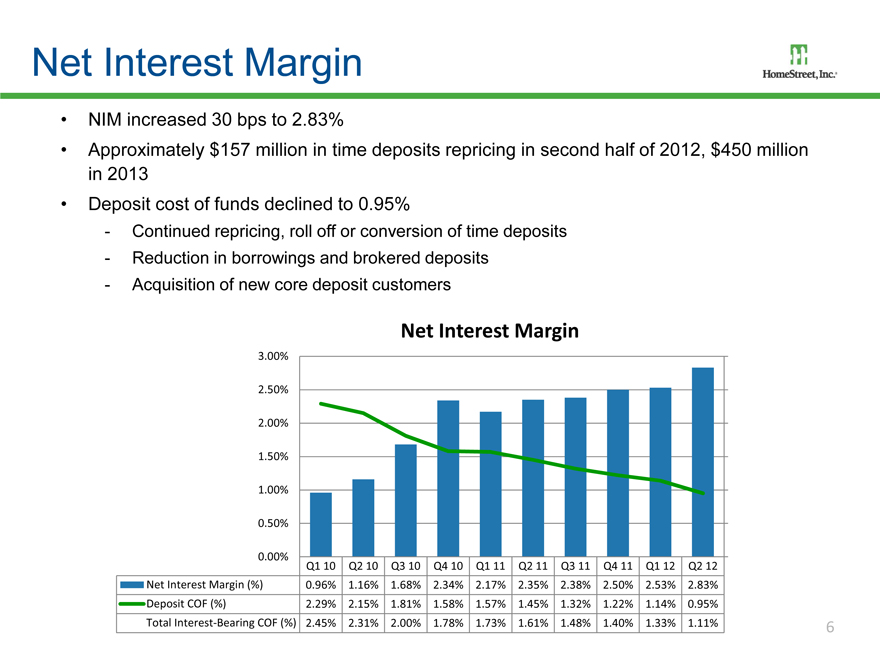

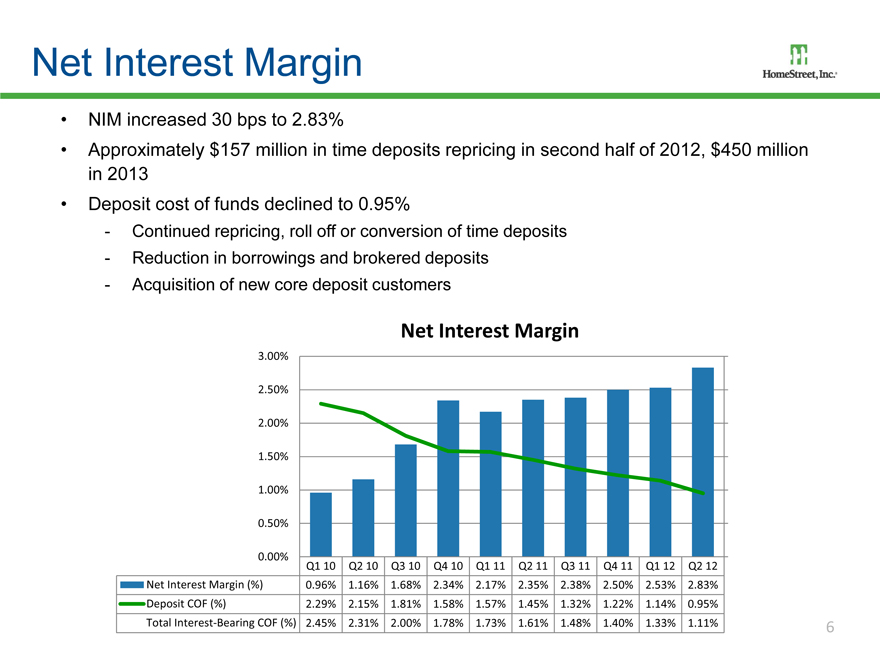

Net Interest Margin

NIM increased 30 bps to 2.83%

Approximately $157 million in time deposits repricing in second half of 2012, $450 million in 2013

Deposit cost of funds declined to 0.95%

- Continued repricing, roll off or conversion of time deposits

- Reduction in borrowings and brokered deposits

- Acquisition of new core deposit customers

Net Interest Margin

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

Net Interest Margin (%) 0.96% 1.16% 1.68% 2.34% 2.17% 2.35% 2.38% 2.50% 2.53% 2.83%

Deposit COF (%) 2.29% 2.15% 1.81% 1.58% 1.57% 1.45% 1.32% 1.22% 1.14% 0.95%

Total Interest-Bearing COF (%) 2.45% 2.31% 2.00% 1.78% 1.73% 1.61% 1.48% 1.40% 1.33% 1.11%

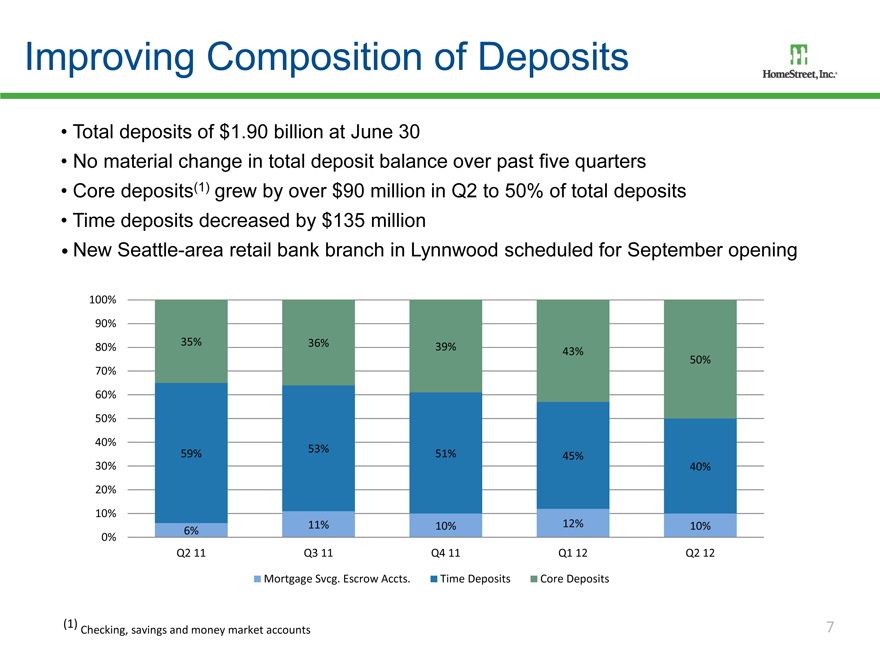

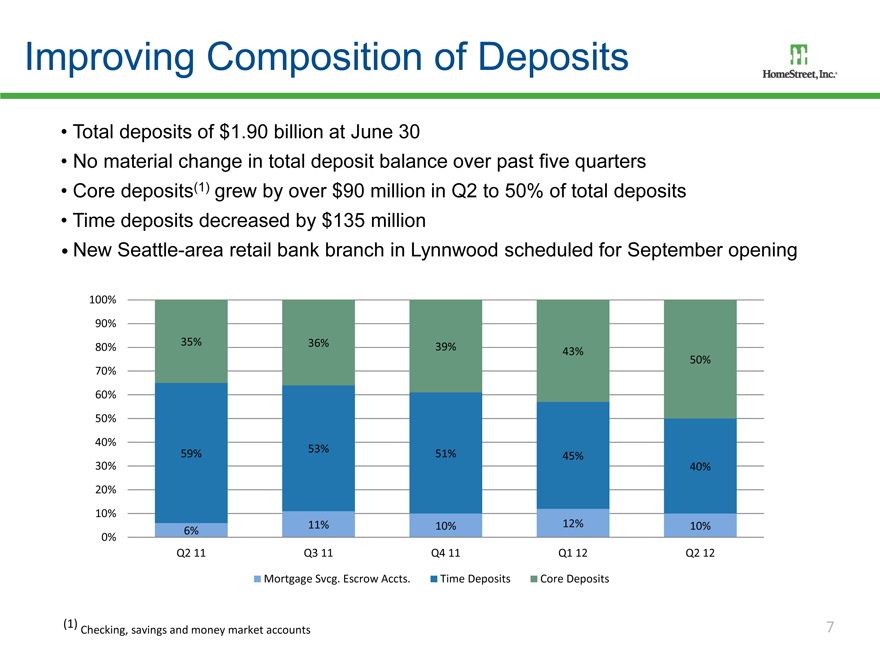

Improving Composition of Deposits

Total deposits of $1.90 billion at June 30

No material change in total deposit balance over past five quarters Core deposits(1) grew by over $90 million in Q2 to 50% of total deposits Time deposits decreased by $135 million

New Seattle-area retail bank branch in Lynnwood scheduled for September opening

100%

90%

80% 35% 36% 39%

43%

50%

70%

60%

50%

40% 53%

59% 51% 45%

30% 40%

20%

10%

6% 11% 10% 12% 10%

0%

Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

Mortgage Svcg. Escrow Accts. Time Deposits Core Deposits

Checking, savings and money market accounts

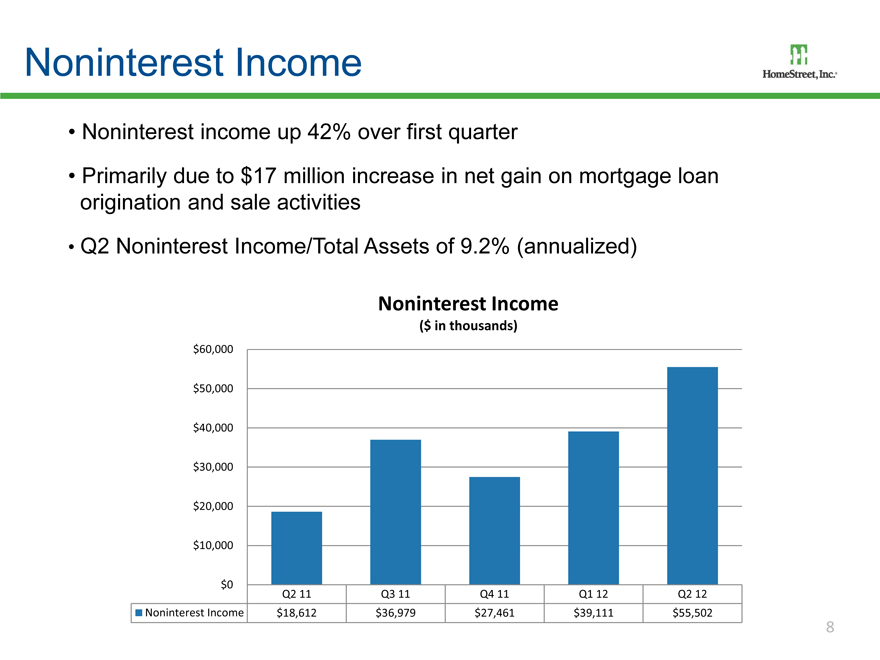

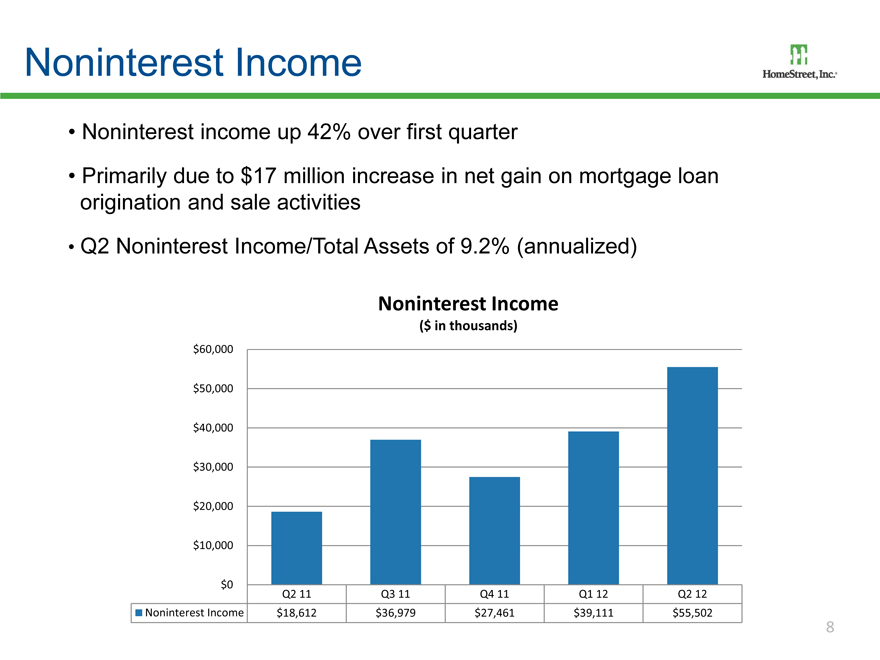

Noninterest Income

Noninterest income up 42% over first quarter

Primarily due to $17 million increase in net gain on mortgage loan origination and sale activities

Q2 Noninterest Income/Total Assets of 9.2% (annualized)

Noninterest Income

($ in thousands)

$60,000

$50,000

$40,000

$30,000

$20,000

$10,000

$0

Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

Noninterest Income $18,612 $36,979 $27,461 $39,111 $55,502

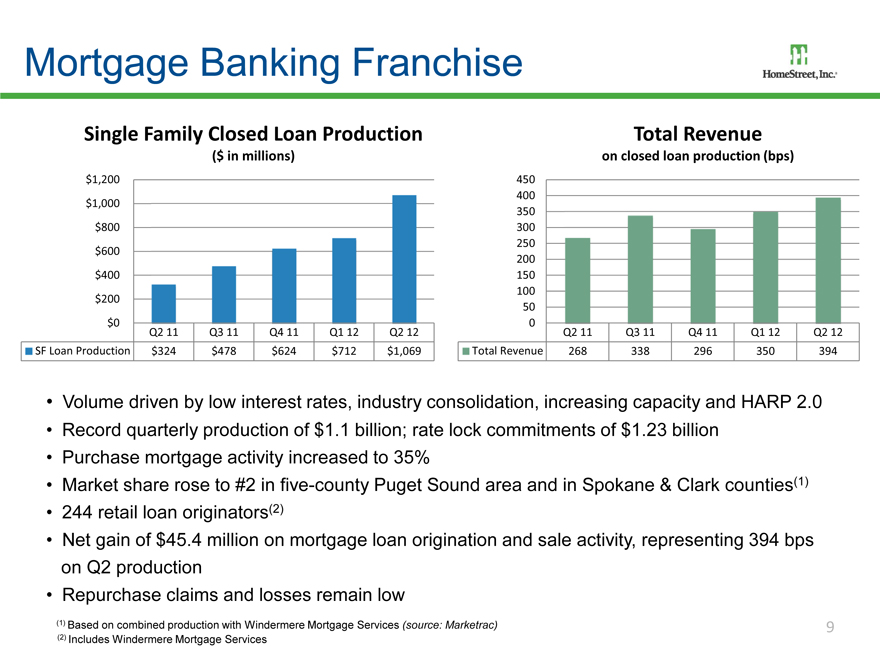

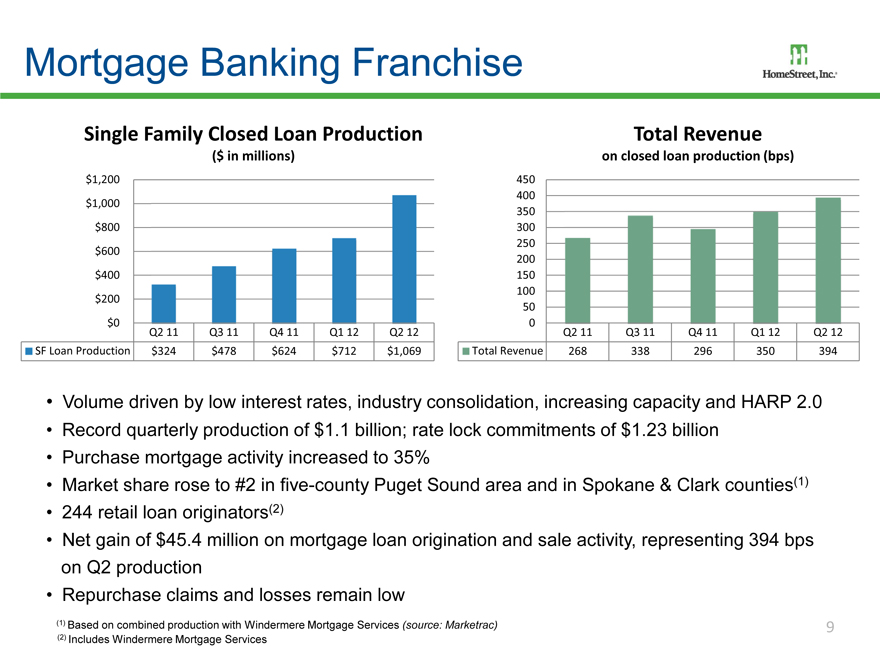

Mortgage Banking Franchise

Single Family Closed Loan Production

($ in millions)

$1,200

$1,000

$800

$600

$400

$200

$0

Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

SF Loan Production $324 $478 $624 $712 $1,069

Total Revenue

on closed loan production (bps)

450

400

350

300

250

200

150

100

50

0

Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

Total Revenue 268 338 296 350 394

Volume driven by low interest rates, industry consolidation, increasing capacity and HARP 2.0 Record quarterly production of $1.1 billion; rate lock commitments of $1.23 billion Purchase mortgage activity increased to 35% Market share rose to #2 in five-county Puget Sound area and in Spokane & Clark counties(1) 244 retail loan originators(2) Net gain of $45.4 million on mortgage loan origination and sale activity, representing 394 bps on Q2 production Repurchase claims and losses remain low

(1) | | Based on combined production with Windermere Mortgage Services (source: Marketrac) |

(2) | | Includes Windermere Mortgage Services |

9

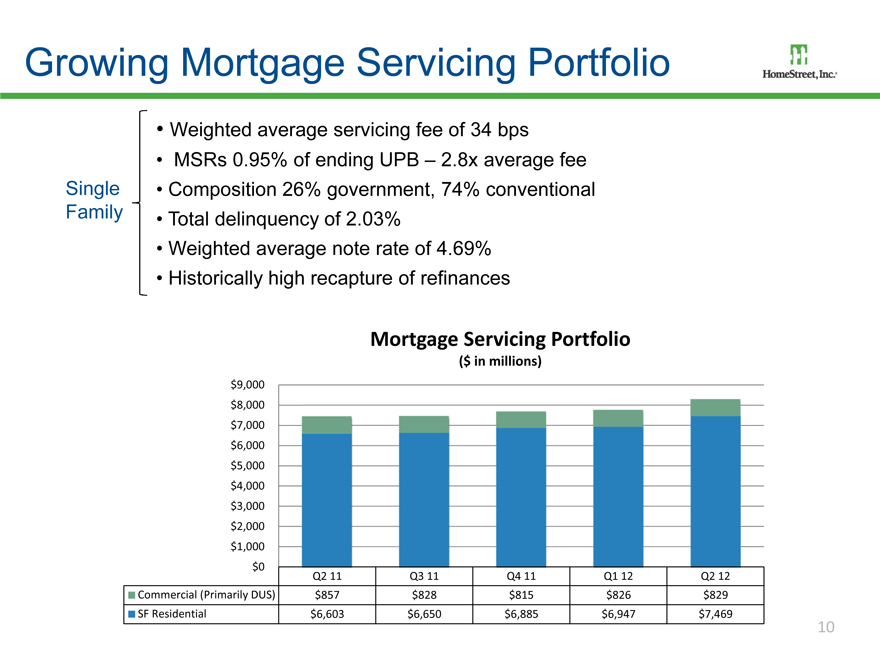

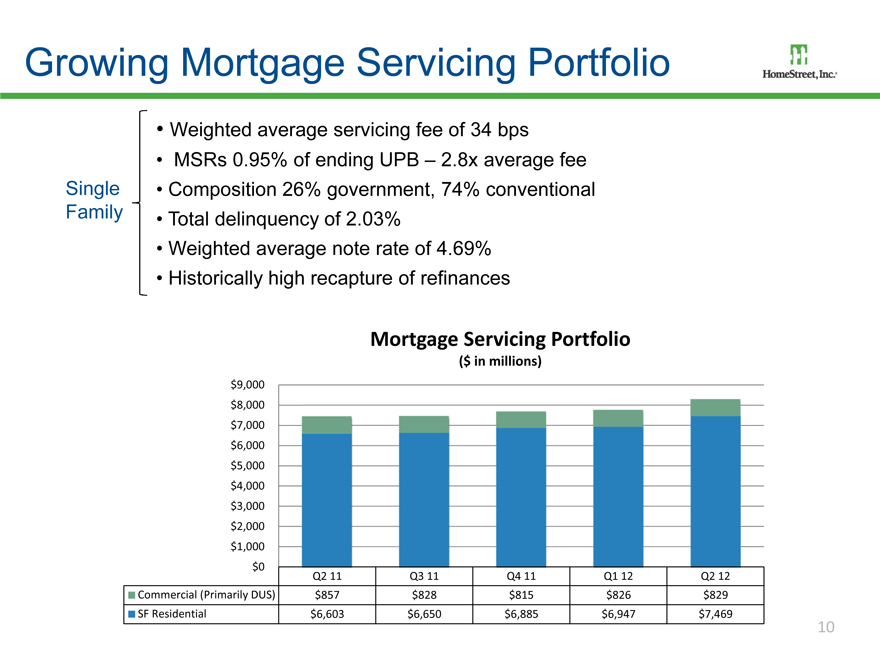

Growing Mortgage Servicing Portfolio

Weighted average servicing fee of 34 bps

MSRs 0.95% of ending UPB – 2.8x average fee Single Composition 26% government, 74% conventional Family

Total delinquency of 2.03%

Weighted average note rate of 4.69%

Historically high recapture of refinances

Mortgage Servicing Portfolio

($ in millions)

$9,000

$8,000

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

Commercial (Primarily DUS) $857 $828 $815 $826 $829

SF Residential $6,603 $6,650 $6,885 $6,947 $7,469

10

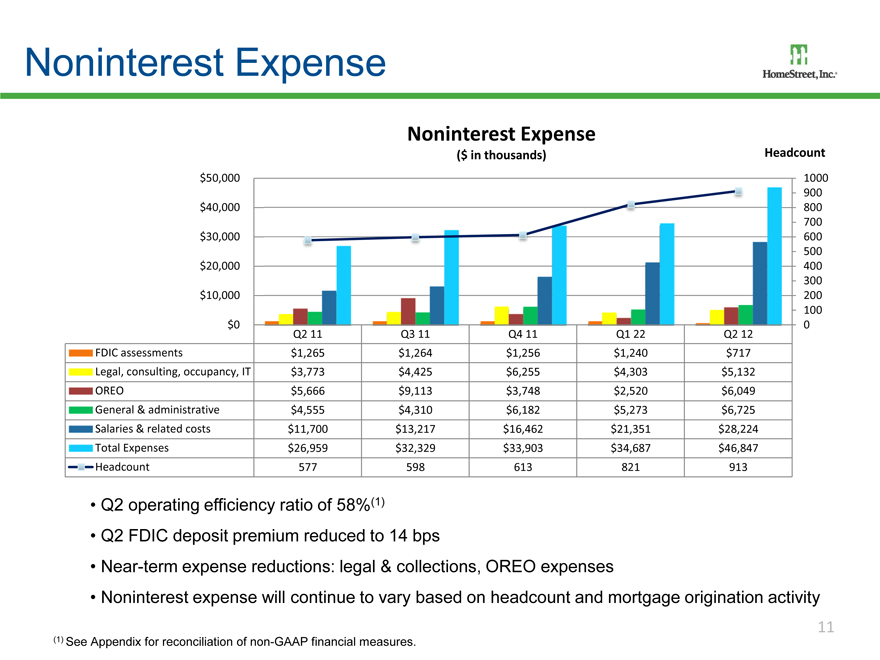

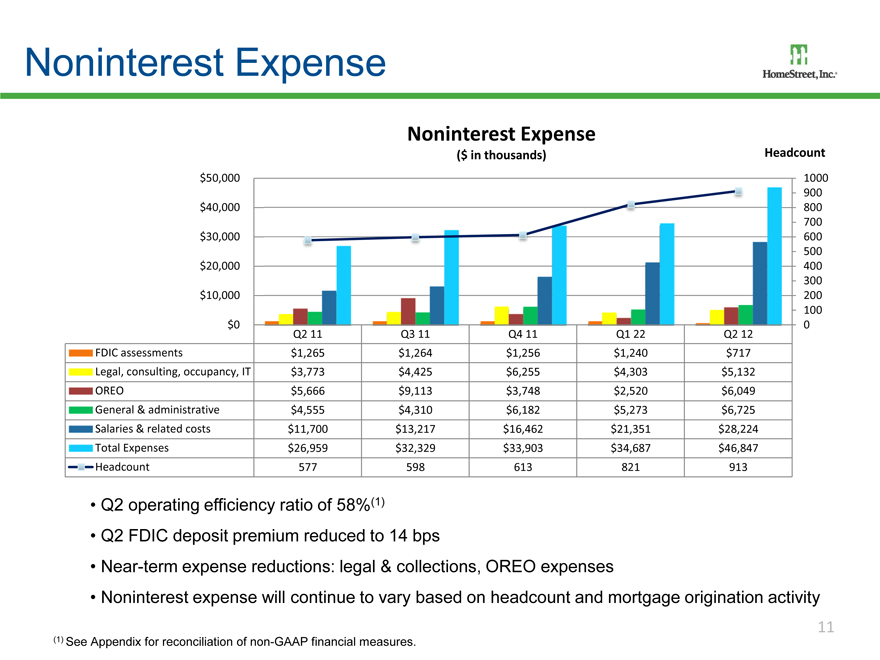

Noninterest Expense

Noninterest Expense

($ in thousands) Headcount

$50,000 1000

900

$40,000 800

700

$30,000 600

500

$20,000 400

300

$10,000 200

100

$0 0

Q2 11 Q3 11 Q4 11 Q1 22 Q2 12

FDIC assessments $1,265 $1,264 $1,256 $1,240 $717

Legal, consulting, occupancy, IT $3,773 $4,425 $6,255 $4,303 $5,132

OREO $5,666 $9,113 $3,748 $2,520 $6,049

General & administrative $4,555 $4,310 $6,182 $5,273 $6,725

Salaries & related costs $11,700 $13,217 $16,462 $21,351 $28,224

Total Expenses $26,959 $32,329 $33,903 $34,687 $46,847

Headcount 577 598 613 821 913

Q2 operating efficiency ratio of 58%(1)

Q2 FDIC deposit premium reduced to 14 bps

Near-term expense reductions: legal & collections, OREO expenses

Noninterest expense will continue to vary based on headcount and mortgage origination activity

(1) | | See Appendix for reconciliation of non-GAAP financial measures. |

11

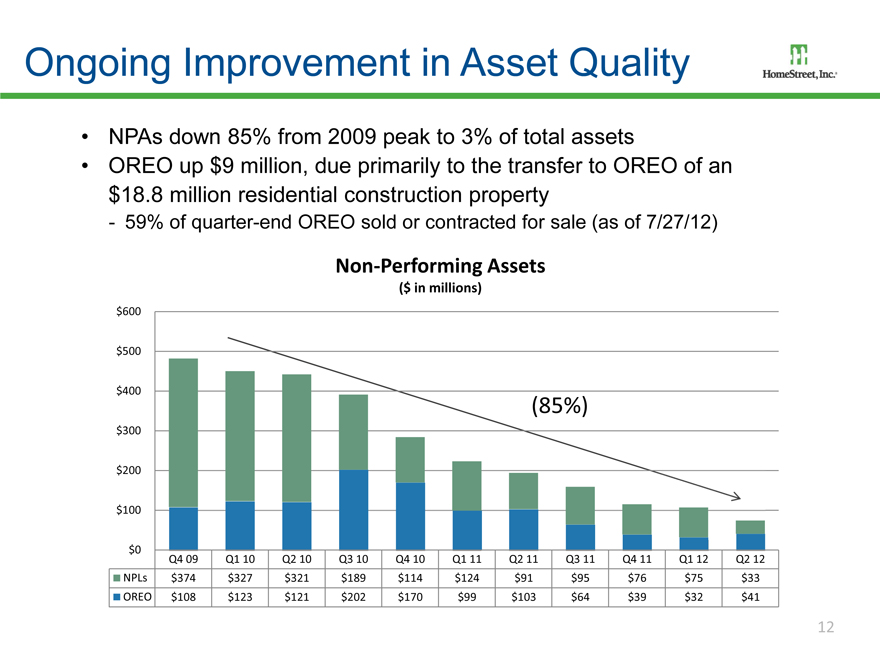

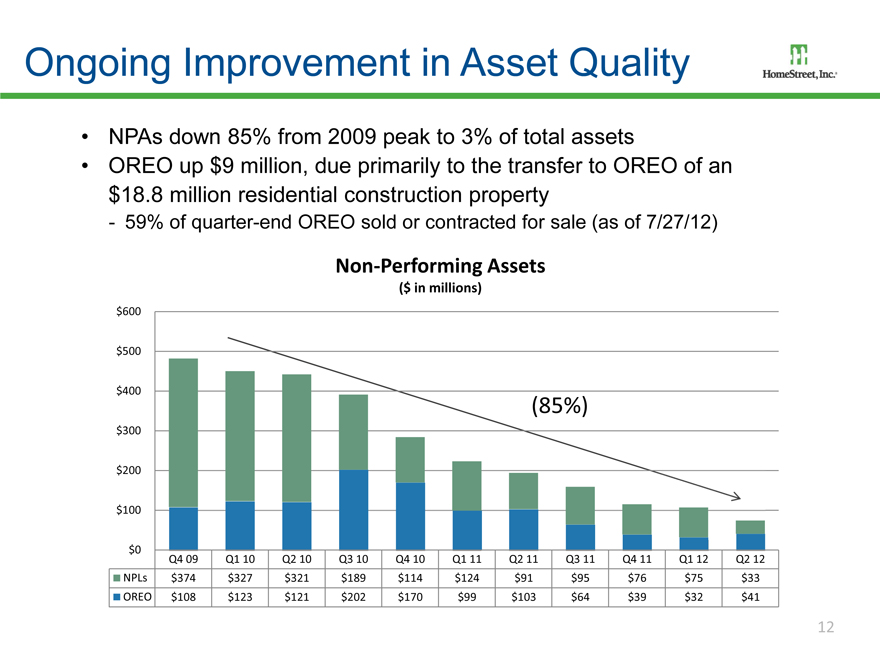

Ongoing Improvement in Asset Quality

NPAs down 85% from 2009 peak to 3% of total assets

OREO up $9 million, due primarily to the transfer to OREO of an $18.8 million residential construction property

- 59% of quarter-end OREO sold or contracted for sale (as of 7/27/12)

Non-Performing Assets

($ in millions)

$600

$500

$400

(85%)

$300

$200

$100

$0

Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12

NPLs $374 $327 $321 $189 $114 $124 $91 $95 $76 $75 $33

OREO $108 $123 $121 $202 $170 $99 $103 $64 $39 $32 $41

12

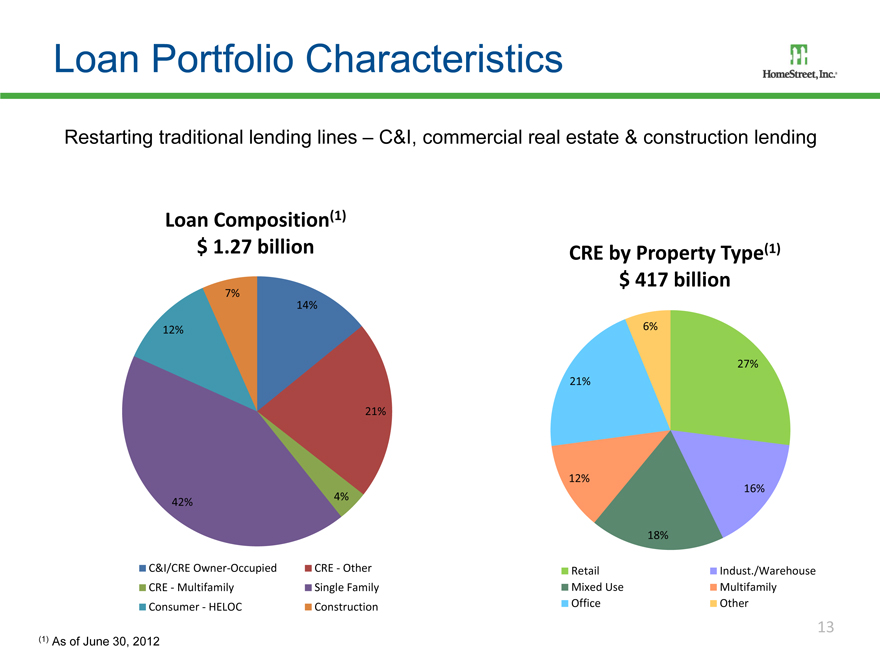

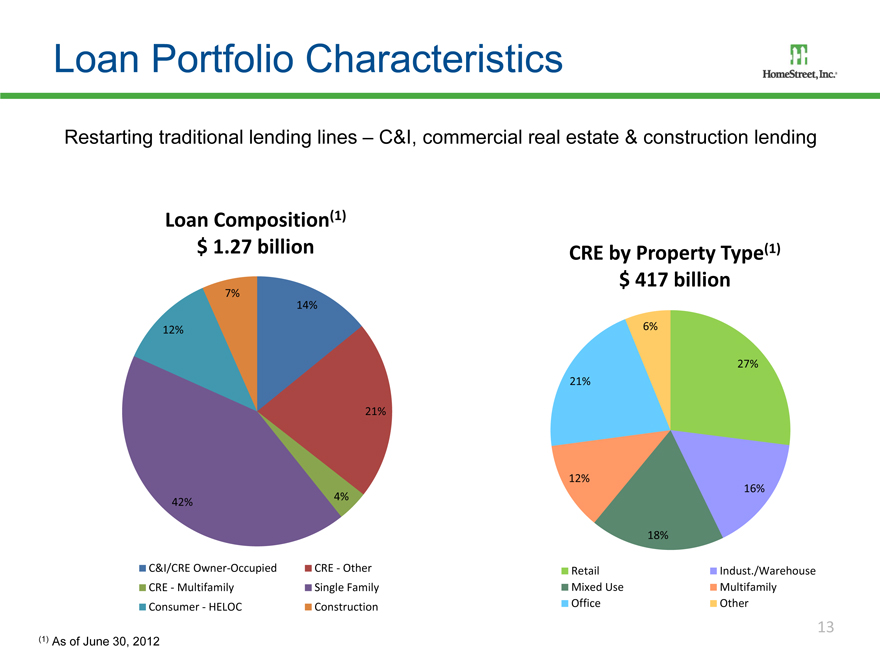

Loan Portfolio Characteristics

Restarting traditional lending lines – C&I, commercial real estate & construction lending

Loan Composition(1)

$ 1.27 billion

7%

14%

12%

21%

42% 4%

C&I/CRE Owner-Occupied CRE—Other

CRE—Multifamily Single Family

Consumer—HELOC Construction

CRE by Property Type(1)

$ 417 billion

6%

27%

21%

12%

16%

18%

Retail Indust./Warehouse

Mixed Use Multifamily

Office Other

13

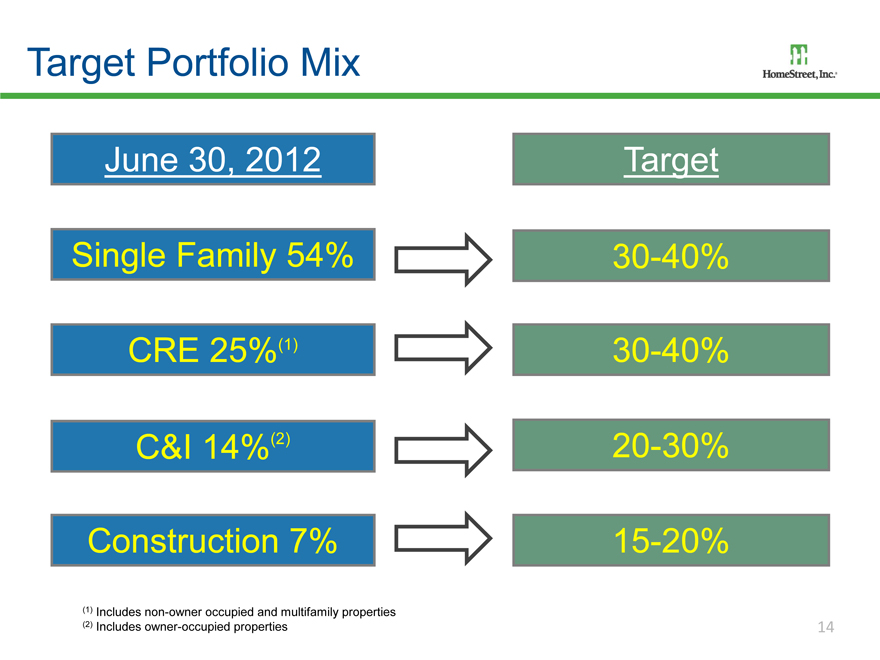

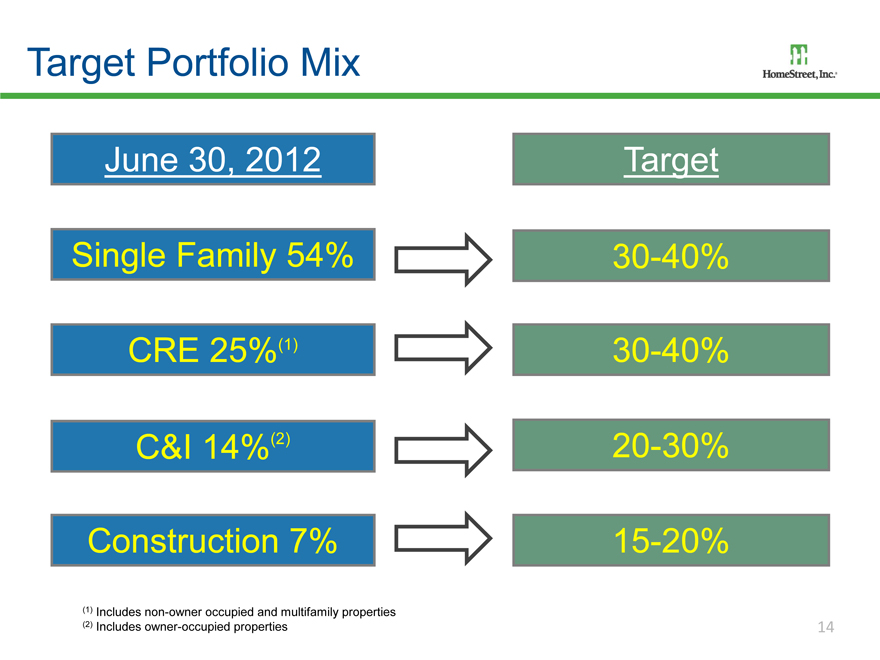

Target Portfolio Mix

June 30, 2012 Target

Single Family 54% 30-40%

CRE 25%(1) 30-40%

C&I 14%(2) 20-30%

Construction 7% 15-20%

(1) | | Includes non-owner occupied and multifamily properties |

(2) | | Includes owner-occupied properties |

14

Long-Term Growth Strategies

Our objective: to be the trusted provider and preferred source of financial services for our clients

Diversify revenue to grow non-mortgage banking revenue:

??Organic growth opportunities driven by attractive market demographics

Expand commercial and consumer banking activities

- Commercial: lending, cash management, insurance

- Consumer: mortgage loans, deposits, investments, insurance

Expand multifamily mortgage banking, primarily through Fannie Mae DUS® program

Expand traditional portfolio lending – C&I, Commercial Real Estate and Construction

Potential growth through acquisition of smaller in-market and near-market institutions

Continue opportunistic expansion of Single Family mortgage banking activities

15

Why Invest in HomeStreet?

Established and expanding community bank with strong ties in the Pacific Northwest and Hawaii

Significant improvement in credit quality with completion in sight

Leading regional Single Family mortgage lender, and only Fannie Mae DUS Multifamily lender headquartered in the Northwest

Focus on growth of community banking and traditional portfolio lending business lines to balance mortgage banking revenue

Superior returns on equity due to high noninterest income

16

Appendix

17

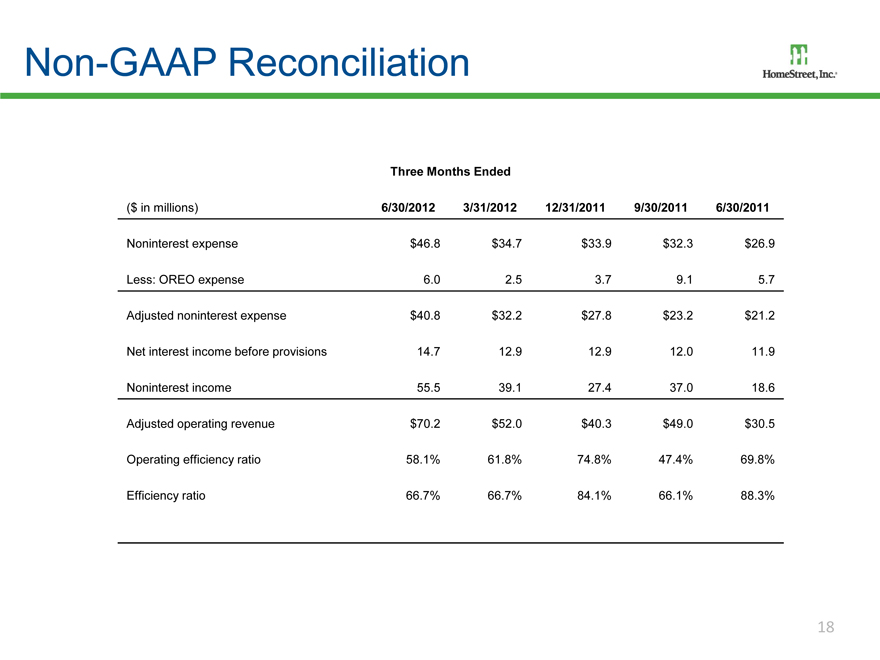

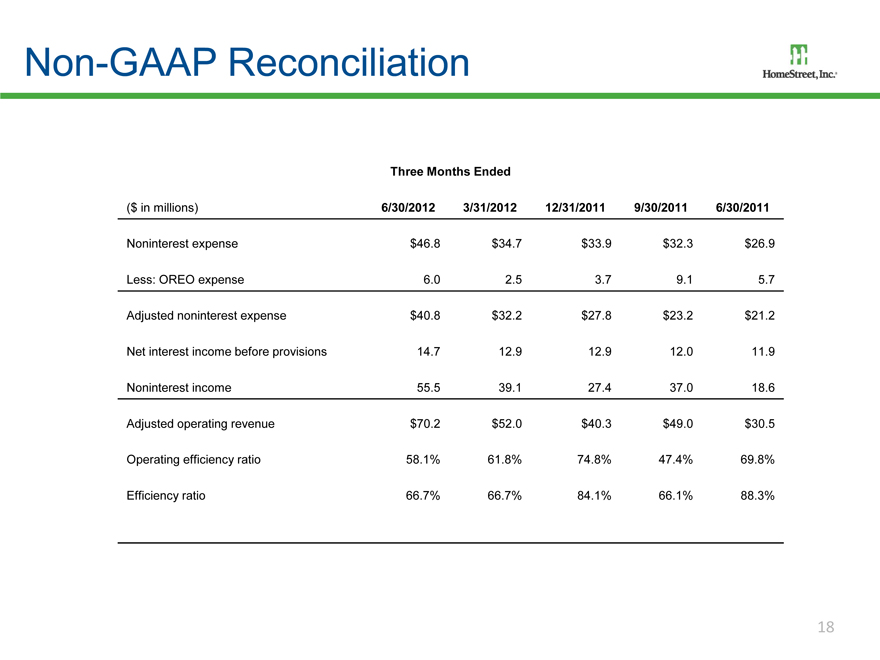

Non-GAAP Reconciliation

Three Months Ended

($ in millions) 6/30/2012 3/31/2012 12/31/2011 9/30/2011 6/30/2011

Noninterest expense $46.8 $34.7 $33.9 $32.3 $26.9

Less: OREO expense 6.0 2.5 3.7 9.1 5.7

Adjusted noninterest expense $40.8 $32.2 $27.8 $23.2 $21.2

Net interest income before provisions 14.7 12.9 12.9 12.0 11.9

Noninterest income 55.5 39.1 27.4 37.0 18.6

Adjusted operating revenue $70.2 $52.0 $40.3 $49.0 $30.5

Operating efficiency ratio 58.1% 61.8% 74.8% 47.4% 69.8%

Efficiency ratio 66.7% 66.7% 84.1% 66.1% 88.3%

18