Nasdaq: HMST 3rd Quarter 2024 October 29, 2024

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our proposed merger (the “Merger”) with FirstSun Capital Bancorp, Inc. (“FirstSun”), our industry, our future financial performance, business plans and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, and related to future plans and strategies, anticipated events, outcomes, or trends, as well as a number of assumptions concerning future events, are not historical facts and are identified by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will,” “would” and similar expressions. Forward-looking statements in this presentation include, among other matters, statements regarding anticipated timing to complete the proposed Merger, anticipated expenses of the Merger, our business plans and strategies, general economic trends, strategic initiatives we have announced, growth scenarios and performance targets and key drivers guidance with respect to loans held for investment, average deposits, net interest margin, noninterest income and noninterest expense. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Annual Report on Form 10-K for the year ended December 31, 2023 as amended by our annual report on Form10-K/A filed on April 29, 2024, and in our subsequent quarterly reports on Form 10-Q and current reports on Form 8-K. Many of these factors and events and their impact on the volatility in our stock price and shareholders’ response to those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include, without limitation, our ability to successfully consummate the Merger with FirstSun, the ability of HomeStreet and FirstSun to obtain required governmental approvals of the Merger, the failure to satisfy the closing conditions in the definitive Agreement and Plan of Merger (the “Merger Agreement”), dated as of January 16, 2024, as amended on April 30, 2024, by and between HomeStreet and FirstSun, or any unexpected delay in closing the Merger, the ability to achieve expected cost savings, synergies and other financial benefits from the Merger within the expected time frames and costs or difficulties relating to integration matters being greater than expected, the diversion of management time from core banking functions due to Merger-related issues; potential difficulty in maintaining relationships with customers, associates or business partners as a result of the announced Merger, changes in the U.S. and global economies, including business disruptions, reductions in employment, inflationary pressures and an increase in business failures, specifically among our customers; changes in the interest rate environment margins; changes in deposit flows, loan demand or real estate values may adversely affect the business of the Bank, through which substantially all of our operations are carried out; there may be increases in competitive pressure among financial institutions or from non-financial institutions; our ability to attract and retain key members of our senior management team; the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control; our ability to control operating costs and expenses; our credit quality and the effect of credit quality on our credit losses expense and allowance for credit losses; the adequacy of our allowance for credit losses; changes in accounting principles, policies or guidelines may cause our financial condition to be perceived or interpreted differently; legislative or regulatory changes that may adversely affect our business or financial condition, including, without limitation, changes in corporate and/or individual income tax laws and policies, changes in privacy laws, and changes in regulatory capital or other rules, and the availability of resources to address or respond to such changes; general economic conditions, either nationally or locally in some or all areas in which we conduct business, or conditions in the securities markets or banking industry, may be less favorable than what we currently anticipate; challenges our customers may face in meeting current underwriting standards may adversely impact all or a substantial portion of the value of our rate-lock loan activity we recognize; technological changes may be more difficult or expensive than what we anticipate; a failure in or breach of our operational or security systems or information technology infrastructure, or those of our third-party providers and vendors, including due to cyber-attacks; success or consummation of new business initiatives may be more difficult or expensive than what we anticipate; our ability to grow efficiently both organically and through acquisitions and to manage our growth and integration costs; staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated charges; litigation, investigations or other matters before regulatory agencies, whether currently existing or commencing in the future, may delay the occurrence or non-occurrence of events longer than what we anticipate; and our ability to obtain regulatory approvals or non-objection to take various capital actions, including the payment of dividends by us or the Bank, or repurchases of our common stock. Actual results may fall materially short of our expectations and projections, and we may be unable to execute on our strategic initiatives, or we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to us as of the date hereof, and we do not undertake to update or revise any forward-looking statements for any reason. As used in this presentation, "HMST," "HomeStreet," the "Company," "we," "us," "our," or similar references refer to HomeStreet, Inc., a Washington corporation, and its consolidated subsidiary, HomeStreet Bank (the "Bank"). Non-GAAP Financial Measures This presentation contains supplemental financial information determined by methods other than in accordance with U.S. generally accepted accounting principles ("GAAP"). Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in the appendix, our SEC filings, and in the earnings release available on our web site. p. 1

Highlights and Developments p. 2 Quarterly Results • Net loss of $7.3 million, or $0.39 per share • Net interest margin of 1.33% • Loans held for investment decreased by $46 million • Excluding broker deposits, total deposits increased $111 million to $5.7 billion • Uninsured deposits were $509 million as of September 30, 2024 (8% of total deposits) • Nonperforming assets to total assets 0.47% on September 30, 2024 • Book value per share of $28.55 on September 30, 2024 Decreasing interest rates positively impact HomeStreet’s results of operations and valuation (1) See appendix for reconciliation of non-GAAP financial measures. Strategic Matters • HomeStreet was notified that regulatory approvals necessary for the merger with FSUN to proceed have not been obtained and FSUN has been asked to withdraw their applications. • Strategic transactions under consideration in the event a proposed merger with FSUN is infeasible.: • Sale of $800 million of multifamily loans • No additional capital needed to support loan sale • Proceeds used to pay off higher cost wholesale funding • Expected impact includes acceleration of return to profitability, reduced loan to deposit ratio, improved liquidity, and reductions in commercial real estate concentration and noncore funding dependency. • Ability to improve results of operations in the near term and pursue other strategic opportunities has improved significantly since we agreed to the proposed merger with FirstSun last January. Expected impact of decreasing interest rates • Reduction in funding costs and increase in interest margin in the fourth quarter and beyond • Tangible book value per share increased to $28.13(1) on September 30, 2024 • Improvement in fair value of Company. Estimated tangible fair value per share has increased to $18.52(1) on September 30, 2024

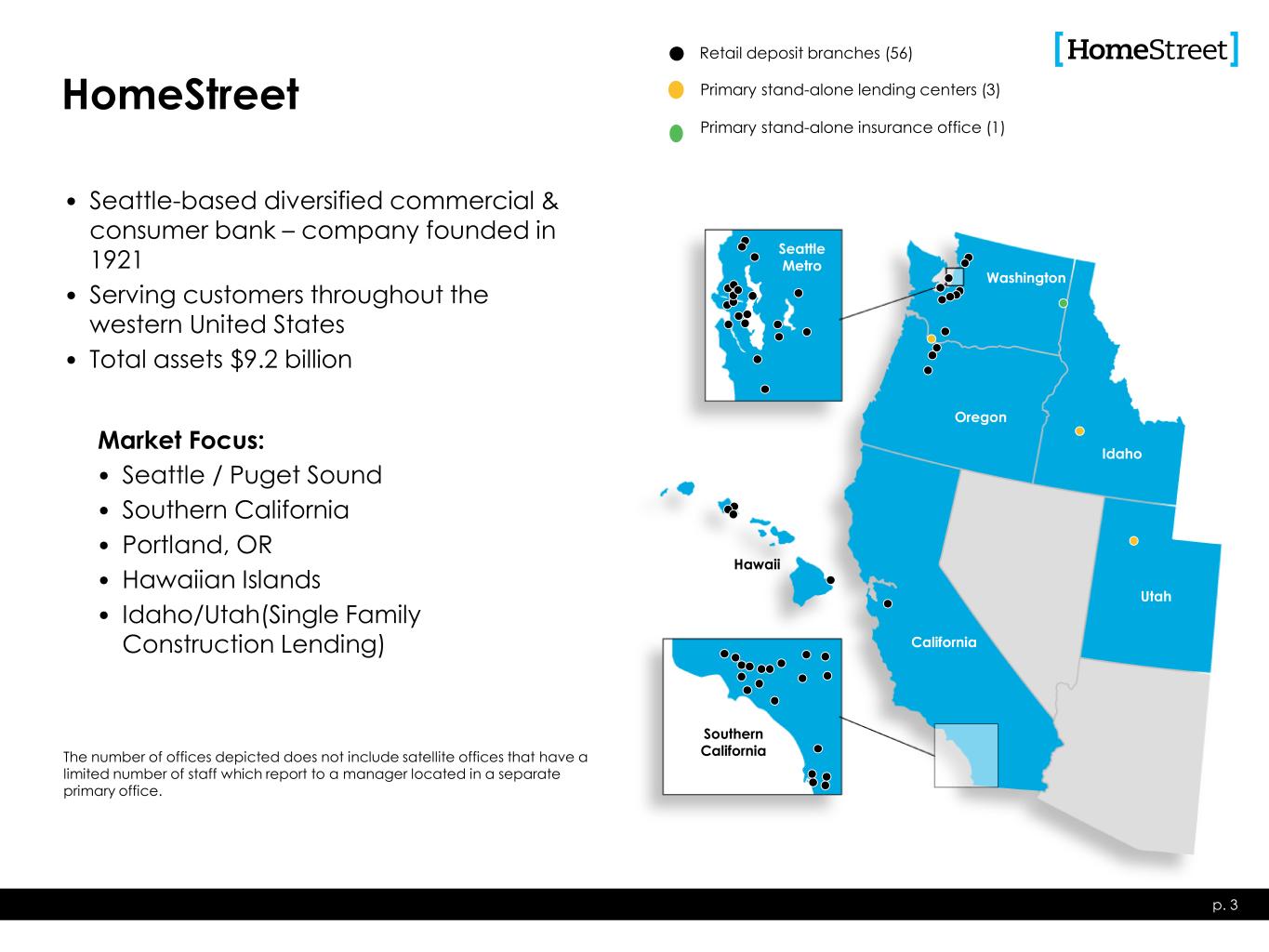

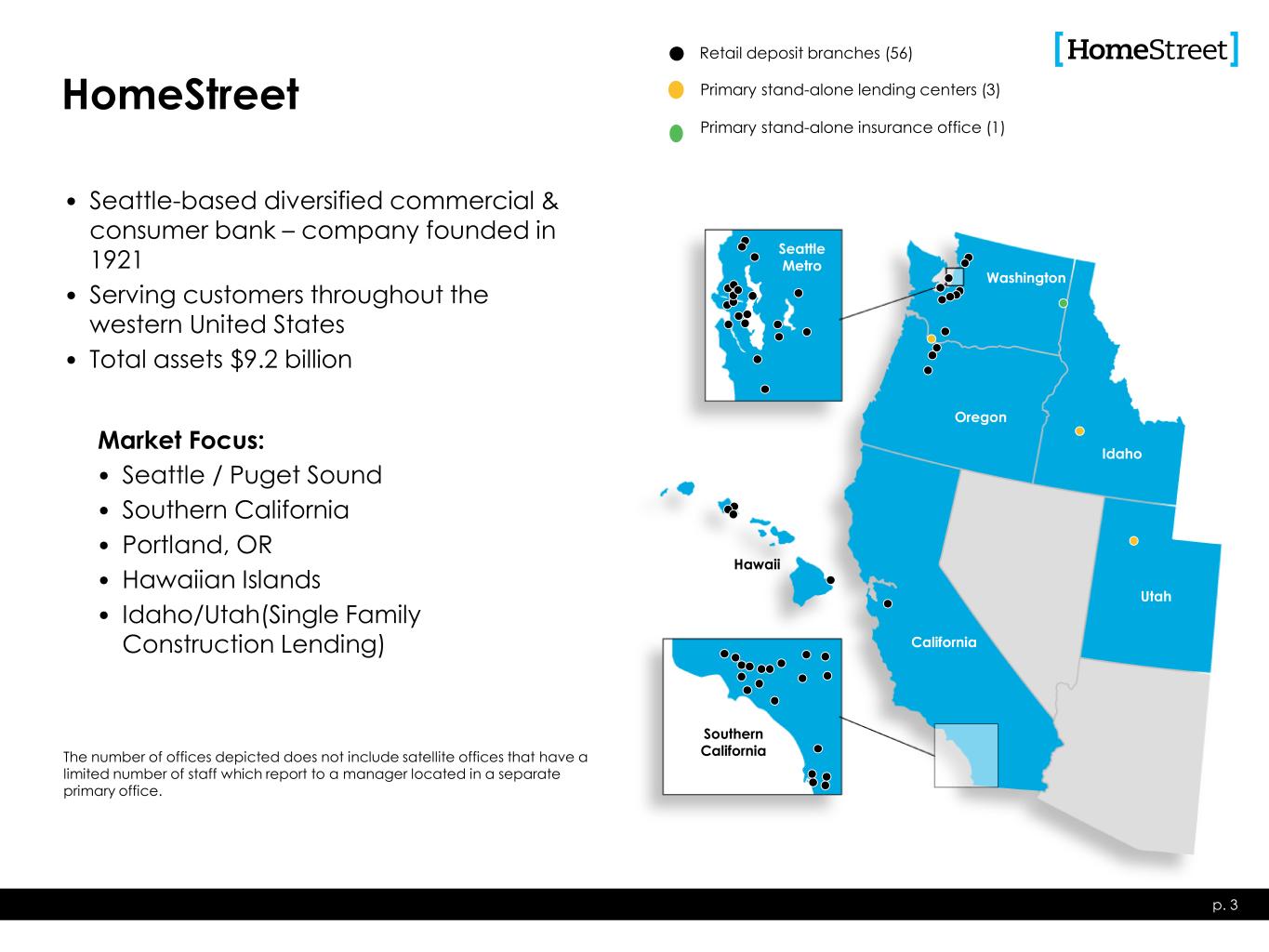

Seattle Metro Washington Oregon Idaho Utah California Hawaii Southern California Retail deposit branches (56) Primary stand-alone insurance office (1) Primary stand-alone lending centers (3)HomeStreet p. 3 The number of offices depicted does not include satellite offices that have a limited number of staff which report to a manager located in a separate primary office. • Seattle-based diversified commercial & consumer bank – company founded in 1921 • Serving customers throughout the western United States • Total assets $9.2 billion Market Focus: • Seattle / Puget Sound • Southern California • Portland, OR • Hawaiian Islands • Idaho/Utah(Single Family Construction Lending)

p. 4 • Low level of uninsured deposits • Diversified deposit base • Continuing ability to attract new deposit clients • Strong on balance sheet and contingent Liquidity • New loan originations focus is on variable rate products Funding Overview

p. 5 Diversified Deposit Base: • The average balance of our noninterest-bearing consumer deposit accounts as of September 30, 2024, was $7,000 and overall average consumer deposit account balance was $30,000. • The average balance of our noninterest-bearing business deposit accounts as of September 30, 2024, was $64,000 and overall average business deposit account balance was $94,000. • As a percentage of our deposit portfolio, our top ten customers make up only 4.4% of our total deposit balances. • Uninsured deposits of $509 million as of September 30, 2024 (8% of total deposits) Continuing ability to attract new deposit clients • Our branch system added 116 new business customers in Q3 2024. • Commercial banking added 9 new customers in Q3 2024. Liquidity: • Our on-balance sheet liquidity as of September 30, 2024, was 14%. • Our available contingent liquidity borrowing sources ($5.1 billion) equal to 80% of the total amount of deposits outstanding as of September 30, 2024. • Optimizing funding costs by utilizing least cost option (borrowings / brokered deposits) Liquidity Considerations

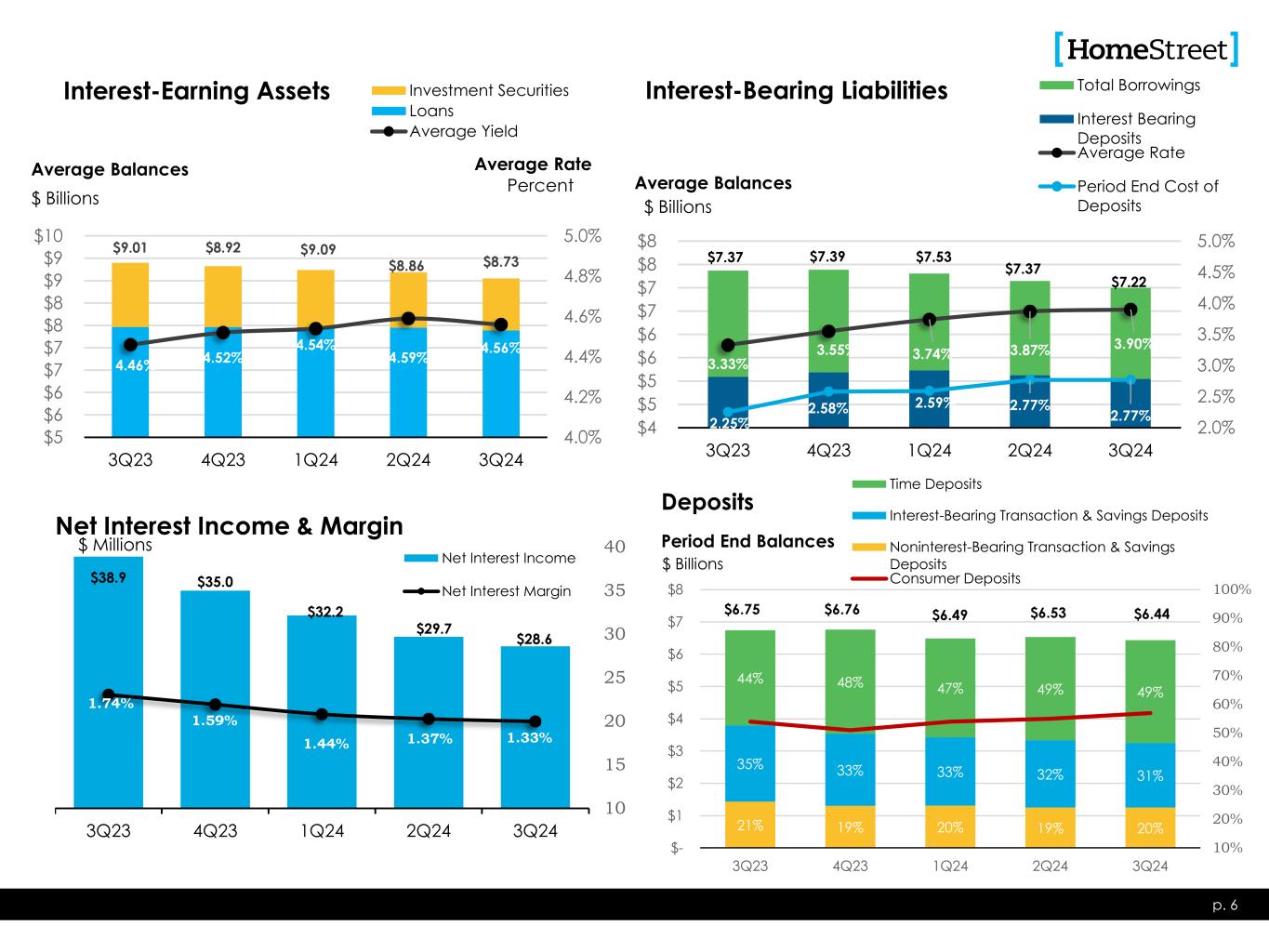

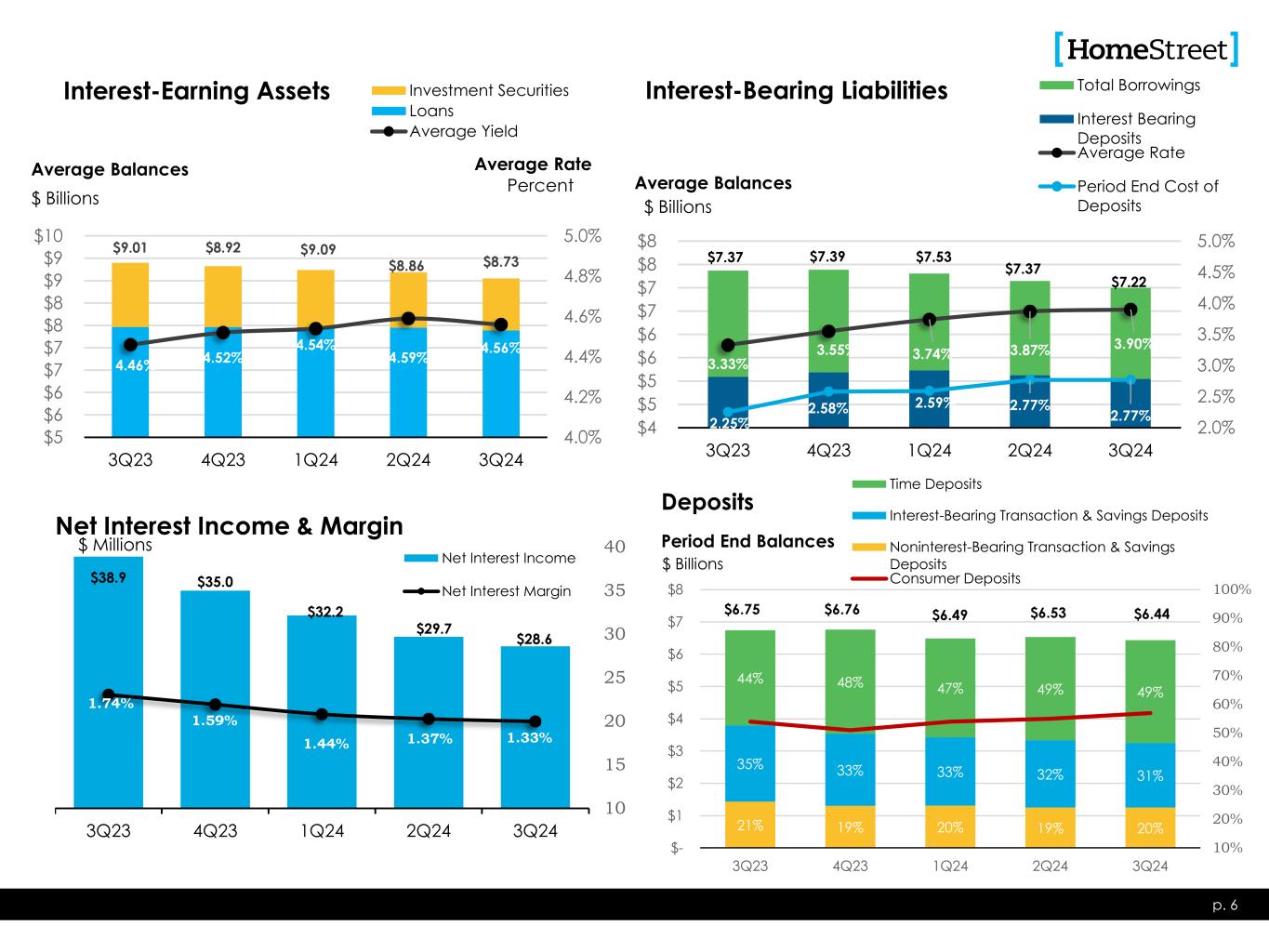

$9.01 $8.92 $9.09 $8.86 $8.73 4.46% 4.52% 4.54% 4.59% 4.56% 4.0% 4.2% 4.4% 4.6% 4.8% 5.0% $5 $6 $6 $7 $7 $8 $8 $9 $9 $10 3Q23 4Q23 1Q24 2Q24 3Q24 Investment Securities Loans Average Yield Interest-Earning Assets p. 6 Average Balances $ Billions Average Rate Percent $38.9 $35.0 $32.2 $29.7 $28.6 1.74% 1.59% 1.44% 1.37% 1.33% 10 15 20 25 30 35 40 3Q23 4Q23 1Q24 2Q24 3Q24 Net Interest Income Net Interest Margin Net Interest Income & Margin $ Millions $7.37 $7.39 $7.53 $7.37 $7.22 3.33% 3.55% 3.74% 3.87% 3.90% 2.25% 2.58% 2.59% 2.77% 2.77% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% $4 $5 $5 $6 $6 $7 $7 $8 $8 3Q23 4Q23 1Q24 2Q24 3Q24 Total Borrowings Interest Bearing Deposits Average Rate Period End Cost of Deposits Interest-Bearing Liabilities Average Balances $ Billions 21% 19% 20% 19% 20% 35% 33% 33% 32% 31% 44% 48% 47% 49% 49% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% $- $1 $2 $3 $4 $5 $6 $7 $8 3Q23 4Q23 1Q24 2Q24 3Q24 Time Deposits Interest-Bearing Transaction & Savings Deposits Noninterest-Bearing Transaction & Savings Deposits Consumer Deposits Deposits Period End Balances $ Billions $6.75 $6.76 $6.49 $6.53 $6.44

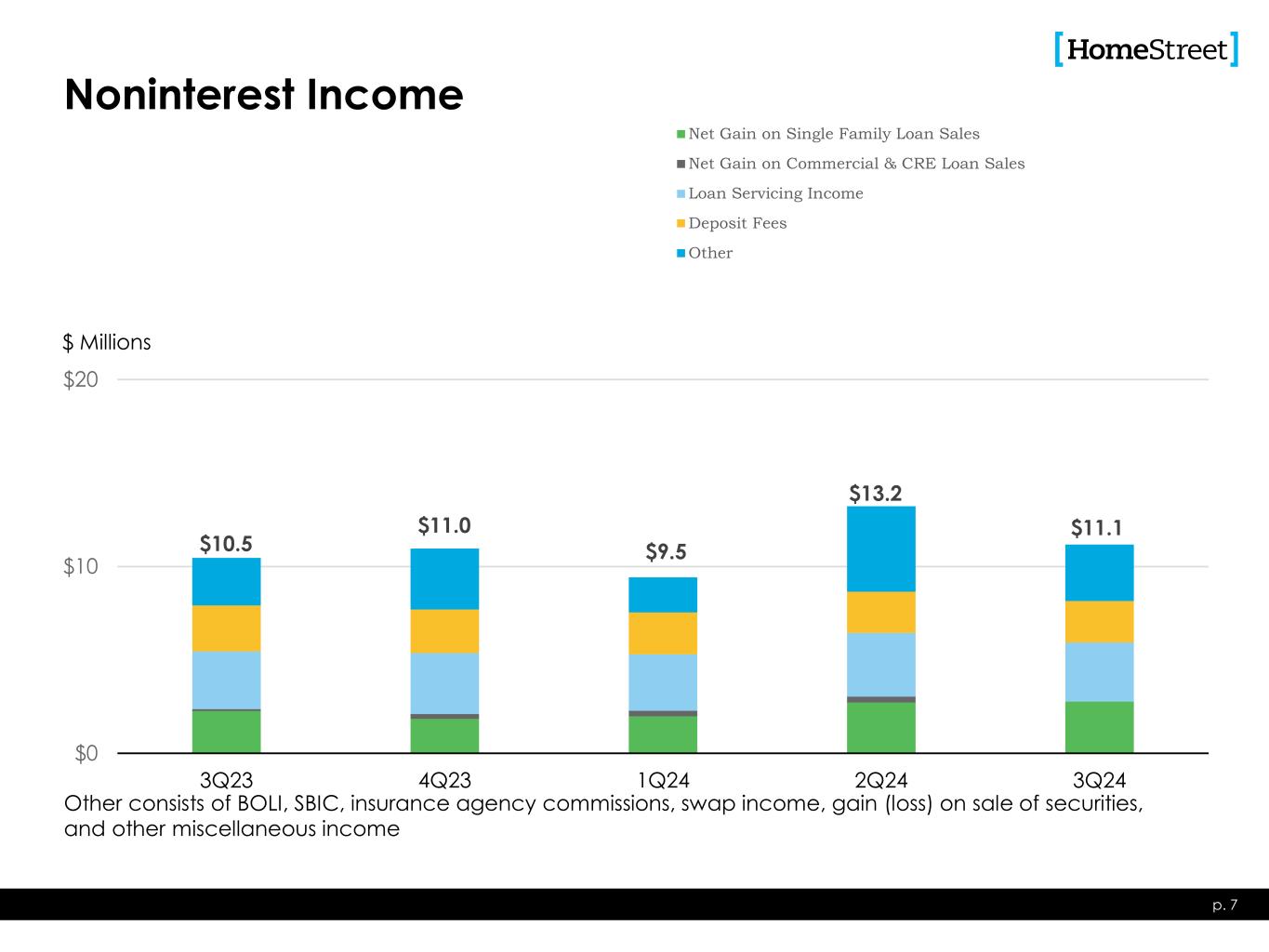

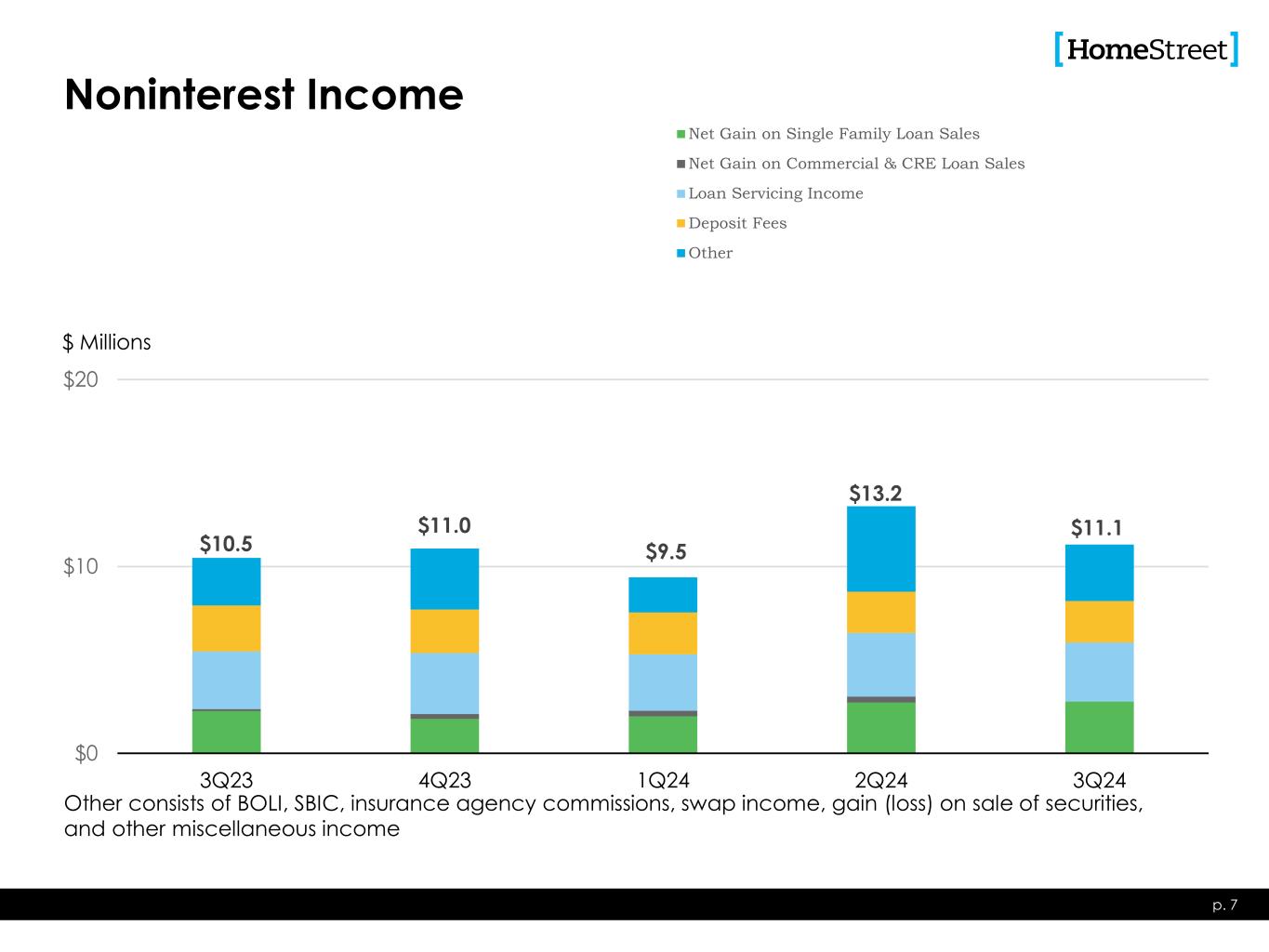

$10.5 $11.0 $9.5 $13.2 $11.1 $0 $10 $20 3Q23 4Q23 1Q24 2Q24 3Q24 Net Gain on Single Family Loan Sales Net Gain on Commercial & CRE Loan Sales Loan Servicing Income Deposit Fees Other Noninterest Income p. 7 $ Millions Other consists of BOLI, SBIC, insurance agency commissions, swap income, gain (loss) on sale of securities, and other miscellaneous income

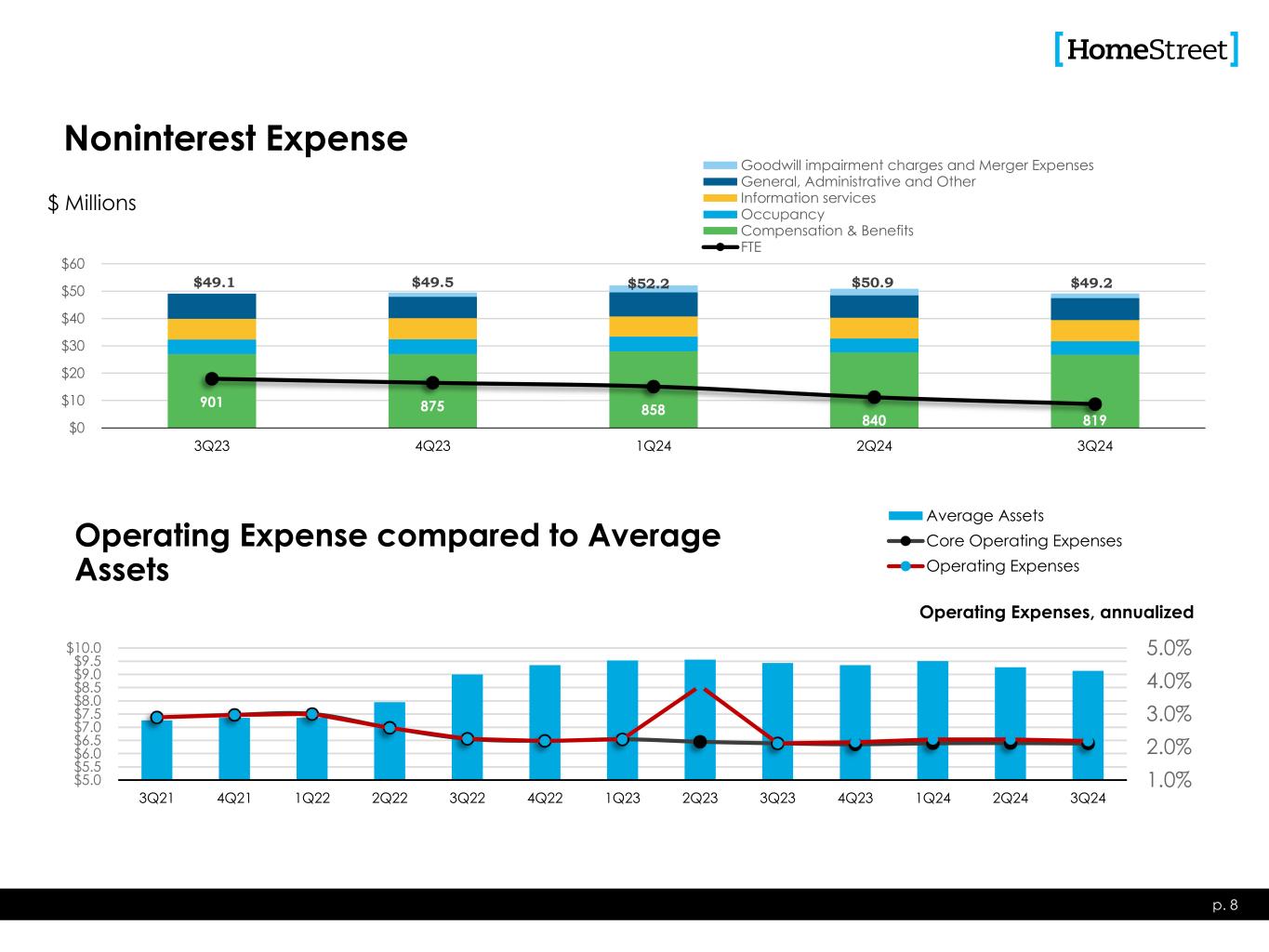

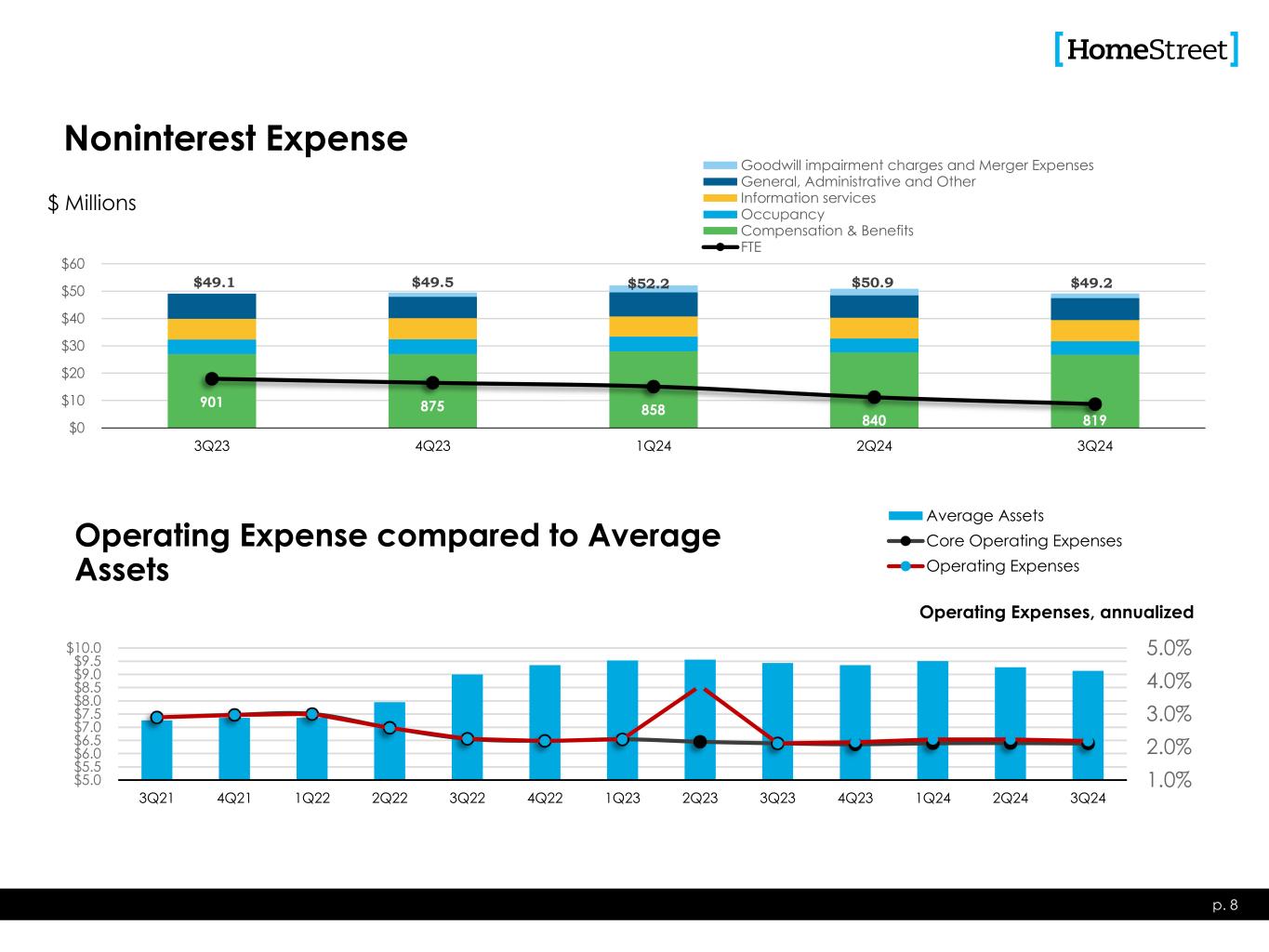

Noninterest Expense p. 8 $ Millions 1.0% 2.0% 3.0% 4.0% 5.0% $5.0 $5.5 $6.0 $6.5 $7.0 $7.5 $8.0 $8.5 $9.0 $9.5 $10.0 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Average Assets Core Operating Expenses Operating Expenses Operating Expense compared to Average Assets Operating Expenses, annualized $49.1 $49.5 $52.2 $50.9 $49.2 901 875 858 840 819$0 $10 $20 $30 $40 $50 $60 3Q23 4Q23 1Q24 2Q24 3Q24 Goodwill impairment charges and Merger Expenses General, Administrative and Other Information services Occupancy Compensation & Benefits FTE

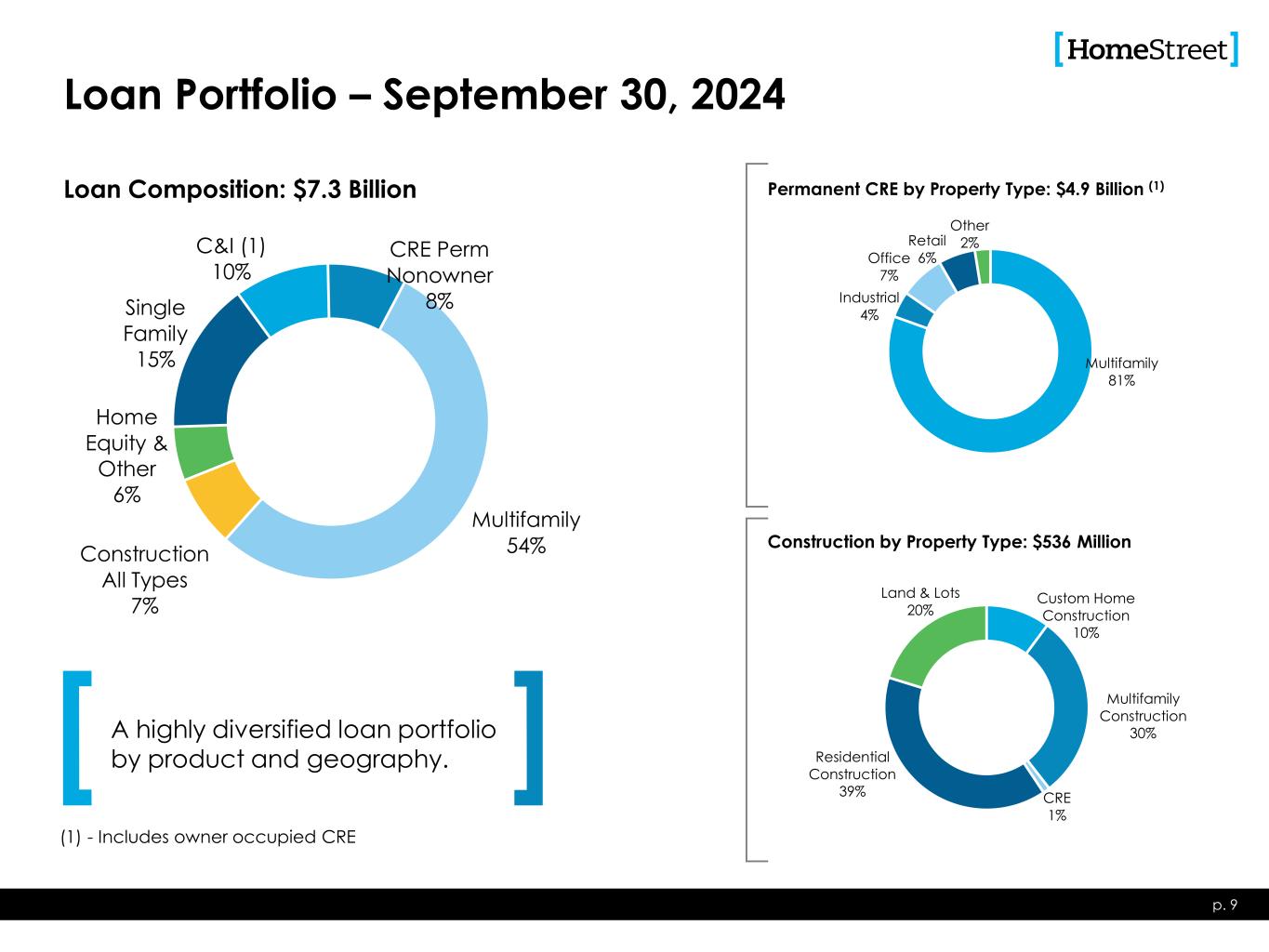

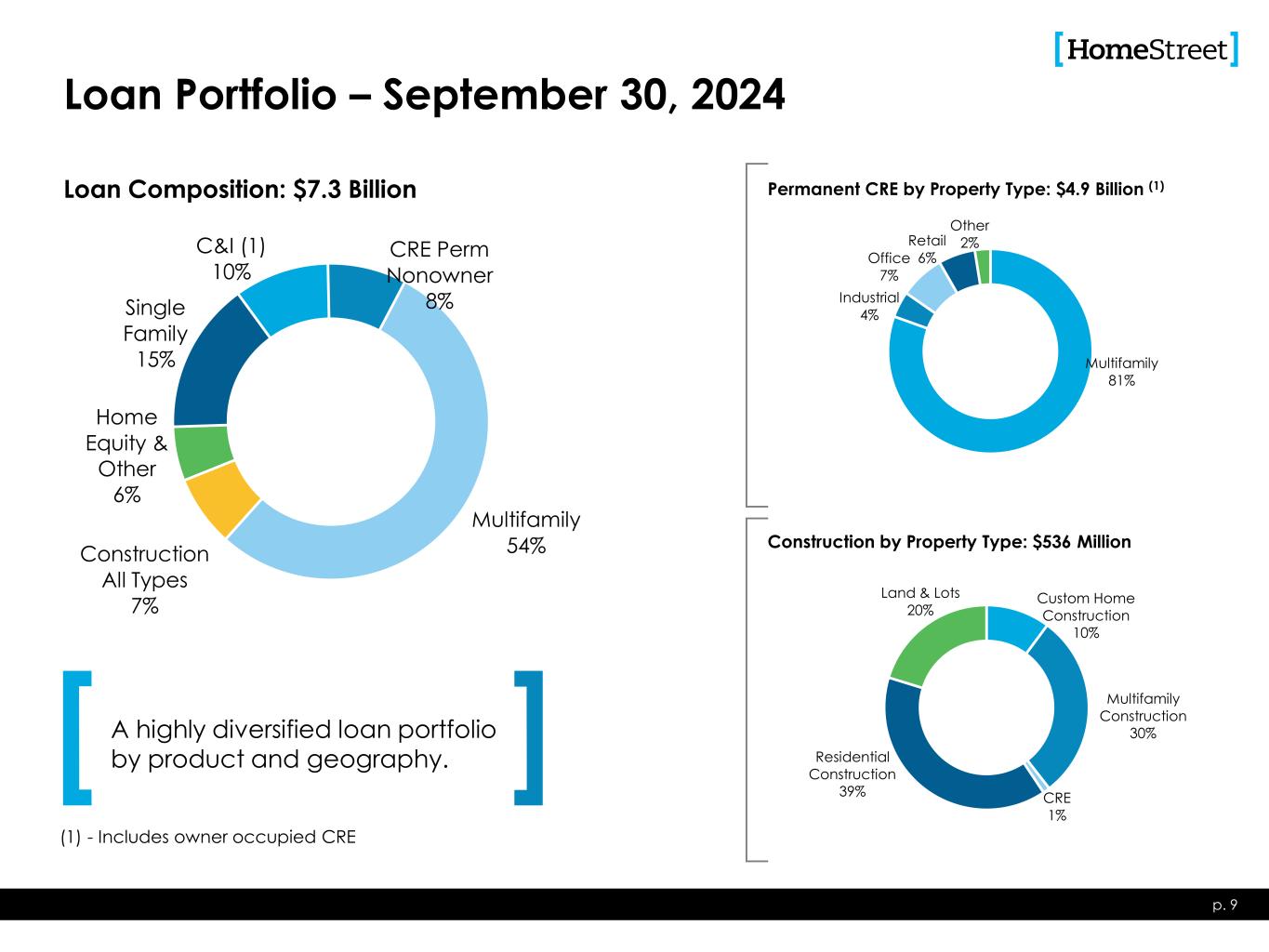

C&I (1) 10% CRE Perm Nonowner 8% Multifamily 54%Construction All Types 7% Home Equity & Other 6% Single Family 15% Loan Portfolio – September 30, 2024 p. 9 A highly diversified loan portfolio by product and geography. Multifamily 81% Industrial 4% Office 7% Retail 6% Other 2% Permanent CRE by Property Type: $4.9 Billion (1) Custom Home Construction 10% Multifamily Construction 30% CRE 1% Residential Construction 39% Land & Lots 20% Construction by Property Type: $536 Million Loan Composition: $7.3 Billion (1) - Includes owner occupied CRE

Permanent Commercial Real Estate Lending Overview September 30, 2024 • Up To 30 Year Term • $30MM Loan Amt. Max • ≥ 1.15 DSCR • Avg. LTV @ Orig. ~ 60% p. 10 Loan Characteristics • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 60% • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 65% • Up To 15 Year Term • $30MM Loan Amt. Max • ≥ 1.25 DSCR • Avg. LTV @ Orig. ~ 54% • Additional property types are reviewed on a case by case basis • Includes acquired loan types • Examples include: hotels, schools, churches, marinas • Balance: $3.9B • % of Balances: 81% • Portfolio Avg. LTV ~ 57%(1) • Portfolio Avg. DSCR ~ 1.57x • Avg. Loan Size: $5.5M • Largest Dollar Loan: $48.0M 09/30/2024 Balances Outstanding Totaling $4.9 Billion • Balance: $201M • % of Balances: 4% • % Owner Occupied: 52% • Portfolio LTV ~ 47%(1) • Portfolio Avg. DSCR ~ 2.18x • Avg. Loan Size: $2.5M • Largest Dollar Loan: $21.3M • Balance: $350M • % of Balances: 7% • % Owner Occupied: 30% • Portfolio LTV ~ 51%(1) • Portfolio Avg. DSCR ~ 1.64x • Avg. Loan Size: $2.3M • Largest Dollar Loan: $23.4M • Balance: $286M • % of Balances: 6% • % Owner Occupied: 24% • Portfolio LTV ~ 45%(1) • Portfolio Avg. DSCR ~ 1.83x • Avg. Loan Size: $2.9M • Largest Dollar Loan: $15.1M • Balance: $120M • % of Balances: 2% • % of Owner Occupied: 73% • Portfolio LTV ~ 39%(1) • Portfolio Avg. DSCR ~ 2.09x • Avg. Loan Size: $3.4M • Largest Dollar Loan: $19.4M 46% 21% 9% 15% 6% 3% Geographical Distribution (Balances) Multifamily 16% 30% 2%2% 42% 8% Industrial / Warehouse 16% 14% 4% 5% 48% 13% Office 18% 23% 8% 7% 43% 1% Retail 8% 7% 70% 15% Other CA Los Angeles County CA Other Oregon Other WA King/Pierce/Snohomish WA Other (1) Property values as of origination date. • HomeStreet lends across the full spectrum of commercial real estate lending types, but is deliberate in its effort to achieve diversification among property types and geographic areas to mitigate concentration risk. • “Other” category includes loans secured by Schools ($54.2 million), Hotels ($12.3 million), and Churches ($8.1 million).

Construction Lending Overview September 30, 2024 • 12 Month Term • Consumer Owner Occupied • Borrower Underwritten similar to Single Family p. 11 Loan Characteristics • 18-36 Month Term • ≤ 80% LTC • Minimum 15% Cash Equity • ≥ 1.20 DSC • Avg. LTV @ Orig. ~ 65% • Liquidity and DSC covenants • 18-36 Month Term • ≤ 80% LTC • Minimum 15% Cash Equity • ≥ 1.25 DSC • ≥ 50% pre-leased office/retail • Avg. LTV @ Orig. ~ 41% • Liquidity and DSC covenants • 12-18 Month Term • LTC: ≤ 95% Presale & Spec • Leverage, Liquid. & Net Worth Covenants as appropriate • Avg. LTV @ Orig. ~ 70% • 12-24 Month Term • ≤ 50% -80% LTC • Strong, experienced, vertically integrated builders • Avg. LTV @ Orig. ~ 69% • Balance: $54M • Unfunded Commitments: $23M • % of Balances: 10% • % of Unfunded Commitments: 7% • Avg. Loan Size: $935K • Largest Dollar Loan: $2.5M 09/30/2024 Balances Outstanding Totaling $536 Million • Balance: $157M • Unfunded Commitments: $14M • % of Balances: 30% • % of Unfunded Commitments: 4% • Avg. Loan Size: $15.7M • Largest Dollar Loan: $28.5M • Balance: $6M • Unfunded Commitments: $4M • % of Balances: 1% • % of Unfunded Commitments: 1% • Avg. Loan Size: $5.8M • Largest Dollar Loan: $5.8M • Balance: $210M • Unfunded Commitments: $266M • % of Balances: 39% • % of Unfunded Commitments: 78% • Avg. Loan Size: $496K • Largest Dollar Loan: $9.4M • Balance: $109M • Unfunded Commitments: $33M • % of Balances: 20% • % of Unfunded Commitments: 10% • Avg. Loan Size: $1.2M • Largest Dollar Loan: $7.1M 22% 3%1% 5%3% 64% 2% Geographical Distribution (Balances) Custom Home Construction 63% 7% 4% 26% Multifamily 100% CRE 18% 7% 27% 22% 10% 13% 3% Residential Construction 32% 3% 7% 10%8% 21% 19% Land and Lots Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho Other: AZ, CO Construction lending is a broad category that includes many different loan types, which possess different risk profiles. HomeStreet lends across the full spectrum of construction lending types.

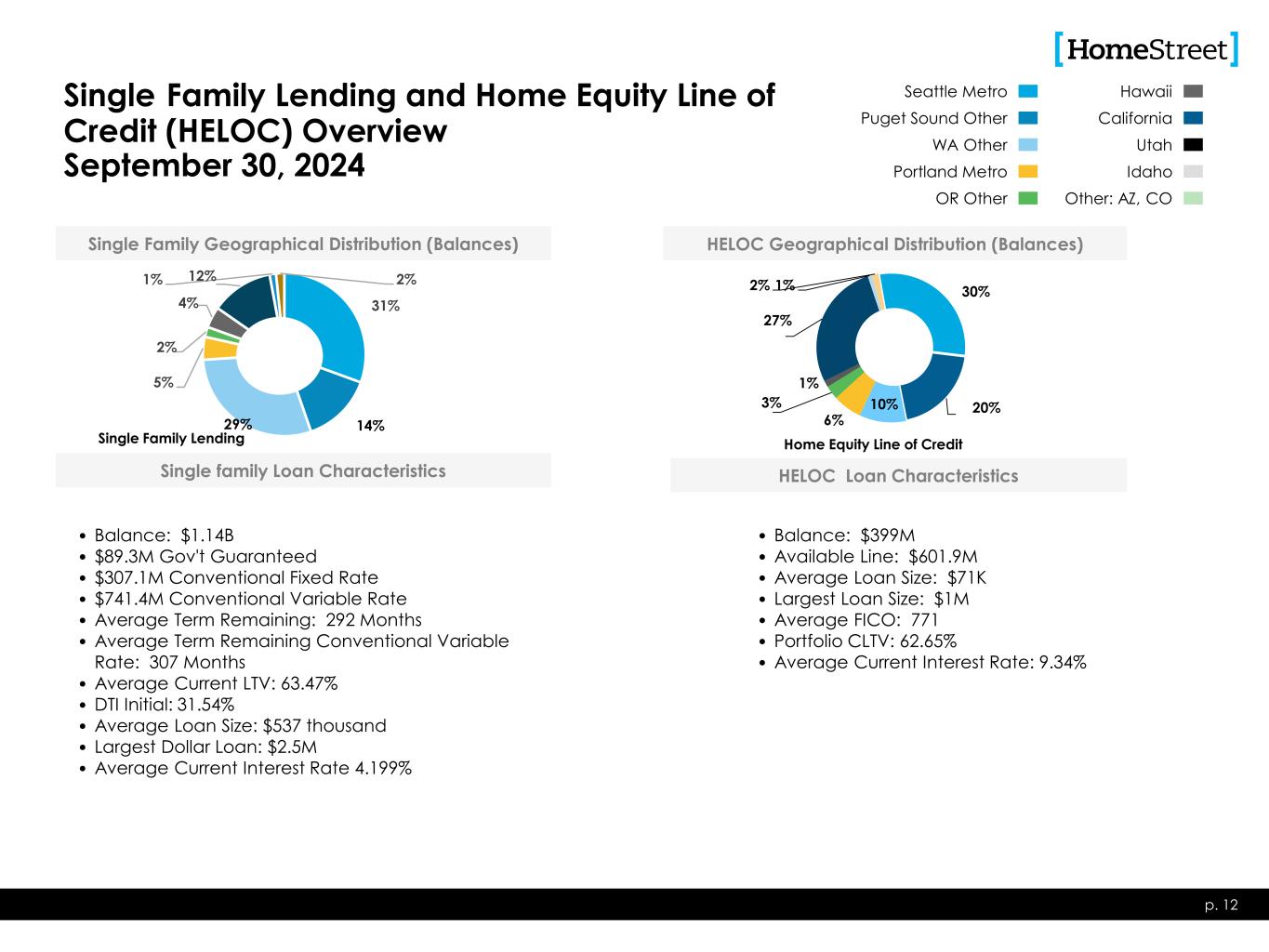

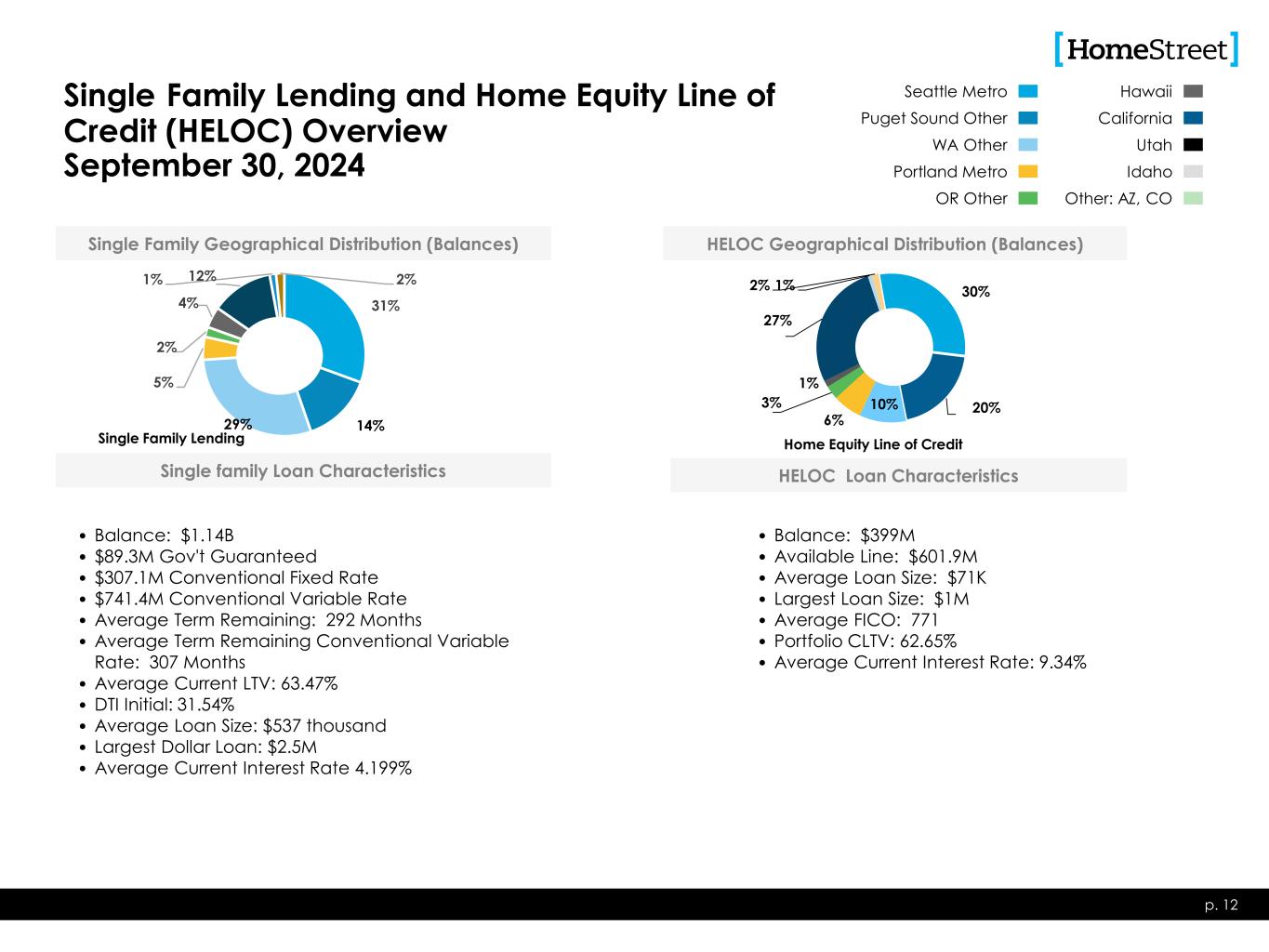

Single Family Lending and Home Equity Line of Credit (HELOC) Overview September 30, 2024 p. 12 Single family Loan Characteristics • Balance: $1.14B • $89.3M Gov't Guaranteed • $307.1M Conventional Fixed Rate • $741.4M Conventional Variable Rate • Average Term Remaining: 292 Months • Average Term Remaining Conventional Variable Rate: 307 Months • Average Current LTV: 63.47% • DTI Initial: 31.54% • Average Loan Size: $537 thousand • Largest Dollar Loan: $2.5M • Average Current Interest Rate 4.199% • Balance: $399M • Available Line: $601.9M • Average Loan Size: $71K • Largest Loan Size: $1M • Average FICO: 771 • Portfolio CLTV: 62.65% • Average Current Interest Rate: 9.34% 31% 14%29% 5% 2% 4% 12%1% 2% Single Family Geographical Distribution (Balances) Single Family Lending 30% 20%10% 6% 3% 1% 27% 1%2% Home Equity Line of Credit Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho Other: AZ, CO HELOC Geographical Distribution (Balances) HELOC Loan Characteristics

Commercial Business Lending Overview Commercial Business Balances by Industry Type as of September 30, 2024 p. 13 20% 18% 14%12% 10% 7% 4% 4% 3% 8% Health Care and Social Assistance Finance and Insurance Manufacturing Wholesale Trade Construction Real Estate and Rental and Leasing Administrative and Support and Waste Management and Remediation Services Information Professional, Scientific and Technical Services All Other $346.0M

The content Operational Metric: Net Promotor Score We are pleased to announce that we achieved a Net Promotor Score (NPS) of 38 in 2023– exceeding the bank industry benchmark for the eighth consecutive year. The NPS is a measure of customer satisfaction calculated based on responses to a single question: How likely is it that you would recommend HomeStreet Bank to a friend or colleague? To calculate the bank’s latest NPS rating, we surveyed 33,000 checking customers and received more than 2,000 survey responses. 14 37 50 56 60 53 44 40 38 2016 2017 2018 2019 2020 2021 2022 2023 HomeStreet Bank Net Promoter Score NPS Bank Industry NPS** 87 65 57 57 57 38 38 37 24 20 -1 -1 Industry NPS Benchmarks US Bank* BECU*** USAA* WaFd Bank**** Wells Fargo* HomeStreet Bank KeyBank* Bank of America* Bank Industry Average** Banner Bank* Sources: *NetPromoterScore.guru (estimated Net Promoter Score based on the publicly available information including the sentiment of the company- related tweets, 3rd party reviews, and Alexa ratings), **Qualtrics XM institute, ***BECU Annual Report Summary 2022, and ****WaFD Bank Investor Presentation 2023.

Appendix

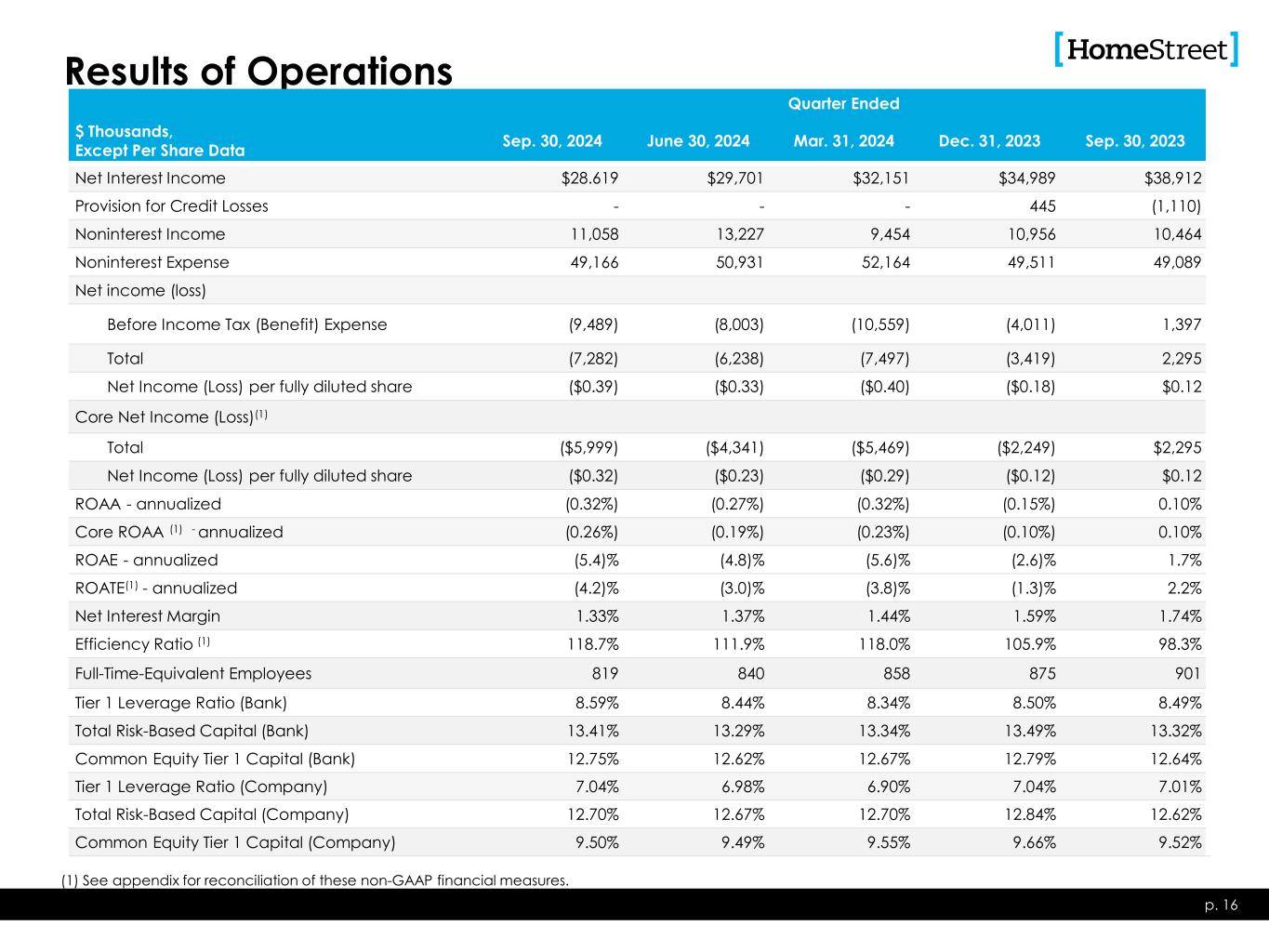

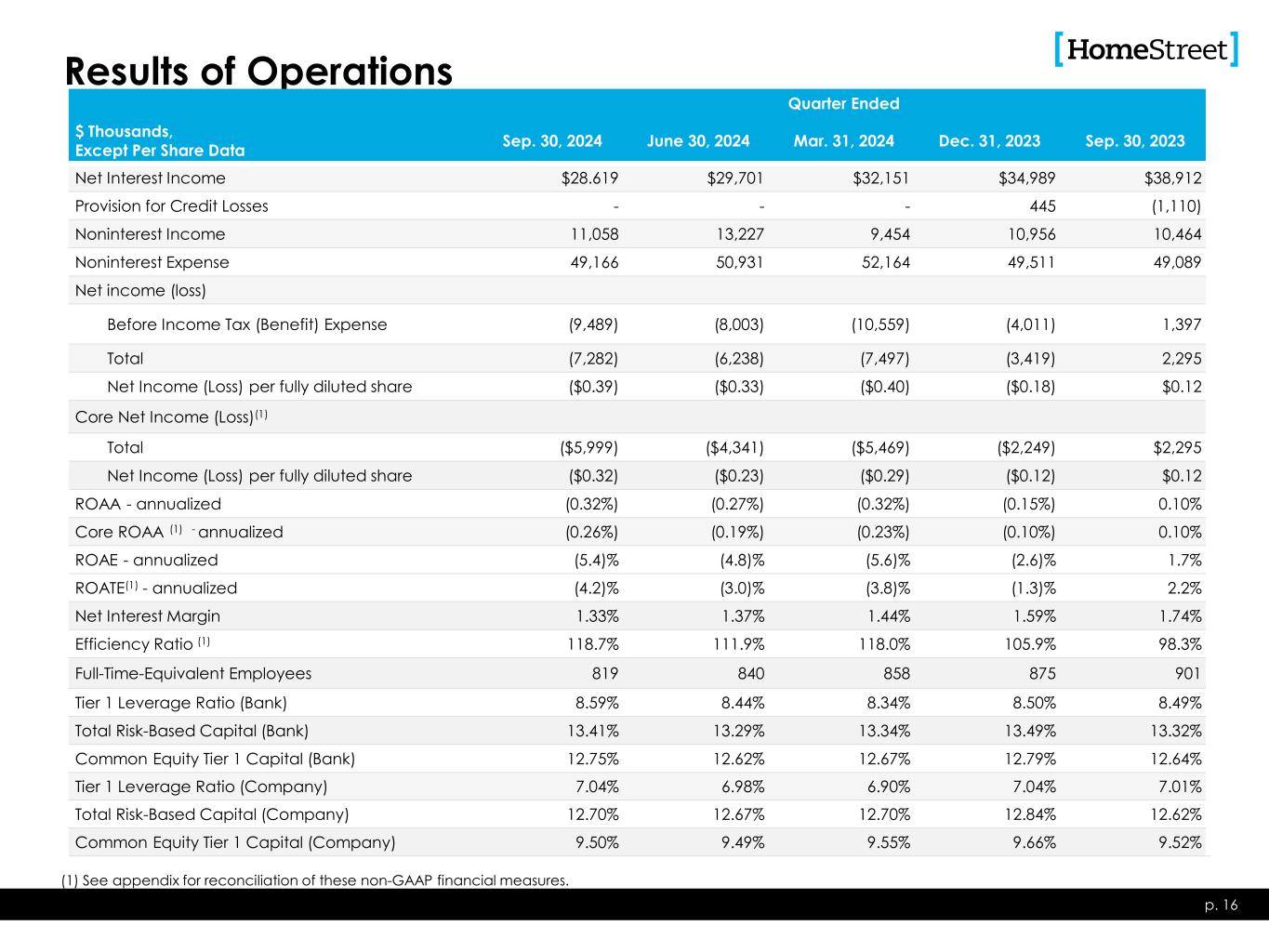

Results of Operations Quarter Ended $ Thousands, Except Per Share Data Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Net Interest Income $28.619 $29,701 $32,151 $34,989 $38,912 Provision for Credit Losses - - - 445 (1,110) Noninterest Income 11,058 13,227 9,454 10,956 10,464 Noninterest Expense 49,166 50,931 52,164 49,511 49,089 Net income (loss) Before Income Tax (Benefit) Expense (9,489) (8,003) (10,559) (4,011) 1,397 Total (7,282) (6,238) (7,497) (3,419) 2,295 Net Income (Loss) per fully diluted share ($0.39) ($0.33) ($0.40) ($0.18) $0.12 Core Net Income (Loss)(1) Total ($5,999) ($4,341) ($5,469) ($2,249) $2,295 Net Income (Loss) per fully diluted share ($0.32) ($0.23) ($0.29) ($0.12) $0.12 ROAA - annualized (0.32%) (0.27%) (0.32%) (0.15%) 0.10% Core ROAA (1) - annualized (0.26%) (0.19%) (0.23%) (0.10%) 0.10% ROAE - annualized (5.4)% (4.8)% (5.6)% (2.6)% 1.7% ROATE(1) - annualized (4.2)% (3.0)% (3.8)% (1.3)% 2.2% Net Interest Margin 1.33% 1.37% 1.44% 1.59% 1.74% Efficiency Ratio (1) 118.7% 111.9% 118.0% 105.9% 98.3% Full-Time-Equivalent Employees 819 840 858 875 901 Tier 1 Leverage Ratio (Bank) 8.59% 8.44% 8.34% 8.50% 8.49% Total Risk-Based Capital (Bank) 13.41% 13.29% 13.34% 13.49% 13.32% Common Equity Tier 1 Capital (Bank) 12.75% 12.62% 12.67% 12.79% 12.64% Tier 1 Leverage Ratio (Company) 7.04% 6.98% 6.90% 7.04% 7.01% Total Risk-Based Capital (Company) 12.70% 12.67% 12.70% 12.84% 12.62% Common Equity Tier 1 Capital (Company) 9.50% 9.49% 9.55% 9.66% 9.52% p. 16 (1) See appendix for reconciliation of these non-GAAP financial measures.

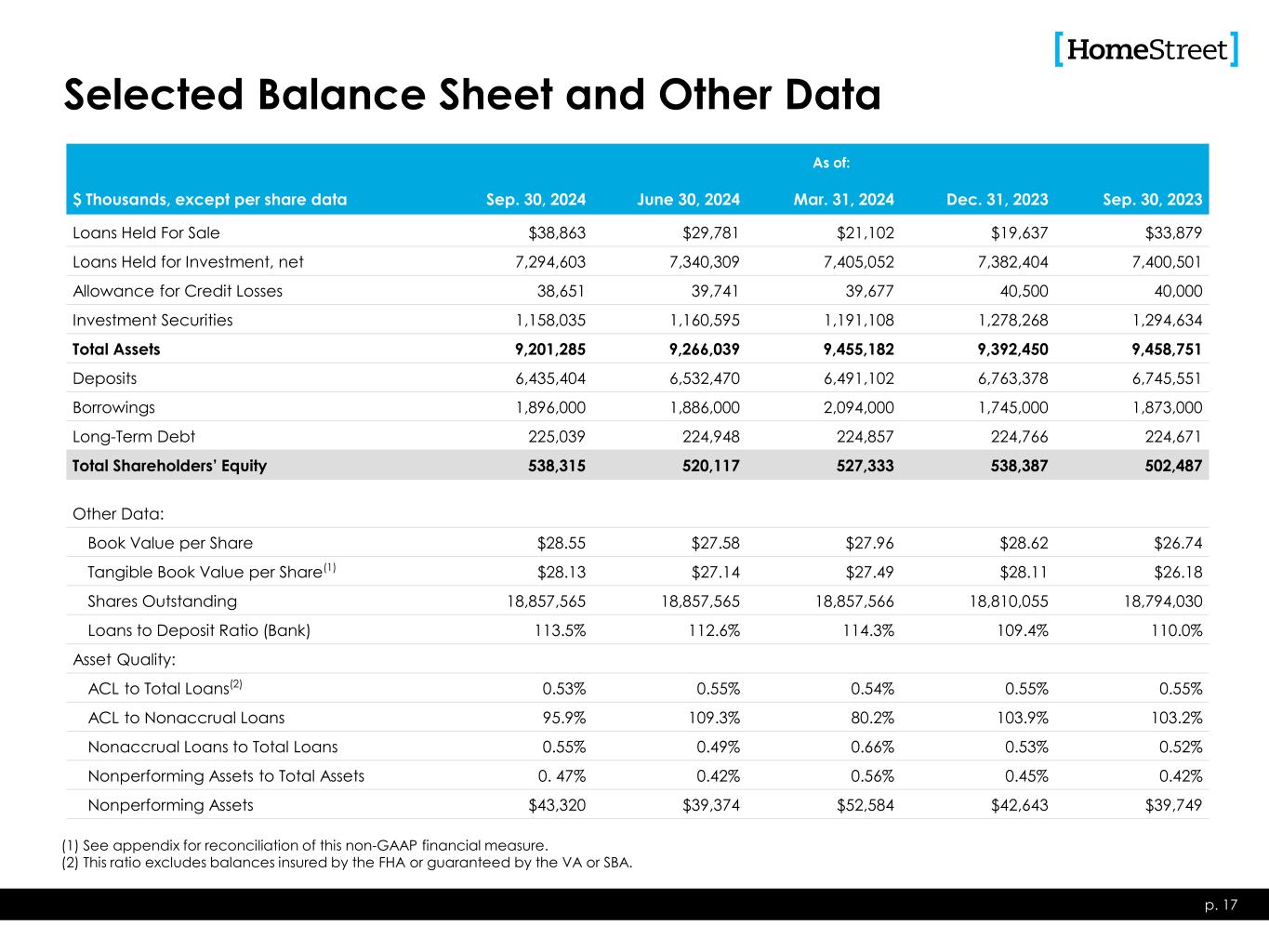

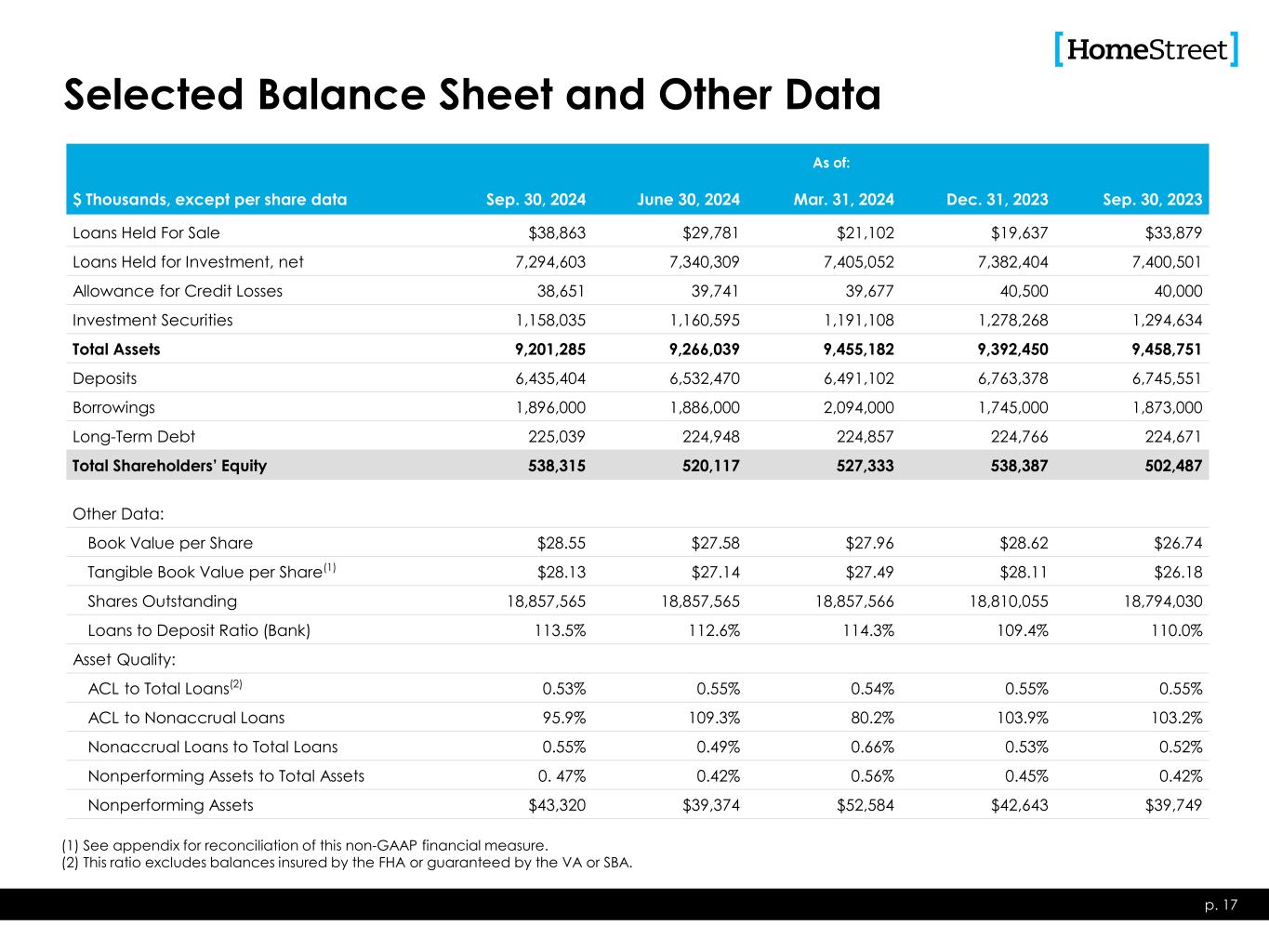

Selected Balance Sheet and Other Data As of: $ Thousands, except per share data Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Loans Held For Sale $38,863 $29,781 $21,102 $19,637 $33,879 Loans Held for Investment, net 7,294,603 7,340,309 7,405,052 7,382,404 7,400,501 Allowance for Credit Losses 38,651 39,741 39,677 40,500 40,000 Investment Securities 1,158,035 1,160,595 1,191,108 1,278,268 1,294,634 Total Assets 9,201,285 9,266,039 9,455,182 9,392,450 9,458,751 Deposits 6,435,404 6,532,470 6,491,102 6,763,378 6,745,551 Borrowings 1,896,000 1,886,000 2,094,000 1,745,000 1,873,000 Long-Term Debt 225,039 224,948 224,857 224,766 224,671 Total Shareholders’ Equity 538,315 520,117 527,333 538,387 502,487 Other Data: Book Value per Share $28.55 $27.58 $27.96 $28.62 $26.74 Tangible Book Value per Share(1) $28.13 $27.14 $27.49 $28.11 $26.18 Shares Outstanding 18,857,565 18,857,565 18,857,566 18,810,055 18,794,030 Loans to Deposit Ratio (Bank) 113.5% 112.6% 114.3% 109.4% 110.0% Asset Quality: ACL to Total Loans(2) 0.53% 0.55% 0.54% 0.55% 0.55% ACL to Nonaccrual Loans 95.9% 109.3% 80.2% 103.9% 103.2% Nonaccrual Loans to Total Loans 0.55% 0.49% 0.66% 0.53% 0.52% Nonperforming Assets to Total Assets 0. 47% 0.42% 0.56% 0.45% 0.42% Nonperforming Assets $43,320 $39,374 $52,584 $42,643 $39,749 p. 17 (1) See appendix for reconciliation of this non-GAAP financial measure. (2) This ratio excludes balances insured by the FHA or guaranteed by the VA or SBA.

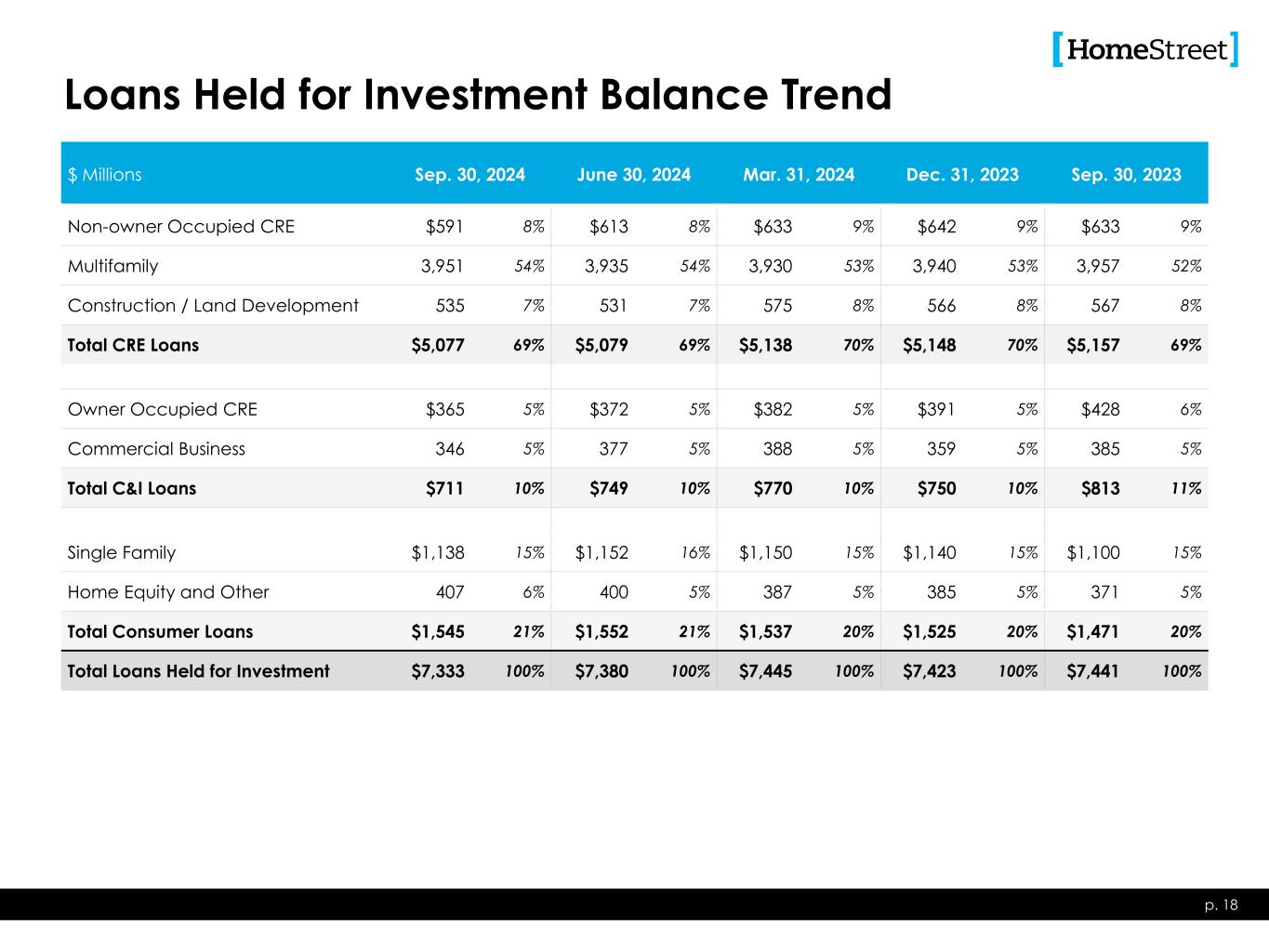

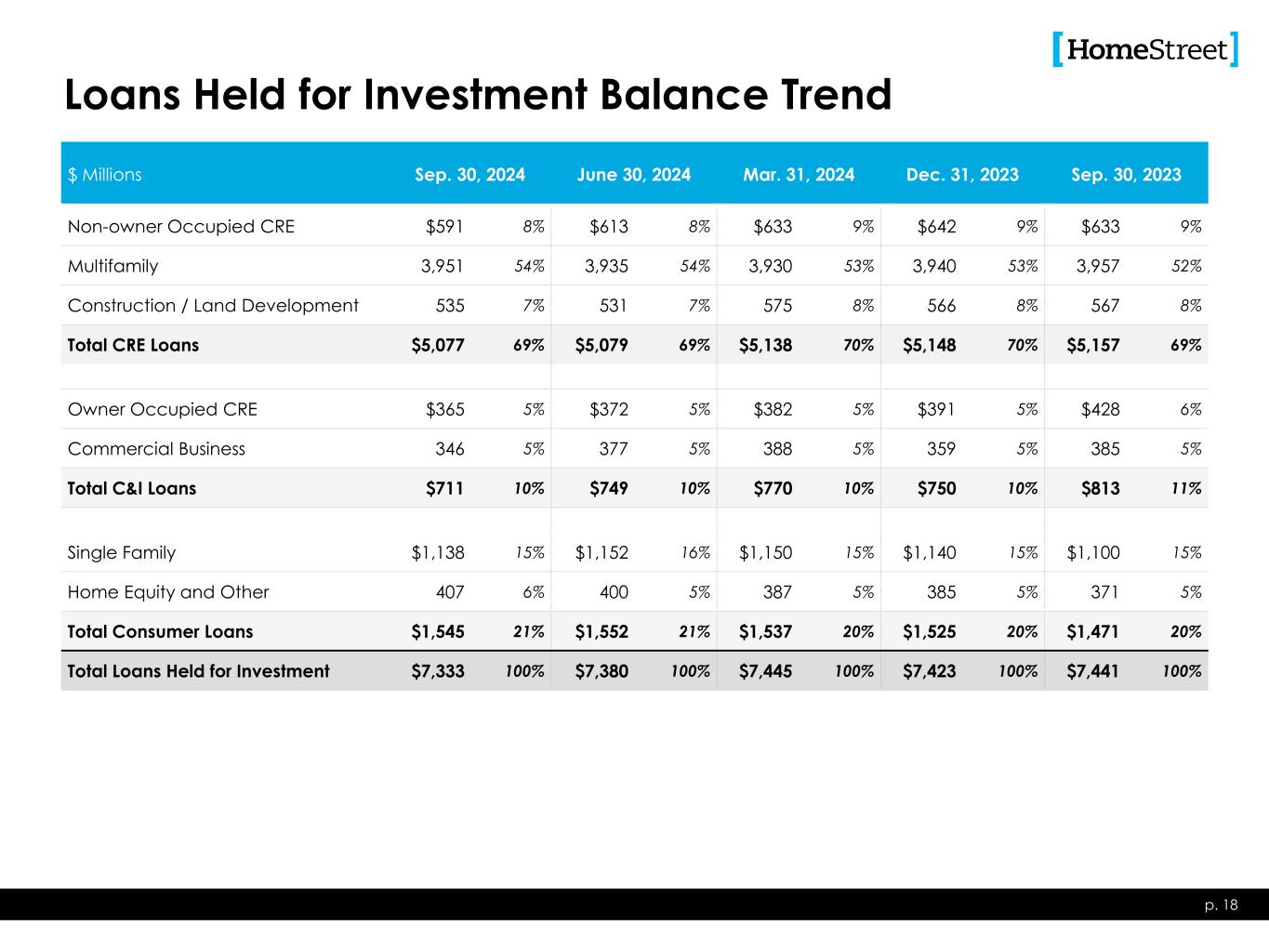

Loans Held for Investment Balance Trend p. 18 $ Millions Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Non-owner Occupied CRE $591 8% $613 8% $633 9% $642 9% $633 9% Multifamily 3,951 54% 3,935 54% 3,930 53% 3,940 53% 3,957 52% Construction / Land Development 535 7% 531 7% 575 8% 566 8% 567 8% Total CRE Loans $5,077 69% $5,079 69% $5,138 70% $5,148 70% $5,157 69% Owner Occupied CRE $365 5% $372 5% $382 5% $391 5% $428 6% Commercial Business 346 5% 377 5% 388 5% 359 5% 385 5% Total C&I Loans $711 10% $749 10% $770 10% $750 10% $813 11% Single Family $1,138 15% $1,152 16% $1,150 15% $1,140 15% $1,100 15% Home Equity and Other 407 6% 400 5% 387 5% 385 5% 371 5% Total Consumer Loans $1,545 21% $1,552 21% $1,537 20% $1,525 20% $1,471 20% Total Loans Held for Investment $7,333 100% $7,380 100% $7,445 100% $7,423 100% $7,441 100%

Loan Originations and Advances Trend p. 19 $ Millions Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Non-owner Occupied CRE $0 0% $1 1% $1 0% $12 4% $2 1% Multifamily 49 17% 17 6% 1 0% 2 1% 44 13% Construction / Land Development 160 57% 153 54% 157 55% 159 53% 156 47% Total CRE Loans $209 74% $171 61% $159 55% $173 58% $202 61% Owner Occupied CRE $0 0% $1 0% $1 0% $8 3% $2 1% Commercial Business 13 5% 39 14% 62 22% 21 7% 34 10% Total C&I loans $13 5% $40 14% $63 22% $29 10% $36 11% Single Family $16 6% $33 12% $32 11% $62 21% $58 18% Home Equity and Other 42 15% 38 13% 34 12% 34 11% 33 10% Total Consumer loans $58 21% $71 25% $66 23% $96 32% $91 28% Total $280 100% $282 100% $288 100% $298 100% $329 100%

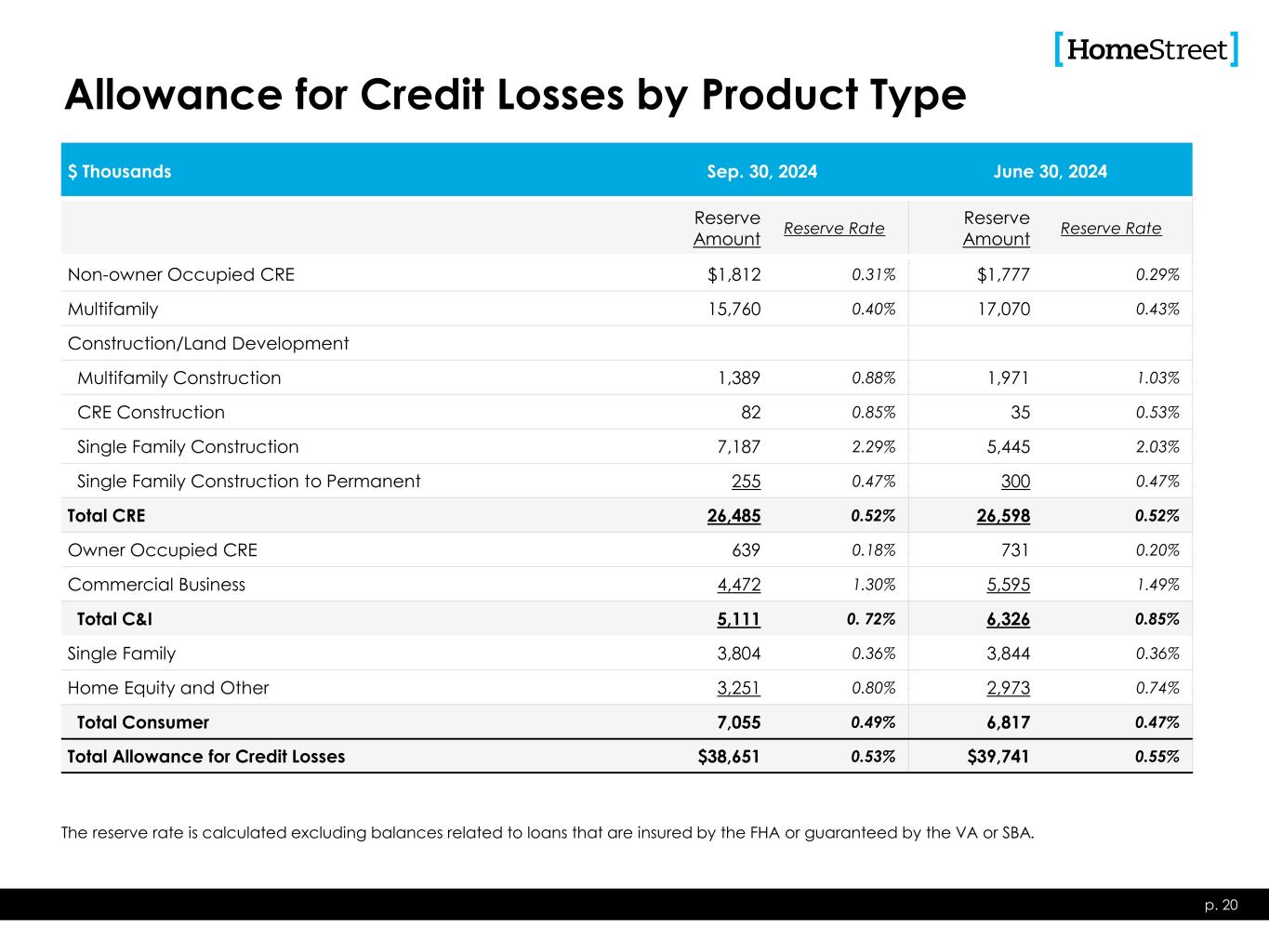

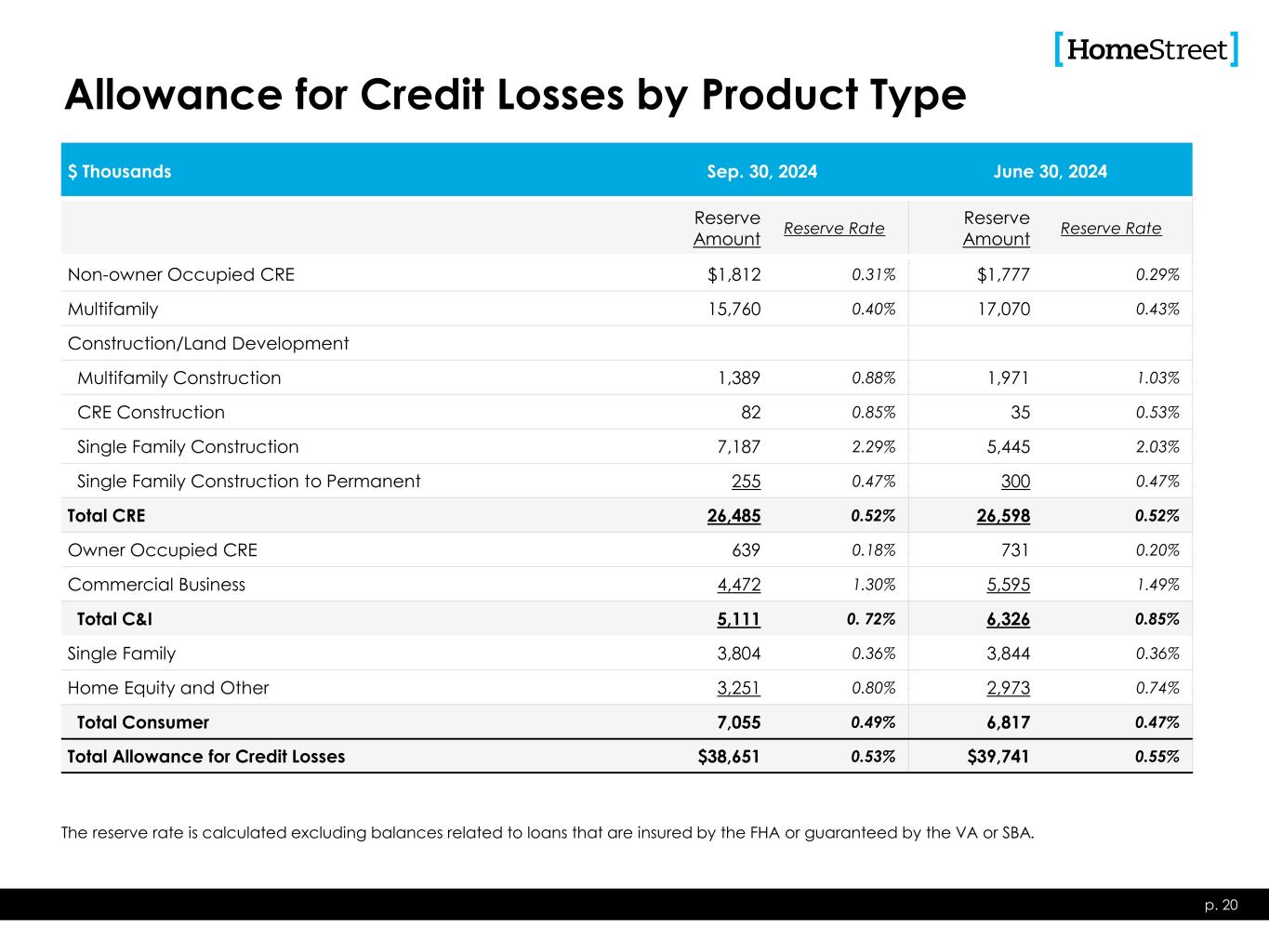

Allowance for Credit Losses by Product Type p. 20 $ Thousands Sep. 30, 2024 June 30, 2024 Reserve Amount Reserve Rate Reserve Amount Reserve Rate Non-owner Occupied CRE $1,812 0.31% $1,777 0.29% Multifamily 15,760 0.40% 17,070 0.43% Construction/Land Development Multifamily Construction 1,389 0.88% 1,971 1.03% CRE Construction 82 0.85% 35 0.53% Single Family Construction 7,187 2.29% 5,445 2.03% Single Family Construction to Permanent 255 0.47% 300 0.47% Total CRE 26,485 0.52% 26,598 0.52% Owner Occupied CRE 639 0.18% 731 0.20% Commercial Business 4,472 1.30% 5,595 1.49% Total C&I 5,111 0. 72% 6,326 0.85% Single Family 3,804 0.36% 3,844 0.36% Home Equity and Other 3,251 0.80% 2,973 0.74% Total Consumer 7,055 0.49% 6,817 0.47% Total Allowance for Credit Losses $38,651 0.53% $39,741 0.55% The reserve rate is calculated excluding balances related to loans that are insured by the FHA or guaranteed by the VA or SBA.

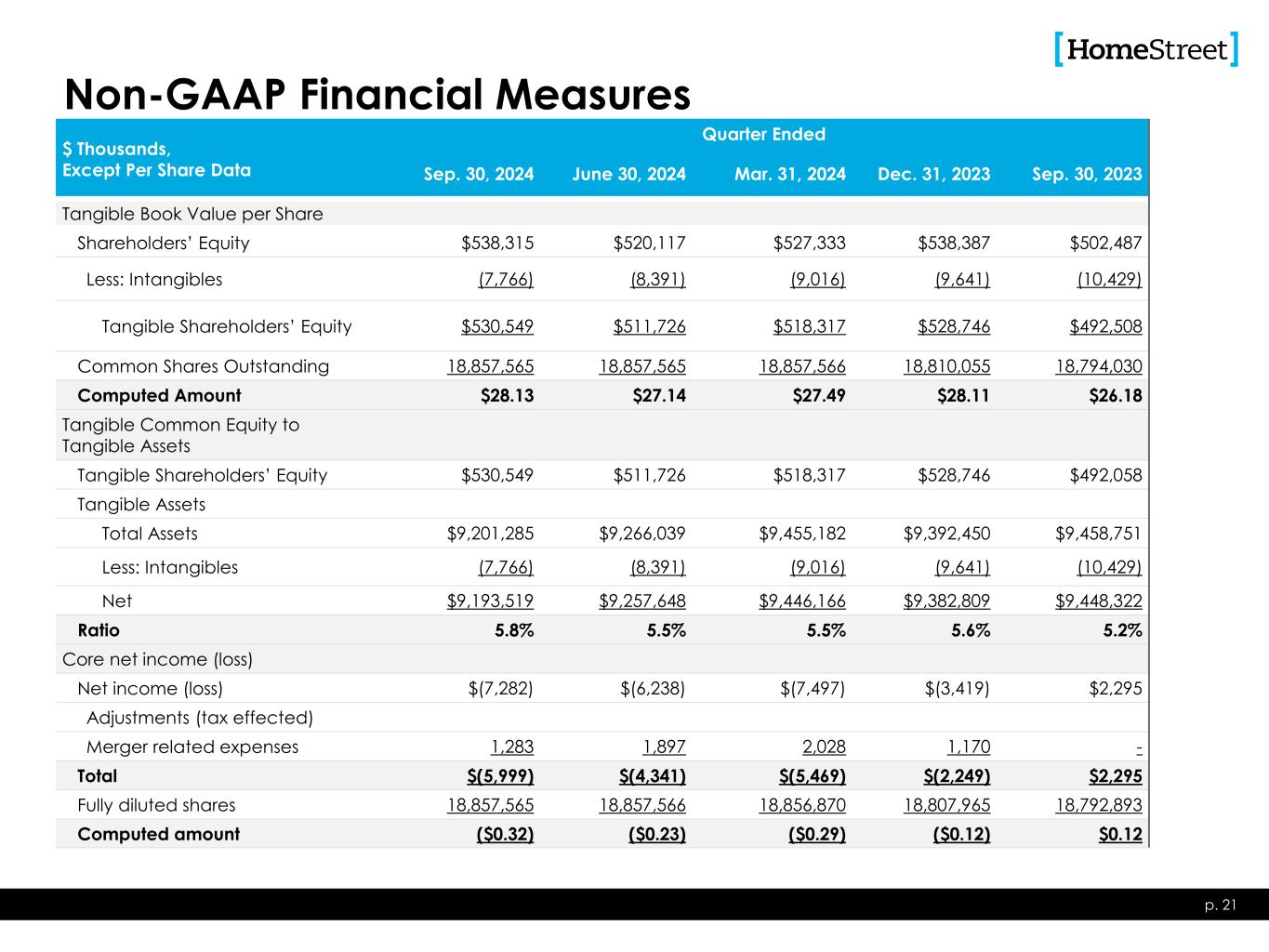

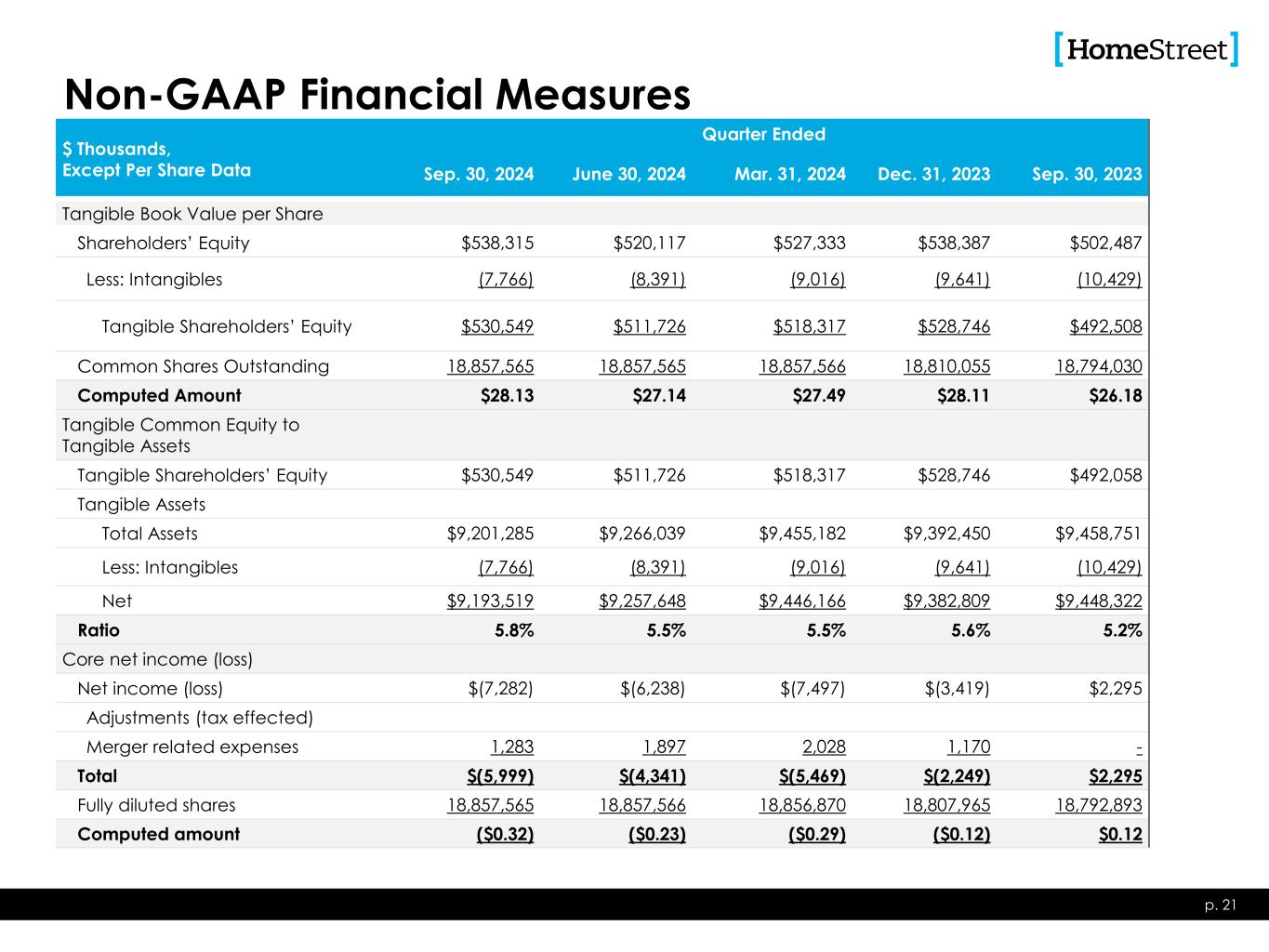

Non-GAAP Financial Measures $ Thousands, Except Per Share Data Quarter Ended Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Tangible Book Value per Share Shareholders’ Equity $538,315 $520,117 $527,333 $538,387 $502,487 Less: Intangibles (7,766) (8,391) (9,016) (9,641) (10,429) Tangible Shareholders’ Equity $530,549 $511,726 $518,317 $528,746 $492,508 Common Shares Outstanding 18,857,565 18,857,565 18,857,566 18,810,055 18,794,030 Computed Amount $28.13 $27.14 $27.49 $28.11 $26.18 Tangible Common Equity to Tangible Assets Tangible Shareholders’ Equity $530,549 $511,726 $518,317 $528,746 $492,058 Tangible Assets Total Assets $9,201,285 $9,266,039 $9,455,182 $9,392,450 $9,458,751 Less: Intangibles (7,766) (8,391) (9,016) (9,641) (10,429) Net $9,193,519 $9,257,648 $9,446,166 $9,382,809 $9,448,322 Ratio 5.8% 5.5% 5.5% 5.6% 5.2% Core net income (loss) Net income (loss) $(7,282) $(6,238) $(7,497) $(3,419) $2,295 Adjustments (tax effected) Merger related expenses 1,283 1,897 2,028 1,170 - Total $(5,999) $(4,341) $(5,469) $(2,249) $2,295 Fully diluted shares 18,857,565 18,857,566 18,856,870 18,807,965 18,792,893 Computed amount ($0.32) ($0.23) ($0.29) ($0.12) $0.12 p. 21

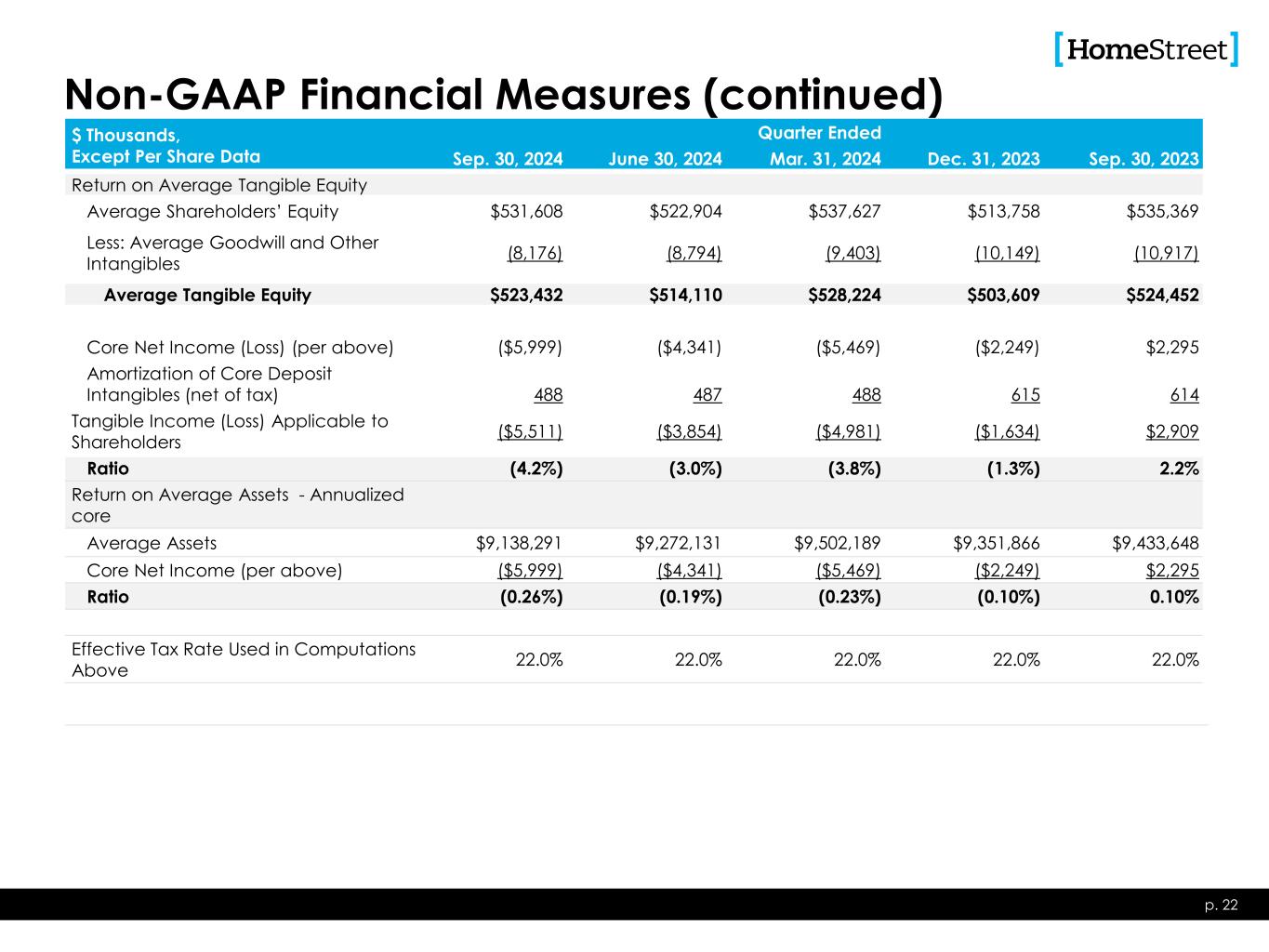

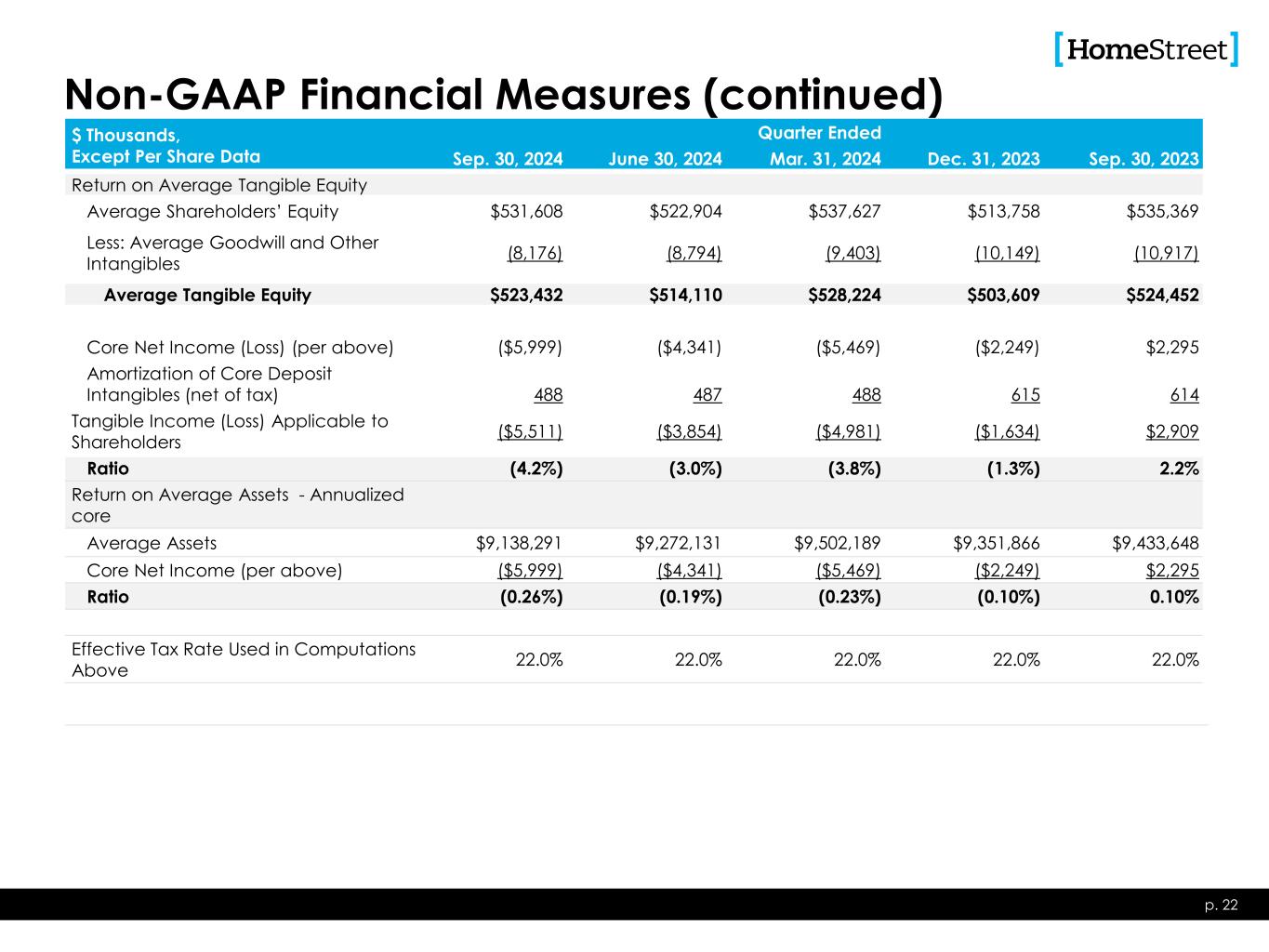

Non-GAAP Financial Measures (continued) $ Thousands, Except Per Share Data Quarter Ended Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Return on Average Tangible Equity Average Shareholders’ Equity $531,608 $522,904 $537,627 $513,758 $535,369 Less: Average Goodwill and Other Intangibles (8,176) (8,794) (9,403) (10,149) (10,917) Average Tangible Equity $523,432 $514,110 $528,224 $503,609 $524,452 Core Net Income (Loss) (per above) ($5,999) ($4,341) ($5,469) ($2,249) $2,295 Amortization of Core Deposit Intangibles (net of tax) 488 487 488 615 614 Tangible Income (Loss) Applicable to Shareholders ($5,511) ($3,854) ($4,981) ($1,634) $2,909 Ratio (4.2%) (3.0%) (3.8%) (1.3%) 2.2% Return on Average Assets - Annualized core Average Assets $9,138,291 $9,272,131 $9,502,189 $9,351,866 $9,433,648 Core Net Income (per above) ($5,999) ($4,341) ($5,469) ($2,249) $2,295 Ratio (0.26%) (0.19%) (0.23%) (0.10%) 0.10% Effective Tax Rate Used in Computations Above 22.0% 22.0% 22.0% 22.0% 22.0% p. 22

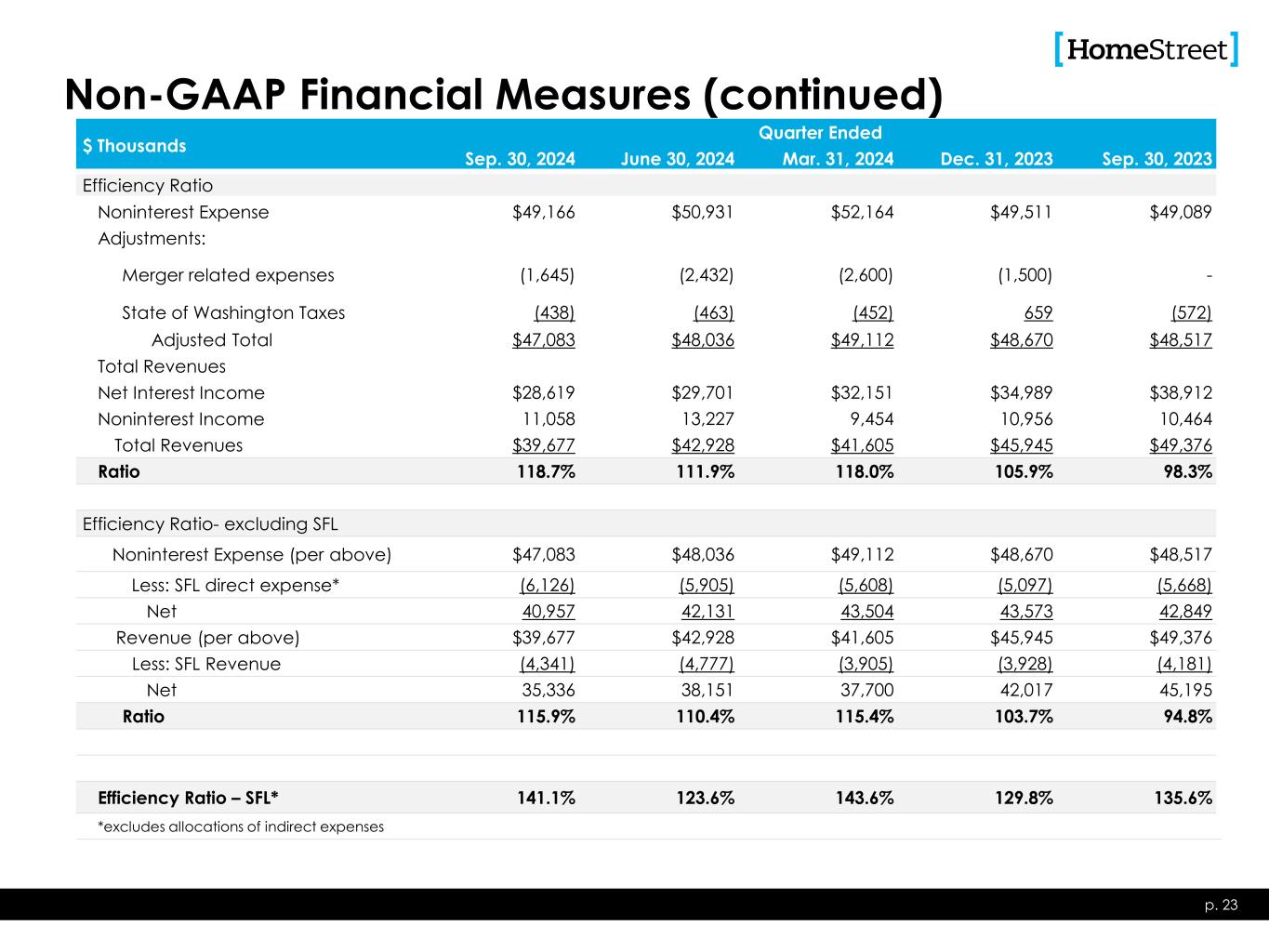

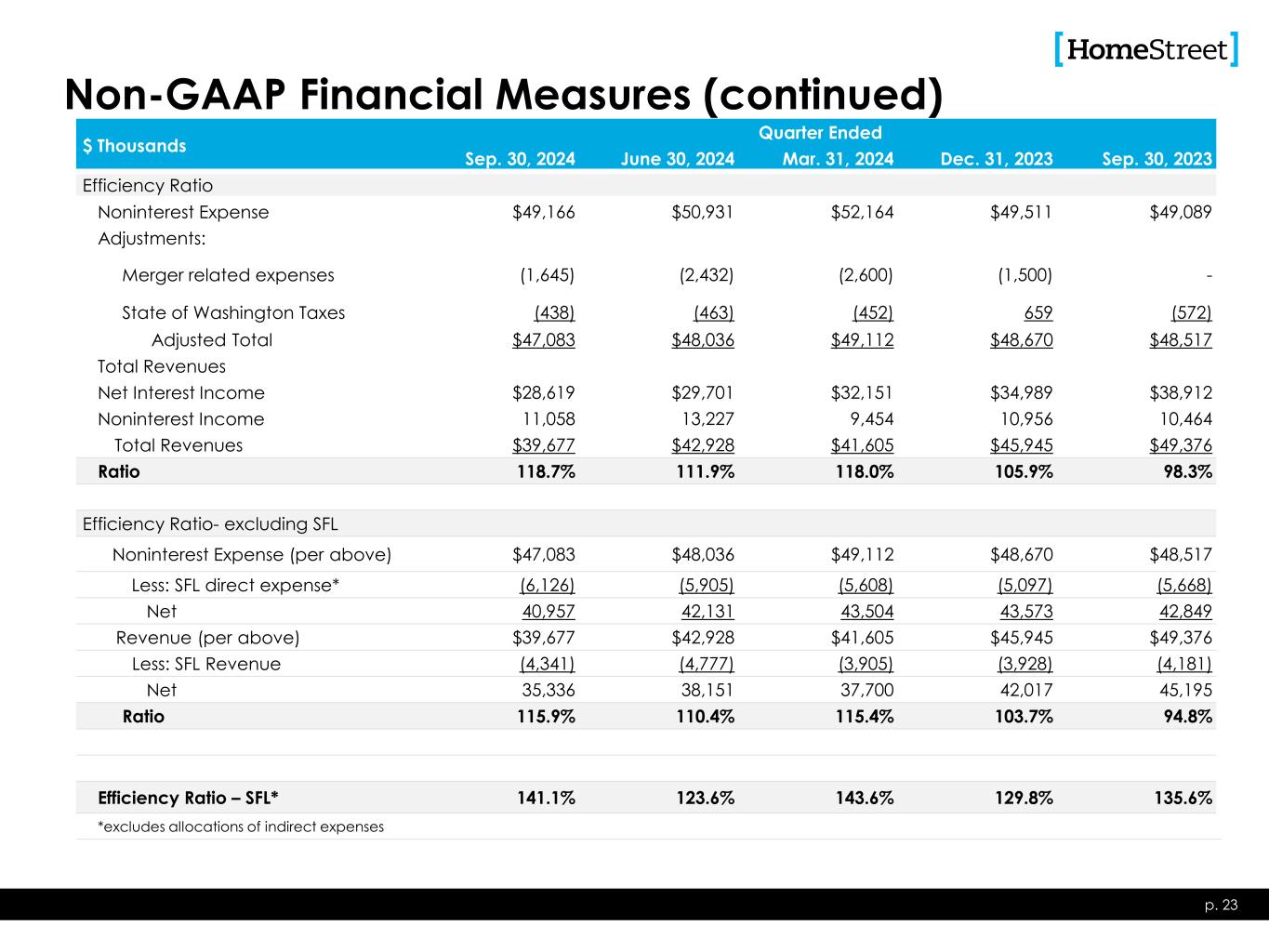

Non-GAAP Financial Measures (continued) $ Thousands Quarter Ended Sep. 30, 2024 June 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Sep. 30, 2023 Efficiency Ratio Noninterest Expense $49,166 $50,931 $52,164 $49,511 $49,089 Adjustments: Merger related expenses (1,645) (2,432) (2,600) (1,500) - State of Washington Taxes (438) (463) (452) 659 (572) Adjusted Total $47,083 $48,036 $49,112 $48,670 $48,517 Total Revenues Net Interest Income $28,619 $29,701 $32,151 $34,989 $38,912 Noninterest Income 11,058 13,227 9,454 10,956 10,464 Total Revenues $39,677 $42,928 $41,605 $45,945 $49,376 Ratio 118.7% 111.9% 118.0% 105.9% 98.3% Efficiency Ratio- excluding SFL Noninterest Expense (per above) $47,083 $48,036 $49,112 $48,670 $48,517 Less: SFL direct expense* (6,126) (5,905) (5,608) (5,097) (5,668) Net 40,957 42,131 43,504 43,573 42,849 Revenue (per above) $39,677 $42,928 $41,605 $45,945 $49,376 Less: SFL Revenue (4,341) (4,777) (3,905) (3,928) (4,181) Net 35,336 38,151 37,700 42,017 45,195 Ratio 115.9% 110.4% 115.4% 103.7% 94.8% Efficiency Ratio – SFL* 141.1% 123.6% 143.6% 129.8% 135.6% *excludes allocations of indirect expenses p. 23

Non-GAAP Financial Measures (continued) $ Thousands, except share data As of or for the Quarter Ended September 30, 2024 Carrying Value Fair Value Changes in Value Tangible Fair Value Per Share Tangible Shareholder’s Equity $530,549 Assets: Investment Securities HTM $2,318 $2,296 $(22) Loans held for investment 7,293,274 7,019,085 (274,189) MSRs – multifamily and SBA 26,322 31,970 5,648 Liabilities: Certificates of deposit 3,181,412 3,180,057 1,355 Borrowings 1,896,000 1,909,471 (13,471) Long term debt 225,039 184,609 40,430 Total Change in Value (240,249) Deferred taxes at 24.5% 58,861 $349,161 Shares outstanding 18,857,565 Computed Amount $18.52 p. 24

Non-GAAP Financial Measures (continued) p. 25 To supplement our unaudited condensed consolidated financial statements presented in accordance with GAAP, we use certain non- GAAP measures of financial performance. In this presentation, we use the following non-GAAP measures: (i) tangible common equity and tangible assets as we believe this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios; (ii) core net income (loss) which excludes goodwill impairment charges and merger related expenses as we believe this is a better comparison to be used in projecting future results; (iii)tangible fair value per share as we believe this information provides an estimate of what the current value per share is of the Company’s net assets; and (iv)an efficiency ratio, which is the ratio of noninterest expense to the sum of net interest income and noninterest income, excluding certain items of income or expense and excluding taxes incurred and payable to the state of Washington as such taxes are not classified as income taxes, and we believe including them in noninterest expense impacts the comparability of our results to those companies whose operations are in states where assessed taxes on business are classified as income taxes. These supplemental performance measures may vary from, and may not be comparable to, similarly titled measures provided by other companies in our industry. Non-GAAP financial measures are not in accordance with, or an alternative for, GAAP. Generally, a non- GAAP financial measure is a numerical measure of a company’s performance that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. A non- GAAP financial measure may also be a financial metric that is not required by GAAP or other applicable requirements. We believe that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by providing additional information used by management that is not otherwise required by GAAP or other applicable requirements. Our management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing our operating results and when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate a comparison of our performance to prior periods. We believe these measures are frequently used by securities analysts, investors and other parties in the evaluation of companies in our industry. Rather, these non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures prepared in accordance with GAAP. We have provided reconciliations of, where applicable, the most comparable GAAP financial measures to the non-GAAP measures used in this presentation, or a reconciliation of the non-GAAP calculation of the financial measure.