October 4, 2011 | ATTORNEYS AT LAW 777 EAST WISCONSIN AVENUE MILWAUKEE, WI 53202-5306 414.271.2400 TEL 414.297.4900 FAX foley.com CLIENT/MATTER NUMBER 041754-0130 |

Via E-Mail and EDGAR System

Peggy Kim Special Counsel Office of Mergers & Acquisitions U.S. Securities and Exchange Commission Division of Corporation Finance 100 F Street, N.E. Mail Stop 3628 Washington, DC 20549-3628 | |

Re: HF Financial Corp.

Soliciting Material filed under Rule 14a-12 by PL Capital et al.

Filed September 16, 2011

File No. 033-44383

Dear Ms. Kim:

We are writing on behalf of the PL Capital Group. The PL Capital Group currently consists of the following (collectively, “PL Capital Group”): Financial Edge Fund, L.P., a Delaware limited partnership; Financial Edge-Strategic Fund, L.P., a Delaware limited partnership; PL Capital/Focused Fund, L.P., a Delaware limited partnership; PL Capital, LLC, a Delaware limited liability company; PL Capital Advisors, LLC, a Delaware limited liability company; Goodbody/PL Capital, L.P., a Delaware limited partnership; Goodbody/PL Capital, LLC, a Delaware limited liability company; John W. Palmer; Richard J. Lashley; Beth R. Lashley; Robin Lashley and PL Capital Defined Benefit Pension Plan, a pension plan for PL Capital, LLC and its managing members. The PL Capital Group, Kevin V. Schieffer and the Kevin V. Schieffer Grantor Retained Annuity Trust are participants in the PL Capital Group’s solicitation to elect two directors to the board of directors of HF Financial Corp. (“HF Financial” or the “Company”). Set forth below are the PL Capital Group’s responses to comments of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in the Staff’s letter, dated September 19, 2011, with respect to the above-referenced solicitation material. The numbered items set forth below (in bold italics) repeat the comments of the Staff reflected in the comment letter, and following such comments are the PL Capital Group’s responses (in regular type).

In connection with the responses below, each participant and filing person acknowledges (1) that the participant or filing person is responsible for the adequacy and accuracy of the disclosure in the filing; (2) that Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and (3) that the participant or filing person may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

BOSTON BRUSSELS CHICAGO DETROIT | JACKSONVILLE LOS ANGELES MADISON MIAMI | MILWAUKEE NEW YORK ORLANDO SACRAMENTO | SAN DIEGO SAN DIEGO/DEL MAR SAN FRANCISCO SHANGHAI | SILICON VALLEY TALLAHASSEE TAMPA TOKYO WASHINGTON, D.C. |

.1

October 4, 2011

Page 2

Soliciting Material filed under Rule 14a-12

Why are we proposing our own nominees?

1. We note that you “believe HF Financial’s 2009 capital raise was massively dilutive to shareholders and ill-advised” and that you “have been disappointed by HF Financial’s financial performance.” Please further describe the capital raising transaction and why you believe it to be “massively dilutive and ill-advised.” Please also further describe your view of the issuer’s financial performance. Please provide supplementally to us, and revise future filings to disclose, your support for any statements relating to the company’s financial and market performance. In addition, to facilitate our review, where the bases are other documents, such as prior proxy statements, Forms 10-K and 10-Q, annual reports, analysts’ reports and newspaper articles, provide either complete copies of the documents or sufficient pages of information so that we can assess the context of the information upon which you rely. Mark the supporting documents provided to identify the specific information relied upon, such as quoted statements, financial statement line items, press releases, and mathematical computations, and identify the sources of all data utilized.

Response: In a letter from PL Capital, LLC to the Board of Directors of HF Financial dated December 1, 2009, the PL Capital Group provided detailed facts and figures on why it believed the 2009 capital raise was massively dilutive and ill-advised. See Exhibit A for a copy of the letter. In future filings, the PL Capital Group will describe the capital raising transaction and why it believes it to be “massively dilutive and ill-advised,” and will further describe its view of HF Financial’s financial performance, along with identifying support for any statements relating to the Company’s financial and market performance. See Exhibit B for a sample of such disclosure. In addition, under separate cover, the PL Capital Group will provide you an annotated copy of such filings with schedules setting forth the supplemental information that you have requested.

2. Please further describe why you believe that each candidate is “highly qualified.” Please also revise to include the dates for each position held during the past five years.

Response: In future filings, the PL Capital Group will further describe why it believes that each candidate is “highly qualified,” and will include the dates for each position held during the past five years. See Exhibit C for a sample of such disclosure.

Participants in Solicitation

3. We note you indicate that a description of direct and indirect interests will be contained in disclosure documents to be filed later. Please note that although participants relying upon Rule 14a-12 may refer to participant information provided in another filed document, the information must be available, current, and on file for review by security holders at the time the Rule 14a-12 materials are made publicly available. Participants may not refer to participant information to be provided at some future time such as the proxy statement. Refer to Rule 14a-12(a)(1)(i) and Exchange Act Release No. 42055, October 22, 1999, at Section II.C.1.b. In future filings, please revise to describe any direct or indirect interests.

Response: In future filings, the PL Capital Group will describe any direct or indirect interests by reference to its amended Schedule 13D filing. The disclosure will read as follows:

“Participants in Solicitation

The PL Capital Group currently consists of the following persons who will be participants in the solicitation from the Company’s stockholders of proxies in favor of the PL Capital Nominee, along with Kevin V. Schieffer and Kevin V. Schieffer Grantor Retained Annuity Trust: PL Capital, LLC; Goodbody/PL Capital, LLC; Financial Edge Fund, L.P.; Financial Edge-Strategic Fund, L.P.; PL Capital/Focused Fund, L.P.; Goodbody/PL Capital, L.P.; PL Capital Advisors, LLC; Richard J. Lashley; Beth R. Lashley; Dr. Robin Lashley; John W. Palmer; PL Capital Defined Benefit Pension Plan. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Stockholders may obtain current information regarding the participants and their interests in the amended Schedule 13D that the participants filed with the SEC on August 22, 2011, in particular Exhibit 5 to the amended Schedule 13D. These materials may be accessed from the SEC’s website free of charge.”

* * *

If the Staff has any questions with respect to any of the foregoing, please contact the undersigned at (414) 297-5596.

Very truly yours,

/s/ Peter D. Fetzer

Peter D. Fetzer

Enclosures

cc: John W. Palmer (w/o enclosures)

Richard J. Lashley (w/o enclosures)

PL Capital Group

Kevin V. Schieffer (w/o enclosures)

Phillip M. Goldberg (w/o enclosures)

Foley & Lardner LLP

Exhibit A

PL Capital LLC

20 East Jefferson Avenue

Suite 22

Naperville, IL 60540

December 1, 2009

via email, facsimile and mail

Board of Directors

HF Financial Corp.

225 South Main Avenue

Sioux Falls, SD 57104

Dear Directors:

The PL Capital Group is the second largest shareholder of HF Financial Corp. (the Company), holding approximately 7.1% of the currently outstanding shares (apparently, the largest shareholder is now Sandler O’Neill Asset Management, an affiliate of the Company’s underwriter for the recent offering, which recently filed a Schedule 13d reporting ownership of 9.86% of the Company, all acquired at $8.00 per share in the offering).

We are writing to express our deep concern that the Company’s Board of Directors (the Board) approved the recent capital transaction in which the Company increased its outstanding shares by more than 70%, at a net offering price equal to 45% of its tangible book value (TBV) per share (2.875 million shares issued for net proceeds of $20.744 million which equals $7.22 per issued share as compared to the pre-offering TBV per share of $16.20).

We believe the transaction is so dilutive to existing shareholders that the Board should have never approved it, and now that the offering is completed we see no viable way for the Company to offset it in any reasonable time frame, as discussed in more detail below. In our opinion, you must not have understood the massively dilutive impact on existing shareholders, because if you did, we do not believe that you would have approved it. Furthermore, to our knowledge this capital raise was completely discretionary, and not necessary to meet any regulatory capital mandates, pending net losses or other issues. It was also done against our repeated advice to CEO Curt Hage over the past few weeks and months.

Indeed, in our opinion, the capital raise was an unnecessary destruction of shareholder value, and the Board breached its fiduciary duty to shareholders when it approved the transaction, for the reasons discussed in more detail below.

The Board Inexplicably Allowed the Stock to be Sold at the Lowest Historical Valuation Ever

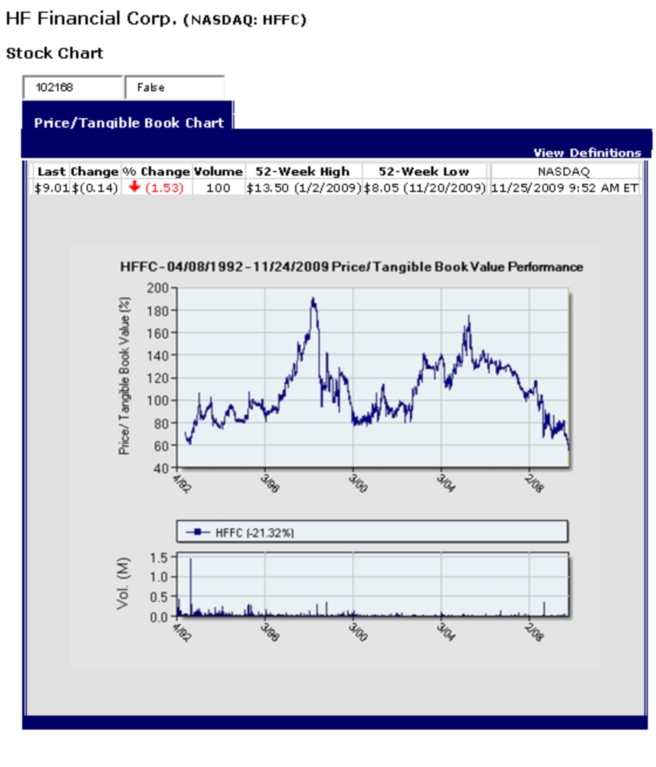

We simply do not understand the Board’s willingness to sell stock at 45% of tangible book value and approximately 5x earnings (FY 2009 EPS was $1.61 and the first quarter adjusted earnings run rate annualized is $1.64). 45% of TBV per share is the lowest valuation that the Company’s stock has ever traded for, including the initial conversion in April 1992 (see the attached chart of the historical stock price compared to tangible book value, from April 8, 1992 to the present). Mutual to stock conversion transactions are not being priced at those valuations, even in this market, let alone a well established franchise with solid earnings and minimal credit and capital issues. In our opinion, the Company and its shareholders would have both been better off if the Company had retained the preferred stock issued under the TARP program instead of doing this capital raise at that price.

In Our View the Board Breached its Fiduciary Duty to Shareholders by Inexplicably Issuing Stock at $8.00 Per Share ($7.22 of net proceeds); Effectively Re-Issuing Treasury Stock that Took 14 Years to Acquire at an Average Cost of $14.82 per Share; This Cost the Company and its Shareholders $20 Million or More

We are stunned by the Board’s willingness to issue 2.875 million shares at $8.00 per share ($7.22 of net proceeds), effectively re-issuing the 2.083 million shares of treasury stock which were patiently acquired over the past 14 years at an average cost of $14.82. The net direct after tax cost of acquiring and then re-issuing these treasury shares is $16 million (2.083 million treasury shares acquired at $14.82 average cost per share, reissued for net proceeds of $7.22 per share). If a reasonable amount of foregone earnings is added to the cost of acquiring the treasury stock, the cost to the Company and its shareholders easily exceeds $20 million. All that said, if the capital raise was done out of necessity, we would understand it. However, to our understanding this was a completely discretionary capital raise, and therefore inexplicable and indefensible as far as we are concerned. Indeed, in our opinion, the capital raise was an unnecessary destruction of shareholder value, and the Board breached its fiduciary duty to shareholders when it approved the transaction.

We Reject Management’s View That the Dilution Can Be Earned Back in any Reasonable Time Frame

Management has attempted to justify the capital raise dilution by suggesting that “possible” acquisition(s) of FDIC failed banks(s) will restore the diluted value, potentially “within one year.” We believe this is at best naïve because the dilution is so severe that the Company must earn back approximately $26 million to fully recover the TBV per share dilution ($16.20 TBV per share prior to the capital raise compared to $12.47 after, for a loss of $3.73 of TBV per share, times 6,919,000 currently outstanding shares equals $25.8 million needed to recover the dilution in TBV per share). To generate approximately $26 million after tax, the Company must earn approximately $40 million on a pretax basis. Simply put, we do not see any realistic way for the Company to earn that much, particularly given the relatively small bank that can be purchased with the available net proceeds from the capital raise (the available net proceeds will be approximately $10 to $12 million after the Company pays off the $6 million line of credit and holds back some cash at the holding company for dividends and expenses). With $10 to $12 million of available capital and a 6% or greater capital requirement, the Company might be able to purchase a $150 to $200 million asset failed bank from the FDIC. A generous 1.00% Return on Assets (ROA) on that size failed bank would generate at most $2 million of net income per year. So how is a $150 to $200 million asset failed bank acquisition, generating at most $2 million of net income per year (combined with ongoing historical earnings and the savings on the payoff of the line of credit), going to generate enough income to offset the $26 million of actual TBV per share dilution? Even if it does accomplish this, it would merely get the existing shareholders back to break even on a TBV per share basis!

The market figured out the cost of the dilutive capital raise to existing shareholders right away. The $26 million needed to restore the TBV per share dilution is consistent with the change needed in the market cap to restore the decline in the stock price after the capital raise was announced and completed. Prior to the public announcement of the capital raise, the stock was trading in the $13.00 range, compared to last Friday’s post offering close of $9.00, an approximate decline of 30%. To restore that decline, the market cap will now have to increase $28 million (6.9 million shares times $4.00 per share).

To recover the annual earnings per share (EPS) dilution on the 2.875 million additional shares issued, the Company will have to earn approximately $4.6 million per year after tax (assumes pre-offering EPS of $1.60 times 2.875 million incremental shares). As detailed above, how will a $150 to $200 million asset failed bank acquisition (plus the minimal after tax savings from the line of credit payoff) earn $4.6 million per annum, even if we assume a failed bank transaction can be found?

In our view, the transaction(s) and income needed to recover the TBV per share dilution ($26 million) and EPS dilution ($4.6 million per year) simply cannot be achieved in any reasonable time frame. We do not believe that the offering was in the best interests of the Company and its shareholders or that the Board fully understood the negative impact of the offering on the Company and its shareholders, which, in our opinion, is a breach of fiduciary duty to shareholders.

The Company’s Local Retail Investors Were Hurt

The Company’s existing individual retail investors, many of whom have owned the stock for years and are customers of the Bank, were damaged as much or worse than us and the existing institutional investors. Not only did the retail investor get diluted, but they were not even allowed to participate in the capital raise (as we were). If the Board was willing to sell stock at 45% of tangible book value, we believe the ethical thing to do was a rights offering (with standby institutional investors) instead of a secondary offering, thereby giving all existing investors a chance to offset their dilution by participating.

Since Shareholders Have Been Diluted, it is Time for Shared Sacrifice by the Board and Management

Since the Board and management appear to have decided that the hypothetical future rewards of additional capital and potential failed bank acquisitions are worth the actual sacrifice by existing shareholders, we believe it is time for shared sacrifice by the Board and management. As noted above, we think the capital raise was a mistake (in fact, we cannot recall another comparable discretionary capital raise that was as dilutive and ill-advised in our collective 52 years of experience). Nonetheless, now that the Board and management have committed to this path, it is time for the Board and management to share in the collective sacrifice. So, we request that the Board immediately reduce its fees and benefits by at least 30%, in line with the approximate decline in the stock price and the dilution incurred by existing shareholders. If and when the dilution is recovered, the Board can consider re-instating the historical Board fee and benefits structure. With regard to senior management’s compensation, we request that the Board reduce senior management’s total compensation and benefits by at least 30%, at least until such time as the dilution in TBV is recovered ($16.20 TBV per share).

We also request that no stock options be issued by the Company that have an exercise price below $13.00, the approximate price at which the stock traded before this ill-advised capital raise was announced.

PL Capital Regrets Previously Trusting the Company’s Management and the Board

As you know, PL Capital signed a standstill agreement with respect to the Company for the 2009 and 2010 Annual Meetings. We signed that agreement in part due to our belief that PL Capital did not need to take an active role in the governance of the Company because the management and the Board were doing a good job and had shareholders’ best interests in mind. Given the magnitude of the damage done by this ill-timed and ill-advised capital raise, we regret trusting the Company’s management and Board. It is obvious to us that the Board and management are either incapable of understanding the concept of shareholder value, or do understand, but don’t care. Either way, we have lost confidence in management and the Board. We also regret signing the standstill agreement and look forward to its expiration. We also fear that the Board and management have lost credibility among other investors and shareholders.

We look forward to the Board’s response. We are also available to meet with the Board to further explain our concerns and requests.

Sincerely,

/s/ John W. Palmer /s/ Richard J. Lashley

John W. Palmer Richard J. Lashley

Exhibit B

THE PL CAPITAL GROUP IS SEEKING TWO BOARD SEATS

We are seeking to elect John W. Palmer and Kevin V. Schieffer as directors of the board, in opposition to the candidates nominated by HF Financial because of the following concerns about HF Financial’s performance and management:

HF FINANCIAL’S EARNINGS AND CREDIT QUALITY HAVE DETERIORATED:

| ● | Fiscal 2011 EPS Declined 90% vs. Fiscal 2010 |

| ● | Fiscal 2011 EPS Declined 94% vs. Fiscal 2009 |

| ● | Nonperforming Assets (NPAs) Have Increased From 0.73% of Total Assets as of 6/30/10 to 3.12% as of 6/30/11 |

HF FINANCIAL’S 2009 CAPITAL RAISE WAS DILUTIVE TO SHAREHOLDERS:

| ● | HF Financial Issued 2.875 Million Shares in the 2009 Capital Raise at $8.00 per Share ($7.22 per share net of issuance costs) |

| ● | Tangible Book Value (“TBV”) Was $16.20 per Share Before the Capital Raise (9/30/09) |

| ● | TBV Was Diluted to $12.47 per Share After the Capital Raise (12/31/09); a Decrease of 23% |

| ● | This TBV Dilution Remains; TBV was $12.92 per Share (6/30/11) |

| ● | The Effective Net Issuance Price ($7.22 per share) Was 45% of TBV per Share; That is the LOWEST VALUATION LEVEL that HF Financial’s Common Stock EVER TRADED For in its History (compared to its Tangible Book Value per Share) |

| ● | HF Financial Held 2.083 Million Shares in its Treasury Prior to the 2009 Capital Raise (9/30/09) Which Were Repurchased Over the Years at an Average Price of $14.82 Per Share—The 2009 Capital Raise Effectively Re-Issued Those Shares at a Price of $8.00 Per Share ($7.22 per share net of issuance costs)—Net Difference to Shareholders: -$15.8 Million |

| ● | We Have Not Seen or Heard Any Plan from HF Financial on How They Will Recover This Dilution |

| ● | PL Capital Opposed the 2009 Capital Plan at that Time But HF Financial Effected Capital Raise in Spite of Such Opposition |

HF FINANCIAL IS AT A CRITICAL JUNCTURE IN ITS HISTORY AS A PUBLIC COMPANY AS IT SEEKS TO REPLACE ITS RETIRING CEO.

WE BELIEVE IT’S AN APPROPRIATE TIME FOR THE BOARD TO LOOK AT ALL STRATEGIC ALTERNATIVES:

| ● | Long-time Chairman and CEO Curt Hage Announced That He is Retiring Effective 12/31/11 |

| ● | In Our View, Before Hiring a New CEO, the Board Should Actively Consider All Strategic Alternatives, Including a sale of HF Financial, a Merger of Equals, Acquisitions by HF Financial, Stock Buybacks, and Franchise Expansion into New Markets |

HF FINANCIAL’S STOCK PRICE HAS DECLINED:

| ● | One Year Period Ended 9/23/11: -19% |

| ● | Three Year Period Ended 9/23/11: -42% |

| ● | Five Year Period Ended 9/23/11: -49% |

| ● | Ten Year Period Ended 9/23/11: -12% |

Exhibit C

OUR NOMINEES

HF Financial’s board of directors currently consists of seven members. At the Annual Meeting, the PL Capital Group will seek to elect Mr. Palmer and Mr. Schieffer to fill two of the three open seats, in opposition to the candidates nominated by the Company’s incumbent board of directors. The election of Mr. Palmer and Mr. Schieffer requires the affirmative vote of a plurality of the votes cast. If elected, Mr. Palmer and Mr. Schieffer would be entitled to serve a three-year term ending in 2014.

In our opinion, the Company would benefit from fresh perspectives, fresh ideas, fresh viewpoints and new energy as it seeks to confront the current challenges and the challenges that lie ahead. Our nominees will act to have the Company conduct a meaningful review of its operational and strategic plans to ensure that the enhancement of shareholder value is one of the ultimate objectives. We do not have any specific plans as we do not have access to the information necessary to formulate meaningful plans for the Company.

INDEPENDENCE AND QUALIFICATIONS OF OUR DIRECTORS

We believe that all of our nominees would be deemed “independent” under the NASDAQ Marketplace Rules. We also believe that one of our nominees, Mr. Palmer, would qualify as an “audit committee financial expert,” as that term is defined by the Securities and Exchange Commission (SEC) and the NASDAQ Marketplace Rules.

Mr. Palmer’s extensive financial and accounting background, combined with his extensive knowledge of the banking industry, qualify him to serve on the Company’s board of directors. Specifically, his extensive experience with, and understanding of, financial and accounting issues will allow him to provide the board with valuable recommendations and ideas. In addition, Mr. Palmer’s extensive knowledge of the banking industry makes him a valuable source of information, and will allow him to provide useful insight and advice.

Mr. Schieffer’s deep financial understanding and legal background qualify him to serve on the Company’s board of directors. Specifically, his extensive experience as a chief executive officer and businessman has honed his understanding of financial statements and the varied issues that confront businesses, which will make him a valuable source of knowledge for the Board of Directors. In addition, Mr. Schieffer’s training and experience as an attorney will allow him to efficiently and effectively address and understand the complex regulatory issues that confront the Company, which will allow him to provide the board with valuable recommendations and ideas.

Furthermore, the role of an effective director inherently requires certain personal qualities, such as integrity, as well as the ability to comprehend, discuss and critically analyze materials and issues that are presented so that the director may exercise judgment and reach conclusions in fulfilling his duties and fiduciary obligations. The PL Capital Group believes that Mr. Palmer’s and Mr. Schieffer’s backgrounds and expertise, as set forth below, evidences those abilities and is appropriate to their serving on the Company’s board of directors.

MR. JOHN W. PALMER

Mr. Palmer is the co-founder and a principal of PL Capital, LLC, an investment firm specializing in the banking industry. PL Capital focuses on small-capitalization and mid-capitalization publicly-traded banks, such as HF Financial.

Prior to co-founding PL Capital in 1996, Mr. Palmer was employed by KPMG LLP, an international public accounting firm, from 1983 to 1996. While at KPMG, Mr. Palmer was a Certified Public Accountant (CPA) who specialized as an auditor and a strategic advisor to companies in the commercial banking, consumer finance, thrift, mortgage banking and discount brokerage industries, serving public and privately held clients ranging in size from $25 million to $25 billion in assets. He has extensive involvement in merger and acquisition transactions, public and private securities offerings, and filings with the SEC and other regulatory authorities, including offerings to convert mutual thrift organizations to stock form thrifts. He has advised numerous banking organizations in strategic decisions regarding acquisition alternatives, mergers of equals and opportunities to enhance or expand existing lines of business. In 1994, Mr. Palmer was promoted to the position of Director, KPMG Financial Services - Capital Strategies Group, a corporate finance practice providing merger and acquisition advisory services to thrifts, banks, mortgage companies and other financial services companies nationwide. In this capacity, Mr. Palmer developed expertise in bank mergers and acquisitions, thrift mutual to stock conversions, valuations, capital restructurings, strategic planning and asset purchases and divestitures. He has been involved in numerous mergers and acquisitions with transaction values ranging from $10 million to $600 million.

Mr. Palmer also instructed financial institution classes for other KPMG professionals, and spoke at national and regional banking industry conferences. Mr. Palmer has previously been designated as an “audit committee financial expert” due to his prior experience, understanding of generally accepted accounting principles and financial statements; the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; experience preparing, auditing, analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised in financial statements of publicly traded banks such as HF Financial; an understanding of internal control over financial reporting; and an understanding of audit committee functions. Mr. Palmer acquired these attributes through his education and experience as a CPA. Mr. Palmer previously served on the audit committee of a public company (Franklin Bancorp, Inc.) where he was designated as an “audit committee financial expert.”

Mr. Palmer currently serves on the board of CFS Bancorp, Inc. which is the parent holding company of Citizens Financial Bank, a $1.1 billion asset federal savings bank which operates 23 offices throughout adjoining markets in Chicago’s Southland and Northwest Indiana. Mr. Palmer is the former Chairman of the Board of Directors of Security Financial Bancorp, Inc., a publicly-traded $200 million in assets thrift located in St. John, Indiana which was sold in 2003. Mr. Palmer also previously served as a director of Franklin Bancorp and its wholly owned subsidiary Franklin Bank, NA, a $700 million in assets commercial bank located in Southfield, Michigan, where he also served on the audit, compensation, and loan committees of the board. Mr. Palmer also served as Chairman of the strategic planning committee of Franklin Bancorp. He formerly served on the Board of Directors of Clever Ideas, Inc., a privately-held specialty finance company located in Chicago, Illinois from 1998 to 2006.

Mr. Palmer obtained his Bachelor of Accounting Degree from Walsh College in 1983. He formerly practiced as a Certified Public Accountant in Michigan and Illinois and is currently a member of the American Institute of Certified Public Accountants and the Illinois CPA Society. Mr. Palmer, age 51, is married, has three children, and resides in Naperville, Illinois.

Mr. Palmer is the beneficial owner of 567,852 shares. He has consented to being named in this proxy and to serve, if elected.

We note that there can be no assurances given that Mr. Palmer, if elected, will be successful in persuading other members of the board to adopt any of his suggestions, because Mr. Palmer would only constitute one member out of seven, a minority position.

MR. KEVIN V. SCHIEFFER

Mr. Schieffer is currently a self-employed investor. From 1996 to 2008, Mr. Schieffer served as the President and Chief Executive Officer of Cedar American Rail Holdings, Inc. (and Dakota, Minnesota & Eastern Railroad Corporation and Iowa, Chicago & Eastern Railroad Corporation). He is also trained as an attorney, and has served in a number of legal capacities, including serving as a United States Attorney for the State of South Dakota (1991-1993) and managing partner of a law firm based in Sioux Falls (1993-1996). He also served as Chief of Staff to Senator Larry Pressler (R-South Dakota) from 1982 to 1991.

Mr. Schieffer received his J.D. in 1986 from the Georgetown University Law Center, and he received his B.A. from the University of South Dakota in 1982. He was an Adjunct Professor of Law at Georgetown University Law Center (1990-1991).

Mr. Schieffer, age 53, resides in Sioux Falls, South Dakota. He is the beneficial owner of 116,365 shares. He has consented to being named in this proxy and to serve, if elected.

We note that there can be no assurances given that Mr. Schieffer, if elected, will be successful in persuading other members of the board to adopt any of his suggestions, because Mr. Schieffer would only constitute one member out of seven, a minority position.