Exhibit 14

A Call for Action Strategic Alternatives for Magyar Bancorp Richard Lashley, PL Capital, LLC January 9, 2012

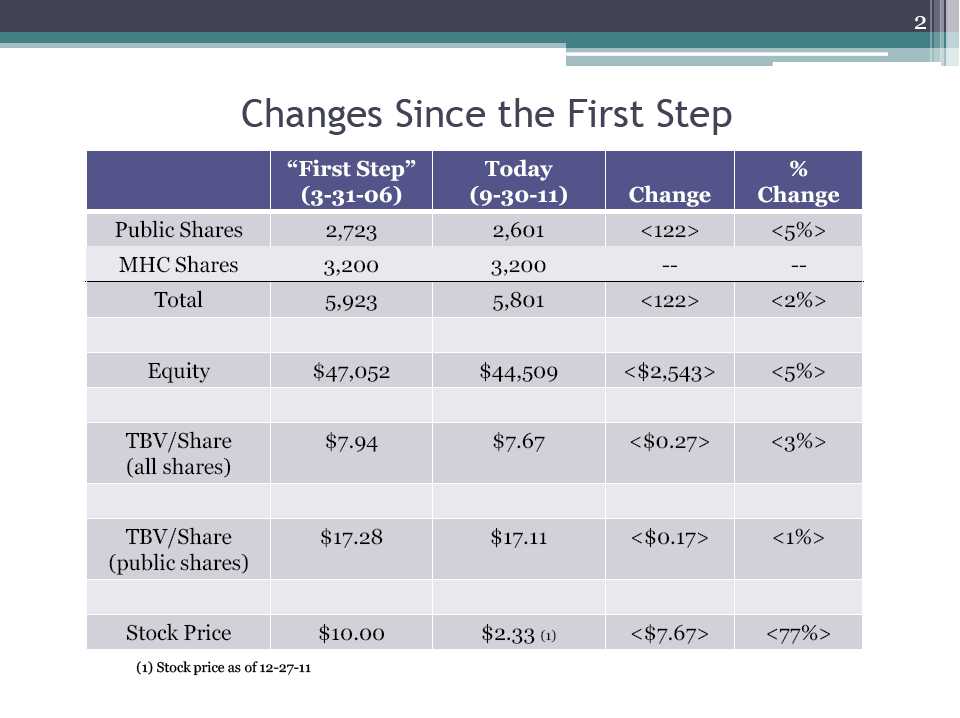

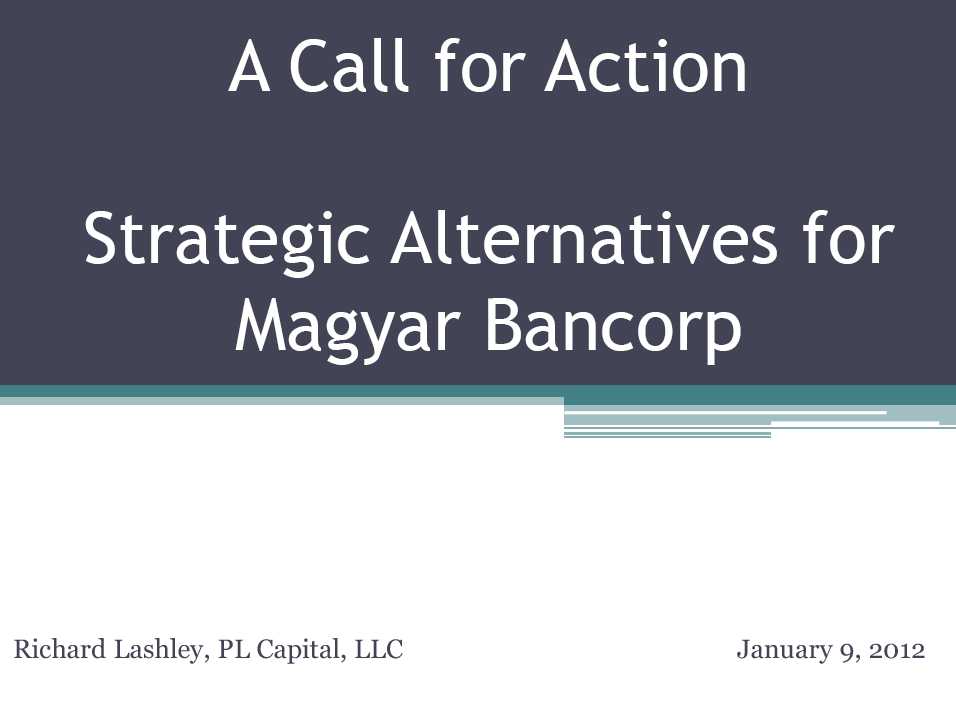

2 Changes Since the First Step “First Step” Today % (3-31-06) (9-30-11) Change Change Public Shares 2,723 2,601 <122> <5%> MHC Shares 3,200 3,200 -- -- Total 5,923 5,801 <122> <2%> Equity $47,052 $44,509 <$2,543> <5%> TBV/Share $7.94 $7.67 <$0.27> <3%> (all shares) TBV/Share $17.28 $17.11 <$0.17> <1%> (public shares) Stock Price $10.00 $2.33 (1) <$7.67> <77%> (1) Stock price as of 12-27-11

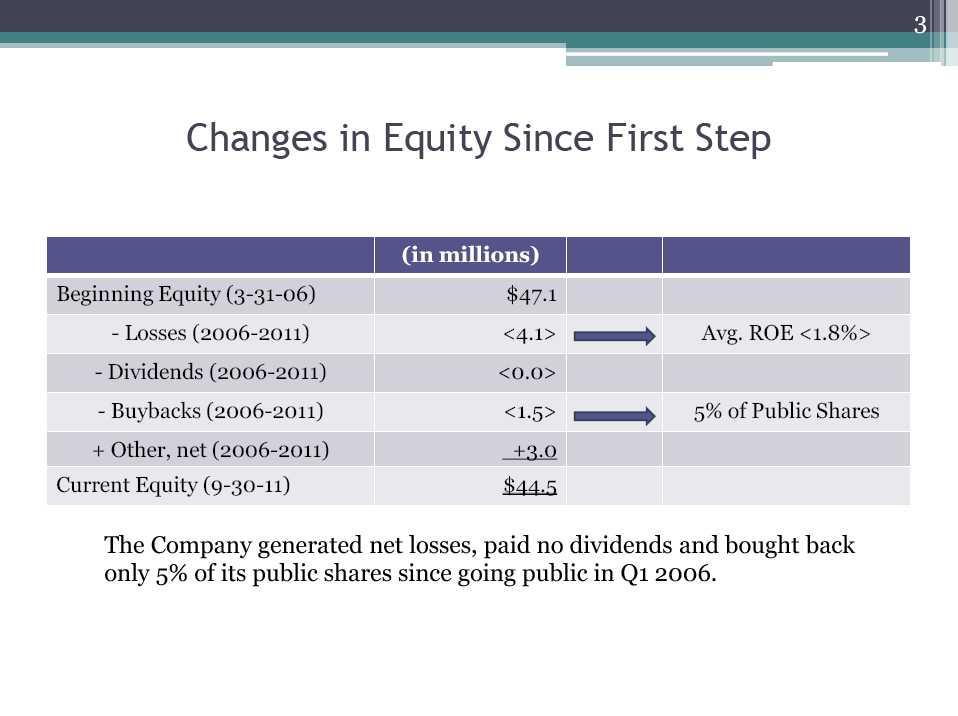

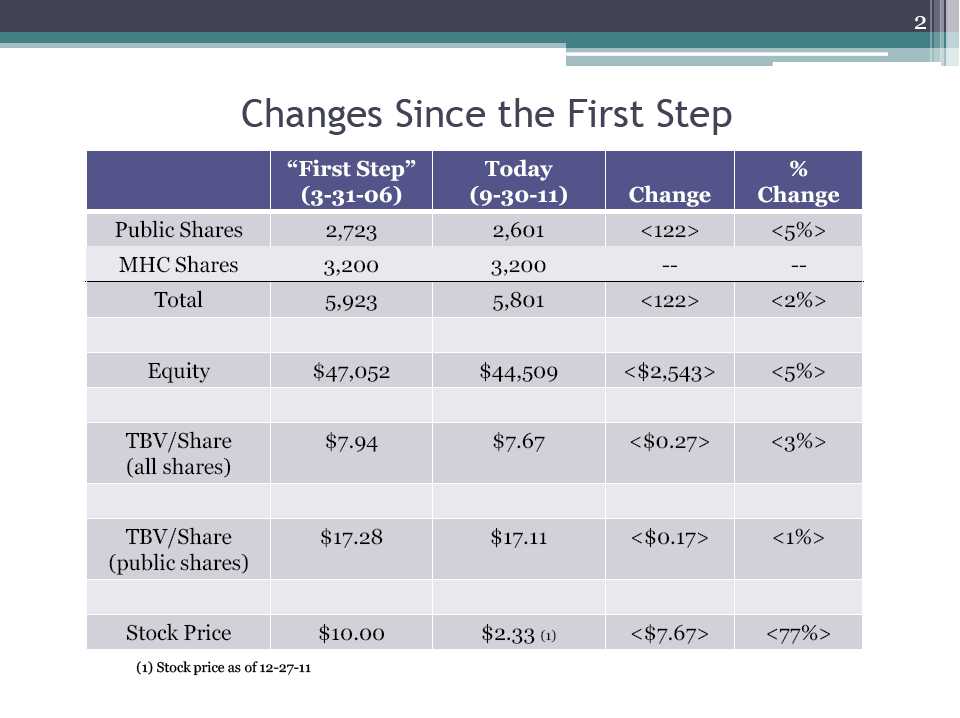

3 Changes in Equity Since First Step (in millions) Beginning Equity (3-31-06) $47.1 - Losses (2006-2011) <4.1> Avg. ROE <1.8%> - Dividends (2006-2011) <0.0> - Buybacks (2006-2011) <1.5> 5% of Public Shares + Other, net (2006-2011) +3.0 Current Equity (9-30-11) $44.5 The Company generated net losses, paid no dividends and bought back only 5% of its public shares since going public in Q1 2006.

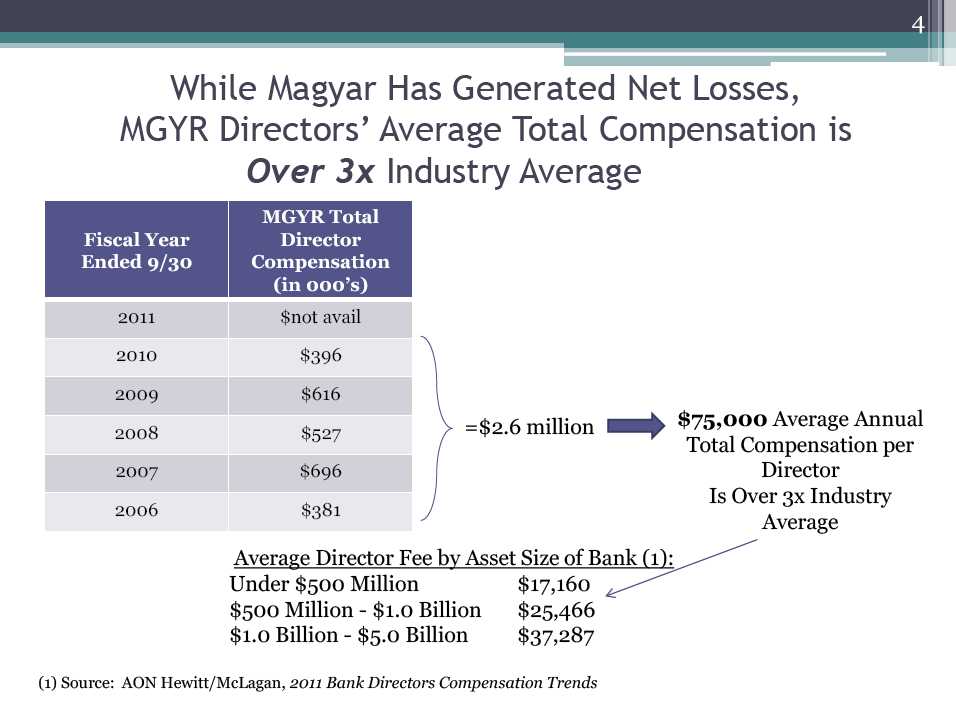

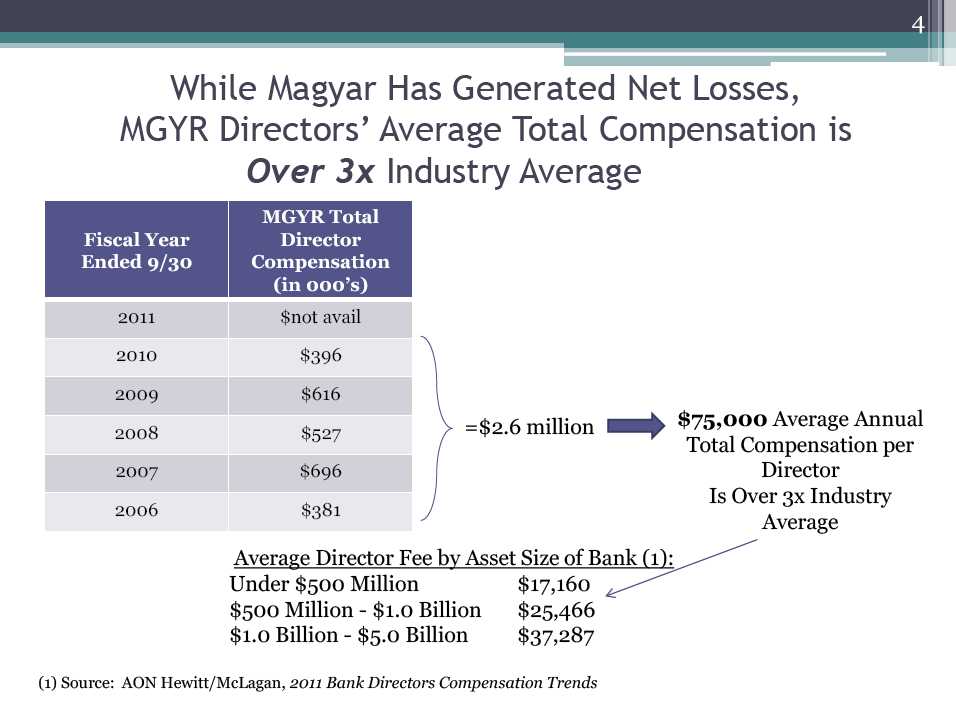

4While Magyar Has Generated Net Losses, MGYR Directors’ Average Total Compensation is Over 3x Industry Average MGYR Total Fiscal Year Director Ended 9/30 Compensation (in 000’s) 2011 $not avail 2010 $396 2009 $616 = $2.6 million $75,000 Average Annual 2008 $527 Total Compensation per 2007 $696 Director Is Over 3x Industry 2006 $381 Average Average Director Fee by Asset Size of Bank (1): Under $500 Million $17,160 $500 Million - $1.0 Billion $25,466 $1.0 Billion - $5.0 Billion $37,287 (1) Source: AON Hewitt/McLagan, 2011 Bank Directors Compensation Trends

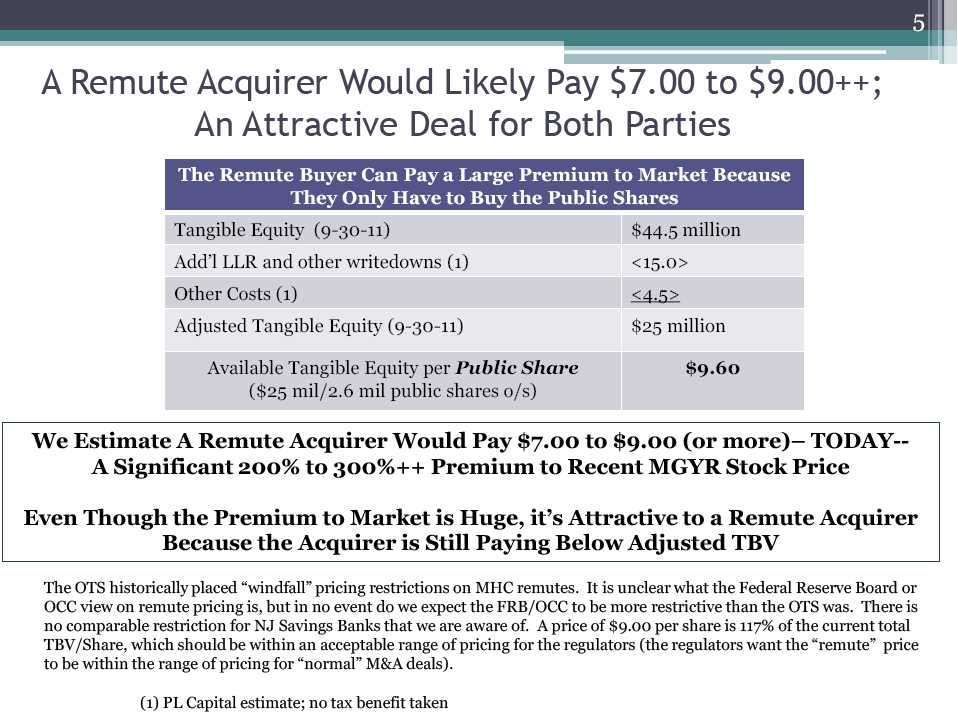

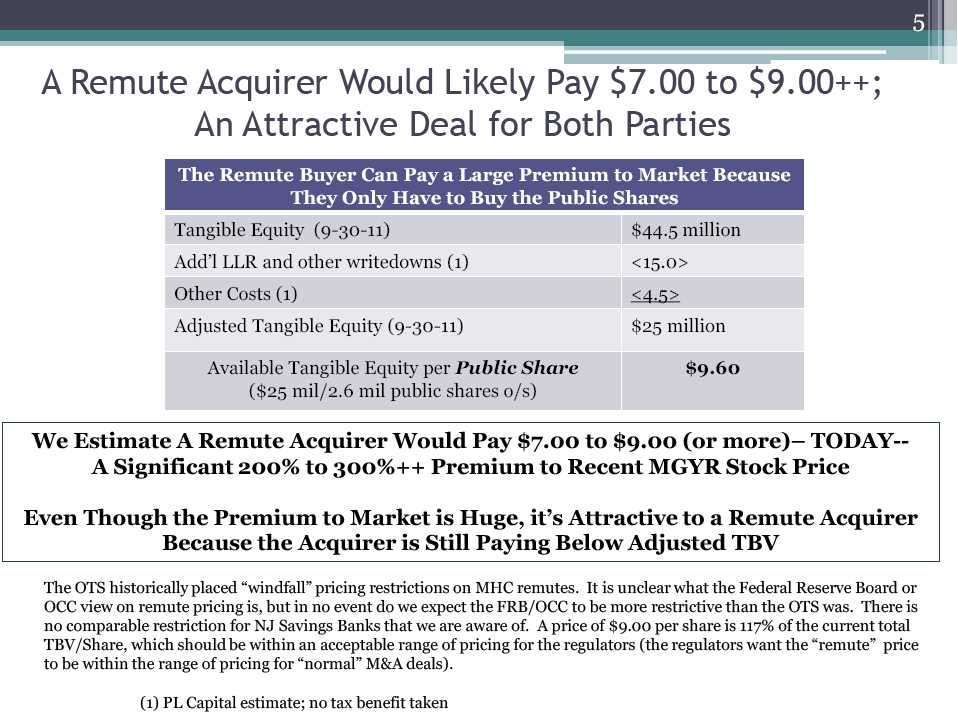

5A Remute Acquirer Would Likely Pay $7.00 to $9.00++; An Attractive Deal for Both Parties The Remute Buyer Can Pay a Large Premium to Market Because They Only Have to Buy the Public Shares Tangible Equity (9-30-11) $44.5 million Add’l LLR and other writedowns (1) <15.0> Other Costs (1) <4.5> Adjusted Tangible Equity (9-30-11) $25 million Available Tangible Equity per Public Share $9.60 ($25 mil/2.6 mil public shares o/s) We Estimate A Remute Acquirer Would Pay $7.00 to $9.00 (or more)– TODAY-- A Significant 200% to 300%++ Premium to Recent MGYR Stock Price Even Though the Premium to Market is Huge, it’s Attractive to a Remute Acquirer Because the Acquirer is Still Paying Below Adjusted TBV The OTS historically placed “windfall” pricing restrictions on MHC remutes. It is unclear what the Federal Reserve Board or OCC view on remute pricing is, but in no event do we expect the FRB/OCC to be more restrictive than the OTS was. There is no comparable restriction for NJ Savings Banks that we are aware of. A price of $9.00 per share is 117% of the current total TBV/Share, which should be within an acceptable range of pricing for the regulators (the regulators want the “remute” price to be within the range of pricing for “normal” M&A deals). (1) PL Capital estimate; no tax benefit taken

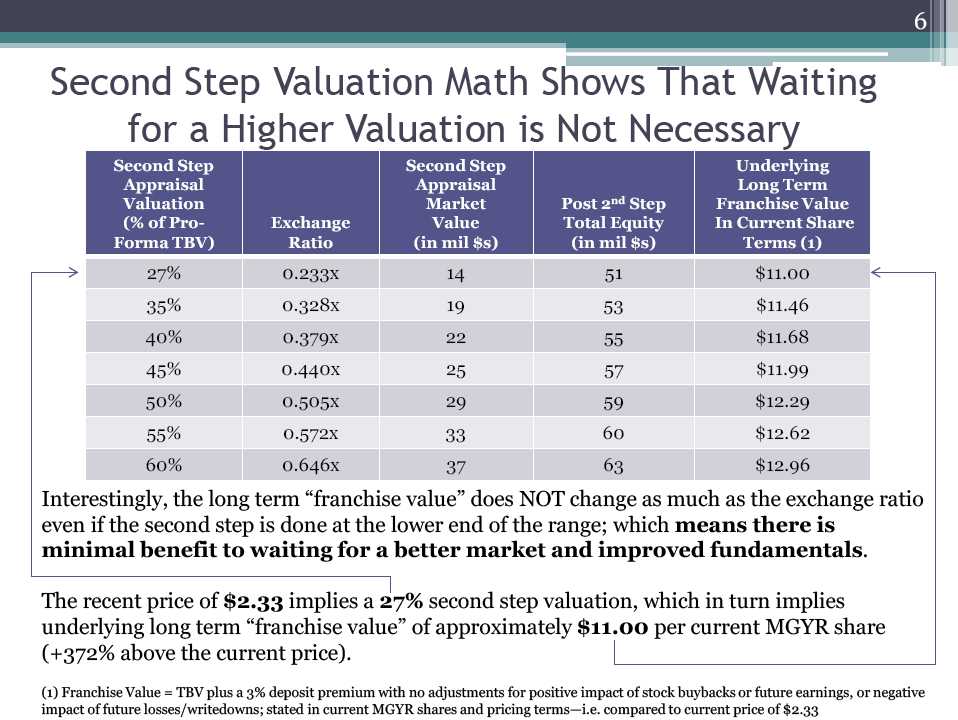

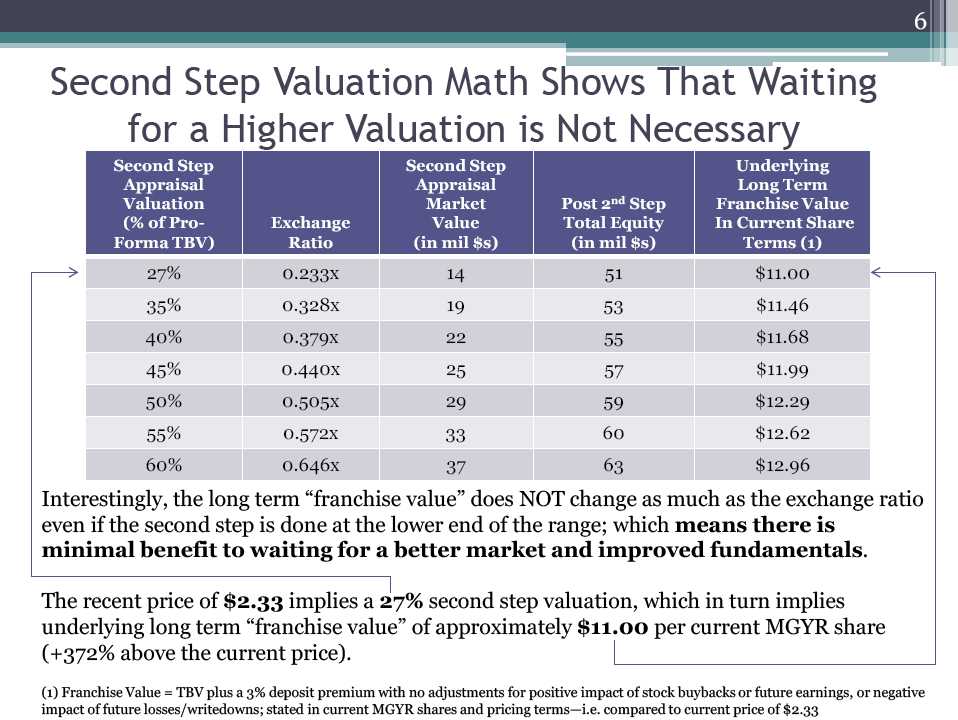

6 Second Step Valuation Math Shows That Waiting for a Higher Valuation is Not Necessary Second Step Second Step Underlying Appraisal Appraisal Long Term Valuation Market Post 2nd Step Franchise Value (% of Pro- Exchange Value Total Equity In Current Share Forma TBV) Ratio (in mil $s) (in mil $s) Terms (1) 27% 0.233x 14 51 $11.00 35% 0.328x 19 53 $11.46 40% 0.379x 22 55 $11.68 45% 0.440x 25 57 $11.99 50% 0.505x 29 59 $12.29 55% 0.572x 33 60 $12.62 60% 0.646x 37 63 $12.96 Interestingly, the long term “franchise value” does NOT change as much as the exchange ratio even if the second step is done at the lower end of the range; which means there is minimal benefit to waiting for a better market and improved fundamentals. The recent price of $2.33 implies a 27% second step valuation, which in turn implies underlying long term “franchise value” of approximately $11.00 per current MGYR share (+372% above the current price). (1) Franchise Value = TBV plus a 3% deposit premium with no adjustments for positive impact of stock buybacks or future earnings, or negative impact of future losses/writedowns; stated in current MGYR shares and pricing terms—i.e. compared to current price of $2.33

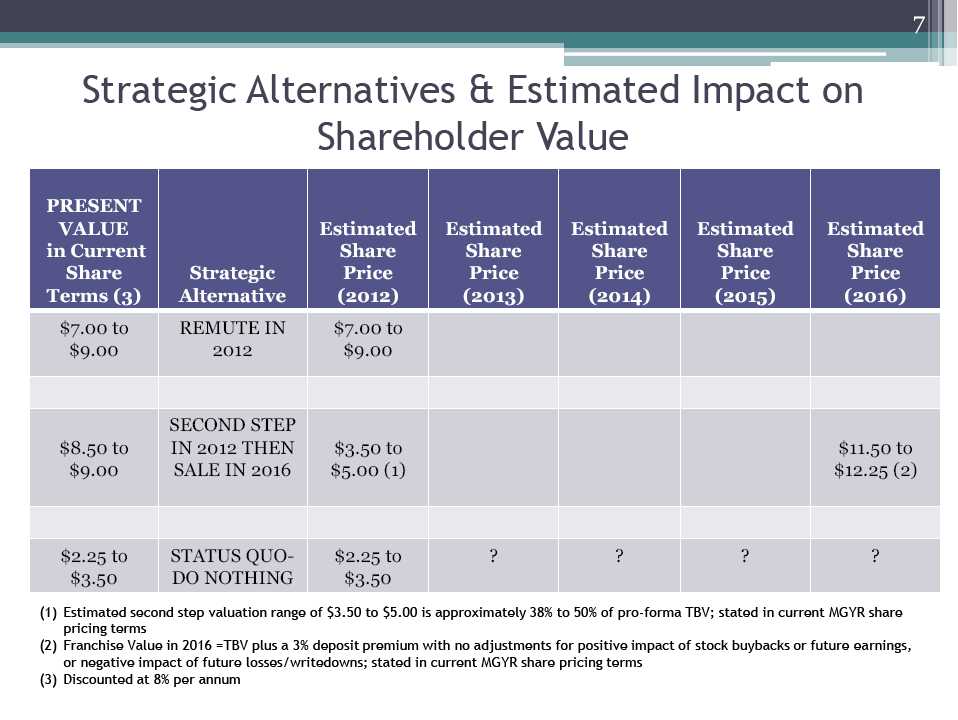

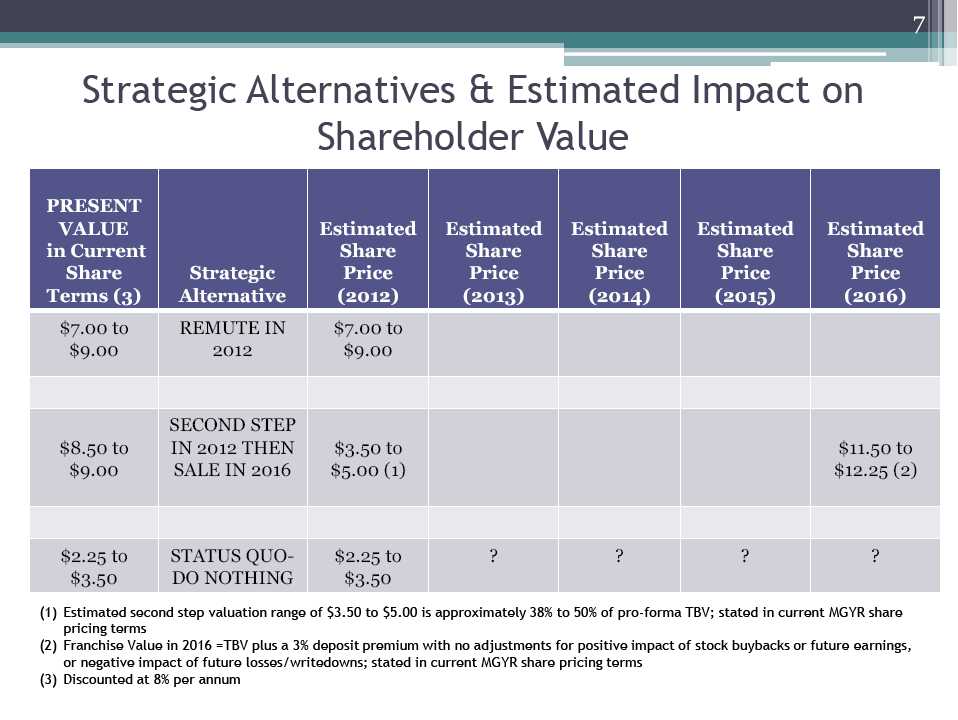

7 Strategic Alternatives & Estimated Impact on Shareholder Value PRESENT VALUE Estimated Estimated Estimated Estimated Estimated in Current Share Share Share Share Share Share Strategic Price Price Price Price Price Terms (3) Alternative (2012) (2013) (2014) (2015) (2016) $7.00 to REMUTE IN $7.00 to $9.00 2012 $9.00 SECOND STEP $8.50 to IN 2012 THEN $3.50 to $11.50 to $9.00 SALE IN 2016 $5.00 (1) $12.25 (2) $2.25 to STATUSQUO - $2.25 to ? ? ? ? $3.50 DO NOTHING $3.50 (1) Estimated second step valuation range of $3.50 to $5.00 is approximately 38% to 50% of pro-forma TBV; stated in current MGYR share pricing terms (2) Franchise Value in 2016 =TBV plus a 3% deposit premium with no adjustments for positive impact of stock buybacks or future earnings, or negative impact of future losses/writedowns; stated in current MGYR share pricing terms (3) Discounted at 8% per annum

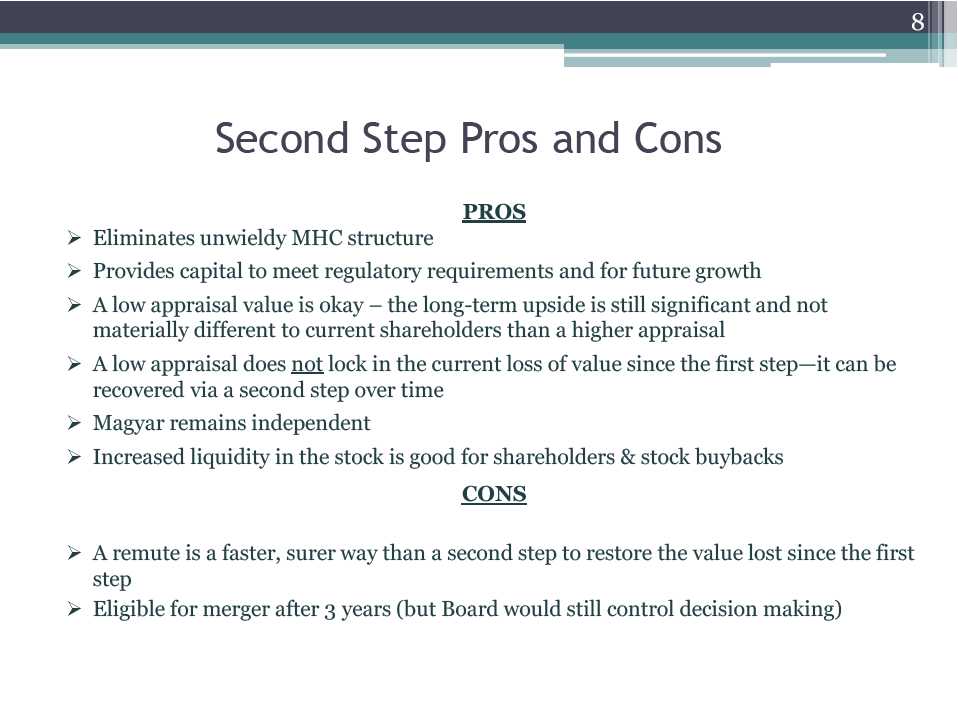

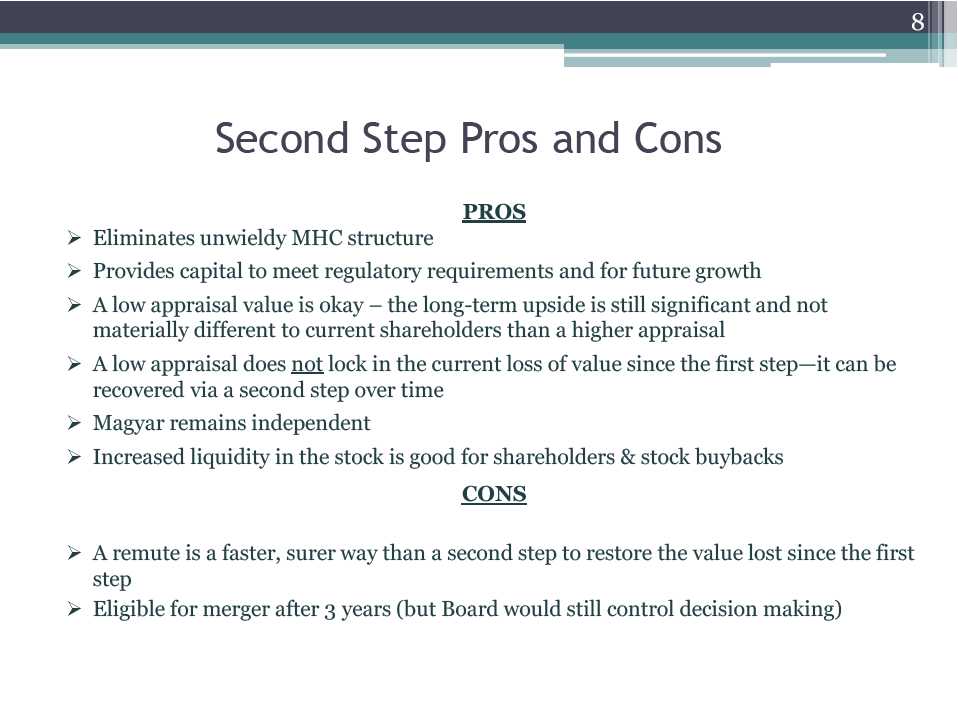

8 Second Step Pros and Cons PROS Eliminates unwieldy MHC structure Provides capital to meet regulatory requirements and for future growth A low appraisal value is okay – the long-term upside is still significant and not materially different to current shareholders than a higher appraisal A low appraisal does not lock in the current loss of value since the first step—it can be recovered via a second step over time Magyar remains independent Increased liquidity in the stock is good for shareholders & stock buybacks CONS A remute is a faster, surer way than a second step to restore the value lost since the first step Eligible for merger after 3 years (but Board would still control decision making)

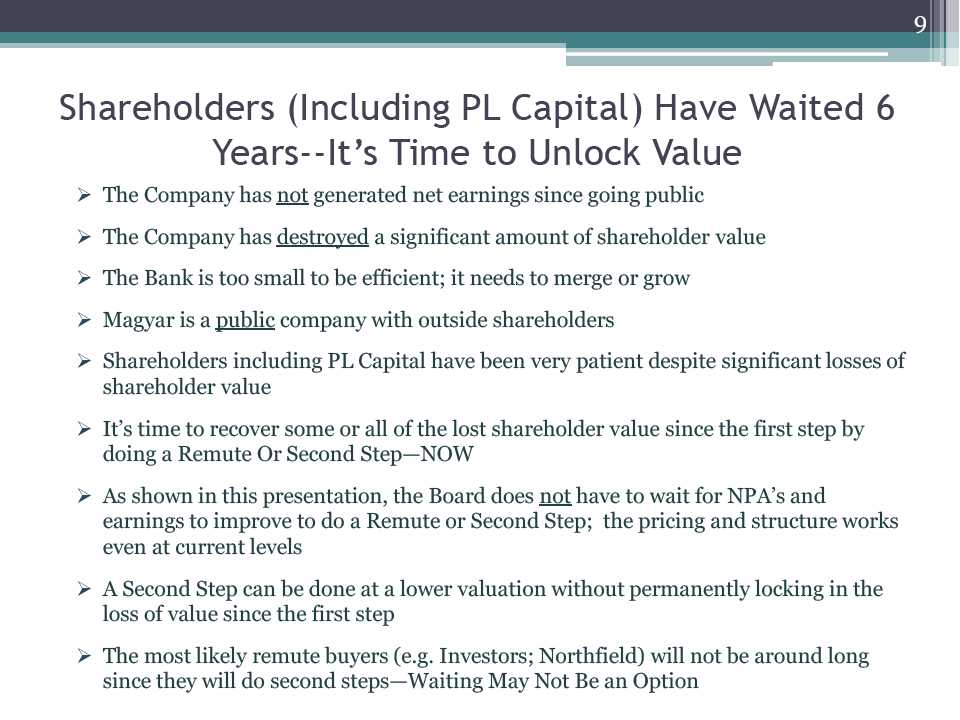

9 Shareholders (Including PL Capital) Have Waited 6 Years--It’s Time to Unlock Value The Company has not generated net earnings since going public The Company has destroyed a significant amount of shareholder value The Bank is too small to be efficient; it needs to merge or grow Magyar is a public company with outside shareholders Shareholders including PL Capital have been very patient despite significant losses of shareholder value It’s time to recover some or all of the lost shareholder value since the first step by doing a Remute Or Second Step—NOW As shown in this presentation, the Board does not have to wait for NPA’s and earnings to improve to do a Remute or Second Step; the pricing and structure works even at current levels A Second Step can be done at a lower valuation without permanently locking in the loss of value since the first step The most likely remute buyers (e.g. Investors; Northfield) will not be around long since they will do second steps—Waiting May Not Be an Option