As filed with the Securities and Exchange Commission on July 28, 2011

Registration No. 333-—

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TIM W.E. SGPS, S.A.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| | | | |

| Republic of Portugal | | 7372 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Avenida Infante Santo

2H, 3º 1350-178

Lisbon, Portugal

+351-212-487-800

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CT Corporation System

111 Eighth Avenue, 13th Floor

New York, NY 10011

(212) 590-9200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| | |

| Copies to: |

Michael J. Willisch, Esq. Davis Polk & Wardwell LLP Paseo de la Castellana 41 Madrid, Spain 28046 Phone: (34) 91 768-9610 Fax: (34) 91-768-9710 | | Sebastian R. Sperber, Esq. Cleary Gottlieb Steen & Hamilton LLP City Place House, 55 Basinghall Street London EC2V 5EH Phone: (44) 20 7614-2200 Fax: (44) 20 7600-1698 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| Title of each class of securities to be registered | | Amount to be

registered(1) | | Proposed maximum

aggregate offering

price per share | | Proposed maximum

aggregate offering

price(2) | | Amount of

registration fee |

Common shares, par value €0.03 per common share | | 12,937,500 | | $14.00 | | $181,125,000 | | $21,028.61 |

| (1) | Includes common shares that the underwriters may purchase solely to cover over allotments, if any. |

| (2) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 28, 2011

PROSPECTUS

11,250,000 Common Shares

TIM W.E. SGPS, S.A.

(incorporated in the Republic of Portugal)

We are offering 7,500,000 of our common shares, and the selling shareholders are offering an additional 3,750,000 common shares. We expect that the initial public offering price will be between $12.00 and $14.00 per common share.

Prior to the offering, there has been no public market for our common shares. We have applied to list the common shares on The NASDAQ Stock Market under the symbol “TMWE”.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per common

share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discount | | $ | | | | $ | | |

Proceeds to us (before expenses) | | $ | | | | $ | | |

Proceeds to the selling shareholders (before expenses) | | $ | | | | $ | | |

We and the selling shareholders have granted to the underwriters a 30-day option to purchase on a pro rata basis up to 843,750 additional shares from us and an aggregate of 843,750 additional outstanding shares from the selling shareholders at the initial public offering price less the underwriting discounts and commissions. The option may be exercised only to cover any overallotments of common shares. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total underwriting discounts and commissions payable by the selling shareholders will be $ , and the total proceeds to us, before expenses, will be $ million, and the total proceeds to the selling shareholders, before expenses, will be $ million.

Immediately following the offering, the selling shareholders will continue to own, in the aggregate, 80.4% of our common shares. The selling shareholders are members of our management and will continue to exercise significant influence over us. See “Principal and Selling Shareholders” on page 114 of this prospectus.

Investing in the common shares involves a high degree of risk. See“Risk Factors” beginning on page 13 of this prospectus for certain factors you should consider before investing in the common shares.

Delivery of the common shares will be made against payment in New York, New York on or about , 2011.

| | | | |

| | |

| Needham & Company, LLC | | Pacific Crest Securities | | Piper Jaffray |

| | |

| |

| Santander | | ThinkEquity LLC |

, 2011

TABLE OF CONTENTS

We and the selling shareholders have not, and the underwriters have not, authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may refer you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling shareholders and the underwriters have not authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. Neither we nor the underwriters are making an offer to sell the common shares in any jurisdiction where their offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

No offer or sale of the common shares may be made to the public in Portugal except in circumstances that do not constitute a public offer or distribution under Portuguese laws and regulations. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution of the prospectus outside the United States.

Until 25 days after the date of this prospectus, all dealers that buy, sell, or trade the common shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

SUMMARY

This summary highlights selected information about us and the common shares that we and the selling shareholders are offering. It may not contain all of the information that may be important to you. Before investing in our common shares, you should read this entire prospectus carefully for a more complete understanding of our business and this offering, including our audited consolidated financial statements and the related notes, and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus.

Overview

We are a global provider of mobile monetization solutions to mobile carriers, media groups, governments, nongovernmental organizations (“NGOs”), brand owners and content owners. We provide mobile marketing, mobile entertainment and mobile money services through our proprietary platform, which incorporates software-as-a-service technologies. We have connections to more than 280 mobile carriers, giving our clients access to a network of nearly three billion end users worldwide. We leverage this broad reach, along with our in-depth knowledge of local markets to facilitate the monetization and distribution of content and services that are tailored to local preferences. Our services allow end users to consume mobile entertainment, such as music and video, receive marketing and advertising messages and make mobile payments on-the-go and free from the constraints of traditional content, marketing and payment channels. We believe, based on feedback our regional managers receive from local mobile carriers, that we are the leading provider of these services in our core markets, including Brazil, Argentina, Colombia and Mexico. We have a proven track record of execution, growth and diversification, evidenced by both the double-digit organic revenue growth and the profitability we have achieved in each year since 2006.

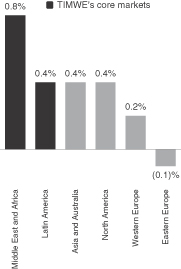

Our primary focus is delivering our services in high-growth, emerging markets. We have grown 100% organically to become, based on feedback our regional managers receive from local mobile carriers, what we believe to be one of the largest providers of mobile solutions in Latin America and a global participant with 25 local offices and offerings in more than 75 different countries. Our core market is Latin America, where we generated 79% of our 2010 revenues and have local offices in 11 countries. Brazil is our largest market, accounting for 44% of our 2010 revenues. We also have offices and are rapidly expanding in a number of countries in Africa, the Asia Pacific region, Europe and the Middle East.

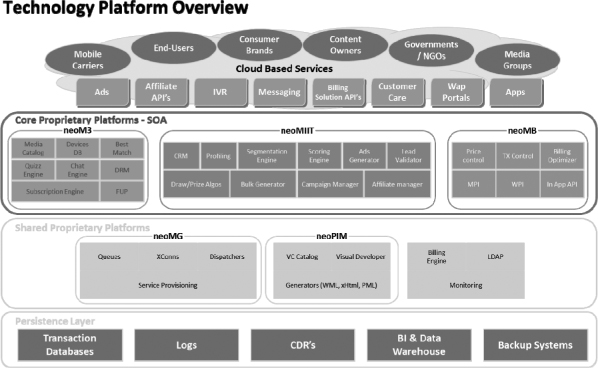

Our platform is used by clients and end users in connection with three principal activities: mobile marketing, mobile entertainment and mobile money. For the year ended December 31, 2010, we derived €101.3 million, €116.2 million and €16.3 million in revenues from mobile marketing, mobile entertainment and mobile money activities, respectively. In mobile marketing, mobile carriers, media groups, governments, NGOs and brand owners use our platform to leverage the convenience, prevalence and targeting capabilities of mobile telephones for marketing and communications purposes. Next, in mobile entertainment, our connections with mobile carriers and our highly scalable, easily adaptable technology platform give end users access to a broad array of third-party and proprietary mobile entertainment services and allow content owners to connect to a large end user base, which included nearly 20 million mobile entertainment subscribers as of December 31, 2010. Finally, mobile money clients and end users use our platform to leverage our connections with mobile carriers to facilitate easy, mobile-based billing solutions and micropayments for goods and services sold online.

Our business model puts us at the center of the mobile ecosystem, as we facilitate communications and transactions between mobile carriers, media groups, governments, NGOs, brand owners, online merchants, content owners and mobile end users. We believe that our central role allows us to leverage our scale and knowledge to deliver value to these stakeholders. Furthermore, we believe it positions us to benefit from the growth and evolution of this ecosystem as a whole.

1

Our Strengths

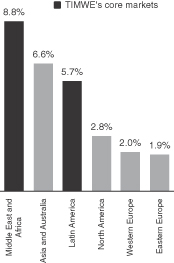

High-growth, emerging markets focus

We provide mobile monetization solutions in emerging markets and have a strong presence in Latin America, including large countries such as Brazil, Argentina, Mexico and Colombia. Our expansion into Latin America began in 2005 when we opened offices in Colombia and Argentina, and since then we have expanded within Latin America, where we currently operate in 18 countries through 11 local offices. In 2010, 79% of our revenues were generated in Latin America, with Brazil, our largest market, accounting for 44% of our 2010 revenues. Our extensive footprint and experience in Latin America has made us a partner of choice for mobile carriers in the region, and our deeply embedded local relationships, including those with leading carriers such as Vivo, Movistar and Claro, give us access to a user base of more than 529 million end users throughout Latin America. More recently, we have leveraged our existing assets to expand into other emerging markets, such as those in Africa, the Middle East, the Asia Pacific region and Eastern Europe.

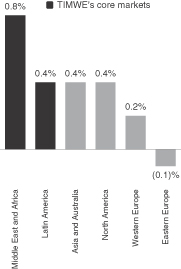

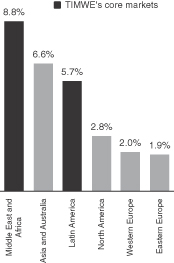

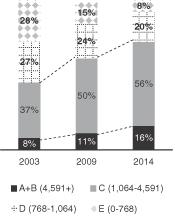

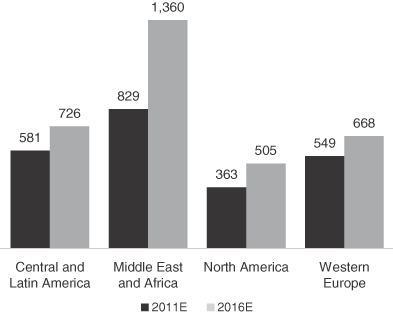

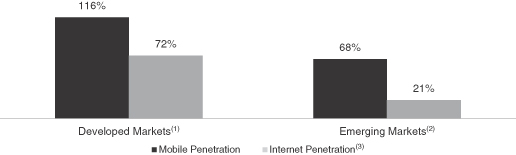

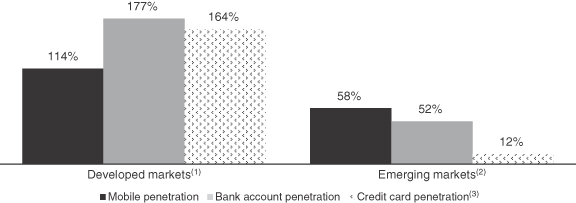

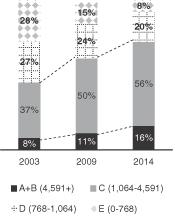

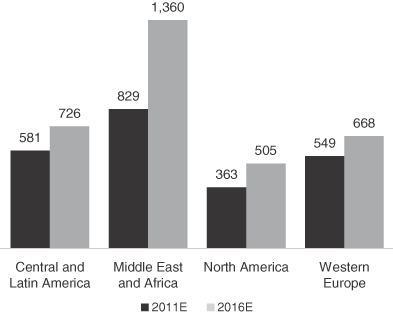

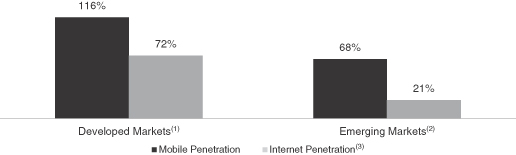

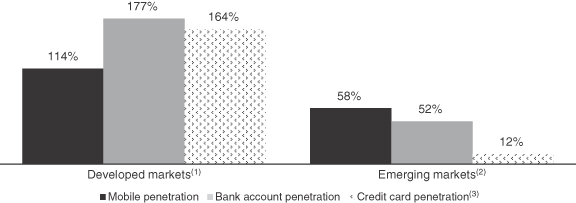

The emerging markets that we target have generally experienced faster economic growth in recent years than those of developed countries. For example, the Economist Intelligence Unit (2011) reported that GDP per capita in Latin America grew at a compound average rate of 5.7% during 2010, compared with just 2% in Western Europe during the same period. Such growth is expected to facilitate the growth of a middle class with more disposable income, contributing to a greater overall demand for mobile services. For example, the number of cellular connections in Central and Latin America is expected to grow by 145 million between 2011 and 2016, according to Analysys Mason Research (2011). The number of cellular connections in the Middle East and Africa is expected to grow by an even greater amount—531 million phones—over this same period. We anticipate that a rapidly growing subscriber base will generate demand for new mobile services and increase demand for existing mobile services. Moreover, individuals in emerging markets tend to rely more upon mobile channels for the delivery of and payment for mobile services such as ours than do people in more developed countries who have greater access to computers, broadband Internet and credit card and banking services. Thus, we believe that our focus on these emerging markets and our experience monetizing mobile channels puts us in a position to service this expected increase in demand and is one of the fundamental strengths of our business.

Dynamic and fast-growing mobile market

The market for mobile services is growing rapidly. For example, Macquarie Equities Research (2010) estimates that worldwide spending on mobile advertising will grow to $14 billion in 2015, compared with $3.5 billion spent on mobile ads in 2010. Similarly, the demand for mobile payment services is expected to increase significantly. For example, Gartner (2011) calculates that approximately $49 billion worth of mobile payment transactions were made worldwide in 2010 and estimates that that figure will increase to approximately $426 billion for 2015. We believe our experience in the mobile market and numerous connections with mobile carriers put us in a unique position to capitalize on this significant opportunity.

A global leader in mobile marketing and monetization

We believe we are one of the largest participants in the mobile marketing and monetization market worldwide, based on feedback our regional managers receive from local mobile carriers. With €233.9 million in total revenues in 2010 and organic revenue growth since our formation in 2002, we have grown with the mobile market and we now provide solutions that leverage our position as a market leader. We have billing connections with more than 280 mobile carriers, many of which have been in place for several years. Our global reach—with access to a network of nearly three billion end users—and our positioning in between mobile carriers, media groups, governments, NGOs, brand owners, content owners and end users, give us unique insights into industry trends and end user demands. We leverage these insights in order to deliver targeted and customized mobile marketing, mobile entertainment and mobile money services to end users, and we draw upon our local market

2

insight, technological platform and experience to offer tailored strategies to our broad range of clients. We believe that these factors combine to create a self-reinforcing cycle that has contributed to the strong growth of our business: our large end user base tends to attract more content owners and marketers; more content owners and marketers tend to drive greater monetization; greater monetization tends to attract more mobile carriers; and more mobile carriers, in turn, tends to increase our end user base.

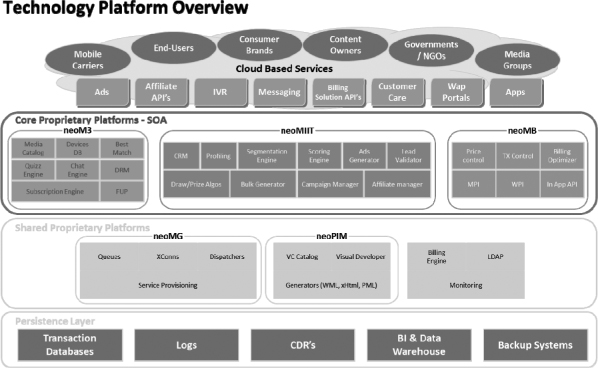

Scalable, cloud-based technology platform

Every area of our business draws upon our platform, which incorporates flexible, cloud-based, software-as-a-service technologies and spans multiple customer segments and channels. Proprietary technology powers our platform, allowing us to offer unique and differentiated solutions to our clients. In addition to being deeply integrated with the systems of more than 280 mobile carriers worldwide, our platform modules are also integrated with one another, across all our business activities and customer segments. Finally, with its highly scalable and modular architecture, our proprietary platform has given us the flexibility and agility we need to respond to the rapid growth and change that have been hallmarks of the mobile market. This design allows us to leverage our existing platform assets to build our business according to local demands and to deliver significant benefits to our advertiser, content owner and media group clients, including time savings, revenue enhancement, ease of use and risk reduction, even within an evolving mobile ecosystem.

Local presence provides unique market insight and sustainable leadership

Our local presence enables us to deliver location-specific solutions along with targeted services. We have on-the-ground teams in 25 local offices and have created more than 50 local legal entities, each structurally tailored to meet local requirements. This presence provides firsthand insights into local culture, business practices and demographics and allows us to identify up-to-the-minute trends and evolving end user demand, which influence our marketing and targeting strategies in each of our distinct markets. Correspondingly, our ties to these markets enable us to respond to demands and trends we identify by sourcing and then delivering local content, tailored to the particular location, taking into account such factors as language and the predominant handsets used in the area. Additionally, our local focus has played a crucial role in the development and maintenance of lasting connections with mobile carriers, media groups, including broadcasters, as well as advertising agencies and media buyers who, themselves, frequently refer us to their own partners or affiliates in other regions, providing growth opportunities and broadening our reach. We draw on all these benefits to provide a range of monetization solutions to our clients that we believe only a company with such an extensive local knowledge and expertise could provide.

Multiple solutions provide value across the entire mobile value chain

Our cloud-based technology platform, our billing connections to mobile carriers worldwide and corresponding global presence, our local client and carrier relationships and our marketing and sales expertise are common features of each of our mobile marketing, mobile entertainment and mobile money activities. As we grow and devote resources to enhancing any one of these business activities, we also enhance the other business activities by virtue of strengthening our core assets and building upon our mobile monetization solutions platform.

Additionally, by drawing upon resources across our different business activities, we are able to create valuable synergies. For example, end user insights and industry trends that we learned as a providers of mobile entertainment have proven extremely useful to the design of mobile marketing campaigns. Similarly, the close relationships we maintain with mobile carriers in connection with both our mobile entertainment and mobile marketing business activities drive our mobile money activities.

3

We believe our portfolio presents an attractive value proposition to clients, whether for a single monetization solution or as a one-stop shop for multiple solutions in the mobile value chain.

Best-in-class management with an outstanding track record of organic growth

We believe that our success can be traced to the experience and capabilities of our management team. With rich mobile market expertise, nuanced knowledge of local markets, a solid network of business relationships and a proven track record of diversification, internationalization and financial results, our management team has led TIMWE from an idea in 2002, to a large, innovative, global participant in the fast-moving and highly competitive mobile industry.

Our close relationships with key clients give us early insights into new business opportunities and facilitate our expansion into new markets. By drawing on our existing assets—our relationships, adaptable technology and experience—our management team has guided our expansion into new geographical and service markets effectively and without resorting to acquisitions.

Business Strategy

Reinforce our leading position in current, attractive markets

We believe, based on feedback our regional managers receive from local mobile carriers, that we are one of the leading providers of mobile entertainment and mobile marketing services in Latin America, and our historical presence there dates back to 2005. We intend to continue to reinforce our position in our historic stronghold and use our market position to capitalize upon new opportunities, whether in the form of increasing the penetration of our existing monetization solutions or strategically rolling out new services. For example, with Brazil slated to host the World Cup in 2014 and the Olympic Games in 2016, we believe we are ideally positioned to take advantage of the media attention, growth and related opportunities these events are expected to bring, and we are already working with clients to develop related strategies. In addition, we have identified what we believe to be strong growth prospects in each of our business areas that we intend to pursue in our effort to sustain our leading position in Latin America. For example, we have already developed initiatives to capitalize upon location-based chat in our mobile entertainment area, we are focusing on creative solutions for media group and government clients in mobile marketing and in mobile money we are preparing to participate in the expected growth of in-app payments.

Expand into new geographies

We intend to follow our historical business model and expand our current offerings into new, emerging markets where we see high-growth potential. By focusing on geographies such as Africa and the Middle East in particular, and also Asia and Central and Eastern Europe, we can leverage our scalable, cloud-based distribution platform technology and participate in the anticipated growth in demand for mobile services in these markets. In Latin America, we aim to draw upon the experience we have in successfully establishing a strong presence in countries such as Brazil, Argentina and Mexico in order to pursue parallel growth opportunities in smaller markets in Latin America where we do not yet have a footprint, as well as enhance our presence in markets such as Puerto Rico, Ecuador and Nicaragua. We see opportunities in Africa and the Middle East—regions that are characterized by low mobile services penetration—and particularly, in countries such as Nigeria and Pakistan, to build a strong leadership position and participate in the expected rapid growth in these markets. Finally, in Asia, we intend to work to grow our existing operations in countries such as Malaysia, Indonesia and Vietnam.

4

Increase penetration of high-potential customer verticals

In addition to capitalizing upon existing offerings and territories, we believe we have a substantial opportunity to increase our penetration into new verticals, namely those of government/NGO and consumer brand clients.

We currently provide services to government entities and NGOs and we see significant potential for future growth in partnering with government entities and NGOs who wish to leverage the cost-effectiveness, convenience and targeting capability of mobile, digital channels to offer solutions such as awareness campaigns, information services, surveys, support to remote populations and information requests. For instance, in 2010 we worked with the ColombianAgencia Presidencial para la Acción Social y la Cooperación Internacional(“Acción Social”) to design a campaign aimed toward fostering the economic development and social inclusion of vulnerable groups in Colombia who were plagued by poverty, drugs and violence. Leveraging the mobile communication channel, we created a bulk SMS and SMS-based chat service to enhance interactivity between Acción Social and these target groups. End users in these groups were delivered important information concerning government services while Acción Social employed social workers to respond to SMS-based queries in real time. Acción Social was able to communicate with more than 1.2 million individuals—many of whom reside in remote locations—and register their information in its database in order to continue fostering the development of these groups.

We also see significant potential in continuing to work with and develop solutions for consumer brand clients. Consumer brand owners invest considerable amounts in marketing efforts and communicating with existing and potential customers. We believe that consumer brand clients who work with us can differentiate themselves from their competitors by delivering customized, targeted solutions—electronic coupons, loyalty-based discounts and pricing or other key information services—to a narrowly defined audience and exploring new ways that mobile channels can facilitate interaction with their customers. For example, in 2010 we worked with Kellogg’s to develop a campaign for its Special K brand cereal. Leveraging our connections with several mobile carriers in Mexico, we created a Calorie Counter application to supplement Special K’s 15 Day Program initiative to connect with customers and underscore its image as a promoter of healthy lifestyles. More than 120,000 end users in Mexico downloaded the Calorie Counter application, increasing awareness of the Special K initiative and enhancing Kellogg’s relationships with its customers.

Deepen relationships with carriers and media groups

In addition to our numerous, solid relationships with mobile carriers, we have strong existing relationships with media groups, particularly television broadcasters and programmers. We see the potential to develop these relationships through loyalty programs and other innovative solutions that draw on our expertise and combine the power of the broad-reaching mobile and media channels. For example, by combining television advertisements with mobile text-based trivia and other games, we are developing with mobile carriers and media groups joint “anti-zapping” campaigns aimed at reducing the likelihood of viewers skipping or ignoring advertisements and at increasing traffic across the carriers’ networks. Given media groups’ and carriers’ relative lack of mobile marketing experience and scale, we believe that such partnerships could leverage our mobile monetization platform and the wide appeal of television in our markets and deliver significant benefits to our partners and us.

Exploit significant opportunity in the mobile money market

We see significant growth prospects in the mobile money market, and we believe that, with our billing solutions and micropayment services, we are well positioned to participate in such growth. For instance, Gartner (2011) calculated that the total volume of mobile money payments was approximately $49 billion worldwide in 2010 and estimates that such volume will grow to approximately $426 billion in 2015. With our worldwide presence, numerous connections with mobile carriers in our territories and technological expertise, we believe

5

that we can move up the value chain and offer our own brand of compelling micropayment solutions to capitalize upon growth in the mobile money market. By providing both billing and payment services, we can streamline the value chain for online merchants who wish to leverage our direct access to mobile carriers around the world and improve their economics.

Capitalize upon smartphone app opportunity

Our mobile carrier connections and access to a network of nearly three billion end users together with our mobile marketing and sales expertise lay the foundation for our initiative to use our existing technology platform to monetize and distribute mobile apps under our own brand—App Republic Plus—and as a white label service to mobile carrier and other clients. With App Republic Plus and our white label initiatives, we believe that we can offer advantages to each link in the smartphone app distribution value chain. Our ability to offer payment solutions benefits end users who, like the substantial majority of individuals in our target geographies, do not have access to credit cards or banking services. The billing connections we have with mobile carriers and our local presence in our markets, which allows us to service those carriers, provide the global footprint, large-scale access to end users and mobile payment solutions that are important to content owners and aggregators. Lastly, our capabilities address what we believe is a growing concern among mobile carriers that credit-card based app stores, such as those operated by Apple and Google, will cut them out of the app distribution value chain. We believe that our model for App Republic Plus and white label stores combined with our deep relationships with mobile carriers and expertise in developing and operating mobile monetization platforms positions us to monetize and distribute smartphone apps while delivering value.

Recent Developments

Based on our preliminary results of operations, our revenues for the three months ended June 30, 2011 grew approximately in the high teens in percentage terms compared with the same period of 2010, with growth across most geographies, particularly in Brazil and Africa. Revenues for the three months ended June 30, 2010 and the subsequent three month period of 2010 were particularly strong as a result of large and successful campaigns in Brazil, which straddled such periods of 2010. Margins were broadly stable in the three months ended June 30, 2011 compared with the same period of the prior year based on our preliminary results of operations, with certain operating expense line items to some degree varying as a percentage of revenues due to changes in our revenue and geographic mix. The preliminary results discussed in this paragraph are not yet final, are subject to ongoing review and may differ from our final results.

Risk Factors

We face numerous risks and uncertainties that may affect our future financial and operating performance, including, among others, the following: risks related to our reliance on mobile carriers, risks relating to a substantial portion of our business being concentrated in Brazil, risks related to the housing of our technology platform in a single datacenter facility, risks relating to the fluctuation of our quarterly results, risks related to the competitive industry in which we operate and risks related to the global nature of our business. One or more of these matters could negatively affect our business or financial performance as well as our ability to successfully implement our strategy. This list of risks is not comprehensive, and you should see the section entitled “Risk Factors” for a more detailed discussion of the risks associated with an investment in our common shares.

Our registered and principal executive offices are located at Avenida Infante Santo, 2H, 3º 1350-178, Lisbon, Portugal, and our general telephone number is +351-212-487-800. We maintain a number of web sites, including www.timwe.com. The information on, or accessible through, our web sites, including those web sites listed in “Business—Intellectual Property—Proprietary” is not part of this prospectus.

6

THE OFFERING

Issuer

Common shares offered by us

Common shares offered by the selling shareholders

Selling shareholders

| | The selling shareholders, who are also members of our management, will in the aggregate own 80.4% of our common shares upon completion of the offering and will continue to exercise significant influence over us. See “Principal and Selling Shareholders.” |

Overallotment option

| | We and the selling shareholders have granted to the underwriters a 30-day option to purchase on a pro rata basis up to 843,750 additional shares from us and an aggregate of 843,750 additional outstanding shares from the selling shareholders at the initial public offering price less the underwriting discounts and commissions. The option may be exercised only to cover any overallotments of common stock. |

Common shares to be outstanding immediately after this offering

Proposed NASDAQ Stock Market symbol

Lockup agreements

| | We have agreed with the underwriters, subject to certain exceptions, not to sell or dispose of any common shares or securities convertible into or exchangeable or exercisable for any common shares during the period commencing on the date of this prospectus until 180 days after the completion of this offering. Our shareholders, executive officers and directors have agreed to similar lockup restrictions for a period of 180 days. See “Underwriting.” |

Use of proceeds

| | We expect to receive total estimated net proceeds from this offering of approximately $77.9 million, after deducting estimated underwriting discounts and expenses and assuming no exercise of the overallotment option by the underwriters. We will not receive any proceeds from the sale of common shares by the selling shareholders. We intend to use the proceeds from this offering to accelerate expansion into new markets, enhance our monetization solutions portfolio through new developments and strengthen our capacity to pursue strategic acquisitions. |

Corporate governance

| | We rely on NASDAQ rules that exempt us, as a “foreign private issuer,” from certain NASDAQ corporate governance requirements applicable to U.S. issuers. See “Risk Factors—Risks Related to our Common Shares—Our status as a foreign private issuer exempts us from certain of the corporate governance standards of the NASDAQ Stock Market (“NASDAQ”), limiting the protections afforded to investors.” |

7

Risk factors

| | You should carefully read the information set forth under “Risk Factors” and the other information set forth in this prospectus before investing in the common shares. |

Unless otherwise indicated, all information contained in this prospectus:

| | • | | assumes no exercise of the underwriters’ option to purchase up to 1,687,500 additional common shares to cover overallotments of common shares, if any; |

| | • | | assumes the common shares to be sold in this offering will be sold at $13.00, which is the midpoint of the range set forth on the cover page of this prospectus, and the resulting amount will be translated into euro at the rate of $1.4366 per €1.00, the noon buying rate for the euro on July 22, 2011, the most recent practicable date prior to the date of this prospectus. The “noon buying rate” is the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. No representation is made that euro could have been, or could be, converted into U.S. dollars at that rate or at any other rate; |

| | • | | gives effect to certain common share splits we have effected in advance of the offering, the most recent of which was a 1.667-for-1 common share split effective as of July 15, 2011 and which increased the number of common shares outstanding from 30,000,000 to 50,000,000 immediately prior to the offering; and |

| | • | | does not give effect to (i) the proposed incentive plan involving up to a maximum of 10% of our capital stock following the offering described under “Management—Incentive Plan” or (ii) the award by us to one of our executive officers of rights to receive approximately 134,000 common shares from us in connection with the offering which will vest over a three year period, as described under “Management—Compensation.” |

8

SUMMARY FINANCIAL AND OPERATING DATA

The following financial data of TIMWE at March 31, 2011 and for the three months ended March 31, 2011 and March 31, 2010 and at December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and 2008 have been derived from the consolidated financial statements prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (or “IFRS-IASB”). The financial data of TIMWE at December 31, 2007 and 2006 and for the years ended December 31, 2007 and 2006 have been prepared in accordance with IFRS-IASB, using as a basis our consolidated financial statements prepared in accordance with IFRS as adopted by the European Union (or “EU-IFRS”) for those years, which are not included herein. There are no differences, applicable to TIMWE, between IFRS-IASB and EU-IFRS for any of the periods presented. Our historical results are not necessarily indicative of results to be expected for future periods.

This financial data should be read in conjunction with our audited consolidated financial statements and the related notes and “Selected Financial and Operating Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | | | Year Ended December 31, | |

| | | 2011(1) | | | 2011 | | | 2010 | | | 2010(1) | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (in thousands, except share and per share data) | |

| Income Statement Data | | | | |

Revenues | | $ | 67,205 | | | € | 47,384 | | | € | 34,600 | | | $ | 331,671 | | | € | 233,851 | | | € | 166,241 | | | € | 125,339 | | | € | 67,813 | | | € | 43,548 | |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of service delivery | | | 34,202 | | | | 24,115 | | | | 18,798 | | | | 166,392 | | | | 117,318 | | | | 97,056 | | | | 65,059 | | | | 32,118 | | | | 15,660 | |

Commercial and production costs | | | 22,999 | | | | 16,216 | | | | 10,237 | | | | 107,826 | | | | 76,025 | | | | 37,130 | | | | 35,292 | | | | 21,511 | | | | 19,918 | |

Personnel costs | | | 4,059 | | | | 2,862 | | | | 2,269 | | | | 13,594 | | | | 9,585 | | | | 8,758 | | | | 6,519 | | | | 4,430 | | | | 1,435 | |

General and administrative | | | 2,926 | | | | 2,063 | | | | 1,631 | | | | 10,674 | | | | 7,526 | | | | 6,980 | | | | 6,162 | | | | 3,258 | | | | 1,791 | |

Tax expenses | | | 472 | | | | 333 | | | | 445 | | | | 4,628 | | | | 3,263 | | | | 2,306 | | | | 2,150 | | | | 420 | | | | 93 | |

Amortization and depreciation | | | 1,879 | | | | 1,325 | | | | 932 | | | | 5,992 | | | | 4,225 | | | | 2,490 | | | | 1,605 | | | | 517 | | | | 129 | |

Provisions expense | | | 129 | | | | 91 | | | | 46 | | | | 835 | | | | 589 | | | | 405 | | | | 116 | | | | 853 | | | | 20 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expense | | | 66,667 | | | | 47,005 | | | | 34,358 | | | | 309,943 | | | | 218,531 | | | | 155,125 | | | | 116,903 | | | | 63,107 | | | | 39,046 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 538 | | | | 379 | | | | 242 | | | | 21,728 | | | | 15,320 | | | | 11,116 | | | | 8,436 | | | | 4,706 | | | | 4,502 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Finance income | | | 153 | | | | 108 | | | | 314 | | | | 2,340 | | | | 1,650 | | | | 139 | | | | 570 | | | | 511 | | | | 484 | |

Finance costs | | | (600 | ) | | | (423 | ) | | | (440 | ) | | | (3,654 | ) | | | (2,576 | ) | | | (2,415 | ) | | | (1,500 | ) | | | (687 | ) | | | (618 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net finance income (costs) | | | (447 | ) | | | (315 | ) | | | (126 | ) | | | (1,313 | ) | | | (926 | ) | | | (2,276 | ) | | | (930 | ) | | | (176 | ) | | | (134 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Profit before income taxes | | | 91 | | | | 64 | | | | 116 | | | | 20,415 | | | | 14,394 | | | | 8,840 | | | | 7,506 | | | | 4,530 | | | | 4,368 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income tax expenses | | | (254 | ) | | | (179 | ) | | | 25 | | | | 4,807 | | | | 3,389 | | | | 1,676 | | | | 2,119 | | | | 1,973 | | | | 1,691 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 345 | | | | 243 | | | | 91 | | | | 15,608 | | | | 11,005 | | | | 7,164 | | | | 5,387 | | | | 2,557 | | | | 2,677 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Profit attributable to non-controlling interests | | | (31 | ) | | | (22 | ) | | | (120 | ) | | | 1,513 | | | | 1,067 | | | | 930 | | | | (26 | ) | | | 46 | | | | 50 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Profit attributable to controlling interests | | $ | 376 | | | € | 265 | | | € | 211 | | | $ | 14,095 | | | € | 9,938 | | | € | 6,234 | | | € | 5,413 | | | € | 2,511 | | | € | 2,627 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings per share (basic and diluted) | | | — | | | | — | | | | — | | | $ | 0.17 | | | € | 0.12 | | | € | 0.08 | | | € | 0.07 | | | € | 0.03 | | | € | 0.03 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares used to compute earnings per share | | | 65,319 | | | | 65,319 | | | | 82,917 | | | | 82,917 | | | | 82,917 | | | | 82,917 | | | | 82,917 | | | | 83,333 | | | | 83,333 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

9

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | At March 31, | | | At December 31, | |

| | | 2011

(Pro Forma)(2) | | | 2011(1) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (in thousands, except share and per share data) | |

| Balance Sheet Data | | | | |

Cash and cash equivalents | | € | 62,225 | | | $ | 10,349 | | | € | 7,297 | | | € | 8,610 | | | € | 5,667 | | | € | 4,456 | | | € | 3,886 | | | € | 2,671 | |

Net working capital(3) | | | 70,738 | | | | 22,423 | | | | 15,811 | | | | 19,032 | | | | 11,284 | | | | 14,222 | | | | 5,725 | | | | 4,039 | |

Total assets | | | 115,080 | | | | 85,186 | | | | 60,153 | | | | 59,576 | | | | 46,738 | | | | 40,049 | | | | 24,000 | | | | 14,074 | |

Total liabilities | | | 40,630 | | | | 57,308 | | | | 40,630 | | | | 35,564 | | | | 32,729 | | | | 31,684 | | | | 16,923 | | | | 9,005 | |

Total debt | | | 13,724 | | | | 19,465 | | | | 13,724 | | | | 9,835 | | | | 10,204 | | | | 15,973 | | | | 4,329 | | | | 1,117 | |

Total stockholders’ equity | | | 74,451 | | | | 27,689 | | | | 19,524 | | | | 24,012 | | | | 14,009 | | | | 8,366 | | | | 7,078 | | | | 5,068 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Year Ended December 31, | |

| | | 2011 | | | 2010 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Other Operating Data | | | | | | | | | | | | | | | | | | | | | | | |

Mobile Marketing | | | | | | | | | | | | | | | | | | | | | | | |

Number of mobile marketing campaigns | | | 30 | | | | 28 | | | | 93 | | | 115 | | | | 51 | | | | — | |

Average revenue per campaign (€ thousands) | | | 420.6 | | | | 134.8 | | | | 1,089.5 | | | 470.9 | | | | 741.8 | | | | — | |

Mobile Entertainment | | | | | | | | | | | | | | | | | | | | | | | |

Number of mobile entertainment subscribers (4)(thousands) | | | 18,190 | | | | 18,765 | | | | 19,334 | | | 19,175 | | | | 11,675 | | | | — | |

Average revenue per mobile entertainment subscriber (monthly)(€) | | | 0.48 | | | | 0.48 | | | | 0.48 | | | 0.45 | | | | 0.61 | | | | — | |

Mobile Money | | | | | | | | | | | | | | | | | | | | | | | |

Number of mobile money clients(5)(6) | | | 49 | | | | 30 | | | | 44 | | | 19 | | | | 1 | | | | — | |

Average revenue per client (monthly) (€ thousands) | | | 45.0 | | | | 32.2 | | | | 31.0 | | | 20.0 | | | | 19.4 | | | | — | |

| |

| | | (in thousands) | |

Total revenues | | € | 47,384 | | | € | 34,600 | | | | €233,851 | | € | 166,241 | | | € | 125,339 | | | € | 67,813 | |

Mobile marketing revenues | | | 13,499 | | | | 3,774 | | | | 101,320 | | | 54,154 | | | | 37,832 | | | | — | |

Mobile entertainment revenues | | | 27,264 | | | | 27,931 | | | | 116,185 | | | 107,534 | | | | 87,274 | | | | 67,813 | |

Mobile money revenues | | | 6,621 | | | | 2,895 | | | | 16,346 | | | 4,552 | | | | 233 | | | | — | |

Adjusted EBITDA(7) | | | 2,128 | | | | 1,665 | | | | 23,397 | | | 16,317 | | | | 12,307 | | | | 6,496 | |

Net income | | | 243 | | | | 91 | | | | 11,005 | | | 7,164 | | | | 5,387 | | | | 2,557 | |

| (1) | Certain euro amounts are translated into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such euro amounts have been translated at the rate of $1.4183 per €1.00, which corresponds to the noon buying rate for the euro calculated on March 31, 2011. |

| (2) | Pro forma reflects the issuance by us of 7,500,000 common shares at an offering price of $13.00 per share, the midpoint of the range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and estimated expenses for the offering payable by us, translated into euro at $1.4183 per €1.00, the noon buying rate on March 31, 2011. |

| (3) | Calculated as total current assets, which includes inventories, trade receivables, other receivables, current tax assets, other public entities, cash and cash equivalents and assets as held for sale; less total current liabilities, which includes loans and borrowings, financial lease obligations, suppliers and other current liabilities, current tax liabilities and other public entities. |

| (5) | Represents the number of clients with whom mobile money contracts have been signed. |

| (7) | We define Adjusted EBITDA as net income plus income tax expenses, finance costs, finance income, provisions expense, amortization and depreciation and tax expenses. Please see “—Adjusted EBITDA” for more information and for a reconciliation of Adjusted EBITDA to our net income calculated in accordance IFRS-IASB. |

10

Adjusted EBITDA

We include Adjusted EBITDA in this prospectus because (i) we seek to manage our business to a consistent level of Adjusted EBITDA as a percentage of total revenue, (ii) it is a key basis upon which our management assesses our operating performance, (iii) it is one of the primary metrics investors use in evaluating technology companies, and (iv) it is a factor in the evaluation of the performance of our management in determining compensation. We define Adjusted EBITDA as net income plus income tax expenses, finance costs, finance income, provisions expense, amortization and depreciation and tax expenses.

We use Adjusted EBITDA as a key performance measure because we believe it facilitates operating performance comparisons from period to period by excluding potential differences caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or subsidiaries of changes in effective tax rates or fluctuations in permanent differences or discrete quarterly items) and the impact of depreciation and amortization expense on definite-lived intangible assets. Because Adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we also use Adjusted EBITDA for business planning purposes, to incentivize and compensate our management personnel and in evaluating acquisition opportunities.

In addition, we believe Adjusted EBITDA and similar measures are widely used by investors, securities analysts, ratings agencies and other interested parties in our industry as a measure of financial performance and debt-service capabilities. Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for, analysis of our results as reported under IFRS-IASB. Some of these limitations are:

| | • | | Adjusted EBITDA does not reflect our cash expenditures for capital equipment or other contractual commitments; |

| | • | | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements; |

| | • | | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| | • | | Adjusted EBITDA does not consider the potentially dilutive impact of issuing equity-based compensation to our management team and employees; |

| | • | | Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our indebtedness; |

| | • | | Adjusted EBITDA does not reflect certain tax payments that may represent a reduction in cash available to us; and |

| | • | | other companies, including companies in our industry, may calculate Adjusted EBITDA measures differently, which reduces their usefulness as a comparative measure. |

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net income and our other IFRS-IASB financial results.

11

The following table presents a reconciliation of Adjusted EBITDA to net income, the most comparable IFRS-IASB measure, for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Year Ended December 31, | |

| | | 2011 | | | 2010 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (in thousands) | |

Net income | | € | 243 | | | € | 91 | | | € | 11,005 | | | € | 7,164 | | | € | 5,387 | | | € | 2,557 | | | € | 2,677 | |

Income tax expenses | | | (179 | ) | | | 25 | | | | 3,389 | | | | 1,676 | | | | 2,119 | | | | 1,973 | | | | 1,691 | |

Finance costs | | | 423 | | | | 440 | | | | 2,576 | | | | 2,415 | | | | 1,500 | | | | 687 | | | | 618 | |

Finance income | | | (108 | ) | | | (314 | ) | | | (1,650 | ) | | | (139 | ) | | | (570 | ) | | | (511 | ) | | | (484 | ) |

Provisions expense | | | 91 | | | | 46 | | | | 589 | | | | 405 | | | | 116 | | | | 853 | | | | 20 | |

Amortization and depreciation | | | 1,325 | | | | 932 | | | | 4,225 | | | | 2,490 | | | | 1,605 | | | | 517 | | | | 129 | |

Tax expenses | | | 333 | | | | 445 | | | | 3,263 | | | | 2,306 | | | | 2,150 | | | | 420 | | | | 93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | € | 2,128 | | | € | 1,665 | | | € | 23,397 | | | € | 16,317 | | | € | 12,307 | | | € | 6,496 | | | € | 4,744 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12

RISK FACTORS

You should carefully consider the risks and uncertainties described below, as well as the other information in this prospectus, before deciding to purchase the common shares offered hereby. Our business, results of operations, financial condition or prospects could be adversely affected by any of these risks and uncertainties, and as a result, the market price of the common shares could decline and you could lose part or all of your investment. The risks and uncertainties described below are those that are known to us and that we currently believe may materially affect us.

Risks Relating to our Business

We rely on mobile carriers for the delivery and billing of most of our mobile marketing, mobile entertainment and mobile money services and, therefore, we may experience a material adverse effect on our business, results of operations or financial condition if our relationship with any key mobile carrier ceases or deteriorates.

We deliver most of our mobile marketing, mobile entertainment and mobile money services to clients and end users through mobile carriers, and we are therefore dependent on these mobile carriers to a significant degree. During the year ended December 31, 2010 as well as the three months ended March 31, 2011, we received nearly all of our revenue via mobile carriers, which remit to us an agreed portion of the sales price of the services we offer to clients and end users through these carriers’ respective networks and retain the remainder as compensation for the delivery of our services as well as the carrier’s billing and collection efforts. If our contracts with any of the mobile carriers through which we offer our services are terminated or adversely altered, whether as to fee structure or otherwise, it may be difficult to find appropriate replacement operators with the requisite licenses and permits, infrastructure and customer base to offer our services profitably, or at all, and as a result, our business would suffer. Even if available, securing and negotiating alternative delivery and billing channels could cause interruptions to our business, and such alternative channels could greatly limit the usability of our services, all of which could materially and adversely impact our business, results of operations or financial condition.

The terms of our contracts with mobile carriers vary, but generally allow for termination by either party with one to three months’ notice at the discretion of the terminating party, and generally allow for unilateral modification of the contract by the mobile carrier at any time. Except in the instances where our relationship with mobile carriers is arranged through an agreement with a third-party connectivity service provider, all of our contracts with mobile carriers are negotiated directly between the carrier and us.

We provide our services through a network of more than 280 mobile carriers in more than 75 countries. In 2010, 77% of our revenues were generated through the billing systems of our top ten mobile carriers, with approximately a quarter of our revenue in such year being generated through the billing system of our largest carrier in terms of revenues, Vivo (Brazil). The termination of or failure to renew any of the agreements we have with any large mobile carrier, and particularly with Vivo, could have a material adverse effect on our business, results of operations or financial condition.

Additionally, we rely on mobile carriers’ networks to deliver our services to our clients and end users and on their billing systems to track and account for the downloading of our services. Any failure of, or technical problem with, the mobile carriers’ billing and delivery systems, information systems or communications networks could result in the inability of our clients and end users to access our services or prevent the completion of billing for our services. Any failure of, or technical problem with, the mobile carriers’ systems could cause us to lose clients, end users or revenues or incur substantial repair costs and distract management from operating our business. From time to time, we have experienced limited failures with mobile carriers’ billing and delivery systems and communication networks. If any such billing and delivery failures or technical problems were to continue for a prolonged period of time, it could reduce our sales, increase costs or result in a loss of clients or end users, which could have a material adverse effect on our business, results of operations and financial condition.

13

Factors beyond our control could cause our relationship with one or more key mobile carriers to deteriorate or terminate, which could severly disrupt our operations and result in the loss of a significant portion of our revenues.

We are substantially dependent upon our relationships with mobile carriers for the delivery and billing of most of our services. There are a number of factors beyond our control that could impair our relationship with mobile carriers, including the following:

| | • | | a carrier’s decision to offer its own, competing mobile entertainment, mobile marketing or mobile money services to its customers; |

| | • | | a carrier’s decision to discontinue or suspend the sale of our services, or altogether discontinue sales of services such as ours; |

| | • | | a carrier’s decision to withdraw a short number allocated to us; |

| | • | | a carrier’s decision to change the terms under which it arranges the delivery and billing of our services; |

| | • | | a carrier’s decision not to approve our desired pricing or other terms for the services we offer through such carrier’s network or its failure to approve a price range within which we can profitably offer our services; |

| | • | | a carrier’s decision to increase the fees it charges to distribute our services or to invoice and collect on our behalf amounts owed by end users, thereby increasing its own revenues and decreasing our share of revenues; or |

| | • | | a carrier’s preference for the services of our competitors, which could affect our ability to maintain an existing agreement or enter into a new agreement with that carrier. For important information concerning competition in our market, see “Risk Factors—Risks Relating to our Industry—We operate in a highly dynamic and competitive industry. If we are unable to compete effectively with our existing or any new competitors, our business, results of operations or financial condition could be materially and adversely affected.” |

Generally, the deterioration of our relationship with any of the mobile carriers through which we offer our services may severely disrupt our operations and result in the loss of a significant portion of our revenues, and may have a material adverse effect on our business, results of operations or financial condition.

A substantial portion of our revenues is derived from our operations in Brazil, and the termination or alteration of our contracts with the mobile carriers in Brazil could have a particularly adverse effect on our results of operations and overall financial condition.

For the year ended December 31, 2010, our operations in Brazil accounted for 44% of our total revenues. No other single country accounted for more than 10% of our total revenues in 2010. Accordingly, if we lose a significant amount of clients or end users in Brazil because of the termination of mobile carrier contracts, the deterioration of important strategic relationships, unexpected government regulation, competitors entering or improving their market share in the Brazilian market, any natural disaster, war or terrorist attack of which Brazil is a victim or for any other reason, our revenue could be substantially reduced, which could materially adversely affect our overall business, results of operations and financial condition.

Because a substantial portion of our revenues is derived from our operations in Brazil, our business is particularly sensitive to economic and political conditions in Brazil. Any economic downturn or adverse political changes in Brazil could have a material, adverse effect on our business, results of operations and financial condition.

A material portion of our business, results of operations and financial condition could be influenced by general economic conditions in Brazil, namely economic growth and its impact on mobile services. Major factors that could have a material adverse effect on our business and results of operations in Brazil include:

Adverse political and economic conditions. The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy. The Brazilian government has utilized salary and

14

price controls, currency devaluation, capital controls and limits on imports, among other things, as tools in its previous attempts to stabilize the Brazilian economy and control inflation. Changes in the Brazilian government’s exchange control policy, or in general economic conditions in Brazil, could have a material adverse effect on the results of our operations in Brazil. Deterioration in economic and market conditions in other countries (mainly in other Latin American and emerging market countries) may adversely affect the Brazilian economy and our business. Past political crises in Brazil have affected the confidence of investors and the public in general, as well as the development of the economy. Future political crises could have an adverse impact on the Brazilian economy and our business, financial condition and results of operations.

Fluctuations in the Real and increases in interest rates. The Brazilian currency historically has experienced frequent fluctuations relative to the Euro and other currencies. In 2005, 2007 and 2009 the Real appreciated against the Euro by 23.5%, 7.5% and 22.6%, respectively, and in 2006, 2008 and 2010 depreciated against the Euro by 1.8%, 24.1% and 12.3%, respectively. Any substantial negative reaction to the policies of the Brazilian government could have a negative impact, including devaluation. The devaluation of the Real could negatively affect the stability of the Brazilian economy and accordingly could negatively affect the profitability and results of our operations. It also would increase costs associated with financing our operations in Brazil.

In response to the global economic and financial crisis, the Brazilian government increased the Banco Central do Brasil’s Special System for Settlement and Custody’s, or “SELIC,” basic interest rate to 13.75% as of December 31, 2008. In 2009, the Brazilian Central Bank reduced the SELIC once more to 8.75%. In 2010, the SELIC was increased to 10.75%. An increase in interest rates could negatively affect our profitability and results of operations and would increase the costs associated with financing our operations in Brazil.

Inflation in Brazil. Brazil historically has experienced high rates of inflation. Inflation, as well as governmental measures put in place to combat inflation, have had a material adverse effect on the Brazilian economy. Since the implementation of the Real Plan in 1994, the rate of inflation has been substantially lower than in previous periods. However, inflationary pressures persist, and actions taken in an effort to curb inflation, coupled with public speculation about possible future governmental actions, have in the past contributed to economic uncertainty in Brazil and heightened volatility in the Brazilian securities market. The Consumer Prices Index (Índice de Preços ao Consumidor), published byInstituto Brasileiro de Geografia e Estatística, rose 5.91% in 2010. The inflation rate was 4.3% in 2009, 5.9% in 2008, 4.5% in 2007 and 3.1% in 2006.

We use a single, leased datacenter to house our information technology, telecommunications and other infrastructure systems and to deliver our services. Any failure of these systems or disruption of service at this datacenter facility could materially and adversely affect our business, financial condition and results of operations.

Our information technology, telecommunications and other infrastructure systems face the risk of failure, which could seriously damage our operations. A significant disruption in the availability of these systems could cause interruptions in our service, loss of or delays in our research and development work or affect our relationships with mobile carriers, clients or end users and present potential liability vis-à-vis end users.

Additionally, we deliver nearly all of our services from a single datacenter facility leased from Mainroad and located in Lisbon, Portugal. This datacenter facility is vulnerable to damage or interruption from earthquakes, hurricanes, floods, fires, terrorist attacks, power losses, telecommunications and Internet failures and similar events. It also could be subject to break-ins, computer viruses, denial of service attacks, sabotage, intentional acts of vandalism and other misconduct. Because we lease our datacenter, we have little control over the physical security of the site and are substantially dependent upon Mainroad to protect the datacenter from physical security threats. The occurrence of a natural disaster or an act of terrorism or other unanticipated problems could result in lengthy interruptions in our services. Although we implement redundancy programs in our platform, maintain off-site backups of our data and have a disaster recovery program in place, we do not currently operate or maintain a backup datacenter for any of our services. This increases our vulnerability to

15

interruptions or delays in the delivery of our services, which could harm our reputation, cause us to incur financial penalties, subject us to potential liability, cause clients to terminate their contracts and materially and adversely affect our business, results of operations or financial condition.

Our quarterly results of operations may fluctuate significantly due to several factors, some of which are not within our control. Fluctuations in our quarterly results may make period-to-period comparisons of our results of operations and financial condition difficult and could affect the market price of our common shares in a manner unrelated to our long-term operating performance.

Our quarterly results of operations have fluctuated significantly in the past and are expected to fluctuate significantly in the future based on a number of factors, some of which are not in our control. Our business is seasonal, with revenues generally lowest in the first quarter of the year and gradually building throughout the year, prior to beginning to level off or decline toward the end of the fourth quarter of the year as a result of the termination of seasonal campaigns, cash conservation and reduced activity around the Christmas and New Year holidays, which tends to carry over into the subsequent year as a result of Carnival holidays in Brazil and the summer season throughout Latin America, our primary market. Next, our operating expenses do not increase or decrease in direct proportion to our generation of revenue, affecting the period-to-period comparability of our results. For example, in some cases we will have incurred significant commercial and production costs relating to client acquisition efforts and must recognize such costs as expenses in the period when incurred despite the fact that related revenues might be recognized in a subsequent period. As a result of this and our commercial strategy, which usually involves higher spending during the first half of the year, in general terms our operating profit tends to increase throughout the year and is significantly weighted toward the end of the year. Finally, some quarters may be exceptionally strong (or weak) due to the effectiveness of a particular marketing campaign. For example, we had particularly strong second and third quarters in 2010 in terms of revenue growth as a result of particularly large and successful campaigns in Brazil, which straddled the two periods. Similarly, in 2009 we completed a number of large and successful campaigns in the third and fourth quarters, which drove comparably stronger fourth quarter revenues for the year. Our operating expenses, which include general and administrative expenses, are relatively fixed in the short term. If our revenues are lower than we expect because end users or clients reduce the use of our services, our mobile marketing campaigns are not successful, we lose our connections with mobile carriers or for other reasons, we may not be able to quickly reduce our spending in response. These factors are difficult to forecast, and these or other factors could adversely affect our business. Any shortfall in our revenues would have a direct impact on our business. To the extent that we disclose information on a quarterly basis, fluctuations in our quarterly results could affect the market price of our common shares in a manner unrelated to our long-term operating performance. See “—Risks Related to our Common Shares—As a foreign private issuer we are not subject to all of the reporting requirements and other rules applicable to domestic companies.”

The success of our businesses is dependent upon effective advertising and marketing, and any failure by us to design and position effective and cost-efficient advertising and marketing, or to do so at sufficient levels, could have a material adverse effect on our business, results of operations or financial condition.

We rely on advertising and marketing that is effectively designed and positioned to make end users aware of our services. In addition to heightening awareness, our advertisements also provide end users with useful information—typically a telephone or SMS number—which they need to purchase a particular service. Currently, we make advertising and marketing decisions such as media mix planning and audience targeting based on the deep experience of our marketing and sales personnel. Because we offer services in more than 75 different countries, we face the challenge of identifying how tastes vary from region to region, end user to end user, and employing this knowledge to create appealing advertising and marketing campaigns. We cannot guarantee that we can continue to effectively design and position advertising and marketing campaigns.

Additionally, for the year ended December 31, 2010, we spent approximately €57.1 million on commercial costs relating to direct media costs for the placement of our advertising on television, the Internet and other media, with advertising costs accounting for €27.7 million of such amount. Given the importance of effective

16

advertising and marketing to our business and to our client acquisition efforts, and given the substantial share of our operating expenses that commercial and production costs represent, our business depends on our ability to deploy client acquisition resources—including commercial costs relating to advertising—effectively and cost-efficiently. We cannot accurately predict the future costs associated with our advertising efforts, including the costs of purchasing media space, and if these costs were to increase, we could be forced to reduce the amount of advertising and marketing we do or opt for less effective media, which could detrimentally affect our client acquisition efforts. Finally, the timing of our commercial costs may be influenced by our available cash levels at any time and whether such costs are likely to lead to revenues in the current period or subsequent periods. Any failure by us to design and position effective and cost-efficient advertising and marketing, or to do so at sufficient levels, could have a material adverse effect on our business, results of operations or financial condition.

Our services currently are designed primarily for use with basic phones. If we fail to capture opportunities in the expected growth of the smartphone market, our growth prospects may be materially and adversely affected.

Our services are designed primarily for use with basic phones, which currently have a substantially larger market share in Latin America and the other countries in which we operate compared with smartphones. Smartphones are already popular in developed countries, however, and may also gain popularity in our target geographies.

Smartphones are higher-priced, technologically advanced devices with personal computer-level versatility that operate advanced operating systems such as Android, Apple’s iOS, BlackBerry OS, Linux, Palm WebOS, Symbian and Windows Phone 7. Smartphones are usually characterized by more powerful processors, larger screens and higher data storage capacity than basic phones, and are able to easily install and run high-performance multimedia content and applications. As smartphones are gaining market share around the world, some of our users may migrate to smartphones, which can deliver mobile marketing, mobile entertainment and mobile money services with enhanced functionalities and additional features that may not be available on basic phones.

We currently offer some services for use with smartphones and plan to actively pursue new services for use with smartphones. However, there is no assurance that we can successfully establish new relationships with smartphone companies and application providers and increase or maintain the volume and/or market share of mobile handsets with our future smartphone services. In addition, many manufacturers of smartphones and companies that design operating systems for smartphones have developed their own content distribution systems and application stores. Even if we develop a complete portfolio of services designed to be compatible with smartphones, we will face significant competition and cannot guarantee that users of smartphones will use our services at the same level as basic phone users do. If we fail to adapt our service offerings for use with smartphones or if we fail to attract end users in the smartphone market, our growth prospects, business, results of operations and financial condition could be materially and adversely affected.

If we are unable to protect our intellectual property and proprietary rights, our competitive position and our business could be harmed.

We rely on a combination of trademarks, trade names, confidentiality and nondisclosure clauses and agreements, copyrights and licenses to define and protect our rights to the intellectual property in our platform and services. However, we cannot assure you that any of our registered or unregistered intellectual property rights, or claims to such rights, will now or in the future successfully protect what we consider to be our intellectual property from third-party use in any or all of the jurisdictions in which we do business, or that our registered or unregistered rights will not be successfully challenged.

To the extent that our innovations, platform and services are not protected by copyrights or other intellectual property rights in any of our key markets, third parties (including competitors) may be able to commercialize our innovations or services or use our know-how. In addition, to the extent we do not register, have not registered or

17

have not been granted trademarks or other intellectual property rights in certain jurisdictions, it may be possible for third parties to obtain conflicting trademarks or other intellectual property rights that would otherwise be limited or blocked by our applications and registration. Further, legal protection of our intellectual property rights in one country may not provide protection in other countries where we operate. We need to secure copyrights or other registrable intellectual property rights in all countries in which we intend to operate in order to have such protection.

The laws of many countries do not protect intellectual property rights to so great an extent as those of the United States or the member states of the European Union. Thus, effective protection of our intellectual property rights may be unavailable or limited in certain foreign countries. For example, many countries, particularly certain developing countries, do not favor the aggressive enforcement of trademarks and other measures to protect intellectual property. Limited intellectual property rights (whether because we do not have a registration or because the laws of some countries are limited) make piracy and misappropriation more difficult to prevent. Moreover, even when we have adequate intellectual property rights to stop an infringer, we may lack the resources to detect all infringements or to trace the source of the infringement. Finally, and despite agreements we have with certain employees prohibiting their disclosure of confidential or proprietary information, or laws in certain jurisdictions that prevent such disclosure, these agreements and laws may not effectively prevent the disclosure of our confidential or proprietary information.