- WPX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

WPX Energy (WPX) 425Business combination disclosure

Filed: 2 Nov 20, 5:20pm

Filed by WPX Energy, Inc.

Pursuant to Rule 425 under the Security Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: WPX Energy, Inc.

Commission File No.: 1-35322

| 3Q2020 EARNINGS CALL R I C K M U N C R I E F , C H A I R M A N & C E O NOVEMBER 3, 2020 N Y S E : W P X |

| ✓ Expected 2020 free cash flow increasing 50% to $300MM+ ✓ Current oil rate of ~140 Mbbl/d and raising 4Q 2020 guide: 137 - 143 Mbbl/d ✓ Lowering FY 2020 Capex by $50MM ($1.0B - $1.1B)1 Lowering FY 2020 LOE per BOE by 14% at midpoint ($5.10 - $5.40)2 ✓ Promising initial results from 2nd & 3rd Bone Spring in Stateline position ✓ Combining with Devon to create a shareholder/stakeholder focused energy company 1. Lowering “Scenario One” capital guidance by $50MM from $1.05B-$1.15B to $1.0B-$1.1B. |

| A Shareholder/Stakeholder Focused Energy Company Announced STRATEGIC Merger of Equals with Devon Energy ✓ (Combines the best capabilities of both businesses) ✓ (Merger enhances free cash flow generating capabilities) ✓ ✓ (400,000 net acres in the economic core of the play) ✓ (Expect $575 million in annual savings by year-end 2021) |

| True Merger Of Equals offers UNIQUE Benefits To WPX SHAREHOLDERS Enhances FREE CASH FLOW GROWTH potential Well positioned for MULTIPLE EXPANSION given pro forma metrics Significant SYNERGIES as % of pro forma market cap Significant OWNERSHIP and shared governance with best of both management teams ACCELERATES & ENHANCES WPX’S 5-year vision targets |

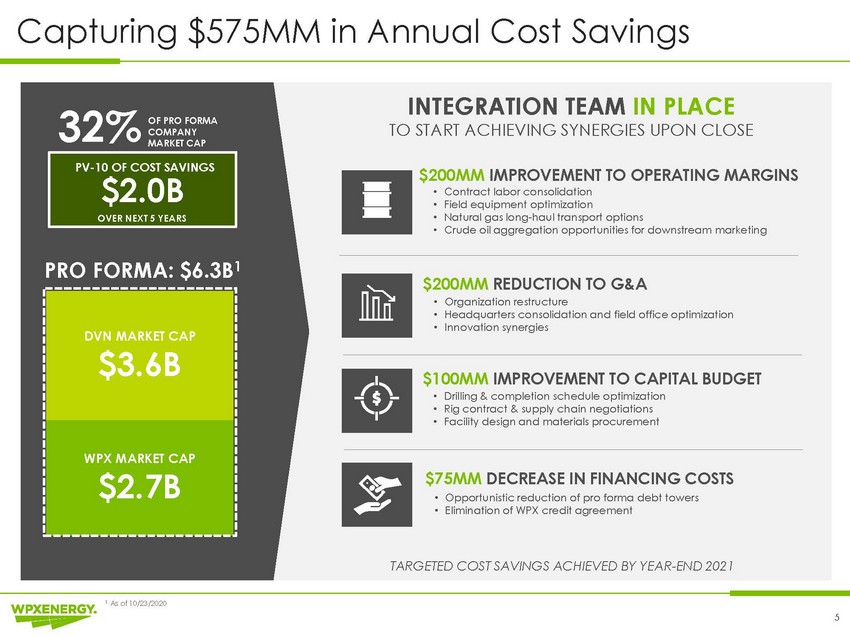

| 32% PV-10 OF COST SAVINGS $2.0B OVER NEXT 5 YEARS INTEGRATION TEAM IN PLACE TO START ACHIEVING SYNERGIES UPON CLOSE $200MM IMPROVEMENT TO OPERATING MARGINS • Contract labor consolidation • Field equipment optimization • Natural gas long-haul transport options • Crude oil aggregation opportunities for downstream marketing PRO FORMA: $6.3B1 DVN MARKET CAP $3.6B $200MM REDUCTION TO G&A • Organization restructure • Headquarters consolidation and field office optimization • Innovation synergies $100MM IMPROVEMENT TO CAPITAL BUDGET • Drilling & completion schedule optimization • Rig contract & supply chain negotiations • Facility design and materials procurement WPX MARKET CAP $2.7B $75MM DECREASE IN FINANCING COSTS • Opportunistic reduction of pro forma debt towers • Elimination of WPX credit agreement TARGETED COST SAVINGS ACHIEVED BY YEAR-END 2021 1. As of 10/23/2020 |

| OPERATIONS C L A Y G A S P A R , P R E S I D E N T & C H I E F O P E R A T I N G O F F I C E R |

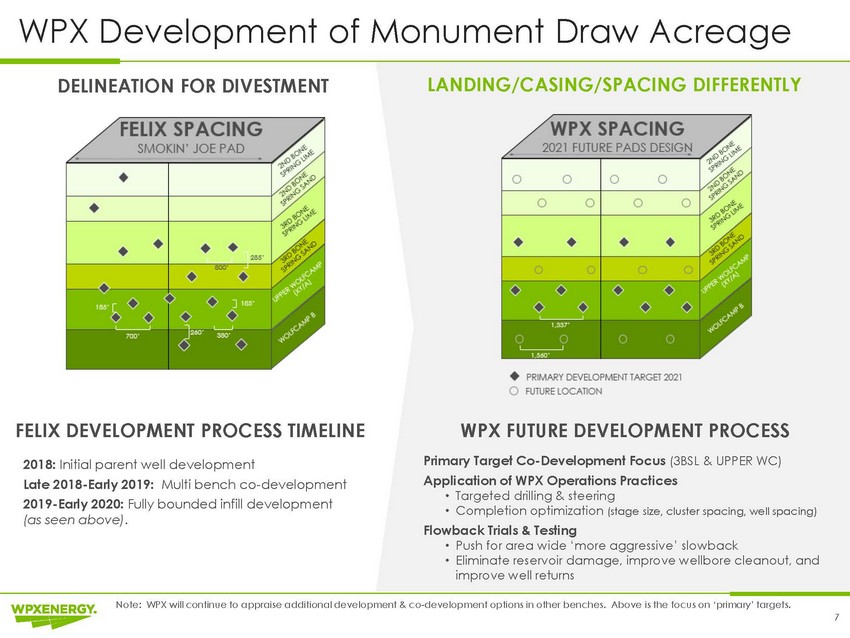

| DELINEATION FOR DIVESTMENT LANDING/CASING/SPACING DIFFERENTLY FELIX DEVELOPMENT PROCESS TIMELINE 2018: Initial parent well development Late 2018-Early 2019: Multi bench co-development 2019-Early 2020: Fully bounded infill development (as seen above). WPX FUTURE DEVELOPMENT PROCESS Primary Target Co-Development Focus (3BSL & UPPER WC) Application of WPX Operations Practices • Targeted drilling & steering • Completion optimization (stage size, cluster spacing, well spacing) Flowback Trials & Testing • Push for area wide ‘more aggressive’ slowback • Eliminate reservoir damage, improve wellbore cleanout, and improve well returns Note: WPX will continue to appraise additional development & co-development options in other benches. Above is the focus on ‘primary’ targets. |

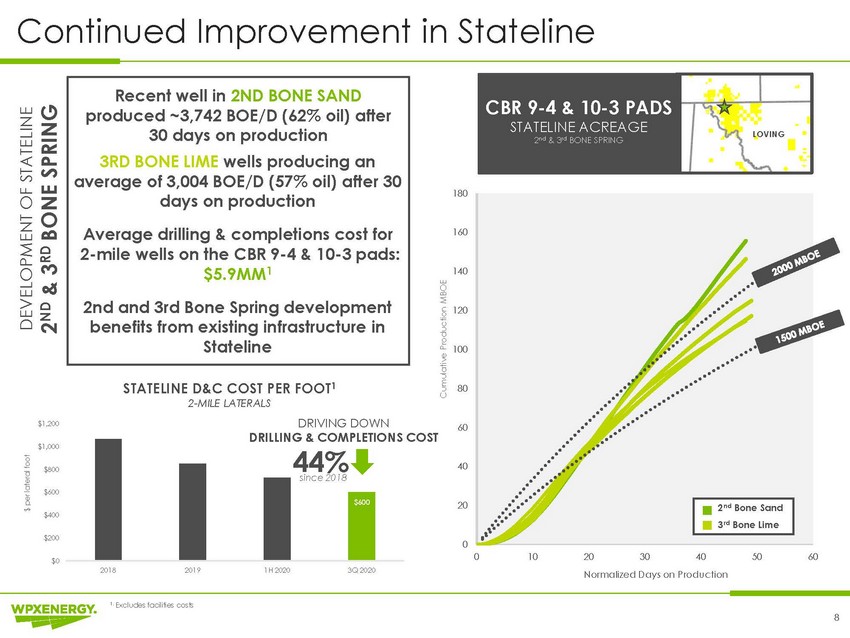

| SPRING DEVELOPMENT OF STATELINE 30 days on production & 3RD BONE Average drilling & completions cost for 2-mile wells on the CBR 9-4 & 10-3 pads: $5.9MM1 180 160 140 CBR 9-4 & 10-3 PADS STATELINE ACREAGE 2nd & 3rd BONE SPRING LOVING 2ND 120 100 $1,200 $ per lateral foot $800 $600 STATELINE D&C COST PER FOOT180 Cumulative Production MBOE DRIVING DOWN60 DRILLING & COMPLETIONS COST 44%40 since 2018 $400 $200 $0 1,064 849 725 $600 202nd Bone Sand 3rd Bone Lime 0 0102030405060 201820191H 20203Q 2020 Normalized Days on Production 1. Excludes facilities costs |

| FINANCIALS K E V I N V A N N , C H I E F F I N A N C I A L O F F I C E R |

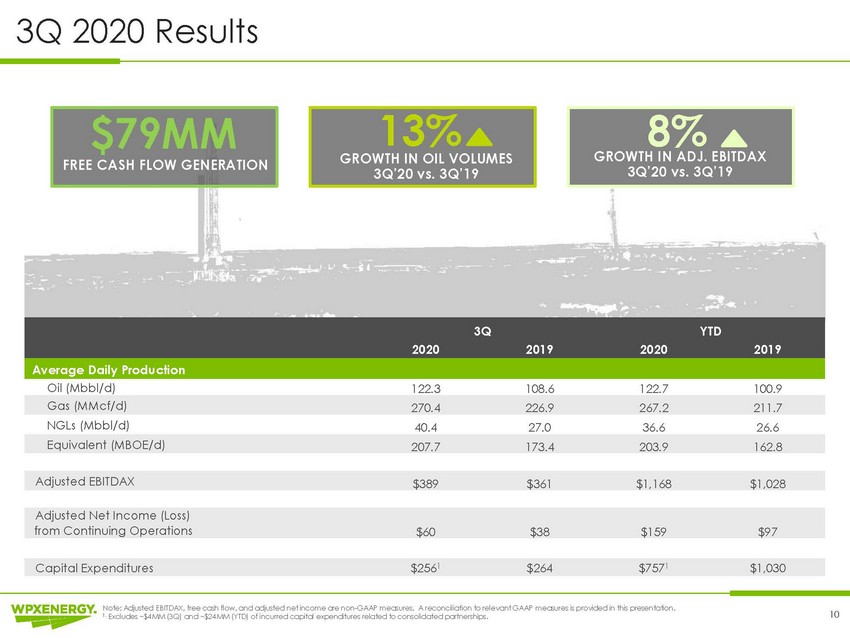

| $79MM 13%8% FREE CASH FLOW GENERATIONGROWTH IN OIL VOLUMES 3Q’20 vs. 3Q’19 GROWTH IN ADJ. EBITDAX 3Q’20 vs. 3Q’19 Note: Adjusted EBITDAX, free cash flow, and adjusted net income are non-GAAP measures. A reconciliation to relevant GAAP measures is provided in this presentation. 1. Excludes ~$4MM (3Q) and ~$24MM (YTD) of incurred capital expenditures related to consolidated partnerships.10 |

| D E V O N+W P X HIGH-IMPACT TRANSACTION DELIVERING LONG-TERM |

| APPENDIX |

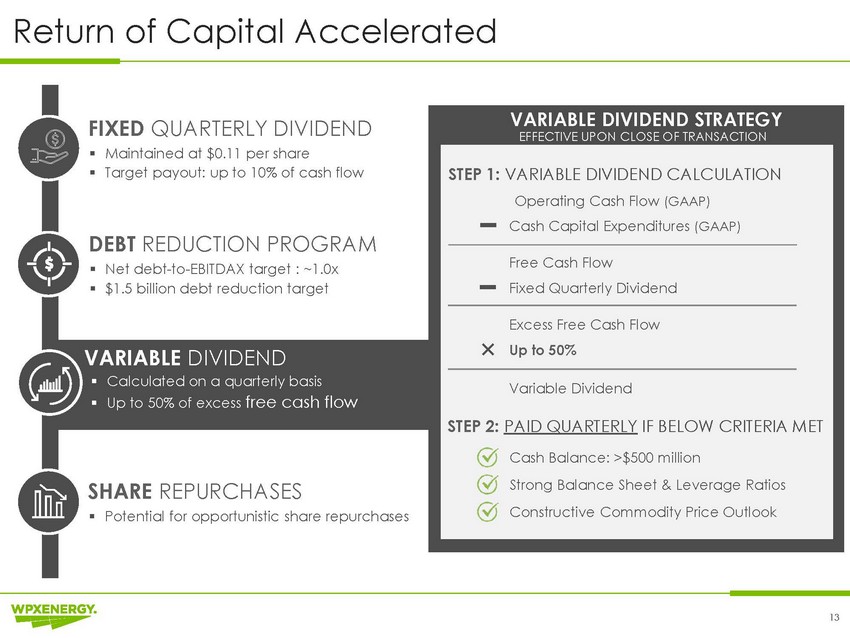

| FIXED QUARTERLY DIVIDEND ▪ Maintained at $0.11 per share ▪ Target payout: up to 10% of cash flow DEBT REDUCTION PROGRAM ▪ Net debt-to-EBITDAX target : ~1.0x ▪ $1.5 billion debt reduction target VARIABLE DIVIDEND ▪ Calculated on a quarterly basis ▪ Up to 50% of excess free cash flow VARIABLE DIVIDEND STRATEGY EFFECTIVE UPON CLOSE OF TRANSACTION STEP 1: VARIABLE DIVIDEND CALCULATION Operating Cash Flow (GAAP) − Cash Capital Expenditures (GAAP) Free Cash Flow − Fixed Quarterly Dividend Excess Free Cash Flow × Up to 50% Variable Dividend STEP 2: PAID QUARTERLY IF BELOW CRITERIA MET SHARE REPURCHASES ▪ Potential for opportunistic share repurchases Cash Balance: >$500 million Strong Balance Sheet & Leverage Ratios Constructive Commodity Price Outlook |

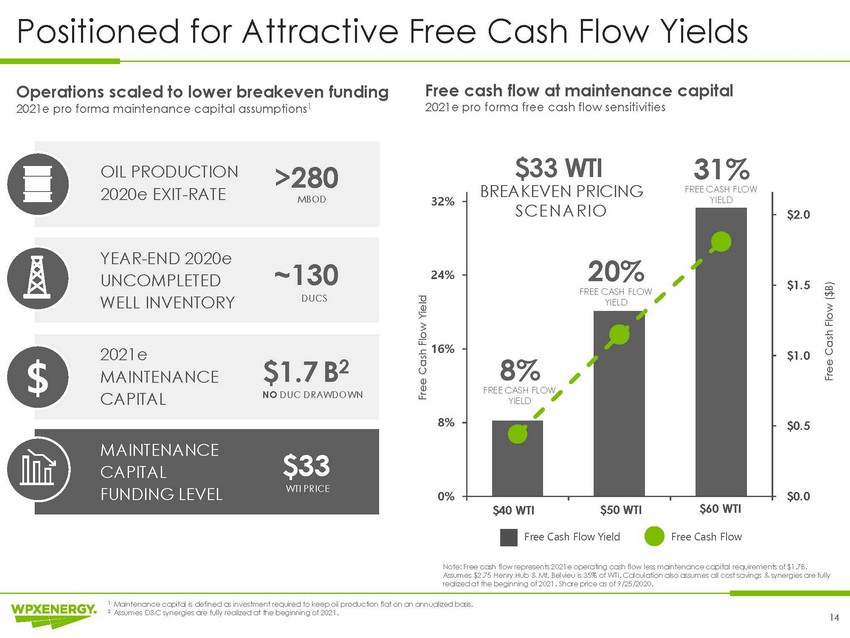

| Operations scaled to lower breakeven funding 2021e pro forma maintenance capital assumptions1 Free cash flow at maintenance capital 2021e pro forma free cash flow sensitivities OIL PRODUCTION 2020e EXIT-RATE >280 MBOD 32% $33 WTI BREAKEVEN PRICING SCE N A RI O 31% FREE CASH FLOW YIELD $2.0 YEAR-END 2020e UNCOMPLETED WELL INVENTORY ~130 DUCS 24% 20% FREE CASH FLOW YIELD Free Cash Flow Yield Free Cash Flow ($B) $ MAINTENANCE CAPITAL FUNDING LEVEL $1.7 B2 NO DUC DRAWDOWN $33 WTI PRICE 16% 8% 0% 8% FREE CASH FLOW YIELD $40 WTI$50 WTI$60 WTI $1.0 $0.5 $0.0 Free Cash Flow Yield Free Cash Flow Note: Free cash flow represents 2021e operating cash flow less maintenance capital requirements of $1.7B. Assumes $2.75 Henry Hub & Mt. Belvieu is 35% of WTI. Calculation also assumes all cost savings & synergies are fully realized at the beginning of 2021. Share price as of 9/25/2020. |

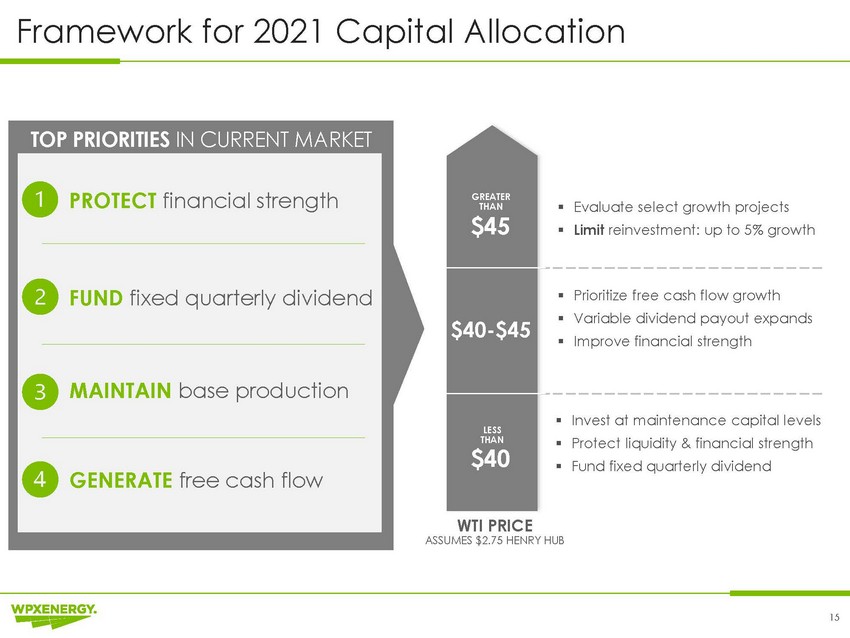

| TOP PRIORITIES IN CURRENT MARKET PROTECT financial strength FUND fixed quarterly dividend GREATER THAN $45 $40-$45 ▪ Evaluate select growth projects ▪ Limit reinvestment: up to 5% growth ▪ Prioritize free cash flow growth ▪ Variable dividend payout expands ▪ Improve financial strength MAINTAIN base production GENERATE free cash flow LESS THAN $40 ▪ Invest at maintenance capital levels ▪ Protect liquidity & financial strength ▪ Fund fixed quarterly dividend WTI PRICE ASSUMES $2.75 HENRY HUB |

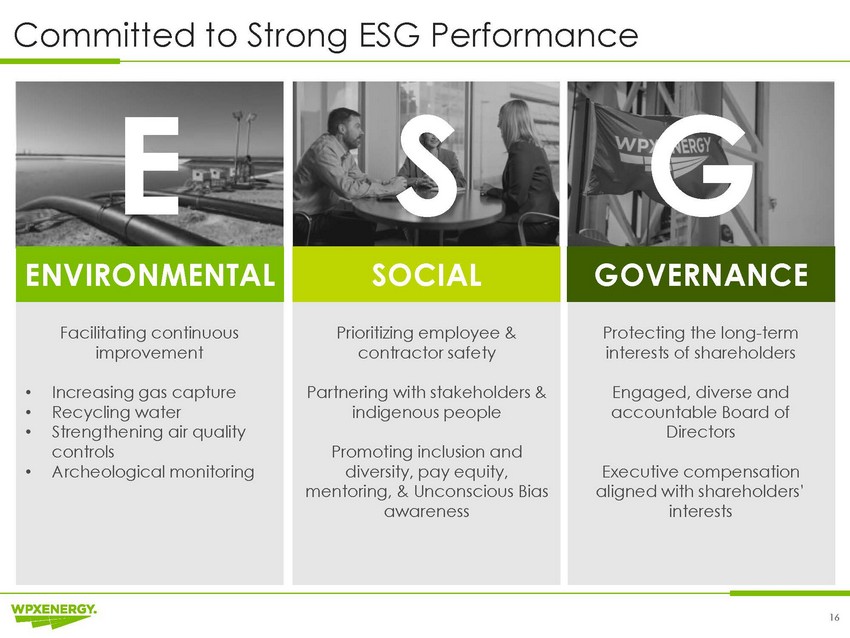

| ESG ENVIRONMENTALSOCIALGOVERNANCE Facilitating continuous improvement •Increasing gas capture •Recycling water •Strengthening air quality controls •Archeological monitoring Prioritizing employee & contractor safety Partnering with stakeholders & indigenous people Promoting inclusion and diversity, pay equity, mentoring, & Unconscious Bias awareness Protecting the long-term interests of shareholders Engaged, diverse and accountable Board of Directors Executive compensation aligned with shareholders’ interests |

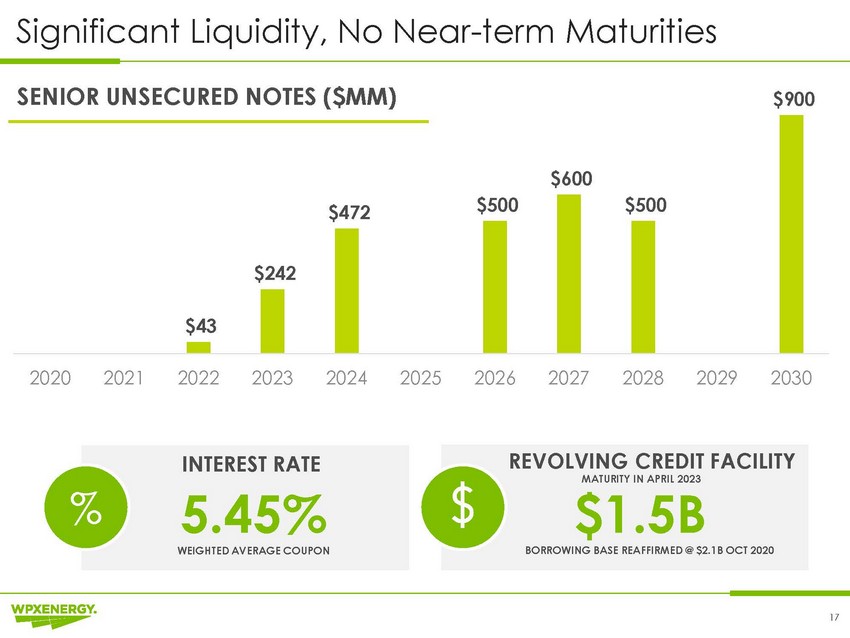

| SENIOR UNSECURED NOTES ($MM) $900 $472$500 $600 $500 $242 $43 20202021202220232024202520262027202820292030 INTEREST RATE %5.45% WEIGHTED AVERAGE COUPON REVOLVING CREDIT FACILITY MATURITY IN APRIL 2023 $1.5B BORROWING BASE REAFFIRMED @ $2.1B OCT 2020 |

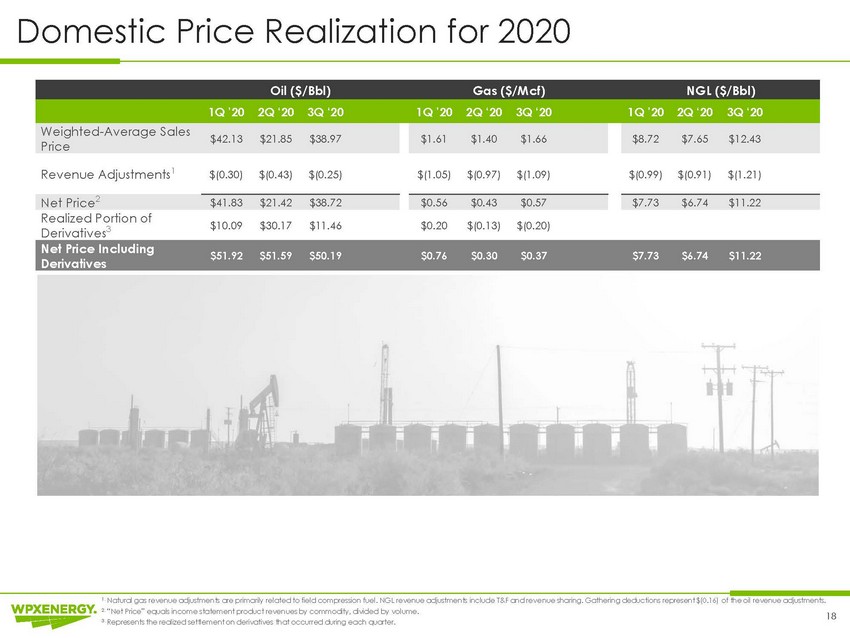

| Revenue Adjustments1$(0.30)$(0.43)$(0.25)$(1.05)$(0.97)$(1.09)$(0.99)$(0.91)$(1.21) Net Price2$41.83$21.42$38.72$0.56$0.43$0.57$7.73$6.74$11.22 Realized Portion of Derivatives3$10.09$30.17$11.46$0.20$(0.13)$(0.20) Net Price Including Derivatives $51.92$51.59$50.19$0.76$0.30$0.37$7.73$6.74$11.22 |

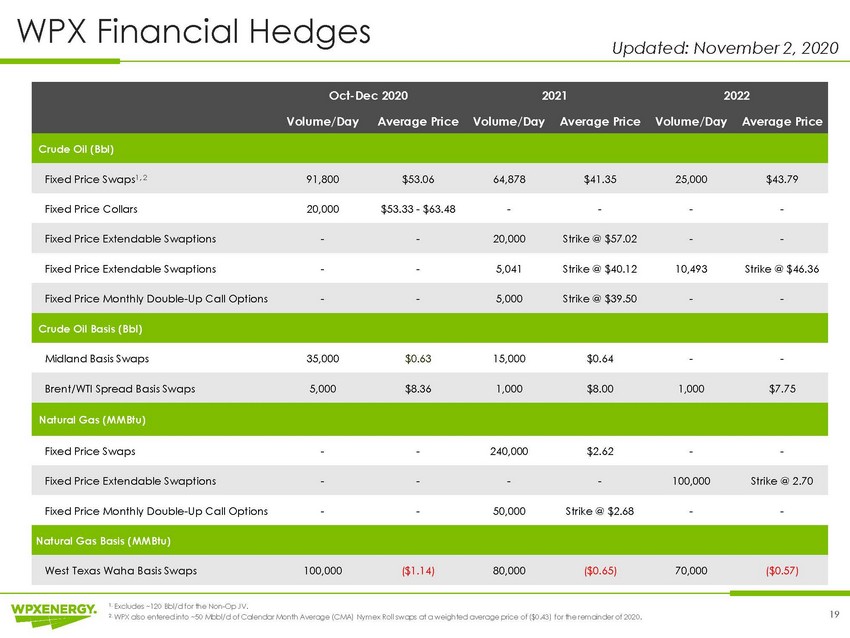

| Crude Oil (Bbl) |

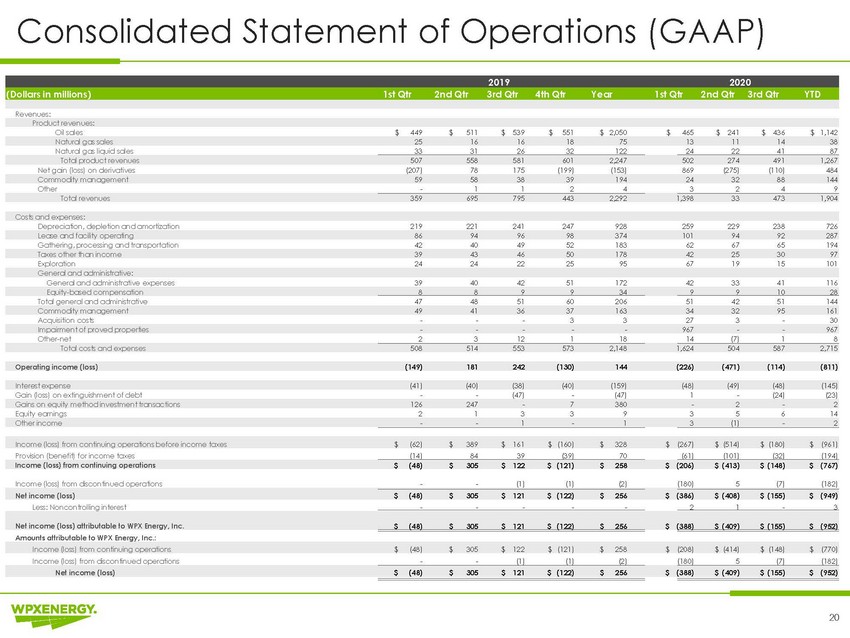

| 20192020 (Dollars in millions)1st Qtr2nd Qtr3rd Qtr4th QtrYear1st Qtr2nd Qtr3rd QtrYTD Revenues: Product revenues: |

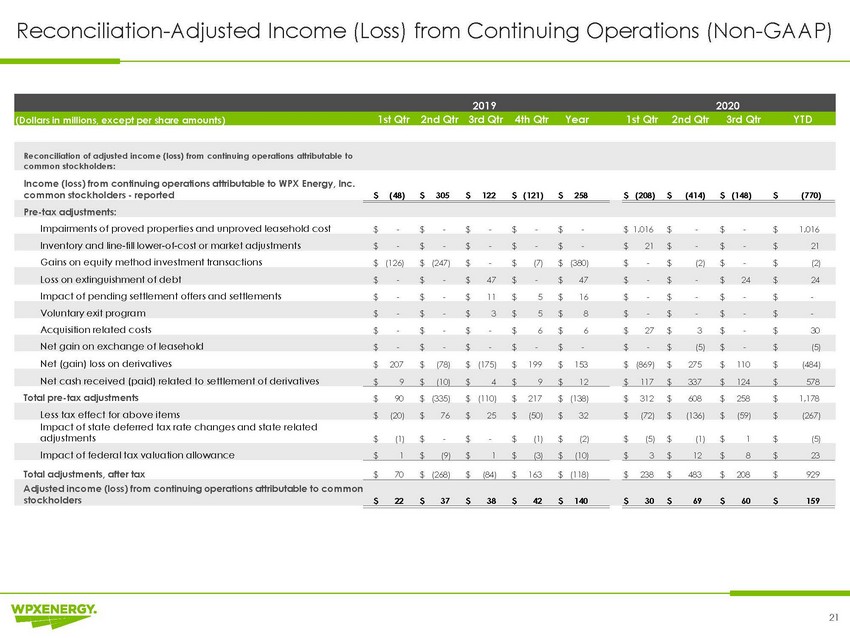

| Reconciliation-Adjusted Income (Loss) from Continuing Operations (Non-GAAP) 20192020 (Dollars in millions, except per share amounts)1st Qtr 2nd Qtr 3rd Qtr4th QtrYear1st Qtr2nd Qtr3rd QtrYTD Reconciliation of adjusted income (loss) from continuing operations attributable to common stockholders: Income (loss) from continuing operations attributable to WPX Energy, Inc. common stockholders - reported$ (48)$ 305$ 122$ (121)$ 258$ (208)$(414)$ (148)$(770) Pre-tax adjustments: Impairments of proved properties and unproved leasehold cost$-$-$-$-$-$ 1,016$-$-$1,016 Inventory and line-fill lower-of-cost or market adjustments$-$-$-$-$-$21$-$-$21 Gains on equity method investment transactions$ (126)$ (247)$-$(7)$ (380)$-$(2)$-$(2) Loss on extinguishment of debt$-$-$47$-$47$-$-$24$24 Impact of pending settlement offers and settlements$-$-$11$5$16$ -$-$-$-Voluntary exit program$-$-$ 3$5$ 8$ -$-$-$-Acquisition related costs$-$-$ -$6$ 6$27$3$-$30 Net gain on exchange of leasehold $ - $ - $ - $ - $ - $ - $ (5) $ - $ (5) Net (gain) loss on derivatives $ 207 $ (78) $ (175) $ 199 $ 153 $ (869) $ 275 $ 110 $ (484) Net cash received (paid) related to settlement of derivatives $ 9 $ (10) $ 4 $ 9 $ 12 $ 117 $ 337 $ 124 $ 578 Total pre-tax adjustments$90$ (335)$ (110)$ 217$ (138)$ 312$608$ 258$1,178 Less tax effect for above items$ (20)$76$25$ (50)$32$ (72)$(136)$ (59)$(267) Impact of state deferred tax rate changes and state related adjustments$(1)$-$-$(1)$(2)$(5) $(1)$1$(5) Impact of federal tax valuation allowance$1$(9)$1$(3)$ (10)$3$12$8$23 Total adjustments, after tax$70$ (268)$ (84)$ 163$ (118)$ 238$483$ 208$929 Adjusted income (loss) from continuing operations attributable to common stockholders $ 22 $ 37 $ 38 $ 42 $ 140 $30$69$60$159 |

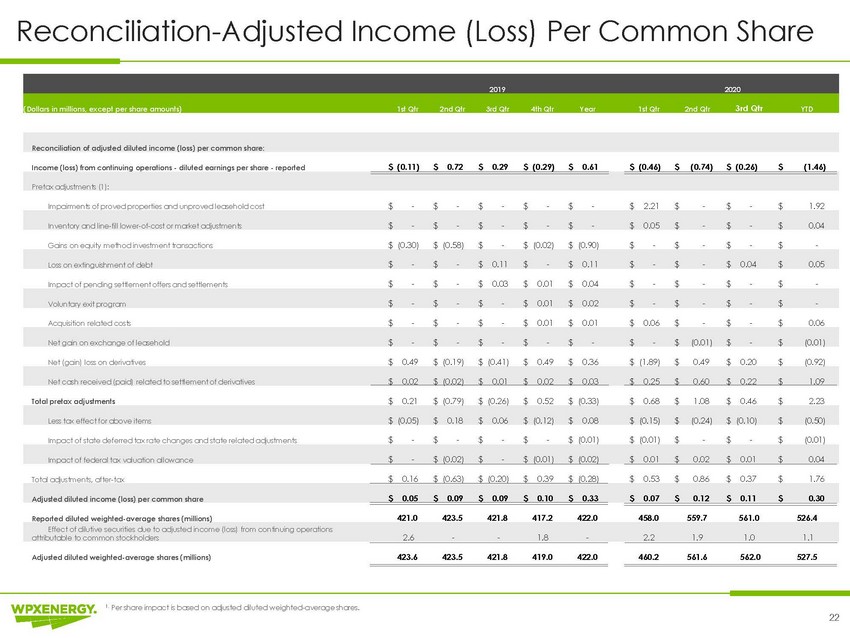

| Reconciliation-Adjusted Income (Loss) Per Common Share 20192020 (Dollars in millions, except per share amounts)1st Qtr2nd Qtr3rd Qtr4th QtrYear1st Qtr2nd Qtr3rd QtrYTD Reconciliation of adjusted diluted income (loss) per common share: Income (loss) from continuing operations - diluted earnings per share - reported$ (0.11)$ 0.72$ 0.29$ (0.29)$ 0.61$ (0.46)$ (0.74)$ (0.26)$(1.46) Pretax adjustments (1): Gains on equity method investment transactions$ (0.30)$ (0.58)$-$ (0.02)$ (0.90)$-$-$-$-Effect of dilutive securities due to adjusted income (loss) from continuing operations attributable to common stockholders 2.6 - - 1.8 - 2.2 1.9 1.0 1.1 Adjusted diluted weighted-average shares (millions)423.6423.5421.8419.0422.0460.2561.6562.0527.5 |

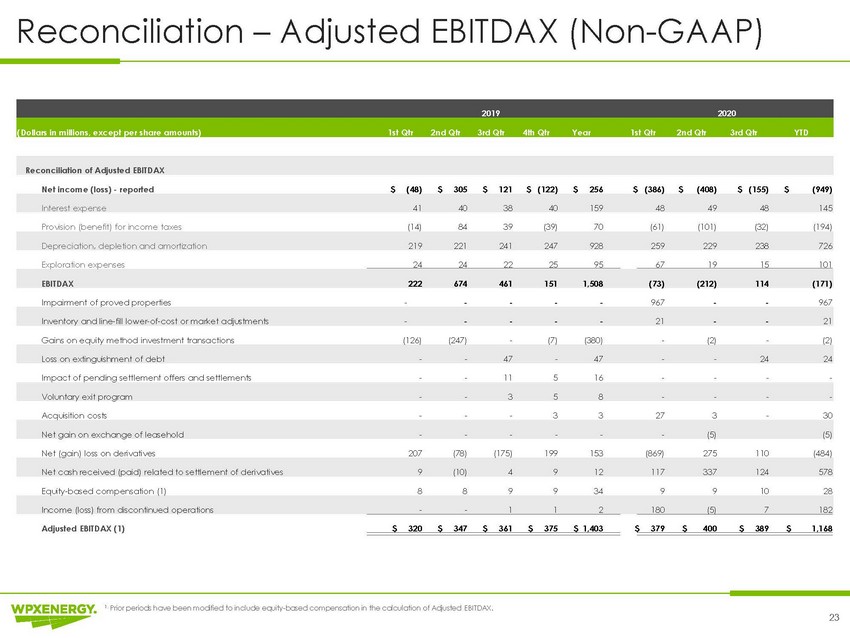

| 20192020 (Dollars in millions, except per share amounts)1st Qtr2nd Qtr3rd Qtr4th QtrYear1st Qtr2nd Qtr3rd QtrYTD Reconciliation of Adjusted EBITDAX Adjusted EBITDAX (1) $ 320 $ 347 $ 361 $ 375 $ 1,403 $ 379$400$ 389$1,168 |

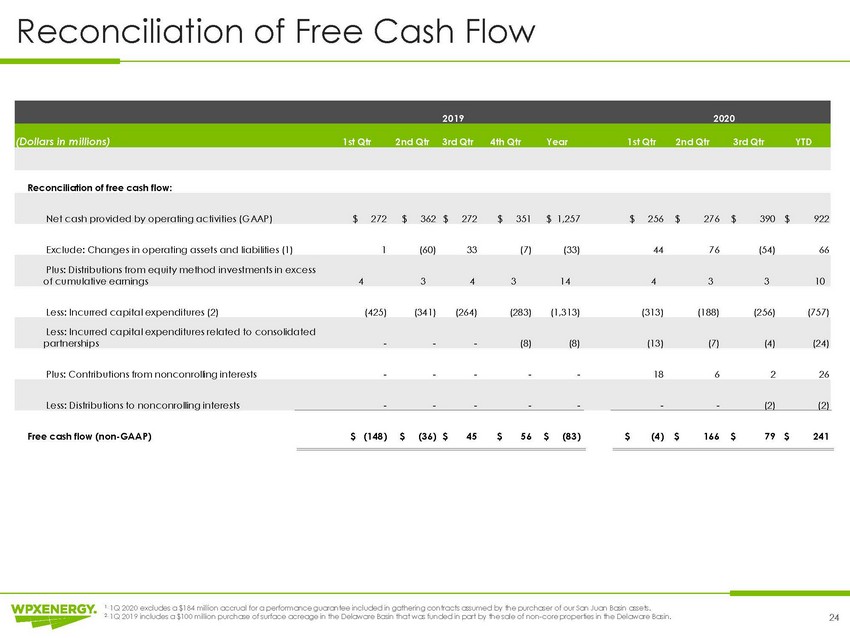

| 20192020 (Dollars in millions)1st Qtr2nd Qtr3rd Qtr4th QtrYear1st Qtr2nd Qtr3rd QtrYTD Reconciliation of free cash flow: Net cash provided by operating activities (GAAP)$272 $362 $272 $351 $ 1,257 $256 $276 $390 $922 Exclude: Changes in operating assets and liabilities (1) 1 (60) 33 (7) (33) 44 76 (54) 66 Plus: Distributions from equity method investments in excess of cumulative earnings 4 3 4 3 14 4 3 3 10 Less: Incurred capital expenditures (2) (425) (341) (264) (283) (1,313) (313) (188) (256) (757) Less: Incurred capital expenditures related to consolidated partnerships - - - (8) (8) (13) (7) (4) (24) Plus: Contributions from nonconrolling interests - - - - - 18 6 2 26 Less: Distributions to nonconrolling interests - - - - - - - (2) (2) e cash flow (non-GAAP) $ (148) $(36) $45 $56 $(83) $(4) $166 $79 $241 1. 1Q 2020 excludes a $184 million accrual for a performance guarantee included in gathering contracts assumed by the purchaser of our San Juan Basin assets. 2. 1Q 2019 includes a $100 million purchase of surface acreage in the Delaware Basin that was funded in part by the sale of non -core properties in the Delaware Basin.24 |

| Forward Looking Statements This presentation includes “forward-looking statements” as defined by the SEC. Such statements include those concerning strategic plans, Devon’s and WPX’s expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases such as “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that Devon or WPX expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond Devon’s and WPX’s control. Consequently, actual future results could differ materially from Devon’s and WPX’s expectations due to a number of factors, including, but not limited to: the risk that Devon’s and WPX’s businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate, incl uding the risk of new restrictions with respect to hydraulic fracturing or other development activities on Devon’s or WPX’s federal acreage or their other assets; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the risk that Devon or WPX may be unable to obtain governmental and regulatory approvals required for the Proposed Transaction, or that required governmental and regulatory approvals may delay the Proposed Transaction or result in the imposition of conditions that could reduce the anticipated benefits from the Proposed Transaction or cause the parties to abandon the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied; the length of time necessary to consummate the Proposed Transaction, which may be longer than anticipated for various reasons; potential liability resulting from pending or future litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the Proposed Transaction on relationships with customers, suppliers, competitors, management and other employees; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; the volatility of oil, gas and natural gas liquids (NGL) prices; uncertainties inherent in estimating oil, gas and NGL reserves; the impact of reduced demand for our products and products made from them due to governmental and societal actions taken in response to the COVID-19 pandemic; the uncertainties, costs and risks involved in Devon’s and WPX’s operations, including as a result of employee misconduct; natural disasters, pandemics, epidemics (including COVID-19 and any escalation or worsening thereof) or other public health conditions; counterparty credit risks; risks relating to Devon’s and WPX’s indebtedness; risks related to Devon’s and WPX’s hedging activities; competition for assets, materials, people and capital; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; cyberattack risks; Devon’s and WPX’s limited control over third parties who operate some of their respective oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses Devon or WPX may experience; risks related to investors attempting to effect change; general domestic and international economic and political conditions, including the impact of COVID-19; and changes in tax, environmental and other laws, including court rulings, applicable to Devon’s and WPX’s business. In addition to the foregoing, the COVID-19 pandemic and its related repercussions have created significant volatility, uncertainty and turmoil in the global economy and Devon’s and WPX’s industry. This turmoil has included an unprecedented supply-and-demand imbalance for oil and other commodities, resulting in a swift and material decline in commodity prices in early 2020. Devon’s and WPX’s future actual results could differ materially from the forward-looking statements in this presentation due to the COVID-19 pandemic and related impacts, including, by, among other things: contributing to a sustained or further deterioration in commodity prices; causing takeaway capacity constraints for production, resulting in urther production shut-ins and additional downward pressure on impacted regional pricing differentials; limiting Devon’s and WPX’s ability to access sources of capital due to disruptions in financial markets; increasing the risk of a downgrade from credit rating agencies; exacerbating counterparty credit risks and the risk of supply chain interruptions; and increasing the risk of operational disruptions due to social distancing measures and other changes to business practices. Additional information concerning other risk factors is also contained in Devon’s and WPX’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other SEC filings. Many of these risks, uncertainties and assumptions are beyond Devon’s or WPX’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Nothing in this presentation is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per share of Devon or WPX for the current or any future financial years or those of the combined company will necessarily match or exceed the historical publis hed earnings per share of Devon or WPX, as applicable. Neither Devon nor WPX gives any assurance (1) that either Devon or WPX will achieve their expectations, or (2) concerning any result or the timing thereof, in each case, with respect to the Proposed Transaction or any regulatory action, administrative proceedings, government investigations, litigation, warning letters, consent decree, cost reductions, business strategies, earnings or revenue trends or future financial results. All subsequent written and oral forward-looking statements concerning Devon, WPX, the Proposed Transaction, the combined company or other matters and attributable to Devon or WPX or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Devon and WPX assume no duty to update or revise their respective forward-looking statements based on new information, future events or otherwise. |

| Additional information and where to find it In connection with the proposed merger (the “Proposed Transaction”) of Devon Energy Corporation (“Devon”) and WPX Energy, Inc. (“WPX”), Devon will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 to register the shares of Devon’s common stock to be issued in connection with the Proposed Transaction. The registration statement will include a document that serves as a prospectus of Devon and a proxy statement of each of Devon and WPX (the “joint proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF DEVON AND WPX ARE ADVISED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DEVON, WPX, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive joint proxy statement/prospectus will be sent to the stockholders of each of Devon and WPX when it becomes available. Investors and security holders will be able to obtain copies of the registration statement and the joint proxy statement/prospectus and other documents containing important information about Devon and WPX free of charge from the SEC’s website when it becomes available. The documents filed by Devon with the SEC may be obtained free of charge at Devon’s website at www.devonenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Devon by requesting them by mail at Devon, Attn: Investor Relations, 333 West Sheridan Ave, Oklahoma City, OK 73102. The documents filed by WPX with the SEC may be obtained free of charge at WPX’s website at www. www.wpxenergy.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from WPX by requesting them by mail at WPX, Attn: Investor Relations, P.O. Box 21810, Tulsa, OK 74102. Participants in the Solicitation Devon, WPX and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Devon’s and WPX’s stockholders with respect to the Proposed Transaction. Information about Devon’s directors and executive officers is available in Devon’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 19, 2020, and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 22, 2020. Information about WPX’s directors and executive officers is available in WPX’s Annual Report on Form 10-K for the 2019 fiscal year filed with the SEC on February 28, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on March 31, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Stockholders, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. No Offer or Solicitation This presentation is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Reserves Disclaimer The SEC requires oil and gas companies, in filings made with the SEC, to disclose proved reserves, which are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible – from a given date forward, from known reservoirs, under existing economic conditions, operating methods, and governmental regulations. The SEC permits the optional disclosure of probable and possible reserves. We have elected to use in this presentation “probable” reserves and “possible” reserves, excluding their valuation. The SEC defines “probable” reserves as “those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.” The SEC defines “possible” reserves as “those additional reserves that are less certain to be recovered than probable reserves.” The Company has applied these definitions in estimating probable and possible reserves. Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves not necessarily cal culated in accordance with, or contemplated by, the SEC’s reserves reporting guidelines. Investors are urged to consider closely the disclosure regarding our business that may be accessed through the SEC’s website at www.sec.gov. The SEC’s rules prohibit us from filing resource estimates. Our resource estimations include estimates of hydrocarbon quantities for (i) new areas for which we do not have sufficient information to date to classify as proved, probable or even possible reserves, (ii) other areas to take into account the low level of certainty of recovery of the resources and (iii) uneconomic proved, probable or possible reserves. Resource estimates do not take into account the certainty of resource recovery and are therefore not indicative of the expected future recovery and should not be relied upon. Resource estimates might never be recovered and are contingent on exploration success, technical improvements in drilling access, commerciality and other factors. WPX Non-GAAP Disclaimer This presentation may include certain financial measures, including adjusted EBITDAX (earnings before interest, taxes, depreciation, depletion, amortization and exploration expenses), that are non-GAAP financial measures as defined under the rules of the Securities and Exchange Commission. This presentation is accompanied by a reconciliation of these non-GAAP financial measures to their nearest GAAP financial measures. Management uses these financial measures because they are widely accepted financial indicators used by investors to compare a company’s performance. Management believes that these measures provide investors an enhanced perspective of the operating performance of the company and aid investor understanding. Management also believes that these non-GAAP measures provide useful information regarding our ability to meet future debt service, capital expenditures and working capital requirements. These non-GAAP financial measures should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with United States generally accepted accounting principles. |