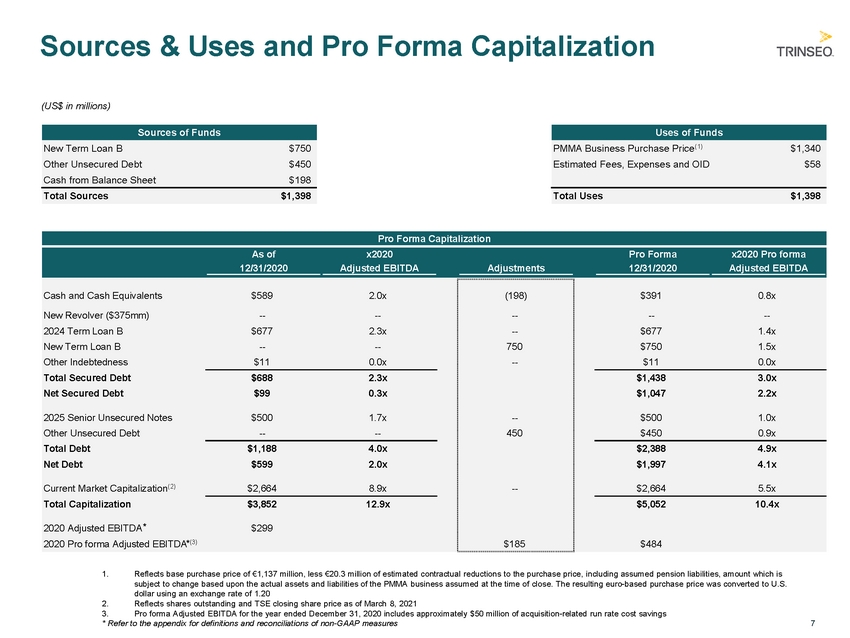

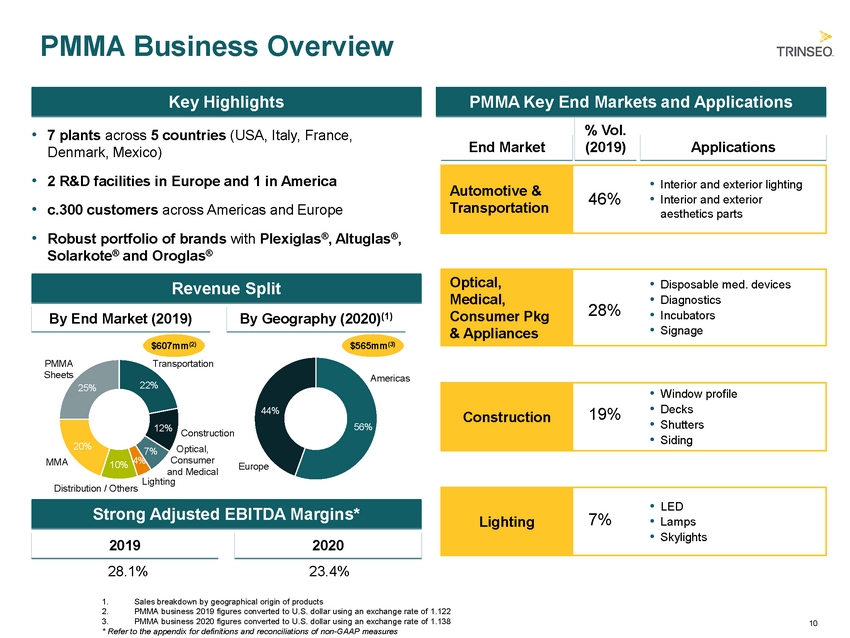

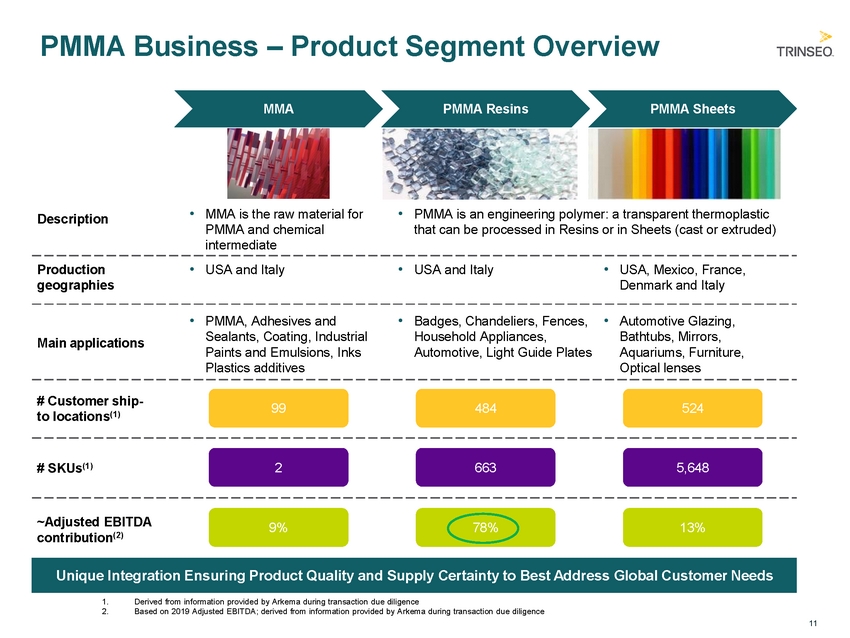

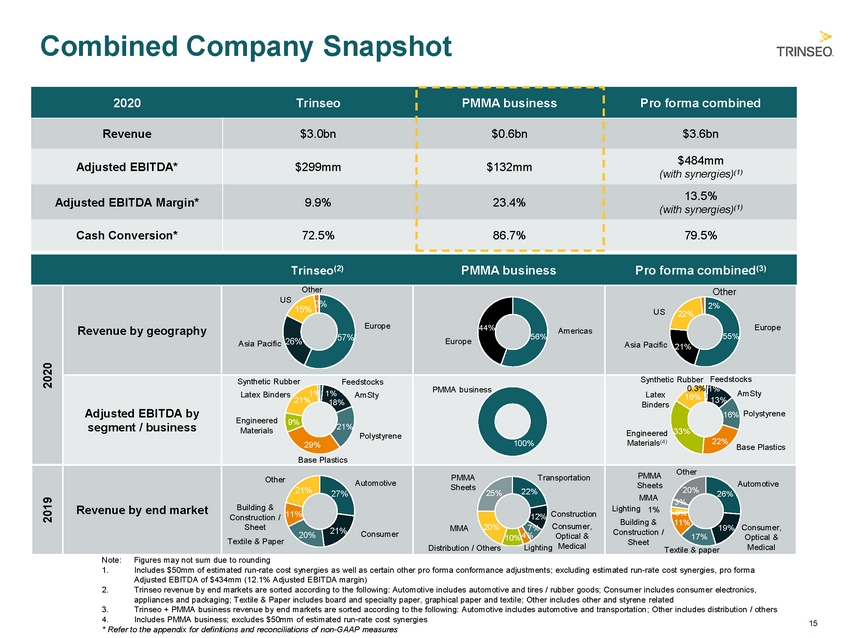

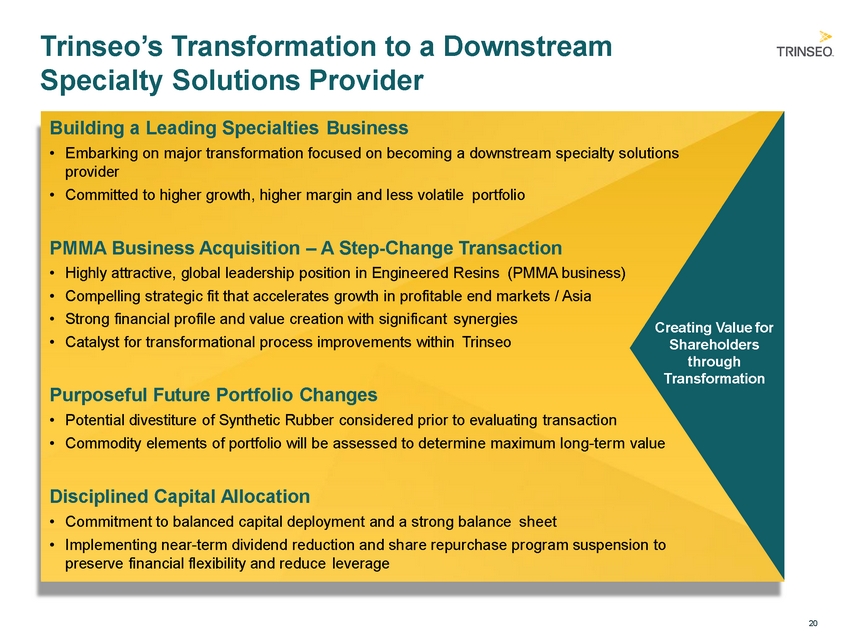

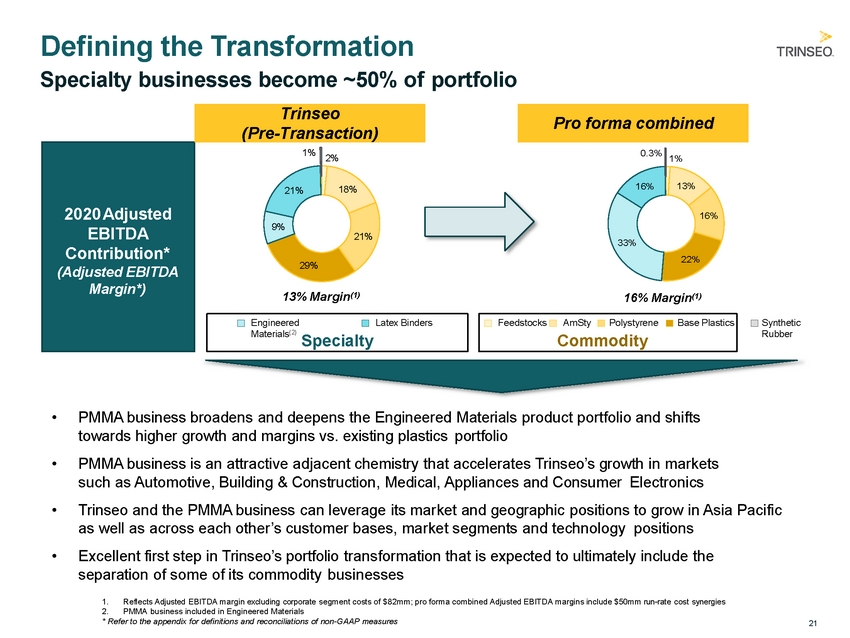

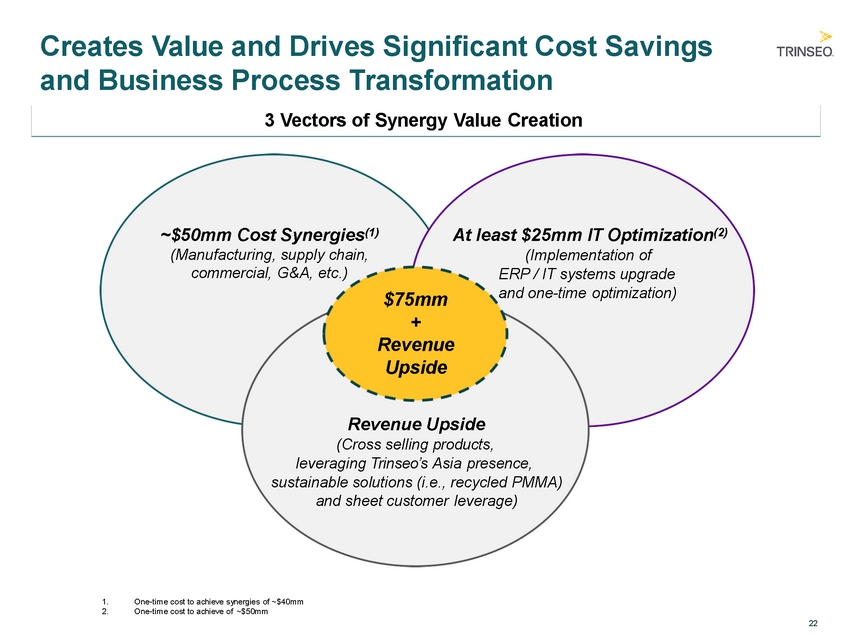

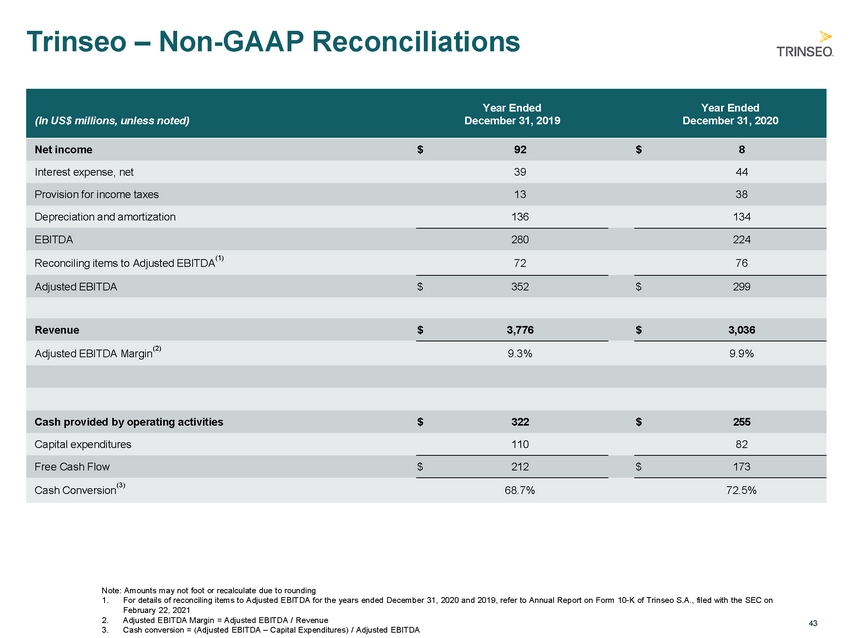

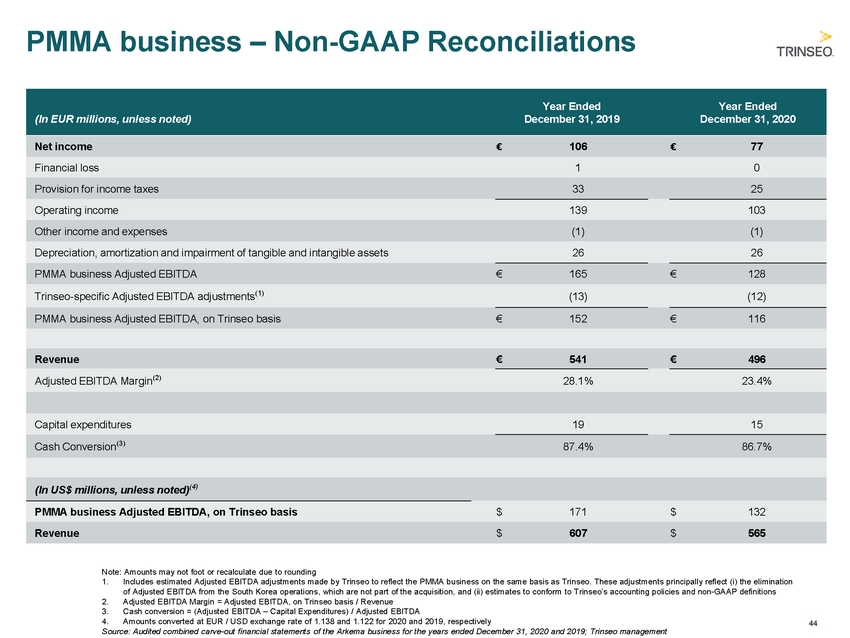

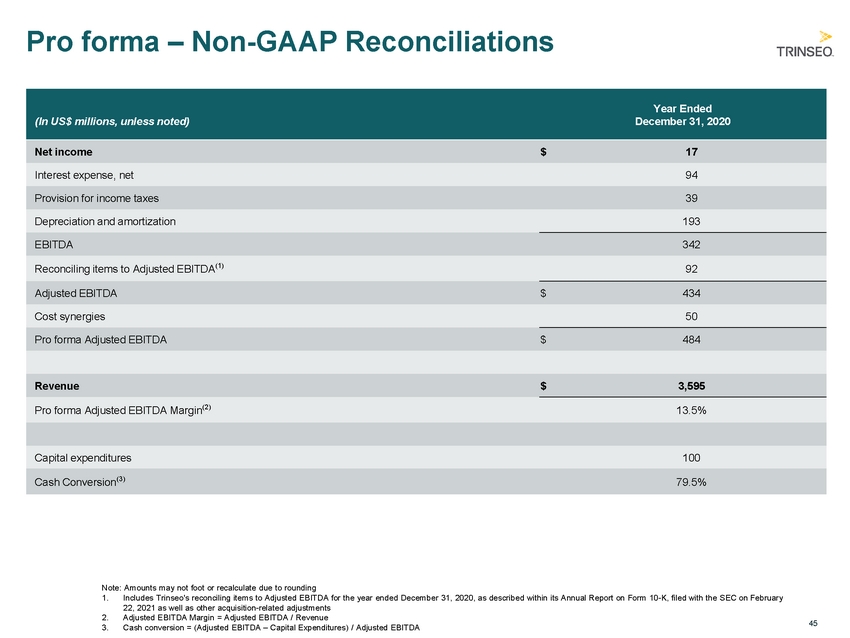

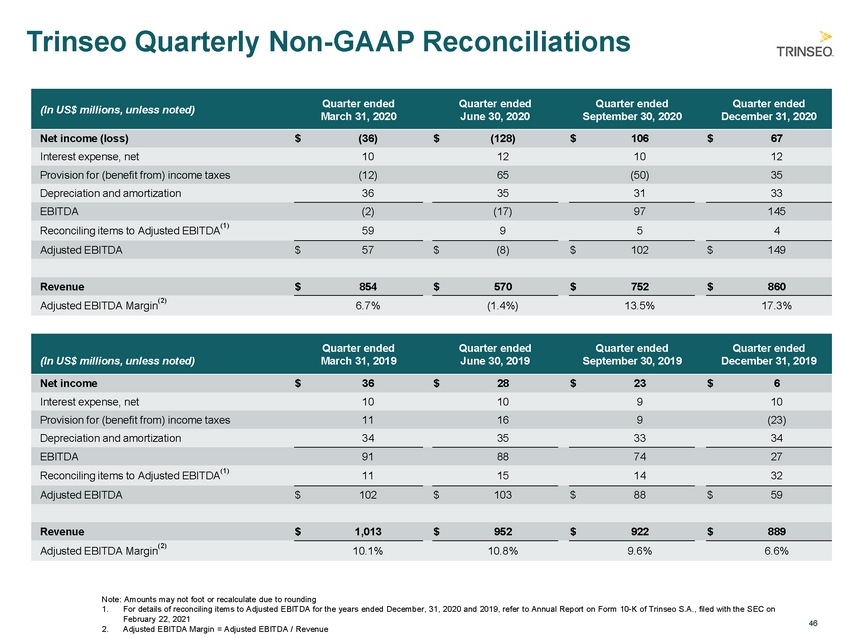

| Disclaimer Disclosure Rules Cautionary Note on Forward-Looking Statements. This presentation contains forward-looking statements including, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts or guarantees or assurances of future performance. Forward-looking statements may be identified by the use of words like “expect,” “anticipate,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “see,” “tend,” “assume,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding the timing of the proposed acquisition of the Arkema MMA and PMMA business (the “Acquisition”); estimated and future results of operations, business strategies, compet itive position, industry environment and potential growth opportunities and cost synergies relating to the Acquisition; the impact from the COVID-19 pandemic, our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Factors that might cause such a difference include, but are not limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of or failure to complete the Acquisition or the agreements and transactions contemplated thereby; our failure to meet the conditions to closing of the Acquisition, including those conditions related to antitrust, works council and other regulatory approvals; the failure to obtain the financing necessary, at terms acceptable to us, to fund the Acquisition; costs related to the proposed Acquisition and the impact of the substantial indebtedness to be incurred to finance the Acquisition; our ability, post-Acquisition, to meet our financial and strategic goals, due to, among other things, our ability to grow and manage growth profitability, maintain relationships with customers and retain key employees; the possibility that following the Acquisition we may be adversely affected by other economic, business, and/or competitive factors; our ability to successfully integrate the acquired businesses or generate expected cost savings and synergies from the Acquisition; the ongoing impact of the COVID-19 pandemic and those discussed in our Annual Report on Form 10-K, under Part I, Item 1A —“Risk Factors” and elsewhere in our other reports filed with the U.S. Securities and Exchange Commission. As a result of these or other factors, our actual results may differ materially from those contemplated by the forward-looking statements. Therefore, we caution you against relying on any of these forward-looking statements. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Use of non-GAAP measures In addition to using standard measures of performance and liquidity that are recognized in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we use additional measures of income excluding certain GAAP items (“non-GAAP measures”) to explain Trinseo’s performance and liquidity, such as Adjusted Net Income, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EPS, Free Cash Flow, and Cash Conversion. We believe these measures are useful for investors and management in evaluating business trends, performance, and liquidity each period. These measures are also used to manage our business and assess profitability, as well as to provide an appropriate basis to evaluate the effectiveness of our pricing strategies. Such measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance and liquidity, as applicable. The definitions of each of these measures, further discussion of usefulness, and reconciliations of non-GAAP measures to GAAP measures are provided within the appendix herein. PMMA business financial information On December 14, 2020, Trinseo announced its entry into a binding offer with Arkema S.A. (“Arkema”), a leader in specialty chemicals, to acquire its polymethyl methacrylates (“PMMA”) and activated methyl methacrylates (“MMA”) businesses (together, referred to herein as the “PMMA business” or the “PMMA Acquisition”). The financial information of the PMMA business provided herein is unaudited and is derived from information provided to Trinseo by Arkema management in conjunction with ongoing due diligence procedures, with various Trinseo management adjustments also reflected. This information has not been conformed to the accounting principles (GAAP) and accounting policies followed by Trinseo. Further, the definitions of performance and liquidity measures of the PMMA business, such as Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow and Cash Conversion, may not align with the definitions of Trinseo. As a result, it may be difficult to use these financial measures to compare the performance of the PMMA business and Trinseo’s performance. 2 |