- RM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Regional Management (RM) DEF 14ADefinitive proxy

Filed: 15 Apr 24, 4:30pm

20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☑ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material Pursuant to §240.14a-12 |

Regional Management Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ | No fee required |

|

|

☐ | Fee paid previously with preliminary materials |

|

|

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2024 Annual Meeting of Stockholders

and Proxy Statement

| Regional Management Corp. |

979 Batesville Road, Suite B | |

Greer, South Carolina 29651 | |

(864) 448-7000 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 16, 2024

To the Stockholders of Regional Management Corp.:

We hereby give notice that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Regional Management Corp. will be held exclusively online via the internet on May 16, 2024, at 1:00 p.m. Eastern Daylight Time. The purposes of the meeting are as follows:

(1) To elect the eight nominees named in the accompanying Proxy Statement to serve as members of our Board of Directors until the next annual meeting of stockholders or until their successors are elected and qualified;

(2) To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

(3) To approve the Regional Management Corp. 2024 Long-Term Incentive Plan;

(4) To hold an advisory vote to approve executive compensation;

(5) To hold an advisory vote on the frequency of future advisory votes to approve executive compensation; and

(6) To transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

We began mailing this Notice of Annual Meeting of Stockholders and our Proxy Statement to stockholders on or about April 15, 2024. Only stockholders whose names appear of record on our books at the close of business on April 2, 2024 will be entitled to notice of and to vote at the Annual Meeting or at any adjournments thereof.

We have once again determined that the Annual Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. If you plan to participate in the virtual meeting, please see “General Information and Frequently Asked Questions” in this Proxy Statement. Stockholders will be able to attend, vote, and submit questions (both before, and during a designated portion of, the meeting) from any location via the internet. The Annual Meeting will be presented exclusively online at www.virtualshareholdermeeting.com/RM2024. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit your questions to management during the Annual Meeting by visiting www.virtualshareholdermeeting.com/RM2024.

To participate in the Annual Meeting (e.g., submit questions and/or vote), you will need the control number provided on your proxy card or voting instruction form. If you are not a stockholder or do not have a control number, you may still access the Annual Meeting as a guest, but you will not be able to participate.

Your vote is important. Whether or not you plan to attend the virtual Annual Meeting, you are urged to cast your vote promptly in order to assure representation of your shares at the meeting and so that a quorum may be established. In advance of the Annual Meeting, you may vote by internet or by mail. If you attend the virtual Annual Meeting, you may revoke your proxy and vote your shares electronically during the meeting.

| To vote by internet prior to the meeting, please visit www.proxyvote.com. Have the enclosed proxy card in hand when you access the website, and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| To vote by mail, please complete, date, and sign the enclosed proxy card, and mail it in the enclosed envelope. No postage need be affixed if the proxy card is mailed in the United States. |

On behalf of our Board of Directors and our management team, we thank you for your interest in Regional Management Corp. and for your participation in the Annual Meeting.

| By Order of the Board of Directors |

|

|

|

|

|

|

| Catherine R. Atwood |

| SVP, General Counsel, and Secretary |

Greer, South Carolina

April 15, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 16, 2024: The Notice of Annual Meeting of Stockholders, Proxy Statement, and Annual Report on Form 10-K are available free of charge at https://materials.proxyvote.com/75902K and on our Investor Relations website at www.regionalmanagement.com. |

Proxy statement

2024 Annual Meeting of Stockholders

Table of Contents

Page | |

1 | |

6 | |

9 | |

9 | |

9 | |

10 | |

Matrix of Director Skills, Experience, and Demographic Background | 14 |

14 | |

15 | |

15 | |

15 | |

17 | |

18 | |

18 | |

18 | |

19 | |

21 | |

22 | |

22 | |

26 | |

29 | |

35 | |

38 | |

39 | |

39 | |

41 | |

42 | |

43 | |

43 | |

44 | |

45 | |

Summary of Employment Arrangements with Named Executive Officers | 49 |

49 | |

51 | |

52 | |

52 | |

58 | |

58 | |

58 | |

60 | |

60 | |

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 60 |

Proposal No. 3: Approval of the Regional Management Corp. 2024 Long-Term Incentive Plan | 62 |

Proposal No. 4: Advisory Vote to Approve Executive Compensation | 71 |

Proposal No. 5: Advisory Vote on the Frequency of Future Advisory Votes to Approve Executive Compensation | 72 |

Regional Management Corp. | Notice of Annual Meeting of Stockholders

73 | |

73 | |

Security Ownership of Certain Beneficial Owners and Management | 74 |

76 | |

77 | |

78 | |

78 |

Regional Management Corp. | Notice of Annual Meeting of Stockholders

REGIONAL MANAGEMENT CORP.

979 Batesville Road, Suite B

Greer, South Carolina 29651

PROXY STATEMENT

For the Annual Meeting of Stockholders to Be Held on May 16, 2024

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on May 16, 2024:

The Notice of Annual Meeting of Stockholders, Proxy Statement, and Annual Report on Form 10-K are available free of charge at https://materials.proxyvote.com/75902K and on the Investor Relations website of Regional Management Corp. at www.regionalmanagement.com.

April 15, 2024

2024 Proxy Statement Summary

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

Date: | May 16, 2024 |

Time: | 1:00 p.m. Eastern Daylight Time |

Access: | Virtually via the internet at www.virtualshareholdermeeting.com/RM2024. Instructions as to how you may attend and participate in the virtual Annual Meeting are set forth in the Proxy Statement under “General Information and Frequently Asked Questions – How do I attend and participate in the Annual Meeting online?” |

Record Date: | April 2, 2024 |

Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each other proposal. Stockholders may vote by proxy or electronically during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/RM2024. Instructions as to how you may cast your vote are found on the accompanying proxy card and are set forth in the Proxy Statement under “General Information and Frequently Asked Questions – How do I vote?” |

Proxy Materials: | The Proxy Statement and the accompanying proxy card are first being mailed on or about April 15, 2024 to the stockholders of Regional Management Corp. |

Meeting Agenda

Proposal | Board Vote Recommendation |

| Page Reference (for more detail) |

Election of eight directors | FOR ALL |

| 60 |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 | FOR |

| 60 |

Approval of the Regional Management Corp. 2024 Long-Term Incentive Plan | FOR |

| 62 |

Advisory vote to approve executive compensation | FOR |

| 71 |

Advisory vote on the frequency of future advisory votes to approve executive compensation | 1 YEAR |

| 72 |

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 1

Transact other business as may properly come before the meeting |

|

|

|

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 2

Election of Director Nominees

The following table provides summary information about each director nominee. The nominees receiving a plurality of the votes cast at the meeting will be elected as directors.

| Director |

|

| Committees | |||

Name | Since | Experience/Qualifications | Independent | AC | HRCC | CGN | RC |

Carlos Palomares, Chair of the Board | 2012 | Financial Services Industry, Leadership, Credit Risk, Corporate Finance, Executive Compensation, Accounting, Risk Management | ✓ | ✓ | ✓ |

|

|

Robert W. Beck | 2020 | Financial Services Industry, Leadership, Credit Risk, Corporate Finance, Marketing, M&A, Accounting, Risk Management, Investor Relations |

|

|

|

|

|

Jonathan D. Brown | 2018 | Financial Services Industry, Capital Allocation, M&A, Corporate Governance, Investor Relations | ✓ |

|

|

| ✓ |

Roel C. Campos | 2012 | Leadership, Cybersecurity, Corporate Governance, Government Affairs, Securities Compliance, Regulatory | ✓ | C |

| ✓ |

|

Maria Contreras-Sweet | 2018 | Financial Services Industry, Leadership, Corporate Finance, Technology/Innovation, Corporate Governance, Regulatory, Public Relations, Government Affairs | ✓ |

| ✓ | C |

|

Michael R. Dunn | 2014 | Financial Services Industry, Leadership, Credit Risk, Corporate Finance, M&A, Risk Management, Investor Relations |

|

|

|

| C |

Steven J. Freiberg | 2014 | Financial Services Industry, Leadership, Credit Risk, Corporate Finance, Marketing, M&A, Executive Compensation, Technology, Risk Management, Investor Relations | ✓ | ✓ | C |

|

|

Sandra K. Johnson | 2020 | Financial Services Industry, Leadership, Information Technology, Cybersecurity, Blockchain Technology, Technology/Innovation, Entrepreneurship | ✓ |

|

| ✓ | ✓ |

AC = Audit Committee | HRCC = Human Resources and Compensation Committee | CGN = Corporate Governance and Nominating Committee | RC = Risk Committee | C = Committee Chair |

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 3

Ratification of Independent Registered Public Accounting Firm

As a matter of good corporate governance, we are asking our stockholders to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Approval of the Regional Management Corp. 2024 Long-Term Incentive Plan

We are proposing that our stockholders approve the Regional Management Corp. 2024 Long-Term Incentive Plan (the “2024 Plan”) in order to: (i) comply with the New York Stock Exchange (the “NYSE”) rules requiring stockholder approval of equity compensation plans and (ii) allow the grant of incentive stock options to employee participants in the 2024 Plan. See “Proposal No. 3: Approval of Regional Management Corp. 2024 Long-Term Incentive Plan,” below.

We believe that our long-term incentive compensation program allows us to compete with comparable companies in our industry in order to attract and retain talented individuals who contribute to our long-term success. We also believe that the 2024 Plan effectively provides substantial incentive to achieve our business objectives and build stockholder value, thereby aligning the interests of plan participants with the interests of our stockholders. Approval of the 2024 Plan should provide us with the continued flexibility needed to use equity compensation and other incentive awards to attract, retain, and motivate talented employees, directors, and/or consultants who are important to our long-term growth and success.

The 2024 Plan incorporates a number of “best practices,” including the following:

✓ Limitation on Shares Issued | ✓ No Discounted Stock Options or Stock Appreciation Rights |

✓ No “Evergreen” Provision | ✓ Limit on Option and Stock Appreciation Rights Terms |

✓ Long-Term Vesting Practices | ✓ No Stock Option or SAR Re-Pricings Without Stockholder Approval |

✓ No Dividends or Dividend Equivalents on Unvested Awards | ✓ Prudent Change of Control Provisions |

✓ Reasonable Plan Duration | ✓ Efficient Use of Equity |

✓ Administered by an Independent Committee |

|

Advisory Vote to Approve Executive Compensation

As required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are providing our stockholders with the opportunity to vote on a non-binding advisory resolution to approve the compensation of our named executive officers (commonly known as a “Say-on-Pay Vote”).

Advisory Vote on the Frequency of Future Advisory Votes to Approve Executive Compensation

As required by Section 14A of the Exchange Act, we are providing our stockholders with the opportunity at the Annual Meeting to vote on a non-binding advisory resolution on whether to have a “Say-on-Pay Vote” every one year, two years, or three years (commonly known as “Say-on-Pay Frequency Vote”).

2023 Compensation-Related Highlights

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 4

Compensation Program “Best Practices” Summary

✓ Compensation program designed to closely align pay with performance ✓ Significant share ownership guidelines for executives (5x base salary for CEO, 2x for other executive officers) ✓ Significant share ownership guidelines for directors (5x annual cash retainer) ✓ Significant portion of compensation is variable and/or performance-based ✓ No excessive perquisites | ✓ No excise tax gross-ups ✓ Formalized clawback policies ✓ Double-trigger change-in-control provisions ✓ Prohibition against hedging and pledging ✓ No re-pricing of equity incentive awards without stockholder approval ✓ Independent Compensation Committee ✓ Independent compensation consultant |

Fiscal 2023 Compensation Summary

The following table sets forth the cash and other compensation that we paid to our named executive officers or that was otherwise earned by our named executive officers during 2023. See the Summary Compensation Table of the Proxy Statement for additional information.

Name and Principal Position |

| Salary |

|

| Stock |

|

| Non-Equity |

|

| All Other |

|

| Total |

| |||||

Robert W. Beck, |

|

| 660,000 |

|

|

| 2,999,987 |

|

|

| 1,451,000 |

|

|

| 180,830 |

|

|

| 5,291,817 |

|

President and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Harpreet Rana, |

|

| 420,000 |

|

|

| 889,964 |

|

|

| 544,250 |

|

|

| 35,367 |

|

|

| 1,889,581 |

|

Executive Vice President and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

John D. Schachtel, |

|

| 441,000 |

|

|

| 824,962 |

|

|

| 557,400 |

|

|

| 89,980 |

|

|

| 1,913,342 |

|

Former Executive Vice President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

and Chief Operating Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Brian J. Fisher, |

|

| 412,000 |

|

|

| 674,968 |

|

|

| 520,800 |

|

|

| 70,744 |

|

|

| 1,678,512 |

|

Executive Vice President and Chief |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Strategy and Development Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Manish Parmar, |

|

| 363,000 |

|

|

| 544,967 |

|

|

| 458,700 |

|

|

| 74,384 |

|

|

| 1,441,051 |

|

Executive Vice President and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Chief Credit Risk Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

__________

Note: The amounts shown in the Non-Equity Incentive Plan Compensation column represent performance-based annual cash awards earned in 2023 and cash-settled performance units that were granted in 2021 and earned over a performance period of January 1, 2021 through December 31, 2023.

2025 Annual Meeting of Stockholders

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 5

GENERAL Information and

Frequently Asked Questions

This proxy statement (the “Proxy Statement”) and the accompanying proxy card are first being sent on or about April 15, 2024, to the stockholders of Regional Management Corp., a Delaware corporation (“Regional,” the “Company,” “we,” “us,” and “our”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 16, 2024, at 1:00 p.m. Eastern Daylight Time and any postponement or adjournment thereof. Our Annual Report on Form 10-K, containing financial statements for the fiscal year ended December 31, 2023, is being mailed together with this Proxy Statement to all stockholders entitled to vote at the Annual Meeting.

Why did I receive a proxy card and Proxy Statement?

As a stockholder of record on April 2, 2024, you are entitled to vote at the Annual Meeting. The accompanying proxy card is for use at the Annual Meeting if a stockholder either will be unable to attend virtually on May 16, 2024 or will attend virtually but wishes to vote by proxy in advance of the Annual Meeting. Even if you plan to attend the virtual Annual Meeting, you are encouraged to vote by proxy in advance. Instructions as to how you may cast your vote by proxy are found on the proxy card. If you attend the virtual Annual Meeting, you may revoke your proxy and vote your shares electronically during the virtual Annual Meeting.

The proxy card is solicited by mail by and on behalf of the Board, and the cost of soliciting proxies will be borne by us. In addition to solicitations by mail, proxies may be solicited in person, by telephone, or via the internet by our directors and officers who will not receive additional compensation for such services. We will request banks, brokerage houses, and other institutions, nominees, and fiduciaries to forward the soliciting material to beneficial owners and to obtain authorization for the execution of proxies. We will, upon request, reimburse these parties for their reasonable expenses in forwarding proxy materials to our beneficial owners.

How do I attend and participate in the Annual Meeting online?

We will host the Annual Meeting exclusively live online. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/RM2024. To enter the Annual Meeting, you will need to log in with the control number provided on your proxy card or voting instruction form. Once you are logged in to the Annual Meeting, instructions on how to participate, including how to submit questions and vote during the meeting, will be provided at www.virtualshareholdermeeting.com/RM2024. If you are not a stockholder or do not have a control number, you may still access the meeting as a guest, but you will not be able to participate. We are committed to ensuring that our stockholders have the same rights and opportunities to participate in the Annual Meeting as if it had been held in a physical location. If you have questions about accessing the website for the virtual Annual Meeting, please contact the Company’s Corporate Secretary by sending an email to investor.relations@regionalmanagement.com or calling (864) 448-7000 by May 13, 2024. If you encounter any technical difficulties with the log-in process or during the Annual Meeting, please call the technical support number that will be posted on the virtual Annual Meeting website.

The virtual meeting platform is fully supported across browsers (Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and mobile phones) running the most updated version of applicable software and plugins. Stockholders (or their authorized representatives) should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. Stockholders (or their authorized representatives) should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

What is the purpose of the Annual Meeting?

The purpose of the Annual Meeting is:

(i) to elect the eight nominees named in the Proxy Statement to serve as members of the Board until the next annual meeting of stockholders or until their successors are elected and qualified;

(ii) to ratify the appointment Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

(iii) to approve the Regional Management Corp. 2024 Long-Term Incentive Plan;

(iv) to hold an advisory vote to approve executive compensation;

(v) to hold an advisory vote on the frequency of future advisory votes to approve executive compensation; and

(vi) to transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 6

Who is entitled to vote?

Only stockholders of record at the close of business on April 2, 2024 (the “Record Date”), will be entitled to receive notice of and to vote at the Annual Meeting. As of the Record Date, 9,868,227 shares of our common stock, $0.10 par value per share, were outstanding. The holders of common stock are entitled to one vote per share for each director nominee and to one vote per share on any other proposal presented at the Annual Meeting.

Brokers that are members of certain securities exchanges and that hold shares of our common stock in “street name” on behalf of beneficial owners have authority to vote on certain items when they have not received instructions from beneficial owners. Under the NYSE rules and regulations governing such brokers, the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm is considered a “discretionary” item. This means that brokers may vote in their discretion on this proposal on behalf of beneficial owners who have not furnished voting instructions. In contrast, certain items are considered “non-discretionary,” and a “broker non-vote” occurs when a broker or other nominee holding shares for a beneficial owner votes on one proposal but does not vote on another proposal because, with respect to such other proposal, the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. The proposals to elect directors, to approve the Regional Management Corp. 2024 Long-Term Incentive Plan, to approve executive compensation, and to determine the frequency of future advisory votes to approve executive compensation are considered “non-discretionary,” and therefore, brokers cannot vote your shares on these proposals when they do not receive voting instructions from you.

What constitutes a quorum?

The representation, virtually or by proxy, of at least a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business. Votes withheld from any nominee, abstentions, and “broker non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for the Annual Meeting but do not represent votes cast. Virtual attendance at our Annual Meeting constitutes presence in person for purposes of determining whether there is a quorum at the meeting.

Can I ask questions at the virtual Annual Meeting?

Stockholders as of the Record Date who attend and participate in our virtual Annual Meeting at www.virtualshareholdermeeting.com/RM2024 will have an opportunity to submit questions about topics of importance to the Company’s business and affairs live via the internet during a designated portion of the meeting. Instructions for submitting questions during the virtual Annual Meeting will be available at www.virtualshareholdermeeting.com/RM2024. Stockholders may also submit a question in advance of the Annual Meeting at www.proxyvote.com. In both cases, stockholders must have available their control number provided on their proxy card or voting instruction form. All questions from stockholders that are pertinent to Annual Meeting matters will be answered during the meeting, subject to time limitations.

How do I vote?

Stockholders may vote by proxy or by attending the virtual Annual Meeting online and voting electronically during the Annual Meeting. Instructions as to how you may cast your vote by proxy are set forth below and are found on the accompanying proxy card.

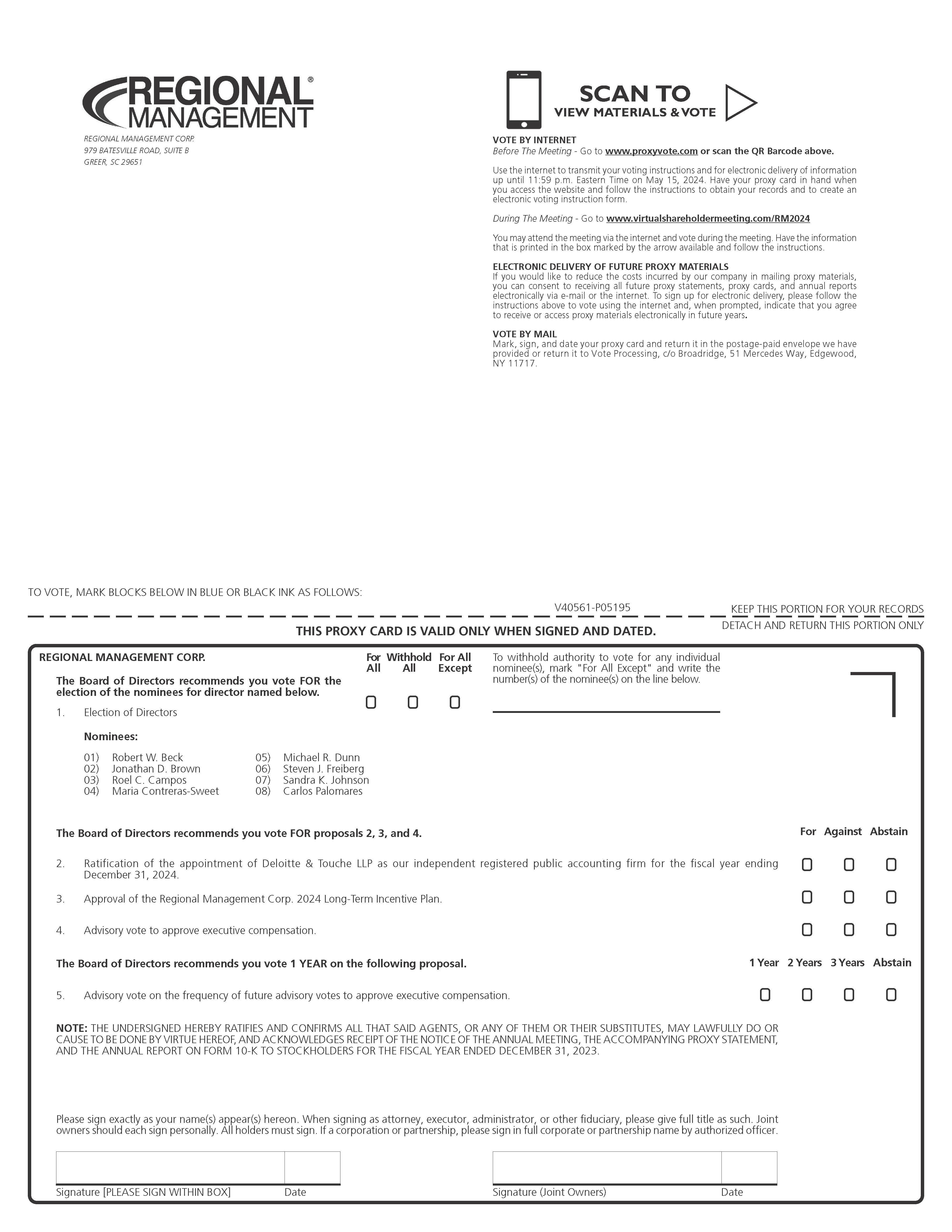

| Vote by Internet: Before the Meeting – Go to www.proxyvote.com Use the internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Daylight Time on May 15, 2024. Have your proxy card in hand when you access the website, and follow the instructions to obtain your records and to create an electronic voting instruction form. During the Meeting – Go to www.virtualshareholdermeeting.com/RM2024 You may attend the meeting via the internet and vote electronically during the meeting. Have your proxy card in hand when you access the website, and follow the instructions. |

| Vote by Mail: Mark, sign, and date your proxy card and promptly return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 7

Will other matters be voted on at the Annual Meeting?

Aside from the five proposals described above, the Board knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by the Board will be voted with respect thereto in accordance with the best judgment of the persons named as proxy holders and attorneys-in-fact in the proxies.

May I revoke my proxy instructions?

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted at the Annual Meeting. Proxies may be revoked by (i) filing with our Corporate Secretary, before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy; (ii) duly completing a later-dated proxy card relating to the same shares and delivering it to our Corporate Secretary before the taking of the vote at the Annual Meeting; or (iii) attending the virtual Annual Meeting and voting electronically (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be sent so as to be delivered to Regional Management Corp., 979 Batesville Road, Suite B, Greer, South Carolina 29651, Attention: Corporate Secretary, before the taking of the vote at the Annual Meeting.

How many votes are required to approve each proposal?

With respect to the proposal to elect directors (Proposal No. 1), the eight nominees receiving the highest number of affirmative votes of the shares present, virtually or represented by proxy, and entitled to vote at the Annual Meeting shall be elected as directors. Votes withheld, abstentions, and “broker non-votes” will have no effect on the election of directors (Proposal No. 1). Regarding the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal No. 2) and approve the Regional Management Corp. 2024 Long-Term Incentive Plan (Proposal No. 3), an affirmative vote of a majority of the shares present, virtually or represented by proxy, and voting on such matter is required for approval. Likewise, the compensation of executive officers (Proposal No. 4) will be approved, on an advisory basis, if a majority of the shares present, virtually or represented by proxy, and voting on such matter is cast in favor of the proposal. Finally, the frequency of the advisory vote on future advisory votes to approve executive compensation (Proposal No. 5) receiving the greatest number of votes cast — one year, two years, or three years — will be deemed by us as the frequency that has been recommended by stockholders. “Broker non-votes,” votes withheld, and abstentions are not considered voted for the particular matter. For proposals subject to majority voting that are considered “non-discretionary” (Proposal No. 3, Proposal No. 4, and Proposal No. 5), “broker non-votes” have the effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of shares from which the majority is calculated. For proposals subject to majority voting that are considered “discretionary” (Proposal No. 2), there will be no “broker non-votes” and brokers may vote in their discretion on behalf of beneficial owners who have not furnished voting instructions. Virtual attendance at our Annual Meeting constitutes presence for purposes of the vote required under our Bylaws.

Because your votes on Proposal No. 4 and Proposal No. 5 are advisory, they will not be binding on us, our Board, or our Human Resources and Compensation Committee (the “Compensation Committee”). However, the Board and the Compensation Committee will consider the outcome of these votes when making future compensation decisions for our executive officers.

The persons named as proxy holders and attorneys-in-fact in the proxy card, Robert W. Beck and Catherine R. Atwood, were selected by the Board and are officers of the Company. All properly executed proxy cards returned in time to be counted at the Annual Meeting will be voted by such persons at the Annual Meeting. Where a choice has been specified on the proxy card with respect to the foregoing matters, the shares represented by the proxy will be voted in accordance with the specifications. If no such specifications are indicated, such shares will be voted “FOR” the election of all director nominees, “FOR” the ratification of the appointment of our independent registered public accounting firm, "FOR" approval of the Regional Management Corp. 2024 Long-Term Incentive Plan, “FOR” the advisory approval of executive compensation, and "ONE YEAR" on the advisory vote on the frequency of future advisory votes on the approval of executive compensation.

How can I correspond directly with Regional Management Corp.?

The address of our principal executive office is 979 Batesville Road, Suite B, Greer, South Carolina 29651, and our telephone number is (864) 448-7000. In addition, any person interested in communicating directly with the Chair of our Board or with any other Board member may address such communication to our Corporate Secretary, 979 Batesville Road, Suite B, Greer, South Carolina 29651, who will forward such communication to the appropriate party.

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 8

Board of Directors and

Corporate Governance Matters

The Board is responsible for directing and overseeing the management of our business and affairs in a manner consistent with the best interests of the Company and its stockholders. The Board has implemented written Corporate Governance Guidelines designed to assist the Board in fulfilling its duties and responsibilities. The Corporate Governance Guidelines address a number of matters applicable to directors, including Board composition, structure, and policies; director qualification standards; Board meetings; committees of the Board; roles and expectations of the Board and its directors; director compensation; management succession planning; and other matters. These Corporate Governance Guidelines are available on our Investor Relations website at www.regionalmanagement.com. A stockholder may request a copy of the Corporate Governance Guidelines by contacting our Corporate Secretary at 979 Batesville Road, Suite B, Greer, South Carolina 29651.

Director Qualifications

Our Corporate Governance and Nominating Committee (the “Nominating Committee”) is responsible for reviewing the qualifications of potential director candidates and recommending to the Board those candidates to be nominated for election to the Board. The Nominating Committee considers minimum individual qualifications, including relevant career experience, strength of character, mature judgment, familiarity with our business and industry, independence of thought, and an ability to work collegially with the other members of the Board, and all other factors it considers appropriate, which may include age, diversity of background, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations (such as antitrust issues), corporate governance background, financial and accounting background, executive compensation background, and the size, composition, and combined expertise of the existing Board. The Board and the Nominating Committee monitor the mix of specific experience, qualifications, and skills of the Company’s directors in order to ensure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of our business and structure. Stockholders may also nominate directors for election at our annual stockholders’ meeting by following the provisions set forth in our Bylaws, and in such a case, the Nominating Committee will consider the qualifications of directors proposed by stockholders.

When determining whether director nominees have the experience, qualifications, attributes, and professional and functional skills, taken as a whole, to enable our Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Nominating Committee has focused primarily on the valuable contributions of incumbent directors to our success in recent years and on the skills, experience, and individual attributes that each director nominee brings to the Board, including those discussed in the biographical descriptions and matrix set forth below. It is expected that, without specific approval from the Board, no director will serve on more than five public company boards (including the Board), and no member of the Audit Committee will serve on more than three public company audit committees (including the Audit Committee of the Board).

Board Diversity

The Board recognizes and embraces the value of a diverse board of directors in improving the quality of its performance and our success. Diversity promotes the exchange of different perspectives and ideas, mitigates against groupthink, and ensures that the Board has the opportunity to benefit from all available talent. The Board is committed to inclusion – ensuring that all directors feel welcomed, valued, and able to contribute their opinions. The Board also recognizes the need for its directors to understand and to be able to respond effectively to the financial needs of its diverse customer base. The promotion of a diverse Board makes prudent business sense and makes for better corporate governance.

The Board maintains, and periodically reviews, a Board Diversity Policy (the “Diversity Policy”), a copy of which is available on our Investor Relations website at www.regionalmanagement.com. The Diversity Policy establishes the Board’s approach to achieving and maintaining diversity on the Board. The Board and the Nominating Committee are committed to actively seeking out highly qualified, diverse candidates to include in the pool from which Board nominees are chosen. The Board seeks to comprise itself of talented and dedicated directors with a diverse mix of expertise in areas needed to foster our business success, as well as a diversity of personal characteristics that include, but are not limited to, gender, race, ethnicity, national origin, sexual orientation, age, and geography. The Board and the Nominating Committee implement the Diversity Policy by maintaining a director candidate list comprised of individuals qualified to fill openings on the Board, which includes candidates with useful expertise who possess diverse personal backgrounds. When conducting searches for new directors, the Nominating Committee will include qualified female and/or ethnically diverse individuals from the list in the pool of candidates. Ultimately, the selection of new directors will be based on the

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 9

Board’s judgment of the overall contributions that a candidate will bring to the Board, giving due weight to diverse personal characteristics that contribute to the Board achieving the objectives of the Diversity Policy.

The Nominating Committee is charged with reviewing all steps taken pursuant to the Diversity Policy on an annual basis, assessing the Board’s progress in achieving and maintaining diversity, and presenting its findings and assessment to the full Board for input. 50% of the Board is racially or ethnically diverse and 25% of the Board is female. In 2019, the Board was awarded the Latino Corporate Directors Association 2019 Corporate Visionary Award in recognition of Regional’s commitment to an inclusive and diverse Board. The Board was also nominated in 2019 for NACD NXT™ recognition by the National Association of Corporate Directors (“NACD”), which applauds exemplary board leadership practices that promote greater diversity and inclusion. In 2020, the Board appointed Sandra K. Johnson, Ph.D. as our second female director and first African American director. In 2021, director Maria Contreras-Sweet was named as one of the most influential leaders in the boardroom by the NACD.

The Nominating Committee and the Board are proud of the diverse characteristics of the Company’s directors and will continue to promote diversity and inclusion initiatives at the Board level and throughout the Company.

Current Directors and Director Nominees

The Board has the discretion to determine the size of the Board, the members of which are elected at each year’s annual meeting of stockholders. Our Board currently consists of eight directors: Carlos Palomares, Robert W. Beck, Jonathan D. Brown, Roel C. Campos, Maria Contreras-Sweet, Michael R. Dunn, Steven J. Freiberg, and Sandra K. Johnson, with Mr. Palomares serving as Chair of the Board. Each of these individuals has been nominated and will stand as a director candidate for election at the Annual Meeting.

Biographical information of each of our directors is provided below. In addition, following the biographical information of our directors, we have provided a matrix summarizing the background, skills, experience, qualifications, and other attributes of our directors that led the Nominating Committee and the Board to conclude that such individuals would provide valuable contributions to our business and should therefore serve our company as its directors.

Carlos Palomares Age: 79 Director Since: 2012 Chair of the Board Member of the Audit Committee and Human Resources and Compensation Committee | Mr. Palomares has been a director of Regional since March 2012 and currently serves as Chair of the Board. Since 2007, Mr. Palomares has been President and Chief Executive Officer of SMC Resources, a consulting practice that advises senior executives on business and marketing strategy. From 2001 to 2007, Mr. Palomares was Senior Vice President at Capital One Financial Corp., and he was Chief Operating Officer of Capital One Federal Savings Bank banking unit from 2004 to 2007. Prior to joining Capital One, Mr. Palomares held a number of senior positions with Citigroup Inc. and its affiliates, including Chief Operating Officer of Citibank Latin America Consumer Bank from 1998 to 2001, Chief Financial Officer of Citibank North America Consumer Bank from 1997 to 1998, President and CEO of Citibank FSB Florida from 1992 to 1997, and Chairman and CEO of Citibank Italia from 1990 to 1992. Mr. Palomares serves on the boards of directors of Pan-American Life Insurance Group, Inc., a leading provider of life, accident, and health insurance throughout the Americas, and Banesco USA, a privately held financial institution. Mr. Palomares earned a B.S. degree in Quantitative Analysis from New York University.

|

robert W. Beck Age: 60 President and Chief Executive Officer Director Since: 2020 | Mr. Beck has served as President and Chief Executive Officer and as a director of Regional since March 2020. From July 2019 until March 2020, Mr. Beck served as Executive Vice President and Chief Financial Officer of Regional. Prior to joining Regional as Chief Financial Officer in July 2019, he was Executive Vice President and Chief Operating Officer of the Leukemia and Lymphoma Society. Before that, he spent 29 years at Citibank, serving in various roles. Most recently, Mr. Beck was the Chief Operating Officer of Citibank’s US Retail Bank, after previously serving as Chief Financial Officer of Citibank’s US Consumer and Commercial Bank. Prior to that, Mr. Beck served in a number of different roles at Citibank, including head of Citigroup Corporate Finance, head of Citigroup Reengineering, and co-head of Citigroup Corporate M&A. Mr. Beck serves as a member of the National Council for Washington University in St. Louis Olin Business School. Mr. Beck received his B.S. in Business Administration and Management from Washington University in St. Louis and his M.B.A. in Finance and International Business from New York University’s Stern School of Business. |

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 10

|

|

JONATHAN D. BROWN Age: 39 Director Since: 2018 Member of the Risk Committee | Mr. Brown has served as a director of Regional since January 2018. He is a partner with Basswood Capital Management L.L.C. (“Basswood”), an alternative asset manager. Mr. Brown joined Basswood in 2009. In his current role, Mr. Brown is responsible for the research and investment analysis of companies across a broad range of sectors, with a specialized focus on financial services. Prior to Basswood, Mr. Brown worked at Sandelman Partners and Goldman Sachs. Mr. Brown graduated from Emory University’s Goizueta School of Business in 2006 with a B.B.A., holding dual concentrations in Finance and Strategy & Management Consulting, as well as a minor in History.

Mr. Brown is the representative of Basswood, our largest stockholder. For a description of our cooperation agreement with Basswood, pursuant to which Mr. Brown is nominated, see “Other Information – Certain Relationships and Related Person Transactions – Cooperation Agreement,” below.

|

Roel C. Campos Age: 75 Director Since: 2012 Chair of the Audit Committee Member of the Corporate Governance and Nominating Committee | Mr. Campos has served as a director of Regional since March 2012. He currently serves as Senior Counsel (retired status) with the law firm of Hughes Hubbard & Reed LLP, where he served as an equity partner since February 2016. Mr. Campos formerly practiced in the areas of securities regulation, corporate governance, and securities enforcement. Prior to joining that firm, Mr. Campos was a partner with Locke Lord LLP (2011 to 2016) and Cooley LLP (2007 to 2011). Prior to that, he received a presidential appointment and served as a Commissioner of the Securities and Exchange Commission (the “SEC”) from 2002 to 2007. Prior to serving with the SEC, Mr. Campos was a founding partner of a Houston-based radio broadcaster. Earlier in his career, he practiced corporate law and later served as a federal prosecutor in Los Angeles, California. Mr. Campos currently serves as an independent director for the board of KPMG US LLP, a professional firm providing audit, tax, and advisory services, as well as various non-profit boards. Mr. Campos also previously served from 2013 to 2017 on the board of directors of WellCare Health Plans, Inc., a public company that provided managed health care services, which was acquired and merged into Centene Corp., a multi-national health care enterprise in 2020. He also previously served as a director of a private registered broker-dealer, Liquidnet Holdings, Inc., which in 2021 was acquired and merged into the TP ICAP group, a London-based broker dealer. Mr. Campos previously served from 2016 to 2020 on the Board of Visitors to the United States Air Force Academy. From 2009 to 2013, Mr. Campos served on the Presidential Intelligence Advisory Board, comprised of selected private citizens who serve as outside advisers to the President on national intelligence issues. Mr. Campos earned his B.S. degree from the United States Air Force Academy, received an M.B.A. degree from the University of California, Los Angeles, and earned his J.D. degree from Harvard Law School.

|

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 11

MARIA CONTRERAS-SWEET Age: 68 Director Since: 2018 Chair of the Corporate Member of the Human Resources and Compensation Committee

| Ms. Contreras-Sweet has served as a director of Regional since January 2018. She is the managing partner of Rockway Equity Partners, LLC and Contreras Sweet Companies, LLC. Prior to founding her current businesses, she served as a member of President Obama’s cabinet as the 24th Administrator of the U.S. Small Business Administration from 2014 to 2017, where she was responsible for a $132 billion loan portfolio. She was a founder of ProAmerica Bank, where she served as Executive Chairwoman from 2006 to 2014, and Co-Founder and Managing Partner of Fortius Holdings, LLC, from 2003 to 2006. Prior to that, Ms. Contreras-Sweet served as the California Cabinet Secretary of the Business, Transportation and Housing Agency from 1999 to 2003, where she oversaw 14 departments including the Department of Financial Institutions and Department of Corporations. Earlier in her career, she was a senior executive with Westinghouse Electric Company’s 7-Up/RC Bottling Company. Ms. Contreras-Sweet is a director of TriNet Group, Inc., a publicly traded professional employer organization, where she serves on the nominating and corporate governance committee and chairs the risk committee, as well as Zions Bancorporation, N.A., a publicly traded bank, where she serves on the audit committee. She previously served as a director of Sempra Group, a publicly-traded leading North American energy infrastructure company (and now known as Sempra), from March 2017 to May 2023. Ms. Contreras-Sweet is the Chairman of the Los Angeles World Affairs Council Town Hall, a board member of the Pan American Development Foundation, a Distinguished Fellow of the LARTA Institute, and a board member of the Bipartisan Policy Center. She has been bestowed with numerous honorary doctorates including from Tufts University, Whittier College, and California State University, Los Angeles.

|

Michael R. Dunn Age: 72 Director Since: 2014 Chair of the Risk Committee | Mr. Dunn has served as a director of Regional since July 2014. He previously served as Chief Executive Officer of Regional from October 2014 through July 2016 and as Executive Chairman of the Board from August 2016 through December 2016. Prior to joining Regional, Mr. Dunn was a partner at the private equity firm of Brysam Global Partners, a specialized firm focusing on investment in international banking and consumer lending companies, from 2007 through 2013. Mr. Dunn served as a board or alternate board member for all of Brysam’s portfolio companies. Prior to that, Mr. Dunn was with Citigroup for over 30 years, where he was the Chief Financial Officer of the Global Consumer Group from 1996 through 2007, adding the title of Chief Operating Officer of the Group in 2005. He was also a member of the Citigroup Management and Operating Committees. Mr. Dunn previously served on the boards of Banamex, a wholly owned Mexican bank subsidiary of Citigroup, and on the U.S.- based Student Loan Corporation, of which Citigroup owned a majority interest. He holds a B.S. degree from New York University and attended the University of Michigan Executive Program. He is a Certified Public Accountant in New York State.

|

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 12

Steven J. Freiberg Age: 67 Director Since: 2014 Chair of the Human Resources and Compensation Committee Member of the Audit Committee | Mr. Freiberg has served as a director of Regional since July 2014. He is the founder of Grand Vista Partners (a private investment office), a Senior Advisor to Towerbook Capital Partners (an investment management firm), a Senior Advisor to The Boston Consulting Group (a global consulting firm), and a Senior Advisor to the Portage Structured Equity Fund. Previously, Mr. Freiberg served as Interim Chief Financial Officer of Social Finance, Inc. from 2017 until 2018 and as a director and the Chief Executive Officer of E*TRADE Financial Corporation from 2010 until 2012. Prior to joining E*TRADE, Mr. Freiberg spent 30 years at Citigroup and its predecessor companies and affiliates. Among his notable roles at Citigroup, Mr. Freiberg served as Co-Chairman/Chief Executive Officer of Citigroup’s Global Consumer Group, Chairman and Chief Executive Officer of Citi Cards—Citigroup’s leading global credit card business— and Chairman and Chief Executive Officer of Citigroup’s North American Investment Products Division. Additionally, he was a member of Citigroup’s Executive, Management, and Operating Committees, and he served on the board of directors of several of Citigroup’s affiliates, including Citibank N.A., Citicorp Credit Services Inc., Citicorp Investment Services, Citicorp Insurance Group, Citibank Trust N.A., Citibank FSB, and the Citigroup Foundation. Mr. Freiberg currently serves as Vice Chair of the board of directors of SoFi Technologies, Inc., a publicly traded personal finance company where he chairs the audit committee and the compensation committee and serves on the risk committee. Mr. Freiberg also serves on the governing body of Purchasing Power, LLC (a private specialty e-retailer offering consumer products, vacations, and online education services through payment plans). He is also chairman of the board of directors of Rewards Network, one of the largest merchant-funded, card-linked reward networks in the United States. Mr. Freiberg served on the board of directors of MasterCard Incorporated, a publicly traded multinational financial services corporation, from 2006 to 2022, Compass Digital Acquisition Corp. from 2021 to 2023, and Portage Fintech Acquisition Corp from 2021 to 2023.

|

Sandra k. johnson, Ph.D. Age: 63 Director Since: 2020 Member of the Corporate Governance and Nominating Committee and Risk Committee | Dr. Johnson has served as a director of Regional since April 2020. Since 2014, she has served as the Chief Executive Officer of SKJ Visioneering, LLC, a technology consulting company. She previously served as the Chief Executive Officer, and Chief Technology Officer of Global Mobile Finance, Inc., a fintech startup company, from 2018 to 2023. From November 2012 to February 2014, Dr. Johnson served as the Chief Technology Officer for IBM Central, East and West Africa. Prior to 2014, she spent 11 years as a Senior Technical Staff Member of the IBM Systems and Technology Group, serving in various roles, including Business Development Executive for IBM Middle East and Africa, Chief Technology Officer for IBM’s Global Small and Medium Business, and the Linux Performance Architect. Dr. Johnson has conducted extensive research and published her findings in numerous computer-related and information technology areas, she has authored and co-authored over 80 publications, and she was part of the design team that developed the prototype for the IBM Scalable Parallel Processor (SP2), the base machine for “Deep Blue,” IBM’s world-famous chess machine. Dr. Johnson was a member of the IBM Academy of Technology, a group consisting of the top 1% of IBM’s over 250,000 technical professionals. She has also received numerous technical and professional awards and is an IBM Master Inventor with over 40 patents issued and pending. Dr. Johnson earned her B.S., M.S., and Ph.D. degrees in electrical engineering from Southern University, Stanford University, and Rice University, respectively. She is the first African American woman to earn a Ph.D. in computer engineering. Dr. Johnson is a member of the Institute of Electrical and Electronics Engineers (“IEEE”) and the Association for Computing Machinery (“ACM”). She is also an IEEE Fellow and an ACM Distinguished Engineer. |

There are no family relationships among any of our directors or executive officers.

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 13

Matrix of Director Skills, Experience, and Demographic Background

The following table provides our stockholders and other interested parties with an overview of our directors’ skills, experience, and demographic background. These qualities are of particular value to our business and led the Nominating Committee and the Board to conclude that such individuals would provide valuable contributions to our company and should therefore serve our company as its directors.

| Robert W. Beck | Jonathan D. Brown | Roel C. Campos | Maria Contreras-Sweet | Michael R. Dunn | Steven J. Freiberg | Sandra K. Johnson | Carlos Palomares |

Skills and Experience | ||||||||

Financial Services Industry | ✓ | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ |

Other Public Co. Board of Directors |

|

| ✓ | ✓ |

| ✓ |

|

|

Executive Management | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Entrepreneurship/Business Operations | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Credit Risk Management | ✓ |

|

|

| ✓ | ✓ |

| ✓ |

Corporate Finance or Capital Allocation | ✓ | ✓ |

| ✓ | ✓ | ✓ |

| ✓ |

Marketing and/or Public Relations | ✓ |

| ✓ | ✓ |

| ✓ | ✓ |

|

Marketing to Hispanic Population |

|

| ✓ | ✓ |

|

|

| ✓ |

Mergers and Acquisitions | ✓ | ✓ | ✓ |

| ✓ | ✓ |

|

|

Human Resources/Executive Comp | ✓ |

|

|

|

| ✓ |

| ✓ |

Cybersecurity or Technology/Innovation | ✓ |

| ✓ | ✓ |

| ✓ | ✓ |

|

Information Technology or Blockchain |

|

|

|

|

|

| ✓ |

|

Corporate Governance |

| ✓ | ✓ | ✓ |

|

|

|

|

Government Affairs |

|

| ✓ | ✓ |

|

|

|

|

Regulatory and/or SEC Compliance |

|

| ✓ | ✓ |

|

|

|

|

Audit Committee Financial Expert |

|

|

|

|

| ✓ |

| ✓ |

SOX and Internal Audit | ✓ |

| ✓ |

| ✓ | ✓ |

| ✓ |

Risk Management | ✓ |

|

| ✓ | ✓ | ✓ |

| ✓ |

Business Ethics | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Investor Relations | ✓ | ✓ |

|

| ✓ | ✓ |

|

|

Demographic Background | ||||||||

Board Tenure and Independence | ||||||||

Year First Appointed or Elected | 2020 | 2018 | 2012 | 2018 | 2014 | 2014 | 2020 | 2012 |

Board Independent |

| ✓ | ✓ | ✓ |

| ✓ | ✓ | ✓ |

Gender | ||||||||

Male | ✓ | ✓ | ✓ |

| ✓ | ✓ |

| ✓ |

Female |

|

|

| ✓ |

|

| ✓ |

|

Age | ||||||||

Years Old | 60 | 39 | 75 | 68 | 72 | 67 | 63 | 79 |

Race/Ethnicity | ||||||||

White/Caucasian | ✓ | ✓ |

|

| ✓ | ✓ |

|

|

Hispanic/Latino |

|

| ✓ | ✓ |

|

|

| ✓ |

African American |

|

|

|

|

|

| ✓ |

|

Board Independence

The Board determined that each of Ms. Contreras-Sweet, Dr. Johnson, and Messrs. Brown, Campos, Freiberg, and Palomares were independent during 2023 in accordance with the criteria established by the NYSE for independent board members. The Board performed a review to determine the independence of its members and made a subjective determination as to each of these independent directors that no transactions, relationships, or arrangements exist that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director of the Company. In making these determinations, the Board reviewed the information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and its management. We define an “independent” director in accordance with Section 303A.02 of the NYSE Rules. The categorical standards that the Board has established to assist it in making independence determinations can be found in our Corporate Governance Guidelines on our Investor Relations website at www.regionalmanagement.com.

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 14

Leadership Structure

As described in the Corporate Governance Guidelines, the Board may select its Chair and our Chief Executive Officer in any way that it considers to be in our best interests. Therefore, the Board does not have a policy on whether the roles of Chair and Chief Executive Officer should be separate or combined and, if they are to be separate, whether the Chair should be selected from the independent directors.

Mr. Palomares was appointed to serve as Chair of our Board in July 2019. At this time, the Board believes that the separation of the roles of Chair and Chief Executive Officer promotes communication between the Board, the Chief Executive Officer, and other senior management, and enhances the Board’s oversight of management. We believe that our leadership structure provides increased accountability of our Chief Executive Officer to the Board and encourages balanced decision-making. We also separate the roles in recognition of the differences in the roles. While the Chief Executive Officer is responsible for day-to-day leadership of the Company and the setting of strategic direction, the Chair provides guidance to the Chief Executive Officer and coordinates and manages the operations of the Board and its committees.

At this time, the Board believes that its current leadership structure, with an independent Chair, is appropriate for the Company and provides many advantages to the effective operation of the Board. The Board will periodically evaluate and reassess the effectiveness of this leadership structure.

Meetings

The Board held 13 meetings during the fiscal year ended December 31, 2023. During 2023, all of our directors attended at least 75% of the aggregate number of meetings of the Board and committees on which he or she served. In addition to formal Board meetings, our Board communicates from time to time via telephone, electronic mail, and informal meetings, and our Board and its committees may act by written consent in lieu of a formal meeting. Our non-employee directors met in executive session following each of our regular, quarterly Board meetings in 2023, and the independent members of our Board also periodically met in executive session in 2023. Mr. Palomares presides over each executive session of our non-employee directors and independent directors.

Other than an expectation set forth in our Corporate Governance Guidelines that each director will make every effort to attend the annual meeting of stockholders, we do not have a formal policy regarding the directors’ attendance at annual meetings. All of our directors attended our last annual meeting of stockholders held on May 18, 2023.

Committees of the Board

Our Board has four standing committees: the Audit Committee, the Human Resources and Compensation Committee, the Corporate Governance and Nominating Committee, and the Risk Committee. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board.

Directors | Audit | Human Resources and Compensation | Corporate Governance | Risk |

Jonathan D. Brown |

|

|

| ✓ |

Roel C. Campos | Chair |

| ✓ |

|

Maria Contreras-Sweet |

| ✓ | Chair |

|

Michael R. Dunn |

|

|

| Chair |

Steven J. Freiberg | ✓ | Chair |

|

|

Sandra K. Johnson |

|

| ✓ | ✓ |

Carlos Palomares | ✓ | ✓ |

|

|

Number of Meetings Held in 2023: | 5 | 6 | 4 | 4 |

Audit Committee

The Audit Committee is a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee currently consists of Messrs. Campos (Chair), Freiberg, and Palomares. Philip V. Bancroft served on the Committee as its Chair until his death in November 2023. Mr. Campos was appointed as the Audit Committee Chair in November 2023, assuming the position left vacant upon Mr. Bancroft's passing. In accordance with SEC rules and NYSE rules, each of

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 15

the members of our Audit Committee is an independent director in accordance with the criteria established by the NYSE for the purpose of audit committee membership independence. In addition, the Board has examined the SEC’s definition of “audit committee financial expert” and has determined that Messrs. Freiberg and Palomares satisfy this definition.

Pursuant to the Audit Committee’s written charter, our Audit Committee is responsible for, among other things:

Human Resources and Compensation Committee

Our Human Resources and Compensation Committee (the “Compensation Committee”) consists of Mr. Freiberg (Chair), Ms. Contreras-Sweet, and Mr. Palomares. In accordance with NYSE rules, each of the members of our Compensation Committee is an independent director in accordance with the criteria established by the NYSE for the purpose of compensation committee membership independence. Pursuant to the Compensation Committee’s written charter, our Compensation Committee is responsible for, among other things:

The Compensation Committee is entitled to delegate any or all of its responsibilities to subcommittees of the Compensation Committee. Additionally, the Compensation Committee may delegate to one or more of our officers the authority to make grants and awards of cash or options or other equity securities to any of our non-Section 16 officers under our incentive-compensation or other equity-based plans, as the Compensation Committee deems appropriate and in accordance with the terms of such plans, provided that such delegation is in compliance with such plans and applicable law.

The Compensation Committee has the authority to hire outside advisors and experts, including compensation consultants to assist it with director and executive officer compensation determinations. See “Compensation Discussion and Analysis –

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 16

Compensation Objectives and Approaches – Compensation Determination Process” for information about our independent compensation consultant.

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee (the “Nominating Committee”) consists of Ms. Contreras-Sweet (Chair), Dr. Johnson, and Mr. Campos. Ms. Contreras-Sweet was appointed Chair in November 2023, assuming the position from Mr. Campos. In accordance with NYSE rules, each of the members of our Nominating Committee is an independent director in accordance with the criteria established by the NYSE for the purpose of corporate governance and nominating committee membership independence. Pursuant to the Nominating Committee’s written charter, the Nominating Committee is responsible for, among other things:

The Nominating Committee will consider a candidate for director proposed by a stockholder. A candidate must be highly qualified and be both willing to serve and expressly interested in serving on the Board. A stockholder wishing to propose a candidate for the Nominating Committee’s consideration in connection with the 2025 Annual Meeting of Stockholders (“2025 Annual Meeting”) should forward the candidate’s name and information about the candidate’s qualifications to Regional Management Corp., 979 Batesville Road, Suite B, Greer, South Carolina 29651, Attn: Corporate Secretary, not earlier than January 16, 2025 nor later than February 15, 2025.

The Nominating Committee will select individuals, including candidates proposed by stockholders, as director nominees who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment, and who will be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of our stockholders. In evaluating nominees, the Nominating Committee will consider, among other things, the director qualifications described above and will apply the objectives outlined in our Diversity Policy.

Risk Committee

Our Risk Committee consists of Mr. Dunn (Chair), Mr. Brown, and Dr. Johnson. Mr. Bancroft served on the Committee until his death in November 2023. Pursuant to the Risk Committee’s written charter, the Risk Committee is responsible for, among other things:

Availability of Committee Charters

The charters of each of our Board committees, which contain more complete explanations of the roles and responsibilities of each of our Board committees, are posted on our Investors Relations website at www.regionalmanagement.com. Information on our website is not considered part of this Proxy Statement. A stockholder may request a copy of any or all of these committee charters by contacting our Corporate Secretary at 979 Batesville Road, Suite B, Greer, South Carolina 29651.

Role in Risk Oversight

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 17

As part of its role in risk oversight, our Risk Committee is responsible for reviewing our risk assessment and risk management practices, and for discussing its findings with both management and our independent registered public accounting firm. Management has established an Enterprise Risk Management Program (the “ERM Program”) to ensure that all of the Company’s risks are managed appropriately and consistently at an enterprise-wide level. The ERM Program details principles used to support effective enterprise-wide risk management across the end-to-end risk management lifecycle, and it provides clarity on the expected activities in relation to risk management of the Board, management, and all employees throughout the organization. The Board and the Risk Committee periodically receive ERM Program updates from management, review the risks that may potentially affect us, and review management’s efforts to manage those risks, including risks reflected in our periodic filings.

The Board may also request supplemental information and disclosure about specific areas of interest and concern relevant to risks it believes are faced by us and our business. The Board also considers emerging or evolving risks as they arise and may either meet as a full Board or assign risks to a committee for continuing oversight. Topics considered span a broad range of matters, including: maintaining the health and safety of our employees; evaluating the impact of recently elevated inflation and rising interest rates on strategy, operations, liquidity, and financial matters; and supporting the communities in which we operate.

The Board believes that our current leadership structure enhances its oversight of risk management because our Chief Executive Officer, who is ultimately responsible for our risk management process, is in the best position to discuss with the Board these key risks and management’s response to them by also serving as a director of the Company.

Role in Cybersecurity Oversight

As part of its risk oversight role, the Board and the Risk Committee provide oversight of management’s efforts to mitigate risk and respond to cyber incidents. The Risk Committee regularly engages with management and/or third-party consultants to assess the cyber threat landscape; evaluate our information security program; review the results of penetration testing; and analyze the design, effectiveness, and ongoing enhancement of our capabilities to monitor, prevent, and respond to cyber threats and events. Management generally briefs the Risk Committee quarterly on information security matters. The Risk Committee then reports any material developments to the Board. The Company further utilizes a comprehensive enterprise-wide cybersecurity program aligned with the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF) industry standard and maintains insurance designed to address certain aspects of cyber risks. Further, the Company requires all employees to perform annual cybersecurity training.

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”). The Code of Ethics applies to all of our directors, officers, and employees and must be acknowledged in writing by our Chief Executive Officer and Chief Financial Officer. The Code of Ethics is posted on our Investor Relations website at www.regionalmanagement.com. A stockholder may request a copy of the Code of Ethics by contacting our Corporate Secretary at 979 Batesville Road, Suite B, Greer, South Carolina 29651. To the extent permissible under applicable law, the rules of the SEC, and NYSE listing standards, we intend to disclose on our website any amendment to our Code of Ethics, or any grant of a waiver from a provision of our Code of Ethics, that requires disclosure under applicable laws, the rules of the SEC, or NYSE listing standards.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2023, Ms. Contreras-Sweet and Messrs. Freiberg and Palomares served on our Compensation Committee. No member of the Compensation Committee has ever served as an officer or employee of the Company or any of its subsidiaries or had any relationship during the fiscal year ended December 31, 2023 that would be required to be disclosed pursuant to Item 404 of Regulation S-K. In addition, during the fiscal year ended December 31, 2023, none of our executive officers served on the compensation committee (or equivalent) or the board of directors of another entity whose executive officer(s) served on our Board or Compensation Committee.

Communications with the Board

Each member of the Board is receptive to and welcomes communications from our stockholders and other interested parties. Stockholders and other interested parties may contact any member (or all members) of the Board, including, without limitation, the Chair of the Board, any independent director, or the independent directors as a group, by addressing such communications or concerns to our Corporate Secretary, 979 Batesville Road, Suite B, Greer, South Carolina, 29651, who will forward such communications to the appropriate party.

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 18

If a complaint or concern involves accounting, internal accounting controls, or auditing matters, the correspondence will be forwarded to the chair of the Audit Committee. If no particular director is named, such communication will be forwarded, depending on the subject matter, to the chair of the Audit Committee, Compensation Committee, Nominating Committee, or Risk Committee, as appropriate.

Anyone who has concerns regarding (i) questionable accounting, internal accounting controls, and auditing matters, including those regarding the circumvention or attempted circumvention of internal accounting controls or that would otherwise constitute a violation of our accounting policies, (ii) compliance with legal and regulatory requirements, or (iii) retaliation against employees who voice such concerns, may communicate these concerns by writing to the attention of the Audit Committee as set forth above or by calling (800) 224-2330 at any time.

Director Compensation

Quality non-employee directors are critical to our success. We believe that the two primary duties of non-employee directors are to effectively represent the long-term interests of our stockholders and to provide guidance to management. As such, our compensation program for non-employee directors is designed to meet several key objectives:

The Compensation Committee, with the assistance of the Compensation Committee’s independent compensation consultant, reviews the compensation of our non-employee directors. In benchmarking director compensation, we use the same compensation peer group that is used to benchmark compensation for our named executive officers (see “Compensation Discussion and Analysis – Compensation Objectives and Approaches – Compensation Determination Process” for information about the peer group).

Our employees who serve as directors receive no separate compensation for service on the Board or on committees of the Board. We maintain a non-employee director compensation program structured as follows:

The restricted stock awards (each, an “RSA”) are granted on the fifth business day following the date of the annual stockholders’ meeting at which directors are elected. The number of shares subject to the RSA is determined by dividing the value of the award by the closing price per share of the Company’s common stock on the grant date. The RSA vests and becomes non-forfeitable as to 100% of the underlying shares on the earlier of the first anniversary of the grant date or the date of the next annual stockholders’ meeting (so long as the period between the date of the annual stockholders’ meeting related to the grant date and the date of the next annual stockholders’ meeting is not less than 50 weeks), subject to the director’s continued service from the grant date until the vesting date, or upon the earlier occurrence of the director’s termination of service as a director by reason of death or disability or upon a change in control of the Company. In the event of the director’s termination of service for any other reason, the director forfeits the RSA immediately. The RSA is subject to the terms and conditions of the Regional Management Corp. 2015 Long-Term Incentive Plan (as amended and restated effective May 20, 2021 and further amended February 17, 2022) (the “2015 Plan”) and an RSA agreement, the form of which was previously approved by the Compensation Committee and the Board and filed with the SEC.

Regional Management Corp. | Proxy Statement for 2024 Annual Meeting of Stockholders | 19