ABS Investor Presentation November 13th, 2024

Legal Disclosures The information contained in this electronic presentation (the “Information”) is being provided to you on a confidential basis solely for your review and may not be downloaded, copied, reproduced, or redistributed, in whole or in part, directly or indirectly, by you. The Information is provided to you solely for informational purposes, is intended for your use only, and does not constitute an offer or a commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise). The Information will not constitute an offer to sell or the solicitation of an offer to buy the Series 2024-2 Class A, Class B, Class C and Class D Notes (the "Offered Notes") contemplated to be issued by Regional Management Issuance Trust 2024-2 (the “Issuer”) discussed in the Information, nor will there be any offer to sell or solicitation of an offer to buy the Offered Notes in any jurisdiction or to any person in which or to whom such offer, solicitation, or sale would be unlawful. This electronic presentation is not an offering circular and the Information does not include all of the information required to be included in the offering circular relating to the Offered Notes. Any indicative terms described in the Information are subject to and qualified in their entirety by the offering circular relating to the Offered Notes, which will supersede the indicative terms described in the Information in their entirety, and other preliminary information made (or to be made) available to you. As such, the Information may not reflect the impact of all structural characteristics of the Offered Notes. The assumptions underlying the Information, including structure and collateral, are for preliminary discussion purposes only and may be modified to reflect changed circumstances. The Information does not purport to contain all of the information that an interested party may desire. In all cases, interested parties should conduct their own investigative analysis of the transaction described in the Information and the data set forth herein. Each person receiving these materials should make an independent assessment of the merits of pursuing a transaction described in these materials and should consult their own professional advisors. THIS ELECTRONIC PRESENTATION AND THE INFORMATION ARE NOT INTENDED TO FURNISH LEGAL, REGULATORY, TAX, ACCOUNTING, INVESTMENT, OR OTHER ADVICE TO ANY PROSPECTIVE INVESTOR IN THE OFFERED NOTES. This presentation contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the Information in this document is complete. For additional financial, statistical, and business information concerning the Company, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. The Information and this presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. 2

Legal Disclosures (continued) Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: managing growth effectively, implementing Regional Management's growth strategy, and opening new branches as planned; Regional Management's convenience check strategy; Regional Management's policies and procedures for underwriting, processing, and servicing loans; Regional Management's ability to collect on its loan portfolio; Regional Management's insurance operations; exposure to credit risk and repayment risk, which risks may increase in light of adverse or recessionary economic conditions; the implementation of evolving underwriting models and processes, including as to the effectiveness of Regional Management’s custom scorecards; changes in the competitive environment in which Regional Management operates or a decrease in the demand for its products; the geographic concentration of Regional Management's loan portfolio; the failure of third-party service providers, including those providing information technology products; changes in economic conditions in the markets Regional Management serves, including levels of unemployment and bankruptcies; the ability to achieve successful acquisitions and strategic alliances; the ability to make technological improvements as quickly as competitors; security breaches, cyber-attacks, failures in information systems, or fraudulent activity; the ability to originate loans; reliance on information technology resources and providers, including the risk of prolonged system outages; changes in current revenue and expense trends, including trends affecting delinquencies and credit losses; any future public health crises, including the impact of such crisis on our operations and financial condition; changes in operating and administrative expenses; the departure, transition, or replacement of key personnel; the ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support Regional Management's operations and initiatives; changes in interest rates; existing sources of liquidity may become insufficient or access to these sources may become unexpectedly restricted; exposure to financial risk due to asset-backed securitization transactions; risks related to regulation and legal proceedings, including changes in laws or regulations or in the interpretation or enforcement of laws or regulations; changes in accounting standards, rules, and interpretations and the failure of related assumptions and estimates; the impact of changes in tax laws and guidance, including the timing and amount of revenues that may be recognized; risks related to the ownership of Regional Management's common stock, including volatility in the market price of shares of Regional Management's common stock; the timing and amount of future cash dividend payments; and anti-takeover provisions in Regional Management's charter documents and applicable state law. The foregoing factors and others are discussed in greater detail in the Company's filings with the SEC. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. Except to the extent required by law, the Company, its respective agents, employees, and advisors, and BMO Capital Markets Corp., J.P. Morgan Securities LLC, Wells Fargo Securities, LLC, and Regions Securities, LLC (collectively, the “Initial Purchasers”) do not intend or have any duty or obligation to supplement, amend, update, or revise any forward-looking statement or other Information, whether as a result of new information, future developments, or otherwise. The Information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. The Initial Purchasers may, from time to time, participate or invest in other financing transactions with the Company and its affiliates, perform services for or solicit business from the Company and its affiliates, and/or have a position or effect transactions in the Notes or derivatives thereof. 3

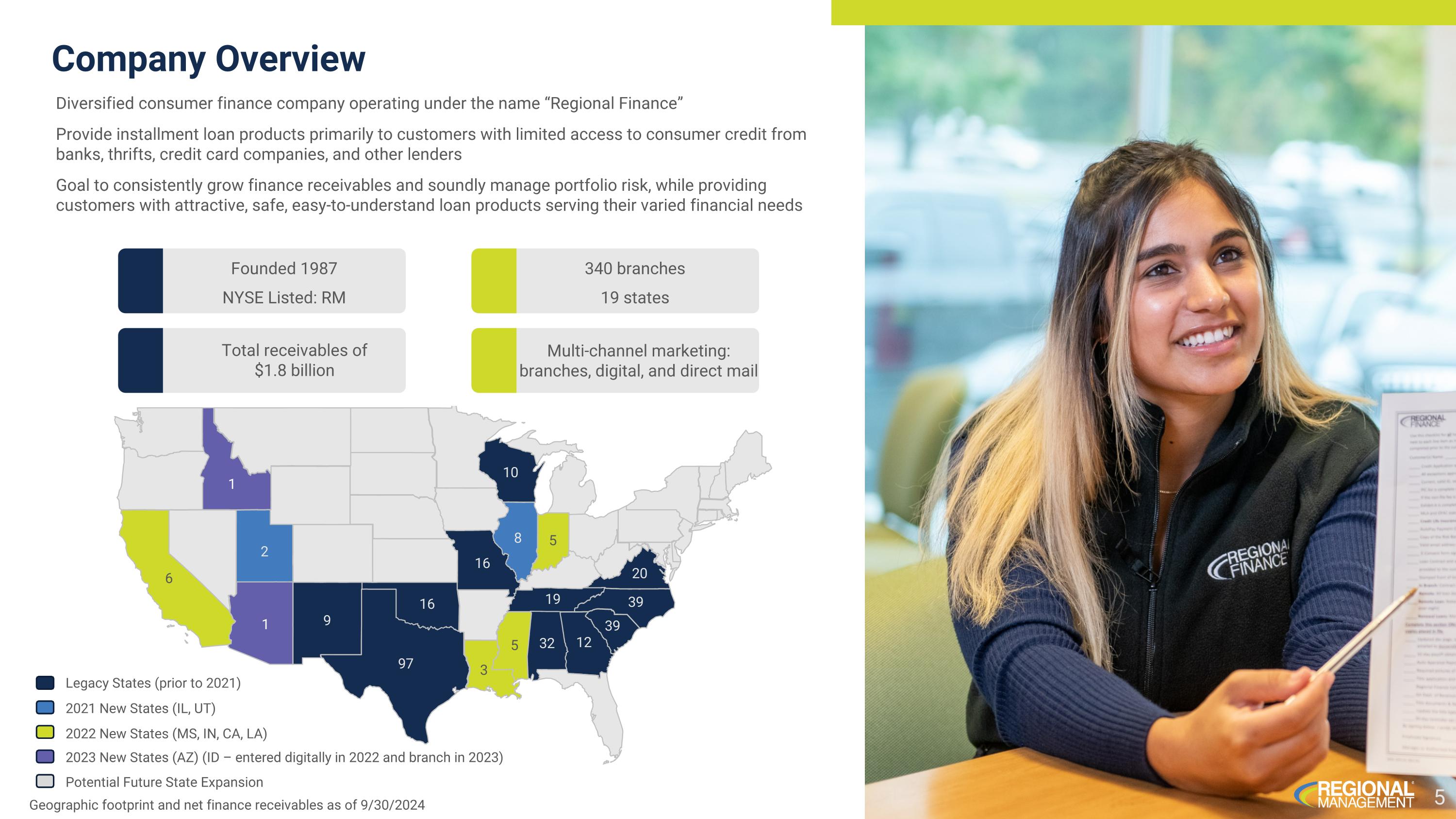

Company Overview

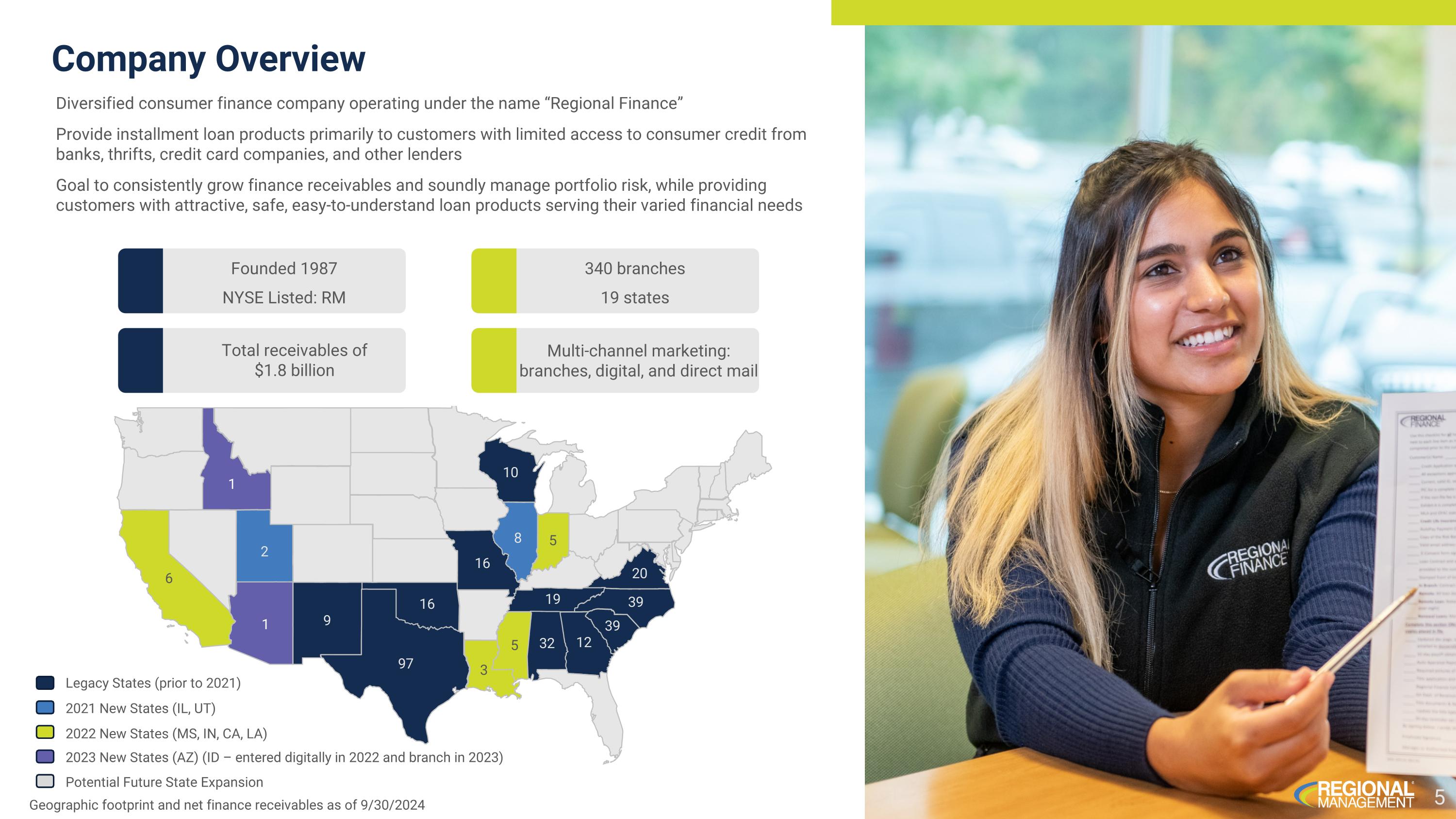

Company Overview 5 Founded 1987 NYSE Listed: RM 340 branches 19 states Total receivables of $1.8 billion Multi-channel marketing: branches, digital, and direct mail Legacy States (prior to 2021) 2021 New States (IL, UT) 2022 New States (MS, IN, CA, LA) Potential Future State Expansion Geographic footprint and net finance receivables as of 9/30/2024 Diversified consumer finance company operating under the name “Regional Finance” Provide installment loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other lenders Goal to consistently grow finance receivables and soundly manage portfolio risk, while providing customers with attractive, safe, easy-to-understand loan products serving their varied financial needs 2023 New States (AZ) (ID – entered digitally in 2022 and branch in 2023)

Growth Strategy Geographic Expansion Accelerated Innovation Product and Channel Expansion Identified states with favorable economics for expansion Continue to identify opportunities to optimize branch network within existing footprint Continue to drive scale using centralized originations and servicing Deploy new technology to further omni-channel experience Leverage data and analytics to improve credit underwriting, customer acquisition and retention, and back-office capabilities Execute on distribution of larger auto-secured loans, higher-margin small loans, and end-to-end digital originations Assess new product offerings in the marketplace National scale should enable additional strategic partnerships 6

Investment Highlights Strong balance sheet supports capital returns Geographic, product, and channel expansion drive growth Omni-channel growth strategy with abundant market opportunity Controlled growth with stable credit using advanced credit tools Modern infrastructure and digital capabilities Deep management experience through credit cycles High customer satisfaction and loyalty Scale, digital capabilities, and lighter footprint will drive operating leverage 7

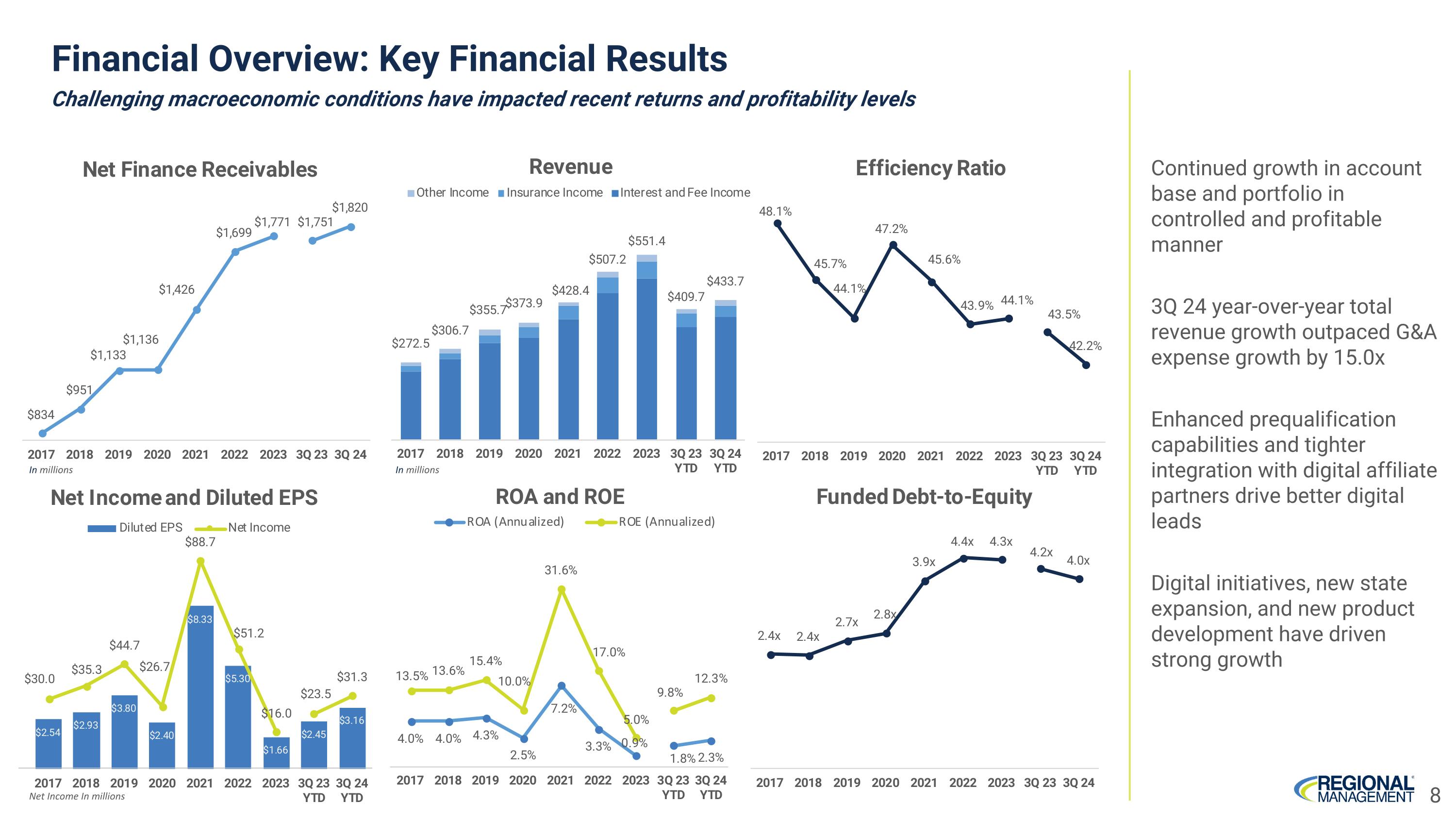

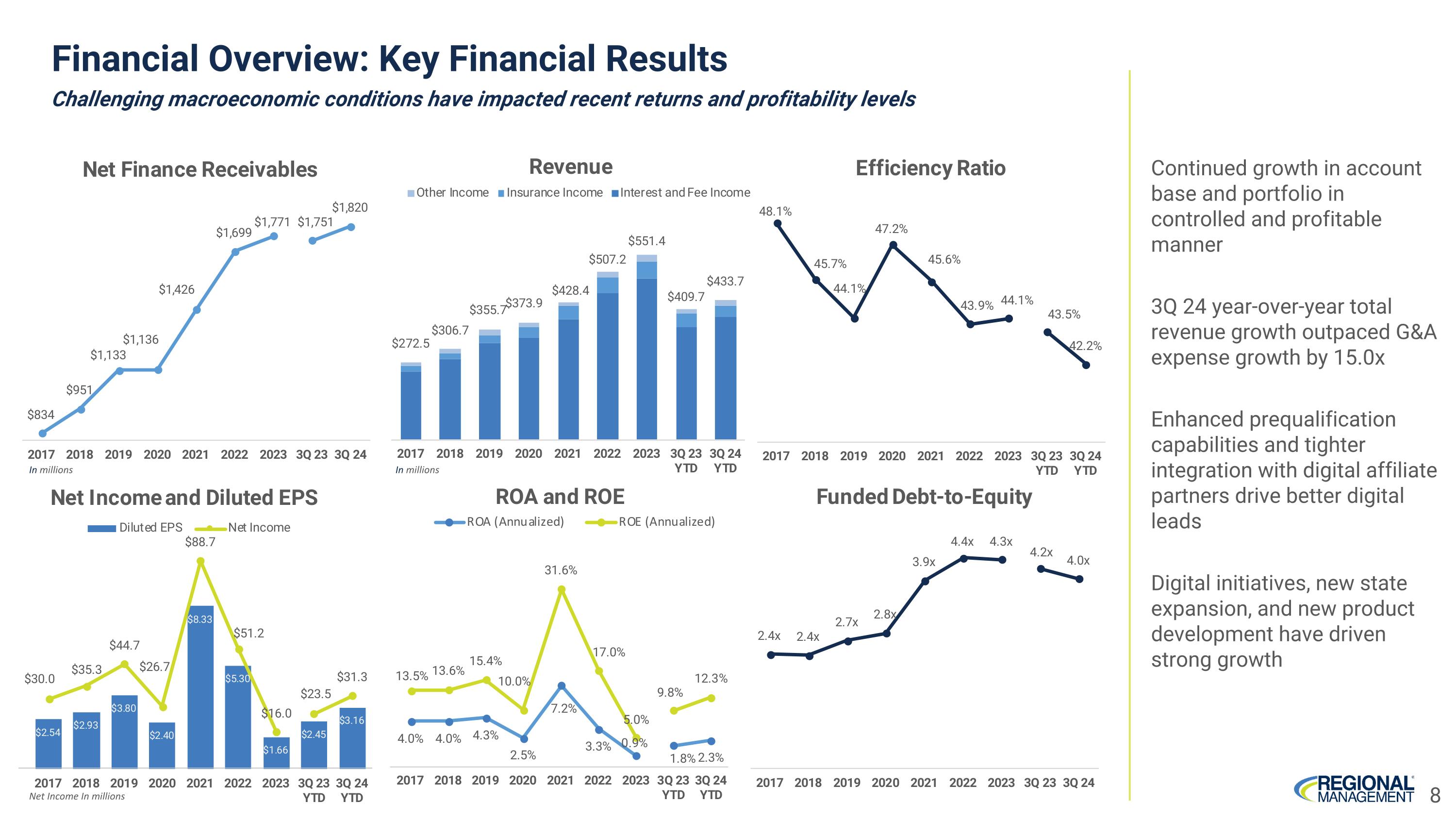

Financial Overview: Key Financial Results In millions In millions Net Income In millions Challenging macroeconomic conditions have impacted recent returns and profitability levels Continued growth in account base and portfolio in controlled and profitable manner 3Q 24 year-over-year total revenue growth outpaced G&A expense growth by 15.0x Enhanced prequalification capabilities and tighter integration with digital affiliate partners drive better digital leads Digital initiatives, new state expansion, and new product development have driven strong growth 8

Abundant Total Addressable Market 9 Approximately 72 million Americans generally align with Regional’s customer base (1)(3) $91 billion market opportunity – RM has less than 2% market share and increased our addressable market by over 80% since 2020; still significant runway for growth $4.7 Trillion Consumer Finance Market (2) 28% of US Population with FICO Between 550 & 700 (3) Personal Installment Loans Account for ~$91 billion (1) Adult US Population sourced from US Census Bureau www.census.gov/library/stories/2021/08/united-states-adult-population-grew-faster-than-nations-total-population-from-2010-to-2020.html Sourced from Equifax US National Consumer Credit Trends Report; June 2023 Sourced from Arkali, Can. “Average U.S. FICO® Score Stays Steady at 716” FICO.com, 30 Aug. 2022, www.fico.com/blogs/average-us-fico-score-stays-steady-716-missed-payments-and-consumer-debt-rises Student Loans (31%) Auto Loans (34%) Credit Cards (21%) Other (11%) Personal Lending (3%)

Serving Our Customers Best Excellent net promoter score of 64 (1) 90+% favorable ratings for key attributes (1): Loan process was quick, easy, and understandable People are professional, responsive, respectful, knowledgeable, helpful, and friendly 92% of customers would apply to Regional Finance first the next time they need a loan Continued investment in digital channels, remote servicing options, and focused on delivering positive customer experience has allowed us to maintain strong metrics Origination Needs Demographics Top-Notch Customer Service Average Age (2) 55 Years Annual Income (2) $53,000 Some College or Advanced Degree (1) 54% (1) Fall 2023 Customer Satisfaction Survey (performed by third-party and commissioned by RM) (2) Based on 3Q 2024 origination volume 10

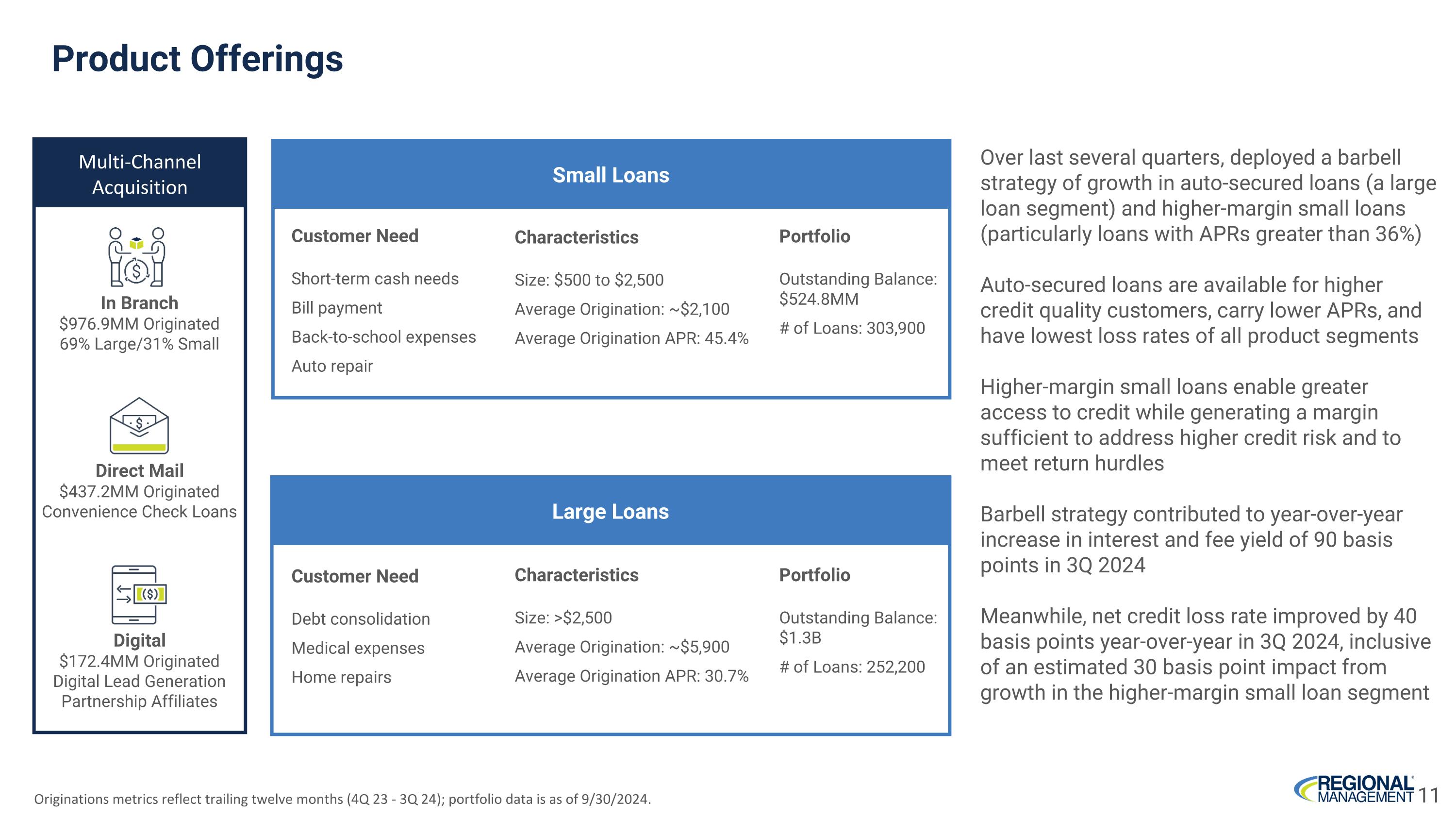

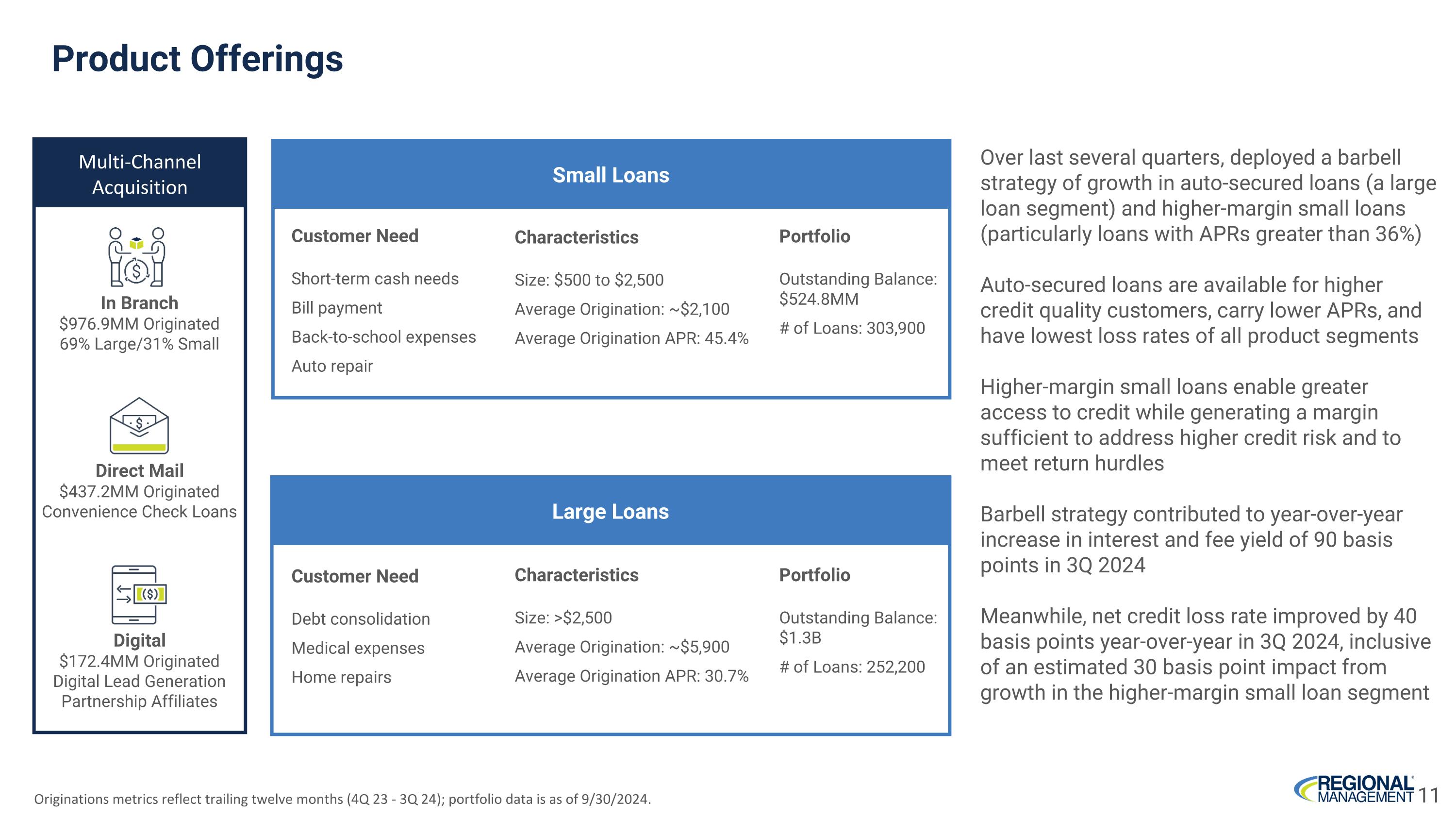

Product Offerings Multi-Channel Acquisition Small Loans Large Loans In Branch $976.9MM Originated 69% Large/31% Small Direct Mail $437.2MM Originated Convenience Check Loans Digital $172.4MM Originated Digital Lead Generation Partnership Affiliates Customer Need Short-term cash needs Bill payment Back-to-school expenses Auto repair Characteristics Size: $500 to $2,500 Average Origination: ~$2,100 Average Origination APR: 45.4% Portfolio Outstanding Balance: $524.8MM # of Loans: 303,900 Customer Need Debt consolidation Medical expenses Home repairs Characteristics Size: >$2,500 Average Origination: ~$5,900 Average Origination APR: 30.7% Portfolio Outstanding Balance: $1.3B # of Loans: 252,200 Originations metrics reflect trailing twelve months (4Q 23 - 3Q 24); portfolio data is as of 9/30/2024. Over last several quarters, deployed a barbell strategy of growth in auto-secured loans (a large loan segment) and higher-margin small loans (particularly loans with APRs greater than 36%) Auto-secured loans are available for higher credit quality customers, carry lower APRs, and have lowest loss rates of all product segments Higher-margin small loans enable greater access to credit while generating a margin sufficient to address higher credit risk and to meet return hurdles Barbell strategy contributed to year-over-year increase in interest and fee yield of 90 basis points in 3Q 2024 Meanwhile, net credit loss rate improved by 40 basis points year-over-year in 3Q 2024, inclusive of an estimated 30 basis point impact from growth in the higher-margin small loan segment 11

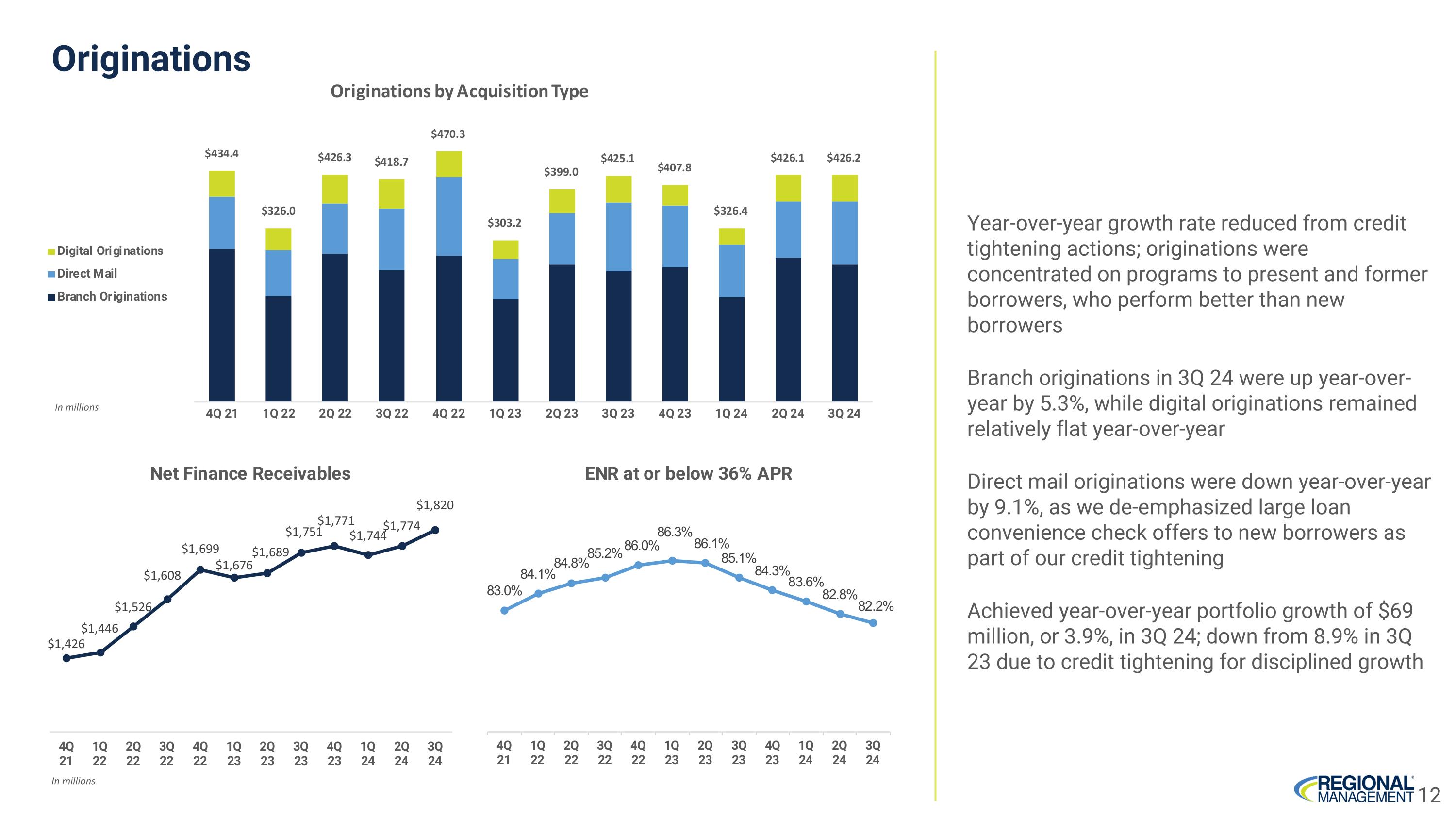

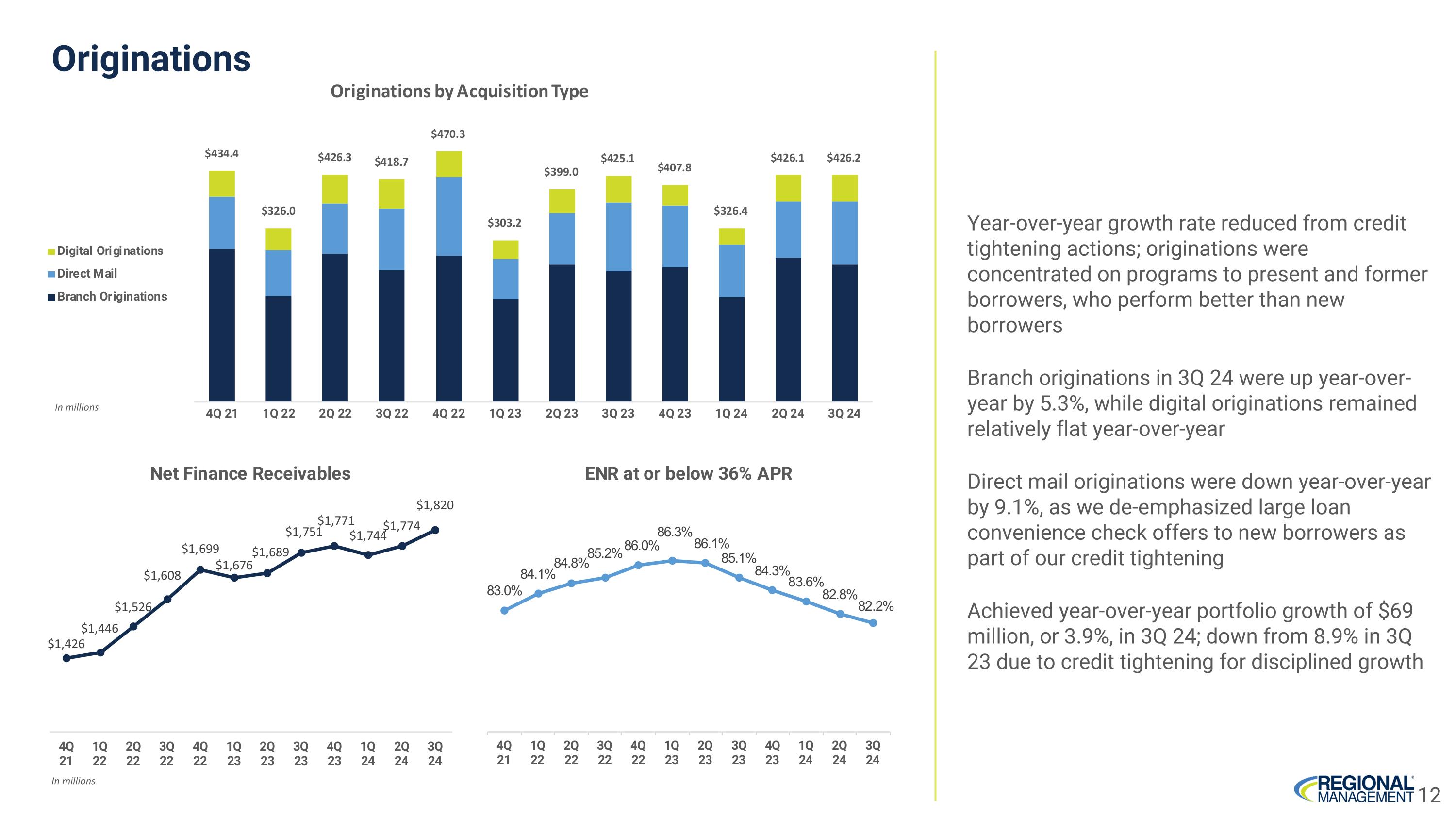

Originations In millions In millions Year-over-year growth rate reduced from credit tightening actions; originations were concentrated on programs to present and former borrowers, who perform better than new borrowers Branch originations in 3Q 24 were up year-over-year by 5.3%, while digital originations remained relatively flat year-over-year Direct mail originations were down year-over-year by 9.1%, as we de-emphasized large loan convenience check offers to new borrowers as part of our credit tightening Achieved year-over-year portfolio growth of $69 million, or 3.9%, in 3Q 24; down from 8.9% in 3Q 23 due to credit tightening for disciplined growth 12

Funding

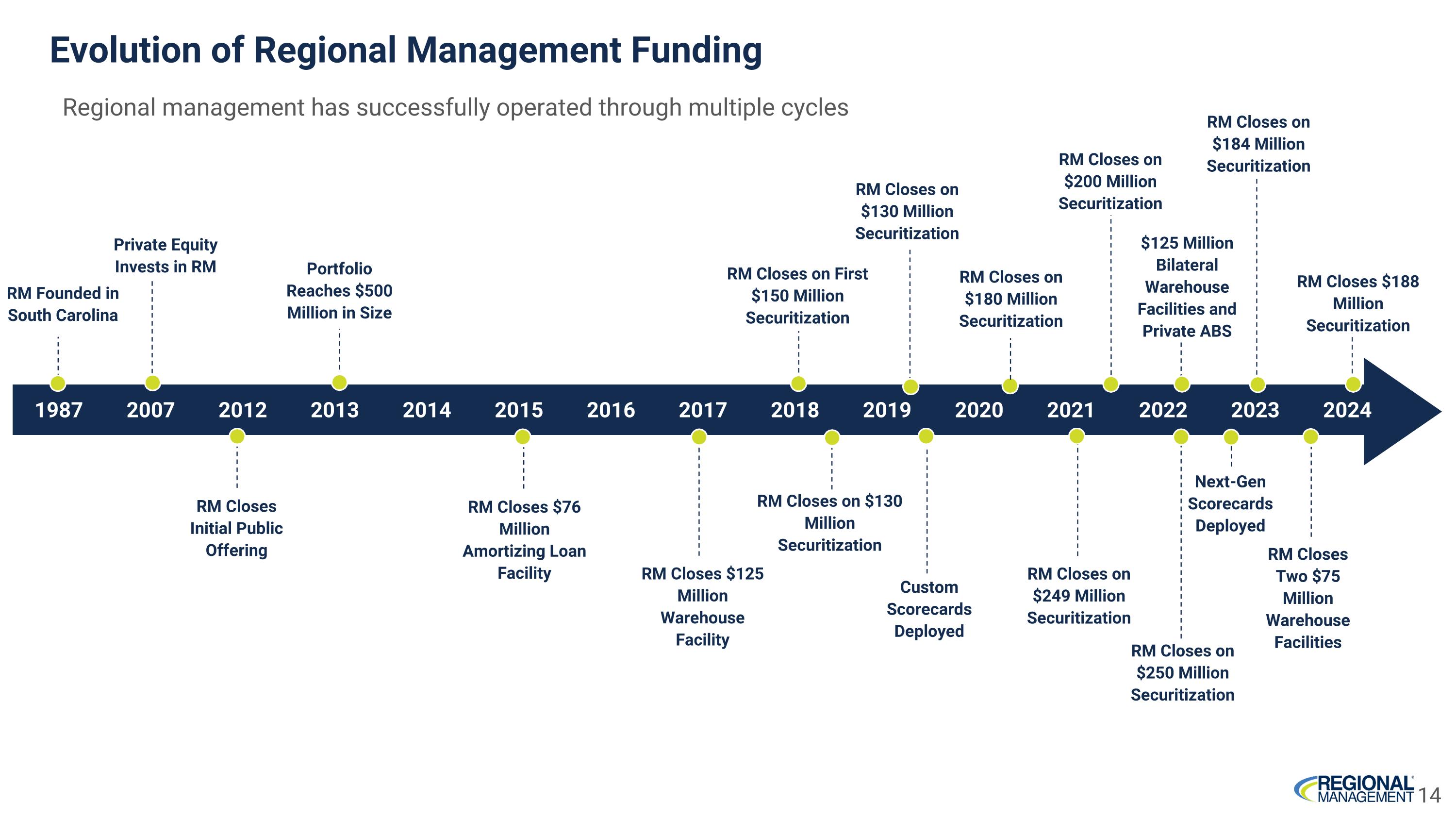

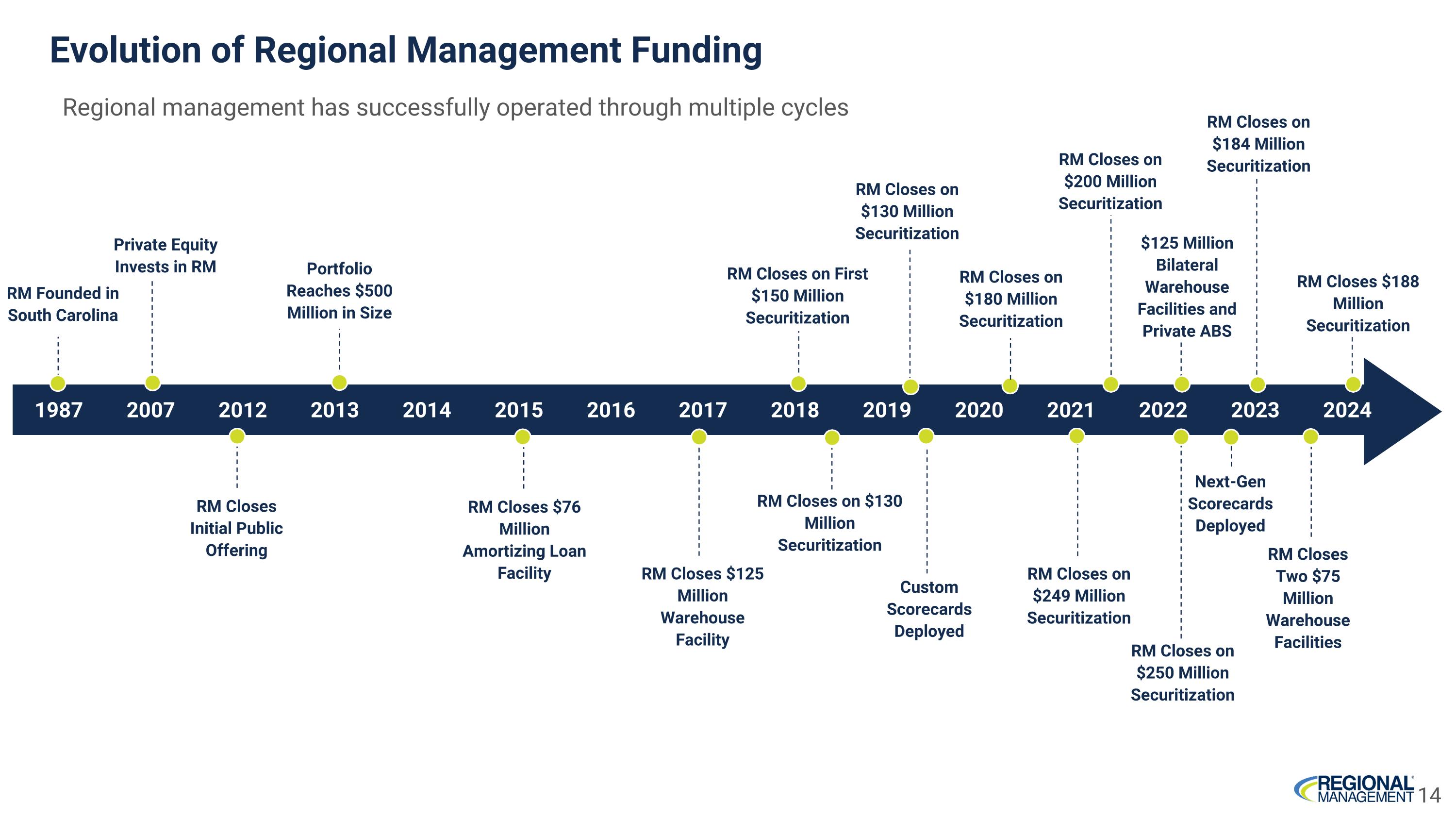

RM Founded in South Carolina Private Equity Invests in RM RM Closes Initial Public Offering Portfolio Reaches $500 Million in Size RM Closes $76 Million Amortizing Loan Facility RM Closes $125 Million Warehouse Facility $125 Million Bilateral Warehouse Facilities and Private ABS Custom Scorecards Deployed Next-Gen Scorecards Deployed RM Closes Two $75 Million Warehouse Facilities RM Closes on First $150 Million Securitization RM Closes on $130 Million Securitization RM Closes on $130 Million Securitization RM Closes on $180 Million Securitization RM Closes on $249 Million Securitization RM Closes on $200 Million Securitization RM Closes on $250 Million Securitization RM Closes on $184 Million Securitization 1987 2007 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 RM Closes $188 Million Securitization Evolution of Regional Management Funding Regional management has successfully operated through multiple cycles 14

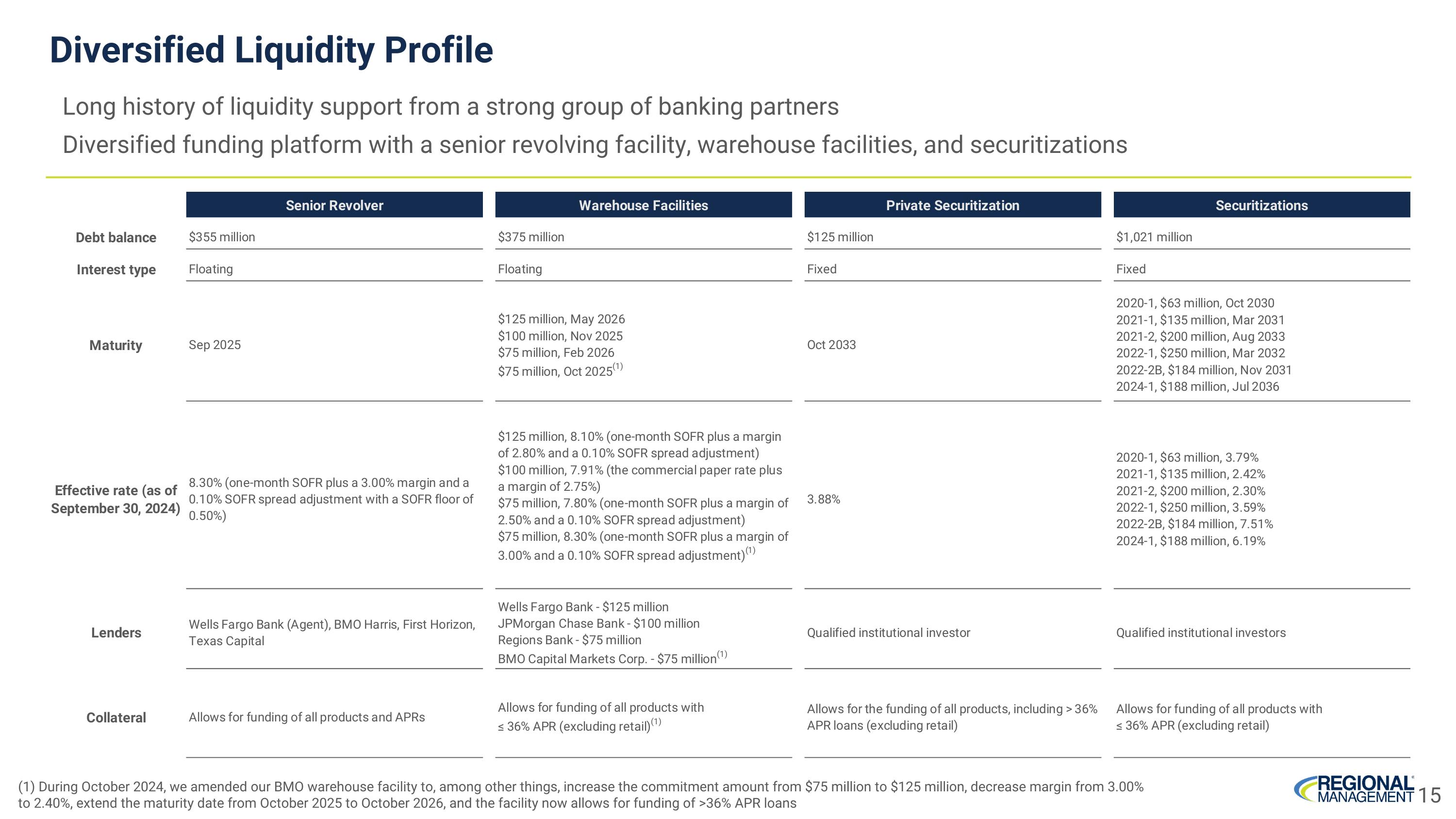

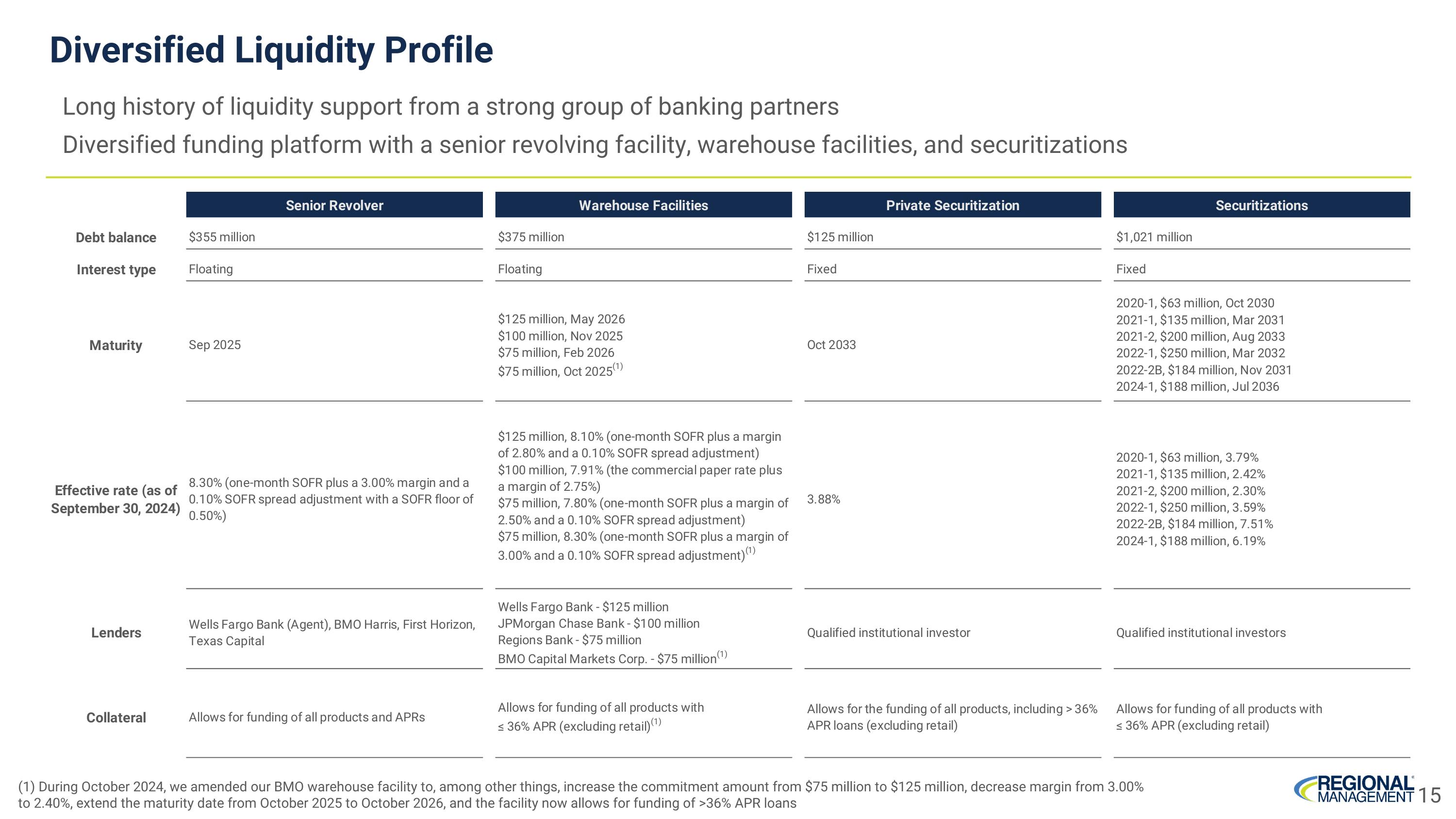

Diversified Liquidity Profile Long history of liquidity support from a strong group of banking partners Diversified funding platform with a senior revolving facility, warehouse facilities, and securitizations (1) During October 2024, we amended our BMO warehouse facility to, among other things, increase the commitment amount from $75 million to $125 million, decrease margin from 3.00% to 2.40%, extend the maturity date from October 2025 to October 2026, and the facility now allows for funding of >36% APR loans 15

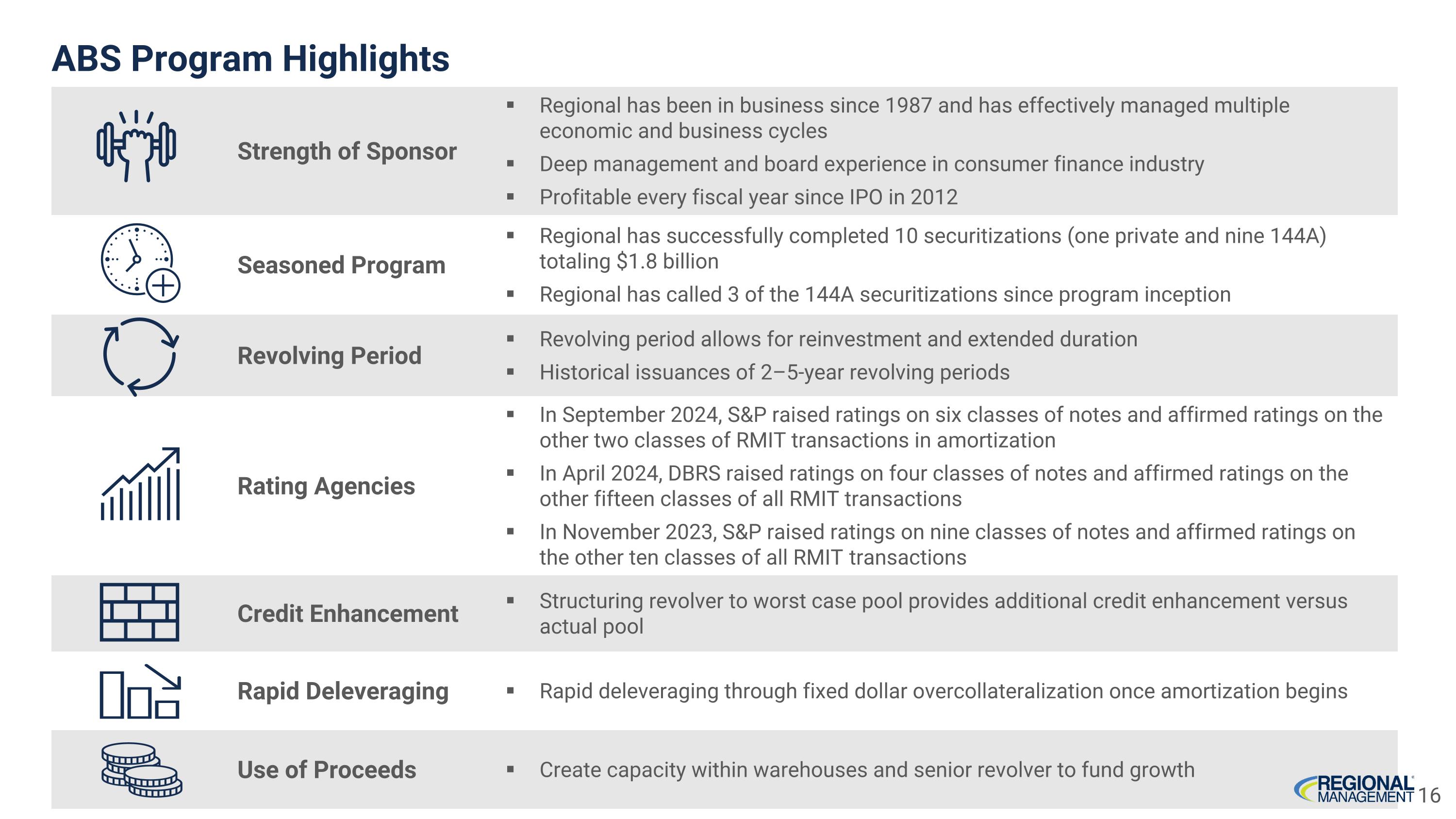

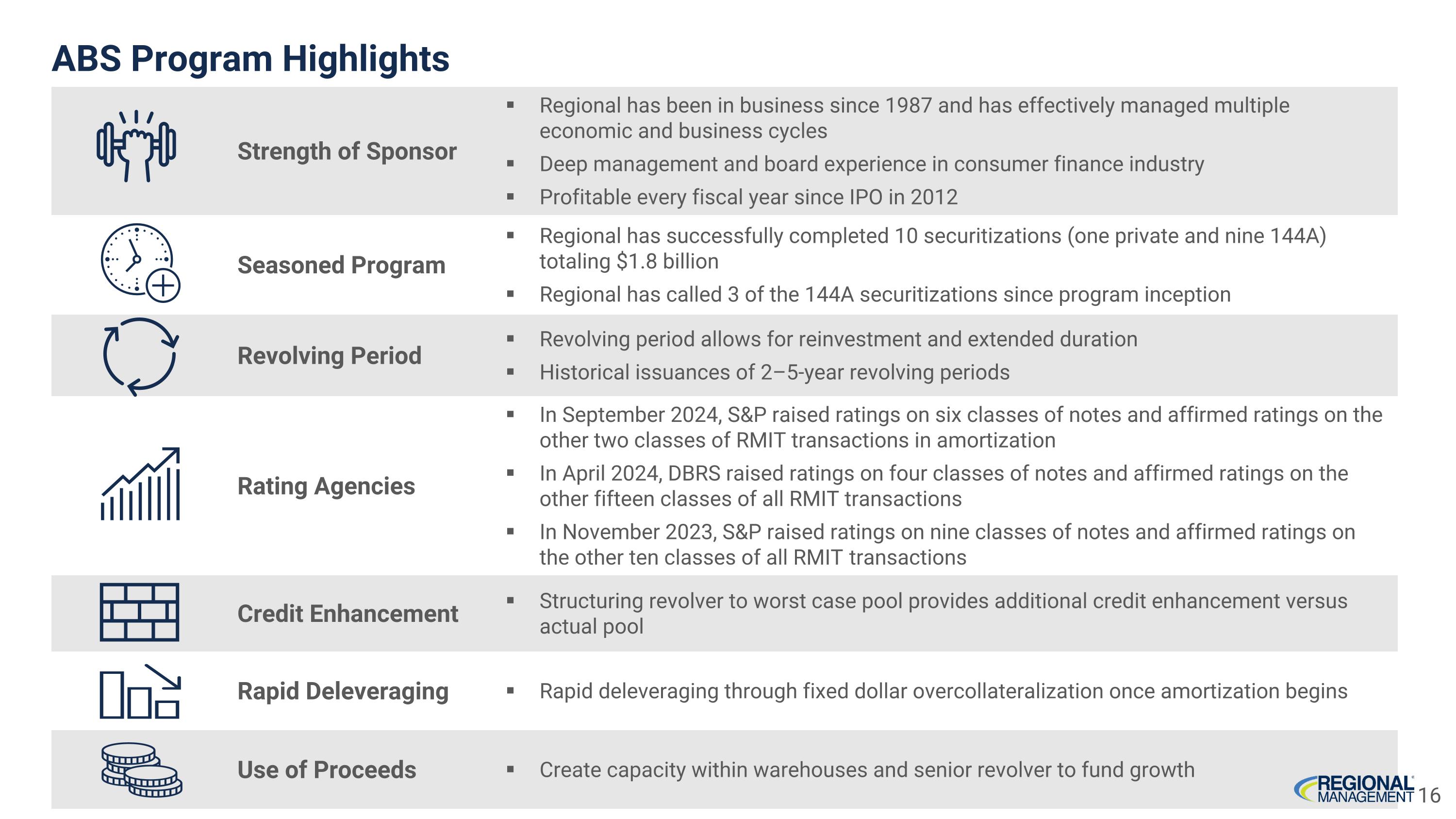

ABS Program Highlights Strength of Sponsor Regional has been in business since 1987 and has effectively managed multiple economic and business cycles Deep management and board experience in consumer finance industry Profitable every fiscal year since IPO in 2012 Seasoned Program Regional has successfully completed 10 securitizations (one private and nine 144A) totaling $1.8 billion Regional has called 3 of the 144A securitizations since program inception Revolving Period Revolving period allows for reinvestment and extended duration Historical issuances of 2–5-year revolving periods Rating Agencies In September 2024, S&P raised ratings on six classes of notes and affirmed ratings on the other two classes of RMIT transactions in amortization In April 2024, DBRS raised ratings on four classes of notes and affirmed ratings on the other fifteen classes of all RMIT transactions In November 2023, S&P raised ratings on nine classes of notes and affirmed ratings on the other ten classes of all RMIT transactions Credit Enhancement Structuring revolver to worst case pool provides additional credit enhancement versus actual pool Rapid Deleveraging Rapid deleveraging through fixed dollar overcollateralization once amortization begins Use of Proceeds Create capacity within warehouses and senior revolver to fund growth 16

Governance & Controls

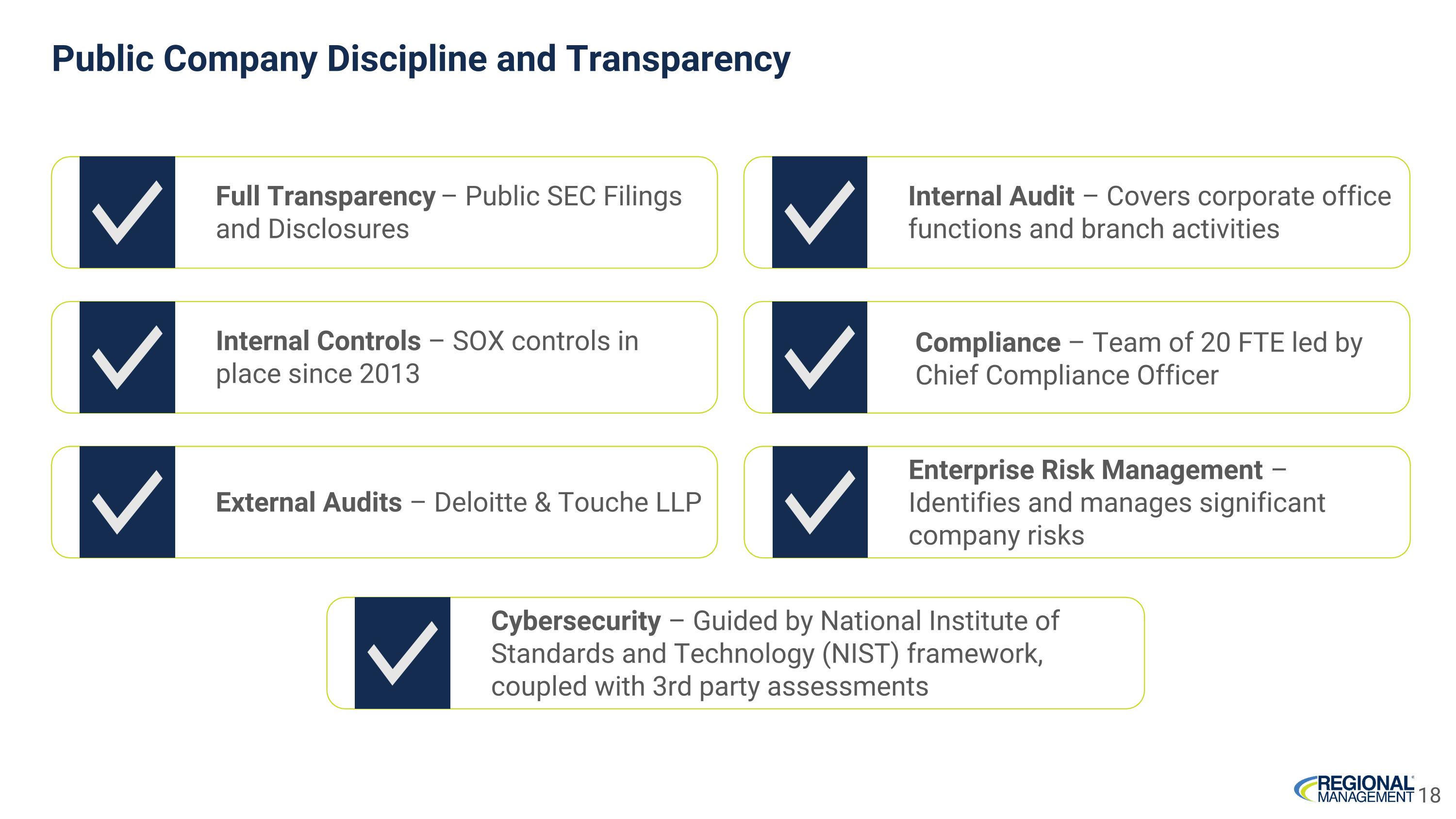

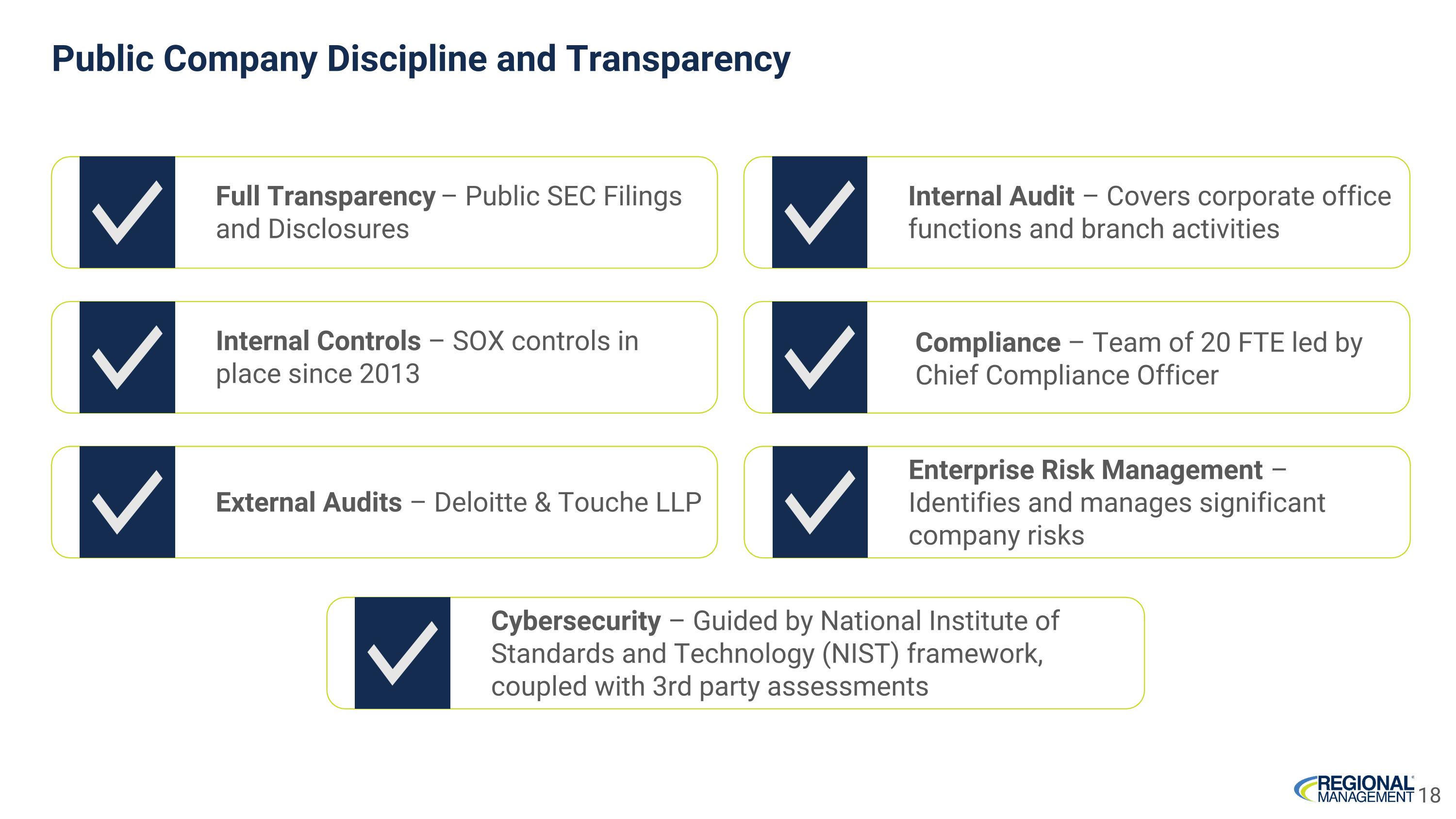

Public Company Discipline and Transparency Full Transparency – Public SEC Filings and Disclosures Internal Controls – SOX controls in place since 2013 External Audits – Deloitte & Touche LLP Compliance – Team of 20 FTE led by Chief Compliance Officer Enterprise Risk Management – Identifies and manages significant company risks Internal Audit – Covers corporate office functions and branch activities Cybersecurity – Guided by National Institute of Standards and Technology (NIST) framework, coupled with 3rd party assessments 18

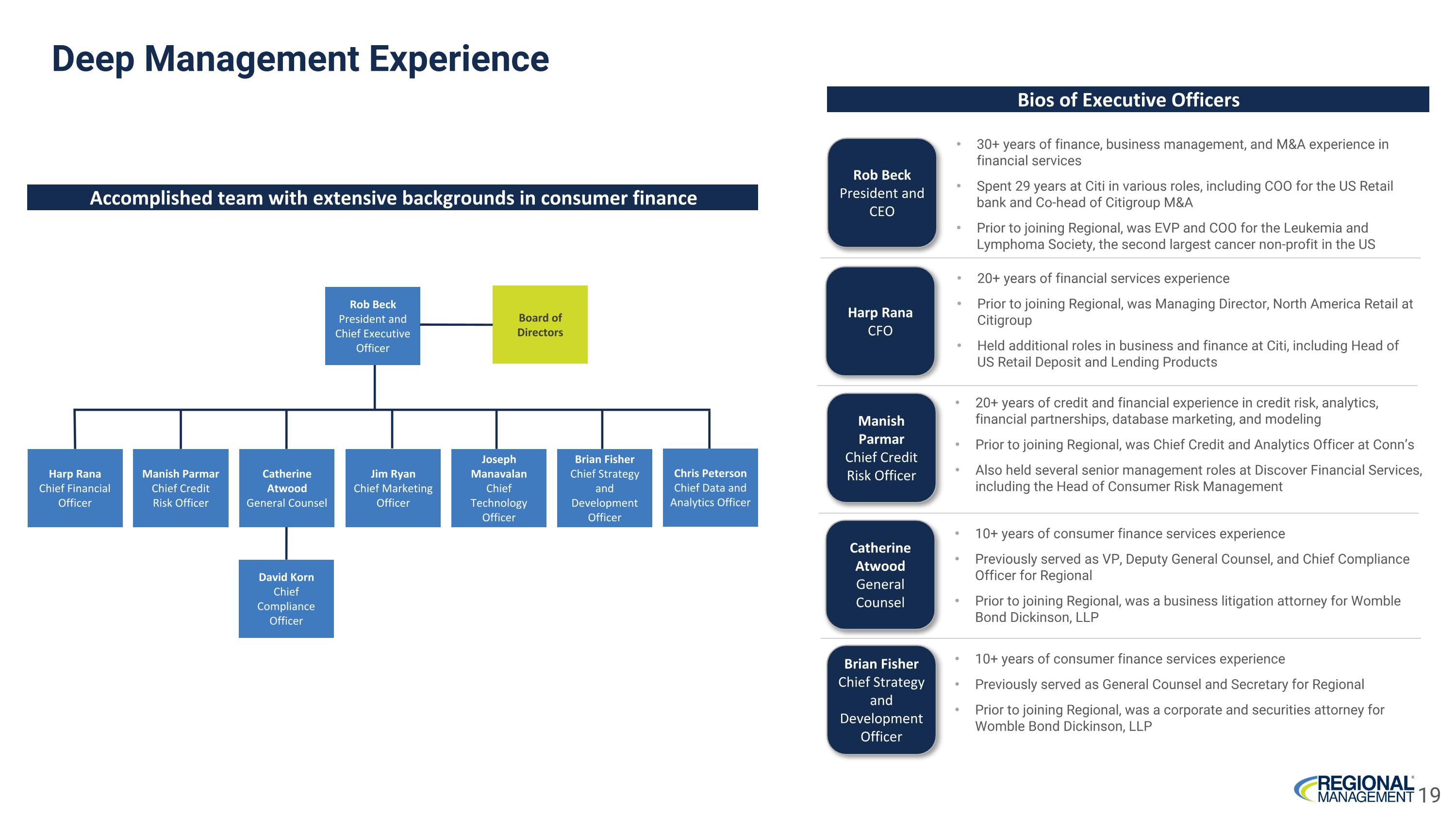

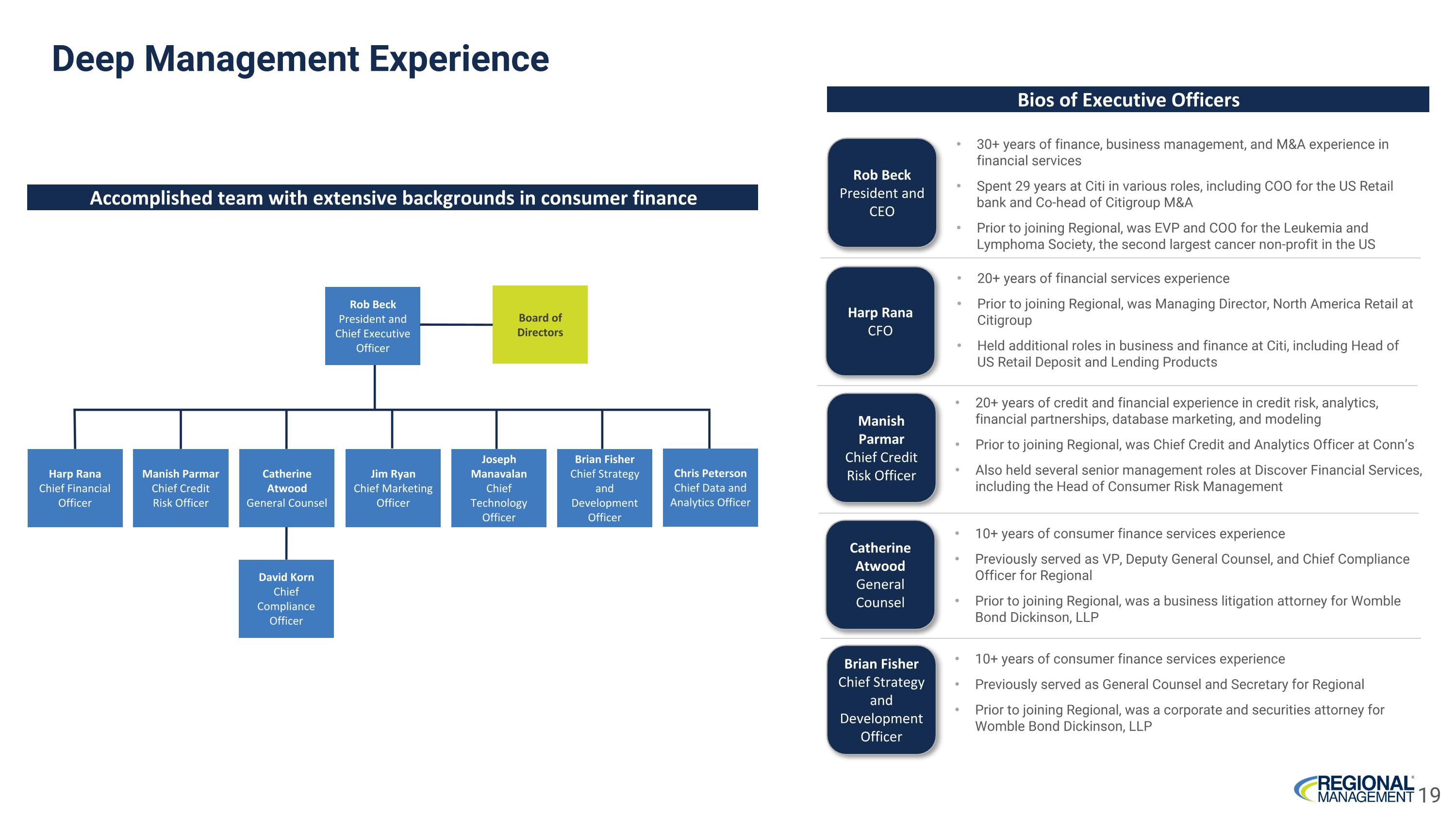

Deep Management Experience Accomplished team with extensive backgrounds in consumer finance Rob Beck President and CEO Manish Parmar Chief Credit Risk Officer Harp Rana CFO 20+ years of financial services experience Prior to joining Regional, was Managing Director, North America Retail at Citigroup Held additional roles in business and finance at Citi, including Head of US Retail Deposit and Lending Products 20+ years of credit and financial experience in credit risk, analytics, financial partnerships, database marketing, and modeling Prior to joining Regional, was Chief Credit and Analytics Officer at Conn’s Also held several senior management roles at Discover Financial Services, including the Head of Consumer Risk Management 30+ years of finance, business management, and M&A experience in financial services Spent 29 years at Citi in various roles, including COO for the US Retail bank and Co-head of Citigroup M&A Prior to joining Regional, was EVP and COO for the Leukemia and Lymphoma Society, the second largest cancer non-profit in the US Harp Rana Chief Financial Officer Manish Parmar Chief Credit Risk Officer Catherine Atwood General Counsel Jim Ryan Chief Marketing Officer Joseph Manavalan Chief Technology Officer Brian Fisher �Chief Strategy and Development Officer Rob Beck President and Chief Executive Officer Board of Directors David Korn Chief Compliance Officer Brian Fisher Chief Strategy and Development Officer 10+ years of consumer finance services experience Previously served as General Counsel and Secretary for Regional Prior to joining Regional, was a corporate and securities attorney for Womble Bond Dickinson, LLP Catherine Atwood General Counsel 10+ years of consumer finance services experience Previously served as VP, Deputy General Counsel, and Chief Compliance Officer for Regional Prior to joining Regional, was a business litigation attorney for Womble Bond Dickinson, LLP Bios of Executive Officers Chris Peterson�Chief Data and Analytics Officer 19

Strong Corporate Governance and Diverse Board of Directors Jonathan Brown Partner with Basswood Capital Management, LLC Formerly at Sandelman Partners Formerly at Goldman Sachs Maria Contreras-Sweet Former Administrator of U.S. Small Business Administration Founder of ProAmerica Bank Former Secretary of CA’s Business, Transportation and Housing Agency Board of Directors (Non-Employee Directors) Awarded the Latino Corporate Directors Association 2019 Corporate Visionary Award, recognizing RM’s commitment to an inclusive and diverse Board of Directors. Nominated for NACD NXT™ recognition in 2019 by the National Association of Corporate Directors (NACD). This recognition, part of the NACD NXT initiative, applauds exemplary board leadership practices that promote greater diversity and inclusion. 20

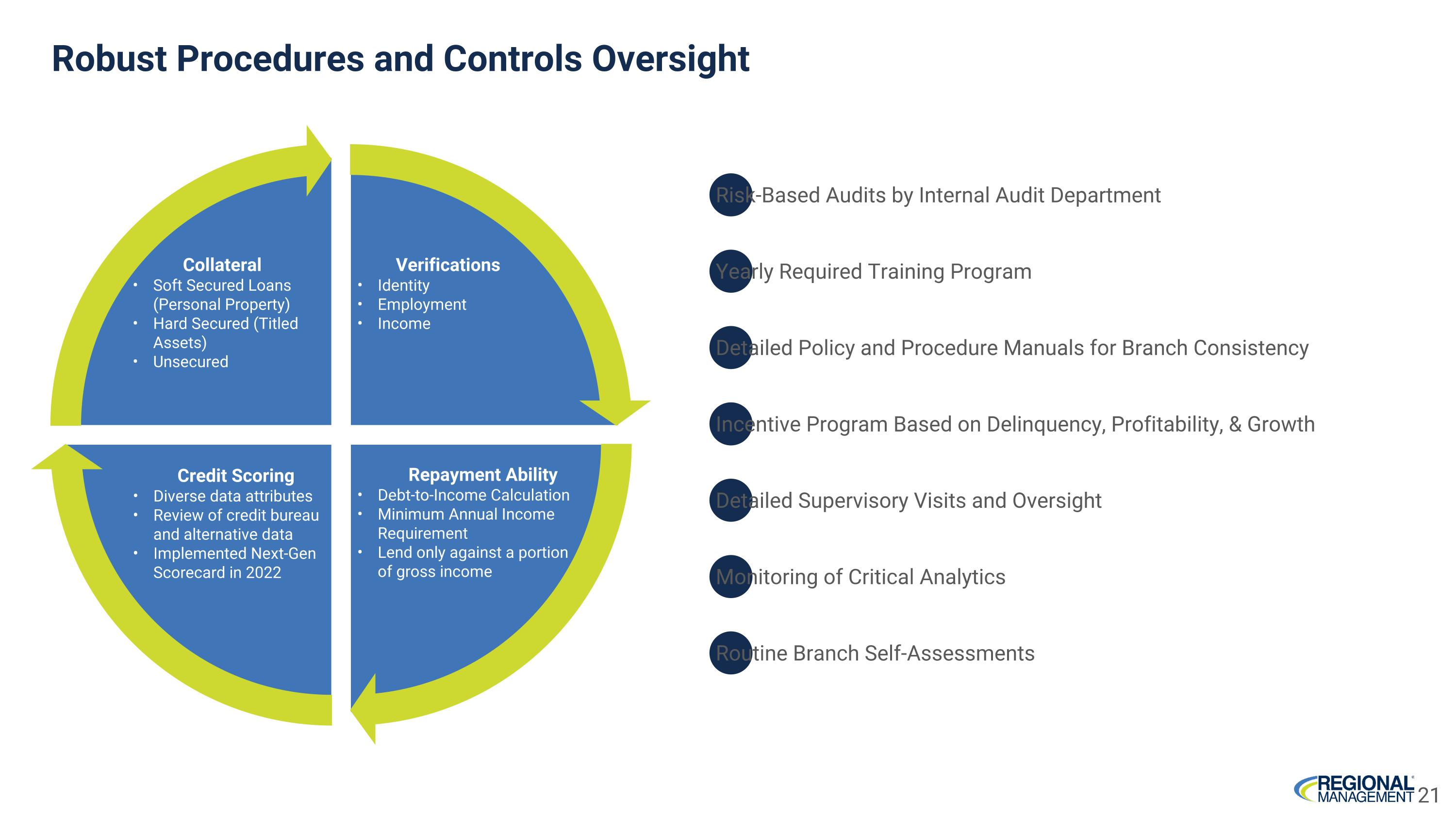

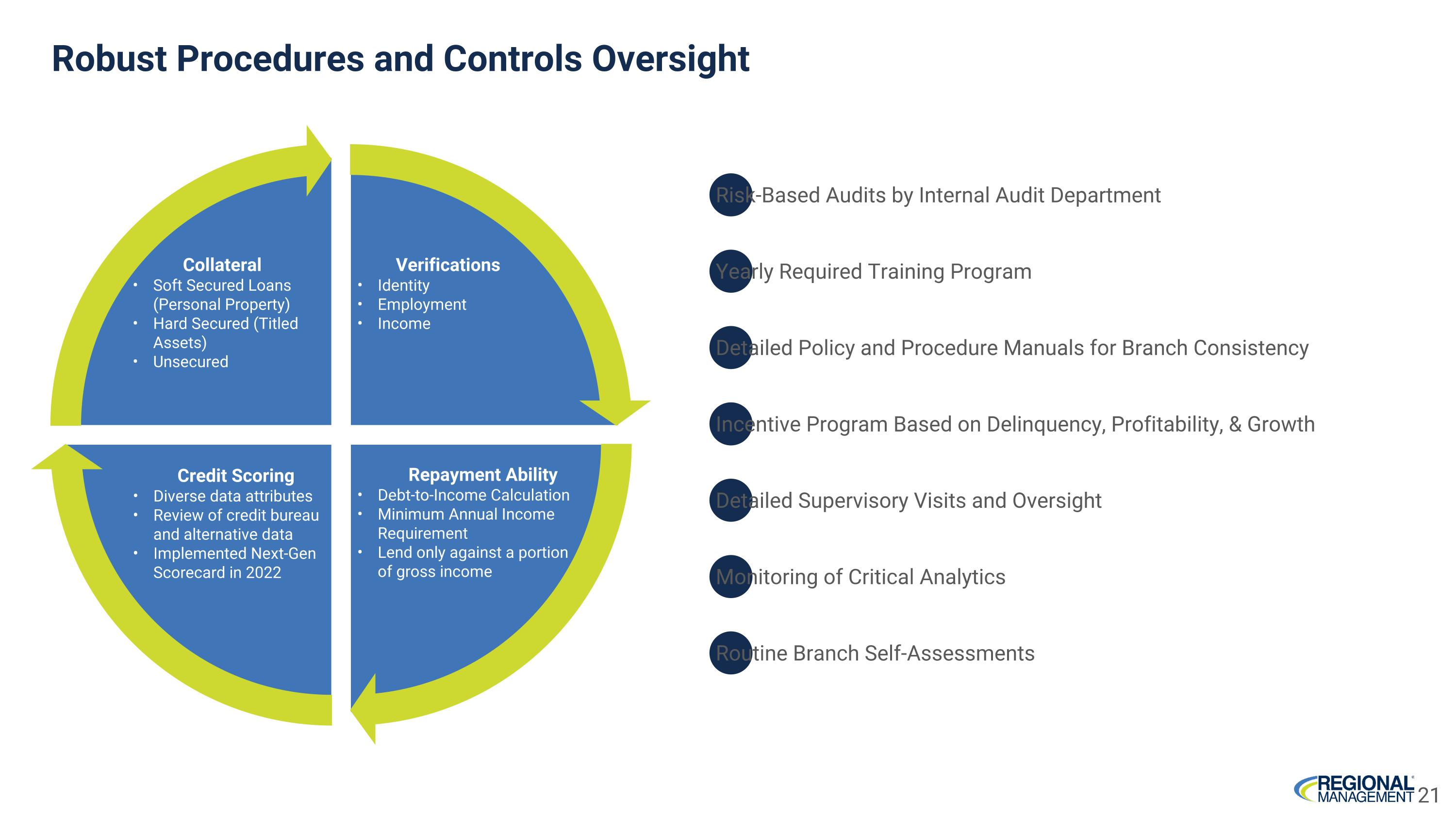

Robust Procedures and Controls Oversight Collateral All borrowers must provide collateral Secured by titled assets (hard secured) or personal property (soft secured) Verifications Identity Employment Income Credit Scoring Diverse data attributes Review of credit bureau information Implementation of custom scorecards in 2018 Repayment Ability Debt to Income Calculation Minimum Annual Income Requirement Lend only against a portion of gross income Collateral Soft Secured Loans (Personal Property) Hard Secured (Titled Assets) Unsecured Verifications Identity Employment Income Credit Scoring Diverse data attributes Review of credit bureau and alternative data Implemented Next-Gen Scorecard in 2022 Repayment Ability Debt-to-Income Calculation Minimum Annual Income Requirement Lend only against a portion of gross income Risk-Based Audits by Internal Audit Department Yearly Required Training Program Detailed Policy and Procedure Manuals for Branch Consistency Incentive Program Based on Delinquency, Profitability, & Growth Detailed Supervisory Visits and Oversight Monitoring of Critical Analytics Routine Branch Self-Assessments 21

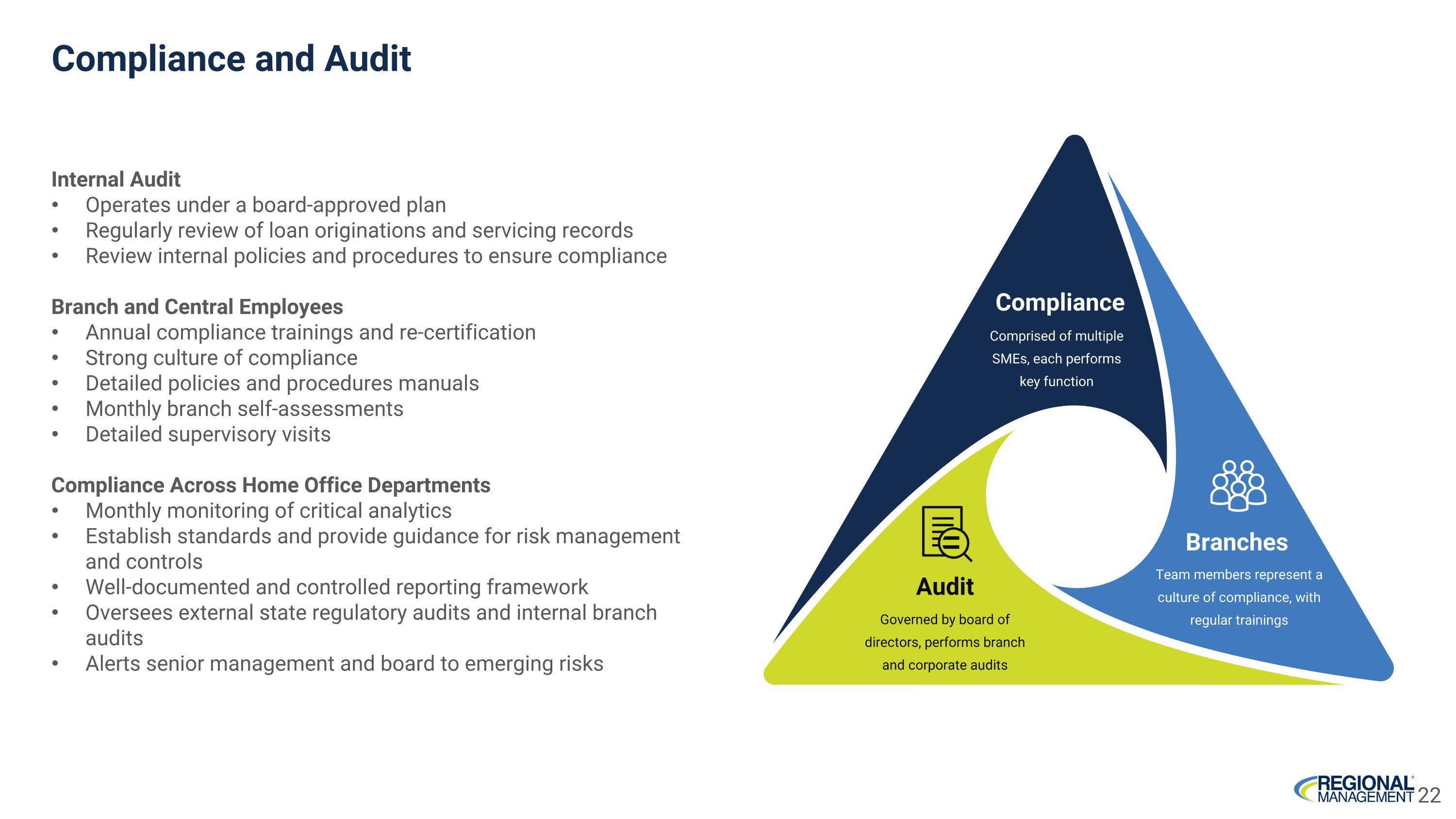

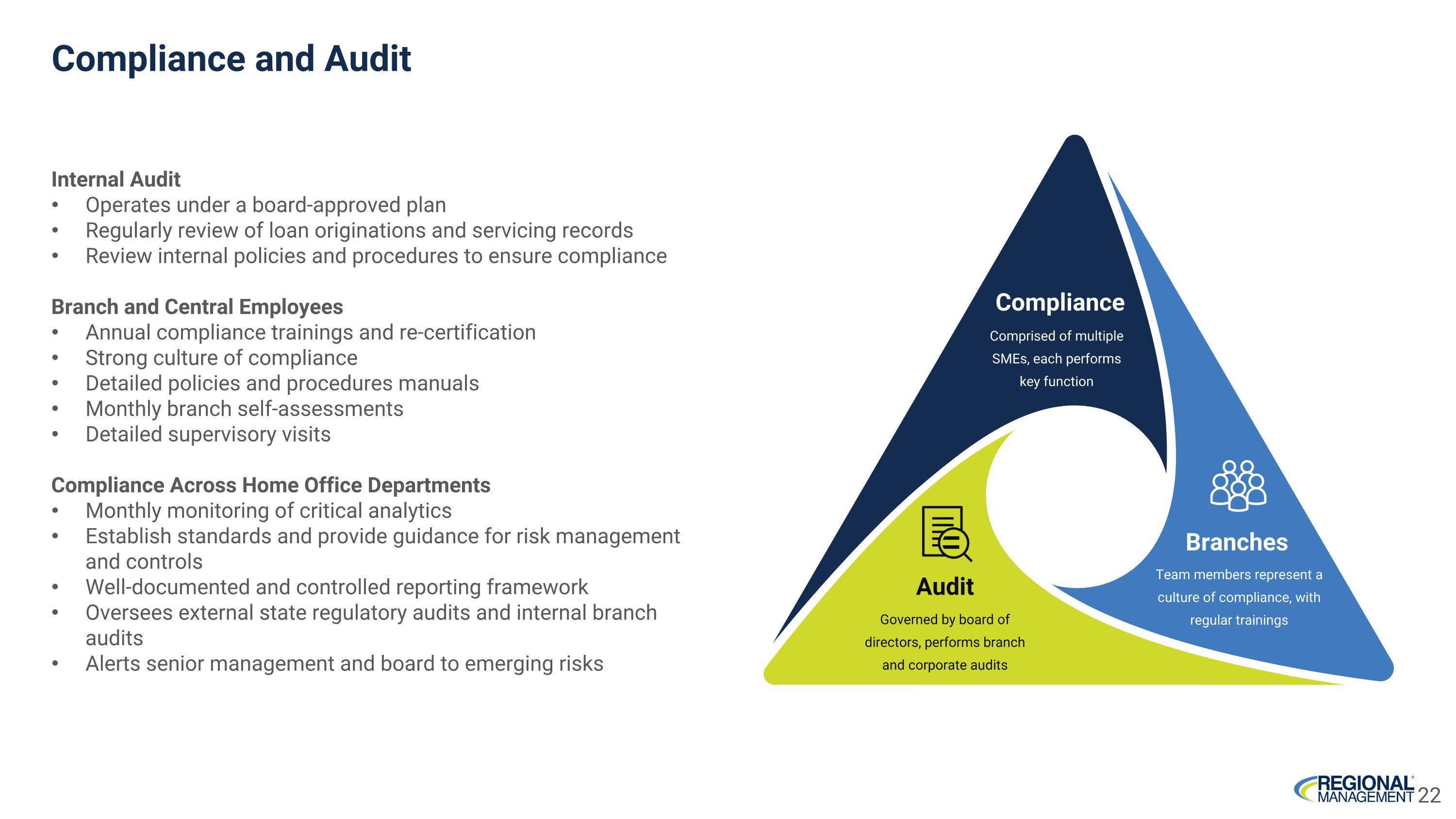

Compliance and Audit Internal Audit Operates under a board-approved plan Regularly review of loan originations and servicing records Review internal policies and procedures to ensure compliance Branch and Central Employees Annual compliance trainings and re-certification Strong culture of compliance Detailed policies and procedures manuals Monthly branch self-assessments Detailed supervisory visits Compliance Across Home Office Departments Monthly monitoring of critical analytics Establish standards and provide guidance for risk management and controls Well-documented and controlled reporting framework Oversees external state regulatory audits and internal branch audits Alerts senior management and board to emerging risks Governed by board of directors, performs branch and corporate audits Audit Comprised of multiple SMEs, each performs key function Compliance Team members represent a culture of compliance, with regular trainings Branches 22

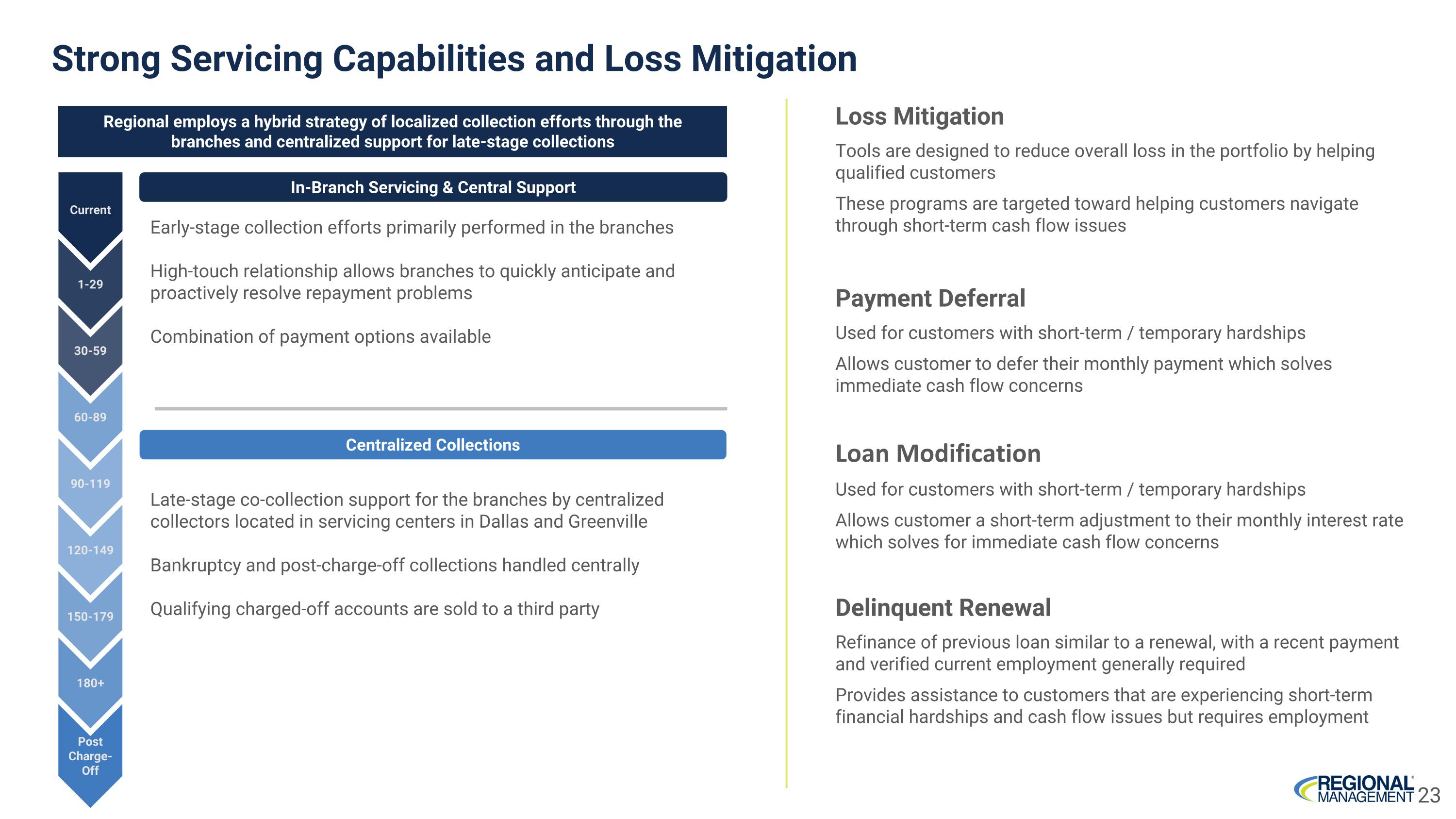

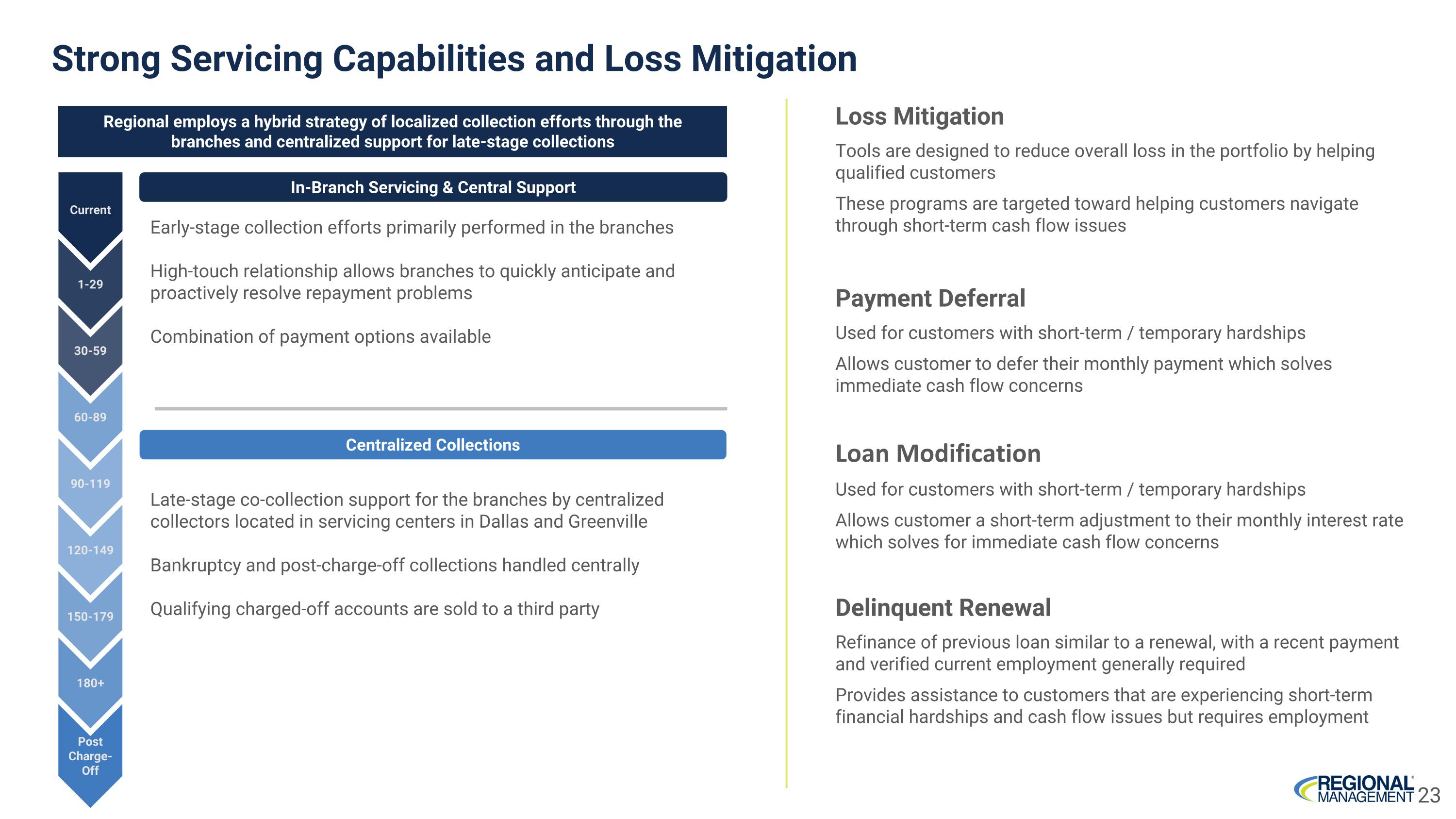

Loss Mitigation Tools are designed to reduce overall loss in the portfolio by helping qualified customers These programs are targeted toward helping customers navigate through short-term cash flow issues Payment Deferral Used for customers with short-term / temporary hardships Allows customer to defer their monthly payment which solves immediate cash flow concerns Loan Modification Used for customers with short-term / temporary hardships Allows customer a short-term adjustment to their monthly interest rate which solves for immediate cash flow concerns Delinquent Renewal Refinance of previous loan similar to a renewal, with a recent payment and verified current employment generally required Provides assistance to customers that are experiencing short-term financial hardships and cash flow issues but requires employment Strong Servicing Capabilities and Loss Mitigation Early-stage collection efforts primarily performed in the branches High-touch relationship allows branches to quickly anticipate and proactively resolve repayment problems Combination of payment options available Late-stage co-collection support for the branches by centralized collectors located in servicing centers in Dallas and Greenville Bankruptcy and post-charge-off collections handled centrally Qualifying charged-off accounts are sold to a third party Regional employs a hybrid strategy of localized collection efforts through the branches and centralized support for late-stage collections In-Branch Servicing & Central Support Centralized Collections Current 1-29 30-59 60-89 90-119 120-149 150-179 180+ Post Charge-Off 23

Credit Performance

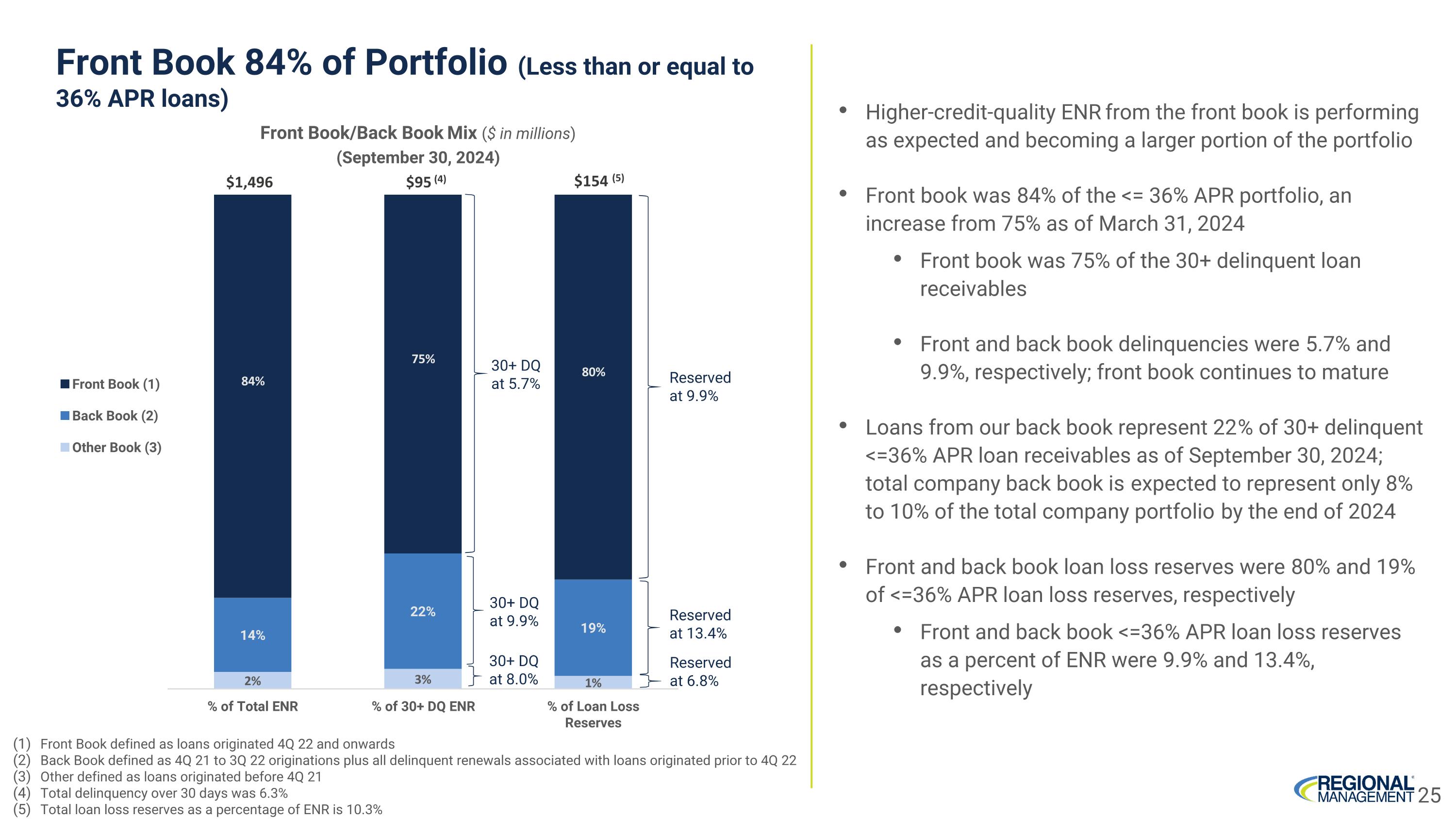

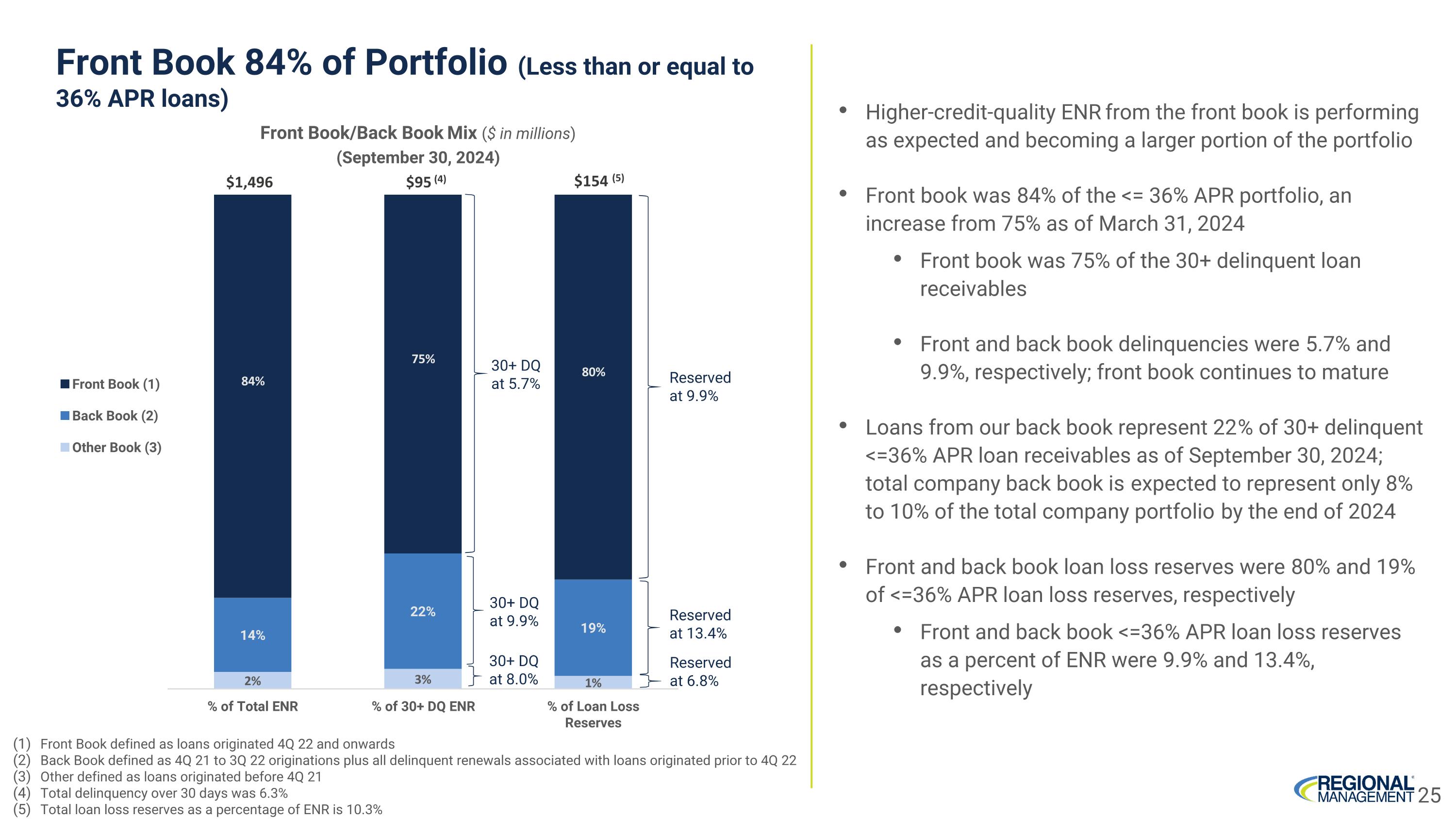

Front Book 84% of Portfolio (Less than or equal to 36% APR loans) Front Book defined as loans originated 4Q 22 and onwards Back Book defined as 4Q 21 to 3Q 22 originations plus all delinquent renewals associated with loans originated prior to 4Q 22 Other defined as loans originated before 4Q 21 Total delinquency over 30 days was 6.3% Total loan loss reserves as a percentage of ENR is 10.3% Higher-credit-quality ENR from the front book is performing as expected and becoming a larger portion of the portfolio Front book was 84% of the <= 36% APR portfolio, an increase from 75% as of March 31, 2024 Front book was 75% of the 30+ delinquent loan receivables Front and back book delinquencies were 5.7% and 9.9%, respectively; front book continues to mature Loans from our back book represent 22% of 30+ delinquent <=36% APR loan receivables as of September 30, 2024; total company back book is expected to represent only 8% to 10% of the total company portfolio by the end of 2024 Front and back book loan loss reserves were 80% and 19% of <=36% APR loan loss reserves, respectively Front and back book <=36% APR loan loss reserves as a percent of ENR were 9.9% and 13.4%, respectively $1,496 $95 (4) $154 (5) Reserved at 13.4% Reserved at 9.9% 30+ DQ at 5.7% 30+ DQ at 9.9% Reserved at 6.8% 30+ DQ at 8.0% 25

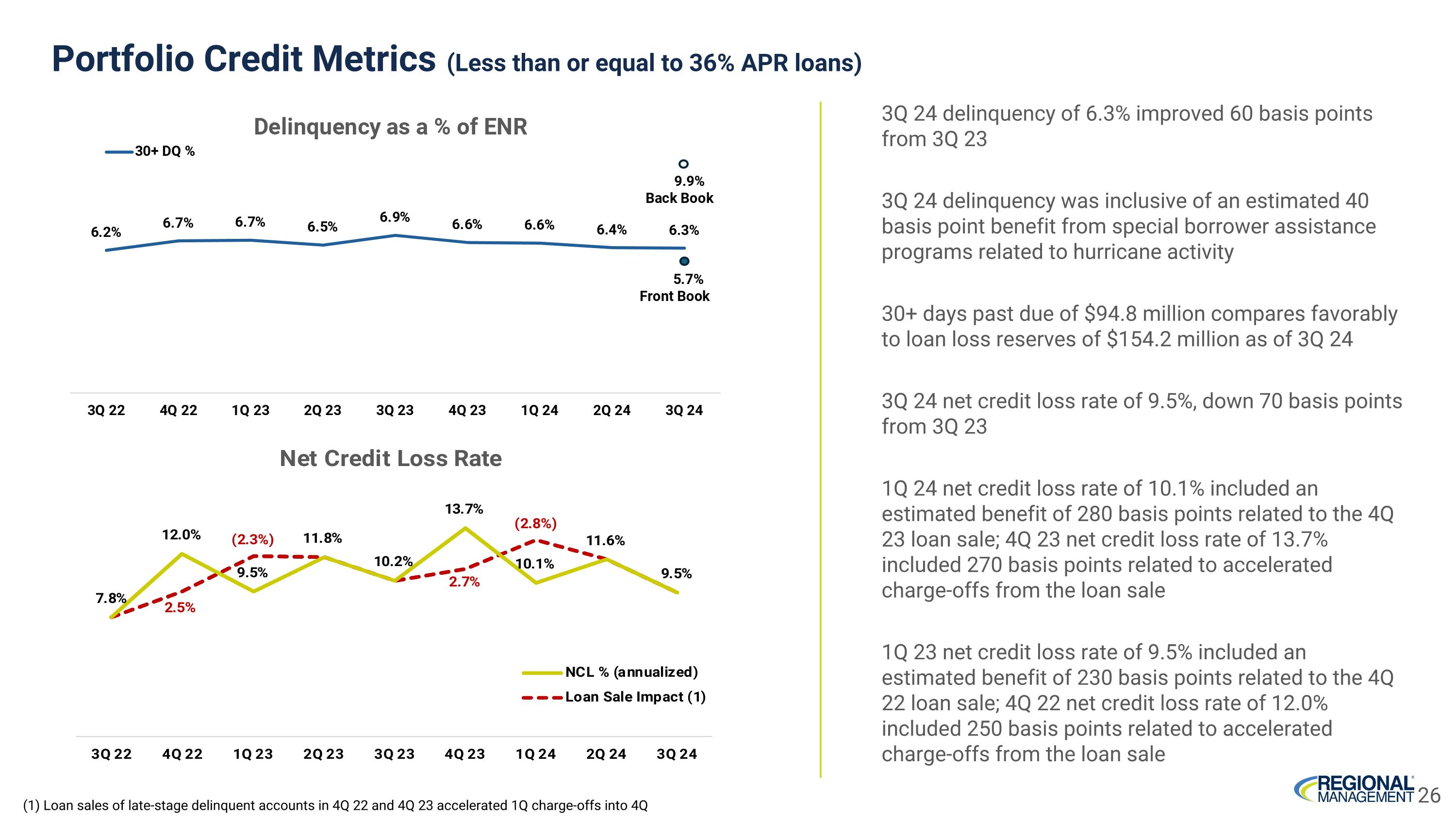

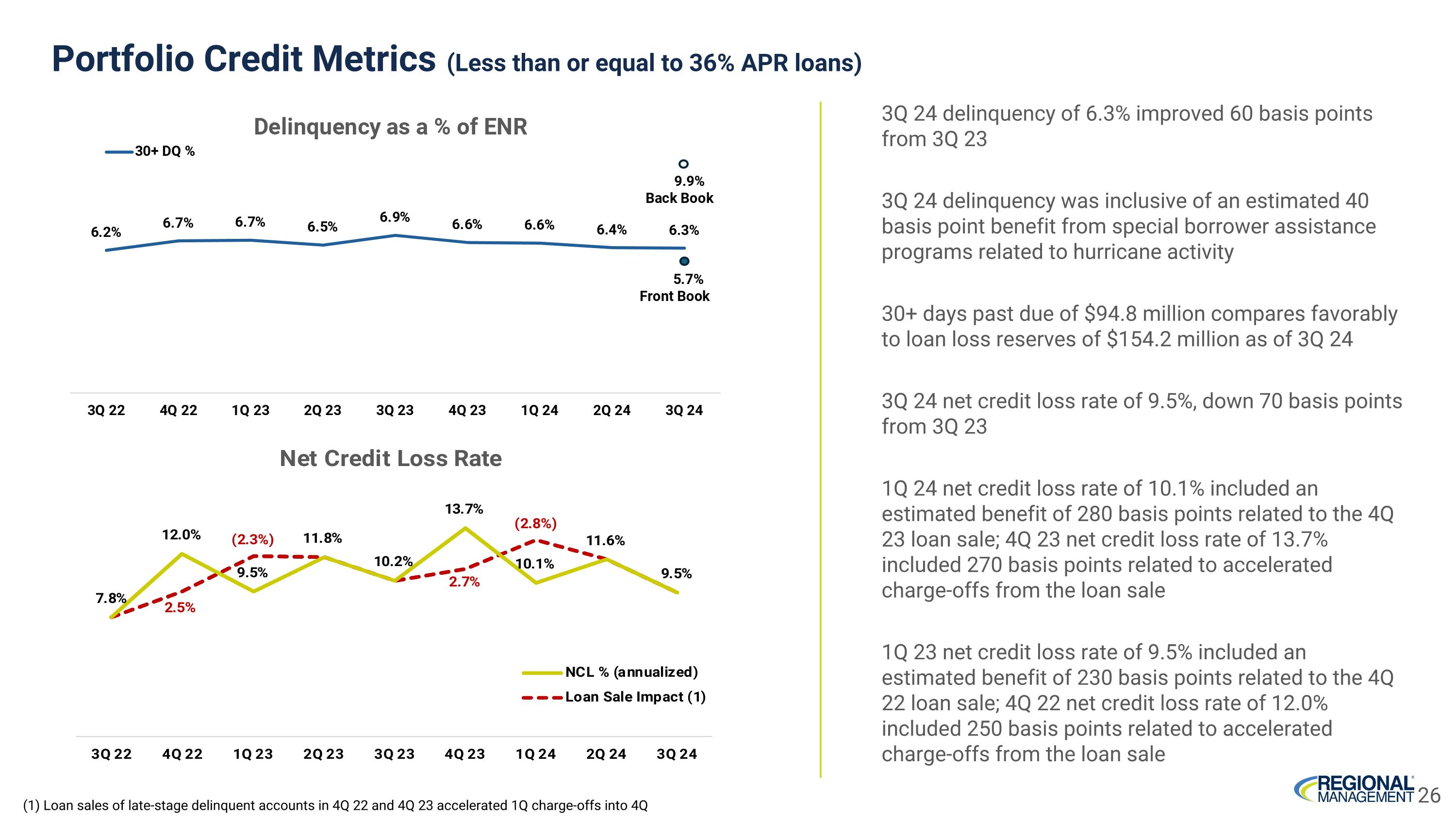

Portfolio Credit Metrics (Less than or equal to 36% APR loans) 3Q 24 delinquency of 6.3% improved 60 basis points from 3Q 23 3Q 24 delinquency was inclusive of an estimated 40 basis point benefit from special borrower assistance programs related to hurricane activity 30+ days past due of $94.8 million compares favorably to loan loss reserves of $154.2 million as of 3Q 24 3Q 24 net credit loss rate of 9.5%, down 70 basis points from 3Q 23 1Q 24 net credit loss rate of 10.1% included an estimated benefit of 280 basis points related to the 4Q 23 loan sale; 4Q 23 net credit loss rate of 13.7% included 270 basis points related to accelerated charge-offs from the loan sale 1Q 23 net credit loss rate of 9.5% included an estimated benefit of 230 basis points related to the 4Q 22 loan sale; 4Q 22 net credit loss rate of 12.0% included 250 basis points related to accelerated charge-offs from the loan sale (1) Loan sales of late-stage delinquent accounts in 4Q 22 and 4Q 23 accelerated 1Q charge-offs into 4Q 26

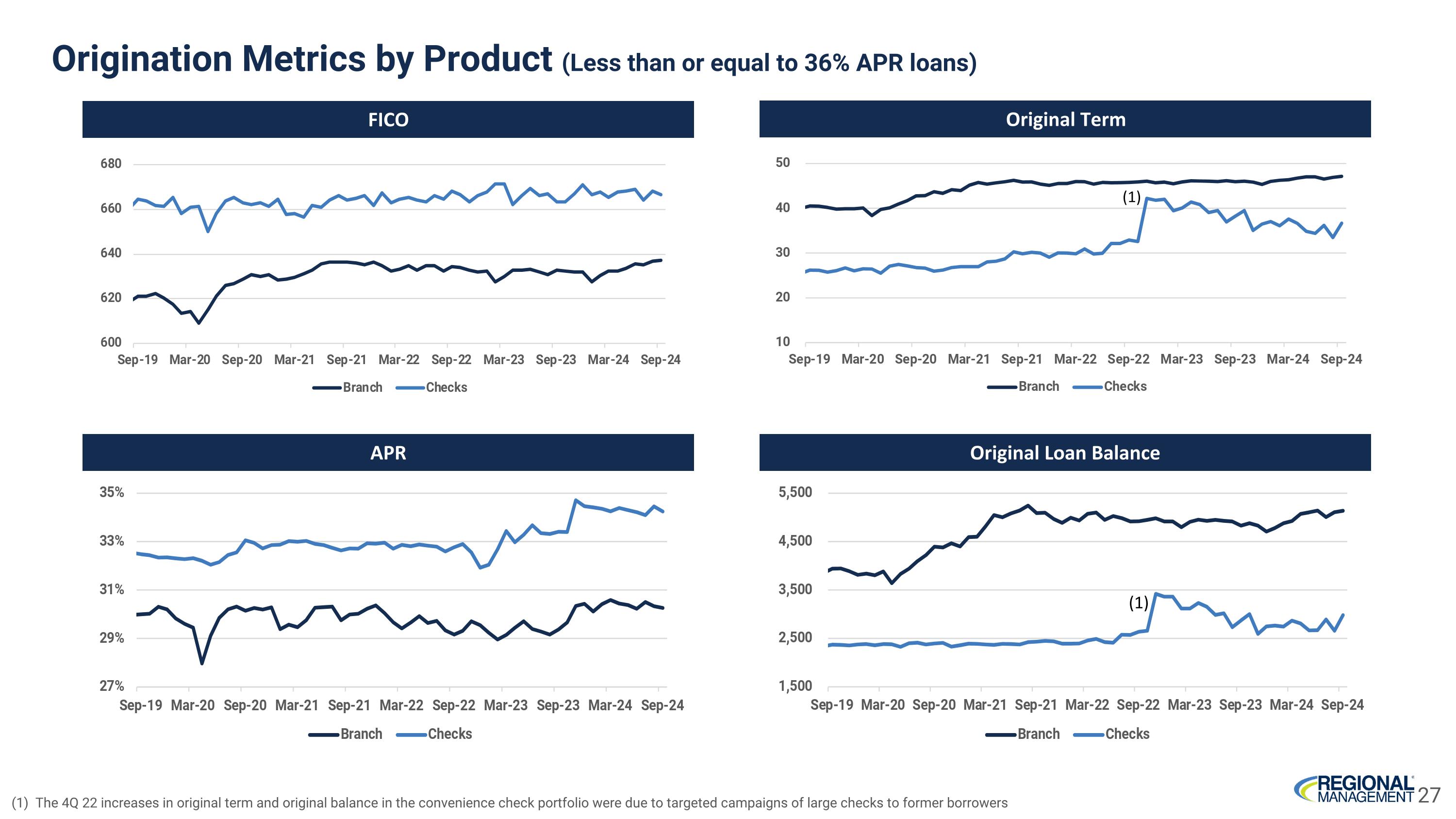

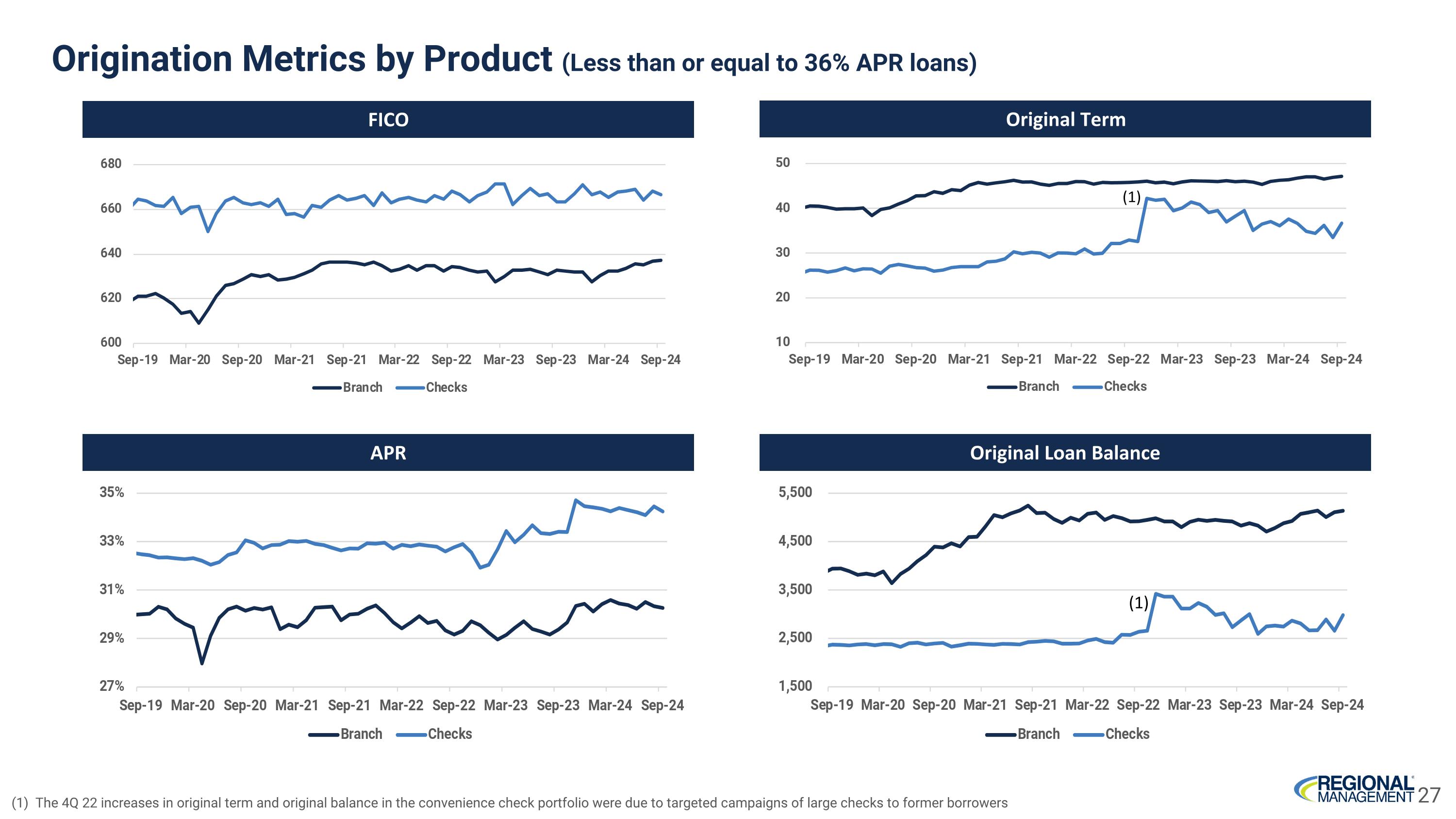

Origination Metrics by Product (Less than or equal to 36% APR loans) FICO Original Term APR Original Loan Balance (1) The 4Q 22 increases in original term and original balance in the convenience check portfolio were due to targeted campaigns of large checks to former borrowers (1) (1) 27

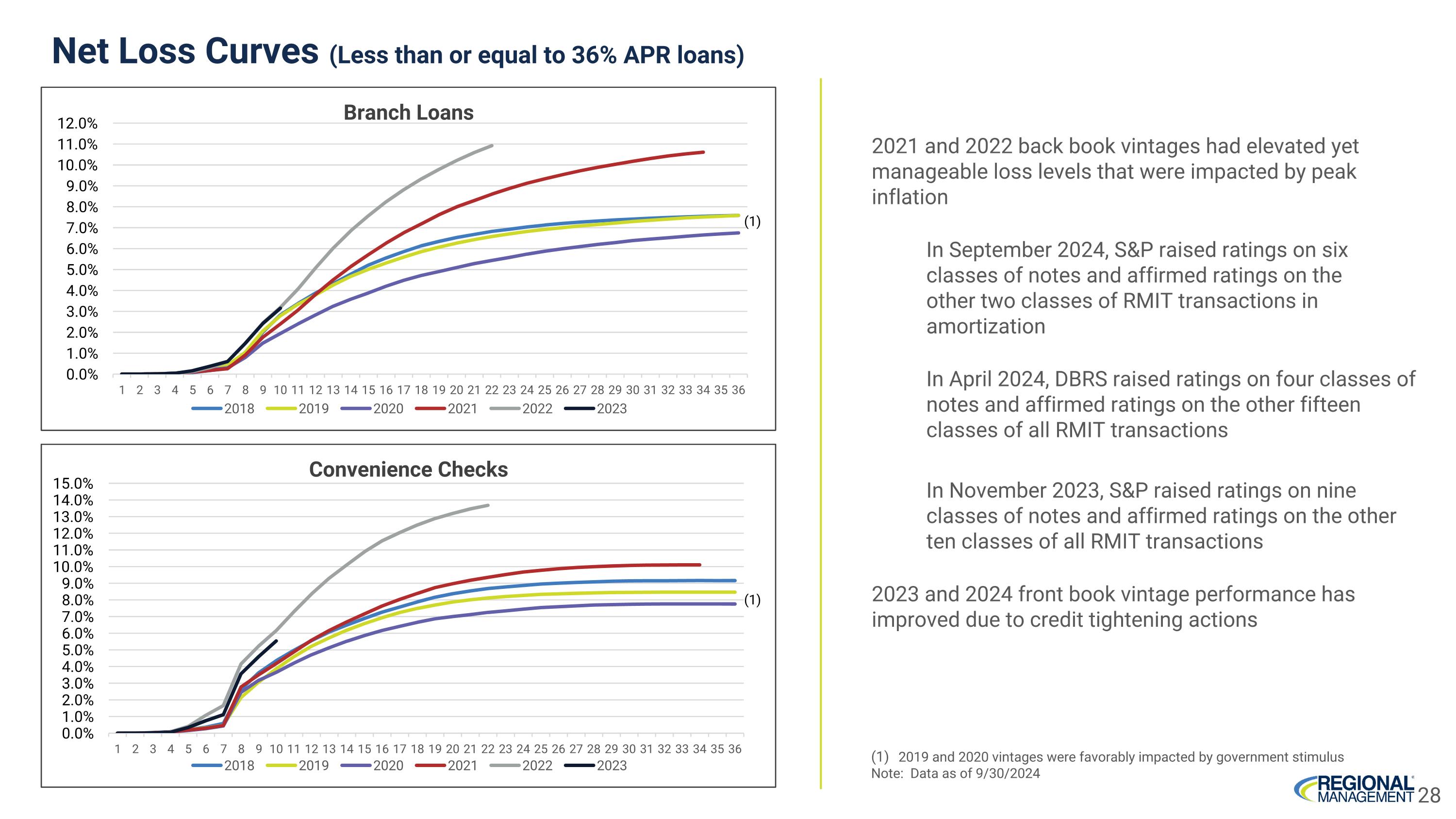

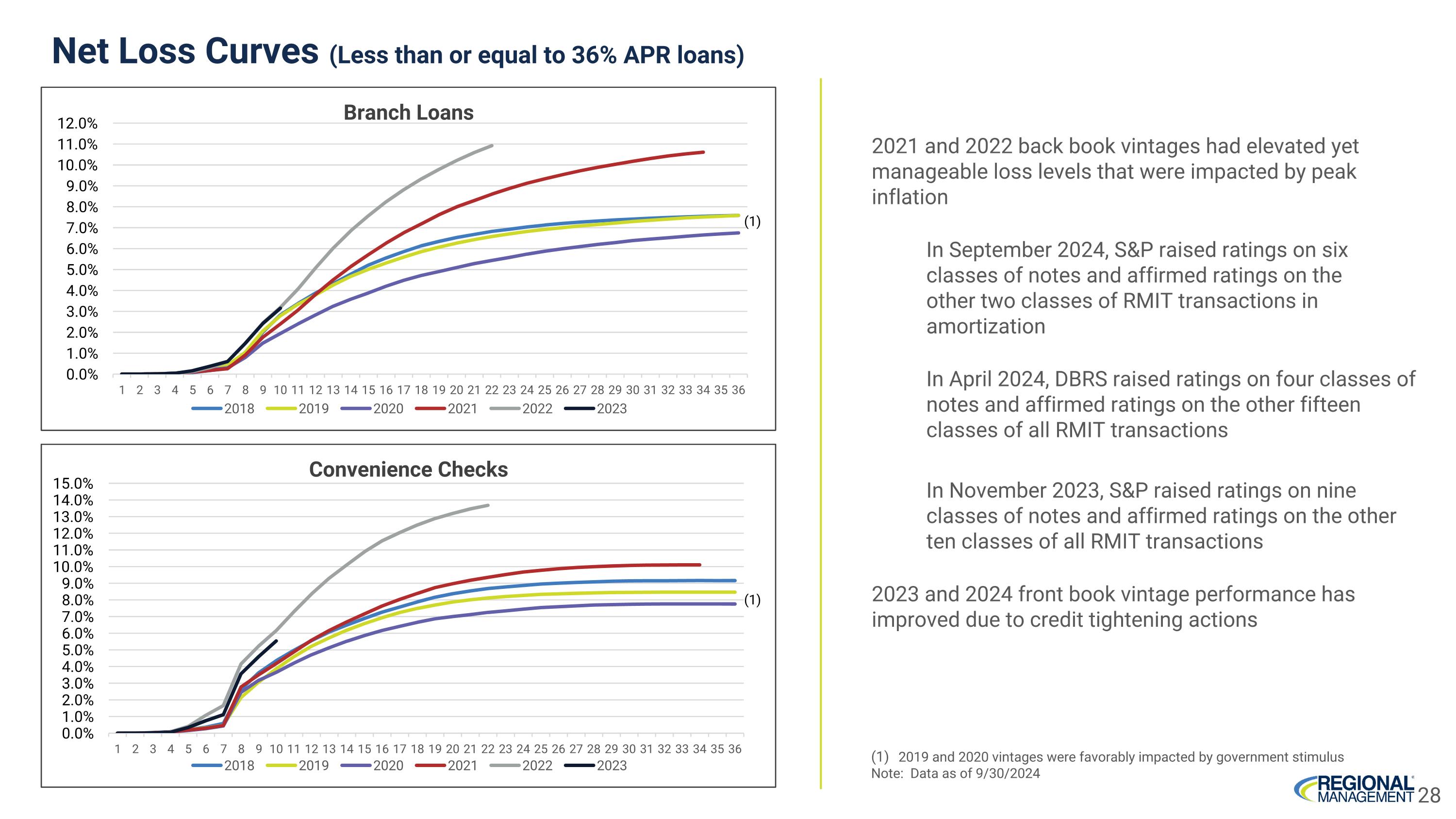

2021 and 2022 back book vintages had elevated yet manageable loss levels that were impacted by peak inflation In September 2024, S&P raised ratings on six classes of notes and affirmed ratings on the other two classes of RMIT transactions in amortization In April 2024, DBRS raised ratings on four classes of notes and affirmed ratings on the other fifteen classes of all RMIT transactions In November 2023, S&P raised ratings on nine classes of notes and affirmed ratings on the other ten classes of all RMIT transactions 2023 and 2024 front book vintage performance has improved due to credit tightening actions Net Loss Curves (Less than or equal to 36% APR loans) 2019 and 2020 vintages were favorably impacted by government stimulus Note: Data as of 9/30/2024 (1) (1) 28

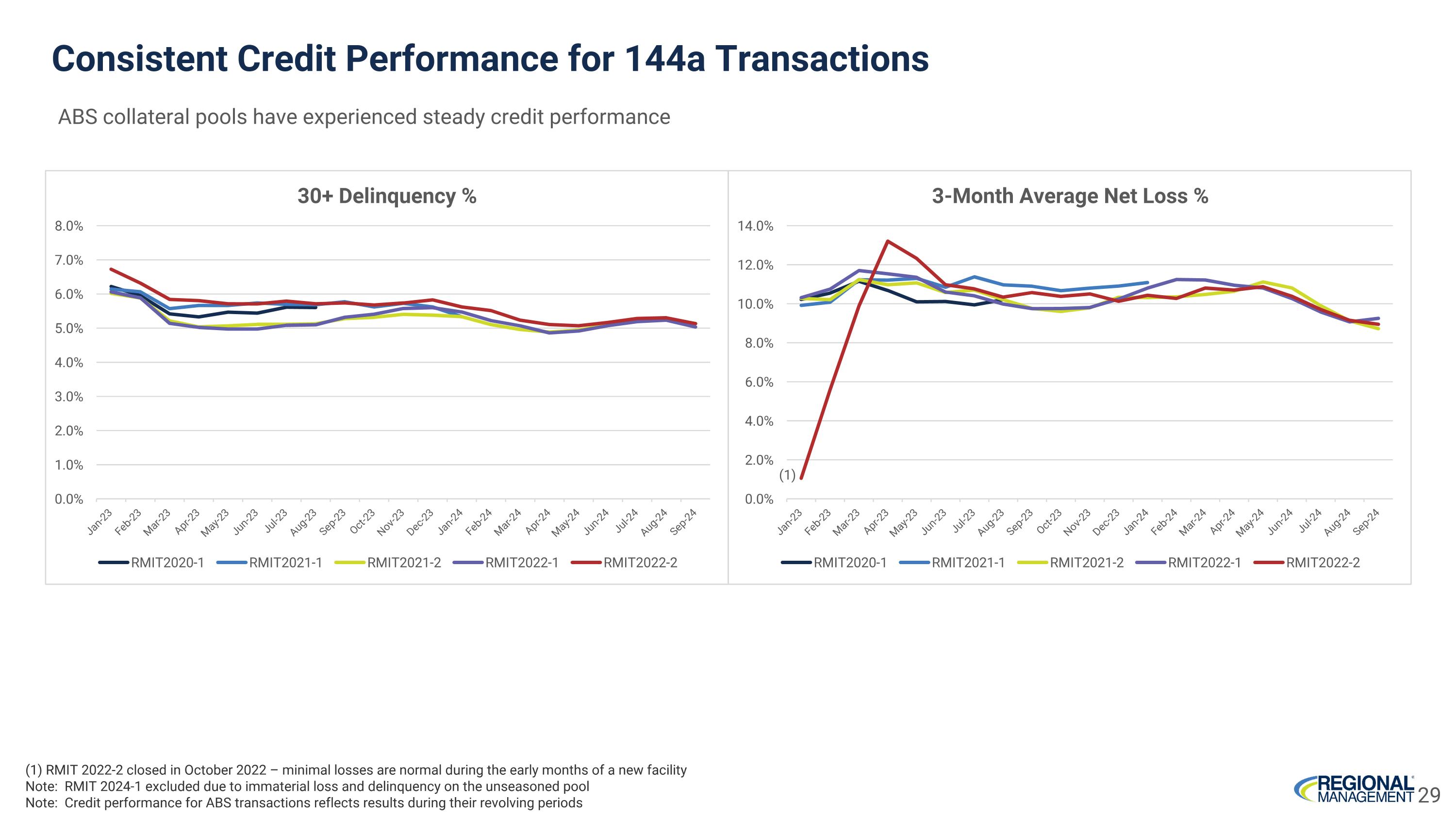

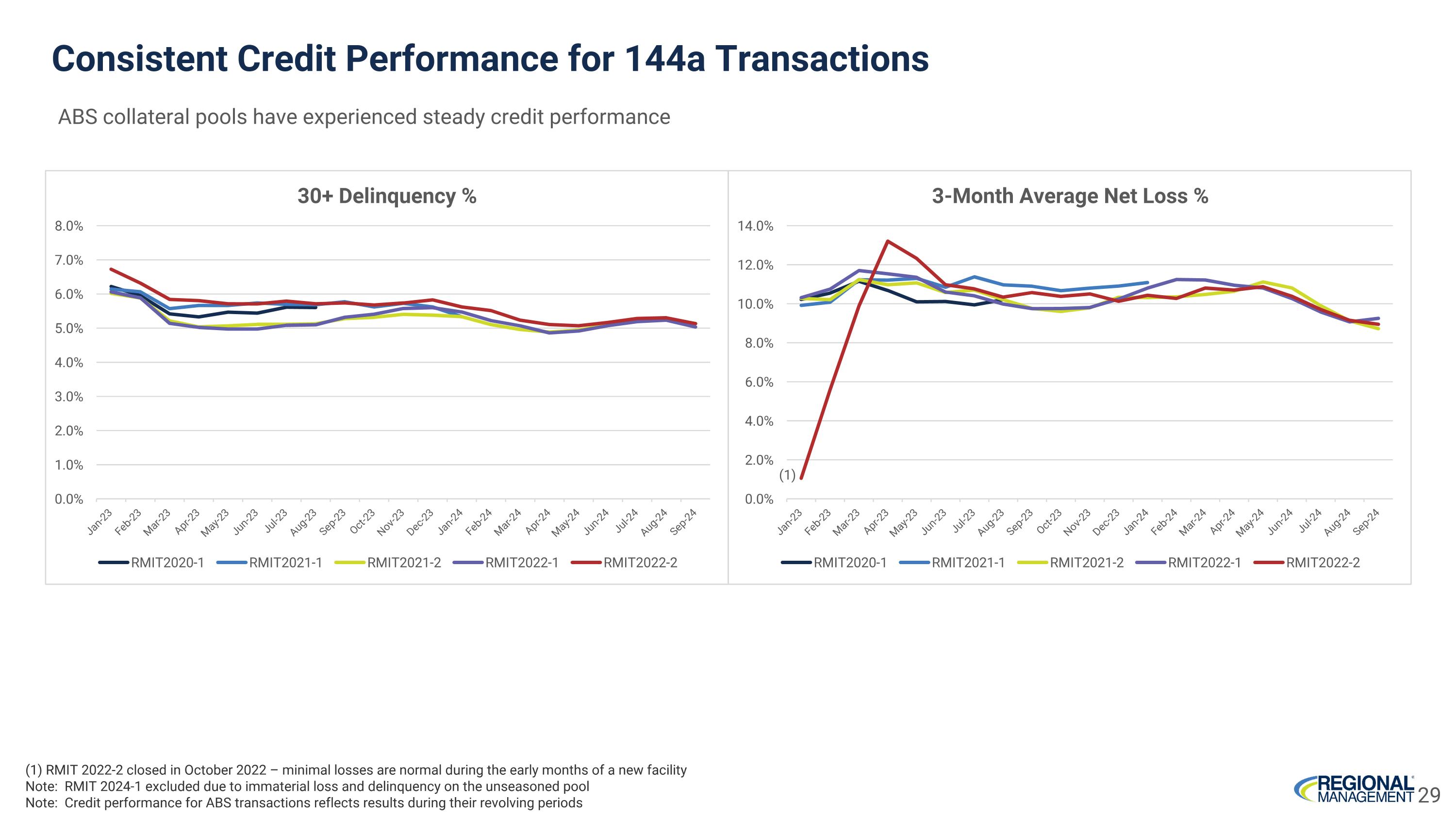

Consistent Credit Performance for 144a Transactions (1) RMIT 2022-2 closed in October 2022 – minimal losses are normal during the early months of a new facility Note: RMIT 2024-1 excluded due to immaterial loss and delinquency on the unseasoned pool Note: Credit performance for ABS transactions reflects results during their revolving periods ABS collateral pools have experienced steady credit performance (1) 29

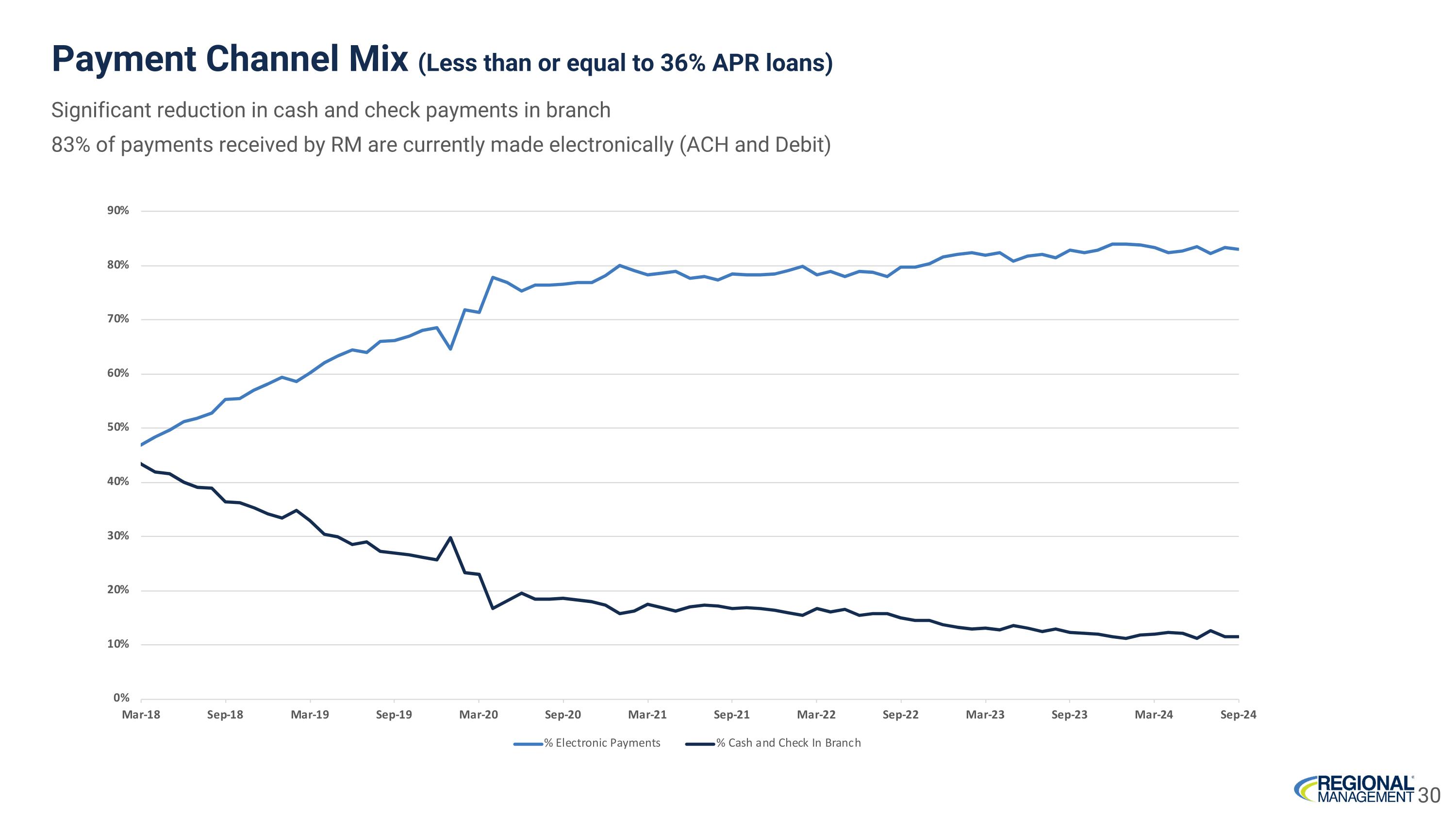

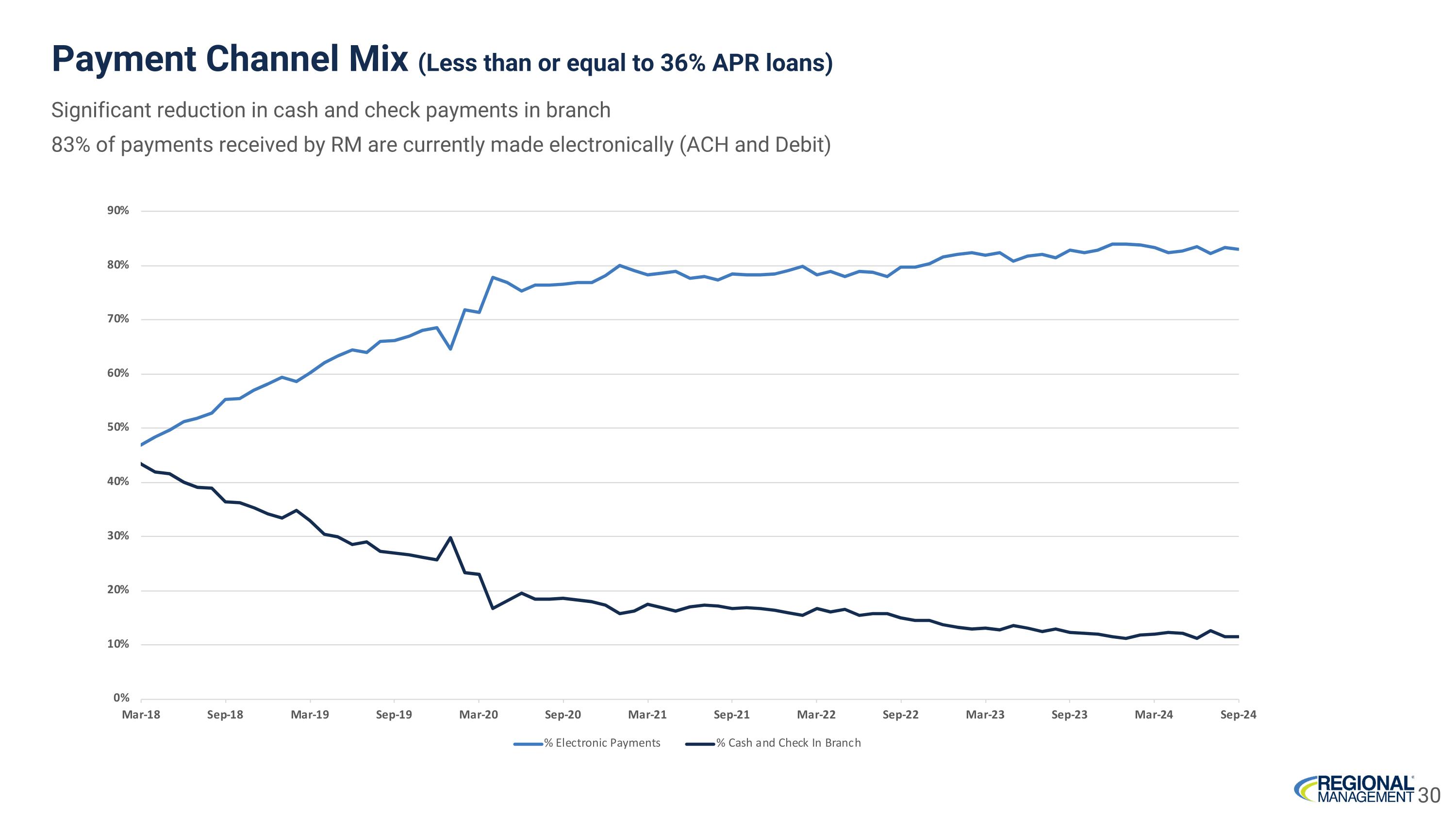

Payment Channel Mix (Less than or equal to 36% APR loans) Significant reduction in cash and check payments in branch 83% of payments received by RM are currently made electronically (ACH and Debit) 30

Appendix

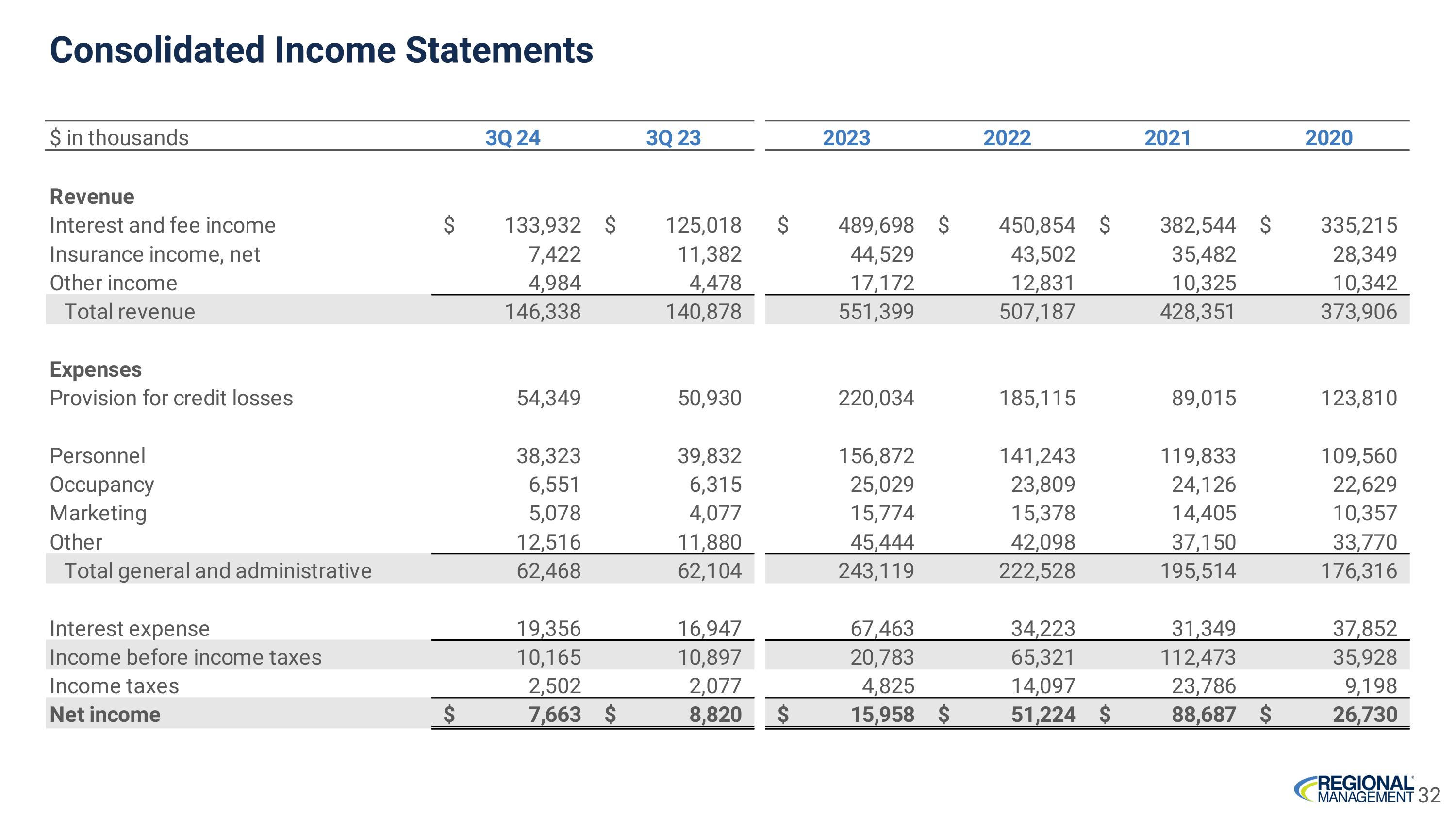

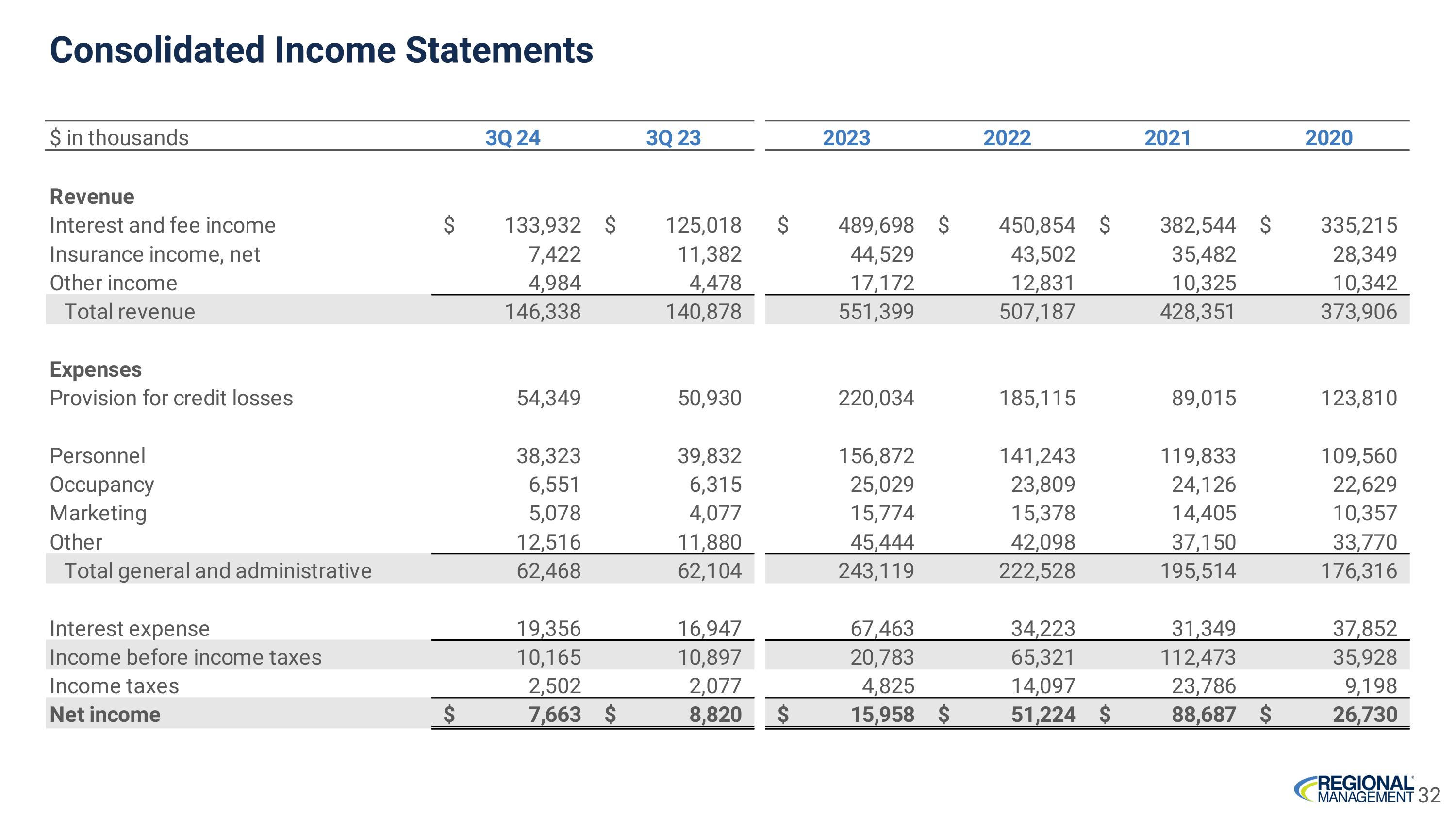

Consolidated Income Statements 32

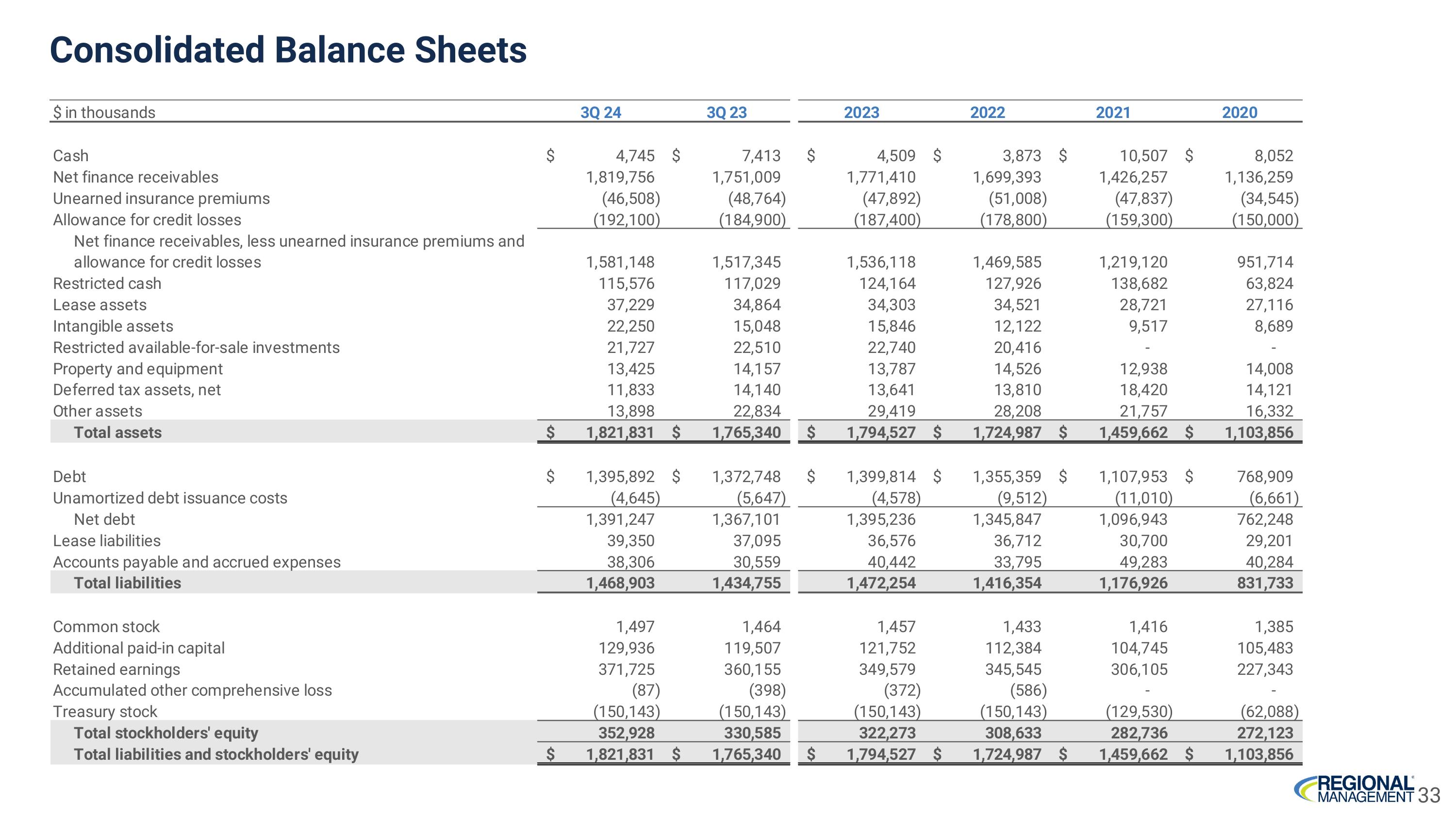

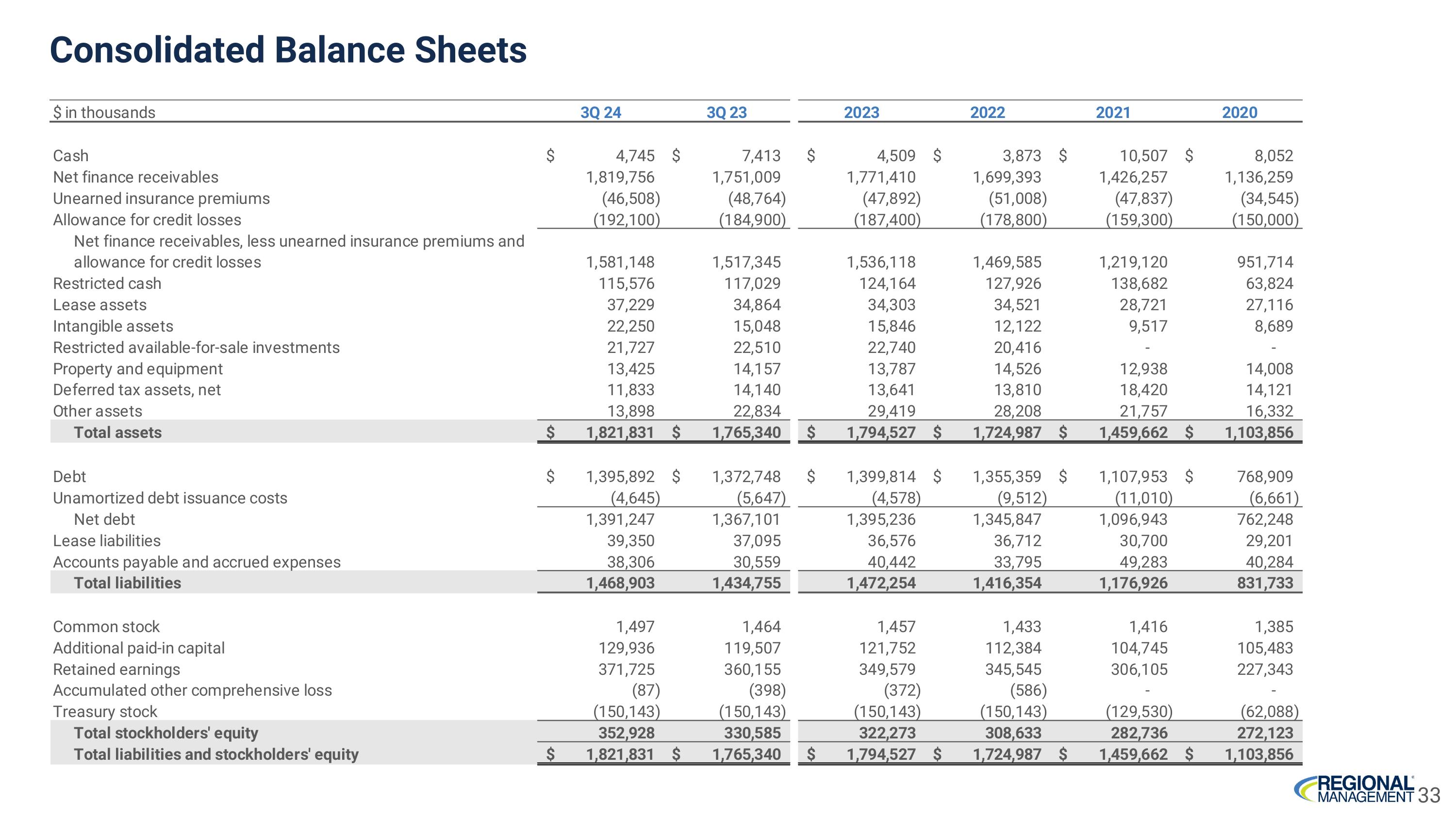

Consolidated Balance Sheets 33