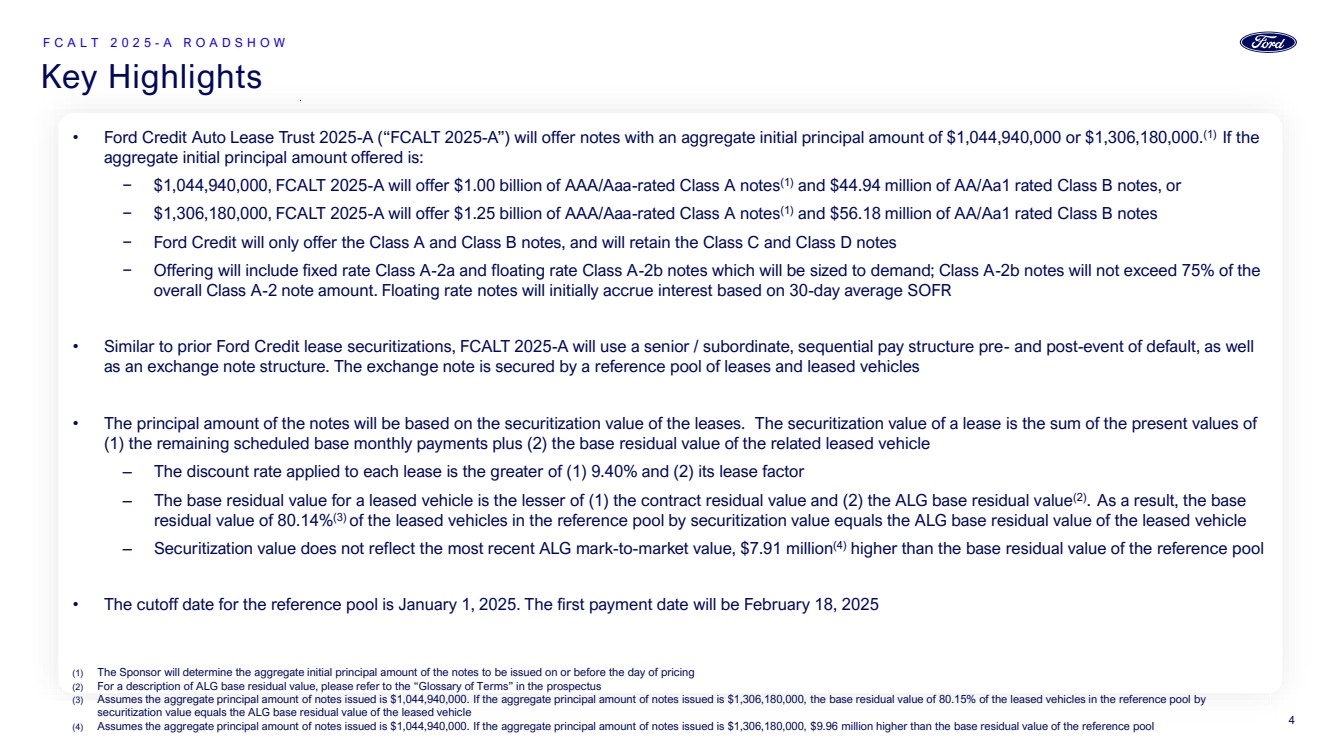

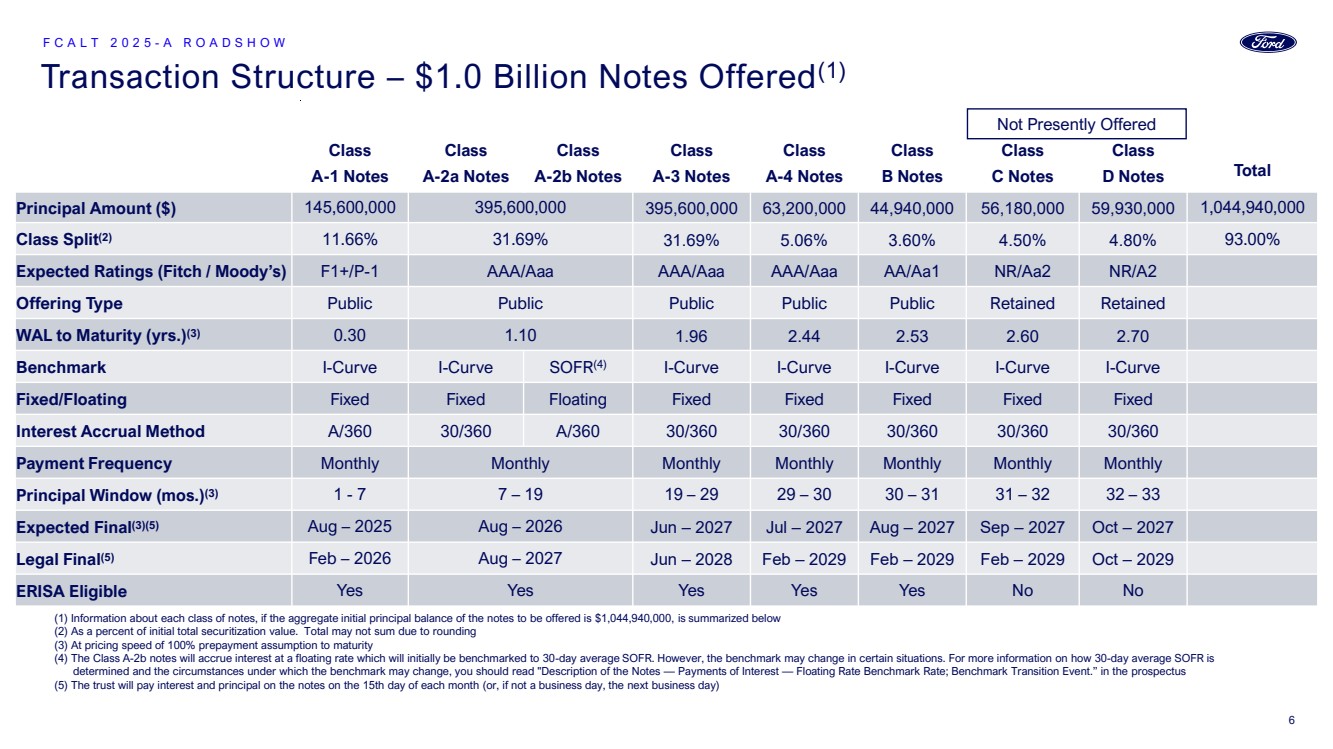

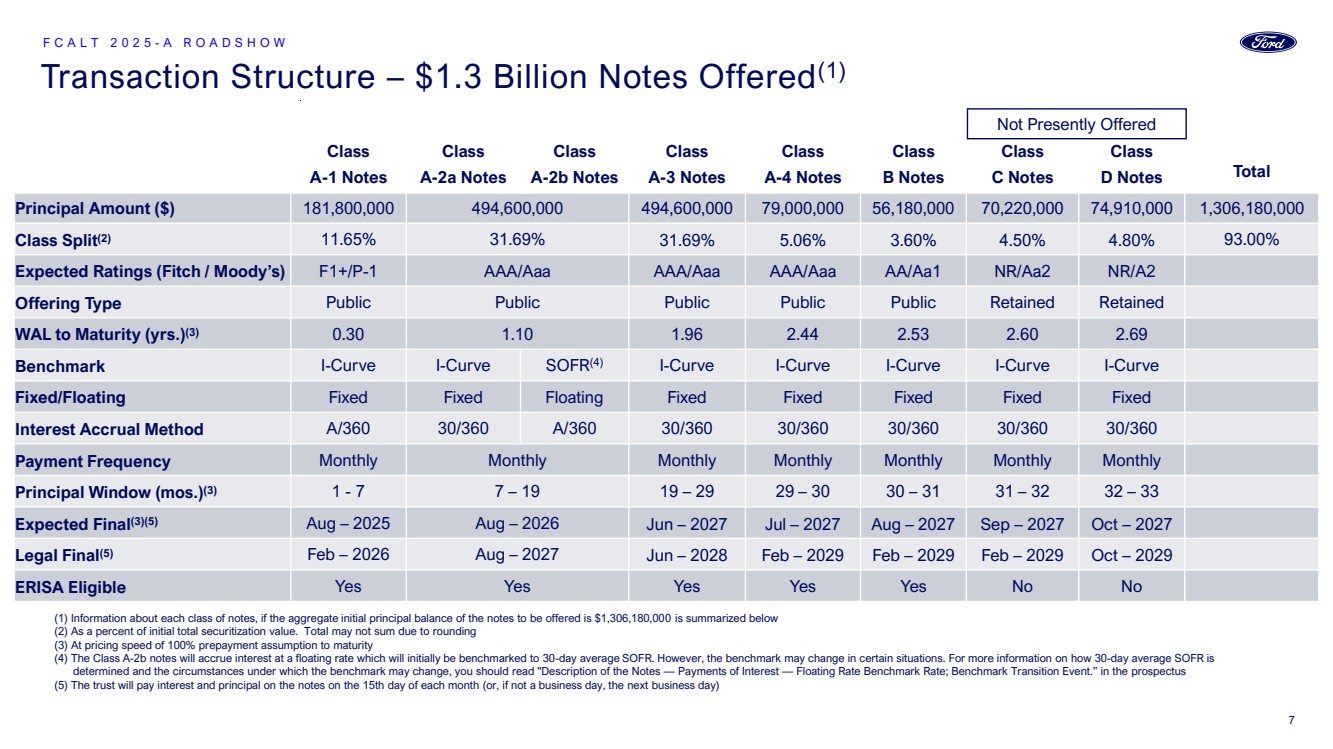

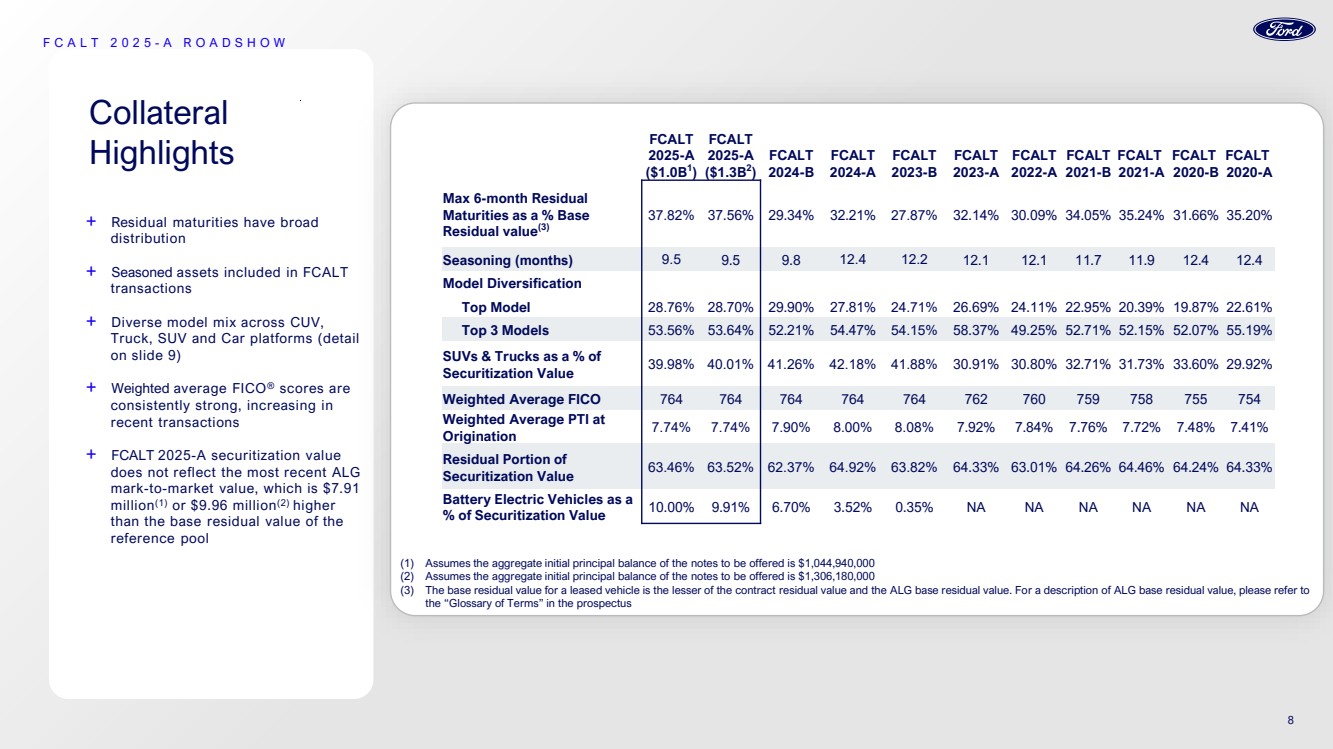

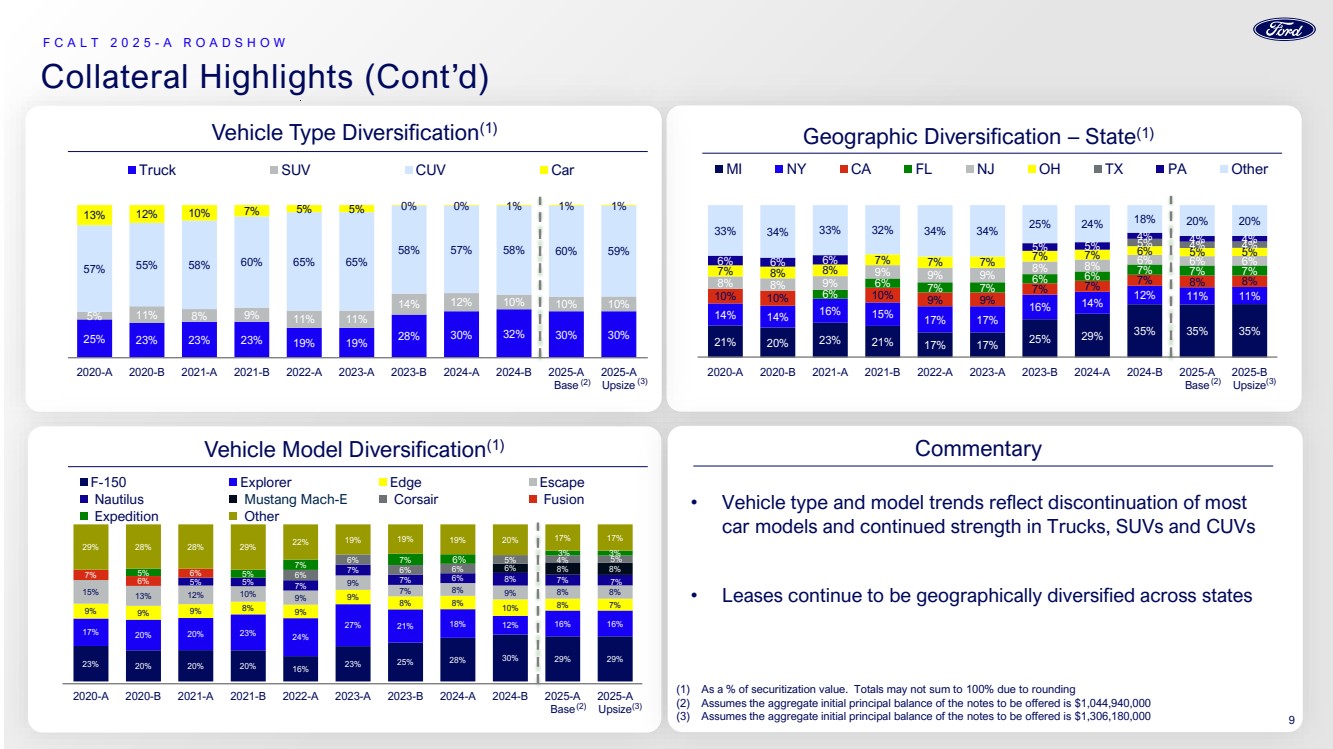

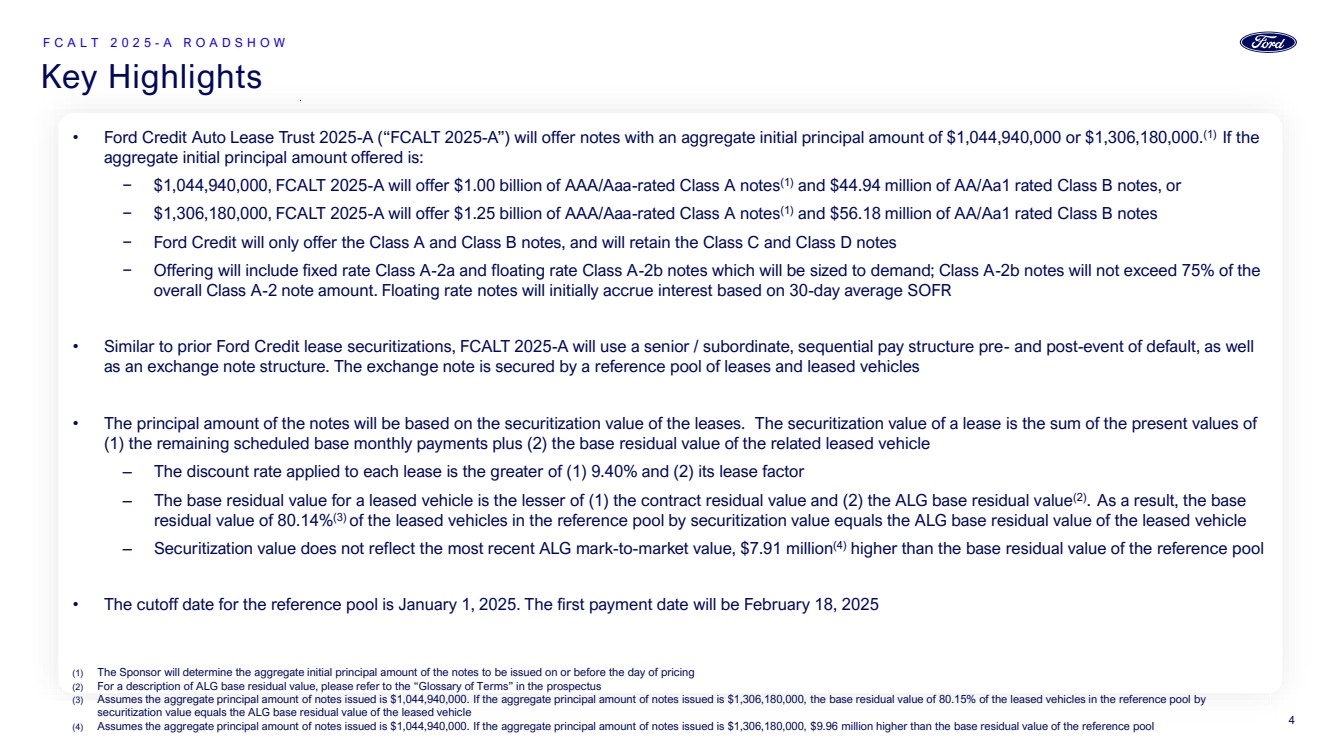

| Secret • Ford Credit Auto Lease Trust 2025-A (“FCALT 2025-A”) will offer notes with an aggregate initial principal amount of $1,044,940,000 or $1,306,180,000.(1) If the aggregate initial principal amount offered is: − $1,044,940,000, FCALT 2025-A will offer $1.00 billion of AAA/Aaa-rated Class A notes(1) and $44.94 million of AA/Aa1 rated Class B notes, or − $1,306,180,000, FCALT 2025-A will offer $1.25 billion of AAA/Aaa-rated Class A notes(1) and $56.18 million of AA/Aa1 rated Class B notes − Ford Credit will only offer the Class A and Class B notes, and will retain the Class C and Class D notes − Offering will include fixed rate Class A-2a and floating rate Class A-2b notes which will be sized to demand; Class A-2b notes will not exceed 75% of the overall Class A-2 note amount. Floating rate notes will initially accrue interest based on 30-day average SOFR • Similar to prior Ford Credit lease securitizations, FCALT 2025-A will use a senior / subordinate, sequential pay structure pre- and post-event of default, as well as an exchange note structure. The exchange note is secured by a reference pool of leases and leased vehicles • The principal amount of the notes will be based on the securitization value of the leases. The securitization value of a lease is the sum of the present values of (1) the remaining scheduled base monthly payments plus (2) the base residual value of the related leased vehicle ‒ The discount rate applied to each lease is the greater of (1) 9.40% and (2) its lease factor ‒ The base residual value for a leased vehicle is the lesser of (1) the contract residual value and (2) the ALG base residual value (2) . As a result, the base residual value of 80.14%(3) of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle ‒ Securitization value does not reflect the most recent ALG mark-to-market value, $7.91 million(4) higher than the base residual value of the reference pool • The cutoff date for the reference pool is January 1, 2025. The first payment date will be February 18, 2025 Key Highlights F C A L T 2025 - A R O A D S H O W (1) The Sponsor will determine the aggregate initial principal amount of the notes to be issued on or before the day of pricing (2) For a description of ALG base residual value, please refer to the “Glossary of Terms” in the prospectus (3) Assumes the aggregate principal amount of notes issued is $1,044,940,000. If the aggregate principal amount of notes issued is $1,306,180,000, the base residual value of 80.15% of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle (4) Assumes the aggregate principal amount of notes issued is $1,044,940,000. If the aggregate principal amount of notes issued is $1,306,180,000, $9.96 million higher than the base residual value of the reference pool 4 |