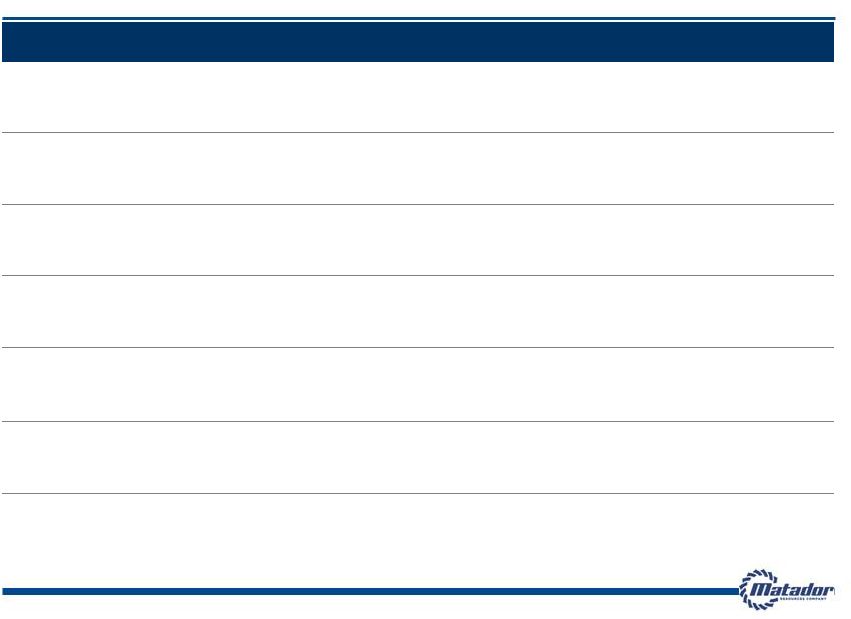

Year Ended December 31, (In thousands) 2007 2008 2009 2010 2011 2010 2011 2012 Unaudited Adjusted EBITDA reconciliation to Net Income (Loss): Net (loss) income ($300) $103,878 ($14,425) $6,377 ($10,309) ($984) $7,153 ($6,676) Interest expense - - - 3 683 - 184 1 Total income tax provision (benefit) - 20,023 (9,925) 3,521 (5,521) (516) (46) (3,713) Depletion, depreciation and amortization 7,889 12,127 10,743 15,596 31,754 3,702 8,180 19,914 Accretion of asset retirement obligations 70 92 137 155 209 30 57 58 Full-cost ceiling impairment - 22,195 25,244 - 35,673 - - 33,205 Unrealized loss (gain) on derivatives 211 (3,592) 2,375 (3,139) (5,138) 2,821 (332) (15,114) Stock option and grant expense 205 605 622 824 2,362 154 117 41 Restricted stock grants 15 60 34 74 44 7 11 150 Net loss (gain) on asset sales and inventory impairment - (136,977) 379 224 154 - - 60 Adjusted EBITDA $8,090 $18,411 $15,184 $23,635 $49,911 $5,216 $15,324 $27,926 Year Ended December 31, (In thousands) 2007 2008 2009 2010 2011 2010 2011 2012 Unaudited Adjusted EBITDA reconciliation to Net Cash Provided by Operating Activities: Net cash provided by operating activities $7,881 $25,851 $1,791 $27,273 $61,868 $24,624 $6,799 $46,416 Net change in operating assets and liabilities 209 (17,888) 15,717 (2,230) (12,594) (19,408) 8,387 (18,491) Interest expense - - - 3 683 - 184 1 Current income tax provision (benefit) - 10,448 (2,324) (1,411) (46) - (46) - Adjusted EBITDA $8,090 $18,411 $15,184 $23,635 $49,911 $5,216 $15,324 $27,926 Three Months Ended June 30, Three Months Ended June 30, 29 Adjusted EBITDA Reconciliation The following table presents our calculation of Adjusted EBITDA and reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively. We believe Adjusted EBITDA helps us evaluate our operating performance and compare our results of operation from period to period without regard to our financing methods or capital structure. We define Adjusted EBITDA as earnings before interest expense, income taxes, depletion, depreciation and amortization, accretion of asset retirement obligations, property impairments, unrealized derivative gains and losses, certain other non-cash items and non-cash stock-based compensation expense, including stock option and grant expense and restricted stock and restricted stock units expense, and net gain or loss on asset sales and inventory impairment. Adjusted EBITDA is not a measure of net income (loss) or cash flows as determined by GAAP. Adjusted EBITDA should not be considered an alternative to, or more meaningful than, net income or cash flows from operating activities as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. |