June 2014 Investor Presentation NYSE: MTDR

2 Disclosure Statements Safe Harbor Statement – This presentation and statements made by representatives of Matador Resources Company (“Matador” or the “Company”) during the course of this presentation include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. “Forward-looking statements” are statements related to future, not past, events. Forward-looking statements are based on current expectations and include any statement that does not directly relate to a current or historical fact. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “could,” “believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “should,” “continue,” “plan,” “predict,” “potential,” “project” and similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Actual results and future events could differ materially from those anticipated in such statements, and such forward-looking statements may not prove to be accurate. These forward- looking statements involve certain risks and uncertainties, including, but not limited to, the following risks related to Matador’s financial and operational performance: general economic conditions; Matador’s ability to execute its business plan, including whether Matador’s drilling program is successful; changes in oil, natural gas and natural gas liquids prices and the demand for oil, natural gas and natural gas liquids; Matador’s ability to replace reserves and efficiently develop its current reserves; Matador’s costs of operations, delays and other difficulties related to producing oil, natural gas and natural gas liquids; Matador’s ability to make acquisitions on economically acceptable terms; availability of sufficient capital to execute Matador’s business plan, including from its future cash flows, increases in Matador’s borrowing base and otherwise; weather and environmental conditions; and other important factors which could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. For further discussions of risks and uncertainties, you should refer to Matador’s SEC filings, including the “Risk Factors” section of Matador’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. Matador undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after the date of this presentation, except as required by law, including the securities laws of the United States and the rules and regulations of the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. Cautionary Note – The Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves. Potential resources are not proved, probable or possible reserves. The SEC’s guidelines prohibit Matador from including such information in filings with the SEC. Definitions – Proved oil and natural gas reserves are the estimated quantities of oil and natural gas that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. Matador’s production and proved reserves are reported in two streams: oil and natural gas, including both dry and liquids-rich natural gas. Where Matador produces liquids-rich natural gas, the economic value of the natural gas liquids associated with the natural gas is included in the estimated wellhead natural gas price on those properties where the natural gas liquids are extracted and sold. Estimated ultimate recovery (EUR) is a measure that by its nature is more speculative than estimates of proved reserves prepared in accordance with SEC definitions and guidelines and is accordingly less certain.

Company Summary

Founded by Joe Foran in 1983 – most participants are still shareholders today. Foran Oil funded with $270,000 in contributed capital from 17 friends and family members Sold to Tom Brown, Inc.(1) in June 2003 for an enterprise value of $388 million in an all-cash transaction Foran Oil & Matador Petroleum 4 Matador History Matador Resources Company Founded by Joe Foran in 2003 with $6 million and a proven management and technical team and board of directors Grown entirely through the drill bit, with focus on unconventional reservoir plays, initially in Cotton Valley and Haynesville In 2008, sold Haynesville rights in approximately 9,000 net acres to Chesapeake for approximately $180 million; retained 25% participation interest, carried working interest and overriding royalty interest Redeployed capital into the Eagle Ford early in the play, acquiring over 30,000 net acres for approximately $100 million, mainly in 2010 and 2011 2012, 2013 and 2014E capital spending focused primarily on developing Eagle Ford and transitioning to oil IPO in February 2012 (NYSE: MTDR) at $12.00 (now $24.65)(2) had net cash proceeds of approximately $136 million Follow-on Offering in September 2013 at $15.25 (now $24.65)(2) had net cash proceeds of approximately $142 million Follow-on Offering in May 2014 at $24.25 (now $24.65)(2) had net cash proceeds of approximately $181 million Predecessor Entities (1) Tom Brown acquired by Encana in 2004. (2) As of May 23, 2014. Matador Today

5 Company Overview Exchange: Ticker NYSE: MTDR Shares Outstanding(1) 73.3 million common shares Share Price(2) $24.65/share Market Capitalization(1)(2) $1.8 billion (1) Shares outstanding as reported in the Form 10-Q for the quarter ended March 31, 2014 filed on May 7, 2014, plus an additional 7.5 million shares issued pursuant to an underwritten public offering that is expected to close on May 29, 2014. (2) As of May 23, 2014. (3) As of May 6, 2014 except for capital spending which was updated to $570 million as of May 22, 2014. (4) As of May 6, 2014, the Company guided investors to the top end of its oil production guidance range. (5) Estimated 2014 oil and natural gas revenues and Adjusted EBITDA based on production guidance range. Estimated average realized prices for oil and natural gas used in these estimates were $95.00/Bbl and $5.00/Mcf, respectively, for the period April through December 2014. (6) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. 2012 Actual 2013 Actual 2014 Guidance(3) Capital Spending $335 million $374 million $570 million Total Oil Production 1.214 million Bbl 2.133 million Bbl 2.8 to 3.1 million Bbl(4) Total Natural Gas Production 12.5 Bcf 12.9 Bcf 16.0 to 17.5 Bcf Oil and Natural Gas Revenues $156.0 million $269.0 million $380 to $400 million(5) Adjusted EBITDA(6) $115.9 million $191.8 million $270 to $290 million(5)

Matador’s Execution History – “Doing What We Say” Oil Production 414 Bbl/d of oil 6% oil 4,916 Bbl/d of oil 46% oil 7,344 Bbl/d of oil 62% oil Proved Reserves 27 MMBOE 1.1 MMBbl of oil 4% oil 39 MMBOE 12.1 MMBbl of oil 31% oil 55 MMBOE 16.9 MMBbl of oil 31% oil PV-10(2) $155.2 million 24% of PV-10 in Eagle Ford $522.3 million 90% of PV-10 in Eagle Ford $739.8 million 72% of PV-10 in Eagle Ford LTM Adjusted EBITDA(3) $50 million(4) $148 million $207 million Acreage ~7,500 net Permian acres ~32,900 net Permian acres ~56,200 net Permian acres(10) Enterprise Value (“EV”)(5) $0.65 billion(6) $1.2 billion(8) $2.1 billion(11) 12x growth in oil production 11x growth in oil reserves ~200% growth Doubled EV Over 4x growth in Permian acres 6 At IPO(1) Follow-On(7) Over 3x growth in PV-10 (1) Unless otherwise noted, at or for the nine months ended September 30, 2011. (2) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. (3) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (4) For the twelve months ended December 31, 2011. (5) Enterprise value equals market capitalization plus borrowings under our revolving credit agreement. (6) As of February 7, 2012 at time of IPO. (7) Unless otherwise noted, at or for the three months ended June 30, 2013. (8) As of September 1, 2013. (9) Unless otherwise noted, at or for the three months ended March 31, 2014. (10) As of May 6, 2014. (11) As of May 23, 2014. ~50% growth in oil production ~40% growth in oil reserves ~40% growth ~75% EV growth 71% growth in Permian acres ~42% growth in PV-10 Today(9) Matador continues to execute on its core strategy of acquiring great assets, retaining a best-in-class workforce, maintaining a strong balance sheet and generating significant shareholder returns

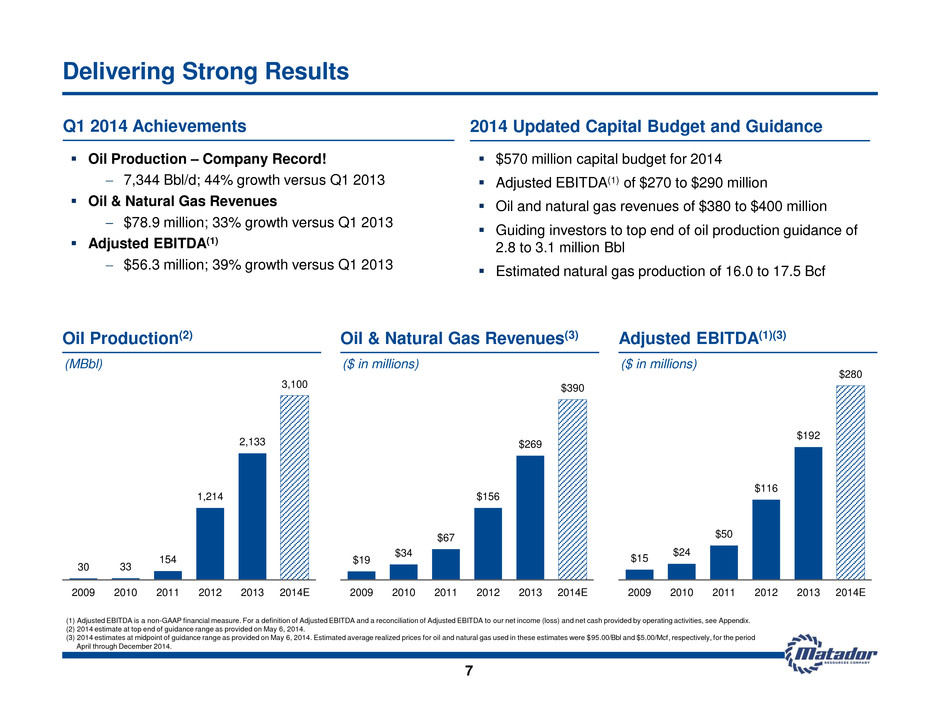

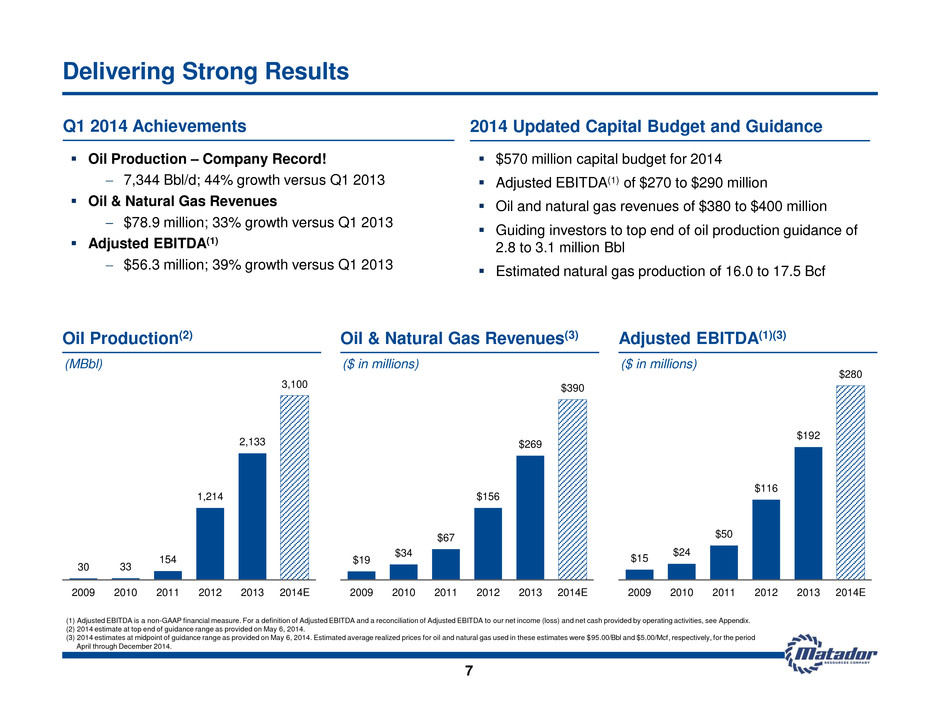

Delivering Strong Results 7 Q1 2014 Achievements Oil Production(2) 2014 Updated Capital Budget and Guidance Oil Production – Company Record! 7,344 Bbl/d; 44% growth versus Q1 2013 Oil & Natural Gas Revenues $78.9 million; 33% growth versus Q1 2013 Adjusted EBITDA(1) $56.3 million; 39% growth versus Q1 2013 $570 million capital budget for 2014 Adjusted EBITDA(1) of $270 to $290 million Oil and natural gas revenues of $380 to $400 million Guiding investors to top end of oil production guidance of 2.8 to 3.1 million Bbl Estimated natural gas production of 16.0 to 17.5 Bcf Oil & Natural Gas Revenues(3) Adjusted EBITDA(1)(3) (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (2) 2014 estimate at top end of guidance range as provided on May 6, 2014. (3) 2014 estimates at midpoint of guidance range as provided on May 6, 2014. Estimated average realized prices for oil and natural gas used in these estimates were $95.00/Bbl and $5.00/Mcf, respectively, for the period April through December 2014. (MBbl) ($ in millions) ($ in millions) $15 $24 $50 $116 $192 $280 2009 2010 2011 2012 2013 2014E $19 $34 $67 $156 $269 $390 2009 2010 2011 201 2013 2014E 30 33 154 1,214 2,133 3,100 2009 2010 2011 201 2013 2 14E

8 Matador Resources Company Overview Market Capitalization(1) $1.8 billion Average Daily Production(2) 11,904 BOE/d Oil (% total) 7,344 Bbl/d (62%) Natural Gas (% total) 27.4 MMcf/d (38%) Proved Reserves @ 3/31/14 54.6 million BOE % Proved Developed 34% % Oil 31% 2014E CapEx $570 million % South Texas ~56% % Oil and Liquids ~89% Gross Acreage(3) 231,737 acres Net Acreage(3) 145,672 acres Engineered Drilling Locations(4)(5) 1,112 gross / 570.8 net Eagle Ford 273 gross / 229.3 net Permian 241 gross / 177.7 net Haynesville/Cotton Valley 598 gross / 163.8 net (1) Market capitalization based on shares outstanding as reported in the Form 10-Q for the three months ended March 31, 2014 filed on May 7, 2014, plus an additional 7.5 million shares issued pursuant to an underwritten public offering that is expected to close on May 29, 2014, and closing share price as of May 23, 2014. (2) Average daily production for the three months ended March 31, 2014. (3) At May 6, 2014. (4) Presented as of December 31, 2013. (5) Identified and engineered Tier 1 and Tier 2 locations identified for potential future drilling, including specified production units and estimated lateral lengths, costs and well spacing using objective criteria for designation.

Asset Highlights 9 Completion of equity offering will provide capital to continue two-rig drilling program (177.7 net drilling locations(1)) ~56,200 net acres(2) in Lea and Eddy Counties, NM and Loving County, TX in the Permian Basin with multi-zone drilling potential Successful performance of 3 initial horizontal wells Ranger 33: 87,000 BOE (91% oil) in first 6 months; producing 450 to 500 Bbl/d of oil(3); shallower than expected decline Dorothy White: 100,000 BOE in about 4 months; producing 900 BOE/d (1.8 MMcf/d of natural gas and 600 Bbl/d of oil)(3); shallower than expected decline Rustler Breaks: Recently connected to natural gas pipeline; flowing at 1,160 BOE/d (560 Bbl/d of oil and 3.6 MMcf/d of natural gas)(3) Currently running a 2 “walking” rig drilling program in South Texas (229.3 net drilling locations(1)) Net oil production of ~6,400 Bbl/d in Q1 2014 (up 27% as compared to Q1 2013)(4) ~28,400 net acres(3) primarily located in the oil window Estimated CapEx of $318 million in 2014 (56% of total) Expect batch drilling operations to continue to improve drilling times and costs Fracture stimulation techniques continue to improve Gas lift operations adding value and reducing costs Continuing to acquire new leasehold interests at attractive prices to replace developed acreage and replenish inventory Encouraging 40-acre downspacing results ~25,100 net acres in NW Louisiana and East Texas(3)(5) ~6,900 net Tier 1 acres in the core of the play with 6 to 12 Bcf EURs Estimated ROR ranges from 60% to 100% at $4.50/Mcf and above in Elm Grove area Increased industry activity as a result of higher natural gas prices leading to additional non-operated participation opportunities Expect 56 gross (7.8 net) non- operated wells to be drilled on Matador’s acreage in 2014(6) Anticipate Chesapeake to drill up to 30 gross (6.3 net) Haynesville wells in Elm Grove area in 2014 Permian Basin Exploratory Program Eagle Ford Shale Development Program Haynesville Shale Natural Gas Bank Applying our Expertise (1) As of December 31, 2013. (2) At May 6, 2014. Includes small amounts of acreage in Reeves, Ward, Howard and Dawson Counties, TX. (3) As of or at May 6, 2014. (4) Includes two wells producing small quantities of oil from the Austin Chalk formation and two wells producing small quantities of natural gas from the San Miguel formation in Zavala County, Texas. (5) Includes acreage prospective for Cotton Valley. (6) Includes 26 gross (1.5 net) non-operated wells accounted for in original $440 million 2014 capital expenditure budget and 30 gross (6.3 net) wells operated by Chesapeake not accounted for in original $440 million capital expenditure budget.

Keys to Matador’s Success 10 People We have a strong, committed technical and financial team in place, and we continue to make additions and improvements to our staff, our capabilities and our process Board and Special Advisor additions have strengthened Board skills and stewardship Properties Matador’s acreage positions and multi-year drilling inventory are significant and located in three of the industry’s best plays – Eagle Ford, Permian and Haynesville Our property mix provides us with a balanced opportunity set for both oil and natural gas Process Continuous improvement in all aspects of our business leading to better production and financial results and increased shareholder value Gaining experience in being a publicly-held company Execute Increase oil production from 2.1 million barrels of oil to 3.1 million barrels of oil Maintain quality acreage position in the Eagle Ford, Permian and Haynesville Maintain strong financial position, technical team and approach

Eagle Ford South Texas

2014 South Texas Plan Details 12 2014 projected capital expenditures of ~$318 million or ~56% of total 2-rig program with almost all of the 2014 South Texas capital budget directed to the Eagle Ford shale Drill and/or complete or participate in 50 gross (47.0 net) wells; 43 gross (40.0 net) wells turned to sales 2014 Eagle Ford program is development drilling, with most locations planned at 40-acre spacing No Upper Eagle Ford tests currently planned for 2014 Key objectives of 2014 South Texas plan Further improvement in operational efficiencies and well performance in the Eagle Ford Batch drilling to continue reducing drilling times and costs; picked up second “walking” rig Continue to improve and optimize stimulation operations – increased fluid and proppant volumes, reduced cluster spacing and additional stages, as needed Continue to optimize artificial lift program – gas lift to rod pump implementations Reduce LOE throughout all properties Successful implementation of 40-acre downspacing across acreage position Continue to add to acreage position as opportunities arise, particularly in and near existing properties

13 Eagle Ford Overview (1) At December 31, 2013. Includes two wells producing small volumes of oil from the Austin Chalk formation and two wells producing small quantities of natural gas from the San Miguel formation in Zavala County, Texas. (2) For the twelve months ended December 31, 2011. (3) For the three months ended March 31, 2014. (4) Presented as of December 31, 2013. (5) Identified and engineered Tier 1 and Tier 2 locations identified for potential future drilling, including specified production units and estimated lateral lengths, costs and well spacing using objective criteria for designation. (6) At May 6, 2014. Proved Reserves @ 3/31/14 19.4 million BOE % Proved Developed 59% % Oil 74% Daily Oil Equivalent Production(3) 8,734 BOE/d (74% Oil) Gross Acres(6) 40,377 acres Net Acres(6) 28,405 acres 2014E CapEx Budget $318 million Engineered Drilling Locations(4)(5) 273 gross (229.3 net) Operations Summary 73 gross (63.3 net) wells(1) producing from the Eagle Ford An increase in oil production from ~330 Bbl/d(2) in 2011 to ~6,400 Bbl/d(3) 273 gross (229.3 net) engineered drilling locations identified for potential future drilling(4)(5) 2014 South Texas Drilling Plan Continuing a 2-rig program in the Eagle Ford $318 million CapEx (including facilities, land and seismic) Drill 50 gross wells (45 operated) Complete 45 gross wells (43 operated) Turn 43 gross wells to sales (38 operated) Approximately 5 to 10% of yearly production capacity shut-in during 2014

14 Eagle Ford Well Costs and Estimated Ultimate Recovery (“EUR”) Note: All acreage at May 6, 2014. EURs represent typical range of results over last 12 months by area. Well costs reflect actual costs of all 2013 wells by area. Karnes Uvalde Medina Zavala Frio Dimmit La Salle Webb Atascosa McMullen Live Oak Bee Goliad Dewitt Gonzales Wilson Matador Resources Acreage San Antonio Glasscock Ranch Shelton Newman Martin Ranch Northcut Affleck Troutt Sutton MRC/EOG Pawelek Danysh Sickenius Lyssy Repka RCT Wilson Love Cowey Keseling Lewton Hennig Nickel Ranch Pena COMBO LIQUIDS / GAS FAIRWAY DRY GAS FAIRWAY OIL FAIRWAY EAGLE FORD “WEST” Measured Depth: 13,500’ – 14,500’ Well Costs: $6-7 million EUR: 300-500 MBOE EAGLE FORD “EAST” Measured Depth: 17,000’ – 18,000’ Well Costs: $8-10 million EUR: 600-1,000 MBOE EAGLE FORD “CENTRAL” Measured Depth: 15,500’ – 16,500’ Well Costs: $7-8 million EUR: 400-500 MBOE EAGLE FORD ACREAGE TOTALS 40,377 gross / 28,405 net acres ZLS Carroll Lloyd Hurt Sojourner

Overview 15 Operational Improvements (Normalized) Eagle Ford Drilling Costs / Drilled Foot(1) Eagle Ford Completion Costs / Completed Foot(2) West Central East West Central East Over the past two years, made significant progress and increased knowledge of how to drill, complete and produce Eagle Ford wells Experience and operational improvements have led to significant reductions in drilling and completion costs In 2013, began drilling from batch drilled pads using a drilling rig equipped with a “walking” package Realized cost savings of approx. $325,000 per well on initial wells drilled using this rig Expect the use of batch drilling and the “walking” rig will lead to total cost savings of approx. $400,000 per well or more going forward Note: “2014 YTD” – As of March 1, 2014. Year classification is based on spud date. (1) Drilled foot is the measured depth from surface to total depth. Excludes any/all wells drilled with a pilot hole, any/all wells drilled outside the West, Central and East and any/all wells drilled with three strings of casing. (2) Completed foot is the completed length of the lateral. Excludes any/all wells drilled with a pilot hole. Excludes any/all wells in the West and Central where premium proppant was used. $260 $203 2012 2013 $271 $258 $186 2011 2012 2013 $242 $209 $193 $153 2011 2012 2013 2014 YTD $1,280 $1,322 2012 2013 $1,132 $908 $845 2011 2012 2013 $1,129 $874 $854 2011 2012 2013

Gen 2 Gen 3 Gen 4 Gen 5 5,770 Bbl 7,825 Bbl 9,550 Bbl 11,750 Bbl 375 Mlbs 500 Mlbs 405 Mlbs 515 Mlbs 0 ft. 300 ft. 11,750 Bbl 650 Mlbs Gen 6 Evolution of Matador Eagle Ford Frac Design 16 Note: Figure depicts proppant and fluid volume pumped per 300 ft. of horizontal wellbore. (1) Mlbs = thousands of pounds of proppant pumped. Fluid Volume Pumped Proppant Pumped(1)

0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 120,000 0 20 40 60 80 100 120 140 160 180 200 220 240 260 280 300 320 340 360 Cum ula tiv e P ro du cti on (B bl) Time (Days) GEN 2 (80 Acre) GEN 4 (80 Acre) GEN 5 (80 Acre) 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 120,000 0 20 40 60 80 100 120 140 160 180 200 220 240 260 280 300 320 340 360 Cum ula tiv e P ro du cti on (B bl) Time (Days) GEN 2 (80 Acre) GEN 4 (80 Acre) GEN 5 (80 Acre) 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 120,000 0 20 40 60 80 100 120 140 160 180 200 220 240 260 280 300 320 340 360 Cum ula tiv e P ro du cti on (B bl) Time (Days) GEN 2 (80 Acre) GEN 4 (80 Acre) GEN 3 (80 Acre) 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 120,000 0 20 40 60 80 100 120 140 160 180 200 220 240 260 280 300 320 340 360 Cu mu lati ve Pr od ucti on (B bl) Time (Days) GEN 2 (80 Acre) GEN 5 (40 Acre) GEN 3 (80 Acre) 17 Frac Generation Comparison (all wells normalized to 5,000’ horizontal) EF “CENTRAL” EF “CENTRAL” EF “WEST” EF “WEST”

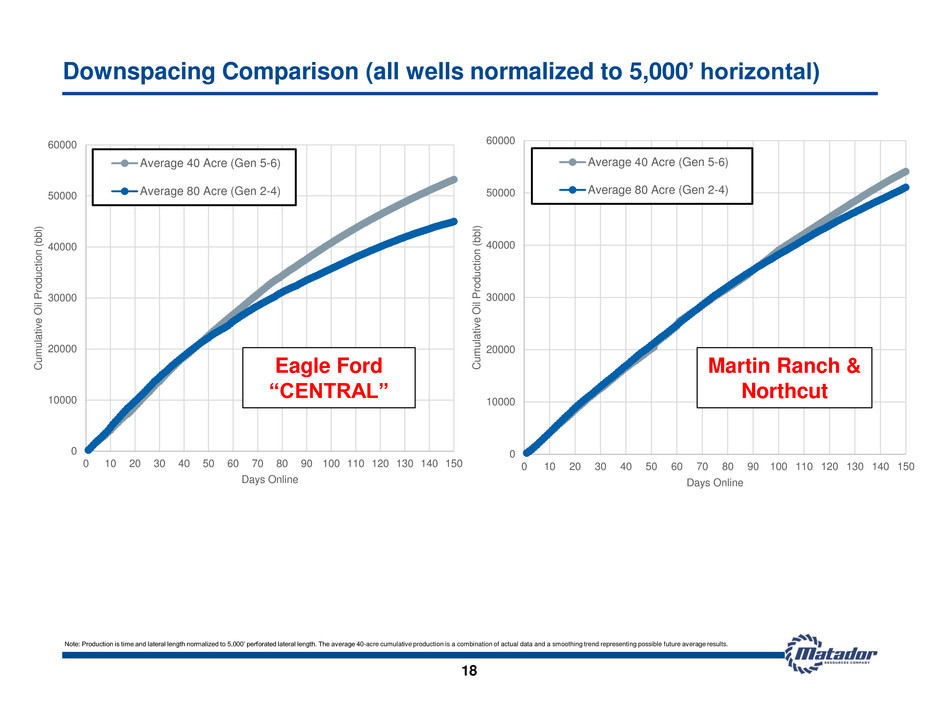

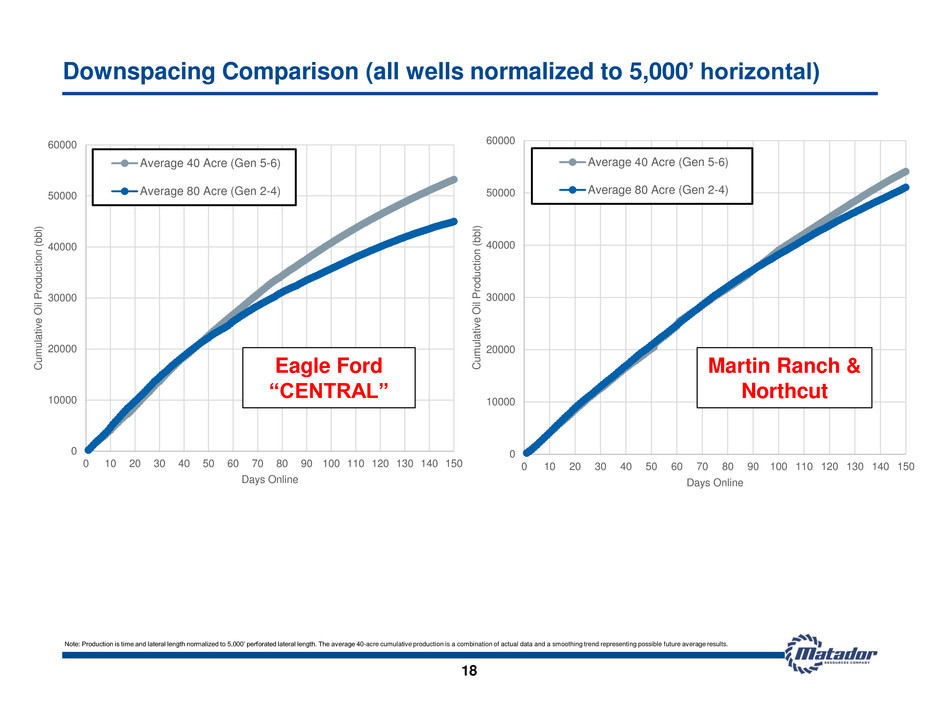

0 10000 20000 30000 40000 50000 60000 0 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 C u m u la ti v e Oil P ro d u c tio n ( b b l) Days Online Average 40 Acre (Gen 5-6) Average 80 Acre (Gen 2-4) 0 10000 20000 30000 40000 50000 60000 0 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 C u m u la ti v e Oil P ro d u c tio n ( b b l) Days Online Average 40 Acre (Gen 5-6) Average 80 Acre (Gen 2-4) 18 Downspacing Comparison (all wells normalized to 5,000’ horizontal) Eagle Ford “CENTRAL” Martin Ranch & Northcut Note: Production is time and lateral length normalized to 5,000’ perforated lateral length. The average 40-acre cumulative production is a combination of actual data and a smoothing trend representing possible future average results.

0 50,000 100,000 150,000 200,000 250,000 300,000 2014 2013 2012 2011 2010 Lateral Feet Drilled 19 La eral Fee Single Well Drilling PAD Drilling BATCH Drilling EXPLORATION DEVELOPMENT 1/3 RIG 2/3 RIG 2 RIGS 1 1/2 RIGS 2 RIGS 60 to 70% increase in Rig Efficiency from 2012 to 2014E! Improvement in Drilling Efficiency – Moving Towards Batch Drilling E

Compressing Drill Times Improving rig fleet High tech, fast moving, faster drilling, walking style rigs Improving Rate of Penetration (ROP) Bit selection and development Bottom Hole Assembly (BHA) selection Rotary steerable systems Vertical seeking Directional drilling Minimize directional work related to surface locations Utilization of Managed Pressure Drilling Development Phase Pre-setting surface casing Simultaneous operations 20

Progression of Drilling Rig Technology from 2010 to 2014 21 RIG # ELECTRIC 1600 HP PUMPS INTEGRATED TOP DRIVE APEX RIG (FAST MOVE) HYDRAULIC CATWALK AC DRIVE SYSTEM TECHNOLOGY ROUND BOTTOM MUD PITS WALKING PACKAGE BOP HANDLER THREE SHAKERS 521 135 534 203 250 239 279 Advancing Rig Technology

22 Flowing Rod Pumping Gas Lifting 300 Bbl/d 100 Bbl/d Accelerated Production Benefits of Gas Lift • Accelerates production • Reduces LOE • Lower maintenance • Helps wells recover faster from offset fracs Artificial Lift Time Note: Graph and data is for illustrative purposes only and not meant to reflect historical or forecasted data from actual well.

Blackbrush O&G 10 Buda Completions May 2011 – Feb. 2014 Cum: 240 MBbl 1.13 Bcf TX American Resources Buchanan-1H 5/3/2013 11 mo avg: 331 Bbl/d 526 Mcf/d Cum: 109 MBbl 1.7 Bcf Dan A. Hughes Heitz Lease 4 Buda Completions Dec. 2011 – Feb. 2014 Cum: 900 MBbl 1.58 Bcf Crimson Exploration Beeler-6H Spud on 2-13-14 Peak early 24-hr flow back rate of 1,185 BOE/d (91% oil yield) Buda Wells Activity Since January 1, 2010 – Potential Test 23 Pearsall Field and Pearsall Arch Note: Well information from public sources as of April 2014. Blackbrush O&G Oppenheimer-101H Comp May 2013 11 mo avg: 165 Bbl/d 440 Mcf/d Cum: 55 MBbl 145,206 Mcf Matador Resources Acreage Trend of Austin Chalk and Buda Production

Buda Productive Area Glasscock Ranch Seismic Mapping of Natural Fracture Trends Note: Well information from public sources as of March 2014. 24 TX American Resources Buchanan-1H 5/3/2013 IP: 756 Bbl/d 556 Mcf/d 11 mo.cum: 109 MBbl 1.7 Bcf Glasscock Ranch – Frio South Survey: Amplitude at Time Slice Near Top Buda Dan A. Hughes Heitz Lease 4 Buda Completions Dec. 2011 – Feb. 2014 Cum: 900 MBbl 1.58 Bcf Crimson Exploration Beeler-4H Oct. 2013 – Feb. 2014 Avg: 580 Bbl/d 5 mo.cum: 87 MBbl Wireline log results from MTDR Glasscock Ranch #2H delineation well indicates fracture trends consistent with structure and amplitude trends observed in 3-D seismic data acquired by Matador in 2013. Special seismic attribute analyses are currently underway to determine fracture trends and intensity of fracture frequency.

Permian Basin Southeast New Mexico and West Texas

26 2014 projected capital expenditures of ~$190 million or ~33% of total Continue 2-rig program working in Lea and Eddy Counties, NM and Loving County, TX Drill and/or complete or participate in 14 gross (12.3 net) wells; several Wolf area wells drilled with second Permian rig not on production until Q4 2014 or early 2015 Completion targets include various Bone Spring and Wolfcamp intervals across acreage position $80 million allocated to land, seismic and facilities Key objectives of Permian Basin plan Further evaluate our acreage position and completion targets to define an expanded development program for 2015 and beyond With success, prepare for potential multi-rig development program beginning in late 2014 or early 2015 Validate and convert acreage position to held by production (“HBP”) Leverage and transfer knowledge from Eagle Ford and Haynesville experience to improve operating efficiencies in the Permian Basin Continue to add to acreage position as opportunities arise, particularly in and near existing properties 2014 Permian Basin Plan Details

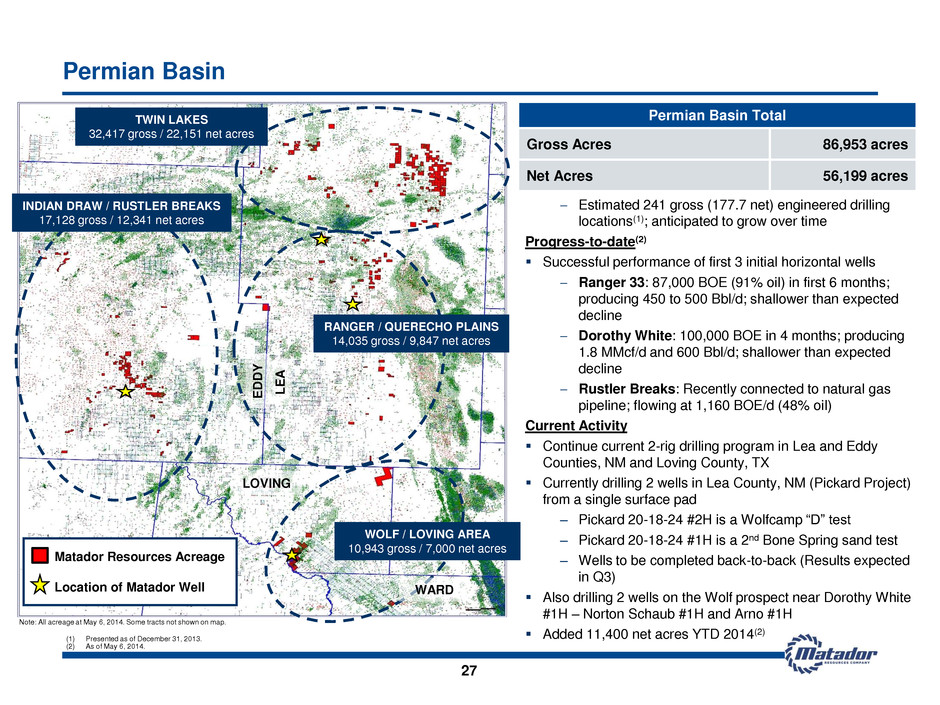

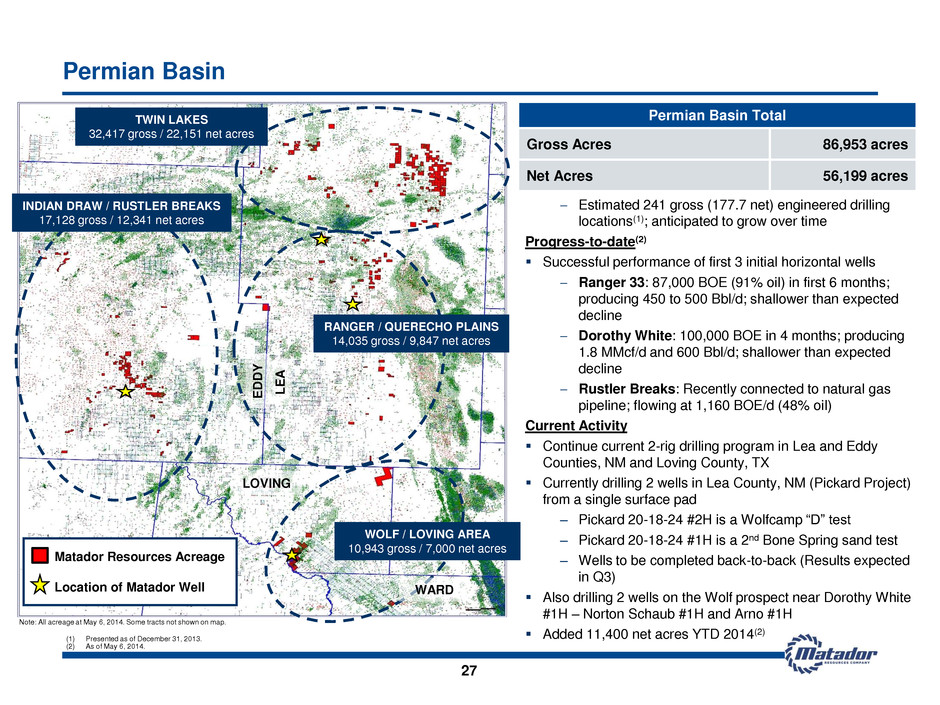

Permian Basin Total Gross Acres 86,953 acres Net Acres 56,199 acres Permian Basin (1) Presented as of December 31, 2013. (2) As of May 6, 2014. 27 Estimated 241 gross (177.7 net) engineered drilling locations(1); anticipated to grow over time Progress-to-date(2) Successful performance of first 3 initial horizontal wells Ranger 33: 87,000 BOE (91% oil) in first 6 months; producing 450 to 500 Bbl/d; shallower than expected decline Dorothy White: 100,000 BOE in 4 months; producing 1.8 MMcf/d and 600 Bbl/d; shallower than expected decline Rustler Breaks: Recently connected to natural gas pipeline; flowing at 1,160 BOE/d (48% oil) Current Activity Continue current 2-rig drilling program in Lea and Eddy Counties, NM and Loving County, TX Currently drilling 2 wells in Lea County, NM (Pickard Project) from a single surface pad – Pickard 20-18-24 #2H is a Wolfcamp “D” test – Pickard 20-18-24 #1H is a 2nd Bone Spring sand test – Wells to be completed back-to-back (Results expected in Q3) Also drilling 2 wells on the Wolf prospect near Dorothy White #1H – Norton Schaub #1H and Arno #1H Added 11,400 net acres YTD 2014(2) Note: All acreage at May 6, 2014. Some tracts not shown on map. E D D Y L E A LOVING Matador Resources Acreage Location of Matador Well WARD TWIN LAKES 32,417 gross / 22,151 net acres INDIAN DRAW / RUSTLER BREAKS 17,128 gross / 12,341 net acres RANGER / QUERECHO PLAINS 14,035 gross / 9,847 net acres WOLF / LOVING AREA 10,943 gross / 7,000 net acres

2014 Wells Drilled Targeting Multiple Benches in Permian Appraisal Program 28 Sand Carbonates (Limestones and Dolomites) Shale/ Mudstone Bone Spring Lime Upper Avalon Shale Lower Avalon Shale First Bone Spring Sand Second Bone Spring Carbonate Second Bone Spring Sand Third Bone Spring Carbonate Wolfcamp “D” Strawn Wolfcamp “A” Wolfcamp “B” Wolfcamp “C” Third Bone Spring Sand GR RES Brushy Canyon Sand Pickard 20-18-24 #2H (Awaiting Completion) Rustler Breaks 12-24-27 #1H (1,160 BOE/d(1)) Dorothy White #1H (100,000 BOE in 4 mo.(1)) Ranger 33 State Com #1H (87,000 BOE in 6 mo. (1)) Matador has successfully drilled four horizontal wells targeting separate Bone Spring and Wolfcamp benches Potential Future Targets (1) As of May 6, 2014.

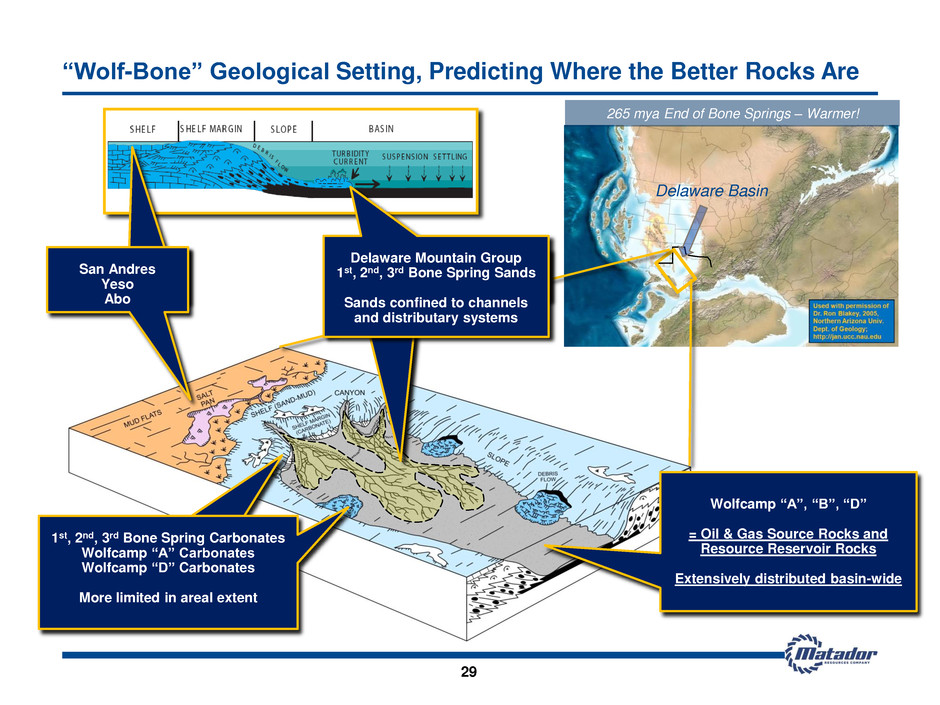

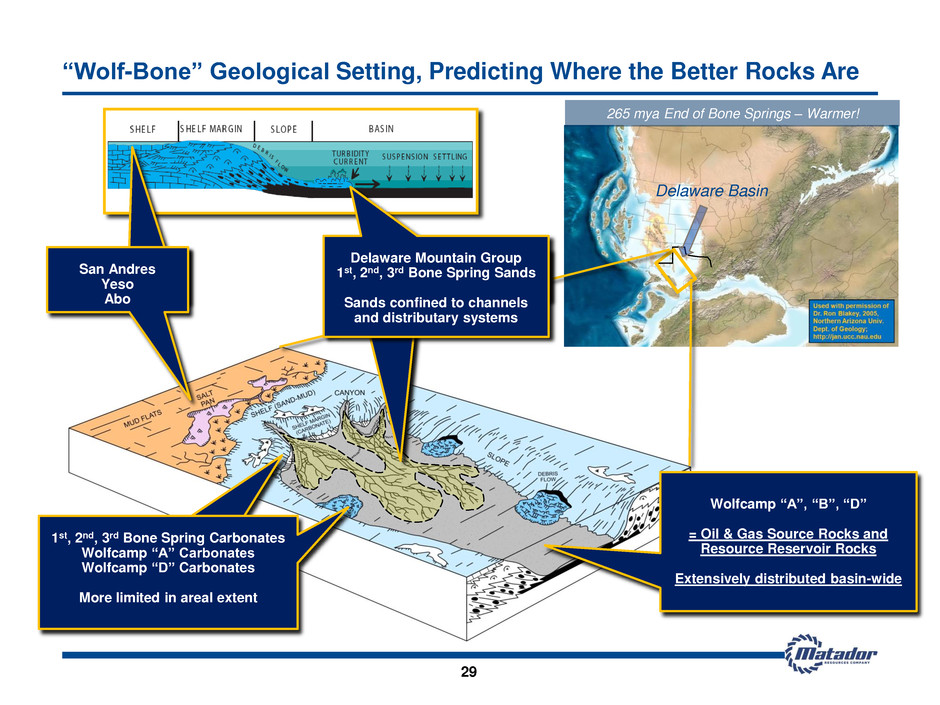

265 mya End of Bone Springs – Warmer! Delaware Basin San Andres Yeso Abo Delaware Mountain Group 1st, 2nd, 3rd Bone Spring Sands Sands confined to channels and distributary systems 1st, 2nd, 3rd Bone Spring Carbonates Wolfcamp “A” Carbonates Wolfcamp “D” Carbonates More limited in areal extent Wolfcamp “A”, “B”, “D” = Oil & Gas Source Rocks and Resource Reservoir Rocks Extensively distributed basin-wide “Wolf-Bone” Geological Setting, Predicting Where the Better Rocks Are 29

DELAWARE BASIN CENTRAL BASIN PLATFORM MIDLAND BASIN Wolfcamp Simpson ~23,000’ Sediment Fill East West Source “Kitchens” Now Unconventional Resource Plays 70,000 square mile area Up to 25,000 feet of multiple, stacked, petroleum systems Extensive drilling, coring and geological studies since 1920s >1,500 conventional reservoirs with cumulative production > 1.0 million Bbl each Cumulative production from 1,500 conventional reservoirs, as of year 2000 (pre- horizontal drilling) > 30.0 billion Bbl(1) (1) Dutton et al, AAPG 2005 Permian Basin Petroleum Systems and the Wolfcamp “Kitchens” 30

Wolf / Loving Prospect Area 31 10,943 gross (7,000 net) acres 50 gross (35.4 net) locations(1) Primary Targets Wolfcamp “A” 3rd Bone Spring Avalon Other Potential Targets 1st Bone Spring 2nd Bone Spring Wolfcamp “B” 6 wells planned for 2014 Wolf Energy Wolf #1 (Vertical well) 3rd BS / Wolfcamp “A” 34 years cum: 61 MBbl; 642 MMcf OXY Reagan-McElvain #1H Wolfcamp “A” IP: 570 Bbl/d 2.6 MMcf/d 13 mo.cum: 120 MBbl; 315 MMcf Energen Grayling 1-69 #1H and 2H Wolfcamp “A” and “B”, resp. 17 mo.cum: 136 MBbl; 1 Bcf (commingled) Energen Black Mamba 1-57 Wolfcamp “A” 16 mo.cum: 273 MBbl; 718 MMcf Dorothy White #1H Wolfcamp “A” 4 mo.cum: 100,000 BOE (66% oil) Loving Matador Resources Acreage Norton Schaub #1H Wolfcamp “A” Awaiting Completion Arno #1H Wolfcamp “A” Location of Matador wells Note: All Matador acreage and well information as of May 6, 2014. Other well information from public sources as of March 2014. (1) Presented as of December 31, 2013.

Ranger / Querecho Plains Prospect Area 32 14,035 gross (9,847 net) acres 83 gross (59.6 net) locations(1) Primary Targets 2nd Bone Spring 3rd Bone Spring Wolfcamp “A”, “B” and “D” Other Potential Targets Delaware Avalon 1st Bone Spring Bone Spring Carbonates 3 wells planned for 2014 Location of Matador wells Concho Stratojet 31 State #3H 2nd Bone Spring 29 mo.cum: 386 MBbl; 456 MMcf Concho AirCobra 12 #2H 3rd Bone Spring 30 mo.cum: 333 MBbl; 257 MMcf Ranger 12 State #1 Data Well Ranger 33 State Com #1H 2nd Bone Spring 6 mo.cum: 87,000 BOE (91% oil) Matador Resources Acreage Three Rivers 3rd Bone Spring Eagle 2 State 6H 13 mo.cum: 117 MBbl; 71 MMcf Pickard Project Results expected in Q3 2014 Pickard 20-18-24 #1H – 2nd Bone Spring Pickard 20-18-24 #2H – Wolfcamp “D” Note: All Matador acreage and well information as of May 6, 2014. Other well information from public sources as of March 2014. (1) Presented as of December 31, 2013.

33 17,128 gross (12,341 net) acres 108 gross (82.8 net) locations(1) Primary Targets Wolfcamp “B” 2nd Bone Spring Delaware Other Potential Targets Avalon 1st Bone Spring 3rd Bone Spring Wolfcamp “A” 4 wells planned for 2014 Indian Draw / Rustler Breaks Prospect Area Concho R. Scary Fed 5H 2nd Bone Spring Sand 18 mo.cum: 113 MBbl; 344 MMcf Mewbourne Oil Co. San Lorenzo 15 DM 1H Wolfcamp 14 mo.cum: 60 MBbl; 367 MMcf Mewbourne Oil Co. Layla 35 MD Fee 1H Delaware 13 mo.cum: 136 MBbl; 615 MMcf Devon Energy 8 Drilling Permits Approved 2nd Bone Spring Sand Matador Resources Acreage Rustler Breaks 12-24-27 #1H Wolfcamp “B” Flowing: 1,160 BOE/d (560 Bbl/d + 3.6 MMcf/d; 48% oil) FTP(2): 2,750 psi on 20/64th inch choke Location of Matador wells Note: All Matador acreage and well information as of May 6, 2014. Other well information from public sources as of March 2014. (1) Presented as of December 31, 2013. (2) Flowing tubing pressure. Mewbourne Oil Co. Malaga 30 MP Fed Com 1H 2nd Bone Spring Sand 5 mo.cum: 47 MBbl; 82 MMcf

Twin Lakes Prospect Area 34 32,417 gross (22,151 net) acres Primary Targets Wolfcamp “D” Strawn Abo Other Potential Targets Cisco/Canyon Devonian Glorieta/San Andres 1 vertical well planned for 2014 − Vertical pilot hole to collect whole core and log data Vacuum Field Grayburg/ San Andreas/ABO 690 MMBbl, 1.1 Tcf Maljamar Field Grayburg/San Andreas/Yeso 185 MMBbl, 186 BCF Denton Wolfcamp/Devonian 157 MMBbl, 78 Bcf Lovington West San Andres 27 MMBbl, 45 Bcf Lovington Paddock 74 MMBbl, 35 Bcf Townsend Field Penn/Perm 26 MMBbl, 105 Bcf Saunders Penn/Perm 43 MMBbl, 62 Bcf Dean Penn/Perm 9.5 MMBbl, 6.0 Bcf Caudill Penn/Perm 8.1 MMBbl, 6.0 Bcf Kemnitz Lower Wolfcamp 20 MMBbl, 153 Bcf A A’ Matador Resources Acreage Location of Matador well Note: All acreage at May 6, 2014. Well information from public sources as of March 2014.

Twin Lakes Area Cross Section 35 A TEST VOLUMES: 268 Bbl/d oil 350 Mcf/d gas No water TEST VOLUMES: 118 Bbl/d oil 625 Mcf/d gas 1,155 Bbl/d water Wolfcamp “D” A’ ~400ft

Bone Spring 0 ft. 300 ft. Wolfcamp Matador Permian Basin – First Generation Frac Designs 36 Note: Figure depicts proppant and fluid volume pumped per 300 ft. of horizontal wellbore. (1) Mlbs = thousands of pounds of proppant pumped. 550 Mlbs 600 Mlbs 11,750 Bbl 11,750 Bbl Fluid Volume Pumped Proppant Pumped(1)

Haynesville Shale

2014 Tier 1 Haynesville Shale Plan 38 2014 projected capital expenditures of ~$62 million or about 11% of total Estimated participation in 56 gross (7.8 net) non-operated wells(1) Chesapeake may drill up to 30 gross (6.3 net to Matador) wells at Elm Grove in 2014; estimated CapEx of $50 million 2014 capital plan includes no Matador operated Haynesville wells Haynesville/Cotton Valley acreage in Northwest Louisiana and East Texas is essentially all held by existing production Operational flexibility to drill operated Haynesville shale well(s) in 2014 should natural gas prices continue to improve, but no plans to do so at present time Completion of natural gas gathering agreement in December 2013 for a portion of our Haynesville natural gas should reduce transportation costs by an average of approximately $0.70 or more per MMBtu in 2014 and increase net gas realizations by the same amount Haynesville/Cotton Valley continue to represent large “gas bank” providing significant and increasing value as natural gas prices improve above $4.00/Mcf Highly competitive well economics for Tier 1 Haynesville at $4.50/Mcf and above, with estimated RORs of 60% to 100% in Elm Grove area (1) Includes 26 gross (1.5 net) non-operated wells accounted for in original $440 million 2014 capital expenditure budget and 30 gross (6.3 net) wells operated by Chesapeake not accounted for in original $440 million capital expenditure budget.

Significant Option Value on Natural Gas Significant acreage position in the Haynesville Recently added 3 sections to provide more operated drilling opportunities Also prospective for the Cotton Valley, Travis Peak / Hosston and other shallow formations Highly competitive well economics on Tier 1 Haynesville wells at $4.50/Mcf and above Estimated ROR ranges from 60% to 100% in Elm Grove area Elm Grove natural gas gathering contract should reduce costs an average of approximately $0.70 or more per MMBtu – improved economics Non-operated drilling activity increasing CHK may drill up to 30 wells at Elm Grove in 2014; 15 wells already proposed(4) Other operators continuing activity Expect 7.8 net wells(8) in 2014; production impact in 3rd and 4th quarters 2014 Cotton Valley horizontal EURs ~6 Bcf NW Louisiana / East Texas(1) Proved Reserves(2) 187.8 Bcfe Daily Production(3) 2,104 BOE/d (>99% natural gas) Net Acres(4) 25,064 acres Net Producing Wells(5) 76.7 Drilling Locations(5)(6) 163.8 net wells % HBP(5)(7) 97% (1) Includes both Haynesville and Cotton Valley acreage. Includes one well producing from the Frio formation in Orange County, Texas. (2) At March 31, 2014. (3) For the three months ended March 31, 2014. (4) At May 6, 2014. (5) Presented as of December 31, 2013. (6) Identified and engineered Tier 1 and Tier 2 locations identified for potential future drilling, including specified production units and estimated lateral lengths, costs and well spacing using objective criteria for designation. (7) Acreage held by production or fee mineral interests owned by Matador. (8) Includes 26 gross (1.5 net) non-operated wells accounted for in original $440 million 2014 capital expenditure budget and 30 gross (6.3 net) wells operated by Chesapeake not accounted for in original $440 million capital expenditure budget. 39 HAYNESVILLE OPERATORS MATADOR CHESAPEAKE ENCANA EXCO GOODRICH - J W PETROHAWK / BHP QUESTAR SAMSON SHELL CADDO BOSSIER BIENVILLE RED RIVER DESOTO Elm Grove Cotton Valley: 49 Net Locations Matador Operated Acreage: 9,992 gross, 9,802 net Locations(5)(6): 71 gross, 49.3 net Tier 1 Haynesville: 63.6 Net Locations Acreage: 13,757 gross, 6,924 net Locations(5)(6): 452 gross, 63.6 net MTDR CV Horizontal T. Walker #1H MTDR Haynesville L.A. Wildlife #1H MTDR Haynesville Williams (BLM) #1H TIER 1: 6 – 10+ Bcf TIER 2: 4 – 6 Bcf TIER 3: 2 – 4 Bcf Note: All acreage at May 6, 2014. Matador acreage shown in red. Elm Grove Area

0 25 50 75 100 125 150 175 200 225 250 275 300 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 E sti m a te d Ra te o f Re tu rn, % Natural Gas Price, $/Mcf 8 Bcf - $8.0mm D&C Cost 9 Bcf - $8.0mm D&C Cost 10 Bcf - $8.0mm D&C Cost 8 Bcf - $9.0mm D&C Cost 9 Bcf - $9.0mm D&C Cost 10 Bcf - $9.0mm D&C Cost 40 Elm Grove Tier 1 Haynesville – Chesapeake Operated Note: Individual well economics only. Excludes costs prior to drilling (i.e. acquisition or acreage costs). Economics use a NRI / WI of 85% but actual interests vary. Natural gas price differential = ($0.55)/Mcf. D&C cost = drilling and completion cost.

2014 Capital Investment Plan

42 Summary and Updated 2014 Guidance(1) (1) As of May 6, 2014, except for capital spending which was updated to $570 million as of May 22, 2014. (2) As of May 6, 2014, the Company guided investors to the high end of its oil production guidance range. (3) Estimated 2014 oil and natural gas revenues and Adjusted EBITDA based on production guidance range. Estimated average realized prices for oil and natural gas used in these estimates were $95.00/Bbl and $5.00/Mcf, respectively, for the period April through December 2014. (4) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. Continue 4-rig program full-time in H2 2014 – 2 rigs in the Eagle Ford and 2 rigs in the Permian Eagle Ford development expected to be the major driver of our growth in 2014 Permian drilling program designed to further evaluate our acreage position and define an expanded development plan for 2015 and beyond 2012 Actual 2013 Actual 2014 Guidance(1) Capital Spending $335 million $374 million $570 million Total Oil Production 1.214 million Bbl 2.133 million Bbl 2.8 to 3.1 million Bbl(2) Total Natural Gas Production 12.5 Bcf 12.9 Bcf 16.0 to 17.5 Bcf Oil and Natural Gas Revenues $156.0 million $269.0 million $380 to $400 million(3) Adjusted EBITDA(4) $115.9 million $191.8 million $270 to $290 million(3)

43 2014 Updated Capital Investment Plan Summary Continue 4-rig program full time in H2 2014: 2 rigs in the Eagle Ford and 2 rigs in the Permian 2014E capital expenditures of $570 million(1) Eagle Ford development expected to be the major driver of our growth in 2014 Permian drilling program designed to further evaluate our acreage position and define an expanded development plan for 2015 and beyond Haynesville development assumes increased participation in non-operated wells 2014E CapEx by Region 2014E CapEx by Expense Type Haynesville Non-Op / Other $62 million 10.9% Permian $190 million 33.3% Eagle Ford $318 million 55.8% Land, Seismic, Etc. $80 million 14.0% Facilities, Infrastructure, Etc. $20 million 3.5% Drilling and Completions $470 million 82.5% 2014E CapEx: $570 million(1) (1) As updated May 22, 2014.

Funding for 2014 Capital Investment Plan 44 Anticipate funding 2014 capital expenditures through proceeds from recent equity offering, operating cash flows and borrowings under revolving credit facility 1.8 million barrels of oil (between 70 and 75% of estimated oil production(1)) hedged for remainder of 2014, protecting cash flows below ~$88/Bbl oil price Simple capital structure Strong liquidity position with Debt/LTM Adjusted EBITDA(2) ~0.7x Flexibility to manage liquidity Most drilling is operated and with few non-operated drilling obligations $80 million estimated for discretionary land/seismic acquisitions No long-term drilling rig or service contract commitments (1) 2014 oil production estimate at top end of guidance range at 2.8 to 3.1 million Bbl. Volumes hedged as of May 6, 2014. (2) Assumes borrowings outstanding of approximately $150 million after closing of equity offering on May 29, 2014 and partial repayment of borrowings, and LTM Adjusted EBITDA of $207 million at March 31, 2014. Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix.

45 Investment Highlights Strong Growth Profile with Increasing Focus on Oil / Liquids YE2011 to 2014E oil production CAGR of ~172%(1) with expected year-over-year growth of ~45%(1) in 2014 ~89% of 2014E CapEx program focused on oil / liquids exploration and development High Quality Asset Base in Attractive Areas(2) ~56,200 net acres in the Permian Basin prospective for the liquids-rich Wolfcamp, Bone Spring and other targets ~28,400 net acres in the Eagle Ford in some of the most active counties in South Texas, including Atascosa, DeWitt, Gonzales, Karnes, La Salle, Wilson and Zavala Counties Long-term option on natural gas with Haynesville, Cotton Valley and Bossier assets almost all HBP Multi-year Drilling Inventory(3)(4) 177.7 net drilling locations in the Permian Basin with escalating activity to de-risk the play; anticipate significant increase in locations with further delineation drilling 229.3 net drilling locations in the Eagle Ford 163.8 net drilling locations in the Haynesville and Cotton Valley Low Cost Operations Substantially reduced Eagle Ford drilling days and well costs since IPO Batch drilling program and other improvements have potential to further reduce well costs and improve spud to sales times Strong Financial Position Low leverage(5) of ~0.7x allows for operational flexibility Liquidity available to execute planned drilling program Proven Management and Technical Team and Active Board of Directors Management and senior technical team average over 25 years of industry experience Board with extensive industry knowledge, business experience and company ownership Strong record of stewardship (1) Represents the growth to top end of range of 2014 oil production guidance of 2.8 to 3.1 million barrels. (2) As of May 6, 2014. (3) Presented as of December 31, 2013. (4) Identified and engineered Tier 1 and Tier 2 locations identified for potential future drilling, including specified production units and estimated lateral lengths, costs and well spacing using objective criteria for designation. (5) Calculated as total debt divided by LTM Adjusted EBITDA for the 12 months ended March 31, 2014, and estimating approximately $150 million in borrowings outstanding after closing of the equity offering on May 29, 2014 and partial repayment of borrowings. Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix.

Appendix

$18.4 $15.2 $23.6 $49.9 $115.9 $191.8 2008 2009 2010 2011 2012 2013 $30.6 $19.0 $34.0 $67.0 $156.0 $269.0 2008 2009 2010 2011 2012 2013 7% 4% 2% 6% 37% 50% 2008 2009 2010 2011 2012 2013 1.5 2.3 3.9 7.0 9.0 11.7 2008 2009 2010 2011 2012 2013 Matador’s Continued Growth Average Daily Production (MBOE/d) Oil Production Mix (% of Average Daily Production) Oil & Natural Gas Revenues ($ in millions) Adjusted EBITDA(1) ($ in millions) 47 Growth since IPO Growth since IPO Growth since IPO Growth since IPO (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net (loss) income and net cash provided by operating activities, see Appendix.

Recent Semi-Annual Performance Metrics Through Year-End 2013 Oil Equivalent Production (BOE in thousands) Adjusted EBITDA(1) ($ in millions) Oil and Natural Gas Revenues ($ in millions) Oil Production (Bbl in thousands) 84 485 729 908 1,225 2H 2011 1H 2012 2H 2012 1H 2013 2H 2013 1,277 1,525 1,768 1,944 2,341 H 011 1H 012 H 2012 1H 2013 2H 2013 48 (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net (loss) income and net cash provided by operating activities, see Appendix. $32.4 $65.2 $90.8 $117.5 $151.5 2H 2011 1H 2012 2H 2012 1H 2013 2H 2013 $24.4 $49.3 $66.7 $81.5 $110.3 H 011 1H 012 H 2012 1H 2013 2H 2013

$0.47 $0.83 $1.57 $2.89 $4.58 $5.55 2009 2010 2011 2012 2013 2014E $1.75 $2.92 $5.82 $7.84 $11.15 2009 2010 2011 2012 2013 $0.38 $0.58 $1.17 $2.15 $3.26 $3.99 2009 2010 2011 2012 2013 2014E Matador Provides Growth on a Per Share(1) Basis 49 Oil and Natural Gas Revenues(4) per Share ($ per share) PV-10(2) per Share ($ per share) Adjusted EBITDA(3)(4) per Share ($ per share) (1) Weighted Average Basic Shares Outstanding. Value for 2014E assumes no shares issued for remainder of 2014. (2) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. (3) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (4) 2014 estimates at midpoint of guidance range as provided on May 6, 2014. Estimated average realized prices for oil and natural gas used in these estimates were $95.00/Bbl and $5.00/Mcf, respectively, for the period April through December 2014. (in thousands) Shares (1) PV-10 (2) Adj. EBITDA (3)(4) Oil & Natural Gas Revenues (4) 2009 40,123 $70,359 $15,184 $19,039 2010 41,037 $119,869 $23,635 $34,042 2011 42,718 $248,700 $49,911 $67,000 2012 53,957 $423,200 $115,923 $155,998 2013 58,777 $655,200 $191,771 $269,030 2014E 70,255 $280,000 $390,000

Year Ended December 31, 2011 2012 2013 Production Oil Production (MBbl) 154 1,214 2,133 Natural Gas Production (Bcf) 14.5 12.5 12.9 % Oil 6% 37% 50% Total Production (MBOE) 2,573 3,294 4,285 Average Daily Production (BOE/d) 7,049 9,000 11,740 Realized Oil Price ($/Bbl)(1) $93.80 $103.55 $98.67 Realized Natural Gas Price ($/Mcf)(1) $4.11 $3.55 $4.47 Total Oil & Natural Gas Revenues ($ thousands)(1) $74,106 $169,958 $268,121 Total Revenues per BOE ($/BOE)(1) $28.80 $51.60 $62.57 Operating Expenses Lease Operating ($/BOE) $2.82 $8.56 $9.04 Production Taxes and Marketing ($/BOE) $2.44 $3.54 $4.89 Cash G&A ($/BOE)(2) $4.27 $4.37 $3.94 Total Cash Costs ($/BOE) $9.53 $16.47 $17.87 Cash Margin ($/BOE) $19.27 $35.13 $44.70 Adjusted EBITDA ($ thousands)(3) $49,911 $115,923 $191,771 Historical Financials and Margins 50 (1) Realized prices and total oil and natural gas revenues include the impact of realized gain or loss on derivatives. (2) Excludes non-cash stock-based compensation expense. (3) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net (loss) income and net cash provided by operating activities, see Appendix. Significant increases in oil production . . . . . . primarily responsible for increasing cash margin and per unit costs

Increasing Cash Operating Margin 51 $31.97 $27.45 $28.80 $51.60 $62.57 $17.27 $16.24 $19.27 $35.13 $44.70 54.0% 59.2% 66.9% 68.1% 71.4% 2009 2010 2011 2012 2013 Revenue/BOE with Derivatives Cash Margin per BOE % Margin

1.7 5.1 3.7 4.0 21.5 29.4 30.1 42.6 48.7 44.6 64.2 55.3 63.7 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 209 563 465 448 2,200 3,130 3,291 4,630 5,100 4,916 6,703 6,612 7,344 0 1,000 2,000 3,000 4,000 5,0 0 6,000 7,000 8,000 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 12.0 15.8 13.8 10.9 7.6 6.7 7.9 10.1 10.6 13.5 17.6 14.4 15.3 0.0 5.0 10.0 15.0 20.0 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 36.5 44.6 38.8 39.0 34.8 33.7 33.7 34.5 33.7 33.7 40.2 32.1 27.4 0.0 10.0 20.0 30.0 40.0 50.0 1Q 1 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 Q13 2Q13 3Q13 4Q13 1Q14 52 Oil Production and Revenues Through Q1 2014 Average Daily Natural Gas Production (MMcf/d) Natural Gas Revenues ($ in mm) Oil Revenues ($ in mm) Average Daily Oil Production (Bbl/d) 15 to 20% shut-in at times during Q1 Q1 down due to timing, shut-ins Improved gas prices and NGL revenues in Q1 Oil revenues near all-time highs in Q1

6,300 8,004 6,931 6,953 8,023 8,738 8,838 10,385 10,89710,582 13,482 11,968 11,904 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 53 Quarterly Performance Metrics Through Q1 2014 Oil and Natural Gas Revenues ($ in mm) Total Realized Revenues ($ in mm) Adjusted EBITDA(1) ($ in mm) Average Daily Equivalent Production (BOE/d) 15 to 20% shut-in at times during Q1 $13.7 $20.9 $17.4 $15.0 $29.2 $36.1 $38.0 $52.7 $59.3 $57.7 $81.9 $69.7 $78.9 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Q11 2Q11 3Q11 4Q11 Q12 2Q12 3Q12 4Q12 Q13 2Q13 3Q13 4Q13 1Q14 $10.1 $15.3 $12.1 $12.4 $21.3 $27.9 $28.6 $38.0 $40.7 $40.8 $61.5 $48.8 $56.3 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 $15.5 $21.8 $18.9 $17.9 $32.2 $40.8 $41.4 $55.6 $59.7 $58.0 $80.7 $69.3 $77.1 $0.0 $10.0 $ 0.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Q1 2Q11 3Q11 4Q11 Q12 2Q1 3Q12 4Q12 Q13 2Q13 3Q13 4Q13 1Q14 (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix.

$4 .6 2 $4 .2 5 $6 .6 0 $5 .4 3 $5 .1 9 $5 .1 5 $4 .2 3 $3 .3 7 $4 .6 9 $4 .3 1 $4 .3 5 $6 .0 2 $ 6. 74 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 $2 .8 3 $2 .7 0 $3 .2 4 $2 .5 1 $6 .3 6 $8 .0 2 $7 .9 8 $1 1. 17 $1 1. 11 $1 0. 53 $6 .9 1 $8 .2 8 $8 .7 5 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 $2 .2 9 $2 .2 7 $ 2. 90 $2 .3 1 $ 2. 95 $3 .2 9 $3 .4 7 $4 .2 6 $4 .1 8 $4 .6 2 $5 .2 9 $5 .3 3 $5 .6 1 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 1Q11 2Q11 3Q11 4Q1 Q1 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q 3 1Q14 $1 2. 54 $1 1. 23 $1 1. 43 $1 4. 34 $1 5. 35 $2 5. 04 $2 6. 66 $2 8. 95 $2 8. 79 $2 1. 01 $2 1. 06 $2 1. 62 $2 2. 43 $0.00 $5.00 $10.00 $15.00 2 . 0 $25.00 $30.00 $35.00 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q 3 1Q14 54 Quarterly Expense Metrics Through Q1 2014 Lease Operating (per BOE) General and Administrative (per BOE) Depletion, Depreciation and Amortization (per BOE) Production Taxes and Marketing (per BOE) Reflects growth in oil production/revenues Another good quarter in Q1 DD&A down with added PUD reserves Stock-based costs (non-cash) and payroll up $1.20 per BOE in Q1

55 2014 Hedging Profile – Hedges in Place for Remainder of 2014 At May 6, 2014, Matador had: 1.8 million barrels of oil hedged for remainder of 2014 at weighted average floor and ceiling of $88/Bbl and $99/Bbl, respectively 7.7 Bcf of natural gas hedged for remainder of 2014 at weighted average floor and ceiling of $3.50/MMBtu and $4.93/MMBtu, respectively 5.1 million gallons of natural gas liquids hedged for remainder of 2014 at weighted average price of $1.25/gal Note: Hedged volumes shown in table for 2014 are for remainder of 2014. Oil Hedges (Costless Collars) 2014 Total Volume Hedged by Ceiling (Bbl) 1,750,000 Bbl Weighted Average Price ($ / Bbl) $99.15 /Bbl Total Volume Hedged by Floor (Bbl) 1,750,000 Bbl Weighted Average Price ($ / Bbl) $87.80 /Bbl Natural Gas Hedges (Costless Collars) 2014 Total Volume Hedged by Ceiling (Bcf) 7.7 Bcf Weighted Average Price ($ / MMBtu) $4.93 /MMBtu Total Volume Hedged by Floor (Bcf) 7.7 Bcf We ghted Average Price ($ / MMBtu) $3.50 /MMBtu Natural Gas Liquids (NGLs) Hedges (Swaps) 2014 Total Volume Hedged (gal) 5,096,000 gal Weighted Average Price ($ / gal) $1.25 /gal

Board of Directors and Special Advisors – Expertise and Stewardship 56 Board Members and Advisors Professional Experience Business Expertise Dr. Stephen A. Holditch Director - Professor Emeritus and Former Head of Dept. of Petroleum Engineering, Texas A&M University - Founder and Former President, S.A. Holditch & Associates - Past President of Society of Petroleum Engineers Oil and Gas Operations David M. Laney Lead Director - Past Chairman, Amtrak Board of Directors - Former Partner, Jackson Walker LLP Law and Investments Gregory E. Mitchell Director - President and CEO, Toot’n Totum Food Stores Petroleum Retailing Dr. Steven W. Ohnimus Director - Retired VP and General Manager, Unocal Indonesia Oil and Gas Operations Michael C. Ryan Director - Partner, Berens Capital Management International Business and Finance Carlos M. Sepulveda, Jr. Director - Chairman of the Board, Triumph Bancorp, Inc. - Retired President and CEO, Interstate Battery System International, Inc. - Director and Audit Chair, Cinemark Holdings, Inc. Business and Finance Margaret B. Shannon Director - Retired VP and General Counsel, BJ Services Co. - Former Partner, Andrews Kurth LLP Law and Corporate Governance Marlan W. Downey Special Board Advisor - Retired President, ARCO International - Former President, Shell Pecten International - Past President of American Association of Petroleum Geologists Oil and Gas Exploration Wade I. Massad Special Board Advisor - Managing Member, Cleveland Capital Management, LLC - Former EVP Capital Markets, Matador Resources Company - Formerly with KeyBanc Capital Markets and RBC Capital Markets Capital Markets Edward R. Scott, Jr. Special Board Advisor - Former Chairman, Amarillo Economic Development Corporation - Law Firm of Gibson, Ochsner & Adkins Law, Accounting and Real Estate Development W.J. “Jack” Sleeper, Jr. Special Board Advisor - Retired President, DeGolyer and MacNaughton (Worldwide Petroleum Consultants) Oil and Gas Executive Management

Proven Management Team – Experienced Leadership 57 Management Team Background and Prior Affiliations Industry Experience Matador Experience Joseph Wm. Foran Founder, Chairman and CEO - Matador Petroleum Corporation, Foran Oil Company and James Cleo Thompson Jr. 33 years Since Inception Matthew V. Hairford President - Samson, Sonat, Conoco 29 years Since 2004 David E. Lancaster EVP, COO and CFO - Schlumberger, S.A. Holditch & Associates, Inc., Diamond Shamrock 34 years Since 2003 David F. Nicklin Executive Director of Exploration - ARCO, Senior Geological Assignments in UK, Norway, Indonesia, China and the Middle East 42 years Since 2007 Craig N. Adams EVP – Land & Legal - Baker Botts L.L.P., Thompson & Knight LLP 21 years Since 2012 Ryan C. London VP and General Manager - Matador Resources Company (Began as intern) 10 years Since 2004 Bradley M. Robinson VP and CTO - Schlumberger, S.A. Holditch & Associates, Inc., Marathon 36 years Since Inception Billy E. Goodwin VP of Drilling - Samson, Conoco 29 years Since 2010 William F. McMann VP of Production & Facilities - Independent Consultant, Wagner Oil Company, Denbury Resources 28 years Since 2011 Van H. Singleton, II VP of Land - Southern Escrow & Title, VanBrannon & Associates 17 years Since 2007 G. Gregg Krug VP of Marketing - Williams Companies, Samson, Unit Corporation 30 years Since 2005 Sandra K. Fendley VP and CAO - J-W Midstream, Crosstex Energy 22 years Since 2013 Kathryn L. Wayne Controller and Treasurer - Matador Petroleum Corporation, Mobil 29 years Since Inception

58 PV-10 Reconciliation PV-10 is a non-GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. PV-10 is not an estimate of the fair market value of the Company's properties. Matador and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies and of the potential return on investment related to the companies' properties without regard to the specific tax characteristics of such entities. PV-10 may be reconciled to the Standardized Measure of discounted future net cash flows at such dates by reducing PV-10 by the discounted future income taxes associated with such reserves. At March 31, 2014 At December 31, 2013 At June 30, 2013 At December 31, 2012 At December 31, 2011 At September 30, 2011 At December 31, 2010 At December 31, 2009 PV-10 (in millions) $739.8 $655.2 $522.3 $423.2 $248.7 $155.2 $119.9 $70.4 Discounted Future Income Taxes (in millions) $(86.2) $(76.5) $(44.7) $(28.6) $(33.2) $(11.8) $(8.8) $(5.3) Standardized Measure (in millions) $653.6 $578.7 $477.6 $394.6 $215.5 $143.4 $111.1 $65.1

59 Adjusted EBITDA Reconciliation This investor presentation includes the non-GAAP financial measure of Adjusted EBITDA. Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. “GAAP” means Generally Accepted Accounting Principles in the United States of America. The Company believes Adjusted EBITDA helps it evaluate its operating performance and compare its results of operations from period to period without regard to its financing methods or capital structure. The Company defines Adjusted EBITDA as earnings before interest expense, income taxes, depletion, depreciation and amortization, accretion of asset retirement obligations, property impairments, unrealized derivative gains and losses, certain other non-cash items and non- cash stock-based compensation expense, and net gain or loss on asset sales and inventory impairment. Adjusted EBITDA is not a measure of net income (loss) or net cash provided by operating activities as determined by GAAP. Adjusted EBITDA should not be considered an alternative to, or more meaningful than, net income (loss) or net cash provided by operating activities as determined in accordance with GAAP or as an indicator of the Company’s operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components of understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure. Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA in the same manner. The following table presents the calculation of Adjusted EBITDA and the reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively, that are of a historical nature. Where references are forward-looking or prospective in nature, and not based on historical fact, the table does not provide a reconciliation. The Company could not provide such reconciliation without undue hardship because the forward-looking Adjusted EBITDA numbers included in this investor presentation are estimations, approximations and/or ranges. In addition, it would be difficult for the Company to present a detailed reconciliation on account of many unknown variables for the reconciling items.

60 Adjusted EBITDA Reconciliation The following table presents our calculation of Adjusted EBITDA and reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively. Note: LTM is last 12 months LTM at LTM at (In thousands) 2008 2009 2010 2011 2012 2013 6/30/2013 3/31/2014 Unaudited Adjusted EBITDA reconciliation to Net Income (Loss): Net (loss) income $103,878 ($14,425) $6,377 ($10,309) ($33,261) $45,094 ($20,771) $76,962 Interest expense - - 3 683 1,002 5,687 3,574 5,812 Total income tax (benefit) provision 20,023 (9,925) 3,521 (5,521) (1,430) 9,697 (703) 19,187 Depletion, depreciation and amortization 12,127 10,743 15,596 31,754 80,454 98,395 97,801 94,193 Accretion of asset retirement obligations 92 137 155 209 256 348 307 384 Full-cost ceiling impairment 22,195 25,244 - 35,673 63,475 21,229 51,499 - Unrealized loss (gain) on derivatives (3,592) 2,375 (3,139) (5,138) 4,802 7,232 13,945 5,514 Stock-based compensation expense 665 656 898 2,406 140 3,897 1,836 5,200 Net loss on asset sales and inventory impairment (136,977) 379 224 154 485 192 617 192 Adjusted EBITDA $18,411 $15,184 $23,635 $49,911 $115,923 $191,771 $148,105 $207,444 LTM at LTM at (In thousands) 2008 2009 2010 2011 2012 2013 6/30/2013 3/31/2014 Unaudited Adjusted EBITDA reconciliation to Net Cash Provided by Operating Activities: Net cash provided by operating activities $25,851 $1,791 $27,273 $61,868 $124,228 $179,470 $156,614 $179,186 Net change in operating assets and liabilities (17,888) 15,717 (2,230) (12,594) (9,307) 6,210 (12,161) 20,813 Interest expense - - 3 683 1,002 5,687 3,574 5,812 Current income tax (benefit) provision 10,448 (2,324) (1,411) (46) - 404 78 1,633 Adjusted EBITDA $18,411 $15,184 $23,635 $49,911 $115,923 $191,771 $148,105 $207,444 Year Ended December 31, Year Ended December 31,

61 Adjusted EBITDA Reconciliation The following table presents our calculation of Adjusted EBITDA and reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively. (In thousands) 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Unaudited Adjusted EBITDA reconciliation to Net Income (Loss): Net income (loss) $ (27,596) $ 7,153 $ 6,194 $ 3,941 $ 3,801 $ (6,676) $ (9,197) $ (21,188) $ (15,505) $ 25,119 $ 20,105 $ 15,374 $ 16,363 Interest expense 106 184 171 222 308 1 144 549 1,271 1,609 2,038 768 1,396 Total income tax provision (benefit) (6,906) (46) - 1,430 3,064 (3,713) (593) (188) 46 32 2,563 7,056 9,536 Depletion, depreciation and amortization 7,111 8,180 7,287 9,176 11,205 19,914 21,680 27,655 28,232 20,234 26,127 23,802 24,030 Accretion of asset retirement obligations 39 57 62 51 53 58 59 86 81 80 86 100 117 Full-cost ceiling impairment 35,673 - - - - 33,205 3,596 26,674 21,230 - - - - Unrealized (gain) loss on derivatives 1,668 (332) (2,870) (3,604) 3,270 (15,114) 12,993 3,653 4,825 (7,526) 9,327 606 3,108 Stock-based compensation expense 53 128 1,234 991 (363) 191 (51) 363 492 1,032 1,239 1,134 1,795 Net (gain)/loss on asset sales and inventory impairment - - - 154 - 60 - 425 - 192 - - - Adjusted EBITDA $ 10,148 $ 15,324 $ 12,078 $ 12,361 $ 21,338 $ 27,926 $ 28,631 $ 38,029 $ 40,672 $ 40,772 $ 61,485 $ 48,840 $ 56,345 (I th usa s) 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Unaudited Adjusted EBITDA reconciliation to Net Cash Provided by Operating Activities: Net cash provided by operating activities $ 12,732 $ 6,799 $ 14,912 $ 27,425 $ 5,110 $ 46,416 $ 28,799 $ 43,903 $ 32,229 $ 51,684 $ 43,280 $ 52,278 $ 31,945 Net change in operating assets and liabilities (2,690) 8,386 (3,004) (15,286) 15,920 (18,491) (500) (6,235) 7,126 (12,553) 15,265 (3,630) 21,729 Interest expense 106 184 171 222 308 1 144 549 1,271 1,609 2,038 768 1,396 Current income tax (benefit) provision - (45) (1) - - - 188 (188) 46 32 902 (576) 1,275 Adjusted EBITDA $ 10,148 $ 15,324 $ 12,078 $ 12,361 $ 21,338 $ 27,926 $ 28,631 $ 38,029 $ 40,672 $ 40,772 $ 61,485 $ 48,840 $ 56,345

62 Adjusted EBITDA Reconciliation (In thousands) 12/31/2011 6/30/2012 12/31/2012 6/30/2013 12/31/2013 Unaudited Adjusted EBITDA reconciliation to Net Income (Loss): Net (loss) income 10,135$ (2,875)$ (30,385)$ 9,615$ 35,479$ Interest expense 393 309 693 2,881 2,806 Total income tax (benefit) provision 1,430 (649) (781) 78 9,619 Depletion, depreciation and amortization 16,463 31,119 49,335 48,466 49,929 Accretion of asset retirement obligations 113 111 145 162 186 Full-cost ceiling impairment 0 33,205 30,270 21,229 - Unrealized loss (gain) on derivatives (6,474) (11,844) 16,646 (2,701) 9,933 Stock-based compensation expense 2,225 (172) 312 1,524 2,373 Net loss on asset sales and inventory impairment 154 60 425 192 - Adjusted EBITDA 24,439$ 49,264$ 66,660$ 81,446$ 110,325$ (In thousands) 12/31/2011 6/30/2012 12/31/2012 6/30/2013 12/31/2013 Unaudited Adjusted EBITDA reconciliation to Net Cash Provided by Operating Activities: Net cash provided by operating activities 42,337$ 51,526$ 72,702$ 83,912$ 95,558$ Net change in operating assets and liabilities (18,290) (2,571) (6,735) (5,425) 11,635 Interest expense 393 309 693 2,881 2,806 Current income tax provision (benefit) (1) - - 78 326 Adjusted EBITDA 24,439$ 49,264$ 66,660$ 81,446$ 110,325$ Six Months Ended Six Months Ended The following table presents our calculation of Adjusted EBITDA and reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively.