NEWS RELEASE

MATADOR RESOURCES COMPANY PROVIDES OPERATIONAL UPDATE AND INCREASES 2014 OIL PRODUCTION GUIDANCE

DALLAS, Texas, October 14, 2014 - Matador Resources Company (NYSE: MTDR) (“Matador” or the “Company”), an independent energy company engaged in the exploration, development, production and acquisition of oil and natural gas resources, with an emphasis on oil and natural gas shale and other unconventional plays and with a current focus on its Eagle Ford operations in South Texas and its Permian Basin operations in Southeast New Mexico and West Texas, today is pleased to provide the following update of its ongoing operations.

Production Update and Oil Production Guidance Increase

Matador is pleased to announce today its quarterly production results for the three months ended September 30, 2014, which were the best quarterly oil equivalent production and quarterly oil production results in the Company’s history.

| |

| • | Oil equivalent production increased 19% year over year from approximately 1.24 million barrels of oil equivalent (“BOE”) (50% oil) or an average of about 13,500 BOE per day in the third quarter of 2013 to approximately 1.5 million BOE (57% oil) or an average of about 16,100 BOE per day in the third quarter of 2014. Oil equivalent production increased approximately 6% sequentially quarter over quarter from approximately 1.4 million BOE (57% oil) or an average of about 15,400 BOE per day in the second quarter of 2014 and increased 38% from approximately 1.1 million BOE (62% oil) or an average of about 11,900 BOE per day in the first quarter of 2014. Oil equivalent production year over year increased 24% from 3.2 million BOE for the nine months ended September 30, 2013 or about 11,700 BOE per day to 4.0 million BOE for the nine months ended September 30, 2014 or about 14,500 BOE per day. |

| |

| • | Oil production increased 36% year over year from 617,000 barrels (“Bbl”) of oil or about 6,700 Bbl of oil per day in the third quarter of 2013 to 839,000 Bbl of oil or about 9,100 Bbl of oil per day in the third quarter of 2014. Oil production increased about 5% sequentially quarter over quarter from 802,000 Bbl of oil or about 8,800 Bbl of oil per day in the second quarter of 2014 and increased 27% from 661,000 Bbl of oil or about 7,300 Bbl of oil per day in the first quarter of 2014. Oil production year over year increased 51% from 1.5 million Bbl for the nine months ended September 30, 2013 or about 5,600 Bbl of oil per day to 2.3 million Bbl for the nine months ended September 30, 2014 or about 8,400 Bbl of oil per day. |

| |

| • | Natural gas production increased 3% year over year from approximately 3.7 billion cubic feet (“Bcf”) of natural gas, or about 40.7 million cubic feet of natural gas per day in the third quarter of 2013 to approximately 3.85 Bcf of natural gas, or about 41.8 million cubic feet of natural gas per day in the third quarter of 2014. Natural gas production increased about 7% sequentially quarter over quarter from approximately 3.6 Bcf of natural gas per day or about 39.7 million cubic feet of natural gas in the second quarter of 2014 and increased 56% from approximately 2.5 Bcf of natural |

gas or about 27.4 million cubic feet of natural gas per day in the first quarter of 2014. Natural gas production year over year remained essentially flat at approximately 10.0 Bcf for the nine months ended both September 30, 2013 and 2014 or about 36.4 million cubic feet of natural gas per day.

| |

| • | In early October 2014, Matador’s average daily oil equivalent production increased to more than 20,000 BOE per day for the first time in the Company’s history as a result of temporarily shut-in wells being returned to production along with initial production from several new wells. |

| |

| • | Matador expects a sequential quarter over quarter percentage increase of 25 to 33% in its total oil equivalent production in the fourth quarter over the third quarter of 2014, as compared to the 6% sequential increase achieved in the third quarter over the second quarter of 2014. |

Matador’s third quarter production results were consistent with its production estimates for the third quarter of 2014, as outlined in its August 6, 2014 press release, of a 6 to 8% increase in oil equivalent production. For the nine months ended September 30, 2014, Matador’s total oil equivalent production was approximately 4.0 million BOE, including about 2.3 million barrels of oil and about 10.0 Bcf of natural gas. This growth in the third quarter of 2014 was limited in part as a result of the timing of Matador’s completion operations, particularly in the Eagle Ford shale during the quarter, and the planned temporary shut-ins of certain of its Eagle Ford and Haynesville wells while Matador and its partners on Matador’s non-operated properties conducted hydraulic fracturing operations on multi-well pads. Matador had up to 15 to 20% of its production temporarily shut in at various times during the third quarter of 2014 and particularly so in the month of September. In the first few days of October, Matador’s daily production surged as most of these temporarily shut-in wells, particularly in the Eagle Ford shale, were returned to production, along with the initial production from several newly completed Eagle Ford shale wells. In addition, Chesapeake Energy Corporation (“Chesapeake”) placed four new Haynesville shale wells on production in early October. This increased Eagle Ford and Haynesville production, as well as the initial production from one new Permian Basin well in Matador’s Wolf prospect area and the continued strong early performance of its other Permian Basin wells, resulted in an increase in Matador’s average daily oil equivalent production to more than 20,000 BOE per day for the first time in the Company’s history. Matador expects to maintain its average daily oil equivalent production at or above 20,000 BOE per day for the remainder of 2014.

Matador is pleased to announce that based on its projections for the remainder of 2014, the Company currently anticipates that its total oil equivalent production for 2014 will be between 5.9 and 6.0 million BOE, representing an anticipated increase of between 25 and 33% in the fourth quarter of 2014 as compared to the third quarter, and the sequential quarter to quarter increase of about 6% between the second and third quarter of 2014.

Matador is also pleased today to announce that it is increasing its 2014 oil production guidance range from the high end of 2.8 to 3.1 million barrels to 3.2 to 3.3 million barrels. Matador further guides its investors to the middle or lower half of its 2014 natural gas guidance range of 16.0 to 17.5 Bcf, primarily as a result of better visibility around the expected timing of initial natural gas production from several new Haynesville wells on its Elm Grove properties in northwest Louisiana to be completed and placed on production by Chesapeake in the latter portion of the fourth quarter. Matador is very pleased by the initial results of the wells completed and placed on production by Chesapeake thus far. At October 14, 2014, Chesapeake had completed and placed nine new Haynesville wells on production, and each of these nine wells continued to produce between 8 and 12 million cubic feet (gross) of natural gas per day, representing a total of approximately 17 million cubic feet of natural gas per day net to Matador’s interest. In early October, including the addition of these new Haynesville wells, Matador’s natural gas production had increased to approximately 58 million cubic feet of natural gas per day, more than double the average

daily natural gas production of 27.4 million cubic feet of natural gas per day reported for the first quarter of 2014. Matador currently expects eight additional Haynesville wells to be completed and placed on production by Chesapeake later in the fourth quarter.

Permian Basin Update - Southeast New Mexico and West Texas

Wolf Prospect Area

Matador is pleased to announce the 24-hour initial potential test results of three of its most recent wells completed in the Permian Basin - the Johnson 44-02S-B53 #204H, the Arno #1H and the Pickard State 20-18-34 #2H wells. These 24-hour initial potential tests were conducted over a full 24-hour stabilized flow period on a constant choke size, typically after several days of cleanup following stimulation, and reflect the average production rates and pressures achieved during that 24-hour period. In the Wolf prospect area of Loving County, Texas, the Johnson 44-02S-B53 #204H well flowed 1,286 BOE per day, including 793 Bbl of oil per day and 3.0 million cubic feet of natural gas per day (62% oil), at approximately 4,000 pounds per square inch (“psi”) surface pressure on a 24/64th inch choke during its 24-hour initial potential test. This well was completed in the upper portion of the geopressured Wolfcamp formation, the Wolfcamp “A,” at approximately 11,200 feet true vertical depth. Matador drilled a 4,600-ft horizontal lateral in the Johnson 44-02S-B53 #204H well and completed the well with 19 frac stages, including approximately 200,000 Bbl of fluid and 9.4 million pounds of sand.

Also in the Wolf prospect area, the Arno #1H well flowed 1,110 BOE per day, including 300 Bbl of oil per day and 4.9 million cubic feet of natural gas per day (27% oil), at approximately 4,100 psi surface pressure on a 26/64th inch choke during its 24-hour initial potential test using the same practices described above. This well was also completed in the Wolfcamp “A” bench at approximately 10,600 feet true vertical depth. Matador drilled a 5,400-ft horizontal lateral in the Arno #1H well and completed the well with 22 frac stages, including 226,000 Bbl of fluid and 10.6 million pounds of sand.

The Johnson 44-02S-B53 #204H and the Arno #1H wells, each of which has produced less than 30 days, are the third and fourth successful tests of the Wolfcamp “A” bench in Matador’s Wolf prospect area, along with the Dorothy White #1H and the Norton Schaub #1H wells. The Dorothy White #1H has produced approximately 226,000 BOE, including 153,000 Bbl of oil (68% oil) in nine months of production and is currently producing about 550 Bbl of oil per day and 1.4 million cubic feet of natural gas per day at almost 2,100 psi flowing surface pressure. As previously reported, Matador estimates this well is on track for an estimated ultimate recovery of approximately 1,000,000 BOE. The Norton Schaub #1H has produced almost 70,000 BOE, including 48,000 Bbl of oil (70% oil), in three months of production and is currently producing about 475 Bbl of oil per day and 1.2 million cubic feet of natural gas per day at almost 2,000 psi flowing surface pressure. The Company estimates that this well is on track for an estimated ultimate recovery of approximately 700,000 BOE. Obviously, Matador is pleased with both the early test results and the longer-term performance of its initial wells in the Wolf prospect area and expects comparable performance from the Arno #1H and Johnson 44-02S-B53 #204H wells. The Company expects to continue operating one of its two Permian rigs continuously in the Loving County area in development mode given these encouraging results.

Ranger Prospect Area

In the Ranger prospect area in Lea County, New Mexico, the Pickard State 20-18-34 #2H well flowed 270 BOE per day, including 232 Bbl per day of oil and 225 thousand cubic feet per day of natural gas (86% oil) at 1,150 psi surface pressure on an 18/64th inch choke during its 24-hour initial potential test. This well was completed in the Wolfcamp “D” bench at approximately 12,000 feet true vertical depth. Matador drilled a 4,300-ft horizontal lateral in the Pickard State 20-18-34 #2H well and completed the well with 17 frac stages, including 192,000 Bbl of fluid and 8.2 million pounds of sand. The Pickard State 20-18-34 #2H well has produced approximately 16,000 BOE in almost three months of production and is still producing approximately 200 BOE per day, including 160 Bbl per day of oil and 260 thousand cubic feet of natural gas per day, at approximately 220 psi surface pressure with gas-lift assist.

This initial test result on the Pickard State 20-18-24 #2H well, while modest when compared to Matador’s Wolfcamp “A” results in Loving County, is still considered by the Company to be an important and positive development. The Wolfcamp formation in the northern part of the Delaware Basin has proven to be productive, at times prolifically, from a number of different porous and permeable zones within the upper portion of the Wolfcamp formation. The oil and natural gas produced from these zones is believed to be sourced by organic-rich mudstones and shales within the lowermost portion of the Wolfcamp, or the Wolfcamp “D” bench, which was the target for the Pickard State 20-18-24 #2H well. Matador believes this test of the Wolfcamp “D” formation may be the northernmost horizontal test of the Wolfcamp formation in the Delaware Basin. The horizontal landing target chosen for the Pickard State 20-18-34 #2H well was the most organically rich portion of the mudstones and shales within the Wolfcamp “D.” Matador considers the initial test results from this well to be both significant and encouraging because they demonstrate, for perhaps the first time, the ability to produce oil and natural gas from these organically rich source rocks in the Wolfcamp “D” in the northern Delaware Basin. Further, the Wolfcamp “D” bench in the Pickard State 20-18-34 #2H well and other wells in the area, including in Matador’s Twin Lakes area, is composed not only of highly organic-rich mudstones and shales, but also contains multiple, interbedded sandy and silty intervals that may prove to be more optimal drilling and completion targets in future Wolfcamp “D” wells. Given these positive and indicative results, Matador expects to continue to explore and test the Wolfcamp “D” in future wells in the northern Delaware Basin. In fact, Matador’s exploration concept for its Twin Lakes area targets a porous and permeable interbedded sandy and silty interval within the organically rich Wolfcamp “D.” This concept is similar to that Matador is using in Loving County in its Wolf prospect area targeting the interbedded “X” sand within the Wolfcamp “A” interval. Matador now anticipates drilling its first Twin Lakes test in early 2015.

Elsewhere in the Ranger prospect area, Matador’s first two Second Bone Spring completions continue to perform very well. The Ranger 33 State Com #1H well has produced 150,000 BOE, including 137,000 Bbl of oil (91% oil), after eleven months of production and continues to produce 300 to 350 Bbl of oil per day with gas-lift assist. As previously reported, Matador estimates this well is on track for an estimated ultimate recovery of approximately 500,000 BOE. The Pickard State 20-18-34 #1H well has produced 33,000 BOE, including 30,000 Bbl of oil (91% oil), after about 2.5 months of production. Given the early success of the gas-lift assist on the Ranger 33 State Com #1H and in its Eagle Ford shale program, the Pickard State 20-18-34 #1H well was also equipped with gas-lift assist within about 30 days following its initial completion. Since that time, the well’s production has remained relatively flat, averaging between 400 and 450 Bbl of oil per day. The Company continues to be very encouraged by the early performance of these initial Second Bone Spring wells, and in particular, the way that these wells have responded to the early implementation of gas-lift assist. Matador is currently completing its Jim Rolfe 22-18-34 RN State #131Y well, the Company’s first test of the Third Bone Spring formation, in the northern portion of its Ranger prospect area.

Acreage Additions

Matador began 2014 with approximately 70,800 gross (44,800 net) acres in the Permian Basin in Southeast New Mexico and West Texas. Between January 1 and October 1, 2014, Matador acquired an additional approximately 27,700 gross (20,200 net) acres in this area, primarily in Lea and Eddy Counties, New Mexico and Loving County, Texas. Including these acreage acquisitions, at October 1, 2014, Matador’s total Permian Basin acreage position was approximately 98,400 gross (65,000 net) acres. This leasehold position includes 11,200 gross (7,200 net) acres in Loving County, Texas (including a few small tracts in Reeves and Ward Counties), 14,900 gross (10,800 net) acres in the Ranger prospect area in Lea County, New Mexico, 21,000 gross (14,800) net acres in the Rustler Breaks prospect area in Eddy County, New Mexico, 39,000 gross (27,500 net) acres in the Twin Lakes prospect area in Lea County, New Mexico, and 4,000 gross (3,400 net) acres in Howard and Dawson Counties, Texas.

Eagle Ford Shale Update - South Texas

At October 14, 2014, Matador is operating two drilling rigs in the Eagle Ford shale, and both are currently drilling in La Salle County. Both rigs are “walking” rigs, and Matador plans to conduct batch drilling on its Eagle Ford properties using these two rigs for the remainder of 2014. Matador continues to achieve improvements in both drilling times and costs with these “walking” rigs. One recent well on Matador’s western acreage in La Salle County, was drilled from spud to a total depth of 12,300 feet, including an approximate 5,100-foot lateral, in 7.4 days, which was a new Company record. Costs have also continued to move somewhat lower, primarily as a result of continued drilling efficiencies, and several wells on Matador’s western acreage have been drilled and completed for between $5.5 and $6.0 million. The Company has continued to observe small decreases in overall service costs in the areas it operates in the Eagle Ford shale.

Matador’s downspacing efforts in the Eagle Ford shale have continued to achieve very positive results. Since the beginning of the third quarter, the Company drilled, completed and placed on production six gross (6.0 net) wells on its Danysh and Pawelek leases at 40 to 50-acre spacing. The initial flow rates and flowing pressures on these newer wells completed with Generation 7 fracture treatment designs have been consistently better than those results observed on the initial 80-acre wells completed with earlier generation fracture treatment designs, and the flowing pressures on these wells suggest minimal pressure depletion at these locations from earlier wells drilled and completed on the same leases. On its Danysh lease, 24-hour initial potential tests from Matador’s three most recent wells averaged 880 BOE per day, including 770 Bbl of oil per day and 650 thousand cubic feet of natural gas per day (88% oil), at 2,400 to 2,500 psi flowing surface pressure on a 14/64th inch choke. On its Pawelek lease, 24-hour initial potential tests from Matador’s three most recent wells averaged 790 BOE per day, including 694 Bbl of oil per day and 575 thousand cubic feet of natural gas per day (88% oil), at 2,700 to 3,000 psi flowing surface pressure on a 14/64th inch choke.

On the Company’s Northcut lease in La Salle County, 40-acre infill wells have also delivered comparable to better initial results than the previous 80-acre wells drilled on this lease using earlier generation fracture treatment designs, and initial flowing pressures on these wells also suggest minimal pressure depletion at these locations. Initial potential tests from Matador’s three most recent Northcut wells averaged about 440 BOE per day, including 405 Bbl of oil per day and 230 thousand cubic feet of natural gas per day (91% oil), at flowing pressures from 760 to 1,520 psi on 12/64th to 14/64th inch chokes. The most recent three wells drilled and placed on production on Matador’s Martin Ranch lease were also drilled at 40-acre spacing with strong initial test results. These wells were drilled on the western portion of Matador’s Martin Ranch lease and completed with Generation 7 fracture treatments. The 24-hour initial potential

tests from these three wells averaged approximately 790 BOE per day, including 730 Bbl of oil per day and 380 thousand cubic feet of natural gas per day (92% oil), at flowing surface pressures ranging from 1,900 to 2,750 psi on a 14/64th inch choke. Matador will also continue to test 40 to 50-acre spacing on its other properties in northwest La Salle County throughout the remainder of 2014. Given the results from its leases in both the central and western portions of the Eagle Ford play thus far, Matador currently expects to develop its remaining acreage in these areas on 40 to 50-acre spacing.

Haynesville Shale Update - Northwest Louisiana

During the first quarter of 2014, Matador was notified by Chesapeake of its intent to drill up to a total of 30 gross (6.3 net) Haynesville wells on Matador’s Elm Grove acreage in southern Caddo Parish, Louisiana during 2014. The Company retains the right to participate for up to a 25% working interest in all wells drilled on this property, with its working interest proportionately reduced to the leasehold position in any individual drilling unit. Chesapeake has been actively drilling on these properties since the second quarter of 2014, and at October 14, 2014, is currently operating three drilling rigs on the properties. On September 8, 2014, Matador reported that Chesapeake had completed and placed on production the first five of these Elm Grove Haynesville wells. In the first week of October, Chesapeake placed another four new Haynesville wells on production, making a total of nine wells on production. Drilling and completion costs for these initial wells have been between $7.0 and $8.0 million. At October 13, 2014, these nine gross wells (2.0 net to Matador) each continue to produce between 8 and 12 million cubic feet (gross) of natural gas per day, representing a total of approximately 17 million cubic feet of natural gas per day net to Matador’s interest. With the addition of these new Haynesville wells in early October, Matador’s natural gas production has risen to approximately 58 million cubic feet of natural gas per day, more than double the Company’s average daily production of 27.4 million cubic feet of natural gas per day during the first quarter of 2014. Matador currently expects eight additional Haynesville wells to be completed and placed on production by Chesapeake later in the fourth quarter. The benefits of this new natural gas production coming on line later in the third quarter and in the fourth quarter of 2014 will be primarily realized in 2015. Matador expects these new Haynesville wells to have rates of return of 60 to 100% or higher, due in part to Matador’s higher net revenue interests (often 85 to 90%) and improved natural gas price realizations on these wells resulting from taking its natural gas production in kind from these wells.

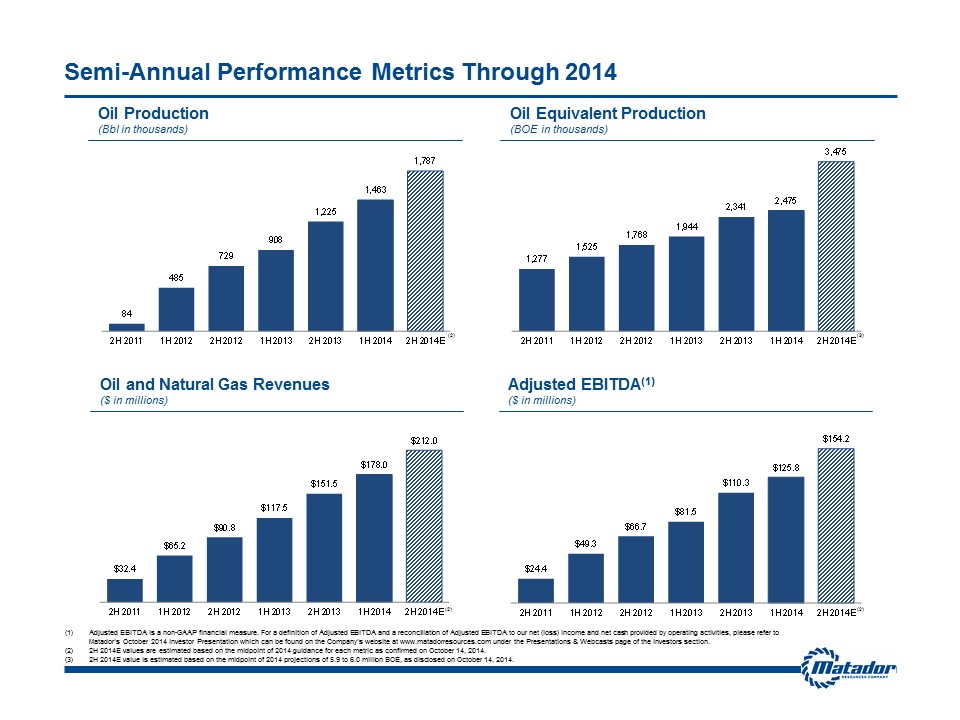

2014 Guidance Affirmation

As previously noted in this press release, Matador today increased its full year 2014 oil production guidance range from the high end of 2.8 to 3.1 million barrels to 3.2 to 3.3 million barrels. Matador reaffirms its remaining full year 2014 guidance as revised upwards on May 6 and May 22, 2014 for (1) estimated capital expenditures of $570 million, (2) estimated natural gas production of 16.0 to 17.5 Bcf (although pointing investors to the middle or lower half of this range), (3) estimated total oil and natural gas revenues of $380 to $400 million and (4) estimated Adjusted EBITDA of $270 to $290 million.

Should oil prices remain in the mid-to-low $80 per barrel range, Matador will be cautious in its spending and anticipates presently that its 2015 capital expenditures could remain relatively flat as compared to 2014, with the Company continuing to rely on only a modest amount of debt to fund any outspend of capital. Even with relatively flat capital expenditures in 2015 and primary reliance on cash flows, Matador would still expect its total oil equivalent (BOE) production to increase by approximately 50% in 2015, particularly as a result of the strong growth in both oil and natural gas production anticipated in the fourth quarter of 2014. As is its practice, Matador will remain alert to economic circumstances and expects to adjust its capital expenditures as the situation requires.

About Matador Resources Company

Matador is an independent energy company engaged in the exploration, development, production and acquisition of oil and natural gas resources in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Its current operations are focused primarily on the oil and liquids-rich portion of the Eagle Ford shale play in South Texas and the Wolfcamp and Bone Spring plays in the Permian Basin in Southeast New Mexico and West Texas. Matador also operates in the Haynesville shale and Cotton Valley plays in Northwest Louisiana and East Texas. Currently, Matador has two drilling rigs operating in South Texas and two drilling rigs operating in Southeast New Mexico and West Texas.

For more information, visit Matador Resources Company at www.matadorresources.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. “Forward-looking statements” are statements related to future, not past, events. Forward-looking statements are based on current expectations and include any statement that does not directly relate to a current or historical fact. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “could,” “believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “should,” “continue,” “plan,” “predict,” “potential,” “project” and similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Actual results and future events could differ materially from those anticipated in such statements, and such forward-looking statements may not prove to be accurate. These forward-looking statements involve certain risks and uncertainties, including, but not limited to, the following risks related to financial and operational performance: general economic conditions; the Company’s ability to execute its business plan, including whether its drilling program is successful; changes in oil, natural gas and natural gas liquids prices and the demand for oil, natural gas and natural gas liquids; its ability to replace reserves and efficiently develop current reserves; costs of operations; delays and other difficulties related to producing oil, natural gas and natural gas liquids; its ability to make acquisitions on economically acceptable terms; availability of sufficient capital to execute its business plan, including from future cash flows, increases in its borrowing base and otherwise; weather and environmental conditions; and other important factors which could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. For further discussions of risks and uncertainties, you should refer to Matador's SEC filings, including the “Risk Factors” section of Matador's most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. Matador undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after the date of this press release, except as required by law, including the securities laws of the United States and the rules and regulations of the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement.

Contact Information

Mac Schmitz

Investor Relations

(972) 371-5225

mschmitz@matadorresources.com