Advance Energy Partners Holdings, LLC Consolidated Financial Statements December 31, 2022

Advance Energy Partners Holdings, LLC Index December 31, 2022 Page(s) Report of Independent Auditors ........................................................................................................... 1–2 Consolidated Financial Statements Balance Sheet .............................................................................................................................................. 3 Statement of Operations .............................................................................................................................. 4 Statement of Changes in Members’ Capital ................................................................................................ 5 Statement of Cash Flows ............................................................................................................................. 6 Notes to Financial Statements ..................................................................................................................... 7

PricewaterhouseCoopers LLP, 1000 Louisiana St., Suite 5800, Houston, TX 77002-5021 T: (713) 356 4000, www.pwc.com/us Report of Independent Auditors To the Management of Advance Energy Partners Holdings, LLC Opinion We have audited the accompanying consolidated financial statements of Advance Energy Partners Holdings, LLC and its subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2022, and the related consolidated statements of operations, changes in members’ capital and cash flows for the year then ended, including the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the consolidated financial statements are available to be issued.

2 Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with US GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Houston, Texas April 21, 2023

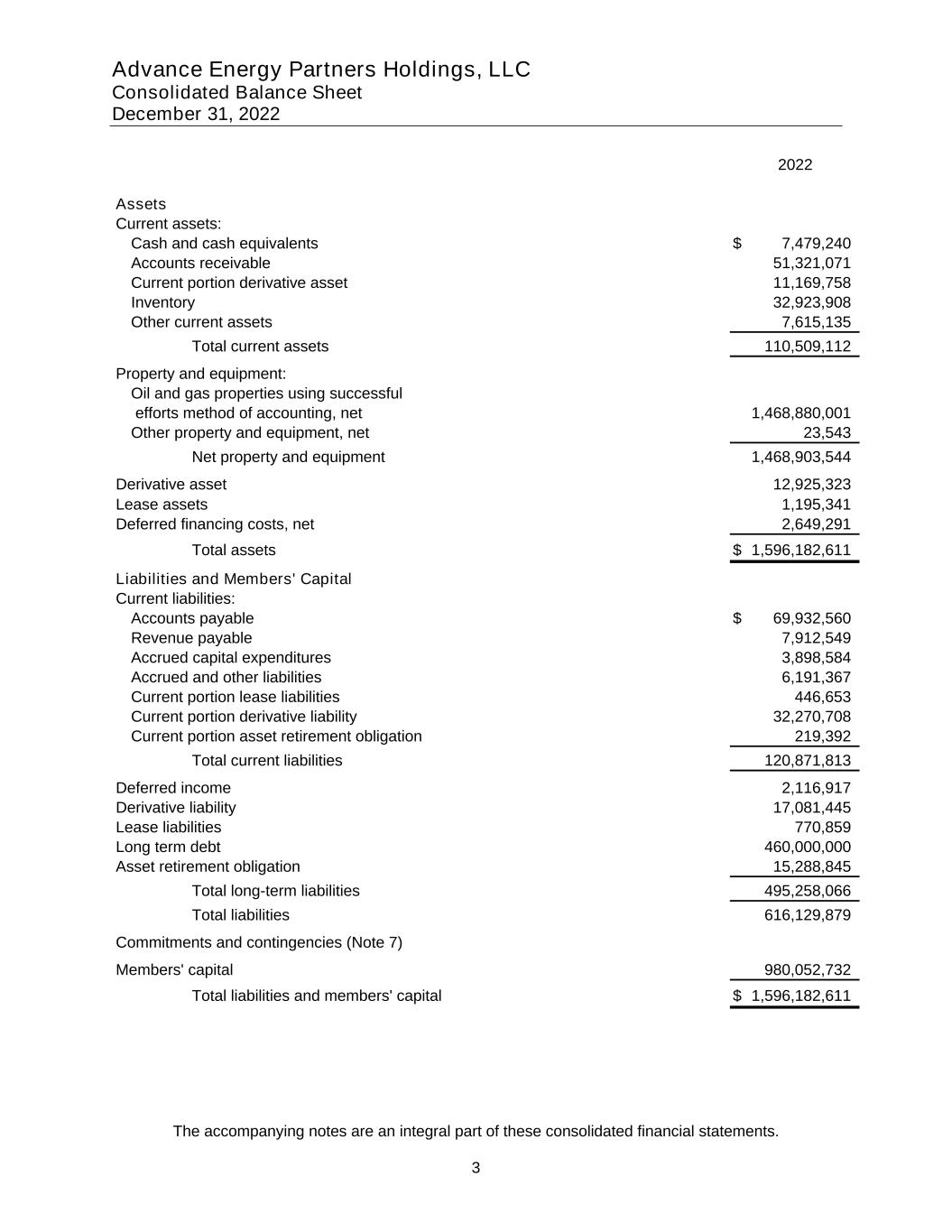

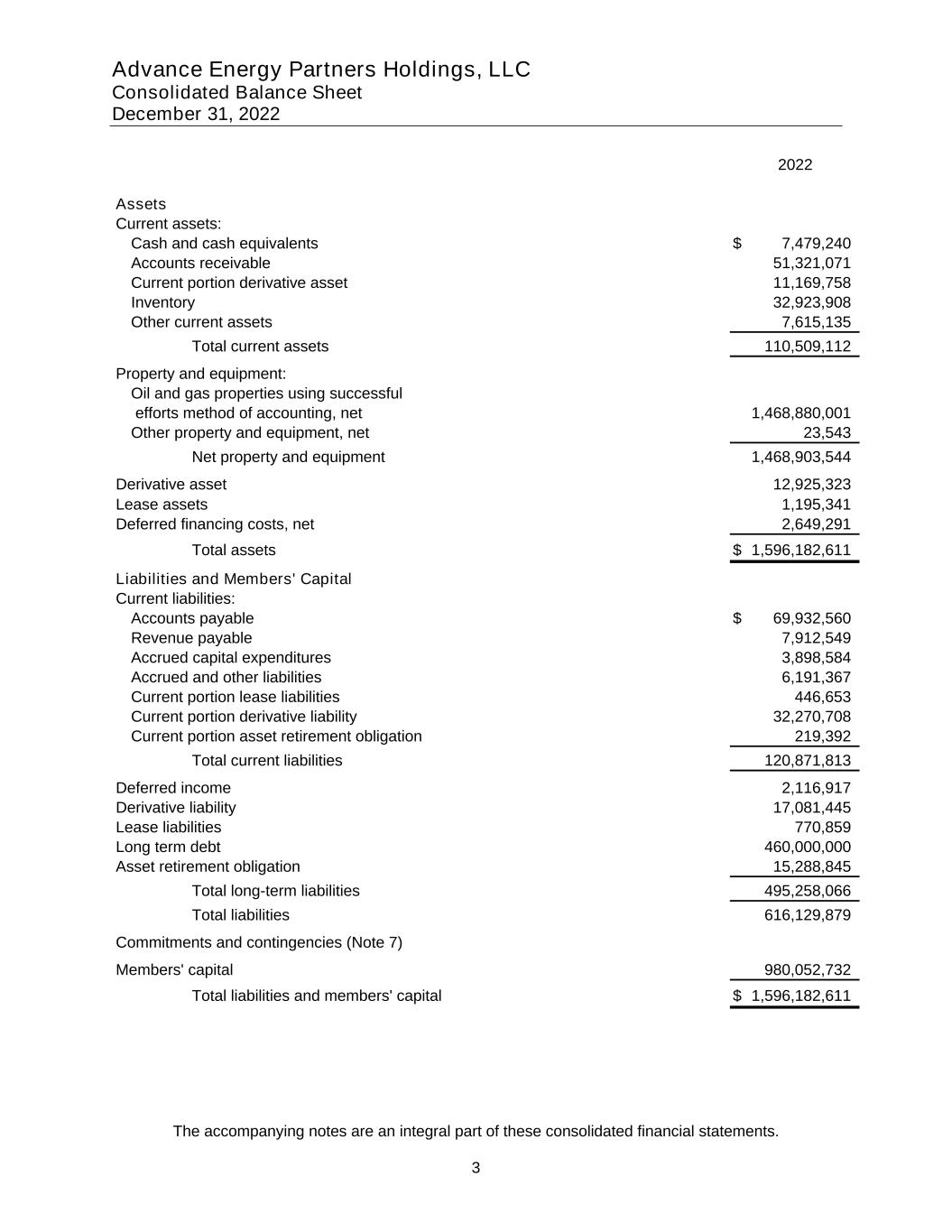

Advance Energy Partners Holdings, LLC Consolidated Balance Sheet December 31, 2022 The accompanying notes are an integral part of these consolidated financial statements. 3 2022 Assets Current assets: Cash and cash equivalents 7,479,240$ Accounts receivable 51,321,071 Current portion derivative asset 11,169,758 Inventory 32,923,908 Other current assets 7,615,135 Total current assets 110,509,112 Property and equipment: Oil and gas properties using successful efforts method of accounting, net 1,468,880,001 Other property and equipment, net 23,543 Net property and equipment 1,468,903,544 Derivative asset 12,925,323 Lease assets 1,195,341 Deferred financing costs, net 2,649,291 Total assets 1,596,182,611$ Liabilities and Members' Capital Current liabilities: Accounts payable 69,932,560$ Revenue payable 7,912,549 Accrued capital expenditures 3,898,584 Accrued and other liabilities 6,191,367 Current portion lease liabilities 446,653 Current portion derivative liability 32,270,708 Current portion asset retirement obligation 219,392 Total current liabilities 120,871,813 Deferred income 2,116,917 Derivative liability 17,081,445 Lease liabilities 770,859 Long term debt 460,000,000 Asset retirement obligation 15,288,845 Total long-term liabilities 495,258,066 Total liabilities 616,129,879 Commitments and contingencies (Note 7) Members' capital 980,052,732 Total liabilities and members' capital 1,596,182,611$

Advance Energy Partners Holdings, LLC Consolidated Statement of Operations Year Ended December 31, 2022 The accompanying notes are an integral part of these consolidated financial statements. 4 2022 Revenues Oil and condensate 637,945,856$ Gas 71,378,721 Plant products 51,416,340 Total revenues 760,740,917 Expenses Production 153,159,717 Exploration 92,348 Depreciation, depletion, and amortization 120,490,836 Accretion of asset retirement obligations 572,155 General and administrative 15,384,061 Impairment of inventory 5,307,954 Loss on disposal of oil and gas properties 92,018 Total expense 295,099,089 Operating income 465,641,828 Other income (expense) Change in unrealized gain on derivative contracts, net 38,553,605 Realized loss on commodity derivative contracts, net (119,574,590) Interest expense (21,239,172) Other income 263,673 Income before income tax 363,645,344 Income tax expense - Net income 363,645,344$

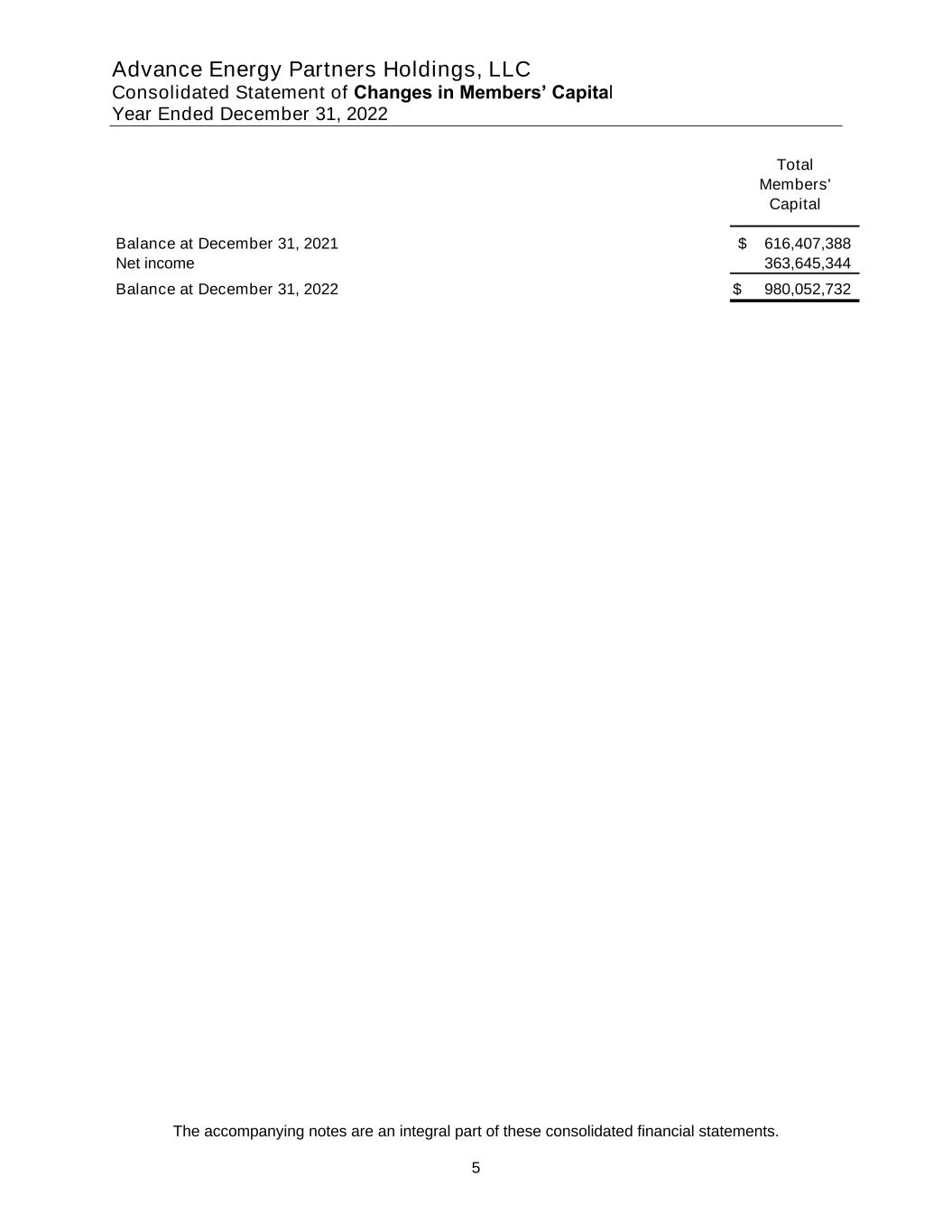

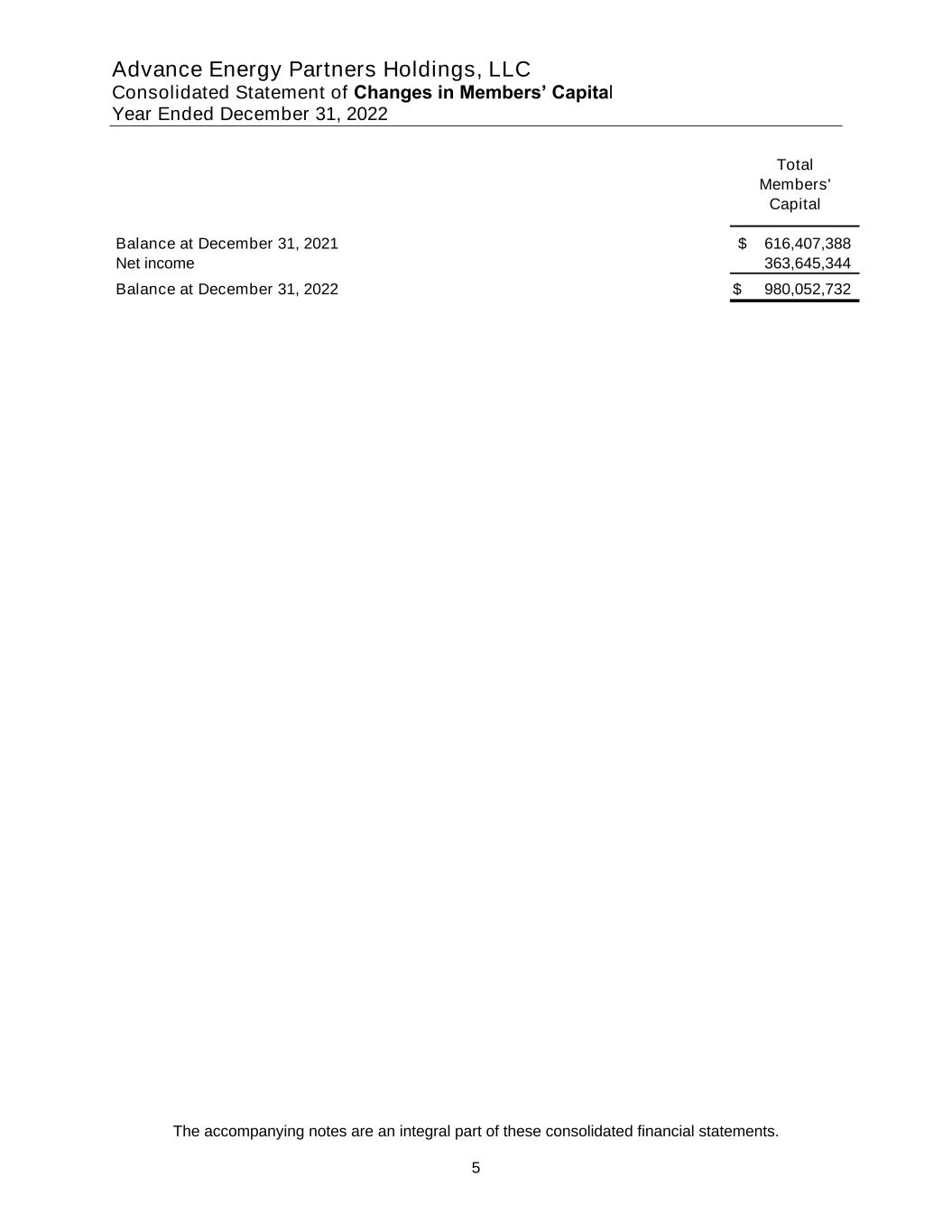

Advance Energy Partners Holdings, LLC Consolidated Statement of Changes in Members’ Capital Year Ended December 31, 2022 The accompanying notes are an integral part of these consolidated financial statements. 5 Total Members' Capital Balance at December 31, 2021 616,407,388$ Net income 363,645,344 Balance at December 31, 2022 980,052,732$

Advance Energy Partners Holdings, LLC Consolidated Statement of Cash Flows Year Ended December 31, 2022 The accompanying notes are an integral part of these consolidated financial statements. 6 Cash flows from operating activities Net income 363,645,344$ Adjustments to net income to net cash from operating activities Amortization of deferred financing costs 1,784,535 Depreciation, depletion, and amortization 120,490,836 Accretion of asset retirement obligations 572,155 Impairment of inventory 5,307,954 Loss on sale of oil and gas properties 92,018 Unrealized gain on derivatives (38,553,605) Deferred income (262,500) Other 195,552 Changes in assets and liabilities: Accounts receivable (11,602,171) Accounts payable 6,894,944 Revenue payable (937,019) Other current assets (37,074,333) Accrued payroll and benefits (3,747,692) Accrued and other liabilities (5,446,412) Lease liabilities (184,313) Net cash provided in operating activities 401,175,293 Cash flows from investing activities Capital expenditures of oil and gas properties (575,398,327) Net cash used in investing activities (575,398,327) Cash flow from financing activities Proceeds from revolving line of credit 200,000,000 Repayments of borrowings from revolving line of credit (25,000,000) Payments of lease obligations (258,929) Deferred financing costs (2,788,219) Net cash provided by financing activities 171,952,852 Net change in cash and cash equivalents (2,270,182) Cash and cash equivalents Beginning of year 9,749,422 End of year 7,479,240$ Supplemental cash flow information Interest paid 20,691,038$ Taxes paid - Supplemental disclosure of noncash investing activity Capital expenditures included in accounts payable and accrued liabilities 63,341,260$ Noncash asset retirement obligations 11,121,278 Noncash proceeds from exchange of oil and gas properties 6,703,955

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 7 1. Organization and Ownership Advance Energy Partners Holdings, LLC (the “Company” or “Advance”), headquartered in Houston, Texas, is an independent energy company engaged in the acquisition, exploration, development and production of crude oil and natural gas from onshore properties located in Texas and New Mexico, in the United States of America (“U.S.”). The Company’s wholly owned subsidiary Advance Energy Partners, LLC was initially funded by Encap Energy Capital Fund X, LP (“Encap”) and AEPXCON Management LLC (or “AEPXCON”) (collectively the “Members”), by initial cash call in September 2014. The Company’s LLC agreement initially obligated the Members to commit $300,000,000 equity to the Company. During 2017 this commitment was increased to $450,000,000. The LLC agreement authorized three classes of membership interests: Class A, Class B, and Class C Profit Units. The number of units authorized is 4,455,000, 45,000 and 100,000, respectively. The Class A and Class B units are issued at $100 per share. As of December 31, 2022, 3,911,607 Class A and 0 Class B Units were issued and outstanding. There is no cost per unit for the Profit C Units and as of December 31, 2022 there were 0 units issued. 2. Summary of Significant Accounting Policies Basis of Accounting The Company maintains its accounts on the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America. Use of Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Principles of Consolidation The Company’s consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All material intercompany accounts and transactions have been eliminated in these financial statements upon consolidation. Revenue Recognition and Natural Gas Imbalances Revenue is recognized in accordance with Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (“ASC 606”) when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. Revenues are recognized for the sale of crude oil and condensate, plant products or natural gas liquids (NGLs) and natural gas at the point control of the product is transferred to the customer, typically when production is delivered and title or risk of loss transfers to the customer. Arrangements for such sales are evidenced by signed contracts with prices typically based on stated market indices, with certain adjustments for product quality and geographic location. As the Company typically invoices customers shortly after performance obligations have been fulfilled, contract assets and contract liabilities are not recognized.

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 8 The balance of accounts receivable from contracts with customers as of December 31, 2022, was $45,538,577 and is included in accounts receivable on the consolidated balance sheet. As a nonpublic entity the Company has elected not to apply the quantitative disaggregation of revenue. The Company’s revenues are recognized at a point in time. The location of the Company’s customers and the types of contracts entered into may affect the nature, amount, timing, and uncertainty of revenue and cash flows. The Company does not disclose information on the future performance obligations for any contract with expected duration of one year or less at inception. As of December 31, 2022, the Company does not have future performance obligations that are material to future periods. Revenue from the sale of oil, natural gas and natural gas liquids (NGLs) and plant products are recognized when title passes, net of royalties due to third parties. The Company follows the sales method of accounting for their revenue whereby they recognize sales revenue on all commodity sold to their purchasers, regardless of whether the sales are proportionate to the Company’s ownership in the property. An asset or a liability is recognized to the extent that the Company has an imbalance in excess of the remaining estimated commodity reserves on the underlying properties. The imbalance as of December 31, 2022 was $356,277. Cash and Cash Equivalents The Company considers all highly liquid debt instruments with maturities of three months or less at the date of purchase to be cash equivalents. The Company maintains its cash and cash equivalents at financial institutions. The balances may exceed the Federal Deposit Insurance Corporation (“FDIC”) insurance coverage and, as a result, there is a concentration of credit risk related to amounts on deposit in excess of FDIC insurance coverage. Management believes this risk is not significant. Accounts Receivable Accounts receivable consist of uncollateralized accrued oil and gas revenues due under normal trade terms and joint interest billings consist of uncollateralized joint interest owner obligations due within 30 days of the invoice date. Management reviews receivables periodically and reduces the carrying amount by a valuation allowance that reflects management’s best estimate of the amount that may not be collectible. As of December 31, 2022, no valuation allowance was considered necessary. Inventory From time to time, the Company purchases materials to be used in future drilling and completion activities. This inventory is recorded at cost in inventory, which is included in the accompanying consolidated balance sheet. During early 2022 amid concerns about the supply chain shortage the Company purchased higher quantities than normal of casing and tubing amid concerns supplies could become scarce later in the year which could adversely affect it’s on going drilling program. After review and changes to some drilling and completion casing and tubing programs it was determined the Company had excess inventory that would not be used in current or future planned drilling programs. The Company is carrying these amounts as inventory held for resale in the amount of $15,594,721 and is carried at the lower of cost or market. The Company recognized an impairment of $5,307,954 on the inventory held for resale during the year ended December 31, 2022. The remaining $17,329,187 is carried at cost in equipment inventory.

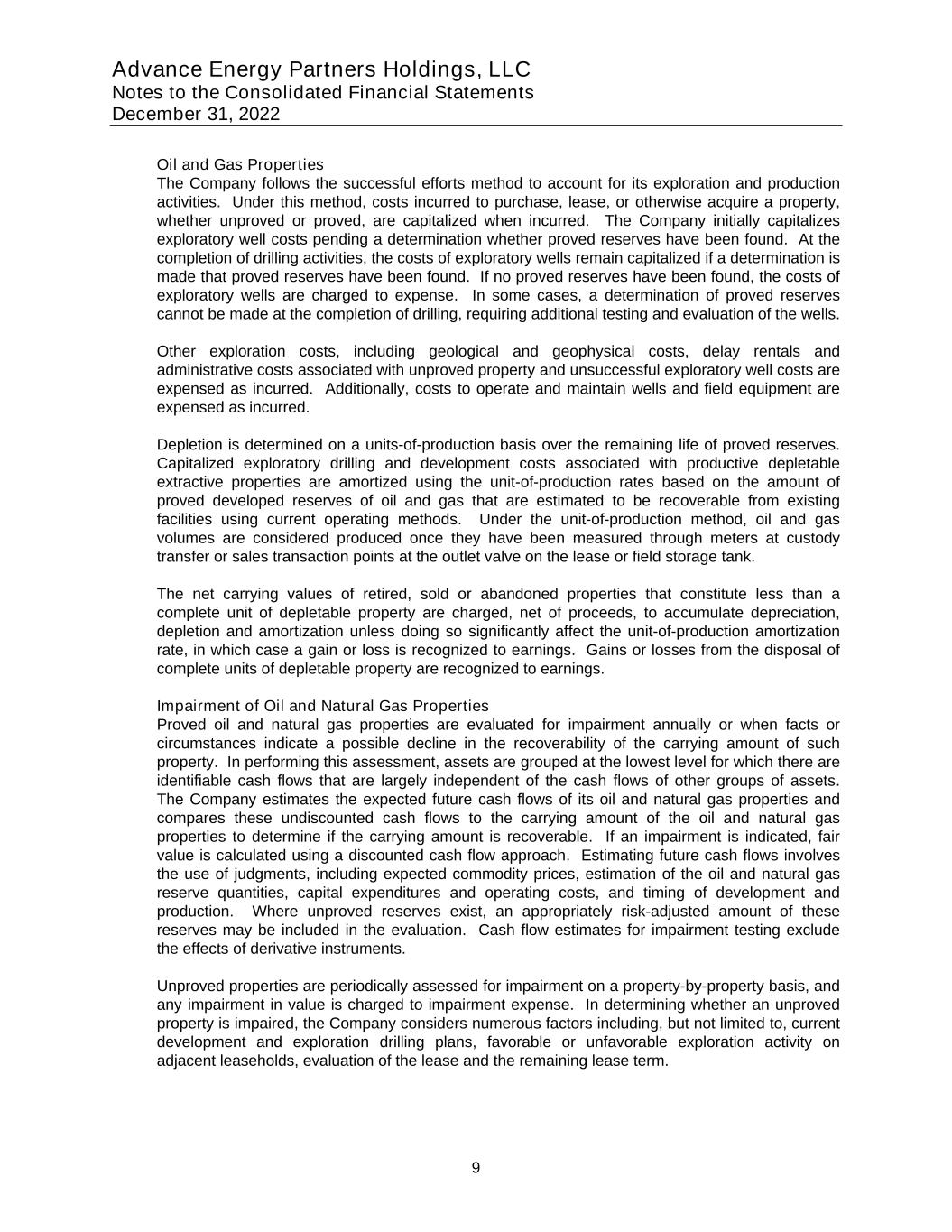

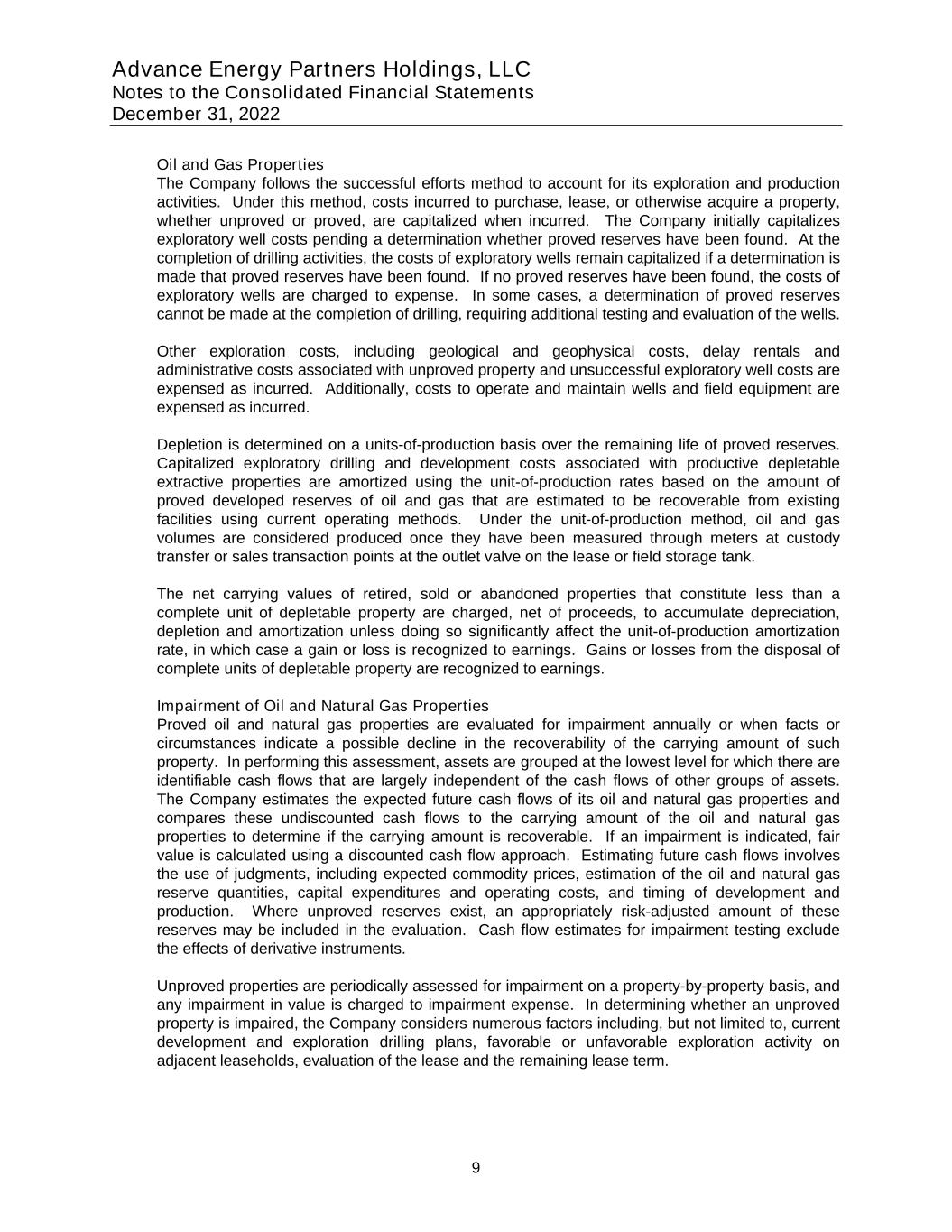

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 9 Oil and Gas Properties The Company follows the successful efforts method to account for its exploration and production activities. Under this method, costs incurred to purchase, lease, or otherwise acquire a property, whether unproved or proved, are capitalized when incurred. The Company initially capitalizes exploratory well costs pending a determination whether proved reserves have been found. At the completion of drilling activities, the costs of exploratory wells remain capitalized if a determination is made that proved reserves have been found. If no proved reserves have been found, the costs of exploratory wells are charged to expense. In some cases, a determination of proved reserves cannot be made at the completion of drilling, requiring additional testing and evaluation of the wells. Other exploration costs, including geological and geophysical costs, delay rentals and administrative costs associated with unproved property and unsuccessful exploratory well costs are expensed as incurred. Additionally, costs to operate and maintain wells and field equipment are expensed as incurred. Depletion is determined on a units-of-production basis over the remaining life of proved reserves. Capitalized exploratory drilling and development costs associated with productive depletable extractive properties are amortized using the unit-of-production rates based on the amount of proved developed reserves of oil and gas that are estimated to be recoverable from existing facilities using current operating methods. Under the unit-of-production method, oil and gas volumes are considered produced once they have been measured through meters at custody transfer or sales transaction points at the outlet valve on the lease or field storage tank. The net carrying values of retired, sold or abandoned properties that constitute less than a complete unit of depletable property are charged, net of proceeds, to accumulate depreciation, depletion and amortization unless doing so significantly affect the unit-of-production amortization rate, in which case a gain or loss is recognized to earnings. Gains or losses from the disposal of complete units of depletable property are recognized to earnings. Impairment of Oil and Natural Gas Properties Proved oil and natural gas properties are evaluated for impairment annually or when facts or circumstances indicate a possible decline in the recoverability of the carrying amount of such property. In performing this assessment, assets are grouped at the lowest level for which there are identifiable cash flows that are largely independent of the cash flows of other groups of assets. The Company estimates the expected future cash flows of its oil and natural gas properties and compares these undiscounted cash flows to the carrying amount of the oil and natural gas properties to determine if the carrying amount is recoverable. If an impairment is indicated, fair value is calculated using a discounted cash flow approach. Estimating future cash flows involves the use of judgments, including expected commodity prices, estimation of the oil and natural gas reserve quantities, capital expenditures and operating costs, and timing of development and production. Where unproved reserves exist, an appropriately risk-adjusted amount of these reserves may be included in the evaluation. Cash flow estimates for impairment testing exclude the effects of derivative instruments. Unproved properties are periodically assessed for impairment on a property-by-property basis, and any impairment in value is charged to impairment expense. In determining whether an unproved property is impaired, the Company considers numerous factors including, but not limited to, current development and exploration drilling plans, favorable or unfavorable exploration activity on adjacent leaseholds, evaluation of the lease and the remaining lease term.

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 10 Unproved properties and the related costs are transferred to proved properties when reserves are discovered on, or otherwise attributed, to the property. Leases The Company primarily leases office space and vehicles from third parties. The Company determines if a contract is a lease at inception. A contract contains a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The lease term begins on the commencement date, which is the date the Company takes possession of the asset, and may include options to extend or terminate the lease when it is reasonably certain that the option will be exercised. Certain of the Company’s leases contain renewal options for varying periods which either require mutual agreement by both lessee and lessor or can be exercised solely at the control of the lessee. Leases are classified as operating or finance leases based on factors such as the lease term, lease payments, and the economic life, fair value and estimated residual value of the asset. Where leases include options to purchase the leased asset at the end of the lease term, this is assessed as a part of the Company’s lease classification determination. Under ASC 842, the Company recognizes a right-of-use (“ROU”) asset and lease liability to account for its leases. ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized on the commencement date based on the present value of lease payments over the lease term. ROU assets are based on the lease liability and are increased by prepaid lease payments and decreased by lease incentives received. Lease incentives are amortized through the lease asset as reductions of expense over the lease term. For leases where the Company is reasonably certain to exercise a renewal option, such option periods have been included in the determination of the Company’s ROU assets and lease liabilities. The Company’s leases typically contain rent escalations over the lease term. The Company recognizes expense for these leases on a straight-line basis over the lease term. Certain leases require the Company to pay taxes, insurance, maintenance, and other operating expenses associated with the leased asset. Such amounts are not included in the measurement of the ROU assets and lease liabilities to the extent they are variable in nature. These variable lease costs are recognized as a variable lease expense when incurred. The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants. As a practical expedient, lease agreements with lease and non-lease components are accounted for as a single lease component for all asset classes. The Company estimates contingent lease incentives when it is probable that the Company is entitled to the incentive at lease commencement. The Company elected the short-term lease recognition exemption for all leases that qualify. Therefore, leases with an initial term of 12 months or less are not recorded on the consolidated balance sheet; instead, lease payments are recognized as lease expense on a straight-line basis over the lease term. The depreciable life of the ROU assets and leasehold improvements are limited by the expected lease term unless the Company is reasonably certain of a transfer of title or purchase option. The Company elected to use the risk-free rate as the discount rate for all asset classes if the rate implicit in the lease was not readily available.

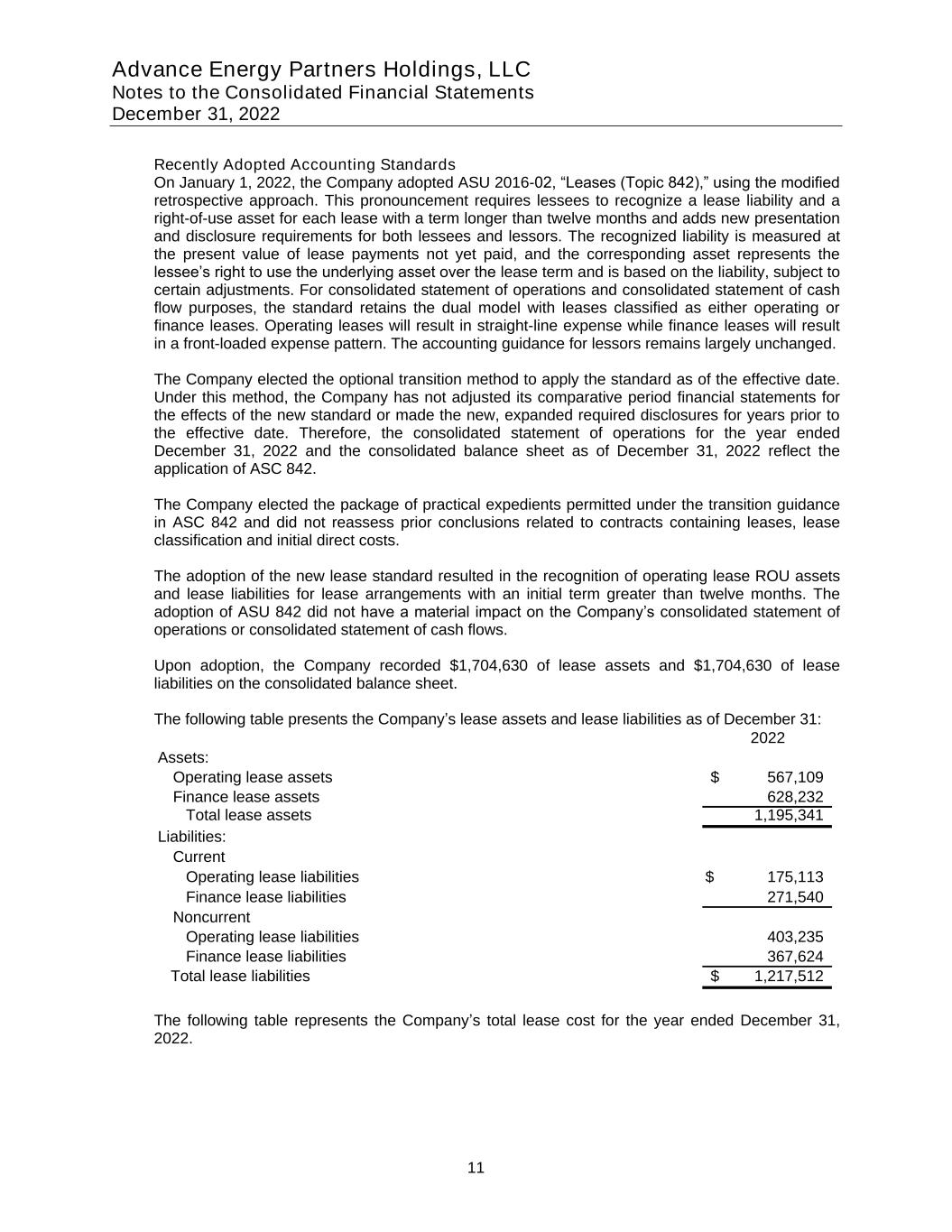

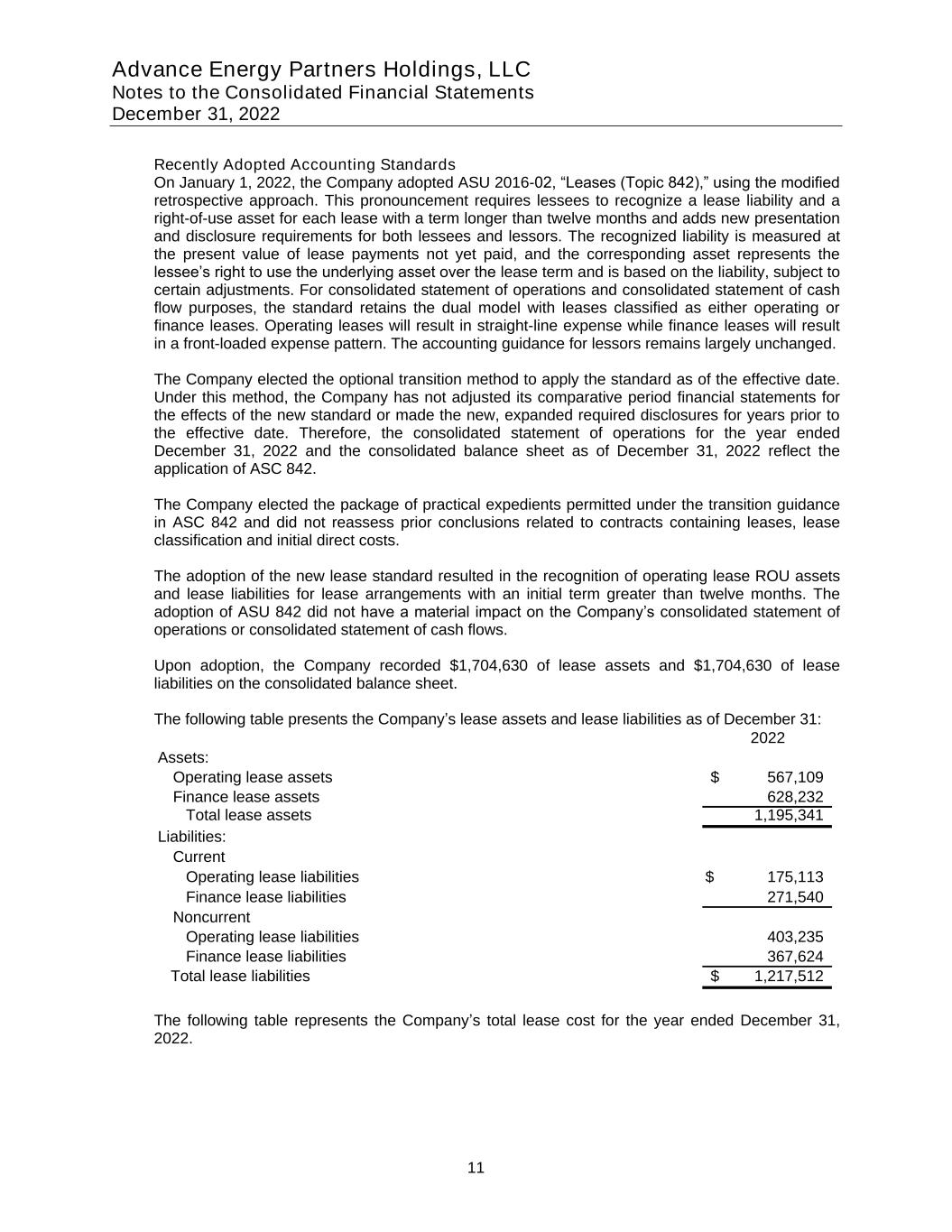

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 11 Recently Adopted Accounting Standards On January 1, 2022, the Company adopted ASU 2016-02, “Leases (Topic 842),” using the modified retrospective approach. This pronouncement requires lessees to recognize a lease liability and a right-of-use asset for each lease with a term longer than twelve months and adds new presentation and disclosure requirements for both lessees and lessors. The recognized liability is measured at the present value of lease payments not yet paid, and the corresponding asset represents the lessee’s right to use the underlying asset over the lease term and is based on the liability, subject to certain adjustments. For consolidated statement of operations and consolidated statement of cash flow purposes, the standard retains the dual model with leases classified as either operating or finance leases. Operating leases will result in straight-line expense while finance leases will result in a front-loaded expense pattern. The accounting guidance for lessors remains largely unchanged. The Company elected the optional transition method to apply the standard as of the effective date. Under this method, the Company has not adjusted its comparative period financial statements for the effects of the new standard or made the new, expanded required disclosures for years prior to the effective date. Therefore, the consolidated statement of operations for the year ended December 31, 2022 and the consolidated balance sheet as of December 31, 2022 reflect the application of ASC 842. The Company elected the package of practical expedients permitted under the transition guidance in ASC 842 and did not reassess prior conclusions related to contracts containing leases, lease classification and initial direct costs. The adoption of the new lease standard resulted in the recognition of operating lease ROU assets and lease liabilities for lease arrangements with an initial term greater than twelve months. The adoption of ASU 842 did not have a material impact on the Company’s consolidated statement of operations or consolidated statement of cash flows. Upon adoption, the Company recorded $1,704,630 of lease assets and $1,704,630 of lease liabilities on the consolidated balance sheet. The following table presents the Company’s lease assets and lease liabilities as of December 31: 2022 Assets: Operating lease assets 567,109$ Finance lease assets 628,232 Total lease assets 1,195,341 Liabilities: Current Operating lease liabilities 175,113$ Finance lease liabilities 271,540 Noncurrent Operating lease liabilities 403,235 Finance lease liabilities 367,624 Total lease liabilities 1,217,512$ The following table represents the Company’s total lease cost for the year ended December 31, 2022.

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 12 2022 Lease Cost Operating lease cost 204,101$ Finance lease cost: Amortization of right-of-use asset 269,861 Interest on lease liabilities 29,921 Total lease cost 503,883$ Supplemental cash flow information related to leases are as follows: 2022 Cash flows from financing activities Payments on finance lease obligations 258,929$ Supplemental cash flows information Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows used in operating leases 192,862$ Operating cash flows used in finance leases 29,921 Finance cash flows used in finance leases 258,929 Supplemental noncash information Right-of-use assets obtained in exchange for lease liabilities: Operating leases 762,661$ Finance leases 941,969 Other information Weighted-average remaining lease term (in years): Finance leases 2.33 Operating leases 2.84 Weighted-average discount rate: Finance leases 4.25% Operating leases 1.26% The Company has lease arrangements for office space and vehicles. These leases expire at various dates through 2025. The future minimum lease payments related to the Company's operating and finance leases are as follows: Year ended December 31, Operating Leases Finance Leases 2023 288,850$ 192,862$ 2024 288,850 178,470 2025 288,850 221,072 2026 94,817 189,984 2027 - - Thereafter - - Total lease payments 961,367 782,388 Less: Interest (383,019) (143,224) Present value of lease liabilities 578,348$ 639,164$

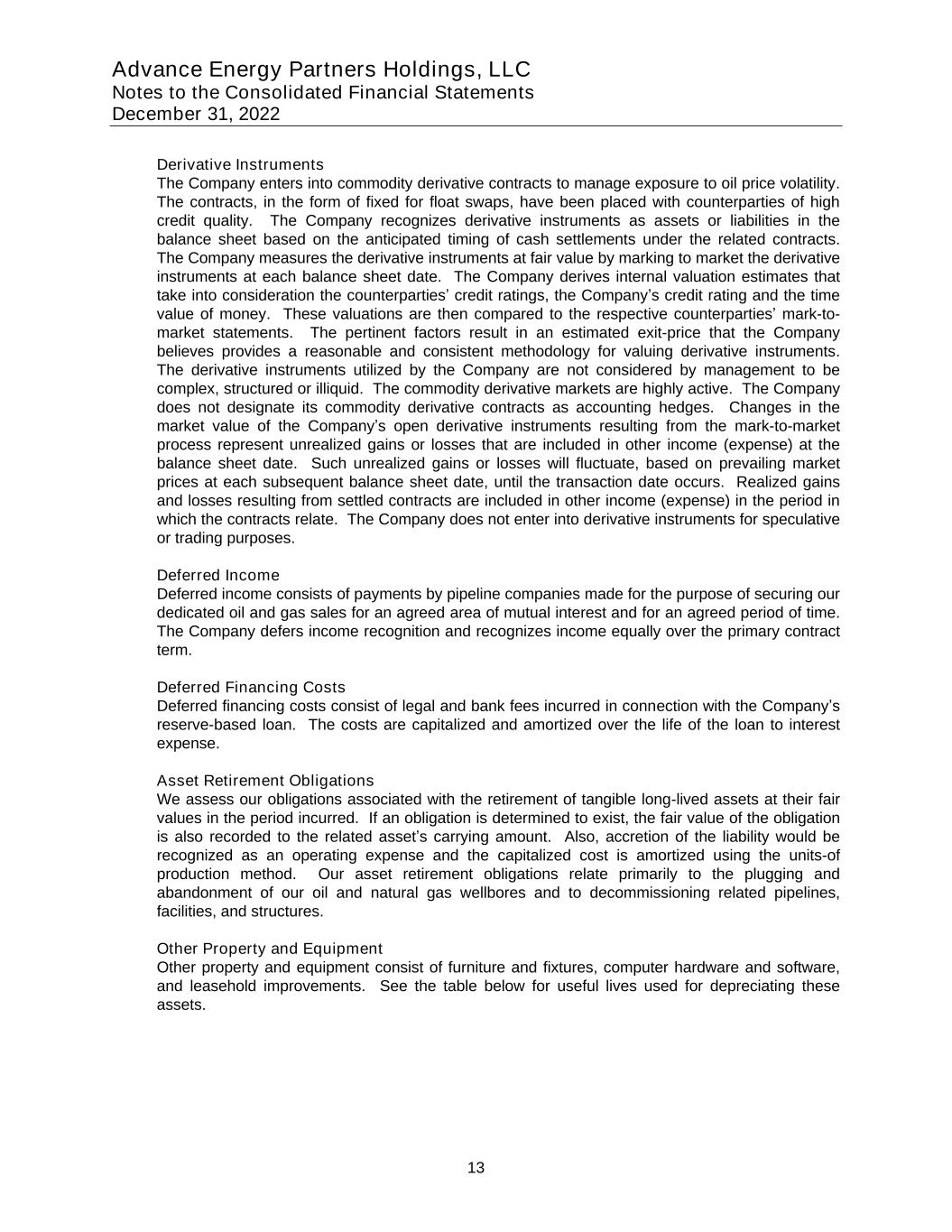

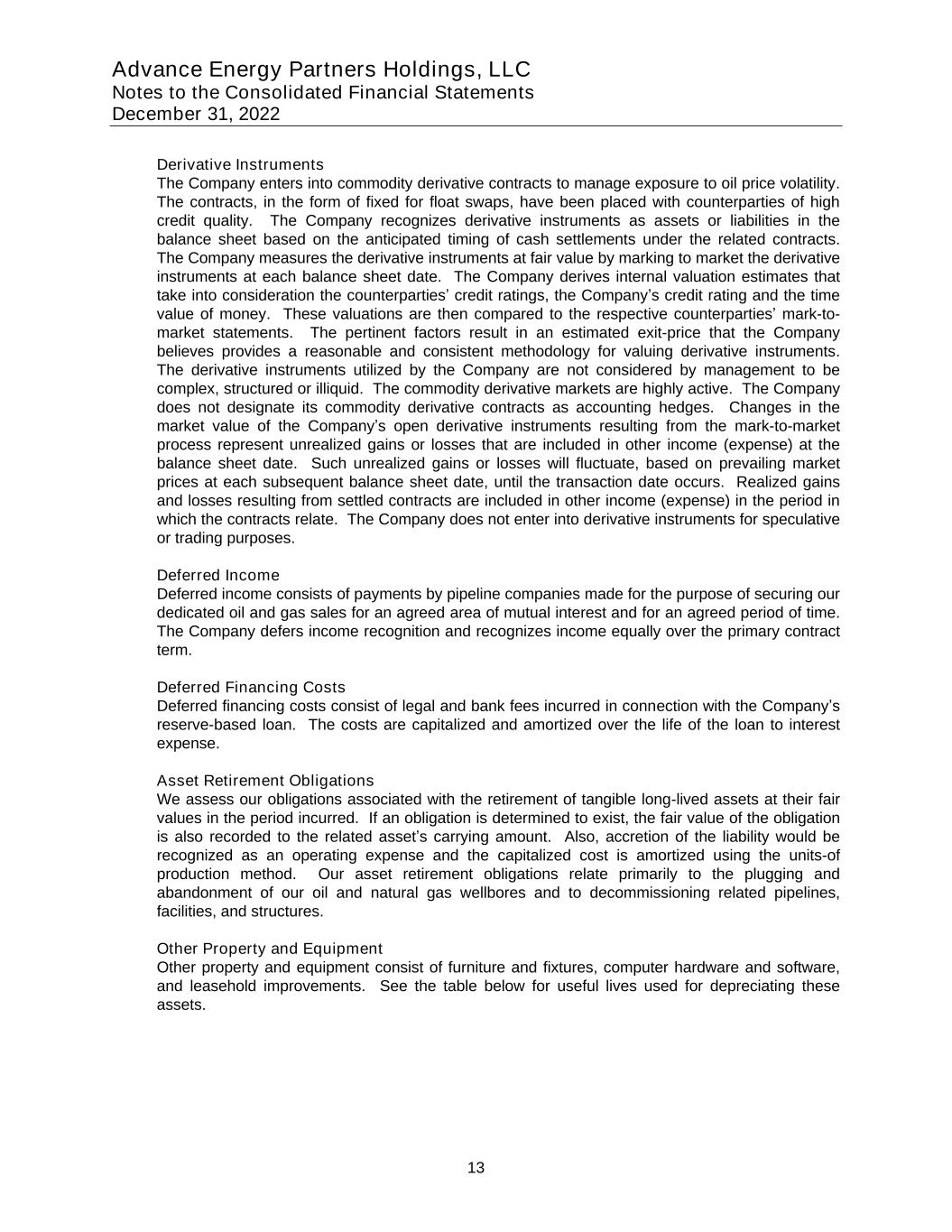

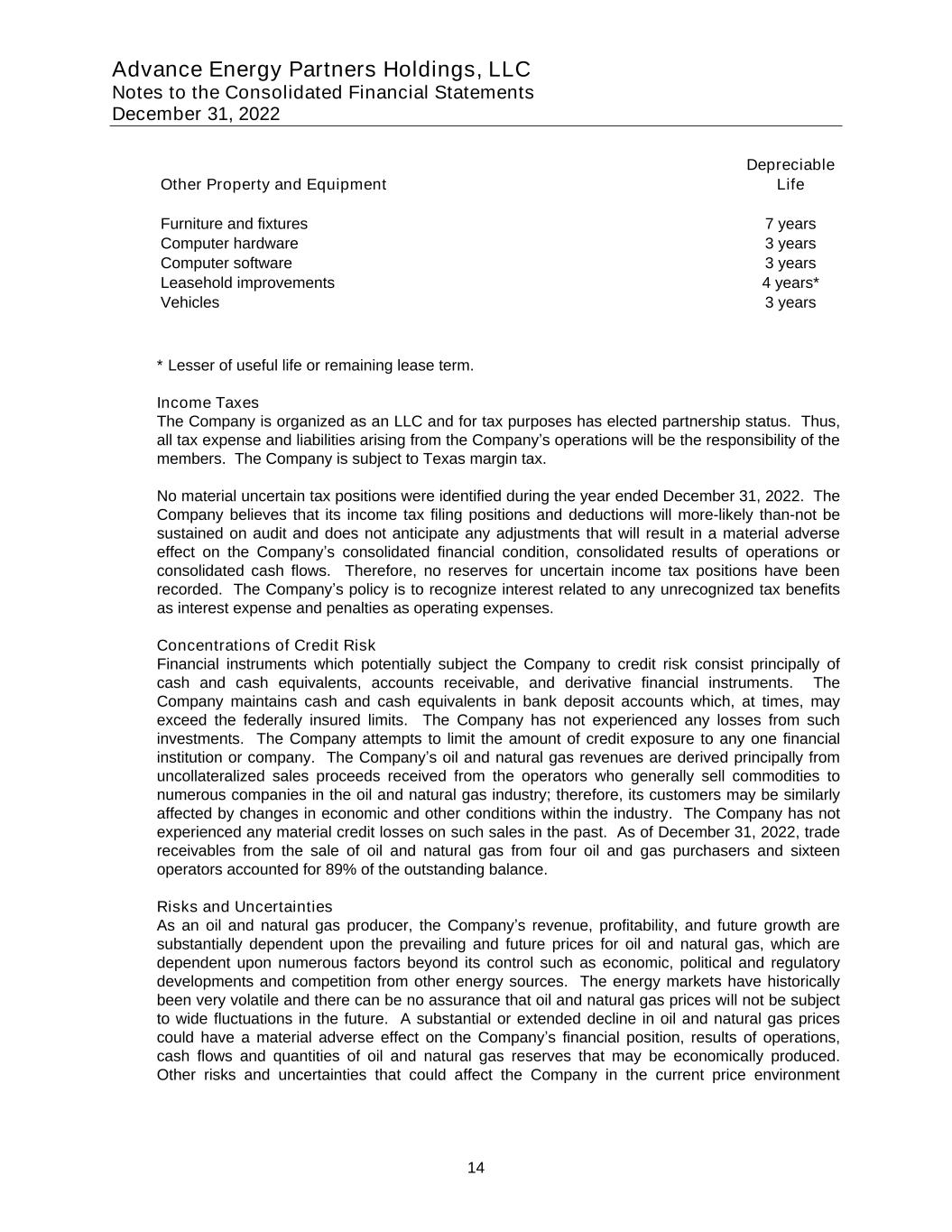

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 13 Derivative Instruments The Company enters into commodity derivative contracts to manage exposure to oil price volatility. The contracts, in the form of fixed for float swaps, have been placed with counterparties of high credit quality. The Company recognizes derivative instruments as assets or liabilities in the balance sheet based on the anticipated timing of cash settlements under the related contracts. The Company measures the derivative instruments at fair value by marking to market the derivative instruments at each balance sheet date. The Company derives internal valuation estimates that take into consideration the counterparties’ credit ratings, the Company’s credit rating and the time value of money. These valuations are then compared to the respective counterparties’ mark-to- market statements. The pertinent factors result in an estimated exit-price that the Company believes provides a reasonable and consistent methodology for valuing derivative instruments. The derivative instruments utilized by the Company are not considered by management to be complex, structured or illiquid. The commodity derivative markets are highly active. The Company does not designate its commodity derivative contracts as accounting hedges. Changes in the market value of the Company’s open derivative instruments resulting from the mark-to-market process represent unrealized gains or losses that are included in other income (expense) at the balance sheet date. Such unrealized gains or losses will fluctuate, based on prevailing market prices at each subsequent balance sheet date, until the transaction date occurs. Realized gains and losses resulting from settled contracts are included in other income (expense) in the period in which the contracts relate. The Company does not enter into derivative instruments for speculative or trading purposes. Deferred Income Deferred income consists of payments by pipeline companies made for the purpose of securing our dedicated oil and gas sales for an agreed area of mutual interest and for an agreed period of time. The Company defers income recognition and recognizes income equally over the primary contract term. Deferred Financing Costs Deferred financing costs consist of legal and bank fees incurred in connection with the Company’s reserve-based loan. The costs are capitalized and amortized over the life of the loan to interest expense. Asset Retirement Obligations We assess our obligations associated with the retirement of tangible long-lived assets at their fair values in the period incurred. If an obligation is determined to exist, the fair value of the obligation is also recorded to the related asset’s carrying amount. Also, accretion of the liability would be recognized as an operating expense and the capitalized cost is amortized using the units-of production method. Our asset retirement obligations relate primarily to the plugging and abandonment of our oil and natural gas wellbores and to decommissioning related pipelines, facilities, and structures. Other Property and Equipment Other property and equipment consist of furniture and fixtures, computer hardware and software, and leasehold improvements. See the table below for useful lives used for depreciating these assets.

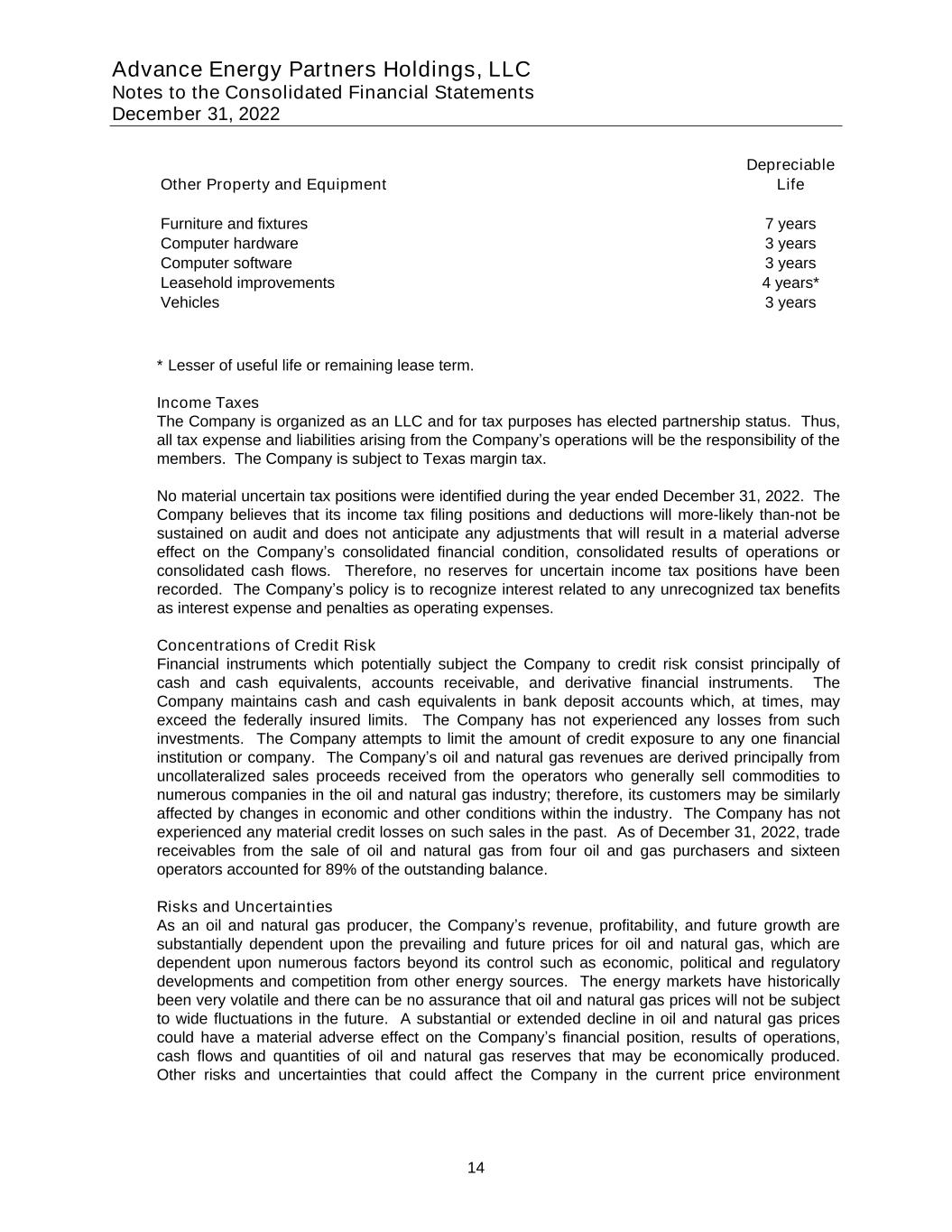

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 14 Depreciable Other Property and Equipment Life Furniture and fixtures 7 years Computer hardware 3 years Computer software 3 years Leasehold improvements 4 years* Vehicles 3 years * Lesser of useful life or remaining lease term. Income Taxes The Company is organized as an LLC and for tax purposes has elected partnership status. Thus, all tax expense and liabilities arising from the Company’s operations will be the responsibility of the members. The Company is subject to Texas margin tax. No material uncertain tax positions were identified during the year ended December 31, 2022. The Company believes that its income tax filing positions and deductions will more-likely than-not be sustained on audit and does not anticipate any adjustments that will result in a material adverse effect on the Company’s consolidated financial condition, consolidated results of operations or consolidated cash flows. Therefore, no reserves for uncertain income tax positions have been recorded. The Company’s policy is to recognize interest related to any unrecognized tax benefits as interest expense and penalties as operating expenses. Concentrations of Credit Risk Financial instruments which potentially subject the Company to credit risk consist principally of cash and cash equivalents, accounts receivable, and derivative financial instruments. The Company maintains cash and cash equivalents in bank deposit accounts which, at times, may exceed the federally insured limits. The Company has not experienced any losses from such investments. The Company attempts to limit the amount of credit exposure to any one financial institution or company. The Company’s oil and natural gas revenues are derived principally from uncollateralized sales proceeds received from the operators who generally sell commodities to numerous companies in the oil and natural gas industry; therefore, its customers may be similarly affected by changes in economic and other conditions within the industry. The Company has not experienced any material credit losses on such sales in the past. As of December 31, 2022, trade receivables from the sale of oil and natural gas from four oil and gas purchasers and sixteen operators accounted for 89% of the outstanding balance. Risks and Uncertainties As an oil and natural gas producer, the Company’s revenue, profitability, and future growth are substantially dependent upon the prevailing and future prices for oil and natural gas, which are dependent upon numerous factors beyond its control such as economic, political and regulatory developments and competition from other energy sources. The energy markets have historically been very volatile and there can be no assurance that oil and natural gas prices will not be subject to wide fluctuations in the future. A substantial or extended decline in oil and natural gas prices could have a material adverse effect on the Company’s financial position, results of operations, cash flows and quantities of oil and natural gas reserves that may be economically produced. Other risks and uncertainties that could affect the Company in the current price environment

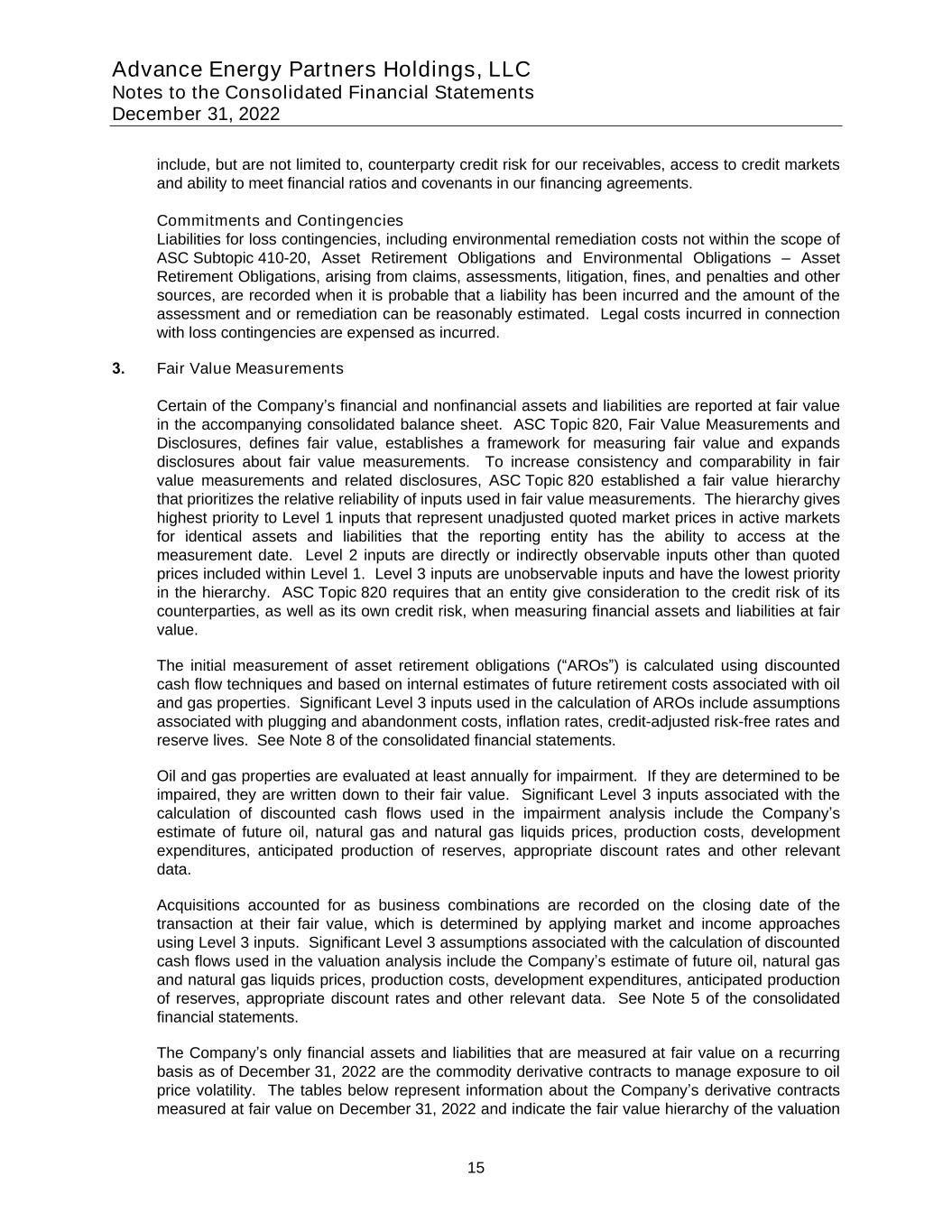

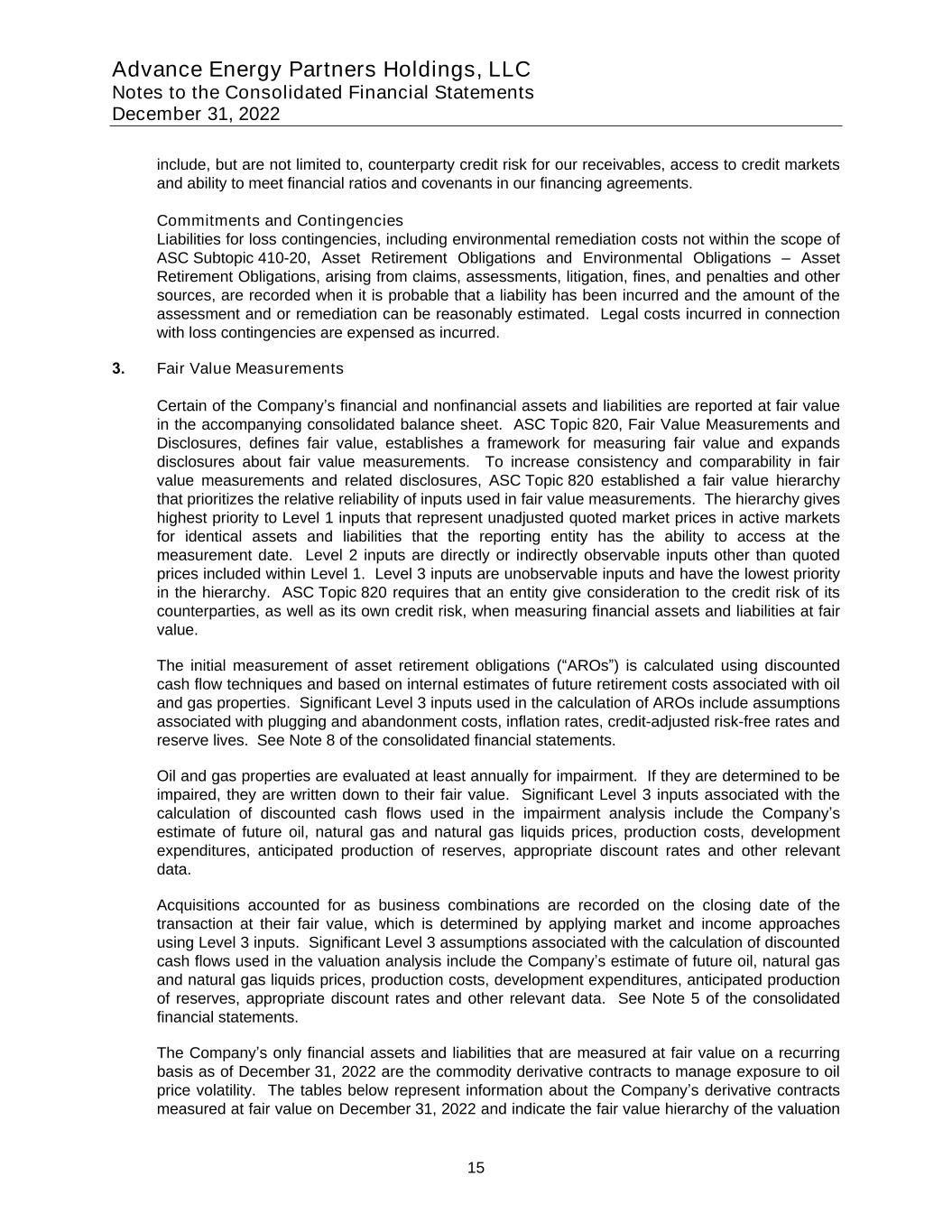

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 15 include, but are not limited to, counterparty credit risk for our receivables, access to credit markets and ability to meet financial ratios and covenants in our financing agreements. Commitments and Contingencies Liabilities for loss contingencies, including environmental remediation costs not within the scope of ASC Subtopic 410-20, Asset Retirement Obligations and Environmental Obligations – Asset Retirement Obligations, arising from claims, assessments, litigation, fines, and penalties and other sources, are recorded when it is probable that a liability has been incurred and the amount of the assessment and or remediation can be reasonably estimated. Legal costs incurred in connection with loss contingencies are expensed as incurred. 3. Fair Value Measurements Certain of the Company’s financial and nonfinancial assets and liabilities are reported at fair value in the accompanying consolidated balance sheet. ASC Topic 820, Fair Value Measurements and Disclosures, defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, ASC Topic 820 established a fair value hierarchy that prioritizes the relative reliability of inputs used in fair value measurements. The hierarchy gives highest priority to Level 1 inputs that represent unadjusted quoted market prices in active markets for identical assets and liabilities that the reporting entity has the ability to access at the measurement date. Level 2 inputs are directly or indirectly observable inputs other than quoted prices included within Level 1. Level 3 inputs are unobservable inputs and have the lowest priority in the hierarchy. ASC Topic 820 requires that an entity give consideration to the credit risk of its counterparties, as well as its own credit risk, when measuring financial assets and liabilities at fair value. The initial measurement of asset retirement obligations (“AROs”) is calculated using discounted cash flow techniques and based on internal estimates of future retirement costs associated with oil and gas properties. Significant Level 3 inputs used in the calculation of AROs include assumptions associated with plugging and abandonment costs, inflation rates, credit-adjusted risk-free rates and reserve lives. See Note 8 of the consolidated financial statements. Oil and gas properties are evaluated at least annually for impairment. If they are determined to be impaired, they are written down to their fair value. Significant Level 3 inputs associated with the calculation of discounted cash flows used in the impairment analysis include the Company’s estimate of future oil, natural gas and natural gas liquids prices, production costs, development expenditures, anticipated production of reserves, appropriate discount rates and other relevant data. Acquisitions accounted for as business combinations are recorded on the closing date of the transaction at their fair value, which is determined by applying market and income approaches using Level 3 inputs. Significant Level 3 assumptions associated with the calculation of discounted cash flows used in the valuation analysis include the Company’s estimate of future oil, natural gas and natural gas liquids prices, production costs, development expenditures, anticipated production of reserves, appropriate discount rates and other relevant data. See Note 5 of the consolidated financial statements. The Company’s only financial assets and liabilities that are measured at fair value on a recurring basis as of December 31, 2022 are the commodity derivative contracts to manage exposure to oil price volatility. The tables below represent information about the Company’s derivative contracts measured at fair value on December 31, 2022 and indicate the fair value hierarchy of the valuation

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 16 techniques utilized by the Company to determine such fair value. Certain amounts may be presented on a net basis on the consolidated financial statements when such amounts are with the same counterparty and subject to a master netting arrangement. As of December 31, 2022, all amounts are presented on a gross basis. As of December 31, 2022, assets and liabilities recorded at fair value in the consolidated balance sheet were determined to be based on Level 2 inputs. The following table summarizes the location and fair value amounts of all derivative contracts at December 31, 2022: Total Level 1 Level 2 Level 3 Balance Short-term commodity derivative asset -$ 11,169,758$ -$ 11,169,758$ Long-term commodity derivative asset 12,925,323 12,925,323 Total fair value measurement, assets - 24,095,081 - 24,095,081 Short-term commodity derivative liability 32,270,708 32,270,708 Long-term commodity derivative liability 17,081,445 17,081,445 Total fair value measurement, liabilities - 49,352,153 - 49,352,153 -$ (25,257,072)$ -$ (25,257,072)$ Assets and Liabilities Measured at Fair Value on a Recurring Basis

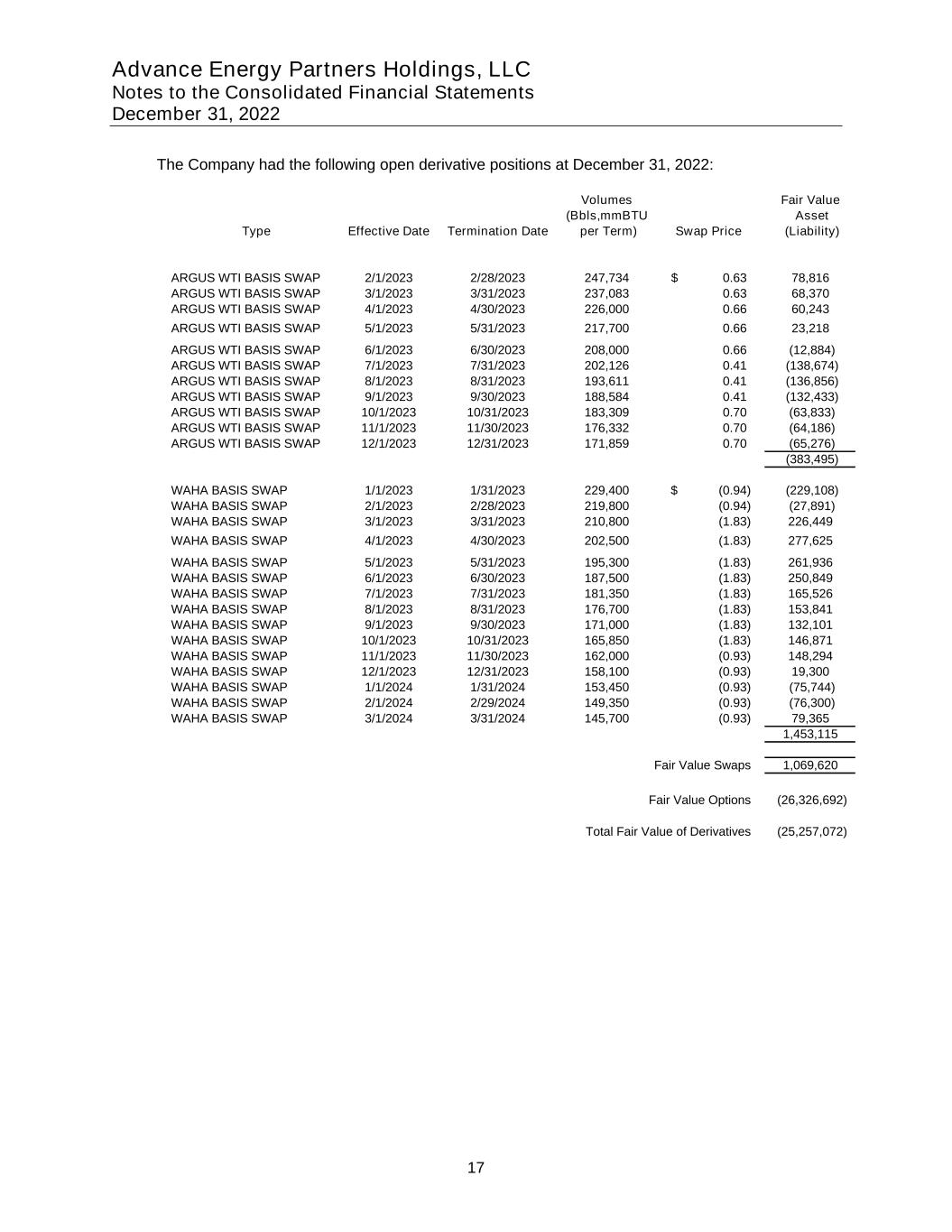

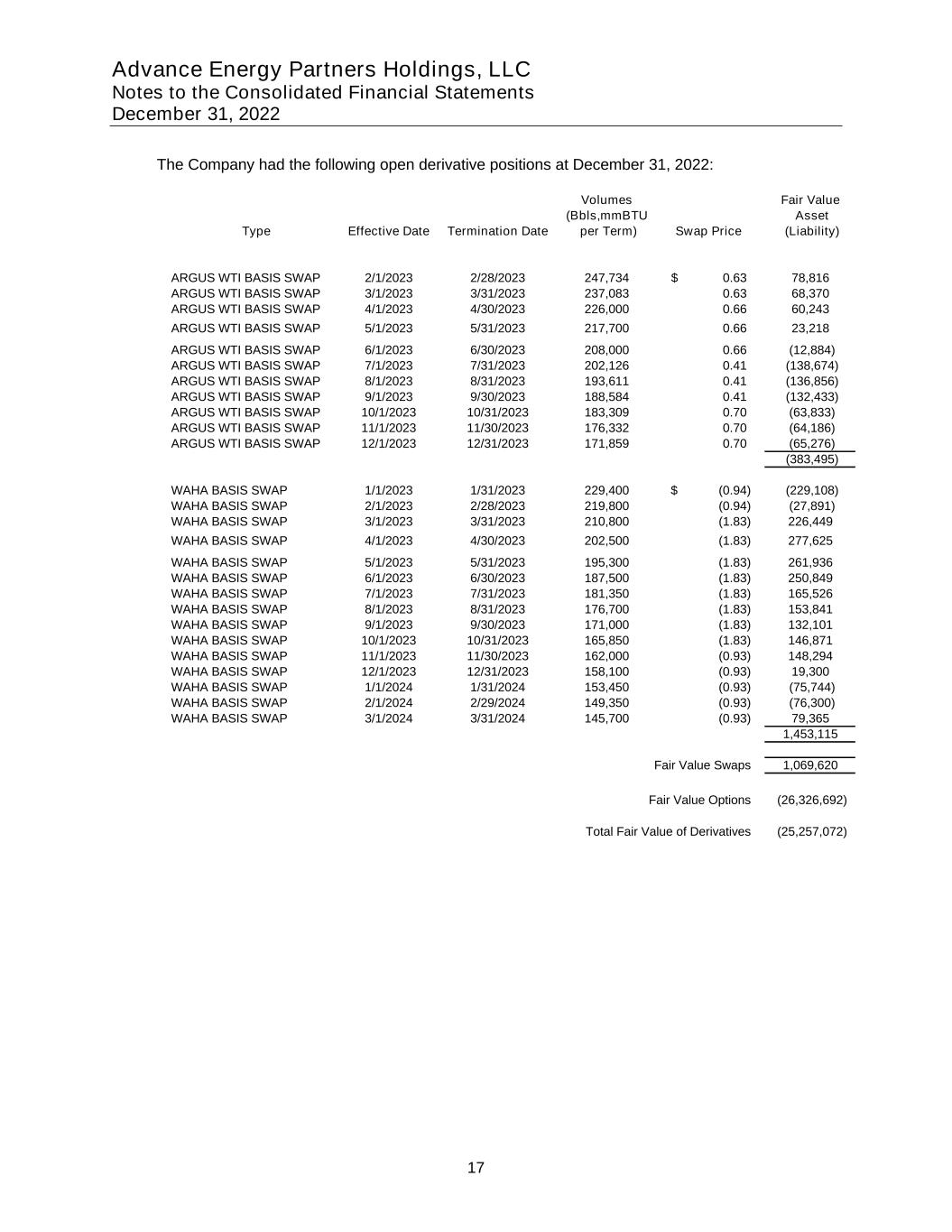

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 17 The Company had the following open derivative positions at December 31, 2022: Volumes Fair Value (Bbls,mmBTU Asset Type Effective Date Termination Date per Term) Swap Price (Liability) ARGUS WTI BASIS SWAP 2/1/2023 2/28/2023 247,734 0.63$ 78,816 ARGUS WTI BASIS SWAP 3/1/2023 3/31/2023 237,083 0.63 68,370 ARGUS WTI BASIS SWAP 4/1/2023 4/30/2023 226,000 0.66 60,243 ARGUS WTI BASIS SWAP 5/1/2023 5/31/2023 217,700 0.66 23,218 ARGUS WTI BASIS SWAP 6/1/2023 6/30/2023 208,000 0.66 (12,884) ARGUS WTI BASIS SWAP 7/1/2023 7/31/2023 202,126 0.41 (138,674) ARGUS WTI BASIS SWAP 8/1/2023 8/31/2023 193,611 0.41 (136,856) ARGUS WTI BASIS SWAP 9/1/2023 9/30/2023 188,584 0.41 (132,433) ARGUS WTI BASIS SWAP 10/1/2023 10/31/2023 183,309 0.70 (63,833) ARGUS WTI BASIS SWAP 11/1/2023 11/30/2023 176,332 0.70 (64,186) ARGUS WTI BASIS SWAP 12/1/2023 12/31/2023 171,859 0.70 (65,276) (383,495) WAHA BASIS SWAP 1/1/2023 1/31/2023 229,400 (0.94)$ (229,108) WAHA BASIS SWAP 2/1/2023 2/28/2023 219,800 (0.94) (27,891) WAHA BASIS SWAP 3/1/2023 3/31/2023 210,800 (1.83) 226,449 WAHA BASIS SWAP 4/1/2023 4/30/2023 202,500 (1.83) 277,625 WAHA BASIS SWAP 5/1/2023 5/31/2023 195,300 (1.83) 261,936 WAHA BASIS SWAP 6/1/2023 6/30/2023 187,500 (1.83) 250,849 WAHA BASIS SWAP 7/1/2023 7/31/2023 181,350 (1.83) 165,526 WAHA BASIS SWAP 8/1/2023 8/31/2023 176,700 (1.83) 153,841 WAHA BASIS SWAP 9/1/2023 9/30/2023 171,000 (1.83) 132,101 WAHA BASIS SWAP 10/1/2023 10/31/2023 165,850 (1.83) 146,871 WAHA BASIS SWAP 11/1/2023 11/30/2023 162,000 (0.93) 148,294 WAHA BASIS SWAP 12/1/2023 12/31/2023 158,100 (0.93) 19,300 WAHA BASIS SWAP 1/1/2024 1/31/2024 153,450 (0.93) (75,744) WAHA BASIS SWAP 2/1/2024 2/29/2024 149,350 (0.93) (76,300) WAHA BASIS SWAP 3/1/2024 3/31/2024 145,700 (0.93) 79,365 1,453,115 Fair Value Swaps 1,069,620 Fair Value Options (26,326,692) Total Fair Value of Derivatives (25,257,072)

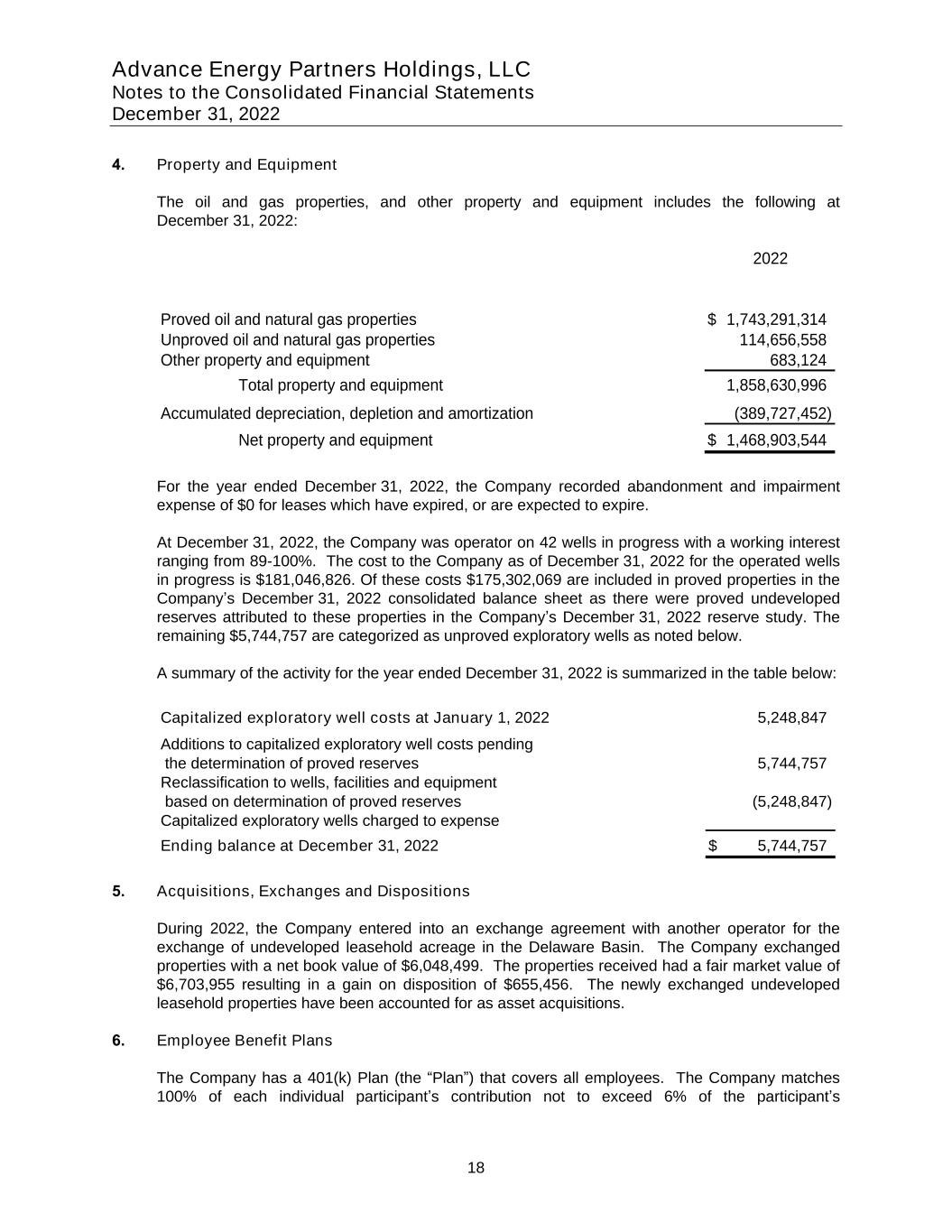

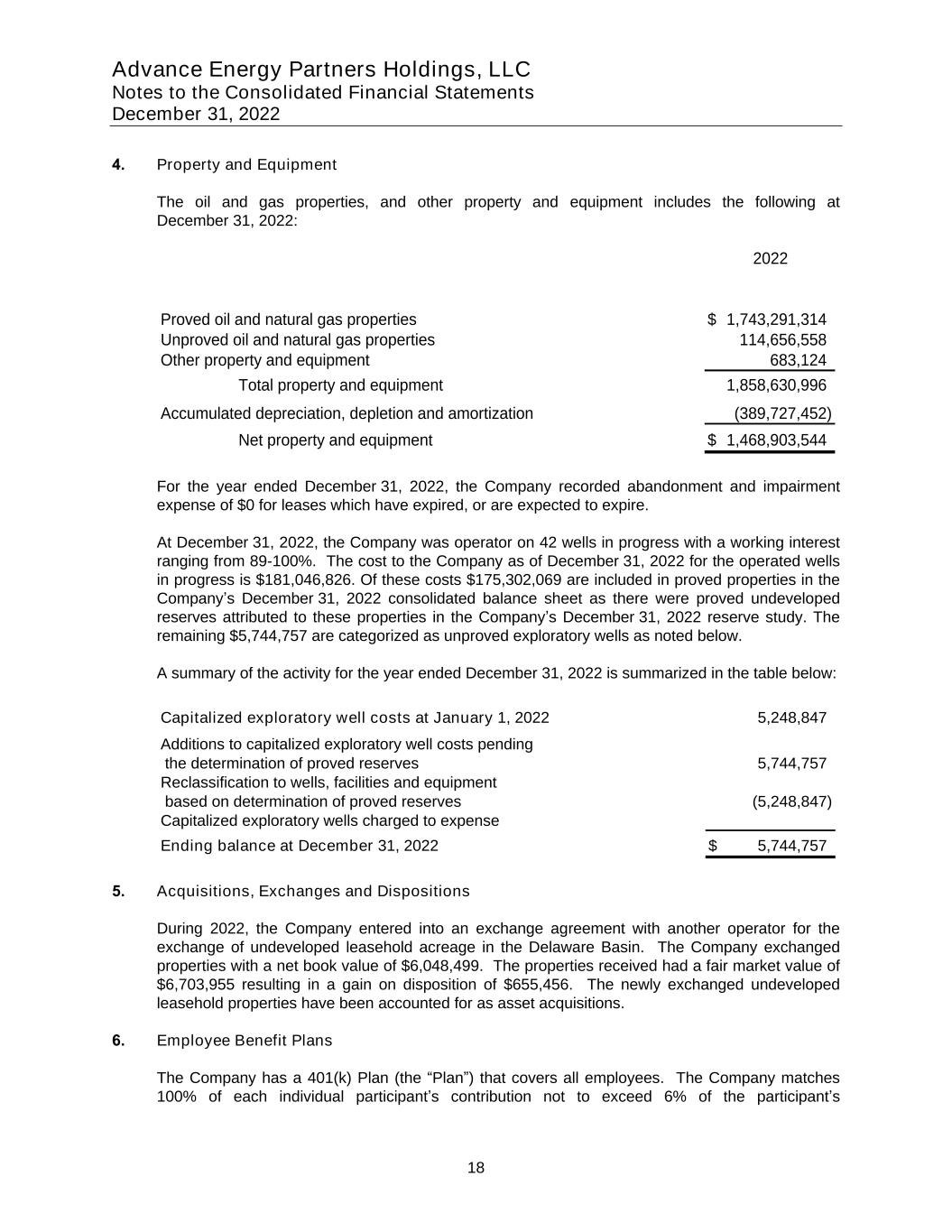

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 18 4. Property and Equipment The oil and gas properties, and other property and equipment includes the following at December 31, 2022: 2022 Proved oil and natural gas properties 1,743,291,314$ Unproved oil and natural gas properties 114,656,558 Other property and equipment 683,124 Total property and equipment 1,858,630,996 Accumulated depreciation, depletion and amortization (389,727,452) Net property and equipment 1,468,903,544$ For the year ended December 31, 2022, the Company recorded abandonment and impairment expense of $0 for leases which have expired, or are expected to expire. At December 31, 2022, the Company was operator on 42 wells in progress with a working interest ranging from 89-100%. The cost to the Company as of December 31, 2022 for the operated wells in progress is $181,046,826. Of these costs $175,302,069 are included in proved properties in the Company’s December 31, 2022 consolidated balance sheet as there were proved undeveloped reserves attributed to these properties in the Company’s December 31, 2022 reserve study. The remaining $5,744,757 are categorized as unproved exploratory wells as noted below. A summary of the activity for the year ended December 31, 2022 is summarized in the table below: Capitalized exploratory well costs at January 1, 2022 5,248,847 Additions to capitalized exploratory well costs pending the determination of proved reserves 5,744,757 Reclassification to wells, facilities and equipment based on determination of proved reserves (5,248,847) Capitalized exploratory wells charged to expense Ending balance at December 31, 2022 5,744,757$ 5. Acquisitions, Exchanges and Dispositions During 2022, the Company entered into an exchange agreement with another operator for the exchange of undeveloped leasehold acreage in the Delaware Basin. The Company exchanged properties with a net book value of $6,048,499. The properties received had a fair market value of $6,703,955 resulting in a gain on disposition of $655,456. The newly exchanged undeveloped leasehold properties have been accounted for as asset acquisitions. 6. Employee Benefit Plans The Company has a 401(k) Plan (the “Plan”) that covers all employees. The Company matches 100% of each individual participant’s contribution not to exceed 6% of the participant’s

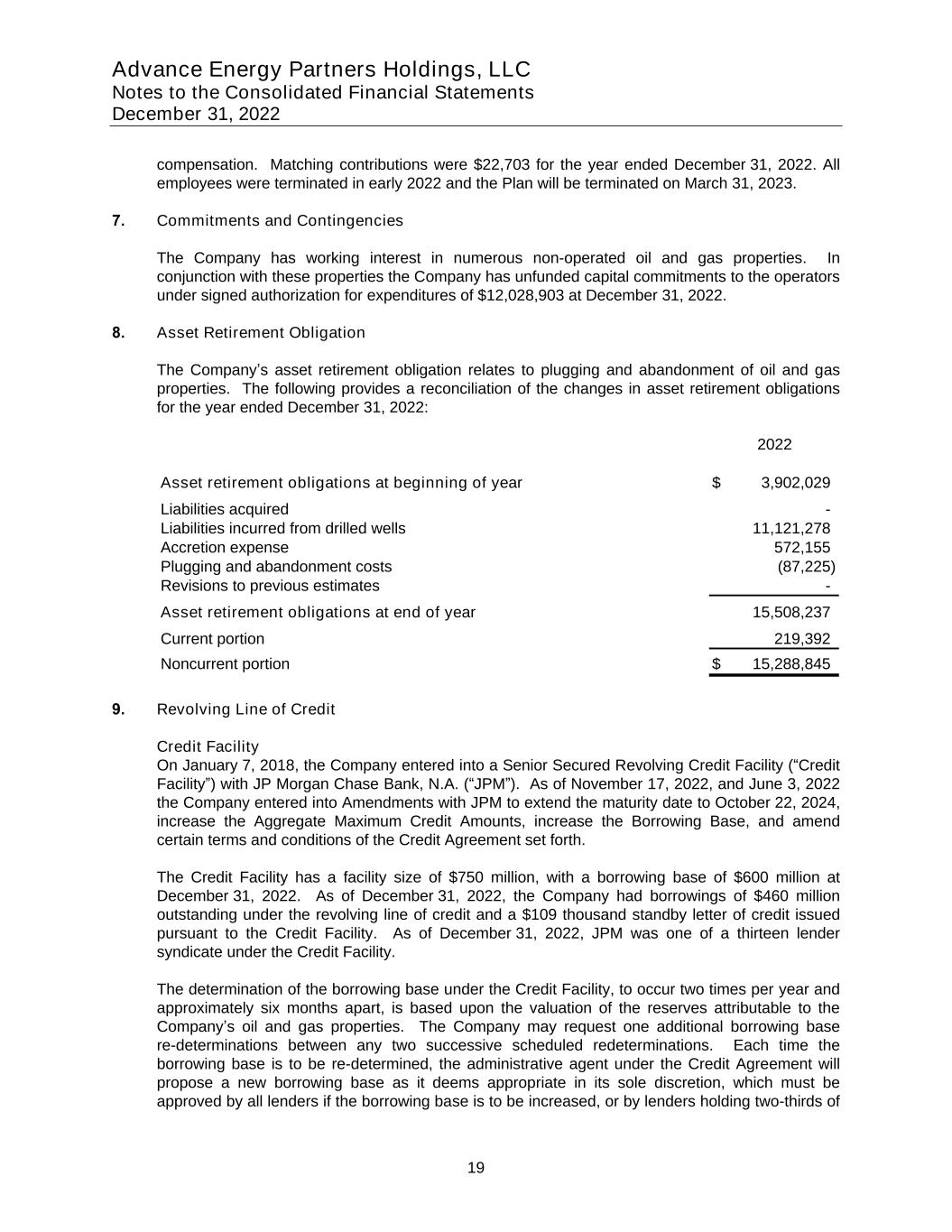

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 19 compensation. Matching contributions were $22,703 for the year ended December 31, 2022. All employees were terminated in early 2022 and the Plan will be terminated on March 31, 2023. 7. Commitments and Contingencies The Company has working interest in numerous non-operated oil and gas properties. In conjunction with these properties the Company has unfunded capital commitments to the operators under signed authorization for expenditures of $12,028,903 at December 31, 2022. 8. Asset Retirement Obligation The Company’s asset retirement obligation relates to plugging and abandonment of oil and gas properties. The following provides a reconciliation of the changes in asset retirement obligations for the year ended December 31, 2022: 2022 Asset retirement obligations at beginning of year 3,902,029$ Liabilities acquired - Liabilities incurred from drilled wells 11,121,278 Accretion expense 572,155 Plugging and abandonment costs (87,225) Revisions to previous estimates - Asset retirement obligations at end of year 15,508,237 Current portion 219,392 Noncurrent portion 15,288,845$ 9. Revolving Line of Credit Credit Facility On January 7, 2018, the Company entered into a Senior Secured Revolving Credit Facility (“Credit Facility”) with JP Morgan Chase Bank, N.A. (“JPM”). As of November 17, 2022, and June 3, 2022 the Company entered into Amendments with JPM to extend the maturity date to October 22, 2024, increase the Aggregate Maximum Credit Amounts, increase the Borrowing Base, and amend certain terms and conditions of the Credit Agreement set forth. The Credit Facility has a facility size of $750 million, with a borrowing base of $600 million at December 31, 2022. As of December 31, 2022, the Company had borrowings of $460 million outstanding under the revolving line of credit and a $109 thousand standby letter of credit issued pursuant to the Credit Facility. As of December 31, 2022, JPM was one of a thirteen lender syndicate under the Credit Facility. The determination of the borrowing base under the Credit Facility, to occur two times per year and approximately six months apart, is based upon the valuation of the reserves attributable to the Company’s oil and gas properties. The Company may request one additional borrowing base re-determinations between any two successive scheduled redeterminations. Each time the borrowing base is to be re-determined, the administrative agent under the Credit Agreement will propose a new borrowing base as it deems appropriate in its sole discretion, which must be approved by all lenders if the borrowing base is to be increased, or by lenders holding two-thirds of

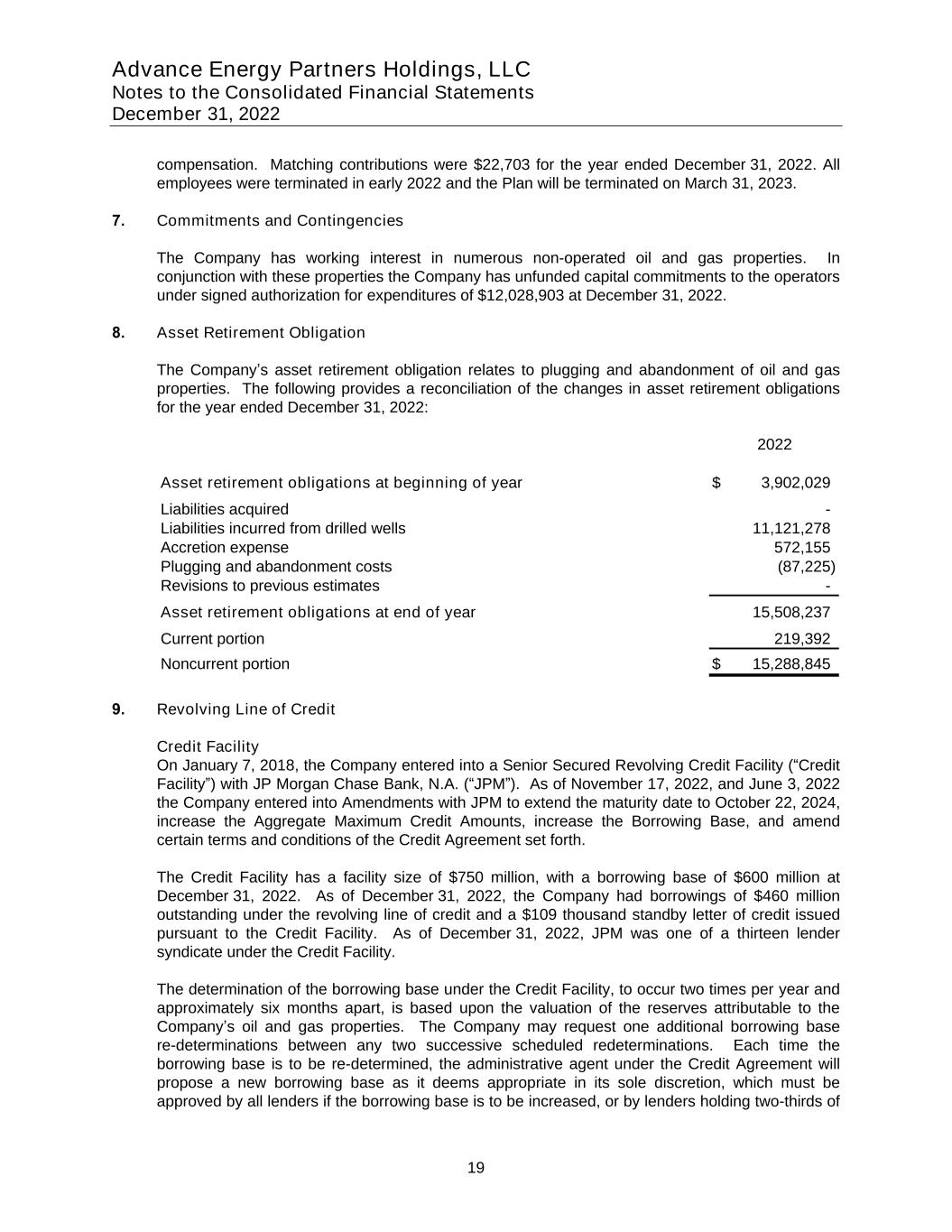

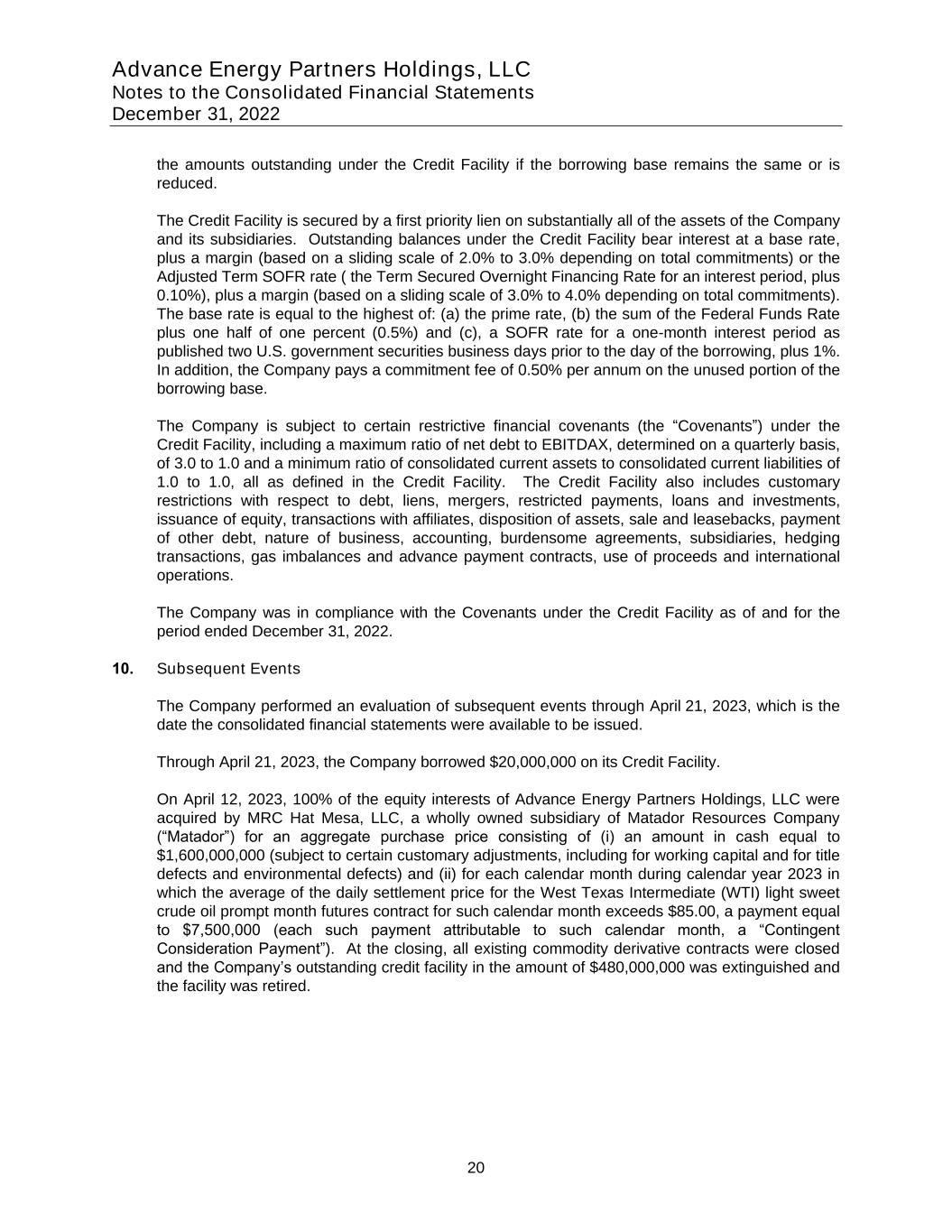

Advance Energy Partners Holdings, LLC Notes to the Consolidated Financial Statements December 31, 2022 20 the amounts outstanding under the Credit Facility if the borrowing base remains the same or is reduced. The Credit Facility is secured by a first priority lien on substantially all of the assets of the Company and its subsidiaries. Outstanding balances under the Credit Facility bear interest at a base rate, plus a margin (based on a sliding scale of 2.0% to 3.0% depending on total commitments) or the Adjusted Term SOFR rate ( the Term Secured Overnight Financing Rate for an interest period, plus 0.10%), plus a margin (based on a sliding scale of 3.0% to 4.0% depending on total commitments). The base rate is equal to the highest of: (a) the prime rate, (b) the sum of the Federal Funds Rate plus one half of one percent (0.5%) and (c), a SOFR rate for a one-month interest period as published two U.S. government securities business days prior to the day of the borrowing, plus 1%. In addition, the Company pays a commitment fee of 0.50% per annum on the unused portion of the borrowing base. The Company is subject to certain restrictive financial covenants (the “Covenants”) under the Credit Facility, including a maximum ratio of net debt to EBITDAX, determined on a quarterly basis, of 3.0 to 1.0 and a minimum ratio of consolidated current assets to consolidated current liabilities of 1.0 to 1.0, all as defined in the Credit Facility. The Credit Facility also includes customary restrictions with respect to debt, liens, mergers, restricted payments, loans and investments, issuance of equity, transactions with affiliates, disposition of assets, sale and leasebacks, payment of other debt, nature of business, accounting, burdensome agreements, subsidiaries, hedging transactions, gas imbalances and advance payment contracts, use of proceeds and international operations. The Company was in compliance with the Covenants under the Credit Facility as of and for the period ended December 31, 2022. 10. Subsequent Events The Company performed an evaluation of subsequent events through April 21, 2023, which is the date the consolidated financial statements were available to be issued. Through April 21, 2023, the Company borrowed $20,000,000 on its Credit Facility. On April 12, 2023, 100% of the equity interests of Advance Energy Partners Holdings, LLC were acquired by MRC Hat Mesa, LLC, a wholly owned subsidiary of Matador Resources Company (“Matador”) for an aggregate purchase price consisting of (i) an amount in cash equal to $1,600,000,000 (subject to certain customary adjustments, including for working capital and for title defects and environmental defects) and (ii) for each calendar month during calendar year 2023 in which the average of the daily settlement price for the West Texas Intermediate (WTI) light sweet crude oil prompt month futures contract for such calendar month exceeds $85.00, a payment equal to $7,500,000 (each such payment attributable to such calendar month, a “Contingent Consideration Payment”). At the closing, all existing commodity derivative contracts were closed and the Company’s outstanding credit facility in the amount of $480,000,000 was extinguished and the facility was retired.