As filed with the Securities and Exchange Commission on February 29, 2012

Registration No. _______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Quinko-Tek International, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 5020 | | 45-0676267 |

| (State or other jurisdiction of incorporation) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

1855 Hymus Blvd.

Dorval, Quebec

Canada H9P 1J8

Tel: (514) 685-2707

Fax: (514) 685-5920

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Vcorp Services, LLC

1645 Village Center Circle, Suite 170

Las Vegas, NV 89134

Tel: 888-528-2677

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Gregg E. Jaclin, Esq. Anslow + Jaclin, LLP 195 Route 9 South, Suite 204 Manalapan, New Jersey 07726 Tel: (732) 409-1212 Fax: (732) 577-1188 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | | |

Calculation OF Registration Fee

Title of Each Class Of Securities to be Registered | | Amount to be Registered | | | Proposed Maximum Offering Price per share | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| Common stock, $0.001 par value per share | | | 4,005,640 | | | $ | 0.033 | | | $ | 132,186.12 | | | $ | 15.15 | |

This Registration Statement covers the resale by our selling shareholders of up to 4,005,640 shares of common stock previously issued to such selling shareholders. The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price of the shares that were sold to our shareholders in a private offering. The price of $0.033 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board (“OTCBB”) at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC BB, nor can there be any assurance that such an application for quotation will be approved.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS | Subject to Completion on , 2012 |

4,005,640 shares of common stock

Quinko-Tek International, Inc.

This prospectus relates to periodic offers and sales of 4,005,640 shares of our common stock by the selling security holders.

Our common stock is presently not traded on any market or securities exchange. The 4,005,640 shares of our common stock can be sold by selling security holders at a fixed price of $0.033 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained. In the absence of a trading market or an active trading market, investors may be unable to liquidate their investment or make any profit from the investment.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 2 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____________, 2012

| | | 1 |

| | | 2 |

| | | 5 |

| | | 6 |

| | | 6 |

| | | 6 |

| | | 6 |

| | | 8 |

| | | 14 |

| | | 16 |

| | | 19 |

| | | 20 |

| | | 21 |

| | | 22 |

| | | 22 |

| | | 23 |

| | | 25 |

| | | 27 |

| | | 28 |

| | | 28 |

| | | 28 |

| | | F-1 |

| | | II-1 |

| | | II-5 |

Please read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read the entire prospectus, including “Risk Factors” and the consolidated financial statements and the related notes before making an investment decision.

“We,” “us,” “our company,” “our,” “Quinko” and the “Company” refer to the combined business Quinko-Tek International, Inc. and its consolidated subsidiaries, but do not include the shareholders of Quinko-Tek International, Inc.

Business Overview

We were incorporated under the laws of the State of Nevada on December 28, 2010. We are a holding company and conduct our operations through our subsidiary in Canada named 152724 Canada Inc. (“CanCo”). CanCo was incorporated in 1986 and is headquartered in Montreal, Canada. It is a wholesaler and importer of hardware for the furniture and cabinet trade.

In August 2011, we completed a private placement offering by selling 4,005,640 shares of common stock to 111 non-U.S. investors for approximately $130,000.

On December 12, 2011, we formed a company named Quinko-Tek Call Corp. (“CallCo”) in accordance with the Business Corporations Act (Ontario) whereby CallCo became our wholly owned subsidiary. On the same day, we formed a company named Quinko-Tek Acquisition Corp. (“AcquisitionCo”) in accordance with the Business Corporations Act (Ontario) whereby AcquisitionCo becames a wholly owned subsidiary of CallCo.

On January 26, 2012, we completed a series of transaction by entering into a share exchange agreement, rollover agreement, support agreement, and voting and trust exchange agreement with certain parties. As a result, CanCo become our wholly owned subsidiary. See “Corporate History and Structure” of this prospectus.

Risk Factors

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed in the section titled “Risk Factors,” beginning on page 2.

Corporate Information

The address of our principal executive office is at 1855 Hymus Blvd., Dorval, Quebec, Canada H9P 1J8, and our telephone number is (514) 685-2707. We maintain a website at www.quinkotek.com. Information available on our website is not incorporated by reference in and is not deemed a part of this prospectus.

The Offering

| Shares of common stock offered by selling shareholders | | 4,005,640 |

| | | |

| Shares of common stock outstanding before the offering | | 7,843,831 (not including 8,133,309 shares of common stock to be issued upon conversion of the Exchangeable Shares of AcquisitionCo) |

| | | |

| Shares of common stock outstanding after the offering | | 7,843,831 (not including 8,133,309 shares of common stock to be issued upon conversion of the Exchangeable Shares of AcquisitionCo) |

| | | |

| Terms of the offering | | The selling shareholders will determine when and how they will sell the securities offered in this prospectus. |

| | | |

| Use of proceeds | | We will not receive proceeds from the resale of shares by the selling shareholders. |

| | | |

| Risk Factors | | The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” below. |

You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

The effects of the recent global economic slowdown may continue to have a negative impact on our business, results of operations or financial condition.

The recent global economic slowdown has caused disruptions and extreme volatility in global financial markets, increased rates of default and bankruptcy, and declining consumer and business confidence, which has led to decreased levels of consumer spending. These macroeconomic developments have and could continue to negatively impact our business, which depends on the general economic environment and levels of consumer spending in Canada and other parts of the world that affect not only the ultimate consumer, but also retailers. As a result, we may not be able to maintain or increase our sales to existing customers, make sales to new customers, or maintain or improve our earnings from operations as a percentage of net sales. If the global economic slowdown continues for a significant period or continues to worsen, our results of operations, financial condition, and cash flows could be materially adversely affected.

We cannot assure you that our growth strategy will be successful which may result in a negative impact on our growth, financial condition, results of operations and cash flow.

One of our strategies is to expand our sourcing and supplier network, as well as to increase our sales to the United States. We cannot assure you that we will be able to successfully overcome the obstacles and establish our products in the United States or expand our sales network. Our inability to implement this growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

We currently do not have any agreement with our suppliers or customers. If these suppliers decide not to provide us products or these customers decide not to purchase products from us, our business operations and financial results will be adversely affected.

We currently do not have any agreement with our suppliers or customers. We do not know if these suppliers or customers will continue to cooperate with us although we have good relationships with them. Also, the terms of the transactions are not guaranteed and may be changed from time to time or subject to negotiation based on supply and demand. If these suppliers decide not to provide us products or these customers decide not to purchase products from us, or if the terms of the transaction negatively change, our revenues and operations will be adversely affected.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

If adequate additional financing is not available on reasonable terms, we may not be able to expand our production lines and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our securities can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If we need additional funding we will, most likely, seek such funding in the United States and Canada, and the market fluctuations affect on our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the units. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Need for additional employees.

Our future success also depends upon our continuing ability to attract and retain highly qualified personnel. Expansion of our business and the management and operation will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. There can be no assurance that we will be able to attract or retain highly qualified personnel. Competition for skilled personnel in our industries is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

Our future success is dependent, in part, on the performance and continued service of Ira Kroo, our president and director. Without his continued service, we may be forced to interrupt or eventually cease our operations.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Ira Kroo, our president and director. Without his continued service, we may be forced to interrupt or eventually cease our operations. The loss of any key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

Our inability to protect our intellectual property rights may force us to incur unanticipated costs.

Our success will depend, in part, on our ability to obtain and maintain protection in Canada and the United States for certain intellectual property incorporated into our products. Our intellectual properties may be challenged, narrowed, invalidated or circumvented, which could limit our ability to prevent competitors from marketing similar solutions that limit the effectiveness of our trademark protection and force us to incur unanticipated costs.

We may incur significant costs to be a public company to ensure compliance with U.S corporate governance and accounting requirements and we may not be able to absorb such costs.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $75 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

The lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. Securities Laws.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our senior management has never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including the establishing and maintaining of internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

As a Nevada corporation, we are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Some foreign companies, including some that may compete with our company, may not be subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the Angola or any other countries in which we conduct our business. However, our employees or other agents may engage in conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Risks Associated with Our Securities

We have never declared or paid any cash dividends or distributions on our capital stock. And we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

The offering price of our common stock was determined based on the price of our private offering, and therefore should not be used as an indicator of the future market price of the securities. Therefore, the offering price bears no relationship to our actual value, and may make our shares difficult to sell.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.033 per share for the shares of common stock was determined based on the price of our private offering. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

You will experience dilution of your ownership interest because of the future issuance of additional shares of our common stock and our preferred stock.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 160,000,000 shares of capital stock consisting of 150,000,000 shares of common stock, par value $.001 per share, and 10,000,000 shares of preferred stock, par value $.001 per share.

We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes.

Our common stock is considered a penny stock, which may be subject to restrictions on marketability, so you may not be able to sell your shares.

If our common stock becomes tradable in the secondary market, we will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our shareholders to sell their securities.

Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

There is no assurance of a public market or that our common stock will ever trade on a recognized stock exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our common stock. Our shares have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

Our Board of Directors’ ability to issue undesignated preferred stock and the existence of anti-takeover provisions may depress the value of our common stock.

Our authorized capital includes 10,000,000 shares of undesignated preferred stock, of which one (1) share is designated as share of Series A Preferred Stock. Please see “Description of Securities—Series A Preferred Stock.” Our Board of Directors has the power to issue any or all of the shares of preferred stock, including the authority to establish one or more series and to fix the powers, preferences, rights and limitations of such class or series, without seeking stockholder approval. Our Board of Directors may, in the future, consider adopting additional anti-takeover measures. The authority of our board of directors to issue undesignated stock and the anti-takeover provisions of Nevada law, as well as any future anti-takeover measures adopted by us, may, in certain circumstances, delay, deter or prevent takeover attempts and other changes in control of us that are not approved by our Board of Directors. As a result, our stockholders may lose opportunities to dispose of their shares at favorable prices generally available in takeover attempts or that may be available under a merger proposal and the market price, voting and other rights of the holders of common stock may also be affected.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this prospectus. You should read this prospectus and the documents that we reference in this prospectus, or that we filed as exhibits to the registration statement of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

The selling stockholders are selling shares of common stock covered by this prospectus for their own account. We will not receive any of the proceeds from the sale of these shares. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

DETERMINATION OF OFFERING PRICE

Since our common stock is not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was determined by the price of the common stock that was sold to our security holders pursuant to an exemption under Section 4(2) of the Securities Act of 1933 and Regulation S promulgated under the Securities Act of 1933.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value.

Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

The common stock to be sold by the selling shareholders is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders. However, in the future if we decide to issue more shares our existing shareholders will experience dilution.

MARKET FOR OUR SECURITIES AND RELATED SHAREHOLDER MATTERS

There is presently no established public trading market for our shares of common stock. We anticipate on applying for trading of our common stock on the OTC Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms apart. However, we can provide no assurance that our shares of common stock will be traded on the Bulletin Board or, if traded, that a public market will materialize.

Holders

As of the date of this prospectus, we had 112 shareholders of our common stock.

Transfer Agent and Registrar

Island Stock Transfer Company is currently the transfer agent and registrar for our common stock. Its address is 15500 Roosevelt Boulevard, Suite 301, Clearwater, Florida 33760. Its phone number is (727) 289-0010.

Dividends

Since inception we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future. Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Securities Authorized for Issuance Under Equity Compensation Plans

We presently do not have any equity based or other long-term incentive programs. In the future, we may adopt and establish an equity-based or other long-term incentive plan if it is in the best interest of the Company and our shareholders to do so.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The information and financial data discussed below is derived from the audited financial statements of CanCo for its fiscal years ended January 31, 2011 and 2010, and the unaudited financial statements of CanCo for its nine month periods ended October 31, 2011 and 2010. The financial statements of CanCo were prepared and presented in accordance with generally accepted accounting principles in the United States. The information and financial data discussed below is only a summary and should be read in conjunction with the historical financial statements and related notes of CanCo contained elsewhere in this prospectus. The financial statements contained elsewhere in this prospectus fully represent CanCo’s financial condition and operations; however, they are not indicative of the Company’s future performance.

Company Overview

We were incorporated under the laws of the State of Nevada on December 28, 2010. We are a holding company and conduct our operations through our subsidiary in Canada named 152724 Canada Inc. (“CanCo”). CanCo was incorporated in 1986 and is headquartered in Montreal, Canada. It is a wholesaler and importer of hardware for the furniture and cabinet trade.

In August 2011, we completed a private placement offering by selling 4,005,640 shares of common stock to 111 non-U.S. investors for approximately $130,000.

On December 12, 2011, we formed a company named Quinko-Tek Call Corp. (“CallCo”) in accordance with the Business Corporations Act (Ontario) whereby CallCo became our wholly owned subsidiary. On the same day, we formed a company named Quinko-Tek Acquisition Corp. (“AcquisitionCo”) in accordance with the Business Corporations Act (Ontario) whereby AcquisitionCo became a wholly owned subsidiary of CallCo.

On January 26, 2012, we completed a series of transactions by entering into a share exchange agreement, rollover agreement, support agreement, and voting and trust exchange agreement with certain parties. As a result, CanCo became our wholly owned subsidiary. See “Corporate History and Structure” of this prospectus.

We plan to take the following action to implement our business plan and maintain our growth:

| - | Continue expansion and growth in the United States and regions of Canada outside Quebec; |

| - | Introduce additional product lines branded under the Q-Line Elite trademark. We hope that each of these new lines will offer new or better options to customers than existing similar product choices; |

| - | Strengthen or establish new relationships with manufacturing partners who offer unique and exceptional product lines of their own; |

| - | Increase investment in web based marketing and on-line ordering capabilities; |

| - | Increase investment in internal operational procedures to enable better inventory control and even better delivery of service and advice; and |

| - | Further develop relationships with existing customers and expansion of products they are currently purchasing. |

Foreign Currency Risk

We make purchases and sales in both Canadian (CAD) and USD in the normal course of business. A significant percentage of our goods are purchased in US dollars. A significant percentage of our sales are made in Canadian dollars.

To offset the risk involved in fluctuations in the CAD/USD exchange rate, we have strategically been increasing our sales denominated in USD, even to our Canadian customers. As well, sales to the U.S. market are made in USD. In addition, we use a very conservative policy with regard to our CAD selling prices, including as part of our costing model a significant factor to protect against a negative foreign exchange move.

Finally, we monitor daily the changes in the CAD/USD exchange rate and where appropriate we either cover our USD requirements in spot purchases or protect us with the purchase of futures.

Results of Operations

The following table summarizes changes in selected operating indicators of the Company, illustrating the relationship of income and expense items to net earnings (loss) for the respective periods presented (components may not add or subtract to totals due to rounding):

| | | For the Nine Months Ended October 31, | | | For the Three Months Ended October 31, | | | For the Year Ended January 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Sales | | $ | 8,775,575 | | | $ | 7,642,502 | | | $ | 2,893,758 | | | $ | 2,481,683 | | | $ | 9,912,698 | | | $ | 8,081,931 | |

| Cost of Goods Sold | | | 5,900,789 | | | | 5,166,502 | | | | 1,935,664 | | | | 1,684,889 | | | | 6,698,077 | | | | 5,689,781 | |

| Gross Profit | | | 2,874,786 | | | | 2,476,000 | | | | 958,094 | | | | 796,794 | | | | 3,214,621 | | | | 2,392,150 | |

| Total Operating Expenses | | | 2,759,743 | | | | 2,361,727 | | | | 889,036 | | | | 802,646 | | | | 3,127,883 | | | | 2,617,009 | |

| Forgiveness of debt – loans payable | | | - | | | | - | | | | - | | | | - | | | | - | | | | 54,567 | |

| Forgiveness of debt – advances from related parties | | | - | | | | - | | | | - | | | | - | | | | 974,300 | | | | - | |

| Current Income Taxes (recovery) | | | 39,177 | | | | 37,509 | | | | 18,894 | | | | - | | | | 44,233 | | | | - | |

| Net Earnings (Loss) | | | 75,866 | | | | 76,764 | | | | 50,164 | | | | (5,852 | ) | | | 880,403 | | | | (90,048 | ) |

| Other Comprehensive Income (Foreign currency translation) | | | 2,295 | | | | 6,120 | | | | 3,303 | | | | (174 | ) | | | 11,199 | | | | (12,880 | ) |

| Comprehensive Income | | $ | 78,161 | | | $ | 82,884 | | | $ | 53,467 | | | $ | (6,026 | ) | | $ | 891,602 | | | $ | (102,928 | ) |

Results of Operations for the Nine Months Ended October 31, 2011 as Compared to the Nine Months Ended October 31, 2010

For the nine months ended October 31, 2011, sales continued to increase and gross profit continued to improve. Growth came in all sectors of operations, both from existing customers and product groups as well as from new customers and new product introductions. Particularly, we gained important growth in the U.S. market, both in terms of a number of new customers and in terms of growth in sales. The markets we have chosen to focus on have been positively responding to the Company’s products and services. We plan to continue our strategies- of expanding into the U.S. markets.

Sales

Sales for the nine months ended October 31, 2011 were approximately $8.78 million as compared to approximately $7.64 million for the same period in 2010, reflecting an increase of 14.9%. The increase in sales during this period is mostly attributed to an increase in the number of customers, the Company’s continued implementation of its strategy to expand into new markets and expand its product lines, and the benefits of a higher average CAD/USD exchange rate.

For the nine months ended October 31, 2011, the number of our U.S. customers increased by 52% as compared to the same period in 2010. and therefore the Sales in the U.S. market increased by 37% during the nine months ended October 31, 2011. For the nine months the percentage of sales from the U.S. market compared to the total sales increased from 4.7% in 2010 to 6.3% in 2011 (of a higher total). For the three months the percentage of sales from the U.S. market compared to the total sales increased from 4.8% in 2010 to 8% in 2011 (of a higher total).

We also continued our expansion into the retail home renovation center section and entered into new geographic regions such as western Canada.

We were also the beneficiary of a higher average CAD/USD exchange rate. The average exchange rate for the nine months ended October 31, 2011was 1.0199 versus an average exchange rate for the same period in 2010 of .9678. Without this foreign exchange translation, the increase in sales was 8.96%.

Cost of Goods Sold

Cost of goods sold for the nine months of ended October 31, 2011 was approximately $5.90 million as compared to approximately $5.17 million for the same period in 2010. This represents an increase of 14.21%. The increase can be attributed to increased purchases during the period to support the increased sales and a higher average CAD/USD exchange rate, which added 5.83% to the increase in cost of goods sold when translated into USD.

Gross Profit

Gross profit for the nine months October 31, 2011 was approximately $2.87 million as compared to approximately $2.48 million for the same period in 2010. Gross profit margin improved from 32.40% to 32.76%.

Total Operating Expenses

Total operating expenses for the first nine months of 2011 were approximately $2.76 million as compared to approximately $2.36 million for the same period in 2010, reflecting an increase of 16.85%. The increase can be mostly attributed to continued investment in U.S. operations. In July 2010, we opened a warehouse facility in Maryland and engaged a manager responsible for opening the Mid-Atlantic market. We plan to continue to expand this operation going forward.

We also significantly increased investment in displays for the retail home renovation programs in 2011 in order to support our penetration of the sector. Furthermore we hired additional personnel in the Montreal operation in order to handle the increased volume and implemented training programs in preparation for continued growth in the future.

The higher average CAD/USD exchange rate in this period used in the translation of the expenses to the reporting currency also added 5.97% to the increase.

Net Earnings (Loss)

As a result of the above factors, net earnings for the nine months October 31, 2011 were $75,866 as compared to $76,764 for the same period in 2010, reflecting a slight decrease of 1.17%. The decrease was primarily attributable to the increase expenses for the U.S. operations.

Results of Operations for the Three Months Ended October 31, 2011 as Compared to the Three Months Ended October 31, 2010

Sales

Sales for the three months ended October 31, 2011 were approximately $2.89 million as compared to approximately $2.48 million for the three months ended October 31, 2010, reflecting an increase of 16.6%. The increase in sales during this period is mostly attributed to an increase in the number of customers, the Company’s continued implementation of its strategy to expand into new markets, expansion of our product lines, and the benefits of a higher average CAD/USD exchange rate.

For the three months ended October 31, 2011, we continued growth in the U.S. market by gaining new customers. We also continued expansion into the retail home renovation center section and entered into new geographic regions such as western Canada.

We were also the beneficiary of a higher average CAD/USD exchange rate. The average exchange rate for the three months ended October 31, 2011 was .9998 versus an average exchange rate for the same period in 2010 of .9701. Without this foreign currency translation, the increase in sales in our reporting currency was 13.14%.

Cost of Goods Sold

Cost of goods sold for the three months ended October 31, 2011 was approximately $1.94 million as compared to approximately $1.68 million for the three months ended October 31, 2010. This represents an increase of 14.88%. The increase can be attributed to increased purchases during the period to support the increased sales and a higher average CAD/USD exchange rate, which added 3.41% to the increase in the cost of goods sold when translated into USD.

Gross Profit

Gross profit for the three months ended October 31, 2011 was approximately $0.96 million as compared to approximately $0.8 million for the three months ended October 31, 2010. Gross profit margin for the quarter improved year over year from 32.11% to 33.11%.

Total Operating Expenses

Total operating expenses for the three months ended October 31, 2011 were approximately $0.89 million as compared to approximately $0.8 million for the three months ended October 31, 2010, reflecting an increase of 10.76%. The increase can be mostly attributed to the Company engaging additional personnel in the Montreal operations in order to handle the increased volume and in preparation for continued growth in the future by implementing training programs. Additional financial expenses reflected additional borrowing in order to finance operations.

Net Earnings (Loss)

As a result of the above factors, net earnings for the three months ended October 31, 2011 were $50,164 as compared to a loss of $5,852 for the three months ended October 31, 2010.

Results of Operations for the Year ended January 31, 2011 as Compared to the Year ended January 31, 2010

During the year ended January 31, 2011, expansion and investing in U.S. market was a key strategy of the Company. We were able to increase our sales and gross profit during this period, mainly due to increase in number of new customers and introduction of new products. During the year, we continued our penetration into the U.S. market.

Sales

Sales for the year ended January 31, 2011 were approximately $9.91 million as compared to approximately $8.08 million for the year ended January 31, 2010, reflecting an increase of 22.65%. The increase was mainly due to an increase in customer base and the Company’s expansion geographically to both eastern Canada and U.S. mid-Atlantic markets during the period.

We were also the beneficiary of a higher average CAD/USD exchange rate. The average exchange rate for the year ended January 31, 2011 was .9743 versus .8916 for the year ended January 31, 2010. This added 10.41% to the increase. Without this foreign currency translation addition, the increase in sales was 12.24%.

Cost of Goods Sold

Cost of goods sold for the year ended January 31, 2011 was approximately $6.7 million as compared to approximately $5.69 million for the year ended January 31, 2010. This represents an increase of 18.32%. The increase can be attributed to increased purchases during the period to support the increased sales and the changes in the CAD/USD exchange rate. The average CAD/USD exchange rate was lower during the period. Without this foreign currency translation difference, the cost of goods sold would have been 7.73% higher during the year ended January 31, 2011.

Gross Profit

Gross profit for the year ended January 31, 2011 was approximately $3.21 million as compared to approximately $2.39 million for the year ended January 31, 2010. This represents an improvement in gross profit margin from 29.6% to 32.43%. This improvement is primarily a consequence of changes to the mix of products sold and specific management of pricing policies (price lists) designed to increase the overall gross profit.

Total Operating Expenses

Total operating expenses for the year ended January 31, 2011 were approximately $3.13 million as compared to approximately $2.62 million for the year ended January 31, 2010, reflecting an increase of 19.52%. The increase is due to our expansion and investment in the U.S. market during this period. There was no significant expense related to U.S. operations for the year ended January 31, 2010. This component alone added $103,940 to expenses or 3.32%. The increased financial expense reflected additional borrowing in order to finance operations.

The average CAD/USD exchange rate was also higher over the period. This added 10.14% to the increase. Without this foreign currency translation difference, the increase in total operating expenses would have been 9.38%.

Forgiveness of Debt – Advances from Related Parties

For the year ended January 31, 2011, we were the beneficiary of a forgiveness of debt in the amount of $974,300. This was a non-cash transaction. Over the history of CanCo, Vinn Investments, a company controlled by Emil Kroo, had loaned significant amounts to CanCo in order to maintain liquidity and provide working capital. Emil Kroo was formerly a principal shareholder of CanCo and is the father of a current principal shareholder of the Company. On May 4, 2010, Vinn Investments forgave $974,300 of the advances owing by CanCo. See “Certain Relationships and Related Transactions.”

Net Earnings (Loss)

As a result of the above factors, net earnings for the year ended January 31, 2011 were $880,403 as compared to a loss of $90,048 for the year ended January 31, 2010.

Liquidity and Capital Resources

As of October 31, 2011, CanCo had current assets of $6,302,111 and current liabilities of $5,372,146. The following table provides a summary of CanCo’s net cash flows from operating, investing, and financing activities.

| | | For the Nine Months Ended October 31, | | For the Year Ended January 31, |

| | | 2011 | | 2010 | | 2011 | | 2010 |

| Cash used in operating activities | | $ | (370,001 | ) | | $ | (448,851 | ) | | $ | (341,886 | ) | | $ | (14,479 | ) |

| Cash provided by financing activities | | | 389,663 | | | | 502,072 | | | | 407,002 | | | | 62,646 | |

| Cash used in investing activities | | | (21,957 | ) | | | (47,101 | ) | | | (65,116 | ) | | | (48,167 | ) |

| Net change in cash | | | - | | | | - | | | | - | | | | - | |

| Cash, beginning of period | | | - | | | | - | | | | - | | | | - | |

| Cash, end of period | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Cash used in operating activities

Cash used in operating activities increased by $78,850 for the nine months ended October 31, 2011 as compared to the nine months ended October 31, 2010. This reflects a significant increase in accounts receivable and a decrease in accounts payable partially offset by a reduction in inventory and net earnings.

Cash used in operating activities decreased by $327,407 for the year ended January 31, 2011 as compared to the year ended January 31, 2010. This reflects a significant increase in inventory offset partially by a significant increase in accounts payable. It should be noted that $212,000 of the inventory increase is directly attributable to the difference in the value of the CAD versus USD on January 31, 2011 (.9985) as compared to January 31, 2010 (.9352). The increase in inventory in the reporting currency was $1.144 million. It should also be noted that the Company imports a significant amount of its product from China which each year has a three week suspension in production beginning in the second half of January. Consequently, we must purchase significant quantities of product just prior to this temporary shutdown and these goods that are in transit as of the fiscal year end of the Company are included in the inventory asset on the balance sheet.

Cash provided by financing activities

Cash provided by financing activities was $389,663 for the nine months ended October 31, 2011 which consisted of proceeds from bank indebtedness, proceeds of loans payable and advances from related parties. For the nine months ended October 31, 2010, the Company received $502,072 from financing activities. Increased use of the Company’s line of credit and short term loans from external financing provided the funds required to offset the net outflow.

Cash provided by financing activities was $407,002 for the year ended January 31, 2011 as compared to $62,646 for the year ended January 31, 2010.

Cash used in investing activities

For the nine months ended October 31, 2011, investment in equipment amounted to $21,957 and non-cash amortization amounted to $64,134. For the nine months ended October 31, 2010, investment in equipment amounted to $47,101 and non-cash amortization amounted to $66,955.

Cash used for the acquisition of property and equipment was $65,116 for the year ended January 31, 2011 and $48,167 for the year ended January 31, 2010.

Working capital is adequate for current operations, however is not considered enough to support the expected future growth. Consequently we are striving to continue to reduce inventory levels while at the same time pursuing additional financing opportunities. These may be in the form of increased borrowing from our current lenders, private placements or short term financing from third parties. As our sales and profits grow there will also be the contribution of increased earnings.

Critical Accounting Policies

The accounting policies of the Company are in accordance with accounting principles generally accepted in the United States.

Revenue Recognition

Revenue is recognized once products are delivered to the customer and the transfer of ownership risks and benefits inherent to the property occurs. Revenue is recognized if persuasive evidence of an agreement exists, the sales price is fixed or determinable, and collectability is reasonably assured.

Inventory

Inventory is comprised of finished goods that the Company intends to resell to its customers. It is valued at the lower of cost and net realizable value. Cost is determined on a first-in, first-out basis. Cost includes components of invoice cost, foreign exchange, freight and duties. Net realizable value is the estimated selling price in the normal course of business, less applicable variable selling costs. The Company records lower of cost or market value adjustments based upon changes in market pricing, customer demand, or other economic factors for on-hand excess or slow-moving inventory.

Income Taxes

The Company accounts for income taxes in accordance with Accounting Standards Codification ("ASC") No. 740 Income Taxes which prescribes the use of the liability method whereby deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates. The effects of future changes in tax laws or rates are not anticipated.

Under ASC No. 740 income taxes are recognized for the following: a) amount of tax payable for the current year, and b) deferred tax liabilities and assets for future tax consequences of events that have been recognized differently in the financial statements than for tax purposes.

Foreign Currency Translation

Management has determined that the functional currency of the Company is the Canadian dollar. The Company's accounts have been translated into United States dollars in accordance with the provisions of ASC No. 830 Foreign Currency Matters. Certain assets and liabilities of the Company are denominated in US dollars and European Euros. In accordance with the provisions of ASC No. 830, transaction gains and losses on these assets and liabilities are included in the determination of income for the relevant years.

Adjustments resulting from the translation of the financial statements from their functional currencies to US dollars are accumulated as a separate component of accumulated other comprehensive income and have not been included in the determination of net income for the relevant years.

Comprehensive Income

ASC No. 220 Comprehensive Income establishes standards for reporting and presentation of comprehensive income and its components in a full set of financial statements. Comprehensive income is presented in the statements of changes in stockholders' equity, and consists of foreign currency translation adjustments. ASC No. 220 requires only additional disclosures in the financial statements and does not affect the Company's financial position or results of operations.

Property and Equipment

Property and equipment are recorded at historical cost less accumulated depreciation. Depreciation, based on the estimated useful lives of the assets, is provided using the under noted annual rates and methods:

| | Equipment | 20% declining balance |

| | Furniture and fixtures | 20% declining balance |

| | Computer hardware | 30% declining balance |

| | Computer software | 30% declining balance |

| | Leasehold improvements | 10 years straight line |

Off Balance Sheet Arrangements

We do not have any off balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, sales or expenses, results of operations, liquidity or capital expenditures, or capital resources that are material to an investment in our securities.

CORPORATE HISTORY AND STRUCTURE

We were incorporated under the laws of the State of Nevada on December 28, 2010 as Quinko-Tek International, Inc. (“USCo”). We are a holding company and conduct our operations through our subsidiary in Canada named 152724 Canada Inc. (“CanCo”). CanCo was incorporated in 1986 and is headquartered in Montreal, Canada. It is a wholesaler and importer of hardware for the furniture and cabinet trade.

In August 2011, we completed a private placement offering by selling 4,005,640 shares of common stock to 111 non-U.S. investors for approximately $130,000.

On December 12, 2011, USCo formed a company named Quinko-Tek Call Corp. (“CallCo”) in accordance with the Business Corporations Act (Ontario) whereby CallCo became the wholly owned subsidiary of USCo. On the same day, USCo formed a company named Quinko-Tek Acquisition Corp. (“AcquisitionCo”) in accordance with the Business Corporations Act (Ontario) whereby AcquisitionCo becomes the wholly owned subsidiary of CallCo.

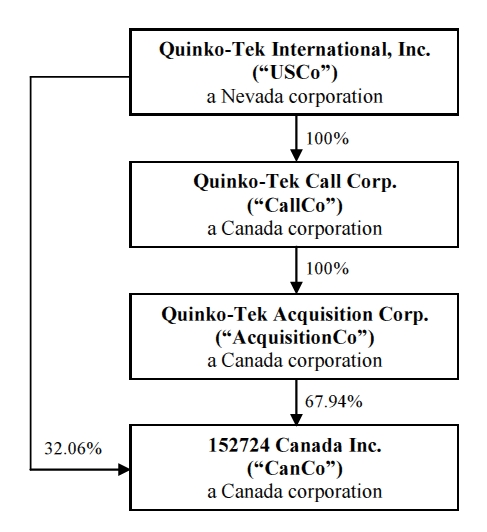

On January 26, 2012, USCo entered into a share exchange agreement with CanCo and Joshua Kroo, a former shareholder of CanCo, pursuant to which USCo issued 3,838,191 shares of its common stock to Joshua Kroo in exchange for 210 common shares of CanCo owned by Joshua Kroo. In connection with the foregoing share exchange transaction, Ira Kroo transferred 445 shares of common stock of CanCo to AcquisitionCo, for the issuance of a total of 8,133,309 non-voting class of shares (“Exchangeable Shares”) in the capital stock of AcquisitionCo, pursuant to a rollover agreement by and between Ira Kroo and AcquisitionCo, dated January 26, 2012. As a result of the transaction, AcquisitionCo owns 67.94% of the capital stock of CanCo while USCo owns the remaining 32.06% of CanCo. Exchangeable Shares shall mean non-voting shares of AcquisitionCo issued to a person or persons that have the right to be issued common shares of USCo on a one to one basis, subject to certain adjustment, in exchange for the redemption or cancellation of each Exchangeable Share.

On January 26, 2012, USCo filed with the State of Nevada Secretary of State a Certificate of Designations, Preferences and Rights of Series A Preferred Stock (the “Certificate of Designations for Series A Preferred Stock”). Such Series A Preferred Stock consists of one (1) share, $0.001 par value per share, which was issued to Patriquin Law Professional Corporation (the “Trustee”). The holder of Series A Preferred Stock has equivalent voting rights to the common stock of USCo, as if the holder of Series A Preferred Stock held the number of shares of common stock of USCo equals to the number of Exchangeable Shares issued and outstanding at that point in time, pursuant to a support agreement and a voting and exchange trust agreement entered into by and among the USCo, AcquisitionCo, CallCo and the Trustee, dated January 26, 2012. See “Description of Securities – Series A Preferred Stock” of this prospectus.

The support agreement and the Exchangeable Shares provisions create certain obligations for the USCo, including the obligation to reserve sufficient common shares in its stock to issue to the owners of the Exchangeable Shares, the obligation to ensure that equivalent dividends are paid to the owners of the Exchangeable Shares if dividends are paid on the common shares of USCo while any Exchangeable Shares are outstanding, and the obligation to not issue any special voting shares or designate or issue any other shares in its capital that are superior to the Series A Preferred Stock, except with the consent of the owners of the Exchangeable Shares.

The voting and exchange trust agreement creates a trust for the benefit of the registered holders of the Exchangeable Shares that enables the Trustee to exercise voting rights on behalf of the holders of the Exchangeable Shares, until such time as the exchangeable shareholders (or their designates, transferees or assignees) are issued common shares of USCo in exchange for their Exchangeable Shares. The voting and exchange trust agreement shall remain in force until the date that all the Exchangeable Shares are exchanged for shares of common stock in the USCo. At that time, the share of Series A Preferred Stock shall be redeemed for cancellation for nominal consideration.

The following chart reflects our organizational structure as of the date of this prospectus:

Overview

We operate our business through CanCo, which is a distributor of functional hardware, decorative and complementary products used in the manufacture of furniture and kitchen cabinets. We sell our products in Canada, the United States and Central and South America.

Our Industry

The industry consists of distributors and wholesalers of products generally used in the manufacture or renovation of furniture, kitchens and vanity cabinets, commercial and architectural millwork and similar end uses. Customers can be large-scale manufacturers, woodworkers, home renovation centers, construction projects and do-it-yourself consumers. The overall market is relatively stable due to the broad range customers and the multitude of new construction as well as renovation.

Although the current economic environment is very difficult to predict new housing and new construction, there is an ongoing demand for the products offered by the Company for renovation and improvement of existing homes and commercial properties.

Products and Growth Strategy

We import and resell hardware for the furniture and cabinet trade. We are committed to achieving growth, enhancing profitability and generating positive cash flows through building strong relationships with our suppliers and making arrangements for exclusive distribution across wide geographic areas. Our current product lines and growth strategies are as follows:

| - | Building on our trademarked Q-Line Elite line of hardware products, |

| - | Maintaining our unique relationships with our supplier factories and developing relationships with new supplier factories, |

| - | Continuing our strong emphasis on service to our customers, |

| - | Broadening our distribution networks, and, |

| - | Distributing and marketing specific product lines for which we have exclusive distribution agreements for specific geographic regions. |

Keys to Organic growth, Competitive Advantages and Q-Line Elite

Sourcing and Supplier Relationships

We do not manufacture the products. We have been importing approximately 65% of our products from the Far East since our inception and we were one of the earliest companies in the industry to begin sourcing in China in 1991 when China first began to open its borders to the world. As such, an extraordinary amount of experience has been accumulated over the years with regard to determining the very best factories to work with.

We consciously source each of our product lines from different factories and even sub-divide our product lines in order to ensure specialization from our supplier factories. Once we have determined that a product line is to be added to our company’s product families, a very specific approach has been developed with regard to the research and procedure undertaken to find the right “partner” supplier.

This approach is quite unique in the industry and as a result the relationships we have with our various factory suppliers is exceptional. In many cases it provides the company with strong competitive advantages in the market both with regard to quality and price. It has also allowed us to develop our own brand which gradually is becoming more and more known amongst customers: Q-Line Elite. We have products manufactured at the various factories and branded with the Q-Line Elite trademark.

All manufacturers must meet our very specific and very high quality and technical standards. We regularly test our products once received in Montreal with our own testing machinery to ensure the quality technical features meet our requirements.

A number of our factory suppliers have also agreed to grant us exclusive distribution rights of their production for either Canada or all of North America and these rights can be leveraged to great effect as the company expands geographically.

We also purchase from suppliers in North America, Europe, Taiwan, Columbia, and Brazil.

Insofar as the Company distributes many product lines and given the specific corporate strategy of purchasing from many factories, each specializing in a particular product line or sub-products line, the company’s purchases are spread across a broad spectrum of suppliers and there is no dependence of significance on any one supplier.

Experienced Personnel

Our corporate philosophy with regard to personnel is that success can only be achieved if the best people available are in place at all positions in the company. Our senior personnel are very experienced, dedicated, motivated and have complete belief in the future and potential of our company. In the future, we also intend to recruit more group leaders, other than the management, to join our company to increase the product sales and achieve the growth of the Company.

Personal Attention

It is also a very specific corporate philosophy that all customers and suppliers must at all times feel they can receive personal attention from the staff at our company and in particular from senior management. Our staffs are trained to give personal attention to our customers and suppliers. Most of our customers, new and old, consider this level of service as one of the most important elements we provide to them and the marketplace.

Intellectual Property

We have registered the trademark “Q-Line Elite” in Canada and United States.

Suppliers

We do not manufacture our products. We distribute the products purchased from our suppliers in North America or imported from various countries including but not limited to People’s Republic of China, Taiwan, Columbia, South America and Brazil. We purchase from a large number of manufacturers who meet our high standards of quality control and technical features. Therefore, such factory suppliers must specialize in the particular product line which we purchase from. None of our suppliers accounted for 10% or more of the total purchase price for the year ended January 31, 2011.

Marketing, Sales & Distribution

Geographic expansion into the U.S. market

In 2008, we began to sell our products in the New York and New Jersey markets through several regional distributors. In late 2009, we began to sell directly in the New York market through an independent sales agency. In July 2010, we opened a small warehouse in the Mid-Atlantic region in the United States. The reception of customers to these sales initiatives over the last three years has been very positive and has proven the potential for growth in these markets. We are also considering expansion into other geographic areas in the United States.

We maintain inventories for our regional operations by regular deliveries from our central warehouse in Montreal. All transportation, both to the regional operations and to their respective customers is via independent carriers.

Internet

Over the past six months, we have been developing a website www.qlineshop.com targeting small and medium sized woodworkers as well as individuals (who do their own home improvements or are simply looking for decorative hardware to enhance their existing homes). All products offered on the site are those which the Company inventories and sells in its normal day to day business. The site is designed to reach the end user/consumer who would either be buying in a home renovation store or on-line from another site. These are customers not currently served by the Company. Further, as the internet reaches a global market, the site is a vehicle to make its products available across the entire United States and Canada and even overseas.

Purchase of goods from internet websites has become a multi-billion dollar business and while there are already a number of sites offering furniture hardware and complementary decorative products on-line, a well designed site which is well marketed can generate very significant sales and high profit margins. We have done extensive research with regard to competitive websites and there is a major opportunity for a well-designed site which can take advantage of our existing purchasing power and product knowledge. We expect to generate significant and increasing sales from the web site over the next two to three years.

Sub-distributors

In 2007, we started a program to establish relationships with a network of independent regional sub-distributors across Quebec, Canada. On average these sub-distributors which had a base of at least 300 customers. We offered a breadth of product families that was far greater than the sub-distributors had access to, a large inventory to rely upon for supply, territorial protection and joint marketing programs.

To date the network comprises twenty-four sub-distributors and they are located not only in Quebec but also in other provinces of Canada as well as the northeastern US. Each sub-distributor essentially becomes an extension of our sales network and allows to reach a much broader universe of customers then we could reach with a direct sales force.

We plan to add to the network as we expand to more and more geographic areas.

New product lines

It is the Company’s plan to introduce new product lines in the future. The Company is often approached by manufacturers to take on the distribution of a product line and each such opportunity is evaluated with regard to the fit with the company’s existing product lines, customer base and the terms of the distribution arrangement.

Several examples of relatively new arrangements are:

WoodMaax Premium Screw Line

This product line is for sale under our Q-Line Elite brand. We are entitled to exclusive distribution rights in the United States market and non-exclusive distribution rights in Canada.

It is the first and only family of screws developed exclusively for the woodworking industry, featuring many unique and highly desirable features. Virtually all woodworking requires screws. It was first introduced to the Canadian market in 2009. There is a program targeted towards the volume manufacturing industry with the appropriate package quantities and pricing and there is a different program intended for distribution through the home renovation centers with smaller package quantities and higher pricing. We sell such products either to industry or retail buyers. In addition, we sell them on the website www.qlineshop.com, which is discussed below under Marketing, Sales and Distribution.

Kitchen Cabinet Doors

Most kitchens and closets have cabinet doors made from one of the three materials: solid wood, composite wood with laminated surfaces and composite wood with thermofoil surfaces. Thermofoil is a very thin decorative paper vacuum sealed to the substrate. All cabinet doors are custom made as the dimensions vary with the design of each kitchen or closet, particularly high end designs. Due to this constraint there are no inventory implications; the critical success factors are selection, quality, price and service.

We have negotiated oral agreements with two companies manufacturing cabinet doors. One is actually a customer currently purchasing laminates from us and has developed a very unique and European look series of cabinet door options using our laminates which we sell to them, the other is based in Ontario.

We are entitled to exclusive distribution rights in the United States market. This is a new product for our company, which we believe has great potential.

Initial presentations to customers of all three materials have been met with great success. We have been able to exceed the competition in all four of the critical factors that the customers are sensitive to. We have already started to market and sell this product line but on a limited basis as we continue to research and develop our approach to the market and the existing competition.

Natural Wood Finishing and Maintenance Oils and Treatments

We are the U.S. distributor for the only 100% natural and environmentally wood finishing and wood maintenance line available today on the market. The manufacturer is in Quebec and we are targeting customers who are small woodworkers and consumers.

We are entitled to exclusive distribution rights in the United States market and non-exclusive distribution rights in Ontario and Eastern Canada.